UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended:

For the transition period from ____________ to _____________

Commission

File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As

of June 30, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market

value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported

on The OTCQB Market) was approximately $

There were a total of

DOCUMENTS INCORPORATED BY REFERENCE

None.

Aerkomm Inc.

Annual Report on Form 10-K

Year Ended December 31, 2020

TABLE OF CONTENTS

i

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following:

| ● | our future financial and operating results; |

| ● | our intentions, expectations and beliefs regarding anticipated growth, market penetration and trends in our business; |

| ● | our ability to attract and retain customers; |

| ● | our dependence on growth in our customers’ businesses; |

| ● | the effects of changing customer needs in our market; |

| ● | the impact and effects of the global outbreak of the coronavirus (COVID-19) pandemic, and other potential pandemics or contagious diseases or fear of such outbreaks, on the global airline and tourist industries, especially in the Asia Pacific region; |

| ● | the impact and effects of the conflict between Russia and Ukraine; |

| ● | the effects of market conditions on our stock price and operating results; |

| ● | our ability to maintain our competitive advantages against competitors in our industry; |

| ● | our ability to timely and effectively adapt our existing technology and have our technology solutions gain market acceptance; |

| ● | our ability to introduce new offerings and bring them to market in a timely manner; |

| ● | our ability to maintain, protect and enhance our intellectual property; |

| ● | the effects of increased competition in our market and our ability to compete effectively; |

| ● | our plans to use the proceeds from our completed public offering; |

| ● | our expectations concerning relationship with customers and other third parties; |

| ● | the attraction and retention of qualified employees and key personnel; |

| ● | future acquisitions of our investments in complementary companies or technologies; and |

| ● | our ability to comply with evolving legal standards and regulations. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Item 1A. Risk Factors” and elsewhere in this report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this annual report may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this report and the documents that we reference in this report and have filed with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

ii

This report includes market and industry data that has been obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s knowledge of such industries has been developed through its experience and participation in these industries. While our management believes the third-party sources referred to in this annual report are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this report or ascertained the underlying economic assumptions relied upon by such sources. Internally prepared and third-party market forecasts, in particular, are estimates only and may be inaccurate, especially over long periods of time. Furthermore, references in this report to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this report.

Summary of Risk Factors

Our annual report should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

Risks Related to Our Business

Risks and uncertainties related to our business include, but are not limited to, the following:

| ● | Excluding non-recurring revenues in 2021 and the second quarter of 2019 from affiliates, we have incurred operating losses in every quarter since we launched our business and may continue to incur quarterly operating losses, which could negatively affect the value of our company; | |

| ● | An extended delay in the transfer of title to us of the Taiwan land parcel that we recently purchased could delay the building of our first satellite ground station and have a negative impact on our business prospects; | |

| ● | If the transactions contemplated by several memorandums of understanding (MOU) do not proceed, our results of operations and financial condition could be materially adversely affected; | |

| ● | We may not be able to grow our business with our current airline partner or successfully negotiate agreements with airlines to which we do not currently provide our service; | |

| ● | We may experience network capacity constraints in our future operation regions and we expect capacity demands to increase, and we may in the future experience capacity constraints internationally. If we are unable to successfully implement planned or future technology enhancements to increase our network capacity, or our airline partners do not agree to such enhancements, our ability to acquire and maintain sufficient network capacity and our business could be materially and adversely affected; | |

| ● | We may not be successful in our efforts to develop and monetize new products and services that are currently in development, including our operations-oriented IFEC communications services; | |

| ● | The demand for in-flight broadband internet access service may decrease or develop more slowly than we expect. We cannot predict with certainty the development of the U.S. or international in-flight broadband internet access market or the market acceptance for our products and services; | |

| ● | Our possession and use of personal information and the use of credit cards by our customers present risks and expenses that could harm our business. Unauthorized disclosure or manipulation of such data, whether through breach of our network security or otherwise, could expose us to costly litigation and damage our reputation; | |

| ● | We will source our content from studios, distributors and other content providers, and any reduction in the volume of content produced by such content providers could hurt our business by providing us with less quality content to choose from and resulting in potentially less attractive offerings for passengers; and | |

| ● | We are a holding company with no operations of our own, and we depend on our subsidiaries for cash. |

iii

Risks Relating to Our Industry

Risks and uncertainties related to our industry include, but are not limited to, the following:

| ● | Air traffic congestion at airports, air traffic control inefficiencies, weather conditions, such as hurricanes or blizzards, increased security measures, new travel-related taxes, the outbreak of disease or any other similar event could harm the airline industry; and |

| ● | The COVID-19 pandemic may result in a long-term contraction in the global airline industry, the bulk of which likely would be borne by carriers in the Asia-Pacific region. As a development stage IFEC service provider with an emphasis on Asia Pacific, the continuation of the coronavirus pandemic may have a material adverse effect on our business, results of operation, financial condition and stock price. |

Risks Relating to Our Technology and Intellectual Property

Risks and uncertainties related to our technology and intellectual property include, but are not limited to, the following:

| ● | We rely on service providers for certain critical components of and services relating to our satellite connectivity network; |

| ● | Our use of open-source software could limit our ability to commercialize our technology; |

| ● | The satellites that we currently rely on or may rely on in the future have minimum design lives, but could fail or suffer reduced capacity before then; and |

| ● | Satellites that are not yet in service are subject to construction and launch related risks. |

Risks Relating to Ownership of our Common Stock

Risks and uncertainties related to our common stocks include, but are not limited to, the following:

| ● | Our common stock is quoted on the OTCQX Best Market, which may have an unfavorable impact on our stock price and liquidity; |

| ● | Our common stock is quoted on the Professional Segment of the regulated market of Euronext Paris, which may have an unfavorable impact on our stock price and liquidity; |

| ● | We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock; | |

| ● | Investors may experience immediate and substantial dilution; and | |

| ● | Our articles of incorporation, bylaws and Nevada law have anti-takeover provisions that could discourage, delay or prevent a change in control, which may cause our stock price to decline. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in Item 1A. “Risk Factors” and elsewhere in this annual report before investing in our common stocks.

iv

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

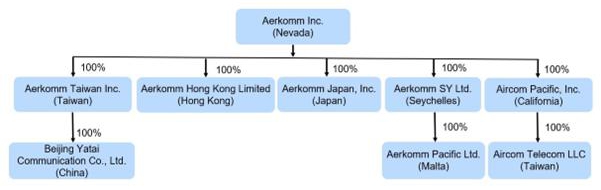

| ● | “we,” “us,” “our,” or “our company,” are to the combined business of Aerkomm Inc., a Nevada corporation, and its consolidated subsidiaries; |

| ● | “Aircom” are to Aircom Pacific, Inc., a California corporation and wholly owned subsidiary of our company; |

| ● | “Aerkomm HK” are to Aerkomm Hong Kong Limited, previously Aircom Pacific Inc. Limited, a Hong Kong company and wholly owned subsidiary of Aircom; |

| ● | “Aerkomm Japan” are to Aerkomm Japan Inc., previously Aircom Japan, Inc., a Japanese company and wholly owned subsidiary of Aircom; |

| ● | “Aerkomm Malta” are to Aerkomm Pacific Limited, a Malta company and wholly owned subsidiary of Aircom Seychelles; |

| ● | “Aerkomm Taiwan” are to Aerkomm Taiwan Inc., a Taiwanese company and wholly owned subsidiary of our company; |

| ● | “Aerkomm SY” are to Aerkomm SY Ltd., previously Aircom Pacific Ltd., a Republic of Seychelles company and wholly owned subsidiary of Aerkomm; |

| ● | “Aircom Taiwan” are to Aircom Telecom LLC, a Taiwanese company and wholly owned subsidiary of Aircom; |

| ● | “Beijing Yatai” are to Beijing Yatai Communication Co., Ltd., a company organized under the laws of China and a wholly owned subsidiary of Aerkomm Taiwan; |

| ● | “SEC” refers to the U.S. Securities and Exchange Commission; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

v

PART I

| ITEM 1. | BUSINESS. |

Overview

With advanced technologies and a unique business model, we, as a development stage service provider of IFEC solutions, intend to provide airline passengers with a broadband in-flight experience that encompasses a wide range of service options. Such options include Wi-Fi, cellular, movies, gaming, live TV, and music. We plan to offer these core services, which we are currently still developing, through both built-in in-flight entertainment systems, such as a seat-back display, as well as on passengers’ own personal devices. We also expect to provide content management services and e-commerce solutions related to our IFEC solutions.

We plan to partner with airlines and offer airline passengers free IFEC services. We expect to generate revenue through advertising and in-flight transactions. We believe that this is an innovative approach that differentiates us from existing market players.

To complement and facilitate our planned IFEC service offerings, we intend to build satellite ground stations and related data centers within the geographic regions where we expect to be providing IFEC airline services.

