Exhibit 3.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark one)

For the quarterly period

ended

For the transition period from ____________ to ____________

Commission file number

| (Exact name of registrant as specified in its charter) |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of Principal Executive Offices, including zip code) |

| (Registrant’s telephone number, including area code) |

| n/a |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark

whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Indicate by check mark

whether the Registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant

was required to submit such files.)

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |

| ☒ | Smaller Reporting Company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark

whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered | ||

As of August 10, 2022, there were

INNOVATIVE PAYMENT SOLUTIONS, INC.

Form 10-Q

For the Quarter Ended June 30, 2022

Index

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “report”) contains “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) that reflect our current expectations and views of future events. The forward-looking statements are contained principally in the section of this report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers are cautioned that significant known and unknown risks, uncertainties and other important factors (including those over which we may have no control and others listed in report and in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Form 10-K”)) may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | our ability to implement our business plan (including our ability to fully launch our IPSIPay digital payment solution) and scale our Beyond Wallet and IPSIPay business; | |

| ● | acceptance by the marketplace of our products and services, notably Beyond Wallet and IPSIPay; | |

| ● | our ability to formulate, implement and modify as necessary effective sales, marketing, and strategic initiatives to drive revenue growth; | |

| ● | the viability of our current intellectual property and intellectual property created in the future; | |

| ● | our ability to comply with currently applicable laws and government regulations and those that may be applicable in the future; | |

| ● | our ability to retain key employees; | |

| ● | adverse changes in general market conditions for payment solutions such as Beyond Wallet and IPSIPay and other products and services we offer; | |

| ● | our ability to generate cash flow and profitability and continue as a going concern; | |

| ● | our future financing plans; and | |

| ● | our ability to adapt to changes in market conditions (including as a result of the COVID-19 pandemic) which could impair our operations and financial performance. |

These forward-looking statements involve numerous and significant risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results of operations or the results of other matters that we anticipate herein could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in the “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” section contain in this report and in the “Business,” “Risk Factors” and other sections of the 2021 Form 10-K. You should thoroughly read this report and the documents that we refer to with the understanding that our actual future results may be materially different from, and worse than, what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this report relate only to events or information as of the date of this report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this report completely and with the understanding that our actual future results may be materially different from what we expect

ii

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

INNOVATIVE PAYMENT SOLUTIONS, INC.

Condensed Consolidated Balance Sheets

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash | $ | $ | ||||||

| Other current assets | ||||||||

| Total Current Assets | ||||||||

| Non-current assets | ||||||||

| Plant and equipment | ||||||||

| Intangible assets | ||||||||

| Security deposit | ||||||||

| Investment | ||||||||

| Total Non-Current Assets | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Equity | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Convertible debt, net of unamortized discount of $ | ||||||||

| Derivative liability | ||||||||

| Total Current Liabilities | ||||||||

| Non-Current Liabilities | ||||||||

| Federal relief loans | ||||||||

| Total Non-Current Liabilities | ||||||||

| Total Liabilities | ||||||||

| Equity | ||||||||

| Preferred stock, $ | ||||||||

| Common stock, $ | ||||||||

| Additional paid-in-capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total equity attributable to Innovative Payment Solutions, Inc. Stockholders | ||||||||

| Non-controlling interest | ||||||||

| Total Equity | ||||||||

| Total Liabilities and Equity | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

1

INNOVATIVE PAYMENT SOLUTIONS, INC.

Condensed Consolidated Statements of Operations

(Unaudited)

| Three months ended | Three months ended | Six months ended | Six months ended | |||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net Revenue | $ | $ | $ | $ | ||||||||||||

| Cost of Goods Sold | ||||||||||||||||

| Gross profit | ||||||||||||||||

| General and administrative | ||||||||||||||||

| Depreciation and amortization | ||||||||||||||||

| Total Expense | ||||||||||||||||

| Loss from Operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Loss on debt conversion | ( | ) | ||||||||||||||

| Penalty on convertible notes | ( | ) | ||||||||||||||

| Interest expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Amortization of debt discount | ( | ) | ( | ) | ( | ) | ||||||||||

| Derivative liability movements | ( | ) | ( | ) | ||||||||||||

| Loss before Income Taxes | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income Taxes | ||||||||||||||||

| Net Loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net loss attributable to non-controlling interest | ||||||||||||||||

| Net loss attributable to Innovative Payment Solutions, Inc. stockholders | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| ( | ) | ( | ) | ( | ) | ( | ) | |||||||||

See accompanying notes to condensed consolidated financial statements.

2

INNOVATIVE PAYMENT SOLUTIONS, INC.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

(Unaudited)

For the Three and Six Months Ended June 30, 2022

| Preferred Stock Shares | Amount | Common Stock Shares* | Amount | Additional Paid-in Capital | Accumulated Deficit | Non-controlling shareholders interest | Total Stockholders’ Equity (Deficit) | |||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ( | ) | $ | $ | |||||||||||||||||||||||||

| Stock based option expense | - | - | ||||||||||||||||||||||||||||||

| Restricted stock awards | - | - | ||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

| Contribution by minority shareholders | ||||||||||||||||||||||||||||||||

| Stock based option expense | - | - | ||||||||||||||||||||||||||||||

| Restricted stock awards | - | - | - | - | - | - | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

| Preferred Stock Shares | Amount | Common Stock Shares* | Amount | Additional Paid-in Capital | Accumulated Deficit | Non-controlling shareholders interest | Total Stockholders’ Equity (Deficit) | |||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | ( | ) | $ | $ | ( | ) | |||||||||||||||||||||||

| Warrants exercised | - | |||||||||||||||||||||||||||||||

| Share subscriptions | - | |||||||||||||||||||||||||||||||

| Share issue expenses | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Conversion of debt to equity | - | |||||||||||||||||||||||||||||||

| Fair value of warrants issued as compensation | - | - | ||||||||||||||||||||||||||||||

| Stock based compensation | - | |||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balance at March 31, 2021 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

| Warrants exercised | - | |||||||||||||||||||||||||||||||

| Shares issued for services | - | |||||||||||||||||||||||||||||||

| Stock based compensation | - | - | ||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2021 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

3

INNOVATIVE PAYMENT SOLUTIONS, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| Six months ended | Six months ended | |||||||

| June 30, | June 30, | |||||||

| 2022 | 2021 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Derivative liability movements | ( | ) | ||||||

| Depreciation | ||||||||

| Amortization of debt discount | ||||||||

| Loss on conversion of debt to equity | ||||||||

| Penalty on convertible debt | ||||||||

| Deposit forfeited | ||||||||

| Shares issued for services | ||||||||

| Stock based compensation | ||||||||

| Amortization of right of use asset | ||||||||

| Changes in Assets and Liabilities | ||||||||

| Other current assets | ( | ) | ||||||

| Accounts payable and accrued expenses | ( | ) | ( | ) | ||||

| Operating lease liabilities | ( | ) | ||||||

| Interest accruals | ||||||||

| CASH USED IN OPERATING ACTIVITIES | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Investment in intangibles | ( | ) | ||||||

| Investment in Frictionless Financial Technologies Inc. | ( | ) | ||||||

| Deposits paid | ( | ) | ||||||

| Plant and equipment purchased | ( | ) | ||||||

| NET CASH USED IN INVESTING ACTIVITIES | ( | ) | ( | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from minority shareholder contributions | ||||||||

| Proceeds from share issuances | ||||||||

| Share issue expenses | ( | ) | ||||||

| Proceeds from warrants exercised | ||||||||

| Repayment of loans payable | ( | ) | ||||||

| Repayment of convertible notes | ( | ) | ( | ) | ||||

| Proceeds from short term notes and convertible notes | ||||||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | ( | ) | ||||||

| NET INCREASE (DECREASE) IN CASH | ( | ) | ||||||

| CASH AT BEGINNING OF PERIOD | ||||||||

| CASH AT END OF PERIOD | $ | $ | ||||||

| CASH PAID FOR INTEREST AND TAXES: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest | $ | $ | ||||||

| NON CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

| De-recognition of right of use lease on early termination | $ | $ | ( | ) | ||||

| Conversion of convertible debt to equity | $ | $ | ||||||

| Debt discount on convertible debt | $ | $ | ||||||

See notes to the unaudited condensed financial statements.

