As filed with the Securities and Exchange Commission on May 23, 2018

Registration No. 333-223038

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

MASSROOTS,

INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7370 | 46-2612944 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

2420

17th Street, Office 3118, Denver, Colorado 80202

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

(833)

467-6687

______________________

Isaac Dietrich, Chief Executive Officer

MassRoots,

Inc.

2420 17th Street, Office 3118

Denver, Colorado 80202

(833)

467-6687

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

______________________

Copies to:

Richard A. Friedman, Esq. Andrea Cataneo, Esq. Nazia J. Khan, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, New York 10112 Phone: (212) 653-8700 Fax: (212) 370-7889 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐

Accelerated filer ☐

Non-accelerated filer (Do not check if a smaller reporting company) ☐

Smaller reporting company ☒

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered (1)

|

Amount

to be Registered |

Proposed Maximum Offering Price Per Share (2) |

Proposed Maximum Aggregate Offering Price (2) |

Amount

of Registration Fee |

||||||||||||

| Common Stock, par value $0.001 per share | 28,083,290 | $ | 0.40 | $ | 11,233,316 | $ | 1,398.55 | |||||||||

| Common Stock, par value $0.001 per share (3) | 24,635,750 | $ | 0.40 | $ | 9,854,300 | $ | 1,226.86 | |||||||||

| Total | 52,719,040 | $ | 0.40 | $ | 21,087,616 | $ | 2,625.41 | * | ||||||||

| (1) | The shares of our common stock being registered hereunder are being registered for sale by the selling security holders named in the prospectus. Under Rule 416 of the Securities Act of 1933, as amended, the shares being registered include such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered in this registration statement as a result of any stock splits, stock dividends or other similar event. |

| (2) | The proposed maximum offering price per share and the proposed maximum aggregate offering price have been estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended using the average of the high and low prices as reported on the OTCQB on February 13, 2018. |

(3) |

Represents shares of common stock issuable upon exercise of outstanding warrants to purchase shares of common stock offered by the selling stockholders. |

| * | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. |

PRELIMINARY PROSPECTUS - SUBJECT TO COMPLETION Dated May 23, 2018 |

52,719,040 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders of MassRoots, Inc., a Delaware corporation (the “Company”) identified in this prospectus of up to 52,719,040 shares of our common stock, par value par value $0.001 per share (“Common Stock”), including 28,083,290 outstanding shares of Common Stock and 24,635,750 shares of Common Stock issuable upon exercise of outstanding warrants (collectively, the “Resale Shares”). All of the Resale Shares were initially purchased from the Company in private placement transactions and are being offered for resale by the selling stockholders. For a description of the transactions pursuant to which this resale registration statement relates, please see “Recent Unregistered Financings.”

The Resale Shares may be sold by the selling stockholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

The prices at which the selling stockholders may sell the Resale Shares will be determined by the prevailing market price for shares of the Company’s Common Stock or in negotiated transactions. We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; provided, however, we will receive the proceeds from any cash exercise of warrants.

We will bear all costs relating to the registration of the Resale Shares, other than any selling stockholders legal or accounting costs or commissions.

Our Common Stock is presently quoted on the OTCQB tier of the OTC Markets Group, Inc. (“OTCQB”) under the symbol “MSRT.” The closing price of our Common Stock on May 22, 2018, as reported by OTCQB, was $0.26 per share.

Investing in our Common Stock involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 6 of this prospectus and elsewhere in this prospectus for a discussion of information that should be considered in connection with an investment in our Common Stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”). For more information, see the sub-section titled “Emerging Growth Company Status” in the Prospectus Summary section of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is_________, 2018.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer to sell these securities and are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere in this prospectus and incorporated by reference. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the Risk Factors and the financial statements and related notes included in this prospectus and incorporated by reference.

Unless the context indicates or otherwise requires, the “Company,” “we,” “us,”, “our” “MassRoots” of the “Registrant” refer to MassRoots, Inc., a Delaware corporation, and its subsidiaries.

Unless otherwise indicated, all share and per share information relating to our Common Stock in this prospectus has been adjusted to reflect the Exchange which occurred during our Reorganization. See “The Reorganization And Exchange” for additional discussion of the Exchange and Reorganization.

Overview

MassRoots was formed in April 2013 as a technology platform for the cannabis industry. Powered by more than one million registered users, MassRoots enables consumers to rate cannabis products and strains based on their efficacy (i.e., effectiveness for treating ailments such as back-pain or epilepsy) and then presents this information in easy-to-use formats for consumers to make educated purchasing decisions at their local dispensary. Businesses are able to leverage MassRoots by strategically advertising to consumers based on their preferences and tendencies.

“Registered users” (“Users”) are defined as users who currently have an account with MassRoots. It does not include users who have deleted their account nor does it reflect active usage over any set period of time.

Over the past five years, MassRoots has established itself as a leading technology company in the emerging cannabis industry, building a User-base of one million registered Users, partnering with some of the most recognized brands in the industry and raising significant capital from institutional and private investors. Since inception, the Company has generated approximately $1.2 million in revenue.

Historically, we have focused on building a consumer-facing application and have not spent significant resources on developing our advertising portal for dispensaries. We are now focusing our efforts on developing our advertising portal so as to automate the processes and platform needed to deliver our underlying services. In December 2017, we began developing an advertising portal for dispensaries that will enable dispensaries to list their products on the MassRoots dispensary finder and view analytics of their local consumers. During the second quarter of 2018, we intend to launch an updated version of the portal and to charge dispensaries a minimum recurring monthly fee, per location, for access to the portal.

With MassRoots’ wide-spread audience and following in some of the leading medical cannabis markets in the country, we believe our business portal will be well-received by our client base. According to ArcView Market Research, there are projected to be over 2,700 state-regulated dispensaries in the United States by 2020.

