Alpha Architect International Quantitative Value ETF Ticker Symbol: IVAL Listed on The Nasdaq Stock Market, LLC | SUMMARY PROSPECTUS January 31, 2024, as supplemented June 21, 2024 www.alphaarchitect.com/funds | ||||

| Before you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Fund and its risks. The current Prospectus and SAI, each dated January 31, 2024, as supplemented June 21, 2024, are incorporated by reference into this Summary Prospectus. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at www.alphaarchitect.com/funds. You can also get this information at no cost by calling 215-882-9983. | |||||

INVESTMENT OBJECTIVE

The Alpha Architect International Quantitative Value ETF (the “Fund”) seeks long-term capital appreciation.

FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may also pay brokerage commissions on the purchase and sale of Shares, which are not reflected in the table and example below.

ANNUAL FUND OPERATING EXPENSES (EXPENSES THAT YOU PAY EACH YEAR AS A PERCENTAGE OF THE VALUE OF YOUR INVESTMENT)

Management Fee1 | 0.39 | % | |||

Distribution and/or Service (12b-1) Fees | 0.00 | % | |||

Other Expenses | 0.00 | % | |||

Total Annual Fund Operating Expenses | 0.39 | % | |||

1.Management Fee has been restated to reflect current fee.

EXAMPLE

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. The example also assumes that the Fund provides a return of 5% a year and that operating expenses remain the same. You may also pay brokerage commissions on the purchase and sale of Shares, which are not reflected in the example. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| One Year: | Three Years: | Five Years: | Ten Years: | ||||||||

| $40 | $125 | $219 | $493 | ||||||||

PORTFOLIO TURNOVER

The Fund may pay transaction costs, including commissions when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. For the fiscal year ended September 30, 2023, the Fund’s portfolio turnover rate was 74% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund’s Investment Strategy

The Fund is actively managed by Alpha Architect, LLC, the Fund’s investment sub-adviser (“Alpha Architect” or the “Sub-Adviser”). The Sub-Adviser manages the Fund using proprietary methodology developed by the parent company of the Adviser and Sub-Adviser, Empirical Finance, LLC, dba Alpha Architect.

The Sub-Adviser employs a multi-step, quantitative, rules-based methodology to identify a portfolio of approximately 50 to 200 undervalued international equity securities with the potential for capital appreciation. A security is considered to be undervalued when it trades at a price below the price at which the Sub-Adviser believes it would trade if the market reflected all factors relating to the company’s worth.

The Sub-Adviser analyzes an initial universe of liquid stocks that principally trade developed non-U.S. markets securities exchanges in countries included in the MSCI EAFE Index. Typically, the minimum market capitalization for the smallest-capitalization stocks in the initial universe is above $1 billion.

The Sub-Adviser eliminates from the initial universe illiquid securities, real estate investment trusts, exchange-traded funds (ETFs), stocks of financial firms, and stocks of companies with less than twelve months of available financial data. The resulting universe is composed primarily of highly liquid, small-, mid- and large-cap stocks.

The Sub-Adviser then employs proprietary screens, which evaluate among other things, the firms’ accounting practices, to eliminate firms that are potential “value traps.” That is, these screens eliminate firms with, in the Sub-Adviser’s view, negative characteristics. Those could include situations where firms appear to be experiencing financial distress or have manipulated accounting data. For example, we may seek to avoid firms that have large accruals (i.e., their net income greatly exceeds their free cash flow).

Next, the Sub-Adviser employs a value-driven approach to identify the cheapest companies based on a value-centric metric known as the “enterprise multiple,” a firm’s total enterprise value (TEV) divided by a firm’s earnings before interest and taxes (EBIT, often referred to as operating income). While enterprise multiples are the focus of the Sub-Adviser’s approach, the Sub-Adviser also incorporates information from other common value metrics, such as book-to-market, cash-flow to price, and earnings to price to identify the cheapest companies. Last, the Sub-Adviser employs an ensemble of quality screens, which consider metrics like current profitability, stability, and recent operational improvements, to select the top 50 to 200 stocks from the cheapest stocks.

