prct-2022123100015889782022FYfalseP3Y0.2105http://fasb.org/us-gaap/2022#DerivativeLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#DerivativeLiabilitiesNoncurrenthttp://www.procept-biorobotics.com/20221231#FairValueAdjustmentOfWarrantsAndGainLossOnDerivativeInstrumentsNetPretaxhttp://www.procept-biorobotics.com/20221231#FairValueAdjustmentOfWarrantsAndGainLossOnDerivativeInstrumentsNetPretax00015889782022-01-012022-12-3100015889782022-06-30iso4217:USD00015889782023-02-23xbrli:shares00015889782022-12-3100015889782021-12-31iso4217:USDxbrli:shares0001588978us-gaap:CommonStockMember2022-12-310001588978us-gaap:CommonStockMember2021-12-3100015889782021-01-012021-12-3100015889782020-12-310001588978us-gaap:CommonStockMember2020-12-310001588978us-gaap:AdditionalPaidInCapitalMember2020-12-310001588978us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001588978us-gaap:RetainedEarningsMember2020-12-3100015889782021-06-012021-06-300001588978us-gaap:CommonStockMember2021-01-012021-12-310001588978us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001588978us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001588978us-gaap:RetainedEarningsMember2021-01-012021-12-310001588978us-gaap:AdditionalPaidInCapitalMember2021-12-310001588978us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001588978us-gaap:RetainedEarningsMember2021-12-310001588978us-gaap:CommonStockMember2022-01-012022-12-310001588978us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001588978us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001588978us-gaap:RetainedEarningsMember2022-01-012022-12-310001588978us-gaap:AdditionalPaidInCapitalMember2022-12-310001588978us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001588978us-gaap:RetainedEarningsMember2022-12-310001588978prct:SeriesGRedeemableConvertiblePreferredStockMember2021-01-012021-12-310001588978us-gaap:CommonStockMemberus-gaap:IPOMember2021-09-012021-09-300001588978us-gaap:CommonStockMemberus-gaap:OverAllotmentOptionMember2021-09-012021-09-300001588978us-gaap:CommonStockMember2021-09-3000015889782021-09-012021-09-3000015889782021-09-300001588978us-gaap:AdditionalPaidInCapitalMember2021-09-012021-09-3000015889782021-05-3100015889782021-06-300001588978us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberprct:Customer1Member2021-01-012021-12-31xbrli:pure0001588978srt:MinimumMember2022-01-012022-12-310001588978srt:MaximumMember2022-01-012022-12-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityMember2022-01-012022-12-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityMember2022-12-310001588978prct:LoanFacilityMember2022-12-310001588978us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001588978us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001588978us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001588978us-gaap:FairValueMeasurementsRecurringMember2022-12-310001588978us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001588978us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001588978us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001588978us-gaap:FairValueMeasurementsRecurringMember2021-12-310001588978us-gaap:FairValueMeasurementsRecurringMember2020-12-310001588978us-gaap:FairValueMeasurementsRecurringMember2022-01-012022-12-310001588978us-gaap:FairValueMeasurementsRecurringMember2021-01-012021-12-310001588978us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2022-12-31prct:pure0001588978prct:LaboratoryAndManufacturingEquipmentMember2022-12-310001588978prct:LaboratoryAndManufacturingEquipmentMember2021-12-310001588978us-gaap:EquipmentMember2022-12-310001588978us-gaap:EquipmentMember2021-12-310001588978us-gaap:LeaseholdImprovementsMember2022-12-310001588978us-gaap:LeaseholdImprovementsMember2021-12-310001588978prct:EvaluationUnitsMember2022-12-310001588978prct:EvaluationUnitsMember2021-12-310001588978us-gaap:ConstructionInProgressMember2022-12-310001588978us-gaap:ConstructionInProgressMember2021-12-3100015889782019-03-012019-03-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityMember2019-09-30prct:installment0001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityTrancheOneMember2019-09-012019-09-300001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityTrancheTwoMember2020-03-012020-03-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityTrancheThreeMember2021-03-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityTrancheThreeMember2021-01-012021-06-300001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityTrancheThreeMember2021-01-012021-01-310001588978us-gaap:LineOfCreditMemberprct:LoanFacilityTrancheFourMemberus-gaap:LineOfCreditMember2021-06-300001588978us-gaap:LineOfCreditMemberprct:LoanFacilityTrancheFourMemberus-gaap:LineOfCreditMember2021-01-012021-06-300001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityMemberus-gaap:BaseRateMember2022-01-012022-12-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMemberprct:LoanFacilityMember2022-01-012022-12-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityMember2019-09-012019-09-300001588978us-gaap:LineOfCreditMemberprct:LoanFacilityTrancheFourMemberus-gaap:LineOfCreditMember2022-12-310001588978us-gaap:LineOfCreditMemberprct:LoanFacilityTrancheFourMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001588978us-gaap:LineOfCreditMemberus-gaap:LineOfCreditMemberprct:LoanFacilityMember2021-09-012021-09-3000015889782021-01-012021-01-310001588978exch:CIBCus-gaap:SeniorLoansMember2022-10-310001588978exch:CIBCsrt:ScenarioForecastMemberus-gaap:SeniorLoansMember2022-10-012023-09-300001588978exch:CIBCsrt:ScenarioForecastMemberus-gaap:SeniorLoansMember2022-10-012023-06-300001588978exch:CIBCus-gaap:SeniorLoansMemberprct:SecuredOvernightFinancingRateOneMonthTermMember2022-10-012022-10-310001588978exch:CIBCus-gaap:SeniorLoansMemberprct:SecuredOvernightFinancingRateThreeMonthTermMember2022-10-012022-10-310001588978exch:CIBCus-gaap:SeniorLoansMemberprct:SecuredOvernightFinancingRateSixMonthTermMember2022-10-012022-10-310001588978exch:CIBCus-gaap:SeniorLoansMemberprct:SecuredOvernightFinancingRateFloorRateMember2022-10-012022-10-310001588978exch:CIBCus-gaap:SeniorLoansMemberprct:SecuredOvernightFinancingRateMarginRateMember2022-10-012022-10-310001588978exch:CIBCus-gaap:SeniorLoansMember2022-01-012022-12-310001588978prct:A2021EquityIncentiveAwardPlanMember2021-09-300001588978prct:A2021EquityIncentiveAwardPlanMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001588978prct:IncentiveStockOptionsAndNonqualifiedStockOptionsMemberprct:A2021EquityIncentiveAwardPlanMemberprct:ShareholderOfTenPercentOwnershipOrGreaterMembersrt:MinimumMember2022-12-310001588978prct:IncentiveStockOptionsAndNonqualifiedStockOptionsMemberprct:A2021EquityIncentiveAwardPlanMembersrt:MinimumMember2022-01-012022-12-310001588978prct:A2021EquityIncentiveAwardPlanMemberus-gaap:EmployeeStockMember2022-01-012022-12-310001588978prct:A2021EquityIncentiveAwardPlanMemberprct:FollowOnOptionsMember2022-01-012022-12-310001588978prct:A2021EquityIncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001588978prct:A2021EquityIncentiveAwardPlanMemberus-gaap:EmployeeStockMember2022-12-310001588978us-gaap:EmployeeStockOptionMemberprct:A2008StockPlanMember2022-12-310001588978prct:A2021EmployeeStockPurchasePlanMember2021-09-300001588978prct:A2021EmployeeStockPurchasePlanMember2022-01-012022-12-310001588978srt:MaximumMemberprct:A2021EmployeeStockPurchasePlanMember2022-12-310001588978prct:A2021EmployeeStockPurchasePlanMember2022-12-310001588978us-gaap:CostOfSalesMember2022-01-012022-12-310001588978us-gaap:CostOfSalesMember2021-01-012021-12-310001588978us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001588978us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001588978us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001588978us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001588978prct:A2021EmployeeStockPurchasePlanMember2021-01-012021-12-310001588978us-gaap:EmployeeStockOptionMember2021-12-310001588978us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001588978us-gaap:EmployeeStockOptionMember2022-12-310001588978us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001588978us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001588978us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001588978us-gaap:RestrictedStockUnitsRSUMember2021-12-310001588978us-gaap:RestrictedStockUnitsRSUMember2022-12-310001588978us-gaap:EmployeeStockOptionMemberprct:A2021EmployeeStockPurchasePlanMember2022-01-012022-12-310001588978us-gaap:DomesticCountryMember2022-12-310001588978us-gaap:DomesticCountryMember2021-12-310001588978us-gaap:StateAndLocalJurisdictionMember2022-12-310001588978us-gaap:StateAndLocalJurisdictionMember2021-12-310001588978us-gaap:DomesticCountryMemberus-gaap:ResearchMemberus-gaap:InternalRevenueServiceIRSMember2022-12-310001588978us-gaap:DomesticCountryMemberus-gaap:ResearchMemberus-gaap:InternalRevenueServiceIRSMember2021-12-310001588978us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2022-12-310001588978us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2021-12-310001588978us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001588978us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001588978us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001588978us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001588978prct:A2021EmployeeStockPurchasePlanMember2022-01-012022-12-310001588978prct:A2021EmployeeStockPurchasePlanMember2021-01-012021-12-310001588978country:USprct:SystemSalesAndRentalsMember2022-01-012022-12-310001588978country:USprct:SystemSalesAndRentalsMember2021-01-012021-12-310001588978country:USprct:HandPiecesAndOtherConsumablesMember2022-01-012022-12-310001588978country:USprct:HandPiecesAndOtherConsumablesMember2021-01-012021-12-310001588978country:USprct:ServiceRevenueMember2022-01-012022-12-310001588978country:USprct:ServiceRevenueMember2021-01-012021-12-310001588978country:US2022-01-012022-12-310001588978country:US2021-01-012021-12-310001588978prct:SystemSalesAndRentalsMemberprct:OutsideTheUnitedStatesMember2022-01-012022-12-310001588978prct:SystemSalesAndRentalsMemberprct:OutsideTheUnitedStatesMember2021-01-012021-12-310001588978prct:HandPiecesAndOtherConsumablesMemberprct:OutsideTheUnitedStatesMember2022-01-012022-12-310001588978prct:HandPiecesAndOtherConsumablesMemberprct:OutsideTheUnitedStatesMember2021-01-012021-12-310001588978prct:ServiceRevenueMemberprct:OutsideTheUnitedStatesMember2022-01-012022-12-310001588978prct:ServiceRevenueMemberprct:OutsideTheUnitedStatesMember2021-01-012021-12-310001588978prct:OutsideTheUnitedStatesMember2022-01-012022-12-310001588978prct:OutsideTheUnitedStatesMember2021-01-012021-12-310001588978prct:RedwoodCityCAMember2013-07-310001588978us-gaap:SubsequentEventMemberprct:TerminatedOnOctober292023Member2023-01-31prct:building0001588978us-gaap:SubsequentEventMemberprct:TerminateNoLaterThanJanuary312024Member2023-01-310001588978us-gaap:BuildingMember2021-12-31utr:sqft0001588978us-gaap:BuildingMember2022-12-3100015889782021-12-312021-12-31prct:renewalOption

