UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

Amendment No. 1

(Mark One)

For

the fiscal year ended:

For the transition period from ____________ to _____________

Commission

File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | N/A |

Securities

registered pursuant to Section 12(g) of the Act:

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As

of June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market

value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported

on the OTC Pink Market tier) was approximately $

There were a total of

DOCUMENTS INCORPORATED BY REFERENCE

AERKOMM INC.

Form 10-K/A Amendment No. 1 Explanatory Note

Background of Restatement

This Amendment No. 1 (“Amendment”) on Form 10-K/A to the Annual Report on Form 10-K of Aerkomm Inc. (the “Company”) for the year ended December 31, 2023 (“Original Form 10-K”), which Original Form 10-K was initially filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 7, 2024. This Amendment includes restatements of December 31, 2023 and December 31, 2022 financial statements (the “Relevant Periods”) Considering such restatement, the Company concluded that such financial statements for the Relevant Periods should no longer be relied upon. This Amendment includes the restated financial statements for the Relevant Periods. The restatement is related to correction to the Company’s accounting for certain debt previously characterized as long-term debt, as short-term debt instead Also, due to the Company’s evidence indicating an intention to hold an investment for more than one year, the Company has reclassified the investment from short-term to long-term. Consequently, the valuation method has been adjusted from market value (used for short-term investments) to cost (used for long-term investments). In addition, a correction has been made to reclassify other receivable-related party loans to short-term loan-others, based on the confirmation letter, In addition, The Credit Enhanced Zero Coupon Convertible Bonds have been redeemed by the bond holder and early redemption loss and default interest expenses are accrued.

Effects of Restatement

The Company has included in this Amendment certain restated items on the previously issued balance sheet, statement of operations, statement of stockholders’ equity and statement of cashflow dated as of December 31, 2023 and December 31, 2022 that were previously reported in the Original 10-K, to restate, in pertinent part, the following:

| ● | For December 31, 2023, to reflect a decrease of short-term investment from $3,804,850 to $1,156,875. | |

| ● | For December 31, 2023, to reflect an increase of other receivable-related parties from $1,167,749 to $2,147,501. | |

| ● | For December 31, 2023, to reflect an increase of long-term investment from $4,261,920 to $5,013,814. | |

| ● | For December 31, 2023, to reflect a net increase of short-term loan from $132,257 to $5,712,244. | |

| ● | For December 31, 2023, to reflect an increase of Convertible Long-term bonds payable - current from $0 to $10,303,775. | |

| ● | For December 31, 2023, to reflect a net decrease of other payable from $12,617,277 to $8,057,112. | |

| ● | For December 31, 2023, to reflect an increase of convertible long-term notes payable – current from 0 to $23,173,200 and a decrease of convertible long-term notes payable from $23,173,200 to 0. | |

| ● | For December 31, 2023, to reflect a decrease of convertible long-term bonds payable from $9,648,155 to $200,000. | |

| ● | For December 31, 2023, to reflect an increase of net loss from $21,073,973 to $23,833,723. | |

| ● | For December 31, 2023, to reflect a decrease of foreign currency translation adjustment from $39,391 to $7,370. |

| ● | For December 31, 2023, to reflect a net decrease in net cash provided by (used) in operating activities to ($2,145,787) from $522,721. | |

| ● | For December 31, 2023, to reflect a net increase in net cash used in investing activities to $6,005,023 from $8,096,308. | |

| ● | For December 31, 2023, to reflect an increase in net cash provided by financing activities to $8,430,528 from $3,670,735. | |

| ● | For December 31, 2023, to reflect an increase of $2,759,750 in accumulated deficits to $77,479,704 from $74,719,954. | |

| ● | For December 31, 2023, to reflect an increase of $32,021 in accumulated other comprehensive loss to $366,604 from $334,583. | |

| ● | For December 31, 2023, to reflect an increase of $2,759,750 in net non-operating loss to $2,360,799 from net non-operating gain of $398,951. | |

| ● | For December 31, 2023, to reflect an increase in net loss per common shares from $(1.81) to $(2.04) for both basic and diluted. | |

| ● | For December 31, 2022, to reflect a decrease of short-term investment from $2,009,238 to $1,159,060. | |

| ● | For December 31, 2022, to reflect an increase of long-term investment from $4,572,243 to $5,422,425. | |

| ● | For December 31, 2022, to reflect the omission of $8,937,006 in convertible long-term bonds payable – current. | |

| ● | For December 31, 2022, to increase short-term loan to $1,799,090 from $978,896 and to reduce other payable from $5,017,040 to $4,196,846. | |

| ● | For December 31, 2022, to reduce convertible long-term bonds payable to $200,000 from $9,648,155. | |

| ● | For December 31, 2022, to reflect a net increase in net cash used by operating activities to $11,914,443 from $11,094,249. | |

| ● | For December 31, 2022, to reflect a net increase in net cash provided by financing activities to $19,006,704 from $19,826,898. |

The restatement of the financial statements involved changes to the Company’s balance sheet, statement of operations, statement of stockholders’ equity and statement of cashflow the statement of operation, equity, and cashflow and its corresponding Notes to Consolidated Financial Statements. See Note 2, Note 4, Note 8, Note 11, Note 13, Note 15, and Note 22 to Financial Statements included this Amendment for additional information on the restatements and the related financial statement effects.

Internal Control Considerations

In connection therewith, the Company’s management identified a material weakness in its internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the financial statements will not be prevented or detected and corrected on a timely basis. For a discussion of management’s consideration of the material weakness identified, see Item 9A. Controls and Procedures included in this Amendment.

Items Amended

The following items are amended in this Amendment: (i) Part I, Item 1A. Risk Factors; (ii) Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations; and (iii) Part II, Item 9A. Controls and Procedures. Additionally, in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the Company is including with this Amendment currently dated certifications from its principal executive and principal financial officer. These certifications are filed or furnished, as applicable, as Exhibits 31.1 and 32.1.

This Amendment is as of the filing date of the Original Form 10-K and should be read in conjunction with the Original Form 10-K. This Amendment does reflect subsequent information and events under “Subsequent Events” in Note 25. Otherwise, no other information included in the Original Form 10-K has been modified or updated in any way, except as described above.

Aerkomm Inc.

Annual Report on Form 10-K

Year Ended December 31, 2023

TABLE OF CONTENTS

i

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following:

| ● | our future financial and operating results; |

| ● | our intentions, expectations and beliefs regarding anticipated growth, market penetration and trends in our business; |

| ● | our ability to attract and retain customers; |

| ● | our dependence on growth in our customers’ businesses; |

| ● | the effects of changing customer needs in our market; |

| ● | the impact and effects of the global coronavirus (COVID-19) pandemic, and other potential pandemics or contagious diseases or fear of such outbreaks, on global supply chains as well as the global airline and tourist industries, especially in the Asia Pacific region; |

| ● | the impact and effects of the conflict between Russia and Ukraine; |

| ● | the impact and effects of the conflict between Israel and Hamas; |

| ● | the effects of market conditions on our stock price and operating results; |

| ● | our ability to maintain our competitive advantages against competitors in our industry; |

| ● | our ability to timely and effectively adapt our existing technology and have our technology solutions gain market acceptance; |

| ● | our ability to introduce new product offerings and bring them to market in a timely manner; |

| ● | Our ability to maintain, protect and enhance our intellectual property, including trade secrets; |

| ● | the effects of increased competition in our market and our ability to compete effectively; |

| ● | our expectations concerning relationship with customers and other third parties; |

| ● | the attraction and retention of qualified employees and key personnel; |

| ● | future acquisitions of our investments in complementary companies or technologies; and |

| ● | our ability to comply with evolving legal standards and regulations. |

ii

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Item 1A. Risk Factors” and elsewhere in this annual report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this annual report may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this annual report and the documents that we reference in this report and have filed with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

This report includes market and industry data that has been obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s knowledge of such industries has been developed through its experience and participation in these industries. While our management believes the third-party sources referred to in this annual report are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this report or ascertained the underlying economic assumptions relied upon by such sources. Internally prepared and third-party market forecasts, in particular, are estimates only and may be inaccurate, especially over long periods of time. Furthermore, references in this report to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this report.