As of September 30, 2023, the Fund had significant exposures to the following sectors: Consumer Discretionary (32.4%), Energy (22.7%), and Industrials (18.4%).

The Sub-Adviser will reallocate the Fund’s portfolio on a periodic basis, generally each month.

The Fund may also invest up to 20% of its assets in cash and cash equivalents, other investment companies, as well as securities and other instruments.

PRINCIPAL RISKS

An investment in the Fund involves risks, including those described below. There is no assurance that the Fund will achieve its investment objective. An investor may lose money by investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency.

Foreign Investment Risk. Returns on investments in foreign securities could be more volatile than, or trail the returns on, investments in U.S. securities. Investments in or exposures to foreign securities are subject to special risks, including risks associated with foreign securities generally, including differences in information available about issuers of securities and investor protection standards applicable in other jurisdictions; capital controls risks, including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; currency risks; political, diplomatic and economic risks; regulatory risks; and foreign market and trading risks, including the costs of trading and risks of settlement in foreign jurisdictions.

•Risks Related to Investing in Australia. To the extent the Fund invests in Australian securities, it will be subject to risks related to investing in Australia. Investments in Australian issuers may subject the Fund to regulatory, political, currency, security, and economic risk specific to Australia. The Australian economy is heavily dependent on exports from the agricultural and mining sectors. This makes the Australian economy susceptible to fluctuations in the commodity markets. Australia is also dependent on trading with key trading partners.

•Risks Related to Investing in Europe. To the extent the Fund invests in European securities, it will be subject to risks related to investing in Europe. The economies and markets of European countries are often closely connected and interdependent, and events in one country in Europe can have an adverse impact on other European countries. The Fund makes investments in securities of issuers that are domiciled in, or

- 2 -

have significant operations in, member countries of the European Union (the “EU”) that are subject to economic and monetary controls that can adversely affect the Fund’s investments. The European financial markets have experienced volatility and adverse trends in recent years and these events have adversely affected the exchange rate of the euro and may continue to significantly affect other European countries. Decreasing imports or exports, changes in governmental or EU regulations on trade, changes in the exchange rate of the euro, the default or threat of default by an EU member country on its sovereign debt, and/or an economic recession in an EU member country may have a significant adverse effect on the economies of EU member countries and their trading partners, including some or all of the European countries in which the Fund invests.

In addition, the United Kingdom resolved to leave the EU, an event commonly known as “Brexit.” The United Kingdom officially left the EU on January 31, 2020. Although the UK and EU have made a trade agreement that was entered into force on May 1, 2021, certain post-EU arrangements were outside the scope of the negotiating mandate and remain unresolved and subject to further negotiation and agreement. There remains significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes are difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may continue to be a source of instability and cause considerable disruption in securities markets, including increased volatility and illiquidity, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar.

•Risks Related to Investing in Japan. As of September 30, 2023, a significant portion of the Fund’s assets was invested in Japanese securities. As a result, the Fund is subject to greater risks of adverse developments in Japan and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in Japan or the region, even in countries in which the Fund is not invested, may adversely affect the value of investments held by the Fund.

The Japanese economy may be subject to considerable degrees of economic, political and social instability, which could have a negative impact on Japanese securities. Since the year 2000, Japan’s economic growth rate has remained relatively low and it may remain low in the future. In addition, Japan is subject to the risk of natural disasters, such as earthquakes, volcanoes, typhoons and tsunamis.

Additionally, decreasing U.S. imports, new trade regulations, changes in the U.S. dollar exchange rates, a recession in the United States or continued increases in foreclosure rates may have an adverse impact on the economy of Japan. Japan also has few natural resources, and any fluctuation or shortage in the commodity markets could have a negative impact on Japanese securities. In addition, Japan is subject to the risk of natural disasters, such as earthquakes, volcanic eruptions, typhoons and tsunamis, which could negatively affect the Funds’ investment in Japan.