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 10-K

___________________________________

(Mark One)

| | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-04321

___________________________________

PROCEPT BIOROBOTICS CORPORATION

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 3841 | 26-0199180 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

| | |

900 Island Drive Redwood City, CA | | 94065 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(650) 232-7200

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.00001 par value per share | PRCT | Nasdaq Global Market |

| | |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2022, the aggregate market value of shares held by non-affiliates of the Registrant (based upon the closing sale prices of such shares on the Nasdaq Global Select Market on June 30, 2022) was approximately $1.0 billion. Shares of common stock held by each executive officer, director, and their affiliated holders have been excluded in that such persons may be deemed to be affiliates. The determination of affiliate status for this purpose is not necessarily a conclusive determination for any other purpose.

The registrant had outstanding 44,865,826 shares of common stock as of February 23, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2023 Annual Stockholders’ Meeting, to be filed within 120 days of the registrant’s fiscal year ended December 31, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K,

Table of Contents

| | | | | | | | |

| | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

__________________

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Annual Report are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” "can," “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. All statements other than statements of historical facts contained in this Annual Report, including without limitation statements regarding our business model and strategic plans for our products, technologies and business, including our implementation thereof, the impact on our business, financial condition and results of operations from the ongoing and global COVID-19 pandemic, or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide, the timing of and our ability to obtain and maintain regulatory approvals, our commercialization, marketing and manufacturing capabilities and strategy, our expectations about the commercial success and market acceptance of our products, the sufficiency of our cash and cash equivalents, and the plans and objectives of management for future operations and capital expenditures are forward-looking statements.

The forward-looking statements in this Annual Report are only predictions and are based largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of known and

unknown risks, uncertainties, and assumptions, including those described under the sections in this Annual Report entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon these forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. We intend the forward-looking statements contained in this Annual Report to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Part I. Item 1A. “Risk Factors” in this Annual Report on Form 10-K. You should carefully consider these risks and uncertainties when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

•We are an early-stage company with a history of significant net losses, we expect to continue to incur operating losses for the foreseeable future and we may not be able to achieve or sustain profitability.

•Our revenue is primarily generated from sales of our AquaBeam Robotic System and the accompanying single-use disposable handpieces, and we are therefore highly dependent on the success of those products.

•Our quarterly and annual operating results may fluctuate significantly and may not fully reflect the underlying performance of our business. This makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide.