Additionally, we have developed and begun to market two internet connectivity systems, one for hotels primarily located in remote regions and the other for maritime use. Both systems operate through a Ku/Ku high throughput satellite, or HTS. We also expect to develop a remote connectivity system that will be applicable to the highspeed rail industry.

Recent Developments

Changes in Company’s Certifying Accountant

Former Independent Registered Public Accounting Firm

On January 27, 2022, Chen & Fan Accountancy Corporation (“Chen & Fan”) resigned as the independent accounting firm of Aerkomm Inc. (the “Company”), effective as of January 27, 2022.

The audit reports of Chen & Fan on the Company’s financial statements as of and for the fiscal years ended December 31, 2020 and 2019 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s two most recent fiscal years ended December 31, 2020 and 2019, and for the subsequent interim period through September 30, 2021, the Company had no “disagreements” (as described in Item 304(a)(1)(iv) of Regulation S-K) with Chen & Fan on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Chen & Fan, would have caused it to make reference in connection with its opinion to the subject matter of the disagreements.

During the Company’s two most recent fiscal years ended December 31, 2020 and 2019, and for the subsequent interim period through September 30, 2021, there was no “reportable event,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K and the instructions related thereto.

New Independent Registered Public Accounting Firm

On January 27, 2022, the Audit Committee and the Board of Directors of the Company appointed Friedman LLP (“Friedman”) as its new independent registered public accounting firm. Friedman was subsequently dismissed on May 19, 2022, and on May 19, 2022, the Audit Committee and the Board of Directors of the Company appointed WWC, P.C. (“WWC”) as its new independent registered public accounting firm to audit and review the Company’s financial statements, effective May 20, 2022.

During the Company’s two most recent fiscal years ended December 31, 2020 and 2019, and for the subsequent interim period through the date hereof prior to the engagement of WWC, neither the Company nor anyone on its behalf consulted WWC regarding (i) the application of accounting principles to a specified transaction, either completed or proposed; or on the type of audit opinion that might be rendered on the consolidated financial statements of the Company, and neither a written report nor oral advice was provided to the Company that WWC concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement as defined in Item 304(a)(1)(iv) of Regulation S-K or a reportable event as described in Item 304(a)(1)(v) of Regulation S-K.

Aircom Pacific Ltd. (Seychelles)

On November 8, 2021, our Company completed the transfer of ownership of Aircom Pacific Ltd. to Aerkomm from Aircom and the name was also changed to Aerkomm SY Ltd.

1

Aircom Pacific Inc. Limited (Hong Kong)

On November 8, 2021, our Company completed the transfer of ownership of Aircom Pacific Inc. Limited to Aerkomm from Aircom and the name was also changed to Aerkomm Hong Kong Limited.

Aircom Japan, Inc. (Japan)

On November 9, 2021, our Company completed the transfer of ownership of Aircom Japan, Inc. to Aerkomm from Aircom and the name was also changed to Aerkomm Japan, Inc.

Aerkomm Trademark

On December 1, 2020, the United States Patent and Trademark Office (the “USPTO”) issued a Final Office Action relating to Aerkomm Inc. indicating that our US trademark application (Serial No. 88464588) for the name “AERKOMM,” which was originally filed with the USPTO on June 7, 2019, was being rejected because of a likelihood of confusion with a similarly sounding name trademarked at, and in use from, an earlier date. We successfully appealed this USPTO action and the USPTO issued a trademark registration for the service mark AERKOMM under Trademark Class 38 (telecommunications) on November 2, 2021 and Trademark Class 41 (entertainment services) on November 23, 2021.

Aircom Telecom obtains Telecom License from the National Communications Commission of Taiwan

On May 25, 2021, Aircom Telecom was awarded a telecom license from the National Communications Commission of Taiwan. This is significant achievement for Aerkomm as it is a prerequisite for our future planned entry into the Asia/Pacific rim satellite market.

Vietjet Service Agreement

On October 25, 2021, we signed an agreement with Vietjet Air (“Vietjet”) to provide them with our Aerkomm AirCinema In-Flight Entertainment and Connectivity (“IFEC”) solutions.

Under the terms of the agreement, we will provide to Vietjet our Aerkomm AirCinema Cube IFEC system for installation on Vietjet’s fleet of Airbus A320, A321 and Airbus A330-300 aircraft.

Our AirCinema Cube system, will provide Vietjet with connectivity to passengers’ personal electronic devices with WiFi capability, including laptops, mobile phones and tablets, using an intranet-based solution. The AirCinema Cube system will host music, documentaries and movies provided by Google Play Movies and Television, as well as news feeds, both in the English and Vietnamese languages, provided by global and local news suppliers. The AirCinema Cube will also be customized to Vietjet’s branding, will host an in-flight moving map, an in-flight sales platform and a cabin management system together with Vietjet’s own in-flight services.

Joint Venture Agreement

On January 10, 2022, we entered into a joint venture (the “Joint Venture”) agreement (the “Agreement”) with Sakai Display Products Corporation, a company incorporated under the laws of Japan (“SDPJ”), and PanelSemi Corporation, a company incorporated under the laws of Taiwan (“PanelSemi”). We did not have any relationship with SDPJ or PanelSemi prior to entering into the Agreement.

Through this Joint Venture, we will develop and commercialize a tile antenna (“Tile Antenna”). The Joint Venture will be operated through Mepa Labs Inc., a newly formed California corporation (“MLI”), which will be owned initially 100% by SDPJ. We will license to MLI our intellectual property, know-how and research and development results related to the Tile Antenna. SDPJ will provide MLI with working capital to develop the Tile Antenna proof of concept (“POC”). Upon approval of the POC by an initial customer or a laboratory each approved by SDPJ, we will contribute the intellectual property to MLI in exchange for 52% of the equity interest in Newco, and SDPJ and PanelSemi collectively will contribute $20 million in cash (less the contributions funded prior to the POC approval). SDPJ will hold 45% of Newco’s equity interest and PanelSemi will hold the remaining 3%.

Moreover, according to the Agreement, SDPJ will invest €7.5 million in Aerkomm via private placement subject to and upon approval of the POC.

In the event that the POC is not approved within 11 months following the signing of the Agreement, the Joint Venture will be terminated, at which time we will terminate the intellectual property license to Newco and Newco will remain 100% owned by SDPJ.

Effective October 1, 2021, we entered into a finder’s agreement with a Seychelles based company that introduced us to SDPJ. In accordance with the terms of this finder’s agreement and as the fee for the introduction to SDPJ, we have agreed to issue to the finder warrants to purchase a number of shares of our common stock equal to 10% of the gross proceeds of capital contributed to the Joint Venture by SDPJ and its related parties.

2

Aerkomm chairs MIH Consortium “Next Generation Communication” Interest Group

In February 2022, Aerkomm was appointed as the chair of the “Next Generation Communication” interest group of the MIH Consortium. This MIH group was formed to begin an industry discussion on the standardization of 6G satellite communication protocols.

The MIH Consortium of Taipei operates the MIH Open EV Alliance and was formed with the objective of creating an open EV ecosystem to promote collaboration in the mobility industry. MIH’s goal is to bring strategic partners together to build the next generation of EV, autonomous driving, and mobility service applications.

Our Corporate History and Structure

Aircom was incorporated in the State of California on September 29, 2014. On December 28, 2016, Aircom purchased 140,000 shares, or approximately 86.3%, of the outstanding common stock of the public company then known as Maple Tree Kids, Inc. (“MTKI”) for the purpose of engaging in a reverse acquisition with MTKI. MTKI was incorporated on August 14, 2013 in the State of Nevada. On January 10, 2017, in anticipation of the reverse acquisition and Aircom’s new business, MKTI changed its name to Aerkomm Inc. On February 13, 2017, Aircom and its shareholders entered into a share exchange agreement with Aerkomm pursuant to which Aerkomm acquired 100% of the issued and outstanding capital stock of Aircom in exchange for approximately 99.7% of the issued and outstanding capital stock of Aerkomm (or 87.8% on a fully-diluted basis). As a result of the share exchange, Aircom became a wholly-owned subsidiary of Aerkomm, and the former shareholders of Aircom became the holders of approximately 99.7% of Aerkomm’s issued and outstanding capital stock.

Aerkomm SY was formed under the laws of Seychelles on December 15, 2009 as Gulach Ltd. and changed its name to Aircom Pacific Ltd. on August 19, 2014 and to Aerkomm SY Ltd. on November 8, 2021. Aerkomm SY was acquired by Aircom on December 31, 2014 and the ownership was transferred to Aerkomm on November 8, 2021 to facilitate Aerkomm’s global corporate structure for both business operations and tax planning. Presently, Aerkomm SY has no operations. Aerkomm is working with corporate and tax advisers in optimizing its global corporate structure and has not yet concluded a revised plan of organization.

