UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended:

or

For the transition period from ____________ to _____________

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices, Zip Code)

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ||

| Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of October 23, 2023, there were

AERKOMM INC.

Quarterly Report on Form 10-Q

Period Ended March 31, 2023

TABLE OF CONTENTS

i

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

AERKOMM INC.

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1

AERKOMM INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Balance Sheets

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash | $ | $ | ||||||

| Short-term investment | ||||||||

| Inventories, net | ||||||||

| Prepaid expenses | ||||||||

| Other current assets | ||||||||

| Total Current Assets | ||||||||

| Long-term Investment | ||||||||

| Property and Equipment | ||||||||

| Cost | ||||||||

| Accumulated depreciation | ( | ) | ( | ) | ||||

| Prepayment for land | ||||||||

| Prepayment for equipment | ||||||||

| Net Property and Equipment | ||||||||

| Other Assets | ||||||||

| Prepaid expenses – non-current | ||||||||

| Restricted cash | ||||||||

| Intangible asset, net | ||||||||

| Goodwill | ||||||||

| Right-of-use assets, net | ||||||||

| Deposits | ||||||||

| Total Other Assets | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current Liabilities | ||||||||

| Short-term loans | $ | $ | ||||||

| Accounts payable | ||||||||

| Accrued expenses and other current liabilities | ||||||||

| Long-term loan - current | ||||||||

| Lease liability – current | ||||||||

| Total Current Liabilities | ||||||||

| Long-term Liabilities | ||||||||

| Long-term bonds payable | ||||||||

| Convertible long-term note payable | ||||||||

| Long-term loan – non-current | ||||||||

| Contract liability – non-current | ||||||||

| Lease liability – non-current | ||||||||

| Restricted stock deposit liability | ||||||||

| Total Long-Term Liabilities | ||||||||

| Total Liabilities | ||||||||

| Stockholders’ Equity | ||||||||

| Preferred stock, $ | ||||||||

| Common stock, $ | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficits | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total Stockholders’ Equity | ||||||||

| Total Liabilities and Stockholders’ Equity | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

AERKOMM INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

| For the Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Net sales | $ | $ | ||||||

| Service income – related party | ||||||||

| Total Revenue | ||||||||

| Cost of sales | ||||||||

Gross Profit | ||||||||

| Operating expenses | ||||||||

| Loss from Operations | ( | ) | ( | ) | ||||

| Non-operating loss | ||||||||

| Foreign currency exchange gain (loss) | ( | ) | ||||||

| Unrealized investment loss | ( | ) | ( | ) | ||||

| Bond issuance cost | ( | ) | ( | ) | ||||

| Other gain (loss), net | ( | ) | ||||||

| Net Non-Operating Loss | ( | ) | ( | ) | ||||

| Loss Before Income Taxes | ( | ) | ( | ) | ||||

| Income Tax Expense | ||||||||

| Net Loss | ( | ) | ( | ) | ||||

| Other Comprehensive Income | ||||||||

| Change in foreign currency translation adjustments | ||||||||

| Total Comprehensive Loss | $ | ( | ) | $ | ( | ) | ||

| Net Loss Per Common Share: | ||||||||

| Basic | $ | ( | ) | $ | ( | ) | ||

| Diluted | $ | ( | ) | $ | ( | ) | ||

| Weighted Average Shares Outstanding - Basic | ||||||||

| Weighted Average Shares Outstanding - Diluted | ||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

AERKOMM INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Changes in Stockholders’ Equity

For the three months ended March 31, 2022

| Common Stock | Additional Paid in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficits | Income (Loss) | Equity | |||||||||||||||||||

| Balance as of January 1, 2022 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

| Stock compensation expense | - | |||||||||||||||||||||||

| Other comprehensive income | - | |||||||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||||||

| Balance as of March 31, 2022 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

For the three months ended March 31, 2023

| Common Stock | Additional Paid in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficits | Income (Loss) | Equity | |||||||||||||||||||

| Balance as of January 1, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

| Stock compensation expense | - | |||||||||||||||||||||||

| Other comprehensive income | - | |||||||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||||||

| Balance as of March 31, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

AERKOMM INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Cash Flows

| For the Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Stock-based compensation | ||||||||

| Unrealized investment loss | ||||||||

| Amortization of bonds issuance costs | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ||||||||

| Inventories | ||||||||

| Prepaid expenses and other current assets | ( | ) | ( | ) | ||||

| Deposits | ( | ) | ( | ) | ||||

| Accounts payable | ( | ) | - | |||||

| Accrued expenses and other current liabilities | ||||||||

| Operating lease liability | ( | ) | ( | ) | ||||

| Net Cash Used for Operating Activities | ( | ) | ( | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Proceeds from disposal of short-term investment | ||||||||

| Proceeds from disposal of long-term investment | ||||||||

| Purchase of property and equipment | ( | ) | ( | ) | ||||

| Net Cash (Used) Provided by Investing Activities | ( | ) | ||||||

| Cash Flows from Financing Activities | ||||||||

| Proceeds from short-term loan | ||||||||

| Repayment of long-term loan | ( | ) | ( | ) | ||||

| Payment on finance lease liability | ( | ) | ( | ) | ||||

| Net Cash Provided by Financing Activities | ||||||||

| Net Decrease in Cash and Restricted Cash | ( | ) | ( | ) | ||||

| Cash and Restricted Cash, Beginning of Period | ||||||||

| Foreign Currency Translation Effect on Cash | ( | ) | ||||||

| Cash and Restricted Cash, End of Period | $ | $ | ||||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid during the period for interest | $ | $ | ||||||

| Cash and Restricted Cash: | ||||||||

| Cash | $ | $ | ||||||

| Restricted cash | ||||||||

| Total | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 1 - Organization

Aerkomm Inc. (formerly Maple Tree Kids Inc.) (“Aerkomm”) was incorporated on August 14, 2013 in the State of Nevada. Aerkomm was a retail distribution company selling all of its products over the internet in the United States, operating in the infant and toddler products business market. Aerkomm’s common stock is quoted for trading on the OTC Markets Group Inc. OTCQX Market under the symbol “AKOM.” On July 17, 2019, the French Autorité des Marchés Financiers (the “AMF”) granted visa number 19-372 on the prospectus relating to the admission of Aerkomm’s common stock to list and trade on the Professional Segment of the regulated market of Euronext Paris (“Euronext Paris”). Aerkomm’s common stock began trading on Euronext Paris on July 23, 2019 under the symbol “AKOM” and is denominated in Euros on Euronext Paris. This listing did not alter Aerkomm’s share count, capital structure, or current common stock listing on the OTCQX, where it is also traded (in US dollars) under the symbol “AKOM.”