•The terms of our loan and security agreement require us to meet certain operating and financial covenants and place restrictions on our operating and financial flexibility. If we raise additional capital through debt financing, the terms of any new debt could further restrict our ability to operate our business.

•We may need additional funding to finance our planned operations, and may not be able to raise capital when needed, which could force us to delay, reduce or eliminate one or more of our product development programs and future commercialization efforts.

•The commercial success of our AquaBeam Robotic System and Aquablation therapy will depend upon the degree of market acceptance of our products among hospitals, surgeons and patients.

•We have limited experience in training and marketing and selling our products and we may provide inadequate training, fail to increase our sales and marketing capabilities or fail to develop and maintain broad brand awareness in a cost-effective manner.

•We may not be able to obtain or maintain adequate levels of third-party coverage and reimbursement, and third parties may rescind or modify their coverage or delay payments related to our products.

•We face competition from many sources, including larger companies, and we may be unable to compete successfully.

•We have limited experience manufacturing our products in large-scale commercial quantities, and we face a number of manufacturing risks that may adversely affect our manufacturing abilities which could delay, prevent or impair our growth.

•We may experience disruption in our business as a result of the relocation of our headquarters and manufacturing facility and general expansion of our operations.

•We depend upon third-party suppliers, including contract manufacturers and single source suppliers, making us vulnerable to supply shortages and price fluctuations that could negatively affect our business, financial condition and results of operations.

•We may encounter difficulties in managing our growth, which could disrupt our operations.

•Our information technology systems, or those used by our contractors or consultants, may fail or suffer security breaches, and such failure could negatively affect our business, financial condition and results of operations.

•Failure to comply with data protection laws and regulations could lead to government enforcement actions (which could include civil or criminal penalties), private litigation, and/or adverse publicity and could negatively affect our operating results and business.

•The sizes of the addressable markets for our AquaBeam Robotic System have not been established with precision and our potential market opportunity may be smaller than we estimate and may decline.

•If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit or halt the marketing and sale of our products. The expense and potential unavailability of insurance coverage for liabilities resulting from our products could harm us and our ability to sell our products.

•Cost-containment efforts of our customers, purchasing groups and governmental organizations could have a material adverse effect on our sales and profitability.

•We are highly dependent on our senior management team and key personnel, and our business could be harmed if we are unable to attract and retain personnel necessary for our success.

•Changes to the reimbursement rates for BPH treatments and measures to reduce healthcare costs may adversely impact our business.

•Our AquaBeam Robotic System and our operations are subject to extensive government regulation and oversight in the United States. If we fail to maintain necessary marketing authorizations for our AquaBeam Robotic System, or if approvals or clearances for future products or modifications to existing products are delayed or not issued, it will negatively affect our business, financial condition and results of operations.

•Even though we have obtained marketing authorization for our AquaBeam Robotic System, we are subject to ongoing regulatory review and scrutiny. Failure to comply with post-marketing regulatory requirements could subject us to enforcement actions, including substantial penalties, and might require us to recall or withdraw a product from the market.

•We have to obtain, maintain and protect our intellectual property and failure to do so may adversely impact our competitive position.

•We may become a party to intellectual property litigation or administrative proceedings that could be expensive, time-consuming, unsuccessful, and could interfere with our ability to sell and market our products or services.

•The market price of our common stock may be volatile or may decline steeply or suddenly regardless of our operating performance, which could result in substantial losses for purchasers of our common stock, and we may not be able to meet investor or analyst expectations.

•Future securities issuances could result in significant dilution to our stockholders and impair the market price of our common stock.

•If we are not able to maintain adequate internal control over financial reporting, or if we are unable to produce timely or accurate financial statements, investors may lose confidence in our operating results and the trading price of our common stock could decline.

Part I

Item 1. Business

Overview

We are a surgical robotics company focused on advancing patient care by developing transformative solutions in urology. We develop, manufacture and sell the AquaBeam Robotic System, an advanced, image-guided, surgical robotic system for use in minimally invasive urologic surgery, with an initial focus on treating benign prostatic hyperplasia, or BPH. BPH is the most common prostate disease and impacts approximately 40 million men in the United States. The AquaBeam Robotic System employs a single-use disposable handpiece to deliver our proprietary Aquablation therapy, which combines real-time, multi-dimensional imaging, personalized treatment planning, automated robotics and heat-free waterjet ablation for targeted and rapid removal of prostate tissue. We designed our AquaBeam Robotic System to enable consistent and reproducible BPH surgery outcomes. We believe that Aquablation therapy represents a paradigm shift in the surgical treatment of BPH by addressing compromises associated with alternative surgical interventions. We designed Aquablation therapy to deliver effective, safe and durable outcomes for males suffering from lower urinary tract symptoms, or LUTS, due to BPH that is independent of prostate size and shape, and delivers resection independent of surgeon experience. We have developed a significant and growing body of clinical evidence, which includes nine clinical studies and nearly 150 peer-reviewed publications, supporting the benefits and clinical advantages of Aquablation therapy. As of December 31, 2022, we had an install base of 243 AquaBeam Robotic Systems globally, including 167 in the United States.

BPH refers to the non-malignant enlargement of the prostate gland, a small gland in the male reproductive system. The prostate sits underneath the bladder and surrounds the top part of the urethra, which carries urine from the bladder.

As the prostate enlarges, the gland presses against the urethra, which may obstruct or restrict the flow of urine from the bladder and result in uncomfortable LUTS, such as urgency, frequency, urinary retention, straining to urinate and a weak urinary stream. Without treatment, prolonged obstruction may eventually lead to acute urinary retention, urinary tract infections or renal insufficiency.

In the United States it is estimated that approximately 40 million men are impacted by BPH, with aging demographics expected to drive future growth. Of these men, approximately 12 million are being managed by a physician for symptoms related to their disease. Our total addressable patient population in the United States includes approximately 8.2 million patients, comprising 6.7 million receiving drug therapy, 1.1 million who have tried but failed drug therapy and 400,000 undergoing surgical intervention each year. Over the next ten years, it is expected that the number of men over 65 years old in the United States will double and include a corresponding increase in the number of men with enlarged prostates. Based on the average selling price of our single-use handpiece, we estimate that our total addressable market opportunity is in excess of $20 billion in the United States. The global incidence of BPH among men over 50 years old is similar to that of the United States, representing a significant incremental market opportunity outside of the United States.

