As filed with the Securities and Exchange Commission on August 11, 2015

Registration No. 333- 196735

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

POST EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

MASSROOTS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7370 | 46-2612944 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

1624 Market Street, Suite 201, Denver, CO 80202

(720) 442-0052

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

______________________

Isaac Dietrich, Chief Executive Officer

MassRoots, Inc.

1624 Market Street, Suite 201, Denver, CO 80202

(720) 442-0052

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________________

Please send copies of all communications to:

Peter J. Gennuso, Esq. Christopher A. Moore, Esq. Thompson Hine LLP Fax: (212) 344-6101 |

Isaac Dietrich, Chief Executive Officer MassRoots, Inc. 1624 Market Street, Suite 201, Denver, CO 80202 Tel: (720) 442-0052

|

______________________

As soon as practicable after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | Non-accelerated filer | [ ] | Smaller Reporting Company | [x] | |||

| (Do not check if a smaller reporting company) |

____________________

This registration statement shall hereafter become effective in accordance with the provisions of section 8(c) of the Securities Act of 1933, as amended on such date as the Commission, acting pursuant to Section 8(c), may determine.

________________

EXPLANATORY NOTE

This Post-Effective Amendment No. 2 to the Registration Statement on Form S-1 of MassRoots, Inc. (the “Company”), originally became effective by the Securities and Exchange Commission (the “SEC”) on September 15, 2014, is being filed pursuant to the undertakings in Item 17 of the Registration Statement to include the information contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, that was filed with the SEC on March 31, 2015. We have also included information with respect to the quarters ended March 31, 2015, and June 30, 2015 that were subject of a Form 10-Q filing made on May 15, 2015 and July 21, 2015, respectively, and other updating information throughout the Registration Statement, as well as responded to SEC comments to the Company’s Post-Effective Amendment No. 1.

The information included in this filing amends this Registration Statement and the Prospectus contained therein. No additional securities are being registered under this Post-Effective Amendment No. 2. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

MASSROOTS, INC.

49,148,192 Shares of Common Stock

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”). This prospectus relates to the resale from time-to-time of up to 49,148,192 shares of our common stock by selling security holders, of which: (1) 38,842,783 shares are issued and outstanding; (2) 2,091,000 shares are issuable upon the conversion of outstanding convertible debentures; and (3) 8,113,659 shares are issuable upon the exercise of outstanding warrants. The selling security holders named in this prospectus are offering to sell shares of our common stock of MassRoots, Inc. through this prospectus and they may be deemed “underwriters” as that term is defined in Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

Our common stock is currently quoted on the OTCQB under the symbol “MSRT.” On August 3, 2015, the last closing sale price of our common stock was $1.01 per share. The selling security holders will pay all brokerage commissions and discounts attributable to the sale of the shares, plus brokerage fees. The selling security holders will receive all of the net proceeds from the offering.

The selling security holders may use any one or more of the following methods when selling shares: (i) ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; (ii) block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; (iii) purchases by a broker-dealer as principal and resale by the broker-dealer for its account; (iv) an exchange distribution in accordance with the rules of the applicable exchange; (v) privately negotiated transactions; (vi) effected short sales after the date the registration statement of which this prospectus is a part is declared effective by the SEC; (vii) through the writing or settlement of options or other hedging transactions, whether through options exchange or otherwise; (viii) broker-dealers may agree with the selling security holders to sell a specified number of such shares at a stipulated price per share; and (ix) a combination of any such methods of sale.

Our common stock involves a high degree of risk. You should read the "RISK FACTORS" section beginning on page 10 before you decide to purchase any of our common stock.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”). For more information, see the prospectus section titled “Emerging Growth Company Status” starting on page 5.

The Company has minimal revenues to date and there can be no assurance that the Company will be successful in furthering its operations and/or revenues. Persons should not invest unless they can afford to lose their entire investment. Investing in our securities involves a high degree of risk. You should purchase these units only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 10 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 11, 2015

| PROSPECTUS SUMMARY | 3 | |

| THE OFFERING | 6 | |

| THE REORGANIZATION AND PREVIOUS OFFERINGS | 7 | |

| SUMMARY FINANCIAL DATA | 9 | |

| RISK FACTORS | 10 | |

| NOTE ABOUT FORWARD-LOOKING STATEMENTS | 19 | |

| TAX CONSIDERATIONS | 20 | |

| USE OF PROCEEDS | 20 | |

| DETERMINATION OF OFFERING PRICE | 20 | |

| DIVIDEND POLICY | 20 | |

| CAPITALIZATION | 20 | |

| SELLING SECURITY HOLDERS | 23 | |

| PLAN OF DISTRIBUTION | 27 | |

| DESCRIPTION OF BUSINESS | 28 | |

| PROPERTIES | 40 | |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND CONTROL PERSONS | 40 | |

| EXECUTIVE COMPENSATION | 44 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 48 | |

| DESCRIPTION OF SECURITIES | 49 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 51 | |

| DECEMBER 31, 2014 FINANCIAL STATEMENTS | 68 | |

| MARCH 31, 2015 FINANCIAL STATEMENTS (UNAUDITED) | 83 | |

| JUNE 30, 2015 FINANCIAL STATEMENTS (UNAUDITED) | 93 | |

| LEGAL MATTERS | 115 | |

| EXPERTS | 115 | |

| WHERE YOU CAN FIND MORE INFORMATION | 115 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. The information in this prospectus is accurate only as of the date on the front of this prospectus. Our business, financial condition, results of operations and prospects may have changed since the date of this prospectus. This prospectus is not an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. You should not consider this prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider prior to investing. After you read this summary, you should read and consider carefully the more detailed information and financial statements and related notes that we include in this prospectus, especially the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If you invest in our securities, you are assuming a high degree of risk.

Unless we have indicated otherwise or the context otherwise requires, references in the prospectus to “MassRoots,” the “Company,” “we,” “us” and “our” or similar terms are to MassRoots, Inc. Unless otherwise indicated, all share and per share information relating to our common stock in this prospectus has been adjusted to reflect the “Exchange” which occurred during our “Reorganization”. See “The Reorganization And Previous Offerings” for additional discussion of the Exchange and Reorganization.