4

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 1 | ORGANIZATION AND DESCRIPTION OF BUSINESS |

| a) | Organizational History |

On May 12, 2016, Innovative Payment Solutions, Inc., a Nevada corporation (“IPSI” or the “Company”) (originally formed on September 23, 2013 under the name “Asiya Pearls, Inc.”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Qpagos Corporation, a Delaware corporation (“Qpagos Corporation”), and Qpagos Merge, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub”). Pursuant to the Merger Agreement, on May 12, 2016, the merger was consummated, and Qpagos Corporation and Merger Sub merged (the “Merger”), with Qpagos Corporation continuing as the surviving corporation of the Merger. On May 27, 2016, the Company’s name was changed from “Asiya Pearls, Inc.” to “QPAGOS”.

Pursuant to the Merger Agreement, upon consummation of the Merger, each share of Qpagos Corporation’s capital stock issued and outstanding immediately prior to the Merger was converted into the right to receive two shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”). Additionally, pursuant to the Merger Agreement, upon consummation of the Merger, the Company assumed all of Qpagos Corporation’s warrants issued and outstanding immediately prior to the Merger, which were exercisable for an aggregate of approximately 621,920 shares of Common Stock as of the date of the Merger. Prior to and as a condition to the closing of the Merger, a then-current holder of 500,000 shares of Common Stock agreed to return 497,500 shares of Common Stock held by such holder to the Company and such holder retained an aggregate of 2,500 shares of Common Stock. The other then stockholders of the Company retained 500,000 shares of Common Stock. Therefore, immediately following the Merger, Qpagos Corporation’s former stockholders held 4,992,900 shares of Common Stock which represented approximately 91% of the outstanding Common Stock.

The Merger was treated as a reverse acquisition of the Company, then a public shell company, for financial accounting and reporting purposes. As such, Qpagos Corporation was treated as the acquirer for accounting and financial reporting purposes while the Company was treated as the acquired entity for accounting and financial reporting purposes.

Qpagos Corporation was incorporated on May 1, 2015 under the laws of the state of Delaware to effectuate a reverse merger transaction with Qpagos, S.A.P.I. de C.V. (“Qpagos Mexico”) and Redpag Electrónicos S.A.P.I. de C.V. (“Redpag”). Each of the entities were incorporated in November 2013 in Mexico. Qpagos Mexico was formed to process payment transactions for service providers it contracts with, and Redpag was formed to deploy and operate kiosks as a distributor.

On June 1, 2016, the board of directors of the Company (the “Board”) changed the Company’s fiscal year end from October 31 to December 31.

On November 1, 2019,

On December 31, 2019,

5

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 1 | ORGANIZATION AND DESCRIPTION OF BUSINESS (continued) |

| b) | Description of current business |

The Company is presently focused on operating and developing e-wallets that enable consumers to deposit cash, convert it into a digital form and remit the funds to Mexico and other countries quickly and securely. The Company’s first e-wallet, Beyond Wallet, is currently operational. The Company’s flagship e-wallet, IPSIPay, is fully operational. IPSIPay was first launched in December 2021 and its commercial launch has continued during 2022. Previously the Company intended to invest in physical kiosks, which required the user presence at the kiosk location. The Company still intends to use its existing kiosks in certain target markets within Southern California, but its principal focus will be on downloadable apps used via smartphones.

The Company acquired a

On August 26, 2021, the Company formed

a new subsidiary, Beyond Fintech, Inc. (“Beyond Fintech”), in which it owns a

| c) | COVID-19 |

The COVID-19 pandemic has required the Company’s management to focus its attention primarily on responding to the challenges presented by the pandemic, including ensuring continuous operations, and adjusting its operations to address changes in the virtual payments industry. Due to measures imposed by the local governments in areas affected by COVID-19 (including both in the United States and Mexico), businesses had been suspended due to quarantines intended to contain this outbreak and many people had been forced to work from home in those areas. As a result, the commercial launch of the Company’s e-wallets and the limited installation of the Company’s network of kiosks in Southern California had been delayed, which has had an adverse impact on the Company’s business and financial condition and has hampered the Company’s ability to generate revenues. As the COVID-19 pandemic evolves, the Company may face similar challenges in the future which could lead to material adverse impacts on the Company.

| 2 | ACCOUNTING POLICIES AND ESTIMATES |

| a) | Basis of Presentation |

The accompanying unaudited condensed financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information with the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, these unaudited condensed financial statements do not include all of the information and disclosures required by U.S. GAAP for complete financial statements. In the opinion of management, the accompanying unaudited condensed financial statements include all adjustments (consisting only of normal recurring adjustments), which the Company considers necessary, for a fair presentation of those financial statements. The results of operations and cash flows for the six months ended June 30, 2022 may not necessarily be indicative of results that may be expected for any succeeding quarter or for the entire fiscal year. The information contained in this Quarterly Report on Form 10-Q (“Report”) should be read in conjunction with the audited financial statements of IPSI for the year ended December 31, 2021, included in the Annual Report on Form 10-K as filed with the Securities and Exchange Commission (the “SEC”) on March 31, 2022.

All amounts referred to in the notes to the unaudited condensed financial statements are in United States Dollars ($) unless stated otherwise.

6

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 2 | ACCOUNTING POLICIES AND ESTIMATES (continued) |

| b) | Principles of Consolidation |

The unaudited condensed consolidated financial statements include the financial statements of the Company and its subsidiary in which it has a majority voting interest. All significant inter-company accounts and transactions have been eliminated in the unaudited condensed consolidated financial statements.

The entities included in the accompanying unaudited condensed consolidated financial statements are as follows:

Innovative Payment Solutions, Inc. - Parent Company

Beyond Fintech Inc., 51% owned.

| c) | Use of Estimates |

The preparation of unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions, which are evaluated on an ongoing basis, that affect the amounts reported in the unaudited condensed consolidated financial statements and accompanying notes. Management bases its estimates on historical experience and on various other assumptions that it believes are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the amounts of revenues and expenses that are not readily apparent from other sources. Actual results could differ from those estimates and judgments. In particular, significant estimates and judgments include those related to, the estimated useful lives for plant and equipment, the fair value of long-lived investments, the fair value of warrants and stock options granted for services or compensation, estimates of the probability and potential magnitude of contingent liabilities, derivative liabilities, the valuation allowance for deferred tax assets due to continuing operating losses and the allowance for doubtful accounts.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the unaudited condensed consolidated financial statements, which management considered in formulating its estimate could change in the near term due to one or more future confirming events. Accordingly, the actual results could differ significantly from our estimates.

| d) | Contingencies |

Certain conditions may exist as of the date the financial statements are issued, which may result in the generation of continuing losses by the Company, but which will only be resolved when one or more future events occur or fail to occur.

The Company’s management assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s unaudited condensed consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed. Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

7

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 2 | ACCOUNTING POLICIES AND ESTIMATES (continued) |

| e) | Fair Value of Financial Instruments |

The Company adopted the guidance of Accounting Standards Codification (“ASC”) 820 for fair value measurements which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the balance sheets for the investment in Vivi Holdings was evaluated at fair value using Level 3 Inputs based on the Company’s estimate of the market value of the entities disposed to Vivi Holdings. Vivi Holdings does not have sufficient information available to assess the current market price of its equity.

The carrying amounts reported in the balance sheets for cash, accounts receivable, other current assets, other assets, accounts payable, accrued liabilities, and notes payable, approximate fair value due to the relatively short period to maturity for these instruments. The Company has identified the short-term convertible notes and certain warrants attached to certain of the notes that are required to be presented on the balance sheets at fair value in accordance with the accounting guidance.

ASC 825-10 “Financial Instruments” allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. We evaluate the fair value of variably priced derivative liabilities on a quarterly basis and report any movements thereon in earnings.

| f) | Risks and Uncertainties |

The Company’s operations are and will be subject to significant risks and uncertainties including financial, operational, regulatory, and other risks, including the potential risk of business failure. These risks include, without limitation, risks associated with (i) COVID-19 and its variants, (ii) launching and scaling the Company’s products and the use by customers of such products, (iii) developing and implementing successful marketing campaigns and other strategic initiatives; (iv) competition, (iv) compliance with applicable laws, rules and regulations (including those related to fund remittance); (v) the Company’s outstanding indebtedness, including the Company’s ability to repay or extend the maturity of such indebtedness (see Note 8); (vi) inflation and other economic factors and (vii) the Company’s ability to obtain necessary financing. These conditions may not only limit the Company’s access to capital, but also make it difficult for its customers, vendors and the Company to accurately forecast and plan future business activities.

The Company’s results may also be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things. Many of these risks are beyond the Company’s control and are unpredictable. The Company may be unable to adequately manage such risks and similar risks, which could impair the viability of the Company.

| g) | Recent accounting pronouncements |

The Financial Accounting Standards Board (“FASB”) issued additional updates during the quarter ended June 30, 2022. None of these standards are either applicable to the Company or require adoption at a future date and none are expected to have a material impact on the Company’s condensed consolidated financial statements upon adoption.

8

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 2 | ACCOUNTING POLICIES AND ESTIMATES (continued) |

| h) | Reporting by Segment |

No segmental information is required as the Company has not generated any revenue for the six months ended June 30, 2022 and 2021 and only has one operating segment.

| i) | Cash and Cash Equivalents |

The Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents. At June 30, 2022 and 2021, respectively, the Company had no cash equivalents.

The Company minimizes credit risk associated

with cash by periodically evaluating the credit quality of its primary financial institution in the United States. The balance at times

may exceed federally insured limits. At June 30, 2022 and December 31, 2021, the balance exceed the federally insured limit by $

| j) | Accounts Receivable and Allowance for Doubtful Accounts |

Accounts receivable are reported at realizable value, net of allowances for doubtful accounts, which is estimated and recorded in the period the related revenue is recorded. The Company has a standardized approach to estimate and review the collectability of its receivables based on a number of factors, including the period they have been outstanding. Historical collection and payer reimbursement experience is an integral part of the estimation process related to allowances for doubtful accounts. In addition, the Company regularly assesses the state of its billing operations in order to identify issues, which may impact the collectability of these receivables or reserve estimates. Revisions to the allowance for doubtful accounts estimates are recorded as an adjustment to bad debt expense. Receivables deemed uncollectible are charged against the allowance for doubtful accounts at the time such receivables are written-off. Recoveries of receivables previously written-off are recorded as credits to the allowance for doubtful accounts. There were no recoveries during the period ended June 30, 2022 and December 31, 2021.

| k) | Investments |

The Company’s non-marketable

equity securities are investments in privately held companies without readily determinable market values. The carrying value of our non-marketable

equity securities is adjusted to fair value for observable transactions for identical or similar investments of the same issuer or impairment

(referred to as the measurement alternative). All gains and losses on non-marketable equity securities, realized and unrealized, are

recognized in other income (expense), net. Non-marketable equity securities that have been remeasured during the period are classified

within Level 3 in the fair value hierarchy because the Company estimates the value based on valuation methods using the observable transaction

price at the transaction date and other unobservable inputs including volatility, rights, and obligations of the securities the Company

holds. The cost method is used when the Company has a passive, long-term investment that doesn’t result in influence over the Company.

The cost method is used when the investment results in an ownership stake of less than

| l) | Plant and Equipment |

Plant and equipment is stated at cost,

less accumulated depreciation. Plant and equipment with costs greater than $

| Description | Estimated Useful Life | |

| Kiosks (not used in the Company’s current business) | ||

| Computer equipment | ||

| Leasehold improvements | ||

| Office equipment |

The cost of repairs and maintenance is expensed as incurred. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition.

9

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 2 | ACCOUNTING POLICIES AND ESTIMATES (continued) |

| m) | Long-Term Assets |

Assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets are considered impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets.

| n) | Revenue Recognition |

The Company’s revenue recognition policy is consistent with the requirements of FASB ASC 606, Revenue Recognition.

The Company’s revenues will be recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those services. The Company derives its revenues from the sale of its services, as defined below. The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its revenue transactions:

| i. | identify the contract with a customer; |

| ii. | identify the performance obligations in the contract; |

| iii. | determine the transaction price; |

| iv. | allocate the transaction price to performance obligations in the contract; and |

| v. | recognize revenue as the performance obligation is satisfied. |

The Company had no revenues during the six months ended June 30, 2022 and 2021.

| o) | Share-Based Payment Arrangements |

Generally, all forms of share-based payments, including stock option grants, restricted stock grants and stock appreciation rights are measured at their fair value on the awards’ grant date, based on the estimated number of awards that are ultimately expected to vest. Share-based compensation awards issued to non-employees for services rendered are recorded at either the fair value of the services rendered or the fair value of the share-based payment, whichever is more readily determinable. The expense resulting from share-based payments is recorded in operating expenses in the consolidated statement of operations.

Prior to the Company’s reverse merger which took place on May 12, 2016, all share-based payments were based on management’s estimate of market value of the Company’s equity. The factors considered in determining managements estimate of market value includes, assumptions of future revenues, expected cash flows, market acceptability of our technology and the current market conditions. These assumptions are complex and highly subjective, compounded by the business being in its early stage of development in a new market with limited data available.

Where equity transactions with arms-length third parties, who had applied their own assumptions and estimates in determining the market value of our equity, had taken place prior to and within a reasonable time frame of any share-based payments, the value of those share transactions have been used as the fair value for any share-based equity payments.

Where equity transactions with arms-length third parties, included both shares and warrants, the value of the warrants have been eliminated from the unit price of the securities using a Black-Scholes valuation model to determine the value of the warrants. The assumptions used in the Black Scholes valuation model includes market related interest rates for risk-free government issued treasury securities with similar maturities; the expected volatility of the Common Stock based on companies operating in similar industries and markets; the estimated stock price of the Company; the expected dividend yield of the Company and; the expected life of the warrants being valued.

Subsequent to the Company’s reverse merger which took place on May 12, 2016, the Company has utilized the market value of its Common Stock as quoted on the OTCQB, as an indicator of the fair value of its Common Stock in determining share- based payment arrangements.

10

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 2 | ACCOUNTING POLICIES AND ESTIMATES (continued) |

| p) | Derivative Liabilities |

ASC 815 generally provides three criteria that, if met, require companies to bifurcate conversion options from their host instruments and account for them as free standing derivative financial instruments. These three criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re- measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument subject to the requirements of ASC 815. ASC 815 also provides an exception to this rule when the host instrument is deemed to be conventional, as described.

| q) | Income Taxes |

The Company is based in the US and currently enacted US tax laws are used in the calculation of income taxes.

Income taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A full valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized. It is the Company’s policy to classify interest and penalties on income taxes as interest expense or penalties expense. As of June 30, 2022 and December 31, 2021, there have been no interest or penalties incurred on income taxes.

| r) | Comprehensive income |

Comprehensive income is defined as the change in equity of a company during a period from transactions and other events and circumstances excluding transactions resulting from investments from owners and distributions to owners. The Company does not have any comprehensive income (loss) for the periods presented.

| s) | Reclassification of prior year presentation |

Certain prior year amounts have been reclassified for consistency with the current year presentation. These reclassifications had no effect on the reported results of operations.

| 3 | LIQUIDITY MATTERS |

The Company has incurred net losses

since its inception and anticipates net losses and negative operating cash flows for the near future. For and as of the end of six

months ended June 30, 2022, the Company had a net loss of $

The Company had a cash balance of $

However, given the Company’s losses, negative cash flows and existing indebtedness, it is likely that the Company will be required to raise significant additional funds to progress its business as planned by issuing equity or equity-linked securities. Should this occur, the Company’s stockholders would experience dilution, perhaps significantly. Additional debt financing, if available, may involve covenants restricting the Company’s operations or its ability to incur additional debt. Any additional debt financing or additional equity that the Company raises may contain terms that are not favorable to the Company or its stockholders and require significant debt service payments, which diverts resources from other activities. Moreover, there is a risk that financing may be unavailable to support the Company’s operations on favorable terms, or at all.

There is also a significant risk that none of the Company’s plans to raise financing will be implemented in a manner necessary to sustain the Company for an extended period of time. If adequate funds are not available to the Company when needed, the Company may be required to continue with reduced operations or to obtain funds through arrangements that may require the Company to relinquish rights to technologies or potential markets, any of which could have a material adverse effect on the Company. In addition, the Company’s inability to secure additional funding when needed could cause the Company’s business to fail or become bankrupt or force the Company to wind down or discontinue operations.

11

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 4 | INTANGIBLES |

On

August 26, 2021, the Company formed a new subsidiary, Beyond Fintech. to acquire a product known as Beyond Wallet from a third party for

gross proceeds of $

During

the year ended December 31, 2021, the Company paid gross proceeds of $

| June 30, 2022 | December 31, 2021 | |||||||

| Purchased Technology | $ | $ | ||||||

| 5 | INVESTMENTS |

Investment in Frictionless Financial Technologies Inc.

On

June 22, 2021, the Company entered into a Stock Purchase Agreement (the “SPA”) with Frictionless, to purchase

The

Company has undertaken to issue Frictionless a non-restricted, non-dilutable

The Company has the right to appoint, and has appointed, one member to the board of directors of Frictionless, which appointee will remain on the board as long as the Company is the holder of the Frictionless common stock.

The

Company has an irrevocable right to acquire up to an additional

The shares in Frictionless are unlisted as of June 30, 2022.

Investment in Vivi Holdings, Inc.

Effective December 31, 2019, the Company sold 100% of the outstanding common stock of its subsidiary, Qpagos Corporation, together with its 99.9% ownership interest of Qpagos Corporation’s two Mexican entities: Qpagos S.A.P.I. de C.V. and Redpag Electrónicos S.A.P.I. de C.V, to Vivi.

As

consideration for the disposal, Vivi issued an aggregate of

Due to the lack of available information, the Vivi Shares were valued by a modified market method, whereby the value of the assets disposed of were determined by management using the enterprise value of the entire Company less the liabilities and assets retained by the Company.

As

of June 30, 2022 and December 31, 2021, the Company maintained the impairment of the carrying value of the investment in Vivi Holdings

based on no activity by Vivi’s management for its proposed initial public offering and fund raising activities. The total impairment

as of June 30, 2022 and December 31, 2021 was $

The shares in Vivi Holdings are unlisted as of June 30, 2022.

| June 30, 2022 | December 31, 2021 | |||||||

| Investment in Frictionless Financial Technologies, Inc. | $ | $ | ||||||

| Investment in Vivi Holdings, Inc. | ||||||||

| $ | $ | |||||||

12

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 6 | LEASES |

On

March 22, 2021, the Company entered into a real property lease for an office located at 56B 5th Avenue, Lot 1 #AT, Carmel

by The Sea, California.

Total Lease Cost

Individual components of the total lease cost incurred by the Company is as follows:

Six months ended 2022 | Six months ended June 30, 2021 | |||||||

| Operating lease expense | $ | $ | ||||||

Other lease information:

Six months ended 2022 | Six months ended June 30, 2021 | |||||||

| Cash paid for amounts included in the measurement of lease liabilities | ||||||||

| Operating cash flows from operating leases | $ | ( | ) | $ | ( | ) | ||

| Remaining lease term – operating lease | ||||||||

Maturity of Operating Leases

The amount of future minimum lease payments under operating leases are as follows:

| Amount | ||||

| Undiscounted minimum future lease payments under leases with terms twelve months or less | ||||

| Total instalments due: | ||||

| 2022 | $ | |||

| 7 | FEDERAL RELIEF LOANS |

Small Business Administration Disaster Relief loan

On

July 7, 2020, the Company received a Small Business Economic Injury Disaster loan amounting to $

The

Company has accrued interest of $

13

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 8 | CONVERTIBLE NOTES PAYABLE |

Convertible notes payable consists of the following:

| Description | Effective Interest Rate | Maturity date | Principal | Accrued Interest | Unamortized debt discount | June 30, Amount, | December 31, Amount, | |||||||||||||||||||

| Cavalry Fund I LP | % | 2022 | ||||||||||||||||||||||||

| Mercer Street Global Opportunity Fund, LLC | % | 2022 | ||||||||||||||||||||||||

| Bellridge Capital LP. | % | 2022 | ||||||||||||||||||||||||

| Total convertible notes payable | $ | $ | $ | - | $ | $ | ||||||||||||||||||||

Interest expense totaled

$

Cavalry Fund I LP

| ● | On February 16, 2021, the Company closed a transaction with Cavalry Fund I LP (“Cavalry”), pursuant to which the Company received net proceeds of $ |

On February 3, 2022, the Company extended the maturity date of its Cavalry Note from February 16, 2022 to August 16, 2022. The Cavalry Note was due to mature on February 16, 2022 and would have resulted in the accrual of a $157,499 prepayment penalty on the principal of $572,000 and interest of $57,994 outstanding, totaling $787,493. Cavalry agreed to extend the maturity date of the Cavalry Note to August 16, 2022 in consideration of the principal amount outstanding under the Cavalry Note being increased by an additional $78,749, thereby increasing the total principal outstanding to $866,242. This change to the maturity date of the Cavalry Note was assessed in terms of ASC 470-50 as a debt extinguishment, which resulted in the additional $78,749 being expensed.

The

balance of the Cavalry Note plus accrued interest at June 30, 2022 was $

Mercer Street Global Opportunity Fund, LLC

| ● |

On February 3, 2022, the Company extended the maturity date of its Mercer Note from February 16, 2022 to August 16, 2022. The Mercer Note was due to mature on February 16, 2022 and would have resulted in the accrual of a $157,499 prepayment penalty on the principal of $572,000 and interest of $57,994 outstanding, totaling $787,493. Mercer agreed to extend the maturity date of the Mercer Note to August 16, 2022 in consideration of the principal amount outstanding under the Cavalry Note being increased by an additional $78,749, thereby increasing the total principal outstanding to $866,242. This change to the maturity date of the Mercer Note was assessed in terms of ASC 470-50 as a debt extinguishment, which resulted in the additional $78,749 being expensed.

The

balance of the Mercer Note plus accrued interest at June 30, 2022 was $

14

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 8 | CONVERTIBLE NOTES PAYABLE (continued) |

Bellridge Capital LP.

| ● | On February 16, 2021, the Company closed a transaction with Bellridge Capital LP., pursuant to which the Company received net proceeds of $ |

The

Bellridge Note was repaid on February 4, 2022 for gross proceeds of $

| 9 | DERIVATIVE LIABILITY |

Certain of the short-term convertible notes disclosed in note 8 above and certain warrants disclosed in note 10 below have fundamental transaction clauses which might result in cash settlement, due to these factors, all convertible notes and any warrants attached thereto are valued and give rise to a derivative financial liability, which was initially valued at inception of the convertible notes using a Black-Scholes valuation model.

The

value of this derivative financial liability was re-assessed at June 30, 2022 at $

The following assumptions were used in the Black-Scholes valuation model:

| Six months ended June 30\, 2022 |

Year ended December 31, 2021 |

|||||||

| Conversion price | $ | $ | ||||||

| Risk free interest rate | % | % | ||||||

| Expected life of derivative liability | ||||||||

| Expected volatility of underlying stock | % | % | ||||||

| Expected dividend rate | % | % | ||||||

The movement in derivative liability is as follows:

| June 30, 2022 | December 31, 2021 | |||||||

| Opening balance | $ | $ | ||||||

| Derivative financial liability arising from convertible note | ||||||||

| Fair value adjustment to derivative liability | ( | ) | ||||||

| $ | $ | |||||||

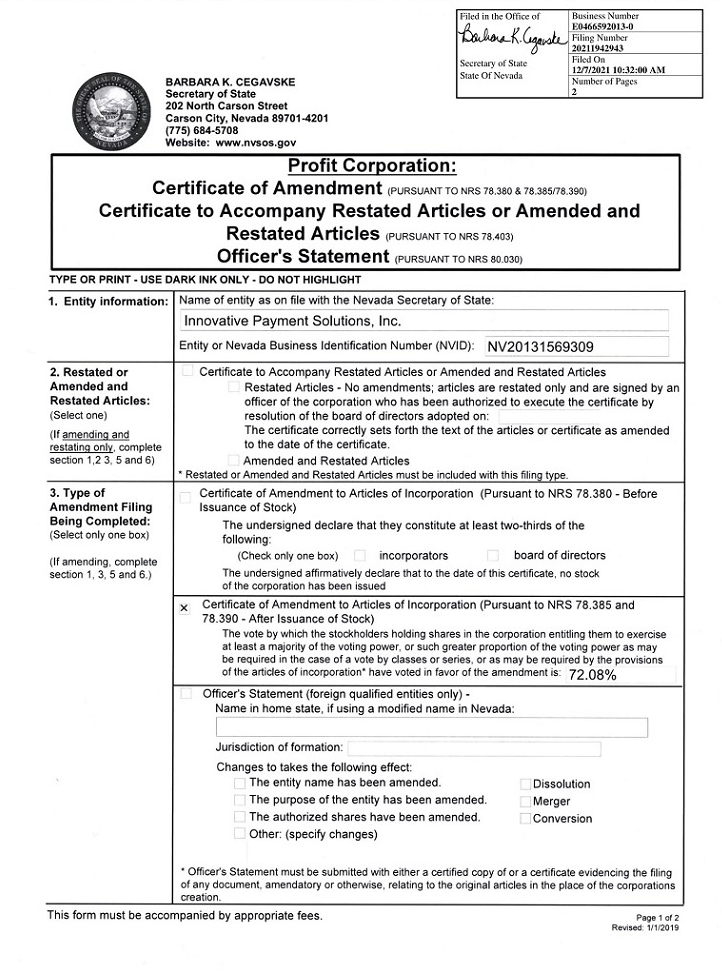

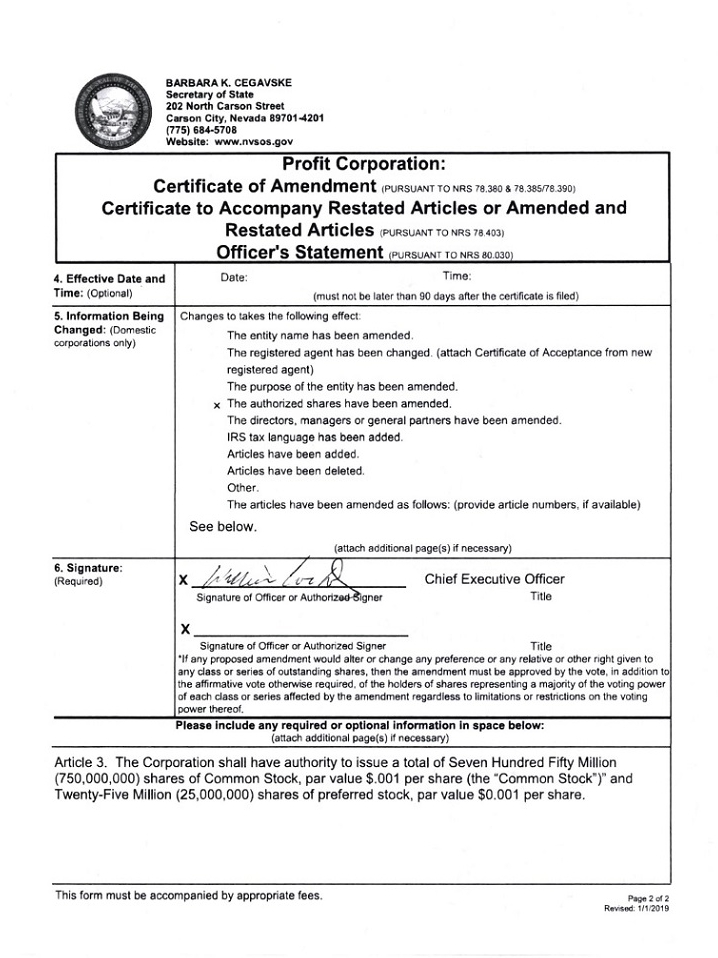

| 10 | STOCKHOLDERS’ EQUITY |

| a. | Common Stock |

The

Company has total authorized Common Stock of

15

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 10 | STOCKHOLDERS’ EQUITY (continued) |