The main goal of BPH treatment is to alleviate the symptoms associated with the disease and improve the patient’s quality of life. While drug therapy is typically a first line treatment option, limited efficacy and negative side effects contribute to low compliance and high failure rates and drop outs. On the other hand, surgical intervention is proven to provide effective and durable symptom relief compared to drug therapy, but the use of surgery is significantly underpenetrated, largely due to the compromise patients must make between the incidence of irreversible side effects associated with alternative resective surgical interventions, where obstructive tissue is removed at the time of intervention, or the lower rates of efficacy and durability associated with non-resective surgical interventions, where obstructive tissue is not removed, but rather the prostatic urethra is re-shaped. In addition, most alternative surgical interventions are limited by prostate size and shape, with no single procedure capable of effectively addressing the full range of prostate anatomies regardless of surgeon experience level.

We began developing our proprietary AquaBeam Robotic System in 2009 to address many of the shortcomings of alternative surgical interventions by delivering our Aquablation therapy, the first and only image-guided robotic therapy for the treatment of BPH. We believe our Aquablation therapy provides the following unique combination of benefits:

•Significant and durable symptom relief. Given obstructive prostate tissue is removed during the procedure, Aquablation therapy has demonstrated significant and long-lasting levels of symptom relief similar to those of alternative resective procedures. In our U.S. pivotal trial, Waterjet Ablation Therapy for Endoscopic Resection of prostate tissue, or the WATER study, Aquablation therapy demonstrated superior safety and non-inferior efficacy results compared to transurethral resection of the prostate, or TURP, the historical standard of care for the surgical

treatment of BPH. In the WATER and WATER II studies, surgical retreatment rates were only 5.2% at five years and 3.0% at four years, respectively. In the OPEN WATER study, there were no surgical retreatments at one year. The retreatment rates in the WATER and WATER II studies compare favorably to surgical retreatment rates observed for alternative treatments for BPH. One study published in the BJU International Journal reported on 52,748 men undergoing TURP or photoselective vaporation of the prostate or PVP, with an approximated three-year freedom from surgical retreatment of 92% and 89%, respectively. A second study published in the Journal of Urology reported on 43,041 men undergoing TURP, PVP, enucleation, or open simple prostatectomy with an approximated three-year freedom from surgical retreatment of 93%, 89%, 94%, and 96%, respectively.

•Favorable safety profile. Aquablation therapy has demonstrated low rates of irreversible complications, including urinary incontinence, erectile dysfunction and ejaculatory dysfunction, compared to published rates observed for other resective surgeries. In our WATER study, patients who underwent Aquablation therapy maintained a higher level of sexual function compared to those who underwent TURP.

•Resection independent of prostate size and shape and surgeon experience. We designed Aquablation therapy to deliver outcomes that are effective, safe and durable for males suffering from LUTS due to BPH across all prostate sizes and shapes. Additionally, in the WATER and WATER II studies, 50% and 83% of men, respectively, had an obstructive median lobe, and the average prostate size in each study was 54 ml and 107 ml, respectively. Compared to other resective procedures, we believe Aquablation therapy is relatively simple to learn, enabled by the intuitive user interface of the conformal planning unit, or CPU, and automated robotic resection, and delivers resection that is independent of surgeon experience.

•Personalized treatment planning and improved decision-making. Aquablation therapy combines cystoscopic visualization, which uses a camera attached to a hollow tube, along with ultrasound imaging and advanced planning software to provide the surgeon with a multidimensional view of the treatment area and enable personalized treatment planning for the patient’s unique anatomy, improved decision-making and real-time monitoring during the procedure.

•Targeted and controlled resection with consistent resection times. Aquablation therapy utilizes automated robotic resection to remove prostate tissue using a precise, heat-free waterjet. These features enable targeted and controlled tissue removal with rapid resection times that are highly consistent across prostate sizes and shapes and surgeon experience.

We have developed a significant and growing body of clinical data that demonstrate the efficacy, safety and durability of Aquablation therapy, with resection that is independent of prostate size and shape and surgeon experience. Our robust body of clinical evidence includes nine clinical studies and nearly 150 peer-reviewed publications. Our WATER study is the only FDA pivotal study randomized against TURP. In this study, Aquablation therapy demonstrated superior safety and non-inferior efficacy compared to TURP across prostate sizes between 30 ml and 80 ml, and superior efficacy in a subset of patients with prostates larger than 50 ml. We have established strong relationships with key opinion leaders or KOLs within the urology community and collaborated with key urological societies in global markets. This support has been instrumental in facilitating broader acceptance and adoption of Aquablation therapy. We believe that as a result of our strong KOL network and our compelling clinical evidence, Aquablation therapy has been added to clinical guidelines of various professional associations, including the American Urological Association, European Association of Urology, Canadian Urological Association, German Urology Society, and National Institute for Health and Care Excellence.

In the United States, we sell our products to hospitals. These customers in turn bill various third-party payors, such as commercial payors and government agencies, for reimbursement for the procedures using our products. Effective in 2021, all local Medicare Administrative Contractors, or MACs, which represent 100% of eligible Medicare patients, issued final positive local coverage determinations to provide Medicare beneficiaries with access to Aquablation therapy in all 50 states so long as such beneficiaries meet certain clinical criteria set forth in the local coverage determination. We believe that our strong body of clinical evidence and support from key societies, supplemented by the momentum from Medicare coverage, have led to favorable coverage decisions from many large commercial payors. We plan to leverage these recent successes in our active discussions with commercial payors to establish additional positive national and regional coverage policies, although we cannot provide any assurances that we will be successful in doing so. Outside of the United States, we have ongoing efforts in key markets to expand established coverage and improve payment which we believe will expand patient access to Aquablation therapy.

We primarily sell our products through our direct sales organization in the United States, which targets urologists across the United States, who we believe represent the primary physician specialty managing the care of patients with BPH. We are initially targeting 860 high-volume hospitals that perform, on average, more than 200 resective procedures annually and account for approximately 70% of all hospital-based resective procedures. Additionally, there are approximately 1,840

additional U.S. hospitals that perform the remaining 30% of resective BPH procedures we are also targeting. We estimate that approximately 50% of BPH patients who are on drug therapy as well as 50% who have failed drug therapy are under the care of a urologist, equating to approximately 3.9 million men. We believe we can reach these patients by continuing to educate our network of urologists about the clinical benefits of Aquablation therapy, provide comprehensive training programs and deepen our relationships with key urologists and various medical societies. Outside the United States, we sell our products using both our direct sales organization and, in certain regions, our network of distribution partners.

We generated revenue of $75.0 million and $34.5 million for the years ended December 31, 2022 and 2021, respectively, and incurred a net loss of $87.2 million and $59.9 million for the years ended December 31, 2022 and 2021, respectively. As of December 31, 2022, we had an accumulated deficit of $348.7 million.