On December 28, 2016, Aircom Pacific

Inc. (“Aircom”) purchased approximately

On February 13, 2017, Aerkomm entered

into a share exchange agreement (“Exchange Agreement”) with Aircom and its shareholders, pursuant to which Aerkomm acquired

On December 31, 2014, Aircom acquired a newly incorporated subsidiary, Aircom Pacific Ltd. (“Aircom Seychelles”), a corporation formed under the laws of the Republic of Seychelles. On November 8, 2021, Aircom Seychelles changed its name to Aerkomm SY Ltd. (“Aerkomm SY”) and the ownership was transferred from Aircom to Aerkomm. Aerkomm SY was formed to facilitate Aircom’s global corporate structure for both business operations and tax planning. Presently, Aerkomm SY has no operations. Aerkomm is working with corporate and tax advisers in finalizing its global corporate structure and has not yet concluded its final plan.

On October 17, 2016, Aircom acquired a wholly owned subsidiary, Aircom Pacific Inc. Limited (“Aircom HK”), a corporation formed under the laws of Hong Kong. On November 8, 2021, Aircom HK changed its name to Aerkomm Hong Kong Limited (“Aerkomm HK”) and its ownership was transferred from Aircom to Aerkomm. The purpose of Aerkomm HK is to conduct Aircom’s business and operations in Hong Kong. Presently, its primary function is business development, both with respect to airlines as well as content providers and advertisement partners based in Hong Kong. Aerkomm HK is also actively seeking strategic partnerships whom Aerkomm may leverage in order to provide more and better services to its customers. Aerkomm also plans to provide local supports to Hong Kong-based airlines via Aerkomm HK and teleports located in Hong Kong.

On December 15, 2016, Aircom acquired a wholly owned subsidiary, Aircom Japan, Inc. (“Aircom Japan”), a corporation formed under the laws of Japan. On November 9, 2021, Aircom Japan changed its name to Aerkomm Japan, Inc. (“Aerkomm Japan”) and its ownership was transferred from Aircom to Aerkomm. The purpose of Aerkomm. The purpose of Aerkomm Japan is to conduct business development and operations located within Japan. Aerkomm Japan is in the process of applying for, and will be the holder of, Satellite Communication Blanket License in Japan, which is necessary for Aerkomm to provide services within Japan. Aerkomm Japan will also provide local supports to airlines operating within the territory of Japan.

Aircom Telecom LLC (“Aircom Taiwan”), which became a wholly owned subsidiary of Aircom in December 2017, was organized under the laws of Taiwan on June 29, 2016. Aircom Taiwan is responsible for Aircom’s business development efforts and general operations within Taiwan.

On June 13, 2018, Aerkomm established

a then wholly owned subsidiary, Aerkomm Taiwan Inc. (“Aerkomm Taiwan”), a corporation formed under the laws of Taiwan. The

purpose of Aerkomm Taiwan is to purchase a parcel of land and raise sufficient fund for ground station building and operate the ground

station for data processing (although that cannot be guaranteed). On December 29, 2022, Aerkomm and dMobile System Co., Ltd. (the “Buyer”)

entered into an equity sales contract pursuant to the terms of which Aerkomm sold a majority interest of

On November 15, 2018, Aircom Taiwan

acquired a wholly owned subsidiary, Beijing Yatai Communication Co., Ltd. (“Beijing Yatai”), a corporation formed under the

laws of China. The purpose of Beijing Yatai is to conduct Aircom’s business and operations in China. Presently, its primary function

is business development, both with respect to airlines as well as content providers and advertisement partners based in China as most

business conducted in China requires a local registered company. Beijing Yatai is also actively seeking strategic partnerships whom Aircom

may leverage in order to provide more and better services to its customers. Aircom also plans to provide local supports to China-based

airlines via Beijing Yatai and teleports located in China. On November 6, 2020,

6

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 1 - Organization - Continued

On October 31, 2019, Aerkomm SY established a new a wholly owned subsidiary, Aerkomm Pacific Limited (“Aerkomm Malta”), a corporation formed under the laws of Malta. The purpose of Aerkomm Malta is to conduct Aerkomm’s business and operations and to engage with suppliers and potential airlines customers in the European Union.

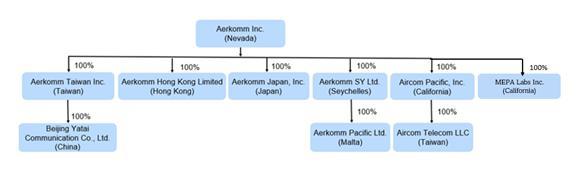

The Company’s organization structure is as following:

On September 04, 2022, Aerkomm acquired a wholly owned subsidiary, MEPA Labs Inc. (MEPA), a California corporation. The purpose of the acquisition is to extend business development and operations related to the satellite products.

Aerkomm and its subsidiaries (the “Company”) are full-service, development stage providers of in-flight entertainment and connectivity solutions with their initial market in the Asian Pacific region.

The Company has not generated significant

revenues, excluding non-recurring revenues, and will incur additional expenses as a result of being a public reporting company. Currently,

the Company has taken measures that management believes will improve its financial position by financing activities, including through

public offerings, private placements, short-term borrowings and equity contributions. Two of the Company’s current shareholders

(the “Lenders”) each committed to provide to the Company a $

With the $

The Company’s common stock is quoted for trading on the OTC Markets Group Inc. OTCQX Market under the symbol “AKOM.” On July 17, 2019, the French Autorité des Marchés Financiers (the “AMF”) granted visa number 19-372 on the prospectus relating to the admission of the Company’s common stock to list and trade on the Professional Segment of the regulated market of Euronext Paris (“Euronext Paris”). The Company’s common stock began trading on Euronext Paris on July 23, 2019 under the symbol “AKOM” and is denominated in Euros on Euronext Paris. This listing did not alter the Company’s share count, capital structure, or current common stock listing on the OTCQX, the Company’s primary trading market for its common stock.

7

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies

Unaudited Interim Financial Information

The accompanying condensed consolidated balance sheet as of March 31, 2023, and the condensed consolidated statements of operations and comprehensive loss and cash flows for the three months ended March 31, 2023 and 2022 are unaudited. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s financial position as of March 31, 2023 and the results of operations and cash flows for the three months ended March 31, 2023 and 2022. The financial data and other information disclosed in these notes to the condensed consolidated financial statements related to these three months periods are unaudited. The results of operations for the three months ended March 31, 2023 are not necessarily indicative of the results to be expected for the year ending December 31, 2023 or for any other interim period or other future year.

Principle of Consolidation

Aerkomm consolidates the accounts of its subsidiaries, MEPA, Aircom, Aircom Seychelles, Aircom HK, Aircom Japan, Aircom Taiwan, Aerkomm Taiwan, Beijing Yatai and Aerkomm Malta. All significant intercompany accounts and transactions have been eliminated in consolidation.

Reclassifications of Prior Year Presentation

Certain prior year balance sheet, and cash flow statement amounts have been reclassified for consistency with the current year presentation. These reclassifications had no effect on the reported results of operations.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results may differ from these estimates.

Concentrations of Credit Risk

Financial instruments that potentially

subject the Company to significant concentrations of credit risk consist primarily of cash in banks. As of March 31, 2023 and December

31, 2022, the total balance of cash in bank exceeding the amount insured by the Federal Deposit Insurance Corporation (FDIC) for the Company

was approximately $

The Company performs ongoing credit evaluation of its customers and requires no collateral. An allowance for doubtful accounts is provided based on a review of the collectability of accounts receivable. The Company determines the amount of allowance for doubtful accounts by examining its historical collection experience and current trends in the credit quality of its customers as well as its internal credit policies. Actual credit losses may differ from management’s estimates.