| b. | Restricted stock awards |

A summary of restricted stock activity during the period January 1, 2021 to June 30, 2022 is as follows:

| Total restricted shares | Weighted average fair market value per share | Total unvested restricted shares | Weighted average fair market value per share | Total vested restricted shares | Weighted average fair market value per share | |||||||||||||||||||

| Outstanding January 1, 2021 | $ | $ | $ | |||||||||||||||||||||

| Granted | ||||||||||||||||||||||||

| Forfeited/Cancelled | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||

| Vested | ( | ) | ( | ) | ||||||||||||||||||||

| Outstanding December 31, 2021 | $ | $ | $ | |||||||||||||||||||||

| Granted | ||||||||||||||||||||||||

| Forfeited/Cancelled | ||||||||||||||||||||||||

| Vested | ( | ) | ( | ) | ||||||||||||||||||||

| Outstanding June 30, 2022 | $ | $ | $ | |||||||||||||||||||||

The restricted stock granted and exercisable at June 30, 2022 is as follows:

| Restricted Stock Granted | Restricted Stock Vested | |||||||||||||||||

| Grant date Price | Number Granted | Weighted Average Fair Value per Share | Number Vested | Weighted Average Fair Value per Share | ||||||||||||||

| $ | $ | $ | ||||||||||||||||

| $ | ||||||||||||||||||

| $ | $ | |||||||||||||||||

The

Company has recorded an expense of $

Subsequent to June 30, 2022, the Company issued additional restricted stock awards to Richard Rosenblum and Samad Harake. See Note 14 – Subsequent Events for further information.

| c. | Preferred Stock |

The

Company has authorized

16

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 10 | STOCKHOLDERS’ EQUITY (continued) |

| d. | Warrants |

A summary of warrant activity during the period January 1, 2021 to June 30, 2022 is as follows:

| Shares Underlying Warrants | Exercise price per share | Weighted average exercise price | ||||||||||

| Outstanding January 1, 2021 | $ | $ | ||||||||||

| Granted | | |||||||||||

| Forfeited/Cancelled | ( | ) | ||||||||||

| Exercised | ( | ) | ||||||||||

| Outstanding December 31, 2021 | $ | | $ | |||||||||

| Granted | ||||||||||||

| Forfeited/Cancelled | ||||||||||||

| Exercised | ||||||||||||

| Outstanding June 30, 2022 | $ | | $ | |||||||||

The warrants outstanding and exercisable at June 30, 2022 are as follows:

| Warrants Outstanding | Warrants Exercisable | |||||||||||||||||||||||||

| Exercise Price | Number Outstanding | Weighted Average Remaining Contractual life in years | Weighted Average Exercise Price | Number Exercisable | Weighted Average Exercise Price | Weighted Average Remaining Contractual life in years | ||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

The

warrants outstanding have an intrinsic value of $

Subsequent to June 30, 2022, the Company issued warrants to Mario Lopez pursuant to an endorsement agreement. See Note 14 – Subsequent Events for further information.

| e. | Stock options |

On

June 18, 2018, the Company established its 2018 Stock Incentive Plan (the “Plan”). The purpose of the Plan is to promote the

interests of the Company and the stockholders of the Company by providing directors, officers, employees and consultants of the Company

with appropriate incentives and rewards to encourage them to enter into and continue in the employ or service of the Company, to acquire

a proprietary interest in the long-term success of the Company and to reward the performance of individuals in fulfilling long-term corporate

objectives. The Plan terminates after a period of

The Plan is administered by the Board or a committee appointed by the Board, who have the authority to administer the Plan and to exercise all the powers and authorities specifically granted to it under the Plan.

The

maximum number of securities available under the Plan is

On

October 22, 2021, the Company established its 2021 Stock Incentive Plan (“2021 Plan”). The purpose of the Plan is to promote

the interests of the Company and the stockholders of the Company by providing directors, officers, employees and consultants, advisors

and service providers of the Company with appropriate incentives and rewards to encourage them to enter into and continue in the employ

or service of the Company, to acquire a proprietary interest in the long-term success of the Company and to reward the performance of

individuals in fulfilling long-term corporate objectives. The Plan terminates after a period of

The 2021 Plan is administered by the Board or a Compensation Committee appointed by the Board, who have the authority to administer the Plan and to exercise all the powers and authorities specifically granted to it under the Plan.

The

maximum number of securities available under the 2021 Plan is

17

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 10 | STOCKHOLDERS’ EQUITY (continued) |

| e. | Stock options |

Under the 2021 Plan the company may award the following: (i) non-qualified stock options; (ii)) incentive stock options; (iii) stock appreciation rights; (iv) restricted stock; (v) restricted stock unit; and (vi) other stock-based awards.

No options were granted for the six months ended June 30, 2022.

A summary of option activity during the period January 1, 2021 to June 30, 2022 is as follows:

| Shares Underlying options | Exercise price per share | Weighted average exercise price | ||||||||||

| Outstanding January 1, 2021 | ||||||||||||

| Granted | ||||||||||||

| Forfeited/Cancelled | ||||||||||||

| Exercised | ||||||||||||

| Outstanding December 31, 2021 | $ | $ | ||||||||||

| Granted | ||||||||||||

| Forfeited/Cancelled | ||||||||||||

| Exercised | ||||||||||||

| Outstanding June 30, 2022 | $ | | $ | |||||||||

The options outstanding and exercisable at June 30, 2022 are as follows:

| Options Outstanding | Options Exercisable | |||||||||||||||||||||||

| Exercise Price | Number Outstanding | Weighted Average Remaining Contractual life in years | Weighted Average Exercise Price | Number Exercisable | Weighted Average Exercise Price | Weighted Average Remaining Contractual life in years | ||||||||||||||||||

| $ | $ | |||||||||||||||||||||||

The

options outstanding have an intrinsic value of $

The

option expense was $

Subsequent to June 30, 2022, additional options were granted to William Corbett. See Note 14 – Subsequent Events for further information.

| 11 | NET LOSS PER SHARE |

Basic loss per share is based on the weighted-average number of common shares outstanding during each period. Diluted loss per share is based on basic shares as determined above plus Common Stock equivalents. The computation of diluted net loss per share does not assume the issuance of common shares that have an anti-dilutive effect on net loss per share. For the three and six months ended June 30, 2022 and 2021 all warrants, options and convertible debt securities were excluded from the computation of diluted net loss per share.

Dilutive shares which could exist pursuant to the exercise of outstanding stock instruments and which were not included in the calculation because their affect would have been anti-dilutive for the three and six months ended June 30 2022 and 2021 are as follows:

| Three and six months ended June 30, 2022 (Shares) | Three and six months ended June 30, 2021 (Shares) | |||||||

| Convertible debt | ||||||||

| Stock options | ||||||||

| Warrants to purchase shares of Common Stock | ||||||||

18

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 12 | RELATED PARTY TRANSACTIONS |

The following transactions were entered into with related parties:

James Fuller

On

February 22, 2021, the Board awarded James Fuller options under the Company’s 2018 Stock Incentive Plan to purchase

On

July 22. 2021, the Company granted Mr. Fuller

Additionally,

the Board approved the repricing of the options exercisable for

Andrey Novikov

On

February 22, 2021, the Board awarded Andrey Novikov options under the Company’s 2018 Stock Incentive Plan to purchase

On May 31, 2021, Mr. Novikov notified the Board of his decision to resign as a member of the Board and as Secretary of the Company, effective as of June 1, 2021. Since August 2021, Mr. Novikov has been on suspension from service as the Company’s Chief Technology Officer.

