UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[x] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

For the quarterly period ended June 30, 2015

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

For the transition period from ___________to ____________

Commission File Number 333-196735

MASSROOTS, INC.

(Exact name of business as specified in its charter)

| Delaware | 46-2612944 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1624 Market Street, Suite 201, Denver, CO 80202

(Address, including zip code, of principal executive offices)

(720) 442-0052

(Issuer’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [x]*

*The Company has not been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [x] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated Filer [ ]

Non-accelerated filer [ ] Smaller reporting company [x]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of June 30, 2015, the issuer had 44,505,238 shares of common stock issued and outstanding.

MASSROOTS, INC.

FORM 10-Q QUARTERLY REPORT

JUNE 30, 2015

| NOTE ABOUT FORWARD-LOOKING STATEMENTS | 1 |

| PART I. FINANCIAL INFORMATION | 2 |

| Item 1. Financial Statements | 2 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 3. Quantitative & Qualitative Disclosures about Market Risks | 25 |

| Item 4. Controls and Procedures | 26 |

| PART II OTHER INFORMATION | 27 |

| Item 1. Legal Proceedings | 27 |

| Item 1A. Risk Factors | 27 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 27 |

| Item 3. Defaults upon Senior Securities | 27 |

| Item 5. Other Information | 27 |

| Item 6. Exhibits | 28 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Statements in this report may be "forward-looking statements." Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements include, among other things, statements regarding:

| • | the growth of our business and revenues and our expectations about the factors that influence our success; |

| • | our plans to continue to invest in systems, facilities, and infrastructure, increase our hiring and grow our business; |

| • | our plans for our MassRoots for Business portal and the strategy and timing of any plans to monetize our network, including the paid conversion rates and the willingness of businesses to utilize our premium memberships; |

| • | our user growth expectations; |

| • | our ability to attain funding and the sufficiency of our sources of funding; |

| • | our proposed partnership with Flowhub and the consummation of such a partnership and/or the results of the partnership, if created; |

| • | our expectation that our cost of revenues, development expenses, sales and marketing expenses, and general and administrative expenses will increase; |

| • | fluctuations in our capital expenditures; |

as well as other statements regarding our future operations, financial condition and prospects, and business strategies. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this report, including the risks described under "Risk Factors" in our Registration Statement filed and any risks described in any other filings we make with the SEC. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this report.

Management’s discussion and analysis of financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. On an on-going basis, we evaluate these estimates, including those related to useful lives of real estate assets, cost reimbursement income, bad debts, impairment, net lease intangibles, contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There can be no assurance that actual results will not differ from those estimates.

Unless we have indicated otherwise or the context otherwise requires, references in the prospectus to “MassRoots,” the “Company,” “we,” “us” and “our” or similar terms are to MassRoots, Inc.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

| MASSROOTS, INC. | ||||||||

| BALANCE SHEETS | ||||||||

| AS OF JUNE 30, 2015 AND DECEMBER 31, 2014 | ||||||||

| Jun 30, 2015 | Dec 31, 2014 | |||||||

| (UNAUDITED) | (AUDITED) | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 171,363 | $ | 141,928 | ||||

| Other receivables | 70 | 11,201 | ||||||

| Prepaid expense | 979,925 | 130,797 | ||||||

| TOTAL CURRENT ASSETS | 1,151,358 | 283,926 | ||||||

| FIXED ASSETS | ||||||||

| Computer and office equipment | 54,347 | 16,189 | ||||||

| Accumulated depreciation | (6,121 | ) | (2,027 | ) | ||||

| NET FIXED ASSETS | 48,226 | 14,162 | ||||||

| OTHER ASSETS | ||||||||

| Prepaid expense | 65,891 | 65,891 | ||||||

| Investment in Flowhub | 175,000 | 0 | ||||||

| Deposits | 35,352 | 2,550 | ||||||

| Total Other Assets | 276,243 | 68,441 | ||||||

| TOTAL ASSETS | 1,475,827 | 366,529 | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts Payable | 69,599 | 25,842 | ||||||

| Accrued expenses | 25,695 | 23,917 | ||||||

| Accrued payroll tax | 0 | 1,778 | ||||||

| Derivative liabilities | 386,432 | 1,099,707 | ||||||

| TOTAL CURRENT LIABILITIES | 481,726 | 1,151,244 | ||||||

| LONG-TERM LIABILITY | ||||||||

| Convertible debentures, net of $56,669 and $107,016 discount, respectively | 152,430 | 162,084 | ||||||

| TOTAL LIABILITIES | 634,156 | 1,313,328 | ||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Common stock, $0.001 par value, 200,000,000 shares authorized; 44,505,238 and 38,909,000 shares issued and outstanding | 44,505 | 38,909 | ||||||

| Common stock to be issued | 857 | 1,048 | ||||||

| Common stock - warrants | 0 | 0 | ||||||

| Additional paid in capital | 6,303,740 | 2,372,867 | ||||||

| Common stock subscription receivable | (80,000 | ) | 0 | |||||

| Deficit accumulated through the development stage | (5,427,431 | ) | (3,359,623 | ) | ||||

| TOTAL STOCKHOLDERS' EQUITY | 841,671 | (946,799 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,475,827 | $ | 366,529 | ||||

| The accompanying notes are an integral part of these financial statements. | ||||||||

| MASSROOTS, INC. | ||||||||||||||||

| STATEMENT OF OPERATIONS | ||||||||||||||||

| FOR THE 3 MONTHS ENDED JUNE 30, 2015 | FOR THE 3 MONTHS ENDED JUNE 30, 2014 | FOR THE 6 MONTHS ENDED JUNE 30, 2015 | FOR THE 6 MONTHS ENDED JUNE 30, 2014 | |||||||||||||

| (UNAUDITED) | (UNAUDITED) | (UNAUDITED) | (UNAUDITED) | |||||||||||||

| ADVERTISING REVENUE | $ | 2,126 | $ | 744 | $ | 3,066 | $ | 1,739 | ||||||||

| COST OF GOODS SOLD | 0 | 0 | 0 | 690 | ||||||||||||

| GROSS PROFIT | 2,126 | 744 | 3,066 | 1,049 | ||||||||||||

| GENERAL AND ADMINISTRATIVE EXPENSES: | ||||||||||||||||

| Advertising | 208,830 | 50,426 | 263,119 | 80,930 | ||||||||||||

| Depreciation | 2,997 | 396 | 4,094 | 628 | ||||||||||||

| Independent contractor expense | 67,961 | 37,660 | 133,950 | 59,728 | ||||||||||||

| Legal expenses | 70,080 | 115,375 | 86,005 | 124,575 | ||||||||||||

| Accounting and Consulting | 121,723 | 10,662 | 147,654 | 10,662 | ||||||||||||

| Payroll and related expense | 359,440 | 54,082 | 522,370 | 86,990 | ||||||||||||

| Common stock issued for services | 254,388 | 4,612 | 368,100 | 4,612 | ||||||||||||

| Options issued for services | 266,562 | 7,363 | 313,571 | 7,363 | ||||||||||||

| Warrants issued for services | 22,579 | 0 | 26,411 | 555,598 | ||||||||||||

| Travel and related expenses | 46,443 | 0 | 66,611 | 1,140 | ||||||||||||

| Other general and administrative expenses | 72,128 | 21,301 | 126,998 | 51,158 | ||||||||||||

| Total General and Administrative expenses | 1,493,131 | 301,877 | 2,058,883 | 983,384 | ||||||||||||

| (LOSS) FROM OPERATIONS | (1,491,005 | ) | (301,133 | ) | (2,055,817 | ) | (982,335 | ) | ||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Change in derivative liabilities | 0 | 0 | 42,737 | 0 | ||||||||||||