Summary of Risk Factors

Our annual report should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

Risks Relating to Our Business

Risks and uncertainties related to our current and future business include, but are not limited to, the following:

| ● | Excluding non-recurring revenues in 2019 and 2021 from affiliates, we have incurred operating losses in every quarter since we launched our business and may continue to incur quarterly operating losses, which could negatively affect the value of our company; |

iii

| ● | We may not be successful in our efforts to develop and monetize new products and services that are currently in development, including value-added resale of satellite bandwidth in certain geographies where we are already licensed or intend to be licensed, our multi-orbit universal satellite communications terminals that incorporate flat panel antennas (FPAs) or electronically steered arrays (ESAs) with both hardware and software defined modems, communications systems for manned and unmanned aerospace and defense platforms, system integration for manned and unmanned aerospace and defense platforms, our proprietary glass semiconductor antenna (also referred to as “FGSA”), distributed content delivery network (“CDN”), distributed computing or mesh computing applications and inflight entertainment and connectivity services; | |

| ● | We may not be able to grow our business with our current satellite and satellite constellation partners or to successfully negotiate agreements with satellite and satellite constellation partners whose bandwidth and services we do not currently resell or otherwise distribute; | |

| ● | We may not be able to grow our business with our current aerospace and defense partners or to successfully negotiate agreements with aerospace and defense partners to which we do not currently provide our technologies or services; | |

| ● | We may not be able to grow our business with our current civilian telecommunications partners or successfully negotiate agreements with civilian telecommunications partners to which we do not currently provide our service; | |

| ● | We may not be able to grow our business with our current commercial aviation partners or successfully negotiate agreements with commercial aviation partners to which we do not currently provide our service; | |

| ● | We may experience network capacity constraints in both our current and our future operation regions as we expect capacity demands to increase, and we may in the future experience capacity constraints internationally. If we are unable to successfully implement planned or future technology enhancements to increase our network capacity, or our aerospace and defense partners or civilian telecommunication partners do not agree to such enhancements, our ability to acquire and maintain sufficient network capacity and our business could be materially and adversely affected; | |

| ● | The demand for satellite bandwidth may decrease or develop more slowly than we expect. We cannot predict with certainty the development of the international satellite bandwidth market in general or the general market acceptance for our products and services; | |

| ● | The price of satellite bandwidth may decrease or develop more slowly than we expect. | |

| ● | An extended delay in the transfer of title to Aerkomm Taiwan of the Taiwan land parcel that we purchased could delay the building of our first satellite ground station and have a negative impact on our business prospects; | |

| ● | If the transactions contemplated by several memorandums of understanding (MOU) do not proceed, our results of operations and financial condition could be materially adversely affected; | |

| ● | We will source components and products, both hardware and software as well as content, from other companies, which we then assemble or integrate into our products and service offerings from other companies, and any disruptions in their supply chains or businesses or reductions in the quality or availability of the components or products produced by such partners could hurt our business by providing us with less quality or quantity components and products and resulting in potentially less attractive offerings for customers; |

iv

Risks Relating to Our Industries

Risks and uncertainties related to our industries include, but are not limited to, the following:

| ● | In the satellite industry, satellite service operators may face delays in deploying their satellites or constellations due to technological challenges or regulatory hurdles, or may otherwise have insufficient bandwidth, which could hinder the services we offer to our customers and damage customer relations; |

| ● | In the aerospace and defense industry, government budget uncertainties, geopolitical conflicts, public perception, or ITAR issues could adversely affect industry stability and growth; and |

| ● | In the semiconductor industry, supply chain concentration, geopolitical conflicts, single-source dependency, or natural disasters could present challenges for semiconductor manufacturers’ operations and resilience. |

Risks Relating to Our Technology and Intellectual Property

Risks and uncertainties related to our technology and intellectual property include, but are not limited to, the following:

| ● | We rely on service providers for certain critical components of and services relating to our satellite connectivity network; |

| ● | Our use of open-source software could limit our ability to commercialize our technology; |

| ● | The satellites that we currently or may in the future rely on have minimum design lives, but could fail or suffer reduced capacity before then; | |

| ● | Satellites that are not yet in service may not be manufactured and successfully launched at rates adequate to meet demand; and |

| ● | The development of our proprietary glass semiconductor antenna may require licenses to intellectual property rights from third parties, including standards-based patent pools for Wi-Fi, audio-visual compression, or data transmission technologies. |

Risks Relating to Ownership of our Common Stock

Risks and uncertainties related to our common stocks include, but are not limited to, the following:

| ● | Our common stock is currently quoted on the OTC Pink Market, which may have an unfavorable impact on our stock price and liquidity; |

| ● | Our common stock is quoted on the Professional Segment of the regulated market of Euronext Paris, which may have an unfavorable impact on our stock price and liquidity; |

| ● | We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock; | |

| ● | Investors may experience immediate and substantial dilution; and | |

| ● | Our articles of incorporation, bylaws and Nevada law have anti-takeover provisions that could discourage, delay or prevent a change in control, which may cause our stock price to decline. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in Item 1A. “Risk Factors” and elsewhere in this annual report before investing in our common stocks.

v

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

| ● | “we,” “us,” “our,” or “our company,” “the Company”, or “Aerkomm” are to the combined business of Aerkomm Inc., a Nevada corporation, and its consolidated subsidiaries; |

| ● | “Aircom” are to Aircom Pacific, Inc., a California corporation and wholly owned subsidiary of our company; |

| ● | “Aerkomm HK” are to Aerkomm Hong Kong Limited, previously Aircom Pacific Inc. Limited, a Hong Kong company and wholly owned subsidiary of Aircom; |

| ● | “Aerkomm Japan” are to Aerkomm Japan Inc., previously Aircom Japan, Inc., a Japanese company and wholly owned subsidiary of Aircom; |

| ● | “Aerkomm Malta” are to Aerkomm Pacific Limited, a Malta company and wholly owned subsidiary of Aircom Seychelles; |

| ● | “Aerkomm Taiwan” are to Aerkomm Taiwan Inc., a Taiwanese company and subsidiary of our company; |

| ● | “Aerkomm SY” are to Aerkomm SY Ltd., previously Aircom Pacific Ltd., a Republic of Seychelles company and wholly owned subsidiary of Aerkomm; |

| ● | “Aircom Taiwan” are to Aircom Telecom LLC, a Taiwanese company and wholly owned subsidiary of Aircom; |

| ● | “Beijing Yatai” are to Beijing Yatai Communication Co., Ltd., a company organized under the laws of China and a wholly owned subsidiary of Aerkomm Taiwan; |

| ● | “MEPA” are to MEPA Labs Inc., a US company and wholly owned subsidiary of our company; |

| ● | “Mesh Tech” are to Mesh Technology Taiwan Limited, a Taiwanese company and wholly owned subsidiary of Mixnet Technology Limited Seychelles; |

| ● | “Mixnet” are to Mixnet Technology Limited, name changed to Mesh Technology Limited as of September 7, 2023, a Republic of Seychelles company and wholly owned subsidiary of Aerkomm Inc.; |

| ● | “SEC” refers to the U.S. Securities and Exchange Commission; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

vi

PART I

ITEM 1. BUSINESS.