8

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Investment in Equity Securities

According to FASB issued Accounting Standards Updates 2016-01 (ASU 2016-01), it requires equity investments (except those accounted for under the equity method of accounting or those that result in consolidation of the investee) to be measured at fair value with changes in fair value being recorded in current period earnings, impacting the net income. For the investments in equity securities without readily determinable fair values, the investments may be recorded at cost, subject to impairment, and adjusted through net income for observable price changes.

Holdings of marketable equity securities with no significant influence over the investee are accounted for using cost method. Marketable equity security costs are initially recognized at fair value plus transaction costs which are directly attributable to the acquisition. The cost of the securities sold is based on the weighted average cost method. Stock dividends from the investment are included to recalculate the cost basis of the investment based on the total number of shares.

Accounts receivable

Inventories

Inventories are recorded at the lower of weighted-average cost or net realizable value. The Company assesses the impact of changing technology on its inventory on hand and writes off inventories that are considered obsolete. Estimated losses on scrap and slow-moving items are recognized in the write down cost for losses.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. When value impairment is determined, the related assets are stated at the lower of fair value or book value. Significant additions, renewals and betterments are capitalized. Maintenance and repairs are expensed as incurred.

Depreciation is computed by using the

straight-line and double declining methods over the following estimated service lives: ground station equipment –

Upon sale or disposal of property and equipment, the related cost and accumulated depreciation are removed from the corresponding accounts, with any gain or loss credited or charged to income in the period of sale or disposal.

The Company reviews the carrying amount of property and equipment for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. It determined that there was no impairment loss for the years ended December 31, 2022 and 2021.

9

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Right-of-Use Asset and Lease Liability

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (Topic 842) (“ASU 2016-02”), which modifies lease accounting for both lessees and lessors to increase transparency and comparability by recognizing lease assets and lease liabilities by lessees for those leases classified as operating leases and finance leases under previous accounting standards and disclosing key information about leasing arrangements.

A lessee should recognize the lease liability to make lease payments and the right-of-use asset representing its right to use the underlying asset for the lease term. For operating leases and finance leases, a right-of-use asset and a lease liability are initially measured at the present value of the lease payments by discount rates. The Company’s lease discount rates are generally based on its incremental borrowing rate, as the discount rates implicit in the Company’s leases is readily determinable. Operating leases are included in operating lease right-of-use assets and lease liabilities in the consolidated balance sheets. Finance leases are included in property and equipment and lease liability in our consolidated balance sheets. Lease expense for operating expense payments is recognized on a straight-line basis over the lease term. Interest and amortization expenses are recognized for finance leases on a straight-line basis over the lease term.

For the leases with a term of twelve months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lessee makes this election, it should recognize lease expense for such leases generally on a straight-line basis over the lease term.

Goodwill and Purchased Intangible Assets

The Company’s goodwill represents the amount by which the total purchase price paid exceeded the estimated fair value of net assets acquired from acquisition of subsidiaries. The Company tests goodwill for impairment on an annual basis, or more often if events or circumstances indicate that there may be impairment.

Purchased intangible assets with finite

life are amortized on the straight-line basis over the estimated useful lives of respective assets. Purchased intangible assets with indefinite

life are evaluated for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be

recoverable. Purchased intangible asset consists of satellite system software and is amortized over

Fair Value of Financial Instruments

The Company utilizes the three-level valuation hierarchy for the recognition and disclosure of fair value measurements. The categorization of assets and liabilities within this hierarchy is based upon the lowest level of input that is significant to the measurement of fair value. The three levels of the hierarchy consist of the following:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 - Inputs to the valuation methodology are quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active or inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the instrument.

Level 3 - Inputs to the valuation methodology are unobservable inputs based upon management’s best estimate of inputs market participants could use in pricing the asset or liability at the measurement date, including assumptions.

The carrying amounts of the Company’s cash and restricted cash, short-term investment, accounts receivable, inventory, prepaid expenses, other receivable, accounts payable, short-term loan, accrued expenses, and other payable approximated their fair value due to the short-term nature of these financial instruments. The Company’s long-term bonds payable, long-term notes payable, long-term loan and lease payable approximated the carrying amount as its interest rate is considered as approximate to the current rate for comparable loans and leases, respectively. There were no outstanding derivative financial instruments as of March 31, 2023 and December 31, 2022.

10

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Revenue Recognition

The Company recognizes revenue when performance obligations identified under the terms of contracts with its customers are satisfied, which generally occurs upon the transfer of control in accordance with the contractual terms and conditions of the sale. The Company’s revenue for the year ended December 31, 2021 composed of the sales of ground antenna units to a related party and sales of network hardware to a non-related party. The majority of the Company’s revenue is recognized at a point in time when product is shipped, or service is provided to the customer. Revenue is measured as the amount of consideration the Company expects to receive in exchange for transferring goods, which includes estimates for variable consideration. The Company adopted the provisions of ASU 2014-09 Revenue from Contracts with Customers (Topic 606) and the principal versus agent guidance within the new revenue standard. As such, the Company identifies a contract with a customer, identifies the performance obligations in the contract, determines the transaction price, allocates the transaction price to each performance obligation in the contract and recognizes revenue when (or as) the Company satisfies a performance obligation. Customers may make payments to the Company either in advance or in arrears. If payment is made in advance, the Company will recognize a contract liability under prepayments from customers until which point the Company has satisfied the requisite performance obligations to recognize revenue.

Stock-based Compensation

The Company adopted the modified prospective method to measure stock-based compensation expense. Under the modified prospective method, stock-based compensation expense recognized during the period is based on the portion of the share-based payment awards granted after the effective date and ultimately expected to vest during the period. Stock-based compensation expense recognized in the Company’s statement of income is based on the vesting terms and the estimated fair value of the award at grant date. As stock-based compensation expense recognized in the statement of income is based on awards ultimately expected to vest, it is reduced for estimated forfeiture. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates.

The Company uses the Black-Scholes option pricing model in its determination of fair value of share-based payment awards on the date of grant. Such option pricing model is affected by assumptions based on a number of highly complex and subjective variables.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities. Adjustments to prior period’s income tax liabilities are added to or deducted from the current period’s tax provision.

The Company follows FASB guidance on uncertain tax positions and has analyzed its filing positions in all the federal, state and foreign jurisdictions where it is required to file income tax returns, as well as all open tax years in those jurisdictions. The Company files income tax returns in the US federal, state and foreign jurisdictions where it conducts business. It is not subject to income tax examinations by US federal, state and local tax authorities for years before 2018. The Company believes that its income tax filing positions and deductions will be sustained on audit and does not anticipate any adjustments that will result in a material adverse effect on its consolidated financial position, results of operations, or cash flows. Therefore, no reserves for uncertain tax positions have been recorded. The Company does not expect its unrecognized tax benefits to change significantly over the next twelve months.

