Table of Contents

Exhibit 99.1

SPECTRUM BRANDS HOLDINGS, INC.

3001 Deming Way

Middleton, WI 53562

December 21, 2016

Dear Stockholder:

On behalf of the Board of Directors, I am pleased to invite you to join us for our annual meeting of stockholders on Tuesday, January 24, 2017. The meeting will be held at 8:30 a.m., local time, at the Westin Stonebriar Hotel, 1549 Legacy Drive, Frisco, Texas 75034.

This year you will be asked to vote on the following proposals:

| (1) | the election of two Class I directors to the Board of Directors for a three-year term; |

| (2) | the ratification of the Board of Directors’ appointment of KPMG LLP as our independent registered public accounting firm for our 2017 fiscal year; |

| (3) | the approval of a non-binding advisory resolution to approve the compensation of our named executive officers; |

| (4) | the approval, on a non-binding advisory basis, of the frequency (every one, two, or three years) of the non-binding stockholder vote on the compensation of our named executive officers; and |

| (5) | the approval of the Spectrum Brands Holdings, Inc. Amended and Restated 2011 Omnibus Equity Award Plan. |

The Board of Directors recommends a vote FOR proposals 1, 2, 3, and 5, and FOR every “One Year” with respect to proposal 4. These proposals are described in the attached proxy statement, which you are encouraged to read fully. We will also consider any additional business that may be properly brought before the annual meeting. The Board of Directors has fixed December 14, 2016 as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting and any adjournment or postponement thereof. Only holders of record of shares of common stock of Spectrum Brands Holdings, Inc. at the close of business on the record date are entitled to notice of, and to vote at, the annual meeting. At the close of business on the record date, Spectrum Brands Holdings, Inc. had 59,666,219 shares of common stock outstanding and entitled to vote.

If you wish to attend the annual meeting in person, you must reserve your seat by January 17, 2017 by contacting our Investor Relations Department at (608) 275-3340. Additional details regarding requirements for admission to the annual meeting are described in the proxy statement under the heading “Voting in Person.” Your vote is important and it is important that your shares be represented at the annual meeting. To ensure that your shares are represented at the annual meeting, whether or not you plan to attend, please vote by proxy using the Internet or the telephone, or by completing, signing, dating, and returning the enclosed proxy card in the envelope provided. Stockholders of record who attend the annual meeting may revoke their proxies and vote in person at the annual meeting, if they wish to do so. We appreciate your continued support.

Sincerely,

Andreas Rouvé

Chief Executive Officer

Table of Contents

SPECTRUM BRANDS HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Spectrum Brands Holdings, Inc.:

The annual meeting of the stockholders of Spectrum Brands Holdings, Inc. (the “Annual Meeting”) will be held on Tuesday, January 24, 2017 at 8:30 a.m., local time, at the Westin Stonebriar Hotel, 1549 Legacy Drive, Frisco, Texas 75034, for the following purposes:

| (1) | the election of two Class I directors to the Board of Directors for a three-year term; |

| (2) | the ratification of the Board of Directors’ appointment of KPMG LLP as our independent registered public accounting firm for our 2017 fiscal year; |

| (3) | the approval of a non-binding advisory resolution to approve the compensation of our named executive officers; |

| (4) | the approval, on a non-binding advisory basis, of the frequency (every one, two, or three years) of the non-binding stockholder vote on the compensation of our named executive officers; and |

| (5) | the approval of the Spectrum Brands Holdings, Inc. Amended and Restated 2011 Omnibus Equity Award Plan. |

All stockholders of record as of December 14, 2016 will be entitled to vote at the Annual Meeting, whether in person or by proxy. If you are a stockholder of record you can vote your shares in one of two ways: either in person or by proxy at the Annual Meeting. If you are a stockholder of record and choose to vote in person, you must attend the Annual Meeting. If you wish to attend the Annual Meeting in person, you must reserve your seat by January 17, 2017 by contacting our Investor Relations Department at (608) 275-3340. Additional details regarding requirements for admission to the Annual Meeting are described in the attached proxy statement under the heading “Voting in Person.”

If you choose to vote by proxy you may do so by using the Internet or the telephone, or by completing, signing, dating, and returning the enclosed proxy card in the envelope provided. Whichever method you use to vote by proxy, each valid proxy received in time will be voted at the Annual Meeting in accordance with your instructions. To ensure that your proxy is voted, your proxy, whether given by the Internet, the telephone, or mailing the proxy card, should be received by 5:00 p.m., Central time, on January 23, 2017. If you submit a proxy without giving instructions, your shares will be voted as recommended by the Board of Directors. If your shares are held on your behalf by a bank, broker, or other nominee, the proxy statement accompanying this notice will provide additional information on how you may vote your shares. Stockholders of record who attend the Annual Meeting may revoke their proxies and vote in person at the Annual Meeting, if they wish to do so.

By Order of the Board of Directors,

Nathan E. Fagre

Senior Vice President, General Counsel and Secretary

3001 Deming Way

Middleton, WI 53562

December 21, 2016

Table of Contents

Table of Contents

| Page | ||||

| 65 | ||||

| 66 | ||||

| PROPOSAL 3: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION |

68 | |||

| 70 | ||||

| 71 | ||||

| 83 | ||||

| 83 | ||||

| 83 | ||||

| 84 | ||||

| A-1 | ||||

| A Amended and Restated Spectrum Brands Holdings, Inc. 2011 Omnibus Equity Award Plan |

||||

Table of Contents

SPECTRUM BRANDS HOLDINGS, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, JANUARY 24, 2017

We are furnishing this proxy statement to stockholders of record of Spectrum Brands Holdings, Inc. (“Spectrum” or the “Company”) in connection with the solicitation of proxies for use at the annual meeting of stockholders to be held on Tuesday, January 24, 2017 at 8:30 a.m., local time, at the Westin Stonebriar Hotel, 1549 Legacy Drive, Frisco, Texas 75034, and at any adjournments or postponements thereof (the “Annual Meeting”).

The Notice of Annual Meeting of Stockholders (the “Annual Meeting Notice”), this proxy statement, the accompanying proxy card, and an Annual Report to stockholders for the fiscal year ended September 30, 2016 (the “Annual Report”) containing financial statements and other information of interest to stockholders are expected to be first mailed to stockholders on or about December 23, 2016.

Matters to be Voted Upon at the Annual Meeting

At the Annual Meeting you will be voting on the following proposals:

| 1. | to elect two Class I directors to the Board of Directors for a three-year term expiring at the 2020 annual meeting; |

| 2. | to ratify the Board of Directors’ appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending on September 30, 2017 (“Fiscal 2017”); |

| 3. | to approve a non-binding advisory resolution regarding the compensation of our named executive officers; |

| 4. | to approve, on a non-binding advisory basis, the frequency (every one, two, or three years) of the non-binding stockholder vote on the compensation of our named executive officers; and |

| 5. | to approve the Spectrum Brands Holdings, Inc. Amended and Restated 2011 Omnibus Equity Award Plan. |

You will also be voting on such other business as may properly come before the meeting or any adjournment thereof.