Overview

We are a development stage innovative satellite communication technology company providing carrier-neutral and software-defined infrastructure to deliver mission-critical, multi-orbit satellite broadband connectivity for the public and private sectors.

We offer a range of next-generation technologies that bring high-throughput performance, interoperability and virtualization to provide high performance and resilient end-to-end broadband connectivity to our customers in collaboration with satellite or constellation partners and mobile network operators.

Our business model is asset-light and far less capital intensive than most companies operating in the space industry as we do not operate, or intend to operate, our own satellites or constellations.

Our key proprietary cutting-edge technology is a universal terminal that we develop. It provides carrier-neutral satellite broadband access. These terminals are designed to meet the diverse needs of users across various sectors, and connecting those users to the right satellite, independent of which orbit it is located in, ensuring seamless connectivity and unparalleled performance.

Our universal terminals consist of both a multi-orbit flat panel antenna (FPA), or electronically steered array (ESA), as well as a carrier-neutral, software-defined modem.

Our groundbreaking glass semiconductor ESA antenna technology enhances performance by more than 50% in terms of throughput per square inch, compared to other antenna designs and constructions. The advantages of our ESA technology mean that our universal terminals can be smaller and lighter while also consuming less power and generating less waste heat than other satellite broadband terminals, while also delivering high throughput.

Our work on custom beamformer chips, or application specific integrated circuits (ASICs), and on custom radiofrequency (RF) chipsets aims to optimize power and performance, enabling seamless connectivity across multiple orbits.

Our modem is designed with a software-defined radio (SDR) to provide secure and agile signal transmission with military-grade security features. Our work on a custom high-speed analog-to-digital (ADC) chipset aims to unlock hybrid-orbit links and to enable advanced signal intelligence capabilities.

In addition to designing and developing proprietary technologies for end-to-end solutions based around our universal terminal, we also strategically source and integrate partner technologies to create robust and reliable satellite networks that can be tailored to meet the demands of public and private sector clients.

To enable resiliency and scalability, we are also at the forefront of implementing virtualization for satellite communications through our software-defined approach, which enhances flexibility, scalability, and efficiency and allows for dynamically adapting to evolving communication needs.

By orchestrating a comprehensive system of technologies, we endeavor to revolutionize satellite communication alongside our industry partners, delivering unparalleled capabilities to empower industries and individuals worldwide.

Our technologies, combined with our current and prospective regional satellite operators licenses, enable us to be a distribution partner for our current and potential satellite operator partners’ bandwidth. We aim to identify, unlock and expand new use-cases for satellite communications, providing value both to our customers, and to enable new revenue streams for both our satellite operator partners whose bandwidth we resell and for us.

1

Merger Agreement with IXAQ

On March 29, 2024, we entered into a business combination agreement (the “Merger Agreement”) with IX Acquisition Corp., a Cayman Islands corporation (“IXAQ”) and AKOM Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of IXAQ (“Merger Sub”). Pursuant to the terms of the Merger Agreement, we and IXAQ have agreed to effect a business combination (the “Merger”), subject to satisfaction of conditions set forth in the Merger Agreement described briefly below. Additional information relating to the Merger along with the Merger Agreement can be found in our Current Report on Form 8-K filed with the SEC on April 4, 2024. The Merger Agreements contemplates that:

| ● | Before the closing the Merger, IXAQ will redomicile from being a Cayman Islands company to becoming a Delaware corporation. |

| ● | Merger Sub will merge with and into the Company, with the Company being the surviving company following the merger. |

| ● | Each issued and outstanding share of the Company common stock will automatically be converted into common stock of IXAQ at the Conversion Ratio (as defined in the Merger Agreement); and |

| ● | Outstanding Company convertible securities of the Company will be assumed by IXAQ. |

| ● | In connection with the Merger, IXAQ will be renamed “AKOM Inc.” |

Pursuant to the terms of the Merger Agreement, each share of common stock of the Company issued and outstanding immediately before the closing of the Merger (other than any such shares that were held by dissenters to the Merger exercising appraisal rights, the “Merger Shares”) will be converted into shares of Class A Common Stock of IXAQ based on a Closing Purchase Price (as defined in the Merger Agreement) for the Company of $200,000,000 (as may be adjusted under the Merger Agreement prior to the closing of the Merger) and a price of $11.50 per share of Class A Common Stock of IXAQ (thereby resulting in the holders of Merger Shares receiving 17,391,304 shares of Class A Common Stock of IXAQ assuming no adjustment from the $200,000,000 Closing Purchase Price). Further, if certain milestones are achieved in the five years following the Merger, those who held Merger Shares immediately before consummation of the Merger will be entitled to receive their pro rata share of up to an aggregate of an additional 17,391,304 shares of Class D Common Stock of IXAQ (as may be adjusted under the Merger Agreement prior to the closing of the Merger), representing an additional Incentive Purchase Price (as defined in the Merger Agreement) of $200,000,000 that is additional to the $200,000,000 Closing Purchase Price for the Company under the Merger Agreement.

In addition to closing conditions that are usual and customary for a transaction like the Merger, the Merger Agreement closing conditions include that at least $45,000,000 of investor PIPE (private investment in public entity) financing commitments (inclusive of SAFE (simple agreement for future equity) financing obtained by the Company before the closing of the Merger) are obtained for the combined company resulting from the Merger, unless waived by IXAQ. As of date of this filing, PIPE agreements for aggregate commitments of $35,000,000, at a price of $11.50 per share, have been signed with Investors.

As of the date of this Annual Report on Form 10-K, the Insiders of the Company (as defined in the Merger Agreement) have all signed Company Support Agreements in favor of the transaction.

Our Strategic Position

The Company is an innovative satellite technology company providing multi-orbit broadband connectivity solutions, based around our universal terminal. Our carrier-neutral and software-defined infrastructure enables end-to-end satellite broadband connectivity across multiple orbits, such as low-earth orbit (LEO), medium-earth orbit (MEO), geostationary-earth orbit (GEO), and highly elliptical orbit (HEO). We serve both public and private sectors, including Aerospace & Defense and Civilian Telecommunications.

We have a range of next-generation satellite technologies that offer broadband connectivity by collaborating with satellite partners and mobile network operators to link users and platforms on the edge to core infrastructure hubs. The Company has established a strong engagement with leading satellite constellation operators spanning multiple orbits, including LEO, MEO, GEO and HEO. Additionally, our technology is currently being implemented in the Aerospace & Defense market, having been tested in full-scale operational scenarios.

We are developing partnerships with both public and private sector clients that have increasing demands for multi-beam and multi-orbit satellite communications solutions. Our solutions deliver high-throughput multi-orbit connectivity in a very compact package. We can leverage these advantages in minimizing size, weight and power without compromising performance to open up new use cases and applications for satellite communications.