| Interest expense | (2,091 | ) | 0 | (4,381 | ) | 0 | ||||||||||

| Amortization of discount on notes payable | (24,201 | ) | (16,418 | ) | (50,347 | ) | (17,681 | ) | ||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | (1,517,297 | ) | (317,551 | ) | (2,067,808 | ) | (1,000,016 | ) | ||||||||

| PROVISION FOR INCOME TAXES | 0 | 0 | 0 | 0 | ||||||||||||

| NET (LOSS) | $ | (1,517,297 | ) | $ | (317,551 | ) | $ | (2,067,808 | ) | $ | (1,000,016 | ) | ||||

| Basic and fully diluted net income (loss) per common share: | $ | (0.03 | ) | N/A | $ | (0.05 | ) | N/A | ||||||||

| Weighted average common shares outstanding | 43,535,697 | N/A | 41,972,190 | N/A | ||||||||||||

| The accompanying notes are an integral part of these financial statements. | ||||||||||||||||

| MASSROOTS, INC. | ||||||||

| STATEMENT OF CASHFLOWS | ||||||||

| FOR THE 6 MONTHS ENDED JUNE 30, 2015 AND JUNE 30, 2014 | ||||||||

| FOR THE 6 MONTHS ENDED JUNE 30, 2015 (UNAUDITED) | FOR THE 6 MONTHS ENDED JUNE 30, 2014 (UNAUDITED) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net (loss) | $ | (2,067,808 | ) | $ | (1,000,016 | ) | ||

| Adjustments to reconcile net (loss ) to net cash (used in) operating activities: | ||||||||

| Amortization of discounts on notes payable | 50,347 | 17,681 | ||||||

| Depreciation | 4,094 | 628 | ||||||

| Common stock issued for services | 368,100 | 4,612 | ||||||

| Options issued for services | 313,571 | 7,363 | ||||||

| Warrants issued for services | 26,411 | 555,598 | ||||||

| Change in derivative liabilities | (42,737 | ) | — | |||||

| Imputed Interest expense | 4,381 | — | ||||||

| Changes in operating assets and liabilities | — | |||||||

| Other receivables | 11,131 | — | ||||||

| Prepaid expense | — | (451 | ) | |||||

| Deposit | (32,802 | ) | — | |||||

| Accounts payable and other liabilities | 15,911 | 333 | ||||||

| Accrued payroll tax | (2,642 | ) | (1,846 | ) | ||||

| Net Cash (Used in) Operating Activities | (1,352,043 | ) | (416,098 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Payments for equipment | (38,158 | ) | (6,512 | ) | ||||

| Investment in Flowhub | (175,000 | ) | — | |||||

| Net Cash (Used in) Investing Activities | (213,158 | ) | (6,512 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Issuance of convertible Debentures for cash | — | 269,100 | ||||||

| Issuance of common stock for cash | 1,298,700 | 205,900 | ||||||

| Warrants Exercised | 295,936 | |||||||

| Net Cash Provided by Financing Activities | 1,594,636 | 475,000 | ||||||

| NET INCREASE IN CASH | 29,435 | 52,390 | ||||||

| CASH AT BEGINNING OF PERIOD | 141,928 | 80,479 | ||||||

| CASH AT END OF YEAR | $ | 171,363 | $ | 132,869 | ||||

| NON-CASH FINANCING ACTIVITIES | ||||||||

| Common stock, Warrants, and Options issued as prepaid expense | $ | 849,128 | — | |||||

| Repayment of short term borrowing - related party through issuance of preferred stock | — | — | ||||||

| The report on the financial statements and accompanying notes are an integral part of these financial statements. | ||||||||

MassRoots, Inc.

Notes to Financial Statements

June 30, 2015

(Unaudited)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

MassRoots, Inc. (the “Company”) is a social network for the cannabis community. Through its mobile applications, systems and websites, MassRoots enables people to share their cannabis-related content and for businesses to connect with those consumers. The Company was incorporated in the State of Delaware on April 24, 2013.

The Company’s primary focus during the first two quarters of 2015 was increasing our userbase from around 275,000 to 420,000 users.

The Company has not focused on generating revenue to date. However, the primary source of revenue generated to date is advertising from businesses, brands and non-profits. Its secondary source of income is merchandise sales.

Basis of Presentation

The financial statements include the accounts of MassRoots, Inc. under the accrual basis of accounting.

Management’s Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. The financial statements above reflect all of the costs of doing business.

Deferred Taxes

The Company accounts for income taxes under Section 740-10-30 of the FASB Accounting Standards Codification. Deferred income tax assets and liabilities are determined based upon differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of operations in the period that includes the enactment date.

Cash and Cash Equivalents

For purposes of the Statement of Cash Flows, the Company considers highly liquid investments with an original maturity of three months or less to be cash equivalents.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when services are realized or realizable and earned less estimated future doubtful accounts. The Company considers revenue realized or realizable and earned when all of the following criteria are met:

| (i) | persuasive evidence of an arrangement exists, |

| (ii) | the services have been rendered and all required milestones achieved, |

| (iii) | the sales price is fixed or determinable, and |

| (iv) | Collectability is reasonably assured. |

MassRoots primarily generates revenue by charging businesses to advertise on the network. MassRoots has the ability to target advertisements directly to a clients’ target audience, based on their location, on their mobile devices. All advertising services take between a few hours to up to one month to complete, unless otherwise noted.

MassRoots’ secondary source of income is merchandise sales. The objective with the sales is not to generate large profit margins, but to help offset the cost of marketing. Each t-shirt, sticker and jar MassRoots sells will likely lead to more downloads and active users.

Cost of Sales

The Company’s policy is to recognize cost of sales in the same manner in conjunction with revenue recognition, when the costs are incurred. Cost of sales includes the costs directly attributable to revenue recognition. Selling, general and administrative expenses are charged to expense as incurred.

Comprehensive Income (Loss)

The Company reports comprehensive income and its components following guidance set forth by section 220-10 of the FASB Accounting Standards Codification which establishes standards for the reporting and display of comprehensive income and its components in the financial statements. There were no items of comprehensive income (loss) applicable to the Company during the periods covered in the financial statements.

Loss Per Share

Net loss per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period.

Risk and Uncertainties

The Company is subject to risks common to emerging companies in the technology and cannabis industries, including, but not limited to, the uncertain governmental regulation of cannabis, the development of new technological innovations, potential lack of funding needed to reach our business goals and dependence on key personnel.

Convertible Debentures

If the conversion features of conventional convertible debt provides for a rate of conversion that is below market value at issuance, this feature is characterized as a beneficial conversion feature (“BCF”). A BCF is recorded by the Company as a debt discount pursuant to ASC Topic 470-20 “Debt with Conversion and Other Options.” In those circumstances, the convertible debt is recorded net of the discount related to the BCF, and the Company amortizes the discount to interest expense, over the life of the debt using the effective interest method.

Stock-Based Compensation

The Company accounts for stock-based compensation using the fair value method following the guidance set forth in section 718-10 of the FASB Accounting Standards Codification for disclosure about Stock-Based Compensation. This section requires a public entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award (with limited exceptions). That cost will be recognized over the period during which an employee is required to provide service in exchange for the award- the requisite service period (usually the vesting period). No compensation cost is recognized for equity instruments for which employees do not render the requisite service.

Fair Value for Financial Assets and Financial Liabilities

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

Our financial instruments include cash, accounts receivable, prepaid expense, investment in Flowhub, deposit, accounts payable, accrued liabilities, convertible note payable, and derivative liabilities.

