UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File No. 001 - 36629

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address and zip code of principal executive offices)

(775 ) 328-0100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the Registrant’s Common Stock, $0.00001 par value per share, outstanding as of April 25, 2024 was 216,415,536 .

CAESARS ENTERTAINMENT, INC.

TABLE OF CONTENTS

| Page | ||||||||

PART I - FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

CAESARS ENTERTAINMENT, INC.

CONSOLIDATED CONDENSED BALANCE SHEETS

(UNAUDITED)

| (In millions) | March 31, 2024 | December 31, 2023 | |||||||||

| ASSETS | |||||||||||

| CURRENT ASSETS: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Accounts receivable, net | |||||||||||

| Inventories | |||||||||||

| Prepayments and other current assets | |||||||||||

| Total current assets | |||||||||||

| Investments in and advances to unconsolidated affiliates | |||||||||||

| Property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets other than goodwill | |||||||||||

| Deferred tax asset | |||||||||||

| Other long-term assets, net | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| CURRENT LIABILITIES: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued interest | |||||||||||

| Accrued other liabilities | |||||||||||

| Current portion of long-term debt | |||||||||||

| Total current liabilities | |||||||||||

| Long-term financing obligations | |||||||||||

| Long-term debt | |||||||||||

| Deferred tax liability | |||||||||||

| Other long-term liabilities | |||||||||||

| Total liabilities | |||||||||||

| Caesars stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

The accompanying notes are an integral part of these consolidated condensed financial statements.

CAESARS ENTERTAINMENT, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

| Three Months Ended March 31, | |||||||||||

| (In millions, except per share data) | 2024 | 2023 | |||||||||

| NET REVENUES: | |||||||||||

| Casino | $ | $ | |||||||||

| Food and beverage | |||||||||||

| Hotel | |||||||||||

| Other | |||||||||||

| Net revenues | |||||||||||

| OPERATING EXPENSES: | |||||||||||

| Casino | |||||||||||

| Food and beverage | |||||||||||

| Hotel | |||||||||||

| Other | |||||||||||

| General and administrative | |||||||||||

| Corporate | |||||||||||

| Depreciation and amortization | |||||||||||

| Transaction and other costs, net | |||||||||||

| Total operating expenses | |||||||||||

| Operating income | |||||||||||

| OTHER EXPENSE: | |||||||||||

| Interest expense, net | ( | ( | |||||||||

| Loss on extinguishment of debt | ( | ( | |||||||||

| Other income | |||||||||||

| Total other expense | ( | ( | |||||||||

| Loss from continuing operations before income taxes | ( | ( | |||||||||

| Benefit (provision) for income taxes | ( | ||||||||||

| Loss from continuing operations, net of income taxes | ( | ( | |||||||||

| Net loss | ( | ( | |||||||||

| Net income attributable to noncontrolling interests | ( | ||||||||||

| Net loss attributable to Caesars | $ | ( | $ | ( | |||||||

| Net loss per share - basic and diluted: | |||||||||||

| Basic loss per share | $ | ( | $ | ( | |||||||

| Diluted loss per share | $ | ( | $ | ( | |||||||

| Weighted average basic shares outstanding | |||||||||||

| Weighted average diluted shares outstanding | |||||||||||

The accompanying notes are an integral part of these consolidated condensed financial statements.

CAESARS ENTERTAINMENT, INC.

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Foreign currency translation adjustments | |||||||||||

| Other | ( | ||||||||||

| Other comprehensive income (loss), net of tax | ( | ||||||||||

| Comprehensive loss | ( | ( | |||||||||

| Comprehensive income attributable to noncontrolling interests | ( | ||||||||||

| Comprehensive loss attributable to Caesars | $ | ( | $ | ( | |||||||

The accompanying notes are an integral part of these consolidated condensed financial statements.

CAESARS ENTERTAINMENT, INC.

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

| Caesars Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Common Stock | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Shares | Amount | Shares | Amount | Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income (Loss) | Amount | Noncontrolling Interests | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax | — | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares withheld related to net share settlement of stock awards | — | — | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares withheld related to net share settlement of stock awards | — | — | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated condensed financial statements.

CAESARS ENTERTAINMENT, INC.

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Amortization of deferred financing costs and discounts | |||||||||||

| Provision for doubtful accounts | |||||||||||

| Loss on extinguishment of debt | |||||||||||

| Non-cash lease amortization | |||||||||||

| (Gain) loss on investments | ( | ||||||||||

| Stock compensation expense | |||||||||||

| Loss on sale of business and disposal of property and equipment | |||||||||||

| Deferred income taxes | ( | ||||||||||

| Other non-cash adjustments to net loss | ( | ||||||||||

| Change in operating assets and liabilities: | |||||||||||

| Accounts receivable | |||||||||||

| Prepaid expenses and other assets | ( | ( | |||||||||

Income taxes receivable and payable, net | ( | ( | |||||||||

| Accounts payable, accrued expenses and other liabilities | ( | ( | |||||||||

| Net cash provided by operating activities | |||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||

| Purchase of property and equipment | ( | ( | |||||||||

| Proceeds from sale of business, property and equipment, net of cash sold | |||||||||||

| Other | |||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||

| Proceeds from long-term debt and revolving credit facilities | |||||||||||

| Repayments of long-term debt and revolving credit facilities | ( | ( | |||||||||

| Financing obligation payments | ( | ||||||||||

| Debt issuance and extinguishment costs | ( | ( | |||||||||

| Taxes paid related to net share settlement of equity awards | ( | ( | |||||||||

| Net cash used in financing activities | ( | ( | |||||||||

Decrease in cash, cash equivalents and restricted cash | ( | ( | |||||||||

| Cash, cash equivalents and restricted cash, beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | $ | |||||||||

| RECONCILIATION OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH TO AMOUNTS REPORTED WITHIN THE CONSOLIDATED CONDENSED BALANCE SHEETS: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Restricted and escrow cash included in other assets, net | |||||||||||

| Total cash, cash equivalents and restricted cash | $ | $ | |||||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||||||||

| Cash interest paid for debt | $ | $ | |||||||||

| Cash interest paid for rent related to financing obligations | |||||||||||

| Income taxes paid, net | |||||||||||

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | |||||||||||

| Payables for capital expenditures | |||||||||||

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

The accompanying consolidated condensed financial statements include the accounts of Caesars Entertainment, Inc., a Delaware corporation, and its consolidated subsidiaries which may be referred to as the “Company,” “CEI,” “Caesars,” “we,” “our,” or “us” within these financial statements.

This Form 10-Q should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”). Capitalized terms used but not defined in this Form 10-Q have the same meanings as in the 2023 Annual Report.

We also refer to (i) our Consolidated Condensed Financial Statements as our “Financial Statements,” (ii) our Consolidated Condensed Balance Sheets as our “Balance Sheets,” (iii) our Consolidated Condensed Statements of Operations and Consolidated Condensed Statements of Comprehensive Income (Loss) as our “Statements of Operations,” and (iv) our Consolidated Condensed Statements of Cash Flows as our “Statements of Cash Flows.”

Note 1. Organization and Description of Business

Organization

The Company is a geographically diversified gaming and hospitality company that was founded in 1973 by the Carano family with the opening of the Eldorado Hotel Casino in Reno, Nevada. Beginning in 2005, the Company grew through a series of acquisitions, including the acquisition of MTR Gaming Group, Inc. in 2014, Isle of Capri Casinos, Inc. in 2017, Tropicana Entertainment, Inc. in 2018, Caesars Entertainment Corporation in 2020 and William Hill PLC in 2021. The Company’s ticker symbol on the NASDAQ Stock Market is “CZR.”