Our Success Factors

We believe the continued growth of our company will be driven by the following success factors:

•First and only image-guided, heat-free robotic therapy for BPH that addresses the compromise between safety and efficacy of alternative surgical interventions. We have developed the AquaBeam Robotic System, an advanced, image-guided, surgical robotic system for use in minimally invasive BPH surgery. The AquaBeam Robotic System delivers our Aquablation therapy, the first and only image-guided, robotic therapy for the treatment of BPH. Aquablation therapy combines real-time, multidimensional imaging, personalized treatment planning, automated robotics and heat-free waterjet ablation for targeted and rapid removal of prostate tissue. We believe that alternative surgical interventions for BPH have a number of shortcomings which require patients to compromise between safety and efficacy, either providing significant symptom relief but with a heightened risk of irreversible complications or a lower risk of complications but with significantly less symptom relief. We believe Aquablation therapy represents a paradigm shift in the surgical treatment of BPH by addressing this compromise.

•Large, growing and underpenetrated market opportunity. BPH is the number one reason men visit a urologist and we estimate that approximately 40 million men in the United States alone are impacted by BPH, with aging demographics expected to drive future growth. Of these men, approximately 12 million are being managed by a physician for symptoms related to their disease. While drug therapy is typically a first-line treatment option, limited efficacy and negative side effects, including neurologic, ophthalmic and sexual complications, contribute to low compliance and high failure rates, often as high as 30%. On the other hand, surgical intervention is proven to provide effective and durable symptom relief compared to drug therapy, but the use of surgery is significantly underpenetrated, largely due to the compromise and limitations associated with alternative surgical interventions. Our total addressable patient population in the United States includes approximately 8.2 million patients, comprised of 6.7 million who are receiving drug therapy, 1.1 million who have tried but failed drug therapy and 400,000 who are undergoing surgical intervention each year. Based on the average selling price of our single-use handpiece, we estimate that our total U.S. addressable market opportunity is in excess of $20 billion. The global incidence of BPH among men over 50 years old is similar to that of the United States, representing a significant incremental market opportunity outside of the United States.

•Significant and growing body of clinical evidence and strong support from key opinion leaders, or KOLs, resulting in the inclusion of Aquablation therapy into societal guidelines and rapid expansion of positive reimbursement coverage policies. We have developed a significant and growing body of clinical data that demonstrates the efficacy, safety and durability of Aquablation therapy, consistent across all prostate sizes and shapes with resection that is independent of surgeon experience. Our robust clinical evidence includes nine clinical studies that we sponsored and enrolled between 2013 and 2018, as well as nearly 150 peer-reviewed publications. Our employees participated in protocol design, data management, monitoring, and statistical analysis in all nine clinical studies and results were provided to authors for publication upon request. Our WATER study is the only FDA pivotal study randomized against TURP, which is the historical standard of care for the surgical treatment of BPH. In this study, Aquablation therapy demonstrated superior safety and non-inferior efficacy results compared to TURP across prostate sizes between 30 ml and 80 ml, and superior efficacy results in a subset of patients with prostates larger than 50 ml. We have established strong relationships with KOLs within the urology community and collaborated with key urological societies in global markets. This support has been instrumental in facilitating broader acceptance and adoption of Aquablation therapy. As a result of our strong KOL network and our compelling clinical evidence, Aquablation therapy has been added to clinical guidelines of various professional associations, including the American Urological Association, European Association of Urology, Canadian Urological Association, German Urology Society, and National Institute for Health and Care Excellence; has achieved favorable coverage determinations from MACs; and has been designated by the Centers for Medicare and Medicaid Services, or CMS, as demonstrating substantial clinical improvement over alternative

surgical interventions and granted transitional pass-through payment status, effective January 1, 2020, which has been extended through December 31, 2023. We believe our compelling clinical evidence, strong KOL relationships and engagement with global urological societies will continue to play an important role in growing awareness and increasing adoption of Aquablation therapy.

•Compelling value proposition and benefits to hospitals, surgeons and patients. We designed our AquaBeam Robotic System to enable consistent and reproducible resections that are independent of surgeon experience and require minimal training. In addition, we believe the differentiated features of Aquablation therapy allow for improved predictability of outcomes and, as such, increase surgeon confidence in recommending surgical intervention to their patients. Given its ability to treat prostate sizes of all shapes and sizes, Aquablation therapy enables hospitals to consolidate the surgical treatment of BPH in a single therapy. We also believe that hospital administrators will be able to leverage the differentiation of Aquablation therapy as a marketing tool to attract skilled surgeons and patients to their hospital system. Furthermore, the AquaBeam Robotic System is highly mobile and compact, requiring no retrofitting of the operating room, and we believe is competitively priced compared to other robotic systems and capital equipment devices, both factors which we believe remove adoption hurdles for hospital customers and allow for a more streamlined hospital sales cycle. For patients, Aquablation therapy offers significant and durable symptom relief with an attractive safety profile. We believe these benefits will continue to support the adoption of Aquablation therapy by hospitals and surgeons.

•Recurring revenue model. We generate revenue primarily from hospitals making capital purchases of our AquaBeam Robotic System and purchasing our single-use handpieces for individual patient use. We also generate revenue by providing post-warranty service for the AquaBeam Robotic System. We believe our business model of selling capital equipment that generates corresponding disposables utilization and post-warranty service contracts provides a path to predictable, recurring revenue.

•Broad research and development capabilities and a robust intellectual property portfolio. We have invested in establishing strong research and development capabilities for over a decade, including in surgical robotics and imaging-enabled surgery as well as integrating hardware and software to create an exceptional user and patient experience. We believe our focus on this experience will allow us to continue to bring new upgrades, capabilities and products to market, allowing us to innovate and maintain our competitive positioning. We have a broad patent portfolio, including 135 issued patents and 88 pending patent applications as of December 31, 2022. We believe our intellectual property and know-how present a significant barrier to entry for our competitors.

•Proven leadership team and board members with deep industry experience. We are led by a highly experienced management team and board with a successful track record of building businesses by identifying and providing solutions for underserved markets in the medical device industry. Our team has successfully led and managed dynamic growth phases in organizations and commercialized products in markets with established incumbents by addressing the unmet needs of the physicians and patients they serve.

Our Growth Strategies

Our mission is to establish Aquablation therapy as the surgical standard of care for BPH. The key elements of our growth strategy are:

•Grow our installed base of AquaBeam Robotic Systems by driving adoption of Aquablation therapy among urologists. In the United States, we are initially focused on driving adoption of Aquablation therapy among urologists that perform hospital-based resective BPH surgery. We estimate that approximately 290,000 of the 400,000 annual BPH surgeries are resective procedures performed across approximately 2,700 hospitals. We are initially targeting 860 high-volume hospitals that we estimate perform, on average, more than 200 resective procedures annually and account for approximately 70% of all hospital-based resective procedures. . Additionally, there are approximately 1,840 U.S. hospitals that perform the remaining 30% of resective BPH procedures we are also targeting. To penetrate these hospitals, we will continue to increase our direct team of capital sales representatives, who are focused on driving system placement within hospitals by engaging with key surgeons and decision makers to educate them about the compelling value proposition of Aquablation therapy. We also intend to increase awareness of Aquablation therapy by continuing to publish clinical data in various industry and scientific journals, present our clinical data at various industry conferences and sponsor peer-to-peer education programs and proctorships.

