Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-217084

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 25, 2017)

Up to $20,000,000 of Shares of Common Stock

plus 959,079 Commitment Shares

Common Stock

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering up to $20.0 million in the aggregate amount, or the Purchase Shares, plus an additional 959,079 shares, or the Commitment Shares, of our common stock, par value $0.01 per share, to Aspire Capital Fund, LLC, an Illinois limited liability company, or Aspire Capital, under a Common Stock Purchase Agreement entered into on December 11, 2019, or the Purchase Agreement.

The shares offered include (i) 959,079 Commitment Shares to be issued to Aspire Capital in consideration for entering into the Purchase Agreement, (ii) 1,598,465 Purchase Shares to be issued to Aspire Capital for an aggregate sale price of $1.0 million, or the Initial Purchase Shares, and (iii) additional Purchase Shares with an aggregate offering price of up to $19.0 million which may be sold from time to time to Aspire Capital over the 30-month term of the Purchase Agreement. The purchase price for the Purchase Shares, other than the Initial Purchase Shares, will be based upon one of two formulas set forth in the Purchase Agreement depending on the type of purchase notice we submit to Aspire Capital from time to time. The purchase price for the Initial Purchase Shares was based on the average of the closing prices of our common stock for the five trading days prior to December 11, 2019. Please see “The Aspire Transaction” for more details on how the price for sales of the Purchase Shares (excluding the Initial Purchase Shares) will be determined.

Our common stock is traded on The Nasdaq Capital Market under the symbol “MGEN.” On December 10, 2019, the last reported sales price of our Common Stock on The Nasdaq Capital Market was $0.6388 per share.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we are eligible for reduced public company reporting requirements. Please see “Prospectus Supplement Summary – Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page S-9 of this prospectus supplement and under similar headings in the other documents that are incorporated by reference into this prospectus supplement and accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 12, 2019.

Table of Contents

| PAGE | ||||

| S-i | ||||

| S-1 | ||||

| S-9 | ||||

| S-14 | ||||

| S-15 | ||||

| S-16 | ||||

| S-17 | ||||

| S-18 | ||||

| S-22 | ||||

| S-23 | ||||

| S-23 | ||||

| S-23 | ||||

| S-24 | ||||

| PROSPECTUS |

||||

| i | ||||

| 1 | ||||

| 4 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 17 | ||||

| 24 | ||||

| 27 | ||||

Table of Contents

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement on Form S-3 (File No. 333-217084) that we initially filed with the Securities and Exchange Commission, or SEC, on March 31, 2017 and was declared effective by the SEC on April 25, 2017. This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, dated April 25, 2017, including the documents incorporated by reference, provides more general information about our common stock. Generally, when we refer to the prospectus, we are referring to this prospectus supplement and the accompanying prospectus combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference therein that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement, the accompanying prospectus and in any free writing prospectuses we have authorized for use in connection with this offering. We have not authorized anyone to provide you with different information. We are not making an offer to sell or seeking an offer to buy securities under this prospectus supplement, the accompanying prospectus and any related free writing prospectus in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus supplement, the accompanying prospectus or any related free writing prospectus, and the documents incorporated by reference herein and therein, are accurate only as of their respective dates, regardless of the time of delivery of this prospectus, the accompanying prospectus or any related free writing prospectus, or any sale of a security.

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference into this prospectus supplement and accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

This prospectus supplement and the accompanying prospectus incorporates by reference, and any free writing prospectus may contain and incorporate by reference, industry, statistical and market data from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified statistical, market and industry data from third-party sources. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit or incorporated by reference to the registration statement of which this prospectus supplement and accompanying prospectus form a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement, the accompanying prospectus and the documents incorporated herein and therein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement, the accompanying prospectus, or any related free writing prospectus are the property of their respective owners.

Unless the context requires otherwise, references in this prospectus supplement to “Miragen,” “the Company,” “we,” “us” and “our” refer to Miragen Therapeutics, Inc. and its subsidiaries.

S-i

Table of Contents

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before making an investment decision. To fully understand this offering and its consequences to you, you should read this entire prospectus supplement and the accompanying prospectus carefully, including the factors described under the heading “Risk Factors” in this prospectus supplement beginning on page S-9 and page 7 of the accompanying prospectus, together with any free writing prospectus we have authorized for use in connection with this offering and the financial statements and all other information incorporated by reference in this prospectus supplement and the accompanying prospectus.

Company Overview

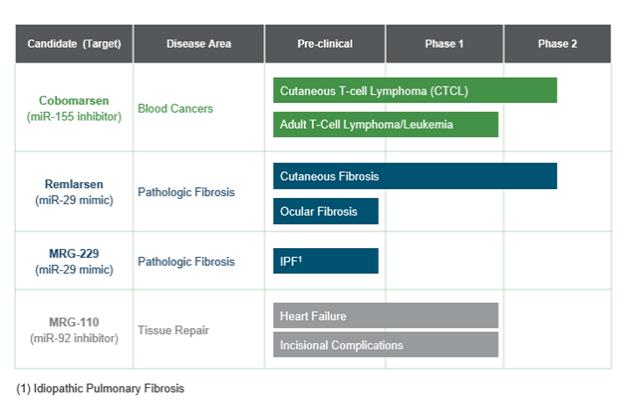

We are a clinical-stage biopharmaceutical company discovering and developing proprietary RNA-targeted therapies with a specific focus on microRNAs and their role in diseases where there is a high unmet medical need. We have three clinical stage product candidates: cobomarsen, remlarsen, and MRG-110. We are developing cobomarsen for the treatment of patients with certain cancers, including cutaneous T-cell lymphoma, or CTCL, and adult T-cell leukemia/lymphoma, or ATLL. Cobomarsen, is an inhibitor of microRNA-155, which is found at abnormally high levels in malignant cells of several blood cancers. We are also developing remlarsen and MRG-229, which are product candidates for the treatment of patients with pathological fibrosis. These product candidates are replacements for microRNA-29, which is found at abnormally low levels in a number of pathological fibrotic conditions, including cutaneous, cardiac, renal, hepatic, pulmonary and ocular fibrosis, as well as in systemic sclerosis. MRG-110, an inhibitor of microRNA-92, is our product candidate for the treatment of heart failure and other ischemic disease.