Description of Business

The Company owns, leases, brands or manages an aggregate of 53 domestic properties in 18 states with approximately 50,500 slot machines, video lottery terminals and e-tables, approximately 2,700 table games and approximately 45,000 hotel rooms as of March 31, 2024. In addition, the Company has other properties in North America that are authorized to use the brands and marks of Caesars Entertainment, Inc., as well as other non-gaming properties. The Company’s primary source of revenue is generated by its casino properties’ gaming operations, which includes retail and online sports betting and online gaming, and the Company utilizes its hotels, restaurants, bars, entertainment, racing, retail shops and other services to attract customers to its properties.

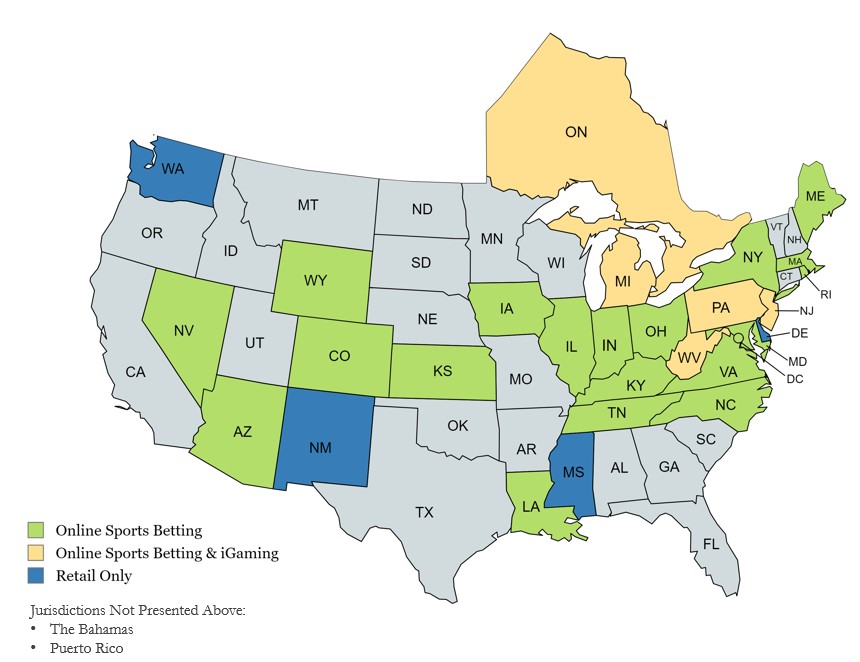

The Company’s operations for retail and online sports betting, iGaming, horse racing and online poker are included under the Caesars Digital segment. The Company operates the Caesars Sportsbook app, the Caesars Racebook app and the recently launched Caesars Palace Online Casino app. The Company operates retail and online sports wagering in 31 jurisdictions in North America, 26 of which offer online sports betting, and operates iGaming in five jurisdictions in North America as of March 31, 2024. The Company expects to continue to grow its operations in the Caesars Digital segment as new jurisdictions legalize retail and online sports betting and iGaming.

Note 2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The accompanying unaudited Financial Statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information with the instructions for Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, the accompanying unaudited Financial Statements contain all adjustments, all of which are normal and recurring, considered necessary for a fair presentation. The results of operations for these interim periods are not necessarily indicative of the operating results for other quarters, for the full year or any future period.

The presentation of financial information herein for the periods after our completed divestiture of Rio All-Suite Hotel & Casino in the third quarter of 2023 is not fully comparable to the periods prior to such divestiture.

Consolidation of Subsidiaries and Variable Interest Entities

Our Financial Statements include the accounts of Caesars Entertainment, Inc. and its subsidiaries after elimination of all intercompany accounts and transactions.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

We consolidate all subsidiaries in which we have a controlling financial interest and variable interest entities (“VIEs”) for which we or one of our consolidated subsidiaries is the primary beneficiary. Control generally equates to ownership percentage, whereby (i) affiliates that are more than 50% owned are consolidated; (ii) investments in affiliates of 50% or less but greater than 20% are generally accounted for using the equity method where we have determined that we have significant influence over the entities; and (iii) investments in affiliates of 20% or less are generally accounted for as investments in equity securities.

We consider ourselves the primary beneficiary of a VIE when we have both the power to direct the activities that most significantly affect the results of the VIE and the right to receive benefits or the obligation to absorb losses of the entity that could be potentially significant to the VIE. We review investments for VIE consideration if a reconsideration event occurs to determine if the investment qualifies, or continues to qualify, as a VIE. If we determine an investment qualifies, or no longer qualifies, as a VIE, there may be a material effect to our Financial Statements.

Fair Value Measurements

The Company measures certain of its financial assets and liabilities at fair value, on a recurring basis, which is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. Levels of the hierarchy prioritize the inputs used to measure fair value and include:

•Level 1: Observable inputs such as quoted prices in active markets.

•Level 2: Inputs other than quoted prices in active markets that are either directly or indirectly observable.

•Level 3: Unobservable inputs that reflect the Company’s own assumptions, as there is little, if any, related market activity.

Cash and Cash Equivalents

Cash equivalents include investments in money market funds that can be redeemed immediately at the current net asset value per share. A money market fund is a mutual fund whose investments are primarily in short-term debt securities designed to maximize current income with liquidity and capital preservation, usually maintaining per share net asset value at a constant amount, such as one dollar. The carrying amounts approximate the fair value because of the short maturity of those instruments (Level 1). Cash and cash equivalents also include cash maintained for gaming operations.

Restricted Cash

Restricted cash includes cash equivalents held in certificates of deposit accounts or money market type funds, that are not subject to remeasurement on a recurring basis, which are restricted under certain operating agreements or restricted for future capital expenditures in the normal course of business.

Marketable Securities

Derivative Instruments

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Advertising

Interest Expense, Net

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Interest expense | $ | $ | |||||||||

| Capitalized interest | ( | ( | |||||||||

| Interest income | ( | ( | |||||||||

| Total interest expense, net | $ | $ | |||||||||

Recently Issued Accounting Pronouncements

Pronouncements to Be Implemented in Future Periods

In December 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-09, “Income Taxes: Improvements to Income Tax Disclosures,” which requires disaggregated information about an entity’s effective tax rate reconciliation as well as information on income taxes paid. These updates apply to all entities subject to income taxes and will be effective for annual periods beginning after December 15, 2024. Early adoption is permitted. Updates will be applied on a prospective basis with the option to apply the standard retrospectively. We do not expect the amendments in this update to have a material impact on our Financial Statements.

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting: Improvements to Reportable Segment Disclosures,” which requires public entities to disclose information about their reportable segments’ significant expenses on an interim and annual basis. This guidance is effective for years beginning after December 15, 2023, and interim periods within years beginning after December 15, 2024. Early adoption is permitted. Amendments in this update should be applied retrospectively to all prior periods presented in the financial statements. We do not expect the amendments in this update to have a material impact on our Financial Statements.

In October 2023, the FASB issued ASU 2023-06, “Disclosure Improvements: Codification Amendments In Response to the SEC’s Disclosure Update and Simplification Initiative,” to clarify or improve disclosure and presentation requirements on a variety of topics and align the requirements in the FASB accounting standard codification with the Securities and Exchange Commission regulations. This guidance is effective for the Company no later than June 30, 2027. We do not expect the amendments in this update to have a material impact on our Financial Statements.