•Increase system utilization by establishing Aquablation therapy as the surgical treatment of choice for BPH. Once we place a system within a hospital, our objective is to establish Aquablation therapy as the surgical treatment of choice for BPH. Within each hospital, we are initially focused on targeting urologists who perform

medium-to-high volumes of resective procedures and converting their resective cases to Aquablation therapy. To accomplish this, we will continue expanding our team of highly trained Aquablation representatives and clinical specialists, who are focused on driving system utilization within the hospital, providing education and training support and ensuring excellent user experiences. As urologists gain experience with Aquablation therapy, we will leverage their experiences to capture more surgical volumes and establish Aquablation therapy as the surgical standard of care. Over time, we intend to leverage our relationships with urologists to drive utilization of Aquablation therapy beyond the current surgical market. We estimate that approximately 50% of BPH patients who are on drug therapy as well as 50% who have failed drug therapy are under the care of a urologist, equating to approximately 3.9 million men. We believe we can reach these patients by continuing to educate our network of urologists of the clinical benefits of Aquablation therapy, provide comprehensive training programs and deepen our relationships with key urologists and various medical societies. Furthermore, we believe that additional coverage by private payors will continue to drive increased utilization.

•Continue to broaden private payor coverage. Since the addition of Aquablation therapy to AUA clinical guidelines in May 2019, we have significantly grown coverage for Aquablation therapy in the United States. Effective in 2021, all local MACs, which represent 100% of eligible Medicare patients, issued final positive local coverage determinations to provide Medicare beneficiaries with access to Aquablation therapy in all 50 states so long as such beneficiaries meet certain clinical criteria set forth in the local coverage determinations. We believe that these favorable coverage decisions have been a catalyst for hospital adoption of our AquaBeam Robotic System. Our strong body of clinical evidence and support from key societies, supplemented by the momentum from Medicare coverage, have led to favorable coverage decisions from many large private payors. We plan to leverage these recent successes in our active discussions with private payors to establish additional positive national and regional coverage policies. We believe that additional private payor coverage will contribute to increasing utilization of our system over time. Outside of the United States, we have ongoing efforts in key markets to expand established coverage and further improve patient access to Aquablation therapy.

•Build upon our strong base of clinical evidence. We are committed to continuing to build upon our foundation of clinical evidence, which we believe will help drive increased awareness and adoption of our products. For example, we are continuing to follow patients in our WATER and WATER II studies to collect five-year clinical outcomes as well as conducting sub-group analyses across our base of clinical data that we believe will further define the role of Aquablation therapy across patient populations. We also plan to further build our base of clinical evidence by supporting new clinical studies intended to support commercial, regulatory and reimbursement efforts. For example, we are supporting an investigator-initiated clinical study, called WATER III, which is a randomized controlled trial evaluating Aquablation therapy against laser enucleation in treating BPH patients with large prostate sizes.

•Invest in research and development to drive continuous improvements and innovation. We are currently developing additional and next generation technologies to support and improve Aquablation therapy to further satisfy the evolving needs of surgeons and their patients as well as to further enhance the usability and scalability of the AquaBeam Robotic System. We also plan to leverage our treatment data and software development capabilities to integrate artificial intelligence and machine-learning to enable computer-assisted anatomy recognition and improved treatment planning and personalization. In the future, we may evaluate the application of the AquaBeam Robotic System in new urologic conditions beyond BPH.

•Drive increased awareness of Aquablation therapy beyond the urology community. As we expand our network of urologists and grow our installed base, we intend to increase awareness and brand recognition of Aquablation therapy beyond urologists, primarily among primary care physicians who manage BPH patients. We estimate that approximately 3.9 million men, including approximately 3.3 million patients who are on drug therapy and 600,000 who have failed drug therapy, are under the care of a primary care physician. To achieve this objective, we will invest in marketing initiatives directed at primary care physicians in order to expand networks for BPH patients to visit a urologist. Once we have established a broader installed base of systems, we may seek to further increase patient awareness through various direct-to-patient marketing initiatives.

•Further penetrate and expand into existing and new international markets. We plan to establish and strengthen our presence internationally. While the United States remains our primary focus in the near-term, we are growing our existing presence in other markets, including Germany, France, Italy, Spain, United Kingdom, Korea and Japan, by continuing to promote the clinical benefits of Aquablation therapy, supporting investments in clinical studies to improve coverage and reimbursement and fostering relationships with KOLs. We plan to strategically

invest in new markets based on our assessment of market size and opportunity and prospects for compelling reimbursement.

Market Overview

Our Addressable Market Opportunity in BPH

In the United States, BPH is the number one reason men visit a urologist. BPH is estimated to occur in more than 50% of men in their 50s, growing to 70% of men in their 60s, and is the fourth most common diagnosed disease in men above 50 years old, ranking behind coronary artery disease, hypertension and type 2 diabetes. BPH often results in uncomfortable LUTS, which can have a significant impact on quality of life. If left untreated, BPH may eventually lead to more serious complications.

In the United States, we estimate that approximately 40 million men are impacted by symptoms of BPH, with aging demographics expected to drive future growth. Over the next ten years, we expect that the number of men over 65 years old in the United States will double and include a corresponding increase in the number of men with enlarged prostates. Of these men, approximately 12 million are being managed by a physician for symptoms related to their disease. While drug therapy is typically a first line treatment option, limited efficacy and negative side effects contribute to low patient compliance, high failure rates and drop outs. On the other hand, surgical intervention is proven to provide effective and durable symptom relief compared to drug therapy, but the use of surgery is significantly underpenetrated, largely due to the compromise patients must make between (1) the incidence of irreversible side effects associated with current resective surgical interventions, or (2) the lower rates of efficacy and durability associated with non-resective surgical interventions. Our total addressable patient population in the United States includes approximately 8.2 million patients, comprised of 6.7 million receiving drug therapy, 1.1 million who have tried but failed drug therapy and 400,000 undergoing surgical intervention each year. Based on the average selling price of our single-use handpiece, we estimate that our total addressable market opportunity is in excess of $20 billion in the United States. The global incidence of BPH among men over 50 years old is similar to that of the United States, representing a significant incremental market opportunity outside of the United States.

Overview of the Prostate

The prostate is a small gland in the male reproductive system. The prostate sits underneath the bladder and surrounds the top part of the urethra, which carries urine from the bladder.

The prostate is approximately the size of a walnut in men younger than 30 years old; as men age, the prostate grows larger. At puberty, testosterone levels in boys start to increase and the prostate grows to about eight times its size. The prostate continues to grow, doubling in size between the ages of 21 and 50 years, and almost doubles again in size between the ages of 50 and 80 years. Prostate size is generally measured in volume using milliliters, or ml.