Sector Risk. Companies with similar characteristics may be grouped together in broad categories called sectors. A certain sector may underperform other sectors or the market as a whole. As the Sub-Adviser allocates more of the Fund’s portfolio holdings to a particular sector, the Fund’s performance will be more susceptible to any economic, business or other developments which generally affect that sector.

•Consumer Discretionary Sector Risk. Companies engaged in the design, production or distribution of products or services for the consumer discretionary sector are subject to the risk that their products or services may become obsolete quickly. The success of these companies can depend heavily on disposable household income and consumer spending. During periods of an expanding economy, the consumer discretionary sector may outperform the consumer staples sector, but may underperform when economic conditions worsen.

•Energy Sector Risk. The market value of securities in the energy sector may decline for many reasons including, fluctuations in energy prices and supply and demand of energy fuels caused by geopolitical events, the success of exploration projects, weather or meteorological events, taxes, increased governmental or environmental regulation, resource depletion, rising interest rates, declines in domestic or foreign production, accidents or catastrophic events that result in injury, loss of life or property, pollution or other environmental damage claims, terrorist threats or attacks, among other factors. Markets for various energy-related commodities can have

- 3 -

significant volatility and are subject to control or manipulation by large producers or purchasers. Companies in the energy sector may need to make substantial expenditures, and may incur significant amounts of debt, to maintain or expand their reserves through exploration of new sources of supply, through the development of existing sources, through acquisitions, or through long-term contracts to acquire reserves. Factors adversely affecting producers, refiners, distributors, or others in the energy sector may adversely affect companies that service or supply those entities, either because demand for those services or products is curtailed, or those services or products come under price pressure. Issuers in the energy sector may also be impacted by changing investor and consumer preferences arising from the sector’s potential exposure to sustainability and environmental concerns.

•Industrials Sector Risk. The value of securities issued by companies in the industrials sector may be affected by supply and demand both for their specific products or services and for industrials sector products in general. The products of manufacturing companies may face obsolescence due to rapid technological developments and frequent new product introduction.

Depositary Receipts Risk. The risks of investments in depositary receipts, including American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”), and Global Depositary Receipts (“GDRs”), are substantially similar to Foreign Investment Risk. In addition, depositary receipts may not track the price of the underlying foreign securities, and their value may change materially at times when the U.S. markets are not open for trading.

Value Style Investing Risk. A value stock may not increase in price if other investors fail to recognize the company’s value and bid up the price or the markets favor faster-growing companies. Cyclical stocks in which the Fund may invest tend to lose value more quickly in periods of anticipated economic downturns than non-cyclical stocks. Companies that may be considered out of favor, particularly companies emerging from bankruptcy, may tend to lose value more quickly in periods of anticipated economic downturns, may have difficulty retaining customers and suppliers and, during economic downturns, may have difficulty paying their debt obligations or finding additional financing.

Quantitative Security Selection Risk. Data for some companies may be less available and/or less current than data for companies in other markets. The Sub-Adviser uses a quantitative model, and its processes could be adversely affected if erroneous or outdated data is utilized. In addition, securities selected using the quantitative model could perform differently from the financial markets as a whole as a result of the characteristics used in the analysis, the weight placed on each characteristic and changes in the characteristic’s historical trends.

Equity Investing Risk. An investment in the Fund involves risks similar to those of investing in any fund holding equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market, or securities markets generally.

Investment Risk. When you sell your Shares of the Fund, they could be worth less than what you paid for them. Therefore, you may lose money by investing in the Fund.

Large-Capitalization Companies Risk. Large-capitalization companies may trail the returns of the overall stock market. Large-capitalization stocks tend to go through cycles of doing better - or worse - than the stock market in general. These periods have, in the past, lasted for as long as several years. Larger, more established companies may be slow to respond to challenges and may grow more slowly than smaller companies.

Small- and Mid-Capitalization Company Risk. Investing in securities of small- and mid-capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. Often small- and mid-capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions.

Management Risk. The Fund is actively managed and may not meet its investment objective based on the Sub-Adviser’s success or failure to implement investment strategies for the Fund.