Note 3. Property and Equipment

| (In millions) | March 31, 2024 | December 31, 2023 | |||||||||

| Land | $ | $ | |||||||||

| Buildings, riverboats, and leasehold and land improvements | |||||||||||

| Furniture, fixtures, and equipment | |||||||||||

| Construction in progress | |||||||||||

| Total property and equipment | |||||||||||

| Less: accumulated depreciation | ( | ( | |||||||||

| Total property and equipment, net | $ | $ | |||||||||

A portion of our property and equipment is subject to various operating leases for which we are the lessor. Leased property includes our hotel rooms, convention space and retail space through various short-term and long-term operating leases.

| Depreciation Expense | |||||||||||

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Depreciation expense | $ | $ | |||||||||

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Depreciation is calculated using the straight-line method over the shorter of the estimated useful life of the asset or the related lease.

Note 4. Goodwill and Intangible Assets, net

| Changes in Carrying Value of Goodwill and Other Intangible Assets | |||||||||||||||||

| Non-Amortizing Intangible Assets | |||||||||||||||||

| (In millions) | Amortizing Intangible Assets | Goodwill | Other | ||||||||||||||

Balances as of December 31, 2023 | $ | $ | $ | ||||||||||||||

| Amortization expense | ( | — | — | ||||||||||||||

Balances as of March 31, 2024 | $ | $ | $ | ||||||||||||||

| Gross Carrying Value and Accumulated Amortization of Intangible Assets Other Than Goodwill | |||||||||||||||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Useful Life | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | ||||||||||||||||||||||||||||||||||

| Amortizing intangible assets | |||||||||||||||||||||||||||||||||||||||||

| Customer relationships | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||

| Gaming rights and other | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Trademarks | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Reacquired rights | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Technology | ( | ( | |||||||||||||||||||||||||||||||||||||||

| $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||||||||||||||

| Non-amortizing intangible assets other than Goodwill | |||||||||||||||||||||||||||||||||||||||||

| Trademarks | |||||||||||||||||||||||||||||||||||||||||

| Gaming rights | |||||||||||||||||||||||||||||||||||||||||

| Caesars Rewards | |||||||||||||||||||||||||||||||||||||||||

| Total amortizing and non-amortizing intangible assets other than Goodwill, net | $ | $ | |||||||||||||||||||||||||||||||||||||||

Amortization expense with respect to intangible assets totaled $36

| Estimated Five-Year Amortization | |||||||||||||||||||||||||||||||||||

| Remaining 2024 | Years Ended December 31, | ||||||||||||||||||||||||||||||||||

| (In millions) | 2025 | 2026 | 2027 | 2028 | 2029 | ||||||||||||||||||||||||||||||

| Estimated annual amortization expense | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

Note 5. Litigation, Commitments and Contingencies

Litigation

General

We are party to various legal proceedings, which have arisen in the normal course of our business. Such proceedings can be costly, time consuming and unpredictable and, therefore, no assurance can be given that the final outcome of such proceedings will not materially impact our consolidated financial condition or results of operations. Estimated losses are accrued for these proceedings when the loss is probable and can be estimated. While we maintain insurance coverage that we believe is adequate to mitigate the risks of such proceedings, no assurance can be given that the amount or scope of existing insurance coverage will be sufficient to cover losses arising from such matters. The current liability for the estimated losses associated with these proceedings is not material to our consolidated financial condition and those estimated losses are not expected to have a material impact on our results of operations.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Contractual Commitments

Capital Commitments

Harrah’s New Orleans

In April 2020, the Company and the State of Louisiana, by and through the Louisiana Gaming Control Board, entered into an Amended and Restated Casino Operating Contract. Additionally, the Company, New Orleans Building Corporation and the City entered into a Second Amended and Restated Lease Agreement. Based on these amendments related to Harrah’s New Orleans, the Company was required to make a capital investment of $325 million on or around Harrah’s New Orleans by July 15, 2024. The capital investment involves the rebranding of the property to Caesars New Orleans which includes a renovation and full interior and exterior redesign, updated casino floor, new culinary experiences and a new 340 -room hotel tower. The project has a current capital plan of approximately $430 million, and as of March 31, 2024, total capital expenditures have been $329 million since the project began.

Sports Sponsorship/Partnership Obligations

The Company has agreements with certain professional sports leagues and teams, sporting event facilities and media companies for tickets, suites, advertising, marketing, promotional and sponsorship opportunities including communication with partner customer databases. Some of the agreements provide Caesars with exclusivity to access the aforementioned rights within the casino and/or sports betting category. As of March 31, 2024 and December 31, 2023, obligations related to these agreements were $566 million and $605 million, respectively, with contracts extending through 2040. These obligations include leasing of event suites that are generally considered short-term leases for which the Company does not record a right of use asset or lease liability. The Company recognizes expenses in the period services are received in accordance with the various agreements. In addition, assets or liabilities may be recorded related to the timing of payments as required by the respective agreement.

Self-Insurance

The Company is self-insured for workers compensation and other risk insurance, as well as health insurance and general liability. The Company’s total estimated self-insurance liability as of March 31, 2024 and December 31, 2023, was $218 million and $200 million, respectively, which is included in Accrued other liabilities in our Balance Sheets.

The assumptions utilized by our actuaries are subject to significant uncertainty and if outcomes differ from these assumptions or events develop or progress in a negative manner, the Company could experience a material adverse effect and additional liabilities may be recorded in the future.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Note 6. Long-Term Debt

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||

| (Dollars in millions) | Final Maturity | Rates | Face Value | Book Value | Book Value | ||||||||||||||||||||||||

| Secured Debt | |||||||||||||||||||||||||||||

| CEI Revolving Credit Facility | 2028 | variable | $ | $ | $ | ||||||||||||||||||||||||

| CEI Term Loan A | 2028 | variable | |||||||||||||||||||||||||||

| CEI Term Loan B | 2030 | variable | |||||||||||||||||||||||||||

| CEI Term Loan B-1 | 2031 | variable | |||||||||||||||||||||||||||

| CEI Senior Secured Notes due 2030 | 2030 | ||||||||||||||||||||||||||||

| CEI Senior Secured Notes due 2032 | 2032 | ||||||||||||||||||||||||||||

| CEI Senior Secured Notes due 2025 | N/A | N/A | |||||||||||||||||||||||||||

| CRC Senior Secured Notes | N/A | N/A | |||||||||||||||||||||||||||

| Unsecured Debt | |||||||||||||||||||||||||||||

| CEI Senior Notes due 2027 | 2027 | ||||||||||||||||||||||||||||

| CEI Senior Notes due 2029 | 2029 | ||||||||||||||||||||||||||||

| Special Improvement District Bonds | 2037 | ||||||||||||||||||||||||||||

| Long-term notes and other payables | |||||||||||||||||||||||||||||

| Total debt | |||||||||||||||||||||||||||||

| Current portion of long-term debt | ( | ( | ( | ||||||||||||||||||||||||||

| Deferred finance charges associated with the CEI Revolving Credit Facility | ( | ( | |||||||||||||||||||||||||||

| Long-term debt | $ | $ | $ | ||||||||||||||||||||||||||

| Unamortized discounts and deferred finance charges | $ | $ | |||||||||||||||||||||||||||

| Fair value | $ | ||||||||||||||||||||||||||||

Annual Estimated Debt Service Requirements as of March 31, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Remaining | Years Ended December 31, | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2025 | 2026 | 2027 | 2028 | Thereafter | Total | ||||||||||||||||||||||||||||||||||

| Annual maturities of long-term debt | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| Estimated interest payments | |||||||||||||||||||||||||||||||||||||||||

Total debt service obligation (a) | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

____________________

(a)Debt principal payments are estimated amounts based on contractual maturity and scheduled repayment dates. Interest payments are estimated based on the forward-looking SOFR curve, where applicable. Actual payments may differ from these estimates.