2

We have considerable multi-national technical expertise with executives and innovators drawn from semi-conductors, aerospace, defense, dual-use technology, telecommunications and satellite communications sectors. In the defense sector, we have been pioneering a first-of-its-kind satellite communications architecture for unmanned aerial vehicles (UAVs) engaged in intelligence, surveillance, and reconnaissance (ISR) missions with our development partner and customer.

By late 2023, our technology was tested and achieved positive results in operational environments. We anticipate starting to deliver on our first major contract in 2024. We will continue to invest in our talent, our technology and our partnerships and expect to be in a position to introduce higher volume and higher margin solutions by 2026.

Overview of our capabilities, competitive edge, markets and opportunities

Our key standout capabilities deliver differentiated solutions:

| ● | High throughput |

Our glass semiconductor antenna transmits and receives 50% Mbps more throughput per square-inch compared to previous state-of-the-art satellite broadband terminals.

| ● | Interoperability |

Our universal terminals, including our multi-orbit glass semiconductor antennas and software-defined radio (SDR) modems, aim to provide carrier-neutral broadband connectivity. These terminals are designed to meet the diverse needs of users across various sectors, delivering high-quality connectivity and performance regardless of which satellite or which orbit they are using.

| ● | Virtualization |

Our software-defined core network waveforms integrate satellites and constellations across all major orbits, as well as 5G advanced and emerging 6G non-terrestrial networks (NTN). This approach enhances flexibility, scalability, and efficiency, allowing for dynamic adaptation to evolving communication needs.

Our competitive edges are:

| ● | Our universal terminals, equipped with our glass semiconductor antennas, can provide 50% higher throughput than comparably sized devices, which gives us an advantage in the size, weight and power of our terminals. We are pioneering a breakthrough in the application of satellite communication technology by installing our universal terminals on unmanned aerial, maritime, and land vehicles for a range of our customers. Unlike traditional C-band communications, our small form factor antenna and terminal aims to deliver new capabilities and performance for unmanned operations with compelling size, weight and power. |

| ● | Our multi-orbit capability can leverage hybrid-orbit connectivity to combine potentially underutilized capacity of Geosynchronous Orbit (GSO) or Geostationary Equatorial Orbit (GEO) satellites and the lower latency services of non-geosynchronous orbit (NGSO) satellite constellations, such as Medium Earth Orbit (MEO) and Low Earth Orbit (LEO). |

| ● | Our carrier-neutral solution supports critical communications while providing flexibility, redundancy, and resiliency. It can also eliminate vendor lock-in and reduce capex investment for our customers and partners. |

| ● | Our antenna control algorithms and ability to integrate our satellite communications solutions with diverse sensors, payloads and guidance, navigation and control (GNC) systems position us to meet the needs of both civil and defense aerospace customers. |

Markets – We believe that we are at the point of monetization, poised to deliver differentiated solutions in the fast-growing market for satellite communications.

| ● | Market Growth |

According to a 2023 annual report by Boeing on the commercial aviation industry, reports by the Teal Group on the unmanned aerial vehicle (UAV) industry, and reports by NSR on the role of satellite communications for the telecommunications industry, we believe that our target segments of Aerospace & Defense and Civilian Telecommunications are projected to grow threefold, from approximately $20 billion to $60 billion by 2030. Geopolitical conflicts are driving the adoption of dual-use applications for satellite communications.

3

We believe there are a numerous opportunities to rapidly develop the Company.

| ● | Product Readiness |

We have successfully delivered solutions to our development partner and customer and are experiencing interest from additional potential customers. The Company’s technology has demonstrated positive results in both operational and lab environments.

| ● | Poised for Expansion |

We expect to execute our first major contract in 2024 and plan to invest in talent and strategic partnerships to fuel growth. Additionally, we aim to be in a position to introduce higher volume and higher margin solutions by 2026.

| ● | Top-tier Talent |

We bring together a constellation of expert talent, including semiconductor and satellite communication innovators, as well as veterans in aerospace and telecommunications commercializing dual-use technologies.

As of April 27, 2023, the Company has been awarded a regional satellite service spectrum usage permit. With this permit and our proprietary technology, we believe that we will be able to develop and expand our revenue stream from satellite services. This positions us as not only a hardware and system supplier, but also a distributor of multi-orbit satellite bandwidth \and satellite connectivity services provider, which expands the markets in which we can participate.

As a satellite service provider in Taiwan, we will be authorized to provide satellite services in the Civilian Telecommunications market, such as for mobile backhaul, and Aerospace & Defense markets, for both aviation and maritime applications. We expect these capabilities also to enable us to secure network resiliency contracts.

Outlook

The Company intends to capitalize on our numerous initiatives in the Aerospace & Defense and Civilian Telecommunications markets to establish a leading position as innovators at the forefront of the booming satellite communications industry. We are primed to capitalize on the opportunities presented by the rapidly evolving satellite communication landscape, driving innovation and delivering value to customers and stakeholders.

Our Technology and Product Overview

4

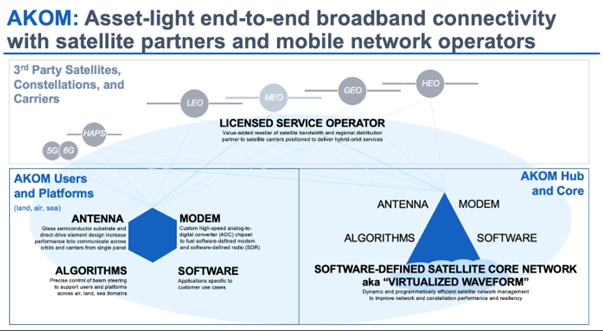

We aim to provide asset-light end-to-end broadband connectivity with satellite partners and mobile network operators, by leveraging advanced technology and partnerships to offer innovative connectivity solutions. We will remain less capital intensive than many comparable companies in the space industry as we do not operate, nor intend in the future to operate, our own satellites or constellations.

We aim to work with a variety of satellite operators across different orbits, including LEO, MEO, GEO, and HEO. We also aim to engage with MNOs on both their 5G and 6G terrestrial technology roadmaps, as well as their plans to implement localized network resiliency to their connectivity services by deploying High Altitude Platform Stations (HAPS). This combination allows for extensive coverage and flexibility in providing broadband services to users and platforms on land, in the air, and at sea.

As a distribution partner to satellite service providers, we aim to provide hybrid-orbit services, combining the strengths of various satellite constellations to optimize connectivity solutions for customers.

Our broadband connectivity solutions aim to cater to a diverse range of users and platforms, for both military and civilian applications, in order to ensure that customers across different domains can benefit from reliable and high-speed satellite connectivity.

Our software-defined satellite core network aims to enable dynamic and programmatically efficient management of satellite networks. This technology aims to improve network and constellation performance, resilience, and adaptability to changing conditions.

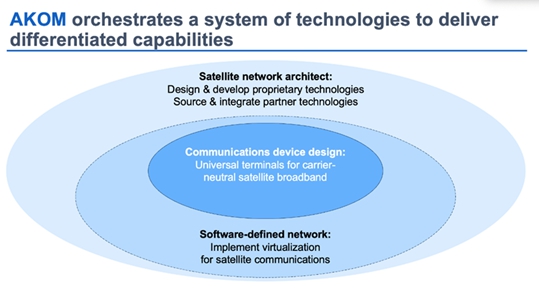

We aim to orchestrate a comprehensive system of technologies to deliver differentiated capabilities to revolutionize satellite communication and to deliver unparalleled capabilities and value both to our customers and to our partners.