The carrying values of the Company's cash, prepaid expense, investment in Flowhub, deposit, accrued liabilities approximate their fair value due to their short-term nature. The Company's convertible notes payable are measured at amortized cost.

The derivative liabilities are stated at their fair value as a Level 3 measurement. The Company used a Black-Scholes model to determine the fair values of these derivative liabilities. See Note 4 for the Company's assumptions used in determining the fair value of these financial instruments.

Embedded Conversion Features

The Company evaluates embedded conversion features within convertible debt under ASC 815 “Derivatives and Hedging” to determine whether the embedded conversion feature(s) should be bifurcated from the host instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings. If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated under ASC 470-20 “Debt with Conversion and Other Options” for consideration of any beneficial conversion feature.

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market, or foreign currency risks. The Company evaluates all of it financial instruments, including stock purchase warrants, to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported as charges or credits to income.

For option-based simple derivative financial instruments, the Company uses the Black-Scholes option-pricing model to value the derivative instruments at inception and subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records a "beneficial conversion feature" ("BCF") and related debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument (offset to additional paid in capital) and amortized to interest expense over the life of the debt.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. ASU 2014-10 eliminates the distinction of a development stage entity and certain related disclosure requirements, including the elimination of inception-to-date information on the statements of operations, cash flows and stockholders' equity. The amendments in ASU 2014-10 will be effective prospectively for annual reporting periods beginning after December 15, 2014, and interim periods within those annual periods, however early adoption is permitted for financial statements not yet issued. The Company adopted ASU 2014-10 during the fourth quarter of 2014, thereby no longer presenting or disclosing any information required by Topic 915. The Company has reviewed all recently issued, but not yet effective, accounting pronouncements up to ASU 2015-10, and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

NOTE 2 - FIXED ASSETS

Fixed assets were comprised of the following as of June 30, 2015 and December 31, 2014. Depreciation is calculated using the straight-line method over a 5 year period.

| December 31, 2014 | June 30, 2015 | |||||||

| Cost: | ||||||||

| Computers | 12,134 | 31,033 | ||||||

| Office equipment | 4,055 | 23,314 | ||||||

| Total | 16,189 | 54,347 | ||||||

| Less: Accumulated depreciation | 2,027 | 6,121 | ||||||

| Property and equipment, net | 14,162 | 1,294 | ||||||

NOTE 3 - PREPAID EXPENSE

During the first quarter 2015, the Company issued 430,000 shares of its common stock, 100,000 warrants and 1,065,000 options in exchange for services, valued in the aggregate at $782,695. The $782,695 is being charged to operations over a one-year term.

On April 28, 2015, the Company entered into a consulting agreement with Torrey Hills Capital. Under the terms of the agreement, Torrey Hills Capital is to receive 75,000 shares of common stock and $5,000 per month for setting-up non-deal roadshows for the Company. The service period is 4 months.

On May 12, 2015, the Company entered into a consulting agreement with Caro Capital. Under the terms of the agreement, Caro is to receive 200,000 shares of common stock and $2,000 per month for setting-up non-deal roadshows for the Company for a period of one year.

On June 15, 2015, the Company entered into a consulting agreement with Demeter Capital. Under the terms of the agreement, Demeter Capital is to receive 100,000 shares of common stock for introductions to investors. The service period is 6 months.

On June 4, 2014, the Company issued a total of 850,000 shares of its common stock and 2,050,000 options in exchange for consulting services, valued in the aggregate at $286,818. The $286,818 is being charged to operations over a three-year term.

Compensation from equity issuances charged to operations during the six months ended June 30, 2015 and June 30, 2014 was $708,082 and $567,573, respectively. The expense related to the amortization of prepaid expense is $593,939. The unamortized balance at June 30, 2015 and at December 31, 2014 was $1,045,816 and $196,688, respectively.

NOTE 4 - DERIVATIVE LIABILITIES

The Company had previously identified conversion features embedded within warrants received in connection with the issuance of convertible debt and, separately, within warrants received in connection with the issuance of common stock. The Company has determined that the features associated with the embedded conversion option, in the form a ratchet provision, should be accounted for at fair value, as a derivative liability, as the Company cannot determine if a sufficient number of shares would be available to settle all potential future conversion transactions.

During the second quarter of 2015, the Company and the holders of warrants previously issued as part of our offering in March 2014 with an exercise price of $0.40 agreed to amend the warrants to remove the ratchet provision. This reduced the Company’s derivative liability by $835,593 and increased additional paid in capital by the same amount.

As a result of the application of ASC No. 815, the fair value of the ratchet feature related to convertible debt and warrants is summarized as follow:

| Warrants with Convertible Debt | Warrants with Issuance of Common Stock | Warrants Issued For Services | Total | |||||||||||||

| Fair value at the commitment date | $ | 87,189 | $ | 259,278 | $ | 0 | $ | 346,467 | ||||||||

| Fair value mark to market adjustment | 429,948 | 323,293 | 753,241 | |||||||||||||

| Balances as of December 31, 2014 | 517,137 | 582,571 | 0 | 1,099,708 | ||||||||||||

| Fair value at the commitment date - in first quarter 2015 | 125,708 | 0 | 43,704 | 169,412 | ||||||||||||

| Fair value mark to market adjustment | (24,677 | ) | (17,841 | ) | (219 | ) | (42,737 | ) | ||||||||

| Balances as of March 31, 2015 | 618,168 | 564,730 | 43,485 | 1,226,383 | ||||||||||||

| Fair value at the commitment date - in second quarter 2015 | 51,378 | 51,378 | ||||||||||||||

| Reclassified to additional paid-in capital due to amendment of agreements. | (618,168) | (273,161 | ) | — | (835,593 | ) | ||||||||||

| Balances as of June 30, 2015 | $ | 0 | $ | 291,569 | $ | 94,863 | $ | 386,432 | ||||||||

The fair value at the commitment and re-measurement dates for the Company’s derivative liabilities were based upon the following management assumptions as of June 30, 2015:

| Commitment Date | Remeasurement Date | |||||||

| Expected dividends | 0% | 0% | ||||||

| Expected volatility | 150% | 150% | ||||||

| Expected term | 3-5 years | 1.83 – 4.70 years | ||||||

| Risk free interest rate | 0.75% - 1.1% | 0.89% - 1.35% | ||||||

NOTE 5 - DEBT DISCOUNT

The Company recorded the $174,378 debt discount due to beneficial conversion feature of $87,189 for the detachable warrants issued with convertible debt, and $87,189 in derivative liabilities related to the ratchet feature warrants.

The debt discount was recorded in 2014 and pertains to convertible debt and warrants issued that contain ratchet features that are required to be bifurcated and reported at fair value.

Debt discount is summarized as follows:

| June 30, 2015 | December 31, 2014 | |||||||

| Deb discount on notes payable | $ | 107,016 | $ | 174,379 | ||||

| Accumulated amortization | (50,347 | ) | (67,363 | ) | ||||

| Debt discount on notes payable, net | $ | 56,669 | $ | 107,016 | ||||

Amortization of debt discount on notes payable for the six months ended June 30, 2015 and June 30, 2014 was $50,347 and $17,681, respectively.

NOTE 6 - CONVERTIBLE DEBENTURES

On March 24, 2014, the Company issued convertible debentures to certain accredited investors. The total principal amount of the debentures is $269,100 and matures on March 24, 2016 with a zero percent interest rate. The debentures are convertible into shares of the Company’s common stock at $0.10 per share.

The debentures were discounted in the amount of $174,378 due to the intrinsic value of the beneficial conversion option and relative derivative liabilities of the warrants.

