UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from _____ to _____

Commission file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| Incorporation or organization) | ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| The (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As of June 30, 2023, the aggregate market

value of shares held by non-affiliates of the registrant (based upon the closing price of such shares on the Nasdaq Global Market on

June 30, 2023) was $

The number of shares outstanding of the registrant’s common stock, $0.001 par value, outstanding as of April 1, 2024: .

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| i |

FOCUS UNIVERSAL INC.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including, but not limited to, the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| · | the uncertainty of profitability based upon our history of losses; |

| · | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; |

| · | risks related to our international operations and currency exchange fluctuations; and |

| · | other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on our forward-looking statements. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we,” “us,” “our,” the “Company” and “Focus Universal” mean Focus Universal Inc. unless otherwise indicated.

| ii |

PART I

Item 1. BUSINESS

Company Background.

Focus Universal Inc. (the “Company,” “we,” “us,” or “our”) is a Nevada corporation. We are based in the city of Ontario, California, and were incorporated in Nevada in 2012. In December of 2013, we filed an S-1 registration statement that went effective on March 14, 2014. From March 14, 2014, through August 30, 2021, our securities traded on the OTCQB Market. From August 31, 2021, through January 27, 2022, our securities traded on the Nasdaq Capital Market. From January 28, 2022, to the present, our securities have traded on the Nasdaq Global Market.

Our company websites are www.focusuniversal.com, www.avxdesign.com, www.smart-avx.com, and www.attechsystems.com. Our website and the information contained therein or connected thereto are not intended to be incorporated into this report.

We have developed five proprietary platform technologies that we believe solve the most fundamental problems plaguing the internet of things (“IoT”) industry by: (1) increasing the overall degree of chip integration capabilities by shifting integration from the component level directly to the device level; (2) creating a faster 5G cellular technology by using ultra-narrowband technology; (3) leveraging ultra-narrowband power line communication (“PLC”) technology; (4) developing a natural integrated programming language (“NIPL”) applied to software development, which generates a user interface through machine auto generation technology; and (5) developing a universal smart instrumentation platform (“USIP”).

Index of Key Technical Abbreviated Terms

| Abbreviation | Full Term |

| 5G | Fifth Generation Mobile Wireless Telecommunications Network |

| FSK | Gaussian Frequency Shift Keying |

| HANs | Home Area Networks |

| IC | Integrated Chip |

| IoT | Internet of Things |

| LTE Networks | Long-Term Evolution Networks |

| MOS Transistor | Metal-Oxide-Silicon Transistor |

| PLC | Power Line Communication |

| UNB | Ultra-narrowband |

| USIO | Universal Smart Instrumentation Operating System |

| USIP | Universal Smart Instrumentation Platform |

| 1. | Our goal is to increase the overall degree of chip integration capabilities by shifting integration from the component level directly to the device level. |

We have developed an innovative and proprietary “device on a chip” (“DoC”) technology, which combines the required electronic circuits of various integrated circuit components onto a single, integrated chip (“IC”) and pushes beyond the limits of current integrated chips. Our DoC technology works as a single component but is capable of handling entire IoT device functions (excluding sensors and architecture-specific components). Our DoC technology includes both the hardware and software, uses less power compared to traditional IoT devices, with better performance, includes smaller overall devices, and offers greater reliability despite decreasing the number of interconnections between components. We believe that incorporating our DoC technology into our product offering, will simplify the manufacturing process, lowering our costs and allowing us to achieve a faster time-to-market, when compared to our competitors’ who only manufacture and sell multi-chip devices. Our planned DoC technology allows devices to achieve interoperability with one another and are interchangeable, both features where traditional IoT devices fall short.

Our research and development suggest that the existing IC integration in IoT devices is mainly focused on hardware-to-hardware integration, not incorporating software solutions. This lack of incorporating software under a common operating system, application software, and extra interface into ICs, limits IC integration to the component level. Software is a critical component in electronics, and the more tightly integrated the software, the better the power and performance. Software also adds an element of flexibility and allows multiple discrete ICs, which in the past were unable to be further integrated into a single IC.

| 1 |

Currently, ICs integration requires the development and manufacture of customized hardware and software. As a result, IC fabrication is too expensive to manufacture on a large scale. IC is ideally designed for products that are intended for mass production to keep manufacturing costs low by producing uniform products using repetitive and standardized processes. Product standardization has become a major bottleneck in device-level IC fabrication because most devices are custom-designed and manufactured.

The Universal Smart Instrumentation Platform (“USIP”) we developed is a standardized, universal hardware and software integration platform that provides a universal common foundation for what we anticipate will be used by thousands of IoT and standalone devices. The electronic design and production start from a 90% completed common foundation, our USIP, instead of the individual components that necessitate the current method of building each standalone instrument from scratch. USIP allows ICs to be integrated from the component level up to the device level, which pushes the frontier of semiconductor technology beyond Moore’s Law. Our USIP also eliminates redundant hardware and software and results in significant cost savings and production efficiency.

Figure 1. From USIP to device level integrated circuits (“IC”).

| 2. | Creating a faster 5G cellular technology by using ultra-narrowband technology. |

Fifth generation (“5G”) telecommunications networks will revolutionize the digital economy by enabling new applications that depend on ultra-fast communications on an industrial scale. 5G promises to deliver an improved end-user experience by offering new applications and services through gigabit speeds and significantly improved performance and reliability. 5G will build on the successes of 2G, 3G, and 4G mobile networks, which have transformed society, supporting new services and new business models. 5G provides an opportunity for wireless operators to move beyond providing connectivity services to developing rich solutions and services for consumers and industries across a wide range of sectors at an affordable cost. 5G is an opportunity to implement wired and wireless converged networks and offers opportunities to integrate network management systems. The United States and China are in a race to deploy 5G wireless networks, and the country that gets there first will lead in standard-setting, patents, and the global supply chain. A World Economic Forum report stated that by 2035 5G networks would contribute $13.2 trillion in economic value globally and generate 22.3 million jobs in the 5G global value chain from direct network investments and residual services[1]. 5G networks and their related applications are expected to add three million jobs and $1.2 trillion to the economy in the U.S. [2]

____________________

| [1] | World Economic Forum, January 2020 “The Impact of 5G: Creating New Value across Industries and Society,” available at: http://www3.weforum.org/docs/WEF_The_Impact_of_5G_Report.pdf (last accessed March 6, 2023). |

| [2] | https://www.marketsandmarkets.com/Market-Reports/power-line-communication-plc-market-912.html (last accessed on March 6, 2023). |

| 2 |

Though 5G offers a significant increase in speed and bandwidth over previous generation telecommunication networks, its more limited range for high-speed internet will require further infrastructure investments. A 5G network requires spectrum across low, mid, and high spectrum bands to deliver widespread coverage and support a wide range of use cases[3]. A low-band cell site can cover hundreds of square miles and deliver a downlink data rate in the range of 30-250 Mbps.[4] Mid-band frequencies (2.5/3.5Ghz) can also travel long distances but can carry a lot more data than low-band cell sites.[5] Mid-band 5G base stations can transmit and receive high-capacity signals over fairly large areas. They can represent an ideal mix of performance—including some networks providing download speeds around 100-900 Mbps—for the bulk of 5G traffic in metropolitan areas.[6] High-band 5G uses millimeter-wave (mmWave) frequency bands. Despite receiving plenty of publicity, high-band is a very specialized part of the 5G offering.[7] Functioning over a shorter radius, it’s particularly useful in urban areas and busy venues like stadiums and shopping malls.[8] With the potential to offer data rates of up to 10 Gbps, high-band 5G is already being deployed in several major cities. Download speeds for carriers’ high band 5G can sometimes clock in around 450 Mbps, with peak speeds of nearly 1 Gbps, and upload speeds near 50 Mbps.[9]