5

We design comprehensive solutions for our customers that take advantage of both the proprietary technologies that we design and develop as well as the world-class technologies that we can source and integrate from partners, as outlined below:

| ● | Revolutionary Communication Device Design |

Our cutting-edge technology includes the development of universal terminals, providing carrier-neutral satellite broadband access. These terminals are designed to meet the diverse needs of users across various sectors and domains, ensuring seamless connectivity and unparalleled performance.

| ● | Next-Generation Software-Defined Non-Terrestrial Network |

We are at the forefront of implementing virtualization for satellite communications through our software-defined radios, software-defined modems and our progress towards a software-defined non-terrestrial network (NTN) that connects satellites to users and platforms across domains. This approach enhances flexibility, scalability, and efficiency, allowing for dynamic adaptation to evolving communication needs.

| ● | Innovative System Integrator |

Our expertise extends to system integration where we blend our expertise in satellite communications and satellite network architecture with our understanding of the needs of our customers and the platforms they are operating. We can strategically source partner technologies and integrate them together with our own systems to create robust and reliable satellite communications solutions tailored to meet the mission-critical demands of our current and prospective customers.

One of our key system-level advantages is built on our team’s fabless semiconductor chip and panel design and engineering expertise, which allows us to remain asset-light while also developing state-of-the-art technologies. With a focus on delivering superior connectivity, we believe our universal terminals for satellite communications are poised to set a new high bar for the industry.

6

Our universal terminals for satellite communications incorporate:

| ● | Multi-orbit flat panel antenna (FPA) |

We implement an electronically steered array (ESA) or FPA using glass semiconductor processes, which is the key enabler for our universal terminals capability to connect to satellites in multiple orbits from a single antenna aperture. By virtue of being able to link to different satellites in different orbits with the same hardware, we aim to enable more reliable, higher performance and more resilient satellite communications.

Our semiconductor glass antenna can also transmit and receive 50% more Mbps per square-inch than previous state-of-the-art satellite broadband terminals. This also enables us to optimize size, weight and power, while also delivering competitive performance and resiliency to customers using our universal terminals.

Our glass antenna can also deliver multi-beam connectivity that allows for seamless or “make-before-break” handovers between satellites, as well as multi-channel connectivity that uses difference frequency bands in both licensed and unlicensed spectrum.

| ● | Software-defined modem |

We are developing a carrier-neutral software-defined modem in order to provide carrier-neutral broadband connectivity over our software-defined radio (SDR). Our implementation of SDR technology aims to provide secure and agile signal transmission with military-grade security features.

Our implementation of software-defined modems aims to enable the flexibility, security, adaptability and efficiency our customers need by providing programmable signal processing functions that can be reconfigured to support different modulation and coding schemes, as well as the latest protocols and standards.

Our software-defined modems aim to enable flexibility, adaptability, and efficiency by providing programmable signal processing functions that can be reconfigured to support different modulation and coding schemes, as well as the latest protocols and standards. By applying a single hardware platform for multiple standards, we aim to create a unique system to be more flexible and compatible with different satellite constellation waveforms, and more easily upgraded for new waveforms via software updates.

Both end users and our satellite operator partners can benefit from deploying our universal terminals with our high efficiency antennas and software-defined modems. Customers benefit because they can use a single terminal to communicate across satellites, orbits and operators, which means they do not need to invest in dedicated terminals for each satellite, orbit or operator they wish to connect with. Furthermore, our universal terminals aim to deliver high-performance in a package that takes up less size, weight and power than other systems, end users may experience additional benefits in terms of total cost of ownership when choosing our universal terminals.

For satellite operators, the high efficiency of our glass semiconductor antenna and the software-programmability of our modem, when used by their customers—on land, in the air, or at sea—can potentially reduce the maintenance and replacement schedule of satellites and constellations, which hare huge drivers of cost and capital expenditures across the satellite industry.

7

Regional Satellite Service Operation (TW)

We made strides in licensing, securing our first satellite spectrum usage permit from the Government of Taiwan. With the approval from Taiwan’s Ministry of Digital Affairs in 2023 of our satellite operator license, we will continue to be one of the few satellite service providers to offer satellite services to customers in the region. As a result, we are in the unique position to be the only Non-Geostationary Satellite Orbit, or NGSO, service operator in the Taiwan market. We have established ties with operators in the LEO, MEO, GEO, and HEO sectors.

The receipt of our satellite service spectrum usage permit in Taiwan, also qualifies us to apply for an ITU (International Telecommunication Union) operator’s membership. As a qualified ITU member, we should be able to expand our global operations by gaining access to the global radio frequency spectrum, regulatory compliance, international coordination and cooperation, and representation in global forums.

Our Markets

In recent years, with the accelerated development of the satellite industry, particularly in significant investment in LEO and MEO development, the ecosystem has matured considerably. We aim to secure a substantial market share in both the “Ground Equipment” and “Satellite Services” sectors.

According to a 2021 report by the Satellite Industry Association, these sectors represent nearly 68% of an industry valued at $386 billion. This growing market is expected to experience significant growth over the next decade and a half, reaching a total value of approximately $1,053 billion by 2040.

With the competitive advantages of our products and solutions, we aim to leverage emerging trends and capitalize on business opportunities for growth.

8

We recognize rapid growth in the satellite technology communications market serving customers in both the public and private sector across the civilian telecommunications, aerospace and defense sectors. Our target segments of the global market are growing from approximately $20 billion in 2023 to approximately $60 billion by 2030, representing a 16% blended compound annual growth rate (CAGR), as outlined below.

Within civilian telecommunications, the key subset of the market we are targeting is anticipated to grow from $3 billion in 2023 to $25 billion by 2030. Market reports published by NSR indicate that “non-terrestrial networks” (NTN) will become a central feature of 5G Advanced and 6G networks, and that satellite connectivity needs of MNOs will evolve from a nice-to-have “back-up” in their 4G LTE networks into a must-have “back bone” of their 5G Advanced and 6G.

Within aerospace, one of the key subsets we are targeting is commercial aviation, which is anticipated to grow from $7 billion in 2023 to $21 billion by 2030. According to annual reports by Boeing and Airbus, commercial airlines plan to outfit approximately 70% of passenger aircraft for high-throughput inflight broadband by 2030 up from just approximately 25% in 2023, meaning that delivering a solution that is approved and qualified for both retrofit and “line-fit” installations will be necessary.

Within defense, one of the key subsets of the market we are targeting is UAVs for the military, which is anticipated to grow from $12 billion in 2023 to $16 billion by 2030, according to the Teal Group. According to the same reports, an even steeper growth trajectory is anticipated in the civilian UAV market, which is forecast to grow from $7 billion in 2023 to $20 billion by 2030.

We do not yet include this projected civilian UAV market in our target segments, but we aim to be in a strong position to enter the civilian UAV market in the future after first focusing on the defense UAV market. Similarly, we see future opportunities to enter the market for both manned and unmanned maritime and land-based vehicles and platforms for the defense industry, which are complementary to our focus on the defense UAV market, as they often include the same prime contractors and military customers.

