As filed with the Securities and Exchange Commission on June 30, 2017

Registration No. 333-212859

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 4 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

QPAGOS

(Exact Name of Registrant as Specified in Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

5961

(Primary Standard Industrial Classification Code Number)

33-1230229

(I.R.S. Employer Identification No.)

Paseo de la

Reforma 404 Piso 15 PH

Col. Juarez, Del. Cuauhtemoc

Mexico, D.F. C.P. 06600

+52 (55) 55-110-110

(Address and telephone number of principal executive offices)

1900 Glades Road, Suite 265

Boca Raton, Florida 33431

(Mailing Address)

Gaston Pereira

Chief Executive Officer

Paseo del la Reforma

404 Piso 15 PH

Col. Juarez, Del. Cuauhtemoc

Mexico, D.F. C.P. 06600

+52 (55) 55-110-110

(Name, address and telephone number of agent for service)

Copy to:

Leslie Marlow, Esq.

Hank Gracin, Esq.

Gracin & Marlow, LLP

The Chrysler Building

405 Lexington Avenue, 26th Floor

New York, New York 10174

(212) 907-6457

Approximate Date of Proposed Sale to the Public: From time to time after the date this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act of 1934.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered (1)(2) | Proposed Maximum Offering Price per Security (2) | Proposed Maximum Aggregate Offering Price(3) | Amount of Registration Fee | ||||||||||||

| Common stock, par value $0.0001 per share | 9,917,074 | $ | 0.91 | $ | 9,024,537 | $ | 909 | (4) | ||||||||

| Common stock, par value $0.0001 per share, issuable upon exercise of warrants with an exercise price of $.625 per share | 6,219,200 | $ | 0.91 | $ | 5,659,472 | $ | 570 | (4) | ||||||||

| Total | 16,136,274 | $ | 14,684,009 | $ | 1,479 | (5) | ||||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include such indeterminate number of shares of our common stock as may be issuable with respect to the shares being registered hereunder to prevent dilution by reason of any stock dividend, stock split, recapitalization or other similar transaction. |

| (2) | 9,917,074 shares of common stock are to be offered by the Selling Stockholders named herein and 6,219,200 are shares of common stock issuable upon exercise of warrants having an exercise price of $.625 per share. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) of the Securities Act based upon the closing price of the Registrant’s common stock on the OTCQB on August 1, 2016. |

| (4) | Estimated solely for the purpose of calculating the registration fee for these shares in accordance with Rule 457(c) of the Securities Act based upon the closing price of the Registrant’s common stock on the OTCQB on August 1, 2016. |

| (5) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION CONTAINED IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS DECLARED EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED JUNE 30, 2017

QPAGOS

16,136,274 Shares of Common Stock

This prospectus relates to the resale by the investors listed in the section titled “Selling Stockholders,” which we refer to as the Selling Stockholders (the “Selling Stockholders”) of up to 16,136,274 shares (the “Shares”) of our common stock, par value $0.0001 per share, of which (i) 9,917,074 are shares of common stock; and (ii) 6,219,200 are shares of common stock issuable upon exercise of warrants having an exercise price of $.625 per share (the “Warrants”), which warrants were assumed by us in the Merger that we consummated in May 2016 (the “Merger”) and were originally issued in the December 2015 private placement conducted by our subsidiary, Qpagos Corporation (the “2015 Offering”) (of which 1,435,200 were issued to Paulson Investment Company, LLC (the “Placement Agent”). We are registering the resale of the 4,784,000 shares of common stock that were issued in the Merger in exchange for shares of stock held by investors that engaged in the 2015 Offering and all of the shares issuable upon exercise of the Warrants as required by the Registration Rights Agreement that we entered into with certain of the Selling Stockholders (the “Registration Rights Agreements”) and the placement agent agreement that we entered into with the Placement Agent.

The Selling Stockholders may offer and sell or otherwise dispose of the Shares described in this prospectus from time to time through public or private transactions at prevailing market prices, at prices related to such prevailing market prices, at varying prices determined at the time of sale, at negotiated prices, or at fixed prices. See “Plan of Distribution” for more information.

We will not receive any of the proceeds from the Shares sold by the Selling Stockholders. However, we will receive net proceeds of any Warrants exercised (unless warrants are exercised on a cashless basis, which feature only applies to certain warrants). See “Use of Proceeds.”

Our common stock is traded on the OTCQB, under the symbol “QPAG.” The closing price of our stock on June 28, 2017 was $0.32.

Investing in our securities involves a high degree of risk. We have also received an opinion from our independent auditors which raises substantial doubt about our ability to continue as a going concern. See “Risk Factors” beginning on page 5 of this prospectus for more information regarding the risks relating to an investment in our securities.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or the prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company” within the meaning of the recently enacted Jumpstart Our Business Startups Act and we have elected to comply with certain reduced public company reporting requirements.

The date of this prospectus is June _, 2017.

TABLE OF CONTENTS

i

You should rely only on the information contained in this prospectus. Neither we nor the Selling Stockholders have authorized anyone to provide you with information that is different from such information. If anyone provides you with different or inconsistent information, you should not rely on it. The Selling Stockholders are offering to sell common stock only in jurisdictions where offers and sales are permitted. You should not assume that the information we have included in this prospectus is accurate as of any date other than the date of this prospectus or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since that date.

The distribution of this prospectus and the issuance of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the issuance of the common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the common stock offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

It is important for you to read and consider all of the information contained in this prospectus in making your investment decision. To understand the offering fully and for a more complete description of the offering you should read this entire document carefully, including particularly the “Risk Factors” section beginning on page 5. You also should read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information.”

As used in this prospectus, unless the context requires otherwise, the terms “we,” “us,” “our,” or “the Company” refer to QPAGOS and its subsidiaries on a consolidated basis. References to “Selling Stockholders” refer to those stockholders listed herein under “Selling Stockholders” and their successors, assignees and permitted transferees.

ABOUT FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act, about us and our subsidiaries and its subsidiaries. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “could,” “should,” “projects,” “plans,” “goal,” “targets,” “potential,” “estimates,” “pro forma,” “seeks,” “intends,” or “anticipates” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of various transactions, and statements about the future performance, operations, products and services of our Company and our subsidiaries. We caution our stockholders and other readers not to place undue reliance on such statements.

Our businesses and operations are and will be subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may materially differ from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the risk factors set forth in the section entitled “Risk Factors” beginning on page 5 of this prospectus, the risk factors set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 filed with the Securities and Exchange Commission (the “SEC”) on December 13, 2016, our Annual Report on Form 10-K for the year ended December 31, 2016 filed with the SEC on April 17, 2017 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 filed with the SEC on May 22, 2017.