BPH Disease Overview and Diagnosis

BPH refers to the non-malignant enlargement of the prostate gland. As the prostate enlarges, the gland presses against the urethra, which may obstruct or restrict the flow of urine from the bladder and result in uncomfortable LUTS, such as urgency, frequency, urinary retention, straining to urinate and a weak urinary stream. Without treatment, prolonged obstruction may eventually lead to acute urinary retention, urinary tract infections or renal insufficiency.

According to the AUA guidelines, it is estimated that 90% of men between the ages of 45 and 80 will experience LUTS, and 50% of them will experience moderate-to-severe symptoms by the time they are 85 years old, which we believe are predominantly caused by BPH. Furthermore, 50% of men between the ages of 51-60 have pathological BPH. According to our internal marketing survey, 99% of men diagnosed with BPH say symptoms impact their quality of life.

Clinical diagnosis of BPH typically involves a number of tests that are used to assess the degree of LUTS and determine whether the symptoms are caused by BPH or another condition. LUTS are classified as either mild, moderate or severe. Patients suffering from symptoms of BPH are typically first seen by a primary care physician, who may diagnose and manage the patient, or refer the patient to a urologist. Urologists are trained to perform surgery for various types of urologic conditions, including BPH.

BPH Treatment Options

The main goal of BPH treatment is to alleviate the symptoms associated with the disease and improve the patient’s quality of life. As such, a patient’s recommended course of treatment is largely based on the patient’s degree of symptoms.

Patients who choose this approach are generally advised to implement lifestyle changes and return for yearly visits with their physician to determine if symptoms are changing. For most men, the prostate will continue to grow and symptoms will worsen. As symptoms become more bothersome, active treatment may be recommended. The two primary categories of active treatment for BPH are drug therapy and surgical intervention.

Drug Therapy

Drug therapy is often the first step in actively treating mild-to-moderate symptoms of BPH. While there is no pharmacological cure for BPH, drugs may be used to manage symptoms. Without surgical intervention, most men with BPH who start drug therapy will need to continue it indefinitely in order to relieve symptoms. While drug therapy can provide relief for some men, two out of three patients are not satisfied with the effectiveness of their medication. Drug therapy is also often associated with negative side effects, including headaches, dizziness, nausea, erectile dysfunction, ejaculatory dysfunction, loss of libido, cardiac failure and dementia. These side effects often contribute to poor treatment compliance, with drug therapy failing in up to 30% of men within two years. Furthermore, drug therapy may be costly, particularly in light of limited symptom relief.

Surgical Intervention

Surgical intervention is recommended for patients who have failed or are unwilling to consider drug therapy, or are suffering from complications due to their BPH. Although more invasive than drug therapy, surgical intervention generally provides more significant, longer-lasting symptom relief. We believe that growth in the use of surgical intervention over the past several years is due to the introduction of new technologies that better balance the compromise between efficacy and safety as well as growing awareness of surgical intervention as an effective way to manage BPH symptoms compared to drug therapy.

There are two categories of surgical intervention, resective, where obstructive tissue is removed at the time of intervention, and non-resective, where obstructive tissue is not removed, but rather the prostatic urethra is re-shaped.

Resective Procedures

Resective prostate procedures generally provide more significant and longer-lasting symptom relief than non-resective procedures, but may result in a higher incidence of irreversible complications, including urinary incontinence, erectile dysfunction and ejaculatory dysfunction.

Resective surgeries may be performed endoscopically, allowing the procedure to be completed through a tubular instrument, or via an open or a laparoscopic procedure, called a simple prostatectomy.

Endoscopic procedures access the prostate through the urethra, so no incisions are made in the patient’s abdomen. Common alternative endoscopic resective procedures include:

•Transurethral Resection of the Prostate. TURP is a resective procedure which uses electrocautery to cut and remove prostate tissue. Despite being used for almost a century, this procedure is still the most frequently performed resective surgery and is considered the historical standard of care for the surgical treatment of BPH for prostates less than 80 ml.

•Photoselective Vaporization of the Prostate, or PVP. PVP is a transurethral form of treatment that utilizes a laser fiber to vaporize prostate tissue sequentially outwards until the surgeon creates a sufficient cavity through which the patient may now void. PVP is generally used in patients with small- to average-sized prostates and can be used in patients who are at high risk of bleeding complications.

•Laser Enucleation of the Prostate. Laser enucleation utilizes a surgical laser to manually resect prostate tissue through the urethra. This procedure allows the surgeon to follow anatomic planes to separate entire lobes of the prostate. In general, separated prostate lobes are then pushed into the bladder and suctioned out via a special tool. Laser enucleation is prostate size-independent; however, this procedure is more commonly used in larger prostates, and adoption has been limited due to the high degree of skill and experience required.

A simple prostatectomy is an invasive, open procedure that requires one or more incisions to be made in the patient’s abdomen to access and remove part or all of the prostate. This procedure is typically a last resort treatment for BPH in patients with very large prostates or those patients with severe complications due to BPH. This surgery may be done manually, or with the assistance of a robot, but in either case is a procedure that requires a high degree of surgeon skill.

Non-Resective Procedures

In non-resective procedures, prostate tissue is not removed at the time of surgery. By not removing tissue, symptom relief is generally less significant and durable compared to resective procedures. The two most common commercially available non-resective procedures are prostatic urethral lift, or PUL, and water vapor therapy. PUL uses permanent implants of nitinol and stainless steel placed transurethrally to pin back and compress obstructing prostate tissue, thus creating a channel for improved urinary flow. Water vapor therapy utilizes principles of convection by transurethrally delivering water vapor into obstructing prostate tissue, which results in cell death and reduction of prostate volume over a period of three to six months. Non-resective procedures are generally approved for small- to average-sized prostates.

Limitations of Alternative Surgical Interventions

Two factors that surgeons and patients commonly consider when evaluating surgical intervention are efficacy and safety. Efficacy is generally measured by symptom relief as well as durability of relief, and safety by the occurrence of irreversible complications such as urinary incontinence, erectile dysfunction and ejaculatory dysfunction. We believe that alternative surgical interventions for BPH require patients to compromise between efficacy and safety. Alternative interventions either provide significant symptom relief with a heightened risk of irreversible complications or a lower risk of complications with significantly less symptom relief. In addition, most alternative surgical interventions are limited by prostate size and shape, with no single procedure capable of effectively addressing the full range of prostate anatomies regardless of surgeon experience level. We believe that the compromise and limitations associated with alternative surgical interventions have contributed to the relatively low penetration rate of surgical intervention.