Geopolitical/Natural Disaster Risks. The Fund’s investments are subject to geopolitical and natural disaster risks, such as war, terrorism, trade disputes, political or economic dysfunction within some nations, public health crises and related geopolitical events, as well as environmental disasters, epidemics and/or pandemics, which may add to

- 4 -

instability in world economies and volatility in markets. The impact may be short-term or may last for extended periods.

Periodic Reallocation Risk. Because the Sub-Adviser will generally reallocate the Fund’s portfolio on a periodic basis, generally each month, (i) the Fund’s market exposure may be affected by significant market movements promptly following the periodic reconstitution that are not predictive of the market’s performance for the subsequent period and (ii) changes to the Fund’s market exposure may lag a significant change in the market’s direction (up or down) by as long as a month if such changes first take effect promptly following the periodic reallocation. Such lags between market performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market.

ETF Risks.

•Authorized Participants, Market Makers and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

•Premium-Discount Risk. The Shares may trade above or below their net asset value (“NAV”). The market prices of Shares will generally fluctuate in accordance with changes in NAV as well as the relative supply of, and demand for, Shares on The Nasdaq Stock Market, LLC (the “Exchange”) or other securities exchanges. The trading price of Shares may deviate significantly from NAV during periods of market volatility or limited trading activity in Shares. In addition, you may incur the cost of the “spread,” that is, any difference between the bid price and the ask price of the Shares. In addition, because securities held by the Fund may trade on foreign exchanges that are closed when its primary listing exchange is open, the Fund is likely to experience premiums and discounts greater than those of domestic ETFs.

•Cost of Trading Risk. Investors buying or selling Shares in the secondary market will pay brokerage commissions or other charges imposed by brokers as determined by that broker. Brokerage commissions are often a fixed amount and may be a significant proportional cost for investors seeking to buy or sell relatively small amounts of Shares.

•Trading Risk. Although the Shares are listed on the Exchange, there can be no assurance that an active or liquid trading market for them will develop or be maintained. In addition, trading in Shares on the Exchange may be halted. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of its underlying portfolio holdings, which can be less liquid than Shares, potentially causing the market price of Shares to deviate from its NAV. The spread varies over time for Shares of the Fund based on the Fund’s trading volume and market liquidity and is generally lower if the Fund has high trading volume and market liquidity, and higher if the Fund has little trading volume and market liquidity (which is often the case for funds that are newly launched or small in size).