The MassRoots Story – Our Company

MassRoots, Inc. was formed on April 24, 2013 to be a social network for the cannabis community. Given the history of cannabis in the United States, many people would prefer to keep their cannabis experiences separate from Facebook, Instagram and Twitter where a user’s family, co-workers and employers may be connected with them. Our goal was to provide a platform where users were not required to provide personally identifiable information, and to create a semi-anonymous environment where users feel comfortable posting about cannabis.

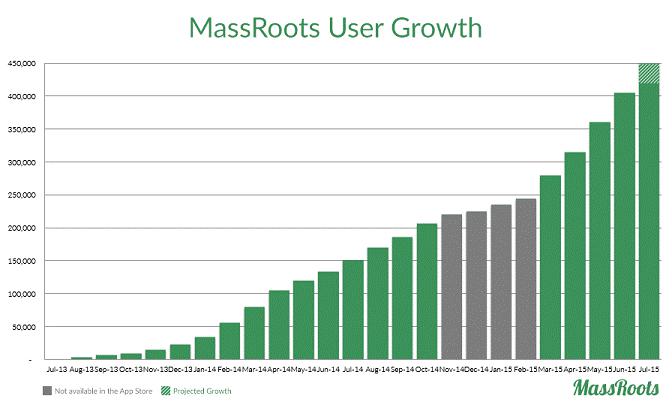

MassRoots launched in the App Store in July 2013 and in our first 6 weeks we obtained about 6,500 users. We took that initial traction to the ArcView Group meeting in September 2013, where we were able to raise seed capital of $150,000. From October 2013 to March 2014, we invested those funds into scaling our network to 100,000 users. In March 2014, we closed a $475,000 common stock round, investing half the funds into becoming a publicly traded company and half the funds into continuing to scale our network. By September 2014, MassRoots had grown into a community of 170,000 users and our Registration Statement on Form S-1 went effective by operation of law in September 2014. We then began a common stock round, closing $776,000 from September 2014 to March 2015, and completed an additional $576,200 in April 2014. We have invested these funds into growing and scaling our network, which reached 325,000 users in May 2015.

We launched MassRoots for Business in early March 2015 as a free online portal for dispensaries to schedule posts, view analytics and gain insights into their followers. Over 300 dispensaries and cannabis brands were using MassRoots for Business by March 31, 2015. Over the coming months, we will expand its functionality to allow businesses to sponsor posts in our users’ newsfeeds and begin to monetize our network. We believe we will have 1,000 dispensaries using MassRoots for Business and begin to receive revenue during the second half of a 2015. We plan to have a 20% paid conversion rate during Q3 2015 and 2,500 dispensaries with a 40% paid conversion rate during first quarter of 2016. We define paid conversion rate as the percent of dispensaries who are paying MassRoots cash for value or services we provide to them.

MassRoots’ Value Proposition to Advertisers:

To date, MassRoots has mainly focused on building out its user-facing platforms and growing its network; businesses are only interested in advertising on networks with a large and active user base, which we are just now starting to achieve. The reasons we believe businesses will advertise on MassRoots are:

| • | Nature of MassRoots Users. The typical MassRoots user is an active cannabis consumer, which is the target demographic for cannabis-related businesses. MassRoots allows these businesses to maximize their lead on target. Unlike other forms of advertising like magazine, banner and display ads that are seen by the general population, every dollar spent on MassRoots advertising puts their product and service directly in front of cannabis consumers. Additionally, the most active users on MassRoots are generally the most active cannabis users, offering an engaging audience for advertisers to communicate with directly. |

| • | Social Endorsements of Products and Services. The majority of cannabis consumers do not feel comfortable recommending cannabis-related products and services on Facebook, Instagram and Twitter as their family and co-workers follow them on these networks. By introducing a social recommendation tool |

| • | similar to Facebook’s, MassRoots will allow cannabis consumers to recommend their favorite strains, products and services to their friends on MassRoots and the community at large. |

| • | Necessity. Currently, Google, Facebook and Twitter prohibit dispensaries from advertising on their networks, forcing cannabis-related companies to rely on magazine, billboard and other alternative forms of advertising that may be far less cost effective due to their broad and un-targeted nature. We believe there is a need for a self-service advertising portal that enables cannabis-related businesses to reach potential customers by digital channels. The MassRoots platform will be compelling for advertisers as it offers direct access to a precise segment of their target market as well as an extensive set of metrics to determine the effectiveness of advertising campaigns. |

| • | Reaching Consumers on Mobile Devices. Mobile advertising is quickly becoming a valuable and effective way for businesses to market themselves. As MassRoots’ users are almost entirely mobile-based, MassRoots will provide cannabis businesses a unique and extremely valuable channel to reach cannabis consumers directly on their mobile devices. |

| • | Location-Based Solutions. All users are required to allow MassRoots to access their location, giving us the ability to target advertisements based on a user’s location. For advertisers with physical locations, this will enable them to target their advertising within a specific radius of their store, ensuring their marketing reaches their target consumers. This will also provide demographic data on emerging cannabis markets, providing value for companies as they improve their offerings locally and begin to expand their operations. |

MassRoots’ Value Proposition to Developers:

Over the coming months, we will be introducing an Application Programming Interface (API) to developers looking to integrate MassRoots’ network into their cannabis-related platform. We believe the benefits to developers are:

| • | One Click Registration and Sign-In. Users do not like creating usernames, passwords and profiles for every app and website they access, which underlies the recent popularity of the “Sign in with Facebook” button. However, because the majority of cannabis consumers do not feel comfortable syncing their Facebook profile with cannabis-related websites and apps, we believe there is a need for a “Login with MassRoots” button on cannabis-related digital properties. This will not only allow users to sync data between applications and save time, but also give developers access to data and services they otherwise would not have. |

| • | Real-Time Content Displayed on Digital Properties. Whether it is posts about a cannabis-related event, a particular strain of cannabis, or any given cannabis product, MassRoots’ approximately 325,000 users are constantly posting high-quality, user-generated content that developers will be able to integrate and display on their own websites in real-time in a similar manner as Facebook Pages and Live Tweets. |

| • | Content Distribution. Similar to users “Pinning” items on Pinterest, MassRoots’ API will allow users to easily share cannabis-related photos, articles, products and events they find on the Internet. This allows content providers to gage which products or articles are most popular or “trending,” gain feedback from the cannabis community and boost their website traffic as they enhance their social reputation. |

MassRoots’ Value Proposition to Investors:

For investors looking to capitalize on the rapidly growing cannabis industry permissible under laws of certain states, we believe MassRoots presents a unique and valuable opportunity for the following reasons:

| • | Owning the Marketing and Distribution Channel. By creating a network of end cannabis consumers, MassRoots is creating a valuable marketing and distribution channel for cannabis and its ancillary products. Over the coming months, we plan to expand MassRoots’ functionality to include live inventory, live pricing and order ahead; we will be able to push these features to hundreds of thousands of cannabis consumers already engaging with the MassRoots Platform, allowing us to expand and conquer adjacent verticals in the cannabis market. |

| • | Network Growth as a Barrier to Entry. Network effects have come to dominate consumer habits. Google+ failed to obtain a dominant market share in desktop-based social networking because it wasn’t introduced until Facebook had already conquered the market. Similarly, when Facebook introduced Poke as a competitor to SnapChat in late 2012, it failed to gain market share due to the market dominance already achieved by SnapChat. Even if a well-financed competitor to MassRoots were to emerge, they would not only have to convince users on why their platform is superior, but also get them to switch away from the network their friends are already using – every user that MassRoots gains, every interaction that takes place on our network and every day that we grow, the barrier to entry grows ever higher. |

| • | The Right Industry, the Right Time, the Right Product. MassRoots sits at the intersection of mobile technology and cannabis, two rapidly growing industries. Per an October 2013 Gallup poll, 58% of the American people support the legalization of cannabis, while 14 states are projected to pass adult-use laws and two states medical-use laws within the next five years. This is projected to cause cannabis sales permitted under certain state laws to grow from $1.43 billion in 2013 to $10.2 billion by 2018. MassRoots has built a mobile network for the cannabis community that has approximately 325,000 users and continues to grow. Over the coming months, we will be adding new features for our users, advertisers and developers that will expand the reach and utility of our network, further accelerating growth and creating significant shareholder value. |

Government Regulation

Our business plan includes allowing cannabis dispensaries to advertise on our network which we believe could be deemed to be aiding and abetting illegal activities, a violation of Federal law. We intend on remaining within the guidelines outlined in the Cole Memo (as more fully described in this prospectus), which does not alter the Department of Justice's authority to enforce Federal law, including Federal laws relating to cannabis, but does recommend that U.S. Attorneys prioritize enforcement of Federal law away from the cannabis industry operating as permitted under certain state laws so long as certain conditions are met. However, we cannot provide assurance that we are in full compliance with the Cole Memo or any other laws or regulations.

Company Information

We are a Delaware corporation. Our address is 1624 Market Street, Suite 201, Denver, CO 80202, our telephone number is (720) 442-0052 and our website is www.MassRoots.com. The information on our website or mobile apps is not a part of this prospectus.

Emerging Growth Company

We are an "emerging growth company," as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies.

Section 107(b) of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues are $1 billion, as adjusted, or more, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

THE OFFERING

| Securities offered | Up to 49,148,192 shares of our common stock. | |

| Offering price | The selling stockholders will offer their shares at prevailing market or privately negotiated prices, in one or more transactions that may take place by ordinary broker's transactions, privately-negotiated transactions or through sales to one or more dealers for resale. | |

| Common stock issued and outstanding before this offering | 43,692,738 shares. | |

| Common stock issued and outstanding after this offering | 53,897,397 shares, if all shares are sold (and therefore, all shares underlying convertible debentures and warrants included in this offering are converted and exercised, respectively.) | |

| Use of proceeds | We will not receive any proceeds from the resale of the common stock or the conversion of outstanding convertible debentures into common stock. However, we may receive up to $1,904,050 in gross proceeds from the exercise of outstanding warrants. For a more complete description, see “Use of Proceeds.” | |

| Risk factors | See “Risk Factors” beginning on page 10 and the other information set forth in this prospectus for a discussion of factors you should consider before deciding to invest in our securities. | |

| Market for Common Stock | Since April 9, 2015, our common stock has been quoted on the OTCQB under the symbol “MSRT”. The last reported sale price of the Company’s common stock, as of August 3, 2015, was $1.01 per share. | |

| Dividends | We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future. |

The number of shares of our common stock outstanding before this offering excludes:

| · | 2,091,000 shares that are issuable upon the conversion of outstanding convertible debentures, the underlying shares of which are included in this offering; |

| · | 8,113,659 shares that are issuable upon the exercise of outstanding warrants; the underlying shares of which are included in this offering; |

| · | 1,016,000 shares of common stock not included in this offering that are issuable upon the exercise of warrants currently outstanding; |

| · | 2,320,000 shares of common stock issuable upon the exercise of options granted under our 2014 Equity Incentive Plan to certain employees and directors, not included in this offering. The number of shares of our common stock that will be outstanding after completion of this offering excludes: |

| · | 1,016,000 shares of common stock not included in this offering that are issuable upon the exercise of warrants currently outstanding; |

| · | 2,320,000 shares of common stock issuable upon the exercise of options granted under our 2014 Equity Incentive Plan to certain employees and directors, not included in this offering. Except as otherwise indicated, per share amounts and shares in this prospectus have been adjusted to reflect the “Exchange” which occurred during our “Reorganization.” These post-Exchange amounts are shown in addition original unadjusted amounts for ease of comparison. |

THE REORGANIZATION AND PREVIOUS OFFERINGS

The following is a discussion detailing the transactions in which the selling security holders acquired the securities offered under this prospectus.

MassRoots was incorporated in the state of Delaware on April 24, 2013. Our original Certificate of Incorporation authorized the issuance of 1,000 shares of common stock with a par value of $1.00 per share. On April 24, 2013, the Company approved the issuance of 15.25 shares of common stock (4,646,136 shares post-Exchange, as defined herein) to the Company’s CEO and Chairman, Isaac Dietrich, to repay $17,053 in short term borrowings from him and for services provided. The Company also approved the issuance of 3.75, 3.00, and 3.00 shares of common stock (1,142,493, 913,994, and 913,994 shares post-Exchange) to the Company’s officers, Hyler Fortier, Stewart Fortier, and Tyler Knight, respectively, in exchange for their services. In addition, options to purchase 42.81, 11.25, 9.0, and 9.0 shares (13,042,695, 3,427,478, 2,741,982 and 2,741,982 shares post-Exchange) of the Company’s common stock at $1.00 per share (approximately $0.000003 per share post-Exchange) were issued to Mr. Dietrich, Ms. Fortier, Mr. Fortier, and Mr. Knight, respectively. The options vested through January 1, 2017 and contained an acceleration clause which was triggered on January 1, 2014 that caused all options to vest immediately. On that date, all outstanding options were exercised at that time by each officer named herein.