On October 17, 2016, Aircom acquired Aerkomm HK. Aerkomm HK is a Hong Kong limited company formed on October 3, 2008 as Yanwei Information Technology Limited. Aerkomm HK changed its name to Dadny Inc Limited on September 6, 2011 and changed its name again to Aircom Pacific Inc. Limited on July 22, 2015 and again to Aerkomm Hong Kong Limited on November 8, 2021. On November 8, 2021, the ownership of Aerkomm HK was transferred from Aircom to Aerkomm. Aerkomm HK is in charge of all of Aircom’s business and operations in Hong Kong and China. Presently, Aerkomm HK’s primary function is business development, both with respect to airlines as well as content providers and advertising partners based in Hong Kong and China. It is also actively seeking strategic partnerships in those areas, through which Aerkomm may leverage its product offerings to provide enhanced services to prospective customers. Aerkomm also plans to provide local support to Hong Kong-based airlines via Aerkomm HK and Aerkomm HK owned teleports located in Hong Kong.

On December 15, 2016, Aircom acquired Aerkomm Japan. Aerkomm Japan was formed under the laws of Japan on August 29, 2011 as Dadny (Japan) Inc. and changed its name to Aircom Japan, Inc. on July 1, 2016 and changed its name again to Aerkomm Japan, Inc. on November 8, 2021. The ownership of Aerkomm Japan was transferred from Aircom to Aerkomm on November 8, 2021. Aerkomm Japan is responsible for Aerkomm’s business development efforts and general operations located within Japan.

Aircom Taiwan, which became a wholly owned subsidiary of Aircom in December 2017, was organized under the laws of Taiwan on June 29, 2016. During 2017, prior to Aircom Taiwan becoming a wholly owned subsidiary of Aircom, Aircom advanced a total of $460,000 (the “Prepayment”) to Aircom Taiwan for working capital as part of a planned $1,500,000 aggregate equity investment (the “Equity Investment”) in Aircom Taiwan. Aircom Taiwan at that time acted as Aircom’s agent in Taiwan. Before Aircom Taiwan was allowed to issue equity to Aircom, because Aircom was a foreign investor, the Equity Investment had to be approved by the Investment Review Committee of the Ministry of Economic affairs of Taiwan (the “Committee”). Aircom entered into an Equity Pre-Subscription Agreement with Aircom Taiwan dated as of August 13, 2017, to memorialize the terms of the Equity Investment. On December 19, 2017, the Committee approved Aircom’s initial Equity Investment (valued as of that date at NT$15,150,000, or approximately US$500,000) and the purchase of the Aircom Taiwan’s founding owner’s total equity of NT$100,000 (approximately US$3,350). As a result of the approval of the Equity Investment, Aircom Taiwan became a 100% wholly owned subsidiary of Aircom.

3

On June 13, 2018, Aerkomm established Aerkomm Taiwan Inc. as a new wholly owned subsidiary under the laws of Taiwan. Aerkomm Taiwan Inc. is responsible for Aircom’s business development efforts and general operations within Taiwan. We are currently planning to locate the site of our first ground station in Taiwan and we expect that if we raise sufficient funds to move forward with this project (although that cannot be guaranteed), Aerkomm Taiwan Inc. will play a significant role in building and operating that ground station.

On November 15, 2018, Aircom Taiwan acquired Beijing Yatai. The purpose of this acquisition is for Beijing Yatai is to conduct Aircom’s business and operations in China. Presently, Beijing Yatai’s primary function is business development, both with respect to airlines as well as content providers and advertisement partners based in China as most business conducted in China requires a local registered company. Beijing Yatai is also actively seeking strategic partnerships through which Aircom may leverage its product offerings in order to provide enhanced services to prospective customers. Aircom also plans to provide local support to China-based airlines via Beijing Yatai and its future planned teleports to be located in China. On November 6, 2020, 100% ownership of Beijing Yatai was transferred from Aircom Taiwan to Aerkomm Taiwan for restructuring purpose.

On October 31, 2019, Aerkomm SY established a new wholly owned subsidiary, Aerkomm Pacific Limited, or Aerkomm Malta, a corporation formed under the laws of Malta. The purpose of Aerkomm Malta is to conduct Aerkomm’s business and operations and to engage with suppliers and potential airline customers both in Europe and worldwide.

Our Corporate Operational Structure

We are a holding company. All of our business operations are conducted through our several operating subsidiaries with our core operational and business activities being directed through Aircom. The chart below presents our corporate structure as of the date of this annual report:

Our principal executive offices are located at 44043 Fremont Blvd., Fremont, CA 94538. The telephone number at our principal executive office is (877) 742-3094.

4

Our Industry

The following discussion takes into account the negative impact on our industry and markets of the onset of the COVID-19 coronavirus which was reported to have surfaced in Wuhan, China in December 2019, to the extent that it is currently possible to quantify such impact. Although it is too early to determine the medium- and long-term impact and effect of the coronavirus and to quantitatively measure that impact and effect, there can be no certainty with respect to any of the growth projections referenced below, and we expect that, at least in the short term, the coronavirus could have a negative impact on our business prospects and the market introduction of our IFEC product offerings. See our discussion of the coronavirus in the Risk Factors section of this annual report, below.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic is having a particularly adverse impact on the airline industry. The outbreak in China and throughout the world since December 2019 has led to a precipitous decrease in the number of daily departures and arrivals for domestic and international flights.

Recent Market Information

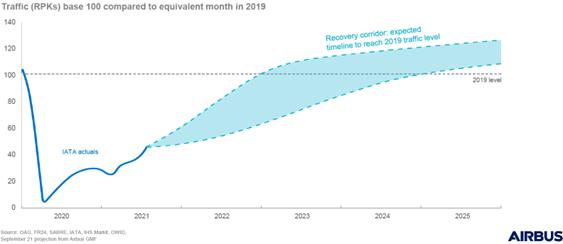

In the IATA (International Air Transportation Association) Report COVID-19 Airline Industry Outlook, published on October 4, 2021, the following key points were highlighted:

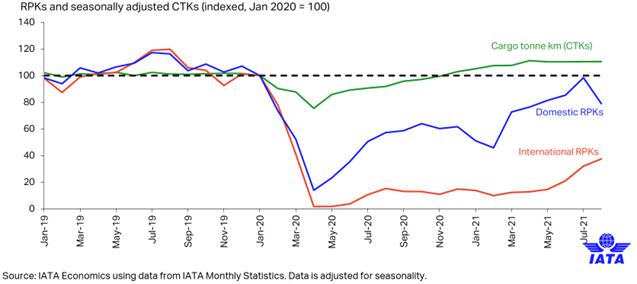

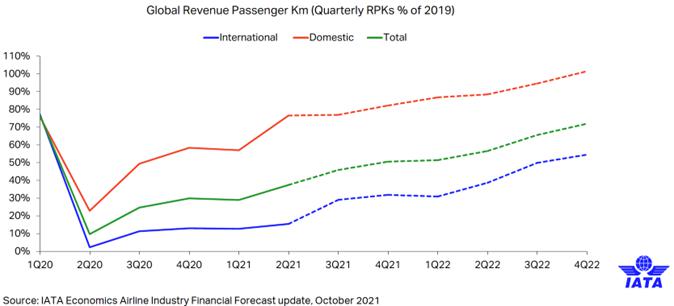

| ● | Economic recovery boost air cargo and domestic travel. International RPKs (Revenue per Kilometer) -68.8%, Domestic RPKs (Revenue per Kilometer) -32.2%, CTKs (Cargo Tonne Kilometer) +7.7% (Aug 21 vs Aug19) |

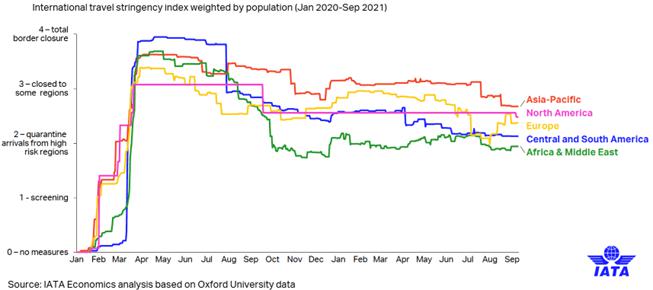

| ● | Travel restrictions limit the international travel recovery. There has been a modest easing of travel restrictions. |

5

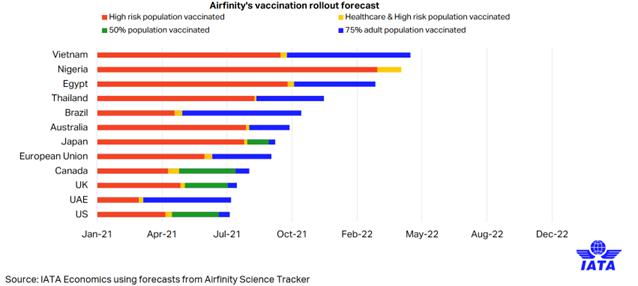

| ● | Progress in vaccination would allow ease of restrictions. Widespread vaccination has been achieved in major developed markets. |