All written or oral forward-looking statements attributable to us or any person acting on our behalf made after the date of this prospectus are expressly qualified in their entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

ii

This summary highlights information contained elsewhere in this prospectus. This summary is not intended to be complete and does not contain all of the information that you should consider before deciding to invest in our securities. We urge you to read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 5. Except where the context requires otherwise, in this prospectus the terms “Company,” “QPAGOS,” “we,” “us” and “our” refer to QPAGOS, a Nevada corporation, and its direct and indirect subsidiaries, Qpagos Corporation and Qpagos S.A.P.I de C.V and Redpag Electronicos S.A.P.I de C.V

Company Overview

Overview

We are a provider of next generation physical and virtual payment services that we introduced to the Mexican market in the third quarter of 2014. We have a ten-year renewable exclusive license agreement for the use of technology that can be used to perform services that are similar to services that have been successfully deployed with this technology in several European, Asian, North and South American countries.

We provide an integrated network of kiosks, terminals and payment channels that enable consumers to deposit cash, convert it into a digital form and remit the funds to any merchant in our network quickly and securely. We help consumers and merchants connect more efficiently in markets and consumer segments, such as Mexico, that are largely cash-based and lack convenient alternatives for consumers to pay for goods and services in physical, online and mobile environments. For example, we license technology that can be used to pay bills, add minutes to mobile phones, purchase transportation tickets, shop online, buy digital services or send money to a friend or relative.

Our current focus is on Mexico which remains a cash-dominated society for retail consumer payments with approximately 80% of the value of personal payments exchanged in cash (Bank of Mexico). The penetration of electronic payment services, such as credit and debit cards and point of sale terminals, significantly lags behind more developed economies. We believe that opportunities for our services in Mexico are vast. With over 109 million mobile subscribers in Mexico, 85% of which are under prepaid plans, mobile top-up alone, was a $12 billion business in 2014 as reported by PwC Telecom in Mexico 2015, America Móvil 4Q 2015. We believe that there is opportunity for growth in the Mexican market and we have expanded to service providers beyond the mobile telephone operators to service providers of electricity, transportation, utilities, municipal services and taxes, consumer credit installments, insurance premiums, and many more. Altogether as of the end of the first quarter of 2017 our platform had integrated 140 such services.

Our primary strategy in Mexico to date has been the attraction of service providers as well as the deployment of kiosks through Redpag Electrónicos S.A.P.I. de C.V., our kiosk management subsidiary. During the three months ended March 31, 2017 and 2016, QPAGOS generated net revenues of $927,310 and $629,934, respectively, from its operations in Mexico, an increase of 47.2 %. During the years ended December 31, 2016 and 2015, we generated net revenues of $2,691,896 and $1,127,944, respectively, an increase of 139%, from our operations in Mexico. Our primary source of revenue are fees we receive for processing payments made by consumers to service providers. We also generate revenue from non-payment services such as kiosk sales. We currently have in excess of 140 service providers integrated into our payment gateway, which includes all mobile phone providers in Mexico as well as most utility companies, financial services, entertainment venues and others. As of March 31, 2017, QPAGOS deployed over 274 kiosks and terminals and we service an additional 440 kiosks of an independent distributor. QPAGOS kiosks and terminals can be found at convenience stores, next to metro stations, retail stores, airport terminals, education centers, and malls in major urban centers, as well as many small and rural towns.

In addition, QPAGOS has contracted for an electronic wallet which should enable consumers to hold balances in its kiosks for future use or to receive change. Launched in the first quarter of 2016 customers can now use cash and/or stored value in order to pay for goods and services across physical or virtual environments interchangeably. Also in the first quarter of 2016, QPAGOS launched our mobile app by which smart phone users can now access the exact menu of services available in our kiosks and make payments from the convenience of their phones. Cash is uploaded to the electronic wallet app via kiosks.

We believe that QPAGOS platform provides simple and intuitive user interfaces, convenient access and best-in-class services. QPAGOS runs its network and processes its transactions using a proprietary, advanced technology platform that leverages the latest virtualization, analytics and security technologies to create a fast, highly reliable, secure and redundant system. We believe that the breadth and reach of this network, along with the proprietary nature of its technology platform, differentiate us from our competitors and allow us to effectively manage and update our services and realize significant operating leverage with growth in volumes.

1

QPAGOS Corporate History and Background

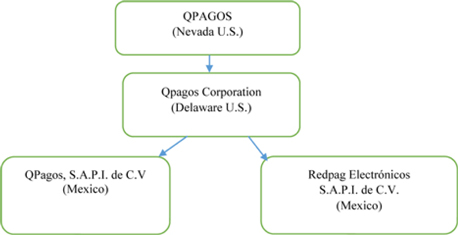

Our current corporate structure is as follows:

QPAGOS was incorporated on September 25, 2013 under the laws of the State of Nevada originally under the name Asiya Pearls, Inc. On May 27, 2016, Asiya Pearls, Inc. filed a Certificate of Amendment to its Articles of Incorporation to change its name to QPAGOS.

Qpagos Corporation was incorporated on May 1, 2015 under the laws of Delaware under the name Qpagos Corporation as the holding company for its two 99.9% owned operating subsidiaries, QPagos, S.A.P.I. de C.V. and Redpag Electrónicos S.A.P.I. de C.V. Each of these entities were incorporated in November 2013 in Mexico.

QPagos, S.A.P.I. de C.V. was formed to process payment transactions for service providers it contracts with, and Redpag Electrónicos S.A.P.I. de C.V. was formed to deploy and operate kiosks as a distributor.

On August 31, 2015, QPAGOS Corporation entered into various agreements with the shareholders of Qpagos and Redpag to give effect to a reverse merger transaction (the "Reverse Merger''). Pursuant to the Reverse Merger, the majority of the shareholders of Qpagos and Redpag effectively received shares in Qpagos Corporation, through various consulting and management agreements entered into with Qpagos Corporation and sold an effective 99.996% and 99.990% of the outstanding shares in Qpagos and Redpag, respectively to Qpagos Corporation. The series of transactions closed effective August 31, 2015. Upon the close of the Reverse Merger, Qpagos Corporation became the parent of Qpagos and Redpag and assumed the operations of these two companies as its sole business.