The Company’s policy for recording interest and penalties associated with any uncertain tax positions is to record such items as a component of income before taxes. Penalties and interest paid or received, if any, are recorded as part of other operating expenses in the consolidated statement of operations.

Foreign Currency Transactions

Foreign currency transactions are recorded in U.S. dollars at the exchange rates in effect when the transactions occur. Exchange gains or losses derived from foreign currency transactions or monetary assets and liabilities denominated in foreign currencies are recognized in current income. At the end of each period, assets and liabilities denominated in foreign currencies are revalued at the prevailing exchange rates with the resulting gains or losses recognized in income for the period.

11

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Translation Adjustments

If a foreign subsidiary’s functional currency is the local currency, translation adjustments will result from the process of translating the subsidiary’s financial statements into the reporting currency of the Company. Such adjustments are accumulated and reported under other comprehensive loss as a separate component of stockholders’ equity.

Earnings (Loss) Per Share

Basic earnings (loss) per share is computed

by dividing income available to common shareholders by the weighted average number of shares of common stock outstanding during the period.

Diluted earnings per share is computed by dividing income available to common shareholders by the weighted-average number of shares of

common outstanding during the period increased to include the number of additional shares of common stock that would have been outstanding

if the potentially dilutive securities had been issued. Potentially dilutive securities include stock warrants and outstanding stock options,

shares to be purchased by employees under the Company’s employee stock purchase plan. The Company had

NOTE 3 - Recent Accounting Pronouncements

Simplifying the Accounting for Debt with Conversion and Other Options.

In June 2020, the FASB issued ASU 2020-06 to simplify the accounting in ASC 470, Debt with Conversion and Other Options and ASC 815, Contracts in Equity’s Own Entity. The guidance simplifies the current guidance for convertible instruments and the derivatives scope exception for contracts in an entity’s own equity. Additionally, the amendments affect the diluted EPS calculation for instruments that may be settled in cash or shares and for convertible instruments. This ASU will be effective beginning in the first quarter of the Company’s fiscal year 2022. Early adoption is permitted. The amendments in this update must be applied on either full retrospective basis or modified retrospective basis through a cumulative-effect adjustment to retained earnings/(deficit) in the period of adoption. The adoption of ASU 2020-06 does not have a significant impact on the Company’s consolidated financial statements as of and for the year ended March 31, 2023.

Financial Instruments

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which modifies the measurement of expected credit losses of certain financial instruments. In February 2020, the FASB issued ASU 2020-02 and delayed the effective date of ASU 2016-13 until fiscal year beginning after December 15, 2022. In March 2022, the FASB issued ASU 2022-02 and eliminate the Troubled Debt Restructuring recognition and measurement guidance. The Company is currently evaluating the impact of adopting ASU 2016-13 on its consolidated financial statements.

Earnings Per Share

In April 2021, the FASB issued ASU 2021-04, which included Topic 260 “Earnings Per Share”. This guidance clarifies and reduces diversity in an issuer’s accounting for modifications or exchanges of freestanding equity-classified written call options due to a lack of explicit guidance in the FASB Codification. The ASU 2021-04 is effective for all entities for fiscal years beginning after December 15, 2021. The adoption of ASU 2021-04 does not have a significant impact on the Company’s consolidated financial statements as of and for the year ended March 31, 2023.

12

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 4 - Short-term Investment

On September 9, 2019, the Company entered into a liquidity agreement

with a security company (“the Liquidity Provider”) in France, which is consistent with customary practice in the French securities

market. The liquidity agreement complies with applicable laws and regulations in France and authorizes the Liquidity Provider to carry

out market purchases and sales of shares of the Company’s common stock on the Euronext Paris market. To enable the Liquidity Provider

to carry out the interventions provided for in the contract, the Company contributed approximately $

On December 3, 2020, the Company entered

into three separate stock purchase agreements (or “Stock Purchase Agreement”) from three individuals to purchase an aggregate

of

As of December 31, 2021,

On September 30, 2022, the Company entered

into a stock purchase agreement (or “Stock Purchase Agreement”) to purchase common stock of Shinbao in a total amount of NT$

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Investment cost – Ejectt – short-term | $ | $ | ||||||

| Investment cost - Liquidity | ||||||||

| Total Investment Cost | ||||||||

| Appreciation in market value (Allowance for value decline) | ||||||||

| Prepaid investment | ||||||||

| Total | $ | $ | ||||||

13

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 5 - Inventories

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Satellite equipment for sale under construction | $ | $ | ||||||

NOTE 6 - Prepaid Expenses

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Prepaid engineering expense | $ | $ | ||||||

| Prepaid professional expense | ||||||||

| Others | ||||||||

| Total | $ | $ | ||||||

| Prepaid expense - current | ||||||||

| Prepaid expense – non-current | ||||||||

NOTE 7 - Property and Equipment

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Ground station equipment | $ | $ | ||||||

| Computer software and equipment | ||||||||

| Satellite equipment | ||||||||

| Vehicle | ||||||||

| Leasehold improvement | ||||||||

| Furniture and fixture | ||||||||

| Accumulated depreciation | ( | ) | ( | ) | ||||

| Net | ||||||||

| Prepayments - land | ||||||||

| Prepaid equipment | ||||||||

| Total | $ | $ | ||||||

Depreciation expense was $

14

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 8 - Long-term Investment

As of March 31, 2023 and December 31,

2022,

Also on September 29, 2022, the Company

entered into a stock purchase agreement (or “Stock Purchase Agreement”) to purchase

In Q1 2023, the Company disposed AnaNaviTek

for amount of $

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Investment cost – Ejectt – long-term | $ | $ | ||||||

| Investment cost – AnaNaviTek | ||||||||

| Net | $ | $ | ||||||

NOTE 9 - Intangible Asset, Net

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Satellite system software | $ | $ | ||||||

| Accumulated amortization | ( | ) | ( | ) | ||||

| Net | $ | $ | ||||||

Amortization expense was $

15

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

Note 10 - Goodwill

The Company obtained the goodwill from

various merge and acquisition events described in Note 1. On September 4, 2022, the Company acquired

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Gross amount | $ | $ | ||||||

| Accumulated Impairment | ||||||||

| Net | $ | $ | ||||||

No impairment loss on goodwill were recognized for three-month period ended March 31, 2023 and the year ended December 31, 2022.