Current Portion of Long-Term Debt

The current portion of long-term debt as of March 31, 2024 includes the principal payments on the term loans, other unsecured borrowings, and special improvement district bonds that are contractually due within 12 months. The Company may, from time to time, seek to repurchase or prepay its outstanding indebtedness. Any such purchases or repayments may be funded by existing cash balances or the incurrence of debt. The amount and timing of any repurchase will be based on business and market conditions, capital availability, compliance with debt covenants and other considerations.

Debt Discounts or Premiums and Deferred Finance Charges

Debt discounts or premiums and deferred finance charges incurred in connection with the issuance of debt are amortized to interest expense based on the related debt agreements primarily using the effective interest method. Unamortized discounts are written off and included in our gain or loss calculations to the extent we extinguish debt prior to the original maturity or scheduled payment dates.

Fair Value

The fair value of debt has been calculated primarily based on the borrowing rates available as of March 31, 2024 and based on market quotes of our publicly traded debt. We classify the fair value of debt within Level 1 and Level 2 in the fair value hierarchy.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Terms of Outstanding Debt

CEI Term Loans and CEI Revolving Credit Facility

CEI is party to a credit agreement, dated as of July 20, 2020, with JPMorgan Chase Bank, N.A., as administrative agent, U.S. Bank National Association, as collateral agent, and certain banks and other financial institutions and lenders party thereto (the “CEI Credit Agreement”), which, as amended, provides for the CEI Revolving Credit Facility in an aggregate principal amount of $2.25 billion (the “CEI Revolving Credit Facility”) and will mature on January 31, 2028. The CEI Revolving Credit Facility includes a letter of credit sub-facility of $388 million and contains reserves of $40 million which are available only for certain permitted uses.

On October 5, 2022, Caesars entered into an amendment to the CEI Credit Agreement pursuant to which the Company incurred a senior secured term loan in an aggregate principal amount of $750 million (the “CEI Term Loan A”) as a new term loan under the credit agreement and made certain other amendments to the CEI Credit Agreement. The CEI Term Loan A will mature on January 31, 2028, subject to a springing maturity in the event certain other long-term debt of Caesars is not extended or repaid. The CEI Term Loan A requires scheduled quarterly payments in amounts equal to 1.25 % of the original aggregate principal amount of the CEI Term Loan A, with the balance payable at maturity. The Company may make voluntary prepayments of the CEI Term Loan A at any time prior to maturity at par.

Borrowings under the CEI Revolving Credit Facility and the CEI Term Loan A bear interest, paid monthly or quarterly, at a rate equal to, at the Company’s option, either (a) a forward-looking term rate based on Secured Overnight Financing Rate (“Term SOFR”) for the applicable interest period plus an adjustment of 0.10 % per annum (“Adjusted Term SOFR”), subject to a floor of 0 % or (b) a base rate (the “Base Rate”) determined by reference to the highest of (i) the rate of interest per annum last quoted by The Wall Street Journal as the “Prime Rate” in the United States, (ii) the federal funds rate plus 0.50 % per annum and (iii) the one-month Adjusted Term SOFR plus 1.00 % per annum, in each case, plus an applicable margin. Such applicable margin is 2.25 % per annum in the case of any Adjusted Term SOFR loan and 1.25 % per annum in the case of any Base Rate loan, subject to three 0.25 % step-downs based on the Company’s net total leverage ratio. In addition, on a quarterly basis, the Company is required to pay each lender under the CEI Revolving Credit Facility a commitment fee in respect of any unused commitments under the CEI Revolving Credit Facility in the amount of 0.35 % per annum of the principal amount of the unused commitments of such lender, subject to three 0.05 % step-downs based on the Company’s net total leverage ratio.

On February 6, 2023, Caesars entered into an Incremental Assumption Agreement No. 2 pursuant to which the Company incurred a new senior secured term loan facility in an aggregate principal amount of $2.5 billion (the “CEI Term Loan B”) as a new term loan under the CEI Credit Agreement. The CEI Term Loan B requires scheduled quarterly principal payments in amounts equal to 0.25 % of the original aggregate principal amount of the CEI Term Loan B, with the balance payable at maturity. Borrowings under the CEI Term Loan B bear interest, paid monthly, at a rate equal to, at the Company’s option, either (a) a forward-looking term rate based on the Adjusted Term SOFR, subject to a floor of 0.50 % or (b) a base rate (the “TLB Base Rate”) determined by reference to the highest of (i) the Prime Rate in the United States, (ii) the federal funds rate plus 0.50 % per annum and (iii) the one-month Adjusted Term SOFR plus 1.00 % per annum, in each case, plus an applicable margin. Such applicable margin is 3.25 % per annum in the case of any Adjusted Term SOFR loan and 2.25 % per annum in the case of any TLB Base Rate loan, subject to one 0.25 % step-down based on the Company’s net total leverage ratio. The CEI Term Loan B was issued at a price of 99.0 % of the principal amount and will mature on February 6, 2030.

On February 6, 2024, the Company entered into an Incremental Assumption Agreement No. 3 pursuant to which the Company incurred a new senior secured incremental term loan in an aggregate principal amount of $2.9 billion (the “CEI Term Loan B-1”) under the CEI Credit Agreement. The CEI Term Loan B-1 requires quarterly principal payments in amounts equal to 0.25 % of the original aggregate principal amount of the CEI Term Loan B-1, with the balance payable at maturity. Borrowings under the CEI Term Loan B-1 bear interest at a rate equal to, at the Company’s option, either (a) a forward-looking term rate based on the Term SOFR, subject to a floor of 0.50 % or (b) a base rate (the “TLB-1 Base Rate”) determined by reference to the highest of (i) the “Prime Rate” in the United States, (ii) the federal funds rate plus 0.50 % per annum and (iii) the one-month Term SOFR plus 1.00 % per annum, in each case, plus an applicable margin. Such applicable margin is 2.75 % per annum in the case of any Term SOFR loan and 1.75 % per annum in the case of any TLB-1 Base Rate loan. The CEI Term Loan B-1 was issued at a price of 99.75 % of the principal amount and will mature on February 6, 2031.

The net proceeds from the CEI Term Loan B-1 and the net proceeds from the issuance of the CEI Senior Secured Notes due 2032 (as described below), together with borrowings under the CEI Revolving Credit Facility, were used to tender, redeem, repurchase, defease, and/or satisfy and discharge any and all of the principal amounts, including accrued and unpaid interest, related expenses and fees of both the 5.75 % Senior Secured Notes due 2025 (the “CRC Senior Secured Notes”) and the 6.25 %

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Senior Secured Notes due 2025 (the “CEI Senior Secured Notes due 2025”). As a result of these transactions, the Company recognized $48 million of loss on early extinguishment of debt.

During the three months ended March 31, 2024, the Company utilized and fully repaid the CEI Revolving Credit Facility. Such activity is presented in the financing section in the Statements of Cash Flows. As of March 31, 2024, the Company had $2.1 billion of available borrowing capacity under the CEI Revolving Credit Facility, after consideration of $70 million in outstanding letters of credit, $46 million committed for regulatory purposes, and the reserves described above.

CEI Senior Secured Notes due 2030

On February 6, 2023, the Company issued $2.0 billion in aggregate principal amount of 7.00 % senior secured notes (the “CEI Senior Secured Notes due 2030”) pursuant to an indenture by and among the Company, the subsidiary guarantors party thereto from time to time, U.S. Bank Trust Company, National Association, as trustee, and U.S. Bank National Association, as collateral agent. The CEI Senior Secured Notes due 2030 rank equally with all existing and future first-priority lien obligations of the Company and the subsidiary guarantors. The CEI Senior Secured Notes due 2030 will mature on February 15, 2030, with interest payable semi-annually on February 15 and August 15 of each year.