We believe our experience in microRNA biology and chemistry, drug discovery, bioinformatics, translational medicine, and drug development allows us to identify and develop microRNA-targeted drugs that are designed to regulate gene pathways to return diseased tissues to a healthy state. We believe that our drug discovery and development strategy will enable us to progress our product candidates from preclinical discovery to confirmation of mechanism of action in humans quickly and efficiently. The elements of this strategy include identification of biomarkers that may predict clinical benefit and monitoring outcomes in early-stage clinical trials to help guide later clinical development.

Cobomarsen

Cobomarsen is currently being evaluated for multiple indications where elevated levels of miR-155 have been implicated. Our most advanced trial is a Phase 2 clinical trial of cobomarsen, called SOLAR, in which cobomarsen is being evaluated in patients with mycosis fungoides, or MF, the most common type of CTCL.

In April 2019, the first CTCL patients were dosed in the SOLAR trial. The SOLAR trial is designed to evaluate the safety and efficacy of cobomarsen given in 300 mg doses by intravenous, or IV, infusion in an active control comparison trial versus Zolinza (vorinostat). The primary endpoint of the SOLAR trial is the rate of an objective response that is durable for four months, defined as 50% or greater improvement in the severity of a patient’s skin disease over the entire body with no evidence of disease progression in the blood, lymph nodes, or viscera. In December 2019, we announced that we will stop the enrollment of new patients in SOLAR, effective as of the end of the 2019. Patients enrolled in the trial at that time will continue to be evaluated for safety and clinical response. We initially planned to enroll up to 126 patients and now expect to enroll approximately 30 patients. Despite the reduction in patient enrollment, we believe that evaluation of data from this set of patients can provide important evidence regarding the safety and efficacy of cobomarsen for the treatment of CTCL in a shorter period of time and require fewer resources. We also believe that obtaining controlled clinical data from this cohort of patients may allow for a better assessment of the clinical potential of cobomarsen as compared to data from our Phase 1 trial. We intend for this controlled clinical data to form the basis of determining what additional clinical investigation of cobomarsen in CTCL is warranted, if any, and what would be required to potentially obtain regulatory approval. Topline data from this amended trial is expected to be announced in the third quarter of 2020.

In addition to CTCL, we are also evaluating cobomarsen in a Phase 1 basket trial of other cancers where the disease process appears to be correlated with an increase in miR-155 levels, ATLL, diffuse large B-cell lymphoma, and chronic lymphocytic leukemia. In this clinical trial, we believe that cobomarsen has demonstrated promising interim results in several ATLL patients. Based on these interim results, in December 2019, we announced that we are focusing our cobomarsen expansion indication efforts on ATLL and will request a meeting with the FDA to explore a potential expedited development pathway for cobomarsen in ATLL. We expect to have a meeting with the FDA in the second quarter of 2020.

S-1

Table of Contents

microRNA-29 mimics

We are developing miR-29 mimics or replacements for miR-29, a microRNA that is found at abnormally low levels in a number of pathological fibrotic conditions. Our lead microRNA-29 mimics are remlarsen and MRG-229. Remlarsen is our most advanced product candidate in fibrosis, which is currently being evaluated in a Phase 2 clinical trial assessing its safety, tolerability, and activity in the potential prevention or reduction of keloid formation in patients with a history of keloid scars, a form of pathological scarring. In December 2019, we reported interim data from this clinical trial, which suggests that remlarsen was generally safe and well tolerated, treatment had no negative effect on healing reported and initial volume reductions in treated keloids compared to placebo in a subset of patients were observed. Based on this data, we have decided to continue our analysis of patient data at the one-year primary endpoint of the study and expect to provide additional guidance in the second quarter of 2020. With this data, we expect to seek a collaboration partner from remlarsen.

In addition, based on preclinical data with MRG-229, in December 2019 we announced that our pipeline development efforts and allocation of future capital will be primarily focused on the development of MRG-229 for IPF. We believe that the efficacy and safety profile of MRG-229 positions it as a potentially differentiated approach to the treatment of IPF. We expect to report additional preclinical safety and efficacy data during the first half of 2020. This program is supported by a grant in collaboration with the National Institutes of Health and Yale University.

MRG-110

MRG-110 is an inhibitor of miR-92, a microRNA expressed in endothelial cells. We have completed two Phase 1 clinical trials of MRG-110, which is being evaluated for the potential treatment of heart failure and other conditions where patients may benefit from increased vascular flow and accelerated healing, such as complicated lacerations in high risk patients. We have historically developed MRG-110 under a license and collaboration agreement, or the Servier Collaboration Agreement, with Les Laboratoires Servier and Institut de Recherches Servier, or collectively, Servier. In August 2019, we received notice of Servier’s intention to terminate the Servier Collaboration Agreement effective February 1, 2020. As a result, we will regain rights to MRG-110 in all indications and all territories globally, including rights in the US and Japan, which we already controlled under the Servier Collaboration Agreement. We continue to explore potential collaborations in support of the development of MRG-110. Any future development of MRG-110 is subject to the availability of sufficient capital resources to continue such development.

Anticipated Milestones

| • | Report preclinical safety and efficacy data for MRG-229 (1H-2020) |

| • | FDA meeting exploring a potential expedited clinical development path for cobomarsen in ATLL (Q2-2020) |

| • | Presentation of Phase 2 cobomarsen data in CTCL (Q3-2020) |

S-2

Table of Contents

Overview of Our Clinical Pipeline

Cost Restructuring Plan

In December 2019, we announced a plan to streamline our operations, which we expect will result in the reduction of approximately 18 employees through the period ending June 30, 2020. The reductions are primarily in positions relating to research and development and corresponding project, general and administrative support. We estimate that we will incur approximately $0.7 million in restructuring charges primarily for severance and other related costs for the employees impacted by the reduction in force between the date of this prospectus and June 30, 2020. In addition, we plan to enter into severance and retention bonus agreements with our remaining workforce.

In December 2019, we also announced that Paul Rubin, M.D., Executive Vice President of R&D, is leaving miRagen effective December 31, 2019. With the departure of Dr. Rubin, we announced the promotion of Diana Escolar, M.D. as our Chief Medical Officer. Dr. Escolar joined us in January 2018 and has served as our Senior Vice President of Clinical Sciences.

After changes to the SOLAR clinical trial and the reduction in workforce, we believe our cash and cash equivalents will now be sufficient to fund our operations into the fourth quarter of 2020.

Our Strategy

We seek to use our expertise and understanding of microRNA biology, oligonucleotide chemistry and product development to create novel products that have the potential to transform the treatment of patients with serious diseases. The key components of our strategy are as follows:

| • | Continue to develop cobomarsen for blood cancers where the disease process appears to be correlated with an increase in miR-155 levels, focusing on CTCL and ATLL. |

S-3

Table of Contents

| • | Continue to develop remlarsen and MRG-229 for pathological fibrosis, focusing on the development of MRG-229 in IPF. |

| • | Utilize rare disease development pathways at the FDA and comparable foreign regulatory agencies to accelerate progression to late stage development and early approval. |

| • | Collaborate with biotechnology and pharmaceutical companies to develop additional product candidates. |

| • | Use our in-house research and translational expertise to further develop our product candidate pipeline. |

Our Approach to Drug Discovery and Development

Our research and development strategy is designed to accelerate timelines and reduce development risk. The goal of our translational medicine strategy is to progress rapidly to first-in-human trials once we have adequately established mechanistic proof-of-concept, consisting of pharmacokinetics, pharmacodynamics, safety, and manufacturability of the product candidate in preclinical studies. Programs that progress into human trials are designed to be accompanied by a validated set of pharmacodynamic biomarkers that allow us to verify the mechanism of drug action in humans and to potentially stratify and enrich the study population. Through this approach, we seek to reduce the risk of the programs by quantifying target engagement and identifying the likely efficacious dose prior to progression to Phase 2 clinical trials.

Background on microRNA

microRNAs are transcribed from the genome and unlike messenger RNA, or mRNA, they do not encode proteins. microRNAs typically function by preventing the translation of mRNAs into proteins and/or by triggering degradation of these mRNAs. Studies have shown that microRNA gene regulation is often not a decisive on and off switch but a subtle function that fine-tunes cellular phenotypes that becomes more pronounced during stress or disease conditions. microRNAs were first discovered in 1993 and have since been found in nearly every biological system examined since that time. They are highly conserved across species, which underscores their importance to biological functions and cellular processes. According to the Sanger Institute, over 1,000 microRNAs have been identified in humans.

A body of evidence has shown that inappropriate levels of particular microRNAs are directly linked to a range of serious diseases, many of which are poorly served by existing therapies. microRNAs can affect the balance of protein expression and serve as “command and control” nodes that directly coordinate multiple critical systems simultaneously. This effect on systems biology is a naturally occurring homeostatic process that becomes disrupted in certain disease states. As a result, developing microRNA therapeutics is fundamentally different from the single-protein, single-target approach that is the foundation of traditional small and large molecule drugs.

Risks Associated with our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” on page S-9 of this prospectus supplement and those described under similar headings in the documents incorporated by reference into this prospectus supplement. These risks include:

| • | We will need to raise additional capital, and if we are unable to do so when needed, we will not be able to continue as a going concern. |

| • | Our management, as of September 30, 2019, has concluded that due to our need for additional capital, and the uncertainties surrounding our ability to raise such funding, substantial doubt exists as to our ability to continue as a going concern. |

| • | We have historically incurred losses, have a limited operating history on which to assess our business, and anticipate that we will continue to incur significant losses for the foreseeable future. |

| • | Clinical trials are costly, time consuming, and inherently risky, and we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities. |

S-4

Table of Contents

| • | Our microRNA-targeted therapeutic product candidates are based on a relatively novel technology, which makes it unusually difficult to predict the time and cost of development and the time and cost, or likelihood, of subsequently obtaining regulatory approval. To date, no microRNA-targeted therapeutics have been approved for marketing in the United States. |

| • | We are heavily dependent on the success of our product candidates, which are in the early stages of clinical development. Some of our product candidates have produced results only in non-clinical settings, or for other indications than those for which we contemplate conducting development and seeking FDA approval, and we cannot give any assurance that we will generate data for any of our product candidates sufficiently supportive to receive regulatory approval in our planned indications, which will be required before they can be commercialized. |

| • | We may find it difficult to enroll patients in our clinical trials given the limited number of patients who have the diseases for which our product candidates are being studied. Difficulty in enrolling patients could delay or prevent clinical trials of our product candidates. |

| • | We may attempt to obtain accelerated approval of our product candidates. If we are unable to obtain accelerated approval, we may be required to conduct clinical trials beyond those that we contemplate, or the size and duration of our pivotal clinical trials could be greater than currently planned, which could increase the expense of obtaining, reduce the likelihood of obtaining, and/or delay the timing of obtaining necessary marketing approvals. Even if we receive accelerated approval from the FDA, the FDA may require that we conduct confirmatory trials to verify clinical benefit. If our confirmatory trials do not verify clinical benefit, or if we do not comply with rigorous post-approval requirements, the FDA may seek to withdraw accelerated approval. |

| • | We may not be successful in obtaining or maintaining necessary rights to microRNA targets, product compounds and processes for our development pipeline through acquisitions and in-licenses. |

| • | We rely on third parties to conduct our clinical trials, manufacture our product candidates, and perform other services. If these third parties do not successfully perform and comply with regulatory requirements, we may not be able to successfully complete clinical development, obtain regulatory approval, or commercialize our product candidates and our business could be substantially harmed. |

| • | If we do not effectively manage changes in our operations, our business may be harmed; we have taken substantial restructuring charges in the past and we may need to take material restructuring charges in the future. |

| • | The market price of our common stock is expected to be volatile, and the market price of our common stock may drop in the future. |

| • | Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a delisting of our common stock. |

Our Corporate Information

We were founded in New York as a Delaware limited liability company in January 2010 under the name Myeloma Health LLC. Signal Genetics LLC was formed as a Delaware limited liability company in December 2010. Effective January 1, 2011, substantially all of the member interests in Myeloma Health LLC were exchanged for member interests in Signal Genetics LLC and Myeloma Health LLC became a subsidiary of Signal Genetics LLC. Immediately prior to the pricing of our initial public offering, on June 17, 2014, Signal Genetics LLC converted from a Delaware limited liability company to a Delaware corporation, or the Corporate Conversion. In connection with the Corporate Conversion, each unit of Signal Genetics LLC was converted into a share of our common stock, the members of Signal Genetics LLC became our stockholders and we succeeded to the business of Signal Genetics LLC and its consolidated subsidiaries. On February 13, 2017, we acquired a privately-held company named Miragen Therapeutics, Inc. and, immediately following the acquisition, we changed our name to “Miragen Therapeutics, Inc.” Our common stock began trading on The Nasdaq Capital Market under the ticker symbol “MGEN” on February 14, 2017.

Our principal executive office is located at 6200 Lookout Road, Boulder, CO 80301, and our telephone number is (720) 643-5200. Our corporate website address is www.miragen.com. We do not incorporate the information on, or accessible through, our website into this prospectus supplement and the accompanying prospectus, and you should not consider any information on, or accessible through, our website as part of this prospectus supplement and the accompanying prospectus.

S-5

Table of Contents

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For so long as we remain an emerging growth company, or EGC, we are permitted and intend to take advantage of specified reduced reporting requirements that are applicable to public companies, including:

| • | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We currently take advantage of some or all these reporting exemptions and we may continue to do so until we are no longer an EGC. Accordingly, the information that we provide stockholders may be different than the information you receive from other public companies in which you hold stock. We will remain an EGC until the earlier of (1) the last day of the fiscal year (a) ending December 31, 2019, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Under Section 107(b) of the JOBS Act, an EGC can delay adopting new or revised accounting standards until those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we are subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

We are also a smaller reporting company as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as (i) our voting and non-voting common stock held by non-affiliates is less than $250.0 million as of June 30 of such fiscal year or (ii) our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700.0 million measured as of June 30 of such fiscal year.

S-6

Table of Contents

THE OFFERING

| Common stock offered by us | Up to $19.0 million of Purchase Shares that we may sell to Aspire Capital from time to time over the next 30 months, at our sole discretion, in accordance with the Purchase Agreement, plus (i) 959,079 Commitment Shares issued to Aspire Capital as consideration for its commitment to purchase shares of our common stock under the Purchase Agreement and (ii) 1,598,465 Initial Purchase Shares issued to Aspire Capital for an aggregate sale price of $1.0 million. We will not receive any cash proceeds from the issuance of the Commitment Shares. | |

| Common stock outstanding before this offering | 31,181,749 shares (as of September 30, 2019). | |

| Common stock to be outstanding immediately after this offering | Up to 63,482,561 shares, assuming the issuance of 959,079 Commitment Shares, 1,598,465 Initial Purchase Shares and sales of 29,743,268 additional Purchase Shares at an assumed price of $0.6388 per share, which was the closing price of our common stock on The Nasdaq Capital Market on December 10, 2019. The actual number of Purchase Shares issued will vary depending on the sales prices under this offering, but will not be greater than 6,457,635, which number includes the 959,079 Commitment Shares, the 1,598,465 Initial Purchase Shares and up to 3,900,091 additional Purchase Shares, in the aggregate representing 19.99% of the shares of our common stock outstanding on the date of the Purchase Agreement, unless such sales are made in accordance with applicable rules of The Nasdaq Stock Market LLC. | |

| Manner of offering | Issuance of 959,079 Commitment Shares to Aspire Capital in consideration for entering into the Purchase Agreement, 1,598,465 Initial Purchase Shares to Aspire Capital for an aggregate sale price of $1.0 million, and additional Purchase Shares to Aspire Capital from time to time, subject to certain minimum stock price requirements, and daily and other caps, for an aggregate offering price of up to $20.0 million (including the Initial Purchase Shares). See “The Aspire Transaction” and “Plan of Distribution.” | |

| Use of proceeds | Any proceeds from Aspire Capital that we receive under the Purchase Agreement are expected be used to advance the development of MRG-229, as well as general corporate purposes including business development initiatives. | |

| See “Use of Proceeds” on page S-15 of this prospectus supplement for more information. | ||

| Market for the common stock | Our common stock is listed on The Nasdaq Capital Market under the symbol “MGEN”. | |

| Risk factors | Investing in our common stock involves significant risks. See “Risk Factors” on page S-9 of this prospectus supplement, and under similar headings in other documents incorporated by reference into this prospectus supplement and accompanying prospectus, for a discussion of certain factors to consider carefully before deciding to purchase any shares of our common stock. | |

The number of shares of common stock to be outstanding after the offering is based on the number of shares outstanding as of September 30, 2019. As of that date, we had 31,181,749 shares of common stock outstanding, excluding, in each case as of September 30, 2019:

| • | 4,034,348 shares of our common stock issuable upon the exercise of our options outstanding, with a weighted-average exercise price of $5.20 per share; |

S-7

Table of Contents

| • | 46,522 shares of our common stock issuable upon the exercise of our warrants outstanding, with a weighted-average exercise price of $17.93 per share; |

| • | 1,290,930 shares of our common stock reserved for future issuance under our 2016 Equity Incentive Plan and any shares of our common stock that become available pursuant to provisions in such plan that automatically increase the share reserve on January 1 of each calendar year; and |

| • | 622,346 shares of our common stock reserved for future issuance under our 2016 Employee Stock Purchase Plan and any shares of our common stock that become available pursuant to provisions in such plan that automatically increase the share reserve on January 1 of each calendar year. |

Except as otherwise indicated, all information in this prospectus supplement assumes:

| • | no exercise of our outstanding options to purchase our common stock since September 30, 2019; and |

| • | no exercise of our outstanding warrants to purchase our common stock since September 30, 2019. |

The number of shares of common stock to be outstanding immediately following this offering as shown above does not include up to $39.0 million of shares of our common stock that remained available for sale at September 30, 2019 under our Common Stock Sales Agreement with Cowen and Company, LLC, or the ATM Agreement. Between September 30, 2019 and the date of this prospectus supplement, 513,759 shares were sold under the ATM Agreement.

The number of shares of common stock to be outstanding immediately following this offering as shown above does not include up to $4.0 million of shares of our common stock that remained available for sale at September 30, 2019 under our Common Stock Purchase Agreement, or the LLS Stock Purchase Agreement, with LLS TAP Miragen, LLC, or LLS TAP, as assignee of the Leukemia and Lymphoma Society, or LLS. Between September 30, 2019 and the date of this prospectus supplement, 606,364 shares were sold under the LLS Stock Purchase Agreement.

S-8

Table of Contents

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described under the heading “Risk Factors” included or incorporated by reference in this prospectus supplement and the accompanying prospectus and discussed under the heading “Risk Factors” contained in our most recent Quarterly Report on Form 10-Q, as may be amended or updated by subsequent reports that are incorporated by reference into this prospectus supplement in their entirety. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be adversely affected, which could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the discussion below under the heading “Special Note Regarding Forward-Looking Statements.”