The following table summarizes

the fair values of the assets acquired and liabilities assumed at the date of acquisition.

| Total purchase considerations | $ | |||

| Fair Value of tangible assets acquired: | ||||

| Cash | ||||

| Loan receivable | ||||

| Prepaid expenses and other current assets | ||||

| Property and equipment | ||||

| Deposits | ||||

| Total identifiable assets acquired | ||||

| Fair value of liabilities assumed: | ||||

| Accounts payable | ||||

| Loan from stockholder | ( | ) | ||

| Other payable | ( | ) | ||

| Total liabilities assumed | ( | ) | ||

| Net identifiable liabilities assumed | ( | ) | ||

| Goodwill as a result of the acquisition | $ |

NOTE 11 - Operating and Finance Leases

| A. | Lease term and discount rate: |

| 2023 | 2022 | |||||||

| Weighted-average remaining lease term | (Unaudited) | |||||||

| Operating lease | ||||||||

| Finance lease | ||||||||

| Weighted-average discount rate | ||||||||

| Operating lease | % | % | ||||||

| Finance lease | % | % | ||||||

16

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 11 - Operating and Finance Leases - Continued

| B. | The balances for the operating and finance leases are presented as follows within the unaudited condensed consolidated balance sheets as of March 31, 2023 and December 31, 2022: |

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Right-of-use assets | $ | $ | ||||||

| Lease liability – current | $ | $ | ||||||

| Lease liability – non-current | $ | $ | ||||||

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Property and equipment, at cost | $ | $ | ||||||

| Accumulated depreciation | ( | ) | ( | ) | ||||

| Property and equipment, net | $ | $ | ||||||

| Lease liability - current | $ | $ | ||||||

| Lease liability – non-current | ||||||||

| Total finance lease liabilities | $ | $ | ||||||

The components of lease expense are as follows within the unaudited condensed consolidated statements of operations and comprehensive loss for the three months periods ended March 31, 2023 and 2022:

| March 31, 2023 | March 31, 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Lease expense | $ | $ | ||||||

| Sublease rental income | ( | ) | ( | ) | ||||

| Net lease expense | $ | $ | ||||||

| March 31, 2023 | March 31, 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Amortization of right-of-use asset | $ | $ | ||||||

| Interest on lease liabilities | ||||||||

| Total finance lease cost | $ | $ | ||||||

17

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 11 - Operating and Finance Leases - Continued

| March 31, 2023 | March 31, 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash paid for amounts included in the measurement of lease liabilities: | ||||||||

| Operating cash outflows from operating leases | $ | $ | ||||||

| Operating cash outflows from finance lease | $ | $ | ||||||

| Financing cash outflows from finance lease | $ | $ | ||||||

| Leased assets obtained in exchange for lease liabilities: | ||||||||

| Operating leases | $ | $ | ||||||

Maturity of lease liabilities:

| Others | Total | |||||||

| (Unaudited) | (Unaudited) | |||||||

| April 1, 2023 – March 31, 2024 | $ | $ | ||||||

| April 1, 2024 – March 31, 2025 | ||||||||

| Total lease payments | $ | $ | ||||||

| Less: Imputed interest | ( | ) | ( | ) | ||||

| Present value of lease liabilities | $ | $ | ||||||

| Current portion | ( | ) | ( | ) | ||||

| Non-current portion | $ | $ | ||||||

| Total | ||||

| (Unaudited) | ||||

| April 1, 2023 – March 31, 2024 | $ | |||

| April 1, 2024 – March 31, 2025 | ||||

| Total lease payments | $ | |||

| Less: Imputed interest | ( | ) | ||

| Present value of lease liabilities | $ | |||

| Current portion | ( | ) | ||

| Non-current portion | $ | |||

18

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 12 - Short-term Loan

In June 2021, the Company entered

into a loan agreement in the amount of $

NOTE 13 - Long-term Loan

The Company has a car loan credit line

of NT$

| Twelve months ending March 31, | (Unaudited) | |||

| 2024 | ||||

| 2025 | ||||

| Total installment payments | ||||

| Less: Imputed interest | ( | ) | ||

| Present value of long-term loan | ||||

| Current portion | ( | ) | ||

| Non-current portion | $ | |||

| Year ending December 31, | ||||

| 2023 | $ | |||

| 2024 | ||||

| Total installment payments | ||||

| Less: Imputed interest | ( | ) | ||

| Present value of long-term loan | ||||

| Current portion | ( | ) | ||

| Non-current portion | $ | |||

NOTE 14 - Convertible Long-term Bonds Payable and Restricted Cash

On December 3, 2020, the Company closed

a private placement offering consisting of US$

Unless previously redeemed, converted

or repurchased and cancelled, the Bonds may be converted at any time on or after December 3, 2020 up to November 20, 2025 into shares

of Common Stock of the Company with a par value of $

Holders of the Bonds may also require the Company to repurchase all or part of the Bonds on the third anniversary of the Issue Date, at the Early Redemption Amount. Unless the Bonds have been previously redeemed, converted or repurchased and cancelled, Holders of the Bonds will also have the right to require the Company to repurchase the Bonds for cash at the Early Redemption Amount if an event of delisting or a change of control occurs.

19

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 14 - Long-term Bonds Payable and Restricted Cash - Continued

Pursuant to the agreements of Bonds,

Bank of Panhsin Co., Ltd. (the “BG Bank”) committed to issue a bank guarantee for the benefit of the holders of the Bonds.

The Bank Guarantee is intended to provide a source of funds for the principal, premium, interest (if any) and any other payment obligations

of the Company which shall include the default interest under the Bonds upon the Company’s failure to pay amounts pursuant to the

Indenture or upon the Bonds being declared due and payable on the occurrence of an Event of Default pursuant to this Indenture. In order

to obtain the guarantee from BG Bank, the Company entered into a line of credit in the amount of $

Management has accounted for the convertible bonds by assuming that they will be repaid and redeemed at maturity; accordingly, the Company has included the redemption premium as part of the accretion tables and calculation of interest and issuance cost to be amortized over the life of the bond. Any value borne from the conversion feature of the bond and or issuance costs related to the origination and distribution of these bonds have been accounted for as debt discounts to be amortized using the effective interest method over the life of the bond.

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Credit Enhanced Zero Coupon Convertible Bonds | $ | $ | ||||||

| Coupon Bonds | ||||||||

| Unamortized loan fee | ( | ) | ( | ) | ||||

| Net | $ | $ | ||||||

Bond issuance cost was $

NOTE 15 - Convertible Long-term notes Payable and Restricted Cash

On December 7, 2022, Aerkomm Inc. (the

“Company”) entered into an investment conversion and note purchase agreement (the “Agreement”) with World Praise

Limited, a Samoa registered company (“WPL”). Pursuant to the terms of this agreement, (i) a subscription for the common stock

of the Company in the amount of $

In addition, and as indicated in the

Agreement, WPL agreed to lend an additional $

The Convertible Note allows for loans

to the Company up to an aggregate principal amount of $

20

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 16 - Contract Liability

On March 9, 2015, the Company entered

into a

NOTE 17 - Income Taxes

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Current: | (Unaudited) | (Unaudited) | ||||||

| Federal | $ | $ | ||||||

| State | ||||||||

| Foreign | ||||||||

| Total | $ | $ | ||||||

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Tax benefit at statutory rate | $ | ( | ) | $ | ( | ) | ||

| Net operating loss carryforwards (NOLs) | ||||||||

| Foreign investment losses | ( | ) | ( | ) | ||||

| Stock-based compensation expense | ||||||||

| Amortization expense | ||||||||

| Accrued payroll | ||||||||

| Unrealized exchange losses | ( | ) | ||||||

| Others | ( | ) | ( | ) | ||||

| Tax expense at effective tax rate | $ | $ | ||||||

21

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 17 - Income Taxes - Continued