CEI Senior Secured Notes due 2032

On February 6, 2024, the Company issued $1.5 billion in aggregate principal amount of 6.50 % senior secured notes due 2032 (the “CEI Senior Secured Notes due 2032”) pursuant to an indenture by and among the Company, the subsidiary guarantors party thereto, U.S. Bank Trust Company, National Association, as trustee, and U.S. Bank National Association, as collateral agent. The CEI Senior Secured Notes due 2032 rank equally with all existing and future first-priority lien obligations of the Company and the subsidiary guarantors. The CEI Senior Secured Notes due 2032 will mature on February 15, 2032, with interest payable semi-annually on February 15 and August 15 of each year, commencing August 15, 2024.

CEI Senior Secured Notes due 2025

On July 6, 2020, Colt Merger Sub, Inc. (the “Escrow Issuer”) issued $3.4 billion in aggregate principal amount of the CEI Senior Secured Notes due 2025 pursuant to an indenture dated July 6, 2020, by and among the Escrow Issuer, U.S. Bank National Association, as trustee, and U.S. Bank National Association, as collateral agent. The CEI Senior Secured Notes due 2025 ranked equally with all existing and future first-priority lien obligations of the Company and the subsidiary guarantors. The CEI Senior Secured Notes due 2025 were scheduled to mature on July 1, 2025, with interest payable semi-annually on January 1 and July 1 of each year. On April 5, 2023, the Company purchased $1 million in principal amount of the CEI Senior Secured Notes due 2025. On February 6, 2024, the Company fully tendered, redeemed, repurchased, defeased, and/or satisfied and discharged any and all of the principal amounts, including accrued and unpaid interest, related expenses and fees.

CRC Senior Secured Notes due 2025

On July 6, 2020, the Escrow Issuer issued $1.0 billion in aggregate principal amount of the CRC Senior Secured Notes due 2025 pursuant to an indenture, dated July 6, 2020, by and among the Escrow Issuer, U.S. Bank National Association, as trustee and Credit Suisse AG, Cayman Islands Branch, as collateral agent. The CRC Senior Secured Notes ranked equally with all existing and future first priority lien obligations of CRC, CRC Finco, Inc. and the subsidiary guarantors. The CRC Senior Secured Notes were scheduled to mature on July 1, 2025, with interest payable semi-annually on January 1 and July 1 of each year. On February 6, 2024, the Company fully tendered, redeemed, repurchased, defeased, and/or satisfied and discharged any and all of the principal amounts, including accrued and unpaid interest, related expenses and fees.

CEI Senior Notes due 2027

On July 6, 2020, the Escrow Issuer issued $1.8 billion in aggregate principal amount of 8.125 % Senior Notes due 2027 pursuant to an indenture, dated July 6, 2020 (the “CEI Senior Notes due 2027”), by and between the Escrow Issuer and U.S. Bank National Association, as trustee. The CEI Senior Notes due 2027 rank equally with all existing and future senior unsecured indebtedness of the Company and the subsidiary guarantors. The CEI Senior Notes due 2027 will mature on July 1, 2027, with interest payable semi-annually on January 1 and July 1 of each year.

CEI Senior Notes due 2029

On September 24, 2021, the Company issued $1.2 billion in aggregate principal amount of 4.625 % Senior Notes due 2029 (the “CEI Senior Notes due 2029”) pursuant to an indenture dated as of September 24, 2021, between the Company and U.S. Bank National Association, as trustee. The CEI Senior Notes due 2029 rank equally with all existing and future senior unsecured

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

indebtedness of the Company and the subsidiary guarantors. The CEI Senior Notes due 2029 will mature on October 15, 2029, with interest payable semi-annually on April 15 and October 15 of each year.

Debt Covenant Compliance

The CEI Revolving Credit Facility, the CEI Term Loan A, the CEI Term Loan B, the CEI Term Loan B-1, and the indentures governing the CEI Senior Secured Notes due 2030, the CEI Senior Secured Notes due 2032, the CEI Senior Notes due 2027, and the CEI Senior Notes due 2029 contain covenants which are standard and customary for these types of agreements. These include negative covenants, which, subject to certain exceptions and baskets, limit the Company’s and its subsidiaries’ ability to (among other items) incur additional indebtedness, make investments, make restricted payments, including dividends, grant liens, sell assets and make acquisitions.

The CEI Revolving Credit Facility and the CEI Term Loan A include a maximum net total leverage ratio financial covenant of 7.25 :1 until December 31, 2024 and 6.50 :1 from and after December 31, 2024. In addition, the CEI Revolving Credit Facility and the CEI Term Loan A include a minimum fixed charge coverage ratio financial covenant of 1.75 :1 until December 31, 2024 and 2.0 :1 from and after December 31, 2024. From and after the repayment of the CEI Term Loan A, the financial covenants applicable to the CEI Revolving Credit Facility will be tested solely to the extent that certain testing conditions are satisfied. Failure to comply with such covenants could result in an acceleration of the maturity of indebtedness outstanding under the relevant debt document.

As of March 31, 2024, the Company was in compliance with all of the applicable financial covenants described above.

Guarantees

The CEI Revolving Credit Facility, the CEI Term Loan A, the CEI Term Loan B, the CEI Term Loan B-1, the CEI Senior Secured Notes due 2030 and the CEI Senior Secured Notes due 2032 are guaranteed on a senior secured basis by each existing and future material wholly-owned domestic subsidiary of the Company and are secured by substantially all of the existing and future property and assets of the Company and its subsidiary guarantors (subject to certain exceptions). The CEI Senior Notes due 2027 and the CEI Senior Notes due 2029 are guaranteed on a senior unsecured basis by such subsidiaries.

Note 7. Revenue Recognition

The Company’s Statements of Operations present net revenue disaggregated by type or nature of the good or service. A summary of net revenues disaggregated by type of revenue and reportable segment is presented below. Refer to Note 12 for additional information on the Company’s reportable segments.

| Three Months Ended March 31, 2024 | |||||||||||||||||||||||||||||||||||

| (In millions) | Las Vegas | Regional | Caesars Digital | Managed and Branded | Corporate and Other | Total | |||||||||||||||||||||||||||||

| Casino | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||

| Food and beverage | |||||||||||||||||||||||||||||||||||

| Hotel | |||||||||||||||||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||||||||

| Net revenues | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||

| Three Months Ended March 31, 2023 | |||||||||||||||||||||||||||||||||||

| (In millions) | Las Vegas | Regional | Caesars Digital | Managed and Branded | Corporate and Other | Total | |||||||||||||||||||||||||||||

| Casino | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||

| Food and beverage | |||||||||||||||||||||||||||||||||||

| Hotel | |||||||||||||||||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||||||||

| Net revenues | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

| Accounts Receivable, Net | |||||||||||

| (In millions) | March 31, 2024 | December 31, 2023 | |||||||||

| Casino | $ | $ | |||||||||

| Food and beverage and hotel | |||||||||||

| Other | |||||||||||

| Accounts receivable, net | $ | $ | |||||||||

Contract and Contract-Related Liabilities

The Company records contract or contract-related liabilities related to differences between the timing of cash receipts from the customer and the recognition of revenue. The Company generally has three types of liabilities related to contracts with customers: (1) outstanding chip liability, which represents the amounts owed in exchange for gaming chips held by customers, (2) Caesars Rewards player loyalty program obligations, which represent the deferred allocation of revenue relating to reward credits granted to Caesars Rewards members based on certain types of customer spend, including online and retail gaming, hotel, dining, retail shopping, and player loyalty program incentives earned, and (3) customer deposits and other deferred revenue, which primarily represents funds deposited by customers related to gaming play and advance payments received for goods and services yet to be provided (such as advance ticket sales, deposits on rooms and convention space, unpaid wagers, iGaming deposits, or future sports bets). These liabilities are generally expected to be recognized as revenue within one year of being purchased, earned, or deposited and are recorded within Accrued other liabilities on the Company’s Balance Sheets. Liabilities expected to be recognized as revenue beyond one year of being purchased, earned, or deposited are recorded within Other long-term liabilities on the Company’s Balance Sheets.