High band, mmWave spectrum is used primarily for urban and dense urban markets. The characteristics of high band, mmWave spectrum is that it is very wide and provides a significant increase in capacity. Because of the greater spectrum width, speed is increased, and transmission latency is reduced. However, the drawback is that high-band spectrum does not propagate over a large coverage area. For example, a 28 GHz mmWave spectrum can only travel 500 feet.[10]

Low-band frequencies can travel long distances and penetrate buildings but can only carry a limited amount of data. High-band frequencies can carry a substantial amount of data, but due to their shorter wavelength, they travel shorter distances and are more susceptible to buildings and trees blocking the signal.[11]

____________________

| [3] | Horwitz, Jeremy (December 10, 2019). “The definitive guide to 5G low, mid, and high band speeds.” VentureBeat online magazine (available at: https://venturebeat.com/2019/12/10/the-definitive-guide-to-5g-low-mid-and-high-band-speeds/ (Last accessed March 7, 2023)). |

| [4] | Id. |

| [5] | Id. |

| [6] | Id. |

| [7] | See “5G Rollout—Beyond the Hype.” Parsons Cyber Blog, June 16, 2020 (“As a result, 5G base stations must be positioned as close as a third of a mile, whereas 4G base stations can provide coverage of 20 to 45 miles. This limitation becomes especially acute in more rural and/or remote areas, wherein 5G networks become impractical”) (available at: https://www.parsons.com/2020/06/5g-rollout-beyond-the-hype/ (last accessed, March 7, 2023)). |

| [8] | Id. |

| [9] | https://www.t-mobile.com/business/resources/articles/benefits-of-the-5g-spectrum-for-businesses (last accessed March 7, 2023). |

| [10] | https://dgtlinfra.com/american-tower-5g-deployed-in-layers-different-spectrum-bands/ (last accessed March 7, 2023). |

| [11] | https://www.md7.com/perspectives/infrastructure-challenges-of-5g-frequency/ (last accessed March 7, 2023). |

| 3 |

Unlike 4G LTE, which operates on established frequency bands below 6GHz, 5G requires frequencies up to 300GHz. Wireless carriers still need to bid for the costly higher spectrum bands, as they build and roll out their respective 5G networks. Adding the hardware required for 5G networks can significantly increase operating expenses. Building 5G networks is expensive. According to THALES, total global spending on 5G is set to reach $620 billion by 2025.[12]

A typical 5G base station consumes up to twice or more the power of a 4G base station. Energy costs can grow even more at higher frequencies due to a need for more antennas and a denser layer of small cells. Edge computing facilities needed to support local processing and new internet of things (IoT) services will also add to overall network power usage.

Our ultra-narrowband wireless communication 5G+ technology aims to achieve both low band 5G coverage and 1 Gbps high-band speed because we employ an ultra-narrow spectrum channel (<1KHz) to establish an ultra-long-distance link between the 5G base station and the receiver. The ultra-narrowband modulation was initially conceived in 1985 by Dr. Harold R. Walker as a method to be used with ‘frequency modulation (FM) Sub-Carriers’ (as opposed to “FM Supplementary Carriers” or “In Band On Channel” Carriers). In its original form, data rates as high as 196 kb/s were obtained from a subcarrier at 98 kHz, and bandwidth spectral efficiencies as high as 15 bits/sec/Hz were achieved. A pulse width modulation baseband encoding method called the “Slip Code” was used. That method, which was a baseband method, was limited in data rate and required excessive filtering, which precluded it from being a practical ultra-narrowband method.

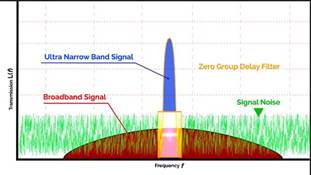

Ultra-narrowband (“UNB”) technology employs an ultra-narrow spectrum channel (<1KHz) to establish an ultra-long-distance link between transmitter and receiver. UNB allows for long-range coverage, making it an optimal low-power wide-area network technique for industrial IoT systems. Additionally, its ultra-high power spectral density creates endurance against interference and jamming, which enables the friendly coexistence of UNB on shared frequency bands. The narrower the bandwidth, the fewer occurrences of noise and interference entering the bandwidth. In addition, UNB’s transmission of energy concentrates on ultra-narrowband width, resulting in a very high concentration of power in a very narrow frequency band.

Figure 4. Comparison between Ultra-Narrowband and Broadband

Many traditional modulation approaches require allowance for upper and lower sidebands throughout the carrier frequency. UNB modulation is a modified approach for data transmission without sidebands. UNB is extremely robust in an environment with other signals, including spread spectrum signals. However, spread spectrum networks are affected by UNB signals.

____________________

| [12] | THALES, Dec 29,2022, A 5G PROGRESS REPORT: LAUNCHES, SUBSCRIBERS, DEVICES & MORE, https://www.thalesgroup.com/en/worldwide/digital-identity-and-security/magazine/5g-progress-report-launches-subscribers-devices, (last accessed March 7, 2023) |

| 4 |

UNB modulation utilizes a coded baseband with abrupt edges. Any bandpass filter used at the transmitter for ultra-narrowband modulation must exhibit zero group delay to pass the instantaneous phase changes. However, it may lack the bandwidth required to pass instantaneous changes in frequency. Conventional filters cannot be used with ultra-narrowband signals, which are dependent upon negative or zero group delay filters.

One important characteristic has restricted widespread adoption of ultra-narrowband modulation, and that is the zero group delay filters, which are complex and must be hand-tuned. Furthermore, zero group delay filters are responsible for restricting data rates to just 196 kb/s from a subcarrier at 98 kHz and bandwidth spectral efficiency to 15 bits/sec/Hz.

We developed an ultra-narrowband technology that offers a potential alternative and/or complementary solution to the broadband technology used in 5G networks and meets the challenging 5G demands. A comparison of our ultra-narrowband technology with 4G and 5G is illustrated in the table below:

| Technology | Bandwidth | No. of subcarriers | Operating Frequency | Speed | Spectral |

| MHz | GHz | Mbps | Bits/s/Hz | ||

| 4G | 20 | 1200 | 6 | 4-60 | 6 |

| 5G | 100 | 3276 | Up to 300 | 40-1100 | 10 |

| UNB (finished) | 0.001 | 1 | 0.004 | 4 | ~4000 |

| UNB (in development) | 0.001 | 1 | 0.064 | 64-256 | >4000 |

As shown by the above table, our internal testing shows that our finished ultra-narrowband technology can achieve speeds of 4 Mbps per second at a bandwidth of less than 1000 Hz. The spectral efficiency of our finished technology has reached 4000 bits/sec/Hz. Development work of our ultra-narrowband technology is underway for speeds of 64 Mbps at a bandwidth of 64 MHz with spectral efficiency of over 4000 bits/sec/Hz.