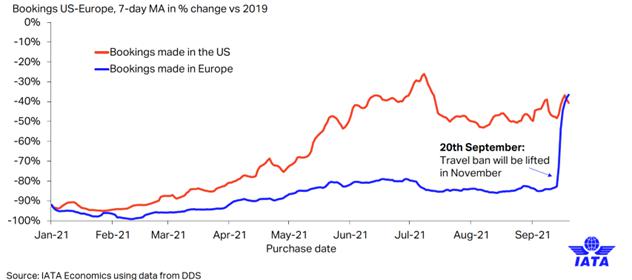

| ● | There is a substantial pent-up demand for travel. US – Europe reopening followed by surge bookings: |

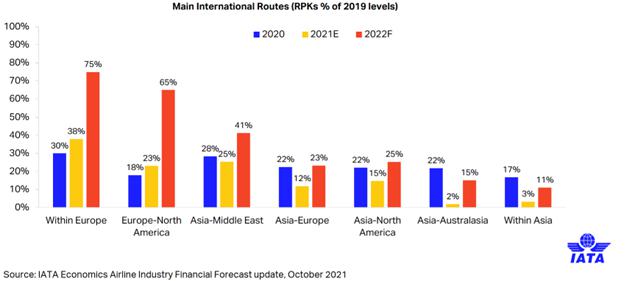

| ● | Recovery in international travel will be uneven in 2022. Intra-European and Europe – North America travel will outpace Asia. |

6

| ● | Domestic air travel demand will continue to be strong. Domestic RPKs (Revenue per Kilometer) will be 93%., whilst international will be 44% of pre-crisis levels in 2022. |

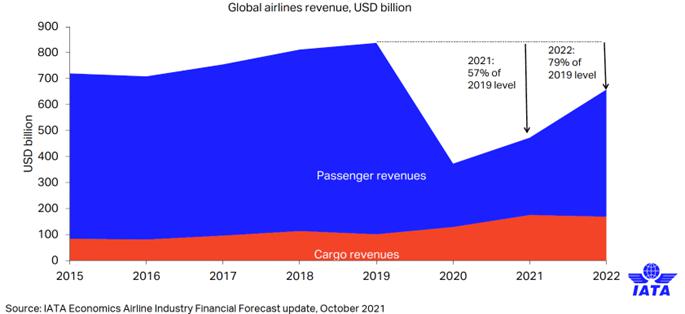

| ● | Revenue recovery will continue in 2022, to 79% of 2019. |

In the IATA (International Air Transportation Association) Airlines Financial Monitor dated December 2021 – January 2022, published on January 17, 2022, the following key points were highlighted:

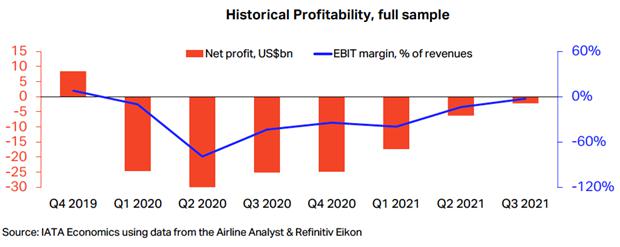

| ● | The latest financial results confirm that the pressure on the industry’s operating profitability eased in Q3 2021. In the sample of 87 airlines, the operating loss improved from 13.6% of revenues in Q2 to 2.6% in Q3. |

| ● | The Global airline share price index picked up in January 2022 rising by 5.8% in the first half of January. The improvement was driven by investors’ confidence that the new Omicron variant will lead to fewer hospitalizations than other strains and therefore related disruptions might have a smaller impact on the travel industry than previously expected. |

| ● | The latest financial results confirm that pressure on airlines’ operating profitability eased in Q3 thanks to a gradual improvement in passenger traffic and a booming air cargo business. The industry-wide operating loss was 2.6% of revenues over the July- September period, compared with a 13.6% loss in Q2. |

7

| ● | In the sample of 58 airlines, the industry-wide net cashflow from operating activities was at -1% of revenues in Q3. This represents a significant improvement versus Q3 2020 (around -50%). |

| ● | Taking a closer look at different sources of passenger revenues, premium class passenger traffic continues to lag the recovery in the economy counterpart. |

| ● | Looking ahead, some of the North American airlines improved their revenue forecast for Q4, stating that travel demand remained robust during the holiday season despite Omicron disruptions. That said, costs pressures are expected to rise as well. |

| ● | For March 2022, the global aircraft fleet size stands at 28,394 aircraft, with 22,798 aircraft active and 5,596 grounded. When March 2022 is compared to March 2021, there is a 15% increase in the active global active fleet. |

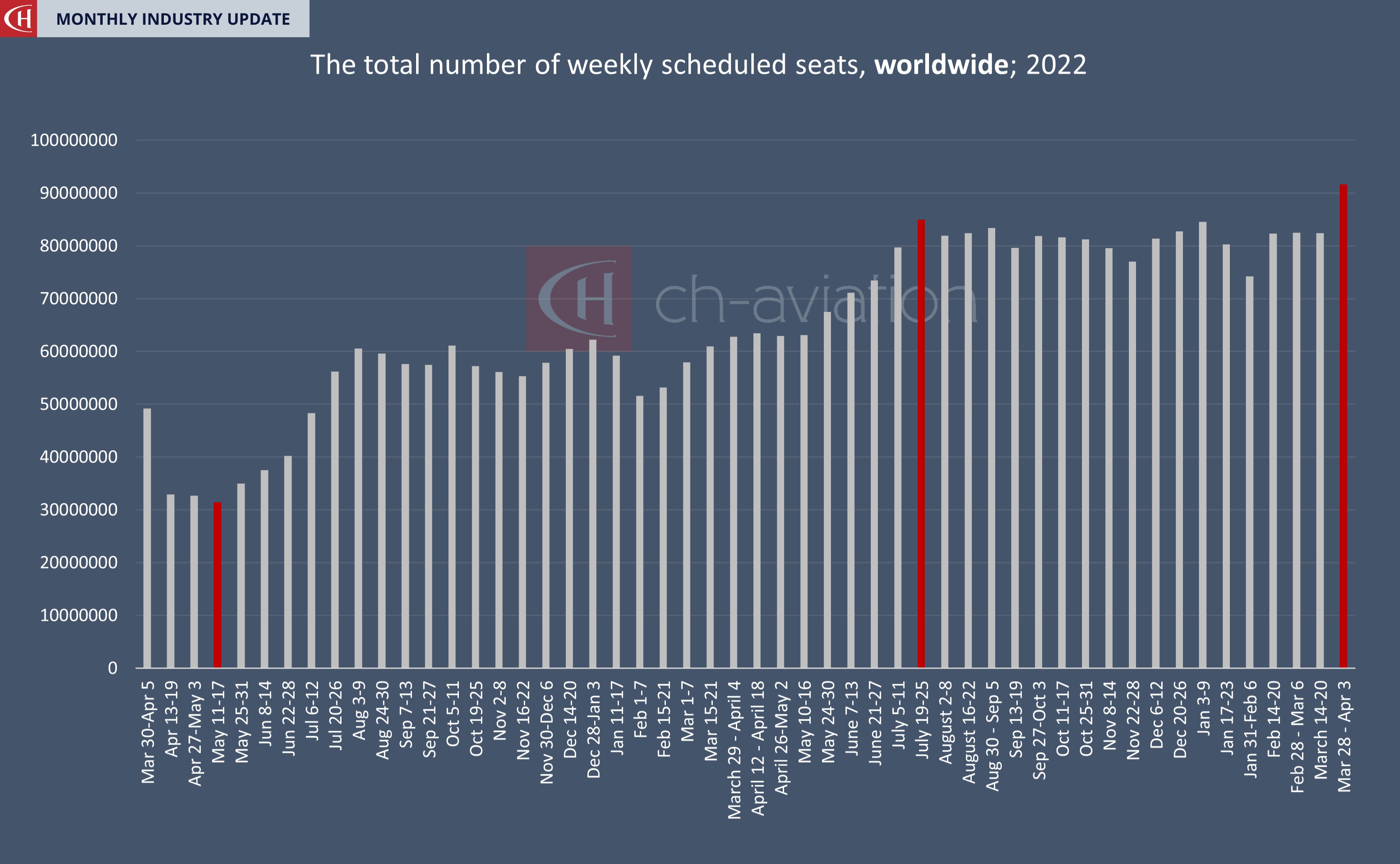

| ● | The global capacity figures are steadily rising | |

| ● | Having reached 91.6 million weekly scheduled seats, global capacity figures peaked at the end of March 2022 |

| ● | There is a 46% increase compared to the same week in March 2021 and an 86% increase compared to March 2020. |