The following table summarizes the activity related to contract and contract-related liabilities:

| Outstanding Chip Liability | Caesars Rewards | Customer Deposits and Other Deferred Revenue | |||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||

| Balance at January 1 | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Balance at March 31 | |||||||||||||||||||||||||||||||||||

| Increase / (decrease) | $ | ( | $ | ( | $ | ( | $ | $ | ( | $ | ( | ||||||||||||||||||||||||

Lease Revenue

Lodging Arrangements

Lodging arrangements are considered short-term and generally consist of lease and nonlease components. The lease component is the predominant component of the arrangement and consists of the fees charged for lodging. The nonlease components primarily consist of resort fees and other miscellaneous items. As the timing and pattern of transfer of both the lease and nonlease components are over the course of the lease term, we have elected to combine the revenue generated from lease and nonlease components into a single lease component based on the predominant component in the arrangement. During the three months ended March 31, 2024 and 2023, we recognized approximately $493 million and $503 million, respectively, which is included in Hotel revenues in the Statements of Operations.

Conventions

Convention arrangements are considered short-term and generally consist of lease and nonlease components. The lease component is the predominant component of the arrangement and consists of fees charged for the use of meeting space. The nonlease components primarily consist of food and beverage and audio/visual services. Revenue from conventions is included in Food and beverage revenue in the Statements of Operations and during the three months ended March 31, 2024 and 2023, lease revenue related to conventions was approximately $13 million and $14 million, respectively.

Real Estate Operating Leases

Real estate lease revenue is included in Other revenue in the Statements of Operations. During the three months ended March 31, 2024 and 2023, we recognized approximately $35 million and $37 million, respectively.

Real estate lease revenue includes $13 million and $14 million of variable rental income for the three months ended March 31, 2024 and 2023, respectively.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Note 8. Earnings per Share

The following table illustrates the reconciliation of the numerators and denominators of the basic and diluted net income (loss) per share computations for the three months ended March 31, 2024 and 2023:

| Three Months Ended March 31, | |||||||||||

| (In millions, except per share data) | 2024 | 2023 | |||||||||

| Net loss attributable to Caesars | $ | ( | $ | ( | |||||||

| Shares outstanding: | |||||||||||

| Weighted average shares outstanding – basic | |||||||||||

| Weighted average shares outstanding – diluted | |||||||||||

| Net loss per common share attributable to common stockholders – basic: | $ | ( | $ | ( | |||||||

| Net loss per common share attributable to common stockholders – diluted: | $ | ( | $ | ( | |||||||

For a period in which the Company generated a net loss from continuing operations, the Weighted average shares outstanding - basic was used in calculating Diluted loss per share because using diluted shares would have been anti-dilutive to loss per share.

| Weighted-Average Number of Anti-Dilutive Shares Excluded from the Calculation of Earnings per Share | |||||||||||

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Stock-based compensation awards | |||||||||||

| Total anti-dilutive common stock | |||||||||||

Note 9. Stock-Based Compensation and Stockholders’ Equity

Stock-Based Awards

The Company maintains long-term incentive plans which allow for granting stock-based compensation awards to directors, employees, officers, and consultants or advisers who render services to the Company or its subsidiaries, based on Company Common Stock, including stock options, restricted stock, restricted stock units (“RSUs”), performance stock units (“PSUs”), market-based performance stock units (“MSUs”), stock appreciation rights, and other stock-based awards or dividend equivalents. Forfeitures are recognized in the period in which they occur.

Total stock-based compensation expense in the accompanying Statements of Operations totaled $25 million and $27 million during the three months ended March 31, 2024 and 2023, respectively. These amounts are included in Corporate expense in the Company’s Statements of Operations.

2015 Equity Incentive Plan (“2015 Plan”)

During the three months ended March 31, 2024, as part of the annual incentive program, the Company granted 1.7 million RSUs to eligible participants with an aggregate fair value of $78 million and a ratable vesting period of to three years . Each RSU represents the right to receive payment in respect of one share of the Company’s Common Stock.

During the three months ended March 31, 2024, the Company also granted 107 thousand PSUs that are scheduled to cliff vest over a period of to three years . On the vesting date, recipients will receive between 0 % and 200 % of the target number of PSUs granted, in the form of Company Common Stock, based on the achievement of specified performance and service conditions. The fair value of the PSUs is based on the market price of our common stock when a mutual understanding of the key terms and conditions of the awards between the Company and recipient is achieved. The awards are remeasured each period until such an understanding is reached. The aggregate value of PSUs granted during the quarter was $4.7 million as of March 31, 2024.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

In addition, during the three months ended March 31, 2024, the Company granted 429 thousand MSUs that are scheduled to cliff vest over a period of to three years . On the vesting date, recipients will receive between 0 % and 200 % of the target number of MSUs granted, in the form of Company Common Stock, based on the achievement of specified market and service conditions. The grant date fair value of the MSUs was determined using a Monte-Carlo simulation model. Key assumptions for the Monte-Carlo simulation model are the risk-free interest rate, expected volatility, expected dividends and correlation coefficient. The effect of market conditions is considered in determining the grant date fair value, which is not subsequently revised based on actual performance. The aggregate value of MSUs granted during the three months ended March 31, 2024 was $25 million.

During the three months ended March 31, 2024, there were no grants of stock options. In addition, during the three months ended March 31, 2024, 799 thousand, 99 thousand and 19 thousand of RSUs, PSUs and MSUs, respectively, vested under the 2015 Plan.

Outstanding at End of Period

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||

| Quantity | Wtd-Avg (a) | Quantity | Wtd-Avg (a) | ||||||||||||||||||||

| Restricted stock units | |||||||||||||||||||||||

| Performance stock units | |||||||||||||||||||||||

| Market-based stock units | |||||||||||||||||||||||

____________________

(a)Represents the weighted-average grant date fair value for RSUs, weighted-average grant date fair value for PSUs where the grant date has been achieved, the price of CEI common stock as of the balance sheet date for PSUs where a grant date has not been achieved, and the grant date fair value of the MSUs determined using the Monte-Carlo simulation model.

Accumulated Other Comprehensive Income (Loss)

The changes in Accumulated other comprehensive income (loss) by component, net of tax, for the three months ended March 31, 2024 and 2023 are shown below.

| (In millions) | Unrealized Net Gains on Derivative Instruments | Foreign Currency Translation Adjustments | Other | Total | |||||||||||||||||||

Balances as of December 31, 2022 | $ | $ | ( | $ | ( | $ | |||||||||||||||||

| Other comprehensive income before reclassifications | |||||||||||||||||||||||

| Total other comprehensive income, net of tax | |||||||||||||||||||||||

Balances as of March 31, 2023 | $ | $ | $ | $ | |||||||||||||||||||

Balances as of December 31, 2023 | $ | $ | $ | $ | |||||||||||||||||||

| Other comprehensive loss before reclassifications | ( | ( | |||||||||||||||||||||

| Total other comprehensive loss, net of tax | ( | ( | |||||||||||||||||||||

Balances as of March 31, 2024 | $ | $ | $ | $ | |||||||||||||||||||

Share Repurchase Program

In November 2018, the Company’s Board of Directors authorized a $150 million common stock repurchase program (the “Share Repurchase Program”) pursuant to which the Company may, from time to time, repurchase shares of common stock on the open market (either with or without a 10b5-1 plan) or through privately negotiated transactions. The Share Repurchase Program has no time limit and may be suspended or discontinued at any time without notice. There is no minimum number of shares of common stock that the Company is required to repurchase under the Share Repurchase Program.

As of March 31, 2024, the Company has acquired 223,823 shares of common stock under the Share Repurchase Program at an aggregate value of $9 million and an average of $40.80 per share. No

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Note 10. Income Taxes

The Company utilized a discrete effective tax rate method, as allowed by ASC 740-270 “Income Taxes, Interim Reporting,” to calculate taxes for the three months ended March 31, 2024 and 2023. The Company determined that small changes in estimated “ordinary” income would result in significant changes in the estimated annual effective tax rate (“AETR”), and therefore, the AETR method would not provide a reliable estimate.

| Income Tax Allocation | |||||||||||

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Loss from continuing operations before income taxes | $ | ( | $ | ( | |||||||

| Benefit (provision) for income taxes | ( | ||||||||||

| Effective tax rate | ( | % | % | ||||||||

The Company classifies accruals for uncertain tax positions within Other long-term liabilities on the Balance Sheets, separate from any related income tax payable or deferred income taxes. Reserve amounts relate to any potential income tax liabilities resulting from uncertain tax positions as well as potential interest or penalties associated with those liabilities.

Management assesses the available positive and negative evidence to estimate if sufficient future taxable income will be generated to use existing deferred tax assets. During the second quarter of 2023, the Company evaluated its forecasted adjusted taxable income and objectively verifiable evidence and placed substantial weight on its 2022 and 2023 quarterly earnings, adjusted for non-recurring items, including the interest expense disallowed under current tax law. Accordingly, the Company determined it was more likely than not that a portion of the federal and state deferred tax assets will be realized and, as a result, during the second quarter of 2023, the Company reversed the valuation allowance related to these deferred tax assets and recorded an income tax benefit of $940 million. The Company is still carrying a valuation allowance on certain federal and state deferred tax assets that are not more likely than not to be realized in the future. The Company has assessed the changes to the valuation allowance, including realization of the disallowed interest expense deferred tax asset, using the integrated approach.

The income tax provision for the three months ended March 31, 2024 differed from the expected income tax benefit based on the federal tax rate of 21% primarily due to an increase in federal and state valuation allowances against the deferred tax assets for excess business interest expense.

The income tax benefit for the three months ended March 31, 2023 differed from the expected income tax benefit based on the federal tax rate of 21% primarily due to state deferred tax benefits generated from net operating losses becoming available due to elections to treat certain subsidiary corporations as disregarded entities for income tax purposes.

The Company, including its subsidiaries, files tax returns with federal, state, and foreign jurisdictions. The Company does not have tax sharing agreements with the other members within its consolidated group. The Company is subject to exam by various state and foreign tax authorities. With few exceptions, the Company is no longer subject to US federal or state and local tax assessments by tax authorities for years before 2020, and it is possible that the amount of the liability for unrecognized tax benefits could change during the next 12 months.

Note 11. Related Party and Affiliate Transactions

C. S. & Y. Associates

The Company owns the entire parcel on which Eldorado Resort Casino Reno is located, except for approximately 30,000 square feet which is leased from C. S. & Y. Associates (“CSY”) (the “CSY Lease”). CSY is a general partnership in which a trust has an approximate 27 % interest. The Company’s Executive Chairman of the Board, Gary L. Carano, and his siblings are direct or indirect beneficiaries of the trust. The CSY Lease expires on June 30, 2057. Annual rent pursuant to the CSY Lease is currently $0.6 million, paid monthly. Annual rent is subject to periodic rent escalations of 1 to 2 percent through the term of the lease. Commensurate with its interest, the trust receives directly from the Company approximately 27 % of the rent paid by the Company. As of March 31, 2024 and December 31, 2023, there were no

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

CVA Holdco, LLC

In May 2023, the Company entered into a joint venture, CVA Holdco, LLC, with EBCI and an additional minority partner, to construct, own and operate a gaming facility in Danville, Virginia (“Caesars Virginia”). Caesars Virginia opened in a temporary facility on May 15, 2023 which will be replaced by a permanent facility that is currently under construction and is estimated to open in December 2024. As the managing member, the Company will operate the business and manage the development, construction, financing, marketing, leasing, maintenance and day-to-day operation of the various phases of the project. While the Company holds a 49.5 % variable interest in the joint venture, it is the primary beneficiary; as such, the joint venture’s operations are included in the Financial Statements, with a minority interest recorded reflecting the operations attributed to the other partners. The Company participates ratably, based on ownership percentage, with the partners in the profits and losses of the joint venture. As of March 31, 2024, the Company has received $116 million in contributions for the project. Subsequent to March 31, 2024, Caesars Virginia, LLC, a subsidiary of CVA Holdco, LLC, entered into a five-year term loan and revolving credit facility agreement totaling $425 million on April 26, 2024.

Pompano Joint Venture

In April 2018, the Company entered into a joint venture with Cordish Companies (“Cordish”) to plan and develop a mixed-use entertainment and hospitality destination expected to be located on unused land adjacent to the casino and racetrack at the Company’s Pompano property. As the managing member, Cordish will operate the business and manage the development, construction, financing, marketing, leasing, maintenance and day-to-day operation of the various phases of the project. Additionally, Cordish will be responsible for the development of the master plan for the project with the Company’s input and will submit it for the Company’s review and approval. While the Company holds a 50 % variable interest in the joint venture, it is not the primary beneficiary; as such, the investment in the joint venture is accounted for using the equity method and is recorded in Investment in and advances to unconsolidated affiliates on the Balance Sheet. The Company participates evenly with Cordish in the profits and losses of the joint venture, which are included in Transaction and other costs, net on the Statements of Operations.

As of March 31, 2024, the Company has contributed a total of $7 million in cash contributions since inception of the joint venture, which includes capital calls totaling $3 million in October 2023 that the Company elected to participate in. Additionally, the Company has contributed approximately 209 acres of land with a total fair value of approximately $69 million. The Company has no further obligation to contribute additional real estate or cash. During the year ended December 31, 2023, the Company recorded $64 million of income related to the investment, primarily due to the joint venture’s gain on the sale of a land parcel. As of both March 31, 2024 and December 31, 2023, the Company’s investment in the joint venture was $147

Note 12. Segment Information

The executive decision maker of the Company reviews operating results, assesses performance and makes decisions on a “significant market” basis. Management views each of the Company’s casinos as an operating segment. Operating segments are aggregated based on their similar economic characteristics, types of customers, types of services and products provided, and their management and reporting structure. The Company’s principal operating activities occur in four reportable segments. The reportable segments are based on the similar characteristics of the operating segments with the way management assesses these results and allocates resources, which is a consolidated view that adjusts for the effect of certain transactions between these reportable segments within Caesars: (1) Las Vegas, (2) Regional, (3) Caesars Digital, and (4) Managed and Branded, in addition to Corporate and Other. See table below for a summary of these segments. Also, see Note 3 and Note 4 for a discussion of any impairment of intangible assets or long-lived assets related to certain segments, when applicable.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

The following table sets forth certain information regarding our properties (listed by segment in which each property is reported) as of March 31, 2024:

| Las Vegas | Regional | Managed and Branded | ||||||||||||||||||

Caesars Palace Las Vegas | Caesars Atlantic City | Harveys Lake Tahoe | Managed | |||||||||||||||||

The Cromwell | Caesars Virginia (a) | Horseshoe Baltimore | Harrah’s Ak-Chin | |||||||||||||||||

Flamingo Las Vegas | Circus Circus Reno | Horseshoe Black Hawk | Harrah’s Cherokee | |||||||||||||||||

Harrah’s Las Vegas | Eldorado Gaming Scioto Downs | Horseshoe Bossier City | Harrah’s Cherokee Valley River | |||||||||||||||||

Horseshoe Las Vegas | Eldorado Resort Casino Reno | Horseshoe Council Bluffs | Harrah’s Resort Southern California | |||||||||||||||||

The LINQ Hotel & Casino | Grand Victoria Casino | Horseshoe Hammond | Caesars Windsor | |||||||||||||||||

Paris Las Vegas | Harrah’s Atlantic City | Horseshoe Indianapolis | Branded | |||||||||||||||||

Planet Hollywood Resort & Casino | Harrah’s Columbus Nebraska (b) | Horseshoe Lake Charles | Caesars Republic Scottsdale | |||||||||||||||||

Harrah’s Council Bluffs | Horseshoe St. Louis | Caesars Southern Indiana | ||||||||||||||||||

| Caesars Digital | Harrah’s Gulf Coast | Horseshoe Tunica | Harrah’s Northern California | |||||||||||||||||

| Caesars Digital | Harrah’s Hoosier Park Racing & Casino | Isle Casino Bettendorf | ||||||||||||||||||

Harrah’s Joliet | Isle of Capri Casino Boonville | |||||||||||||||||||

Harrah’s Lake Tahoe | Isle of Capri Casino Lula | |||||||||||||||||||

Harrah’s Laughlin | Isle Casino Waterloo | |||||||||||||||||||

Harrah’s Metropolis | Lady Luck Casino - Black Hawk | |||||||||||||||||||

Harrah’s New Orleans | Silver Legacy Resort Casino | |||||||||||||||||||

Harrah’s North Kansas City | Trop Casino Greenville | |||||||||||||||||||

Harrah’s Philadelphia | Tropicana Atlantic City | |||||||||||||||||||

Harrah’s Pompano Beach | Tropicana Laughlin Hotel & Casino | |||||||||||||||||||

____________________

(a)Temporary gaming facility opened on May 15, 2023. The construction of the permanent facility of Caesars Virginia is expected to be completed in December 2024.

(b)Temporary gaming facility opened on June 12, 2023 and closed on March 20, 2024 in anticipation of the permanent facility opening in May 2024.

Certain of our properties operate off-track betting locations, including Harrah’s Hoosier Park Racing & Casino, which operates Winner’s Circle Indianapolis and Winner’s Circle New Haven, and Horseshoe Indianapolis, which operates Winner’s Circle Clarksville. The LINQ Promenade is an open-air dining, entertainment, and retail promenade located on the east side of the Las Vegas Strip next to The LINQ Hotel & Casino (the “LINQ”) that features the High Roller, a 550 -foot observation wheel, and the Fly LINQ Zipline attraction. We also own the CAESARS FORUM convention center, which is a 550,000 square feet conference center with 300,000 square feet of flexible meeting space, two of the largest pillarless ballrooms in the world and direct access to the LINQ.

Corporate and Other includes certain unallocated corporate overhead costs and other adjustments, including eliminations of transactions among segments, to reconcile to the Company’s consolidated results.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

The following table sets forth, for the periods indicated, certain operating data for the Company’s four reportable segments, in addition to Corporate and Other:

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Las Vegas: | |||||||||||

| Net revenues | $ | $ | |||||||||

| Adjusted EBITDA | |||||||||||

| Regional: | |||||||||||

| Net revenues | |||||||||||

| Adjusted EBITDA | |||||||||||

| Caesars Digital: | |||||||||||

| Net revenues | |||||||||||

| Adjusted EBITDA | ( | ||||||||||

| Managed and Branded: | |||||||||||

| Net revenues | |||||||||||

| Adjusted EBITDA | |||||||||||

| Corporate and Other: | |||||||||||

| Net revenues | ( | ||||||||||

| Adjusted EBITDA | ( | ( | |||||||||

Reconciliation of Net Income (Loss) Attributable to Caesars to Adjusted EBITDA by Segment

Adjusted EBITDA is presented as a measure of the Company’s performance. Adjusted EBITDA is defined as revenues less certain operating expenses and is comprised of net income (loss) before (i) interest income and interest expense, net of interest capitalized, (ii) income tax (benefit) provision, (iii) depreciation and amortization, and (iv) certain items that we do not consider indicative of our ongoing operating performance at an operating property level.

In evaluating Adjusted EBITDA you should be aware that, in the future, we may incur expenses that are the same or similar to some of the adjustments in this presentation. The presentation of Adjusted EBITDA should not be construed as an inference that future results will be unaffected by unusual or unexpected items.

Adjusted EBITDA is a financial measure commonly used in our industry and should not be construed as an alternative to net income (loss) as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity (as determined in accordance with GAAP). Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies within the industry. Adjusted EBITDA is included because management uses Adjusted EBITDA to measure performance and allocate resources, and believes that Adjusted EBITDA provides investors with additional information consistent with that used by management.

CAESARS ENTERTAINMENT, INC.

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

| Three Months Ended March 31, | |||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Net loss attributable to Caesars | $ | ( | $ | ( | |||||||

| Net income attributable to noncontrolling interests | |||||||||||

| (Benefit) provision for income taxes | ( | ||||||||||

Other income (a) | ( | ( | |||||||||

| Loss on extinguishment of debt | |||||||||||

| Interest expense, net | |||||||||||

| Depreciation and amortization | |||||||||||

Transaction costs and other, net (b) | |||||||||||

| Stock-based compensation expense | |||||||||||

| Adjusted EBITDA | $ | $ | |||||||||

| Adjusted EBITDA by Segment: | |||||||||||

| Las Vegas | $ | $ | |||||||||

| Regional | |||||||||||

| Caesars Digital | ( | ||||||||||

| Managed and Branded | |||||||||||

| Corporate and Other | ( | ( | |||||||||

____________________

(a)Other income for the three months ended March 31, 2024 primarily represents a change in estimate of our disputed claims liability.

| Total Assets - By Segment | |||||||||||

| (In millions) | March 31, 2024 | December 31, 2023 | |||||||||

| Las Vegas | $ | $ | |||||||||

| Regional | |||||||||||

| Caesars Digital | |||||||||||

| Managed and Branded | |||||||||||

Corporate and Other (a) | ( | ( | |||||||||

| Total | $ | $ | |||||||||

____________________

(a)Includes eliminations of transactions among segments, to reconcile to the Company’s consolidated results.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of the financial position and operating results of Caesars Entertainment, Inc., a Delaware corporation, and its consolidated subsidiaries, which may be referred to as the “Company,” “CEI,” “Caesars,” “we,” “our,” or “us,” for the three months ended March 31, 2024 and 2023 should be read in conjunction with the unaudited consolidated condensed financial statements and the notes thereto and other financial information included elsewhere in this Form 10-Q as well as our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Annual Report”). Capitalized terms used but not defined in this Form 10-Q have the same meanings as in the 2023 Annual Report.