UNB speeds will increase proportionally if it operates at the higher frequencies used by 4G or 5G networks or adopts multiple subcarriers, equivalent to increasing bandwidth. As a result, we believe that our ultra-narrowband technology can reach 5G speeds and has the potential for much higher speeds. Utilizing the same bandwidth, our internal results show that UNB can save energy of up to 20,000 times when compared to current 4G technology and 100,000 times when compared to current 5G technology. Keeping the same bandwidth and energy consumption, our internal testing results suggest the coverage provided by UNB can increase by two orders of magnitude. UNB breaks through the Shannon Law’s critical limit that current 5G cellular communication is reaching, overcomes the current 5G challenges, and allows cellular communication development beyond 5G.

Despite the excitement surrounding 5G networks, several challenges need to be address before global adoption of 5G technology can occur.

| 1) | Spectrum availability. |

5G networks operate on higher bandwidth frequencies reaching up to 300 GHz, which permit data rates capable of delivering ultra-fast speeds measuring as much as 20 times more than those provided by 4G LTE networks. However, the availability and cost of spectrum bands are still an issue for wireless operators. Wireless operators need to bid for these costly higher spectrum bands as they build and deploy their respective 5G networks. On February 24, 2021, the Federal Communications Commission announced the winning bids in Auction 107, the auction of 3.7 GHz service licenses. The winning bids for all 5,684 available licenses totaled over $81 billion and were concentrated among just 21 bidders.[13] Given that Focus Universal operates in the ultra-narrowband spectrum where very limited spectrum is required and public access spectrum is also available, this is potentially less of a concern than pursuing the traditional broadband capacity pathways F-24.

____________________

| [13] | Federal Communications Commissions (February 17, 2021), https://www.fcc.gov/document/fcc-announces-winning-bidders-37-ghz-service-auction, (last accessed March 7, 2023) |

| 5 |

| 2) | Coverage. |

Despite 5G networks offering significantly increased speeds, their more limited range will require increased infrastructure investments. 5G requires three to four times the number of base stations to provide the same coverage area as 4G LTE because higher frequencies are more readily absorbed by solid objects than lower frequencies. For example, a signal at 700 MHz provides a coverage area three to four times that of a 2.6 GHz signal. Likewise, we expect UNB coverage to potentially increase coverage over standard 5G broadband pathways.

| 3) | Cost. |

Building a 5G network is expensive. To do so is not just building a layer on top of an existing 4G network; instead, it is laying the groundwork for something new altogether. The cost of a current 5G base station is approximately three times that of a 4G base station.[14]

| 4) | Energy consumption. |

Two factors relate directly to the increased energy consumption of 5G networks. First, 5G’s operating on higher frequency spectrums require greater energy input.[15] For example, a typical 5G base station consumes up to twice the power consumed by a 4G base station. Second, to provide the same coverage area as a 4G network, a 5G network requires three to four times the number of base stations. Accordingly, the overall energy consumption of a typical 5G network will be at least six to eight times more than the energy consumption of a 4G network with equivalent coverage. Like the coverage applications, we also expect energy consumption to be potentially significantly less with UNB technologies over the conventional broadband pathways.

5G+

We are currently developing 5G+, which we believe is a promising alternative wireless technology that uses our innovative ultra-narrowband (UNB) wireless technology. UNB technology employs an ultra-narrow spectrum channel (<1 kHz) to establish an ultra-long-distance link between transmitter and receiver. Our internal testing suggests that a single 5G+ subcarrier wave has the potential to provide speeds of 64 to 256 Mbps. Moreover, multiple UNB subcarriers may be combined, which effectively increases bandwidth. Given anticipated data rates of 64 Mbps, we believe only 4 to 16 5G+ subcarrier waves would be needed to achieve the current 5G speeds, and just 40 to 160 5G+ subcarrier waves would be needed to achieve 6G speeds. By contrast, 5G technology requires 3,276 subcarrier waves to achieve its current speeds. Fewer subcarriers translate into cost savings because they are more compact and consume less energy. Our goal is to increase the speed of 5G networks while simultaneously reducing the number of subcarriers.

Our internal testing suggests that to achieve speeds of 1 Gbps, our 5G+ technology would only require bandwidths of 4 to 16 kHz, which is narrow enough to be operated in lower frequency spectrums. This would mean that 5G+ providers would not need to purchase the higher frequency spectrums required by 5G technology. Accordingly, a 5G+ provider would realize significant savings from not having to bid for costly higher spectrum band licenses. Operating in relatively lower frequency spectrum bands, when compared to 5G, also means that 5G+ would have a more extensive coverage area than that of 5G, in many cases three to ten times larger. It would also mean that we could reduce the number of subcarriers and reduce the overall costs of the 5G networks infrastructure.

Further, the design of 5G+ infrastructure means that cost savings could be realized as there is the potential of piggybacking the required 5G+ infrastructure on the current 4G infrastructure. Finally, 5G+ only consumes 1/25,000 to 1/6,250 of the energy consumed by 5G. As outlined above, 5G+ has the potential to overcome the challenges presented using higher broadband spectrums required for the implementation of the broadband technology used in 5G.

____________________

| [14] | “How much does it cost to build a 5G base station?” Phate Zhang, April 7, 2020, CNTechPost (available at: https://cntechpost.com/2020/04/07/how-much-does-it-cost-to-build-a-5g-base-station/ (last accessed March 7, 2023)). |

| 6 |

| 3. | Leveraging ultra-narrowband power line communication (“PLC”) technology. |

Our patented PLC is an innovative communication technology that enables sending data over existing power cables in the electric grid. Because PLC uses the existing power lines, it does not require substantial new investment for a dedicated wiring infrastructure. Existing power lines already form a distribution network that penetrates every residential, commercial, and industrial property. Given that the power grid is, for the most part, an established ubiquitous network, PLC is potentially the most cost-effective, scalable interconnectivity approach for the backbone communication infrastructure required for the IoT. PLC allows IoT devices to be plugged into power outlets to establish a connection using the existing electrical wiring, permitting data sharing without the substantial investment and inconvenience of running dedicated network cables.

Historically, the primary design goal of the power line network was electric power distribution. The power line network was not originally designed to function as a communication channel. Consequently, while PLC has been around for many years, the harsh electrical noise present on power lines and variations in equipment and standards make communications over the power grid difficult and present several challenges for data transfer. Signals propagating along the power line are subjected to substantial amounts of noise, attenuation, and distortion that make them erratic, with several attributes varying over time. PLC is susceptible to noise from devices linked to the power supply infrastructure, including, for example, fluorescent tube lights, drills, hair dryers, microwave ovens, computers, switch-mode power supply, cellphone chargers, dimmers, refrigerators, televisions, washing machines, and vacuum cleaners. The result is that previous attempts at implementing PLC technology resulted in power companies and internet service providers deciding that the technology is not a viable means of delivering data or broadband internet access. These technological challenges have impeded or even halted progress in PLC technology’s development.

We have successfully developed ultra-narrowband PLC technology that can transfer data through the power grid. According to our internal testing, our ultra-narrowband PLC technology can send and receive data without the customary interference that occurs in standard office and residential environments, achieving speeds of 4 Mbps at a bandwidth of less than 1000 Hz. To test noise interference and disturbance, we utilized six industrial blowers simultaneously when testing, and no significant interference was found. By comparison, a single hair dryer will render our competitors’ legacy PLC technology completely useless. We have completed the development of our 4Mbps PLC modules and the printed circuit board layout. These modules will be used for IoT systems involving over 1,000 sensors.

Our ultra-narrowband PLC technology is a considerably more effective way to transfer data than current in-home and commercial network systems, such as Zigbee and Z-Wave. While Zigbee and Z-Wave will need new infrastructure to be installed, our PLC technology could operate by itself or complement existing wideband communication tools like Wi-Fi, Zigbee, or Z-Wave. Penetrating physical barriers like walls within a single floor or reaching out to different floors in a single building is a challenge for the wireless technology that current IoT systems are using. Moreover, wireless networks often face performance issues due to radio-frequency interference caused by microwave ovens, cordless telephones, or even Bluetooth devices at home. However, our PLC technology can reach every node connected via the power lines. Our technology converts virtually every standard wall socket into an access point, in many ways incorporating the best of wired and wireless communication, making it a more consistent and reliable system for crucial and sensitive operations. Our ultra-narrowband PLC technology’s ability to reach long distances via power lines becomes especially useful in commercial networks that require the ability to avoid physical barriers like walls, underground structures, and hills, such as those networks used in industrial facilities, underground structures, golf course irrigation systems, and campuses. Moreover, our technology can be an integral part of any smart city, community, or campus.

| 7 |

| 4. | Developing a natural integrated programming language (“NIPL”) applied to software development, which generates a user interface through machine auto generation technology. |

We have developed a proprietary and patented “user interface machine auto generation platform” (“UIMAGP”) to replace the manual software designs that are currently used. This platform is used to build the IoT user interface. The natural integrated programming language we have developed is like the language humans use to communicate with each other, which makes it is easy for humans to learn, while still being understood by a machine. The UIMAGP simplifies the process of software programming by saving hundreds of lines of code into a micro code that can be saved to a sensor module. When that sensor module is plugged into a USIP, the user interface specification codes saved to the sensor module is sent to the platform and a universal display, such as a smartphone, a computer, or a display unit. The UIMAGP saved on the universal display automatically generates the user interface within milliseconds instead of requiring months or years of software development work. An embedded coding hardware engineer can design sensor module hardware and provide the user interface specification code. Thus, the hardware-defining software is achieved.

UIMAGP is similar to low code or no code programming because it reduces the amount of traditional hand-coding, enabling accelerated delivery of business applications. However, low code and no code programming suffer from integration restrictions, absence of customization, and security risks issues, making them unsuitable for large-scale and mission-critical enterprise applications such as IoT applications. UIMAGP has overcome these challenges while requiring only a minimum amount of coding. The UIMAGP and user interface specification codes work collectively to perform the function of traditional customized software, enabling UIMAGP to be shared by the estimated 20 billion IoT devices worldwide,[15}[16] a feat that current manual software designs could not achieve.

| 5. | Developing a universal smart instrumentation platform (“USIP”) |

Instrumentation is a vast industry that covers a variety of fields, including medical, healthcare, scientific, commercial, industrial, military, and daily life. Lack of instrumentation universality results in every instrument design starting from scratch. Moreover, each instrument can only carry out a determined measurement or control a specific operation. Integrating existing instruments that lack interoperability and compatibility into a platform can be difficult and expensive. This integration is impeded by the inability of instruments to easily communicate with devices and sensors for perception, mobility, and manipulation. As society enters the IoT era, it is not unreasonable to assume that millions of devices will need to be connected in one square kilometer. If each IoT device requires unique hardware and software developed from scratch, implementation in dense urban areas is simply not feasible. Wireless networks can be accessed by any device within the network’s signal range.

USIP is an advanced hardware and software integrated instrumentation platform with a large-scale modular design approach. USIP integrates many technologies, including cloud technology, wired and wireless communication technology, software programming, instrumentation technology, artificial intelligence, PLC, sensor networking, and IoT technology into a single platform. This results in circuit designs that we believe are vastly cheaper and faster than those constructed of discrete integrated circuit components designed from scratch.

USIP has primary functionalities and an open architecture capable of incorporating a variety of individual instruments, functions, sensors, and probes from different industries and vendors into a single unit. Instruments, sensors, or probes ranging from a few to several hundred or even thousands in any combination from various industries and vendors can share or reuse the same platform. Adding, removing, or changing instruments or sensors is all the platform requires to switch from one type of device to another without revising the software and redesigning the hardware.

Compared to traditional stand-alone instruments, USIP exploits the processing power of a computer or a mobile device. Productivity, display, and connectivity capabilities to provide a more powerful, flexible, and cost-effective measurement solution. Traditional hardware-centered instrumentation systems are made up of multiple stand-alone instruments interconnected to carry out a determined measurement or control an operation. They have fixed vendor-defined functionality, and the components that comprise the instruments are also fixed and permanently associated with each other. Different instruments provided by different vendors cannot be interoperated and interchanged. For example, we simply cannot use a traditional blood pressure meter to measure temperature or vice versa. USIP is designated to be compatible with all instruments, sensors, or probes on the market and capable of monitoring and controlling any combination of instruments or sensors. We believe our USIP will revolutionize the field of instrumentation, measurement, control, and automation.

____________________

| [15] | Environmental Health Trust, https://ehtrust.org/science/reports-on-power-consumption-and-increasing-energy-use-of-wireless-systems-and-digital-ecosystem/, (last accessed March 7, 2023) |

| [16] | Gartner Insights “Leading the IoT,” available at: https://www.gartner.com/imagesrv/books/iot/iotEbook_digital.pdf (last accessed March 7, 2023). |

| 8 |

USIP is a versatile platform, able to perform and combine different measurements and controls, to substitute some instruments for others, and to integrate existing instruments into it. The development of USIP is closely associated with the development and proliferation of computers and mobile devices that provide the foundation and technical support to the universal smart instrument such as an attractive graphical user touch screen interface, data processing and analysis capabilities, video and audio, cameras, GPS, ubiquitous wireless connectivity, artificial intelligence, cloud-based communications and a diverse number of functions and software available to users that are not contained in traditional instruments. These features embody the advantages of USIP, which are lacking stand-alone instrument systems. When compared with traditional instrument systems, USIP’s biggest advantage is cost savings. Other distinctive features include universality, interoperability, flexibility, compatibility, upgradeability, expandability, scalability, security, modularity, fast prototyping, reducing inventory, plug-and-play operation, remote accessibility, simplification, standardization, and cloud instrumentation.

We have been dedicated to solving instrumentation interoperability for over a decade. We subdivide instruments into a reusable foundation component to the maximum extent possible, architecture-specific components, and sensor modules, which perform traditional instruments’ functions at a fraction of their cost. For most instruments, 90% of the design, parts, and firmware are the same. These parts can be replaced by USIP.

USIP utilizes a computer or a mobile device as its display and control to communicate with a group of sensors, instruments, probes, or controllers manufactured by different vendors in a manner that requires the user to have little or no knowledge of their unique characteristics.

The portable version of USIP is illustrated below. When a blood pressure sensor is plugged into the universal device, the user interface specification code saved on the blood pressure sensor is sent to the universal device, and a computer or smartphone will then generate the user interface for the blood pressure device based on the interface specification code saved in the sensor.

Figure 5. A blood pressure sensor is connected to our universal device, which we call the Ubiquitor, and changes our device into a blood pressure measurement instrument.

| 9 |

Similarly, if we remove the blood pressure sensor and connect our universal device to both a pH sensor and a CO2 sensor, the universal device changes to a two-sensor device capable of measuring pH and CO2 concentration. Each sensor has its own user interface automatically generated based on the user interface specification code saved in each sensor.

Figure 6. A pH sensor and a CO2 sensor are connected to our universal device, and our device changes into a two-sensor device. A computer or smartphone can also be used for display.

As illustrated below, when a light sensor is also plugged into our universal device using a three-way splitter, the universal device becomes a three-sensor device.

Figure 7. A pH sensor, a CO2 sensor, and a light sensor are connected to the universal device, and the device changes into a three-sensor device. A computer or smartphone can also be used for display.

| 10 |

As illustrated in Figure 8, the universal device can connect any number of sensors in any combination.

Figure 8. Any number of sensors in any combination can be connected to the universal device and changed it into a multiple sensor device. A computer or smartphone can also be used for the display.

As an example of the capabilities of the Ubiquitor, we implemented our universal device in the configuration pictured in Figure 9. This configuration demonstrates that our universal device simultaneously controls 27 light sensors, 21 pH sensors, and 23 temperature humidity sensors (which have 23 temperature sensors and 23 humidity sensors), representing one device controlling a total of 72 devices and 95 sensors. Our universal device also controls two lights in this configuration, which it can control by turning the lights on or off (including on a schedule) or by using a light sensor to control the lights’ output intensity.

Figure 9. Our universal platform simultaneously monitors and controls 72 different devices and 95 sensors.

| 11 |

To illustrate, the entire horticulture industry has only a few hundred devices from different vendors for various measurement and control purposes. One of our universal smart devices and corresponding sensors or actuators can replace all at a fraction of the cost. Leveraging the same technical principles discussed above, we can simplify the smart control and monitoring in this and related industries (including agriculture and aquaculture) with a platform that requires little design work for interoperability between sensors and control devices.

Figure 10. Traditional horticulture measurement and control devices.

Figure 11. Universal Smart Device.

All household measurement and control devices, such as air conditioner controls, swimming pool controls, garage door controls, sprinkler controls, lighting controls, and motorized curtain controls, can be replaced by a single universal device and corresponding unique accessories.

Figure 12. A single universal smart device can replace all these household control devices.

| 12 |

| Internet of Things Overview |

IoT refers to the overarching network created by billions of internet-compatible devices and machines that share data and information worldwide. According to a Gartner report, by the end of 2020, there were an estimated 20 billion IoT-connected devices in use around the world. As the sophistication of both hardware and software in the consumer electronics industry skyrockets, an increasing share of the electronic devices produced around the world are manufactured with internet connectivity. Forecasts suggest that by 2030, around 50 billion of these IoT devices will be in use worldwide, creating a massive web of interconnected devices spanning everything from smartphones to kitchen appliances.[17] The IoT will significantly impact the economy by transforming many enterprises into digital businesses, facilitating new business models, improving efficiency, and increasing employee and customer engagement. It is foreseeable that the explosive growth in IoT will rapidly deplete natural and human labor resources. We believe that IoT will soon reach a critical limit; we do not have enough human labor and natural resources to support IoT growth. Twenty billion IoT devices challenge existing resources. We have overcome the current massive IoT production challenges by developing a shared distributed universal IoT. Billions of internet-compatible devices and machines share data and information around the world and share a large section of hardware and software (up to 90%).

Billions of IoT devices are in use worldwide, each with different terminologies, technical specifications, and functional capabilities. These differences make it challenging to create one standard interoperability format for acquiring, harmonizing, storing, accessing, analyzing, and sharing data in near real-time. In fact, not even those instruments built on the same platform are necessarily interoperable because they are often highly customized to an organization’s unique workflow and preferences.

Wireless networks are far from perfect for IoT. They are typically slower, expensive, and highly susceptible to radio signals and radiation interference. They can be accessed by any device within range of the network’s signal, so unauthorized users may intercept information transmitted through the network (including encrypted data). Walls and floors can seriously limit the range of the wireless network. Our proprietary ultra-narrowband PLC technology offers a promising alternative to wireless networks. Integrating USIP with our ultra-narrowband PLC technology results in significant simplification and cost savings in implementing IoT, as illustrated in Figure 13. Using these technologies, we have designed IoT products for both residential and industrial usage and are now in the process of testing.

Figure 13. Comparison between (a) a traditional machine to machine IoT and (b) a shared distributed universal IoT, which depicts a USIP and sensors forming a local network through PLC technology. The platform communicates with the cloud to form a remote cloud-based system.

____________________

| [17] | Statista Report “Number of internet of things (IoT) connected devices worldwide in 2018, 2025 and 2030” available at https://www.statista.com/statistics/802690/worldwide-connected-devices-by-access-technology/ (last accessed March 7, 2023). |

| 13 |

Figure 14. Comparison between (a) a traditional wireless network and (b) Focus Universal Inc.’s PLC network.

How we will implement our business plan

We currently operate in the scientific instruments industry and the smart home installations industry and plan to apply several of our new technologies to the IoT marketplace.

Four divisions have been established within our Company to develop and promote our technologies. We believe that our technologies, as depicted above, can be used in standalone device design and production and on large scale IoT device design and production, aiming to solve the attendant complexity and cost challenges.

a) Ultra-narrowband power line communication division.

Our ultra-narrowband PLC technology has achieved data transfer speeds of 4 megabits per second (“Mbps”), with a bandwidth of less than 1000 hertz (Hz). These results are 15 times faster than the Zigbee short-range wireless technology mesh networks and 100-400 times faster than Z-Wave’s low-energy wave short-range wireless technology. The current 4Mbps PLC modules will be used for IoT applications involving thousands of sensors. We are developing even higher communication speeds through our PLC. The ultra-narrowband PLC module will be integrated into ICs. This division will focus on ultra-narrowband PLC research and development, promoting and marketing ultra-narrowband PLC, ICs and finished products. We also intend to promote and market ICs, licensing, and contract designing.

| 14 |

Given that the power grid is an already established, ubiquitous network, connectivity via PLC technology may be the most cost-effective and scalable interconnectivity approach for the IoT. Due to the harsh electrical noise and interference currently present on power lines and to the variations in equipment and standards, that make data transfer using PLC technology limited and difficult, the global market for PLC technology is very limited.

Figure 15. Markets and Markets Updated date – Oct 25

The market size for PLC is expected to reach $17.4 billion at the end of 2028.[18] This prediction is based on current PLC technology, which provides speeds that are too slow (usually less than 9,600 bps), coverage that is too short (200-300 yards), and harsh electrical noise and interference. The major vendors of PLC technology include ABB, General Electric, Siemens, AMETEK, Schneider Electric, Texas Instruments, Maxim Integrated, Devolo, Cypress Semiconductor, ST Microelectronics, Panasonic, Microchip, Qualcomm Atheros, TP-Link Technologies, NETGEAR, D-Link, NXP Semiconductor NV, Landis+Gyr, Sigma Designs, Zyxel Communications, Nyx Hemera Technologies, and Renesas Electronics Corporation.

