UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to ______

Commission File Number:

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

|

|

|

(I.R.S. Employer Identification Number) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

|

|

|

|

|

|

|

|

|

|

( (Registrant’s telephone number, including area code) |

|

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None

Indicate by check mark if the registrant is a well-known seasoned issued, as defined in Rule 405 of the Securities Act of 1933. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1913. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the common stock held by non-affiliates of the Registrant, based on the closing price of $25.06 per share of the Registrant’s common stock on June 30, 2021, the last business day of the Registrant’s most recently completed second fiscal quarter, as reported by the New York Stock Exchange on such date, was approximately $

As of February 28, 2022, the number of shares of the registrant’s common stock outstanding was

Documents Incorporated by Reference: Certain information required in response to Item 5 of Part II of Form 10-K and Part III of Form 10-K is hereby incorporated by reference to portions of the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held in 2022. The Proxy Statement will be filed by the Registrant with the Securities and Exchange Commission no later than 120 days after the end of the Registrant’s fiscal year ended December 31, 2021.

ASSETMARK FINANCIAL HOLDINGS, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page No. |

|

|

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

4 |

|

|

Item 1A. |

14 |

|

|

Item 1B. |

35 |

|

|

Item 2. |

35 |

|

|

Item 3. |

35 |

|

|

Item 4. |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

36 |

|

|

Item 6. |

37 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 |

|

Item 7A. |

59 |

|

|

Item 8. |

60 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

89 |

|

Item 9A. |

89 |

|

|

Item 9B. |

89 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

90 |

|

|

Item 11. |

90 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

90 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

90 |

|

Item 14. |

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

91 |

|

|

Item 16. |

91 |

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Annual Report on Form 10-K are forward-looking statements. For example, statements in this Form 10-K regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “would,” “could,” “should,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology that conveys uncertainty of future events or outcomes. In addition, any statements that refer to projections of our future financial performance and financial results, our anticipated growth strategies and anticipated trends in our business; our expectations regarding our industry outlook, market position, liquidity and capital resources, addressable market, investments in new products, services and capabilities; our ability to execute on strategic transactions; our ability to comply with existing, modified and new laws and regulations applying to our business; the impacts of the COVID-19 pandemic on our operations; demand from our customers and end investors; and other characterizations of future events or circumstances are forward-looking statements. These statements are only predictions based on our current expectations and projections about future events and are based upon information available to us as of the date of this Annual Report on Form 10-K, and are subject to risks, uncertainties and assumptions, including those identified under “Item 1A. Risk Factors,” any of which could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. While we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. We are under no duty to update any of these forward-looking statements after the date of this Annual Report on Form 10-K to conform our prior statements to actual results or revised expectations, except as required by law. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements as predictions of future events.

2

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, any one of which could materially adversely affect our results of operations, financial condition or business. These risks include, but are not limited to, those listed below. This list is not complete, and should be read together with the section titled “Risk Factors” in this Annual Report on Form 10-K, as well as the other information in this Annual Report on Form 10-K and the other filings that we make with the U.S. Securities and Exchange Commission (the “SEC”).

|

|

• |

Our revenue may fluctuate from period to period, which could cause our share price to fluctuate. |

|

|

• |

We operate in an intensely competitive industry, and this competition could hurt our financial performance. |

|

|

• |

We derive nearly all of our revenue from clients in the financial advisory industry and our revenue could suffer if that industry experiences a downturn. |

|

|

• |

Our clients that pay us asset-based fees may seek to negotiate lower fees, choose to use lower-revenue products or cease using our services, which could limit the growth of our revenue or cause our revenue to decrease. |

|

|

• |

Investors may redeem or withdraw their investment assets generally at any time. Significant changes in investing patterns or large-scale withdrawal of investment funds could have a material adverse effect on our business. |

|

|

• |

Changes in market and economic conditions (including as a result of the ongoing COVID-19 pandemic, or geopolitical conditions or events) could lower the value of assets on which we earn revenue and could decrease the demand for our investment solutions and services. |

|

|

• |

We may be subject to liability for losses that result from a breach of our or another’s fiduciary duties. |

|

|

• |

We are exposed to data and cybersecurity risks that could result in data breaches, service interruptions, harm to our reputation, protracted and costly litigation or significant liability. |

|

|

• |

Our controlling stockholder is subject to supervision by regulatory authorities in the People’s Republic of China (“PRC”) and must comply with certain PRC laws and regulations that may influence our controlling stockholder’s decisions relating to our business. |

|

|

• |

We are subject to extensive government regulation in the United States, and our failure or inability to comply with these regulations or regulatory action against us could adversely affect our results of operations, financial condition or business. |

|

|

• |

Failure to properly disclose conflicts of interest could harm our reputation, results of operations or business. |

|

|

• |

Control by our principal stockholder could adversely affect our other stockholders. |

3

PART I

Item 1. Business

Overview

AssetMark is a leading provider of extensive wealth management and technology solutions that power financial advisers and their clients. Our platform drives transformational value across all aspects of the adviser’s business. Through innovative digital tools, deep expertise, and hands-on service, our platform enables advisers to outsource services and capabilities that would otherwise require significant investments of time and money. Our purpose-built solutions support each adviser’s unique goals, including growing their business, increasing client engagement and driving scale and efficiency. We provide an end-to-end experience, spanning nearly all elements of an adviser’s engagement with his or her client—from initial conversations to ongoing financial planning discussions, including performance reporting and billing. In addition, our platform provides tools and capabilities for advisers to better manage their day-to-day business activities, giving them more time for meaningful conversations with investors.

We believe that financial advisers who have a deep understanding of their communities and put the needs of investors first provide the best path for investors to achieve their long-term financial goals. When an adviser chooses to work with AssetMark, we recognize that their success is paramount, and it is our role to support their goals. We serve as an extension of an adviser’s team, and we are equally committed to the best interest of their clients and the success of their business.