8

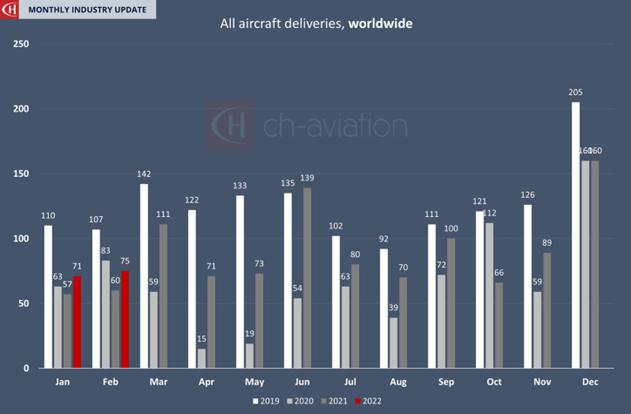

| ● | In February 2022 compared to the same month in 2021, there is a 25% increase in worldwide aircraft deliveries |

9

Impact of the conflict between Russia and Ukraine on aviation

The impact on aviation pales in comparison to the unfolding humanitarian crisis, though the aviation industry promotes peace and freedom by bringing people together, and its implications need to be both assessed and addressed. IATA has issued the latest fact sheet on the conflict issued March 8, 2022:

| ● | The Ukrainian airspace is closed, putting a halt to the movements by air of roughly 3.3% of total air passenger traffic in Europe, and to 0.8% of total traffic globally, as per 2021. |

| ● | Belarus has prohibited flights over parts of its territory, while Moldova has fully shut its airspace. Those two countries account for minor shares of regional and global air passenger traffic. |

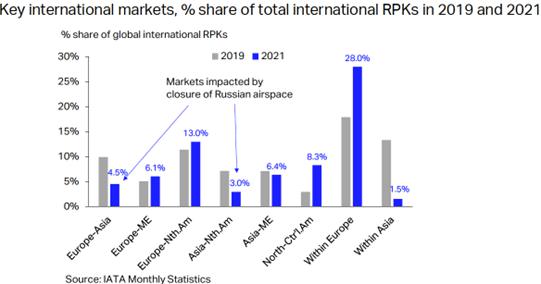

| ● | Based on the latest news, close to 40 countries, including EU countries, the UK and the US, have closed their airspace to Russian airlines. Russia has in turn banned airlines in most of those countries from entering or flying over Russia. International air passengers between Russia and Europe accounted for 5.7% of total European traffic in 2021, 5.2% of global international traffic and for 1.3% of global total traffic (Table 1). |

| ● | In 2021, Russian domestic RPKs (revenue passenger kilometers) accounted for 4.5% of global RPKs. The Russian domestic air passenger and cargo market will be impacted by sanctions on leased aircraft, spare parts, maintenance, and training. At present, airlines continue to operate regular schedules, outside of the airspace close to Ukraine, which has been shut. Industry experts in Russia estimate that after the extent of the disruption is likely to become more apparent within two months from the start of the war. |

| ● | With Russian airspace closed to carriers from close to 40 countries, flights will have to be rerouted or cancelled. The most heavily impacted markets are Europe-Asia and Asia-North America. This includes flights between the US and Northeast Asia, and between Northern Europe and most of Asia. In 2021, RPKs flown between Asia-North America and Asia-Europe accounted for 3.0% and 4.5% of global international RPKs respectively, both below their shares prior to the pandemic, due to the slow international recovery in Asia. |

| ● | The conflict and related sanctions will clearly reduce global trade, investment, and overall economic activity. Much uncertainty still reigns regarding the war, its potential reach, and its duration. From where we stand today, we can expect up to 1 percentage point of global GDP growth to be lost. Hence, a global recession is not currently in the cards, as the IMF forecasted global GDP to grow by 4.4% before the war. It is also worth noting that the world faced a Brent oil price in excess of USD 100 per barrel during 2011-2014, a period when global GDP growth averaged close to 3%. |

10

| ● | Though Russia and Ukraine are important to the world economy as large exporters of energy, precious metals, wheat, and other commodities, the two together account for less than 2% of global GDP. Most major economies have only limited trade exposure to Russia. Only 0.5% of US trade is with Russia, and the latter represents 2.4% of China’s trade. The economy of Russia, on the other hand, is likely to see a double-digit outright contraction this year, and for Ukraine the outcome will in all probability be worse still. |

| ● | Longer term, Russia’s war on Ukraine will almost certainly lead to increased military spending. Total global military expenditure rose to nearly USD 2 trillion in 2020, according to the Stockholm International Peace Research Institute (SIPRI), representing 2.4% of global GDP. Military spending adds to GDP growth but detracts from achieving development goals in a world already carrying record levels of debt. |

| 1. | Aviation Industry |

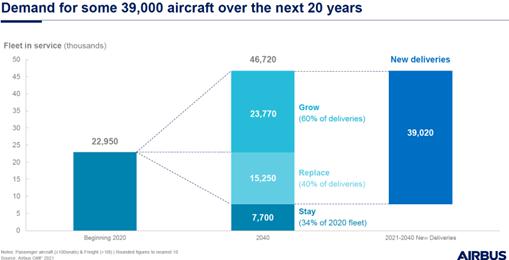

Immediately prior to the onset of the COVID-19 pandemic, there were, according to Airbus and Boeing, more than 23,000 commercial aircraft flying globally, a number that was expected to more than double in the next 20 years. Both Airbus and Boeing had estimated that the global fleet of commercial aircraft would increase from 23,000 planes in 2019 to more than 45,000 in 2040, according to their respective 2021 reports, “Global Market Forecast report 2021 – 2040” and “Commercial Market Outlook 2021 – 2040.” The Global Market Forecast report 2021 – 2040 predicted that the increase would include 40% for aircraft replacement and 60% for growth, with Asia-Pacific (excluding Peoples Republic of China) accounting for 25% of deliveries.

11

Prior to COVID-19, passenger numbers were also experiencing strong growth. While COVID-19 brought disruption to business practices and shifted demand, it is important to remember the resiliency of this market and the significance of servicing the industry. This is driven by global commerce, peoples’ desire to travel, the need to visit family and friends, explore the world and build relationships.

Airbus expects a full recovery of air traffic between 2023 and 2025.

We cannot predict the future; however, the success of our business is predicated on the return to sustainability of the airlines industry and the acceptance of our IFEC product offerings which are discussed below.

| 2. | In-Flight Entertainment and Connectivity |

Recently, there have been more than 4 billion passengers flying globally, annually, spread across 23,000 airplanes. Only approximately 25% of these airplanes are equipped to offer some form of onboard connectivity with sometimes erratic quality, slow speeds and low broadband. According to the industry’s largest poll of passenger attitudes, Inmarsat’s Inflight Connectivity Survey3, in-flight Wi-Fi is a key driver in forming customer loyalty and satisfaction among today’s airline passengers.

Aviation – an industry hammered by the fallout from COVID-19 more than most – is certainly facing the future with a reset ethos powered by the potential of digitalization. That’s the belief of a new paper by Cranfield University. Entitled Digital Now: Why the Future of Aviation Starts with Connectivity, the report, presented in partnership with Inmarsat, outlines how a ‘perfect storm’ of the pandemic and a heightened awareness of climate change, and what needs to be done to mitigate these affects, has caused aviation’s “key industry stakeholders, its customers, and governments across the globe to fundamentally reconsider their priorities and the sector’s future service offering.”

Central to this change is digital connectivity. In her foreword, Cranfield University’s Chief Executive and Vice-Chancellor Professor Karen Holford CBE FREng notes that technology can put aviation on a path “towards a brighter and more sustainable future.”

The report considers how digital connectivity “in all its forms, can enable and accelerate the rapidly changing needs of air travellers and of the aviation sector itself. It has identified specific challenges and opportunities that, if addressed, will have a direct effect on the sector’s resilience, its contribution to reducing climate change, and to new customer service offerings that will enhance passengers’ willingness to travel in the post-pandemic world.”