On January 7, 2015, one holder of a convertible debenture converted $40,000 of principal into 400,000 shares of common stock.

On April 4, 2015, one holder of a convertible debenture converted $20,000 of principal into 200,000 shares of common stock.

As of June 30, 2015, the aggregate carrying value of the debentures was $152,430 net of debt discounts of $56,670, while as of December 31, 2014, the aggregate carrying value of the debentures was $162,084 net of debt discounts of $107,016.

NOTE 7 - CAPITAL STOCK

The Company is currently authorized to issue 21 Series A preferred shares at $1.00 par value per share with 1:1 conversion and voting rights. As of June 30, 2015, there were 0 shares of Series A preferred shares issued and outstanding.

The Company is currently authorized to issue 200,000,000 shares of its common stock at $0.001 par value per share. As of June 30, 2015, there were 44,505,238 shares of common stock issued and outstanding and 857,000 shares of common stock to be issued.

On March 18, 2014, the Company entered into a Plan of Reorganization with its shareholders in which the following was effected: (i) on March 21, 2014, the Company’s Certificate of Incorporation was amended to allow for the authorization of 200,000,000 shares of the Company’s common stock; (ii) on March 24, 2014, each of the Company’s preferred shareholders converted their shares into common stock on a one for one basis; and (iii) on March 24, 2014, each of the Company’s shareholders surrendered their shares of the Company’s common stock in exchange for the pro-rata distribution of 36,000,000 newly issued shares of Company’s common stock, based on the percentage of the total shares of common stock held by the shareholder immediately prior to the exchange (the “Exchange”).

On January 1, 2014, the Company’s directors and officers exercised all of the then outstanding 72.06 stock options and acquired 72.06 shares of common stock at $1 per share. These 72.06 shares of common stock were exchanged for 21,954,160 shares of common stock during the Exchange.

On March 18, 2014, immediately prior to the Exchange, the Company converted $4,358 accrued dividends from Series A preferred shares into 0.513 shares of common stock, which was exchanged for 156,293 shares of common stock during the Exchange.

On March 24, 2014, the Company issued 2,059,000 shares of common stock in exchange for $205,900 cash.

On June 4, 2014, the Company issued 250,000 shares of common stock to Vincent “Tripp” Keber valued at $0.10 per share in exchange for his services on the Company’s Board of Directors for three years under the 2014 Equity Incentive Plan (“2014 Plan”). These shares had a fair market value of $25,000, of which $2,055 and $4,110 was amortized during the quarter and six months ended June 30, 2015, respectively.

On June 4, 2014, the Company issued 250,000 shares of common stock under the 2014 Plan to Ean Seeb valued at $0.10 per share in exchange for his services on the Company’s Board of Directors for three years. These shares had a fair market value of $25,000, of which $2,055 and $4,110 was amortized during the quarter and six months ended June 30, 2015, respectively.

On June 4, 2014, the Company issued 250,000 shares of common stock under the 2014 Plan to Sebastian Stant valued at $0.10 per share in exchange for his services as the Company’s Lead Web Developer for one year. These shares had a fair market value of $25,000, of which $4,452 and 10,616 was amortized during the quarter and six months ended June 30, 2015, respectively.

On May 1, 2014, the Company issued 100,000 shares of common stock under the 2014 Plan to Jesus Quintero valued at $0.10 per share in exchange for his services as the Company’s Chief Financial Officer for one year. These shares had a fair market value of $10,000, of which $849 and $3,315 was amortized during the quarter and six months ended June 30, 2015, respectively.

From September 15, 2014 to March 11, 2015, we completed an offering of $866,000 of our securities to certain accredited and non-accredited investors consisting of 1,732,000 shares of our common stock at $0.50 per share. As of June 30, 2015, all 1,732,000 shares of common stock had been issued.

On March 3, 2015, MassRoots entered into an investment banking relationship with Chardan Capital Markets, LLC. Under the terms of the agreement, MassRoots shall pay Chardan a non-refundable retainer of 200,000 common shares and pay a commission equal to: (a) an aggregate cash fee equal to four percent (4%) of the gross proceeds received from the sale of common stock; and (b) an aggregate restricted stock fee equal to eight percent (8.0%) of the aggregate number of shares of common stock sold in the offering.

From January 1 to March 31, 2015, the Company issued 230,000 shares of common stock to five employees and consultants under our 2014 Employee Stock Option Program.

During April 2015, the Company issued 960,335 shares of common stock in exchange for $576,200 cash.

On April 28, 2015, the Company entered into a consulting agreement with Torrey Hills Capital. Under the terms of the agreement, Torrey Hills Capital is to receive 75,000 shares of common stock and $5,000 per month for setting-up non-deal roadshows for the Company.

On May 12, 2015, the Company entered into a consulting agreement with Caro Capital. Under the terms of the agreement, Caro is to receive 200,000 shares of common stock and $2,000 per month for setting-up non-deal roadshows for the Company for a period of one year.

On June 15, 2015, the Company entered into a consulting agreement with Demeter Capital. Under the terms of the agreement, Demeter Capital is to receive 100,000 shares of common stock for consulting services. The 100,000 shares have not been issued as of June 30, 2015 and were recorded as common stock to be issued.

In June 2015, the Company signed agreements to issue 607,335 shares of common stock in exchange for $455,500 cash. The 607,335 shares have not been issued as of June 30, 2015 and were recorded as common stock to be issued.

During the second quarter of 2015, the Company issued 1,686,341 shares of common stocks and received $300,936 due to the exercise of warrants. As of June 30, 2015, 1,536,341 shares of common stock had been issued from these exercises. The remaining 150,000 shares have not been issued as of June 30, 2015 and were recorded as common stock to be issued.

During the second quarter of 2015, the Company issued 654,050 shares of common stock which previously were classified as common stock to be issued on March 31, 2015.

NOTE 8 - STOCK WARRANTS

On March 24, 2014, the Company issued warrants to a third party for the purchase of 4,050,000 and 2,375,000 shares of common stock, at an exercise price of $0.001 and $0.40 per share, respectively. The warrants may be exercised any time after issuance through and including the third (3rd) anniversary of its original issuance. The Company recorded an expense of $555,598 equal to the estimated fair value of the warrants at the date of grants. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 0.75% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 3 years

On March 24, 2014, in connection to the issuance of convertible debentures of $269,100 to certain investors, which are convertible into shares of the Company’s common stock at $0.10 per share, the Company granted to the same investors three−year warrants to purchase an aggregate of up to 1,345,500 shares of the Company’s common stock at $0.4 per share. The warrants may be exercised any time after the issuance through and including the third (3rd) anniversary of its original issuance.

On March 24, 2014, in connection to the issuance of 2,059,000 shares of common stock, the Company granted to the same investor three−year warrants to purchase an aggregate of 1,029,500 shares of the Company’s common stock at $0.4 per share. The warrants may be exercised any time after the issuance through and including the third (3rd) anniversary of its original issuance. The warrants have a fair market value of $66,712. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 0.75% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 3 years. See Note 4 for further discussion.

During the four months ended December 31, 2014, in connection to the sale of 1,048,000 shares of common stock, the Company granted to the same investors three−year warrants to purchase an aggregate of 524,000 shares of the Company’s common stock at $1.00 per share. The warrants may be exercised any time after the issuance through and including the third (3rd) anniversary of its original issuance. The warrants have a fair market value of $42,650. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 1% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 3 years. See Note 4 for further discussion.