William Corbett

On

February 22, 2021, the Board appointed William Corbett as the Company’s Chief Executive Officer and Interim Chief Financial Officer,

as its Chairman of the Board and issued him a five-year warrant to purchase

On

August 16, 2021, the Company and Mr. Corbett entered into an Executive Employment Agreement that replaced and superseded the previous

executive employment agreement (the “August 2021 Corbett Employment Agreement”). The purpose of the August 2021 Corbett Employment

Agreement was to provide a replacement grant for warrants previously granted to Mr. Corbett under the terms of his previous employment

agreement with the Company. Pursuant to the August 2021 Corbett Employment Agreement, Mr. Corbett would continue to serve as the Company’s

Chief Executive Officer on a full time basis effective as of the date of the August 2021 Corbett Employment Agreement until the close

of business on December 31, 2024. Mr. Corbett’s base salary will be $

In addition, the Company and Mr. Corbett entered into an Indemnification Agreement on August 16, 2021 (the “August 2021 Corbett Indemnification Agreement”), pursuant to which the Company agreed to indemnify Mr. Corbett to indemnify Indemnitee to the fullest extent permitted by or under the Nevada Corporation Law in respect of claims, including third-party claims and derivative claims and provides for advancement of expenses. The August 2021 Corbett Indemnification Agreement amends the indemnification agreement in effect prior to entering into the August 2021 Corbett Indemnification Agreement to provide that unless Company shall pay Mr. Corbett’s attorneys’ fees and costs, including the compensation and expenses of any arbitrator, unless the arbitrator or the court determines that (a) Company has no liability in such dispute, or (b) the action or claims by Executive are frivolous in nature. In any other case or matter, the Company and Mr. Corbett shall each bear its or his own attorney fees and costs.

19

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 12 | RELATED PARTY TRANSACTIONS (continued) |

Clifford Henry

On May 1, 2021, the Company appointed Mr. Henry to the Board.

On

July 22, 2021, the Company granted Mr. Henry

Mr.

Henry has an oral consulting arrangement with the Company whereby he is paid $

Madisson Corbett

On May 1, 2021, the Company appointed Ms. Corbett to the Board. Ms. Corbett is the daughter of Mr. William Corbett, the Company’s Chief Executive Officer and Chairman of the Board.

On

July 22, 2021, the Company granted Ms. Corbett

David Rios

On July 22, 2021, the Company appointed David Rios to the Board.

On

July 22, 2021, the Company granted Mr. Rios

Richard Rosenblum

On July 22, 2021, the Company appointed Richard Rosenblum as President and Chief Financial Officer of the Company. In addition, Mr. Rosenblum was elected to the Board to serve until the Company’s next annual meeting of shareholders.

On

July 27, 2021,

If

Mr. Rosenblum’s employment with Company is terminated at any time during the term of the Employment Agreement other than for Cause

(as defined in the Employment Agreement), or due to voluntary termination, retirement, death or disability, then Mr. Rosenblum shall be

entitled to severance equal to fifty percent (

20

INNOVATIVE PAYMENT SOLUTIONS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| 12 | RELATED PARTY TRANSACTIONS (continued) |

Richard Rosenblum (continued)

On

August 16, 2021, the Company entered into an amendment to the Rosenblum Executive Employment Agreement (the “First Amendment”)

with Mr. Rosenblum. Under the terms of the Executive Employment Agreement, the Company had agreed to grant to Mr. Rosenblum an option

to purchase

In addition, the Company and Mr. Rosenblum entered into an Indemnification Agreement, pursuant to which the Company agreed to indemnify Mr. Rosenblum to indemnify Indemnitee to the fullest extent permitted by or under the Nevada Corporation Law in respect of claims, including third-party claims and derivative claims and provides for advancement of expenses.

| 13 | COMMITMENTS AND CONTINGENCIES |

The Company has convertible notes, disclosed under note 8 above which mature on August 16, 2022. Should these notes not be converted to Common Stock prior to that date, the Company may need to repay the principal and interest outstanding on these notes.

| 14 | SUBSEQUENT EVENTS |

Effective July 8, 2022 the Company entered into an Endorsement Agreement with Pez-Mar, Inc., a California corporation to furnish the services of Mario Lopez (“Lopez”). Pursuant to the Endorsement Agreement, Lopez will act as a Company spokesperson in connection with the promotion, advertisement and endorsement of the Company’s physical and virtual payment processing and money remittance business and the Company’s related products and services.

The Endorsement

Agreement has a term of

As compensation for the Services, Lopez or their designees will be

paid the following:

On July 8, 2022, the Company entered

into a consulting agreement with a contractor for a period of twelve months to (i) review the Company’s business plan; (ii) analyze

and assess the Company’s revenues, costs, and cash flow; and (iii) introduce the Company to and interface on the Company’s

behalf with potential and actual commercial partners. The Company issued 2,000,000 shares of common stock as compensation for the services

rendered which were fully earned on the date of issue.

On July 8, 2022, the Company entered

into a second consulting agreement with a separate contractor for a period of twelve months to (i) review the Company’s business

plan; (ii) analyze and assess the Company’s revenues, costs, and cash flow; and (iii) introduce the Company to and interface on

the Company’s behalf with potential and actual commercial partners. The Company issued

On July 11, 2022, the Board approved

the issuance of

On August 5, 2022, the Board approved

the issuance of

Other than the above, the Company has evaluated subsequent events through the date the financial statements were issued, and did not identify any subsequent events that would have required adjustment or disclosure in the financial statements.

21

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

All references to “we,” “us,” “our” and the “Company” refer to Innovative Payment Solutions, Inc., a Delaware corporation and its consolidated subsidiaries unless the context requires otherwise.

Overview

We are a provider of digital payment solutions and services to businesses and consumers. We are focused on operating and developing “e-wallets” that enable consumers to deposit cash, convert it into a digital form, and remit the funds to Mexico and other countries quickly and securely. Our first e-wallet, the Beyond Wallet, is currently operational. Our flagship e-wallet, IPSIPay, was soft launched in December 2021. Our platform (which can be used both business-to-business and business-to-consumer) will facilitate the transfer of funds in digital form to other countries, initially Mexico but also, India and the Philippines, primarily from hand-held devices as well as on desktop or laptop computers. During the second quarter of 2022, and subsequently, we began publicly testing the capabilities of IPSIPay and have achieved the first commercial downloads of the app. Additionally, we continued our initial launch efforts during the second quarter, and subsequently, we entered into an endorsement agreement with Mario Lopez, which we believe will be a significant part of our commercial launch efforts. We will continue our IPSIPay launch efforts through the remainder of 2022.