The Cranfield University report is divided into seven highly illuminating chapters and the main conclusions from this report are the following:

| ● | The COVID-19 pandemic has shifted the behavior of key stakeholders in the aviation sector; customers, governments and the airlines themselves are reconsidering their priorities and the sector’s future service offering. In some instances, the pandemic has helped accelerate efforts towards a more efficient and secure airspace that is fit for the future, but most of all it has created a new stronger focus on the sector’s use of digital data. Whether considering climate change, system design and reliability or economic resilience, the acquisition of new and higher quality data from across the entire sector will be increasingly important for building a sustainable future for the aviation system as a whole. Data will be needed for anticipating risks and ensuring there is greater cross-sector flexibility to deal with them; or testing the alternative technologies needed for a sustainable aviation business; to develop new kinds of shared frameworks, systems and technologies; and for improving and ensuring cybersecurity. |

| ● | New aircraft-based technologies and standards are giving rise to both “Connected Aircraft” and the “Connected Cockpit” connected-anywhere concepts that have fully connected digital ecosystems enabled by multiple data links. These ecosystems feature secure, high-bandwidth satellite connectivity alongside a combination of radio and internet streaming (5G, LTE, Wi-Fi and commercial networks) transferring significant quantities of data (terabytes). The complexity and interoperability of future ecosystems is seen as a significant challenge for the technology providers, regulators and airlines. A future vision of an aircraft connected system network is presented where radio-based infrastructure and satellite-based communications systems support airport communications systems for advanced connected aircraft systems and surface movement guidance and control. |

12

| ● | As a result of the rapidly increasing availability of aircraft technical performance data, Integrated Vehicle Health Management (IVHM) is transforming the use of aircraft sensors into information than can be used to support platform health management decisions. As a result, scheduled time-based maintenance is replaced by condition-based maintenance strategies, so reducing engineer time and costs. Looking further into the future, aircraft performance management towards “Conscious Aircraft” concepts which, through self-sensing and monitoring of a system’s components, can either suggest appropriate maintenance actions or take action itself, so creating the potential for a zero-maintenance aircraft platform. |

| ● | The pandemic and the concern over climate change has changed society’s attitude towards air travel and is causing both airports and airlines to reconsider their service offerings and business models. Increased biosafety awareness has accelerated the introduction of a variety of new digital technologies including; ‘health passports’ or travel passes, touchless identity screening, virtual queuing and airport flow management, that together are enabling safe, seamless movement through airports by reducing contact points, increasing border bio security and so seeking to restore passenger confidence in travel. By whatever means, it is recognized that air travel needs to be made safe, workable and convenient, and, most of all, airlines and airports, with their supply chains and collaborators, will need to be able to adapt rapidly to changing market needs. Airlines in particular will need tro be more flexible and agile than they been in the past if they are to survive inevitable new shocks. |

| ● | Enhanced digital connectivity is enabling the concept of a ‘connected journey’ to become possible through creating more efficient and personalized wayfinding through airport, more intelligent and responsive baggage tracking and real-time updates on the condition and progress of cargo in transit. Passengers, are moreover, requesting that they are better informed of unavoidable weather-related disruptions and that alternative personalized travel arrangements are made available to them in a timely manner and digitally. |

| ● | Inflight, passengers and crew now expect the same levels of personal digital connectivity as they experience in their everyday lives. Digital IFE services, for example, that were once only provided by the premium long-haul carriers, are now having to be considered by the low-cost carriers. Providing seamless connectivity to passengers’ own tablets and smartphones (“bring your own”) is seen as a means of avoiding costly and heavy aircraft upgrades, and potentially introducing new IFE service revenue streams through subscription of third-party advertising for the low-cost carriers. Beyond IFE, new digital services could support a greater sensing of individual passenger wellbeing (e.g. anxiety levels) and service satisfaction, provide individual onward travel information, support onboard virtual queueing for toilets and meal distribution. The overall effect would be to provide an enhanced and, most importantly, personal inflight service. Various options to monetize passenger connectivity services are being considered and will be essential to defray additional launch and operational costs. Ranging from simple time-charged data access to online retail purchasing from the trolley service, access to subscription and entertainment services and clickable third-party advertising from destination providers (hotels, tourist attractions, etc.), it is anticipated that the commercial viability of these services will regulate the pace of adoption within the sector. |

Currently, less than 25% of the world’s airline companies are providing some form of in-flight WiFi services through third-party providers. We believe that there is a huge market potential among the remaining unconnected airlines.

According to the Boeing Report titled “Commercial Market Outlook 2019 – 2038,” it has been projected that by the end of 2030, two-thirds of the world’s aircraft fleet will have some form of connectivity, whether through retrofit or line fit at production stage. Currently, the majority of connectivity upgrades are being done through aircraft modification as in-service aircraft are outfitted with new and high-speed systems. It is estimated that more than one thousand commercial aircraft are being upgraded annually. Eventually, more airplanes will be delivered from the production line with connectivity installed. However, whether aircraft connectivity is being carried out as a retrofit, or built into the initial aircraft production line, the evolution of IFEC technology shows that the demand for connectivity is increasing.

The Internet of Things (IOT) will also be an important enabler, to link in real time not only passenger but also core cabin components, including aircraft galleys, meal trolleys and other cabin elements. These IOT enhancements will allow simultaneous data exchange for the crew of an aircraft throughout the cabin.

Furthermore, airlines will be able to use increased cabin connectivity to perform predictive maintenance analytics over their entire fleet, thus improving the overall cabin service reliability, quality and performance on board all of their aircraft.

13

Our IFEC Solutions

Aviation

With our advanced technologies and an innovative business model, we plan to provide airline passengers with a broadband in-flight experience that encompasses a wide range of service options. Such options include Wi-Fi, cellular, movies, gaming, live TV, and music. We plan to offer these core services through both built-in in-flight entertainment systems, such as a seatback display, as well as on passengers’ personal devices including laptops, mobile telephones and tablets. We also plan to provide content management services and e-commerce solutions related to our IFEC solutions. This system will operate through Ka high throughput satellites, or HTSs.

The diagram below shows Aircom’s planned services options and e-commerce options.

|

|

We also plan to provide related content management services and on-board e-commerce solutions for commercial airlines. We expect that a complete e-commerce and mobile entertainment platform will place control of content, service delivery and commercial strategy firmly in Aircom’s hands vis a vis the airlines that may acquire our IFEC products and services. Our in-flight e-commerce solution will encompass on-line shopping, trading, travel options and duty-free sales, as well as other varied product offerings.

We have two business models in place for our approach to the IFEC aviation market, one relating to commercial airlines and one to corporate business jets:

| 1. | Commercial Airlines |

Traditionally, providers of in-flight connectivity have focused primarily on the profit margin derived from the sale of hardware to airlines and of bandwidth to passengers. Both airlines and passengers must “pay to play,” which results in low participation and usage rates.

We break away from this model and expect to set a new trend with our innovative business approach which, we believe, will set us apart from our competitors by our partnering with airlines and other strategic partners, such as online advertisers and content providers, to offer commercial airlines our IFEC system hardware at no cost and to airline passengers free connectivity solutions. Airlines will potentially be able to generate new revenues through participating in our revenue sharing model while passengers will not be required to pay for connectivity. We believe that, taken together, this novel approach will create an incentive for airlines to work with us, and this collaboration should act to drive up passenger usage rates. We believe that this is an innovative approach that will differentiate us from most existing market players. We currently have an agreement in place with our first commercial airliner customer, Hong Kong Airlines (discussed below).

Our main source of revenue is expected to be derived from the content channeled through our IFEC network from selected partners including internet companies, content providers, advertisers, telecom service providers, e-commerce participants, and premium sponsors. In other words, we plan to use connectivity as a tool rather than as a commodity for sale, which we believe will allow us to achieve a greater return. By providing free connectivity which, we expect, will result in the generation of a large volume of content traffic, we believe that we will create a multiplying effect that will result in a value that exceeds the “sum of its parts.”

Once our Aerkomm K++ system is approved by Airbus and receives the applicable airworthiness certifications, which process we expect to be completed in the beginning of second quarter of 2021, as further discussed below, we will begin providing our Aerkomm K++ systems for installation on commercial airline aircraft.

| 2. | Corporate Jet Customers |

According to the 2018 business aviation forecast published by Honeywell Aerospace4, during the next five years, 87% of new purchased business jets are expected to require satellite communications technology to facilitate internet connectivity. The same report states that business jet manufacturers are projected to deliver 7,700 new aircraft valued at $251 billion during the next 10 years. We believe that these statistics, as well as our own research, indicate that there is a strong demand by corporate jet owners to have high-speed internet connectivity installed on their aircraft. We do not believe, however, that corporate jet customers would generate sufficient internet traffic to make a free-service business model profitable for us. Consequently, we have modified our business model to address the limitations of this additional market.

| 4 | Avionics International, Business & General Aviation, Connectivity “Buying Trends Favorable for Satellite Connectivity”, October 14, 2018 |

14

To capitalize on this market, we plan to sell our IFEC system hardware to corporate jet owners through the Airbus Corporate Jets (ACJ) and Boeing Business Jets (BBJ) programs. In addition to selling our IFEC systems equipment, we will also sell these corporate jet aircraft owners the bandwidth required for the operation of our services, priced on a subscription plan basis. This business model would generate revenue and income directly from the sale of our IFEC hardware and related bandwidth. We already have an agreement in place with our first corporate jet and launch customer, MJet GMBH (discussed below), and we are in advanced discussion with a number of additional potential customers both directly through our corporate network and through Airbus. We cannot give any assurances at this time, however, that we will be able to successfully complete any of these additional discussions.

Once our Aerkomm K++ system is approved by Airbus and receives the applicable airworthiness certifications, which process we expect to be completed during the first quarter of 2023, we will begin selling our Aerkomm K++ systems for installation on Airbus ACJ aircraft.