During the three months ended March 31, 2015, in connection to the sale of 684,000 shares of common stock, the Company granted to the same investors three−year warrants to purchase an aggregate of 342,000 shares of the Company’s common stock at $1.00 per share. The warrants may be exercised any time after the issuance through and including the third (3rd) anniversary of its original issuance. The warrants have a fair market value of $125,708. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 1% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 3 years. See Note 4 for further discussion.

On February 27, 2015, the Company sold warrants for a nominal amount to purchase 100,000 shares of common stock at $0.50 per share to certain service providers.

On April 8, 2015, the Company issued warrants to purchase 50,000 shares of common stock at $0.60 per share to certain service providers.

From April 1 to June 30, 2015, 750,000 of warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.40 per share for proceeds of $300,000, of which $295,000 was received during the second quarter of 2015 and the remaining $5,000 was received during the third quarter of 2015.

From April 1 to June 30, 2015, 936,341 warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.001 per share for proceeds of $936.

Stock warrants outstanding and exercisable on June 30, 2015 are as follows:

| Exercise Price per Share | Shares Under Warrants | Remaining Life in Years | ||||||||||

| Outstanding | ||||||||||||

| $ | 0.001 | 3,113,659 | 2 | |||||||||

| $ | 0.4 | 4,000,000 | 2 | |||||||||

| $ | 0.5 | 100,000 | 5 | |||||||||

| $ | 0.6 | 50,000 | 5 | |||||||||

| $ | 1 | 866,000 | 3 | |||||||||

| Exercisable | ||||||||||||

| $ | 0.001 | 3,113,659 | 2 | |||||||||

| $ | 0.4 | 4,000,000 | 2 | |||||||||

| $ | 0.5 | 100,000 | 5 | |||||||||

| $ | 0.6 | 50,000 | 5 | |||||||||

| $ | 1 | 866,000 | 3 | |||||||||

No other stock warrants have been issued or exercised during the three months ended June 30, 2015.

NOTE 9 - EMPLOYEE EQUITY INCENTIVE PLAN

In June 2014, our shareholders approved our 2014 Equity Incentive Plan (“2014 Plan”), which provides for the grant of incentive stock options to our employees and our parent and subsidiary corporations' employees, and for the grant of nonstatutory stock options, stock bonus awards, restricted stock awards, performance stock awards and other forms of stock compensation to our employees, including officers, consultants and directors. A total of 4 million shares of common stock are reserved for issuance under our 2014 Plan.

On June 4, 2014, the Company granted options to purchase 750,000 shares at $0.10 per share to Vincent “Tripp” Keber for his services on the Company’s Board of Directors for 3 years. Under the terms of the grant, 250,000 shares shall begin vesting on October 1, 2014 such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall begin vesting the later of: October 1, 2015 or the Company reaching 830,000 users such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall vest immediately upon the later of: October 1, 2016 or the Company reaching 1,080,000 users. These options were issued in exchange for his services on the Company’s Board of Directors for 3 years. The options may be exercised any time after the issuance through and including the tenth (10th) anniversary of its original issuance. The options have a fair market value of $73,836. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 2.61% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 10 years. For the six months ended June 30, 2015 $12,138 was amortized.

On June 4, 2014, the Company granted options to purchase 750,000 shares at $0.10 per share to Ean Seeb for his services on the Company’s Board of Directors for 3 years. Under the terms of the grant, 250,000 shares shall begin vesting on October 1, 2014 such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall begin vesting the later of: October 1, 2015 or the Company reaching 830,000 users such that 20,833 shares shall vest on the first of every month except for every three months, when 20,834 shares shall vest. An additional 250,000 shares shall vest immediately upon the later of: October 1, 2016 or the Company reaching 1,080,000 users. These options were issued in exchange for his services on the Company’s Board of Directors for 3 years. The options may be exercised any time after the issuance through and including the tenth (10th) anniversary of its original issuance. The options have a fair market value of $73,836. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 2.61% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 10 years. For the six months ended June 30, 2015 $12,138 was amortized.

On June 4, 2014, the Company granted options to purchase 550,000 shares at $0.10 per share to Sebastian Stant for his services as the Company’s Lead Web Developer for 1 year. Under the terms of the grant, 250,000 shares shall vest immediately upon the Company reaching 250,000 users. An additional 150,000 shares shall vest immediately upon the Company reaching 500,000 users. An additional 150,000 shares shall vest immediately upon the Company reaching 750,000 users. The options were issued in exchange for his services as the Company’s Lead Web Developer for 1 year. The options may be exercised any time after the issuance through and including the tenth (10th) anniversary of its original issuance. The options have a fair market value of $54,146. The fair market value was calculated using the Black-Scholes options pricing model, assuming approximately 2.61% risk-free interest, 0% dividend yield, 150% volatility, and expected life of 10 years. For the six months ended June 30, 2015 $12,328 was amortized.

On March 9, 2015, Sebastian Stant resigned his position as Lead Developer of MassRoots and surrendered 350,000 options with a strike price of $0.10 per share back to the 2014 Plan.

From January 1 to March 31, 2015, the Company granted 230,000 shares and options to purchase 1,065,000 shares at $0.50 per share to 20 employees and consultants of the Company, with most vesting monthly over the course of one year. The fair market value of the options are $523,991.

On April 8, 2015, the Company granted options to purchase 105,000 shares at $0.6 per share to 3 employees and consultants of the Company, with most vesting monthly over the course of one year. The fair market value of the options are $114,143.

Stock options outstanding and exercisable on June 30, 2015 are as follows:

| Exercise Price per Share | Shares Under Options | Remaining Life in Years | ||||||||||

| Outstanding | ||||||||||||

| $ | 0.10 | 1,750,000 | 9 | |||||||||

| $ | 0.50 | 1,065,000 | 10 | |||||||||

| $ | 0.60 | 105,000 | 10 | |||||||||

| Exercisable | ||||||||||||

| $ | 0.10 | 625,000 | 9 | |||||||||

| $ | 0.50 | 532,584 | 10 | |||||||||

| $ | 0.60 | 17,498 | 10 | |||||||||

No other stock options have been issued or exercised during the three months ended June 30, 2015.

NOTE 10 - GOING CONCERN AND UNCERTAINTY

The Company has suffered losses from operations since inception. In addition, the Company has yet to generate an significant cash flow from its business operations. These factors raise substantial doubt as to the ability of the Company to continue as a going concern.

Management’s plans with regard to these matters encompass the following actions: 1) obtain funding from new and potentially current investors to alleviate the Company’s working deficiency, and 2) implement a plan to generate sales. The Company’s continued existence is dependent upon its ability to translate its vast user base into sales. However, the outcome of management’s plans cannot be ascertained with any degree of certainty. The accompanying unaudited financial statements do not include any adjustments that might result from the outcome of these risks and uncertainties.

NOTE 11 - SIGNIFICANT EVENTS

From April 1, 2015 through April 17, 2015, the Company completed an offering of 960,933 restricted shares of the Company’s common stock, par value $0.001 per share to certain accredited and unaccredited investors. The shares were offered pursuant to subscription agreements with each investor for aggregate gross proceeds to the Company of $576,200. The Company compensated Chardan Capital $20,000 cash and 262,560 shares of common stock as commission for this placement.

From April 1, 2015 to June 30, 2015, the Company issued 3,020,828 shares of common stock: 200,000 shares for the conversion of a debenture with a face value of $20,000 at $0.10 per share, 224,000 shares to the $0.50 round investors from January to March 2015, 960,337 shares to the $0.60 round investors during April 2015, 262,650 shares to Chardan Capital for placement agent services, 936,341 shares for the exercise of $0.001 warrants, and 600,000 shares for the exercise of the $0.40 financing warrants.