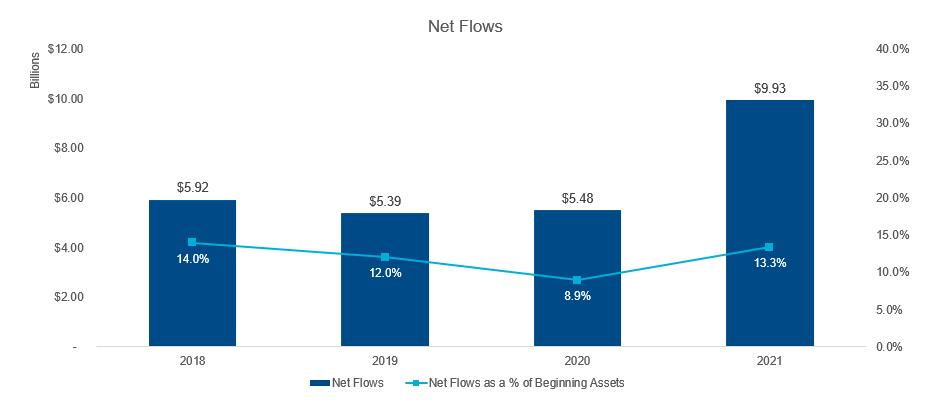

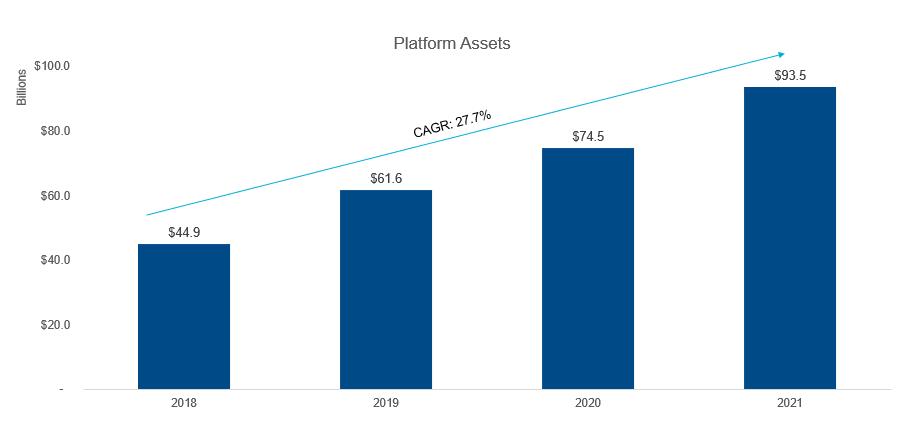

The compelling value of our tools for advisers and their clients has facilitated our rapid growth. From December 31, 2018 to December 31, 2021, our platform assets(1) grew from $44.9 billion to $93.5 billion, representing a compounded annual growth rate of 27.7%. Over the last year, platform assets grew 25.5% from December 31, 2020 to December 31, 2021. Further, our investors value the services they receive from advisers as evidenced by the growth in our net flows(2) from $5.9 billion in 2018 to $9.9 billion in 2021, representing 14.0% and 13.3% of beginning platform assets, respectively. As of December 31, 2021, excluding Voyant, our platform served over 209,000 investor Households (as defined in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics”) through our approximately 8,600 adviser relationships.

Our platform provides advisers with an integrated suite of products and services that facilitates growth, streamlines workflows and provides scale to advisers’ businesses so they can better serve their clients, who are large and small investors. Highlights of our platform include:

|

|

• |

Fully integrated technology platform: Our integrated platform is built for advisers, providing advisers access to a broad range of highly automated processes, including new account opening, portfolio construction, streamlined financial planning, customer billing, investor reporting, progress to goal analysis and client activity tracking. Our dual focus on technology utility and design has resulted in a platform that is accessible, integrates industry-leading solutions, and is easy-to-use, intuitive and expansive. |

|

|

• |

Personalized and scalable adviser service: We surround our advisers with highly experienced consulting and service support. We provide a full spectrum of services for many aspects of the adviser’s firm. These services include high-value day-to-day business support from field professionals, operations and service support teams and specialty teams including business management consultants, investment specialists and retirement consultants. Our offering is guided by extensive intellectual capital and well-established business performance benchmarking tools and responsive back- and middle-office outsourcing support from highly tenured service and operations professionals. We aim for every adviser to feel that their AssetMark service and consulting team is an integral part of their business. |

|

|

• |

Curated investment platform: We provide independent advisers with a curated set of thoroughly vetted specialty and leading third-party asset managers, in addition to our two proprietary investment providers. Our due diligence team narrows the universe of potential investment solutions to a select group of time-tested and emerging investment choices. In effect, we equip each adviser with a team of skilled investment professionals that act as a virtual extension of their investment staff, who deliver our solutions through an array of technology-enabled tools that assist in the creation and monitoring of goal-based portfolios. Further, the flexibility and breadth of our platform allows us to offer custom portfolios designed to meet the unique needs of investors, specifically mass-affluent and high-net-worth investors. |

|

|

• |

Financial planning technology: Our integrated financial planning tools facilitate holistic wealth management and enable advisers to help investors achieve their individual goals. Our proprietary solution, Voyant, offers dynamic planning capabilities to ensure advisers across the globe and their diverse clients collaborate towards a better, more secure financial future. Voyant’s solution provides ongoing, comprehensive support across varying life goals – from retirement savings to legacy planning. We believe that our innovative planning technology will allow advisers to further deepen their relationships with clients. |

|

|

1 |

We define platform assets as all assets on the AssetMark platform, whether these are assets for which we provide advisory services, referred to as assets under management, or non-advisory assets under administration, assets held in cash accounts or assets otherwise not managed. |

|

2 |

We define net flows for a period as production (the amount of new assets that are added to existing and new client accounts in the period) minus redemptions (the amount of assets that are terminated or withdrawn from client accounts in the period), excluding the impact of changes in the market value of investments held in client accounts and fees charged to advisers and end-investors. |

4

Our offering’s distinctive combination of a compelling technology platform, extensive and scalable value-added services and curated investment solutions has been a key driver of our market share expansion from 10% to 11% from December 31, 2018 to September 30, 2021, excluding Voyant. We define our market share based on assets managed by third-party vendors as calculated by Cerulli Associates (“Cerulli”), excluding non-advisory assets managed by Schwab’s Marketplace and Fidelity’s Separate Account Network, and, for SEI Investments, including only assets reported in Advisor Network, their third-party asset management segment; and, for AssetMark, adding our cash assets to the managed assets as reported by Cerulli. We have not made similar adjustments for other third-party vendors analyzed by Cerulli. Additionally, our platform can act as a critical accelerant for the success of our advisers’ businesses, which in turn can result in an increase in assets on our platform; the success of our advisers is reflected in our continued strong net flows of $9.9 billion in 2021. Further, given that our platform and services are tightly integrated into our advisers’ businesses, we believe that we have engendered and will continue to engender deep loyalty from our advisers.

Our revenue model is almost entirely composed of fees that are recurring in nature, which provides a high level of visibility into our near-term financial performance. The two main components of our revenue are asset-based revenue and spread-based revenue. We generate asset-based revenue from fees billed to investors on a bundled basis in advance of each quarter. The quarterly nature of our asset-based revenue provides significant visibility into near-term revenue and helps minimize unexpected revenue fluctuations stemming from market volatility. Our spread-based revenue is driven by interest rates on the cash assets held by investors at our

5

proprietary trust company. In the year ended December 31, 2021, we generated $512.2 million in asset-based revenue and $8.6 million in spread-based revenue.

In the year ended December 31, 2021, we generated total revenue of $530.3 million, net income of $25.7 million, adjusted EBITDA of $157.2 million and adjusted net income of $103.3 million. In the year ended December 31, 2020, we generated total revenue of $432.1 million, net loss of $7.8 million, adjusted EBITDA of $115.0 million and adjusted net income of $73.2 million. From January of 2018 to December 31, 2021, our total revenue has grown at a compounded annual growth rate of 13.4%.

