UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

Amendment 1

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 12, 2016

Asia Equity Exchange Group, Inc.

(Exact Name of Registrant as Specified in Charter)

| Nevada | 333-192272 | 46-3366428 | ||

| (State or Other Jurisdiction | (Commission | (IRS Employer | ||

| of Incorporation) | File Number) | Identification No.) |

Room 2101, 21/F, Sino Plaza, 255-257 Gloucester Road, Causeway Bay, Hong Kong

(Address of Principal Executive Offices) (Zip Code)

+852 2180 7433

Registrant’s telephone number, including area code

| (Former Name or Former Address | ||

| if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENT

EXPLANATORY NOTE

Item 2.01: Completion of Acquisition or Disposition of Assets

Item 5.01 Changes in Control of Registrant

Item 5.06 Change in Shell Company Status

Item 9.01 Financial Statements and Exhibits

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with our platform development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of the securities industry, lack of product diversification, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents, which we may file from time to time with the SEC.

| 3 |

EXPLANATORY NOTE

Asia Equities Exchange Group, Inc. (“AEEX” or the “Company”) was incorporated in the State of Nevada on July 15, 2013, under the name “I In The Sky, Inc.” (“SYYF”). The Company’s previous plan was to manufacture and market low cost GPS tracking devices and software to businesses and families. AEEX no longer pursues opportunities related to GPS positioning. We filed a name change to AEEX with the state of Nevada on July 22, 2015.

Effective November 30, 2015, AEEX executed a Sale and Purchase Agreement (the “Agreement”) to acquire 100% of the shares and assets of Asia Equity Exchange Group Company Ltd. (“AEEGCL”), a company incorporated under the laws of Samoa on May 29, 2015. AEEGCL is an equity information service platform designed to provide equity investment financing information to all enterprises in the countries and regions of Asia.

Pursuant to the Agreement, AEEX agreed to issue one billion (1,000,000,000) restricted common shares of the Company to the owners of AEEGCL.

For financial reporting purposes, the Agreement represents a “reverse merger”, and AEEGCL is deemed to be the accounting acquirer in the transaction. The Agreement is being accounted for as a reverse-merger and recapitalization. AEEGCL is the acquirer for financial reporting purposes, and AEEX is the acquired company. Consequently, the assets and liabilities and the operations that will be reflected in the historical financial statements prior to the Agreement will be those of AEEGCL, and will be recorded at the historical cost basis of AEEGCL. The consolidated financial statements after completion of the Agreement will include the assets and liabilities of the Company and AEEGCL, and the historical operations of AEEGCL and operations of the combined company from the closing date of the Agreement.

| 4 |

Item 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

The Sale and Purchase Agreement and Related Transactions:

Liu Jun is the president, secretary and a director of Asia Equity Exchange Group, Inc.(AEEX). He is also a director of Yinfu International Enterprise Limited, which is the wholly owned subsidiary of Asia Equity Exchange Group Company Ltd. (AEEGCL). He is familiar with the equity investment and financial information service platform, which is operated by AEEGCL. Mr. Liu was also a former business associate of the three primary affiliates of AEEGCL. Ma Ning, Wang Zhong and Qi Jian. Based on his relationship with these individuals and his knowledge of the AEEGCL business platform, he decided to proceed with the acquisition. Following his appointment as president of AEEX, he negotiated with and completed the acquisition of AEEGCL. No third parties, brokers or agents played any role in arranging or facilitating the transactions and no benefits of any description were given to any third parties.

On July 6, 2015, in anticipation of the reverse merger between the Company and AEEGCL, Liu Jun resigned as a director of AEEGCL and was appointed as the president, secretary and a director of AEEX and Mr. Peng Tao was appoint as a director of AEEX. Additionally, as part of the proposed reverse merge, on July 22, 2015, the Company filed an Amendment to its articles of Incorporation with the Nevada Secretary of State changing its name from I In The Sky to Asia Equity Exchange Group. Being familiar with the platform and recognizing its value and prospect, he proposed acquisition in order to improve the operation of the Company and bring more benefits for the Company’s shareholders, and it is finally accepted by up to 93.8% shareholders of the Company in the shareholder resolution. On April 12, 2016, the Company completed the acquisition of AEEGCL. With reference to the Company’s prior business, the manufacture and marketing of low cost GPS tracking devices and software to businesses and families, the Company found that sufficient capital was not available.

Execution of the Agreement was the first stage of the planned acquisition. Pursuant to the Agreement, closing was to occur on January 31, 2016. Closing was contingent upon an audit of the shares and assets of AEEGCL. All shares issued pursuant to the Agreement were held in escrow and deemed to be in the full control of the Company until the closing. By agreement of the parties, the closing was initially delayed until March 31, 2016, and has been further delayed until April 12, 2016

As of April 12, 2016 the parties have now satisfied all of the closing conditions and we completed the terms of the Agreement. With the filing of this report, the closing is now considered completed, and all shares issued pursuant to the Agreement have been delivered to AEEGCL. This constituted a change of control and reverse merger.

As a result of the closing, the Company has terminated its previous business plan, and we are now pursuing the historical business of AEEGCL. AEEGLC is an international equity service platform designed to provide equity investment financing information services to enterprises in the countries and regions of Asia

| 5 |

Identity of the Persons Acquiring Control

As of April 12, 2016, the date of the closing, all assets of AEEGCL and shares and documents required pursuant to the Agreement were delivered to the Company and the 1,000,000,000 shares were delivered out of escrow to the following entities in the amounts and percentages set opposite their names.

| Blue Tech Holding Limited | 700,000,000 Common Shares | 61.08 | % | |||||

| Ma Ning (Beneficial Owner) | ||||||||

| Room 1504, No.11, | ||||||||

| Sheng Shi Hua Cheng, | ||||||||

| Yinzhou District, Ningbo | ||||||||

| Zhejiang, China | ||||||||

| Honest Billion Investment Limited | 200,000,000 Common Shares | 17.45 | % | |||||

| Wang Zhong, (Beneficial Owner) | ||||||||

| No. 1701, Building E, | ||||||||

| Fu Tong Hao Wang Jiao | ||||||||

| Central, BaoAn District, Shenzhen, | ||||||||

| Guangdong, China | ||||||||

| Qi Jian | 100,000,000 Common Shares | 8.7 | % | |||||

| Unit B, 5/F, CKK Commercial Centre | ||||||||

| 289 Hennessy Road | ||||||||

| Wanchai Hong Kong |

This constituted a change of control of the Company.