On April 28, 2015, the Company entered into a consulting agreement with Torrey Hills Capital. Under the terms of the agreement, Torrey Hills Capital is to receive 75,000 shares of common stock and $5,000 per month for setting-up non-deal roadshows for the Company. These shares were issued on June 3, 2015.

From April 1 to June 30, 2015, 750,000 warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.40 per share for proceeds of $300,000, of which $295,000 was received during the second quarter of 2015 and the remaining $5,000 was received during Q3.

From April 1 to June 30, 2015, 936,341 of warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.001 per share for proceeds of $936.34.

On May 12, 2015, the Company entered into a consulting agreement with Caro Capital. Under the terms of the agreement, Caro is to receive 200,000 shares of common stock and $2,000 per month for setting-up non-deal roadshows for the Company for a period of one year. These shares were issued on June 3, 2015.

On June 15, 2015, the Company entered into a consulting agreement with Demeter Capital. Under the terms of the agreement, Demeter Capital is to receive 100,000 shares of common stock for introductions to investors.

On June 19, 2015, the Company retained Mr. Daniel C. Hunt as Chief Operating Officer of the Company, effective immediately. Mr. Hunt succeeds Ms. Hyler Fortier, who resigned as Chief Operating Officer of the Company as of that same date. Ms. Fortier will continue with the Company as the Company’s Director of Branding, a non-executive role. Mr. Hunt will receive a salary of $78,000 per year and is an “at-will” agreement and may be terminated by either party with or without cause with one (1) month’s written notice. No retirement plan, health insurance or other employee benefits were awarded to Mr. Hunt and he shall serve at the direction of the Company’s Chief Executive Officer and Board.

From June 10 to June 30, 2015, the Company sold 606,669 shares of unregistered common stock for gross proceeds of $455,000, of which $380,000 was received by June 30, 2015.

On June 30, 2015, the Company had recorded 150,000 registered common shares to be issued for the exercise of $0.40 warrants, 606,669 unregistered common stock to be issued for purchasers of the $0.75 private placement, and 100,000 unregistered common shares to be issued to Demeter Capital for services rendered.

NOTE 12 - SUBSEQUENT EVENTS

From July 1 to July 13, 2015, MassRoots sold an additional 834,004 shares of unregistered common stock for gross proceeds totaling $610,502. This round was closed on July 13, 2015. As of July 21, 2015, all $1,065,502 had been received. In connection with this offering, Chardan will receive $27,200 in cash and 76,560 shares of the Company’s common stock as commission for this placement.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with our unaudited financial statements and related notes contained in Part I, Item 1 of this Quarterly Report. Please also refer to the Note About Forward Looking Statements for information on such statements contained in this Quarterly Report immediately preceding Item 1.

Overview

MassRoots, Inc. is a Delaware corporation formed on April 24, 2013. Our principal place of business is located at 1624 Market Street, Suite 201, Denver, CO 80202, our telephone number is (720) 442-0052 and our corporate website is corporate.massroots.com. The information on our website or mobile apps is not a part of this Quarterly Report on Form 10-Q.

User Growth and Social Following

Total users ("Users") is defined as every user who currently has an account with MassRoots. It does not include users who have deleted their account. It does not reflect active usage over any set period of time.

Figure 1: Our monthly User growth beginning from July 2013 through June 2015

During the second quarter of 2015, MassRoots expanded its userbase by 45%, from approximately 275,000 to 400,000 cannabis consumers. We believe MassRoots’ userbase has hit critical mass during the second quarter of 2015. Our growth was primarily driven by MassRoots’ increasing popularity as one of the first national cannabis brands and word of mouth virility from our users. Based on our current projections, we expect MassRoots to cross 1 million Users in late 2015 or early 2016.

During June 2015, MassRoots generated 100 million “newsfeed impressions”, defined as a User viewing a post on MassRoots’ local, global or buds feeds.

We believe MassRoots has the largest social following of any marijuana-related App. During the second quarter of 2015, MassRoots expanded its Instagram from 168,000 to 220,000 followers, its Twitter following from 86,000 to 102,000 followers, and its Facebook from 37,000 to 109,000 followers. In mid-June 2015, MassRoots became one of the first cannabis brands to be verified by Twitter. MassRoots’ large social followings is a major driver of new users, re-engaging existing users and allows us to broadcast our message beyond our current existing userbase.

Business Model and MassRoots for Business

We launched MassRoots for Business in early March 2015 as a free online portal for dispensaries to schedule posts, view analytics and gain insights into their followers. Over 1,000 cannabis businesses were utilizing MassRoots for Business as of June 30, 2015, including 46% of the dispensaries in Colorado and 85% of dispensary chains with more than four stores.

| MassRoots

for Business – Expected Premium Business Memberships (Rollout Planned in Q3 2015) | ||

| Premium Upgrade | Cost | Benefits |

| Premium Profiles | $49/Month | • MassRoots Verified Badge • Enhanced Profile Access |

| Data Access | $149/Month | • Detailed Geo-Based Analytics • Area Activity Heat Maps |

| Market Insights | $349/Month | • Insight on Trending Strains, Products, Services, and Hashtags • Area Reach and Exposure Data |

| Sponsored Posts | $20/CPM | • Targeted, Enhanced Exposure Posts |

During the third quarter of 2015, we expect to begin to extend MassRoots for Business’ functionality to allow dispensaries and cannabis-related businesses to upgrade to premium business profiles, access market data, and to gain premium placement in search results for a monthly fee, as outlined above. Additionally, we plan to allow businesses to sponsor posts in users’ newsfeeds, similar to Facebook and Twitter, and expect to be able to charge roughly $20 per thousand impressions for targeted sponsored posts.

We are not re-creating the wheel with our revenue model: this is already the model WeedMaps and Leafly have used to generate $25 million in annual revenue and $1 million estimated per month revenue, respectively, from cannabis-related technology businesses. As more fully explained in the “Competition,” section below, we believe that a social network offers a superior value proposition than a strain guide and dispensary locator, as social networks have greater recurring usage.

We expect to begin to generate and continue to grow revenues throughout the remainder of the year. Our current monthly burn on Company operations is approximately $250,000 and will not need to significantly scale as we start generating revenue –the main cost of generating revenue is the development of our self-service business portal, which we have been devoting resources to for several months. The system is designed in such a way that clients can set-up, manage and analyze their own campaigns and have access to certain data based on their subscription; the fulfillment of these services is automated in the backend of MassRoots, requiring little marginal manpower as we add additional clients.

Our intention is to prove MassRoots’ business model in 2015 and 2016 while the cannabis industry is still relatively small – of the 23 states with medical cannabis laws, only 4 states have active dispensary systems with wide enough set of conditions to allow a significant portion of the population to purchase cannabis (Colorado, California, Arizona and Washington). We believe the vast majority of the revenue we generate in 2015 and 2016 will come from businesses in these states. The 2016 election cycle has the potential to drastically expand the regulated cannabis market – at least 7 states are expected to have some form of cannabis legalization on the ballot that could cause the cannabis industry to grow to $10.2 billion if these initiatives become law, according to ArcView Market Research.

MassRoots’ business model is designed to scale as marijuana legalization continues to spread: every state that legalizes

the medicinal or adult-use of cannabis expands the number of licensed businesses in the industry, increasing our potential revenue.

On Competitive Advantage and Network Effects

We believe network effects serve as the most powerful form of competitive advantage for all consumer-facing social networks, including MassRoots. Once a person and their friends join a social network, it is unlikely they switch their active usage to another social network in the same category. In 2011, Google+ launched to much fanfare as the, “Facebook Killer,” with the resources of Google at its disposal: billions of dollars in launch and advertising costs, immediate integration with the largest search engine in the world, and the use of the Google brand. However, it failed to gain traction because Facebook already dominated desktop-based social networking.

