UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number: 001-36267

BLUE BIRD CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 46-3891989 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

402 Blue Bird Boulevard Fort Valley, Georgia 31030 | 31030 |

(Address of Principal Executive Offices) | (Zip Code) |

(478) 822-2801

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.0001 par value NASDAQ Global Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and has posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or and emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | x | |||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | x | ||

Emerging growth company | x | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

At April 1, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $172.1 million based on the closing sales price of $17.15 as reported on The NASDAQ Global Market on March 31, 2017. For the purpose of this response, executive officers, directors, and holders of 10% or more of the registrant’s common stock are considered to be affiliates of the registrant at that date.

At December 4, 2017, there were 23,964,312 outstanding shares of the registrant’s $0.0001 par value common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be delivered to shareholders in connection with the Registrant’s 2018 Annual Meeting of Shareholders are incorporated by reference in response to Part III of this report.

BLUE BIRD CORPORATION

FORM 10-K

TABLE OF CONTENTS

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) of Blue Bird Corporation (“Blue Bird” or the “Company”) contains forward-looking statements. Except as otherwise indicated by the context, references in this Report to “we,” “us” and “our” are to the consolidated business of the Company. All statements in this Report, including those made by the management of the Company, other than statements of historical fact, are forward-looking statements. These forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof and include the assumptions that underlie such statements. Forward-looking statements may contain words such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “estimate,” “project,” “forecast,” “seek,” “target,” “anticipate,” “believe,” “estimate,” “predict,” “potential” and “continue,” the negative of these terms, or other comparable terminology. Examples of forward-looking statements include statements regarding the Company’s future financial results, research and trial results, regulatory approvals, operating results, business strategies, projected costs, products, competitive positions, management’s plans and objectives for future operations, and industry trends. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. Specifically, forward-looking statements may include statements relating to:

• | the future financial performance of the Company; |

• | changes in the market for Blue Bird products; and |

• | expansion plans and opportunities. |

These forward-looking statements are based on information available as of the date of this Report (or, in the case of forward-looking statements incorporated herein by reference, as of the date of the applicable filed document), and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different than those expressed or implied by these forward-looking statements.

Any expectations based on these forward-looking statements are subject to risks and uncertainties and other important factors, including those discussed in this Report, specifically the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Other risks and uncertainties are and will be disclosed in the Company’s prior and future SEC filings. The following information should be read in conjunction with the financial statements included in this Report.

Available Information

We are subject to the reporting and information requirements of the Securities Exchange Act of 1934, as amended, and as a result are obligated to file annual, quarterly, and current reports, proxy statements, and other information with the Securities and Exchange Commission ("SEC"). We make these filings available free of charge on our website (http://www.blue-bird.com) as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. Information on our website does not constitute part of this Annual Report on Form 10-K. In addition, the SEC maintains a website (http://www.sec.gov) that contains our annual, quarterly, and current reports, proxy and information statements, and other information we electronically file with, or furnish to, the SEC. Any materials we file with, or furnish to, the SEC may also be read and/or copied at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

1

Item 1. Business

The Company was incorporated in Delaware on September 24, 2013 as a special purpose acquisition company, or SPAC. On February 24, 2015 (the “Closing Date”), the Company consummated a business combination (the “Business Combination”), pursuant to which the Company acquired all of the outstanding capital stock of School Bus Holdings Inc. (“School Bus Holdings” or “SBH”) from The Traxis Group, B.V. (the “Seller”), in accordance with the purchase agreement, dated as of September 21, 2014, by and among the Company, the Seller and, solely for purposes of Section 10.01(a) thereof, Hennessy Capital Partners I LLC (the “HCAC Sponsor”), as amended on February 10, 2015 and February 18, 2015 (as so amended, the “Purchase Agreement”). Pursuant to the Purchase Agreement, the total purchase price was paid in a combination of cash in the amount of $100 million and 12,000,000 shares of the Company’s common stock, $0.0001 par value (the “Common Stock”), valued at $120 million.

In connection with the closing of the Business Combination, the Company changed its name from Hennessy Capital Acquisition Corp. to Blue Bird Corporation. Unless expressly stated otherwise in this Report, Blue Bird Corporation shall be referred to as “Blue Bird” or the “Company,” and includes its consolidated subsidiaries.

The following description of our business describes the business historically operated by School Bus Holdings and its subsidiaries under the “Blue Bird” name as an independent enterprise prior to the Business Combination and as subsidiaries of Blue Bird Corporation (formerly Hennessy Capital Acquisition Corp.) after the Business Combination.

The periodic reports filed by us with the Securities and Exchange Commission (“SEC”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge at http://investors.blue-bird.com. This includes Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports. Section 16 filings made with the SEC by any of our executive officers or directors with respect to our Common Stock also are made available free of charge through our website. We post each of these documents on our website as soon as reasonably practicable after it is electronically filed with the SEC. Our reports filed with the SEC may also be found at the SEC’s website at www.sec.gov. The Company’s Common Stock is traded on The NASDAQ Global Market under the symbol “BLBD”.

The corporate governance information on our website includes our Corporate Governance Principles, Code of Conduct and Ethics and the Charters for each of the Committees of our Board of Directors. Any amendments to our Code of Ethics or waivers granted to our directors and executive officers will be posted on our corporate website.

In addition to the information contained in this Form 10-K for the fiscal year ended September 30, 2017 (“2017 Form 10-K Report” or “Report”), information about our Company can be found at http://investors.blue-bird.com, including extensive information about our management team, our products and our corporate governance.

The foregoing information regarding our website and its content is for convenience only and not deemed to be incorporated by reference into this Report nor filed with the SEC.

Overview

We are the leading independent designer and manufacturer of school buses, with more than 550,000 buses sold since our formation in 1927 and approximately 180,000 buses in operation today.

We review and present our business in two reportable segments (“segments”) - buses and aftermarket parts. Financial information is reported on the basis that it is used internally by the chief operating decision maker in evaluating segment performance and deciding how to allocate resources to segments. Our President and Chief Executive Officer has been identified as the chief operating decision maker. Our management evaluates the segments based primarily upon revenues and gross profit. See Note 12, Segment Information, to the Company’s consolidated financial statements for additional financial information regarding our reportable segments including primary geographic areas in which we earn revenues.