Dual-use technologies expand how satellite broadband is used and is being driven by geopolitical conflict, as has been evident in Ukraine, where satellite broadband has been deployed with great effectiveness, including in combination with UAVs.

In response to growing demand from governments and militaries, prime defense contractors in US, NATO and Japan are reportedly developing unmanned systems for both intelligence, surveillance and reconnaissance missions (ISR) as well as for collaborative combat aircraft (CCA), or the teaming of manned and unmanned aircraft, the latter sometimes referred to as “loyal wingman”, and next generation air dominance (NGAD).

Our technologies are relevant and differentiated for all of these programs, as well as for additional manned and unmanned maritime and land-based platforms and vehicles.

9

Aerospace & Defense Market

In the aerospace and defense sectors, satellite communication plays a critical role in enabling various applications, including commercial aviation, in-flight connectivity (IFC), and defense ISR-type and CCA-type programs.

Commercial aviation relies on satellite communication for in-flight connectivity, enabling passengers to access high-speed internet and other services during flights. The adoption of satellite-based in-flight connectivity (IFC) solutions is expected to increase significantly in the coming years. Airlines are seeking to enhance passenger experience and differentiate their services in a competitive market.

The Fortune Business Insight report projects that approximately 70% of commercial aircraft will be equipped with high-throughput inflight broadband by 2030, up from just around 25% in 2023. This significant increase in adoption rates will necessitate both retrofitting and “line-fit” installations. As a result, the market for inflight broadband services is anticipated to grow from $7 billion to $21 billion, presenting lucrative opportunities for satellite communication providers.

In the defense sector, satellite communication supports ISR and unmanned platforms programs by providing secure and reliable communication links for unmanned aerial, maritime, and land vehicles and the vast majority of military platforms. Satellite-based communication enables real-time data transmission, command and control, and situational awareness, enhancing operational efficiency and effectiveness in defense missions.

Industry projections indicate an increase in market size from $12 billion in 2023 to $16 billion by 2030. In the Defense sector, we have been pioneering a first-of-its-kind satellite communications architecture for unmanned aerial, maritime, and land vehicles engaged in intelligence, surveillance, and reconnaissance (ISR) missions in collaboration with our development partner and the customer.

Defense

Unmanned platforms have revolutionized military operations with their versatility and agility. However, their reliance on connectivity handoffs between ground-based line-of-sight antennas, typically operating in C-band, and GEO, or GSO, satellites present several challenges that limit their effectiveness in certain scenarios.

Prime defense contractors in the US, NATO, Australia, and Japan are actively developing unmanned systems for ISR, and numerous other unmanned platforms to include CCA-type and NGAD applications. This strategic shift towards unmanned systems is expected to drive the demand for satellite communication technology, particularly for data transmission and remote-control capabilities, which can keep a “human-in-the-loop” (HITL).

10

Innovative programs such as the US Air Force’s Loyal Wingman Program, aim at enhancing collaborative combat capabilities. The program involves the deployment of 1,000 CCA with $6.2 billion budget by 2028, which we expect will require advanced satellite communication systems for real-time data sharing, over-the-horizon coordination, and mission execution. These CCA units serve as force multipliers, working in tandem with manned platforms to achieve strategic objectives and maintain battlefield superiority, but are just one example of how governments and militaries are considering how best to deploy both manned and unmanned platforms to accomplish defense objectives.

Collaborative Combat Aircraft, Concept Art (Source: Boeing Image)

Source: The Washington Post: How drones are controlled, 2014

We aim to offer unparalleled flexibility to defense unmanned platforms by enabling communication across six dimensions: domain, orbit, beam, carrier, frequency, and satellite. This innovative approach aims to allow users to establish multiple communication paths simultaneously, enhancing redundancy, resilience, and adaptability in dynamic operational environments, while also offering complementary functionality such as jamming.

We are well positioned to deliver high-value functionality that effectively balances performance with total cost of ownership. We are actively engaged in discussions with leading prime contractors to provide a differentiated satellite communications system tailored specifically for unmanned platforms across all domains to include CCA-type programs and are co-creating new concepts of employment and concepts of operation for satellite communications on these platforms.

Two high profile examples from the US Air Force include planning to spend more than $6 billion on CCA drone programs over the next five years, in addition to an estimate of $16 billion on the NGAD program over the same time period.

11

Commercial Aviation Connectivity

The February 2024 IATA (International Air Transport Association) Air Passenger Market Analysis report announced that industry- industry-wide air passenger traffic, measured in revenue passenger-kilometers (RPK), surpassed 2019 levels in February 2024, marking the first occurrence of full global recovery in both domestic and international travel segments (Chart 1).

Total RPK were 5.7% higher than February 2019 figures, while international and domestic traffic saw 0.9% and 13.7% growth over the same period, respectively. Passenger load factors in all segments were also close to pre-COVID levels, indicating the return of available seat supply and passenger demand on a global scale. Compared to the previous year, total traffic increased in 21.5%.

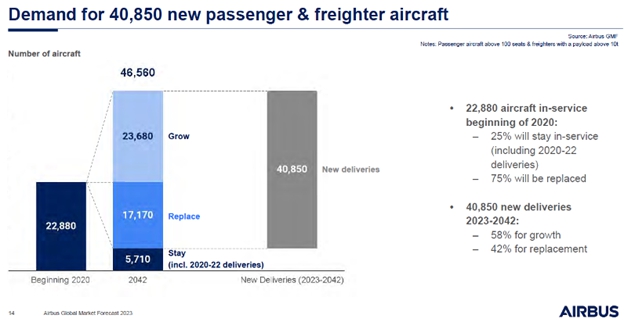

Growth of Aviation Industry

Immediately prior to the onset of the COVID-19 pandemic, there were, according to Airbus and Boeing, more than 23,000 commercial aircraft flying globally, a number that was expected to more than double in the next 20 years. Both Airbus and Boeing estimated in their respective 2023 reports that the global fleet of commercial aircraft would increase from 23,000 planes in 2019 to more than 46,000 in 2042.

The Airbus Global Market Forecast report 2023 – 2042 predicted the following:

Source:https://www.airbus.com/en/products-services/commercial-aircraft/market/global-market-forecast

| ● | Passenger traffic compound annual growth rate of 3.6% and freight traffic compound annual growth rate of 3.2%. |

| ● | Airbus forecasts a demand for 40,850 new passenger and freighter aircraft deliveries over the next 20 years, of which 32,630 will be single aisle and 8,220 widebody. |

12

| ● | Asia-Pacific, China, Europe and US continue to be major drivers for growth and replacement. |

Boeing, in their Commercial Market Outlook 2023-2042 Report, presents an excellent Executive Summary of the 20-Year Market Demand.

Source: https://www.boeing.com/commercial/market/commercial-market-outlook

13

Growth of Private Aircraft (Business Jets / VIP)

In 2022, Airbus Corporate Jets (ACJ) conducted a survey among senior executives of U.S. businesses with an annual revenue of over $500 million. The study showed that 89% of those surveyed expected their organizations to increase their use of business jet aviation in 2023, with 25% predicting it would increase by more than half. Such customers can be expected to consider inflight connectivity to be essential.