-1-

User Growth and Product Distribution Channels

The MassRoots app is distributed free-of-charge through the Apple App Store, the Google Play Marketplace and the Amazon App Store. The MassRoots network is also accessible through desktop and mobile web browsers by navigating to www.massroots.com. Our business and advertising portal can be accessed at www.massroots.com/dispensaries. Through this portal, companies can edit their profiles, distribute information to Users and view analytics such as impressions, views and clicks.

Competitors

We compete with other cannabis information platforms such as WeedMaps and Leafly, which provide information with respect to dispensary locations, strain information, and news relating to the cannabis industry. We believe our primary competitive advantage is the community we have created and the significant reviews and data we have collected on key cannabis markets.

Blockchain Technology

In December 2017, we formed MassRoots Blockchain Technologies, Inc., a wholly-owned subsidiary of MassRoots, to explore how blockchain technology may be utilized in the cannabis industry.

Company Information

We were incorporated in the state of Delaware on April 26, 2013 as a technology platform for the cannabis industry. Our address is 2420 17th Street, Office 3118, Denver, Colorado 80202, our telephone number is (833) 467-6687 and our website is www.massroots.com. The information on our website or mobile apps is not a part of this prospectus.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies.

-2-

Section 107(b) of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues are $1.07 billion, as adjusted, or more, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed fiscal quarter, and (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Potential Corporate Action to be Approved at a Meeting of Stockholders

On May 11, 2018, the Company filed a definitive Proxy Statement on Schedule 14A with the SEC in connection with proposals to be voted upon at the annual meeting of stockholders of the Company to be held on June 8, 2018. Among such proposals is a proposal to approve the Second Amended and Restated Certificate of Incorporation of the Company. The Second Amended and Restated Certificate of Incorporation of the Company provides, among other things, an exclusive forum provision. The exclusive forum provision states that unless the Company consents in writing to the selection of an alternative forum, to the fullest extent permitted by law, all Internal Corporate Claims shall be brought solely and exclusively in the Court of Chancery of the State of Delaware (or, if such court does not have jurisdiction, the Superior Court of the State of Delaware, or, if such other court does not have jurisdiction, the United States District Court for the District of Delaware). “Internal Corporate Claims” means claims, including claims in the right of the Company, brought by a stockholder (including a beneficial owner) (i) that are based upon a violation of a duty by a current or former director or officer or stockholder in such capacity or (ii) as to which the Delaware General Corporation Law confers jurisdiction upon the Court of Chancery of the State of Delaware.

In the event that stockholders of the Company vote in favor of the Second Amended and Restated Certificate of Incorporation, the exclusive forum provision contained therein may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes based upon Internal Corporate Claims, which may discourage lawsuits against us or our current or former directors or officers and/or stockholders in such capacity.

In addition to the foregoing proposal to approve the Second Amended and Restated Certificate of Incorporation of the Company, the Company is proposing the following proposals to be voted upon at the 2018 annual meeting of stockholders (i) election of four directors; (ii) approval of the Company’s 2018 Equity Incentive Plan and the reservation of 25,000,000 shares of common stock for issuance thereunder; (iii) ratification of RBSM LLP as the Company’s independent public accountant for the fiscal year ending December 31, 2018; (iv) an advisory vote on executive compensation; and (v) approval of a three-year frequency for holding an advisory vote on executive compensation.

-3-

THE OFFERING

This prospectus relates to the resale from time to time by the selling stockholders identified herein of up to an aggregate of 52,719,040 shares of our Common Stock, consisting of:

| (i) | 490,000 shares of Common Stock and warrants to purchase up to 1,986,250 shares of Common Stock issued pursuant to the July 2017 Private Placement; |

| (ii) | 1,130,295 shares of Common Stock issued upon conversion of the August Notes and warrants to purchase up to 4,400,000 shares of Common Stock issued pursuant to the August 2017 Private Placement; |

| (iii) | 12,762,995 shares of Common Stock and warrants to purchase up to 4,549,500 shares of Common Stock issued pursuant to the December 2017 Private Placement; and |

| (iv) | 13,700,000 shares of Common Stock and warrants to purchase up to 13,700,000 shares of Common Stock issued pursuant to the January 2018 Private Placement (collectively, the “Resale Shares”). |

| Common stock offered by selling stockholders: | 52,719,040 shares which includes 28,083,290 outstanding shares of Common Stock and 24,635,750 shares of Common Stock issuable upon exercise of outstanding warrants. | |

| Offering price: | Market price or privately negotiated prices. | |

| Common stock outstanding after the offering: | 179,123,284 shares, including shares of Common Stock issuable upon exercise of warrants. | |

| Use of proceeds: | We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; provided, however, we will receive the proceeds from any cash exercise of warrants. | |

Risk factors:

|

An investment in our securities involves a high degree of risk and could result in a loss of your entire investment. Prior to making an investment decision, you should carefully consider all of the information in this prospectus and, in particular, you should evaluate the risk factors set forth under the caption “Risk Factors” beginning on page 6. | |

| Symbol on OTCQB | MSRT |

The number of shares of Common Stock to be outstanding immediately after this offering is based on 154,487,534 shares of Common Stock outstanding as of May 18, 2018 and excludes:

| ● | 15,371,765 shares of Common Stock issuable upon the exercise of options granted under our Plans (as defined below) to certain employees and directors, with a weighted average exercise price of $0.73 per share; and |

| ● | 11,290,589 shares of Common Stock issuable upon the exercise of warrants (excluding warrants covered by this prospectus) with a weighted average exercise price of $1.01 per share. |

-4-

An investment in our securities involves a high degree of risk. This prospectus contains the risks applicable to an investment in our securities. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in this prospectus, together with all of the other information incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed and any updates described in our Annual Reports on Form 10-K and our Quarterly Reports on Form 10-Q, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future and any prospectus supplement related to a particular offering. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment in the offered securities.