Form 10 Information

Prior to the closing of the Agreement, the Company had nominal operations. We were deemed a “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”), and are filing in light of the lack of operations prior to the completion of the Agreement. With the resulting change in our business, we are voluntarily providing the information as is required pursuant to Item 2.01(f) of Form 8-K as if we were filing a general form for registration of securities on Form 10 under the Exchange Act for our common stock, which is the only class of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Agreement.

| 6 |

Asia Equities Exchange Group, Inc. was incorporated in the State of Nevada on July 15, 2013, under the name “I In The Sky, Inc.” to manufacture and market low cost GPS tracking devices and software to businesses and families. We no longer pursue opportunities related to GPS positioning. Our name change to Asia Equity Exchange Group, Inc. was filed with the state of Nevada on July 22, 2015.

We have a fiscal year end of December 31. The business office is located at Unit B, 5/F., CKK Commercial Centre, 289 Hennessy Road, Wanchai, Hong Kong and the telephone number is 852-2845 2281.

Prior to the date of this filing, the Company was a “shell company” within the meaning of Rule 405, promulgated pursuant to the Securities Act, because we had nominal assets and operations. Accordingly, the ability of holders of our common stock to re-sell their shares may be limited by applicable regulations. Specifically, Rule 144 would not be available for the resale of restricted securities by our stockholders until we have complied with the requirements of Rule 144(i).

Following the April 12, 2016 closing under the Agreement to acquire 100% of the shares and assets of Asia Equity Exchange Group Company Ltd., dated November 30, 2015, the Company will no longer be designated as a shell company.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2013 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Current Business

Effective November 30, 2015, AEEX executed an Agreement to acquire 100% of the shares and assets of AEEGCL, a company incorporated under the laws of Samoa. AEEGCL is an international equity assistance and information service platform designed to provide listing assistance services, equity investment financing information and public relationship services to enterprises in the countries and regions of Asia.

| 7 |

Pursuant to the Agreement, the Company agreed to issue one billion (1,000,000,000) restricted common shares of the Company to the owners of AEEGCL

Currently four client companies are listed with us, and an additional forty companies are in the process of preparing the necessary documents for listing with us. All companies currently listed with us are located in China, as are the additional companies in the listing process.

In order to be taken on as a client, we conduct a strict due diligence of the potential client’s business, its history and management. Clients must disclose audited financial statements and legal opinions in accordance with international standards issued by a professional third party institution. They are also required to conform to strict standards for discloser of information after listing, which helps to facilitate their connections to international capital markets.

Client Qualifications: To be a qualified applicant for listing with AEEX, a potential client must:

1. Be established and validly existing pursuant to relevant laws and regulations in a country or region in Asia;

2. Demonstrate that they have a good business reputation and operating performance, and comply with professional ethics;

3. Have an experienced quality and stable management team and operation;

4. Have a sustainable operating project with the expectation of a good return on investment;

5. Have not breached any law or regulation in a material respect, or have received any administrative penalty from a regulatory body or other department in the past twenty four months;

6. Acknowledge and comply with relevant rules of the AEEX, and pay fees relating to our client enterprise listing services;

7. Pass a professional qualification review conducted by AEEX, and pay fees relating to such review.

It is important to note that AEEX is not now nor does it intend to be a trading market or provide quotations services for its clients. It is a platform designed solely for equity investment information and financing information services. It facilitates connections and negotiations between investors and project management. AEEX assists investors seeking investment opportunities and companies seeking international investment.

Since August 2015, we have carried out a number of roadshows in various cities such as Shenyang, Dalian, Faku, Shanghai, Hangzhou, Fuzhou and Shenzhen, which have extended our influence and enhanced our brand recognition. We plan to continue our all-round roadshows at regional, national and international levels to further increase awareness of our brand and advance our business development.

| 8 |

Many small and medium sized enterprises throughout Asia seek to take advantages of the potential offered by becoming a publicly traded company. Greater public awareness, and the corresponding increased ability to have access to financing through international investment channels can make the transition from private to public company status a means by which a company can create real growth.

However, many enterprises may not be familiar with public company listing requirements and financing methods overseas. Management of these small to medium-sized companies find the rules and regulations difficult to comprehend, may consider the intricacies and potential costs too difficult to overcome, and are unable to realize the full potential of their enterprise.

In addition, the jurisdictions into which these companies might want to move may speak different languages and will have different securities laws and legal requirements.

To assist these enterprises, we have developed a program to seek out and engage local personnel with legal, regulatory and language expertise in those jurisdictions. We work to identify qualified personnel through a careful vetting and due diligence process.

Our multi-task service platform serves as a means not only for assisting these companies to secure public company listing and enhanced means of achieving financing overseas, but also assist overseas individual and institutional investors seeking quality equity investment. AEEX also provides registration, supervision and management services.

To accomplish these goals on behalf of our clients, we have established a number of corporate tools. These include:

Listing Planning and Evaluation:

1. We conduct comprehensive evaluation of a client’s prospects, including its assets and liabilities, financial position, management, development prospect and business model;

2. We offer assistance in reorganizing and standardizing the company’s business, work to optimize its business model and procedures, and help the client integrate its resources to highlight the value of the company;

| 9 |

3. We help to reorganize the corporate structure and assist the company to build a management team for going public based on the actual conditions of the company;

4. We assess and recommend qualified lawyers, auditors, investment banks and other institutions which can provide the client with pre-listing services.

We also ensure that we are in regular and efficient communication with all our clients who are planning to become a public company, or have already become public, and make certain that they have received the consulting services they need.

Where necessary, we will meet with clients on critical issues in public listing, or help them become familiar with important regulations in the securities markets and assist them in meeting the standards for going public. We also make sure that clients are updated with regulatory and legal changes.

Listing Solutions: We provide clients planning for a public listing with consulting services, which include models for reference and examples of successful cases. We also use our resources and experience to help clients to connect directly with the corresponding securities regulatory commission.

Assistance with Negotiation and Implementation: With our advantages in resources and information, we assist clients with key negotiations with different parties and help them to deal with various issues and problems before and after their public listing.

Funding Initiation: We use our resources to help clients who plan to go public, but face funding shortages to connect with venture capital, banks or other financial institutions that can provide potential assistance in their financing needs.

