UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________to _____________

Commission file number

(Exact Name of Registrant as specified in its charter) |

| ||

(State or jurisdiction of Incorporation or organization |

| (I.R.S Employer Identification No.) |

|

|

|

| ||

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code:

Securities registered under Section 12(b) of the Exchange Act: Title of each class Name of each exchange on which registered

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Exchange Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation s-K (§ 229.405 of this chapter is not contained herein and will not be contained to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐ | Smaller reporting company | ||

(Do not check if a smaller company) |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter; $

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares outstanding of the issuer’s Common Stock, $.0001 par value, as of April 15, 2024 was

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the documents is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

AMERICAN RESOURCES CORPORATION

ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended December 31, 2023

TABLE OF CONTENTS

| 2 |

| Table of Contents |

Special Note Regarding Forward Looking Statements.

This annual report on Form 10-K of American Resources Corporation for the year ended December 31, 2023 contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. To the extent that such statements are not recitations of historical fact, such statements constitute forward looking statements which, by definition involve risks and uncertainties. In particular, statements under the Sections; Description of Business, Management’s Discussion and Analysis of Financial Condition and Results of Operations contain forward looking statements. Where in any forward-looking statements, the Company expresses an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will result or be achieved or accomplished.

The following are factors that could cause actual results or events to differ materially from those anticipated and include but are not limited to: general economic, financial and business conditions; the price of metallurgical coal and or thermal coal changes in and compliance with governmental regulations; changes in tax laws; and the cost and effects of legal proceedings.

You should not rely on forward looking statements in this annual report. This annual report contains forward looking statements that involve risks and uncertainties. We use words such as “anticipates,” “believes,” “plans,” “expects,” “future,” “intends,” and similar expressions to identify these forward-looking statements. Prospective investors should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. Our actual results could differ materially from those anticipated in these forward-looking statements.

| 3 |

| Table of Contents |

PART I

Item 1. Business.

Overview

When we formed our company, our focus was to (i) construct and/or purchase and manage a chain of combined gasoline, diesel and natural gas (NG) fueling and service stations (initially, in the Miami, FL area); (ii) construct conversion factories to convert NG to liquefied natural gas (LNG) and compressed natural gas (CNG); and (iii) construct conversion factories to retrofit vehicles currently using gasoline or diesel fuel to also run on NG in the United States and also to build a convenience store to serve our customers in each of our locations.

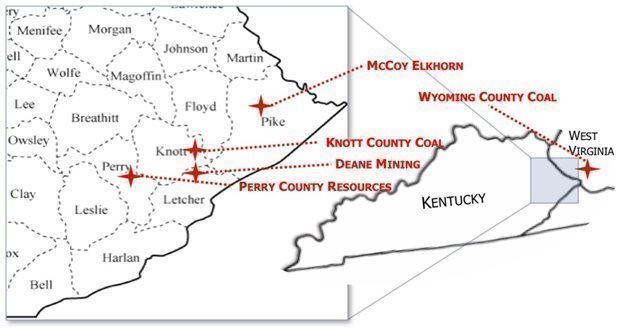

On January 5, 2017, American Resources Corporation (ARC) executed a Share Exchange Agreement between the Company and Quest Energy Inc. (“Quest Energy”), a private company incorporated in the State of Indiana on May 2015 with offices at 12115 Visionary Way, Fishers, IN 46038, and due to the fulfillment of various conditions precedent to closing of the transaction, the control of the Company was transferred to the Quest Energy shareholders on February 7, 2017. This transaction resulted in Quest Energy becoming a wholly-owned subsidiary of ARC. Through Quest Energy, ARC was able to acquire coal mining and coal processing operations, substantially all located in eastern Kentucky and western West Virginia. On November 25, 2020, Quest Energy changed its name to American Carbon Corp. (American Carbon)

American Carbon currently has seven coal mining and processing operating subsidiaries: McCoy Elkhorn Coal LLC (doing business as McCoy Elkhorn Coal Company) (McCoy Elkhorn), Knott County Coal LLC (Knott County Coal), Deane Mining, LLC (Deane Mining), Wyoming County Coal LLC (Wyoming County), Perry County Resources (Perry County) located in eastern Kentucky and western West Virginia within the Central Appalachian coal basin, and ERC Mining Indiana Corporation (ERC) located in southwest Indiana within the Illinois coal basin. The coal deposits under control by the Company are generally comprise of metallurgical coal (used for steel making), pulverized coal injections (used in the steel making process) and high-BTU, low sulfur, low moisture bituminous coal used for a variety of uses within several industries, including industrial customers and specialty products.

Efforts to diversify revenue streams have led to the establishment of additional subsidiaries; American Metals LLC (AM) which is focused on the aggregation, recovery and sale of recovered metal and steel and American Rare Earth LLC (ARE) which is focused on the purification and monetization of critical and rare earth element deposits and end of life magnets and batteries. During 2022, American Rare Earth LLC changed its name to ReElement Technologies LLC (ReElement). During 2023, ReElement filed and changed from a limited liability company to a corporation.

We have not classified, and as a result, do not have any “proven” or “probable” reserves as defined in United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, our company and its business activities are deemed to be in the exploration stage until mineral reserves are defined on our properties.

Since mid-2019, we have not mined or sold coal which is sold into the thermal coal markets. All production and future investment will be for the mining of metallurgical coal. The following table is presented for historical purposes.

Historic Metallurgical Coal Prices |

|

| Historic CAPP Thermal Coal Prices |

| ||||||

Year End |

| Hampton Road Index HCC - High |

|

| Year End |

| Big Sandy / Kanawha Rate District |

| ||

2014 |

| $ | 100.35 |

|

| 2014 |

| $ | 56.00 |

|

2015 |

| $ | 80.25 |

|

| 2015 |

| $ | 45.55 |

|

2016 |

| $ | 223.00 |

|

| 2016 |

| $ | 50.65 |

|

2017 |

| $ | 210.00 |

|

| 2017 |

| $ | 60.90 |

|

2018 |

| $ | 205.34 |

|

| 2018 |

| $ | 68.12 |

|

2019 |

| $ | 135.00 |

|

| 2019 |

| $ | 60.30 |

|

2020 |

| $ | 101.00 |

|

| 2020 |

| $ | 54.35 |

|

2021 |

| $ | 342.00 |

|

| 2021 |

| $ | 92.50 |

|

2022 |

| $ | 364.53 |

|

| 2022 |

| $ | 148.57 |

|

2023 |

| $ | 327.00 |

|

| 2023 |

| $ | 78.65 |

|

| 4 |

| Table of Contents |

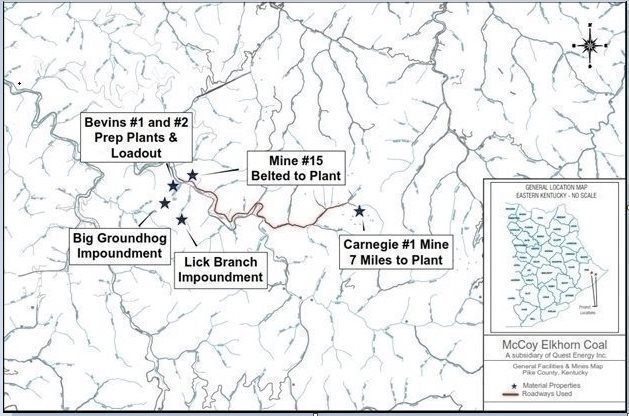

McCoy Elkhorn Coal LLC

General:

Located primarily within Pike County, Kentucky, McCoy Elkhorn is currently comprised of one active mine (the Carnegie 1 Mine), one mine in “idle” status (the Mine#15 Mine), two coal preparation facilities (Bevins #1 and Bevins #2), and other mines and permits in various stages of development or reclamation. The address for the Bevins #1 and #2 preparation facilities is 2069 Highway 194 E Meta, KY 41501. The address for Mine #15 is 2560 Highway194 E Meta, KY 41501. The address for Carnegie 1 is 209 Meathouse Fork Kimper, KY 41502.

McCoy Elkhorn sells its coal to a variety of customers, both domestically and internationally, primarily to the steel making industry as a high-vol “B” coal or blended coal.

The coal controlled at McCoy Elkhorn (along with our other subsidiaries) has not been classified as either “proven” or “probable” as defined in the United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, do not have any “proven” or “probable” reserves under such definition and are classified as an “Exploration Stage” pursuant to Items 1300 through 1305 of Regulation S-K. Approximate coal deposits owned is 0 tons and leased by McCoy Elkhorn totals 11,108,724 tons as of September 30, 2023. The current leases contain minimum annual payments of $20,000 and production royalty payments of 7% of gross sales price.

Mines:

Within the McCoy Elkhorn subsidiary, Carnegie 1 is deemed material under Items 1304 of Regulation S-K.

Mine #15 is an underground mine in the Millard (also known as Glamorgan) coal seam and located near Meta, Kentucky. Mine #15 is mined via room-and-pillar mining methods using continuous miners, and the coal is belted directly from the stockpile to McCoy Elkhorn’s coal preparation facility. Mine #15 is currently a “company run” mine, whereby the Company manages the workforce at the mine and pays all expenses of the mine. The coal from Mine #15 is stockpiled at the mine site and belted directly to the Company’s nearby coal preparation facilities. Production at Mine #15 re-commenced under Quest Energy’s ownership in September 2016. Mine #15 has the estimated capacity to produce up to approximately 40,000 tons per month of coal. The Company acquired Mine #15 as an idled mine, and since acquisition, the primary work completed at Mine #15 by the Company includes changing working sections within the underground mine, air ventilation enhancements primarily through brattice work and the use of overcasts and installing underground mining infrastructure as the mine advances due to coal extraction. In 2023, Mine #15 produced approximately 0 tons. In 2022, Mine #15 produced approximately 0 tons. During 2022 and 2021, 100% and 100%, respectively, of the coal extracted from Mine #15 was high-vol “B” metallurgical coal quality, of which 100% was sold into the PCI market and 100% was sold into the metallurgical market, respectively. The mineral available through Mine #15 is leased from various 3rd party mineral holders. Coal mined from the lease requires a payment of greater of $2.50 per ton or 5% of gross sales price.

The Carnegie 1 Mine is an underground mine in the Alma and Upper Alma coal seams and located near Kimper, Kentucky. In 2011, coal production from the Carnegie 1 Mine in the Alma coal seam commenced and then subsequently the mine was idled. Production at the Carnegie 1 Mine was reinitiated in early 2017 under Quest Energy’s ownership and is currently being mined via room-and-pillar mining methods utilizing a continuous miner. The coal is stockpiled on-site and trucked approximately 7 miles to McCoy Elkhorn’s preparation facilities. The Carnegie 1 Mine is currently a “company run” mine, whereby the Company manages the workforce at the mine and pays all expenses of the mine. The Carnegie 1. Mine has the estimated capacity to produce up to approximately 10,000 tons per month of coal. The Company acquired the Carnegie 1 Mine as an idled mine, and since acquisition, the primary work completed at the Carnegie 1 Mine by the Company includes mine rehabilitation work in preparation for production, changing working sections within the underground mine, air ventilation enhancements primarily through brattice work, and installing underground mining infrastructure as the mine advances due to coal extraction. In 2023, the Carnegie 1 Mine produced approximately 67,372.57 tons and sold at an average of $180.32 per ton. In 2022, the Carnegie 1 Mine produced approximately 59,911.58 tons and sold at an average of $166.09 per ton.. During 2023 and 2022 100% of the coal extracted from the Carnegie 1 Mine was high-vol “B” metallurgical coal quality, of which 100% was sold into the metallurgical market. The mineral being mined through Carnegie 1 is leased from a 3rd party professional mineral company. Coal mined from the lease requires a payment of greater of $1.75 per ton or 6% of gross sales price.

The Carnegie 2 Mine is an underground mine in the Alma and Upper Alma coal seams and located near Kimper, Kentucky. In 2021, mine development began and operations at the Carnegie 2 Mine started in August 2022 and is currently being mined via room-and-pillar mining methods utilizing a continuous miner. The coal is stockpiled on-site and trucked approximately 7 miles to McCoy Elkhorn’s preparation facilities. The Carnegie 2 Mine is currently a “company run” mine, whereby the Company manages the workforce at the mine and pays all expenses of the mine. The Carnegie 2. Mine has the estimated capacity to produce up to approximately 10,000 tons per month of coal. In 2023, the Carnegie 2 Mine produced approximately 13,460.99 tons and sold at an average of $237.31 per ton. In 2022, the Carnegie 2 Mine produced approximately 6,200 tons and sold at an average of $233.11 per ton. During 2023 and 2022 100% of the coal extracted from the Carnegie 2 Mine was high-vol “B” metallurgical coal quality, of which 100% was sold into the metallurgical market. The mineral being mined through Carnegie 1 is leased from a 3rd party professional mineral company. Coal mined from the lease requires a payment of greater of $1.75 per ton or 6% of gross sales price.

American Carbon acquired the PointRock Mine in April 2018. On May 8, 2020, the PointRock Mine permits were released from the Company’s control upon the settlement agreement with prior permit holder.

Beginning in January 2020 through the report date, Mine #15 and Carnegie 1 mines were idled due to the adverse market effects Covid-19 global pandemic. The Carnegie 1 mine restarted during October 2021. The Carnegie 2 mine commenced operations in August 2022.

| 5 |

| Table of Contents |

Processing & Transportation:

The Bevins #1 Preparation Plant is an 800 ton-per hour coal preparation facility located near Meta, Kentucky, across the road from Mine #15. Bevins #1 has raw coal stockpile storage of approximately 25,000 tons and clean coal stockpile storage of 100,000 tons of coal. The Bevins #1 facility has a fine coal circuit and a stoker circuit that allows for enhance coal recovery and various coal sizing options depending on the needs of the customer. The Company acquired the Bevins Preparation Plants as idled facilities, and since acquisition, the primary work completed at the Bevins Preparation Plants by the Company includes rehabilitating the plants’ warehouse and replacing belt lines.

The Bevins #2 Preparation Plant is on the same permit site as Bevins #1 and is a 500 ton-per-hour processing facility with fine coal recovery and a stoker circuit for coal sizing options. Bevins #2 has raw coal stockpile storage of 25,000 tons of coal and a clean coal stockpile storage of 45,000 tons of coal. We are currently utilizing less than 10% of the available processing capacity of Bevins #1 and Bevins #2.

Both Bevins #1 and Bevins #2 have a batch-weight loadout and rail spur for loading coal into trains for rail shipments. The spur has storage for 110 rail cars and is serviced by CSX Transportation and is located on CSX’s Big Sandy, Coal Run Subdivision. Both Bevins #1 and Bevins #2 have coarse refuse and slurry impoundments called Big Groundhog and Lick Branch. While the Big Groundhog impoundment is nearing the end of its useful life, the Lick Branch impoundment has significant operating life and will be able to provide for coarse refuse and slurry storage for the foreseeable future at Bevins #1 and Bevins #2. Coarse refuse from Bevins #1 and Bevins #2 is belted to the impoundments. Both Bevins #1 and Bevins #2 are facilities owned by McCoy Elkhorn, subject to certain restrictions present in the agreement between McCoy Elkhorn and the surface land owner.

Both Bevins #1 and Bevins #2, as well as the rail loadout, are operational and any work required on any of the plants or loadouts would be routine maintenance. The allocated cost of for this property at McCoy Elkhorn Coal paid by the company is $95,210.

Due to additional coal processing storage capacity at Bevins #1 and Bevins #2 Preparation Plants, McCoy Elkhorn processes, stores, and loads coal for other regional coal producers for an agreed-to fee.

Additional Permits:

In addition to the above mines, McCoy Elkhorn holds 11 additional coal mining permits that are idled operations or in various stages of reclamation. For the idled coal mining operations, McCoy Elkhorn will determine which coal mines to bring back into production, if any, as the coal market changes, and there are currently no other idled mines within McCoy Elkhorn that are slated to go into production in the foreseeable future. Any idled mines that are brought into production would require significant upfront capital investment, and there is no assurance of the feasibility of any such new operations.

Below is a map showing the material properties at McCoy Elkhorn:

| 6 |

| Table of Contents |

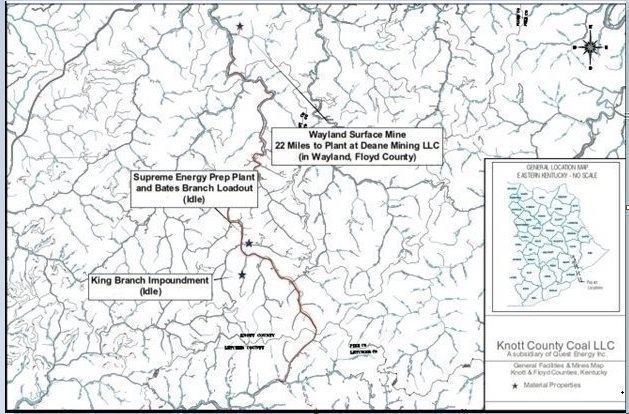

Knott County Coal LLC

General:

Located primarily within Knott County, Kentucky (but with additional idled permits in Leslie County, Perry County, and Breathitt County, Kentucky), Knott County Coal is comprised of one active mine (the Wayland Surface Mine) and 22 idled mining permits (or permits in reclamation), including the permits associated with the idled Supreme Energy Preparation Plant. The idled mining permits are either in various stages of planning, idle status or reclamation. The idled mines at Knott County Coal are primarily underground mines that utilize room-and-pillar mining. The coal controlled at Knott County Coal (along with our other subsidiaries) has not been classified as either “proven” or “probable” as defined in the United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, do not have any “proven” or “probable” reserves under such definition and are classified as an “Exploration Stage” pursuant to Items 1300 through 1305 of Regulation S-K. Approximate coal deposits owned by Knott County is 0 tons and leased by Knott County totals 3,206,713 tons. The current leases contain minimum annual payments of $0 and production royalty payments of the great of $1.50 per clean ton or 6% of gross sales price.

Mines:

The Wayland Surface Mine is a surface waste-rock reprocessing mine in a variety of coal seams (primarily the Upper Elkhorn 1 coal seam) located near Wayland, Kentucky. The Wayland Surface Mine is mined via area mining through the reprocessing of previously processed coal, and the coal is trucked approximately 22 miles to the Mill Creek Preparation Plant at Deane Mining, where it is processed and sold. The Wayland Surface Mine is currently a “company run” mine, whereby the Company manages the workforce at the mine and pays all expenses of the mine. During June 2018, production at the Wayland Surface Mine commenced under Quest Energy’s ownership. The associated permit was purchased during May 2018. Since acquisition, the primary work completed at the Wayland Surface Mine has been removing overburden to access the coal. The Wayland Surface Mine has the estimated capacity to produce up to approximately 15,000 tons per month of coal and started production in mid-2018 with nominal coal extracted and sold as thermal coal. In 2022, the Wayland Surface Mine produced approximately 0 tons. In 2021, the Wayland Surface Mine produced approximately 0 tons. During 2022, the Wayland Surface Mine was idled due to the company’s focus on the metallurgical and industrial markets. No tons were produced during 2023.

Other potential customers of Knott County Coal include industrial customers, specialty customers and utilities for electricity generation, although no definitive sales have been identified yet.

Processing & Transportation:

The idled Supreme Energy Preparation Plant is a 400 ton-per-hour coal preparation facility with a fine coal circuit located in Kite, Kentucky. The Bates Branch rail loadout associated with the Supreme Energy Preparation Plant is a batch-weigh rail loadout with 220 rail car storage capacity and serviced by CSX Transportation in their Big Sandy rate district. The coarse refuse is trucked to the Kings Branch impoundment, which is approximately one mile from the Supreme Energy facility. The slurry from coal processing is piped from the Supreme Energy facility to the Kings Branch impoundment.

The Supreme Energy Preparation Plant is owned by Knott County Coal, subject to certain restrictions present in the agreement between Knott County Coal and the surface land owner, Land Resources & Royalties LLC.

The Company acquired the Supreme Energy Preparation Plants as an idled facility, and since acquisition, no work has been performed at the facility other than minor maintenance. Both the Supreme Energy Preparation Plant and the rail loadout are idled and would require an undetermined amount of work and capital to bring them into operation. The allocated cost of for the property at Knott County Coal paid by the Company is $286,046.

Additional Permits:

In addition to the above mines, Knott County Coal holds 20 additional coal mining permits that are in development, idled or in various stages of reclamation. Any idled mines that are brought into production would require significant upfront capital investment and there is no assurance of the feasibility of any such new operations.

| 7 |

| Table of Contents |

Below is a map showing the location of the idled Supreme Energy Prep Plant, Raven Prep Plant, Loadouts, and plant impoundments at Knott County Coal:

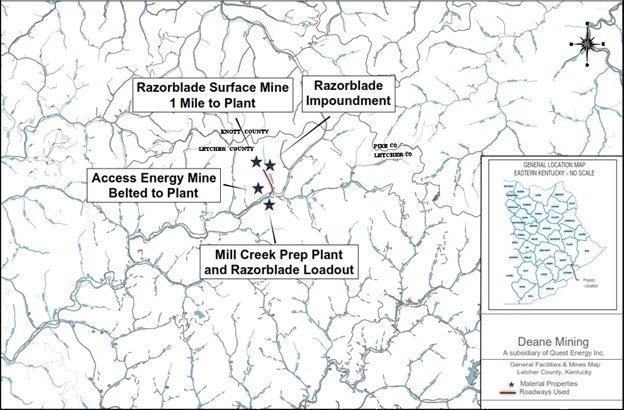

Deane Mining LLC

General:

Located within Letcher County and Knott County, Kentucky, Deane Mining LLC is comprised of one active underground coal mine (the Access Energy Mine), one active surface mine (Razorblade Surface) and one active coal preparation facility called Mill Creek Preparation Plant, along with 12 additional idled mining permits (or permits in reclamation). The idled mining permits are either in various stages of development, reclamation or being maintained as idled, pending any changes to the coal market that may warrant re-starting production. The coal controlled at Deane Mining (along with our other subsidiaries) has not been classified as either “proven” or “probable” as defined in the United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, do not have any “proven” or “probable” reserves under such definition and are classified as an “Exploration Stage” pursuant to Items 1300 through 1305 of Regulation S-K. Approximate coal deposits owned by Deane Mining is 0 tons and leased by Deane Mining totals 0 tons.

| 8 |

| Table of Contents |

Mines:

Access Energy is a deep mine in the Elkhorn 3 coal seam and located in Deane, Kentucky. Access Energy is mined via room-and-pillar mining methods using continuous miners, and the coal is belted directly from the mine to the raw coal stockpile at the Mill Creek Preparation Plant across the road from Access Energy. Access Energy is currently a “company run” mine, whereby the Company manages the workforce at the mine and pays all expenses of the mine. The Company acquired Access Energy as an idled mine, and since acquisition, the primary work completed at Access Energy by the Company includes mine rehabilitation work in preparation for production, air ventilation enhancements primarily through brattice work, and installing underground mining infrastructure as the mine advances due to coal extraction. Access Energy has the estimated capacity to produce up to approximately 20,000 tons per month of coal. In 2023, Access Energy produced approximately 0 tons. In 2022, Access Energy produced approximately 0 tons. During 2019, the permit related to the Access Energy mine was idled and is not expected to produce again under the Company’s control due to the continued focused on the metallurgical and industrial markets.

Razorblade Surface is a surface mine currently mining the Hazard 4 and Hazard 4 Rider coal seams and located in Deane, Kentucky. Razorblade Surface is mined via contour, auger, and highwall mining methods, and the coal is stockpiled on site where it trucked to the Mill Creek Preparation Plant approximately one mile away for processing. Razorblade Surface is run as both a contractor mine and as a “company run” mine for coal extraction and began extracting coal in spring of 2018. Coal produced from Razorblade Surface is trucked approximately one mile to the Mill Creek Preparation Plant. The Company acquired the Razorblade Surface mine as a new, undisturbed mine, and since acquisition, the primary work completed at Razorblade Surface has been some initial engineering work and removing overburden to access the coal. Razorblade Surface mine has the estimated capacity to produce up to approximately 8,000 tons per month of coal and started production in mid-2018 with nominal coal extracted and sold as thermal coal. During 2019, the permit related to the Access Energy mine was idled and is not expected to produce again under the Company’s control due to the continued focused on the metallurgical and industrial markets.

The coal production from Deane Mining LLC was currently sold a utility located in southeast United States under a contract that expired December 2018 and extended until June 2019, along with coal sold in the spot market. Deane Mining is in discussions with various customers to sell additional production from Access Energy, Razorblade, and Wayland Surface mines, combined with other potential regional coal production, as pulverized coal injection (PCI) to steel mills, industrial coal, and thermal coal to other utilities for electricity generation.

Processing & Transportation:

The Mill Creek Preparation Plant is an 800 ton-per-hour coal preparation facility located in Deane, Kentucky. The associated Rapid Loader rail loadout is a batch-weight rail loadout with 110 car storage capacity and services by CSX Transportation in their Big Sandy and Elkhorn rate districts. The Mill Creek Preparation Plant is owned by Deane Mining, subject to certain restrictions present in the agreement between Deane Mining and the surface land owner, Land Resources & Royalties LLC. We are currently utilizing less than 10% of the available processing capacity of the Mill Creek Preparation Plant.

Both the Mill Creek Preparation Plant and the rail loadout are operational, and any work required on any of the plant or loadouts would be routine maintenance. The allocated cost of for the property at Deane Mining paid by the Company is $1,569,641.

Additional Permits:

In addition to the above mines and preparation facility, Deane Mining holds 12 additional coal mining permits that are in development, idled or in various stages of reclamation. Any idled mines that are brought into production would require significant upfront capital investment and there is no assurance of the feasibility of any such new operations.

| 9 |

| Table of Contents |

Below is a map showing the material properties at Deane Mining:

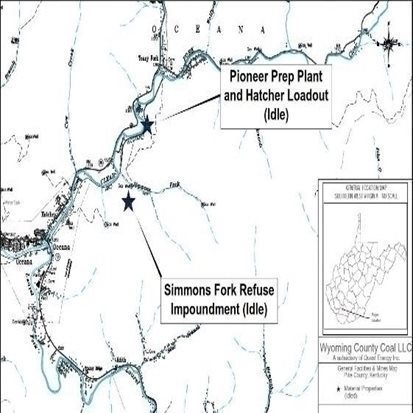

Wyoming County Coal LLC

General:

Located within Wyoming County, West Virginia, Wyoming County Coal is comprised of two idled underground mining permits and the three permits associated with the idled Pioneer Preparation Plant, the Hatcher rail loadout, and Simmons Fork Refuse Impoundment. The two idled mining permits are undisturbed underground mines that are anticipated to utilize room-and-pillar mining. The coal controlled at Wyoming County Coal (along with our other subsidiaries) has not been classified as either “proven” or “probable” as defined in the United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, do not have any “proven” or “probable” reserves under such definition and are classified as an “Exploration Stage” pursuant to Items 1300 through 1305 of Regulation S-K. Approximate coal deposits owned by Wyoming County is 5,668,115 tons and leased by Knott County totals 0 tons.

Mines:

The mining permits held by Wyoming County Coal are in various stages of planning and development with no mines currently in production.

Potential customers of Wyoming County Coal would include steel mills in the United States or international marketplace although no definitive sales have been identified yet.

| 10 |

| Table of Contents |

Processing & Transportation:

The idled Pioneer Preparation Plant is a 350 ton-per-hour coal preparation facility located near Oceana, West Virginia. The Hatcher rail loadout associated with the Pioneer Preparation Plant is a rail loadout serviced by Norfolk Southern Corporation. The refuse from the preparation facility is trucked to the Simmons Fork Refuse Impoundment, which is approximately 1.0 mile from the Pioneer Preparation facility. The preparation plant utilizes a belt press technology which eliminates the need for pumping slurry into a slurry pond for storage within an impoundment.

The Company is in the process of upgrading and redeveloping the preparation facility to a modern 350 ton per hour preparation facility. The Company is also in the planning phase of upgrading the rail load out facility to a modern batch weight load out system.

The Company acquired the Pioneer Preparation Plants as an idled facility, and since acquisition, no work has been performed at the facility. Both the Pioneer Preparation Plant and the rail loadout are idled and would require an undetermined amount of work and capital to bring them into operation, which is currently in the initial phases of planning and no cost estimates have been received. The allocated cost for the property at Wyoming County Coal will pay by the Company is $22,326,101 of which $22,091,688 has been paid using shares of the Company’s Class A Common stock. The remaining portion was satisfied in the form of a convertible note which was converted to company common stock in December 2020.

Permits:

Wyoming County Coal holds two coal mining permits that are in the initial planning phase and three permits associated with the idled Pioneer Preparation Plant, the Hatcher rail loadout, and Simmons Fork Refuse Impoundment. Any mine that is brought into production would require significant upfront capital investment and there is no assurance of the feasibility of any such new operations. As of the report date, the permits have not been fully transferred as they await final regulatory approval. As of the balance sheet date and report date, the West Virginia permit transfers have not yet been approved, and WCC has not substituted its reclamation surety bonds for the seller’s bond collateral. The transfer of any new permits to the Company is subject to regulatory approval. This approval is subject to the review of both unabated or uncorrected violations that are listed on the Applicator Violator List. The Company, to include several of its subsidiaries, does have unabated and/or uncorrected violations that are listed on the Applicator Violator List. Should the state regulators believe that the Company is not in the process of abating or correcting the currently outstanding issues associated with their currently held permits they may choose not to issue the Company any new permits until such issues are properly rectified.

Below is a map showing the location of the idled Pioneer Prep Plant, Hatcher rail Loadout, and Simmons Fork Refuse Impoundment at Wyoming County Coal:

| 11 |

| Table of Contents |

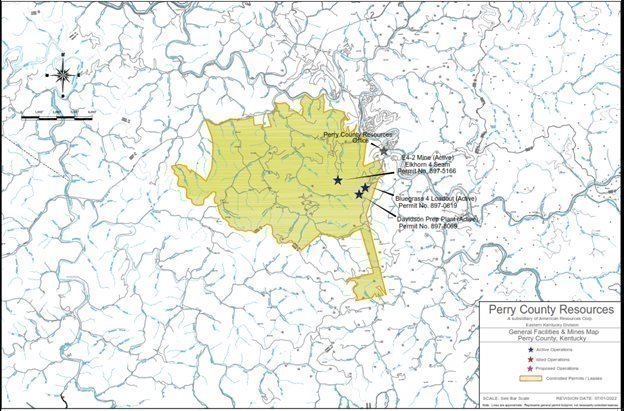

Perry County Resources LLC

General:

Located primarily within Perry County, Kentucky, Perry County Resources LLC is comprised of one active underground mine (the E4-2 mine) and one active coal processing facility called the Davidson Branch Preparation Plant, along with two additional idled underground mining permits. The E4-2 mine and Davidson Branch Preparation Plan are located at 1845 KY-15 Hazard, KY 41701.

The two idled mining permits are for underground mines and have been actively mined in the past and being maintained as idled, pending any changes to the coal market that may warrant re-starting production. The coal controlled at Perry County Resources (along with our other subsidiaries) has not been classified as either “proven” or “probable” as defined in the United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, do not have any “proven” or “probable” reserves under such definition and are classified as an “Exploration Stage” pursuant to Items 1300 through 1305 of Regulation S-K. Approximate coal deposits owned by Perry County is 0 tons and leased by Perry County totals 58,108,612 tons. The current leases contain minimum annual payments of $12,000 and production royalty payments ranging from 6% to 7% of gross sales price.

Mines:

Within the Perry County subsidiary, E4-2 mine is deemed material under Items 1304 of Regulation S-K.

The E4-2 mine is an underground mine in the Elkhorn 4 (aka the Amburgy) coal seam located near the town of Hazard, Kentucky. The E4-2 mine is mined via room-and-pillar mining methods using both continuous miners and continuous haulage systems, and the coal is belted directly from the mine to the raw coal stockpile at the Davidson Branch Preparation Plant less than a mile away. The E4-2 mine is currently a “company-run” mine, whereby the Company manages the workforce at the mine and pays all expenses of the mine. The Company acquired the E4-2 mine as an active mine, and since acquisition in September 2019, the primary work at the E4-2 mine has been rehabilitation of existing infrastructure to increase the operational efficiencies of the mine, including replacing belt structure, repairing equipment, replacing underground mining infrastructure, and installing new mining infrastructure as the mine advances due to coal extraction. The E4-2 mine has the estimated capacity to produce up to approximately 80,000 tons per month of coal. The mineral available through the E4-2 mine is partially owned by the Company and partially leased from various mineral holders. The lease terms are the greater of $1.50 per ton or 6% of gross sales price.

In 2023, the EF-2 mine produced approximately 0 tons.

In 2022, the E4-2 mine produced approximately 105,577.11 tons and sold the coal at an average price of $153.43. During the period of ownership by the Company, 100% of the coal sold was sold as industrial stoker and PCI.

Beginning in January 2020, The E4-2 mine was idled due to the adverse market effects Covid-19 global pandemic. The E4-2 Mine was restarted during March 2021. During 2022, the E4-2 Mine was idled due to regional historic flooding and the declared national emergency.

Processing and Transportation:

The Davidson Branch Preparation Plant is a 1,300 ton-per-hour coal preparation facility located near Hazard, Kentucky. The associated “Bluegrass 4” rail loadout is a batch-weight rail loadout with 135 car storage capacity and services by CSX Transportation in their Hazard/Elkhorn rate district. The Davidson Branch Preparation Plant is owned by Perry County Resources. We are currently utilizing less than 10% of the available processing capacity of the Davidson Branch Preparation Plant.

Both the Davidson Branch Preparation Plant and the rail loadout are operational, and any work required on any of the plant or loadouts would be routine maintenance. The allocated cost of for the property at Perry County Resources paid by the Company is $1,550,663.

Additional Permits:

In addition to the above mine, preparation facility, and related permits, Perry County Resources holds four additional coal mining permits that are idled or in development. Any idled mines that are brought into production would require significant upfront capital investment and there is no assurance of the feasibility of any such new operations. Three of the idled permits were sold to an unrelated entity on March 4, 2020 for $700,000 cash and $300,000 of value for equipment. As of the report date, the permits have not been fully transferred as they await final regulatory approval.

The transfer of any new permits to the Company is subject to regulatory approval. This approval is subject to the review of both unabated or uncorrected violations that are listed on the Applicator Violator List. The Company, to include several of its subsidiaries, does have unabated and/or uncorrected violations that are listed on the Applicator Violator List. Should the state regulators believe that the Company is not in the process of abating or correcting the currently outstanding issues associated with their currently held permits they may choose not to issue the Company any new permits until such issues are properly rectified.

| 12 |

| Table of Contents |

Below is a map showing the location of the Davidson Prep Plant, Bluegrass 4 rail Loadout, and E4-2 Mine at Perry County Resources:

ERC Mining Indiana Corporation (the Gold Star Mine)

General:

Located primarily within Greene and Sullivan Counties, Indiana, ERC Mining Indiana Corporation (“ERC”) is currently comprised of one idled underground mine (the Gold Star Mine), one idled coal preparation plant and rail loadout. ERC sold its coal in the past as thermal coal to utilities. The Company does not plan to mine the property and purchased it for monetization of infrastructure assets and to reclaim the property which was in process during 2021 and continued during 2022 and 2023.

The coal controlled at ERC (along with our other subsidiaries) has not been classified as either “proven” or “probable” as defined in the United States Securities and Exchange Commission Items 1300 through 1305 of Regulation S-K, and as a result, do not have any “proven” or “probable” reserves under such definition and are classified as an “Exploration Stage” pursuant to Items 1300 through 1305 of Regulation S-K. Approximate coal deposits owned by ERC is 4,383,298 tons and leased by ERC totals 0 tons. All of the deposits are in reclamation.

Mines:

The Gold Star Mine is an underground mine in the Indiana IV (aka the Survant) coal seam located near the town of Jasonville, Indiana. Currently idled, the Gold Star Mine has been mined in the past via room-and-pillar mining methods using continuous miners, and the coal is belted directly from the mine to the raw coal stockpile at the preparation plant less than a mile away. The Company is facilitating the full reclamation and remediation of the former mine site.

| 13 |

| Table of Contents |

Processing and Transportation:

The idled preparation plant is a 165 ton-per-hour coal preparation facility located near the underground mine portal. The rail loadout associated with the preparation plant is a rail loadout serviced by the Indiana Rail Road. The preparation plant has a coarse refuse and slurry impoundment. The allocated cost of for the property at Gold Star paid by the Company is $-.

Permits:

ERC holds one permit that covers the Gold Star Mine, processing plant, rail loadout, and related infrastructure which are in reclamation status.

Mineral and Surface Leases

Coal mining and processing involves the extraction of coal (mineral) and the use of surface property incidental to such extraction and processing. All of the mineral and surface related to the Company’s coal mining operations is leased from various mineral and surface owners (the “Leases”). The Company’s operating subsidiaries, collectively, are parties to approximately 200 various Leases and other agreements required for the Company’s coal mining and processing operations. The Leases are with a variety of Lessors, from individuals to professional land management firms such as the Roadrunner Land Company. In some instances, the Company has leases with Land Resources & Royalties LLC (LRR), a professional leasing firm that is an entity wholly owned by Wabash Enterprises, an entity owned by members of the Company’s management.

Coal Sales

ARC sells its coal to domestic and international customers, some which blend ARC’s coal at east coast ports with other qualities of coal for export. During the year ended December 31, 2023, coal sales came from the Company’s Carnegie 1 and 2 mines. During the year ended December 31, 2022, coal sales came from the Company’s Perry’ E4-2 mine and McCoy’s Carnegie 1 and 2 mines. The Company may, at times, purchase coal from other regional producers to sell on its contracts.

Coal sales at the Company is primarily outsource to third party intermediaries who act on the Company’s behalf to source potential coal sales and contracts. The third-party intermediaries have no ability to bind the Company to any contracts, and all coal sales are approved by management of the Company.

Met coal accounted for approximately 100% and 91% of our coal revenues for the years ended December 31, 2023 and 2022, respectively. Two customers made up approximately 74% and 26% of our coal revenues for the year ended December 31, 2023. Three customers made up approximately 62%, 28% and 19% of our coal revenues for the year ended December 31, 2022.

Due to the Covid-19 global pandemic, traditional sales channels have been disrupted. As a supplier of the raw materials into the steel and industrial industries, our customers are sensitive to global fluctuations in steel demand.

| 14 |

| Table of Contents |

Competition

The coal industry is intensely competitive. The most important factors on which the Company competes are coal quality, delivered costs to the customer and reliability of supply. Our principal domestic competitors will include Corsa Coal Corporation, Ramaco Resources, Blackhawk Mining, Coronado Coal, Arch Resources, Contura Energy, and Warrior Met Coal. Many of these coal producers may have greater financial resources and larger coal deposit bases than we do. We also compete in international markets directly with domestic companies and with companies that produce coal from one or more foreign countries, such as China, Australia, Colombia, Indonesia and South Africa.

Legal Proceedings

From time to time, we are subject to ordinary routine litigation incidental to our normal business operations.

Please see financial statement Note 9 for detail on cases.

Environmental, Governmental, and Other Regulatory Matters

Our operations are subject to federal, state, and local laws and regulations, such as those relating to matters such as permitting and licensing, employee health and safety, reclamation and restoration of mining properties, water discharges, air emissions, plant and wildlife protection, the storage, treatment and disposal of wastes, remediation of contaminants, surface subsidence from underground mining and the effects of mining on surface water and groundwater conditions. In addition, we may become subject to additional costs for benefits for current and retired coal miners. These environmental laws and regulations include, but are not limited to, SMCRA with respect to coal mining activities and ancillary activities; the CAA with respect to air emissions; the CWA with respect to water discharges and the permitting of key operational infrastructure such as impoundments; RCRA with respect to solid and hazardous waste management and disposal, as well as the regulation of underground storage tanks; the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA” or “Superfund”) with respect to releases, threatened releases and remediation of hazardous substances; the Endangered Species Act of 1973 (“ESA”) with respect to threatened and endangered species; and the National Environmental Policy Act of 1969 (“NEPA”) with respect to the evaluation of environmental impacts related to any federally issued permit or license. Many of these federal laws have state and local counterparts which also impose requirements and potential liability on our operations.

Compliance with these laws and regulations may be costly and time-consuming and may delay commencement, continuation or expansion of exploration or production at our facilities. They may also depress demand for our products by imposing more stringent requirements and limits on our customers’ operations. Moreover, these laws are constantly evolving and are becoming increasingly complex and stringent over time. These laws and regulations, particularly new legislative or administrative proposals, or judicial interpretations of existing laws and regulations related to the protection of the environment could result in substantially increased capital, operating and compliance costs. Individually and collectively, these developments could have a material adverse effect on our operations directly and/or indirectly, through our customers’ inability to use our products.

Certain implementing regulations for these environmental laws are undergoing revision or have not yet been promulgated. As a result, we cannot always determine the ultimate impact of complying with existing laws and regulations.

Due in part to these extensive and comprehensive regulatory requirements and ever- changing interpretations of these requirements, violations of these laws can occur from time to time in our industry and also in our operations. Expenditures relating to environmental compliance are a major cost consideration for our operations and safety and compliance is a significant factor in mine design, both to meet regulatory requirements and to minimize long-term environmental liabilities. To the extent that these expenditures, as with all costs, are not ultimately reflected in the prices of our products and services, operating results will be reduced.

In addition, our customers are subject to extensive regulation regarding the environmental impacts associated with the combustion or other use of coal, which may affect demand for our coal. Changes in applicable laws or the adoption of new laws relating to energy production, GHG emissions and other emissions from use of coal products may cause coal to become a less attractive source of energy, which may adversely affect our mining operations, the cost structure and, the demand for coal. For example, if the emissions rates or caps adopted under the CPP on GHGs are upheld or a tax on carbon is imposed, the market share of coal as fuel used to generate electricity would be expected to decrease.

| 15 |

| Table of Contents |

We believe that our competitors with operations in the United States are confronted by substantially similar conditions. However, foreign producers and operators may not be subject to similar requirements and may not be required to undertake equivalent costs in or be subject to similar limitations on their operations. As a result, the costs and operating restrictions necessary for compliance with United States environmental laws and regulations may have an adverse effect on our competitive position with regard to those foreign competitors. The specific impact on each competitor may vary depending on a number of factors, including the age and location of its operating facilities, applicable legislation and its production methods.

Surface Mining Control and Reclamation Act

SMCRA establishes operational, reclamation and closure standards for our mining operations and requires that comprehensive environmental protection and reclamation standards be met during the course of and following completion of mining activities. SMCRA also stipulates compliance with many other major environmental statutes, including the CAA, the CWA, the ESA, RCRA and CERCLA. Permits for all mining operations must be obtained from the United States Office of Surface Mining (“OSM”) or, where state regulatory agencies have adopted federally approved state programs under SMCRA, the appropriate state regulatory authority. Our operations are located in states which have achieved primary jurisdiction for enforcement of SMCRA through approved state programs.

SMCRA imposes a complex set of requirements covering all facets of coal mining. SMCRA regulations govern, among other things, coal prospecting, mine plan development, topsoil or growth medium removal and replacement, disposal of excess spoil and coal refuse, protection of the hydrologic balance, and suitable post mining land uses.

From time to time, OSM will also update its mining regulations under SMCRA. For example, in December 2016, OSM finalized a new version of the Stream Protection Rule which became effective in January 2017. The rule would have impacted both surface and underground mining operations, as it would have imposed stricter guidelines on conducting coal mining operations, and would have required more extensive baseline data on hydrology, geology and aquatic biology in permit applications. The rule also required the collection of increased pre-mining data about the site of the proposed mining operation and adjacent areas to establish a baseline for evaluation of the impacts of mining and the effectiveness of reclamation associated with returning streams to pre-mining conditions. However, in February 2017, both the House and Senate passed a resolution disapproving of the Stream Protection Rule pursuant to the Congressional Review Act (“CRA”). President Trump signed the resolution on February 16, 2017 and, pursuant to the CRA, the Stream Protection Rule “shall have no force or effect” and cannot be replaced by a similar rule absent future legislation. On November 17, 2017, OSMRE published a Federal Register notice that removed the text of the Stream Protection Rule from the Code of Federal Regulations. Whether Congress will enact future legislation to require a new Stream Protection Rule remains uncertain. The existing rules, or other new SMCRA regulations, could result in additional material costs, obligations and restrictions upon our operations.

Abandoned Mine Lands Fund

SMCRA also imposes a reclamation fee on all current mining operations, the proceeds of which are deposited in the AML Fund, which is used to restore unreclaimed and abandoned mine lands mined before 1977. The current per ton fee is $0.224 per ton for surface mined coal and $0.096 per ton for underground mined coal. In 2023, we recorded $X.X million of expense related to these reclassification fees.

Mining Permits and Approvals

Numerous governmental permits and approvals are required for mining operations. We are required to prepare and present to federal, state, and local authorities data detailing the effect or impact that any proposed exploration project for production of coal may have upon the environment, the public and our employees. The permitting rules, and the interpretations of these rules, are complex, change frequently, and may be subject to discretionary interpretations by regulators. The requirements imposed by these permits and associated regulations can be costly and time-consuming and may delay commencement or continuation of exploration, production or expansion at our operations. The governing laws, rules, and regulations authorize substantial fines and penalties, including revocation or suspension of mining permits under some circumstances. Monetary sanctions and, in certain circumstances, even criminal sanctions may be imposed for failure to comply with these laws.

Applications for permits and permit renewals at our mining operations are also subject to public comment and potential legal challenges from third parties seeking to prevent a permit from being issued, or to overturn the applicable agency’s grant of the permit. Should our permitting efforts become subject to such challenges, they could delay commencement, continuation or expansion of our mining operations. If such comments lead to a formal challenge to the issuance of these permits, the permits may not be issued in a timely fashion, may involve requirements which restrict our ability to conduct our mining operations or to do so profitably, or may not be issued at all. Any delays, denials, or revocation of these or other similar permits we need to operate could reduce our production and materially adversely impact our cash flow and results of our operations.

| 16 |

| Table of Contents |

In order to obtain mining permits and approvals from state regulatory authorities, mine operators must also submit a reclamation plan for restoring the mined property to its prior condition, productive use or other permitted condition. The conditions of certain permits also require that we obtain surface owner consent if the surface estate has been split from the mineral estate. This requires us to negotiate with third parties for surface access that overlies coal we acquired or intend to acquire. These negotiations can be costly and time-consuming, lasting years in some instances, which can create additional delays in the permitting process. If we cannot successfully negotiate for land access, we could be denied a permit to mine coal we already own.

Finally, we typically submit necessary mining permit applications several months, or even years, before we anticipate mining a new area. However, we cannot control the pace at which the government issues permits needed for new or ongoing operations. For example, the process of obtaining CWA permits can be particularly time-consuming and subject to delays and denials. The EPA also has the authority to veto permits issued by the Corps under the CWA’s Section 404 program that prohibits the discharge of dredged or fill material into regulated waters without a permit. Even after we obtain the permits that we need to operate, many of the permits must be periodically renewed, or may require modification. There is some risk that not all existing permits will be approved for renewal, or that existing permits will be approved for renewal only upon terms that restrict or limit our operations in ways that may be material.

Financial Assurance

Federal and state laws require a mine operator to secure the performance of its reclamation and lease obligations under SMCRA through the use of surety bonds or other approved forms of financial security for payment of certain long-term obligations, including mine closure or reclamation costs. The changes in the market for coal used to generate electricity in recent years have led to bankruptcies involving prominent coal producers. Several of these companies relied on self-bonding to guarantee their responsibilities under the SMCRA permits including for reclamation. In response to these bankruptcies, OSMRE issued a Policy Advisory in August 2016 to state agencies that are authorized under the SMCRA to implement the act in their states. Certain states, including Virginia, had previously announced that it would no longer accept self-bonding to secure reclamation obligations under the state mining laws. This Policy Advisory is intended to discourage authorized states from approving self-bonding arrangements and may lead to increased demand for other forms of financial assurance, which may strain capacity for those instruments and increase our costs of obtaining and maintaining the amounts of financial assurance needed for our operations. In addition, OSMRE announced in August 2016 that it would initiate a rulemaking under SMCRA to revise the requirements for self-bonding. Individually and collectively, these revised various financial assurance requirements may increase the amount of financial assurance needed and limit the types of acceptable instruments, straining the capacity of the surety markets to meet demand. This may delay the timing for and increase the costs of obtaining the required financial assurance.

We may use surety bonds, trusts and letters of credit to provide financial assurance for certain transactions and business activities. Federal and state laws require us to obtain surety bonds to secure payment of certain long-term obligations including mine closure or reclamation costs and other miscellaneous obligations. The bonds are renewable on a yearly basis. Surety bond rates have increased in recent years and the market terms of such bonds have generally become less favorable. Sureties typically require coal producers to post collateral, often having a value equal to 40% or more of the face amount of the bond. As a result, we may be required to provide collateral, letters of credit or other assurances of payment in order to obtain the necessary types and amounts of financial assurance. Under our surety bonding program, we are not currently required to post any letters of credit or other collateral to secure the surety bonds; obtaining letters of credit in lieu of surety bonds could result in a significant cost increase. Moreover, the need to obtain letters of credit may also reduce amounts that we can borrow under any senior secured credit facility for other purposes. If, in the future, we are unable to secure surety bonds for these obligations, and are forced to secure letters of credit indefinitely or obtain some other form of financial assurance at too high of a cost, our profitability may be negatively affected.

Although our current bonding capacity approved by our sureties, Lexon Insurance Company and Continental Heritage, is substantial and enough to cover our current and anticipated future bonding needs, this amount may increase or decrease over time. As of December 31, 2023, and 2022, we had outstanding surety bonds at all of our mining operations totaling approximately $23.49 million and $30.94 million, respectively. While we anticipate reducing the outstanding surety bonds through continued reclamation of any of our permits, that number may increase should we acquire additional mining permits, acquire additional mining operations, expand our mining operations that result in additional reclamation bonds, or if any of our sites encounters additional environmental liability that may require additional reclamation bonding. While we intend to maintain a credit profile that eliminates the need to post collateral for our surety bonds, our surety has the right to demand additional collateral at its discretion.

| 17 |

| Table of Contents |

Mine Safety and Health

The Mine Act and the MINER Act, and regulations issued under these federal statutes, impose stringent health and safety standards on mining operations. The regulations that have been adopted under the Mine Act and the MINER Act are comprehensive and affect numerous aspects of mining operations, including training of mine personnel, mining procedures, roof control, ventilation, blasting, use and maintenance of mining equipment, dust and noise control, communications, emergency response procedures, and other matters. MSHA regularly inspects mines to ensure compliance with regulations promulgated under the Mine Act and MINER Act.

From time to time MSHA will also publish new regulations imposing additional requirements and costs on our operations. For example, MSHA implemented a rule in August 2014 to lower miners’ exposure to respirable coal mine dust. The rule requires shift dust to be monitored and reduces the respirable dust standard for designated occupants and miners. MSHA also finalized a new rule in January 2015 on proximity detection systems for continuous mining machines, which requires underground coal mine operators to equip continuous mining machines, except full-face continuous mining machines, with proximity detection systems.

Kentucky, West Virginia, and Virginia all have similar programs for mine safety and health regulation and enforcement. The various requirements mandated by federal and state statutes, rules, and regulations place restrictions on our methods of operation and result in fees and civil penalties for violations of such requirements or criminal liability for the knowing violation of such standards, significantly impacting operating costs and productivity. The regulations enacted under the Mine Act and MINER Act as well as under similar state acts are routinely expanded or made more stringent, raising compliance costs and increasing potential liability. Our compliance with current or future mine health and safety regulations could increase our mining costs. At this time, it is not possible to predict the full effect that new or proposed statutes, regulations and policies will have on our operating costs, but any expansion of existing regulations, or making such regulations more stringent may have a negative impact on the profitability of our operations. If we were to be found in violation of mine safety and health regulations, we could face penalties or restrictions that may materially and adversely impact our operations, financial results and liquidity.

In addition, government inspectors have the authority to issue orders to shut down our operations based on safety considerations under certain circumstances, such as imminent dangers, accidents, failures to abate violations, and unwarrantable failures to comply with mandatory safety standards. If an incident were to occur at one of our operations, it could be shut down for an extended period of time, and our reputation with prospective customers could be materially damaged. Moreover, if one of our operations is issued a notice of pattern of violations, then MSHA can issue an order withdrawing the miners from the area affected by any enforcement action during each subsequent significant and substantial (“S&S”) citation until the S&S citation or order is abated. In 2013 MSHA modified the pattern of violations regulation, allowing, among other things, the use of non-final citations and orders in determining whether a pattern of violations exists at a mine.

Workers’ Compensation and Black Lung

We are insured for workers’ compensation benefits for work related injuries that occur within our United States operations. We retain exposure for the first $10,000 per accident for all of our subsidiaries and are insured above the deductible for statutory limits. Workers’ compensation liabilities, including those related to claims incurred but not reported, are recorded principally using annual valuations based on discounted future expected payments using historical data of the operating subsidiary or combined insurance industry data when historical data is limited. State workers’ compensation acts typically provide for an exception to an employer’s immunity from civil lawsuits for workplace injuries in the case of intentional torts. However, Kentucky’s workers’ compensation act provides a much broader exception to workers’ compensation immunity. The exception allows an injured employee to recover against his or her employer where he or she can show damages caused by an unsafe working condition of which the employer was aware that was a violation of a statute, regulation, rule or consensus industry standard. These types of lawsuits are not uncommon and could have a significant impact on our operating costs.

The Patient Protection and Affordable Care Act includes significant changes to the federal black lung program including an automatic survivor benefit paid upon the death of a miner with an awarded black lung claim and the establishment of a rebuttable presumption with regard to pneumoconiosis among miners with 15 or more years of coal mine employment that are totally disabled by a respiratory condition. These changes could have a material impact on our costs expended in association with the federal black lung program. In addition to possibly incurring liability under federal statutes, we may also be liable under state laws for black lung claims.

| 18 |

| Table of Contents |

Clean Air Act

The CAA and comparable state laws that regulate air emissions affect coal mining operations both directly and indirectly. Direct impacts on coal mining and processing operations include CAA permitting requirements and emission control requirements relating to air pollutants, including particulate matter such as fugitive dust. The CAA indirectly affects coal mining operations by extensively regulating the emissions of particulate matter, sulfur dioxide, nitrogen oxides, mercury and other compounds emitted by coal-fired power plants. In addition to the GHG issues discussed below, the air emissions programs that may materially and adversely affect our operations, financial results, liquidity, and demand for our coal, directly or indirectly, include, but are not limited to, the following:

| · | Clean Air Interstate Rule and Cross-State Air Pollution Rule. the Clean Air Interstate Rule (“CAIR”) calls for power plants in 28 states and the District of Columbia to reduce emission levels of sulfur dioxide and nitrogen oxide pursuant to a cap-and-trade program similar to the system now in effect for acid rain. In June 2011, the EPA finalized the Cross-State Air Pollution Rule (“CSAPR”), a replacement rule to CAIR, which requires 28 states in the Midwest and eastern seaboard of the U.S. to reduce power plant emissions that cross state lines and contribute to ozone and/or fine particle pollution in other states. Following litigation over the rule, the EPA issued an interim final rule reconciling the CSAPR rule with a court order, which calls for Phase 1 implementation of CSAPR in 2015 and Phase 2 implementation in 2017. In September 2016, the EPA finalized an update to CSAPR for the 2008 ozone NAAQS by issuing the final CSAPR Update. Beginning in May 2017, this rule will reduce summertime (May—September) nitrogen oxide emissions from power plants in 22 states in the eastern United States. For states to meet their requirements under CSAPR, a number of coal-fired electric generating units will likely need to be retired, rather than retrofitted with the necessary emission control technologies, reducing demand for thermal coal. However, the practical impact of CSAPR may be limited because utilities in the U.S. have continued to take steps to comply with CAIR, which requires similar power plant emissions reductions, and because utilities are preparing to comply with the Mercury and Air Toxics Standards (“MATS”) regulations, which require overlapping power plant emissions reductions. |

| · | Acid Rain. Title IV of the CAA requires reductions of sulfur dioxide emissions by electric utilities and applies to all coal-fired power plants generating greater than 25 Megawatts of power. Affected power plants have sought to reduce sulfur dioxide emissions by switching to lower sulfur fuels, installing pollution control devices, reducing electricity generating levels or purchasing or trading sulfur dioxide emission allowances. These reductions could impact our customers in the electric generation industry. These requirements are not supplanted by CSAPR. |

| · | NAAQS for Criterion Pollutants. The CAA requires the EPA to set standards, referred to as NAAQS, for six common air pollutants: carbon monoxide, nitrogen dioxide, lead, ozone, particulate matter and sulfur dioxide. Areas that are not in compliance (referred to as non-attainment areas) with these standards must take steps to reduce emissions levels. The EPA has adopted more stringent NAAQS for nitrogen oxide, sulfur dioxide, particulate matter and ozone. As a result, some states will be required to amend their existing individual state implementation plans (“SIPs”) to achieve compliance with the new air quality standards. Other states will be required to develop new plans for areas that were previously in “attainment,” but do not meet the revised standards. For example, in October 2015, the EPA finalized the NAAQS for ozone pollution and reduced the limit to parts per billion (ppb) from the previous 75 ppb standard. Under the revised ozone NAAQS, significant additional emissions control expenditures may be required at coal-fired power plants. The final rules and new standards may impose additional emissions control requirements on our customers in the electric generation, steelmaking, and coke industries. Because coal mining operations emit particulate matter and sulfur dioxide, our mining operations could be affected when the new standards are implemented by the states. |

| · | Nitrogen Oxide SIP Call. The nitrogen oxide SIP Call program was established by the EPA in October 1998 to reduce the transport of nitrogen oxide and ozone on prevailing winds from the Midwest and South to states in the Northeast, which alleged that they could not meet federal air quality standards because of migrating pollution. The program is designed to reduce nitrogen oxide emissions by one million tons per year in 22 eastern states and the District of Columbia. As a result of the program, many power plants have been or will be required to install additional emission control measures, such as selective catalytic reduction devices. Installation of additional emission control measures will make it costlier to operate coal-fired power plants, potentially making coal a less attractive fuel. |

| · | Mercury and Hazardous Air Pollutants. In February 2012, the EPA formally adopted the MATS rule to regulate emissions of mercury and other metals, fine particulates, and acid gases such as hydrogen chloride from coal- and oil-fired power plants. Following a legal challenge to MATS, the EPA issued a new determination in April 2016 that it is appropriate and necessary to regulate these pollutants from power plants. Like CSAPR, MATS and other similar future regulations could accelerate the retirement of a significant number of coal-fired power plants. Such retirements would likely adversely impact our business. |

| 19 |

| Table of Contents |

Global Climate Change

Climate change continues to attract considerable public and scientific attention. There is widespread concern about the contributions of human activity to such changes, especially through the emission of GHGs. There are three primary sources of GHGs associated with the coal industry. First, the end use of our coal by our customers in electricity generation, coke plants, and steelmaking is a source of GHGs. Second, combustion of fuel by equipment used in coal production and to transport our coal to our customers is a source of GHGs. Third, coal mining itself can release methane, which is considered to be a more potent GHG than CO2, directly into the atmosphere. These emissions from coal consumption, transportation and production are subject to pending and proposed regulation as part of initiatives to address global climate change.

As a result, numerous proposals have been made and are likely to continue to be made at the international, national, regional and state levels of government to monitor and limit emissions of GHGs. Collectively, these initiatives could result in higher electric costs to our customers or lower the demand for coal used in electric generation, which could in turn adversely impact our business.

At present, we are principally focused on metallurgical coal production, which is not used in connection with the production of power generation. However, we may seek to sell greater amounts of our coal into the power-generation market in the future. The market for our coal may be adversely impacted if comprehensive legislation or regulations focusing on GHG emission reductions are adopted, or if our customers are unable to obtain financing for their operations. At the international level, the United Nations Framework Convention on Climate Change released an international climate agreement in December 2015. The agreement has been ratified by more than 70 countries, and entered into force in November 2016. Although this agreement does not create any binding obligations for nations to limit their GHG emissions, it does include pledges to voluntarily limit or reduce future emissions. In addition, in November 2014, President Obama announced that the United States would seek to cut net GHG emissions 26-28 percent below 2005 levels by 2025 in return for China’s commitment to seek to peak emissions around 2030, with concurrent increases in renewable energy.

At the federal level, no comprehensive climate change legislation has been implemented to date. The EPA has, however, has determined that emissions of GHGs present an endangerment to public health and the environment, because emissions of GHGs are, according to the EPA, contributing to the warming of the earth’s atmosphere and other climatic changes. Based on these findings, the EPA has begun adopting and implementing regulations to restrict emissions of GHGs under existing provisions of the CAA. For example, in August 2015, EPA finalized the CPP to cut carbon emissions from existing power plants. The CPP creates individualized emission guidelines for states to follow and requires each state to develop an implementation plan to meet the individual state’s specific targets for reducing GHG emissions. The EPA also proposed a federal compliance plan to implement the CPP in the event that a state does not submit an approvable plan to the EPA. In February 2016, the U.S. Supreme Court granted a stay of the implementation of the CPP. This stay suspends the rule and will remain in effect until the completion of the appeals process. The Supreme Court’s stay only applies to EPA’s regulations for CO2 emissions from existing power plants and will not affect EPA’s standards for new power plants. If the CPP is ultimately upheld and depending on how it is implemented by the states, it could have an adverse impact on the demand for coal for electric generation.

At the state level, several states have already adopted measures requiring GHG emissions to be reduced within state boundaries, including cap-and-trade programs and the imposition of renewable energy portfolio standards. Various states and regions have also adopted GHG initiatives and certain governmental bodies, have imposed, or are considering the imposition of, fees or taxes based on the emission of GHGs by certain facilities. A number of states have also enacted legislative mandates requiring electricity suppliers to use renewable energy sources to generate a certain percentage of power.

The uncertainty over the outcome of litigation challenging the CPP and the extent of future regulation of GHG emissions may inhibit utilities from investing in the building of new coal-fired plants to replace older plants or investing in the upgrading of existing coal-fired plants. Any reduction in the amount of coal consumed by electric power generators as a result of actual or potential regulation of GHG emissions could decrease demand for our coal, thereby reducing our revenues and materially and adversely affecting our business and results of operations. We or prospective customers may also have to invest in CO2 capture and storage technologies in order to burn coal and comply with future GHG emission standards.