2

Our performance in recent years has been driven by the implementation of repeatable processes focused on product initiatives, continuous improvement of competitiveness and manufacturing flexibility, and lowering our cost of capital, as described below:

• | We launched the industry’s first .05g/bhp-hr NOx propane engine, which is 75 percent cleaner than the current emission standard and significantly better for the environment than competitors published offerings. In addition, we have developed electric Type C and Type D buses in collaboration with our electric vehicle development partners Adomani and EDI. Commercial availability for these electric buses is planned for fiscal 2018. Lastly, during fiscal 2017 we commenced work on a major product enhancement program. |

• | Fiscal 2017 was our first full year of sales of the gasoline powered Type C bus. The market demand for this product was substantial and helped differentiate our products from our competitor’s offerings. |

• | We commenced an initiative with industry leaders to make structural reductions in cost on existing and future products to enhance our cost competitiveness. |

• | We refinanced our term debt on substantially better terms. The revised terms resulted in a reduction in interest expense of about $6 million or 3.75 pts per annum. At the same time, we also replaced our $60 million revolving credit facility with a $75 million revolving facility, providing more liquidity at lower interest rates. |

School buses have typically been powered by diesel engines. However, in 2007, Blue Bird introduced the first OEM-installed, propane-powered Type C school bus. In addition, over the past two fiscal years Blue Bird introduced and began volume selling of Type C gasoline and Type C CNG powered buses. Propane and gasoline are currently the fastest growing powertrain offering in the school bus market. Blue Bird was, until recently, the only manufacturer of propane-powered Type C buses for school districts and remains the only manufacturer of gasoline-powered school buses. Our management believes that the growth of the propane and gasoline share of total school bus sales will accelerate further with the entrance of our two principal competitors (Thomas Built Bus and IC Bus) into this market. Although propane-powered school buses require some dedicated infrastructure and are somewhat more expensive on a per unit basis than diesel, they are significantly less expensive to operate. Over the lifetime of a school bus, the fuel and maintenance cost savings from the use of propane-powered engines can be substantial. In addition, propane-powered buses are aligned with the increased national focus on green technologies and improving the environment as they generate significantly less emissions than diesel buses. Further, domestically sourced propane gas reduces dependence on foreign sources of oil. Blue Bird is also a leading manufacturer of school buses fueled by CNG. In the school bus industry, CNG is a niche product that is attractive to customers in certain markets that contain an existing refueling infrastructure. CNG requires significantly higher upfront refueling infrastructure investment and higher acquisition cost compared with propane. CNG-powered buses are typically only sold in states that offer significant grants for clean fuel solutions, such as California. To help reduce the upfront investment, we introduced a CNG solution in our Type C bus. This provides a lower product acquisition price for customers who have access to CNG fueling stations.

As a result of the concentration of Blue Bird’s sales in the school bus industry in the United States and Canada, our operations are affected by national, state and local economic and political factors that impact spending for public and, to a lesser extent, private education. However, unlike the discretionary portion of school budgets, the offering of school bus services is typically viewed as a mandatory part of the public infrastructure across the United States and Canada, ensuring that funding for new school buses receives some level of priority in all economic climates. All 50 States, the District of Columbia, and the 13 Canadian Provinces have fleets of school buses in operation.

Bus Segment

Our buses are sold through an extensive network of 50 United States and Canadian dealers that, in their territories, are exclusive to our Company on Type C and D school buses. We also sell directly to major fleet operators, the United States Government, state governments and authorized dealers in a number of foreign countries.

In fiscal 2017, we sold 11,317 buses throughout the world. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for discussion of our unit volumes.

Approximately 93% of our buses sold in fiscal 2017 were sold through distributors and dealers (“dealerships”). The Company holds no equity or control position in any dealerships or distributors.

We design, engineer, manufacture and sell three types of buses (Type C school buses, Type D school buses and specialty buses). Each of our Type C and Type D buses is manufactured and assembled on its own dedicated purpose-built chassis in Fort Valley, Georgia. Regardless of specifications, all school bus bodies that we manufacture include our signature 14-gauge one piece steel bows roof system, complemented by a rugged and sturdy floor structure.

Specialty buses include school buses that are converted to suit applications required by the United States Government, state and local

3

governments and various customers for commercial and export markets. We also sell a “Sigma” bus that is developed for public transportation using our school bus chassis and a purpose-built body supplied by Autopartes Y Components, S.A. (“AYCO”) in Mexico. The “Sigma” bus is sold primarily to customers in Central and South America.

The Blue Bird Micro Bird by Girardin Type A bus is produced through Micro Bird Holdings, Inc., an unconsolidated Canadian joint venture with Groupe Autobus Girardin LTEE (“Micro Bird”), and is sold through our dealer network. This is a smaller bus than the Type C or Type D bus and is produced on a chassis provided by either Ford or GM.

Aftermarket Parts Segment

Aftermarket parts are key for routine maintenance, replacement of parts that are damaged in service and replacement of parts that suffer from wear and tear through the useful life of the vehicle.

In fiscal 2017, aftermarket parts sales represented 6.0% of Company net sales.

We maintain a parts distribution center in Delaware, Ohio that fills demand for our Company specific and all-makes parts. Additional demand for aftermarket parts is fulfilled by drop ship and direct sales. To fulfill demand for parts that are not maintained at the distribution center, we are linked to approximately 35 suppliers that ship directly to dealers and independent service centers.

Our 50 dealers have approximately 250 aftermarket parts and service locations across the United States and Canada, the majority of which are owned by independent operators, to complement their primary locations. Field service engineers provide technical support to our dealer network. As of the end of fiscal 2017, service engineers had an average of 25 years of experience with our Company and are strategically placed throughout the United States and Canada to serve both dealers and end-customers better. The network leverages our parts inventory, technical training and online warranty network to address customer service needs.

Our Industry

The school bus serves a critical role in the United States and Canadian education systems. According to School Transportation News, nearly 50 percent of the U.S. student population rides a school bus. The United States and Canadian fleet of approximately 550,000 Type C/D school buses transports approximately 26 million children daily. School buses are distinguished from other types of buses by design characteristics associated with increased safety as mandated by federal, state and municipal regulations.

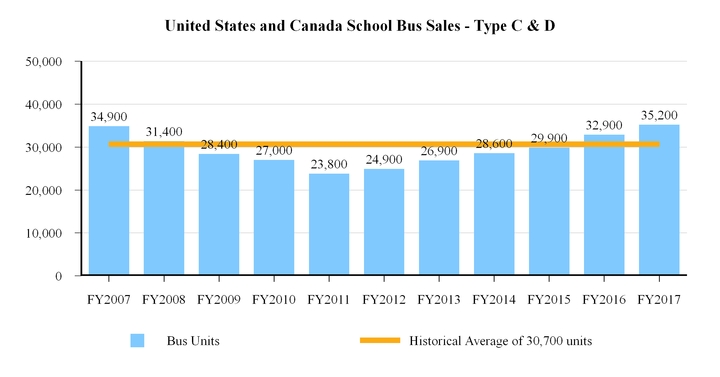

The United States and Canadian school bus industry for Type C and D buses has averaged approximately 30,700 unit sales annually between 1985 and 2017. Unit sales for fiscal 2017 are projected to be about 35,200, an increase of 7.0% versus fiscal 2016.

4

Source: Historical registration data are based on R.L. Polk vehicle registration data.

The low point in the industry occurred in 2011, at approximately 23,800 units, and was the result of the decline in the United States economy and, in particular, the collapse of the housing market in 2008 and 2009. Property tax receipts were impacted in the 2010-2011 period as a result of the substantial dislocation in the United States economy in general, and housing market in particular, preceding and during that period.

The school bus industry is currently in recovery, supported by positive demographic trends. Our management believes, based on our industry forecast model developed using R.L. Polk school bus registration data and considering population changes of school age children, that Type C and Type D school bus registrations are expected to grow by 1% to 2% annually between fiscal 2018 and fiscal 2020. Our management believes that there will be a continued recovery for the school bus industry. We believe that (i) the industry has been operating below its historical long-term average of approximately 30,700 unit sales per year since the recession - fiscal 2017 is only the second year since the recession in which unit sales exceeded this historical average, signaling the ability of the industry to now address the pent-up demand accumulated from fiscal 2009 to fiscal 2015, during which the industry made below-average annual purchases, (ii) there are approximately 150,000 buses in the United States and Canadian fleets that have been in service for 15 or more years, and (iii) the population of school age children is growing.

Local property and municipal tax receipts are key drivers of school district transportation budgets. Budgets for school bus purchases are directly related to property tax receipts, which are projected to continue a recovery that began in 2012. According to one organization - CoreLogic, Haver Analytics and Macroeconomic Advisers - United States housing prices have increased 6.4% annually since 2011 and are projected to continue to rise through 2025. The forecasted continued appreciation in housing prices is expected to have a positive effect on property tax receipts going forward and school transportation budgets are expected to directly benefit from increasing municipal spending budgets. We believe that incremental demand may be achieved as a result of (i) the average age of a school bus in service (approximately 12 years), and (ii) an increased student population during the period from 2013 to 2018 (based on information from the National Center of Education Studies, we expect total student enrollment in the United States to increase by over 2 million students from 2016 to 2023).

Our management has developed a forecasting model using R.L. Polk vehicle registration data, population of school age children forecasts from the National Center for Education Statistics and bus ridership data collected and published by School Transportation News. Our management utilizes this internally developed model to assess historical experience and to predict demand for school buses in future periods. This model is also the source for all forward-looking market information provided with respect to the United States and Canadian school bus industry in this Report. The ability to purchase new buses to fulfill predicted demand, however, is based on the assumption that funds will be available through property taxes and other state sources. Should there be a significant downturn in property tax collections or in the availability of funds from other state sources, growth in the school bus industry could flatten or decline.

5

Our Competitive Strengths

We believe that our competitive strengths are derived from the following factors:

Reputation for safety, product quality/reliability/durability, and drivability. Our longevity and reputation in the school bus industry have made us an iconic American brand. We are the only principal manufacturer with chassis and body production specifically designed for school bus applications and the only school bus company to offer compliance with industry recognized safety tests-Altoona Testing, Colorado Rack Test and the Kentucky Pole Test-as a standard specification across our entire product line.

Alternative fuel leadership. We are the market leader in propane, gasoline and CNG fuel powered-buses, having sold approximately eight times more alternative fuel school buses than all of our competitors combined over the period from fiscal 2010 through fiscal 2017. In fiscal 2017 we sold 3,888 propane, gasoline and CNG powered buses, an increase of 40% versus the prior year.

Innovative product leadership. We have consistently led the school bus industry with innovative product leadership through several industry firsts, including the first Type D CNG school bus, the first unique school bus chassis and the first OEM-manufactured propane bus. During fiscal 2016, we launched the industry's only gasoline powered Type C bus (utilizing an exclusive Ford and Roush Cleantech powertrain) and we were first-to-market with Electronic Stability Control, the new Cummins V8 ISV Diesel engine and Eaton transmissions as available options. We introduced a Type C CNG powered bus in fiscal 2016 based on the exclusive Ford and Roush CleanTech powertrain. In fiscal 2017, we introduced the Type C and Type D electric vehicle offerings which we expect to be commercially available in fiscal 2018. Research and development costs were $7.0 million and $5.4 million for the fiscal years ended 2017 and 2016, respectively.

Strong distribution model. We have built an extensive, experienced network of 50 dealers to distribute our buses across the United States and Canada, and during recent years have significantly enhanced our relationships with large fleet operators. Our dealers have an average tenure of more than 27 years with us and do not sell competing Type C or D school bus products in the areas assigned to them by us.

Highly-skilled and committed workforce. We benefit from a highly-skilled, committed hourly workforce of approximately 1,988 people (full-time and part-time hourly employees) that support our customized assembly operations at our 900,000 square foot integrated chassis manufacturing and body assembly facility and 340,000 square foot component fabrication facility. Our employees are trained to maximize production efficiency by following customized processes developed by us.

Strong management team. We are led by a highly experienced and committed management team with an established track record in the United States and Canadian school bus industry.

Sales Volume

In fiscal 2017, we sold 11,317 Type C/D buses, including 10,867 school buses, 194 commercial buses, 39 export buses and 217 GSA (Government Services Administration) buses. Our Type C school bus accounted for 78% of unit sales and our Type D school bus accounted for 18% of unit sales. Commercial, GSA and export buses, which can be ordered with either the Type C or Type D chassis, accounted for the remaining 4% of unit sales.

Our Dealer Network

During fiscal 2017, we sold approximately 93% of our vehicles through our United States and Canadian dealer network, currently consisting of 50 dealers that, in their territories, are exclusive to us with Type C and D school buses. School buses sold in the United States and Canada through our dealer network are purchased by school districts and private schools, as well as small and medium size contractors that provide services to school districts on a fee basis. Bus purchases and contractor fees are funded through local school district budgets. Purchases of school buses are typically made through a bid process at the district or state level, with dealers coordinating this process. Dealers develop collaborative relationships with school districts, district transportation directors and key officials in their states.

Our dealers have access to financing through Blue Bird Capital Services (“BBCS”), a private-label financing product maintained by an independent third party, De Lage Landen, a member of the Rabobank Group. In September 2017, we signed a contract with TCF Inventory Finance, Inc. under substantially similar terms as De Lage Landen. We do not assume any balance sheet risk with respect to this type of financing and do not receive any direct economic benefit from BBCS.

6

Other Distribution Channels

Fleet Operators. We also sell school buses directly to large national fleets that span multiple states and such sales are managed internally by our National Account Sales Team.

Export Dealers. We regularly monitor opportunities to sell our Type C and Type D buses in either school bus or other configurations in international markets and typically sell these products through dealers assigned to those territories. Additionally, the Blue Bird Sigma Forward Engine chassis is specifically designed for foreign transit applications and has been sold successfully in Bogota, Colombia.

U.S. Government; Other Specialty Sales. We also sell buses through our United States General Services Administration (“GSA”) contract, an expedited procurement procedure designed to meet the needs of bus customers authorized to purchase through the GSA contracting offices, including the U.S. Air Force, U.S. Army, Homeland Security and the U.S. Department of Agriculture. This full line of bus models is configured for adult or school bus use. In addition to the base GSA specifications, we offer several additional configurations to provide a wide range of passenger capacities and optional features. We also offer a full line of activity bus and Multi-Function School Activity Bus (“MFSAB”) products. With varying vehicle sizes, capacities, fuel choices, and engine types, our bus options enable our customers to tailor their transportation solutions to their specific needs, be it transporting a church congregation or shuttling workers to job sites.

Government Contracts

As a U.S. government contractor, we are subject to specific regulations and requirements as mandated by our contracts. These regulations include Federal Acquisition Regulations, Defense Federal Acquisition Regulations and the Code of Federal Regulations. We are also subject to routine audits and investigations by U.S. government agencies such as the Defense Contract Management Agency and Defense Contract Audit Agency. These agencies review and assess compliance with contractual requirements, cost structure, cost accounting, and applicable laws, regulations, and standards.

A portion of our existing U.S. government contracts extend over multiple years and are conditioned upon the continuing availability of congressional appropriations. In addition, our U.S. government contracts generally permit the contracting government agency to terminate the contract, in whole or in part, either for the convenience of the government or for default based on our failure to perform under the contract.

Suppliers

We purchase our engine and transmission components on a single-source basis from major OEM manufacturers with sophisticated engineering, production and logistics capabilities, as reflected in the table below:

Component | OEM Supplier | |

Diesel engines | Cummins Inc. | |

Diesel emissions kits | Cummins Inc. | |

Propane and gasoline engines and transmissions | Ford Motor Company | |

Diesel transmissions | Allison Transmission | |

Propane and gasoline fueling kits | Roush CleanTech | |

Our purchasing department continually works to improve our purchasing processes by rationalizing the supplier base (reducing the supplier base by approximately one-third in the last five years) and by implementing improved control processes. We regularly perform supplier audits and, when necessary, will meet with underperforming suppliers in order to enhance performance. At September 30, 2017, we had in place long-term supply contracts (addressing both component price and supply) covering over 85% of the value of our purchases from suppliers, including long-term agreements with our major single-source suppliers.

Based on our experience to date and our relationships with our suppliers, we do not expect to be subject to sustained shortages on any material components, whether or not single-sourced.

Competition

The school bus industry is highly competitive. Our two principal competitors are Thomas Built Bus and IC Bus. Thomas Built Bus is a subsidiary of Daimler Trucks North America and IC Bus is a subsidiary of Navistar International.

7

We compete primarily on the basis of price, product diversification, school bus innovation, safety, quality, durability and drivability of our products, and the scope and strength of our dealer network. As our principal competitors are parts of larger corporations, our competitors may have greater access to financial capital, human resources and business opportunities. Such access, in turn, may be used by such companies to compete with us and others in the industry.

Facilities

We operate a fabrication plant and an integrated chassis manufacturing and body assembly plant in Fort Valley, Georgia, where we manufacture components and assemble Type C, Type D and specialty buses. We also operate a parts distribution center located in Delaware, Ohio. We own our facilities in Fort Valley, Georgia (approximately 1.2 million square feet) and lease our facility in Delaware, Ohio (approximately 0.2 million square feet). Our Micro Bird joint venture leases its facility (0.1 million square feet) in Drummondville, Quebec.

Intellectual Property and Technology

We seek trademark protection in the United States and outside of the United States where available and when appropriate. Among other trademarks, we have registered trademark rights in the principal names and designs used by us and Micro Bird in the United States, Canada and elsewhere. We use these registered marks in connection with all aspects of our branding. However, we also rely on a number of significant unregistered trademarks and other unregistered intellectual property in the day-to-day operation of our business. Without the protections afforded by registration, our ability to protect and use our trademarks and other unregistered intellectual property may be limited and could negatively affect our business.

In addition to trademarks, we rely heavily on trade secrets and know-how to develop and maintain our competitive position. For example, significant aspects of our product designs, manufacturing processes and cost containment steps are based on unpatented trade secrets and know-how. Trade secrets and know-how can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by confidentiality agreements with our employees, suppliers and other commercial partners. These agreements are designed to protect our proprietary information. We also seek to preserve the integrity and confidentiality of our data, designs and trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations and systems, agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our suppliers or contractors use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how.

Government Regulation

Our products must satisfy various legal, environmental, health and safety requirements at federal, state and municipal levels. Compliance with such requirements adds to the costs that must be incurred in order to manufacture a school bus. Failure to comply with such requirements could lead to substantial additional regulatory costs.

At the federal level, “FMVSS,” or Federal Motor Vehicle Safety Standards, govern the safety of all motor vehicles sold for use in the United States. More than half of the FMVSS regulations apply to school buses. For example, federal regulations require school buses to be painted “school bus yellow” and to be equipped with specific warning and safety devices. School buses are also built with the body on top of chassis frame rails. This so-called “high floor” construction moves the passenger compartment above the typical automotive “crash zone” and therefore provides an added measure of safety should a collision occur. Steel rollover cages and heavy duty bumpers are designed to provide incremental protection, in contrast with standard transit buses with “low floor” construction that offer lower curb height access with limited or no steel reinforcement.

After a school bus is sold, regulation of the operation of the school bus becomes the responsibility of the state in which it operates. Today, each state has its own rules and regulations pertaining to the manufacture, design, operation and safety of the school buses operated in their jurisdictions. As a result, we cannot manufacture to a single set of specifications, but rather must assure that each bus that is manufactured conforms to the specifications of the particular jurisdiction in which it will be operated.

We must also consider the rules and regulations of foreign jurisdictions. In Canada, where our Micro Bird joint venture operates, school buses are governed by the Canadian Motor Vehicle Safety Regulations. These regulations are patterned after the FMVSS regulations, although differences do exist between the two regulatory systems.

8

Seasonality

Our business is highly seasonal. Most school districts seek to buy their new school buses so that they will be available for use on the first day of the school year, typically in mid-August to early September. As a result, our two busiest quarters are our third and fourth fiscal quarters, the latter ending on the Saturday closest to September 30. Our quarterly results of operations, cash flows, and liquidity are likely to be impacted by these seasonal patterns. For example, our revenues are typically highest in our third and fourth fiscal quarters. Working capital, on the other hand, is typically a significant use of cash during the first fiscal quarter and a significant source of cash generation in the fourth fiscal quarter. We typically conduct planned shutdowns during our first fiscal quarter.

Environmental Matters

We are subject to various federal, state and local laws and regulations governing the protection of the environment and health and safety, including those regulating the following: soil, surface water and groundwater contamination; the generation, storage, handling, use, disposal and transportation of hazardous materials; the emission and discharge of materials, including greenhouse gases (“GHGs”) into the environment; and the health and safety of our employees. We are also required to obtain environmental permits from governmental authorities for certain operations. We have taken various steps to comply with these numerous and sometimes complex laws, regulations and permits. Compliance with environmental requirements historically has not had a material impact on our capital expenditures, earnings, or competitive position. We have made, and will continue to make, capital and other expenditures pursuant to such requirements. If we violate or fail to comply with these requirements, we could be subject to fines, penalties, enforcement actions or lawsuits.

For additional information regarding potential remediation at Blue Bird’s Fort Valley, Georgia facility, see Item 1A. “Risk Factors-Risk Factors Relating to Our Business and Industry-Environmental obligations and liabilities could have a negative impact on our financial condition, cash flows and profitability."

Environmental laws, regulations, and permits and the enforcement thereof, change frequently and have become more stringent over time. Among other things, more rigorous GHG emission requirements are in various stages of development. For example, the United States Environmental Protection Agency (“U.S. EPA”) has promulgated the GHG Reporting Rule, which requires reporting of GHG data and other relevant information from large sources and suppliers in the United States, and the GHG Tailoring Rule, which requires certain facilities with significant GHG emissions to obtain emissions permits under the authority of the Clean Air Act (typically limited to only the largest stationary sources of GHGs). The United States Congress has also considered imposing additional restrictions on GHG emissions. Any additional regulation of GHG emissions by either the United States Congress and/or the U.S. EPA could include a cap-and-trade system, technology mandate, emissions tax, reporting requirement, or other program and could subject us to significant costs, including those relating to emission credits, pollution control equipment, monitoring, and reporting, as well as increased energy and raw material prices.

Our facilities and operations could in the future be subject to regulation related to climate change and climate change itself may also have some impact on the Company’s operations. However, these impacts are currently uncertain and the Company cannot predict the nature and scope of those impacts.

Research and Development

Research and development costs were $7.0 million and $5.4 million for the fiscal years ended 2017 and 2016, respectively. Refer to Note 2, Summary of Significant Accounting Policies and Recently Issued Accounting Standards, to the accompanying consolidated financial statements for further information on research and development.

Warranty

We provide warranties on all of the buses and parts we sell. Warranties are offered for specific periods of time and mileage, and vary depending upon the type of product and the geographic location of its sale. Pursuant to these warranties, we will repair, replace, or adjust all parts on a bus that are defective in factory-supplied materials or workmanship during the specified warranty period. In addition to the costs associated with this warranty coverage provided on our vehicles, we also incur costs as a result of field service actions (i.e., safety recalls and service bulletins), and customer satisfaction actions.

Legal Proceedings

We are engaged in legal proceedings in the ordinary course of our business. Although no assurances can be given about the final outcome of pending legal proceedings, at the present time our management does not believe that the resolution or outcome of any of our pending legal proceedings will have a material adverse effect on our financial condition, liquidity or results of operations.

9

Backlog

We define order backlog ("backlog") as orders received but yet to be built and sold as of the end of the fiscal period. The backlog may be cancellable within a certain period and may not represent guarantees of purchases by customers or dealers.

The following table provides our worldwide backlog:

(dollars in millions) | Units | Value | ||||

2017 | 1,446 | $ | 128.7 | |||

2016 | 1,193 | $ | 102.9 | |||

Employees

At September 30, 2017, we employed 2,311 employees, consisting of 2,006 full-time and part-time hourly and 305 salaried employees. Our workforce is non-union.

10

Item 1A. Risk Factors

You should carefully consider the following risk factors in addition to the other information included in this Report, including matters addressed in the section entitled “Cautionary Note Regarding Forward-Looking Statements.” We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business. The following discussion should be read in conjunction with the financial statements and notes to the financial statements included in this Report.

Risk Factors Relating to Our Business and Industry

General economic conditions in the markets we serve have a significant impact on demand for our buses.

The school bus market is predominantly driven by long-term trends in the level of spending by municipalities. The principal factors underlying spending by municipalities are housing prices, property tax levels, municipal budgeting issues and voter initiatives. Demand for school buses is further influenced by overall acquisition priorities of municipalities, availability of school bus financing, student population changes, school district busing policies, price and other competitive factors, fuel prices and environmental regulations. Significant deterioration in the economic environment, housing prices, property tax levels or municipal budgets could result in fewer new orders for school buses or could cause customers to seek to postpone or reduce orders, which could result in lower revenues, profitability and cash flows.

Our products may not achieve or maintain market acceptance or competing products could gain market share, which could adversely affect our competitive position.

We operate in a highly competitive domestic market. Our principal competitors are Thomas Built Bus (owned by Daimler Trucks North America) and IC Bus (owned by Navistar International), which, at the consolidated level, have potential access to more technical, financial and marketing resources than our Company. Our competitors may develop or gain access to products that are superior to our products, develop methods of more efficiently and effectively providing products and services, or adapt more quickly than we do to new technologies or evolving customer requirements. Both Thomas Built Bus and IC Bus sell propane-powered school buses. This brings Thomas Built Bus and IC Bus into direct competition with our propane-powered school buses. Our competitors may achieve cost savings or be able to withstand a substantial downturn in the market because their businesses are consolidated with other vehicle lines. In addition, our competitors could be, and have been in the past, vertically integrated by designing and manufacturing their own components (including engines) to reduce their costs. The school bus market does not have “Buy America” regulations, so competitors or new entrants to the market could manufacture school buses in more cost-effective jurisdictions and import them to the United States to compete with us. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced sales and earnings.

We continue to optimize our product offerings to meet customer needs and specifications. While we target product offerings to meet customer needs, there is no assurance that our product offerings will be embraced and that we will meet our sales projections.

Our business is cyclical, which has had, and could have future, adverse effects on our sales and results of operations and lead to significant shifts in our results of operations from quarter to quarter that make it difficult to project long-term performance.

The school bus market historically has been and is expected to continue to be cyclical. This cyclicality has an impact both on the school bus industry and also on the comparative analysis of quarterly results of our Company.

Customers historically have replaced school buses in lengthy cycles. Moreover, weak macroeconomic conditions can adversely affect demand for new school buses and lead to an overall aging of school bus fleets beyond a typical replacement cycle. While United States and Canadian demand for school buses has steadily increased since 2011, that increase may be partially attributable to the lower volume of purchases during the sustained downturn from 2007 to 2011 and historically low industry sales in 2011. To the extent the increase in school bus demand is attributable to pent-up demand rather than overall economic growth, future school bus sales may lag behind improvements in general economic conditions or property tax levels.

During downturns, we may find it necessary to reduce line rates and employee levels due to lower overall demand. An economic downturn may reduce, and in the past has reduced, demand for school buses, resulting in lower sales volumes, lower prices and decreased profits.

Primarily as a result of the seasonal nature of our business, we operate with negative working capital for significant portions of our fiscal year. During economic downturns, this tends to result in our utilizing a substantial portion of our cash reserves. On the other hand, when economic factors favor growth in the school bus industry, we can be positioned to generate significant sums of cash.

11

We may be unable to obtain critical components from suppliers, which could disrupt or delay our ability to deliver products to customers.

We rely on specialist suppliers for critical components (including engines, transmissions and axles) and replacement of any of these components with like parts from another supplier normally requires engineering and testing procedures, which entail costs and take time. The lack of ready-to-implement alternatives could give such suppliers, some of which have substantial market power, significant leverage over us if these suppliers elected to exert their market power over us, which leverage could adversely impact the terms and conditions, including pricing and delivery schedules, pursuant to which we purchase these products from these suppliers.

We seek to mitigate the risk of losing supply from our key suppliers by entering into long-term agreements, and by commencing contract negotiations with suppliers of critical components significantly before contract expiration dates. We have also diversified the suppliers of key components such as engines and transmissions.

If any of our critical component suppliers limit or reduce the supply of components due to commercial reasons, financial difficulties or other problems that prevent them from supplying us with the necessary components, we could experience a loss of revenues due to our inability to fulfill orders. These single-source and other suppliers are each subject to quality and performance issues, materials shortages, excess demand, reduction in capacity and other factors that may disrupt the flow of goods to us or to our customers, which would adversely affect our business and customer relationships.

We have no guaranteed supply arrangements with our suppliers and there can be no assurance that these suppliers will continue to meet our requirements. If supply arrangements are interrupted, we may not be able to find another supplier on a timely or satisfactory basis. We may incur significant set-up costs, delays and lag time in manufacturing should it become necessary to replace any key suppliers due to work stoppages, shipping delays, financial difficulties, natural or man-made disasters, cyber-attacks or other factors. In addition, strikes, work stoppages or other types of conflicts with labor organizations or employees at a supplier’s facility could delay the production and/or development of the components that they supply to us, which could strain relationships with our customers and cause a loss of revenues which could materially adversely affect our operations. Our business interruption insurance coverage may not be adequate for any such factors that we could encounter and may not continue to be available in amounts and on terms acceptable to us. Production delays could, under certain circumstances, result in penalties or liquidated damages in certain of our General Services Administration (“GSA”) contracts. In addition to the general risks described above regarding interruption of supplies, which are exacerbated in the case of single-source suppliers, the exclusive supplier of a key component potentially could exert significant bargaining power over price, warranty claims or other terms relating to a component.

We rely substantially on single-source suppliers which could materially and adversely impact us if they were to interrupt the supply of component parts to us.

We currently rely on a limited number of single-source suppliers for important component parts. Our major single-source suppliers are Cummins, Inc. and Cummins Emission Solutions (diesel engines and emission components), Ford and Roush CleanTech (propane and gasoline engines, powertrain and up-fit), Bendix Commercial Vehicle Systems (control modules), Specialty Manufacturing, Inc. (rubber flooring, step treads, and stop & crossing arms), Paramount Manufacturing Co., Inc. (plastics and fiberglass), TRW Commercial Steering (steering), Lippert Components (windows), and HSM (seat components). Shortages and allocations by such manufacturers may result in inefficient operations and a build-up of inventory, which could negatively affect our working capital position.

New laws, regulations or policies of governmental organizations regarding environmental, health and safety standards, or changes in existing ones, may have a significant negative effect on how we do business.

Our products must satisfy various legal, environmental, health and safety requirements, including applicable emissions and fuel economy requirements. Meeting or exceeding government-mandated safety standards can be difficult and costly. Such regulations are extensive and may, in certain circumstances, operate at cross purposes. While we are managing our product development and production operations to reduce costs, unique local, state, federal and international standards can result in additional costs for product development, testing and manufacturing. We depend on third party sole-source suppliers to comply with applicable emissions and fuel economy standards in the manufacture of engines supplied to us for our buses. Increased environmental, safety, emissions, fuel economy or other regulations may result in additional costs and lag time to introduce new products to market.

Safety or durability incidents associated with a school bus malfunction may result in loss of school bus sales that could have material adverse effects on our business.

The school bus industry has few competitors due to the importance of brand and reputation for safety and durability, compliance with stringent safety and regulatory requirements, an understanding of the specialized product specifications in each region and specialized technological and manufacturing know-how. If incidents associated with school bus malfunction transpired that called into question our reputation for safety or durability, it could harm our brand and reputation and cause consumers to question the safety, reliability and

12

durability of our products. Lost school bus sales resulting from safety or durability incidents associated with a school bus malfunction could materially adversely affect our business.

Disruption of our manufacturing and distribution operations would have an adverse effect on our financial condition and results of operations.

We manufacture school buses at two facilities in Fort Valley, Georgia and distribute parts from a distribution center located in Delaware, Ohio. If operations at our manufacturing or distribution facilities were to be disrupted for a significant length of time as a result of significant equipment failures, natural disasters, power outages, fires, explosions, terrorism, adverse weather conditions, labor disputes, cyber-attacks or other reasons, we may be unable to fill dealer or customer orders and otherwise meet demand for our products, which would have an adverse effect on our business, financial condition and results of operations. Any interruption in production or distribution capability could require us to make substantial capital expenditures to fill customer orders, which could negatively affect our profitability and financial condition. We maintain property damage insurance that we believe to be adequate to provide for reconstruction of facilities and equipment, as well as business interruption insurance to mitigate losses resulting from any production interruption or shutdown caused by an insured loss. However, any recovery under our insurance policies may not offset the lost sales or increased costs that may be experienced during the disruption of operations, which could adversely affect our financial performance. Also, our property damage and business interruption insurance coverage may not be applicable or adequate for any such disruption that we could encounter and may not continue to be available in amounts and on terms acceptable to us.

Rationalization or restructuring of manufacturing facilities, including plant expansions and system upgrades at our manufacturing facilities, may cause production capacity constraints and inventory fluctuations.

The rationalization of our manufacturing facilities has at times resulted in, and similar rationalizations or restructurings in the future may result in, temporary constraints upon our ability to produce the quantity of products necessary to fill orders and thereby complete sales in a timely manner. In addition, system upgrades at our manufacturing facilities that impact ordering, production scheduling and other related manufacturing processes are complex, and could impact or delay production targets. A prolonged delay in our ability to fill orders on a timely basis could affect customer demand for our products and increase the size of our raw material inventories, causing future reductions in our manufacturing schedules and adversely affecting our results of operations. Moreover, our continuous development and production of new products will often involve the retooling of existing manufacturing equipment. This retooling may limit our production capacity at certain times in the future, which could materially adversely affect our results of operations and financial condition. In addition, the expansion, reconfiguration, maintenance and modernization of existing manufacturing facilities and the start-up of new manufacturing operations, could increase the risk of production delays and require significant investments of capital.

We may incur material losses and costs related to product warranty claims.

We are subject to product warranty claims in the ordinary course of our business. Our standard warranty covers the bus for one year and certain components for up to five years. We attempt to adequately price ongoing warranty costs into our bus purchase contracts; however, our warranty reserves are estimates and if we produce poor quality products, develop new products with deficiencies or receive defective materials or components, we may incur material unforeseen costs in excess of what we have provided for in our contracts or reserved in our financial statements.

In addition, we may not be able to enforce warranties and extended warranties received or purchased from our suppliers if such suppliers refuse to honor such warranties or go out of business. Also, a customer may choose to pursue remedies directly under its contract with us over enforcing such supplier warranties. In such a case, we may not be able to recover our losses from the supplier.

We may incur material losses and costs as a result of product liability claims and recalls.

We face an inherent risk of exposure to product liability claims if the use of our products results, or is alleged to result, in personal injury and/or property damage. If we manufacture a defective product or if component failures result in damages that are not covered by warranty provisions, we may experience material product liability losses in the future. In addition, we may incur significant costs to defend product liability claims. We could also incur damages and significant costs in correcting any defects, lose sales and suffer damage to our reputation. Our product liability insurance coverage may not be adequate for all liabilities we could incur and may not continue to be available in amounts and on terms acceptable to us. Significant product liability claims could have a material adverse effect on our financial condition, results of operations and cash flows. Moreover, the adverse publicity that may result from a product liability claim or perceived or actual defect with our products could have a material adverse effect on our ability to market our products successfully.

We are subject to potential recalls of our products from customers to cure manufacturing defects or in the event of a failure to comply with customers’ order specifications or applicable regulatory standards, as well as potential recalls of components or parts manufactured by suppliers which we purchase and incorporate into our school buses. We may also be required to remedy or retrofit buses in the event

13

that an order is not built to a customer’s specifications or where a design error has been made. Significant retrofit and remediation costs or product recalls could have a material adverse effect on our financial condition, results of operations and cash flows.

A failure to renew dealer agreements or cancellation of, or significant delay in, new bus orders may result in unexpected declines in revenue and profitability.

We rely to a significant extent on our dealers to sell our products to the end consumer. A loss of one or more significant dealers or a reduction in the market share of existing dealers would lead to a loss of revenues that could materially adversely affect our business and results of operations.

Our dealer agreements are typically for a five-year term; however, the dealer can usually cancel the agreement for convenience without penalty upon 90 days’ notice. While most of our dealers have been purchasing from us for more than two decades, we can provide no assurance that we will be able to renew our dealer agreements on favorable terms, or at all, at their scheduled expiration dates.

If we are unable to renew a contract with one or more of our significant dealers, our revenues and results of operations could be adversely affected until an alternative solution is implemented (e.g., a new dealer or combining the territory with another, existing Blue Bird dealer). If dealer agreements are terminated with one or more of our top 10 dealers, significant orders are canceled or delayed or we incur a significant decrease in the level of purchases from any of our top 10 dealers, our sales and operating results would be adversely impacted. In addition, our new bus orders are subject to potential reduction, cancellation and/or significant delay. Although dealers generally only order buses from us after they have a firm order from a school district, orders for buses are also generally cancelable until 14 weeks prior to delivery.

The inability to attract and retain key personnel could adversely affect our business and results of operations.

Our ability to operate our business and implement our strategies depends, in part, on the efforts of our executive officers and other key employees. Our future success depends, in large part, on our ability to attract and retain qualified personnel, including manufacturing personnel, sales professionals and engineers. The unexpected loss of services of any of our key personnel or the failure to attract or retain other qualified personnel could have a material adverse effect on the operation of our business.

While we have enjoyed good relations and a collaborative approach with our work force, employment relationships can deteriorate over time. Given the extent to which we rely on our employees, any significant deterioration in our relationships with our key employees or overall workforce could materially harm us. We cannot predict how stable our relationships with our employees will be in the future and we may experience work stoppages or labor organizing activity in the future, which could adversely affect our business. Work stoppages or instability in our relationships with our employees could delay the production and/or development of our products, which could strain relationships with customers and cause a loss of revenues which would adversely affect our operations. In addition, local economic conditions in the Central Georgia area (where both of our principal manufacturing facilities are located) may impact our ability to attract and retain qualified personnel.

Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business and results of operations.

We are subject to laws and regulations enacted by national, regional and local governments, including non-U.S. governments. In particular, we are required to comply with certain SEC and other legal requirements, as well as laws and regulations regarding the manufacture of school buses. Compliance with, and monitoring of, applicable laws and regulations may be difficult, time consuming and costly. Those laws and regulations and their interpretation and application may also change from time to time and those changes could have a material adverse effect on our business and results of operations. In addition, a failure to comply with applicable laws or regulations, as interpreted and applied, could have a material adverse effect on our business and results of operations.

Our products must satisfy a complex compliance scheme due to variability in and potentially conflicting local, state, federal and international laws and regulations. The cost of compliance may be substantial in a period due to the potential for modification or customization of our school buses in any of the 50 plus jurisdictions. In addition, if we expand into more international jurisdictions, we could potentially incur additional costs in order to tailor our products to the applicable local law requirements of such jurisdictions. Further, we must comply with additional regulatory requirements applicable to us as a federal contractor for our GSA contracts, which increases our costs. GSA contracts are also subject to audit and increased inspections and costs of compliance. Any potential penalties for non-compliance with laws and regulations may not be covered by insurance that we carry.

Our expansion plans in markets outside of North America could entail significant risks.

Our strategies potentially include establishing a greater presence in markets outside of North America. In addition, we are growing our use of component suppliers in these markets. As we progress with these strategies, these strategies may involve a significant investment

14

of capital and other resources and entail various risks. These include risks attendant to obtaining necessary governmental approvals and the construction of the facilities in a timely manner and within cost estimates, the establishment of viable supply channels, the commencement of efficient manufacturing operations and, ultimately, the acceptance of the products by our customers. We cannot be assured that our expansion plans will be implemented or, if implemented, successful.

DIAN, a Colombian governmental taxing agency, has ruled that our Sigma buses must pay tariffs as they are imported into Colombia. The Importer, our dealer in Colombia, has appealed the decision. An adverse outcome would adversely impact any future sales into Colombia.

We sell certain specialty buses in foreign countries including Colombia. Changes to tariffs, duties, and free trade agreements could have a negative impact on our ability to sell buses into those countries at competitive prices. DIAN, a Colombian government taxing agency, has advised us that it has conducted an audit related to the treatment under a free trade agreement of the sale of certain of our buses into Colombia and has issued a negative ruling. That ruling is presently under separate appeal by the importer and exporter of the buses. Although we were neither the importer nor exporter of record of the buses in question, since we sold those buses to a dealer which in turn imported those buses to Colombia, a final adverse finding could result in a determination that would make it significantly more expensive for purchasers of buses in Colombia to purchase our school or specialty buses as compared with buses manufactured domestically or transported into Colombia in a manner that would not raise free trade agreement issues. Any final adverse finding could materially and adversely impact our future sales in Colombia.

Environmental obligations and liabilities could have a negative impact on our financial condition, cash flows and profitability.

Potential environmental violations have been identified at our facility in Fort Valley, Georgia, including the solid waste management units at the facility’s old landfill. We are cooperating with the Georgia Environmental Protection Division and have conducted a site-wide investigation under the current hazardous waste management law. That investigation revealed several areas requiring further assessment and, potentially, remediation, and the implementation of a corrective action plan is ongoing. The proposed remedial actions to be included in the corrective action plan could range from little to no active remediation to institutional controls (such as barriers, groundwater use restrictions and similar protective devices) or active remedial measures. Potential remediation costs and obligations could require the expenditure of capital and, if greater than expected, or in excess of applicable insurance coverage, could have a material adverse effect on our results of operations, liquidity or financial condition.

Our worker’s compensation insurance may not provide adequate coverage against potential liabilities.

Although we maintain a workers’ compensation insurance stop loss policy to cover us for costs and expenses we may incur due to injuries to our employees resulting from work-related injuries over our self-insured limit, this insurance may not provide adequate coverage against potential liabilities as we incur the costs and expenses up to our self-insured limit. In addition, we may incur substantial costs in order to comply with current or future health and safety laws and regulations. These current or future laws and regulations may negatively impact our manufacturing operations. Failure to comply with these laws and regulations also may result in substantial fines, penalties or other sanctions.

Our future competitiveness and ability to achieve long-term profitability depend on our ability to control costs, which requires us to improve our organization continuously and to increase operating efficiencies and reduce costs.

In order to operate profitably in our market, we are continually transforming our organization and rationalizing our operating processes. Our future competitiveness depends upon our continued success in implementing these initiatives throughout our operations. While some of the elements of cost reduction are within our control, others, such as commodity costs, regulatory costs and labor costs, depend more on external factors, and there can be no assurance that such external factors will not materially adversely affect our ability to reduce our costs.

Our operating results may vary widely from period to period due to the sales cycle, seasonal fluctuations and other factors.

Our orders with our dealers and customers generally require time-consuming customization and specification. We incur significant operating expenses when we are building a bus prior to sale or designing and testing a new bus. If there are delays in the sale of buses to dealers or customers, such delays may lead to significant fluctuations in results of operations from quarter to quarter, making it difficult to predict our financial performance on a quarterly basis. Further, if we were to experience a significant amount of cancellations of or reductions in purchase orders, it would reduce our future sales and results of operations.

Our business is subject to seasonal and other fluctuations. In particular, we have historically experienced higher revenues during the third quarter and fourth quarter versus the first quarter and second quarter during each fiscal year. This seasonality is caused primarily by school districts ordering more school buses prior to the beginning of a school year. Our ability to meet customer delivery schedules is dependent on a number of factors including, but not limited to, access to components and raw materials, an adequate and capable workforce,

15

assembling/engineering expertise for certain projects and sufficient manufacturing capacity. The availability of these factors may in some cases be subject to conditions outside of our control. A failure to deliver in accordance with our performance obligations may result in financial penalties under certain of our GSA contracts and damage to existing customer relationships, damage to our reputation and a loss of future bidding opportunities, which could cause the loss of future business and could negatively impact our financial performance.

Our defined benefit pension plans are currently underfunded and pension funding requirements could increase significantly due to a reduction in funded status as a result of a variety of factors, including weak performance of financial markets, declining interest rates and investments that do not achieve adequate returns.

Our employee benefit plans currently hold a significant amount of equity and fixed income securities. Our future funding requirement for our frozen defined benefit pension plan (“Pension Plan”) qualified with the Internal Revenue Service depends upon the future performance of assets placed in trusts for this plan, the level of interest rates used to determine funding levels, the level of benefits provided for by the Pension Plan and any changes in government laws and regulations. Future funding requirements generally increase if the discount rate decreases or if actual asset returns are lower than expected asset returns, as other factors are held constant. If future funding requirements increase, we would be required to contribute more funds, which would negatively affect our cash flows.

We enter into firm fixed-price school bus sales contracts without price escalation clauses which could subject us to losses if we have cost overruns or if our costs increase.

We often bid on contracts weeks or months before school buses are delivered and enter into school bus sales contracts with fixed prices per bus. The sales contracts generally do not have an indexed price escalation formula to account for economic fluctuations between the contract date and the delivery date. As a result, we typically are unable to pass along increased costs due to economic fluctuations to our customers. We generally purchase steel one quarter in advance, but because we generally do not hedge our other primary raw materials (rubber, aluminum and copper), changes in prices of raw materials can significantly impact operating margins. Our actual costs and any gross profit realized on these fixed-price contracts could vary from the estimated costs on which these contracts were originally based.

Our current or future indebtedness could impair our financial condition and reduce the funds available to us for growth or other purposes. Our debt agreements impose certain operating and financial restrictions, with which failure to comply could result in an event of default that could adversely affect our results of operations.

We have substantial indebtedness. If our cash flows and capital resources are insufficient to fund the interest payments on our outstanding borrowings under our credit facility and other debt service obligations and keep us in compliance with the covenants under our debt agreements or to fund our other liquidity needs, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We cannot assure investors that we would be able to take any of these actions, that these actions would permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, which may impose significant operating and financial restrictions on us and could adversely affect our ability to finance our future operations or capital needs; obtain standby letters of credit, bank guarantees or performance bonds required to bid on or secure certain customer contracts; make strategic acquisitions or investments or enter into alliances; withstand a future downturn in our business or the economy in general; engage in business activities, including future opportunities for growth, that may be in our interest; and plan for or react to market conditions or otherwise execute our business strategies.

If we cannot make scheduled payments on our debt, or if we breach any of the covenants in our debt agreements, we will be in default and, as a result, our lenders could declare all outstanding principal and interest to be due and payable, could terminate their commitments to lend us money and foreclose against the assets securing our borrowings, and we could be forced into bankruptcy or liquidation.