See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics—Non-GAAP Financial Metrics” for the definitions of adjusted EBITDA and adjusted net income as well as reconciliations of net income to adjusted EBITDA and net income to adjusted net income.

We were incorporated in the State of Delaware in 2013.

Market Opportunity

We serve fee-based, independent advisers who provide wealth management advice to U.S. investors and advisers around the world seeking financial planning solutions.

First, the U.S. wealth management market is large and has a long history of rapid growth fueled by several secular trends. According to Cerulli, in aggregate across the United States, approximately 291,600 advisers managed $25.7 trillion in assets as of December 31, 2020, and total industry assets have grown at a compounded annual growth rate of 9.3% over the five years ended December 31, 2020. Cerulli expects these assets to grow to $30.7 trillion by 2025. Second, financial planning has accelerated globally over the last several years as comprehensive advice becomes increasingly demanded. According to the Financial Planning Standards Board Ltd., the number of Certified Financial Planning professionals worldwide grew to over 192,000 as of December 31, 2020. Our current offering and growth plans are built to capitalize on favorable industry trends, which we expect will continue to support our growth.

|

|

• |

Total U.S. investible wealth is massive and growing: According to Cerulli, U.S. households had $96.1 trillion in net worth as of December 31, 2019, which has grown at a compounded annual growth rate of 7% over the six years ended December 31, 2019. As of December 31, 2019, advisers managed $22.7 trillion (approximately 24%) of this wealth, indicating ample runway for future growth of the financial advisory industry. |

|

|

• |

Investor demand for financial advisers is expanding: As investors have aged and their financial goals have become more complex, the demand for financial advice has expanded. According to Cerulli, demand for financial advice has increased from 37% to 42% from 2015 to the second quarter of 2021, measured by the percentage of investor households (defined as a household with more than $100,000 in investable assets) surveyed receiving assistance or direction from financial advisers relative to investor households self-managing their financial affairs. |

|

|

• |

Advisers are transitioning to an independent model, and we expect this trend to continue: The U.S. wealth management industry consists primarily of two types of channels, independent and traditional. We consider the “independent” channel to comprise registered investment advisers (“RIAs”), hybrid RIAs, independent broker-dealers and insurance broker-dealer advisers, and the “traditional” channel to comprise national and regional broker-dealers, bank broker-dealers and wirehouse advisers. According to Cerulli data and internal estimates of expected growth of the wealth management industry, from 2015 to 2020, independent channels have grown faster than traditional channels in terms of market share measured by assets, expanding by 10.4% annually at the expense of traditional channels. This trend is expected to continue, with independent assets forecasted to grow from $10.8 trillion in 2020 to $14.4 trillion in 2025, from 42% to 47% of total adviser-managed assets over the same period. |

|

|

• |

Shift from commissions to fee-based models: According to PriceMetrix, in 2020, advisers received almost 75% of their total production from fee-based revenue, which represented a record level relative to commissions. The long-term adviser trend towards a fiduciary standard of advice, catalyzed in part by the 2016 Department of Labor (“DOL”) rule (later vacated) that would have expanded the definition of “fiduciary investment advice” to include all financial professionals providing retirement advice, has helped drive this shift to a fee-based revenue model. The shift may also have been accelerated by SEC Regulation Best Interest, implemented in 2020, which elevated the standard of conduct applicable to broker-dealers (which are typically compensated through commissions) when providing investment recommendations to retails investors. |

6

|

|

• |

Advisers are increasingly reliant on technology to remain price competitive and achieve scale while serving evolving client needs: Investment advisers are increasingly viewing technology as imperative to growth. According to the 2019 InvestmentNews Adviser Technology Study, the percentage of advisers who did not believe technology played a significant role in their growth decreased ten percentage points from 2015 to 2019, from 17% to just 7%. However, investing in technology to improve the client experience can be costly. In 2018, investment adviser firms spent on average $116,000 addressing technology needs, nearly double the average spend in 2013. From 2017 to 2018, median growth of investment adviser technology spend was 12.1%, the highest median growth rate since 2013. |

|

|

• |

Advisers are rapidly expanding their use of model portfolios: Advisers are increasingly choosing to outsource key components of the asset management aspect of their role as financial advisers, including the choice of investment manager. As such, the use of model portfolios (which we define as mutual fund advisory, ETF advisory, unified managed account and separate account assets) among financial advisers grew at a compounded annual growth rate of 15.0% from 2015 to 2020, based on data from Cerulli and internal estimates. |

Our offering is built around advisor needs. In total, AssetMark and Voyant provide technology solutions, investments and expert support, positioning us to benefit from U.S. and global wealth trends. Combined with our scalable, fee-based platform and services that help advisers put investors’ needs first, we believe that these favorable industry trends will give us the opportunity to continue to gain market share. Our gains in market share have been due largely to organic growth, an area on which we plan to continue to focus.

Our Offering and Business Model

AssetMark’s purpose

Our over 870 employees come to work focused on our mission: to make a difference in the lives of our advisers and the investors they serve. Our mission is guided by a singular focus on successful outcomes for those investors. We strive to execute our mission through our stated corporate values of heart, integrity, excellence and respect, in everything that we do.

The AssetMark offering to advisers and the investors they serve

We provide independent financial advisers with an array of tools and services designed to streamline their workflow, help them develop and expand their businesses and provide goal-oriented investment solutions. We believe that the quality of our offering, coupled with our deep relationships with our advisers, has generated significant adviser satisfaction, as measured by our exceptional Net Promoter Score (“NPS”) of 67 as of June 30, 2021. Our offering is defined by solutions in four focus areas:

|

|

• |

Fully integrated technology platform: Independent financial advisers and their teams are faced with a multitude of marketing, administrative and business management tasks. We offer a compelling technology suite that fully integrates leading third-party technology solutions into our core proprietary technology and helps advisers perform these tasks. Our solution helps advisers streamline their operations while providing a superior experience for their staff and clients. The combined capabilities of our technology platform support advisers throughout the investor life cycle, from initial prospecting and onboarding through ongoing service and reporting, and replace a complex array of technologies with a single, streamlined solution. With less time spent navigating multiple systems and technologies, advisers are able to focus on enhancing productivity. As advisers come to rely on our integrated platform, it becomes integral to their daily practices. This reliance, in conjunction with high adviser satisfaction due to our platform’s ability to optimize adviser workflow, has contributed to our strong growth in assets and net flows. |

We are dedicated to innovation and strive to continually improve our offering through the development of new tools and services. From January 1, 2019 to December 31, 2021, we invested over $171 million in technology development and our dedicated technology team, and we have a proven track record of delivering innovative solutions that deepen our advisers’ offerings to their investor clients while also enhancing advisers’ scale. Recent innovations include a new portfolio construction and analysis tool that assists advisers in creating and monitoring investor portfolios, a streamlined account opening solution that reduces the time to onboard new accounts on our platform, a goals-based investor portal that serves as a hub for communications between advisers and their clients and a fully automated digital advice tool that connects our advisers with their clients.