Client Equity Securitization Reform: We help to confirm the equity position of companies planning for going public, and provide assistance for them in working with qualified accounting and law firms to determine the share capital structure, stock par value and holding percentages of shareholders, and, where necessary, help clients to build a new equity structure in accordance with requirements of the relevant securities regulatory commission with whom the client is dealing.

Restructuring Consultancy: We work with qualified lawyers and auditing firms to help reorganize the client’s business model, procedures and organizational structure in order to maximize the client’s value and ensure that its public listing needs and requirements are met.

| 10 |

Route Design: We plan and design the proper procedures and methods for going public on behalf of our clients based on their assets, financial position, operations and other conditions.

Team Establishment: In accordance with the conditions of the clients and requirements by the relevant securities regulatory commission, we assist the clients to establish an organizational structure and a management team best suited for going public.

“Headhunting” Services: We work with headhunting companies, i.e. companies that provide employment or recruiting services to find the most qualified managers and professionals to meet the specific needs of our clients.

Follow-up Service: We provide clients with continuous consultancy and following-up services throughout the entire public listing process, from planning and preparation to success in becoming a public company.

Merger and Acquisition Planning: A major feature of our service is overall merger and acquisition planning and assistance with listing on international main boards of various countries, assistance with the preparation and execution of overseas initial public offering efforts and main board listing through public shell companies by means of reverse merger.

One useful tool in the transition from private to public company is the reverse merger or reverse takeover.

In a reverse merger, the shareholders of a private company acquire a majority of the shares of a “shell company”. The shell company is a public company that does not have an active business operation or significant assets. The shell company is then merged with the private company. This makes the public company registration process less time consuming and potentially less expensive. To finalize the reverse merger, the private company trades shares with the public shell in exchange for the shell company’s stock, and the private enterprise becomes a public company.

With numerous jurisdictions with which to deal, these mergers can be difficult. For small private companies, extra-jurisdictional government regulations and laws governing mergers are often difficult to understand, and without careful planning, there is a high failure rate with companies conducting mergers and acquisitions. Careful planning and pre-merger research is vital. Many companies starting out do not have the experience or resources to do the research necessary to complete a successful merger and to see a successful entity emerge from the process.

| 11 |

Among other requirements for a successful merger is detailed advance evaluation of the merger target, and the evaluation of the merger organization and its business plan. Clients will also need experienced assistance to develop strategies as they move beyond the merger process. Assistance with post-merger or post-acquisition organization, negotiations and planning are also important elements in determining the client’s success or failure. AEEX has designed a program specifically tailored to address those issues for companies seeking to go public by means of a merger.

Assistance with Public Company Corporate Management: Among the services provided by AEEX on behalf of its clients are those corporate services that are fundamental to a company’s survival and success. These include:

1. Assistance with and the preparation of all internal corporate documents, including corporate resolutions, minutes, changes and amendments to corporate documents as required;

2. Assistance with and the preparation of required legal and regulatory documents, including, but not limited to disclosure statements and agreements, subscription agreements, federal, state and regulatory filings, such registration statement(s), as required;

3. Assistance with the preparation of all required responses resulting from the filing of any of the aforesaid documents, and the preparation or assistance with the preparation of any and all required amendments to the aforesaid documents;

4. Guidance for the proper maintenance of all required legal and regulatory filings related to the foregoing documents;

5. Direct and continuous liaison with corporate attorneys, accountants and auditors on behalf of the enterprise;

6. Assisting the client with the proper maintenance of all company files.

Resource Matching: As we move forward in our business and increase our client base, we plan to establish long-term cooperation with a number of qualified accounting firms, law firms, investment banks, venture capital and other relevant institutions.

| 12 |

Developing Public Awareness: We will work to develop public awareness for clients through an in-house publication, by creating and producing road-shows for clients and by developing publicity materials as part of an ongoing commitment to help our client to achieve success.

Markets

Our market will include small and medium-sized enterprises (“SME”) in Asia, enterprises with financial requirements, enterprises seeking to increase public awareness and enterprises planning to expand their business internationally.

Competition

There is a similar equity financing platform in China, the ‘National Equities Exchange and Quotations’ (NEEQ, www.neeq.cc). It is managed by the Chinese Government and has considerable support from the government itself. NEEQ has been in operation since September 2012, and currently services more than 5,000 listed companies. While its services are limited to mainland China, there is no assurance that other countries or groups will not initiate similar services to compete directly with AEEX.

Additionally, the online equity information industry we are entering is intensely competitive. Large companies may preempt the field if they view opportunities that have sufficient financial rewards to enter the market. We are a relatively late entry into a mature market for most online information services. There can be no assurance that we will be able to develop a profitable niche in this market. While we intend to find niche products and services relying on previously unexploited services, there can be no assurance that we will be successful in this endeavor.

Please note also that the National Equities Exchange and Quotations in China is a financial service platform which deals with both equity information services as well as equity trading. While we offer information services for clients, we are not involved with equity trading and we are not an equity trading market and it is important to note that AEEX is not now nor does it intend to be a trading market or provide quotations services for its clients. It is a platform designed solely for equity investment information and financing information services. It facilitates connections and negotiations between investors and project management. AEEX assists investors seeking investment opportunities and companies seeking international investment.

Seasonality

The nature of our products and services does not appear to be affected by seasonal variations.

Government Regulations

Currently there are no government regulations regarding our type of services in China. The Chinese government encourages companies to conduct equity financing and go public overseas, which may help companies raise funds they need for further development. In addition, companies that are successful in going public internationally may be rewarded by the government.

| 13 |

Other than the required adherence to general business laws and regulatory disclosure, our services do not appear to be affected by any specific additional Chinese government regulations. However, this does not preclude the possibility that China will institute regulations that will make it difficult or impossible for us to operate successfully, if at all, in China, and we would have to focus our business on companies located outside China.

However, it should also be noted that our business is operated by AEEGCL, a company incorporated in Samoa. It is a platform for equity investment and financing information release which is in full compliance with laws and regulations of Samoa. No special license is required for its operations in Samoa. Though most of its business currently comes from China, its Samoan operations are not subject to regulations by the Chinese government.