On May 12, 2016, Qpagos Corporation entered into an Agreement and Plan of Merger (the “Merger Agreement”) with QPAGOS and QPAGOS Merge, Inc., a Delaware corporation and wholly owned subsidiary of QPAGOS (“Merger Sub”). Pursuant to the Merger Agreement, on May 12, 2016 Qpagos Corporation and Merger Sub merged (the “Merger”), and Qpagos Corporation continued as the surviving corporation of the Merger and became a wholly owned subsidiary of QPAGOS. As a result of the Merger, each outstanding share of Qpagos Corporation common stock was converted into the right to receive two shares of QPAGOS common stock as set forth in the Merger Agreement. Under the terms of the Merger Agreement, we issued, and Qpagos Corporation stockholders received in a tax-free exchange, shares of our common stock such that Qpagos Corporation stockholders owned approximately 91% of our company immediately after the Merger. In addition, each outstanding warrant of Qpagos Corporation was assumed by us and converted into a warrant to acquire a number of shares of our common stock equal to twice the number of shares of common stock of Qpagos Corporation subject to the warrant immediately before the effective time of the Merger at an exercise price per share of Company common stock equal to 50% of the warrant exercise price for Qpagos Corporation common stock. There are no outstanding stock options of Qpagos Corporation.

On May 27, 2016, we changed our name from Asiya Pearls, Inc. to QPAGOS.

Our principal offices are located at Paseo del la Reforma 404 Piso 15 PH, Col. Juarez, Del. Cuauhtemoc, Mexico, D.F. C.P. 06600, and our telephone number at that office is +52 (55) 55-110-110. We also have offices in the United States that are located at 1900 Glades Road, Suite 265, Boca Raton, Florida 33431. We maintain an Internet website at www.qpagos.com. Neither this website nor the information on this website is included or incorporated in, or is a part of, this prospectus or any supplement to the prospectus.

2

Our Strategy

Our mission is to leverage the experience and success of other global companies in our industry, and establish ourselves as the leading developer and supplier of state-of-the-art electronic payment solutions to Mexican merchants and service providers across all consumer services sectors, such as: fixed and mobile telephone operators, internet services providers, cable, entertainment, public and municipal services such as electricity, water and gas, financial and travel services. Our near term strategy includes:

| · | Positioning ourselves as the leading consumer payment solutions provider for all service providers that rely on electronic payments for their collection needs. |

| · | Establishing a successful distributor network based on a competitive distribution model for entrepreneurs that look at our self-service kiosks as a profitable business opportunity, as well as retail chains and retail banks that need to expedite electronic payments that are clogging teller lines through the assistance of self-service kiosks. |

| · | Supporting distributors and franchisees through training, point of sale marketing materials, and an ever increasing amount of payment services, many of which are regional in nature. |

| · | Developing a Franchising Model through the creation and expansion of one-stop payment services stores which cater to the vast need for a digital payment solution in Mexico. |

| · | Developing a motivated and effective sales management team. |

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and therefore we intend to take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal controls over financial reporting audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an “emerging growth company.” In addition, the JOBS Act provides that an “emerging growth company” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to use the extended transition period for complying with new or revised accounting standards under the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates. We will remain an “emerging growth company” until the earlier of (1) the last day of the fiscal year: (a) following the fifth anniversary of the completion of this offering; (b) in which we have total annual gross revenue of at least $1.0 billion; or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. References herein to “emerging growth company” have the meaning associated with that term in the JOBS Act.

3

| Issuer | QPAGOS |

| Securities offered | This prospectus covers the resale of up to of up to 16,136,274 shares of common stock, of which (i) 9,917,074 are shares of common stock; and (ii) 6,219,200 are shares of common stock issuable upon exercise of the Warrants at an exercise price of $.625 per share. |

Total shares of common stock to be outstanding after this offering(1) |

55,604,000 shares |

| Use of Proceeds | We will not receive proceeds from the sale or other disposition of the shares of our common stock covered by this prospectus. However, we will receive net proceeds of any Warrants exercised (unless warrants are exercised on a cashless basis, which feature only applies to certain warrants). See “Use of Proceeds.” |

| Risk Factors | We have also received an opinion from our independent auditors which raises substantial doubt about our ability to continue as a going concern as a result of our operating losses, negative cash flows from operations and limited alternative sources of revenue. If we cannot raise adequate capital on acceptable terms or generate sufficient revenue from operations, we will need to revise or substantially curtail our business operations. You should carefully read and consider the information which is set forth under “Risk Factors,” together with all of the other information set forth in this prospectus, before deciding to invest in shares of our common stock. |

| OTCQB symbol | Our common stock is traded on the OTCQB, under the symbol “QPAG.” |

(1) The number of shares of our common stock outstanding is based on the number of shares of our common stock outstanding as of June 30, 2017 including the shares of common stock held by the Selling Stockholders and a further 150,000 returnable common shares issued to a convertible note holder which are only earned upon an event of default under the terms of the convertible note. Management considers an event of default unlikely and therefore the shares have not been recorded as issued in the financial statements below, which reflect 55,454,000 shares of common stock outstanding. This number also excludes 6,219,200 of common stock issuable upon exercise of the Warrants with a weighted average exercise price of $.625 per share.

4

Investing in our common stock involves a high degree of risk, and you should be able to bear the complete loss of your investment. You should carefully consider the risks described below, the other information in this prospectus and the documents incorporated by reference herein when evaluating our company and our business. If any of the following risks actually occur, our business could be harmed. In such case, the trading price of our common stock could decline and investors could lose all or a part of the money paid to buy our common stock

RISKS RELATING TO OUR BUSINESS

Risks Relating to Our Business and Industry

We have had limited operations to date.

Qpagos Corporation’s subsidiaries were incorporated in November 2013 and began deploying kiosks in Mexico in November 2014. As such, we have a very limited operating history. We have yet to demonstrate our ability to overcome the risks frequently encountered in the payment services industry and are still subject to many of the risks common to early stage companies, including the uncertainty as to our ability to implement our business plan, market acceptance of our proposed business and services, under-capitalization, cash shortages, limitations with respect to personnel, financing and other resources and uncertainty of our ability to generate revenues. There is no assurance that our activities will be successful or will result in any revenues or profit, and the likelihood of our success must be considered in light of the stage of our development. There can be no assurance that we will be able to consummate our business strategy and plans, or that financial, technological, market, or other limitations may force us to modify, alter, significantly delay, or significantly impede the implementation of such plans. We have insufficient results for investors to use to identify historical trends. Investors should consider our prospects in light of the risk, expenses and difficulties we will encounter as an early stage company. Our revenue and income potential is unproven and our business model is continually evolving. We are subject to the risks inherent to the operation of a new business enterprise, and cannot assure you that we will be able to successfully address these risks.