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Net operating loss carryforwards (NOLs) | $ | $ | ||||||

| Stock-based compensation expense | ||||||||

| Accrued expenses and unpaid expense payable | ||||||||

| Tax credit carryforwards | ||||||||

| Unrealized exchange losses (gain) | ||||||||

| Excess of tax amortization over book amortization | ( | ) | ( | ) | ||||

| Others | ( | ) | ( | ) | ||||

| Gross | ||||||||

| Valuation allowance | ( | ) | ( | ) | ||||

| Net | $ | $ | ||||||

Management does not believe the deferred

tax assets will be utilized in the near future; therefore, a full valuation allowance is provided. The net change in deferred tax assets

valuation allowance was an increase of approximately $

As of March 31, 2023 and December 31,

2022, the Company had federal NOLs of approximately $

As of March 31, 2023 and December 31,

2022, the Company has Japan NOLs of approximately $

As of March 31, 2023 and December 31,

2022, the Company has Taiwan NOLs of approximately $

As of March 31, 2023 and December 31,

2022, the Company had approximately $

The Company’s ability to utilize its federal and state NOLs to offset future income taxes is subject to restrictions resulting from its prior change in ownership as defined by Internal Revenue Code Section 382. The Company does not expect to incur the limitation on NOLs utilization in future annual usage.

22

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 18 - Capital Stock

| 1) | Preferred Stock: |

The Company is authorized to issue

| 2) | Common Stock: |

| March 31, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Restricted stock - vested | ||||||||

| Restricted stock - unvested | ||||||||

| Total restricted stock | ||||||||

The unvested shares of restricted stock were recorded under a deposit liability account awaiting future conversion to common stock when they become vested.

On June 16, 2022, the Company issued

| 3) | Stock Warrant: |

For the years ended December 31, 2022,

the Company recorded an increase of $

23

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 19 - Significant Related Party Transactions

In addition to the information disclosed in other notes, the Company has significant related party transactions as follows:

| Related Party | Relationship | |

| Well Thrive Limited (“WTL”) | ||

| Ejectt Inc. (“Ejectt”) | ||

| STAR JEC INC. (“StarJec”) | ||

| AA Twin Associates Ltd. (“AATWIN”) | ||

| EESquare Japan (“EESquare JP”) |

| B. | Significant related party transactions: |

The Company has extensive transactions with its related parties. It is possible that the terms of these transactions are not the same as those which would result from transactions among wholly unrelated parties.

| March 31, 2023 | December 31, 2022 | |||||||

(Unaudited) | ||||||||

| Other receivable from: | ||||||||

| EESquare JP 1 | $ | $ | ||||||

| StarJec2 | ||||||||

| Others6 | ||||||||

| Total | $ | $ | ||||||

| Rent deposit to Ejectt3 | ||||||||

| Loan from WTL 4 | $ | $ | ||||||

| Prepayment from Ejectt 3 | $ | $ | ||||||

| Other payable to: | ||||||||

| AATWIN 5 | $ | $ | ||||||

| Interest payable to WTL4 | ||||||||

| Others 6 | ||||||||

| Total | $ | $ | ||||||

| 1. | |

| 2. | |

| 3. | |

| 4. | |

| 5. | |

| 6. |

24

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 19 - Significant Related Party Transactions - Continued

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Purchase from Ejectt1 | $ | $ | ||||||

| Revenue from Star Jec 2 | ||||||||

| Interest expense charged by WTL 3 | ||||||||

| Rental income from EESqaure JP 4 | ( | ) | ( | ) | ||||

| 1. |

| 2. | |

| 3. | |

| 4. |

NOTE 20 - Stock Based Compensation

In March 2014, Aircom’s Board

of Directors adopted the 2014 Stock Option Plan (the “Aircom 2014 Plan”). The Aircom 2014 Plan provided for the granting of

incentive stock options and non-statutory stock options to employees, consultants and outside directors of Aircom. On February 13, 2017,

pursuant to the Exchange Agreement, Aerkomm assumed the options of Aircom 2014 Plan and agreed to issue options for an aggregate of

One-third of stock option shares will

be vested as of the first anniversary of the time the option shares are granted or the employee’s acceptance to serve the Company,

and 1/36th of the shares will be vested each month thereafter. Option price is determined by the Board of Directors. The Aircom 2014 Plan

became effective upon its adoption by the Board and shall continue in effect for a term of

On May 5, 2017, the Board of Directors

of Aerkomm adopted the Aerkomm Inc. 2017 Equity Incentive Plan (the “Aerkomm 2017 Plan” and together with the Aircom 2014

Plan, the “Plans”) and the reservation of

25

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 20 - Stock Based Compensation - Continued

On June 23, 2017, the Board of Directors

agreed to issue options for an aggregate of

On July 31, 2017, the Board of Directors

approved to issue options for an aggregate of

On December 29, 2017, the Board of Directors

approved to issue options for an aggregate of

On June 19, 2018, the Compensation Committee

approved to issue options for

On September 16, 2018, the Compensation

Committee approved to issue options for

On December 29, 2018, the Compensation

Committee approved to issue options for an aggregate of

On July 2, 2019, the Board of Directors

approved the grant of options to purchase an aggregate of

On October 4, 2019, the Board of Directors

approved the grant of options to purchase an aggregate of

On December 29, 2019, the Board of Directors

approved to issue options for an aggregate of

On February 19, 2020, the Board of Directors

approved to issue options for

On September 17, 2020, the Board of

Directors approved to issue options for

26

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 20 - Stock Based Compensation - Continued

On December 11, 2020, the Board of Directors

approved the grant of options to purchase an aggregate of

On January 23, 2021, the Board of Directors

approved to issue options for an aggregate of

On September 1, 2021, the Board of Directors

approved to issue options for

On September 17, 2021, the Board of

Directors approved to issue options for

On October 21, 2021, the Board of Directors

approved to issue options for

On December 1, 2021, the Board of Directors

approved to issue options for

On December 29, 2021, the Board of Directors

approved to issue options for an aggregate of

On December 31, 2021, the Board of Directors

approved to issue options for

On March 1, 2022, the Board of Directors

approved to issue options for

On June 1, 2022, the Board of Directors

approved to issue options for

On September 1, 2022, the Board of Directors

approved to issue options for

On September 17, 2022, the Board of

Directors approved to issue options for

On December 1, 2022, the Board of Directors

approved to issue options for

On December 29, 2022, the Board of Directors

approved to issue options for an aggregate of

On March 1, 2023, the Board of Directors

approved to issue options for

Valuation and Expense Information

Measurement and recognition of compensation

expense based on estimated fair values is required for all share-based payment awards made to its employees and directors including employee

stock options. The Company recognized compensation expense of $

27

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 20 - Stock Based Compensation - Continued

Determining Fair Value

Valuation and amortization method

The Company uses the Black-Scholes option-pricing-model to estimate the fair value of stock options granted on the date of grant or modification and amortizes the fair value of stock-based compensation at the date of grant on a straight-line basis for recognizing stock compensation expense over the vesting period of the option.