Aircom Pacific, at Airbus’ invitation, attended the Airbus ACJ Customer Forum which was held in Singapore in February 2019. This Airbus ACJ Customer Forum provided Aircom a unique opportunity to network with ACJ customers, operators and key industry players within the Airbus Corporate Jet community. At the Airbus ACJ Customer Forum, Aircom was provided the opportunity to demonstrate the Aerkomm K++ system. A number of ACJ clients at the Airbus ACJ Customer Forum showed interest in our IFEC product offering and we are currently in active discussions with these parties. We expect to participate in future Airbus ACJ Customer Forums to be scheduled in the future in one or more European venues.

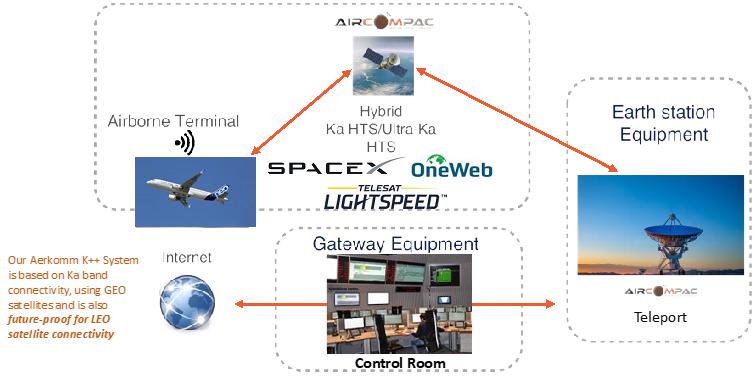

Our Connectivity Solutions – Ka/Ku Band Satellites

We expect to bring connectivity on-board to aircraft through communication satellites. As depicted in the diagram below, aircraft equipped with an on-board connectivity system can communicate with a satellite via an airborne antenna. The satellite then relays the information to a ground station, which is equipped with a high-power satellite dish and is connected to the Internet through our proprietary ground system.

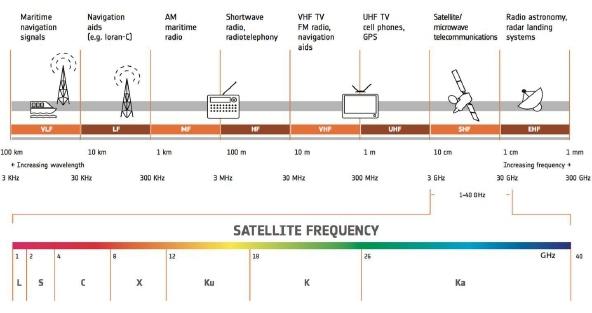

Most in-flight connectivity systems currently in the market rely on the Ku-band satellite signals for communication. Many players in the market are working to provide higher bandwidth and faster transmitting rates using the Ka-band.

Below is a diagram, provided by the European Space Agency, showing the variety of satellite frequency bands. The higher the frequency bands, such as Ka, the wider the bandwidth. With the variety of satellite frequency bands that can be used, designations have been developed so that they can be referred to easily.

15

In satellite communications, the Ka-band allows higher bandwidth communication. Ka-band high-throughput-satellite systems reuse frequency bands in spot beams for much higher system capacity and better spectrum efficiency.

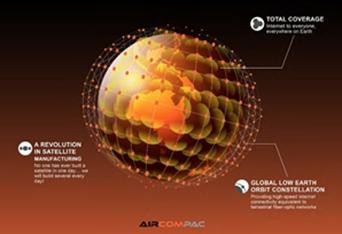

Currently, there are few Ka-enabled satellites, which limits the coverage area in certain areas of the Asia-Pacific region. However, new GEO (Geostationary Earth Orbiting) and LEO (Low Earth Orbiting) Ka-band satellites are being regularly launched and this increase in satellites is expected to provide worldwide Ka-band coverage within the next few years.

Our Aerkomm K++ system architecture will bring our aviation partners and their passengers the benefits of both GEO and LEO Ka-band satellite technology. GEO satellites may scan a hemisphere of earth, or fixed regions of that hemisphere at regular intervals. Performance of GEO satellites diminishes greatly in the areas near the Earth’s poles. LEO satellites orbit the earth from pole to pole and collect data from the areas beneath them. Only LEO satellites can collect high quality data over the poles. The Ka-band satellite increases data throughput. Aircom plans to have the necessary technology ready to take advantage of this new trend in Ka-band aviation connectivity. Future SpaceX, One Web and Telesat satellites are expected to be ready by end of 2022 and with full-service availability by 2023. As of February 3, 2022, SpaceX has launched 2,091 Starlink satellites. As of April 2022, Starlink services were on offer in 29 counties covering North and South America, Europe and Oceania, with applications pending regulatory approval in many more regions.

OneWeb Satellites, which is a joint venture between Airbus and OneWeb, the low Earth orbit (LEO) satellite communications company, on December 2021 confirmed its successful deployment of 36 satellites by Arianespace from the Baikonur Cosmodrome. This latest launch, its twelfth overall and ninth since December 2020, brings OneWeb’s total in-orbit constellation to 394 satellites. This represents over 60 percent of OneWeb’s planned 648 LEO satellite fleet that will deliver high-speed and low-latency global connectivity.

Telesat, which is a privately held Canadian company, launched a test satellite in 2018. To-date, Telesat have 298 LEO satellites which it plans to expand to 1,700 satellites in the near future to provide full global service targeted for the second half of 2024.

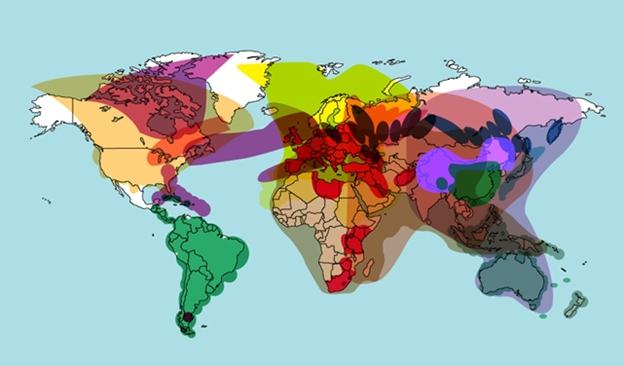

The chart below depicts the coverage of both GEO and LEO Ka-band satellites.

|

|

Source: Aircom

16

The Ku-band offers reliable service outside of the Ka-band coverage over the ocean and in mountainous regions which is aimed to cover hotels and resorts remotely located as well as the maritime sector. The Ku-band also supports the OneWeb LEO satellite systems.

The map below shows areas of satellite coverage that could potentially be served by Aircom’s IFEC product offering.

Source: Aircom

We are actively working with other satellite providers in order to accommodate global airline routes and growing fleets. We are monitoring the satellite industry for growth in coverage, including China Satcom’s plan to launch high-capacity Ka-band and Ka HTS multispot-beam satellites over the Asia-Pacific region, as described in more detail below under Ku-band and GEO/LEO Hybrid Satellite Technology.

In March 2017, we entered into a Master Service Agreement with SKY Perfect JSAT Corporation of Japan for use of its JCSAT-2B/Asia Beam Ku-band satellite telecommunication services, teleport services and housing services. The agreement’s initial term ran for a period of three years from its commencement date of April 15, 2017, subject to the receipt of all governmental licenses and approvals, and will continue to be effective provided any of the services continue after the initial three-year term. We were required to prepay $285,300 of the contract price and a security deposit plus applicable Japanese consumption taxes upon the commencement date of the agreement. Under this agreement, we are able to test the connectivity equipment that we have been developing for ground and maritime uses.

Our Aerkomm K++ system

Our proprietary IFEC system, which is called the AERKOMM K++ system, will contain an ultra-low profile radome containing two Ka-band antennas, one for transmitting and the other for receiving, and will comply with ARINC 791 standard of Aeronautical Radio, Incorporated, or ARINC and meets Airbus Design Organisation Approval.

Our Content Solutions

Traditionally, airlines view in-flight entertainment content as a budgeted expense for which they have to pay hefty royalties. With our business model and technologies, we expect to be able to transform in-flight entertainment into a source of ancillary revenue for our airline customers. We will team up with our current and future prospective airline customers to provide them with our Aerkomm K++ hardware system at no cost and with free onboard Wi-Fi connectivity services to passengers, which will allow us to maintain data traffic control, specifically in terms of blocking or placing advertisements as needed and inserting targeted commercials.

Premium Content Sponsorship

Recently, merchants have begun to take advantage of in-flight connectivity. In May of 2015, Amazon announced its plan to sponsor free video and music streaming for its Prime Video subscribers onboard JetBlue’s planes. The Amazon and JetBlue partnership is a paradigm of a win-win affiliation between an Internet powerhouse and a provider of in-flight connectivity. Amazon gained a platform through which it could display its premium subscription services and expanded its distribution network, while JetBlue generated significant revenue simply by making its in-flight connectivity available to Amazon.