Our consolidated financial statements have been prepared assuming that it will continue as a going concern.

Our operating losses, negative cash flows from operations and limited alternative sources of revenue raise substantial doubt about our ability to continue as a going concern. The consolidated financial statements for the year ended December 31, 2016 do not include any adjustments that might result from the outcome of this uncertainty. If we cannot raise adequate capital on acceptable terms or generate sufficient revenue from operations, we will need to revise our business plans.

We may continue to generate operating losses and experience negative cash flows and it is uncertain whether we will achieve profitability.

For the three months ended March 31, 2017 and 2016, we incurred a net loss of $555,938 and $2,668,938, respectively. We have an accumulated deficit of $9,313,135 through March 31, 2017. For the years ended December 31, 2016 and 2015, we incurred a net loss of $4,731,049 and $3,309,673, respectively. We had an accumulated deficit of $8,757,197 through December 31, 2016. We expect to continue to incur operating losses until such time, if ever, as we are able to achieve sufficient levels of revenue from operations. There can be no assurance that we will ever generate significant sales or achieve profitability. Accordingly, the extent of future losses and the time required to achieve profitability, if ever, cannot be predicted at this point.

We also expect to experience negative cash flows for the foreseeable future as we fund our operating losses. As a result, we will need to generate significant revenues or raise additional financing in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability would likely negatively impact the value of our securities and financing activities.

To date we have not successfully generated sufficient revenue to pay our operating expenses and have relied on proceeds for recent note issuances to pay the deficiency.

As of May 23, 2017, we have outstanding debt in the principal amount of $768,848 owed to 7 investors pursuant to the terms of various notes that we issued. To date, we have not generated sufficient revenue to pay the balances owed under the notes and provide sufficient working capital to run our business. The outstanding principal amount of the notes (if any) is convertible at any time and from time to time at the election of the holder after certain periods of time into shares of our common stock at discounts to the market price of our common stock. In addition, upon the occurrence and during the continuation of an Event of Default (as defined in the notes), the notes each will become immediately due and payable and we have agreed to pay additional default interest rates. In addition, certain notes also provide for piggyback registration rights under certain circumstances, the payment of liquidated damages for failure to comply with such provisions and anti-dilution protection for issuances or deemed issuances of securities below the conversion price. Upon conversion of these notes, our current shareholders will suffer dilution, which could be significant.

If we cannot establish profitable operations, we will need to raise additional capital to fully implement our business plan, which may not be available on commercially reasonable terms, or at all, and which may dilute your investment.

Achieving and sustaining profitability will require us to increase our revenues and manage our operating and administrative expenses. We cannot guarantee that we will be successful in achieving profitability. If we are unable to generate sufficient revenues to pay our expenses and our existing sources of cash and cash flows are otherwise insufficient to fund our activities, we will need to raise additional funds to continue our operations and in order to fully implement our business plan. As of May 23, 2017, we and our subsidiaries have raised an aggregate of $8,023,187 from the sale of debt and equity securities. We estimate that we will need approximately $3,000,000 in order to implement our current business plan. If we do not generate such revenue from operations, we may be forced to limit our expansion. Furthermore, if we issue equity or debt securities to raise additional funds, our existing stockholders, may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we are unsuccessful in achieving profitability, and we cannot obtain additional funds on commercially reasonable terms or at all, we may be required to curtail significantly or cease our operations, which could result in the loss to investors of their investment in our securities.

5

We have identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future. If our internal control over financial reporting or our disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent fraud, or file our periodic reports in a timely manner, which may cause investors to lose confidence in our reported financial information and may lead to a decline in our stock price.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a- 15(f) under the Exchange Act. We have historically operated as a private company and the number and qualifications of our finance and accounting staff have not been consistent with those of a public company. We have identified material weaknesses in our internal controls with respect to our segregation of duties and review and accounting of certain complex transactions.

We have restated our consolidated financial statements as of December 31, 2015 and December 31, 2014 and March 31, 2016 and June 30, 2016.

We have begun to take actions that we believe will substantially remediate the material weaknesses identified in our internal controls over financial reporting. In response to the identification of our material weaknesses, we: (i) have retained a part-time Chief Financial Officer to segregate the duties of Chief Executive Officer and Chief Financial Officer; (ii) are in the process of establishing a review process for key aspects of our financial reporting process, including the accounting for complex transactions; (iii) expanding our finance and accounting staff and (iv) will seek to establish better operating controls and involve our board of directors in our internal controls process, which will involve establishing formal procedures to communicate deficiencies in internal controls on a timely basis, and encourage our board of directors to more actively participate in guiding management as it relates to internal controls matters. However, we cannot assure you that our internal control over financial reporting, as modified, will enable us to identify or avoid material weaknesses in the future. Regardless, following the completion of this annual report we will be required to expend time and resources to further improve our internal controls over financial reporting, including by expanding our finance and accounting staff.

The payment services industry is highly competitive, and many of our competitors are larger and have greater financial and other resources.

The payment services industry is highly competitive, and our continued growth depends on our ability to compete effectively with both traditional and non-traditional payment service providers. Although we do not currently face direct competition from any competitor in exactly the same kiosk-based line of business as ours, we currently and expect to face competition from a variety of financial and non-financial business groups which include retail banks, non-traditional payment service providers, such as retailers, like 7-Eleven and Walmart which provide mobile top-up services, and mobile network operators, traditional kiosk and terminal operators and electronic payment system operators, as well as other companies that provide various forms of payment services, including electronic payment and payment processing services. Competitors in our industry seek to differentiate themselves by features and functionalities such as speed, convenience, network size, accessibility, hours of operation, reliability and price. A significant number of these competitors have greater financial, technological and marketing resources than we have, operate robust networks and are highly regarded by consumers.

6

There is uncertainty as to market acceptance of our technology and services.

We have conducted our own research into the markets for our services; however, because we are a new entrant into the market, we cannot guarantee market acceptance of our services and have somewhat limited information on which to estimate our anticipated level of sales. Our services require consumers and service providers to adopt our technology. Our industry is susceptible to rapid technological developments and there can be no assurance that we will be able to match any new technological advances. If we are unable to match the technological changes in the needs of our customers the demand for our products will be reduced.

The technology upon which our business is dependent is licensed from a third party under the terms of a license agreement, which if terminated, would result in the cessation of our business operations.

The license with Janor Enterprises Ltd. (“Janor”) is for the rights to use three software programs upon which our business is completely dependent. The agreement is for a term of ten years, and may be extended for an additional ten years but may be terminated early by Janor if we fail to comply with its terms and conditions. The rights to the licensed programs terminate upon expiration or termination of the agreement. The payment for the rights granted under the license is a total of $1,000, payable in annual payments of $100 per year over ten years. While we do not expect that we will have difficulties making the annual license payment to Janor to maintain the license or otherwise complying with the agreement terms, we still are substantially dependent on this agreement and have no guarantee a dispute will not arise thereunder with Janor or that Janor will renew our agreement upon expiration of the extended term. In addition, as described below, our ability to maintain the exclusivity of the Janor license is subject to us making quarterly payments to Janor of $5,000 per quarter. If we are not able to maintain this license, we would have to cease operations unless we have developed or secured the rights to technology that would provide the same functionality and we are able to reconfigure our installed base of kiosks, terminals and other system infrastructure to work with the new technology. These hurdles would likely be extremely expensive and time consuming, as well as directly impact our ability to continue our business operations.

Our exclusive right to the technology that we license from Janor is subject to forfeiture if we fail to make certain quarterly payments.

Our ability to maintain the exclusivity of the Janor license is subject to us making quarterly payments to Janor of $5,000 per quarter. In consideration of these payments, Janor has agreed that neither it nor any of its subsidiary or affiliated entity will install a terminal and/or kiosk that incorporates the programs we use or a technology having the same or a similar effect nor will they provide any person or entity with the right to install a terminal and/or kiosk in Mexico that incorporates the programs we use or a technology having the same or a similar effect. If we should fail to make the quarterly payments, there is no prohibition from Janor licensing the same technology to another entity in Mexico that could compete with us. If Janor were to license the same technology to a third party with significant resources our competitive position in Mexico could be substantially harmed.

We rely on an outside vendor for the supply of key kiosk parts and the partial or complete loss of this supplier could cause customer supply or production delays and as a result potentially a loss of revenues.

We currently rely on a vendor based outside Mexico to manufacture substantial portions of critical hardware that are used with or included in our kiosks. Although we do not believe the contract is material to us because there are other vendors that could supply the hardware required for the kiosks, we do not have a contract with any other vendors and therefore, if our present vendor was to delay or terminate its performance, our business could be disrupted.

Although we may add or change our vendors in the future, our reliance on vendors based outside Mexico is expected to continue and involves other risks, including our limited control over the availability of components, delivery schedules, pricing and product quality. We may also experience delays, additional expenses and lost sales as a result of our dependency upon outside vendors. If the outside vendors on which we rely are not able to supply us with needed products or parts, or were to cease or interrupt production, and if other existing vendors were also unable to supply us in a timely manner, or on comparable terms, our business could be materially adversely impacted.

Our reliance on outside vendors for our kiosk hardware involves several risks, including the following:

| · | there are a number of reasons our suppliers of required parts may cease or interrupt production or otherwise fail to supply us with an adequate supply of required parts, including contractual disputes with our supplier or adverse financial developments at or affecting the supplier; |

| · | we have reduced control over the pricing of third party-supplied materials, and our suppliers may be unable or unwilling to supply us with required materials on commercially acceptable terms, or at all; |

| · | we have reduced control over the timely delivery of third party-supplied materials; and |

| · | our suppliers may be unable to develop technologically advanced products to support our growth and development of new systems. |

7

Disruptions in international trade and finance or in transportation also may have a material adverse effect on our business, financial condition and results of operation. Any significant disruption in our operations for any reason, such as regulatory requirements, scheduling delays, quality control problems, loss of certifications, power interruptions, fires, hurricanes, war or threats of terrorism, labor strikes, contract disputes, could adversely affect our sales and customer relationships. In addition, in the event of a breach of law by a vendor based outside of Mexico or a breach of a contractual obligation that has an adverse effect upon our operations, we may have little or no recourse because all of our vendors’ assets could be located in a foreign country, such as Russia, Italy, Germany, Canada or the People’s Republic of China where it may not be possible to effect service of process and uncertainty exists as to whether the courts in such foreign jurisdiction would recognize or enforce a judgment of a Mexican court obtained against the vendor.

We are subject to the economic risk and business cycles of our merchants and agents and the overall level of consumer spending.

The payment services industry depends heavily on the overall level of consumer spending. We are exposed to general economic conditions that affect consumer confidence, consumer spending, consumer discretionary income or changes in consumer purchasing habits. Economic factors such as employment levels, business conditions, energy and fuel costs, interest rates, and inflation rate could reduce consumer spending or change consumer purchasing habits. A reduction in the amount of consumer spending could result in a decrease in our revenue and profits. If our merchants make fewer sales of their products and services using our services or consumers spend less money per transaction, we will have fewer transactions to process at lower amounts, resulting in lower revenue. Weakening in the Mexican economy could have a negative impact on our merchants, as well as consumers who purchase products and services using our payment processing systems, which could, in turn, negatively impact our business, financial condition and results of operations, particularly if the recessionary environment disproportionately affects some of the market segments that represent a larger portion of our payment processing volume. In addition, these factors could force some of our merchants and/or agents to liquidate their operations or go bankrupt, or could cause our agents to reduce the number of their locations or hours of operation, resulting in reduced transaction volumes. We also have a certain amount of fixed costs, including salaries and rent, which could limit our ability to adjust costs and respond quickly to changes affecting the economy and our business.

We do not control the rates of the fees levied by QPAGOS agents on consumers.

QPAGOS agents pay it an agreed fee using a portion of the fees levied by them on consumers. The fee paid to QPAGOS by the agent is based on a percentage of the value of each transaction that QPAGOS processes or a fixed rate per transaction. However, in most cases the amount of fees levied by an agent on a consumer for each particular transaction is determined by such agent at its own discretion. QPAGOS usually does not cap the amount of such fees or otherwise control it. We believe that the fees set by agents are market-driven, and that our interests and QPAGOS agents’ interests are aligned with a view to maintaining fees at a level that would simultaneously result in our agents’ profitability and customer satisfaction. However, we can provide no assurance that agents will not raise fees to a level that will adversely affect the popularity of our services among consumers. At the same time, if QPAGOS is forced to cap customer fees to protect the strength of our brand or otherwise, it may lose a significant number of agents, which would reduce the penetration of our physical distribution network. In limited instances, we have introduced such caps at the request of our merchants. No assurance can be made that this trend will not increase. Material increases in customer fees by our agents or the imposition of caps on the rates of such fees by us could have an adverse effect on the business, financial condition and results of operations.

If consumer confidence in our business deteriorates, our business, financial condition and results of operations could be adversely affected.

Our business is built on consumers’ confidence in our brands, as well as our ability to provide fast, reliable payment services. As a consumer business, the strength of our brand and reputation are of paramount importance to us. A number of factors could adversely affect consumer confidence in our brand, many of which are beyond our control, and could have an adverse impact on our results of operations. These factors include:

| · | any regulatory action or investigation against us; |

| · | any significant interruption to our systems and operations; and |

| · | any breach of our security systems or any compromises of consumer data. |

In addition, we are largely dependent on our agents and, in the future, will be dependent, on franchisees to which we license our products to maintain the reputation of our brand. Despite the measures that we put in place to ensure their compliance with our performance standards, our lack of control over their operations may result in the low quality of service of a particular agent or franchisee being attributed to our brand, negatively affecting our overall reputation. Furthermore, negative publicity surrounding any assertion that our agents and/or merchants are implicated in fraudulent transactions, irrespective of the accuracy of such publicity or its connection with our current operations or business, could harm our reputation. Any event that hurts our brand and reputation among consumers as a reliable payment services provider could have a material adverse effect on our business, financial condition and results of operations.

8

A decline in the use of cash as a means of payment may result in a decline in the use of our kiosks and terminals.

Substantially all of our operations are in Mexico where a substantial part of the population relies on cash payments rather than credit and debit card payments or electronic banking. We believe that consumers making cash payments are more likely to use our kiosks and terminals than where alternative payment methods are available. As a result, we believe that our profitability depends on the use of cash as a means of payment. There can be no assurance that over time, the prevalence of cash payments in Mexico will not decline as a greater percentage of the population adopts credit and debit card payments and electronic banking. The shift from cash payments to credit and debit card payments and electronic banking could reduce our market share and payment volumes and may have a material adverse effect on our business, financial condition and results of operations.

Our business operations are geographically concentrated and could be significantly affected by any adverse change in the regions in which we operate.

Our business operations are located substantially in Mexico. While QPAGOS recently invested in a company developing similar services in the United States and we may expand our business to new geographic regions, we are and will continue to still be highly concentrated in Mexico. Because to date we derive all of our total revenues from our operations in Mexico and expect to continue to derive a significant portion of our revenue from operations in Mexico for the near future, our business is exposed to adverse regulatory and competitive changes, economic downturns and changes in political conditions in Mexico. Moreover, due to the concentration of our businesses in Mexico, our business is less diversified and, accordingly, is subject to greater regional risks than some of our competitors.

We are not currently subject to extensive government regulation; however, we could be subject to extensive government regulation, and there can be no guarantee that new regulations applicable to our business will not be enacted.

Currently our business is not impacted by government regulation; however, we may be subject to a variety of regulations aimed at preventing money laundering and financing criminal activity and terrorism, financial services regulations, payment services regulations, consumer protection laws, currency control regulations, advertising laws and privacy and data protection laws and therefore experience periodic investigations by various regulatory authorities in connection with the same, which may sometimes result in monetary or other sanctions being imposed on us. Many of these laws and regulations are constantly evolving, and are often unclear and inconsistent with other applicable laws and regulations making compliance challenging and increasing our related operating costs and legal risks. In particular, there has been increased public attention and heightened legislation and regulations regarding money laundering and terrorist financing. We may have to make significant judgment calls in applying anti-money laundering legislation and risk being found in non-compliance with such laws.

If local authorities in Mexico choose to enforce specific interpretations of the applicable legislation that differ from ours or enact new laws, we may be found to be in violation and subject to penalties or other liabilities. This could also limit our ability in effecting such payments going forward and may increase our cost of doing business.

In addition, there is significant uncertainty regarding future legislation on taxation of electronic payments in Mexico, including the place of taxation. Subsequent legislation and regulation and interpretations thereof, litigation, court rulings, or other events could expose us to increased costs, liability and reputational damage that could have a material adverse effect on our business, financial condition and results of operations.

We may not be able to complete or integrate successfully any potential future acquisitions, partnerships or joint ventures.

From time-to-time, we may evaluate possible acquisition transactions, partnerships or joint ventures, some of which may be material. Potential future acquisitions, partnerships and joint ventures may pose significant risks to our existing operations if they cannot be successfully integrated. These projects would place additional demands on our managerial, operational, financial and other resources, create operational complexity requiring additional personnel and other resources and require enhanced control procedures. In addition, we may not be able to successfully finance or integrate any businesses, services or technologies that we acquire or with which we form a partnership or joint venture. Furthermore, the integration of any acquisition may divert management’s time and resources from our core business and disrupt our operations. Moreover, even if we were successful in integrating newly acquired assets, expected synergies or cost savings may not materialize, resulting in lower than expected benefits to us from such transactions. We may spend time and money on projects that do not increase our revenue. Additionally, when making acquisitions it may not be possible for us to conduct a detailed investigation of the nature of the assets being acquired due to, for instance, time constraints in making the decision and other factors. We may become responsible for additional liabilities or obligations not foreseen at the time of an acquisition. In addition, in connection with any acquisitions, we must comply with various antitrust requirements. It is possible that perceived or actual violations of these requirements could give rise to regulatory enforcement action or result in us not receiving all necessary approvals in order to complete a desired acquisition. To the extent we pay the purchase price of any acquisition in cash, it would reduce our cash reserves, and to the extent the purchase price is paid with our stock, it could be dilutive to our stockholders. To the extent we pay the purchase price with proceeds from the incurrence of debt, it would increase our level of indebtedness and could negatively affect our liquidity and restrict our operations. All of the above risks could have a material adverse effect on our business, results of operations, financial condition, and prospects.

9

As our business develops we will need to implement enhanced compliance processes, procedures and controls with respect to the rules and regulations that apply to our business.

Our success requires significant public confidence in our ability to handle large and growing payment volumes and amounts of consumer funds, as well as comply with applicable regulatory requirements. Any failure to manage consumer funds or to comply with applicable regulatory requirements could result in the imposition of fines, harm our reputation and significantly diminish use of our products. In addition, if we are not in compliance with anti-corruption laws and other laws governing the conduct of business with government entities and/or officials (including local laws), we may be subject to criminal and civil penalties and other remedial measures, which could have an adverse impact on our business, financial condition, results of operations and prospects.

If we cannot keep pace with rapid developments and change in our industry and provide new services to our clients, the use of our services could decline, reducing our revenues.

The payment services industry in which we operate is characterized by rapid technological change, new product and service introductions, evolving industry standards, changing customer needs and the entrance of more established market players seeking to expand into these businesses. In order to remain competitive, we continually seek to expand the services we offer and to develop new projects, including, for example, the electronic wallet. These projects carry risks, such as delays in delivery, performance problems and lack of customer acceptance. In our industry, these risks are acute. Any delay in the delivery of new services or the failure to differentiate our services or to accurately predict and address market demand could render our services less desirable, or even obsolete, to consumers. In addition, if alternative payment mechanisms become widely available, substituting our current products and services, and we do not develop and offer similar alternative payment mechanisms successfully and on a timely basis, our business and prospects could be adversely affected. Furthermore, we may be unable to recover the costs we have incurred in developing new services. Our development efforts could result in increased costs and we could also experience a loss in business that could reduce our earnings or could cause a loss of revenue if promised new services are not timely delivered to our clients, we are not able to compete effectively with our competitors’ or do not perform as anticipated. If we are unable to develop, adapt to or access technological changes or evolving industry standards on a timely and cost effective basis, our business, financial condition and results of operations could be materially adversely affected.

Our systems and our third party providers’ systems may fail due to factors beyond our control, which could interrupt our service, cause us to lose business and increase our costs.

We depend on the efficient and uninterrupted operation of numerous systems, including our computer systems, software and telecommunications networks, as well as the data centers that we lease from third parties. We only have one data center in central Mexico that controls our operations and hosts our main equipment. Our systems and operations, or those of our third party providers, could be exposed to damage or interruption from, among other things, fire, flood, natural disaster, power loss, telecommunications failure, vendor failure, unauthorized entry, improper operation and computer viruses. Substantial property and equipment loss, and disruption in operations, as well as any defects in our systems or those of third parties or other difficulties could expose us to liability and materially adversely impact our business, financial condition and results of operations. In addition, any outage or disruptive efforts to our data center would result in the failure of our computers and kiosks to operate and would, if for an extensive period of time, adversely impact our reputation, brand and future prospects.

Unauthorized disclosure of data, whether through cybersecurity breaches, computer viruses or otherwise, could expose us to liability, protracted and costly litigation and damage our reputation.

We store and/or transmit sensitive data, such as mobile phone numbers, and we have ultimate liability to our consumers for our failure to protect this data. If breaches occur our encryption of data and other protective measures may not prevent unauthorized disclosure of data. Unauthorized disclosure of data or a cybersecurity breach could harm our reputation and deter clients from using electronic payments as well as kiosks and terminals generally and our services specifically, increase our operating expenses in order to correct the breaches or failures, expose us to uninsured liability, increase our risk of regulatory scrutiny, subject us to lawsuits, result in the imposition of material penalties and fines by state authorities and otherwise materially adversely affect our business, financial condition and results of operations.

Customer complaints or negative publicity about our customer service could affect attractiveness of our services adversely and, as a result, could have an adverse effect on our business, financial condition and results of operations.

Customer complaints or negative publicity about our customer service could diminish consumer confidence in, and the attractiveness of, our services. Breaches of our consumers’ privacy and our security systems could have the same effect. We sometimes take measures to combat risks of fraud and breaches of privacy and security, such as freezing consumer funds, which could damage relations with our consumers. These measures heighten the need for prompt and attentive customer service to resolve irregularities and disputes. Effective customer service requires significant personnel expense, and this expense, if not managed properly, could impact our profitability significantly. Any inability by us to manage or train our customer service representatives properly could compromise our ability to handle customer complaints effectively. If we do not handle customer complaints effectively, our reputation may suffer, and we may lose our customers’ confidence, which could have a material adverse effect on our business, financial condition and results of operations.

10

QPAGOS agreements with our agents and our merchants do not include exclusivity clauses and may be terminated unilaterally at any time or upon short notice.

QPAGOS normally does not include exclusivity clauses in its agreements with agents or merchants, which is standard in the payment services industry. Accordingly, merchants and agents do not have any restrictions on dealings with other providers and can switch from QPAGOS payment processing system to another without significant investment. The termination of contracts with existing agents or merchants or a significant decline in the amount of business we do with them as a result of contracts not having exclusivity clauses could have a material adverse effect on our business, financial condition and results of operations.

Our payment system might be used for fraudulent, illegal or improper purposes, which could expose us to additional liability and harm our business.

Despite measures we have taken and continue to take, our payment system remains susceptible to potentially illegal or improper uses. These may include use of our payment services in connection with fraudulent sales of goods or services, illicit sales of prescription medications or controlled substances, software and other intellectual property piracy, money laundering, bank fraud and prohibited sales of restricted products. In the past there have been news articles on how organized crime groups have used other payment services to transfer money in the course of illegal transactions.

Criminals are using increasingly sophisticated methods to engage in illegal activities such as counterfeiting and fraud. It is possible that incidents of fraud could increase in the future. Our risk management policies and procedures may not be fully effective to identify, monitor and manage these risks. We are not able to monitor in each case the sources for our counterparties’ funds or the ways in which they use them. Increases in chargebacks or other liability could have a material adverse effect on our business, financial condition and results of operations. Furthermore, an increase in fraudulent transactions or publicity regarding chargeback disputes could harm our reputation and reduce consumer confidence in the use of our kiosks and electronic wallets.

We are subject to fluctuations in currency exchange rates.

We are exposed to currency risks. QPAGOS financial statements are expressed in U.S. dollars, while its revenues and expenses are in Mexican pesos. Accordingly, its results of operations and assets and liabilities are exposed to fluctuations in exchange rates between the U.S. dollar and the Mexican peso. In addition, changes in currency exchange rates also affect the carrying value of assets on the balance sheet, which may result in a decline in the dollar amount of our total assets on the balance sheet. During the years ended December 31, 2016 and 2015, Qpagos incurred a foreign currency loss of ($357,855) and $(466,920) attributable to the deterioration of the Mexican Peso against the U.S. Dollar. However, during the three months ended March 31, 2017, we had a foreign currency gain of $233,852.

We may not be able to successfully protect the intellectual property we license and may be subject to infringement claims.

We rely on a combination of contractual rights, copyright, trademark and trade secret laws to establish and protect our technology and the technology that we license. We customarily require our employees and independent contractors to execute confidentiality agreements or otherwise to agree to keep our proprietary information and the information we license confidential when their relationship with us begins. Typically, our employment contracts also include clauses requiring our employees to assign to us all of the inventions and intellectual property rights they develop in the course of their employment and to agree not to disclose our confidential information. Nevertheless, others, including our competitors, may independently develop similar technology to that licensed by us, duplicate our services or design around our intellectual property. Further, contractual arrangements may not prevent unauthorized disclosure of our confidential information or ensure an adequate remedy in the event of any unauthorized disclosure of our confidential information. Because of the limited protection and enforcement of intellectual property rights in Mexico, our intellectual property rights may not be as protected as they may be in more developed markets such as the United States. We may have to litigate to enforce or determine the scope or enforceability of our intellectual property rights (including trade secrets and know-how), which could be expensive, could cause a diversion of resources and may not prove successful. The loss of intellectual property protection could harm our business and ability to compete and could result in costly redesign efforts, discontinuance of certain service offerings or other competitive harm. Additionally, we do not hold any patents for our business model or our business processes, and we do not currently intend to obtain any such patents in Mexico, the United States or elsewhere.

11

We may also be subject to costly litigation in the event our services or the technology that we license are claimed to infringe, misappropriate or otherwise violate any third party’s intellectual property or proprietary rights. Such claims could include patent infringement, copyright infringement, trademark infringement, trade secret misappropriation or breach of licenses. We may not be able to successfully defend against such claims, which may result in a limitation on our ability to use the intellectual property subject to these claims and also might require us to redesign affected services, enter into costly settlement or license agreements, pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our services. In such circumstances, if we cannot or do not license the infringed technology on reasonable terms or substitute similar technology from another source, our revenue and earnings could be adversely impacted. Additionally, in recent years, non-practicing entities have been acquiring patents, making claims of patent infringement and attempting to extract settlements from companies in our industry. Even if we believe that such claims are without merit and successfully defend these claims, defending against such claims is time consuming and expensive and could result in the diversion of the time and attention of our management and employees.

We may use open source software in a manner that could be harmful to our business.

We use open source software in connection with our technology and services. The original developers of the open source code provide no warranties on such code. Moreover, some open source software licenses require users who distribute open source software as part of their software to publicly disclose all or part of the source code to such software and/or make available any derivative works of the open source code on unfavorable terms or at no cost. The use of such open source code may ultimately require us to replace certain code used in our products, pay a royalty to use some open source code or discontinue certain products. Any of the above requirements could be harmful to our business, financial condition and operations.

We do not have and may be unable to obtain sufficient insurance to protect ourselves from business risks.

The insurance industry in Mexico is not yet fully developed, and many forms of insurance protection common in more developed countries are not yet fully available or are not available on comparable or commercially acceptable terms. Accordingly, while we hold certain mandatory types of insurance policies, we do not currently maintain insurance coverage for business interruption, property damage or loss of key management personnel, as we have been unable to obtain these on commercially acceptable terms. We do not hold insurance policies to cover for any losses resulting from counterparty and credit risks or fraudulent transactions. We also do not generally maintain separate funds or otherwise set aside reserves for most types of business-related risks. Accordingly, our lack of insurance coverage or reserves with respect to business-related risks may expose us to substantial losses, which could materially adversely affect our business, financial condition and results of operations.

In a dynamic industry like ours, the ability to attract, recruit, retain and develop qualified personnel is critical to our success and growth.

Our business functions at the intersection of rapidly changing technological, social, economic and regulatory developments that require a wide ranging set of expertise and intellectual capital. In order for us to compete and grow successfully, we must attract, recruit, retain and develop the necessary personnel who can provide the needed expertise across the entire spectrum of our capital needs. This is particularly true with respect to qualified and experienced software engineers and IT staff, who are highly sought after and are not in sufficient supply in Mexico. The market for such personnel is highly competitive, and we may not succeed in recruiting additional personnel or may fail to replace effectively current personnel who depart with qualified or effective successors. Our efforts to retain and develop personnel may result in significant additional expenses, which could adversely affect our profitability. We cannot assure you that we will be able to attract and retain qualified personnel in the future. Failure to retain or attract key personnel could have a material adverse effect on our business, financial condition and results of operations.

The substantial share ownership position of thirteen of our largest stockholders may limit your ability to influence corporate matters.

As of June 1, 2017, 13 stockholders (exclusive of our officers and directors) own 38,928,333 shares of common stock, representing approximately 68% of the voting power of our issued share capital. As a result of this concentration of share ownership, the 13 stockholders have sole discretion over certain matters submitted to our stockholders for approval that require a simple majority vote and has significant voting power on all matters submitted to our stockholders for approval that require a qualified majority vote, including the power to veto them. This concentration of ownership could delay, deter or prevent a change of control or other business combination, which could negatively impact the value of our shares. The interests of these 13 stockholders may not always coincide with the interests of our other stockholders.

12

Certain of our officers may have a conflict of interest.

Certain of our officers are currently working for our company on a part-time basis. One such officer also works at other jobs and has discretion to decide what time he devotes to our activities, which may result in a lack of availability when needed due to responsibilities at other jobs.

Risks Relating to Doing Business in Mexico

Emerging markets, such as Mexico, are subject to greater risks than more developed markets, including significant legal, economic and political risks.

Investors in emerging markets, such as Mexico, should be aware that these markets are subject to greater risk than more developed markets, including in some cases significant legal, economic and political risks. Investors should also note that emerging economies are subject to rapid change and that the information set out herein may become outdated relatively quickly. Accordingly, investors should exercise particular care in evaluating the risks involved and must decide for themselves whether, in light of those risks, their investment is appropriate. Generally, investment in emerging markets is only suitable for sophisticated investors who fully appreciate the significance of the risks involved, and investors are urged to consult with their own legal and financial advisors before making an investment in our securities.

Mexican federal governmental policies or regulations, as well as economic, political and social developments in Mexico, could adversely affect our business, financial condition, results of operations and prospects.

Substantially all of our assets and operations are located in Mexico. As a result, we are subject to political, legal and regulatory risks specific to Mexico, which can have a significant impact on our business, results of operations and financial condition. The Mexican federal government has exercised, and continues to exercise, significant influence over the Mexican economy. Accordingly, Mexican federal governmental actions, fiscal and monetary policy could have an impact on Mexican private sector entities, including our company, and on market conditions. We cannot predict the impact that political conditions will have on the Mexican economy. Furthermore, our business, financial condition, results of operations and prospects may be affected by currency fluctuations, price instability, inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico, over which we have no control. We cannot assure potential investors that changes in Mexican federal governmental policies will not adversely affect our business, financial condition, results of operations and prospects. Mexico has recently experienced periods of violence and crime due to the activities of drug cartels. In response, the Mexican government has implemented various security measures and has strengthened its police and military forces. Despite these efforts, drug-related crime continues to exist in Mexico. These activities, their possible escalation and the violence associated with them may have a negative impact on the Mexican economy or on our operations in the future. The social and political situation in Mexico could adversely affect the Mexican economy, which in turn could have a material adverse effect on our business, results of operations and financial condition.