The Original Offering

In connection with an offering that occurred in October 2013, the Company filed an Amended and Restated Certificate of Incorporation which authorized the issuance of 21 shares of preferred stock (6,397,958 common shares post-Exchange) with a par value of $1.00 per share, 17.65 shares (5,377,332 common shares post-Exchange) of which were designated as Series A Preferred Stock. Among other rights and privileges, holders of Series A Preferred Stock are entitled to a cumulative dividend of 7% annually, preferential payments over common stock in liquidation and other events, and the ability to convert their Series A Preferred Stock to common stock on a one to one basis (taking into account any unpaid dividends).

In October 2013, the Company entered into agreements to issue 5.88, 5.88, and 5.89 Series A Preferred shares (1,791,428, 1,791,428, and 1,791,475 common shares post-Exchange) to Bass Point Capital, LLC, WM18 Finance LTD, and Rother Investments, LLC, respectively, in exchange for a $50,000 investment from each. In addition, the Company entered into an agreement to issue as compensation for services provided a total of 2.94 Series A Preferred shares (895,715 common shares post-Exchange) to Douglas Leighton for financial consulting services (collectively, the “Original Offering”).

The Reorganization, March 2014 Offering and Registration Rights

In preparation for the March 2014 Offering (as defined herein) and the Company’s intention of becoming a publicly traded entity, on March 18, 2014 the Company entered into an Agreement and Plan of Reorganization with its shareholders in which the following was effected: (i) on March 21, 2014, the Company’s Amended and Restated Certificate of Incorporation was amended to allow for the issuance of 200,000,000 shares of the Company’s common stock and amended the par value of the Company’s common stock to $0.001 per share; (ii) on March 24, 2014, each of the Company’s preferred shareholders converted their shares into common stock on a one for one basis (including the accrued divided); and (iii) on March 24, 2014, each of the Company’s shareholders surrendered their shares of the Company’s common stock in exchange for the pro-rata distribution of 36,000,000 newly issued shares of Company’s common stock, based on the percentage of the total shares of common stock held by the shareholder immediately prior to the exchange (the “Exchange”).

In March 2014, we raised gross proceeds of $475,000 through an offering of our securities to certain accredited and non-accredited investors consisting of: (i) $269,100 face amount of convertible debentures convertible into up to 2,691,000 shares of the Company’s common stock at $0.10 per share (the “Debentures”), together with warrants, exercisable into an amount of our common stock equal to fifty percent (50%) of the common stock underlying the Debentures, at $0.40 per share (“Debenture Warrants”); and (ii) 2,059,000 shares of our common stock at $0.10 per share (“Common Stock”) with a warrant, exercisable into an amount of our common stock equal to fifty percent (50%) of the Common Stock purchased, at $0.40 per share (the “Common Stock Warrants”, together with the Debentures, the Debenture Warrants, and the Common Stock, the “March 2014 Offering”). Five investors received Debentures and Debenture Warrants, while 36 accredited and unaccredited investors received the Common Stock and Common Stock Warrants. In July 2015, one investor exchanged 1,000,000 shares of Common Stock for a warrant exercisable into 1,000,000 shares of our common stock at $0.001 per share, with materially the same terms as the $0.001 Consulting Warrants, defined below.

The Debentures mature on March 24, 2016 and do not accrue interest. If any amount of the Debentures remains outstanding on March 24, 2016, the unconverted portion of the Debentures shall automatically be converted into shares of Company’s common stock at $0.10 per share. Each of the Debenture Warrants and Common Stock Warrants may be exercised any time after their issuance date through and including the third anniversary of their issuance date.

In connection with the March 2014 Offering, we entered into certain registration rights agreements (the “Registration Rights Agreement”), whereby we agreed to use our commercially reasonable efforts to prepare and file a registration statement with the SEC within forty-five (45) days after March 24, 2014, covering all outstanding shares of common stock (including all shares of Common Stock sold in the March 2014 Offering), in addition to all shares of common stock underlying the Debentures, Debenture Warrants, and Common Stock Warrants.

Additionally, as payment for consulting services provided in relation to the March 2014 Offering, we issued Dutchess Opportunity Fund, II LP (“Dutchess”) a warrant exercisable into 4,050,000 shares of our common stock at $0.001 per share (the “$0.001 Consulting Warrants”), and a warrant exercisable into 2,375,000 shares of our common stock at $0.40 per share (the “$0.40 Consulting Warrants”, and together with the $0.001 Consulting Warrants, the “Consulting Warrants”) (the $0.40 Consulting Warrants, the Common Stock Warrants, and the Debenture Warrants, are collectively known as the “$0.40 Warrants”). The Consulting Warrants may be exercised any time after their issuance date through and including the third anniversary of their issuance date.. The Company also granted certain registration rights to Dutchess covering all shares of common stock issuable upon the excise of the Consulting Warrants.

Each of the Debentures, the Debenture Warrants, the Common Stock Warrants, and Consulting Warrants contain a provision which prevent the Company from effecting the conversion or exercise of the respective debenture or warrant, to the extent that, as a result of such conversion or exercise, the holder beneficially owns more than 4.99%, in the aggregate, of the issued and outstanding shares of the Company's common stock calculated immediately after giving effect to the issuance of shares of common stock upon the conversion or exercise (collectively, the “4.99% Blocker”).

Offerings Under the 2014 Equity Incentive Plan

On June 6, 2014, each of Ean Seeb, Tripp Keber, and Sebastian Stant received a stock award of 250,000 shares of our common stock, while Jesus Quintero, the Company’s Chief Financial Officer, received a stock award of 100,000 shares of our common stock as compensation for their service. Each of Ean Seeb, Tripp Keber, and Sebastian Stant also received unvested options to purchase shares of our common stock pursuant to our 2014 Equity Incentive Plan; shares of common stock underlying such options are not covered under this registration statement (see “Executive Compensation” for more details).

SUMMARY FINANCIAL DATA

The following summary of our financial data should be read in conjunction with, and is qualified in its entirety by reference to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, appearing elsewhere in this prospectus.

Statements of Operations Data

| For the year ended December 31, 2014 | For the quarter ended March 31, 2015 | For the quarter ended June 30, 2015 | ||||||||||

| Revenue | 9,030 | $ | 941 | $ | 2,126 | |||||||

| Loss from operations | (1,607,223 | ) | $ | (564,810 | ) | $ | (1,491,005 | ) | ||||

| Net loss | (2,436,142 | ) | $ | (550,509 | ) | $ | (1,517,297 | ) | ||||

Balance Sheet Data

| As of December 31, 2014 | As of March 31, 2015 | As of June 30, 2015 | ||||||||||

| Cash | $ | 141,928 | $ | 54,891 | $ | 171,363 | ||||||

| Total assets | $ | 366,524 | $ | 952,296 | $ | 1,475,827 | ||||||

| Total liabilities | $ | 1,313,328 | $ | 1,442,032 | $ | 634,156 | ||||||

| Total stockholders’ equity (deficit) | $ | (946,799 | ) | $ | (489,736 | ) | $ | 841,671 | ||||

RISK FACTORS

You should carefully consider the risks described below and other information in this prospectus, including the financial statements and related notes that appear at the end of this prospectus, before deciding to invest in our securities. These risks should be considered in conjunction with any other information included herein, including in conjunction with forward-looking statements made herein. If any of the following risks actually occur, they could materially adversely affect our business, financial condition, operating results or prospects. Additional risks and uncertainties that we do not presently know or that we currently deem immaterial may also impair our business, financial condition, operating results and prospects.

Risks Relating to Our Financial Condition

Our independent registered accounting firm has expressed concerns about our ability to continue as a going concern.

The report of our independent registered accounting firm expresses concern about our ability to continue as a going concern based on the absence of significant revenues, our significant losses from operations and our need for additional financing to fund all of our operations. It is not possible at this time for us to predict with assurance the potential success of our business. The revenue and income potential of our proposed business and operations are unknown. If we cannot continue as a viable entity, we may be unable to continue our operations and you may lose some or all of your investment in our common stock.

We have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operation.

As we have less than two years of corporate operational history, it is extremely difficult to make accurate predictions and forecasts on our user growth and finances. This is compounded by the fact we operate in both the technology and cannabis industries, two rapidly transforming industries. There is no guarantee our products or services will remain attractive to potential and current users as these industries undergo rapid change.

As a growing technological company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow significantly, we have not achieved profitability and cannot be certain that we will be able to sustain our current growth rate or realize sufficient revenue to achieve profitability. Further, many of our competitors in the technological fields, such as Twitter, Inc., have a significantly larger user base and revenue stream, but have yet to achieve profitability. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions, increasing revenue throughout the year and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

We may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to develop new features and products or enhance our existing products, improve our operating infrastructure or acquire complementary businesses and technologies. Accordingly, we may need to engage in equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing we secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and our business may be harmed.

Risks Relating to Our Business and Industry

Failure to properly scale our network could result in diminished user experience.

To date, we have been able to sustain approximately 325,000 users with only minor issues. As we potentially scale to hundreds of thousands and millions of users, the network's infrastructure as it relates to storage space, bandwidth, processing ability, speed and other factors may begin to deteriorate or fail completely. This may result in deteriorating user experience, system failures or system outages for continued periods of time. Additionally, issues with cross- compatibility of our Android, iOS and Web properties may cause system glitches, failures or other technical issues.

New platform features or changes to existing platform features could fail to attract new users, retain existing users or generate revenue.

Our business strategy is dependent on its ability to develop platforms and features to attract new users and retain existing ones. Staffing changes, changes in user behavior or development of competing networks may cause users to switch to alternative platforms or decrease their use of our platform. To date, MassRoots for Business is only in its beginning stages and is has not begun to generate revenue. There is no guarantee that companies and dispensaries will use these features and we may fail to generate revenue. Additionally, any of the following events may cause decreased use of our properties:

| • | Emergence of competing websites and applications; |

| • | Inability to convince potential users to join our network; |

| • | A decrease or perceived decrease in the quality of posts on the network; |

| • | An increase in content that is irrelevant to our users; |

| • | Technical issues on certain platforms or in the cross-compatibility of multiple platforms; |

| • | An increase in the level of advertisements may discourage user engagement; |

| • | A rise in safety or privacy concerns; and |

| • | An increase in the level of spam or undesired content on the network. |

Conflicts of interest may arise from other business activities of our directors and officers.

Several of our officers and directors are engaged in business activities outside of MassRoots that may cause conflicts of interest to arise. Our Chief Executive Officer, Isaac Dietrich, is also the President of RoboCent, Inc. (“RoboCent”), a political technology company. Per RoboCent's bylaws, it is party and cause-agnostic, meaning RoboCent is retained by candidates of both parties that may be supportive or opposed to cannabis legalization. While RoboCent is not currently retained by any campaigns or political action committees directly related to cannabis legalization, it is possible for it to be retained by committees seeking to pass or defeat cannabis legalization initiatives. Mr. Dietrich is no longer involved in the day-to-day operations of RoboCent, nor is he involved RoboCent's client relations. Mr. Dietrich spends less than one hour per week on RoboCent-related matters and spends 40+ hours per week on MassRoots-related work.

Our independent director, Tripp Keber, is the Managing Partner of Dixie Elixirs & Edibles (“Dixie”), a cannabis edibles brand in Colorado. Dixie is one of MassRoots' partners in beta-testing advertising strategies; however, there is not currently a financial relationship between the two companies.

Our other independent director, Ean Seeb, is also a partner at Denver Relief Consulting LLC. In this capacity, he advises dispensaries and other cannabis-related companies on regulatory compliance, dispensary operations and marketing. His seat on the MassRoots Board of Directors may cause other cannabis-related consulting agencies and competitors to Denver Relief Consulting LLC's clients to be hesitant to advertise with MassRoots. Potential conflicts of interest may arise from Ean Seeb's position as Chairman of the National Cannabis Industry Association (“NCIA”), the leading trade group of the cannabis industry. While MassRoots has been in agreement with the NCIA's decisions and actions to date, we cannot guarantee conflicts will not arise in the future.