Expected term

The expected term is the period of time that granted options are expected to be outstanding. The Company uses the SEC’s simplified method for determining the option expected term based on the Company’s historical data to estimate employee termination and options exercised.

Expected dividends

The Company does not plan to pay cash dividends before the options are expired. Therefore, the expected dividend yield used in the Black-Scholes option valuation model is zero.

Expected volatility

Since the Company has no historical volatility, it used the calculated value method which substitutes the historical volatility of a public company in the same industry to estimate the expected volatility of the Company’s share price to measure the fair value of options granted under the Plans.

Risk-free interest rate

The Company based the risk-free interest rate used in the Black-Scholes option valuation model on the market yield in effect at the time of option grant provided in the Federal Reserve Board’s Statistical Releases and historical publications on the Treasury constant maturities rates for the equivalent remaining terms for the Plans.

Forfeitures

The Company is required to estimate forfeitures at the time of grant and revises those estimates in subsequent periods if actual forfeitures differ from those estimates. The Company uses historical data to estimate option forfeitures and records share-based compensation expense only for those awards that are expected to vest.

| Assumptions | ||||

| Expected term | ||||

| Expected volatility | % | |||

| Expected dividends | % | |||

| Risk-free interest rate | % | |||

| Forfeiture rate | % | |||

28

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 20 - Stock Based Compensation - Continued

Aircom 2014 Plan

| Number of Shares | Weighted Average Exercise Price Per Share | Weighted Average Fair Value Per Share | ||||||||||

| Options outstanding at January 1, 2022 | $ | $ | ||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited/Cancelled | ||||||||||||

| Options outstanding at December 31, 2022 | ||||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited/Cancelled | ||||||||||||

| Options outstanding at March 31, 2023 (unaudited) | ||||||||||||

There are no unvested stock awards under Aircom 2014 Plan for the three months period ended March 31, 2023 and the year ended December 31, 2022.

| Options Outstanding (Unaudited) | Options Exercisable (Unaudited) | |||||||||||||||||||||||||

| Range of Exercise Prices | Shares Outstanding at 3/31/2023 | Weighted Average Remaining Contractual Life (years) | Weighted Average Exercise Price | Shares Exercisable at 3/31/2023 | Weighted Average Remaining Contractual Life (years) | Weighted Average Exercise Price | ||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

As of March 31, 2023, there was no unrecognized stock-based compensation expense for the Aircom 2014 Plan. No option was exercised during the three months periods ended March 31, 2023 and 2022.

Aerkomm 2017 Plan

| Number of Shares | Weighted Average Exercise Price Per Share | Weighted Average Fair Value Per Share | ||||||||||

| Options outstanding at January 1, 2022 | ||||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited/Cancelled | ( | ) | ||||||||||

| Options outstanding at December 31, 2022 | ||||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited/Cancelled | ||||||||||||

| Options outstanding at March 31, 2023 (unaudited) | ||||||||||||

29

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 20 - Stock Based Compensation - Continued

| Number of Shares | Weighted Average Fair Value Per Share | |||||||

| Options unvested at January 1, 2022 | ||||||||

| Granted | ||||||||

| Vested | ( | ) | ||||||

| Forfeited/Cancelled | ( | ) | ||||||

| Options unvested at December 31, 2022 | ||||||||

| Granted | ||||||||

| Vested | ( | ) | ||||||

| Forfeited/Cancelled | ||||||||

| Options unvested at March 31, 2023 (unaudited) | ||||||||

Of the shares covered by options outstanding

under the Aerkomm2017 Plan as of March 31, 2023,

| Options Outstanding (Unaudited) | Options Exercisable (Unaudited) | |||||||||||||||||||||||||

| Range of Exercise Prices |

Shares Outstanding at 3/31/2023 |

Weighted Average Remaining Contractual Life (years) |

Weighted Average Exercise Price |

Shares Exercisable at 3/31/2023 |

Weighted Average Remaining Contractual Life (years) |

Weighted Average Exercise Price |

||||||||||||||||||||

| $ | 2.72 – 4.30 | $ | $ | |||||||||||||||||||||||

| 6.00 – 10.00 | ||||||||||||||||||||||||||

| 11.00 – 14.20 | ||||||||||||||||||||||||||

| 20.50 – 27.50 | ||||||||||||||||||||||||||

| 30.00 – 35.00 | ||||||||||||||||||||||||||

As of March 31, 2023, total unrecognized

stock-based compensation expense related to stock options was approximately $

30

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 21 - Commitments

As of March 31, 2023, the Company’s significant commitment is summarized as follows:

| Airbus SAS Agreement: On November 30, 2018, in furtherance of a memorandum of understanding signed in March 2018, the Company entered into an agreement with Airbus SAS (“Airbus”), pursuant to which Airbus will develop and certify a complete retrofit solution allowing the installation of the Company’s “AERKOMM K++” system on Airbus’ single aisle aircraft family including the Airbus A319/320/321, for both Current Engine Option (CEO) and New Engine Option (NEO) models. Airbus will also apply for and obtain on the Company’s behalf a Supplemental Type Certificate (STC) from the European Aviation Safety Agency, or EASA, as well as from the U.S. Federal Aviation Administration or FAA, for the retrofit AERKOMM K++ system. The EU-China Bilateral Aviation Safety Agreement, or BASA, went into effect on September 3, 2020, giving a boost to the regions’ aviation manufacturers by simplifying the process of gaining product approvals from the European Union Aviation Safety Agency, or EASA, and the Civil Aviation Administration of China, or CAAC, while also ensuring high safety and environment standards will continue to be met. Pursuant to the terms of our Airbus agreement, Airbus agreed to provides the Company with the retrofit solution which will include the Service Bulletin and the material kits including the update of technical and operating manuals pertaining to the aircraft and provision of aircraft configuration control. The timeframe for the completion and testing of this retrofit solution, including the certification, is expected to be in the fourth quarter of 2024, although there is no guarantee that the project will be successfully completed in the projected timeframe. | ||

| Airbus Interior Service Agreement: On July 24, 2020, Aerkomm Malta, entered into an agreement with Airbus Interior Services, a wholly-owned subsidiary of Airbus. This new agreement follows the agreement that Aircom signed with Airbus on November 30, 2018 pursuant to which Airbus agreed to develop, install and certify the Aerkomm K++ System on a prototype A320 aircraft to EASA and FAA certification standards. | ||

| Hong Kong Airlines Agreement: On January 30, 2020, Aircom signed an agreement with Hong Kong Airlines Ltd. (HKA) to provide to Hong Kong Airlines both of its Aerkomm AirCinema and AERKOMM K++ IFEC solutions. Under the terms of this new agreement, Aircom will provide HKA its Ka-band AERKOMM K++ IFEC system and its AERKOMM AirCinema system. HKA will become the first commercial airliner launch customer for Aircom. | ||

| Vietjet Air: On October 25, 2021, the Company signed an agreement with Vietjet Air (“Vietjet”) to provide them with our Aerkomm AirCinema In-Flight Entertainment and Connectivity (“IFEC”) solutions. Under the terms of the agreement, the Company will provide to Vietjet our Aerkomm AirCinema Cube IFEC system for installation on Vietjet’s fleet of Airbus A320, A321 and Airbus A330-300 aircraft. | ||

| Republic Engineers Complaint: On October 15, 2018, Aircom Telecom entered into a product purchase agreement, or the October 15th PPA, with Republic Engineers Maldives Pte. Ltd., a company affiliated with Republic Engineers Pte. Ltd., or Republic Engineers, a Singapore based, private construction and contracting company. On November 30, 2018, the October 15th PPA was re-executed with Republic Engineers Pte. Ltd. as the signing party. The Company refers to this new agreement as the November 30th PPA and, together with the October 15th PPA, the PPA. Under the terms of the PPA, Republic Engineers committed to the purchase of a minimum of 10 shipsets of the AERKOMM K++ system at an aggregate purchase price of $ |

