Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Consolidated Financial Statements

As confidentially submitted to the Securities and Exchange Commission on December 6, 2013.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission and all information contained herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Paylocity Holding Corporation

(Exact name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

7372 (Primary Standard Industrial Classification Code Number) |

46-4066644 (I.R.S. Employer Identification No.) |

3850 N. Wilke Road

Arlington Heights, Illinois 60004

(847) 463-3200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Steven R. Beauchamp

President and Chief Executive Officer

3850 N. Wilke Road

Arlington Heights, Illinois 60004

(847) 463-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

John J. Gilluly III, P.C. DLA Piper LLP (US) 401 Congress Avenue, Suite 2500 Austin, Texas 78701 (512) 457-7000 |

Christopher J. Austin Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, NY 10018 (212) 813-8800 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

||

|---|---|---|---|---|

Common Stock, par value $0.001 |

$ | $ | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. Includes

offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- Calculated pursuant to Rule 457(o) under the Securities Act based on an estimate of the proposed maximum offering price.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell securities, and it is not soliciting an offer to buy these securities, in any state or jurisdiction where the offer or sale is not permitted.

Preliminary prospectus, subject to completion. Dated , 2013

Prospectus

Shares

Paylocity Holding Corporation

Common Stock

This is the initial public offering of our common stock.

We are selling shares of common stock. The selling stockholders identified in this prospectus are selling an additional shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. The estimated initial public offering price is between $ and $ per share. Currently no public market exists for the shares.

We intend to apply to list our common stock on under the symbol "PCTY."

We are an "emerging growth company" under the federal securities laws and are eligible for reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share | Total | ||

|---|---|---|---|---|

Initial public offering price |

$ |

$ |

||

Underwriting discounts and commissions |

$ | $ | ||

Proceeds to us, before expenses |

$ | $ | ||

Proceeds to the selling stockholders, before expenses |

$ | $ |

The underwriters may also purchase up to an additional shares of common stock from us, at the initial public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

The underwriters expect to deliver the shares of common stock on or about , 2013.

| Deutsche Bank Securities | BofA Merrill Lynch | William Blair |

| JMP Securities | Raymond James | Needham & Company |

, 2013.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared and filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date on the front cover of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Until (25 days after the commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should carefully read the entire prospectus, including the financial statements and related notes included in this prospectus and the section entitled "Risk Factors," before deciding whether to invest in our common stock. Unless otherwise indicated or the context otherwise requires, references in this prospectus to "Paylocity," "the Company," "our company," "we," "us," and "our" refer to Paylocity Holding Corporation, a Delaware corporation, and, where appropriate, its wholly-owned subsidiary. References to any year herein refer to the twelve months ended June 30 of the year indicated unless otherwise specified.

Overview

We are a leading provider of cloud-based payroll and human capital management, or HCM, software solutions for medium-sized organizations, which we define as those having between 20 and 1,000 employees. Our comprehensive and easy-to-use solutions enable our clients to manage their workforces more effectively. As of June 30, 2013, we served approximately 6,850 clients across the U.S., which on average had over 100 employees. Our solutions help drive strategic human capital decision-making and improve employee engagement by enhancing the human resource, payroll and finance capabilities of our clients.

Our multi-tenant software platform is highly configurable and includes a unified suite of payroll and HCM applications, such as time and labor tracking, benefits and talent management. Our solutions have been organically developed from our core payroll solution, which we believe is the most critical system of record for medium-sized organizations and an essential gateway to other HCM functionality. Our payroll and HCM applications use a unified database and provide robust on-demand reporting and analytics. Our platform provides intuitive self-service functionality for employees and managers combined with seamless integration across all our solutions. We supplement our comprehensive software platform with an integrated implementation and client service organization, which is designed to meet the needs of medium-sized organizations.

We market and sell our products primarily through our direct sales force. We generate sales leads through a variety of focused marketing initiatives and by referrals from our extensive referral network of 401(k) advisors, benefits administrators, insurance brokers, third-party administrators and HR consultants. Our platform is priced on a per employee basis, and our recurring revenue model provides significant visibility into our future operating results.

We have experienced significant growth in recent years. Our total revenues increased from $39.5 million in fiscal 2011 to $55.1 million in fiscal 2012, representing a 39% year-over-year increase, and to $77.3 million in fiscal 2013, representing a 40% year-over-year increase. Our recurring revenues increased from $37.5 million in fiscal 2011 to $52.5 million in fiscal 2012, representing a 40% year-over-year increase, and to $72.8 million in fiscal 2013, representing a 39% year-over-year increase. As of June 30, 2013, we had approximately 6,850 clients. Our annual revenue retention rate was greater than 92% in each of fiscal years 2011, 2012 and 2013.

We have invested, and intend to continue to invest, in growing our business by expanding our sales and marketing activities, increasing research and development to expand and improve our product offerings, and scaling our technical infrastructure and operations. We incurred net losses of approximately $130,000 in fiscal 2011 and had net income of approximately $1.7 million and $617,000 in fiscal 2012 and 2013, respectively.

1

Industry Background

Effective management of human capital is a core function in all organizations and requires a significant commitment of resources. Organizations are faced with complex and ever-changing requirements, including diverse federal, state and local regulations across multiple jurisdictions. In addition, the workplace operating environment is rapidly changing as employees become increasingly mobile, work remotely and expect a user experience similar to that of consumer-oriented Internet applications. Medium-sized organizations operating without the infrastructure, expertise or personnel of larger enterprises are uniquely pressured in this complex and dynamic environment.

We believe that existing payroll and HCM solutions have limitations that cause them to underserve the unique needs of medium-sized organizations. Traditional payroll service providers are primarily focused on delivery of a variety of payroll processing services, insurance products and HR business process outsourcing solutions. Many of these solutions offer limited capabilities and lack a unified and configurable payroll and HCM suite. Enterprise-focused payroll and HCM software vendors offer solutions that are designed for the complex needs and structures of large enterprises. As a result, their solutions can be overly complex, expensive and time-consuming to implement, operate and maintain.

The market opportunity is driven by the importance of payroll and HCM solutions to the successful management of organizations. According to International Data Corporation, or IDC, the U.S. market for HCM applications and payroll outsourcing services is estimated to be $22.5 billion in 2014. To estimate our addressable market, we focus our analysis on the number of U.S. medium-sized organizations and the number of their employees. According to the U.S. Census Bureau, there were over 565,000 firms with 20 to 999 employees in the U.S. in 2010, employing over 40 million persons. We estimate that if clients were to buy our entire suite of existing solutions at list prices, they would spend approximately $200 per employee annually. Based on this analysis, we believe our current target addressable market is approximately $8.0 billion.