Recommendations of Our Board of Directors

Our Board of Directors recommends that you vote your shares as follows:

| 1. | FOR the election of two Class I directors to the Board of Directors for a three-year term expiring at the 2020 annual meeting (PROPOSAL 1); |

| 2. | FOR the ratification of the appointment by the Board of Directors of KPMG LLP as our independent registered public accounting firm for Fiscal 2017 (PROPOSAL 2); |

| 3. | FOR the approval of the non-binding advisory resolution to approve the compensation of our named executive officers (PROPOSAL 3); |

| 4. | FOR the approval, on a non-binding advisory basis, of the option of every “one year” for holding the non-binding stockholder vote on the compensation of our named executive officers (PROPOSAL 4); and |

| 5. | FOR the approval of the Spectrum Brands Holdings, Inc. Amended and Restated 2011 Omnibus Equity Award Plan (PROPOSAL 5). |

1

Table of Contents

Stockholders Entitled to Vote at the Meeting

Stockholders of Record

Only stockholders of record of the Company’s common stock, par value $.01 per share (the “Common Stock”), as of December 14, 2016 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting. You are considered the stockholder of record with respect to your shares if your shares are registered directly in your name with Computershare Shareowner Services, the Company’s stock transfer agent. If you are a stockholder of record, you can vote your shares in one of two ways: either in person or by proxy at the Annual Meeting. If you are a stockholder of record and choose to vote in person, you must attend the Annual Meeting, which will be held at 8:30 a.m., local time, at the Westin Stonebriar Hotel, 1549 Legacy Drive, Frisco, Texas 75034.

If you choose to vote by proxy you may do so by using the Internet, the telephone, or by completing, signing, dating, and returning the enclosed proxy card in the envelope provided. Whichever method you use to vote by proxy, each valid proxy received in time will be voted at the Annual Meeting in accordance with your instructions. To ensure that your proxy is voted, your proxy, whether given by the Internet, the telephone, or by mailing the proxy card, should be received by 5:00 p.m., Central time, on January 23, 2017. If you submit a proxy without giving instructions, your shares will be voted as recommended by the Board of Directors.

On the Record Date, there were 59,666,219 shares of Common Stock issued and outstanding, constituting all of our issued and outstanding voting securities. Stockholders of record are entitled to one vote for each share of Common Stock they held as of the Record Date.

Shares Held with a Bank, Broker, or Other Nominee

If your shares are held in an account with a bank, broker, or another third party that holds shares on your behalf, referred to herein as a “nominee,” then you are considered the “beneficial owner” of these shares, and your shares are referred to as being held in “street name.” If you hold your shares in “street name,” you must vote your shares in the manner provided for by your bank, broker, or other nominee. Your bank, broker, or other nominee has enclosed or provided a voting instruction card with this proxy statement for you to use in directing the bank, broker, or other nominee how to vote your shares.

If your shares are held by a bank, broker, or other nominee, they may not be voted or may be voted contrary to your wishes if you do not provide your bank, broker, or other nominee with instructions on how to vote your shares. Brokers, banks, and other nominees have the authority under the rules of the New York Stock Exchange (“NYSE”) to vote shares held in accounts by their customers in the manner they see fit, or not at all, on “routine” matters if their customers do not provide them with voting instructions. Proposals 1, 3, 4, and 5 are not considered to be routine matters, but Proposal 2 is considered to be a routine matter. When a proposal is not routine and the bank, broker, or other nominee has not received your voting instructions, a bank, broker, or other nominee will not be permitted to vote your shares and a broker “non-vote” will occur. To ensure your shares are voted in the manner you desire, you should provide instructions to your bank, broker, or other nominee on how to vote your shares for each of the proposals to be voted on at the Annual Meeting in the manner provided for by your bank, broker, or other nominee.

A “quorum” of stockholders is necessary to hold the Annual Meeting. A quorum will exist at the Annual Meeting if the holders of record of a majority of the number of shares of Common Stock outstanding as of the Record Date are present in person or represented by proxy at the Annual Meeting. Broker “non-votes” and shares held as of the Record Date by holders who are present in person or represented by proxy at the Annual Meeting, but who have abstained from voting or have not voted with respect to some or all of such shares on any proposal to be voted on at the Annual Meeting, will be counted as present for purposes of establishing a quorum.

2

Table of Contents

Votes Required with Respect to Each Proposal

To be elected as a Class I director at the Annual Meeting (Proposal 1), each candidate for election must receive a plurality of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting. In a plurality vote, the director nominee with the most affirmative votes in favor of his or her election to a particular directorship will be elected to that directorship.

The affirmative vote of the holders of a majority of the votes represented at the Annual Meeting in person or by proxy is required to ratify the Board of Directors’ appointment of KPMG LLP as our independent registered public accounting firm for Fiscal 2017 (Proposal 2). The affirmative vote of the holders of a majority of the votes cast on the proposal at the Annual Meeting in person or by proxy is required to approve the non-binding advisory resolution relating to the compensation of the Company’s named executive officers (Proposal 3) and the Amended and Restated Spectrum Brands Holdings, Inc. 2011 Omnibus Equity Award Plan (Proposal 5). With respect to the non-binding advisory vote relating to the frequency of the stockholder advisory vote on the named executive officers’ compensation (Proposal 4), the option receiving the most votes cast (i.e., every one, two, or three years) will be considered the frequency approved by the stockholders.

With regards to Proposal 1 (election of directors), shares represented by proxies that are marked “WITHHELD” and shares that are not voted will be excluded entirely from the vote and will have no effect on the outcome of this vote because the directors are elected by a plurality vote. With regards to Proposal 2 (ratification of KPMG LLP’s appointment as auditor), shares marked as “ABSTAIN” and shares which are not voted will be considered present in person or represented by proxy at the Annual Meeting and will have the effect of a vote against this proposal because approval of this proposal requires the affirmative vote of the holders of a majority of the shares of Common Stock represented at the Annual Meeting in person or by proxy. With regards to Proposal 3 (approval of the non-binding advisory resolution relating to the compensation of our named executive officers) and Proposal 5 (approval of the Amended and Restated Spectrum Brands Holdings, Inc. 2011 Omnibus Equity Award Plan), shares marked as “ABSTAIN” will have the effect of a vote against each such proposal, and shares which are not voted will have no effect on the proposals, because approval of each of these proposals requires the affirmative vote of the holders of a majority of the shares of Common Stock cast on the proposal at the Annual Meeting. With regards to Proposal 4 (the non-binding advisory vote on the frequency of the stockholder advisory vote on executive compensation), shares marked as “ABSTAIN” and shares which are not voted will be excluded entirely from the vote and will have no effect on the outcome of this vote because the stockholders’ recommendation with respect to Proposal 4 is determined by a plurality vote.

What is a Proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. For the purposes of the Annual Meeting, if you use the Internet or telephone to vote your shares, or complete the attached proxy card and return it to us by 5:00 p.m., Central time, on January 23, 2017, you will be designating the officers of the Company named on the proxy card to act as your proxy and to vote on your behalf in accordance with the instructions you have given via the Internet, by telephone, or on the proxy card at the Annual Meeting.

Voting by Proxy

Stockholders of Record

If you are a stockholder of record you can vote your shares in one of two ways: either in person or by proxy at the Annual Meeting. If you are a stockholder of record and choose to vote in person, you must attend the Annual Meeting, which will be held at 8:30 a.m., local time, at the Westin Stonebriar Hotel, 1549 Legacy Drive, Frisco, Texas 75034. We recommend that you vote by proxy even if you currently plan to attend the Annual

3

Table of Contents

Meeting so that your vote will be counted if you later decide not to or are unable to attend the Annual Meeting. You may revoke your vote at any time before 5:00 p.m. Central time, on January 23, 2017, by:

| • | attending the Annual Meeting in person and voting again; or |

| • | signing and returning a new proxy card with a later date or by submitting a later-dated proxy by telephone or via the Internet, since only your latest proxy received by 5:00 p.m., Central time, on January 23, 2017 will be counted. |

If you are a stockholder of record, there are several ways for you to vote your shares by proxy:

| • | By Mail. You may submit your proxy by completing, signing, and dating the attached proxy card and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Proxy cards submitted by mail must be received by 5:00 p.m., Central time, on January 23, 2017. |

| • | By Telephone or Over the Internet. You may submit your proxy by telephone or via the Internet by following the instructions provided on the proxy card. If you submit your proxy by telephone or via the Internet, you do not need to return a proxy card by mail. Internet and telephone proxy submission is available 24 hours a day. Proxies submitted by telephone or the Internet must be received by 5:00 p.m., Central time, on January 23, 2017. |

| • | In Person at the Annual Meeting. You may vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you also submit your proxy by telephone or via the Internet, or by completing, signing, dating, and returning the attached proxy card by the applicable deadline so that your vote will be counted if you later decide not to or are unable to attend the meeting. Details regarding requirements for admission to the Annual Meeting are described below under the heading “Voting in Person.” |