Risks Relating to Our Business and Industry

We have a limited history upon which an evaluation of our prospects and future performance can be made and have no history of profitable operations.

We were incorporated in April 2013 and have a limited operating history and our business is subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. We may sustain losses in the future as we implement our business plan. There can be no assurance that we will operate profitably.

Since we have a limited operating history, it is difficult for potential investors to evaluate our business.

Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. As an early stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive and evolving environment. Our business is dependent upon the implementation of our business plan. We may not be successful in implementing such plan and cannot guarantee that, if implemented, we will ultimately be able to attain profitability.

We will need to obtain additional financing to fund our operations.

We will need additional capital in the future to continue to execute our business plan. Therefore, we will be dependent upon additional capital in the form of either debt or equity to continue our operations. At the present time, we do not have arrangements to raise all of the needed additional capital, and we will need to identify potential investors and negotiate appropriate arrangements with them. We may not be able to arrange enough investment within the time the investment is required or that if it is arranged, that it will be on favorable terms. If we cannot obtain the needed capital, we may not be able to become profitable and may have to curtail or cease our operations.

Cannabis remains illegal under Federal law.

Despite the development of a regulated cannabis industry under the laws of certain states, these state laws regulating medical and adult cannabis use are in conflict with the Federal Controlled Substances Act, which classifies cannabis as a Schedule I controlled substance and makes cannabis use and possession illegal on a national level. The United States Supreme Court has ruled that the Federal government has the right to regulate and criminalize cannabis, even for medical purposes, and thus Federal law criminalizing the use of cannabis preempts state laws that regulate its use. Although the prior administration determined that it was not an efficient use of resources to direct Federal law enforcement agencies to prosecute those lawfully abiding by state laws allowing the use and distribution of medical and recreational cannabis, on January 4, 2018, the current administration issued the Sessions Memo announcing a return to the rule of law and the rescission of previous guidance documents. The Sessions Memo rescinds the Cole Memo which was adopted by the Obama administration as a policy of non-interference with marijuana-friendly state laws. The Sessions Memo shifts federal policy from a hands-off approach adopted by the Obama administration to permitting federal prosecutors across the country to decide how to prioritize resources to regulate marijuana possession, distribution and cultivation in states where marijuana use is regulated. There can be no assurance that federal prosecutors will not prosecute and dedicate resources to regulate marijuana possession, distribution and cultivation in states where marijuana use is regulated which may cause states to reconsider their regulation of marijuana which would have a detrimental effect on the marijuana industry. Any such change in state laws based upon the Sessions Memo and the Federal government’s enforcement of Federal laws could cause significant financial damage to us and our stockholders.

-5-

As the possession and use of cannabis is illegal under the Federal Controlled Substances Act, we may be deemed to be aiding and abetting illegal activities through the services and data that we provide to government regulators, dispensaries, cultivators and consumers. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Under Federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Our business provides services to customers that are engaged in the business of possession, use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The Federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a). As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

Federal enforcement practices could change with respect to services provided to participants in the cannabis industry, which could adversely impact us. If the Federal government were to expend its resources on enforcement actions against service providers in the cannabis industry under guidance provided by the Sessions Memo, such actions could have a material adverse effect on our operations, our customers, or the sales of our products.

It is possible that due to the recent Sessions Memo our clients may discontinue the use of our services, our potential source of customers may be reduced and our revenues may decline. Further, additional government disruption in the cannabis industry could cause potential customers and users to be reluctant to use and advertise our products, which would be detrimental to the Company. We cannot predict the impact of the Sessions Memo at this time nor can we predict the nature of any future laws, regulations, interpretations or applications including the effect of such additional regulations or administrative policies and procedures, when and if promulgated, could have on our business.

Our business is dependent on state laws pertaining to the cannabis industry.

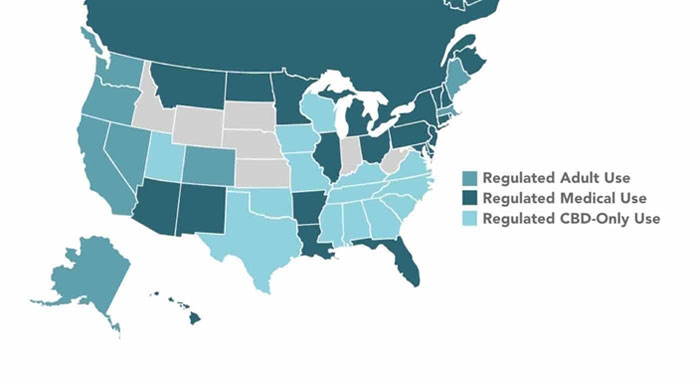

Thirty states allow their citizens to use medical cannabis. In addition, the District of Columbia and eight states (Alaska, California, Colorado, the District of Columbia, Maine, Massachusetts, Nevada, Oregon and Washington) have regulated the sale of cannabis for adult use. Continued development of the cannabis industry is dependent upon continued legislative authorization of cannabis at the state level. Any number of factors could slow or halt progress in this area including, but not limited to, the Sessions Memo. While there may be ample public support for legislative action, numerous factors impact the legislative process. For example, in November 2016, voters in Arizona rejected a ballot initiative that would have permitted the adult-use of cannabis. Further regulation attempts at the state level that create bad public policy could slow or stop further development of the cannabis industry. Any one of these or other factors could slow or halt use of cannabis, which would negatively impact our business.

-6-

New platform features or changes to existing platform features could fail to attract new users, retain existing users or generate revenue.

Our business strategy is dependent on our ability to develop platforms and features to attract new businesses and users, while retaining existing ones. Staffing changes, changes in user behavior or development of competing platforms may cause Users to switch to alternative platforms or decrease their use of our platform. To date, our compliance platform is only in its beginning stages and has not gained widespread market adoption. There is no guarantee that companies and dispensaries will use these features and we may fail to generate revenue. Additionally, any of the following events may cause decreased use of our platform:

| ● | Emergence of competing platforms and applications; |

| ● | Inability to convince potential companies to join our platform; |

| ● | Technical issues on certain platforms or in the cross-compatibility of multiple platforms; |

| ● | Potential securities breaches around our data; |

| ● | A rise in safety or privacy concerns; and |

| ● | An increase in the level of spam or undesired content on the network. |

We are highly dependent on the services of key executives, the loss of whom could materially harm our business and our strategic direction. If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience increases in our compensation costs, our business may materially suffer.

We are highly dependent on our management team, specifically our Chief Executive Officer, Isaac Dietrich. While we have an employment agreement with Isaac Dietrich, such employment agreement permits Mr. Dietrich to terminate such agreement upon notice. If we lose key employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service of our key management personnel and our ability to identify, hire, and retain additional personnel. We do not carry “key-man” life insurance on the lives of our executive officer, employees or advisors. We experience intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our compensation costs may increase significantly.

We will need to obtain additional financing to fund our operations.

We will need additional capital in the future to continue to execute our business plan. Therefore, we will be dependent upon additional capital in the form of either debt or equity to continue our operations. At the present time, we do not have arrangements to raise all of the needed additional capital, and we will need to identify potential investors and negotiate appropriate arrangements with them. We may not be able to arrange enough investment within the time the investment is required or that if it is arranged, that it will be on favorable terms. If we cannot obtain the needed capital, we may not be able to become profitable and may have to curtail or cease our operations. Additional equity financing, if available, may be dilutive to the holders of our capital stock. Debt financing may involve significant cash payment obligations, covenants and financial ratios that may restrict our ability to operate and grow our business.

Our monetization strategy is dependent on many factors outside our control.

There is no guarantee that our efforts to monetize the MassRoots Retail platform will be successful. Furthermore, our competitors may introduce more advanced technologies that deliver a greater value proposition to cannabis related businesses in the future. For example, Google, MJ Freeway, LLC and BioTrackTHC, LLC may decide to introduce features similar to ours to their products, significantly increasing the competitive environment. In addition, dispensaries may not be able to accept credit or bank cards due to banking regulations, which could significantly increase the cost and time required for us to generate revenue. All these factors individually or collectively may preclude us from effectively monetizing our business which would have a material adverse effect on our financial condition and results of operation.

Changes in Amazon App Store, Apple App Store or Google Play Store policies could result in our mobile applications being de-listed. In addition, our third party service providers may decline to provide services due to their policies, or cease to provide services previously provided to us due to a change of policy.

On November 4, 2014, the MassRoots App was removed from Apple’s iOS App Store due to the Apple App Store review team changing their app enforcement guidelines to prohibit all social cannabis applications. After negotiation with Apple and the addition of certain restrictions, the MassRoots App returned to the Apple App Store in February 2015. Although Apple reversed its decision and included our app in the Apple App Store, we cannot provide any assurance that Apple’s policy will not change in the future or that our application will not once again be removed from the Apple App Store.

-7-

The Apple App Store is one of the largest content distribution channels in the world and management believes that it is the only way to effectively distribute our iOS application to users who own iPhones and iPads. The Apple App Store review team effectively operates as our iOS App’s regulator; they decide what guidelines iOS apps must operate under and how to enforce such guidelines. The Apple guidelines related to cannabis related apps are not published, enforcement of such guidelines is difficult to predict, and the review and appeal processes are conducted without public oversight. Although we will continue advocating for a more open and transparent Apple App Store review process that will allow decisions that affect a significant portion of the United States smartphone owning population to be open to public scrutiny, there can be no assurance that we will be successful in these efforts.

MassRoots, along with other cannabis apps, regularly encounter issues with the Google Play Store review team in the normal course of business due to Google Play Store’s absence of clear guidelines regarding cannabis-related apps. In November 2016, the MassRoots App was removed from the Google Play Store due to a compliance review. However, on March 21, 2017, Google Play approved the MassRoots App for distribution to Android devices through the Google Play Store once again.

On December 1, 2016, MassRoots’ Android application received approval from the Amazon App Store for listing, and is currently available for download on the Amazon App Store.

In addition to challenges we face with respect to compliance with the Amazon App Store, Apple App Store and Google Play Store guidelines, service providers may refuse to provide services to us even if they previously provided such services due to our status as a cannabis related company. For example, in January 2016, after building a strong presence on Instagram and having previously used our Instagram account to grow our user count and highlight posts about our business, our account was suspended without warning by Instagram. While the account was reinstated on February 26, 2016, we cannot provide any assurance that our Instagram account will not be suspended in the future and if suspended that our account will be reinstated. Furthermore, we may face similar situations in the future with our other services providers that may cause disruptions to our business plan, all of which may have a material adverse effect on our business and financial condition.

Government actions or digital distribution platform restrictions could result in our products and services being unavailable in certain geographic regions which may harm our future growth.

Due to our connections to the cannabis industry, governments and government agencies could ban or cause our network or apps to become unavailable in certain regions and jurisdictions. This could greatly impair or prevent us from registering new users in affected areas and prevent current users from accessing our network. In addition, government action taken against our service providers or partners could cause our network to become unavailable for extended periods of time.

As discussed herein, as part of our agreement with Apple in connection with our application being returned to the Apple App Store, we agreed to limit registration of new members within our iOS application to the locations where cannabis is permitted under state law (medicinally or recreationally) at the state level. This restriction prohibits users in several states and countries from accessing our network. Expansions of such policies by Apple, Google or Amazon may slow our user registration rate which may have a material adverse effect on our business and future prospects.

Failure to generate user growth or engagement could greatly harm our business model.

Our business model involves attracting users to our mobile application and linking their MassRoots account with their profile in MassRoots Retail. There is no guarantee that growth strategies used in the past will continue to bring new users to our network or that users will agree to link their MassRoots and MassRoots Retail profiles. Changes in relationships with our partners, contractors and businesses we retain to grow our network may result in significant increases in the cost to acquire new users. In addition, new users may fail to engage with our network to the same extent current users are engaging with our network resulting in decreased use of our network. Decreases in the size of our user base and/or decreased engagement on our network may impair our ability to generate revenue.

-8-

Failure to attract clients could greatly harm our ability to generate revenue.

Our ability to generate revenue is dependent on the continued growth of our platform. If we are unable to continue to grow our network or bring new clients to our network, our ability to generate revenue would be greatly compromised. There is no guarantee businesses will want to join our platform or that we will be able to generate revenue from our existing user base.

Historically, we have generated most of our revenue from advertising. The loss of clients or reduction in spending by advertisers may have a material adverse effect on our business.

Historically, we have generated most of our revenue from third parties advertising on our website. Some of our third party advertisers include cannabis companies, including regulated cannabis dispensaries, and mainstream brands such as Uber. As is common in the industry, our advertisers usually do not have long-term advertising commitments with us. It is possible that such advertisers may not continue to do business with us for several reasons including that they no longer believe that their advertisements on our website will generate a competitive return relative to other alternatives or in the alternative they may reduce the prices they are willing to pay to advertise their products and services on our website.

Our revenue could be adversely affected by a number of other factors including, but not limited to:

| ● | decreases in User engagement, including time spent on our website and mobile app; |

| ● | our inability to improve our analytics and measurement solutions that demonstrate the value of our ads and other commercial content; |

| ● | loss of market share to our competitors; |

| ● | adverse legal developments relating to our business, including legislative and regulatory developments and developments in litigation, if any; |

| ● | adverse media reports or other negative publicity involving us or other companies in our industry; and |

| ● | the impact of macroeconomic conditions and conditions in the industry in general. |

The occurrence of any of these or other factors could result in decreased traffic to our website which may result in less views of third party ads. If we are unable to generate traffic to our website and as a result third party advertisers no longer continue to do business with us, our business, financial conditions and results of operation may be materially affected.

User engagement and growth depends on software and device updates beyond our control.

Our mobile application and websites are currently available on multiple operating systems, including iOS and Android, across multiple different manufacturers, including Motorola, LG, Apple and Samsung and on thousands of devices. Changes to the device infrastructure or software updates on such devices could render our platforms and services useless or inoperable and require users to utilize our website rather than our mobile application which may result in decreased user engagement. Any decrease in user engagement may devalue our value proposition to third party advertisers who may no longer continue to do business with us which may have a material adverse effect on business, financial conditions and results of operation.

We may be unable to manage growth.

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we need to continuously:

| ● | Evaluate definitive business strategies, goals and objectives; |

| ● | Maintain a system of management controls; and |

| ● | Attract and retain qualified personnel, as well as, develop, train and manage management-level and other employees. |

-9-

If we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed.

We may not be able to compete successfully with other established companies offering the same or similar services and, as a result, we may not achieve our projected revenue and user targets.

We compete with both start-up and established technology companies. Our competitors may have substantially greater financial, marketing and other resources than we do and may have been in business longer than we have or have greater name recognition and be better established in the technological or cannabis markets than we are. If we are unable to compete successfully with other businesses in our existing market, we may not achieve our projected revenue and/or user targets which may have a material adverse effect on our financial condition.

Expansion by our well-established competitors into the cannabis industry could prevent us from realizing anticipated growth in users and revenues.

Competitors in the social network space, such as Twitter and Facebook, have continued to expand their businesses in recent years into other social network markets. If they decided to expand their social networks into the cannabis community, this could harm the growth of our business and user base and cause our revenues to be lower than we expect. In addition, competitors in the point-of-sale and compliance software space, such as IQ Metrics, may continue to expand their businesses into the cannabis space which could harm the growth of our business and user base and cause our revenues to be lower than we expect.

Government regulation of the Internet and e-commerce is evolving, and unfavorable changes could substantially harm our business and results of operations.

We are subject to general business regulations and laws as well as Federal and state regulations and laws specifically governing the Internet and e-commerce. Existing and future laws and regulations may impede the growth of the Internet, e-commerce or other online services, and increase the cost of providing online services. These regulations and laws may cover sweepstakes, taxation, tariffs, user privacy, data protection, pricing, content, copyrights, distribution, electronic contracts and other communications, consumer protection, broadband residential Internet access and the characteristics and quality of services. It is not clear how existing laws governing issues such as property ownership, sales, use and other taxes, personal privacy apply to the Internet and e-commerce. Unfavorable resolution of these issues may harm our business and results of operations.

The failure to enforce and maintain our intellectual property rights could enable others to use trademarks used by our business which could adversely affect the value of the Company.

The success of our business depends on our continued ability to use our existing tradename in order to increase our brand awareness. As of the date hereof, MASSROOTS is a federally registered trademark owned by us, ODAVA is a state registered trademark owned by us and RETAIL is a state registered trademark of Odava, Inc. In addition, we have applied for the trademark “TOKE”. The unauthorized use or other misappropriation of any of the foregoing trademarks could diminish the value of our business which would have a material adverse effect on our financial condition and results of operation.

Due to our involvement in the cannabis industry, we may have a difficult time obtaining insurance coverage for our business which may expose us to additional risk and financial liabilities.

Insurance that may otherwise be readily available, such as workers compensation, general liability, and directors and officers insurance, is more expensive and difficult for us to obtain because we are a service provider to companies in the cannabis industry. Although we currently maintain director’s and officer’s liability insurance there can be no assurance that we will be able to maintain such policy in the future or at costs that are affordable to us due to the nature of our business operations. If we are unable to maintain insurance related to our Company and business operations we will be exposed to additional risk and financial liabilities which may have a material adverse effect on our business and financial condition.

-10-

Participants in the cannabis industry may have difficulty accessing the service of banks, which may make it difficult for us to operate.

Despite recent rules issued by the United States Department of the Treasury mitigating the risk to banks which do business with cannabis companies operating in compliance with applicable state laws, as well as recent guidance from the United States Department of Justice, banks remain wary of accepting funds from businesses in the cannabis industry. Since the use of cannabis remains illegal under Federal law, there remains a compelling argument that banks may be in violation of Federal law when accepting for deposit funds derived from the sale or distribution of cannabis. Consequently, businesses involved in the cannabis industry continue to have trouble establishing banking relationships. Although we currently have a bank account, our inability to open additional bank accounts or maintain our current account may make it difficult, if not impossible, for us, or some of our advertisers, to do business.

Our independent registered accounting firm has expressed concerns about our ability to continue as a going concern.

The report of our independent registered accounting firm expresses concern about our ability to continue as a going concern based on the absence of significant revenues, our significant losses from operations and our need for additional financing to fund all of our operations. It is not possible at this time for us to predict with assurance the potential success of our business. The revenue and income potential of our proposed business and operations are unknown. If we cannot continue as a viable entity, we may be unable to continue our operations and you may lose some or all of your investment in our securities.

In the past we have experienced material weaknesses in our internal control over financial reporting, which if continued, could impair our financial condition.

As reported in our Annual Report on Form 10-K, our management concluded that our internal control over financial reporting was not effective as of December 31, 2017 and 2016 due to material weaknesses regarding our controls and procedures. The Company did not have sufficient segregation of duties to support its internal control over financial reporting. Due to our small size and limited resources, segregation of all conflicting duties has not always been possible and may not be economically feasible in the near term; however, we do expect to hire additional accounting personnel in the near future. We have and do endeavor to take appropriate and reasonable steps to make improvements to remediate these deficiencies. If we have continued material weaknesses in our internal financial reporting, our financial condition could be impaired or we may have to restate our financials, which could cause us to expend additional funds that would have a material impact on our ability to generate profits and on the success of our business.

Risks Relating to Use of New Technology

Government regulation of the Internet, blockchain technology and cryptocurrency is evolving, and unfavorable changes could substantially harm us and our subsidiary.

We are subject to federal and state regulations and laws governing the Internet, blockchain technology and e-commerce. Existing and future laws and regulations may impede the growth of the Internet, blockchain technology and e-commerce and/or other online services, and may increase the cost of providing online services. Changes in regulations and laws may effect sweepstakes, taxation, tariffs, user privacy, data protection, pricing, content, intellectual property rights, distribution, electronic contracts and other communications, consumer protection, broadband residential Internet access and the characteristics and quality of services. In addition, many governments and regulatory agencies have not established specific regulations pertaining to blockchain technology and other instruments that use such technology and no assurance can be given that such governments or regulatory authorities will not implement adverse changes to laws and regulations. Any such changes to federal and state regulations and laws may harm our and our subsidiary’s business and results of operations.

-11-

There are no assurances that we will be successful in developing blockchain-based solutions, that such solutions will be economically viable or that such solutions will be able to generate any revenue.

While we are devoting development resources to exploring the feasibility of developing block-chain based solutions, there can be no assurances that we will be successful in implementing such solutions, that they will be economically viable, or such solutions will generate any revenue.

The development and acceptance of digital instruments is subject to a variety of factors which are difficult to evaluate.

We may explore the use of digital instruments for use in connection with our platform or programs; however, there can be no assurance that we will adopt or use any such instruments, or be successful in doing so. The development and use of such instruments is subject to a variety of factors that are difficult to evaluate including, but not limited to:

| · | the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the development of a new product or service based upon relatively new and developing technology; |

| · | the acceptance and use of the new technology by consumers; |

| · | regulation by governmental and quasi-governmental agencies; |

| · | the maintenance and development of the protocols for the new technology; |

| · | generic economic conditions and the regulatory environment relating to the new technology; and |

| · | the availability and popularity of other forms or methods of buying and selling goods and services. |

The slowing or stopping of the development, general acceptance, adoption and usage of digital instruments or compliance with regulations by governmental and quasi-governmental agencies may deter or delay the acceptance of such instruments.

The potential application of U.S. laws with respect to traditional investment securities to digital instruments is unclear.

The use of digital instruments is novel and the application of U.S. federal and state securities laws is unclear in many respects. Specifically, regulation with respect to such instruments is currently undeveloped, likely to evolve, may vary significantly among international, federal, state and local jurisdictions and is subject to significant uncertainty. Various legislative and executive bodies in the United States and in other countries may in the future adopt laws, regulations, or guidance, or take other actions, which may severely impact the permissibility of the use of digital instruments, the technology behind them or the means of transaction in or transferring them. In the event that securities laws restrict the ability for digital instruments to be transferred in a manner similar to traditional investment securities, this would have a material adverse effect on the value of such instruments, which could result in a material impact on the use of such instruments as a possible means to provide rewards on the MassRoots platform.

Our failure to comply with any laws, rules and regulations, some of which may not exist yet or that are subject to interpretations that may be subject to change, could result in a variety of adverse consequences, including civil penalties and fines. The effect of any future regulatory change is impossible to predict, but such change could be substantial and materially adverse to the adoption and value our new technology, when and if developed, accepted and adopted.

Risks Relating to our Common Stock

Due to our connection to the cannabis industry, there can be no assurance that our common stock will ever be approved for listing on a national securities exchange.

Currently, shares of our common stock are quoted on the OTCQB and are not traded or listed on any securities exchange. Even if we desire to have our shares listed on a national securities exchange, the fact that our network is associated with the use of cannabis, the legal status of which is uncertain at the state and Federal level, may make any efforts to become listed on a securities exchange more problematic. While we remain determined to work towards getting our securities listed on a national exchange, there can be no assurance that this will occur. As a result we may never develop an active trading market for our securities which may limit our investors’ ability to liquidate their investments

-12-

The market price of our common stock may be volatile and adversely affected by several factors.

The market price of our common stock could fluctuate significantly in response to various factors and events, including, but not limited to: our ability to execute our business plan; operating results below expectations; announcements regarding regulatory developments with respect to the cannabis industry; our issuance of additional securities, including debt or equity or a combination thereof, necessary to fund our operating expenses; announcements of technological innovations or new products by us or our competitors; and period-to-period fluctuations in our financial results.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in the stock.

Rule 15g-9 under the Exchange Act establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (a) that a broker or dealer approve a person’s account for transactions in penny stocks; and (b) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must: (a) obtain financial information and investment experience objectives of the person and (b) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (a) sets forth the basis on which the broker or dealer made the suitability determination; and (b) confirms that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our common stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker or dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We are an “emerging growth company” within the meaning of the Securities Act, and if we decide to take advantage of certain exemptions from various reporting requirements applicable to emerging growth companies, our common stock could be less attractive to investors.

For as long as we remain an “emerging growth company”, as defined in the JOBS Act, we will have the option to take advantage of certain exemptions from various reporting and other requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”) and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We may take advantage of these and other exemptions until we are no longer an “emerging growth company”. In addition, the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year during which we have total annual gross revenues of $1.0 billion or more, (2) the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, (3) the date on which we have, during the previous three-year period, issued more than $1.07 billion in non-convertible debt, and (4) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act (i.e., the first day of the fiscal year after we have (a) more than $700,000,000 in outstanding common equity held by our non-affiliates, measured each year on the last day of our second fiscal quarter, and (b) been public for at least 12 months).

-13-

Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company,” which would allow us to take advantage of many of the same exemptions from disclosure requirements including exemption from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock or warrants less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

We do not anticipate paying dividends on our common stock, and investors may lose the entire amount of their investment.

Cash dividends have never been declared or paid on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future earnings, if any, to fund business growth. Therefore, stockholders will not receive any funds absent a sale of their shares of common stock. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure that stockholders will not lose the entire amount of their investment.

You could lose all of your investment.

An investment in our securities is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company may go down as well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully reflect its underlying value. You could lose your entire investment.

Our management controls a large block of our common stock that will allow them to control us.

As of the date of this prospectus, members of our management team beneficially own approximately 13.35% of our outstanding common stock. As a result, management may have the ability to control substantially all matters submitted to our stockholders for approval including:

| ● | Election and removal of our directors; |

| ● | amendment of our Certificate of Incorporation or Bylaws; and |

| ● | adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

In addition, management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price. Any additional investors will own a minority percentage of our common stock and will have minority voting rights.

Because we can issue additional shares of Common Stock, purchasers of our Common Stock may incur immediate dilution and experience further dilution.

We are authorized to issue up to 200,000,000 shares of Common Stock, of which 154,487,534 shares of Common Stock are issued and outstanding as of May 18, 2018. Our Board of Directors has the authority to cause us to issue additional shares of Common Stock without consent of any of stockholders. Consequently, our stockholders may experience further dilution in their ownership of our stock in the future, which could have an adverse effect on the trading market for our Common Stock.

If our proposal to adopt the Second Amended and Restated Certificate of Incorporation is adopted by a majority of our outstanding voting capital stock at our 2018 annual meeting of stockholders, the Second Amended and Restated Certificate of Incorporation will contain an exclusive forum provision with respect to all Internal Corporate Claims, which may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable and discourage lawsuits against us or our current or former directors or officers and/or stockholders in such capacity.

Our proposed Second Amended and Restated Certificate of Incorporation provides that all Internal Corporate Claims must be brought solely and exclusively in the Court of Chancery of the State of Delaware (or, if such court does not have jurisdiction, the Superior Court of the State of Delaware, or, if such other court does not have jurisdiction, the United States District Court for the District of Delaware). If our proposed Second Amended and Restated Certificate of Incorporation is adopted by a majority of our outstanding voting capital stock at our 2018 annual meeting of stockholders, then all of our stockholders will be subject to the exclusive forum provision of the Second Amended and Restated Certificate of Incorporation. The exclusive forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes based upon Internal Corporate Claims, which may discourage lawsuits against us or our current or former directors or officers and/or stockholders in such capacity. In addition, if a court were to find this exclusive-forum provision to be inapplicable or unenforceable in an action, we may incur costs associated with resolving the dispute in other jurisdictions, which could have a material adverse effect on our business and operations.

-14-

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Any statements in this prospectus about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our Common Stock and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this prospectus. You should read this prospectus and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Because the risk factors referred to on page 6 of this prospectus and incorporated herein by reference, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and any accompanying prospectus supplement, and particularly our forward-looking statements, by these cautionary statements.

The selling stockholders will receive all of the proceeds from the sale of the Resale Shares offered by them pursuant to this prospectus. We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders covered by this prospectus. If the warrants issued pursuant to the July 2017 Private Placement, August 2017 Private Placement, December 2017 Private Placement or January 2018 Private Placement are exercised for cash, such proceeds will be used by the Company for working capital.

-15-

We have not paid any cash dividends on our Common Stock and have no present intention of paying any dividends on the shares of our Common Stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our Board of Directors.