Rapidly Growing In-Flight Internet Markets

The International Air Transport Association (IATA) expects overall traveler numbers to reach 4.0 billion in 2024 spread across 23,000 airplanes. Only about 25% of these airplanes are equipped to offer some form of onboard connectivity, and that connectively is often marked by erratic quality, slow speeds and low broadband. Less than 25% of the world’s airline companies are providing some form of in-flight Wi-Fi services. We believe that there is a huge market potential among the many unconnected airlines.

According to the Boeing Report titled “Commercial Market Outlook 2019 – 2038”, it has been projected that by the end of 2030, two-thirds of the world’s aircraft fleet will have some form of connectivity, whether through retrofit or line fit at production stage. Currently, most connectivity upgrades are being done through aircraft modification as in-service aircraft are outfitted with new and high-speed systems. It is estimated that more than 1,000 commercial aircraft are being upgraded annually.

Whether aircraft connectivity is being carried out as a retrofit or built into the initial aircraft production line, demand for in-flight connectivity is increasing.

14

Civilian Telecommunications

In the 5G Advanced era and during the transition to 6G as defined by the 3GPP (3rd Generation Partnership Project), the Non-Territorial Network (NTN) plays a major role in communication standards. This includes utilizing satellites across all orbits (LEO, MEO, GEO, HEO) and HAPS to extend coverage to areas currently not served by mobile communication systems, such as the sky, sea, and space.

Since the outbreak of the Russia-Ukraine war in 2022, which has showcased the importance of communications networks as critical infrastructure for modern nations, the global landscape has been marked by geopolitical pressures.

The resilience of communication networks has emerged as a focal point of global attention with satellite communication assuming a critical and pivotal role.

We are prioritizing civilian telecommunications within the satellite communication industry, alongside Aerospace & Defense. This focus encompasses two key sectors: mobile backhaul via satellite and network resilience.

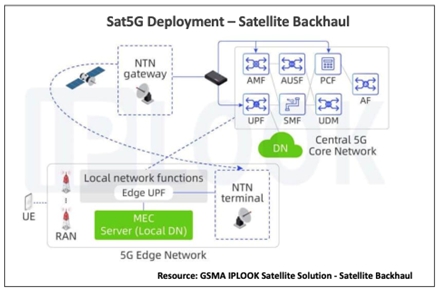

Mobile Backhaul via Satellite

The mobile backhaul sector is projected to see revenue growth from $3 billion in 2023 to $25 billion by 2030, with a compound annual growth rate (CAGR) of 17.6% (Source: NSR “Wireless Backhaul via Satellite, 15th Edition Report). The number of 4G base stations is approximately 6 million to 7 million, while that of 5G is 3.8 million (Sources: GSMA, Huawei). Similarly, the network resilience sector is forecasted to experience revenue growth from $16.2 billion in 2023 to $33 billion by 2028 (Source: Mordor Intelligence: Network Resilience Market Forecast).

These market statistics clearly signal potential business opportunities that the Company aims to actively pursue.

In telecommunications networks, the backhaul network provides high-capacity connections between cell sites and the core network, utilizing fiber optic cables, microwave links, and satellites. Satellite transmission is predominantly employed for mobile backhaul not only in remote areas but also in major backbones and serves as a crucial technology.

15

Satellite backhaul offers an alternative method for connecting cell sites and the core network. Despite being traditionally considered a last resort by mobile operators due to past experiences, recent advancements in satellite technologies, combined with professional services, have addressed these concerns. Today, cost-effective, and high-performing fully managed satellite backhaul solutions are readily available. These solutions empower mobile operators to swiftly deploy 4G, 5G, 5G advanced or Internet of Things (IoT) services in any location. Apart from rural deployments, mobile backhaul via satellite also serves as a backup and backbone solution in the event of outages on fiber or microwave backhauled networks.

At present, MNOs are transitioning their perception of satellite connectivity needs, moving from considering it a supplementary backup to an essential backbone, particularly as non-terrestrial networks (NTN) become integrated into 5G Advanced and 6G systems. Amidst this shift, our products and solutions are well-aligned with and fulfill the evolving market demands.

Currently, MNOs are contending with the challenges posed by oversized and costly antennas. We address this issue with our glass semiconductor flat panel antennas, featuring small form factors and high throughput capabilities. These high throughput antennas are well-suited for managing large volumes of data transmission in mobile backhaul and mobile backbone applications while also facilitating compact installation on cell sites, effectively resolving this prevalent telecommunications industry challenge.

16

NTT DoCoMo’s document on “Research and Development for 6G Wireless” emphasizes the pivotal role of satellites in the research and development of 6G. This strategic emphasis on satellite technology as a solution has been integrated into their practical technical plan and investment strategy.

Source Link: https://www.docomo.ne.jp/27nglish/binary/pdf/info/media_center/event/mwc24/Research_and_Development_for_6G_Wireless.pdf

We are engaged in close collaboration with strategic partners, including global telecommunications service operators, telecommunications equipment manufacturers, and solution providers.

We are poised to actively pursue business opportunities within the 5G and 6G ecosystem, creating a promising future and generating solid revenue income.

17

Network Resilience

Network resilience is becoming increasingly crucial due to several interconnected factors. The growing dependence on digital services and interconnected systems amplifies the impact of network outages and disruptions, making them more costly and disruptive. Moreover, the escalation of cyberattacks, natural disasters, geographical conflicts, and infrastructure failures underscores the significance of resilient networks capable of enduring a variety of challenges. As the world moves towards 5G, 6G, and beyond, with a focus on low latency and high reliability, network resilience emerges as an essential design principle to ensure uninterrupted connectivity in the face of evolving threats and increased network reliance.

Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are crucial technologies that provide dynamic and flexible solutions for network management. SDN centralizes control of network traffic, enabling swift rerouting and resource allocation during disruptions. Similarly, NFV enables virtualized network functions, allowing for rapid deployment and scaling of resources to meet evolving demands or emergencies. The integration of these technologies strengthens network resilience and adaptability, ensuring smooth operations even in challenging scenarios.

The integration of diverse technologies plays a crucial role in enhancing network robustness and resilience. By combining various technologies such as fiber optics, satellites, and microwave links for backhaul, a more resilient network infrastructure can be established. Moreover, leveraging edge computing to process data locally reduces reliance on centralized infrastructure, thereby further strengthening network resilience. This strategic integration of diverse technologies ensures a more flexible and adaptable network architecture capable of withstanding various challenges and disruptions.

Major countries and governments worldwide are increasingly prioritizing network resilience. These entities are allocating significant budgets and making efforts to enhance national network infrastructure to address challenges and prevent disruptions in communication services. This emphasis extends to leveraging satellite technology and service providers, including LEO and MEO solutions.

18

Our Strategy

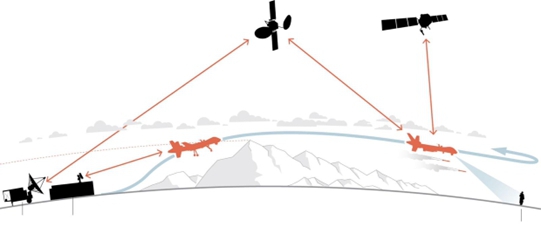

Spotlight: Utilizing Our Universal Terminal for Satellite Communications on Unmanned Platforms

We are pioneering a breakthrough in the application of satellite communication technology by installing our universal terminals on unmanned aerial, maritime, and land vehicles. Unlike traditional C-band communications, our small form factor antenna and terminal aims to deliver new capabilities and performance for unmanned operations with compelling size, weight and power.

Today: Challenges of Current UAV Connectivity with GEO Satellites

While unmanned platforms have revolutionized military operations with their versatility and agility, their reliance on connectivity handoffs between ground-based line-of-sight antennas, typically operating in C-band, and Geostationary Equatorial Orbit (GEO), or geosynchronous orbit (GSO), satellites present several challenges that limit their effectiveness in certain scenarios.

| - | Line-of-Sight Limitations: One of the key reasons that satellite communications have been a critical addition to connectivity over the last two decades is to eliminate the reliance on line-of-sight (LOS) communications, not just for take-off and landing, but also for the full mission autonomy. For unmanned platforms without satellite communications, operations are restricted to areas where direct visibility to the base is maintained, limiting their flexibility and operational range as well as their operational altitude. For example, as the UAV flies further away from the base, even if it can maintain a line-of-sight communication link with the base, due to the curvature of the Earth, the UAV will gradually fly at a higher and higher altitude, resulting in limited operational capability, especially for intelligence, surveillance and reconnaissance (ISR) missions where the UAV may need to fly close to the ground for its cameras and sensors to provide intelligence with sufficient resolution to be informative, usable or actionable. For land or maritime platforms, the issue is compounded because the platform is by nature on the surface of the land or sea, and has to overcome unanticipated movement due to the sea or restrictions from overhead canopies or LOS limitations caused by terrain features. |

19

| - | High-Latency Limitations: One of the weaknesses of unmanned platform connectivity over GEO/GSO satellites is the significant latency, estimated at approximately 600 milliseconds, which is too long for example to remotely control a UAV during critical mission phases, such as take-off and landing, evasive maneuvers and, in some cases, very low altitude flight. Although certain unmanned platforms include software features for automatic take-off and automatic landing, most unmanned platforms still rely on line-of-sight antennas for takeoff and landing operations, which pose additional vulnerabilities related to dependency on the ground infrastructure, noted below. The high-latency of the link over GEO/GSO satellites delivers senor data and camera data with approximately a half second of delay, which similarly delays responsiveness to rapidly unfolding situations in the field. In critical moments, such a delay can lead to a loss of the mission or a failure of mission objectives. |

| - | Dependency on Ground Infrastructure and Ground Crew: The persistent dependency on line-of-sight antennas can require significant numbers of forward-deployed personnel to handle the take-off and landing operations on site, and this can place more personnel in the literal line of fire. Similarly, if the line-of-sight antennas are damaged, destroyed or jammed, all unmanned platforms airborne at that time that require line-of-sight communications to land are likely to be lost. This introduces a single-point-of-failure on the ground infrastructure making the UAV base a high-value target, which puts the ground crew personnel at high risk. |

| - | Vulnerability to Jamming: In scenarios where the gateway station communicating to the GEO/GSO satellite is disrupted by on-orbit jammers or the GEO/GSO satellite itself is disabled by terrestrial jammers, the unmanned platform may lose its communication link and be rendered unable to perform its mission effectively. Because a GEO/GSO satellite is geo-stationary by design, it becomes a relatively easy target for terrestrial jamming. This dependency on GEO/GSO satellites introduces multiple single points-of-failure and compromises the reliability and resilience of unmanned platform operations. |

| - | Mission Disruption: The loss of communication link between the unmanned platform and the GEO/GSO satellite not only halts ongoing missions but also jeopardizes the safety and security of the platform and its payload. Without real-time communication capabilities, the platform may be unable to receive commands or transmit critical data leading to mission failure and potential loss of assets. |

While unmanned platforms have brough compelling capabilities to militaries and governments over the last two decades, in the last two years with the conflict involving Ukraine, the urgent need for the capabilities of unmanned platforms to continue to evolve has become evident.

Aerkomm’s Solution: “Multi-Path ^6” (domain, orbit, beam, carrier, frequency, satellite)

20

We aim to offer unparalleled flexibility to defense unmanned platforms by enabling communication across six dimensions: domain, orbit, beam, carrier, frequency, and satellite. This innovative approach aims to allow users to establish multiple communication paths simultaneously, enhancing redundancy, resilience, and adaptability in dynamic operational environments, while also offering complementary functionality such as jamming.

| - | Enhanced Connectivity: Our universal terminal for defense aim to enable unmanned platforms to establish communication links with non-geosynchronous satellite constellations (NGSO), such as those operating in LEO or MEO, which are less susceptible to jamming due to their proliferation in the sky. We aim to use this groundbreaking feature to allow for remote control of seamless takeoff and landing operations of UAVs over NGSO satellites, which have significantly lower latency than GEO/GSO satellites, thus eliminating the limitations imposed by traditional line-of-sight communication methods, overcoming the high latency issues of GEO/GSO satellites and reducing the need for forward deployed staff. |

| - | Resilient Communication: In the face of adversary actions such as satellite jamming, our technology aims to ensure mission continuity and resilience through multi-beam and multi-orbit connectivity. By connecting to different friendly satellites simultaneously, our antennas aim to provide redundancy and alternate communication paths, enabling unmanned platforms to maintain operational effectiveness even in challenging environments. |

| - | Mission Continuity: With our universal terminal for defense onboard, unmanned platforms could seamlessly transition between different satellite orbits, such as GEO, MEO and LEO, or between different satellites in the same orbit or constellation, in the event of satellite jamming or disruption. This design aims to ensure uninterrupted mission execution and real-time data transmission, enhancing situational awareness and operational flexibility. |

| - | Secure Communication: Leveraging advanced features such as Low Probability of Intercept (LPI) and Low Probability of Detection (LPD), our multi-beam antennas aim to keep unmanned platforms and other manned platforms such as, ships, airplanes, and ground command centers securely connected. Our approach aims to ensure that critical communications remain confidential and protected from hostile interference, enhancing overall mission security and effectiveness. |

| - | Jamming Capabilities: As an additional feature, we aim to enable one or more of the multiple beams of our universal terminal for defense to be used in a jamming mode to disrupt adversary communications or operations. Due to the high transmit power capability that we aim to deliver with our multi-orbit system design, our antennas aim to provide sufficient signal strength to disrupt or impair adversary communications and operations across domains: satellites in all orbits and airborne, maritime and land-based manned and unmanned platforms. For example, our approach aims to make our antennas capable to disrupt the guidance navigation and control systems of adversary manned and unmanned platforms, potentially providing a nimble and cost-effective approach to handling inbound ballistic and drone-based projectiles to complement traditional missile defense systems in the future. |

Our universal terminal for defense aims to drive a paradigm shift in unmanned platform satellite communication, offering unparalleled connectivity, resilience, and security for mission-critical operations. With our innovative solution, unmanned platform operators can confidently navigate complex operational environments, ensuring continuous communication and mission success.

With our extensive experience in satellite communication technology, we are uniquely positioned to serve as a systems integrator for defense payloads. By leveraging our hardware and software platforms, we have the capability to seamlessly integrate onboard sensor payloads and other mission-specific equipment, ensuring interoperability, compatibility, and performance optimization in complex operational environments.

21

Our Solutions and Business Models

Defense & Aerospace

Our Defense Connectivity Solutions

Our universal terminal for defense aims to drive a paradigm shift in unmanned platform satellite communication, offering unparalleled connectivity, resilience, and security for mission-critical operations. With our innovative solution, unmanned platform operators can confidently navigate complex operational environments, ensuring continuous communication and mission success.