Voting instructions are included on your proxy card. If you properly submit your proxy by telephone, the Internet, or by mail in time for it to be voted at the Annual Meeting, one of the individuals named as your proxy, each of whom is one of our officers, will vote your shares as you have directed. If you submit your proxy by telephone, the Internet, or by mail, but do not indicate how your shares are to be voted with respect to one or more of the proposals to be voted on at the Annual Meeting, as necessary to vote your shares on each proposal, your shares will be voted in accordance with the recommendations of our Board of Directors: (1) FOR the election of the director nominees, (2) FOR the ratification of the appointment KPMG LLP as the Company’s independent registered public accounting firm for Fiscal 2017, (3) FOR the approval of the non-binding advisory resolution to approve the compensation of our named executive officers, (4) FOR the approval of the option of every “one year” for holding the non-binding stockholder vote on the compensation of our named executive officers, (5) FOR the approval of the Amended and Restated Spectrum Brands Holdings, Inc. 2011 Omnibus Equity Award Plan, and (6) in accordance with the best judgment of the named proxies on other matters properly brought before the Annual Meeting.

Our Board of Directors has no knowledge of any matters that will be presented for consideration at the Annual Meeting other than those described herein. The named proxies will also have discretionary authority to vote upon any adjournment or postponement of the Annual Meeting, including for the purpose of soliciting additional proxies.

Shares Held with a Bank, Broker, or Other Nominee

If you hold your shares in “street name,” you must vote your shares in the manner provided for by your bank, broker, or other nominee. Your bank, broker, or other nominee has enclosed or provided a voting instruction card for you to use in directing the bank, broker, or other nominee on how to vote your shares. To ensure that your shares are voted according to your wishes, be certain that you provide instructions to your bank, broker, or other nominee on how to vote your shares in the manner that they specify. Your bank, broker, or other

4

Table of Contents

nominee will be permitted to vote your shares without instruction from you on Proposal 2, but will not be permitted to vote your shares on Proposals 1, 3, 4, or 5 without your instructions. As a result, if you do not provide your bank, broker, or other nominee with instructions on how to vote your shares with respect to Proposal 2, your bank, broker, or other nominee may vote your shares in a different manner than you would have voted if you had provided instructions to your bank, broker, or other nominee, and your vote will not be cast for Proposals 1, 3, 4, and 5. Abstentions will have the same effect as a vote against the adoption of Proposals 2, 3, and 5, and will have no effect on the outcome of the vote on Proposals 1 and 4. Broker “non-votes” will have the same effect as a vote against the adoption of Proposal 2, and will have no effect on the outcome of the vote on Proposals 1, 3, 4, and 5.

Revoking Your Proxy

If you are a stockholder of record, you may revoke your proxy before it is voted by:

| • | signing and returning a new proxy card with a later date or by submitting a later-dated proxy by telephone or the Internet, since only your last proxy received by 5:00 p.m., Central time, on January 23, 2017 will be counted; |

| • | notifying the Secretary of the Company in writing by 5:00 p.m., Central time, on January 23, 2017 that you have revoked your proxy; or |

| • | voting in person at the Annual Meeting. |

If you hold your shares in “street name,” you must contact your bank, broker, or other nominee to revoke your proxy.

Voting in Person

If you are a stockholder of record and you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the Annual Meeting. All stockholders planning to attend the Annual Meeting in person must contact our Investor Relations Department at (608) 275-3340 by January 17, 2017 to reserve a seat at the Annual Meeting. For admission, stockholders should come to the Annual Meeting check-in area no less than 15 minutes before the Annual Meeting is scheduled to begin. Stockholders of record should bring a form of photo identification so their share ownership can be verified. A beneficial owner holding shares in “street name” must also bring an account statement or letter from his or her bank or brokerage firm showing that he or she beneficially owns shares as of the close of business on the record date, along with a form of photo identification. Registration will begin at 8:00 a.m., local time and the Annual Meeting will begin at 8:30 a.m., local time.

If your shares are held in the name of your broker, bank, or other nominee, and you plan to attend the Annual Meeting and wish to vote in person, you must bring a legal proxy from your broker, bank, or other nominee authorizing you to vote your “street name” shares held as of the Record Date in order to be able to vote at the Annual Meeting. A legal proxy is an authorization from your bank, broker, or other nominee permitting you to vote the shares that it holds in its name.

We, on behalf of the Board of Directors, are soliciting proxies in connection with this Annual Meeting. The Company will bear the costs of the solicitation. We have engaged Georgeson Inc. to assist us in soliciting proxies for a fee of approximately $7,500 plus reasonable out-of-pocket expenses. In addition to the solicitation of proxies by mail, proxies may also be solicited by our directors, officers, and employees in person or by telephone, e-mail, or fax, for which they will receive no additional compensation. We will also reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to stockholders.

5

Table of Contents

Delivery of Proxy Materials and Annual Report to Households

The rules of the Securities and Exchange Commission (the “SEC”) permit companies and banks, brokers, or other nominees to deliver a single copy of an annual report and proxy statement to households at which two or more stockholders reside (commonly referred to as “householding”). Beneficial owners sharing an address who have been previously notified by their broker, bank, or other nominee and who have consented to householding, either affirmatively or implicitly by not objecting to householding, will receive only one copy of the Annual Meeting Notice, our Annual Report and this proxy statement. If you hold your shares in your own name as a holder of record, householding will not apply to your shares.

Beneficial owners who reside at a shared address at which a single copy of the Annual Meeting Notice, our Annual Report and this proxy statement is delivered may obtain a separate copy of the Annual Meeting Notice, our Annual Report and/or this proxy statement without charge by sending a written request to Spectrum Brands Holdings, Inc., 3001 Deming Way, Middleton, Wisconsin 53562, Attention: Vice President, Investor Relations, by calling us at (608) 275-3340, or by writing to us via e-mail at investorrelations@spectrumbrands.com. We will promptly deliver an Annual Meeting Notice, Annual Report and/or this proxy statement upon request.

Not all banks, brokers, or other nominees may offer the opportunity to permit beneficial owners to participate in householding. If you want to participate in householding and eliminate duplicate mailings in the future, you must contact your bank, broker, or other nominee directly. Alternatively, if you want to revoke your consent to householding and receive separate annual reports and proxy statements for each beneficial owner sharing your address, you must contact your bank, broker, or other nominee to revoke your consent.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JANUARY 24, 2017

You may obtain copies of our public filings, including this proxy statement, our 2016 Annual Report on Form 10-K, and the form of proxy relating to the Annual Meeting, without charge from our website at www.spectrumbrands.com under “Investor Relations – SEC Filings” and “Investor Relations – Annual Report,” or from the SEC’s website at www.sec.gov. You also may request a copy of these materials, without charge, by sending an e-mail to investorrelations@spectrumbrands.com. Please make your request no later than January 16, 2017 to facilitate timely delivery. If you do not request materials pursuant to the foregoing procedures, you will not otherwise receive an e-mail or electronic copy of the materials. For meeting directions please call (608) 275-3340.