This prospectus relates to the resale from time to time by the selling security holders identified herein of up to an aggregate of 52,719,040 Resale Shares consisting of:

| (i) | 490,000 shares of Common Stock and warrants to purchase up to 1,986,250 shares of Common Stock issued pursuant to the July 2017 Private Placement; |

| (ii) | 1,130,295 shares of Common Stock issued upon conversion of the August Notes and warrants to purchase up to 4,400,000 shares of Common Stock issued pursuant to the August 2017 Private Placement; |

| (iii) | 12,762,995 shares of Common Stock and warrants to purchase up to 4,549,500 shares of Common Stock issued pursuant to the December 2017 Private Placement; and |

| (iv) | 13,700,000 shares of Common Stock and warrants to purchase up to 13,700,000 shares of Common Stock issued pursuant to the January 2018 Private Placement. |

The transactions by which the selling stockholders acquired their securities from us were exempt under the registration provisions of the Securities Act.

The Resale Shares referred to above are being registered to permit public sales of the Resale Shares, and the selling stockholders may offer the shares for resale from time to time pursuant to this prospectus. The selling stockholders may also sell, transfer or otherwise dispose of all or a portion of their shares in transactions exempt from the registration requirements of the Securities Act or pursuant to another effective registration statement covering those shares.

The table below sets forth certain information regarding the selling stockholders and the Resale Shares offered in this prospectus. The selling stockholders have had no material relationship with us within the past three years other than as described in the footnotes to the table below or as a result of their acquisition of our shares or other securities.

Beneficial ownership is determined in accordance with the rules of the SEC. The selling stockholder’s percentage of ownership of our outstanding shares in the table below is based upon 153,944,886 shares of Common Stock outstanding as of April 17, 2018.

-16-

| Ownership Before Offering | After Offering (2) | ||||||||

| Selling Stockholder | Number

of Shares of Common stock Beneficially Owned (1) |

Number

of Shares Offered |

Number

of Shares of Common stock Beneficially Owned (1) |

Percentage

of Common stock Beneficially Owned |

|||||

| DBIC Ltd. (3) | 1,440,000 (4) | 1,440,000 (4) | 0 | 0% | |||||

| DSBI Bahamas Ltd. (5) | 1,440,000 (6) | 1,440,000 (6) | 0 | 0% | |||||

| Jayesh Shah | 190,000 (7) | 170,000 (8) | 20,000 | * | |||||

| Jonathan Honig | 1,502,475 | 1,502,475 | 0 | 0% | |||||

| Midori No Nami LLC (9) | 6,400,000 (10) | 4,200,000 (11) | 2,200,000 | 1.43% | |||||

| Pinz Capital International LP (12) | 850,000 (13) | 500,000 (14) | 350,000 | * | |||||

| Richard Taney | 312,500 (15) | 212,500 (16) | 100,000 | * | |||||

| Acquisition Group Limited (17) | 1,500,000 (18) | 1,500,000 (18) | 0 | 0% | |||||

| Grander Holdings, Inc. 401K (19) | 2,500,000 (20) | 2,500,000 (20) | 0 | 0% | |||||

| Robert Halpern | 1,500,000 (21) | 1,500,000 (21) | 0 | 0% | |||||

| The Special Equities Group LLC (22) | 674,500 (23) | 674,500 (23) | 0 | 0% | |||||

| US Commonwealth Life AI Policy 2013-17 (24) | 2,250,000 (25) | 2,250,000 (25) | 0 | 0% | |||||

| David Hall | 250,000 (26) | 250,000 (26) | 0 | 0% | |||||

| ATG Capital LLC (27) | 375,619 (28) | 375,619 (28) | 0 | 0% | |||||

| Azure Capital Corp (29) | 968,396 (30) | 500,000 (31) | 468,396 | * | |||||

| 2330573 Ontario Inc. (32) | 3,500,000 (33) | 3,500,000 (33) | 0 | 0% | |||||

| Cambridge Capital Ltd. (34) | 7,000,000 (35) | 7,000,000 (35) | 0 | 0% | |||||

| Melechdavid, Inc. (36) | 2,500,000 (37) | 2,500,000 (37) | 0 | 0% | |||||

| Mohit Bhansali | 2,500,000 (38) | 250,000 (39) | 2,250,000 | 1.45% | |||||

| NG Bahamas Ltd. (40) | 6,400,000 (41) | 6,400,000 (41) | 0 | 0% | |||||

| Dark Horse Financial Corp (42) | 280,000 (43) | 280,000 (43) | 0 | 0% | |||||

| Caitlin Plunkett | 80,000 (44) | 80,000 (44) | 0 | 0% | |||||

| 2443904 Ontario Inc. (45) | 360,000 (46) | 360,000 (46) | 0 | 0% | |||||

| Iroquois Master Fund Ltd. (47) | 653,835 (48) | 312,500 (49) | 341,335 | * | |||||

| Zachary John Harvey | 605,000 (50) | 500,000 (51) | 105,000 | * | |||||

| DiamondRock, LLC (52) | 1,868,236 (53) | 1,858,236 (54) | 10,000 | * | |||||

| Gerald Lindenmuth & Tim Kirby Trustees U/A DTD 01-01-1991 Lidenmuth & Associates Inc Trust (55) | 2,298,393 (56) | 1,197,059 (57) | 1,101,334 | * |

|||||

| HS Contrarian Investments, LLC (58) | 6,354,053 | 6,009,901 | 344,152 | * | |||||

| L1 Capital Global Opportunities Master Fund (59) | 2,485,000 (60) | 2,475,000 (61) | 10,000 | * | |||||

| Travis Trawick | 704,579 (62) | 150,000 (63) | 554,579 | * | |||||

| Tyler Knight | 1,200,000 (64) | 750,000 (65) | 450,000 | * | |||||

| Arthur Eli Kaplan | 106,250 (66) | 81,250 (67) | 25,000 | * | |||||

-17-

| (1) | Under applicable SEC rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the security, in each case, irrespective of the person’s economic interest in the security. Each listed selling stockholder has the sole investment and voting power with respect to all shares of Common Stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in the footnotes to the table.

|