Stewart Fortier, our director and our Chief Technology Officer, Tyler Knight, our Chief Marketing Officer, and Daniel Hunt, our Chief Operating Officer, are not currently involved in any business outside of MassRoots and devote 100% of their time towards MassRoots-related matters.

If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience increases in our compensation costs, our business may materially suffer.

We are highly dependent on our management team, specifically Isaac Dietrich, Stewart Fortier, Tyler Knight and Daniel Hunt While we have employment agreements currently with Isaac Dietrich, Stewart Fortier, Tyler Knight and Daniel Hunt, which outlines their respective roles and responsibilities, as Chief Executive Officer, Chief Technology Officer, Chief Marketing Officer, and Chief Operating Officer, such employment agreements, permit the parties thereto to terminate such agreements upon notice. As such, each of these individuals may terminate their relationship with us upon notice. If we lose key employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service of our key scientific and management personnel and our ability to identify, hire, and retain additional personnel. We do not carry “key-man” life insurance on the lives of any of our employees or advisors. We experience intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our compensation costs may increase significantly.

We will need to raise additional capital to continue its operations over the coming year.

We anticipate the need to raise approximately $1,000,000 in additional capital to fund our operations through December 31, 2015. We expect to use these cash proceeds from the exercise of warrants, in addition to the current capital on hand, primarily to accelerate our user growth, implement consumer-facing features to boost engagement, develop and market a self-service advertising portal for cannabis-related businesses, and remain in full legal and accounting compliance with the SEC. We cannot guarantee that we will be able to raise these required funds or generate sufficient revenue to remain operational.

Our monetization strategy is dependent on many factors outside our control.

There is no guarantee that our efforts to monetize the MassRoots network will be successful. Furthermore, our competitors may introduce more advanced advertising portals that deliver a greater value proposition to cannabis related businesses over the coming months. For example, Google, Facebook and Twitter may decide to allow dispensary-related advertising on their platforms, significantly increasing the competitive environment. Users may stop using our products for many reasons, including the addition of advertising, preventing any monetization from occurring. The development of our advertising platform may take longer than expected and cost more money than projected. Dispensaries may not have credit or bank cards due to banking regulations, which could significantly increase the cost and time required for us to generate revenue. All these factors individually or collectively may preclude us from effectively monetizing our business.

Operating a network open to all internet users may result in legal consequences.

Our Terms and Conditions clearly state that our network and services are only to be used by users who are over 18 years old and located where the use of cannabis is permissible under state law and only in a manner which would be permissible under the applicable state law. However, it is impractical to independently verify that all activity occurring on our network fits into this description. As such, we run the risk of federal and state law enforcement prosecution.

We have taken several steps which attempt to prevent the use of our network in manners which violate our Terms and Conditions. When a user downloads our App from the Google Play Marketplace or Apple App Store, MassRoots mandates that a user provides their location in order to create account. This location is pulled directly from users’ phones (with their permission) and if a user is not located in one of the 23 states with medical cannabis laws, the application is locked and is unable to be used. We have disabled registration on web and mobile web until we have the financial resources to accurately verify users’ locations through their web browsers, so all prospective users must register through our mobile applications. Lastly, the Google Play Marketplace and the iOS App Store only allow users that are 17 years of age and older to download our app.

We have also implemented an aggressive content reporting review policy to remove any content which violates our Terms and Conditions. We have introduced a system that automatically flags any posts for review, removal, and possible account suspension that includes certain words such as "gun" or "acid.” As soon as content is flagged by one of MassRoots’ automated systems or by another user,it is removed from view until we have had the time to review the content.

Although the Obama Administration has effectively stated that it is not an efficient use of resources to direct Federal law enforcement agencies to prosecute those following certain state laws allowing for the use and distribution of medical and recreational cannabis, there can be no assurance that the administration will not change its stated policy and begin enforcement of the Federal laws against us or our users. Additionally, there can be no assurance that we will not face criminal prosecution from states where the use of cannabis is permitted for the use of cannabis in ways which do not fall under the state law. Finally, even if we attempt to prevent the use of our product in states where cannabis use is not permitted under state law, use of our app by those in such states may still occur and state authorities may still bring an action against us for the promotion of cannabis related material by those residing in such states.

Changes in Apple App Store or Google Play Store policies could result in our mobile applications being de-listed.

On November 4, 2014, the MassRoots App was removed from Apple’s iOS App Store due to the App Store review team changing their app enforcement guidelines to prohibit all social cannabis applications. After negotiation with Apple and the addition of certain restrictions, the MassRoots App returned to the App Store in February 2015.

While we are grateful to Apple for reversing its decision, we cannot guarantee this policy will remain in place forever. The Apple App Store is one of the largest content distribution channels in the world and is the only way to effectively distribute software to the 41.6% of the United States population who own iPhones and iPads. The Apple App Store review team effectively operates as our iOS App’s regulator – they decide what rules that iOS apps must operate under and how to enforce those regulations. The rules related to cannabis-related apps are not published, appear to be arbitrarily enforced, and the review and appeal processes are conducted in secret without public oversight. While we will continue pushing for a more open and transparent App Store review process that will allow decisions that affect 41.6% of the United States population to be open to public scrutiny, there can be no assurance that we will be successful in these efforts.

MassRoots has not encountered issues with the Google Play Store nor have any of our competitors. However, under their respective developer license agreements, Apple and Google have the right to update their App Store and Play Store policies, respectfully, to prohibit cannabis-related applications at any time. This could result in many prospective users being unable to access and join our network and existing users being unable to access our App. If this occurred, this would significantly harm our business model.

Failure to generate user growth or engagement could greatly harm our business model.

Our business model is reliant on its ability to attract and retain new users. There is no guarantee that growth strategies used in the past will continue to bring new users to the network. Changes in relationships with our partners, contractors and businesses we retain to grow the network may result in significant increases in the cost to acquire new users. Additionally, new users may fail to engage with the network to the same extent current users are, resulting in decreased usage of the network. Decreases in the size of our user base and/or decreased engagement on the network would greatly impair our ability to generate revenue.

Failure to attract advertising clients could greatly harm our ability to generate revenue

Our ability to generate revenue is dependent on the continued growth of the network and its ability to convince advertisers of its value. Should we prove unable to continue to grow its network or register advertising partners as the network grows, its ability to generate revenue would be greatly compromised. There is no guarantee businesses will want to advertise on our network or that we will be able to generate revenue from its existing user base.

Our proposed business is dependent on state laws pertaining to the cannabis industry.

As of March 4, 2015, 23 states and the District of Columbia allow their citizens to use medical cannabis. Additionally, Colorado and Washington have legalized cannabis for adult use at the state level. Continued development of the cannabis industry is dependent upon continued legislative authorization of cannabis at the state level. Any number of factors could slow or halt progress in this area. Further, progress in the cannabis industry, while encouraging, is not assured. While there may be ample public support for legislative action, numerous factors impact the legislative process. Any one of these factors could slow or halt use of cannabis, which would negatively impact our proposed business.

Cannabis remains illegal under Federal law.

Despite the development of a legal cannabis industry under the laws of certain states, these state laws legalizing medical and adult cannabis use are in conflict with the Federal Controlled Substances Act, which classifies cannabis as a schedule-I controlled substance and makes cannabis use and possession illegal on a national level. The United States Supreme Court has ruled that it is the Federal government that has the right to regulate and criminalize cannabis, even for medical purposes, and thus Federal law criminalizing the use of cannabis preempts state laws that legalize its use. However, the Obama Administration has effectively stated that it is not an efficient use of resources to direct Federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical and recreational cannabis. Yet, there is no guarantee that the Obama Administration will not change its stated policy regarding the low-priority enforcement of Federal laws in states where cannabis has been legalized. Additionally, we face another presidential election cycle in 2016, and a new administration could introduce a less favorable policy or decide to enforce the Federal laws strongly. Any such change in the Federal government’s enforcement of Federal laws could cause significant financial damage to us and our shareholders.

As the possession and use of cannabis is illegal under the Federal Controlled Substances Act, we may be deemed to be aiding and abetting illegal activities through the services that we provide to users and advertisers. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Under Federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Our business provides services to customers that were engaged in the business of possession, use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The Federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a). As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

Federal enforcement practices could change with respect to services providers to participants in the cannabis industry, which could adversely impact us. If the Federal government were to change its practices, or were to expend its resources attacking providers in the cannabis industry, such action could have a materially adverse effect on our operations, our customers, or the sales of our products.

It is possible that additional Federal or state legislation could be enacted in the future that would prohibit our advertisers from selling cannabis, and, if such legislation were enacted, such advertisers may discontinue the use of our services, our potential source of customers would be reduced, causing revenues could decline. Further, additional government disruption in the cannabis industry could cause potential customers and users to be reluctant use and advertise on our products, which would be detrimental to the Company. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

Government actions could result in our products and services being unavailable in certain geographic regions, harming future growth.

Due to our connections to the cannabis industry, governments and government agencies could ban or cause our network or apps to become unavailable in certain regions and jurisdictions. This could greatly impair or prevent us from registering new users in affected areas and prevent current users from accessing the network. In addition, government action taken against our service providers or partners could cause our network to become unavailable for extended periods of time.

User engagement and growth depends on software and device updates beyond our control.

Our applications and websites are currently available on multiple operating systems, including iOS and Android, across multiple different manufacturers, including Motorola, LG, Apple and Samsung, on thousands of different individual devises. Changes to the device infrastructure or software updates on these devises could render our platforms and services useless or inoperable. This could prevent potential users from registering with us, decrease engagement among current users and devalue our value proposition to advertisers.

We may be unable to manage growth, which may impact our potential profitability.

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we will need to:

| · | Establish definitive business strategies, goals and objectives; |

| · | Maintain a system of management controls; and |

| · | Attract and retain qualified personnel, as well as, develop, train and manage management-level and other employees. |

If we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed, and our stock price may decline.

We may not be able to compete successfully with other established companies offering the same or similar services and, as a result, we may not achieve our projected revenue and user targets.

If we are unable to compete successfully with other businesses in our existing market, we may not achieve our projected revenue and/or user targets. We compete with both start-up and established technology companies. Compared to our business, some of our competitors may have greater financial and other resources, have been in business longer, have greater name recognition and be better established in the technological or cannabis markets.

Expansion by our well-established competitors into the cannabis industry could prevent us from realizing anticipated growth in users and revenues.

Our competitors, such as Twitter and Facebook, have continued to expand their businesses in recent years into other social network markets. If they decided to expand their social networks into the cannabis community, this could hurt the growth of our business and user base and cause our revenues to be lower than we expect.

Government regulation of the Internet and e-commerce is evolving, and unfavorable changes could substantially harm our business and results of operations.

We are subject to general business regulations and laws as well as Federal and state regulations and laws specifically governing the Internet and e-commerce. Existing and future laws and regulations may impede the growth of the Internet, e-commerce or other online services, and increase the cost of providing online services. These regulations and laws may cover sweepstakes, taxation, tariffs, user privacy, data protection, pricing, content, copyrights, distribution, electronic contracts and other communications, consumer protection, broadband residential Internet access and the characteristics and quality of services. It is not clear how existing laws governing issues such as property ownership, sales, use and other taxes, libel and personal privacy apply to the Internet and e-commerce. Unfavorable resolution of these issues may harm our business and results of operations.

If we have material weaknesses in the financial reporting of our company, it may cause us to restate our financial statements in the event such weaknesses are determined to not be acceptable to financial reporting requirements.

While our review of material weaknesses is ongoing, if we discover any weaknesses that could cause us to have to restate our financial statements, this could cause us to expend additional funds that would have a material impact on our ability to generate profits and on the profits of our business.

We will be dependent on clients that want to use the Internet and Mobile Applications.

Our ability to maintain consistent business depends in part upon our ability to acquire new clients. Our inability to gain new clients during periods of high unemployment could increase our costs and could cause a slowdown in business with the sales of our products or cause us to temporarily close our business. If we temporarily close our business, we may experience a significant reduction in revenue during the time affected by the closure.

The failure to enforce and maintain our intellectual property rights could enable others to use names confusingly similar to MassRoots, Inc. and other names and marks used by our business, which could adversely affect the value of the brand.

The success of our business depends on our continued ability to use our existing trade name in order to increase our brand awareness. In that regard, we believe that our trade name is valuable asset that is critical to our success. The unauthorized use or other misappropriation of our trade name could diminish the value of our business concept and may cause a decline in our revenue.

Any new indebtedness may adversely affect our financial condition, results of operations, limit our operational and financing flexibility and negatively impact our business.

Any revolving credit facility, and other debt instruments we may enter into in the future, may have negative consequences to our business, including but not limited to the following:

| · | Our ability to obtain financing for working capital, capital expenditures, acquisitions or general corporate purposes may be impaired; |

| · | We may use a substantial portion of our cash flows from operations to pay interest on any new indebtedness, which will reduce the funds available to us for operations and other purposes; |

| · | Our level of indebtedness could place us at a competitive disadvantage compared to our competitors that may have proportionately less debt; |

| · | Our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate may be limited; and |

| · | Our level of indebtedness may make us more vulnerable to economic downturns and adverse developments in our business. |

We expect that we will depend primarily upon invested capital to provide funds to pay our expenses and to pay any amounts that may become due under any new credit facility and any other indebtedness we may incur. Our ability to make these payments depends on our future performance, which will be affected by various financial, business, economic and other factors, many of which we cannot control.

We depend on the services of key executives, the loss of who could materially harm our business and our strategic direction if we were unable to replace them with executives of equal experience and capabilities.

Our senior executives, Isaac Dietrich, Tyler Knight, Daniel Hunt, and Stewart Fortier, are important to our success because they are instrumental in setting our strategic direction, operating our business, identifying, expansion opportunities and arranging any necessary financing. Losing the services of these individuals could adversely affect our business until suitable replacements could be found. We do not maintain key person life insurance policies on any of our executives.

We expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage our expenses.

We estimate that it will cost approximately $150,000 annually to maintain the proper management and financial controls for our filings required as a public reporting company. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and adversely affect our ability to raise capital.

Due to our involvement in the cannabis industry, we may have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional risk and financial liabilities.

Insurance that is otherwise readily available, such as workers compensation, general liability, and directors and officers insurance, is more difficult for us to find, and more expensive, because we were service providers to companies in the medicinal cannabis industry. There are no guarantees that we will be able to find such insurances in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

Participants in the cannabis industry may have difficulty accessing the service of banks, which may make it difficult for us to operate.

Despite recent rules issued by the United States Department of the Treasury mitigating the risk to banks who do business with cannabis companies operating in compliance with applicable state laws, as well as recent guidance from the United States Department of Justice, banks remain weary to accept funds from businesses in the cannabis industry. Since the use of cannabis remains illegal under Federal law, there remains a compelling argument that banks may be in violation of Federal law when accepting for deposit funds derived from the sale or distribution of cannabis. Consequently, businesses involved in the cannabis industry continue to have trouble establishing banking relationships. An inability to open bank accounts may make it difficult for us, or some of our advertisers, to do business.

Risks Relating to our Common Stock

The market price for our common stock will be particularly volatile given our status as a relatively unknown company, with a limited operating history and lack of profits which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price, which may result in substantial losses to you.

Our stock price will be particularly volatile when compared to the shares of larger, more established companies that trade on a national securities exchange and have large public floats. The volatility in our share price will be attributable to a number of factors. First, our common stock will be compared to the shares of such larger, more established companies, sporadically and thinly traded. As a consequence of this limited liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could decline precipitously in the event that a large number of our common stock are sold on the market without commensurate demand. Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a larger, more established company that trades on a national securities exchange and has a large public float. Many of these factors are beyond our control and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time. Moreover, the OTCQB is not a liquid market in contrast to the major stock exchanges. We cannot assure you as to the liquidity or the future market prices of our common stock if a market does develop. If an active market for our common stock does not develop, the fair market value of our common stock could be materially adversely affected.

Since our securities are subject to penny stock rules you may have difficulty selling your shares.

Our shares of common stock are “penny stocks” and are covered by Section 12(g) of the 1934 Securities and Exchange Act which imposes additional sales practices which requires broker/dealers who sell our securities, including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and furnishing monthly account statements. For sales of our securities a broker/dealer must make a special suitability determination and receive from its client a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder’s ability to dispose of his stock.

Our stockholders may experience significant dilution from the exercise of warrants to purchase shares of our Common Stock and the conversion of debentures into shares of our Common Stock.

We currently have outstanding warrants to purchase a total of 4,087,500 shares of our common stock at an exercise price of $0.40; outstanding warrants to purchase 3,113,659 shares of our common stock at an exercise price of $0.001 per share; outstanding warrants to purchase 866,000 shares of our common stock at an exercise price of $1.00 per share; and outstanding warrants to purchase 100,000 shares of our common stock at an exercise price of $0.50 per share. Further, we have outstanding convertible debentures in the aggregate amount of $209,100 redeemable via conversion into shares of our common stock at $0.10 per share. Lastly, under the 2014 Employee Equity Incentive Plan, there are 1,750,000 options exercisable at $0.10 per share, 1,065,000 options at $0.50 per share and 105,000 options at $0.60 per share. Accordingly, if such warrants are exercised and debentures are converted, in whole or part, prior to their respective expiration dates, you may experience substantial dilution. In addition, the likelihood of such dilution may be accelerated if the price of our common stock increases to a level greater than the exercise price of these warrants.

Because we can issue additional shares of common stock, purchasers of our common stock may incur immediate dilution and experience further dilution.

We are authorized to issue up to 200,000,000 shares of common stock, of which 43,672,738 shares of common stock are issued and outstanding as of July 22, 2015. Our Board of Directors has the authority to cause us to issue additional shares of common stock and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, the stockholders may experience more dilution in their ownership of our stock in the future.

We are classified as an “emerging growth company” as well as a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Notwithstanding the above, we are also currently a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

Because directors and officers currently and for the foreseeable future will continue to control MassRoots, it is not likely that you will be able to elect directors or have any say in the policies of MassRoots.

Our shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder approval will be decided by majority vote. The directors and officers of MassRoots beneficially own approximately 70% of our outstanding common stock. Due to such significant ownership position held by our insiders, new investors may not be able to effect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions made by management.

In addition, sales of significant amounts of shares held by our officer and directors, or the prospect of these sales, could adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.