The Chinese government appears to be prepared to further develop equity financing and trading markets and has promulgated a series of policies and guidelines to promote Chinese companies to develop equity financing and trading, The launch and development of the National Equities Exchange and Quotations, provides Chinese companies with equity financing channels connecting capital markets, which can assist companies with fast and healthy development and contributes to the establishment of China’s multi-layered capital markets. Chinese government has stated many times that China will develop multi-layered capital markets and explore new ways to connect with international capital markets. China’s Premier Li Keqiang said, during his visits across Asia that China will promote cooperation among Asia’s multi-layered capital markets and integrate them with China’s Belt and Road Initiative a development strategy and framework, proposed by Chinese leader Xi Jinping that focuses on connectivity and cooperation among countries primarily between the People’s Republic of China and the rest of Eurasia. . The Chinese government encourages companies in China to connect with international capital markets and seek global cooperation and development through international financing and by going public outside China.

Intellectual Property

We are in the process of registering our trademark in Hong Kong, China and in the United States. Our trademark registration has been approved in Hong Kong. We expect to receive approval of our trademark registration in China and the US by the end of July 2016.

| 14 |

Research and Development

Since our inception, we have employed 20 technicians to develop our platform. It required three months to build the platform. The total development cost for the platform was approximately RMB 600,000 (US$92,800).

Environmental Matters

Our operations are not subject to environmental laws, including any laws addressing air and water pollution and management of hazardous substances and wastes and we do not anticipate capital expenditures for environmental control facilities.

Employees

As of June 7, 2016, we have 10 full-time employees, of which 2 are in the administrative department, 2 in the listing service department, 2 the in finance department and 4 in our technological department. We will employ qualified staff from time to time to meet our development needs.

Our principal place of business and corporate offices are located at Unit B, 5/F., CKK Commercial Centre, 289 Hennessy Road, Wanchai, Hong Kong and the telephone number is 852-2845 2281. Our President, Mr. Liu Jun, supplies our office space and telephone at no cost to us.

Additional Information

We are required to file quarterly, annual and current reports. The Company files its reports electronically with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other electronic information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Historical Background

Name Change

On July 8, 2015, the Board of Directors approved a change of our corporate name from I In The Sky, Inc., to Asia Equity Exchange Group, Inc. The Certificate of Amendment to Articles of Incorporation changing our name was filed with the state of Nevada on July 22, 2015.

| 15 |

Change in Fiscal Year

Pursuant to the approval of our Board of Directors on July 8, 2015, our fiscal year end has been changed from September 30 to December 31. We filed a transition report on form 10-Q for the transition period of October 1, 2015, to December 31, 2015. Beginning for the fiscal year 2016, we will file our quarterly and annual reports with a fiscal year end of December 31, including audited statements of income and cash flows for the transition period on form 10-K for 2016.

Change in Authorized Capital and Stock Split

On July 8, 2015, the Board of Directors approved an amendment to our Articles of Incorporation to increase our authorized number of shares of common stock from 74,000,000 to 3,000,000,000. A majority of the holders of our common stock consented to the amendment to our Articles of Incorporation. On July 22, 2015, we filed our Certificate of Amendment to Articles of Incorporation with the state of Nevada, and the Certificate of Amendment is attached hereto as Exhibit 3.1.

On July 8, 2015, the Board of Directors authorized a ten for one (10:1) forward stock split for shareholders of record as of July 10, 2015 (the “Forward Split”), to be effectuated upon the filing of our amended Articles of Incorporation. The amended Articles of Incorporation were filed with the state of Nevada on July 22, 2015. Accordingly, the Registrant’s issued and outstanding number of shares of common stock increased correspondingly from 14,600,000 to 146,000,000.

On August 11, 2015, the Financial Industry Regulatory Authority (“FINRA”) approved the forward split of the common stock and the name change to Asia Equity Exchange Group, Inc. On August 31, 2015, our trading symbol was changed from SYYF to AEEX.

As a result of the Forward Split and name change, our CUSIP Number has changed to 04521X109.

As a reporting company, we may pursue relationships with entities, which may have made progress developing the opportunities we seek and which may be open to being acquired by a reporting company. Other than the acquisition of AEEGCL, no such entities have been identified at the date hereof, nor have we entered into any discussions with any other parties about a joint venture or acquisition. Any new acquisition or business opportunities that we may acquire will require additional financing. There can be no assurance, however, that we will be able to acquire the financing necessary to enable us to pursue our plan of operation. If our company requires additional financing and we are unable to acquire such funds, our business may fail.

| 16 |

Historically, we were able to raise a limited amount of capital through the registered offering of our equity stock and through loans from our president, Liu Jun, but we are uncertain about our continued ability to raise funds privately. If we are unable to secure adequate capital to continue our acquisition efforts, our shareholders may lose some or all of their investment and our business may fail.

Our officers and directors continue to provide their labor at no charge. We plan to hire up to 10 additional staff members during the next 12 months of operation, and will also rely on the services of independent professionals for the auditing, evaluation and legal requirements for our listing business.

Risks Associated With Our Company

Our independent auditors have issued an audit opinion for our company, which includes a statement describing our going concern status. Our financial status creates a doubt whether we will be able to continue as a going concern.

Our auditors have issued a going concern opinion regarding our company. This means there is substantial doubt we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty regarding our ability to continue in business. As such we may have to cease operations and investors could lose part or all of their investment in our company.

The Company’s business plan is based on a relatively new model that may not be successful and the Company may not successfully implement its business strategies

The Company’s original content, which has not been examined or tested by the market. Products and services of the Company are targeted at an emerging market and any potential increase in the Company’s revenues depends on the achievement of equity financing by our current and future clients, the small and medium-sized enterprises in Asia, which is a new market in the region. In addition, the Company cannot guarantee the full and successful implementation of our business strategies. To ensure the successful reception of our products and services by a large number of SMEs in China, great efforts must to be made in promotion and business partner development. However, the Company cannot guarantee successful promotion of our products and services and we may not be able to realize our business goals.

| 17 |

The Company may not be able to obtain sufficient business partners to effectively cover our targeted market

The business model adopted by the Company is to promote our products and services through our business partners in targeted countries and regions who are more familiar with the local markets and may be able to help us develop clients quickly. However, it takes time to develop qualified business partners and those selected may not turn out to be the right business partners, which may have a negative effect on the Company’s business development

The online equity information industry we are entering is highly competitive and there is no assurance that we will be successful in developing our product and entering the market successfully.