Our launch plan for IPSIPay and Beyond Wallet is to target lower income, migrant communities in California (notably in the agriculture industry), and expanding to other states with large migrant populations such as Texas and Florida. We not only believe the addressable market for our products and services is large and growing, but that servicing this market is socially responsible. We believe our digital payment facilitation platform and related apps will empower and enable the unbanked and under-served and payment providers who service these users, acting as a bridge to provide access to comprehensive and easy to use payment solutions. Given the large size of our addressable market, our ability to capture even a very small share of the market represents a significant revenue opportunity for our company.

Previously, we intended to invest in physical kiosks which required the user presence at digital payment kiosk locations, and we still intend to use our existing kiosks in certain target markets within Southern California.

We acquired a 10% strategic interest in Frictionless Financial Technologies, Inc. (“Frictionless”), on June 22, 2021. Frictionless agreed to deliver to us, a live fully compliant financial payment Software as a Service solution for use by us as a digital payment platform that enables payments within the United States and abroad, including Mexico, together with a service agreement providing a full suite of product services to facilitate our anticipated product offerings. We have an irrevocable right to acquire up to an additional 41% of the outstanding common stock of Frictionless at a purchase price of $300,000 for each 1% acquired.

On August 26, 2021, we formed a new majority owned subsidiary, Beyond Fintech Inc. (“Beyond Fintech”), in which we own a 51% stake, with Frictionless owning the remaining 49%. Beyond Fintech acquired an exclusive license to our Beyond Wallet offering to further its objective of providing virtual payment services allowing U.S. persons to transfer funds to Mexico and other countries.

Known Trends, Demands, Commitments, Events or Uncertainties Impacting Our Business

COVID-19

The novel coronavirus (“COVID-19”) pandemic has resulted in government authorities and businesses throughout the world implementing numerous measures intended to contain and limit the spread of COVID-19, including travel restrictions, border closures, quarantines, shelter-in-place and lock-down orders, mask and social distancing requirements, and business limitations and shutdowns. The spread of COVID-19 and increased variants has caused, and may continue to cause us to make significant modifications to our business practices, including enabling most of our workforce to work from home, establishing strict health and safety protocols for our offices, restricting physical participation in meetings, events, and conferences, and imposing restrictions on employee travel. We will continue to actively monitor the situation and may take further actions that alter our business practices as may be required by federal, state, or local authorities or that we determine are in the best interests of our employees, customers, or business partners.

The rapidly changing global market and economic conditions as a result of the COVID-19 pandemic have impacted, and are expected to continue to impact, our operations and business. For example, COVID-19 related issues has caused a delay in our ability to launch our products and services. The broader implications of the COVID-19 pandemic and related global economic unpredictability on our business, financial condition, and results of operations remain uncertain.

Russia’s Invasion of Ukraine

In February 2022, Russia invaded Ukraine, with Belarus complicit in the invasion. As of the date of this report, the conflict between these two countries is ongoing. We do not have any direct or indirect exposure to Ukraine, Belarus or Russia, through our operations, employee base or any investments in any of these countries. In addition, our securities are not traded on any stock exchanges in these three countries. We do not believe that the sanction levied against Russia or Belarus or individuals and entities associated with these two countries will have a material impact on our operations or business, if any. Further, we do not believe that we have any direct or indirect reliance on goods sourced from Russia, Ukraine or Belarus or countries that are supportive of Russia.

22

We have not fully commercially launched or e-wallet platforms to date, however we will be providing online money transfer and payment services to our customers in the future which may expose us to cybersecurity risks. We employ the latest encryption techniques and firewall practices and constantly monitor the usage of our software, however, this may not be sufficient to prevent the heightened risk of cybersecurity attacks emanating from Russia, Ukraine, Belarus, or any other country.

The impact of the invasion by Russia of Ukraine has increased volatility in stock trading prices and commodities throughout the world. To date, we have not seen a material impact on our operations; however, a prolonged conflict may impact on consumer spending, in general, which could have an adverse impact on the payment services industry as a whole and our business.

Inflation

Macro-economic conditions could affect consumer spending adversely and consequently our future operations when we fully launch our e-wallet products commercially. We believe the U.S. has entered a period of significant inflation, and this may impact consumer’s desire to adopt our products and services and may increase our costs overall. However, as of the date of this report, we do not expect there to be any material impact on our liquidity as forecast in our business plan due to recent inflationary concerns in the U.S.

Foreign Exchange Risks

We intend to operate in several foreign countries, including Mexico. Changes and fluctuations in the foreign exchange rate between the US Dollar and other foreign currencies, including the Mexican Peso, may in future have an effect our results of operations.

Critical Accounting Estimates

Preparation of our consolidated financial statements in accordance with U.S. generally accepted accounting principles ("GAAP") requires us to make estimates and assumptions that affect the reported amounts of certain assets, liabilities, revenues and expenses, as well as related disclosure of contingent assets and liabilities. Significant accounting policies are fundamental to understanding our financial condition and results as they require the use of estimates and assumptions which affect the financial statements and accompanying notes. See Note 2 - Summary of Significant Accounting Policies of the Notes to the condensed Consolidated Financial Statements included in Part I, Item I of this Form 10-Q for further information.

The critical accounting policies that involved significant estimation included the following:

Derivative liabilities

We have certain short-term convertible notes and certain warrants which have fundamental transaction clauses which might result in cash settlement. The conversion feature of these convertible notes and warrants are recorded as derivative liabilities which are valued at each reporting date.

The derivative liability is valued using the following inputs:

| ● | Conversion prices; |

| ● | Current market prices of our equity |

| ● | Risk free interest rates; |

| ● | Expected remaining life of the derivative liability; |

| ● | Expected volatility of the underlying stock; and expected dividend rates |

Any change in the above factors such as a change in risk free interest rates, a significant increase or decrease in our current stock prices and a change in the volatility of our common stock may result in a significant increase or decrease in the derivative liability.

Impairment of Investments and Intangible assets

We carried investments of $500,001 and Intangible assets of $964,310 as more fully described in Notes 4 and 5 to the condensed consolidated financial statements. The Company tests its Investments and intangible assets with an indefinite useful life annually for impairment or more frequently if indicators for impairment exist. The value of our Investments and intangibles is based upon our mutual goal of providing payment services to an underserved market. Currently our investments or our intangible assets have not produced any revenues on which to assess whether the income generated from these assets can support the carrying value of these assets. For impairment testing of investments and intangibles we determine the fair value of the underlying assets using an income-based approach which estimates the fair value using a discounted cash flow model. Key assumptions in estimating fair values include projected revenue growth and the weighted average cost of capital. In addition, management recently reviewed the future revenue and profit projections of our e-wallet services based on management forecasts of the size of the market and expected customer growth and retention, we determined that no impairment charges were necessary, however if we are unable to achieve our forecasts once operations begin, we may need to re-evaluate our forecasts which could result in an impairment charge. Since performing this analysis we have no reason to believe that further impairment is necessary as of June 30, 2022.

23

Results of Operations

Results of Operations for the Three Months Ended June 30, 2022 and 2021

Net revenue

We did not have revenues during the three months ended June 30, 2022 and 2021. We anticipate that we will recommence generating meaningful revenue when we fully launch our e-wallets, the timing for which is uncertain and subject to certain risks and uncertainties. We currently anticipate continuing the commercial launch our e-wallets during the remainder of 2022.

Cost of goods sold

As we did not have revenues during the three months ended June 30, 2022 and 2021, we anticipate that we will begin to recognize cost of goods sold when we launch our e-wallets once we have determined our deployment strategy.

General and administrative expenses