6

Table of Contents

The Board of Directors currently consists of nine members, as determined in accordance with our Second Amended and Restated By-Laws (our “By-Laws”). David M. Maura is our Executive Chairman of the Board of Directors. In accordance with our Amended and Restated Certificate of Incorporation (our “Charter”), the Board of Directors is divided into three classes (designated Class I, Class II, and Class III, respectively), with each class consisting of three directors. The current term of office of the Class I directors expires at the Annual Meeting. The Class II and Class III directors are serving terms that expire at the annual meeting of stockholders to be held in 2018 and 2019, respectively. The three classes are currently comprised of the following directors:

| • | Class I consists of Kenneth C. Ambrecht, Eugene I. Davis, and Andreas Rouvé, who will serve until the Annual Meeting; |

| • | Class II consists of David M. Maura, Terry L. Polistina, and Hugh R. Rovit, who will serve until the annual meeting of stockholders to be held in 2018; and |

| • | Class III consists of Omar M. Asali, Norman S. Matthews, and Joseph S. Steinberg who will serve until the annual meeting of stockholders to be held in 2019. |

Mr. Davis, who currently serves as a Class I director, has informed the Board that he has decided not to stand for re-election and accordingly will be leaving the Board and its committees upon the conclusion of his term at the Annual Meeting, after serving on our Board since 2010. Mr. Davis has served on our Audit Committee and our Compensation Committee. Mr. Davis is leaving the Board to pursue other endeavors, and not as a result of a disagreement with the Company or the Board. The Nominating and Corporate Governance Committee recommended, and the Board approved, the nomination of Mr. Davis for re-election at the upcoming Annual Meeting, given the value he brought to the Board from his background and professional experiences. However, Mr. Davis decided on his own initiative not to stand for re-election in light of his other professional commitments and opportunities. We thank Mr. Davis for his years of service and dedication to the Board and the Company. Following Mr. Davis’ departure at the Annual Meeting, the size of the Board will be reduced to eight directors.

The names of the nominees being presented for consideration by the stockholders (all of whom are incumbent directors) and our continuing directors, their ages, the years in which they became directors of the Company, and certain other information about them are set forth on the following pages. Proxies cannot be voted for a greater number of persons than the two nominees. Except for (i) Spectrum Brands, Inc. (“SBI”), which is a subsidiary of the Company; (ii) Applica Consumer Products, Inc. (“Applica”) which was merged into SBI during fiscal 2015; (iii) Russell Hobbs, Inc. (“Russell Hobbs”), which was merged into SBI during fiscal year 2010; (iv) Shaser, Inc., which is an indirect majority owned subsidiary of the Company; and (v) HRG Group, Inc. (“HRG”), which owns a majority of the Company’s voting securities and may be deemed a parent company or affiliate of the Company, none of the corporations or other organizations referred to on the following pages with which a director or nominee for director has been employed or otherwise associated is currently a parent, subsidiary, or other affiliate of the Company.

7

Table of Contents

Nominees for Re-Election to the Board of Directors

The nominees for directors in Class I, whose three-year terms will expire at the Annual Meeting, are as follows:

| Kenneth C. Ambrecht Age 71 |

Mr. Ambrecht has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI from August 2009 to June 2010. Since December 2005, Mr. Ambrecht has served as a principal of KCA Associates LLC, through which he provides advice on financial transactions. From July 2004 to December 2005, Mr. Ambrecht served as a Managing Director with the investment banking firm First Albany Capital, Inc. Prior to that, Mr. Ambrecht was a Managing Director with Royal Bank Canada Capital Markets. Prior to that post, Mr. Ambrecht worked with the investment bank Lehman Brothers as Managing Director with its capital market division. Mr. Ambrecht is also a member of the Board of Directors of American Financial Group, Inc. During the past five years, Mr. Ambrecht has also served as a director of Dominion Petroleum Ltd. and Fortescue Metals Group Limited. Mr. Ambrecht serves as the Chairman of our Compensation Committee and is a member of our Audit and our Nominating and Corporate Governance Committees. Mr. Ambrecht’s experience in banking and capital markets led the Board of Directors to conclude that he should be a member of the Board of Directors. | |

| Andreas Rouvé Age 55 |

Mr. Rouvé has served as one of our directors since October 2015. Mr. Rouvé was appointed our Chief Executive Officer, effective April 1, 2015, and he previously held the position of Chief Operating Officer of the Company, effective February 2014, until his appointment to Chief Executive Officer. Mr. Rouvé previously held the position of President of the Company’s international activities beginning in January 2013. Previously, commencing in 2007, he served as Senior Vice President and Managing Director of Spectrum Brands’ European Battery and Personal Care business and subsequently led the integration of the Home Appliances and Pet Supplies European businesses in 2010-2011. Mr. Rouvé joined Spectrum Brands in 2002 as Chief Financial Officer of the European Battery division. Prior to that, he worked 13 years with VARTA AG in a variety of management positions, including Chief Financial Officer of VARTA Portable Batteries from 1999 to 2002, Managing Director Asia from 1997 to 1999, and Director of Finance of 3C Alliance L.L.P., a U.S. joint venture of VARTA, Duracell, and Toshiba, from 1995 to 1997. Mr. Rouvé holds a Master’s of Business Administration (Diplom-Kaufmann) from the University of Mannheim (Germany) and a Doctor of Economics and Social Science (Dr. rer. soc. oec.) from the University of Linz (Austria). Mr. Rouvé’s extensive experience with the global operations of the Company since 2002 and his appointment as Chief Executive Officer this year led the Board of Directors to conclude that he should be a member of the Board of Directors. | |

8

Table of Contents

Directors Continuing in Office

The directors continuing in office in Class II, whose three-year terms will expire at the 2018 annual meeting of stockholders, are as follows:

| David M. Maura Age 44 |

Mr. Maura has served as our Executive Chairman, effective as of January 20, 2016. Prior to such appointment, Mr. Maura served as Chairman of the Board of Directors since July 2011 and served as interim Chairman of the Board and as one of our directors since June 2010. Mr. Maura was a Managing Director and the Executive Vice President of Investments at HRG from October 2011 until November 2016, and has been a member of HRG’s board of directors since May 2011. Mr. Maura previously served as a Vice President and Director of Investments of Harbinger Capital from 2006 until 2012, where he was responsible for investments in consumer products, agriculture and retail sectors. Prior to joining Harbinger Capital in 2006, Mr. Maura was a Managing Director and Senior Research Analyst at First Albany Capital, where he focused on distressed debt and special situations, primarily in the consumer products and retail sectors. Prior to First Albany, Mr. Maura was a Director and Senior High Yield Research Analyst in Global High Yield Research at Merrill Lynch & Co. Mr. Maura was a Vice President and Senior Analyst in the High Yield Group at Wachovia Securities, where he covered various consumer product, service, and retail companies. Mr. Maura began his career at ZPR Investment Management as a Financial Analyst. During the past five years, Mr. Maura has served on the board of directors of Ferrous Resources, Ltd., Russell Hobbs (formerly Salton, Inc.), Applica, Inc., and HRG. Mr. Maura received a B.S. in Business Administration from Stetson University and is a CFA charterholder. Mr. Maura’s broad experience in M&A, the consumer products and retail sector, finance and investments, and his relationship with HRG led the Board of Directors to conclude that he should be a member of the Board of Directors. | |

| Terry L. Polistina Age 53 |

Mr. Polistina has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI from August 2009 to June 2010. Mr. Polistina is also a director of Entic, Inc. and Shaser, Inc. Mr. Polistina served as our President, Small Appliances since June 2010 and became President – Global Appliances in October 2010 and left in September 2013. Prior to that time, Mr. Polistina served as the CEO and President of Russell Hobbs. Mr. Polistina served as Chief Operating Officer at Applica, Inc. in 2006 to 2007 and Chief Financial Officer from 2001 to 2007, at which time Applica, Inc. combined with Russell Hobbs. Mr. Polistina also served as a Senior Vice President of Applica, Inc. since June 1998. Mr. Polistina received an undergraduate degree in finance from the University of Florida and holds a Masters of Business Administration from the University of Miami. Mr. Polistina’s experience with the operations of Russell Hobbs and Applica, Inc. led the Board of Directors to conclude that he should be a member of the Board of Directors. | |

9

Table of Contents

| Hugh R. Rovit Age 56 |

Mr. Rovit has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI from August 2009 to June 2010. Mr. Rovit is presently Chief Executive Officer of Ellery Homestyles, a leading supplier of branded and private label home fashion products to major retailers, offering curtains, bedding, throws and specialty products. Previously, Mr. Rovit served as Chief Executive Officer of Sure Fit Inc., a marketer and distributor of home furnishing products from 2006 through 2012, and was a Principal at a turnaround management firm Masson & Company from 2001 through 2005. Previously, Mr. Rovit held the positions of Chief Financial Officer of Best Manufacturing, Inc., a manufacturer and distributor of institutional service apparel and textiles, from 1998 through 2001 and Chief Financial Officer of Royce Hosiery Mills, Inc., a manufacturer and distributor of men’s and women’s hosiery, from 1991 through 1998. Mr. Rovit is a director of Xpress Retail and a director emeritus of Nellson Nutraceuticals, Inc., Kid Brands Inc., Atkins Nutritional, Inc., Oneida, Ltd., Cosmetic Essence, Inc. and Twin Star International. Mr. Rovit received his Bachelor of Arts degree cum laude from Dartmouth College and has a Masters of Business Administration from the Harvard Business School. Mr. Rovit is a member of our Audit Committee. Mr. Rovit’s experience with the operations and management of various consumer products companies led the Board of Directors to conclude that he should be a member of the Board of Directors. |

The directors continuing in office in Class III, whose three-year terms will expire at the 2019 annual meeting of stockholders, are as follows:

| Omar M. Asali Age 46 |

Mr. Asali has served as our Vice Chairman of the Board of Directors and as one of our directors since July 2011. Mr. Asali has served as a director of HRG since May 2011, and has been a senior officer of HRG since June 2011. Mr. Asali has served as the Chief Executive Officer since March 2015 and President of HRG since October 2011; in November 2016, Mr. Asali announced his plan to leave HRG in the second half of Fiscal 2017. Mr. Asali is also a member of the Board of Directors of Fidelity & Guaranty Life, Front Street Re (Cayman) Ltd., and NZCH Corporation, each of which is a subsidiary of HRG. Mr. Asali is responsible for overseeing the day-to-day activities of HRG, including M&A activity and overall business strategy for HRG and its underlying subsidiaries. Mr. Asali has been directly involved in all of HRG’s acquisitions across all sectors, and he is actively involved in HRG’s management and investment activities. Prior to becoming President of HRG, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital Partners LLC (“Harbinger Capital”), where he was responsible for global portfolio strategy and business development. Before joining Harbinger Capital in 2009, Mr. Asali was the co-head of Goldman Sachs Hedge Fund Strategies (“Goldman Sachs HFS”) where he helped manage approximately $25 billion of capital allocated to external managers. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Mr. Asali previously worked at Capital Guidance, a boutique private equity firm. Mr. Asali began his career working for a public accounting firm. Mr. Asali received an MBA from Columbia Business School and a B.S. in Accounting from Virginia Tech. Mr. Asali is a member of our Nominating and Corporate Governance Committee. Mr. Asali’s experience and in-depth knowledge |

10

Table of Contents

| of M&A, capital markets and the financial services industry enables Mr. Asali to provide valuable guidance to the Board of Directors, including with respect to assessment of M&A opportunities, business and financial market trends and strategic planning. These considerations, as well as Mr. Asali’s extensive experience in M&A, finance and investments and his relationship with HRG, led the Board of Directors to conclude that Mr. Asali should be a member of the Board of Directors. | ||

| Norman S. Matthews Age 83 |

Mr. Matthews has served as one of our directors since June 2010. Prior to that time, he had served as a director of SBI since August 2009. Mr. Matthews has over three decades of experience as a business leader in marketing and merchandising, and is currently an independent business consultant. As former President of Federated Department Stores, he led the operations of one of the nation’s leading department store retailers with over 850 department stores, including those under the names of Bloomingdales, Burdines, Foley’s, Lazarus and Rich’s, as well as various specialty store chains, discount chains and Ralph’s Grocery. In addition to his senior management roles at Federated Department Stores, Mr. Matthews also served as Senior Vice President and General Merchandise Manager at E.J. Korvette and Senior Vice President of Marketing and Corporate Development at Broyhill Furniture Industries. Mr. Matthews is a Princeton University graduate, and earned his Master’s degree in Business Administration from Harvard Business School. He also currently serves on the Boards of Directors at Party City, The Children’s Place Retail Stores, Inc., is a director emeritus of Henry Schein, Inc., Sunoco, The Progressive Corporation, Toys R’ Us, Duff & Phelps Corporation, and Federated Department Stores, and is a trustee emeritus at the American Museum of Natural History. Mr. Matthews is the Chairman of our Nominating and Corporate Governance Committee. Mr. Matthews’ extensive experience with the operations of various notable consumer products retailers led the Board of Directors to conclude that he should be a member of the Board of Directors. | |

| Joseph S. Steinberg Age 72 |

Mr. Steinberg has served as one of our directors since February 2015. Mr. Steinberg is currently Chairman of the Board of Leucadia National Corporation, where he has served as a director since 1978 and as President from 1979 to 2013. Mr. Steinberg also is the Chairman of the Board of HRG, a position he has held since December 2014 after becoming a director in July 2014. Mr. Steinberg also has served as Chairman of the Board of HomeFed Corporation since 1999 and as a director since 1998, and is a member of the board of directors of Crimson Wine Group, Ltd. Mr. Steinberg has served as a director of Jefferies Group, LLC since April 2008 and previously served as a director of Mueller Industries, Inc. from September 2011 to September 2012. Mr. Steinberg’s extensive experience with finance and investments and his leadership position at HRG led the Board of Directors to conclude that he should be a member of the Board of Directors. | |

11

Table of Contents

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

In addition to those directors named above who are also executive officers of the Company, set forth below is certain information concerning non-director employees who serve as executive officers of the Company. Our executive officers serve at the discretion of the Board of Directors. Except for SBI, none of the corporations or other organizations referred to below with which an executive officer has been employed or otherwise associated is a parent, subsidiary, or other affiliate of the Company.

Mr. Douglas L. Martin, age 54, was appointed our Executive Vice President and Chief Financial Officer in September 2014. Prior to joining the Company, Mr. Martin served from September 2012 to August 2014 as Executive Vice President and Chief Financial Officer of Newell Brands, Inc. (formerly known as Newell Rubbermaid Inc.), a global marketer of consumer and commercial products, including writing, home solutions, tools, commercial products, and baby and parenting brands. Mr. Martin was employed by Newell Brands, Inc. since 1987, serving in a variety of senior financial roles, including Deputy Chief Financial Officer from February 2012 to September 2012, Vice President of Finance – Newell Consumer from November 2011 to February 2012, Vice President of Finance – Office Products from December 2007 to November 2011, and Vice President and Treasurer from June 2002 to December 2007. Mr. Martin began his career with KPMG LLP, holds a bachelor’s degree in accounting from Rockford College, Illinois, and is a Certified Public Accountant.

Mr. Nathan E. Fagre, age 61, was appointed our Vice President, General Counsel and Secretary in January 2011, and was promoted to Senior Vice President, General Counsel and Secretary in May 2012. In this role, Mr. Fagre serves as the chief legal officer of the Company and also manages the environmental, health, safety and sustainability function, insurance and risk matters, and government affairs. He previously had served as Senior Vice President, General Counsel and Secretary for ValueVision Media, Inc. from May 2000 until January 2011. Prior to that time, he had served as Senior Vice President, General Counsel and Secretary for the exploration and production division of Occidental Petroleum Corporation, from May 1995 until April 2000. Before joining Occidental Petroleum Corporation, Mr. Fagre had been in private law practice with Sullivan & Cromwell, LLP and Gibson, Dunn & Crutcher, LLP. Mr. Fagre graduated with a bachelor’s degree from Harvard College in 1977, received a master of philosophy (M.Phil.) degree in international relations from Oxford University in 1979, and received a J.D. from Harvard Law School in 1982. Mr. Fagre has served as a director of the Greater Madison Chamber of Commerce since 2012, and as a director of Shaser, Inc., a medical device company, since 2013.

Ms. Stacey L. Neu, age 50, was appointed in April of 2010 as Vice President, Human Resources, and was promoted to Senior Vice President, Human Resources in January of 2014. Ms. Neu previously served as the Division Vice President for Human Resources for the Global Batteries and Appliances business, and before that was the Division Vice President for Human Resources for the Home & Garden business. Prior to those assignments, she was Senior Director for Human Resources for the Personal Care business. She was originally hired by Spectrum in October of 2005 to oversee the Battery and Personal Care – Talent Management function and lead the people integration efforts related to the acquisition of United Industries. Before joining Spectrum, Ms. Neu was employed for six years at Charter Communications in various human resources leadership roles culminating in her appointment to Vice President Corporate Human Resources from 2003 to 2005. Ms. Neu holds a Bachelor of Science Degree in Business from the University of Phoenix.

12

Table of Contents

BOARD ACTIONS; BOARD MEMBER INDEPENDENCE;

COMMITTEES OF THE BOARD OF DIRECTORS

During our fiscal year ended September 30, 2016 (“Fiscal 2016”), our Board of Directors held four regular meetings, one special meeting, and acted by unanimous written consent on six occasions. The non-management directors met separately in executive sessions on four occasions immediately following each of the regular board meetings. The chairmen of each of the committees of the Board of Directors rotate service as the presiding director in the executive sessions of the Board of Directors. All of our directors attended all of the Board of Directors meetings and all of the meetings of any committee on which he served during Fiscal 2016.

Our Board of Directors has affirmatively determined that none of the following directors has a material relationship with the Company (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company): Kenneth C. Ambrecht, Eugene I. Davis, Norman S. Matthews, Terry L. Polistina and Hugh R. Rovit. Our Board of Directors has adopted the definition of “independent director” set forth under Section 303A.02 of the New York Stock Exchange Listed Company Manual (the “NYSE Listed Company Manual”) to assist it in making determinations of independence. The Board of Directors has determined that the directors referred to above currently meet these standards and qualify as independent. The Board of Directors has made no determination with respect to the remaining directors.

All of our directors attended our 2016 annual meeting of stockholders, and we expect all continuing members of our Board of Directors to attend the Annual Meeting.

Our Board of Directors evaluates the appropriate leadership structure for the Company on an ongoing basis, including whether or not one individual should serve as both Chief Executive Officer and Chairman of our Board of Directors. While the Board of Directors has not adopted a formal policy, we currently separate the positions of Chief Executive Officer and Chairman of our Board of Directors. Andreas Rouvé currently serves as our Chief Executive Officer and President. Mr. Maura has been serving as the Chairman of the Board of Directors since 2011, as interim Chairman of the Board of Directors and one of our directors since 2010, and became the Executive Chairman of the Board of Directors in 2016. The Board of Directors believes that the respective roles of Mr. Rouvé and Mr. Maura best utilize their skills and qualifications in the service of the Company at this time. The Board retains the ability to adjust its leadership structure as the needs of the business change.

Committees Established by Our Board of Directors

The Board of Directors has designated three principal standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The functions of each committee and the number of meetings held by each committee in Fiscal 2016 are noted below.

Audit Committee. The Audit Committee has been established in accordance with Section 303A.06 of the NYSE Listed Company Manual and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the overall purpose of overseeing the Company’s accounting and financial reporting processes and audits of our financial statements. The Audit Committee is responsible for monitoring (i) the integrity of our financial statements, (ii) the independent registered public accounting firm’s qualifications and independence, (iii) the performance of our internal audit function and independent auditors, and (iv) our compliance with legal and regulatory requirements. The responsibilities and authority of the Audit Committee are described in further detail in the Charter of the Audit Committee of the Board of Directors of Spectrum Brands Holdings, Inc., as adopted by the Board of Directors in June 2010, a copy of which is available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.” The report of the Audit Committee for Fiscal 2016 is included elsewhere in this proxy statement.

The current members of our Audit Committee are Kenneth C. Ambrecht, Eugene I. Davis, and Hugh R. Rovit. Our Audit Committee held four regular meetings, three special meetings, and and acted by unanimous written consent on three occasions during Fiscal 2016. All of the members of the Audit Committee attended all

13

Table of Contents

meetings. Each of the members of the Audit Committee qualifies as independent, as such term is defined in Section 303A.02 of the NYSE Listed Company Manual, Section 10A(m)(3)(B) of the Exchange Act, and Exchange Act Rule 10A-3(b).

Mr. Davis is the current Chairperson of our Audit Committee and is an Audit Committee Financial Expert. Mr. Davis will step down from the Audit Committee upon the expiration of his term as a director at the Annual Meeting. The Board of Directors expects to name a new committee member and a new Chairperson of the Audit Committee at its first meeting following the Annual Meeting. The Board also has determined that Mr. Rovit is an Audit Committee Financial Expert. Mr. Davis and Mr. Rovit possess the attributes of an “audit committee financial expert” set forth in the rules promulgated by the SEC in furtherance of Section 407 of the Sarbanes-Oxley Act of 2002. Mr. Davis currently serves on the audit committee of one other public company. The Board of Directors has determined that such service does not impair the ability of Mr. Davis to serve effectively on the Audit Committee.

Compensation Committee. Our Compensation Committee is responsible for (i) overseeing our compensation and employee benefits plans and practices, including our executive compensation plans and our incentive-compensation and equity-based plans, (ii) evaluating and approving the performance of the Executive Chairman and the CEO and other executive officers in light of those goals and objectives, and (iii) reviewing and discussing with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. The responsibilities and authority of the Compensation Committee are described in further detail in the Charter of the Compensation Committee of the Board of Directors of Spectrum Brands Holdings, Inc., as adopted by the Board of Directors in November 2016, a copy of which is available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.” The report of the Compensation Committee for Fiscal 2016 is included elsewhere in this proxy statement.

The current members of our Compensation Committee are Kenneth C. Ambrecht and Eugene I. Davis. Mr. Davis will step down from the Compensation Committee upon the expiration of his term as a director at the Annual Meeting. The Board of Directors expects to name a new member of the Compensation Committee at its first meeting following the Annual Meeting. Our Compensation Committee held four regular meetings, two special meetings, and acted by unanimous written consent on three occasions during Fiscal 2016. All committee members attended all meetings. Mr. Ambrecht is Chairperson of our Compensation Committee. As a controlled company under Section 303A.00 of the NYSE Listed Company Manual, our Compensation Committee is not required to comply with the independence requirements set forth in Section 303A.05 of the NYSE Listed Company Manual. However, we have made a determination that all of the members of our Compensation Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Listed Company Manual.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is responsible for (i) identifying and recommending to the Board of Directors individuals qualified to serve as our directors and on our committees of the Board of Directors, (ii) advising the Board of Directors with respect to board composition, procedures and committees, (iii) developing and recommending to the Board of Directors a set of corporate governance principles applicable to the Company, and (iv) overseeing the evaluation process of the Board of Directors, our Executive Chairman, and our Chief Executive Officer. The responsibilities and authority of the Nominating and Corporate Governance Committee are described in further detail in the Charter of the Nominating and Corporate Governance Committee of the Board of Directors of Spectrum Brands Holdings, Inc., as adopted by the Board of Directors in January 2016, a copy of which is available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.”

The current members of our Nominating and Corporate Governance Committee are Kenneth C. Ambrecht, Omar M. Asali, and Norman S. Matthews. Our Nominating and Corporate Governance Committee held three regular meetings and acted by unanimous written consent on one occasion during Fiscal 2016. Mr. Matthews is

14

Table of Contents

the Chairperson of our Nominating and Corporate Governance Committee. As a controlled company under Section 303A.00 of the NYSE Listed Company Manual, our Nominating and Corporate Governance Committee is not required to comply with the independence requirements set forth in Section 303A.04 of the NYSE Listed Company Manual. As such, we have not made a determination as to whether all of the members of our Nominating and Corporate Governance Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Listed Company Manual.

Risk Management and the Board’s Role

The Company’s risk assessment and management function is led by the Company’s senior management, which is responsible for day-to-day management of the Company’s risk profile, with oversight from the Board of Directors and its Committees. Central to the Board of Directors’ oversight function is our Audit Committee. In accordance with the Audit Committee Charter, the Audit Committee is responsible for the oversight of the financial reporting process and internal controls. In this capacity, the Audit Committee is responsible for discussing guidelines and policies governing the process by which senior management of the Company and the relevant departments of the Company, including the internal audit department, assess and manage the Company’s exposure to risk, as well as the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

The Company has implemented an annual formalized risk assessment process. In accordance with the Company’s process, a committee (the “Governance Risk and Compliance Committee”) of certain members of senior management has the responsibility to identify, assess, and oversee the management of risk for the Company. This committee obtains input from other members of management and subject matter experts as needed. Management uses the collective input received to measure the potential likelihood and impact of key risks and to determine the adequacy of the Company’s risk management strategy. Periodically representatives of this committee report to the Audit Committee on its activities and the Company’s risk exposure.

Availability of Corporate Governance Guidelines, Committee Charters, and Codes of Ethics

Copies of our (i) Corporate Governance Guidelines, (ii) charters for our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, (iii) Code of Business Conduct and Ethics, and (iv) Code of Ethics for the Principal Executive Officer and Senior Financial Officers are available at our Internet website at www.spectrumbrands.com under “Investor Relations – Corporate Governance.” Any stockholder may obtain copies of these documents by sending a written request to Spectrum Brands Holdings, Inc., 3001 Deming Way Middleton, WI 53562, Attention: Vice President, Investor Relations, by calling us at (608) 275-3340, or by writing to us via e-mail at investorrelations@spectrumbrands.com. None of the information posted on our website is incorporated by reference into this proxy statement.

15

Table of Contents

Nominations for our Board of Directors are made by our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may identify potential board candidates from a variety of sources, including recommendations from current directors or management, recommendations of stockholders or any other source the Nominating and Corporate Governance Committee deems appropriate. The Nominating and Corporate Governance Committee may also engage a search firm or consultant to assist in identifying, screening, and evaluating potential candidates. The Nominating and Corporate Governance Committee has been given the sole authority to retain and terminate any such search firms or consultants.

In considering candidates for our Board of Directors, the Nominating and Corporate Governance Committee evaluates the entirety of each candidate’s credentials. The Nominating and Corporate Governance Committee considers, among other things: (i) business or other relevant experience; (ii) expertise, skills, and knowledge; (iii) integrity and reputation; (iv) the extent to which the candidate will enhance the objective of having directors with diverse viewpoints, backgrounds, expertise, skills, and experience; (v) willingness and ability to commit sufficient time to Board of Directors responsibilities; and (vi) qualification to serve on specialized board committees, such as the Audit Committee or Compensation Committee.

Our stockholders may recommend potential director candidates to our Nominating and Corporate Governance Committee by following the procedures described below. The Nominating and Corporate Governance Committee will evaluate recommendations from stockholders in the same manner that it evaluates recommendations from other sources. If you wish to recommend a potential director candidate for consideration by the Nominating and Corporate Governance Committee, please send your recommendation to Spectrum Brands Holdings, Inc., 3001 Deming Way Middleton, WI 53562, Attention: Corporate Secretary. Any notice relating to candidates for election at the 2018 annual meeting must be received no earlier than September 26, 2017 and no later than October 26, 2017 in accordance with our By-Laws. You should use first class, certified mail in order to ensure the receipt of your recommendation. Any recommendation must include: (i) your name and address and a list of the number of shares of Common Stock that you own; (ii) the name, age, business address, and residence address of the proposed candidate; (iii) the principal occupation or employment of the proposed candidate over the preceding ten years and the person’s educational background; (iv) a statement as to why you believe such person should be considered as a potential candidate; (v) a description of any affiliation between you and the person you are recommending; and (vi) the consent of the proposed candidate to your submitting him or her as a potential candidate. You should note that the foregoing process relates only to bringing potential candidates to the attention of the Nominating and Corporate Governance Committee. This process will not give you the right to directly propose a nominee at any meeting of stockholders.

Under our By-Laws, stockholders may also nominate candidates for election at an annual meeting of stockholders. See “Stockholder Proposals for 2018 Annual Meeting” for details regarding the procedures and timing for the submission of such nominations. Director nominees submitted through this process will be eligible for election at the annual meeting, but information about these candidates will not be included in proxy materials sent to stockholders prior to the meeting, except as described in that section.

16

Table of Contents

Report of the Compensation Committee of the Board of Directors

The Compensation Committee of the Board of Directors (the “Compensation Committee”) has reviewed and discussed the following section of this report entitled “Compensation Discussion and Analysis” with management. Based on this review and discussion, the Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2016.

Compensation Committee

Kenneth C. Ambrecht (Chairman)

Eugene I. Davis

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis section sets forth a description of our practices regarding executive compensation matters with respect to our named executive officers. You should read this section together with the executive compensation tables and narratives which follow, as these sections inform one another.

Executive Summary

Our compensation programs are administered by the Compensation Committee of the Board of Directors. Our compensation programs are designed to attract and retain highly qualified executives, to align the compensation paid to executives with the business strategies of our Company, and to align the interests of our executives with the interests of our stockholders. These programs are based on our “pay-for-performance” philosophy in which variable compensation represents a majority of an executive’s potential compensation.

In terms of our Fiscal 2016 performance, we exceeded both our Company-wide adjusted EBITDA target and our free cash flow target, in each case as defined at the beginning of the fiscal year and then as determined by the Compensation Committee following the end of the fiscal year for our performance plans. Further details on the applicable targets and actual performance are set forth below. During Fiscal 2016, management maintained its focus on cost improvements while continuing its integration of the acquisitions made in Fiscal 2015, investing for future growth and working to overcome the negative impacts of foreign exchange.

Compensation decisions for the named executive officers (“NEOs”) in Fiscal 2016 continued our philosophy of pay-for-performance and our focus on the corporate goals of increased growth, free cash flow generation, and building for superior long-term shareholder returns. During the year, the Company appointed David M. Maura as our new Executive Chairman of the Board, and the Company and SBI entered into an employment agreement with Mr. Maura, effective as of January 20, 2016. The Compensation Committee’s compensation philosophy guided the compensation arrangements for Mr. Maura, with a strong weighting of total compensation on performance-based incentives. During the time periods of Fiscal 2015 and Fiscal 2016, the overall levels of executive compensation (other than for Mr. Maura) have been reduced from previous levels.

For Fiscal 2017, the Compensation Committee established the following incentive programs for the NEOs and other officers and key employees:

| • | An annual cash incentive bonus plan, tied to Board-approved adjusted EBITDA and free cash flow targets; |

17

Table of Contents

| • | An annual equity incentive plan, tied to Board-approved targets for adjusted EBITDA and free cash flow; and |

| • | The Spectrum S3B Plan, a two-year superior achievement incentive program for Fiscal 2017 and 2018, designed to provide incentives for the NEOs, senior management and selected key employees to achieve stretch goals over the two years in the areas of adjusted earnings per share and return on assets. |

In establishing our compensation programs, our Compensation Committee obtains the advice of its independent compensation consultant, Lyons, Benenson & Company Inc. (“LB & Co.”), and evaluates the Company’s programs with reference to a peer group of 15 companies, as specified in the section titled “Role of Committee-Retained Consultants.”

At our 2014 Annual Meeting of Stockholders (the “2014 Annual Meeting”), our stockholders approved, on an advisory basis, the compensation of the Company’s NEOs as disclosed in the Compensation Discussion and Analysis, compensation tables, and related narrative disclosure in the proxy statement for the 2014 Annual Meeting. Our compensation practices as discussed herein are materially consistent with those discussed in the proxy statement for the 2014 Annual Meeting. Additionally, at our 2011 Annual Meeting of Stockholders, our stockholders held a separate vote, on an advisory basis, relating to the frequency of the advisory vote on the compensation of the Company’s NEOs, pursuant to which our stockholders indicated their preference that such vote be held every three years, which was the frequency recommended by the Board of Directors. At the upcoming Annual Meeting, we are conducting both a stockholder advisory vote on executive compensation, as well as an advisory vote relating to the frequency of the advisory vote on executive compensation. This year, our Board of Directors is recommending to the stockholders that the frequency of the advisory vote on pay should be on an annual basis, instead of every three years as in the past. See “Proposal 3: Non-Binding Advisory Vote on Executive Compensation” beginning on page 68 below, and “Proposal 4: Non-Binding Advisory Vote on the Frequency of Stockholder Votes on Executive Compensation” beginning on page 70 below.

Our Named Executive Officers

The Company’s NEOs during Fiscal 2016 consisted of the following persons:

| Named Executive Officer |

Position | |

| David M. Maura |

Executive Chairman of the Board of Directors | |

| Andreas Rouvé |

Chief Executive Officer and President | |

| Douglas L. Martin |

Executive Vice President and Chief Financial Officer | |

| Nathan E. Fagre |

Senior Vice President, General Counsel and Secretary | |

| Stacey L. Neu |

Senior Vice President, Human Resources |

Our Compensation Committee

The Compensation Committee is responsible for developing, adopting, reviewing, and maintaining the Company’s executive compensation programs in order to ensure that they continue to benefit the Company.

Background on Compensation Considerations

The Compensation Committee pursues several objectives in determining its executive compensation programs. It seeks to attract and retain highly qualified executives and ensure continuity of senior management for the Company as a whole and for each of the Company’s business segments, to the extent consistent with the overall objectives and circumstances of the Company. It seeks to align the compensation paid to our executives with the overall business strategies of the Company while leaving the flexibility necessary to respond to changing business priorities and circumstances. It also seeks to align the interests of our executives with those of our

18

Table of Contents

stockholders and seeks to reward our executives when they perform in a manner that creates value for our stockholders. In order to carry out this function, the Compensation Committee:

| • | Considers the advice of the independent compensation consultant engaged to advise on executive compensation issues and program design, including advising on the Company’s compensation program as it compares to similar companies; |

| • | Reviews compensation summaries for each NEO at least once a year, including the compensation and benefit values offered to each executive, accumulated value of equity and other past compensation awards, and other contributors to compensation; |

| • | Consults with our Chief Executive Officer and other management personnel and Company consultants, including our Senior Vice President, Human Resources, in regards to compensation matters and periodically meets in executive session without management to evaluate management’s input; and |

| • | Solicits comments and concurrence from other board members regarding its recommendations and actions at the Company’s regularly scheduled board meetings. |

Philosophy on Performance Based Compensation

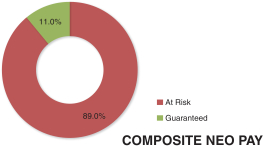

The Compensation Committee has designed the Company’s executive compensation programs so that, at target levels of performance, a significant portion of the value of each executive’s annual compensation (consisting of salary and incentive awards) is based on the Company’s achievement of performance objectives set by the Compensation Committee. We believe that a combination of annual fixed base pay and incentive performance-based pay provides our NEOs with an appropriate mix of current cash compensation and performance compensation. However, in applying these compensation programs to both individual and Company circumstances, the percentage of annual compensation based on the Company’s achievement of performance objectives set by the Compensation Committee varies by individual, and the Compensation Committee is free to design compensation programs that provide for target-level performance-based compensation to be an amount greater than, equal to, or less than 50% of total annual compensation. For example, for Fiscal 2017, the percentage of annual compensation at target based on the Company’s achievement of performance objectives (set by the Compensation Committee) for the NEOs is 89% for the five executives as a group. In addition, to highlight the alignment of the incentive plans with stockholder interests, all of the Company’s equity-based incentive programs are completely performance-based plans.

The remainder of each executive’s compensation is made up of amounts that do not vary based on performance. For all NEOs, these non-performance based amounts are set forth in such executive’s employment agreement or written terms of employment, as described below, subject to annual review and potential increase by the Compensation Committee. These amounts are determined by the Compensation Committee taking into account current market conditions, the Company’s financial condition at the time such compensation levels are determined, compensation levels for similarly situated executives with other companies, experience level, and the duties and responsibilities of such executive’s position.

19

Table of Contents

A component of incentive compensation also consists of multi-year programs. We believe that awards that have multi-year performance periods and that vest over time enhance the stability of our senior management team and provide greater incentives for our NEOs to remain at the Company.

Role of Committee-Retained Consultants

In Fiscal 2016, our Compensation Committee continued to retain an outside consultant, LB & Co., to assist us in formulating and evaluating executive and director compensation programs. During the past year, the Compensation Committee, directly or through our Senior Vice President, Human Resources, periodically requested LB & Co. to:

| • | Provide comparative market data for our peer group, and other groups on request, with respect to compensation matters; |

| • | Analyze our compensation and benefit programs relative to our peer group; |

| • | Advise the Compensation Committee on compensation matters and management proposals with respect to compensation matters; |

| • | Assist in the preparation of this report and the compensation tables provided herewith; and |

| • | On request, participate in meetings of the Compensation Committee. |

In order to encourage an independent view point, the Compensation Committee and its members had access to LB & Co. at any time without management present and have consulted from time to time with LB & Co. without management present.

LB & Co., with input from management and the Compensation Committee, developed a peer group of companies based on a variety of criteria, including type of business, revenue, assets and market capitalization. The composition of this peer group is reviewed annually by the Compensation Committee and the compensation consultant and, if appropriate, revised, based on changes in business orientation of peer group companies, changes in financial size or performance of the Company and the peer group companies, and merger, acquisition, spin-off or bankruptcy of companies in the peer group. At the end of Fiscal 2016, the peer group utilized consisted of 15 companies, comprised of Central Garden and Pet Company, Church & Dwight Co., Inc., The Clorox Company, Edgewell Personal Care Company, Energizer Holdings, Inc., Fortune Brands Home & Security, Inc., Hanesbrands, Inc., Hasbro, Inc., Helen of Troy Limited, Mattel, Inc., Newell Brands, Inc., Nu Skin Enterprises, Inc., The Scotts Miracle-Gro Company, Stanley Black & Decker, Inc., and Tupperware Brands Corporation. During 2016, the peer group was revised to delete Jarden Corporation because it was acquired by Newell Brands Inc. during 2016 and is no longer a public company. In connection with this transaction, Newell Brands Inc. succeeded to the business of Newell Rubbermaid Inc., and therefore Newell Brands Inc. has replaced Newell Rubbermaid Inc. in the peer group. Additionally, for 2016, the peer group has been revised to add Helen of Troy Limited because of its industry focus in personal care products and its comparable annual revenues and market capitalization to the Company. While the Compensation Committee does not target a particular range for total compensation as compared to our peer group, it does take this information into account when establishing compensation programs.