It is our understanding that no other vendor has developed a PLC technology application that is similar to our ultra-narrowband PLC technology. We believe that market size will increase significantly with the introduction of our ultra-narrowband PLC technology, which can overcome the interference and noise challenges presented by traditional PLC technology. We believe that by utilizing ultra-narrowband PLC, the global IoT communication infrastructure costs and operating costs can be reduced.

b) Ultra-narrowband wireless division

This division will focus on developing ultra-narrowband wireless technology and overcoming the challenges facing current 5G networks. We intend to sell DoC for wireless communication, licensing, and contract designing.

While developing our ultra-narrowband PLC technology, we gained insight into the development of a single carrier wave ultra-narrowband wireless technology, which aims to increase data transfer rates from 4 Mbps to 64 Mbps. We expect our ultra-narrowband wireless technology to achieve data transfer rates of 256 Mbps using 4 subcarrier waves, which is close to 5G speeds requiring more than three thousand subcarrier waves. The projected speed can be further increased if multiple carrier waves or higher operating frequencies are used.

____________________

| [18] |

GlobalNewswire, December 19, 2022, https://www.globenewswire.com/en/news-release/2022/12/19/2576452/0/en/Global-Programmable-Logic-Controller-PLC-Market-to-Reach-17-6-Billion-by- 2028-Presence-of-Over-1-500-Manufacturers-Makes-it-Highly-Fragmented.html, (March 7, 2023) |

| 15 |

Our current research and development efforts are focused on an operating frequency of 64 megahertz (MHz), which is about 100 times lower than 4G networks (6 gigahertz (GHz)) and 5,000 times lower than 5G networks (up to 300 GHz). Our technology’s 1,000 Hz bandwidth is approximately 20,000 times narrower than 4G networks and 100,000 times narrower than 5G networks. The narrower the bandwidth, the less energy consumption. By maintaining the 1,000 Hz bandwidth, our ultra-narrowband wireless technology can save electricity usage by a factor of up to 100,000 times when compared with a 5G network. We believe that our ultra-narrowband wireless technology has the potential to push the wireless frontier well beyond 5G. We finalized our ultra-narrowband technology research with data transfer speeds of 64-256 Mbps in the fourth quarter of 2022. We now need to build testing equipment. This requires us to design and build a digital device that can perform the digital speed testing. We have designed the devices and we should receive the finished circuit boards in the next few weeks and hope that such device will be completed by the end of 2023.

Markets and Markets projects that the 5G infrastructure market will reach USD 47,775 million by 2027, at a CAGR of 67.1%. The major players in the 5G infrastructure market are Huawei (China), Ericsson (Sweden), Samsung (South Korea), Nokia Networks (Finland), ZTE (China), NEC (Japan), CISCO (US), CommScope (US), Comba Telecom Systems (Hong Kong), Alpha Networks (Taiwan), Siklu Communication (Israel), and Mavenir (US). Huawei (China) is the leader in the 5G infrastructure market. Limited coverage, high energy consumption, and expensive infrastructure installation are the major holdups for the successful deployment of 5G technology. Most 5G technologies are based on broadband technology; our research suggests there are very few companies working on ultra-narrowband technology. We believe that adopting our ultra-narrowband wireless technology can provide significant cost savings to 5G spectrum bands, 5G network hardware, and 5G energy consumption.

c) User interface machine auto generation division

Established in 2009, our Company’s software user interface machine auto generation technology division has developed 100 sensors in arbitrary combinations, all of which have been tested for the iOS system. RS-485 is an industrial specification that defines the electrical interface and physical layer for point-to-point communication of electrical devices. RS-485 is widely adopted and used in the IoT industry. Standard RS-485 modules available today usually do not support more than 100 sensors. The first version of UIMAGP has been completed and we believe should support more than 1,000 sensors. We intend to sell and license the software to device manufacturers that use our DoC ICs and other industries where the software can be applied.

UIMAGP can be used in IoT software design and can be applied to other industry sectors. This division is planning to expand to other industries as well.

Figure 16. Software market size.

Today, some of the biggest companies within the software industry, including Microsoft, IBM, Oracle, SAP, and Salesforce, have still not developed a UIMAGP. Any software that can be created by low code and no code programming can also be created by using UIMAGP. However, the software created by UIMAGP achieves what low code and no code programming cannot because of the complexities of applying the code to different platforms and the accompanying required customization. One of the distinct features of UIMAGP is that the programming provides a starting point that includes foundational code that may be used on any platform or operating system. This makes the final programming much more efficient, as it needs relatively few lines of code to program a complicated application.

| 16 |

d) Universal smart instrument division

This division will focus on developing and marketing end-user universal smart instruments and shared distributed universal IoT devices for the commercial and residential markets. The development of universal smart instruments and IoT have considerable overlap, with the only difference being the number of devices involved. We will capitalize on this overlap by unifying universal smart instruments and IoT into a single system, eliminating any distinction between them. USIP, a cost-effective and fully production-ready hardware and software platform, provides a considerable advantage in shorting design, building, testing, and fixing cycles. Smart home products, including light controls, air conditioner controls, sprinkler controls, garden light controls, heating floor controls, motorized curtain controls, pool filtration and algae controls, smoke detector controls, carbon monoxide measurement, motion detectors, and doorbells, have been designed and tested.

This division will also develop and market end-user universal smart instruments and shared distributed universal IoT devices in the horticulture, agriculture, and aquaculture industries. Leveraging the Company’s ultra-narrowband PLC technology and USIP, we intend to provide a more stable, secure, and faster network for large industrial operations requiring data-specific sensing and control automation to ensure optimal outcomes. According to Markets and Markets, the agriculture IoT market is expected to grow from $11.4 billion in 2021 to $18.1 billion by 2026, at a CAGR of 9.8%.[19] A key factor driving the growth of this market is the rising demand for agricultural production due to increasing population and adoption of IoT and AI technologies by farmers and growers. Deere & Company (US), Trimble (US), Raven Industries (US), AGCO Corporation (AGCO) (US), AgJunction Inc. (AgJunction) (US), DeLaval (Sweden), GEA Farm Technology (Germany), Lely (Netherlands), Antelliq (France), AG Leader Technology (AG Leader) (US), Tigercat (Canada), Ponsse (Finland), Komatsu Forest AB (Sweden), Caterpillar (US), Treemetrics (Ireland), Topcon Positioning Systems (US), and DICKEY-john Corporation (US) are some of the major players in the agriculture IoT market. We have completed the design of certain PLC industrial IoT devices, including industrial light controls, temperature controls, humidity controls, carbon dioxide controls, digital lighting controls, quantum PAR measurement and controls, pH measurement and controls, TDS measurement and controls, and fan speed controls.

This division will also focus on developing device-on-a-chip (DoC) ICs, which we intend to sell to electronic device manufacturers for use in conjunction with the USIP. We will distinguish our DoC technology from the component ICs; these ICs can perform entire device functions. According to the Cision the globally integrated circuits market will be worth $1,248.6 billion in 2030.[20] Major players in the IC market are Intel Corporation, Texas Instruments, Analog Devices, STMicroelectronics, NXP, ON Semiconductor, Micron, Toshiba, Broadcom, and Qualcomm.

This division will also install and design customer solutions for residential and commercial IoT projects. The Company currently specializes in high-performance, easy-to-use audio/video, home theater, lighting control, automation, and home integration solutions for residential installation and custom solution services. On the commercial side, we plan to add well-trained staff ready to handle all aspects of voice, data, fiber, paging, audio-video services, CATV, and other low voltage premise cabling. All of our service providers hold certifications for multiple product lines and specialty work. The Company plans to use its current client base and expertise from these installation services to integrate products developed on the USIP into the project proposals.

____________________

| [19] | Market and Markets, May 2021, Agriculture IoT Market worth $18.1 billion by 2026, https://www.marketsandmarkets.com/PressReleases/iot-in-agriculture.asp, (last accessed March 7, 2023) |

| [20] | Cision, January 25, 2023, Integrated Circuits Market to Reach USD 1,248.6 Billion by 2030, https://www.prnewswire.com/news-releases/integrated-circuits-market-to-reach-usd-1-248-6-billion-by-2030--301730536.html, (last accessed March 7, 2023) |

| 17 |

Products we are currently selling

We are a wholesaler of various digital, analog, and quantum light meters and filtration products, including fan speed adjusters, carbon filters and HEPA filtration systems. We source these products from various manufacturers in China and then sell them to a major U.S. distributor, Hydrofarm, who resells our products directly to consumers through retail distribution channels and, in some cases, places its own branding on our products.

In an effort to continually develop our product lines, we plan to phase out the traditional, lower-margin products and are preparing to launch a new line of products that have been in development for several years. These newer technology products will be released in phases, and we intend that increasing amounts of technology will be layered upon these products. Additionally, we plan to continue to increase our efforts in protecting more intellectual property rights. We have developed products in both the controlled agriculture industry and home automation industries, taking advantage of our existing relationships in both sectors.

We are building a U.S. sales team to market our product lines. We have already begun marketing our current Smart AVX-branded large format multimedia touch screens, surveillance camera system (cameras and network video recorders (NVRs)), indoor and outdoor LED screens, and Focus Universal-branded VOIP phone service systems, both via our sales staff and the Internet.

Universal Smart Device (Ubiquitor)

The initial, simplified version of universal smart IoT technology is our universal smart device (Ubiquitor). Theoretically, a single Ubiquitor can connect many sensors, including a vast number of independent sensors. When a moderate number of sensors are connected, the cost of the universal Ubiquitor, averaged over the number of sensors, becomes negligible. The Ubiquitor’s efficient and cost-effective approach to the cost of connected sensors is illustrated by the fact that development under Focus’ platform system is a fraction of traditional device development cost. This one-of-a-kind Ubiquitor was first showcased at the Consumer Technology Association’s CES 2024 trade show, which attracted significant interest from potential customers.

| 18 |

Smart Home Installation

Through AVX Design and Integration, Inc. (“AVX”), an IoT installation and management company based in southern California, and a subsidiary of the Company, we offer residential customers an entire smart home product line. We have finished designing smart devices for lighting control, air conditioner control, sprinkler control, garden light control, garage door control, and heating control and are in the process of developing a swimming pool control device, smoke detector, and carbon monoxide monitor.

We believe smart installation based on the USIP, and our Ubiquitor together will include more functionalities than the current systems offered by our competitors. It is our goal that our smart systems would integrate, exchange data, interact and connect utilizing our forthcoming PLC technology. As a result, the installation process would be simplified, and its costs would be reduced.

Once successfully integrated, the Ubiquitor will be central to every smart installation with our IoT Installation Services segment. The Ubiquitor’s connectivity capabilities will allow that system to be expanded and customized in the future. We also plan to offer zero down payment options for installation of our smart systems and charge a monthly subscription fee instead.

Notwithstanding the foregoing, should we be unable to successfully integrate the Ubiquitor into our smart installations, the Ubiquitor will continue to be a flagship product of our Company that can be applied to various other purposes in the different industries and fields mentioned above.

Strategy and Marketing Plan

The Company plans to market the USIP to the industrial sector first, including key growth industries such as indoor agriculture. Once the technology is established in that industry, the core technologies of universality and interoperability through a readily available device, such as a mobile device or smartphone, may be ported to products specifically intended for the consumer and residential markets.

While industrial markets are large, the consumer and residential markets are even more significant. This two-phase approach will allow for continuous and increasing revenue growth. Moreover, during the industrial phase of development, the Company will test and refine its products to ensure that they are ready for the consumer and residential markets.

Once we have successfully entered the industrial sector, we intend to roll out additional technologies that are currently under development. These technologies will advance and support the core technologies marketed in phases one and two to the industrial and consumer markets.

We will continue to design, manufacture, market, and distribute our electronic measurement devices, such as temperature humidity meters, digital meters, quantum PAR meters, pH meters, TDS meters, and CO2 monitors. Over the years, Hydrofarm has developed a broad and loyal customer base that buys our existing products on a repeat basis. The universal smart technology has been applied to our existing traditional devices and demonstrated significant functional improvement and hardware cost savings. We believe hardware cost reductions of up to 90% have been achieved. However, promoting universal smart technology and universal smart IoT devices to our customers, including traditional instrument manufacturers, will be the central focus of our future business.

| 19 |

Our goals over the next three years include:

| · | Raise capital to move into full sales and marketing team for our Ubiquitor device and growing product lines; |

| · | Partner with manufacturers and promote the adoption of our Ubiquitor device in a USIP; |

| · | Acquire a stable market share of the sensor device market; |

| · | Continue performing research and development on PLC technology; |

| · | Focus on building our smart home offerings so that we can reduce the cost of smart home implementation to expand smart home installation and implementation beyond luxury homes; |

| · | File additional patents to expand our intellectual property portfolio related to the many uses of our Ubiquitor device; and |

| · | File patents to protect our PLC technology. |

To achieve these goals, we intend to focus on the following initiatives:

| · | Position the Ubiquitor device as the industry standard in universal sensor reading technology; |

| · | Establish strategic supply chain channels to facilitate efficient production operations; and |

| · | Communicate the product and service differentiation through direct networking and effective marketing. |

Growth Strategy

Growth through Mergers and Acquisitions

Mergers and acquisitions (“M&A”) represent a significant part of our growth strategy because M&A can fill business gaps or add key business operations without requiring us to wait years for marketing and sales cycles to materialize. We have used this growth strategy in our acquisition of AVX, and in the future intend to continue to use M&A to find and secure opportunities that will either: (i) achieve the objective of growth in our market segments; or (ii) provide an area of expansion that will add to the Company’s products and/or service lines in markets that we are currently not serving, but could serve if we had the appropriate expertise. The resulting combination of our existing products and services, new key personnel, and strategic partnerships through M&A will allow us to operate in new markets and provide new offerings to our existing market.

Acquiring key competitors may allow the addition of key personnel to our team. These additions may include people with vast industry knowledge, which can act as a catalyst to further our growth and lead to the development of new products and business lines. We will seek to target synergistic acquisitions in the same industry, targeting different geographic locations, which will allow us to actively compete on a regional or national scale in the IoT segment. If we target businesses in the same sector or location, we hope to combine resources to reduce costs, eliminate duplicate facilities or departments and increase revenue. We believe this strategy will allow for accelerated growth and maximize investor returns.

One of our key strategies to grow through M&A is to acquire smaller businesses that focus on IoT installation technology (industrial or residential) and in the USIP or PLC industries.

| 20 |

Original Equipment Manufacturer (“OEM”) Engineering Consulting and Design Services

Universal smart technology is new to most electronic engineers and manufacturers. One way to promote our universal smart technology is to provide direct OEM engineering design consulting services to potential industrial customers. Direct, on-site consulting will educate our industrial consumers on the many ways our technology can be implemented in a variety of industrial applications. We believe that we are well positioned to perform product design and engineering consulting services for future OEM customers. We believe we can operate as a seamless extension of our customers’ engineering organizations and add scale, flexibility, and speed to their design processes. We will not be able to offer such engineering consulting and design consulting services until the Ubiquitor is being produced and distributed. We believe that once the Ubiquitor is being produced and distributed, we will have hired and trained enough engineers to execute our consulting strategy. Through our engineering consulting services strategy, we intend to become our customers’ engineering partner at all stages of the design cycle so that we may effectively assist them in transforming ideas into production-ready products and accelerate time to market for our universal smart technology product segment.

Technology Licensing

We may also consider entering into licensing arrangements with our customers for our technology. We believe that once we educate our industrial consumers, they may want to integrate our universal smart technology into their own technology through licensing agreements. We believe licensing our intellectual property may provide a revenue stream with no additional overhead, all while allowing us to retain proprietary ownership and create long-term industrial consumers who rely on our products. By creating incentives, such as cost incentives, to license our IP rather than design their own technology, we believe potential customers could save on design costs and create business development opportunities. Licensing may also allow us to rely on the expertise, capacity, and skill of a licensee to commercialize our IP, which is especially valuable if we lack the infrastructure, financial resources, and know-how to bring a product to market independently.

Diversification of the Revenue Streams

We will continue to diversify our revenue stream through various expansion opportunities and in several other markets and industries. As our platforms can be applied to several sectors effectively to eliminate redundancy and increase effectiveness, we will seek to expand our operations into additional markets and adjacent sectors which we believe to have the potential to be effective long term. While this diversification may initially contain the risk during transition and adaption of moving to an adjacent market or sector, we believe the long term benefit of diversification to be net positive as previously, we had been subject to the risk of having one large client within one single sector, which we believe bears greater risk than the initial risk of transition.

Distribution Method

We intend to engage in relationships predominantly with standard U.S. component manufacturers and similar electronics providers for the manufacturing of unassembled parts of the Ubiquitor and its sensor nodes, and to then ship such parts to our Ontario, California facility where we will assemble the Ubiquitor devices and sensor nodes. Afterwards, we would distribute our Ubiquitor devices to distributors and retailers directly and also ship directly to traditional industrial instrument manufacturers. We have a sales department operating out of our Ontario, California office and eventually plan to open a second sales department in China dedicated to promoting our technologies to local instrument manufacturers who can utilize our Ubiquitor devices in their manufacturing and other processes. We intend to market the Ubiquitor to industrial end-users through direct business-to-business sales channels and also directly to consumers via e-commerce internet platforms. For our quantum light meters, and air filtration products, while we still continue to anticipate orders from Hydrofarm in 2024, we have begun to diversify away from one single dominant distributor into more diversified distribution channels, such as direct wholesale into retail outlets and direct distribution to end-users. We also intend to implement a direct sales method via Amazon.com and other online retailers.

| 21 |

Raw Materials

The electronic components used in the Ubiquitor are common and can be easily purchased through a variety of suppliers with little advanced notice. We predominantly use large-scale manufacturers in the United States such as Texas Instruments and Intel for the major components. Other key suppliers we could consider include Analog Devices, Skyworks Solutions, Infineon, STMicroelectronics, NXP Semiconductors, Maxim Integrated, On Semiconductor, and Microchip Technology. Production and assembly lines are also available worldwide if we needed to outsource or increase our capacity, though we intend to complete our assembly in our Ontario, California facility.

Manufacturing and Assembly

We have an assembly facility in Ontario, California where we assemble the Ubiquitor from parts sourced predominantly in the United States. Our quantum light meters and handheld sensors are also manufactured in our Ontario, California facility. Our air filtration products are manufactured and assembled in China by a third-party contract manufacturer, Tianjin Guanglee.

Our subsidiary unit in the Canton province of mainland China, Focus Universal (Shenzhen) Technology Co. LTD, was founded in December 2021 as an office for manufacturing procurement expertise and support research and development activities. Focus Universal (Shenzhen) Technology Co. LTD is designed to function as a branch office accessing high level ability to source products and build relationships with manufacturers in the region and as a lower cost form of support research and development as engineers are more plentiful in the region. In the future, this office could also handle other online marketing and marketing production activities, provided a cost and quality benefit exists at the time. This excludes any projects subject to approval or that require a separate business license in accordance with the local laws. China allows foreign entities to setup wholly owned limited liability companies in China, also known as Wholly Foreign Owned Enterprises (WFOEs), in non “restricted” or “prohibited” industries or business activities. The subsidiary’s business operation has been approved by the local government in Shenzhen to be qualified as a WFOE entity in China. The entity is 100% owned by Focus Universal Inc.

Key Competitive Advantages and Opportunities and Strengths

Across the world, everyday connected devices are getting incorporated in tandem collectively, including thermostats, water meters, home alarms, kitchen gadgets, medical equipment, factory machinery and even vehicles. Collectively, this ecosystem represents the next frontier in the digital revolution, also known as the Internet of Things or IoT. And unlike the simple automation of machinery, IoT is also mobile and virtual, and features a continuous Internet connection. The Internet of Things (IoT) is the next frontier in the digital revolution. It can help companies increase productivity, cut costs, offer new products and services, and deploy new business models. However, the costs of producing a single input or output device have become cost prohibitive to the point where a vast majority of the projects in this innovative field are considered failures.

Despite this forward technological momentum, a sector-wide study conducted by Cisco showed that 60 percent of IoT initiatives stalled at the very-early Proof of Concept (PoC) stage and only 26 percent of companies have had an IoT initiative that they considered a complete success. Furthermore, a third of all completed projects were not considered a failure. Herein lies both the key advantage of the platforms of the company and the opportunities and strengths. Our combined platforms are able to consolidate the eliminate the redundant work in the early stage development production costs within the IoT sector, whereby the project developers need not begin from scratch each time in the development of a new IoT product, eliminating upwards of 90% of the redundant, cost-prohibitive workload.

| 22 |

Competitors

Sensor Node Industry

There are several competitors we have identified in the sensor node industry, including traditional instruments or devices manufacturers such as Hanna Instruments or Extech Instruments.

Hach developed and launched the SC1000 Multi-parameter Universal Controller, a probe module for connecting to 32 digital sensors or analyzers. However, their products are not compatible with smart phones yet; and we believe their price point is still prohibitive to consumers.

Monnit Corporation offers a range of wireless and remote sensors. Many of Monnit’s products are web-based wireless sensors that usually are not portable because of their power consumption. Also, the sensors’ real-time updates are slow; and we believe security of the web-based sensor data acquisition may be a concern. In addition to purchasing the device, consumers usually have to pay a monthly fee for using web-based services.

IoT Installation Industry