31

AERKOMM INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 21 - Commitments - Continued

| Shenzhen Yihe: On June 20, 2018, the Company entered into that certain Cooperation Framework Agreement, as supplemented on July 19, 2019, with Shenzhen Yihe Culture Media Co., Ltd., or Yihe, the authorized agent of Guangdong Tengnan Internet, or Tencent Group, pursuant to which Yihe agreed to assist the Company with public relations, advertising, market and brand promotion, as well as with the development of a working application of the Tencent Group WeChat Pay payment solution and WeChat applets applicable for Chinese users and relating to cell phone and WiFi connectivity on airplanes. As compensation under this Yihe agreement, the Company paid Yihe RMB | ||

| US trademark: On December 1, 2020, the United States Patent and Trademark Office (the “USPTO”) issued a Final Office Action relating to Aerkomm Inc. indicating that the Company’s US trademark application (Serial No. 88464588) for the name “AERKOMM,” which was originally filed with the USPTO on June 7, 2019, was being rejected because of a likelihood of confusion with a similarly sounding name trademarked at, and in use from, an earlier date. The Company successfully appealed this USPTO action and the USPTO issued to the Company a trademark registration for the service mark AERKOMM under Trademark Class 38 (telecommunications) on November 2, 2021 and Trademark Class 41 (entertainment services) on November 23, 2021.

Equity Contract: On December 29, 2022, Aerkomm Inc. (the “Company” or the “Seller”) and dMobile System Co., Ltd. (the “Buyer”) entered into an equity sales contract (the “Equity Sales Contract”). Pursuant to the terms of the Equity Sales Contract, (i) the Company will sell

The Buyer, dMobile System Co., Ltd., is owned by Sheng-Chun Chang, a more than

The purpose of this transaction was to have Aerkomm Taiwan become a qualified company to apply for a telecommunication license in Taiwan. |

NOTE 22 - Subsequent Events

The Company has evaluated subsequent events through the filing of this Form 10-Q, and determined that there have been no events that have occurred that would require adjustments to our disclosures in the consolidated financial statements.

32

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to “we,” “us,” “our,” or “our company” are to the combined business of Aerkomm Inc., a Nevada corporation, and its consolidated subsidiaries, including Aircom Pacific, Inc., a California corporation and wholly-owned subsidiary, or Aircom; Aircom Pacific Ltd., a Republic of Seychelles company and wholly-owned subsidiary of Aircom; Aerkomm Pacific Limited, a Malta company and wholly owned subsidiary of Aircom Pacific Ltd.; Aircom Pacific Inc. Limited, a Hong Kong company and wholly-owned subsidiary of Aircom; Aircom Japan, Inc., a Japanese company and wholly-owned subsidiary of Aircom; and Aircom Telecom LLC, a Taiwanese company and wholly-owned subsidiary of Aircom, Aircom Taiwan, or Aircom Beijing.

Special Note Regarding Forward Looking Statements

Certain information contained in this report includes forward-looking statements. The statements herein which are not historical reflect our current expectations and projections about our future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events. The following factors, among others, may affect our forward-looking statements:

| ● | our future financial and operating results; |

| ● | our intentions, expectations and beliefs regarding anticipated growth, market penetration and trends in our business; |

| ● | the impact and effects of the global outbreak of the coronavirus (COVID-19) pandemic, and other potential pandemics or contagious diseases or fear of such outbreaks, on the global airline and tourist industries, especially in the Asia Pacific region; |

| ● | our ability to attract and retain customers; |

| ● | our dependence on growth in our customers’ businesses; |

| ● | the effects of changing customer needs in our market; |

| ● | the effects of market conditions on our stock price and operating results; |

| ● | our ability to successfully complete the development, testing and initial implementation of our product offerings; |

| ● | our ability to maintain our competitive advantages against competitors in our industry; |

| ● | our ability to timely and effectively adapt our existing technology and have our technology solutions gain market acceptance; |

| ● | our ability to introduce new product offerings and bring them to market in a timely manner; |

| ● | our ability to obtain required telecommunications, aviation and other licenses and approvals necessary for our operations |

| ● | our ability to maintain, protect and enhance our intellectual property; |

| ● | the effects of increased competition in our market and our ability to compete effectively; |

| ● | our expectations concerning relationship with customers and other third parties; |

| ● | the attraction and retention of qualified employees and key personnel; |

| ● | future acquisitions of our investments in complementary companies or technologies; and |

| ● | our ability to comply with evolving legal standards and regulations. |

Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue our operations. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2021, and matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

33

The specific discussions herein about our company include financial projections and future estimates and expectations about our business. The projections, estimates and expectations are presented in this report only as a guide about future possibilities and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on our management’s own assessment of our business, the industry in which we work and the economy at large and other operational factors, including capital resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly from the projections.

Potential investors should not make an investment decision based solely on our company’s projections, estimates or expectations.

Overview

Aerkomm Inc., is a development stage Non-Geostationary Orbit NGSO Low Earth Orbit and Medium Earth Orbit (LEO/MEO) satellite communication technology provider, focusing on B5G / 6G communications. With our advanced technology, we intend to provide our partners the benefits of E / V / Ka / Ku and X band unique solutions that encompasses a wide range of service options. Such options include connectivity solutions (IVI) on Vehicles (RVs, EVs….etc), Internet of Things (IOT) scenarios, internet in rural and remote sites to complement mobile communication weakness, maritime market and aviation market, including Government UAVs, as well as the provision of in-flight broadband entertainment and connectivity (IFEC) for commercial airlines and corporate jets.

Our technology will have several uses including:

| 1. |

Aviation: Target customers will be Government UAVs, commercial airlines and corporate jet operators. For Government UAVs we plan to generate revenue from the product price and monthly subscription fee for satellite bandwidth. We plan to generate revenue from e-commerce and monthly subscription fee for satellite bandwidth from commercial airlines. From corporate jet operators we plan to generate revenue from the product price and monthly subscription fee for satellite bandwidth.

| |

| 2. | Vehicles and Autopilot Trucks: Target customers will be all autopilot vehicles, using B5G, LEO satellites. We plan to generate revenue from the product price and monthly subscription fee for satellite bandwidth. |