|

|

• |

Personalized and scalable adviser service: Providing advisers access to high-quality service is a critical component of our value proposition. We develop deep, multi-level relationships with advisers’ firms, helping to ensure that, at all levels, advisers and their teams are connected with AssetMark. We tailor our services to the size of the adviser, allowing us to provide high service levels to a wide-range of adviser business sizes while also maintaining our operating leverage. |

The “Regional Consultant” is the centerpiece of an adviser’s relationship with AssetMark. Our highly experienced Regional Consultants ensure that advisers can draw from a wide array of resources and institutional knowledge as they build and grow their businesses. These professionals are the single point of contact for the adviser and bring in expertise

7

to help the adviser grow and compete. As of December 31, 2021, our Regional Consultants in the field and phone-based consultants served approximately 8,600 advisers. Depending on the adviser’s business needs, our consultants introduce advisers to investment experts, business development professionals, retirement consultants and business consultants who can help the adviser reach his or her goals. For example, investment experts provide advisers with insights into portfolio construction and how specific investments help investors reach their goals, and our team of business consultants helps advisers build more efficient and scalable businesses. This relationship model provides each adviser with a trusted colleague whom the adviser can contact with questions and who can provide access to an array of specialty resources. The value our clients place on our sales model is reflected in our high Sales NPS of 66 as of June 30, 2021.

The “Relationship Manager” is at the heart of the back-office professional’s relationship with us. Our Relationship Managers work to ensure operational activity is accurately executed and seek to promptly resolve any issues investors may encounter. We feature high-touch, accurate and rapid client servicing from dedicated teams who strive to enhance the responsiveness of the adviser’s back office. In addition, our Relationship Managers provide productivity and client-service best practices, gained through deep industry experience, to the adviser’s back office teams. Like our Regional Consultants, our Relationship Managers are go-to resources for our advisers and their offices. Depending on the size of the office, we offer a range of service models. Our largest advisers receive support from a dedicated Relationship Manager, while smaller offices are served by a centralized team of professionals. Our service model is highly valued by advisers of all sizes, as demonstrated by our high Service NPS of 67 as of June 30, 2021.

|

|

• |

Curated investment solutions: Financial planning is the core competency and value proposition for most wealth managers. The various investment management functions that compose this role, such as formulating capital market assumptions, conducting manager due diligence, constructing portfolios and monitoring markets, managers and portfolios, can take time away from advisers’ ability to help their investors stay on track to reach their goals. As a result, many advisers outsource these activities to independent platforms like AssetMark. |

We perform this challenging work for the adviser through our dedicated team of investment professionals who assess markets, conduct due diligence on asset managers and construct model portfolios for advisers to offer to their clients. We deliver these capabilities through a portfolio construction methodology that can be broadly described in three categories:

|

|

• |

Core markets: Strategies that provide exposure to growth in domestic and global economies. |

|

|

• |

Tactical strategies: Supplemental equity strategies that can augment core performance or provide risk mitigation in periods of market decline. |

|

|

• |

Diversifying strategies: Equity alternative or bond and bond alternative strategies that offer lower volatility or lower correlation to help smooth portfolio performance or allow for greater equity exposure. |

Our portfolios feature a wide range of investment vehicles including ETFs, mutual funds, equities, individual bonds and options strategies. In addition, we provide turnkey solutions for advisers who would prefer to fully outsource a selection of investments, and portfolio components and construction tools for advisers who would prefer to build or customize portfolios themselves using our curated list of strategists.

|

|

• |

Financial planning technology: As advisers continue to evolve their roles from investment managers to holistic wealth planners, we believe demand for financial planning technology will continue to increase. Flexibility and choice are critical for independent financial advisers. Accordingly, we offer an open-architecture solution leveraging both proprietary and third-party planning software. Our integrated planning technology, powered by Voyant, is highly customizable and interactive, enabling meaningful, goals-based conversations between advisers and investors. The product suite visualizes complex scenarios and focuses on collaborative adviser planning, on-demand access and an intuitive user interface. Its modular solution allows for flexibility and the application is configured to optimize a diverse range of individual financial plans. Our dynamic tool combines cash-flow planning with goals-based planning into a single timeline for clients, letting advisers show how changes to income can affect the probability of achieving a goal, or how altering a goal can impact an investor’s plan. We believe that the road to financial wellness and a better financial future begins with advisers providing investors with dynamic, personalized and comprehensive advice. |

The AssetMark business model

To achieve our mission, we have built a business model that allows us to reinvest in our advisers’ and their clients’ success. Our business model has delivered a track record of attractive revenue growth and adjusted EBITDA margin expansion, both driven by strong fundamentals including:

|

|

• |

Strong asset growth: We have experienced (1) platform asset growth from existing clients of approximately 71% from December 31, 2018 to December 31, 2021, (2) $11.1 billion in assets attracted from new advisers representing 14.2% growth to the platform over the same period and (3) $5.9 billion in assets added to our platform through acquisitions of competitors over the same period, measured at the date of acquisition. |

8

|

|

• |

Recurring and resilient revenue model: In the year ended December 31, 2021, 99% of our total revenue was recurring in nature (based on revenue generated from assets that are under contract and not dependent on trading activity) and derived from either asset-based revenue or spread-based revenue from investor cash held at our proprietary custodian. In the year ended December 31, 2021, 97% of our total revenue was derived from asset-based revenue and 2% of our total revenue was derived from spread-based revenue. Since asset-based revenue is influenced by sector, asset class and market returns, while spread-based revenue is influenced by Federal Reserve movements and the amount of cash investors hold, our two sources of revenue are relatively uncorrelated, which has established a foundation for a resilient revenue model through various market fluctuations. |

|

|

• |

Attractive margin profile driven by a mix of proprietary and third-party solutions: Our open-architecture technology, investment solutions and custodial platform offer choice and superior capabilities for advisers. In addition, since we offer a balance of third-party and proprietary solutions, we capture incremental economics, which has led to enhanced margins. By offering proprietary solutions alongside third-party technology, asset management and custody solutions, we foster competition across our offering. This competition drives participants (including us) to improve their offerings or risk losing favor with advisers. Each solution competes on its own value proposition and merits, and we do not promote or advantage our proprietary offerings above those of third parties. Our trust company held approximately 76% of our platform assets, and our proprietary strategists served 27% of our platform assets, as of December 31, 2021, evidencing the strength of our proprietary offerings. |

|

|

• |

Consistently strong net flows: Because our platform offers an array of solutions to advisers and our technology is deeply integrated into advisers’ businesses, our net flows grew from $5.9 billion in 2018 to $9.9 billion in 2021, representing 14.0% and 13.3% of beginning platform assets, respectively. |

|

|

• |

Significant operating leverage: Our purpose-built platform and upfront investments in our business have positioned us to benefit from upside growth and continued scale with meaningful operating leverage, while continuing to deliver enhanced platform capabilities and solutions to advisers. Our net income margin increased from (1.8)% for the year ended December 31, 2020 to 4.8% for the year ended December 31, 2021, primarily driven by platform growth. The power of the operating leverage in our model is most apparent from our ability to expand our adjusted net income margin (defined as adjusted net income divided by total revenue), which expanded from 16.9% for the year ended December 31, 2020 to 19.5% for the year ended December 31, 2021. |

Our strengths

For more than 20 years, we have focused on providing solutions that enhance and simplify the lives of our advisers and the investors they serve. We believe that this approach distinguishes us from many of our competitors. The following strengths underpin our competitive advantage:

|

|

• |

Our mission-driven, client-focused culture: We believe that our exceptional client-centric culture has driven our historical performance. The AssetMark team is dedicated to its mission of making a difference in the lives of advisers and investors through a culture that rests on our core pillars of heart, integrity, excellence and respect. We are also committed to helping advisers and the communities they serve. Through our Summer of Service and Community Inspiration Awards we seek to ensure that our firm’s and our advisers’ communities benefit from our charitable contributions. We believe that our focus on doing the right thing while also running a great business not only results in higher adviser loyalty and referrals, but also increases our employee tenure. |

|

|

• |

A deep understanding of fee-based, independent advisers: Our frequent, value-added interactions with our diverse group of advisers help us tailor offerings to meet their needs, at scale and in the context of their business opportunities and challenges. We also benefit from tracking and evaluating advisers’ extensive activity in our ecosystem. This allows us to create responsive service models, operational processes and solutions that help advisers reduce the time associated with administrative tasks. In addition, members of our community of advisers have access to each other’s best practices as well as data about their specific business activity, which helps our advisers grow their businesses and drives our extensive best practices library. |

|

|

• |

Proven ability to execute superior outsource solutions facilitated by a leading technology offering: We create outsource solutions that transform advisers’ businesses. We believe the transformation that we enable for the advisers on our platform is the result of our deeply integrated service model and robust, user-friendly technology, which together help advisers improve responsiveness to investors. Collectively, our outsource offerings optimize advisers’ time and, as a result, help improve investor outcomes. |

|

|

• |

We are a scale provider: We are an established leader as an outsource service provider for independent, fee-based financial advisers. Our scale and access enable us to establish favorable partnerships with technology and asset management institutions and provide attractive pricing for our advisers’ clients. In addition, scale allows us to consistently invest in our core offering of a fully integrated technology platform, personalized and scalable adviser service, curated investment solutions, and financial planning technology to address the evolving needs of investors and advisers. Our feature-rich technology solution scales to serve a broad-range of business sizes, from solo practices to ensemble firms. The scope and scale of our offering has made us an essential part of our advisers’ businesses. |

9

|

|

• |

We are a disciplined acquirer: Growth through acquisition of small, subscale, outsource providers is a core competency of our business. Our value creation through acquisition is generated by purchase price discipline and our ability to grow relationships formed through these acquisitions. In 2014 and 2015, respectively, we acquired the platform assets of two firms that collectively added $3.5 billion in assets to our platform at the time of acquisition. On average, three years post-acquisition, these acquired assets had grown by 17% compounded annually. Subsequently, in April 2019, we closed our acquisition of Global Financial Private Capital for a cash purchase price of $35.9 million, which added another $3.8 billion in platform assets. In September 2019, we announced our agreement to acquire WBI OBS Financial, Inc. (“OBS”), which closed on February 29, 2020 and which added approximately $2.1 billion in platform assets. In March 2021, we announced our agreement to acquire Voyant, a leading global provider of SaaS-based financial planning and client digital engagement solutions, which closed on July 1, 2021 for a purchase price of $157.1 million, including both cash and equity. |

Our Growth Strategy

We are focused on five key areas of growth to deliver platform enhancements and solutions that are core to our advisers’ businesses and enable us to increase our adviser base and expand our business with existing clients.

|

|

• |

Meet advisers where they are: We are focused on introducing new products and enhancing services and capabilities to further expand our reach into the RIA market, retirement services, bank trusts and the high-net-worth segment. We believe that these solutions will enhance our offering to existing advisers while also deepening and extending our relationships with high-growth segments of advisers. |

|

|

• |

Deliver a holistic, differentiated experience: Our open-architecture integrated platform is designed to maximize adviser efficiency and scale. While we continue to focus on adviser workflows, we also strive to build deeper adviser-investor relationships through meaningful conversations that connect investors’ financial goals, concerns and dreams with their portfolios. We aim to build a comprehensive wellness program that empowers advisers with enhanced capabilities to serve the specific needs of their clients. |

|

|

• |

Enable advisers to serve more investors: Our set of curated investment solutions is designed to help advisers serve evolving needs of investors across the wealth spectrum. We consistently add new products and features to allow for greater personalization and introduce capabilities to help advisers deepen their relationships with investors. |

|

|

• |

Help advisers grow and scale their businesses: Our holistic platform and adviser engagement model are designed to help advisers grow and build sustainable businesses. We plan to continue to help advisers grow through our deep business consulting engagements, comprehensive platform support and turnkey business programs. |

|

|

• |

Continue to pursue strategic transactions: We expect to continue to selectively pursue acquisitions that we believe will enhance the scale and operating leverage of our business. In addition, we may pursue acquisitions that expand the appeal of our offering to independent, fee-based advisers and the investors they serve. |

Competition

We compete with a broad range of wealth management firms that offer services to independent investment advisers. The principal factors on which participants in our industry compete are: 1) technological capabilities, 2) consulting and back-office servicing and 3) investment solutions. We believe that we compete favorably on each of these factors.

Our competitors offer a variety of products and services that compete with one or more of the investment solutions and services provided through our platform. Our principal competitors include:

|

|

• |

Other turnkey asset management platform providers: Most providers of turnkey asset management platforms typically provide financial advisers with one or more types of products and services, and vary in the number of choices offered in terms of custodians, technology features, investments and quality of service. |

|

|

• |

Independent broker-dealer proprietary wealth platforms: Many broker-dealers provide integrated proprietary wealth management platforms that offer an array of asset management solutions to their affiliated financial advisers. |

|

|

• |

Providers of specific service applications: Several of our competitors provide financial advisers with a product or service designed to address one or a limited number of specific needs, such as financial planning or performance reporting. |

|

|

• |

Adviser-built solutions: Some financial advisers have developed in-house solutions that overlap with some or all of the technology or services that we currently provide, including portfolio construction, portfolio analytics and model management. |

10

While we anticipate that we will see increased competition and experience fee pressure, we believe that our technology platform, along with our personalized service and curated investment solutions, will continue to drive revenue expansion.

Human Capital

As of December 31, 2021, we had 874 employees. Our human capital resources objective is to foster community among our employees by identifying, recruiting, retaining, incentivizing, and integrating our existing and new employees. Talent management activities provide consultation and support for employee engagement, while our human resources team ensures that benefit programs meet employee needs. The principal purposes of our equity incentive plans are to attract, retain, and motivate selected employees, consultants, and directors through the granting of stock-based compensation awards. We also provide additional incentives to our employees, including a health and wellness stipend and technology reimbursements. None of our employees is represented by a labor union, and we consider our employee relations to be good.

Employee Engagement

We measure our employee engagement annually through a survey of all associates. We believe the results of our 2021 engagement survey and our employee engagement efforts illustrate our commitment to our mission, values and culture in action. We are especially proud of the feedback and commitment our team members have provided despite the ongoing unprecedented global health crisis and its impact on market volatility.

Diversity, Equity & Inclusion

As of December 31, 2021, our diversity by gender was 57% male and 43% female. Our diversity by race/ethnicity was 67% white, and underrepresented minorities (Hispanic, African American and other races/ethnicities) made up 19% of our employee population. Our commitment to diversity and inclusion is centered on the following pillars: Education. Representation, Development and Community.

In 2021, we expanded and enhanced our formal diversity and inclusion program, Respect at AssetMark – aligned with our core value of respect. The goals of our Respect at AssetMark program are to bring new diverse talent into the financial services industry through our internship program and to focus on recruiting and developing the talent that we already have within our organization to enable our associates to meet their fullest potential. Our continued and focused efforts have resulted in an increase in women in leadership within our organization.

11

Pandemic Response

2021 saw a continuation of the unprecedented impact of the COVID-19 health crisis. Our workforce continued to operate fully remote, except for a small number of essential in-office staff. This shift to remote has protected our associates’ safety and significantly limited the spread of COVID-19 within our workforce. Currently our offices are open to staff on a voluntary basis. Across all of our offices, safety precautions remain in place, including: mask requirements in common spaces, a COVID-19 symptom checker website which must be completed daily before entering the building, enhanced cleaning, higher cubicle and other physical barriers, sanitizer stations at key access and high traffic points, and limitations on capacity in public spaces.

We also understand this is a time of unprecedented challenges for our associates as they work from home and juggle additional family and other commitments. To help support our employees, we enhanced our virtual wellness programs – adding weekly meditation sessions, virtual step challenges, wellness-focused events on topics like stress, nutrition, and financial management, and additional counseling sessions available through our Employee Assistance Program. We have adapted our Day 1 onboarding processes to help ensure that new employees hit the ground running; our new virtual employee orientation launched in the first quarter of 2021 to give those joining us a deeper understanding of our business, beyond just the functional area in which they work.

Information About Our Executive Officers.

The following table sets forth information regarding our executive officers as of March 10, 2022:

|

Name |

Age |

Position |

|

Natalie Wolfsen |

52 |

Chief Executive Officer and Director |

|

Michael Kim |

52 |

President and Chief Client Officer |

|

Gary Zyla |

50 |

EVP, Chief Financial Officer |

|

Ted Angus |

51 |

EVP, General Counsel |

|

Carrie Hansen |

51 |

EVP, Chief Operating Officer |

|

David McNatt |

47 |

EVP, Investment Solutions |

|

Mukesh Mehta |

55 |

EVP, Chief Information Officer |

|

Esi Minta-Jacobs |

49 |

EVP, Human Resources and Program Management |

There is no family relationship between any of our executive officers and any of our other executive officers or directors.

Natalie Wolfsen – Chief Executive Officer and Director

Ms. Wolfsen has served as our Chief Executive Officer and as a member of our Board of Directors since March 2021. Ms. Wolfsen previously served as our Chief Solutions Officer from January 2018 to March 2021, prior to which she served as our Chief Commercialization Officer from May 2014 to December 2017. Prior to joining our company, Ms. Wolfsen served as head of Marketing and Product Development for First Eagle Investment Management, an investment management company, from 2011 to 2014. From 2009 to 2011, Ms. Wolfsen served as head of Product Management and Development for Pershing LLC. From 1999 to 2009, Ms. Wolfsen held numerous roles with The Charles Schwab Corporation, including Senior Marketing Manager (1999-2000), Senior Manager and Director of Technology (2000-2001), Director of Segment Management (2002-2004), Vice President of Strategy (2004-2007), Vice President of Product Management and Development (2007-2008) and Vice President of Equity Product Management and Development (2008-2009). Ms. Wolfsen holds a B.A. in Political Science from the University of California, Berkeley and an M.B.A. from the University of California, Los Angeles.

Michael Kim – President

Mr. Kim has served as our President since March 2021 and our Chief Client Officer since January 2018. Mr. Kim joined our company in 2010 and previously served as our National Sales Leader from January 2018 to March 2021. Prior to becoming our Chief Client Officer and National Sales Leader, Mr. Kim served as our National Sales Manager from 2014 to 2018, and Head of our RIA Channel from 2010 to 2014. Prior to joining our company, Mr. Kim spent over twelve years with Fidelity Investments, Inc., including as a Senior Vice President from 1998 to 2010. From 1995 to 1998, Mr. Kim served as Senior Vice President at Transamerica, and

12

from 1991 to 1995, Mr. Kim was a Senior Associate at Coopers & Lybrand Consulting. Mr. Kim holds a B.A. in Economics from the University of California, Los Angeles.

Gary Zyla – EVP, Chief Financial Officer

Mr. Zyla has served as our Chief Financial Officer since 2011. From 2004 to 2011, Mr. Zyla served in the Corporate and Retirement and Protection segments at Genworth Financial, Inc., where he led the Capital Management team and served as Vice President of Financial Planning & Analysis. Mr. Zyla holds a B.S. in Computer Science-Mathematics and a B.A. in History from the State University of New York-Binghamton and an M.B.A. from the University of Maryland.

Ted Angus – EVP, General Counsel

Mr. Angus has served as our General Counsel since joining us in 2013. From 2010 to 2013, Mr. Angus served as the General Counsel at Genworth Financial Wealth Management, and from 2000 to 2010 he served in various roles at The Charles Schwab Corporation, including as Vice President and Associate General Counsel. From 1998 to 2000, Mr. Angus was an Associate in the securities litigation group at the law firm Brobeck, Phleger & Harrison LLP, and from 1995 to 1998, he was an Associate at Keesal, Young & Logan. Mr. Angus holds a B.A. in both History and Economics from the University of California, Los Angeles and a J.D. from the University of California, Hastings College of the Law.

Carrie Hansen – EVP, Chief Operating Officer

Ms. Hansen joined our company in 2000 and has served as our Chief Operating Officer since 2008 and as President of our Mutual Funds division since 2007. Prior to becoming our Chief Operating Officer, Ms. Hansen served as our Chief Financial Officer (2003-2006) and Chief Compliance Officer (2004-2008). From 1998 to 2000, Ms. Hansen served as head of the Investment Operations Group in the Tokyo office of Barclays Global Investors, prior to which she spent over four years at Coopers & Lybrand Consulting, finishing her career there as an Audit Manager. Ms. Hansen holds a B.S. in Business Administration from the University of California, Berkeley.

David McNatt – EVP, Investment Solutions

Mr. McNatt has served as our Executive Vice President of Investment solutions since April 2021. Mr. McNatt, previously served as the Senior Vice President of Product Management and Development from April 2018 to April 2021, prior to which he served as Vice President of Affluent Product Strategy from October 2017 to April 2018. David has also held the roles of Vice President of Corporate Strategy and Vice President Proprietary Product Development during her tenure at AssetMark. Prior to joining AssetMark, Mr. McNatt was with Russell Investments responsible for the smart beta index product business. Mr. McNatt also spent more than 8 years at The Charles Schwab Corporation in various leadership roles where he was responsible for developing new business lines and investment products, including the launch and growth of the Schwab ETF business. Mr. McNatt received his BA in Finance with a minor in Economics from the University of South Florida and is a member of the CFA Institute and CFA Society of San Francisco.

Mukesh Mehta – EVP, Chief Information Officer

Mr. Mehta has served as our Chief Information Officer since joining our company in 2017. From 2014 to 2017, Mr. Mehta served as the Chief Information and Technology Officer at Cetera Financial Group, a shared services organization serving a family of affiliated independent broker-dealers. From 2010 to 2013, Mr. Mehta served as Chief Information Officer at TD Ameritrade, a brokerage firm, where he also served as a Managing Director in Business Technologies from 2009 to 2010. From 2002 to 2008, Mr. Mehta served as Senior Vice President and Chief Information Officer at Schwab Institutional, Platform Development & Technology, prior to which he served as a Vice President of Finance & Corporate Administration Technology at The Charles Schwab Corporation from 1999 to 2002. Mr. Mehta has also held positions with Bankers Trust (Vice President, Defined Contribution & Participant Services, 1995-1999), Kwasha Lipton (Pension Design & Systems Consultant, 1987-1994), ER Keller & Co. (Investment Account Manager, 1987) and Bell Communications Research (Analyst, 1984-1987). Mr. Mehta holds a B.A. in Mathematics & Economics from Rutgers University and is a graduate of the Stanford University Graduate School of Business Executive Program.

Esi Minta-Jacobs – EVP, Human Resources and Program Management

Ms. Minta-Jacobs joined our company in 2015 and has served as our head of Human Resources and Program Management since March 2020, prior to which she served as our Project Management Office Leader. Prior to joining our company, Ms. Minta-Jacobs served as Senior Vice President at Wells Fargo & Company (2003-2015), overseeing international operations project delivery, and as Partner Integration Manager at PeopleSoft, Inc. (1999-2003). She previously held management consulting roles at Grant Thornton

13

International and PricewaterhouseCoopers (formerly Coopers & Lybrand) (1995-1999). Ms. Minta-Jacobs holds a B.S. in Business Administration with a concentration in Accounting and Management Information Systems from Northeastern University.

Available Information

We make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as amendments to those reports, available free of charge at our corporate website as soon as reasonably practicable after they have been filed with the SEC. Our corporate website address is ir.assetmark.com. Information on or available through our website is not incorporated by reference into nor does it form a part of this Annual Report on Form 10-K, and our reference to the URL for our website is intended to be an inactive textual reference only. The SEC maintains a website that contains the materials we file with the SEC at www.sec.gov.

Item 1A. Risk Factors

Risks Related to Our Business and Operations

Our revenue may fluctuate from period to period, which could cause our share price to fluctuate.

Our revenue may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following events, as well as other factors described elsewhere in this Annual Report on Form 10-K:

|

|

• |

a decline or slowdown of the growth in the value of financial market assets or changes in the mix of assets on our platform, which may reduce the value of our platform assets and therefore our revenue and cash flows; |

|

|

• |

lowering of interest rates, which has a direct and proportionate impact on our spread-based revenue; |

|

|

• |

significant fluctuations in securities prices affecting the value of assets on our platform, including as a result of public health concerns or epidemics such as the COVID-19 pandemic; |

|

|

• |

negative public perception and reputation of the financial services industry, which could reduce demand for our investment solutions and services; |

|

|

• |

unanticipated acceleration of client investment preferences to lower-fee options; |

|

|

• |

downward pressure on fees we charge our investor clients, which would reduce our revenue; |

|

|

• |

changes in laws or regulations that could impact our ability to offer investment solutions and services; |

|

|

• |

failure to obtain new clients or retain existing clients on our platform, or changes in the mix of clients on our platform; |

|

|

• |

failure by our financial adviser clients to obtain new investor clients or retain their existing investor clients; |

|

|

• |

failure to adequately protect our proprietary technology and intellectual property rights; |

|

|

• |

reduction in the suite of investment solutions and services made available by third-party providers to existing clients; |

|

|

• |

reduction in fee percentage or total fees for future periods, which may have a delayed impact on our results given that our asset-based fees are billed to advisers in advance of each quarter; |

|

|

• |

changes in our pricing policies or the pricing policies of our competitors to which we have to adapt; or |

|

|

• |

general domestic and international economic and political conditions that may decrease investor demand for financial advisers or investment services. |

As a result of these and other factors, our results of operations for any quarterly or annual period may differ materially from our results of operations for any prior or future quarterly or annual period and should not be relied upon as indications of our future performance.

We operate in an intensely competitive industry, with many firms competing for business from financial advisers on the basis of the quality and breadth of investment solutions and services, ability to innovate, reputation and the prices of services, among other factors, and this competition could hurt our financial performance.

We compete with many different types of wealth management companies that vary in size and scope. In addition, some of our adviser clients have developed or may develop the in-house capability to provide the technology or investment advisory services they have retained us to perform, obviating the need to hire us. These clients may also offer similar services to third-party financial advisers or financial institutions, thereby competing directly with us for that business.

14

Some of our competitors have greater name recognition or greater resources than we do, and may offer a broader range of services across more markets. These resources may allow our competitors to respond more quickly to new technologies or changes in demand for investment solutions and services, devote greater resources to developing and promoting their services and make more attractive offers to potential clients and strategic partners, which could hurt our financial performance. Further, some of our competitors operate in a different regulatory environment than we do, which may give them certain competitive advantages in the services they offer.

We compete on a number of bases including the performance of our technology, the level of fees charged, the quality of our services, our reputation and position in the industry, our ability to adapt to technological developments or unforeseen market entrants and our ability to address the complex and changing needs of our clients. Our failure to successfully compete on the basis of any of these factors could result in a significant decline in market share, revenue and net income.

We derive nearly all of our revenue from the delivery of investment solutions and services to clients in the financial advisory industry and our revenue could suffer if that industry experiences a downturn.

We derive nearly all of our revenue from the delivery of investment solutions and services to clients in the financial advisory industry and we are therefore subject to the risks affecting that industry. A decline or lack of growth in demand for financial advisory services would adversely affect the financial advisers who work with us and, in turn, our results of operations, financial condition or business. For example, the availability of free or low-cost investment information and resources, including research and information relating to publicly traded companies and mutual funds available on the Internet or on company websites, could lead to lower demand by investors for the services provided by financial advisers. In addition, demand for our investment solutions and services among financial advisers could decline for many reasons. Consolidation or limited growth in the financial advisory industry could reduce the number of financial advisers and their potential clients. Events that adversely affect financial advisers’ businesses, rates of growth or the numbers of customers they serve, including decreased demand for their products and services, adverse conditions in the markets or adverse economic conditions generally, could decrease demand for our investment solutions and services and thereby decrease our revenue. Any of the foregoing could have a material adverse effect on our results of operations, financial condition or business.

Investors that pay us asset-based fees may seek to negotiate lower fees, choose to use lower revenue products or cease using our services, which could limit the growth of our revenue or cause our revenue to decrease.

We derive a significant portion of our revenue from asset-based fees. Individual advisers or their clients may seek to negotiate lower asset-based fees. In particular, recent trends in the broker-dealer industry towards zero-commission trading may make self-directed brokerage services comparatively less expensive and, therefore, more attractive to investors as compared to investment advisory services, which could prompt our investment adviser clients to attempt to renegotiate the fees they pay to us. In addition, clients may elect to use products that generate lower revenue, which may result in lower total fees being paid to us. For example, in the past, one of our broker-dealer clients decided to limit access to certain of our retail share class strategies, resulting in a partial shift to lower-revenue products on our platform. If other broker-dealer clients similarly limit access to certain of our strategies such that advisers shift to our lower-revenue products, we may be required to shift our service offering towards lower-revenue products, which would lead to a decline in asset-based revenue. In addition, in June 2020, we completed the transition of certain third-party mutual fund strategies from retail to institutional share classes, which have lower operating expense ratios than the retail share class mutual fund offerings. This has resulted in a lower overall cost of investment for most clients, and, coupled with changes in pricing for these products, has negatively impacted our revenue and net income. Further, as competition among financial advisers increases, financial advisers may be required to lower the fees they charge to their end investors, which could cause them to seek lower fee options on our platform or to more aggressively negotiate the fees we charge. Any reduction in asset-based fees could persist beyond the near term given the recurring quarterly nature of our asset-based fee arrangements. Any of these factors could result in a fluctuation or decline in our asset-based revenue, which would have a material adverse effect on our results of operations, financial condition or business.

Investors may redeem or withdraw their investment assets generally at any time. Significant changes in investing patterns or large-scale withdrawal of investment funds could have a material adverse effect on our results of operations, financial condition or business.

The clients of our financial advisers are generally free to change financial advisers, forgo the advice and other services provided by financial advisers or withdraw the funds they have invested with financial advisers. These clients of financial advisers may elect to change their investment strategies, including by withdrawing all or a portion of their assets from their accounts to avoid securities markets-related risks. These actions by investors are outside of our control and could materially adversely affect the market value of our platform assets, which could materially adversely affect the asset-based revenue we receive.

15

Changes in market and economic conditions (including as a result of the ongoing COVID-19 pandemic, or geopolitical conditions or events) could lower the value of assets on which we earn revenue and could decrease the demand for our investment solutions and services.

Asset-based revenue makes up a significant portion of our revenue, representing 97% and 95% of our total revenue for the years ended December 31, 2021 and 2020, respectively. In addition, given our fee-based model, we expect that asset-based revenue will continue to account for a significant percentage of our total revenue in the future. Spread-based revenue accounted for 2% and 4% of our total revenue for the years ended December 31, 2021 and 2020, respectively. Significant fluctuations in securities prices, as well as recent and potential decreases in interest rates, have and will continue to materially affect the value of the assets managed by our clients and have and will likely continue to cause a decrease in our spread-based revenue. In particular, our spread-based revenue is directly correlated with changes in interest rates; in the fourth quarter of 2021, interest rates in the U.S. remained near zero after declining beginning in the first quarter of 2020, and our spread-based revenue has similarly declined significantly. Changes in interest rates may also influence financial adviser and investor decisions regarding whether to invest in, or maintain an investment in, one or more of our investment solutions. If such fluctuations in securities prices or decreases in interest rates were to lead to decreased investment in the securities markets, our revenue and earnings derived from asset-based and spread-based revenue could be simultaneously materially adversely affected.

We provide our investment solutions and services to the financial services industry. The financial markets, and in turn the financial services industry, are affected by many factors, such as U.S. and foreign economic and geopolitical conditions and general trends in business and finance that are beyond our control, and could be adversely affected by changes in the equity or debt marketplaces, unanticipated changes in currency exchange rates, interest rates, inflation rates, the yield curve, financial crises, war, terrorism, natural disasters, pandemics and outbreaks of disease or similar public health concerns such as the COVID-19 pandemic and other factors that are difficult to predict. In the event that the U.S. or international financial markets suffer a severe or prolonged downturn, investments may lose value and investors may choose to withdraw assets from financial advisers and use the assets to pay expenses or transfer them to investments that they perceive to be more secure, such as bank deposits and Treasury securities. Any prolonged downturn in financial markets, or increased levels of asset withdrawals could have a material adverse effect on our results of operations, financial condition or business.

We must continue to introduce new investment solutions and services, and enhancements thereon, to address our clients’ changing needs, market changes and technological developments, and a failure to do so could have a material adverse effect on our results of operations, financial condition or business.

The market for our investment solutions and services is characterized by shifting client demands, evolving market practices and, for many of our investment solutions and services, rapid technological change, including an increased use of and reliance on web and social network properties. Changing client demands (including increased reliance on technology), new market practices or new technologies can render existing investment solutions and services obsolete and unmarketable. As a result, our future success will continue to depend upon our ability to develop, enhance and market investment solutions and services that address the future needs of our target markets and respond to technological and market changes. We may not be able to accurately estimate the impact of new investment solutions and services on our business or how their benefits will be perceived by our clients. Further, we may not be successful in developing, introducing and marketing our new investment solutions or services or enhancements on a timely and cost effective basis, or at all, our investment adviser clients may not allow certain investment solutions and services to be marketed through them, and any new investment solutions and services and enhancements may not adequately meet the requirements of the marketplace or achieve market acceptance. In addition, clients may delay purchases in anticipation of new investment solutions or services or enhancements. Any of these factors could materially adversely affect our results of operations, financial condition or business.

We could face liability or incur costs to remediate operational errors or to address possible customer dissatisfaction.

Operational risk generally refers to the risk of loss resulting from our operations, including, but not limited to, improper or unauthorized execution and processing of transactions, deficiencies in our operating systems, business disruptions and inadequacies or breaches in our internal control processes. Operational risk may also result from potential inefficiencies driven by the implementation of a remote workforce during the COVID-19 pandemic. We operate in diverse markets and are reliant on the ability of our employees and systems to process large volumes of transactions often within short time frames. In the event of a breakdown or improper operation of systems (including due to extreme market volumes or volatility or the failure or delay of systems supporting a remote workforce), human error or improper action by employees, we could suffer financial loss, regulatory sanctions or damage to our reputation. In addition, there may be circumstances when our customers are dissatisfied with our investment solutions and services, even in the absence of an operational error. In such circumstances, we may elect to make payments or otherwise incur increased costs or lower revenue to maintain customer relationships. In any of the forgoing circumstances, our results of operations, financial condition or business could be materially adversely affected.

16

We may make future acquisitions which may be difficult to integrate, divert management resources, result in unanticipated costs or dilute our stockholders.