17

The Amazon-JetBlue partnership is only one of many examples whereby an Internet company can improve its reach by gaining access to in-flight connectivity. We seek to exemplify this type of relationship through collaboration with major Internet companies, such as search engine companies. We plan to promote a partner’s brand through our in-flight services by channeling all searches to the partner’s search engine. By designing our user interface around the partnered company, we can present passengers with an on-screen environment populated by the partner’s apps, logos, and colors, providing a powerful marketing tool for the partner company. We can also enhance recognition of our sponsors’ brands by creating a list of portals on the in-flight system’s home screen, which lead to each sponsor’s individual page where passengers can resume their normal entertainment, social, and professional activities.

We are actively in discussions with Internet content providers to establish such premium sponsorships.

Live TV

We are negotiating with television providers along our prospective airline partners’ flight routes to make live TV available through our IFEC system. Airlines will be able to select live TV channels that are appropriate for each flight route. An electronic program guide channel listing will be available for easy viewing and selection.

Several revenue sources will be available for live TV broadcasting, including commercials before and during programs, and banners at the bottom of the screen. Banner advertisements at the bottom of the screen can be interactive, which should generate pay per click, or PPC, or cost per click, or CPC, revenue in addition to the lower priced cost per thousand impressions, or CPM, revenue. In addition, we should be able to receive sponsorship premiums from select TV programs, such as pay-per-view and shopping channels.

Social Media and Instant Messaging: Content Management

We will have firewalls in place both on the ground and in the air. These, in combination with our policy enforcement software, will allow us to filter, classify, block, or forward services in accordance with our service and quality policies. We will be able to control the flow of traffic for each individual application, enabling us to use a white list model through which social media and instant messaging partners can provide their users with onboard access by paying an annual or other periodic fee.

We are in active discussions with Line, WeChat, WhatsApp, and other social media partners regarding an annual premium fee in exchange for user access to their applications and services during air travel. The access to other networks may be limited to a single direction or blocked entirely. For example, we could allow the users of a non-paying instant message service to receive, but not send, instant messages. When a user tries to respond to a received message, the system would present a pop-up message encouraging the user to urge the service provider to enter into a relationship with us.

Airlines will be able to select movies, videos, and other content for their passengers through our content management system. The management system will tailor content suggestions according to the flight route and destination and automatically upload selected content to an onboard server while the aircraft is on the ground. This creates a cache that allows in-flight viewing in areas with limited or no satellite bandwidth connectivity. For premium content, we may maintain a live connection with providers’ networks for accounting and digital rights management purposes.

Video/Content on Demand

Content that is available to passengers for free will generate advertising-based revenue through commercials before and during programming, as well as through banners advertisements. Passengers will be able to choose to pay for premium content, such as first-run movies, where available. For programming of all types, our partnered advertising agents will be able to integrate appropriate and effective advertisements targeted to the viewer. Prior to the start of any program, users will be required to view a commercial with a length determined by the duration of the selected program. Passengers will not be able to skip or close this commercial without closing out of the program. We will be able to place similar advertisements before games or radio programs and during online duty-free shopping.

Frequent flyer passengers will be able to purchase a premium package to allow access to unlimited movies, games, and other entertainment contents with no layered advertising. These packages will include day, trip, monthly, and annual based membership options.

Search Engine

In this information age, people often refer to the Internet for information, yet few individuals are aware that every Internet search they perform generates revenue for the search engine company. Search engine providers, such as Google, Bing, and Yahoo, sell keywords, page ranking in search results, advertisement placement, and other related services. The revenue generated by a search engine fluctuates in relation to its volume of activity. We plan to manage search engines on a white list basis, which means that the in-flight connectivity system will only permit the passage of traffic to and from approved search engines. If a passenger performs a search on a search engine that is not partnered with us, the search will be redirected to one that is.

We plan to enter into agreements with search engine partners to share the revenue generated from passengers’ searches. As discussed under “Premium Content Sponsorship” above, we may grant exclusivity to a particular search engine provider that is a premium sponsor. Such exclusivity may be specific to certain airlines or routes.

18

Internet Advertising Replacement

In Internet traffic, more than 50% of the bandwidth that passes through satellites is consumed by advertisements in the data stream. In order to streamline bandwidth usage, our ground system will detect advertisements from a webpage and replaces them with advertisements from our advertisers or partners. We will work with Internet advertisers to present advertisements that are relevant to passengers’ interests. This system will enable our partners to place their advertisements accordingly and generate revenue for them and us. Advertisers can offer destination-specific commercials and banners, which can be placed in our in-flight entertainment system and in apps and portals on personal devices. By utilizing commercial agents to sell ad space on our systems, we plan to cover all marketable areas, expanding sales opportunities and increasing revenue.

With online advertisement utilizing both CPM and CPC models, we will be able to capitalize on virtually all available ad space and work with any advertising partner.

Online/Streaming Gaming

We plan to make it possible to stream console-quality games in the airline cabin. Through gaming content partnerships, we expect to be able to offer PlayStation, Xbox, and other console games. Passengers will be able to play popular games from their personal devices or in-flight entertainment systems, invite friends to play over the network, and save their gaming data for continued play on the ground. It will require high speed networks to play these interactive action games and we expect to be able to provide the services necessary for the functioning of these interactive games. Our online gaming service will bring our passengers a gaming experience never seen before. We expect to generate revenue from advertisements, including banners and commercials, and from fees for premium games or sales of access passes.

Telecommunications Text Messaging Services

Through strategic partnerships with telecommunication providers, we plan to allow passengers to use 4G messaging services while in flight. Our in-flight system is designed to detect whether a passenger is using one of our partner carrier’s network and will deliver or block messages to and from a passenger’s mobile phone accordingly. For those using a non-partner’s network, the system will urge the passenger to request that their service provider join our network. Passengers will also be able to purchase a premium package to enable text message services.

Destination-Based Services

With flight route and passenger information, we expect that our partners will be able to offer destination-specific merchandise and services, including hotel and rental car bookings, transportation arrangements, restaurant reservations, local tours, ticket purchases, and travel insurance. By partnering with service partners in the region, we plan to share the transaction-based revenue on a fixed dollar amount or percentage of transaction basis.

In-flight Trading and e-Commerce

We have found that in-flight connectivity through our AERKOMM K++ system will allow travelers to make better use of their travel time. With uninterrupted broadband available onboard, passengers will be able to conduct business with professionalism and ease. For example, we plan to partner with trading partners who are registered with the various regulatory authorities to offer financial product trading services and we expect to charge a processing fee when a passenger conducts a trade in-flight. Additionally, a complete e-commerce platform made available through the AERKOMM K++ system will enable travelers to engage in unlimited on-line shopping, to make travel arrangements including holiday destinations, hotel bookings and car rentals and to complete duty-free purchases, among other options.

Black Box Live

For reasons of flight safety, a flight recorder, commonly known as a “black box”, is legally required on every aircraft of a certain size. The Flight Data Recorder (FDR) records data with respect to various metrics of the flight and stores the data on a magnetic tape or solid-state disk with special coding. After retrieving the relevant information from the device, an individual can decode the data and learn what the aircraft encountered during the flight. This makes it possible to determine the potential causes of an accident. When the black box is needed, the aircraft has likely suffered an accident. A massive impact or explosion accompanies most airplane crashes, thus requiring the flight recorder to be shockproof and fire resistant. As a number of aviation accidents happen over oceans, the flight recorder must also be waterproof and corrosion-resistant to avoid being damaged by salt water. Despite advancements in flight recorder design and the continual improvement of the strength of materials used in manufacturing flight recorders, records show that a large number of flight recorders are damaged and unreadable following accidents, if not lost altogether. For this reason, effective, real-time storage and transmission of in-flight data is beneficial for deducing the cause of aviation crashes and preventing them from happening again.

In March 2019, the aviation authorities around the world grounded the Boeing B737 MAX passenger airplane global fleet. This occurred after two new Boeing B737 MAX passenger airplanes crashed within 5 months of each other with fatal consequences. The first aircraft which crashed on October 29, 2018 belonged to Lion Air and the second aircraft which crashed on March 10, 2019 belonged to Ethiopian Airlines. The U.S. Federal Aviation Administration (FAA) and other worldwide aviation authorities worked in coordination to determine the cause of the crashes before issuing additional guidance. Before the causes could be determined, and within 24 hours of the Ethiopian Airlines crash, however, worldwide aviation authorities and operators began banning MAX flight operations. Although the minimal aircraft flight data available from the Ethiopian Airlines crash was not sufficient to link it to the Lion Air crash, there has been pressure from the aviation authorities and the airline operators to implement protective measures. The Boeing B737 MAX fleet was grounded more than two full days before the Ethiopian Airlines’ FDR information was downloaded.

19