Similarly, Facebook launched Poke in 2013 to take out Snapchat. Poke had much more functionality and worked better than Snapchat, it was immediately pushed to millions of Facebook users and it had the backing of Facebook’s billions of dollars in assets at its disposal. However, even this failed to make a dent in Snapchat’s market share and Poke was scrapped shortly after.

We believe MassRoots’ userbase is at the size at which it will be extremely difficult for any potential competitor to enter the social networking for cannabis consumers space, a market that MassRoots created. When Apple banned all social cannabis applications from the App Store last fall, it was MassRoots’ userbase and network that successfully fought to have the policy overturned.

Product Development

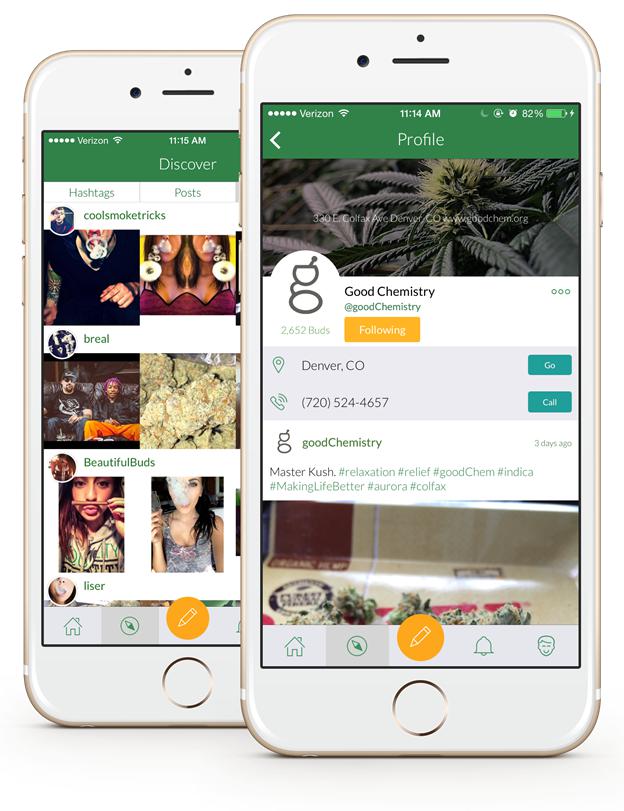

Figure 2: Examples of the current user interface of our iOS application.

During the second quarter of 2015, MassRoots introduced a new user-interface aimed at expanding its appeal beyond the “stoner” demographic into a more mainstream audience. We also introduced new Discover page interface, allowing users to more easily find the best content, connect with top influencers and find trending topics and strains.

Over the coming months, MassRoots plans to introduce premium business profiles, new user discovery features aimed at the “Cannabis Relationship” market, sponsored posts, and a revised business portal to implement the feedback we received from businesses during beta testing. Additionally, we are reviewing the implementation of a new web interface aimed at opening up MassRoots’ content to search engines, which we believe could draw hundreds of thousands of unique visitors per month, accelerating our user growth and adverting inventory.

Market Share

MassRoots’ primary objective during 2015 is rapidly expanding its market share of consumers and businesses in the cannabis industry. As of June 30, 2015, MassRoots had 400,000 users of an estimated 10 million Americans who consume cannabis on a regular basis and actively engage on social media, which we have defined as our target market. We have approximately 1,000 of the estimated 15,000 cannabis-related businesses in America actively posting on a weekly basis on our network, including approximately 46% of the dispensaries in Colorado.

420 Rally

On April 17 and 18, 2015, MassRoots was the national sponsor of the 420 Rally in Civic Center Park in Denver, CO a free music and cultural festival that drew an estimated 125,000 cannabis enthusiasts according to the Denver Post. MassRoots was the official social media application of the event, had the largest on-site presence, and our logo was included on all event collateral. CNN broadcast live from our tent on April 18. In order to discourage smoking and driving, MassRoots partnered with Uber to provide a free ride up to $20 for first time riders.

The 420 Rally primarily attracts local Denver residents, as opposed to tourists. Denver-based dispensaries and cannabis brands are primarily interested in advertising to locals, as they have the potential to become recurring customers. MassRoots' sponsorship of the 420 Rally significantly increased app usage and awareness of our brand in the Denver metro area among both cannabis consumers and dispensaries.

Investment in Flowhub

Figure 3: Our proposed partnership plan with Flowhub (as defined below).

During the second quarter of 2015, MassRoots invested $175,000 in exchange for preferred shares of Flowhub LLC (“Flowhub”), a seed-to-sale system, equal to 8.95% of the outstanding equity of Flowhub. MassRoots and Flowhub are finalizing a partnership that will combine the data from cannabis grow operations, point-of-sale systems and the MassRoots social network in one platform, data that we believe will allow cannabis dispensaries and growers to streamline operations and monitor consumer trends, potentially increasing profits. MassRoots and Flowhub are working to partially combine their systems, giving MassRoots' users access to live pricing, inventory, and an order ahead system of dispensaries. At the same time, Flowhub will be streamlining dispensaries' operations and enabling them to target ads to specific customers based on purchasing patterns and social activity. No assurance can be given that MassRoots and Flowhub will consummate a partnership or, if such a partnership is in fact consummated, that the terms and conditions will be favorable to MassRoots.

Competition

We do not believe we face any significant competition in the social network for the cannabis community niche; however, over the coming months, we expect to actively compete with dispensary locators and strain guides, such as WeedMaps and Leafly, for dispensaries' advertising budgets.

Over the coming months, MassRoots plans to implement many of the utilities WeedMaps and Leafly offer as added-in features of our community. We believe that while you can replicate a map and duplicate a strain database, you cannot replicate relationships and you cannot duplicate a community. As with any social application, recurring engagement and network effects are MassRoots' primary competitive advantage.

Over the coming months, MassRoots plans to develop, partner with, or acquire the leading software solutions for consumers, businesses and developers in the cannabis industry.

Results of Operations

| For the Three - Months Ended | ||||||||||||||||

| June 30, 2015 | June 30, 2014 | |||||||||||||||

| (Unaudited) | (Unaudited) | $ Change | % Change | |||||||||||||

| Gross profit | $ | 2,126 | $ | 744 | $ | 1,382 | 185.8 | % | ||||||||

| General and administrative expenses | 1,493,131 | 301,877 | 1,191,254 | 394.6 | % | |||||||||||

| Loss from operations | (1,491,005 | ) | (301,133 | ) | (1,189,872 | ) | 395.1 | % | ||||||||

| Other Income (Expense) | (26,292 | ) | (16,418 | ) | (9,874 | ) | 60.1 | % | ||||||||

| Net Loss | (1,517,297 | ) | (317,551 | ) | (1,199,746 | ) | 377.8 | % | ||||||||

| Net loss per share - basic and diluted | $ | (0.03 | ) | N/A | N/A | N/A | ||||||||||

| For the Six - Months Ended | ||||||||||||||||

| June 30, 2015 | June 30, 2014 | |||||||||||||||

| (Unaudited) | (Unaudited) | $ Change | % Change | |||||||||||||

| Gross profit | $ | 3,066 | $ | 1,049 | $ | 2,017 | 192.3 | % | ||||||||

| General and administrative expenses | 2,058,883 | 983,384 | 1,075,499 | 109.4 | % | |||||||||||

| Loss from operations | (2,055,817 | ) | (982,335 | ) | (1,073,482 | ) | 109.3 | % | ||||||||

| Other Income (Expense) | (11,991 | ) | (17,681 | ) | 5,690 | -32.2 | % | |||||||||

| Net Loss | (2,067,808 | ) | (1,000,016 | ) | (1,067,792 | ) | 106.8 | % | ||||||||

| Net loss per share - basic and diluted | $ | (0.05 | ) | N/A | N/A | N/A | ||||||||||

Revenues

Since inception on April 24, 2013, our business operations have been primarily focused developing our mobile applications, websites and increasing our user base.