Our Solution

Our solution provides the following key benefits to our clients:

- •

- Comprehensive Platform Optimized for Medium-Sized

Organizations. Our solutions empower finance and HR professionals in medium-sized organizations to drive strategic human capital

decisions by providing enterprise-grade payroll and HCM applications, including robust reporting and analytics. Our unified platform fully automates payroll and HCM processes, enabling our clients to

focus on core business activities.

- •

- Modern, Intuitive User Experience. Our intuitive,

easy-to-use interface is based on current technology and automatically adapts to users' devices, including mobile platforms. Our platform's self-service functionality and performance management

applications provide employees with an engaging experience.

- •

- Flexible and Configurable Platform. We design our

solutions to be flexible and configurable, allowing our clients to match their use of our software with their specific business processes and workflows. Our platform has been organically developed

from a common code base, data structure and user interface, providing a consistent user experience with powerful features that are easily adaptable to our clients' needs.

- •

- Highly-Attractive SaaS Solution for Medium-Sized Organizations. Our solutions are cloud-based and offered on a subscription basis, making them easier and more affordable to implement, operate and update.

2

- •

- Seamless Integration with Extensive Ecosystem of Partners. Our platform offers our clients automated data integration with over 200 related third-party partner systems, such as 401(k), benefits and insurance provider systems. This integration reduces the complexity and risk of error of manual data transfers and saves time for our clients and their employees.

Our Strategy

We intend to strengthen and extend our position as a leading provider of cloud-based payroll and HCM software solutions to medium-sized organizations. Key elements of our strategy include:

- •

- Grow Our Client Base. We believe that our current client

base represents only a small portion of the medium-sized organizations that could benefit from our solutions. In order to acquire new clients, we plan to continue to grow our sales organization

aggressively across all U.S. geographies.

- •

- Expand Our Product Offerings. We plan to increase

investment in software development to continue to advance our platform and expand our product offerings. For example, we recently introduced new healthcare reform functionality that provides clients

with the ability to forecast and model the impact of healthcare reform on their businesses.

- •

- Increase Average Revenue Per Client. Our average revenue

per client has consistently increased in each of the last three years as we have broadened our product offerings. We plan to further grow average revenue per client by selling a broader selection of

products to new clients and deepening relationships with existing clients by expanding their use of our products.

- •

- Extend Technological Leadership. We believe that our

organically developed cloud-based multi-tenant software platform, combined with our unified database architecture, enhances the experience and usability of our products. We plan to continue our

technology innovation, as we have done with our mobile applications, social features and analytics capabilities.

- •

- Further Develop Our Referral Network. We have developed a strong network of referral participants, such as 401(k) advisors, benefits administrators, insurance brokers, third-party administrators and HR consultants, that recommend our solutions and provide referrals. We plan to increase integration with third-party providers and expand our referral network to grow our client base and lower our client acquisition costs.

Summary Risk Factors

Investing in our common stock involves significant risks and uncertainties. You should carefully consider the risks and uncertainties discussed under the section titled "Risk Factors" elsewhere in this prospectus before making a decision to invest in our common stock. If any of these risks and uncertainties occur, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock would likely decline and you may lose all or part of your investment. Below is a summary of some of the principal risks we face:

- •

- We have incurred losses in the past, and we may not be able to achieve or sustain profitability for the foreseeable

future.

- •

- Our quarterly operating results have fluctuated in the past and may continue to fluctuate.

- •

- Failure to manage our growth effectively could increase our expenses, decrease our revenue and prevent us from implementing our business strategy.

3

- •

- The markets in which we participate are highly competitive, and if we do not compete effectively, our operating results

could be adversely affected.

- •

- If we fail to adequately expand our direct sales force with qualified and productive sales representatives, we may not be

able to grow our business effectively.

- •

- Insiders will continue to have substantial control over us after this offering, which may affect the trading price for our

common stock and delay or prevent a third party from acquiring control over us.

- •

- The trading price of our common stock is likely to be volatile, and you might not be able to sell your shares at or above the initial public offering price.

Corporate Information

We were incorporated in July 1997 as an Illinois corporation. In November 2005, we changed our name to Paylocity Corporation. In November 2013, we effected a restructuring whereby Paylocity Corporation became a wholly-owned subsidiary of Paylocity Holding Corporation, a Delaware corporation. Except as otherwise provided herein, this prospectus gives effect to this restructuring. All of our business operations are conducted by Paylocity Corporation.

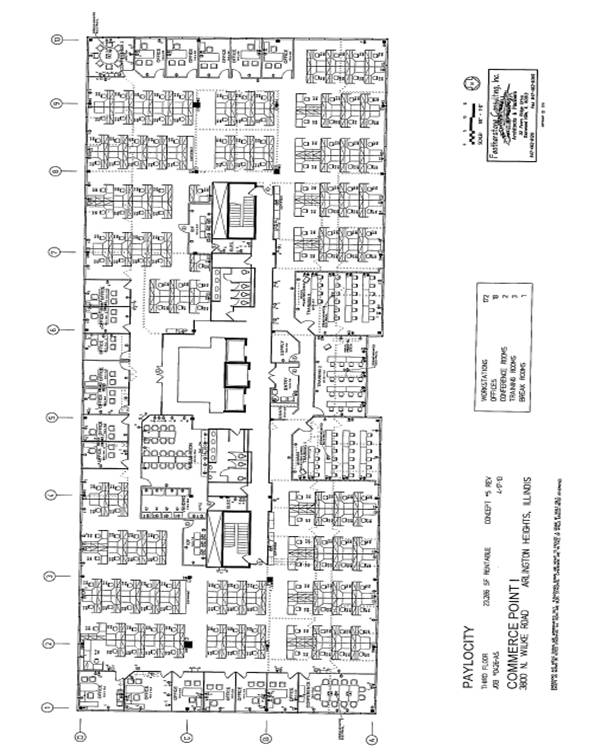

We are headquartered in Arlington Heights, Illinois. Our principal executive offices are located at 3850 N. Wilke Road, Arlington Heights, Illinois 60004. Our telephone number is (847) 463-3200. Our corporate website address is www.paylocity.com. The information contained in, or that can be accessed through, our website is not part of this prospectus.

Paylocity and "Apple and Orange" and other trademarks or service marks of Paylocity appearing in this prospectus are our property. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders.

4

Common stock offered by us |

shares | |

Common stock offered by the selling stockholders |

shares |

|

Common stock to be outstanding after this offering |

shares |

|

Over-allotment option offered by us |

shares |

|

Over-allotment option offered by the selling stockholders |

shares |

|

Use of proceeds |

We intend to use approximately $1.4 million of the net proceeds from this offering to repay outstanding indebtedness under a note. We intend to use the remaining net proceeds from this offering primarily for working capital and other general corporate purposes, including to finance our growth, develop new technologies and fund capital expenditures. We may also seek to expand our existing business through investments in or acquisitions of other businesses or technologies. We will not receive any of the proceeds from the sale of shares by the selling stockholders. See the section titled "Use of Proceeds." |

|

Risk Factors |

You should read carefully "Risk Factors" in this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock. |

|

Proposed symbol |

PCTY |

Except as otherwise indicated, all information in this prospectus is based upon 65,882,448 shares of common stock outstanding as of September 30, 2013 and excludes:

- •

- 3,563,587 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2013, having

a weighted average exercise price of $2.72 per share;

- •

- 443,770 additional common shares reserved for future grant or issuance under our 2013 Equity Incentive Plan; and

- •

- 403,800 shares of common stock subject to restricted stock award agreements.

Unless otherwise noted the information in this prospectus assumes:

- •

- No exercise of outstanding options after September 30, 2013;

- •

- The conversion of all our outstanding shares of preferred stock into shares of common stock prior to or upon the closing

of this offering;

- •

- The filing of our amended and restated certificate of incorporation and the effectiveness of our amended and restated

bylaws, which will occur immediately prior to the completion of this offering;

- •

- No purchase of shares in this offering by our officers and directors;

- •

- No exercise by the underwriters of their option to purchase additional shares; and

- •

- The distribution of all 46,293,499 shares of our common stock held by Paylocity Management Holdings, LLC to its individual members prior to the closing of this offering.

5

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth our summary consolidated financial data as of the dates and for the periods indicated. Our fiscal year ends on June 30. The summary consolidated financial data for each of the three fiscal years ended June 30, 2011, 2012 and 2013 has been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial data for the three months ended September 30, 2012 and 2013 has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of September 30, 2013 has been derived from our unaudited financial statements for such period, included elsewhere in this prospectus. Historical results are not necessarily indicative of future results. You should read this data together with our consolidated financial statements and related notes included elsewhere in this prospectus and the information under the sections titled "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

| |

Year Ended June 30, | Three Months Ended September 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | 2013 | 2012 | 2013 | |||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Consolidated Statements of Operations Data: |

||||||||||||||||

Revenues: |

||||||||||||||||

Recurring fees |

$ | 36,443 | $ | 51,211 | $ | 71,309 | $ | 14,721 | $ | 20,738 | ||||||

Interest income on funds held for clients |

1,100 | 1,263 | 1,459 | 302 | 353 | |||||||||||

Total recurring revenues |

37,543 | 52,474 | 72,768 | 15,023 | 21,091 | |||||||||||

Implementation services and other |

1,941 | 2,622 | 4,526 | 803 | 1,278 | |||||||||||

Total revenues |

39,484 | 55,096 | 77,294 | 15,826 | 22,369 | |||||||||||

Cost of revenues: |

||||||||||||||||

Recurring revenues |

16,329 | 22,054 | 28,863 | 6,386 | 7,993 | |||||||||||

Implementation services and other |

5,416 | 7,040 | 10,803 | 2,133 | 3,754 | |||||||||||

Total cost of revenues |

21,745 | 29,094 | 39,666 | 8,519 | 11,747 | |||||||||||

Gross profit |

17,739 | 26,002 | 37,628 | 7,307 | 10,622 | |||||||||||

Operating expenses: |

||||||||||||||||

Sales and marketing |

9,293 | 12,828 | 18,693 | 3,878 | 5,189 | |||||||||||

Research and development |

1,565 | 1,788 | 6,825 | 1,357 | 1,956 | |||||||||||

General and administrative |

6,868 | 8,618 | 12,079 | 2,688 | 3,911 | |||||||||||

Total operating expenses |

17,726 | 23,234 | 37,597 | 7,923 | 11,056 | |||||||||||

Operating income (loss) |

13 | 2,768 | 31 | (616 | ) | (434 | ) | |||||||||

Other income (expense) |

(179 | ) | (196 | ) | (16 | ) | (42 | ) | 28 | |||||||

Income (loss) before income taxes |

(166 | ) | 2,572 | 15 | (658 | ) | (406 | ) | ||||||||

Income tax (benefit) expense |

(36 | ) | 884 | (602 | ) | (253 | ) | (362 | ) | |||||||

Net income (loss) |

$ | (130 | ) | $ | 1,688 | $ | 617 | $ | (405 | ) | $ | (44 | ) | |||

Net income (loss) attributable to common stockholders |

$ | (774 | ) | $ | 998 | $ | (2,291 | ) | $ | (1,132 | ) | $ | (825 | ) | ||

Net income (loss) per share attributable to common stockholders: |

||||||||||||||||

Basic |

$ | (0.01 | ) | $ | 0.02 | $ | (0.05 | ) | $ | (0.02 | ) | $ | (0.02 | ) | ||

Diluted |

$ | (0.01 | ) | $ | 0.02 | $ | (0.05 | ) | $ | (0.02 | ) | $ | (0.02 | ) | ||

Weighted average shares used in computing net income (loss) per share attributable to common stockholders: |

||||||||||||||||

Basic |

56,308 | 65,808 | 47,983 | 47,983 | 47,983 | |||||||||||

Diluted |

56,308 | 66,475 | 47,983 | 47,983 | 47,983 | |||||||||||

6

| |

Year Ended June 30, | Three Months Ended September 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | 2013 | 2012 | 2013 | |||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Other Financial Data: |

||||||||||||||||

Adjusted Gross Profit(1) |

$ | 19,962 | $ | 28,729 | $ | 40,695 | $ | 8,170 | $ | 11,227 | ||||||

Adjusted EBITDA(1) |

$ | 4,028 | $ | 7,660 | $ | 6,301 | $ | 919 | $ | 1,188 | ||||||

| |

As of September 30, 2013 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma(2) | Pro Forma As Adjusted(3) |

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 5,299 | $ | 5,299 | $ | |||||

Working capital(4) |

501 | 501 | ||||||||

Funds held for clients |

291,559 | 291,559 | ||||||||

Total assets |

313,186 | 313,186 | ||||||||

Debt, current portion |

625 | 625 | ||||||||

Client fund obligations |

291,559 | 291,559 | ||||||||

Long-term debt, net of current portion |

781 | 781 | ||||||||

Redeemable convertible preferred stock |

36,573 | — | ||||||||

Stockholders' equity (deficit) |

(26,455 | ) | 10,118 | |||||||

- (1)

- We

use Adjusted Gross Profit and Adjusted EBITDA to evaluate our operating results. We prepare Adjusted Gross Profit and Adjusted EBITDA to eliminate the

impact of items we do not consider indicative of our ongoing operating performance. However, Adjusted Gross Profit and Adjusted EBITDA are not measurements of financial performance under generally

accepted accounting principles in the United States, or GAAP, and these metrics may not be comparable to similarly-titled measures of other companies.

- We

define Adjusted Gross Profit as gross profit before amortization of capitalized internal-use software and stock-based compensation expenses,

if any. We define Adjusted EBITDA as net income (loss) before interest expense (income), income tax expense (benefit), depreciation and amortization and stock-based compensation expenses.

- We

disclose Adjusted Gross Profit and Adjusted EBITDA, which are non-GAAP measures, because we believe these metrics assist investors and

analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We believe these

metrics are commonly used in the financial community to aid in comparisons of similar companies, and we present them to enhance investors' understanding of our operating performance and cash flows.

- Adjusted

Gross Profit and Adjusted EBITDA have limitations as analytical tools. Some of these limitations

are:

- •

- Adjusted EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures;

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- Adjusted EBITDA does not reflect our income tax expense or the cash requirement to pay our taxes;

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may

have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and

- •

- Other companies in our industry may calculate Adjusted Gross Profit and Adjusted EBITDA differently than we do, limiting their usefulness as a comparative measure.

7

- Additionally,

stock-based compensation will be an element of our overall compensation strategy, although we exclude it from Adjusted Gross

Profit and Adjusted EBITDA as an expense when evaluating our ongoing operating performance for a particular period.

- Because

of these limitations, you should not consider Adjusted Gross Profit as an alternative to gross profit or Adjusted EBITDA as an

alternative to net income (loss) or cash provided by operating activities, in each case as determined in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP

results, and we use Adjusted Gross Profit and Adjusted EBITDA only supplementally.

- Directly comparable GAAP measures to Adjusted Gross Profit and Adjusted EBITDA are gross profit and net income (loss), respectively. We reconcile Adjusted Gross Profit and Adjusted EBITDA as follows:

| |

Year Ended June 30, | Three Months Ended September 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | 2013 | 2012 | 2013 | |||||||||||

| |

(in thousands) |

|||||||||||||||

Reconciliation from Gross Profit to Adjusted Gross Profit |

||||||||||||||||

Gross profit |

$ | 17,739 | $ | 26,002 | $ | 37,628 | $ | 7,307 | $ | 10,622 | ||||||

Amortization of capitalized research and development costs |

2,223 | 2,727 | 3,067 | 863 | 605 | |||||||||||

Adjusted Gross Profit |

$ | 19,962 | $ | 28,729 | $ | 40,695 | $ | 8,170 | $ | 11,227 | ||||||

Year Ended June 30, |

Three Months Ended September 30, |

|||||||||||||||

| |

2011 | 2012 | 2013 | 2012 | 2013 | |||||||||||

| |

(in thousands) |

|||||||||||||||

Reconciliation from Net Income (Loss) to Adjusted EBITDA |

||||||||||||||||

Net income (loss) |

$ | (130 | ) | $ | 1,688 | $ | 617 | $ | (405 | ) | $ | (44 | ) | |||

Interest expense |

238 | 261 | 192 | 57 | 22 | |||||||||||

Income tax (benefit) expense |

(36 | ) | 884 | (602 | ) | (253 | ) | (362 | ) | |||||||

Depreciation and amortization |

3,779 | 4,624 | 5,571 | 1,389 | 1,391 | |||||||||||

EBITDA |

3,851 | 7,457 | 5,778 | 788 | 1,007 | |||||||||||

Stock-based compensation expense |

177 | 203 | 523 | 131 | 181 | |||||||||||

Adjusted EBITDA |

$ | 4,028 | $ | 7,660 | $ | 6,301 | $ | 919 | $ | 1,188 | ||||||

- (2)

- The

pro forma balance sheet data as of September 30, 2013 reflects the conversion of all of our preferred stock outstanding to common stock in

connection with this offering and the distribution of the shares of our common stock held by Paylocity Management Holdings, LLC to its individual members prior to the closing of this offering.

- (3)

- The

pro forma as adjusted balance sheet data as of September 30, 2013 reflects the pro forma adjustments described in footnote (2) above as

adjusted to give effect to receipt by us of the estimated net proceeds from this offering, based on an assumed initial public offering price of $ per share, the mid-point of

the range

set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. A $1.00 increase (decrease) in the assumed initial

public offering price of $ per share, the mid-point of the range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount

of our cash

and cash equivalents, working capital, total assets and total stockholders' equity by approximately $ million, assuming that the number of shares offered by us, as set

forth on

the cover page of this prospectus, remains the same and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

- (4)

- Working capital is defined as current assets minus current liabilities.

8

Investing in our common stock involves a high degree of risk. You should carefully consider all the risk factors and uncertainties described below, together with all of the other information in this prospectus, including the consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding whether to invest in our common stock. If any of the following risks were to materialize, our business, financial condition, results of operations and future prospects could be materially and adversely affected. The trading price of our common stock could decline as a result of any of these risks, and you could lose part or even all of your investment in our common stock.

We have incurred losses in the past, and we may not be able to achieve or sustain profitability for the foreseeable future.

We have incurred net losses from time to time. We have been growing our number of clients rapidly, and as we do so, we incur significant sales and marketing, services and other related expenses. Our profitability will depend in significant part on our obtaining sufficient scale and productivity that the cost of adding and supporting new clients does not outweigh our revenues. We intend for the foreseeable future to continue to focus predominately on adding new clients, and we cannot predict when we will achieve sustained profitability, if at all. We also expect to make other significant expenditures and investments in research and development to expand and improve our product offerings and technical infrastructure. In addition, as a public company, we will incur significant legal, accounting and other expenses that we do not incur as a private company. These increased expenditures will make it harder for us to achieve and maintain profitability. We also may incur losses in the future for a number of other unforeseen reasons. Accordingly, we may not be able to maintain profitability, and we may incur losses for the foreseeable future.

Our quarterly operating results have fluctuated in the past and may continue to fluctuate, causing the value of our common stock to decline substantially.

Our quarterly operating results may fluctuate due to a variety of factors, many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. Moreover, our stock price might be based on expectations of future performance that are unrealistic or that we might not meet and, if our revenue or operating results fall below such expectations, the price of our common stock could decline substantially.

Our number of new clients increases more during our third fiscal quarter ending March 31 than during the rest of our fiscal year, primarily because many new clients prefer to start using our payroll and HCM solutions at the beginning of a calendar year. In addition, client funds and year-end activities are traditionally higher during our third fiscal quarter. As a result of these factors, our total revenue and expenses have historically grown disproportionately during our third fiscal quarter as compared to other quarters.

In addition to other risk factors listed in this section, some of the important factors that may cause fluctuations in our quarterly operating results include:

- •

- The extent to which our products achieve or maintain market acceptance;

- •

- Our ability to introduce new products and enhancements and updates to our existing products on a timely basis;

- •

- Competitive pressures and the introduction of enhanced products and services from competitors;

- •

- Changes in client budgets and procurement policies;

9

- •

- The amount and timing of our investment in research and development activities and whether such investments are

capitalized or expensed as incurred;

- •

- The number of our clients' employees;

- •

- Timing of recognition of revenues and expenses;

- •

- Client renewal rates;

- •

- Seasonality in our business;

- •

- Technical difficulties with our products or interruptions in our services;

- •

- Our ability to hire and retain qualified personnel;

- •

- Changes in the regulatory requirements and environment related to the products and services which we offer; and

- •

- Unforeseen legal expenses, including litigation and settlement costs.

We do not have long-term agreements with clients, and our standard agreements with clients are generally terminable by our clients upon 60 or fewer days' notice. If a significant number of clients elected to terminate their agreements with us, our operating results and our business would be adversely affected.

In addition, a significant portion of our operating expenses are related to compensation and other items which are relatively fixed in the short-term, and we plan expenditures based in part on our expectations regarding future needs and opportunities. Accordingly, changes in our business or revenue shortfalls could decrease our gross and operating margins and could cause significant changes in our operating results from period to period. If this occurs, the trading price of our common stock could fall substantially, either suddenly or over time.

Our operating results for previous fiscal quarters are not necessarily indicative of our operating results for the full fiscal years or for any future periods. We believe that, due to the underlying factors for quarterly fluctuations, quarter-to-quarter comparisons of our operations are not necessarily meaningful and that such comparisons should not be relied upon as indications of future performance.

Failure to manage our growth effectively could increase our expenses, decrease our revenue, and prevent us from implementing our business strategy.

We have been rapidly growing our revenue and number of clients, and we will seek to do the same for the foreseeable future. However, the growth in our number of clients puts significant strain on our business, requires significant capital expenditures and increases our operating expenses. To manage this growth effectively, we must attract, train, and retain a significant number of qualified sales, implementation, client service, software development, information technology and management personnel. We also must maintain and enhance our technology infrastructure and our financial and accounting systems and controls. If we fail to effectively manage our growth or we over-invest or under-invest in our business, our business and results of operations could suffer from the resultant weaknesses in our infrastructure, systems or controls. We could also suffer operational mistakes, a loss of business opportunities and employee losses. If our management is unable to effectively manage our growth, our expenses might increase more than expected, our revenue could decline or might grow more slowly than expected, and we might be unable to implement our business strategy.

10

The markets in which we participate are highly competitive, and if we do not compete effectively, our operating results could be adversely affected.

The market for payroll and HCM solutions is fragmented, highly competitive and rapidly changing. Our competitors vary for each of our solutions, and include enterprise-focused software providers, such as Ultimate Software Group, Inc., Workday, Inc., SAP AG, Oracle Corporation and Ceridian Corporation, payroll service providers, such as Automatic Data Processing, Inc., Paychex, Inc. and other regional providers, and HCM point solutions, such as Cornerstone OnDemand, Inc.

Several of our competitors are larger, have greater name recognition, longer operating histories and significantly greater resources than we do. Many of these competitors are able to devote greater resources to the development, promotion and sale of their products and services. Furthermore, our current or potential competitors may be acquired by third parties with greater available resources and the ability to initiate or withstand substantial price competition. As a result, our competitors may be able to develop products and services better received by our markets or may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, regulations or client requirements.

In addition, current and potential competitors have established, and might in the future establish, partner or form other cooperative relationships with vendors of complementary products, technologies or services to enable them to offer new products and services, to compete more effectively or to increase the availability of their products in the marketplace. New competitors or relationships might emerge that have greater market share, a larger client base, more widely adopted proprietary technologies, greater marketing expertise, greater financial resources, and larger sales forces than we have, which could put us at a competitive disadvantage. In light of these advantages, current or potential clients might accept competitive offerings in lieu of purchasing our offerings. We expect intense competition to continue for these reasons, and such competition could negatively impact our sales, profitability or market share.

If we do not continue to innovate and deliver high-quality, technologically advanced products and services, we will not remain competitive and our revenue and operating results could suffer.

The market for our solutions is characterized by rapid technological advancements, changes in client requirements, frequent new product introductions and enhancements and changing industry standards. The life cycles of our products are difficult to estimate. Rapid technological changes and the introduction of new products and enhancements by new or existing competitors could undermine our current market position.

Our success depends in substantial part on our continuing ability to provide products and services that medium-sized organizations will find superior to our competitors' offerings and will continue to use. We intend to continue to invest significant resources in research and development in order to enhance our existing products and services and introduce new high-quality products that clients will want. If we are unable to predict user preferences or industry changes, or if we are unable to modify our products and services on a timely basis or to effectively bring new products to market, our sales may suffer.

In addition, we may experience difficulties with software development, industry standards, design, or marketing that could delay or prevent our development, introduction or implementation of new solutions and enhancements. The introduction of new solutions by competitors, the emergence of new industry standards or the development of entirely new technologies to replace existing offerings could render our existing or future solutions obsolete.

11

We may not have sufficient resources to make the necessary investments in software development and we may experience difficulties that could delay or prevent the successful development, introduction or marketing of new products or enhancements. In addition, our products or enhancements may not meet the increasingly complex client requirements of the marketplace or achieve market acceptance at the rate we expect, or at all. Any failure by us to anticipate or respond adequately to technological advancements, client requirements and changing industry standards, or any significant delays in the development, introduction or availability of new products or enhancements, could undermine our current market position.

If we are unable to release periodic updates on a timely basis to reflect changes in tax, benefit and other laws and regulations that our products help our clients address, the market acceptance of our products may be adversely affected and our revenues could decline.

Our solutions are affected by changes in tax, benefit and other laws and regulations and generally must be updated regularly to maintain their accuracy and competitiveness. Although we believe our SaaS platform provides us with flexibility to release updates in response to these changes, we cannot be certain that we will be able to make the necessary changes to our solutions and release updates on a timely basis, or at all. Failure to do so could have an adverse effect on the functionality and market acceptance of our solutions. In addition, significant changes in tax, benefit and other laws and regulations could require us to make significant modifications to our products, which could result in substantial expenses.

Because of the way we recognize our revenue and our expenses over varying periods, changes in our business may not be immediately reflected in our financial statements.

We recognize our revenue as services are performed. The amount of revenue we recognize in any particular period is derived in significant part based on the number of employees of our clients served by our solutions. As a result, our revenue is dependent in part on the success of our clients. The effect on our revenue of significant changes in sales of our solutions or in our clients' businesses may not be fully reflected in our results of operations until future periods.

We recognize our expenses over varying periods based on the nature of the expense. In particular, we recognize implementation costs and sales commissions as they are incurred even though we recognize revenue as we perform services over extended periods. When a client terminates its relationship with us, we may not have derived enough revenue from that client to cover associated implementation costs. As a result, we may report poor operating results due to higher implementation costs and sales commissions in a period in which we experience strong sales of our solutions. Alternatively, we may report better operating results due to lower implementation costs and sales commissions in a period in which we experience a slowdown in sales. As a result, our expenses fluctuate as a percentage of revenue, and changes in our business generally may not be immediately reflected in our results of operations.

If our security measures are breached or unauthorized access to client data or funds is otherwise obtained, our solutions may be perceived as not being secure, clients may reduce the use of or stop using our solutions and we may incur significant liabilities.

Our solutions involve the storage and transmission of our clients' and their employees' proprietary and confidential information. This information includes bank account numbers, tax return information, social security numbers, benefit information, retirement account information, payroll information and system passwords. In addition, we collect and maintain personal information on our own employees in the ordinary course of our business. Finally, our business involves the storage and transmission of funds from the accounts of our clients to their employees, taxing and regulatory authorities and others. As a result, unauthorized access or security breaches of our systems or the

12

systems of our clients could result in the unauthorized disclosure of confidential information, theft, litigation, indemnity obligations and other significant liabilities. Because the techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are employed, we may be unable to anticipate these techniques or to implement adequate preventative measures in advance. While we have security measures and controls in place to protect confidential information, prevent data loss, theft and other security breaches, including penetration tests of our systems by independent third parties, if our security measures are breached, our business could be substantially harmed and we could incur significant liabilities. Any such breach or unauthorized access could negatively affect our ability to attract new clients, cause existing clients to terminate their agreements with us, result in reputational damage and subject us to lawsuits, regulatory fines or other actions or liabilities which could materially and adversely affect our business and operating results.

There can be no assurance that the limitations of liability in our contracts would be enforceable or adequate or would otherwise protect us from any such liabilities or damages with respect to any particular claim related to a breach or unauthorized access. We also cannot be sure that our existing general liability insurance coverage and coverage for errors or omissions will continue to be available on acceptable terms or will be available in sufficient amounts to cover one or more large claims, or that the insurer will not deny coverage as to any future claim. The successful assertion of one or more large claims against us that exceed available insurance coverage, or the occurrence of changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could have a material adverse effect on our business, financial condition and results of operations.

If we fail to adequately expand our direct sales force with qualified and productive persons, we may not be able to grow our business effectively.

We primarily sell our products and implementation services through our direct sales force. To grow our business, we intend to focus on growing our client base for the foreseeable future. Our ability to add clients and to achieve revenue growth in the future will depend upon our ability to grow and develop our direct sales force and on their ability to productively sell our solutions. Identifying and recruiting qualified personnel and training them in the use of our software require significant time, expense and attention. The amount of time it takes for our sales representatives to be fully-trained and to become productive varies widely. In addition, if we hire sales representatives from competitors or other companies, their former employers may attempt to assert that these employees have breached their legal obligations, resulting in a diversion of our time and resources.

If our sales organization does not perform as expected, our revenues and revenue growth could suffer. In addition, if we are unable to hire, develop and retain talented sales personnel, if our sales force becomes less efficient as it grows or if new sales representatives are unable to achieve desired productivity levels in a reasonable period of time, we may not be able to grow our client base and revenues and our sales and marketing expenses may increase.

If our referral network participants reduce their referrals to us, we may not be able to grow our client base or revenues in the future.

Referrals from third-party service providers, including 401(k) advisors, benefits administrators, insurance brokers, third-party administrators and HR consultants, represent a significant source of potential clients for our products and implementation services. For example, we estimate that approximately 25% of our new sales in fiscal 2013 were referred to us from our referral network participants, and our referral network may become an even more significant source of client referrals in the future. In most cases, our relationships with referral network participants are informal,

13

although in some cases, we have formalized relationships where we are a recommended vendor for their client.

Participants in our referral network are generally under no contractual obligation to continue to refer business to us, and we do not intend to seek contractual relationships with these participants. In addition, these participants are generally not compensated for referring potential clients to us, and may choose to instead refer potential clients to our competitors. Our ability to achieve revenue growth in the future will depend, in part, upon continued referrals from our network.

There can be no assurance that we will be successful in maintaining, expanding or developing our referral network. If our relationships with participants in our referral network were to deteriorate or if any of our competitors enter into strategic relationships with our referral network participants, sales leads from these participants could be reduced or cease entirely. If we are not successful, we may lose sales opportunities and our revenues and profitability could suffer.

If the market for cloud-based payroll and HCM solutions among medium-sized organizations develops more slowly than we expect or declines, our business could be adversely affected.

We believe that the market for cloud-based payroll and HCM solutions is not as mature among medium-sized organizations as the market for outsourced services or on-premise software and services. It is not certain that cloud-based solutions will achieve and sustain high levels of client demand and market acceptance. Our success will depend to a substantial extent on the widespread adoption by medium-sized organizations of cloud-based computing in general, and of payroll and other HCM applications in particular. It is difficult to predict client adoption rates and demand for our solutions, the future growth rate and size of the cloud-based market or the entry of competitive solutions. The expansion of the cloud-based market depends on a number of factors, including the cost, performance, and perceived value associated with cloud-based computing, as well as the ability of cloud-based solutions to address security and privacy concerns. If other cloud-based providers experience security incidents, loss of client data, disruptions in delivery or other problems, the market for cloud-based applications as a whole, including our solutions, may be negatively affected. If cloud-based payroll and HCM solutions do not achieve widespread adoption among medium-sized organizations, or there is a reduction in demand for cloud-based computing caused by a lack of client acceptance, technological challenges, weakening economic conditions, security or privacy concerns, competing technologies and products, decreases in corporate spending or otherwise, it could result in a loss of clients, decreased revenues and an adverse impact on our business.

We typically pay employees and taxing authorities amounts due for a payroll period before a client's electronic funds transfers are finally settled to our account. If client payments are rejected by banking institutions or otherwise fail to clear into our accounts, we may require additional sources of short-term liquidity and our operating results could be adversely affected.

Our payroll processing business involves the movement of significant funds from the account of a client to employees and relevant taxing authorities. For example, in fiscal 2013 we processed almost $30 billion in payroll transactions. Though we debit a client's account prior to any disbursement on its behalf, there is a delay between our payment of amounts due to employees and taxing and other regulatory authorities and when the incoming funds from the employer to cover these payables actually clear into our operating accounts. There is therefore a risk that the employer's funds will be insufficient to cover the amounts we have already paid on its behalf. While such shortage and accompanying financial exposure has only occurred in very limited instances in the past, should clients default on their payment obligations in the future, we might be required to advance substantial amounts of funds to cover such obligations. In such an event, we may be

14

required to seek additional sources of short-term liquidity, which may not be available on reasonable terms, if at all, and our operating results and our liquidity could be adversely affected and our banking relationships could be harmed.

Adverse changes in economic or political conditions could adversely affect our operating results and our business.

Our recurring revenues are based in part on the number of our clients' employees. As a result, we are subject to risks arising from adverse changes in economic and political conditions. The state of the economy and the rate of employment, which deteriorated in the recent broad recession, may deteriorate further in the future. If weakness in the economy continues or worsens, many clients may reduce their number of employees and delay or reduce technology purchases. This could also result in reductions in our revenues and sales of our products, longer sales cycles, increased price competition and clients' purchasing fewer solutions than they have in the past. Any of these events would likely harm our business, results of operations, financial condition and cash flows from operations.

Trade, monetary and fiscal policies, and political and economic conditions may substantially change, and credit markets may experience periods of constriction and volatility. When there is a slowdown in the economy, employment levels and interest rates may decrease with a corresponding impact on our businesses. Clients may react to worsening conditions by reducing their spending on payroll and other HCM solutions or renegotiating their contracts with us. We have agreements with various large banks to execute Automated Clearing House, or ACH, and wire transfers as part of our client payroll and tax services. While we have contingency plans in place for bank failures, a failure of one of our banking partners or a systemic shutdown of the banking industry could result in the loss of client funds or impede us from accessing and processing funds on our clients' behalf, and could have an adverse impact on our business and liquidity.

If the banks that currently provide ACH and wire transfers fail to properly transmit ACH or terminate their relationship with us or limit our ability to process funds or we are not able to increase our ACH capacity with our existing and new banks, our ability to process funds on behalf of our clients and our financial results and liquidity could be adversely affected.

We currently have agreements with nine banks to execute ACH and wire transfers to support our client payroll and tax services. If one or more of the banks fails to process ACH transfers on a timely basis, or at all, then our relationship with our clients could be harmed and we could be subject to claims by a client with respect to the failed transfers. In addition, these banks have no obligation to renew their agreements with us on commercially reasonable terms, if at all. If these banks terminate their relationships with us or restrict the dollar amounts of funds that they will process on behalf of our clients, their doing so may impede our ability to process funds and could have an adverse impact on our financial results and liquidity.

We depend on our senior management team and other key employees, and the loss of these persons or an inability to attract and retain highly skilled employees could adversely affect our business.

Our success depends largely upon the continued services of our key executive officers, including Steven R. Beauchamp, our President and Chief Executive Officer. We also rely on our leadership team in the areas of research and development, sales, services and general and administrative functions. From time to time, there may be changes in our executive management team resulting from the hiring or departure of executives, which could disrupt our business. While we have employment agreements with certain of our executive officers, including Mr. Beauchamp, these employment agreements do not require them to continue to work for us for any specified

15

period and, therefore, they could terminate their employment with us at any time. The loss of one or more of our executive officers or key employees could have an adverse effect on our business.

If we are unable to recruit and retain highly-skilled product development and other technical persons, our ability to develop and support widely-accepted products could be impaired and our business could be harmed.

We believe that to grow our business and be successful, we must continue to develop products that are technologically-advanced, are highly integrable with third-party services, provide significant mobility capabilities and have pleasing and intuitive user experiences. To do so, we must attract and retain highly qualified personnel, particularly employees with high levels of experience in designing and developing software and Internet-related products and services. Competition for these personnel in the greater Chicago area and elsewhere is intense. If we fail to attract new personnel or fail to retain and motivate our current personnel, our business and future growth prospects could be severely harmed. We follow a practice of hiring the best available candidates wherever located, but as we grow our business, the productivity of our product development and other research and development may be adversely affected. In addition, if we hire employees from competitors or other companies, their former employers may attempt to assert that these employees have breached their legal obligations, resulting in a diversion of our time and resources.

The sale and support of products and the performance of related services by us entail the risk of product or service liability claims, which could significantly affect our financial results.

Clients use our products in connection with the preparation and filing of tax returns and other regulatory reports. If any of our products contain errors that produce inaccurate results upon which users rely, or cause users to misfile or fail to file required information, we could be subject to liability claims from users. Our agreements with our clients typically contain provisions intended to limit our exposure to such claims, but such provisions may not be effective in limiting our exposure. Contractual limitations we use may not be enforceable and may not provide us with adequate protection against product liability claims in certain jurisdictions. A successful claim for product or service liability brought against us could result in substantial cost to us and divert management's attention from our operations.

Privacy concerns and laws or other domestic regulations may reduce the effectiveness of our applications and adversely affect our business.

Our clients collect, use and store personal or identifying information regarding their employees and their family members in our solutions. Federal and state government bodies and agencies have adopted, are considering adopting, or may adopt laws and regulations regarding the collection, use, storage and disclosure of such personal information. The costs of compliance with, and other burdens imposed by, such laws and regulations that are applicable to our clients' businesses may limit the use and adoption of our applications and reduce overall demand, or lead to significant fines, penalties or liabilities for any noncompliance with such privacy laws. Even the perception of privacy concerns, whether or not valid, may inhibit market adoption of our solutions.

All of these legislative and regulatory initiatives may adversely affect our clients' ability to process, handle, store, use and transmit demographic and personal information regarding their employees and family members, which could reduce demand for our solutions.

In addition to government activity, privacy advocacy groups and the technology and other industries are considering various new, additional or different self-regulatory standards that may place additional burdens on us. If the processing of personal information were to be curtailed in this

16

manner, our products would be less effective, which may reduce demand for our applications and adversely affect our business.

Our business could be adversely affected if we do not effectively implement our solutions or our clients are not satisfied with our implementation services.

Our ability to deliver our payroll and HCM solutions depends on our ability to effectively implement and to transition to, and train our clients on, our solutions. We do not recognize revenue from new clients until they process their first payroll. Further, our agreements with our clients are generally terminable by the clients on 60 days' notice. If a client is not satisfied with our implementation services, the client could terminate its agreement with us before we have recovered our costs of implementation services, which would adversely affect our results of operations and cash flows. In addition, negative publicity related to our client relationships, regardless of its accuracy, may further damage our business by affecting our ability to compete for new business with current and prospective clients.

Our business could be affected if we are unable to accommodate increased demand for our implementation services resulting from growth in our business.

We may be unable to respond quickly enough to accommodate increased client demand for implementation services driven by our growth. The implementation process is the first substantive interaction with a new client. As a predicate to providing knowledgeable implementation services, we must have a sufficient number of personnel dedicated to that process. In order to ensure that we have sufficient employees to implement our solutions, we must closely coordinate hiring of personnel with our projected sales for a particular period. Because our sales cycle is typically only three to four weeks long, we may not be successful in coordinating hiring of implementation personnel to meet increased demand for our implementation services. Increased demand for implementation services without a corresponding staffing increase of qualified personnel could adversely affect the quality of services provided to new clients, and our business and our reputation could be harmed.

Any failure to offer high-quality client services may adversely affect our relationships with our clients and our financial results.

Once our applications are deployed, our clients depend on our client service organization to resolve issues relating to our solutions. Our clients are medium-sized organizations with limited personnel and resources to address payroll and other HCM related issues. These clients rely on us more so than larger companies with greater internal resources and expertise. High-quality client services are important for the successful marketing and sale of our products and for the retention of existing clients. If we do not help our clients quickly resolve issues and provide effective ongoing support, our ability to sell additional products to existing clients would suffer and our reputation with existing or potential clients would be harmed.

In addition, our sales process is highly dependent on our applications and business reputation and on positive recommendations from our existing clients. Any failure to maintain high-quality client services, or a market perception that we do not maintain high-quality client services, could adversely affect our reputation, our ability to sell our solutions to existing and prospective clients, and our business, operating results and financial position.

17

If we fail to manage our technical operations infrastructure, our existing clients may experience service outages and our new clients may experience delays in the deployment of our applications.

We have experienced significant growth in the number of users, transactions and data that our operations infrastructure supports. We seek to maintain sufficient excess capacity in our data center and other operations infrastructure to meet the needs of all of our clients. We also seek to maintain excess capacity to facilitate the rapid provision of new client deployments and the expansion of existing client deployments. In addition, we need to properly manage our technological operations infrastructure in order to support version control, changes in hardware and software parameters and the evolution of our applications. However, the provision of new hosting infrastructure requires significant lead time. We have experienced, and may in the future experience, website disruptions, outages and other performance problems. These problems may be caused by a variety of factors, including infrastructure changes, human or software errors, viruses, security attacks, fraud, spikes in client usage and denial of service issues. In some instances, we may not be able to identify the cause or causes of these performance problems within an acceptable period of time. If we do not accurately predict our infrastructure requirements, our existing clients may experience service outages that may subject us to financial penalties, financial liabilities and client losses. If our operations infrastructure fails to keep pace with increased sales, clients may experience delays as we seek to obtain additional capacity, which could adversely affect our reputation and our revenues.

In addition, our ability to deliver our cloud-based applications depends on the development and maintenance of Internet infrastructure by third parties. This includes maintenance of a reliable network backbone with the necessary speed, data capacity, bandwidth capacity, and security. Our services are designed to operate without interruption. However, we have experienced and expect that we will experience future interruptions and delays in services and availability from time to time. In the event of a catastrophic event with respect to one or more of our systems, we may experience an extended period of system unavailability, which could negatively impact our relationship with clients. To operate without interruption, both we and our clients must guard against:

- •

- Damage from fire, power loss, natural disasters and other force majeure events outside our control;

- •

- Communications failures;

- •

- Software and hardware errors, failures and crashes;

- •

- Security breaches, computer viruses, hacking, denial-of-service attacks and similar disruptive problems; and

- •

- Other potential interruptions.

We also rely on computer hardware purchased or leased and software licensed from third parties in order to offer our services. These licenses and hardware are generally commercially available on varying terms. However, it is possible that this hardware and software might not continue to be available on commercially reasonable terms, or at all. Any loss of the right to use any of this hardware or software could result in delays in the provisioning of our services until equivalent technology is either developed by us, or, if available, is identified, obtained and integrated.

Furthermore, our payroll application is essential to our clients' timely payment of wages to their employees. Any interruption in our service may affect the availability, accuracy or timeliness of these programs and could damage our reputation, cause our clients to terminate their use of our

18

application, require us to indemnify our clients against certain losses due to our own errors and prevent us from gaining additional business from current or future clients.

Any disruption in the operation of our data centers could adversely affect our business.

We host our applications and serve all of our clients from data centers located at our company headquarters in Arlington Heights, Illinois with a backup data center at a third-party facility in Kenosha, Wisconsin. We also may decide to employ additional offsite data centers in the future to accommodate growth.

Problems faced by our data center locations, with the telecommunications network providers with whom we or they contract, or with the systems by which our telecommunications providers allocate capacity among their clients, including us, could adversely affect the availability and processing of our solutions and related services and the experience of our clients. If our data centers are unable to keep up with our growing needs for capacity, this could have an adverse effect on our business and cause us to incur additional expense. In addition, any financial difficulties faced by our third-party data center's operator or any of the service providers with whom we or they contract may have negative effects on our business, the nature and extent of which are difficult to predict. Any changes in service levels at our third-party data center or any errors, defects, disruptions or other performance problems with our applications could adversely affect our reputation and may damage our clients' stored files or result in lengthy interruptions in our services. Interruptions in our services might reduce our revenues, subject us to potential liability or other expenses or adversely affect our renewal rates.

In addition, while we own, control and have access to our servers and all of the components of our network that are located in our backup data center, we do not control the operation of this facility. The operator of our Wisconsin data center facility has no obligation to renew its agreement with us on commercially reasonable terms, or at all. If we are unable to renew this agreement on commercially reasonable terms, or if the data center operator is acquired, we may be required to transfer our servers and other infrastructure to a new data center facility, and we may incur costs and experience service interruption in doing so.

Our software might not operate properly, which could damage our reputation, give rise to claims against us, or divert application of our resources from other purposes, any of which could harm our business and operating results.

Our payroll and HCM software is complex and may contain or develop undetected defects or errors, particularly when first introduced or as new versions are released. Despite extensive testing, from time to time we have discovered defects or errors in our products. In addition, because changes in employer and legal requirements and practices relating to benefits are frequent, we discover defects and errors in our software and service processes in the normal course of business compared against these requirements and practices. Material performance problems or defects in our products and services might arise in the future, which could have an adverse impact on our business and client relationship and subject us to claims.

Moreover, software development is time-consuming, expensive and complex. Unforeseen difficulties can arise. We might encounter technical obstacles, and it is possible that we discover problems that prevent our products from operating properly. If they do not function reliably or fail to achieve client expectations in terms of performance, clients could cancel their agreements with us and/or assert liability claims against us. This could damage our reputation, impair our ability to attract or maintain clients and harm our results of operations.

Defects and errors and any failure by us to identify and address them could result in delays in product introductions and updates, loss of revenue or market share, liability to clients or others,

19