The online equity information industry we are entering is intensely competitive. Large companies may preempt the field if they view opportunities that have sufficient financial rewards to enter the market. We are a relatively late entry into a mature market for most online information services. There can be no assurance that we will be able to develop a profitable niche in this market. While we intend to find niche products and services relying on previously unexploited services, there can be no assurance that we will be successful in this endeavor,

China is in a period of transformation, with a great number of SMEs facing industry upgrading and innovation which requires large amount of funding. The Chinese government encourages SMEs to solve the lack of funds through equity financing. As a result, the National Equities Exchange and Quotations (NEEQ) and regional equity transaction centers have experienced rapid development in the past years. Though our products and services have advantages over those of NEEQ and regional equity transaction centers, these other agencies may have already preempted the field and gained recognition among SMEs. The Company must work hard to narrow such gap as quickly as possible and win the recognition by clients of our advantages and their acceptance of our products and services. If we are unable to do so, we may be unable to gain a sufficient number of clients and our business may fail.

As yet we have a limited number of clients or customers and we cannot guarantee we will ever have more. Even if we obtain additional clients or customers, there is no assurance that we will make a profit.

We have a limited number of clients or customers. We have identified additional potential clients, but we cannot guarantee we will be able to bring them in as clients. Even if we obtain additional clients or customers for our services, there is no guarantee that we will develop products and/or services that our clients/customers will want to purchase. If we are unable to attract enough customers/clients to purchase services (and any products we may develop or sell) it will have a negative effect on our ability to generate sufficient revenue from which we can operate or expand our business. The lack of sufficient revenues will have a negative effect on the ability of the Company to continue operations and it could force the Company to cease operations.

| 18 |

The Company provides services or will expand to provide services in a number of different jurisdictions with different legal, regulatory and language requirements. This will require personnel with legal, regulatory and language expertise in those jurisdictions and such personnel may not be readily available.

The Company provides services or will expand to provide services in a number of different countries. All of these jurisdictions may speak different languages and have different securities laws and legal requirements, especially with respect to laws governing reverse mergers. This will require the Company to seek out and engage local personnel with legal, regulatory and language expertise in those jurisdictions. Identifying qualified personnel may be very difficult, and such personnel may not be readily available or may be very expensive. Should the Company be unable to find properly trained and experienced personnel, the Company will be unable to function in those jurisdiction causing costly gaps in the Company’s ability to provide its services.

Our business model will require the use and training of outside personnel, who may not be available to provide qualified services when needed.

Our business model requires relevant services from our business partners in other countries who will be selected in accordance with certain standards and provided with training by the Company in all aspects of the Company’s business. However, their trainability, professionalism and work ethic will vary and may not meet the strict requirements for our business. Additionally, outside personnel may not be available when needed, which may reduce customer satisfaction and further affect the image and business development of the Company. If we are unsuccessful in finding and training the required personnel, our business plan and ultimately our Company will fail.

The failure of our business partners to effectively promote the business may have a negative effect on our business development

Our business partners are required to meet a large number of clients and educate them about all necessary aspects of the listing business. To ensure that our clients, some of which may have poor management skills, can meet the listing standards, extra and long-term efforts will have to be made by our business partners, some of whom may not do their utmost to promote the business. Lack of sufficient effort by our business partners will negatively affect our business development and the Company might fail.

| 19 |

A large amount of investment in promotion and business partner development at the early stage will affect our profits

The Company is currently at the early stage of development and conducts business only in China. Though cooperative relationships have been established with some business partners, it will still require significant effort to achieve full business coverage in China. To promote our business and provide products and services for clients, we have made all-round and detailed promotional plans and policies and will carry out a number of road shows at regional, national and international levels. We will also adopt preferential policies for attracting business partners to advance our business. This will require a large amount of investment at the beginning and may affect the Company’s profits. If the necessary expenses are too high, the Company might not have sufficient funds to carry on its business and the Company will fail.

If we are not able to increase and maintain our brand influence, we may face difficulties in attracting new business partners and clients and may suffer damage to our business

The Asia Equity Exchange brand is still being nurtured. We believe it is critical to increase and maintain our brand influence in our development of clients and in attracting new business partners. Our major competitors have built well-known brands and continue to increase their influence. Our failure to increase and maintain our brand influence for any reason may result in a material adverse effect on our business, operating results and financial position.

The fast growing and changing business environment may intensify our shortage of resources

We plan to expand our business while developing customers and seeking market opportunities. Our limited operating, administrative and financial resources may not support our planned development. As the number of our clients and business activities increase, we will need to increase investment. We will need to improve the existing and implement new operating and financial systems, processes and controls, and expand, train and manage a growing team of employees. In addition, management will need to maintain and strengthen our relations with business partners. If we fail to effectively manage our development and expansion, our service quality may decrease, our business may suffer damage and our operating results may be materially and adversely affected.

| 20 |

We may be adversely affected due to the complicated and unclear regulatory system in the financial sector in which we operate

The Chinese government strictly regulates the financial sector by setting out requirements for licenses and permits of foreign financial investment. Since regulations and rules in the financial sectors are relatively new and continuously changing, how they should be interpreted and exercised is extremely unclear. The interpretation and quotations of the current Chinese regulations and policies, the position of China Securities Regulatory Commission and new regulations and policies that may become materially uncertain factors in the legality of the current and future foreign investment and in the operation and management of Chinese equity financing, including our business. Under some circumstances, our current and former services or business may be deemed to have violated Chinese regulations, and we may be fined or penalized or our business and services may be terminated. This risk does not apply to our Samoan operations, which are not subject to Chinese regulations.

General risks associated with business operations in China

The reversal of political and economic policies by the Chinese government may have a material adverse effect on the China’s overall growth, which may result in the decrease in demand for our services and negatively affect our business and operating results

China’s current economic slowdown may impair our ability to achieve growth and gains.

It has been estimated that our financial performance will continue to be affected by China’s economic growth. China’s growth in the past 30 years cannot guarantee its continuous growth at the current rate. When its growth slows down, the number of companies meeting our listing standards may drop. Therefore, our income is closely associated with China’s uncertain economy.

Foreign exchange fluctuation may cause damage to our business

We accept the payment of listing service fees by companies in RMB, HK dollar or US dollar. Therefore, foreign exchange fluctuation may generate uncertain influences on our business.

We may not be able to obtain the required additional capital

We believe that the current cash and cash equivalents, business income in cash and the amount of sales income are enough to cover estimated cash needs in the immediate future. However, due to changes in the business environment and other future development, including possible decisions to conduct investment or acquisition or mergers, we will need additional cash. If our resources are not enough to meet the cash needs, we may issue additional shares or seek loans. Our ability to gain additional capital may be determined by various uncertain factors, including our future financial position, operating results, cash flows, share prices and cash in the international capital market. In addition, issuance of additional shares will result in dilution of shareholders’ equity. Borrowings may increase our burden of solvency and require business and financial undertakings, which may restrict our business. We can neither guarantee that we will gain the above financial resources in a timely manner, nor in accordance with our requirements, nor that we will gain those additional resources on acceptable terms and conditions nor that we are able to gain any of those financial resources at all. If we are unable to do so our business may fail.

| 21 |

The increase in our authorized capital may lead to significant dilution of our stock

On July 22, 2015, we filed a Certificate of Amendment to our Articles of Incorporation with the state of Nevada increasing our authorized number of shares of common stock from 74,000,000 to 3,000,000,000. This increased our authorized capital by a factor of 40.5. Such an increase is significant and can result in significant dilution of the Company’s stock if we elect to issue shares, for instance, to acquire other businesses or companies.

We are dependent upon our current officers.

We currently are managed by two officers, and we are entirely dependent upon them in order to conduct our operations. If they should resign or be unable to carry out their respective duties, there will be no one to run AEEX. The Company has no Key Man insurance. If our current officers are no longer able to serve as such and we are unable to find other persons to replace them, it will have a negative effect on our ability to continue active business operations, and could result in investors losing some or all of their investment in the Company.

Our business depends on the continuous contribution by our officers and employees, loss of which may result in a severe impediment to our business.

Our success is dependent upon the continuous contribution by our officers, especially our founders. We rely on their expertise in business operations including development of new products and services. The company has no Key Man insurance for our officers to cover the loss if they should die or resign.

If one or more of our officers cannot serve the Company or is not willing to do so, the Company may not be able to find alternatives within a short time period or it may fail to find alternatives at all. This would result in a severe impediment to our business and a have material adverse impact on our financial position and operating results. To continue as a viable operation, the Company may have to employ and train replacement personnel at a higher cost.

In addition, if our officers join our competitors or develop similar business in competition with our company, our business may also be negatively impacted.

| 22 |

Our future success also depends on our ability to attract and employ qualified long-term staff for management, technology, sales, marketing and customer services. We have a great demand for qualified talent, but we may not be successful in attracting, employing, enhancing and retaining the talent required for our success.

With our limited history of operations, our potential to achieve gains and income has not been examined, therefore we are not able to predict whether our future performance may conform to our and others’ expectations

We consider that our future success is dependent upon our ability to substantially increase our business income, however, we have a limited history of operations. Therefore, while assessing the Company’s prospects, we must take into consideration the usual difficulties and other risks at this early stage of the Company’s development. This is particularly true in the emerging and fast growing equity trading market of Asia. Such risks may be associated with our ability to achieve success in the following:

| ● | to gain income from our clients by charging listing service fees; | |

| ● | to attract small and medium-sized companies to list on AEEX | |

| ● | to maintain the existing and newly built strategic relations; | |

| ● | to effectively deal with competition; | |

| ● | to lessen influence from newly built strategic relations by our competitors; | |

| ● | to improve our brand influence and increase confidence of our clients; | |

| ● | to attract and employ qualified officers and staff; | |

| ● | to enrich our products and services. |

Our controlling stockholders have significant influence over the Company.

As of the date of this filing, three individuals collectively own 87.26 % of the outstanding common stock. As a result, they possess significant influence over our affairs. Their stock ownership and relationships with members of our board of directors, of which Mr. Liu Jun and Mr. Peng Tao are the only two, may have the effect of delaying or preventing a future change in control, impeding a merger, consolidation, takeover or other business combination, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could materially and adversely affect the market price of our common stock.

| 23 |

Three shareholders hold a controlling interest in our stock. As a result, the ability of minority shareholders to influence our affairs is extremely limited.

Three shareholders own a controlling interest in our outstanding common stock. As a result, they have the ability to control all matters submitted to the stockholders of AEEX for approval (including the election and removal of directors). A significant change to the composition of our board could lead to a change in management and our business plan. Any such transition could lead to, among other things, a decline in service levels, disruption in our operations and departures of key personnel, which could in turn harm our business.

Moreover, this concentration of ownership may have the effect of delaying, deferring or preventing a change in control, impeding a merger, consolidation, takeover or other business combination involving us, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control, which in turn could materially and adversely affect the market price of the common stock.

Minority shareholders of AEEX will be unable to affect the outcome of stockholder voting as long as the three shareholders retain a controlling interest.

We have only two directors, which limits our ability to establish effective independent corporate governance procedures and increases the control of our President over operations and business decisions.

We have only two directors, who are our principal executive officers and secretary. Accordingly, we cannot establish board committees comprised of independent members to oversee functions like compensation or audit issues. In addition, a tie vote of board members is decided in favor of the chairman, which gives him significant control over all corporate issues, including all major decisions on operations and corporate matters such as approving business combinations.

Until we have a larger board of directors that would include some independent members, if ever, there will be limited oversight of our President’s decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

Risk of Financial Policy Control by the Chinese Government

Financial regulations in China are very strict. The government controls all financial institutions, including equity financing. Interference by the government could seriously damage or terminate our Company.

| 24 |

Because we are currently considered a “shell company” within the meaning of Rule 12B-2 pursuant to the Securities Exchange Act of 1934, the ability of holders of our common stock to sell their shares may be limited by applicable regulations.

We are currently considered a “shell company” as that term is defined in Rule 12b-2 pursuant to the Securities Exchange Act of 1934, and Rule 405 pursuant to the Securities Act of 1933, in that we currently have nominal operations and assets other than cash. Accordingly, the ability of holders of our common stock to sell their shares may be limited by applicable regulations.

As a result of our current classification as a “shell company”, our investors are not allowed to rely on the “safe harbor” provisions of Rule 144 promulgated pursuant to the Securities Act of 1933 so as not to be considered underwriters in connection with the sale of securities until one year from the date that we cease to be a “shell company.” Additionally, as a result of our classification a shell company, investors should consider shares of our common stock to be significantly risky and illiquid investments.

Although pursuant to this filing we are no longer to be considered a “shell company”, we can provide no assurance or guarantee that we will not become a “shell company” in the future, and, accordingly, we can provide no assurance or guarantee that there will be a liquid market for our shares. Accordingly, investors may not be able to sell our shares and lose their investments in the Company.

Risks Associated with Our Common Stock

Our shares are defined as “penny stock.” The rules imposed on the sale of the shares may affect your ability to resell any shares you may purchase, if at all.

The Commission has adopted regulations which generally define a “penny stock” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to specific exemptions. According to rules of the Commission and the Securities and Exchange Act of 1934, our shares are defined as a “penny stock”. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse, or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser’s written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock and may also affect your ability to resell any shares you may purchase.

| 25 |

Market for penny stock has suffered in recent years from patterns of fraud and abuse

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

| ● | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; | |

| ● | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; | |

| ● | Boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; | |

| ● | Excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, | |

| ● | The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses. |

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

| 26 |

Our controlling shareholders make corporate decisions that may differ from those that might be made our officers and directors.

Due to the controlling amount of their share ownership in our Company, the controlling shareholders have a significant influence in determining the outcome of all corporate transactions, including the power to prevent or cause a change in control. Their interests may differ from the interests of other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

Shareholders may be diluted significantly through our efforts to obtain financing and satisfy obligations through issuance of additional shares of our common stock.

We have no committed source of financing. Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the authorized (3,000,000,000) but unissued (1,854,000,000) shares of common stock. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders may further dilute common stock book value, and that dilution may be material.

Inability and unlikelihood to pay dividends

To date, we have not paid, nor do we intend to pay in the foreseeable future, dividends on our common stock, even if we become profitable. Earnings, if any, are expected to be used to advance our activities and for general corporate purposes, rather than to make distributions to stockholders. Since we are not in a financial position to pay dividends on our common stock and future dividends are not presently being contemplated, investors are advised that return on investment in our common stock is restricted to an appreciation in the share price. The potential or likelihood of an increase in share price is questionable.

| 27 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the sections “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should carefully review the risks described in the Annual Report filed with this report and in other documents we file with the Securities and Exchange Commission (“SEC”). You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements.

All references in this report to the “Company,” “AEEGCL,” “we,” “us,” or “our” are to Asia Equity Exchange Group Co., Ltd.

Corporate Overview

AEEGCL is a company incorporated in Samoa on May 29, 2015. Its fiscal year end is December 31. The company’s administrative address is Unit B, 5/F., CKK Commercial Centre, 289 Hennessy Road, Wanchai, Hong Kong and the telephone number is +852-2845 2281.

On July 2, 2015, AEEGCL purchased 100% equity stake in Yinfu International Enterprise Ltd. (“Yinfu”, a private company incorporated in Hong Kong), and hence the 100% equity stake in Yinfu Guotai Investment Consultant (Shenzhen) Co., Ltd. (“Yinfu Guotai”, a private company incorporated in the People’s Republic of China, the “PRC”), which is a wholly owned subsidiary of Yinfu. Yinfu and Yinfu Guotai provide consultancy services in investment and corporate management. Yinfu will attempt to open the market and provide professional consultancy services to companies in the mainland PRC and Hong Kong, the PRC.

| 28 |

Yinfu Guotai is a registered wholly foreign owned entity. Its parent company is Yinfu International Enterprise Limited. Currently, Yinfu Guotai provides management and business consultancy for Chinese business. Such services are within the scope of its business license and permitted by Chinese laws.

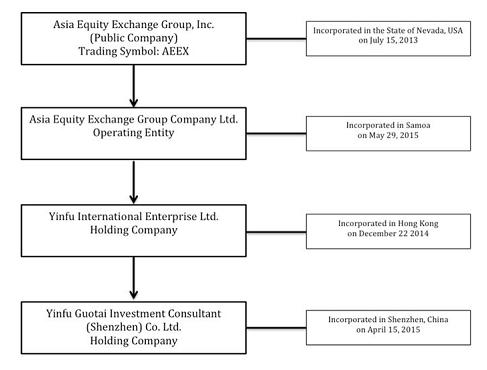

The following is an organizational chart showing the relationships between AEEX, AEEGCL, Yinfu and Yinfu Guotai as well as their jurisdictions and dates of incorporation:

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements for the period from May 29, 2015 (date of incorporation) to December 31, 2015 (the “period”) and our unaudited interim financial statements for the quarter ended March 31, 2016 (the “quarter”), together with notes thereto, which are included in this report.

Results of Operations

We have generated $242,512 revenues since inception and have incurred $237,232 expenses and $1,982 other comprehensive loss in the period ended December 31, 2015. We have generated no revenues and have incurred $182,505 expenses and $2,470 other comprehensive income in the quarter ended March 31, 2016.

| 29 |

The following table provides selected balance sheet data about our company on December 31, 2015 and March 31, 2016.

| March 31, 2016 | December 31, 2015 | |||||||

| Cash | $ | 68,305 | $ | 22,655 | ||||

| Total Assets | $ | 126,368 | $ | 78,439 | ||||

| Total Liabilities | $ | 303,105 | $ | 75,141 | ||||

| Stockholders’ Equity (Deficit) | $ | (176,737 | ) | $ | 3,298 | |||

The following summary of our results of operations and other comprehensive income (loss), for the period ended December 31, 2015 and the quarter ended March 31, 2016.

| Three months ended March 31, 2016 | Period from May 29, 2015 to December 31, 2015 | |||||||

| Revenue | $ | - | $ | 242,512 | ||||

| Cost of sales | - | (908 | ) | |||||

| Gross profit | - | 241,604 | ||||||

| Expenses | ||||||||

| General and administrative | (186,619 | ) | (231,462 | ) | ||||

| Income (loss) from operations | (186,619 | ) | 10,142 | |||||

| Other income (loss) | - | - | ||||||

| Income (loss) before provision for income taxes | (186,619 | ) | 10,142 | |||||

| Provision for income taxes | 4,114 | (4,862 | ) | |||||

| Net income (loss) for the period | $ | (182,505 | ) | $ | 5,280 | |||

| Other comprehensive income (loss), net of tax | ||||||||

| Exchange differences on translating foreign operations | 2,470 | (1,982 | ) | |||||

| Total comprehensive income (loss) for the period | $ | (180,035 | ) | $ | 3,298 | |||

| Basic and diluted income (loss) per common share | $ | (0.00 | ) | $ | 0.00 | |||

| Basic and diluted weighted average common shares outstanding | 1,000,000,000 | 236,111,111 | ||||||

| 30 |

Revenues

Our company has generated $242,512 revenues during the period ended December 31, 2015, from the provision of consultancy services in investment and corporate management. Our company has generated no revenues for the quarter ended March 31, 2016.

Operating expenses

For the period ended December 31, 2015, total operating expenses were $232,370, which included cost of sales of $908 and general and administrative expenses of $231,462. For the quarter ended March 31, 2016, total operating expenses were $186,619, which included general and administrative expenses only.

Net income (loss) and comprehensive income (loss)

For the period ended December 31, 2015, our company had net income of $5,280 and total comprehensive income of $3,298. For the quarter ended March 31, 2016, our company had net loss of $182,505 and total comprehensive loss of $180,035.

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us on which to base an evaluation of our performance. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, a narrow client base, limited sources of revenue, and possible cost overruns due to the price and cost increases in supplies and services.

Without additional funding, management believes that we will not have sufficient funds to meet our obligations beyond one year after the date our consolidated financial statements are issued. These conditions give rise to substantial doubt as to our ability to continue as a going concern.

| 31 |

We have been, and intend to continue, working toward identifying and obtaining new sources of financing. To date we have been dependent on related parties for our source of funding. No assurances can be given that we will be successful in obtaining additional financing in the future. Any future financing that we may obtain may cause significant dilution to existing stockholders. Any debt financing or other financing of securities senior to common stock that we are able to obtain will likely include financial and other covenants that will restrict our flexibility. Any failure to comply with these covenants would have a negative impact on our business, prospects, financial condition, results of operations and cash flows.

If adequate funds are not available, we may be required to delay, scale back or eliminate portions of our operations or obtain funds through arrangements with strategic partners or others that may require us to relinquish rights to certain of our assets. Accordingly, the inability to obtain such financing could result in a significant loss of ownership and/or control of our assets and could also adversely affect our ability to fund our continued operations and our expansion efforts.

Currently we spend approximately $35,000 per month for basic operations. During the next 12 months, we expect to incur the same costs as the current monthly expenses. However, as we work to expand our client base, we expect to incur significant research and development costs and expenses will increase to meet increased demand. We will also need to hire additional employees in order to accommodate new clients.

Liquidity and Capital Resources

Working Capital

| March 31, 2016 | December 31, 2015 | |||||||

| Current Assets | $ | 76,447 | $ | 60,237 | ||||

| Current Liabilities | 303,105 | 75,141 | ||||||

| Working Capital Deficiency | $ | (226,658 | ) | $ | (14,904 | ) | ||

| 32 |

Cash Flows

| Three months ended | Period Ended | |||||||

| March 31, 2016 | December 31, 2015 | |||||||

| Cash Flows From (Used in) Operating Activities | $ | (134,351 | ) | $ | 58,517 | |||

| Cash Flows Used in Investing Activities | (33,323 | ) | (20,409 | ) | ||||

| Cash Flows From (Used in) Financing Activities | 209,683 | (14,284 | ) | |||||

| Effect of foreign exchange rate, net | 3,641 | (1,169 | ) | |||||

| Net Increase in Cash During Period | $ | 45,650 | $ | 22,655 | ||||

Cash Flows From (Used In) Operating Activities

During the period ended December 31, 2015, our company received $58,517 in cash from operating activities. Our company had net income of $10,142, which was increased by a non-cash adjustment for deprecation of $2,207 and a net increase in change of operating assets and liabilities of $46,168.

During the quarter ended March 31, 2016, our company used $134,351 in cash from operating activities. Our company had net loss of $186,619, which was decreased by non-cash adjustments for depreciation and amortization of $907 and $261 respectively and a net increase in change of operating assets and liabilities of $51,100.

Cash Flow Used in Investing Activities

During the period ended December 31, 2015, our company used $20,409 in the purchases of property and equipment.

During the quarter ended March 31, 2016, our company used $5,223 in the purchases of intangible assets, and $28,100 in the purchases of property and equipment.

Cash Flow From (Used in) Financing Activities

During the period ended December 31, 2015, our company advanced $14,284 to a related party.

During the quarter ended March 31, 2016, our company received $209,683 from the related party.

| 33 |

Critical Accounting Policy and Estimates

We believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of June 7, 2016, certain information with respect to the beneficial ownership of our common shares by each shareholder known by us to be the beneficial owner of more than 5% of our common shares, as well as by each of our current directors and executive officers as a group. To the best of our knowledge, except as otherwise indicated each person has sole voting and investment power with respect to the shares of common stock except to the extent such power may be shared with a spouse. Beneficial ownership consists of a direct interest in the shares of common stock, except as otherwise indicated.

| 34 |

| Name and Address of Beneficial Owner(1) | Amount

and Nature of Beneficial Ownership |

Percentage

(2) of Class | ||

Liu Jun Hao, Rong Chao Da Xia Block B Room 609 Bao’an Zhong Xin Qu Shenzhen City 2021-1 China |

44,660,000 (Direct) |

3.9% Common

| ||

Peng Tao Room 208, 5th Block, 19 FuGong Road, FuTian District Shenzhen, Guangdong, China |

5,000,000 (Direct) |

0.44% Common | ||

Blue Tech Holding Limited Ma Ning (Beneficial Owner) Room 1504, No.11, Sheng Shi Hua Cheng, Yinzhou District, Ningbo Zhejiang, China |

700,000,000 (Indirect) |

61.08% Common | ||

Honest Billion Investment Limited Wang Zhong, (Beneficial Owner) No. 1701, Building E, Fu Tong Hao Wang Jiao Central, BaoAn District, Shenzhen, Guangdong, China |

200,000,000 (Indirect) |

17.45% Common

| ||

Qi Jian Unit B, 5/F, CKK Commercial Centre 289 Hennessy Road Wanchai Hong Kong |

100,000,000 (Direct) |

8.7% Common

| ||

Directors and Executive Officers as a Group (2 people) |

49,660,000 | 4.34% |

| 35 |

(1) The persons named above may be deemed to be a “promoter” of the Company, within the meaning of such terms under the Securities Act of 1933, as amended, by virtue of his direct holdings in the Company.

(2) Based on 1,146,000,000 shares issued and outstanding as of June 7, 2016.

Directors, Executive Officers, Promoters and Control Persons