We have generated only minimal revenues from our operations thus far. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies.

For the three months ended June 30, 2015 and June 30, 2014, we generated revenues of $2,126 and $744, respectively, while revenues for the six months ended June 30, 2015 and June 30, 2014 were $3,066 and $1,739, respectively. These revenues were primarily from merchandise purchased through Store.MassRoots.com.

Cost and Expenses

For the three months ended June 30, 2015 and June 30, 2014, our operating expenses were $1,493,131 and $301,877 respectively. This $1,191,254 increase is attributed mainly to an increase of $531,554 in equity issuances for services, an increase of $305,358 in payroll as the company brought on additional developers to accelerate its product pipeline, a $158,404 increase in advertising which was primarily driven by the costs of sponsoring the 420 Rally and attending conferences, In addition, we experienced an increase of $208,331 in travel, accounting and consulting and other general administrative expenses primarily related to non-deal roadshows, investor conferences, and other expenses related to creating a market for our common stock.

For the six months ended June 30, 2015 and June 30, 2014, our operating expenses were $2,058,883 and $983,384 respectively. This $1,075,499 increase is attributed mainly to $140,509 in equity issuances for services, an increase of $453,380 in payroll as the company brought on additional developers to accelerate its product pipeline, a $182,189 increase in advertising which was primarily driven by the costs of sponsoring the 420 Rally and attending conferences. In addition, we experienced an increase of $278,303 in travel, accounting and consulting and other general administrative expenses related to non-deal roadshows, investor conferences, and other expenses related to creating a market for our common stock.

Several of the expenses made during the six months ended June 30, 2015 were one-time expenses: a $30,000 deposit for our office, $25,000 in DTC Application and OTCQB certification fees, roughly $75,000 in costs related to the 420 Rally, $35,000 in new office equipment and computers for our development team, and a $175,000 investment in Flowhub. We determined these investments were necessary to expand MassRoots’ functionality, recruit the best technical talent, and capture the local Denver market.

Other Income (Expense)

For the three months ended June 30, 2015 and June 30, 2014, the Company realized no gain or loss related to the fair value mark to market adjustments of its derivative liabilities. For the six months ended June 30, 2015 and June 30, 2014 the company realized a gain related to the fair value of mark to market adjustments of its derivative liabilities of $42,737 and $0, respectively. These derivative liabilities were determined as of December 31, 2014. For the six months ended June 30, 2015 and June 30, 2014 the company recorded amortization of discount on notes payable of $50,347 and $17,681, respectively. Interest expense related to the derivatives was $2,091 and $0 for the three months ended June 30, 2015 and June 30, 2014, respectively, while incurring interest expense related to derivatives for $4,381 and $0 for the six months ended June 30, 2015 and June 30, 2014, respectively.

For the three months ended June 30, 2015 and June 30, 2014, we had net losses of $1,517,297 and $317,551, respectively. For the six months ended June 30, 2015 and June 30, 2014 - we had losses of $2,067,808 and $1,000,016, respectively.

Liquidity and Capital Resources

For the six months ended June 30, 2015 and 2014, our cash flows were:

| Six months ended | ||||||||

| June 30, | ||||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| Net cash provided by operating activities | $ | (1,352,043 | ) | $ | (416,098 | ) | ||

| Net cash used in investing activities | $ | (213,158 | ) | $ | (6,512 | ) | ||

| Net cash provided by financing activities | $ | 1,594,636 | $ | 475,000 | ||||

Net cash used in operations during the six months ended June 30, 2015 and June 30, 2014 was $1,352,043 and $416,098, respectively. For the six months ended June 30, 2015, net cash used of $1,352,043 was attributed to loss for the six month period, which was offset by increases from equity issuances for services as well as an increase in derivative liabilities and also increase in accounts payable. For the six months ended June 30, 2014, net cash used of $416,098 was attributed mainly to the loss for the period, offset by equity issuances for services rendered.

Net cash used in investing activities was $213,158 and $6,512 for the six months ended June 30, 2015 and June 30, 2014, respectively. The increase was primarily related to our $175,000 investment in Flowhub, a seed-to-sale system.

Net cash provided by financing activities for the six months ended June 30, 2015 and June 30, 2014 was $1,594,636 and $475,000, respectively. These amounts were attributed to equity issuances throughout the periods.

Capital Resources

Our current cash on hand as of June 30, 2015 was $171,363, which will be used to meet our operational expenditures for one month. Subsequent to the close of the quarter, we closed our private offering and received $75,000 that was booked as subscription receivable.

We currently have no external sources of liquidity such as arrangements with credit institutions or off-balance sheet arrangements that will have or are reasonably likely to have a current or future effect on our financial condition or immediate access to capital.

We are dependent on the sale of our securities to fund our operations, and will remain so until we generate sufficient revenues to pay for our operating costs. Our officers and directors have made no written commitments with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees.

Fundraising

During the second quarter of 2015, MassRoots conducted two private placements of its common stock. Beginning on April 1, 2015, MassRoots completed a private placement of 960,933 shares of unregistered common stock gross proceeds of $576,200 to certain accredited investors. This round was closed on April 17, 2015.

Beginning on June 10, 2015, MassRoots sold 606,669 shares of unregistered common stock for gross proceeds of $455,000, of which $380,000 was received by June 30, 2015. Subsequent to the close of the quarter, MassRoots sold an additional 834,004 shares of unregistered common stock for $610,502. This round was closed on July 13, 2015. As of July 21, 2015, all $1,065,502 had been received.

Over the course of the second quarter, 750,000 of warrants previously issued as part of our offering in March 2014 were exercised at an exercise price of $0.40 for proceeds of $300,000, of which $295,000 was received during the second quarter of 2015 and the remaining $5,000 was received during the third quarter. We also received $936 for the exercise of 936,341 of our par warrants.

Required Capital Over the Next Fiscal Year

We believe MassRoots will need to raise an additional $1.5 million over the next fiscal year to sustain operations; however, we expect to be able to raise the majority of these funds through warrant exercises. As of June 30, 2015, there were 4,000,000 warrants exercisable at $0.40 per share that if exercised, will generate approximately $1.6 million of capital for the Company; there are also 866,000 warrants exercisable at $1.00 per share that if exercised, will generate $866,000 of capital the Company.

If we are unable to raise the funds we will seek alternative financing through means such as borrowings from institutions or private individuals. There can be no assurance that we will be able to raise the capital we need for our operations from the sale of our securities. We have not located any sources for these funds and may not be able to do so in the future. We expect that we will seek additional financing in the future. However, we may not be able to obtain additional capital or generate sufficient revenues to fund our operations. If we are unsuccessful at raising sufficient funds, for whatever reason, to fund our operations, we may be forced to cease operations. If we fail to raise funds we expect that we will be required to seek protection from creditors under applicable bankruptcy laws.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern and believes that our ability is dependent on our ability to implement our business plan, raise capital and generate revenues. See Note 10 of our unaudited financial statements.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies and Estimates

For a discussion of our accounting policies and related items, please see the Notes to the Financial Statements, included in Item 1.

Item 3. Quantitative & Qualitative Disclosures about Market Risks

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures