Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Quarterly period ended September

30, 2020

o TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-55247

FOCUS UNIVERSAL INC.

(Exact Name of Small Business Issuer as

specified in its charter)

| Nevada |

46-3355876 |

| (State or other jurisdiction |

(IRS Employer File Number) |

| of incorporation) |

|

| 20511

E. Locust St., Ontario, CA |

91761 |

| (Address of principal executive offices) |

(zip code) |

(626) 272-3883

(Registrant's telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Securities registered pursuant to Section

12(g) of the Act: None

Indicate

by check mark whether the registrant: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the past 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject

to such filing requirements for the past 90 days. Yes x No

o

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the

registrant was required to submit such files. Yes o No

x

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o |

Accelerated filer o |

| Non-accelerated filer o |

Smaller reporting company x |

| Emerging growth company x |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

As of November 12, 2020, registrant had 40,959,741 shares

outstanding of the registrant's common stock at a par value of $0.001 per share.

FORM 10-Q

FOCUS UNIVERSAL INC.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

References in this document to "us," "we,"

or "Company" refer to FOCUS UNIVERSAL INC.

ITEM 1. FINANCIAL STATEMENTS

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Index to the Financial Statements

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

September 30, | | |

December 31, | |

| | |

2020 | | |

2019 | |

| | |

(unaudited) | | |

| |

| ASSETS |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 821,904 | | |

$ | 2,192,870 | |

| Accounts receivable, net | |

| 309,452 | | |

| 137,338 | |

| Accounts receivable - related party | |

| 22,410 | | |

| – | |

| Inventories, net | |

| 65,998 | | |

| 62,933 | |

| Other receivables | |

| 200 | | |

| – | |

| Prepaid expenses | |

| 77,660 | | |

| 46,971 | |

| Deposit - current portion | |

| 100,000 | | |

| – | |

| Total Current Assets | |

| 1,397,624 | | |

| 2,440,112 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 4,533,068 | | |

| 4,653,438 | |

| Operating lease right-of-use asset | |

| 97,648 | | |

| 128,399 | |

| Deposits | |

| 6,630 | | |

| 6,630 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 6,034,970 | | |

$ | 7,228,579 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 156,732 | | |

$ | 192,488 | |

| Other current liabilities | |

| 6,236 | | |

| 16,820 | |

| Interest payable - related party | |

| – | | |

| 1,750 | |

| Customer deposit | |

| 5,819 | | |

| 127,671 | |

| Loan, current portion | |

| 150,006 | | |

| – | |

| Lease liability, current portion | |

| 50,969 | | |

| 44,270 | |

| Promissory note short term - related party | |

| – | | |

| 50,000 | |

| Total Current Liabilities | |

| 369,762 | | |

| 432,999 | |

| | |

| | | |

| | |

| Non-Current Liabilities: | |

| | | |

| | |

| Lease liability, less current portion | |

| 55,627 | | |

| 94,670 | |

| Loan, less current portion | |

| 255,854 | | |

| – | |

| Other liability | |

| 12,335 | | |

| 12,335 | |

| Total Non-Current Liabilities | |

| 323,816 | | |

| 107,005 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 693,578 | | |

| 540,004 | |

| | |

| | | |

| | |

| Contingencies (note 16) | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' Equity: | |

| | | |

| | |

| Common stock, par value $0.001 per share, 75,000,000 shares authorized; 40,959,741 shares

issued and outstanding as of September 30, 2020 and December 31,2019, respectively | |

| 40,959 | | |

| 40,959 | |

| Additional paid-in capital | |

| 14,381,058 | | |

| 13,775,908 | |

| Shares to be issued, common shares | |

| 86,709 | | |

| 50,709 | |

| Accumulated deficit | |

| (9,167,334 | ) | |

| (7,179,001 | ) |

| Total Stockholders' Equity | |

| 5,341,392 | | |

| 6,688,575 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 6,034,970 | | |

$ | 7,228,579 | |

The accompanying notes are an integral

part of these unaudited condensed consolidated financial statements

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2020 | | |

2019 | | |

2020 | | |

2019 | |

| Revenue | |

$ | 544,003 | | |

$ | 431,988 | | |

$ | 1,267,893 | | |

$ | 1,101,390 | |

| Revenue - related party | |

| – | | |

| 7,300 | | |

| 21,267 | | |

| 10,300 | |

| Total Revenue | |

| 544,003 | | |

| 439,288 | | |

| 1,289,160 | | |

| 1,111,690 | |

| Cost of Revenue | |

| 384,371 | | |

| 559,475 | | |

| 1,035,600 | | |

| 1,067,946 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit (Loss) | |

| 159,632 | | |

| (120,187 | ) | |

| 253,560 | | |

| 43,744 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling expense | |

| 677 | | |

| 12,267 | | |

| 17,696 | | |

| 24,023 | |

| Compensation - officers | |

| 34,000 | | |

| 40,000 | | |

| 102,000 | | |

| 110,000 | |

| Research and development | |

| 62,039 | | |

| 66,289 | | |

| 194,232 | | |

| 193,009 | |

| Professional fees | |

| 243,799 | | |

| 397,950 | | |

| 1,071,369 | | |

| 958,337 | |

| General and administrative | |

| 294,795 | | |

| 322,801 | | |

| 974,125 | | |

| 675,935 | |

| Total Operating Expenses | |

| 635,310 | | |

| 839,307 | | |

| 2,359,422 | | |

| 1,961,304 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from Operations | |

| (475,678 | ) | |

| (959,494 | ) | |

| (2,105,862 | ) | |

| (1,917,560 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| (1,878 | ) | |

| (248 | ) | |

| (1,843 | ) | |

| 820 | |

| Interest (expense) - related party | |

| – | | |

| – | | |

| (81 | ) | |

| – | |

| Other income | |

| 39,196 | | |

| 9,643 | | |

| 119,453 | | |

| 11,623 | |

| Total other income (expense) | |

| 37,318 | | |

| 9,395 | | |

| 117,529 | | |

| 12,443 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (438,360 | ) | |

| (950,099 | ) | |

| (1,988,333 | ) | |

| (1,905,117 | ) |

| Income tax expense | |

| – | | |

| | | |

| – | | |

| – | |

| Net Loss | |

$ | (438,360 | ) | |

$ | (950,099 | ) | |

$ | (1,988,333 | ) | |

$ | (1,905,117 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Common Shares Outstanding: Basic and Diluted | |

| 40,959,741 | | |

| 40,959,741 | | |

| 40,959,741 | | |

| 40,945,807 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss per common share: Basic and Diluted | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.05 | ) | |

$ | (0.05 | ) |

The accompanying notes are an integral

part of these unaudited condensed consolidated financial statements

FOCUS UNIVERSAL INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS'

EQUITY

| | |

| | |

| | |

Additional | | |

Shares to be | | |

| | |

Total | |

| | |

Common

stock | | |

Paid-In | | |

issued | | |

Accumulated | | |

Stockholders' | |

| Description | |

Shares | | |

Amount | | |

Capital | | |

Common

Shares | | |

Deficit | | |

Equity | |

| Balance - June 30, 2020 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 14,294,608 | | |

$ | 74,709 | | |

$ | (8,728,974 | ) | |

$ | 5,681,302 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock options issued for services | |

| – | | |

| – | | |

| 86,450 | | |

| – | | |

| – | | |

| 86,450 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock to be issued for services | |

| – | | |

| – | | |

| – | | |

| 12,000 | | |

| – | | |

| 12,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| (438,360 | ) | |

| (438,360 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - September 30, 2020 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 14,381,058 | | |

$ | 86,709 | | |

$ | (9,167,334 | ) | |

$ | 5,341,392 | |

| | |

| | |

| | |

Additional | | |

Shares to be | | |

| | |

Total | |

| | |

Common

stock | | |

Paid-In | | |

issued | | |

Accumulated | | |

Stockholders' | |

| Description | |

Shares | | |

Amount | | |

Capital | | |

Common

Shares | | |

Deficit | | |

Equity | |

| Balance - June 30, 2019 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 13,343,659 | | |

$ | 23,491 | | |

$ | (4,958,476 | ) | |

$ | 8,449,633 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock options issued for services | |

| – | | |

| – | | |

| 172,900 | | |

| – | | |

| – | | |

| 172,900 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock to be issued for services | |

| – | | |

| – | | |

| – | | |

| 11,964 | | |

| – | | |

| 11,964 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| (950,099 | ) | |

| (950,099 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - September 30, 2019 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 13,516,559 | | |

$ | 35,455 | | |

$ | (5,908,575 | ) | |

$ | 7,684,398 | |

FOCUS UNIVERSAL INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS'

EQUITY

(continued)

| | |

| | |

| | |

Additional | | |

Shares to be | | |

| | |

Total | |

| | |

Common

stock | | |

Paid-In | | |

issued | | |

Accumulated | | |

Stockholders' | |

| Description | |

Shares | | |

Amount | | |

Capital | | |

Common

Shares | | |

Deficit | | |

Equity | |

| Balance - December 31, 2019 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 13,775,908 | | |

$ | 50,709 | | |

$ | (7,179,001 | ) | |

$ | 6,688,575 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock options issued for services | |

| – | | |

| – | | |

| 605,150 | | |

| – | | |

| – | | |

| 605,150 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock to be issued for services | |

| – | | |

| – | | |

| – | | |

| 36,000 | | |

| – | | |

| 36,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| (1,988,333 | ) | |

| (1,988,333 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - September 30, 2020 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 14,381,058 | | |

$ | 86,709 | | |

$ | (9,167,334 | ) | |

$ | 5,341,392 | |

| | |

| | |

| | |

Additional | | |

Shares to be | | |

| | |

Total | |

| | |

Common

stock | | |

Paid-In | | |

issued | | |

Accumulated | | |

Stockholders' | |

| Description | |

Shares | | |

Amount | | |

Capital | | |

Common

Shares | | |

Deficit | | |

Equity | |

| Balance - December 31, 2018 | |

| 40,907,010 | | |

$ | 40,907 | | |

$ | 12,956,486 | | |

$ | 72,000 | | |

$ | (4,003,458 | ) | |

$ | 9,065,935 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock options issued for services | |

| – | | |

| – | | |

| 172,900 | | |

| – | | |

| – | | |

| 172,900 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for compensation | |

| 13,445 | | |

| 13 | | |

| 96,496 | | |

| (96,509 | ) | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock to be issued for services | |

| – | | |

| – | | |

| – | | |

| 59,964 | | |

| – | | |

| 59,964 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for acquisition | |

| 39,286 | | |

| 39 | | |

| 290,677 | | |

| – | | |

| – | | |

| 290,716 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| (1,905,117 | ) | |

| (1,905,117 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - September 30, 2019 | |

| 40,959,741 | | |

$ | 40,959 | | |

$ | 13,516,559 | | |

$ | 35,455 | | |

$ | (5,908,575 | ) | |

$ | 7,684,398 | |

The accompanying notes are an integral

part of these unaudited condensed consolidated financial statements

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited)

| | |

Nine Months Ended September 30, |

|

| | |

2020 | | |

2019 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net Loss | |

$ | (1,988,333 | ) | |

$ | (1,905,117 | ) |

| Adjustments to reconcile net loss to net cash from operating activities: | |

| | | |

| | |

| Bad debt expense | |

| 6,927 | | |

| – | |

| Inventories reserve | |

| (3,853 | ) | |

| 3,601 | |

| Depreciation expense | |

| 121,684 | | |

| 112,107 | |

| Amortization of intangible assets | |

| – | | |

| 16,521 | |

| Amortization of right-of-use assets | |

| (1,593 | ) | |

| (296 | ) |

| Stock-based compensation | |

| 36,000 | | |

| 59,964 | |

| Stock option compensation | |

| 605,150 | | |

| 172,900 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (179,041 | ) | |

| 193,726 | |

| Accounts receivable - related party | |

| (22,410 | ) | |

| 39,625 | |

| Inventories | |

| 788 | | |

| (5,210 | ) |

| Other receivable | |

| (200 | ) | |

| (3,625 | ) |

| Prepaid expenses | |

| (30,689 | ) | |

| 68,914 | |

| Deposit – Current portion | |

| (100,000 | ) | |

| – | |

| Deposits | |

| – | | |

| 7,210 | |

| Accounts payable and accrued liabilities | |

| (34,006 | ) | |

| 161,464 | |

| Accounts payable - related party | |

| – | | |

| (4,921 | ) |

| Other current liabilities | |

| (12,334 | ) | |

| – | |

| Interest payable - related party | |

| (1,750 | ) | |

| – | |

| Customer deposit | |

| (121,852 | ) | |

| (36,184 | ) |

| Other liabilities | |

| – | | |

| (7,210 | ) |

| Net cash flows used in operating activities | |

| (1,725,512 | ) | |

| (1,126,531 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Cash from acquisition | |

| – | | |

| 201,482 | |

| Purchase of property and equipment | |

| (1,314 | ) | |

| (220,793 | ) |

| Cash paid for acquisition | |

| – | | |

| (550,000 | ) |

| Net cash flows used in investing activities | |

| (1,314 | ) | |

| (569,311 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from SBA loan | |

| 405,860 | | |

| – | |

| Payment on promissory note | |

| (50,000 | ) | |

| – | |

| Net cash flows provided by financing activities | |

| 355,860 | | |

| – | |

| | |

| | | |

| | |

| Net change in cash | |

| (1,370,966 | ) | |

| (1,695,842 | ) |

| | |

| | | |

| | |

| Cash beginning of period | |

| 2,192,870 | | |

| 4,455,751 | |

| | |

| | | |

| | |

| Cash end of period | |

$ | 821,904 | | |

$ | 2,759,909 | |

| | |

| | | |

| | |

| Supplemental cash flow disclosure: | |

| | | |

| | |

| Cash paid for income taxes | |

$ | – | | |

$ | – | |

| Cash paid for interest | |

$ | 1,831 | | |

$ | – | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash investing and financing activities: | |

| | | |

| | |

| Promissory note issued for acquisition | |

$ | – | | |

$ | 50,000 | |

| Shares issued for acquisition | |

$ | – | | |

$ | 290,716 | |

| Shares issued to reduce notes payable | |

$ | – | | |

$ | – | |

The accompanying notes are an integral

part of these unaudited condensed consolidated financial statements

FOCUS UNIVERSAL INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(unaudited)

Note 1 – Organization and Operations

Focus Universal Inc. (“Focus”)

was incorporated under the laws of the state of Nevada on December 4, 2012 (“Inception”). It is a universal smart

instrument developer and manufacturer, headquartered in the Los Angeles, California metropolitan area, specializing in the development

and commercialization of novel and proprietary universal smart technologies and instruments. Universal smart technology is an off-the-shelf

technology utilizing an innovative hardware integrated platform. The Focus platform provides a unique and universal combined wired

and wireless solution for embedded design, industrial control, functionality testing, and parameter measurement instruments and

functions. Our smart technology software utilizes a smartphone, computer, or a mobile device as an interface platform and display

that communicates and works in tandem with a group of external sensors or probes, or both. The external sensors and probes may

be manufactured by different vendors, but the universal smart technology functions in a manner that does not require the user to

have extensive knowledge of the unique characteristics of the function of each of the sensors and probes. The universal smart instrument

Focus developed (the “Ubiquitor”) consists of a reusable foundation component which includes a wireless gateway (which

allows the instrument to connect to the smartphone via Bluetooth and WiFi technology), universal smart application software (“Application”)

which is installed on the user’s smartphone or other mobile device and allows monitoring of the sensor readouts on the smartphone’s

screen. The Ubiquitor also connects to a variety of individual scientific sensors that collect data, from moisture, light, airflow,

voltage, and a wide variety of applications. The data is then sent through a wired or wireless connection, or a combination thereof

to the smartphone or other mobile device, and the data is organized and displayed on the smartphone screen. The smartphone or other

mobile device, foundation, and sensor readouts together perform the functions of many traditional scientific and engineering instruments

and are intended to replace the traditional, wired stand-alone instruments at a fraction of their cost.

Perfecular Inc. (“Perfecular”)

was founded in September 2009 and is headquartered in Ontario, California, and is engaged in designing certain digital sensor products

and sells a broad selection of horticultural sensors and filters in North America and Europe.

AVX Design & Integration, Inc. (“AVX”)

was incorporated on June 16, 2000 in the state of California. AVX is an internet of things (“IoT”) installation and

management company specializing in high performance and easy to use audio/video, home theater, lighting control, automation, and

integration. Services provided by AVX include full integration of houses, apartments, commercial complexes, office spaces with

audio, visual, and control systems to fully integrate devices in the low voltage field. AVX’s services also include partial

equipment upgrade and installation.

Note 2 – Revision of Prior Period

Financial Statements

The Company corrected certain errors in

its 2019 financial statements. In accordance with ASC 50-10-S99 and S55 (formerly Staff Accounting Bulletins (“SAB”)

No. 99 and No. 108), Accounting Changes and Error Corrections, the Company concluded that these errors were not, individually,

and in the aggregate, quantitatively or qualitatively, material to the financial statements in these periods.

On March 15, 2019, the Company acquired

AVX Design & Integration Inc. Upon further review, we noticed that some revenue recognized immediately after the acquisition

and before the financial statement reporting period were recognized prematurely. There were also some expense reclassifications

between expense items. Consequently, for the three months ended September 30, 2019 revenue was understated by $107,118, cost of

revenue was understated by $211,104, selling expenses were overstated by $81,637, compensation - officers was overstated by $4,905,

professional fees were overstated by $1,700, and general and administrative expenses were understated by $52,840. The Company had

accounted for these errors correctly on the audited year end financials. For the nine months ended September 30, 2019 revenue was

understated by $116,445, cost of revenue was understated by $315,495, selling expenses were overstated by $159,547, compensation

- officers was understated by $3,420, professional fees were overstated by $13,452, and general and administrative expenses were

understated by $56,804. The Company had accounted for these errors correctly on the audited year end financials.

The below discloses the effects of the

revisions on the financial statements for the period reported.

Condensed consolidated statement of operations

for the three months ended September 30, 2019

| | |

Previously reported | | |

| | |

Revised | |

| | |

For the three months ended | | |

| | |

For the three months ended | |

| | |

9/30/2019 | | |

Adjustment | | |

9/30/2019 | |

| Revenue | |

$ | 324,870 | | |

$ | 107,118 | | |

$ | 431,988 | |

| Revenue - related party | |

| 7,300 | | |

| – | | |

| 7,300 | |

| Total revenue | |

| 332,170 | | |

| 107,118 | | |

| 439,288 | |

| | |

| | | |

| | | |

| | |

| Cost of Revenue | |

| 348,371 | | |

| 211,104 | | |

| 559,475 | |

| | |

| | | |

| | | |

| | |

| Gross Profit | |

| (16,201 | ) | |

| (103,986 | ) | |

| (120,187 | ) |

| | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | |

| Selling | |

| 93,904 | | |

| (81,637 | ) | |

| 12,267 | |

| Compensation - officers | |

| 44,905 | | |

| (4,905 | ) | |

| 40,000 | |

| Research and development | |

| 66,282 | | |

| 7 | | |

| 66,289 | |

| Professional fees | |

| 399,650 | | |

| (1,700 | ) | |

| 397,950 | |

| General and administrative | |

| 269,961 | | |

| 52,840 | | |

| 322,801 | |

| Total Operating Expenses | |

| 874,702 | | |

| (35,395 | ) | |

| 839,307 | |

| | |

| | | |

| | | |

| | |

| Loss from Operations | |

| (890,903 | ) | |

| (68,591 | ) | |

| (959,494 | ) |

| | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| (232 | ) | |

| (16 | ) | |

| (248 | ) |

| Other income | |

| 8,460 | | |

| 1,183 | | |

| 9,643 | |

| Total other expense | |

| 8,228 | | |

| 1,167 | | |

| 9,395 | |

| | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (882,675 | ) | |

| (67,424 | ) | |

| (950,099 | ) |

| | |

| | | |

| | | |

| | |

| Tax expense | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (882,675 | ) | |

$ | (67,424 | ) | |

$ | (950,099 | ) |

Condensed consolidated statement

of operations for the nine months ended September 30, 2019

| | |

Previously reported | | |

| | |

Revised | |

| | |

For the nine months ended | | |

| | |

For the nine months ended | |

| | |

9/30/2019 | | |

Adjustment | | |

9/30/2019 | |

| Revenue | |

$ | 984,945 | | |

$ | 116,445 | | |

$ | 1,101,390 | |

| Revenue - related party | |

| 10,300 | | |

| – | | |

| 10,300 | |

| Total revenue | |

| 995,245 | | |

| 116,445 | | |

| 1,111,690 | |

| | |

| | | |

| | | |

| | |

| Cost of Revenue | |

| 752,451 | | |

| 315,495 | | |

| 1,067,946 | |

| | |

| | | |

| | | |

| | |

| Gross Profit | |

| 242,794 | | |

| (199,050 | ) | |

| 43,744 | |

| | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | |

| Selling | |

| 183,570 | | |

| (159,547 | ) | |

| 24,023 | |

| Compensation - officers | |

| 106,580 | | |

| 3,420 | | |

| 110,000 | |

| Research and development | |

| 193,002 | | |

| 7 | | |

| 193,009 | |

| Professional fees | |

| 971,789 | | |

| (13,452 | ) | |

| 958,337 | |

| General and administrative | |

| 619,131 | | |

| 56,804 | | |

| 675,935 | |

| Total Operating Expenses | |

| 2,074,072 | | |

| (112,768 | ) | |

| 1,961,304 | |

| | |

| | | |

| | | |

| | |

| Loss from Operations | |

| (1,831,278 | ) | |

| (86,282 | ) | |

| (1,917,560 | ) |

| | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| 836 | | |

| (16 | ) | |

| 820 | |

| Other income | |

| 10,440 | | |

| 1,183 | | |

| 11,623 | |

| Total other expense | |

| 11,276 | | |

| 1,167 | | |

| 12,443 | |

| | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (1,820,002 | ) | |

| (85,115 | ) | |

| (1,905,117 | ) |

| | |

| | | |

| | | |

| | |

| Tax expense | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (1,820,002 | ) | |

$ | (85,115 | ) | |

$ | (1,905,117 | ) |

Condensed consolidated statement of cash

flows

| | |

Previously reported | | |

| | |

Revised | |

| | |

For the nine months ended | | |

| | |

For the nine months ended | |

| | |

9/30/2019 | | |

Adjustment | | |

9/30/2019 | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (1,820,002 | ) | |

$ | (85,115 | ) | |

$ | (1,905,117 | ) |

| Adjustments to reconcile net loss to net cash from operating activities: | |

| | | |

| | | |

| | |

| Inventories reserve | |

| 3,601 | | |

| – | | |

| 3,601 | |

| Depreciation expense | |

| 112,107 | | |

| – | | |

| 112,107 | |

| Amortization of intangible assets | |

| 16,521 | | |

| – | | |

| 16,521 | |

| Amortization of right-of-use assets | |

| 48,569 | | |

| (48,865 | ) | |

| (296 | ) |

| Stock-based compensation | |

| 59,964 | | |

| – | | |

| 59,964 | |

| Stock option compensation | |

| 172,900 | | |

| – | | |

| 172,900 | |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable | |

| 262,099 | | |

| (68,373 | ) | |

| 193,726 | |

| Accounts receivable - related party | |

| 39,625 | | |

| – | | |

| 39,625 | |

| Inventories | |

| (5,210 | ) | |

| – | | |

| (5,210 | ) |

| Other receivable | |

| (3,625 | ) | |

| – | | |

| (3,625 | ) |

| Prepaid expenses | |

| 68,914 | | |

| – | | |

| 68,914 | |

| Deposit | |

| 7,210 | | |

| – | | |

| 7,210 | |

| Accounts payable and accrued liabilities | |

| (22,860 | ) | |

| 184,324 | | |

| 161,464 | |

| Accounts payable - related party | |

| (4,921 | ) | |

| – | | |

| (4,921 | ) |

| Other liabilities | |

| (7,210 | ) | |

| – | | |

| (7,210 | ) |

| Customer deposit | |

| (5,348 | ) | |

| (30,836 | ) | |

| (36,184 | ) |

| Net cash flows used in operating activities | |

| (1,077,666 | ) | |

| (48,865 | ) | |

| (1,126,531 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | |

| Cash from acquisition | |

| 201,482 | | |

| – | | |

| 201,482 | |

| Purchase of property and equipment | |

| (220,793 | ) | |

| – | | |

| (220,793 | ) |

| Cash paid for acquisition | |

| (550,000 | ) | |

| – | | |

| (550,000 | ) |

| Net cash flows used in investing activities | |

| (569,311 | ) | |

| – | | |

| (569,311 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | |

| Payment on long term debt and finance lease obligation | |

| (48,865 | ) | |

| 48,865 | | |

| – | |

| Net cash flows used in financing activities | |

| (48,865 | ) | |

| 48,865 | | |

| – | |

| | |

| | | |

| | | |

| | |

| Net change in cash | |

| (1,695,842 | ) | |

| – | | |

| (1,695,842 | ) |

| | |

| | | |

| | | |

| | |

| Cash beginning of period | |

| 4,455,751 | | |

| – | | |

| 4,455,751 | |

| | |

| | | |

| | | |

| | |

| Cash end of period | |

$ | 2,759,909 | | |

$ | – | | |

$ | 2,759,909 | |

There was no impact on the Company’s

consolidated balance sheet.

Note 3 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated

financial statements include the accounts of Focus and its wholly-owned subsidiaries, Perfecular Inc. and AVX Design & Integration,

Inc. (collectively, the “Company”, “we”, “our”, or “us”). All intercompany balances

and transactions have been eliminated upon consolidation. The Company’s condensed consolidated financial statements have

been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Going Concern

The accompanying condensed consolidated

financial statements have been prepared assuming that the Company will continue as a going concern basis, which assumes the Company

will continue to realize its assets and discharge its liabilities in the normal course of business. The continuation of the Company

as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to repay

its debt obligations, to obtain necessary equity financing to continue operations, and the attainment of profitable operations.

Recently, the Company has devoted a substantial amount of resources to research and development to bring the Ubiquitor and its

mobile application to full production and distribution. For the nine months ended September 30, 2020, the Company had a net loss

of $1,988,333 and negative cash flow from operating activities of $1,725,512. As of September 30, 2020, the Company also had an

accumulated deficit of $9,167,334. These factors raise certain doubts regarding the Company’s ability to continue as a going

concern. There are no assurances, however, that the Company will be successful in obtaining an adequate level of financing for

the long-term development and commercialization of its Ubiquitor product.

Principles of Consolidation

The accompanying consolidated financial

statements include the accounts of the Company and its wholly-owned subsidiaries, Perfecular Inc. and AVX Design & Integration.

Focus and Perfecular, collectively “the entities” were under common control; therefore, in accordance with Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 805-50-45, the acquisition

of Perfecular was accounted for as a business combination between entities under common control and treated similar to a pooling

of interest transaction. On March 15, 2019, Focus entered into a stock purchase agreement with AVX whereby Focus purchased 100%

of the outstanding stock of AVX. All significant intercompany transactions and balances have been eliminated.

Segment Reporting

The Company currently has two operating

segments. In accordance with ASC 280, Segment Reporting (“ASC 280”), the Company considers operating segments

to be components of the Company’s business for which separate financial information is available and evaluated regularly

by management in deciding how to allocate resources and to assess performance. Management reviews financial information presented

on a consolidated basis for purposes of allocating resources and evaluating financial performance. Accordingly, the Company has

determined that it has two operating and reportable segments.

Asset information by operating segment

is not presented as the chief operating decision maker does not review this information by segment. The reporting segments follow

the same accounting policies used in the preparation of the Company’s unaudited condensed consolidated financial statements.

Use of Estimates

The preparation of consolidated financial

statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the accompanying consolidated

financial statements, and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates

and assumptions on current facts, historical experience, and various other factors that it believes to be reasonable under the circumstances,

the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of

costs and expenses that are not readily apparent from other sources.

The

actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent

there are material differences between the estimates and the actual results, future results of operations will be affected. Significant

estimates in the accompanying financial statements include the lease term impacting right-of use asset and lease liability, useful

lives of property and equipment, useful lives of intangible assets, allowance for doubtful accounts, inventory reserves, debt

discounts, valuation of derivatives, and the valuation allowance on deferred tax assets. The Company regularly evaluates its estimates

and assumptions.

Cash

The Company considers all highly liquid

investments with a maturity of three months or less to be cash. At times, such investments may be in excess of Federal Deposit

Insurance Corporation (FDIC) insurance limit. There were no cash equivalents held by the Company at September 30, 2020 and December

31, 2019.

Accounts Receivable

The Company grants credit to clients that

sell the Company’s products or engage in construction service under credit terms that it believes are customary in the industry

and do not require collateral to support customer receivables. The accounts receivable balances are generally collected within

30 to 90 days of the product sale.

Allowance for Doubtful Accounts

The Company estimates an allowance for

doubtful accounts based on historical collection trends and review of the current status of trade accounts receivable. It is reasonably

possible that the Company's estimate of the allowance for doubtful accounts will change. As of September 30, 2020 and December

31, 2019, allowance for doubtful accounts amounted to $29,539 and $22,612, respectively.

Concentrations of Credit Risk

Financial instruments that potentially

subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company limits its exposure

to credit loss by investing its cash with high credit quality financial institutions.

Inventory

Inventory consists primarily of parts

and finished goods and is valued at the lower of the inventory’s cost or net realizable value under the

first-in-first-out method. Management compares the cost of inventory with its market value and an allowance is made to write

down inventory to market value, if lower. Inventory allowances are recorded for obsolete or slow-moving inventory based on

assumptions about future demand and marketability of products, the impact of new product introductions and specific

identification of items, such as discontinued products. These estimates could vary significantly from actual requirements,

for example, if future economic conditions, customer inventory levels, or competitive conditions differ from expectations.

The Company regularly reviews the value of inventory based on historical usage and estimated future usage. If estimated

realized value of our inventory is less than cost, we make provisions in order to reduce its carrying value to its estimated

market value. As of September 30, 2020 and December 31, 2019, inventory reserve amounted to $67,561 and $71,414,

respectively.

Property and Equipment

Property and equipment are stated at cost.

The cost and accumulated depreciation of assets sold or retired are removed from the respective accounts and any gain or loss is

included in earnings. Maintenance and repairs are expensed currently. Major renewals and betterments are capitalized. Depreciation

is computed using the straight-line method. Estimated useful lives are as follows:

| Fixed assets |

Useful life |

| Furniture |

5 years |

| Equipment |

5 years |

| Warehouse |

39 years |

| Improvement |

5 years |

| Construction in progress |

– |

| Land |

– |

Long-Lived Assets

The Company applies the provisions of FASB

ASC Topic 360, Property, Plant, and Equipment, which addresses financial accounting and reporting for the impairment or disposal

of long-lived assets. ASC 360 requires impairment losses to be recorded on long-lived assets used in operations when indicators

of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’

carrying amounts. In that event, a loss is recognized based on the amount by which the carrying value exceeds the fair value of

the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair values are

reduced for the cost of disposal. Long-term assets of the Company are reviewed when circumstances warrant as to whether their carrying

value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash

flows from related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events

and circumstances warrant revised estimates of useful lives. Based on its review at September 30, 2020 and December 31, 2019, the

Company believes there was no impairment of its long-lived assets.

Intangible Assets

The Company’s intangible assets were

acquired from AVX. Amortization is computed using the straight-line method, and the Company evaluates for impairments annually.

During the year ended December 31, 2019, the Company determined that the intangible assets associated with the acquisition of AVX

were fully impaired. During the year ended December 31, 2019, impairment for intangible assets amounted to $47,975. Estimated useful

lives of intangible assets are as follows:

| Intangible assets |

Useful life |

| Market related intangible assets |

5 years |

Goodwill

Goodwill represents the excess of the purchase

price over the fair value of net assets acquired in a business combination. Goodwill with indefinite useful lives are tested for

impairment at least annually at December 31 and whenever triggering events or changes in circumstances indicate its carrying value

may not be recoverable. Assessment of the potential impairment of goodwill is an integral part of the Company’s normal ongoing

review of operations. Testing for potential impairment of these assets is significantly dependent on numerous assumptions and reflects

management’s best estimates at a particular point in time. The dynamic economic environments in which the Company’s

businesses operate and key economic and business assumptions related to projected selling prices, market growth, inflation rates,

and operating expense ratios, can significantly affect the outcome of impairment tests. Estimates based on these assumptions may

differ significantly from actual results. Changes in factors and assumptions used in assessing potential impairments can have a

significant impact on the existence and magnitude of impairments, as well as the time in which such impairments are recognized.

The management tests for impairment annually at year end. During the year ended December 31, 2019, the Company determined that

the goodwill associated with the acquisition of certain AVX assets was impaired and took a charge to earnings of $458,490.

Share-based Compensation

The Company accounts for stock-based compensation

to employees in conformity with the provisions of ASC Topic 718, Stock-Based Compensation. Stock-based compensation to employees

consist of stock options grants and restricted shares that are recognized in the statement of operations based on their fair values

at the date of grant.

The measurement of stock-based

compensation is subject to periodic adjustments as the underlying equity instruments vest and is recognized as an expense

over the period during which services are received.

The Company calculates the fair value of

option grants utilizing the Black-Scholes pricing model and estimates the fair value of the stock based upon the estimated fair

value of the common stock. The amount of stock-based compensation recognized during a period is based on the value of the portion

of the awards that are ultimately expected to vest.

The resulting stock-based compensation

expense for both employee and non-employee awards is generally recognized on a straight- line basis over the requisite service

period of the award.

Fair Value of Financial Instruments

The Company follows paragraph ASC 825-10-50-10

for disclosures about fair value of its financial instruments and paragraph ASC 820-10-35-37 (“Paragraph 820-10-35-37”)

to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value

in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value

measurements.

To increase consistency and comparability

in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes

the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest

priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable

inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| |

☐ |

Level 1: Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| |

☐ |

Level 2: Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| |

☐ |

Level 3: Pricing inputs that are generally unobservable inputs and not corroborated by market data. |

Financial assets are considered Level 2

when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least

one significant model assumption or input is unobservable.

The carrying amount of the Company’s

financial assets and liabilities, such as cash, prepaid expenses, accounts payable, and accrued expenses, approximate their fair

value because of the short maturity of those instruments.

Transactions involving related parties

cannot be presumed to be carried out on an arm's-length basis, as the requisite conditions of competitive, free-market dealings

may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions

were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated.

However, it is not practical to determine

the fair value of advances from stockholders, if any, due to their related party nature.

Revenue Recognition

On September 1, 2018, the Company adopted

ASC 606 – Revenue from Contracts with Customers using the modified retrospective transition approach. The core principle

of ASC 606 is that revenue should be recognized in a manner that depicts the transfer of promised goods or services to customers

in an amount that reflects the consideration to which the entity expects to be entitled for exchange of those goods or services.

The Company’s updated accounting policies and related disclosures are set forth below, including the disclosure for disaggregated

revenue. The impact of adopting ASC 606 was not material to the Condensed Consolidated Financial Statements.

Revenue from the Company is recognized

under Topic 606 in a manner that reasonably reflects the delivery of its services and products to customers in return for expected

consideration and includes the following elements:

| |

☐ |

executed contracts with the Company’s customers that it believes are legally enforceable; |

| |

☐ |

identification of performance obligations in the respective contract; |

| |

☐ |

determination of the transaction price for each performance obligation in the respective contract; |

| |

☐ |

allocation of the

transaction price to each performance obligation; and |

| |

☐ |

recognition of revenue only when the Company satisfies each performance obligation. |

These five elements, as applied to each

of the Company’s revenue categories, is summarized below:

| |

☐ |

Product sales – revenue is recognized at the time of sale of equipment to the customer. |

| |

☐ |

Service sales – revenue is recognized based on the service been provided to the customer. |

Revenue from construction projects is recognized

over time using the percentage-of-completion method under the cost approach. The percentage of completion is determined by estimating

stage of work completed. Under this approach, recognized contract revenue equals the total estimated contract revenue multiplied

by the percentage of completion. Our construction contracts are unit priced, and an account receivable is recorded for amounts

invoiced based on actual units produced.

Cost of Revenue

Cost of revenue includes the cost of services,

labor, and product incurred to provide product sales, service sales, and project sales.

Research and Development

Research and development costs are expensed

as incurred. Research and development costs primarily consist of efforts to refine existing product models and develop new product

models.

Related Parties

The Company follows ASC 850-10 for the

identification of related parties and disclosure of related party transactions. Pursuant to ASC 850-10-20 the related parties include:

a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election

of the fair value option under the Fair Value Option Subsection of ASC 825–10–15, to be accounted for by the equity

method by the investing entity; c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed

by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with

which the Company may deal if one party controls or can significantly influence the management or operating policies of the other

to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other

parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership

interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting

parties might be prevented from fully pursuing its own separate interests.

The condensed consolidated financial statements

shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and

other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation

of consolidated financial statements is not required in those statements. The disclosures shall include: (a) the nature of the

relationship(s) involved; (b) a description of the transactions, including transactions to which no amounts or nominal amounts

were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to

an understanding of the effects of the transactions on the consolidated financial statements; (c) the dollar amounts of transactions

for each of the periods for which income statements are presented and the effects of any change in the method of establishing the

terms from that used in the preceding period; and (d) amounts due from or to related parties as of the date of each balance sheet

presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and Contingencies

The Company follows ASC 450-20 to report

accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which

may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to occur. The

Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss

contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings,

the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the

amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates

that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated

liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential

material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of

the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are

generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe,

based upon information available at this time that these matters will have a material adverse effect on the Company’s financial

position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely

affect the Company’s business, financial position, and results of operations or cash flows.

Income Tax Provision

The Company accounts for income taxes in

accordance with ASC Topic 740, Income Taxes (ASC 740). ASC 740 requires a company to use the asset and liability method of accounting

for income taxes, whereby deferred tax assets are recognized for deductible temporary differences, and deferred tax liabilities

are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets

and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management,

the Company does not foresee generating taxable income in the near future and utilizing its deferred tax asset, therefore, it is

more likely than not that some portion, or all of, the deferred tax assets will not be realized. Deferred tax assets and liabilities

are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Under ASC 740, a tax position is recognized

as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with

a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is more than 50% likely

to be realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded.

The Company has no material uncertain tax positions for any of the reporting periods presented.

Income taxes are accounted for using the

asset and liability method. Deferred income taxes are provided for temporary differences in recognizing certain income, expense,

and credit items for financial reporting purposes and tax reporting purposes. Such deferred income taxes primarily relate to the

difference between the tax basis of assets and liabilities and their financial reporting amounts. Deferred tax assets and liabilities

are measured by applying enacted statutory tax rates applicable to the future years in which deferred tax assets or liabilities

are expected to be settled or realized. There was no material deferred tax asset or liabilities as of September 30, 2020 and December

31, 2019.

As of September 30, 2020 and December 31,

2019, the Company did not identify any material uncertain tax positions.

Basic and Diluted Net Income (Loss) Per Share

Net income (loss) per share is computed

pursuant to ASC 260-10-45. Basic net income (loss) per share (“EPS”) is computed by dividing net income (loss) by the

weighted average number of shares outstanding during the period.

Diluted EPS is computed by dividing net

income (loss) by the weighted average number of shares of stock and potentially outstanding shares of stock during the period to

reflect the potential dilution that could occur from common shares issuable through contingent shares issuance arrangement, stock

options or warrants.

Due to the net loss incurred by the Company,

potentially dilutive instruments would be anti-dilutive. Accordingly, diluted loss per share is the same as basic loss for all

periods presented. The following potentially dilutive shares were excluded from the shares used to calculate diluted earnings per

share as their inclusion would be anti-dilutive.

| Nine months ended September 30, | |

2020 | | |

2019 | |

| Stock options | |

| 210,000 | | |

| – | |

| Total | |

| 210,000 | | |

| – | |

Subsequent Events

The Company follows the guidance in ASC

855-10-50 for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial

statements were issued. Pursuant to ASU 2010-09, the Company as an SEC filer considers its financial statements issued when they

are widely distributed to users, such as through filing them on EDGAR. Based upon the review, other than described in Note 17 –

Subsequent Events, the Company did not identify any recognized or non-recognized subsequent events that would have required adjustment

or disclosure in the condensed consolidated financial statements.

Reclassification

Certain reclassifications have been made

to the condensed consolidated financial statements for prior years to the current year’s presentation. Such reclassifications

have no effect on net income as previously reported.

Note 4 – Recent Accounting Pronouncement

Recently Adopted Accounting Standards

In February 2016, the Financial Accounting

Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) 2016-02, Leases (Topic 842) (“Topic

842”), which requires lessees to recognize leases on the balance sheet and disclose key information about leasing arrangements.

Topic 842 was subsequently amended by ASU 2018-01, Land Easement Practical Expedient for Transition to Topic 842; ASU 2018-10,

Codification Improvements to Topic 842, Leases; ASU 2018-11, Targeted Improvements; and ASU 2019-01, Codification Improvements.

The new standard establishes a right-of-use model (“ROU”) that requires a lessee to recognize ROU asset and lease

liability on the balance sheet for all leases with a term longer than 12 months. Leases are classified as finance or operating,

with classification affecting the pattern and classification of expense recognition in the statement of income.

The new standard was effective for the

Company on January 1, 2019. A modified retrospective transition approach is required, applying the new standard to all leases existing

at the date of initial application. An entity may choose to use either (1) its effective date or (2) the beginning of the earliest

comparative period presented in the financial statements as its date of initial application. The Company adopted the new standard

on January 1, 2019 and used the effective date as its date of initial application. Consequently, prior period financial information

has not been recast and the disclosures required under the new standard have not been provided for dates and periods before January

1, 2019.

The new standard provides a number of optional

practical expedients in transition. The Company elected the “package of practical expedients,” which permits it not

to reassess under the new standard its prior conclusions about lease identification, lease classification and initial direct costs.

The Company did not elect the use-of-hindsight or the practical expedient pertaining to land easements, the latter not being applicable

to the Company. The new standard also provides practical expedients for an entity’s ongoing accounting. The Company elected

the short-term lease recognition exemption for all leases that qualify. This means, for those leases that qualify, it has not recognized

ROU assets or lease liabilities, and this includes not recognizing ROU assets or lease liabilities for existing short-term leases

of those assets in transition. The Company also elected the practical expedient to not separate lease and non-lease components

for all of its leases.

The Company believes the most significant

effects of the adoption of this standard relate to (1) the recognition of new ROU assets and lease liabilities on its consolidated

balance sheet for its office operating leases and (2) providing new disclosures about its leasing activities. There was no change

in its leasing activities as a result of adoption.

In June 2018, the FASB issued ASU 2018-07,

Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting, which simplifies the accounting for

share-based payments granted to nonemployees for goods and services and aligns most of the guidance on such payments to nonemployees

with the requirements for share-based payments granted to employees. ASU 2018-07 is effective on January 1, 2019. Early adoption

is permitted. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In June 2020, the FASB issued ASU 2020-05

in response to the ongoing impacts to U.S. businesses in response to the COVID-19 pandemic. ASU 2020-05, Revenue from Contracts

with Customers (Topic 606) and Leases (Topic 842) Effective Dates for Certain Entities provide a limited deferral of the effective

dates for implementing previously issued ASU 606 and ASU 842 to give some relief to businesses considering the difficulties they

are facing during the pandemic. These entities may defer application to fiscal years beginning after December 15, 2019, and interim

periods within fiscal years beginning after December 15, 2020. As the Company has already adopted ASU 606 and ASU 842, the Company

does not anticipate any effect on its financial statements.

Recently Issued Accounting Standards Not Yet Adopted

In June 2016, FASB issued ASU 2016-13,

Financial Instruments - Credit Losses, which changes the accounting for recognizing impairments of financial assets. Under the

new guidance, credit losses for certain types of financial instruments will be estimated based on expected losses. The new guidance

also modifies the impairment models for available-for-sale debt securities and for purchased financial assets with credit deterioration

since their origination. In February 2020, the FASB issued ASU 2020-02, Financial Instruments-Credit Losses (Topic 326) and Leases

(Topic 842) - Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 119 and Update to SEC Section on Effective

Date Related to Accounting Standards Update No. 2016-02, Leases (Topic 842), which amends the effective date of the original pronouncement

for smaller reporting companies. ASU 2016-13 and its amendments will be effective for the Company for interim and annual periods

in fiscal years beginning after December 15, 2022. The Company believes the adoption will modify the way the Company analyzes financial

instruments, but it does not anticipate a material impact on results of operations. The Company is in the process of determining

the effects the adoption will have on its consolidated financial statements.

In December 2019, FASB issued ASU 2019-12,

Income Taxes, which provides for certain updates to reduce complexity in the accounting for income taxes, including the utilization

of the incremental approach for intra-period tax allocation, among others. The amendments in ASU 2019-12 are effective for fiscal

years, and interim periods within those fiscal years, beginning after December 15, 2020. The Company does not expect the implementation

of ASU 2019-12 to have a material effect on its consolidated financial statements.

Management does not believe that any recently

issued, but not yet effective, accounting standards could have a material effect on the accompanying financial statements. As new

accounting pronouncements are issued, we will adopt those that are applicable under the circumstances.

Note 5 – Inventory, net

At September 30, 2020 and December 31,

2019, inventory consisted of the following:

| | |

September 30,

2020 | | |

December 31,

2019 | |

| Parts | |

$ | 52,674 | | |

$ | 31,458 | |

| Finished goods | |

| 80,885 | | |

| 102,889 | |

| Total | |

| 133,559 | | |

| 134,347 | |

| Less inventory reserve | |

| (67,561 | ) | |

| (71,414 | ) |

| Inventory, net | |

$ | 65,998 | | |

$ | 62,933 | |

Note 6 – Deposit

Deposit balance as of September 30, 2020

amounted to $106,630, including $6,630 for lease agreement deposit and $100,000 for payment made into an escrow account. Balance

as of December 31, 2019 amounted to $6,630 for lease agreement deposit.

On August 31, 2020, the Company executed

a binding letter of intent with Communication Wiring Specialists, Inc., a California S-Corporation (“CWS”) whereby

the Company will purchase one hundred percent (100%) of the issued and outstanding common stock of CWS for five million dollars

($5,000,000). When the transaction closes, CWS will be capitalized with one million dollars ($1,000,000). The purchase price structure

included a refundable deposit amount of $100,000 to be held in an escrow account upon execution of the letter of intent. The letter

of intent may be terminated by mutual written consent by the Company and CWS, or on November 30, 2020 if the Closing has not occurred.

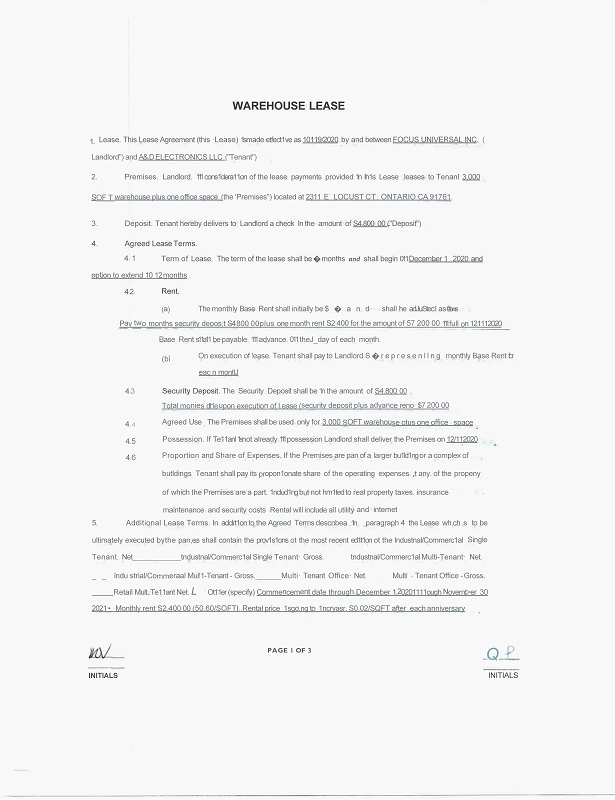

Note 7 – Acquisition

On March 15, 2019, the Company entered

into and closed an asset purchase agreement with AVX Design & Integration, Inc. (“AVX”) as stated in Note 1. A

summary of the purchase price and the purchase price allocations at fair value is below.

| Purchase price | |

| |

| Cash | |

$ | 550,000 | |

| 29,286 shares of common stock (1) | |

| 290,716 | |

| Secured promissory note | |

| 50,000 | |

| Total purchase price | |

$ | 890,716 | |

| | |

| | |

| Allocation of purchase price | |

| | |

| Cash | |

$ | 201,482 | |

| Accounts receivable | |

| 234,561 | |

| Inventories | |

| 16,000 | |

| Property and equipment | |

| 10,381 | |

| Operating lease right-of-use assets | |

| 157,213 | |

| Deposits | |

| 5,968 | |

| Intangible assets | |

| 57,000 | |

| Goodwill | |

| 458,016 | |

| Accounts payable and accrued liabilities | |

| (81,478 | ) |

| Operating lease liability | |

| (168,427 | ) |

| Purchase price | |

$ | 890,716 | |

(1) – the fair value of the common

stock was calculated based on the closing market price of the Company’s common stock at the date of acquisition.

Note 8 – Property and Equipment

At September 30, 2020 and December 31, 2019, property and equipment

consisted of the following:

| | |

June 30,

2020 | | |

December 31,

2019 | |

| Warehouse | |

$ | 3,789,773 | | |

$ | 3,789,773 | |

| Land | |

| 731,515 | | |

| 731,515 | |

| Building Improvement | |

| 238,666 | | |

| 238,666 | |

| Furniture and fixture | |

| 27,631 | | |

| 27,631 | |

| Equipment | |

| 48,378 | | |

| 47,064 | |

| Software | |

| 1,995 | | |

| 1,995 | |

| Total cost | |

| 4,837,958 | | |

| 4,836,644 | |

| Less accumulated depreciation | |

| (304,890 | ) | |

| (183,206 | ) |

| Property and equipment, net | |

$ | 4,533,068 | | |

$ | 4,653,438 | |

Depreciation expense for the nine months

ended September 30, 2020 and 2019 amounted to $121,684 and $112,107, respectively.

The Company purchased a warehouse in

Ontario, California in September 2018 and leased an unused portion to a third party. The tenant paid $12,335 as a security

deposit, shown as other liability in non-current liability.

Note 9 – Promissory Note - Related Party

On March 15, 2019, when the Company

purchased AVX Design & Integration, Inc. the Company agreed to pay the predecessor owner with a promissory note as one of

the forms of consideration. The note was $50,000 with a fixed interest rate of 6% per annum payable in 12 equal monthly

payments commencing on June 1, 2019 with interest calculated from the initial payment date through the date in

which all amount due under the note is paid off. As of December 31, 2019, the balance of the promissory note was $50,000 and

$1,750 accrued interest incurred for the nine months and 15 days ended December 31, 2019. The note and interest amount of

$50,000 and $1,831 were paid off on January 10, 2020.

Note 10 – Related Party Transactions

Revenue generated from Vitashower Corp.,

a company owned by the CEO’s wife, amounted to $21,267 and $10,300 for the nine months ended September 30, 2020 and 2019,

respectively. Account receivable balance due from Vitashower Corp. amounted to $22,410 and $0 as of September 30, 2020 and December

31, 2019, respectively.

Compensation for services provided by the

President and Chief Executive Officer for the nine months ended September 30, 2020 and 2019 amounted to $90,000 and $90,000, respectively.

Note 11 – Business Concentration and Risks

Major customers

One customer accounted for 24% and 18%

of the total accounts receivable as of September 30, 2020 and December 31, 2019, respectively.

Major vendors

One vendor accounted for 0% and 21% of

total accounts payable at September 30, 2020 and December 31, 2019, respectively.

Note 12 – Operating Lease Right-of-use

Asset and Operating Lease Liability

Operating

lease right-of-use assets and liabilities are recognized at the present value of the future lease payments at the lease commencement

date. The interest rate used to determine the present value is our incremental borrowing rate, estimated to be 15%, as the interest

rate implicit in our lease is not readily determinable. During the nine months ended September 30, 2020 and 2019, the Company recorded

$48,885 and $32,412, respectively as operating lease expense.

The Company currently has a lease agreement

for AVX’s operation for a monthly payment of $5,258 and shall increase by 3% every year. The lease commenced July 1, 2015

and expires on August 31, 2022. A security deposit of $5,968 was also held for the duration of the lease term.

In adopting ASC Topic 842, Leases (Topic

842), the Company has elected the ‘package of practical expedients,’ which permit it not to reassess under the new

standard its prior conclusions about lease identification, lease classification and initial direct costs. The Company did not elect

the use-of-hindsight or the practical expedient pertaining to land easements; the latter is not applicable to the Company. In addition,

the Company elected not to apply ASC Topic 842 to arrangements with lease terms of 12 months or less. On March 15, 2019 when AVX

was acquired, upon adoption of ASC Topic 842, the Company recorded a right-of-use asset.

Right-of-use asset is summarized below:

| | |

September 30, 2020 | |

| Office lease | |

$ | 157,213 | |

| Less: accumulated amortization | |

| (59,565 | ) |

| Right-of-use asset, net | |

$ | 97,648 | |

Operating Lease liability is summarized

below:

| | |

September 30, 2020 | |

| Office lease | |

$ | 106,596 | |

| Less: current portion | |

| (50,969 | ) |

| Long-term portion | |

$ | 55,627 | |