Risks Related to this Offering

Sales of our common stock to Aspire Capital may cause substantial dilution to our existing stockholders and the sale of the shares of our common stock acquired by Aspire Capital could cause the price of our common stock to decline.

This prospectus supplement relates to the 959,079 Commitment Shares and an aggregate amount of up to $20.0 million of Purchase Shares that we may issue and sell to Aspire Capital from time to time pursuant to the Purchase Agreement, including the Initial Purchase Shares. It is anticipated that shares offered to Aspire Capital in this offering will be sold over a period of up to 30 months from the date of the Purchase Agreement. The number of shares ultimately offered for sale to Aspire Capital under this prospectus supplement is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. Depending upon market liquidity at the time, sales of shares of our common stock under the Purchase Agreement may cause the trading price of our common stock to decline.

Aspire Capital may ultimately purchase all, some or none of the Purchase Shares remaining after the sale of the 1,598,465 Initial Purchase Shares. After Aspire Capital has acquired shares under the Purchase Agreement, it may sell all, some or none of those shares. Sales to Aspire Capital by us pursuant to the Purchase Agreement under this prospectus supplement may result in substantial dilution to the interests of other holders of our common stock. The sale of a substantial number of shares of our common stock to Aspire Capital in this offering, or anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales. However, we have the right to control the timing and amount of any sales of our shares to Aspire Capital and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

We have a right to sell up to 200,000 Purchase Shares per day under our Purchase Agreement with Aspire Capital, which total may be increased by mutual agreement up to an additional 2,000,000 Purchase Shares per day. In addition, on any date on which we submit a purchase notice to Aspire Capital for at least 200,000 Purchase Shares, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice directing Aspire Capital to purchase an additional amount of our common stock equal to up to 30% of the aggregate shares of common stock traded on the next business day subject to a maximum number of shares determined by us. The extent to which we rely on Aspire Capital as a source of funding will depend on a number of factors, including the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources. The aggregate number of shares that we can sell to Aspire Capital under the Purchase Agreement may in no case exceed 6,457,635 shares of our common stock (which is equal to approximately 19.99% of the common stock outstanding on the date of the Purchase Agreement), including the 959,079 Commitment Shares and the 1,598,465 Initial Purchase Shares, or the Exchange Cap, unless stockholder approval is obtained to issue more or such sales otherwise would comply with the listing rules of The Nasdaq Stock Market, LLC, in which case the Exchange Cap will not apply.

Future sales of a significant number of our shares of common stock in the public markets, or the perception that such sales could occur, could depress the market price of our shares of common stock.

Sales of a substantial number of our shares of common stock in the public markets, or the perception that such sales could occur, could depress the market price of our shares of common stock and impair our ability to raise capital through the sale of additional equity securities. A substantial number of shares of common stock are being offered by this prospectus supplement, and we cannot predict if and when Aspire Capital may sell such shares in the public markets. We cannot predict the number of these shares that might be sold nor the effect that future sales of our shares of common stock would have on the market price of our shares of common stock.

S-9

Table of Contents

We have broad discretion in the use of the net proceeds from this offering and we may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section titled “Use of Proceeds,” and you will be relying on the judgment of our management regarding the application of these proceeds. You will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. Our management might not apply the net proceeds or our existing cash in ways that ultimately increase the value of your investment. If we do not invest or apply the net proceeds from this offering or our existing cash in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline. We intend to use the net proceeds from the offering to advance the development of cobomarsen and MRG-229, as well as general corporate purposes. These investments may not yield a favorable return to our stockholders. See “Use of Proceeds.”

Raising additional capital, including as a result of this offering, may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our product candidates.

Until such time, if ever, as we can generate substantial revenue from the sale of our product candidates, we expect to finance our cash needs through a combination of equity offerings, debt financings and license and development agreements. To the extent that we raise additional capital through the sale of equity securities, including from this offering, or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a common stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends.

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may be required to relinquish valuable rights to our research programs or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings or other arrangements with third parties when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to third parties to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

To the extent that we raise additional capital through the sale of equity, including pursuant to any sales under the ATM Agreement, the LLS Stock Purchase Agreement, convertible debt or other securities convertible into equity, the ownership interest of our stockholders will be diluted, and the terms of these new securities may include liquidation or other preferences that adversely affect rights of our stockholders. For instance, through the date of this prospectus supplement, we had sold (i) pursuant to the terms of the ATM Agreement, 1,871,386 shares of our common stock for aggregate net proceeds of approximately $11.0 million, and (ii) pursuant to the terms of the LLS Stock Purchase Agreement, 757,351 shares of our common stock for aggregate net proceeds of approximately $1.4 million. We anticipate that we will continue to make sales of our common stock under the ATM Agreement from time to time into the foreseeable future, and we may sell shares of our common stock of up to $38.6 million in additional aggregate value under the ATM Agreement. As a result of the modifications of the SOLAR trial we announced in December 2019, we do not anticipate meeting the milestones under the LLS Stock Purchase Agreement and as such, do not expect we will receive the remaining $3.5 million in proceeds available under the LLS Stock Purchase Agreement unless the agreement is amended, which we can provide no assurances will occur. As a result, we may need to finance sooner than we previously anticipated. We cannot guarantee that the terms of any other financing arrangement will not be substantially more restrictive than those contained in the LLS Stock Purchase Agreement. Sales under the ATM Agreement or the LLS Stock Purchase Agreement dilute the ownership interest of our stockholders and may cause the price per share of our common stock to decrease.

Terms of subsequent financings may adversely impact our stockholders.

To finance our future business plans and working capital needs, we will have to raise funds through the issuance of equity or debt securities in addition to sales in this offering. Depending on the type and the terms of any financing we pursue, stockholders’ rights and the value of their investment in our common stock could be reduced. A financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing market price for our common stock. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be senior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results. If the issuance of new securities results in diminished rights to holders of our common stock, the market price of our common stock could be negatively impacted.

S-10

Table of Contents

Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a delisting of our common stock.

Our common stock is currently listed on The Nasdaq Capital Market. To maintain the listing of our common stock on The Nasdaq Capital Market, we are required to meet certain listing requirements, including, among others, a minimum bid price of $1.00 per share.

If we fail to satisfy the continued listing requirements of The Nasdaq Capital Market, such as the corporate governance requirements or the minimum closing bid price requirement, The Nasdaq Capital Market may take steps to delist our common stock, which could have a materially adverse effect on our ability to raise additional funds as well as the price and liquidity of our common stock. Such a delisting would likely have a negative effect on the price of our common stock and would impair our stockholders’ ability to sell or purchase our common stock when they wish to do so. In the event of a delisting, we can provide no assurance that any action taken by us to restore compliance with listing requirements would allow our common stock to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent our common stock from dropping below the Nasdaq minimum bid price requirement, or prevent future non-compliance with The Nasdaq Capital Market’s listing requirements.

On October 28, 2019, we received a letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC, or Nasdaq, notifying us that the listing of our common stock was not in compliance with Nasdaq Listing Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market, as the minimum bid price of our listed securities was less than $1.00 per share for the previous 30 consecutive business days. Under Nasdaq Listing Rule 5810(c)(3)(A), we have a period of 180 calendar days, or until April 27, 2020, to regain compliance with the rule. To regain compliance, during this 180-day compliance period, the minimum bid price of our listed securities must close at $1.00 per share or more for a minimum of 10 consecutive business days.

In the event that we do not regain compliance with the Nasdaq Listing Rules prior to the expiration of the 180-day compliance period, we may be eligible for additional time to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A)(ii) by meeting the continued listing requirement for market value of publicly held shares and all other applicable standards for initial listing on The Nasdaq Capital Market, with the exception of the minimum bid price requirement. In addition, we would need to provide written notice to Nasdaq of our intention to cure the minimum bid price deficiency during the second compliance period by effecting a reverse stock split, if necessary. As part of its review process, the Nasdaq staff will make a determination of whether it believes we will be able to cure this deficiency. Should the Nasdaq staff conclude that we will not be able to cure the deficiency, or should we determine not to make the required representation, Nasdaq will provide notice that our shares of common stock will be subject to delisting.

If we do not regain compliance within the allotted compliance period(s), including any extensions that may be granted by Nasdaq, Nasdaq will provide notice that our shares of common stock will be subject to delisting. At such time, we may appeal the delisting determination to a hearings panel pursuant to the procedures set forth in the applicable Nasdaq Listing Rules. We intend to actively monitor the minimum bid price of our listed securities and, as appropriate, will consider available options to resolve the deficiencies and regain compliance with the Nasdaq Listing Rules, including effecting a reverse stock split.

There can be no assurance that we will be successful in maintaining the listing of our common stock on The Nasdaq Capital Market. This could impair the liquidity and market price of our common stock. In addition, the delisting of our common stock from a national exchange could have a material adverse effect on our access to capital markets, and any limitation on market liquidity or reduction in the price of our common stock as a result of that delisting could adversely affect our ability to raise capital on terms acceptable to us, or at all.

S-11

Table of Contents

We do not currently intend to pay dividends on our common stock, and any return to investors is expected to come, if at all, only from potential increases in the price of our common stock.

At the present time, we intend to use available funds to finance our operations. Accordingly, while payment of dividends rests within the discretion of our board of directors, we have no intention of paying any such dividends in the foreseeable future. Any return to investors is expected to come, if at all, only from potential increases in the price of our common stock.

We are heavily dependent on the success of our product candidates, which are in the early stages of clinical development. Some of our product candidates have produced results only in non-clinical settings, or for other indications than those for which we contemplate conducting development and seeking FDA approval, and we cannot give any assurance that we will generate data for any of our product candidates sufficiently supportive to receive regulatory approval in our planned indications, which will be required before they can be commercialized.

We have invested substantially all of our effort and financial resources to identify, acquire, and develop our portfolio of product candidates. Our future success is dependent on our ability to successfully further develop, obtain regulatory approval for, and commercialize one or more product candidates. We currently generate no revenue from sales of any products, and we may never be able to develop or commercialize a product candidate.

We currently have three product candidates in clinical trials. Of these product candidates, cobomarsen has been predominantly administered in patients with MF. This is only one of the multiple indications for which we plan to develop this product candidate. Additionally, our clinical and preclinical data to date is not validated, and we have no way of knowing if after validation our clinical trial data will be complete and consistent. There can be no assurance that the data that we develop for our product candidates in our planned indications will be sufficiently supportive to obtain regulatory approval.

In December 2019, we decided to cease enrollment in our SOLAR trial, and we no longer believe that results from the SOLAR clinical trial, based on a smaller number of patients than originally planned, could potentially allow us to apply for accelerated approval in the United States. As a result, we cannot guarantee if we will be able to raise sufficient capital necessary to complete a Phase 3 clinical trial of cobomarsen or when, if ever, we will be able to seek approval of cobomarsen.

In addition, none of our other product candidates have advanced into a pivotal clinical trial for our proposed indications, and it may be years before any such clinical trial is initiated and completed, if at all. We are not permitted to market or promote any of our product candidates before we receive regulatory approval from the FDA or comparable foreign regulatory authorities, and we may never receive such regulatory approval for any of our product candidates. We cannot be certain that any of our product candidates will be successful in clinical trials or receive regulatory approval. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue our operations.

We may find it difficult to enroll patients in our clinical trials, in part due to the limited number of patients who have the diseases for which our product candidates are being studied. We cannot predict if we will continue to have difficulty enrolling patients in our current or future clinical trials. Difficulty in enrolling patients could delay or prevent clinical trials of our product candidates.

Identifying and qualifying patients to participate in clinical trials of our product candidates is essential to our success. The timing of our clinical trials depends in part on the rate at which we can recruit patients to participate in clinical trials of our product candidates, and we may experience delays in our clinical trials if we encounter difficulties in enrollment.

The eligibility criteria of our planned clinical trials may further limit the available eligible trial participants as we expect to require that patients have specific characteristics that we can measure or meet the criteria to assure their conditions are appropriate for inclusion in our clinical trials. For instance, prior to ending enrollment in our SOLAR trial in 2019, we planned to enroll approximately 65 patients per treatment group in our SOLAR trial of cobomarsen in patients with MF. Due in part to our enrollment delays we decided to end enrollment in the SOLAR trial by the end of 2019. We cannot guarantee that we will not encounter similar enrollment delays in future clinical trials. Accordingly, we may not be able to

S-12

Table of Contents

identify, recruit, and enroll a sufficient number of patients to complete our clinical trials in a timely manner because of the perceived risks and benefits of the product candidate under study, the availability and efficacy of competing therapies and clinical trials, and the willingness of physicians to participate in our planned clinical trials. If patients are unwilling to participate in our clinical trials for any reason, the timeline for conducting trials and obtaining regulatory approval of our product candidates may be delayed.

If we experience delays in the completion of, or termination of, any clinical trials of our product candidates, the commercial prospects of our product candidates could be harmed, and our ability to generate product revenue from any of these product candidates could be delayed or prevented. In addition, any delays in completing our clinical trials would likely increase our overall costs, impair product candidate development, and jeopardize our ability to obtain regulatory approval relative to our current plans. Any of these occurrences may harm our business, financial condition, and prospects significantly.

If we do not effectively manage changes in our operations, our business may be harmed; we have taken substantial restructuring charges in the past and we may need to take material restructuring charges in the future.

The expansion of our business, as well as business contractions and other changes in our business requirements, have in the past, and may in the future, require that we adjust our business and cost structures by incurring restructuring charges. Restructuring activities involve reductions in our workforce at some locations and closure of certain facilities. All of these changes have in the past placed, and may in the future place, considerable strain on our research and development activities and financial and management control systems and resources, including decision support, accounting management, information systems and facilities. If we do not effectively manage our financial and management controls, reporting systems, and procedures to manage our employees, our business could be harmed.

For instance, in August 2019 and December 2019, we announced cost restructuring plans focused on reducing costs and directing our resources to advance cobomarsen and microRNA-29 mimics, including remlarsen, while reducing investments in new discovery research. As a result of the cost restructuring plan, approximately 44 positions were identified for elimination, primarily in positions relating to research and corresponding projects, general and administrative support, and other costs related to these areas. In 2019, we have incurred approximately $1.1 million in restructuring charges for retention, severance and other restructuring related costs, and anticipate incurring approximately an additional $1.0 million in restructuring charges for retention, severance and other restructuring related costs through June 30, 2020.

We may be required to incur additional charges in the future to align our operations and cost structures with global economic conditions, market demands, cost competitiveness, and our clinical development activities. If we are required to incur additional restructuring charges in the future, our operating results, financial condition, and cash flows could be adversely impacted. Additionally, there are other potential risks associated with our restructuring that could adversely affect us, such as delays encountered with the finalization and implementation of the restructuring activities, work stoppages, and the failure to achieve targeted cost savings.

S-13

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, and the accompanying prospectus contains, and any free writing prospectus we have authorized for use in connection with this offering, including the documents we incorporate by reference therein may contain, forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements contained in this prospectus supplement and the documents referenced above, other than statements of historical fact, including statements regarding our strategy, future operations, future financial position, future revenue, projected expenses, prospects, plans and objectives of management are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect,” “predict,” “potential,” “opportunity,” “goals,” or “should,” and similar expressions are intended to identify forward-looking statements.

Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, statements relating to:

| • | our future research and development activities, including clinical testing and the costs and timing thereof; |

| • | our strategy, including clinical development of cobomarsen, our regulatory and clinical strategies for cobomarsen, remlarsen, MRG-229 and other product candidates, and the clinical and commercial potential of cobomarsen; |

| • | sufficiency of our cash resources; |

| • | our ability to raise additional funding when needed; |

| • | any statements concerning anticipated regulatory activities or licensing or collaborative arrangements; |

| • | our research and development and other expenses; |

| • | our operations and legal risks; |

| • | our ability to maintain listing on a national securities exchange; |

| • | our intended use of the net proceeds from this offering; and |

| • | any statement of assumptions underlying any of the foregoing. |

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described above under the heading “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus supplement and accompanying prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

S-14

Table of Contents

We may receive up to $19.0 million in aggregate gross proceeds under the Purchase Agreement from sales of Purchase Shares we may make to Aspire Capital after the date of this prospectus supplement, excluding the $1.0 million in gross proceeds we received pursuant to the issuance and sale of the Initial Purchase Shares. We estimate that the net proceeds to us from the sale of our common stock to Aspire Capital pursuant to the Purchase Agreement will be up to approximately $19.9 million (including the proceeds received pursuant to the issuance and sale of the Initial Purchase Shares) over an approximately 30-month period, assuming that we sell the full amount of our common stock that we have the right, but not the obligation, to sell to Aspire Capital under the Purchase Agreement, and after estimated fees and expenses. We may sell fewer than all of the shares offered by this prospectus supplement, in which case our net offering proceeds will be less. Because we are not obligated to sell any shares of our common stock under the Purchase Agreement, other than the Commitment Shares, for which we will receive no cash consideration, and the Initial Purchase Shares, the actual total offering amount and proceeds to us, if any, are not determinable at this time. Other than the proceeds we will receive for the sale of the Initial Purchase Shares, there can be no assurance that we will receive any proceeds under or fully utilize the Purchase Agreement. See “Plan of Distribution” elsewhere in this prospectus supplement for more information.

We intend to use the net proceeds from the Purchase Agreement to advance the development of MRG-229, as well as general corporate purposes including business development initiatives.

The expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures depend on numerous factors, including the progress of our product candidate development, status and results from clinical trials, collaborations we may enter into with third parties for our product candidates, and any unforeseen cash needs.

Due to the uncertainties inherent in the clinical development and regulatory process, it is difficult to estimate with certainty the exact amounts of the net proceeds from this offering, if any, that may be used for any purpose. As a result, our management will have broad discretion in applying the net proceeds from this offering. Pending their ultimate use, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

S-15

Table of Contents

We have never declared or paid any cash dividends on our capital stock. We anticipate that we will retain all of our future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. Any future determination to declare cash dividends will be made at the discretion of our board of directors, subject to compliance with certain covenants under our credit facility, which restricts or limits our ability to declare or pay dividends.

S-16

Table of Contents

The sale of our common stock to Aspire Capital pursuant to the Purchase Agreement will have a dilutive impact on our stockholders. In addition, the lower our stock price is at the time we exercise our right to sell shares of common stock to Aspire Capital, the more shares of our common stock we will have to issue to Aspire Capital pursuant to the Purchase Agreement and our existing stockholders would experience greater dilution.

The net tangible book value of our common stock as of September 30, 2019 was approximately $22.6 million, or $0.72 per share of common stock. The net tangible book value per share of our common stock is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of September 30, 2019. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by Aspire Capital in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the sale of the 959,079 Commitment Shares, the 1,598,465 Initial Purchase Shares and the sale of up to $19.0 million of additional Purchase Shares (without giving effect to the Exchange Cap) at an assumed offering price of $0.6388 per share, the last reported sale price of our common stock on The Nasdaq Capital Market on December 10, 2019, and after deducting estimated offering expenses payable by us, our net tangible book value as of September 30, 2019 would have been $43.5 million, or $0.67 per share of common stock. This represents an immediate decrease in the net tangible book value of $0.05 per share to our existing stockholders. The following table illustrates this per share dilution:

| Assumed offering price per share |

$ | 0.6388 | ||||||

| Net tangible book value per share of as of September 30, 2019 |

$ | 0.72 | ||||||

| Decrease per share attributable to Aspire Capital |

$ | 0.05 | ||||||

|

|

|

|||||||

| As adjusted net tangible book value per share as of September 30, 2019, after giving effect to this offering |

$ | 0.67 | ||||||

|

|

|

|||||||

| Net dilution per share to Aspire Capital |

$ | (0.03) | ||||||

|

|

|

The above discussion and table are based on the number of shares outstanding as of September 30, 2019. As of that date, we had 31,181,749 shares of common stock outstanding, excluding, in each case as of September 30, 2019:

| • | 4,034,348 shares of our common stock issuable upon the exercise of our options outstanding, with a weighted-average exercise price of $5.20 per share; |

| • | 46,522 shares of our common stock issuable upon the exercise of our warrants outstanding, with a weighted-average exercise price of $17.93 per share; |

| • | 1,290,930 shares of our common stock reserved for future issuance under our 2016 Equity Incentive Plan and any shares of our common stock that become available pursuant to provisions in such plan that automatically increase the share reserve on January 1 of each calendar year; and |

| • | 622,346 shares of our common stock reserved for future issuance under our 2016 Employee Stock Purchase Plan and any shares of our common stock that become available pursuant to provisions in such plan that automatically increase the share reserve on January 1 of each calendar year. |

The above discussion and table do not include up to $39.0 million of shares of our common stock that remained available for sale at September 30, 2019 under the ATM Agreement. Between September 30, 2019 and the date of this prospectus supplement, 513,759 shares were sold under the ATM Agreement.

The above discussion and table also do not include up to $4.0 million of shares of our common stock that remained available for sale at September 30, 2019 under the LLS Stock Purchase Agreement. Between September 30, 2019 and the date of this prospectus supplement, 606,364 shares were sold under the LLS Stock Purchase Agreement.

To the extent that any of these shares are issued upon exercise of our outstanding options or outstanding warrants, our existing stockholders and the investors purchasing our common stock in this offering will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

S-17

Table of Contents

General

On December 11, 2019, we entered into the Purchase Agreement with Aspire Capital, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $19.0 million of Purchase Shares (excluding the Initial Purchase Shares) from time to time over the 30-month term of the Purchase Agreement. As consideration for entering into the Purchase Agreement, we agreed to issue 959,079 Commitment Shares. In addition, on December 11, 2019, Aspire Capital purchased 1,598,465 Initial Purchase Shares at a purchase price of $0.6256 per share for an aggregate purchase price of $1.0 million, pursuant to the Purchase Agreement.

We are filing this prospectus supplement with regard to the offering of our common stock consisting of (i) the Commitment Shares, (ii) the Initial Purchase Shares and (iii) additional Purchase Shares in an aggregate amount of up to $19.0 million that we may sell to Aspire Capital pursuant to the Purchase Agreement.

Purchase of Shares under the Purchase Agreement

On December 11, 2019, the conditions necessary for purchases under the Purchase Agreement to commence were satisfied. On any business day over the 30-month term of the Purchase Agreement, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice, each, a Purchase Notice, directing Aspire Capital to purchase up to 200,000 Purchase Shares per business day, provided that Aspire Capital will not be required to buy Purchase Shares pursuant to a Purchase Notice that was received by Aspire Capital on any business day on which the last closing trade price of our common stock on the Nasdaq Capital Market (or alternative national exchange in accordance with the Purchase Agreement) is below $0.25 (which price shall not be adjusted for any stock splits or other similar transactions), or the Floor Price. We and Aspire Capital also may mutually agree to increase the number of shares that may be sold to as much as an additional 2,000,000 Purchase Shares per business day. The purchase price per Purchase Share, other than the Initial Purchase Shares, pursuant to such Purchase Notice, or the Purchase Price is the lower of:

| (i) | the lowest sale price for our common stock on the date of sale; or |

| (ii) | the average of the three lowest closing sale prices for our common stock during the 10 consecutive business days ending on the business day immediately preceding the purchase date. |

The applicable Purchase Price will be determined prior to delivery of any Purchase Notice. The purchase price of the Initial Purchase Shares was based on the average of the closing prices of our common stock for the five trading days prior to December 11, 2019.

In addition, on any date on which we submit a Purchase Notice to Aspire Capital for at least 200,000 Purchase Shares, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice, each, a VWAP Purchase Notice, directing Aspire Capital to purchase an additional amount of our common stock equal to up to 30% of the aggregate shares of common stock traded on the next business day, or the VWAP Purchase Date, subject to a maximum number of shares determined by us, or the VWAP Purchase Share Volume Maximum. The purchase price per Purchase Share pursuant to such VWAP Purchase Notice, or the VWAP Purchase Price, shall be the lesser of the closing sale price of our common stock on the VWAP Purchase Date or 97% of the volume weighted average price for our common stock traded on The Nasdaq Capital Market on (i) the VWAP Purchase Date if the aggregate shares to be purchased on that date does not exceed the VWAP Purchase Share Volume Maximum and the sale price of our common stock has not fallen below a price equal to (a) 80% of the closing sales price of our common stock on the business day immediately preceding the VWAP Purchase Date or (b) such higher price as set forth by us in the VWAP Purchase Notice, or the VWAP Minimum Price Threshold, or (ii) the portion of such business day until such time as the sooner to occur of (x) the time at which the aggregate shares to be purchased will equal the VWAP Purchase Share Volume Maximum or (y) the time at which the sales price of our common stock falls below the VWAP Minimum Price Threshold.