- 5 -

PERFORMANCE

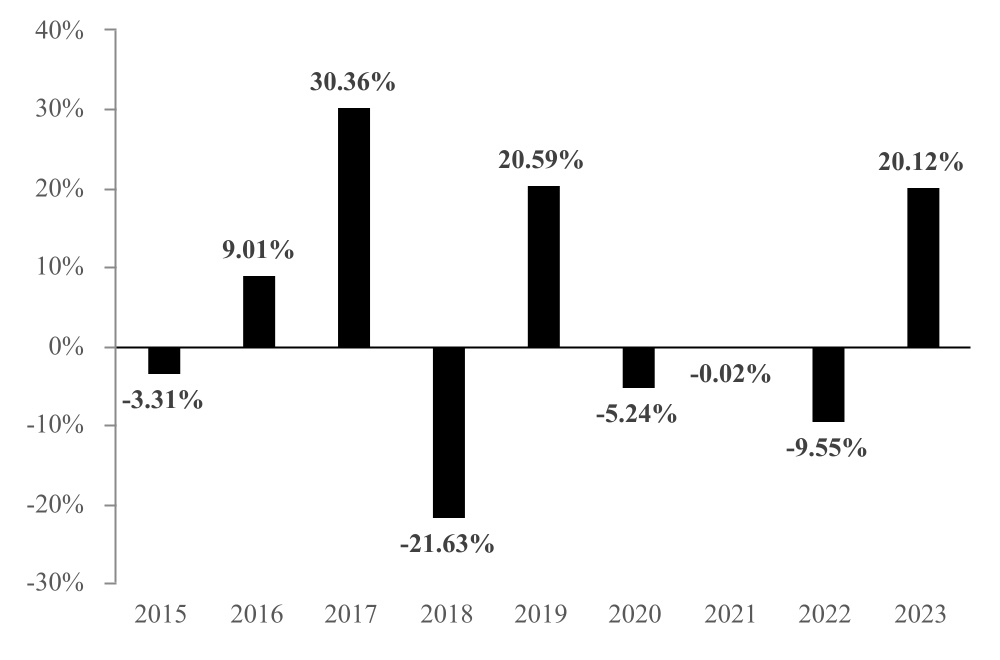

The following information provides some indication of the risks of investing in the Fund. The bar chart shows the Fund’s performance for calendar years ended December 31. The table shows illustrates how the Fund’s average annual returns for one-year, five-year, and since inception periods compare with those of a broad measure of market performance. For the period February 1, 2017 through January 30, 2022, the Fund was passively-managed and the Fund sought to track the performance of a propriety index that was constructed in a manner substantially similar to the methodology used to manage the Fund. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Performance information is also available on the Fund’s website at www.alphaarchitect.com/funds or by calling the Fund at (215) 882-9983.

Calendar Year Total Returns as of December 31

During the period of time shown in the bar chart, the Fund’s highest return for a calendar quarter was 17.39% (quarter ended December 31, 2022) and the Fund’s lowest return for a calendar quarter was -28.77% (quarter ended March 31, 2020).

Average Annual Total Returns (for periods ended December 31, 2023) | 1 Year | 5 Years | Since Inception (12/16/14) | ||||||||

Return Before Taxes | 20.12% | 4.42% | 3.45% | ||||||||

Return After Taxes on Distributions | 18.92% | 3.57% | 2.84% | ||||||||

Return After Taxes on Distributions and Sale of Shares | 13.16% | 3.54% | 2.83% | ||||||||

Solactive Developed Markets ex N.A. Large and Mid-Cap Index (reflects no deduction for fees or expense)1 | 17.91% | 8.07% | 5.43% | ||||||||

1Index assumes withholding taxes on dividends.

After-tax returns are calculated using the highest historical individual U.S. federal marginal income tax rates during the period covered by the table and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown and are not relevant if you hold your shares through a tax-deferred arrangement, such as a 401(k) plan or an IRA.

- 6 -

The Solactive Developed Markets ex N.A. Large and Mid-Cap Index is a broad-based index covering mid- to large- cap equity securities in international, developed markets outside of North America.

INVESTMENT ADVISER AND INVESTMENT SUB-ADVISER

| Investment Adviser: | Empowered Funds, LLC dba EA Advisers serves as the investment adviser of the Fund. | ||||

| Investment Sub-Adviser: | Alpha Architect, LLC serves as the sub-adviser of the Fund. | ||||

PORTFOLIO MANAGERS

Messrs. Wesley R. Gray and John Vogel are co-portfolio managers for the Fund. Messrs. Gray and Vogel have been primarily and jointly responsible for the day-to-day management of the Fund since 2022.

SUMMARY INFORMATION ABOUT PURCHASES, SALES, TAXES, AND FINANCIAL INTERMEDIARY COMPENSATION

PURCHASE AND SALE OF FUND SHARES

The Fund issues and redeems Shares on a continuous basis only in large blocks of Shares, typically 25,000 Shares, called “Creation Units,” and only APs (typically, broker-dealers) may purchase or redeem Creation Units. Creation Units generally are issued and redeemed ‘in-kind’ for securities and partially in cash. Individual Shares may only be purchased and sold in secondary market transactions through brokers. Once created, individual Shares generally trade in the secondary market at market prices that change throughout the day. Market prices of Shares may be greater or less than their NAV. Except when aggregated in Creation Units, the Fund’s shares are not redeemable securities.

TAX INFORMATION

The Fund’s distributions generally are taxable to you as ordinary income, capital gain, or some combination of both, unless your investment is made through an IRA or other tax-advantaged account. However, subsequent withdrawals from such a tax-advantaged account may be subject to U.S. federal income tax. You should consult your own tax advisor about your specific tax situation.

PURCHASES THROUGH BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares through a broker-dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend Shares over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

- 7 -