Limitations of Endoscopic Resective Procedures

While endoscopic resective surgeries such as TURP and laser-based procedures may provide BPH patients with durable symptom relief, these procedures have a number of limitations, including:

•High rates of irreversible complications. Irreversible complications are a common side effect of endoscopic resective procedures. Published studies have shown rates of erectile dysfunction as high as 14%, 20% and 8%, ejaculatory dysfunction as high as 89%, 50% and 77%, and incontinence as high as 2%, 2%, and 33% for TURP, PVP and laser enucleation, respectively. We believe the high rates of irreversible complications are in large part due to these technologies utilizing heat to remove prostate tissue, which may lead to unintended thermal damage to critical parts of the anatomy. Furthermore, minimal intraoperative visualization, which is generally limited to a cystoscope, provides limited visibility of the prostate and makes it difficult for the surgeon to see and preserve critical parts of the prostate during tissue resection. This results in highly variable depth of tissue penetration, damage to tissue which may extend deeper than cavity created, a potential for unintended prostate capsule perforation, potential damage to nerve bundle responsible for erectile function, and delayed healing of prostatic urethra.

•Prostate size limitations. While TURP is considered the standard of care for surgical treatment of BPH, it is generally reserved for small- to average-sized prostates below 80 ml given the length and manual nature of the procedure. For laser-based therapies, PVP is also most commonly used for small- to average-sized prostates, while laser enucleation is generally reserved for treating patients with larger prostates.

•Experience dependent outcomes and long learning curves. Endoscopic resective procedures rely on manual resection of the prostate, with clinical outcomes often highly dependent on the surgeon’s experience level. For example, a study of a large number of patients undergoing TURP found that the rate of reoperation was 1.2-fold higher in men treated by surgeons who had performed 172 or fewer TURP procedures versus surgeons that had performed more than 402 TURP procedures. In addition, a study of 200 procedures by a surgeon performing PVP showed that the surgeon required at least 120 procedures to achieve optimal clinical outcomes. Furthermore, a study of surgeons learning to perform laser enucleation demonstrated that one-third of the surgeons failed to complete the training program.

•Inconsistent and lengthy resection times. Endoscopic resective procedures require manual resection of prostate tissue performed under limited visualization. This manual process contributes to highly inconsistent and lengthy resection times that are strongly correlated with prostate size.

Limitations of a Simple Prostatectomy

While a simple prostatectomy typically provides maximum symptom relief by removing part or all of the prostate gland, this procedure is generally considered a treatment of last resort reserved for patients with large prostates. Limitations of a simple prostatectomy include:

•Surgical safety concerns. Even when performed robotically, a simple prostatectomy still requires incisions to be made in the patient’s abdomen in order to access the prostate gland. Bleeding events are a key risk in these types of procedures, with transfusion rates as high as 25%.

•High rates of irreversible complications. Similar to endoscopic resective procedures, open procedures commonly result in high rates of irreversible complications, with studies showing erectile, ejaculatory dysfunction and incontinence rates as high as 2-3%, 90% and 8%, respectively.

•Long hospital stay and recovery time. Given the invasiveness of open procedures, long hospital stays and post-procedure recovery are common. In addition, patients typically stay in the hospital for an average of five days after surgery and have long recovery times.

Limitations of Non-Resective Procedures

While non-resective procedures are associated with favorable safety profiles and limited impact on sexual function, these procedures generally deliver lower and less durable symptom relief than resective procedures. Limitations of non-resective procedures include:

•Limited symptom relief and durability. By not removing obstructive prostate tissue, non-resective procedures generally results in less significant and durable symptom relief compared to resective procedures. In addition, since prostate tissue continues to grow over time, durability of symptom relief is typically less favorable in non-resective procedures, with higher rates of patients needing to undergo surgical retreatment or go back on drugs. For example, five-year surgical retreatment rates for PUL and water vapor therapy were 13.6% and 4.4%, respectively. In addition, the rates of PUL and water vapor therapy patients back on drug therapy at five years were 10.7% and 11.1%, respectively. Furthermore, since PUL requires the use of a permanent implant, there is risk of post-operative complications due to the implant which may require implant removal, with a published five-year rate of implant removal of 9.3%.

•Limited intraoperative visualization. Similar to endoscopic resective procedures, the surgeon’s view of the prostate in endoscopic non-resective procedures is limited to a cystoscope that provides minimal visibility of the prostate.

•Prostate size and shape limitations. Both PUL and water vapor therapy are generally used for small- to average-sized prostates. Unlike any of the resective procedures, both of these procedures are specifically limited by the FDA for use in certain prostate sizes. The mean prostate volumes for PUL and water vapor therapy were 45 ml and 46 ml, respectively, in their respective U.S. pivotal, prospective, randomized clinical trials. In addition, the use of these procedures may be limited for certain complex prostate shapes.

Our Solution

We have developed the AquaBeam Robotic System, an advanced, image-guided, surgical robotic system for use in minimally invasive urologic surgery. Our proprietary AquaBeam Robotic System delivers our Aquablation therapy, the first and only image-guided robotic therapy for the treatment of BPH. We market the AquaBeam Robotic System in the United States pursuant to FDA 510(k) clearance that we received in March 2021. The most common side effects observed for Aquablation therapy are mild and transient and may include mild pain or difficulty when urinating, discomfort in the pelvis, blood in the urine, inability to empty the bladder or a frequent or urgent need to urinate, and bladder or urinary tract infection. During our clinical studies, we documented a rate of incontinence between 0%-2%, ejaculatory dysfunction between 6.9%-24.6%, and a peri-operative transfusion rate between 0.9%-5.9%. Since then, a number of publications have reported on transfusion rates. A key study published in April 2021 of 2,089 men undergoing Aquablation therapy with prostates ranging in size from 20 ml to 363 ml observed a transfusion rate of only 0.8%.

The AquaBeam Robotic System combines the following highly differentiated features that are intended to deliver effective, safe and durable outcomes for males suffering from LUTS due to BPH that are consistent across all prostate sizes and shapes and resection independent of surgeon experience:

•Real-time image guidance. Intraoperative ultrasound imaging combined with cystoscopic visualization, which provides a multidimensional view of the treatment area, enabling improved decision-making and real-time treatment monitoring.

•Personalized treatment planning. Using ultrasound imaging integrated with advanced planning software, the surgeon is able to map the treatment contour that precisely targets the resection area, personalizing the optimal tissue removal plan based on each patient’s unique anatomy.

•Automated robotic execution. Once the treatment plan is finalized, the robot automatically executes the plan, guiding the precisely calibrated waterjet with speed and accuracy while the surgeon monitors.

•Heat-free waterjet resection. Utilizing the unique power of a pulsating waterjet near the speed of sound, Aquablation therapy removes prostatic tissue with a heat-free waterjet, minimizing the risk of complications arising from prolonged thermal injury.

Components of the AquaBeam Robotic System

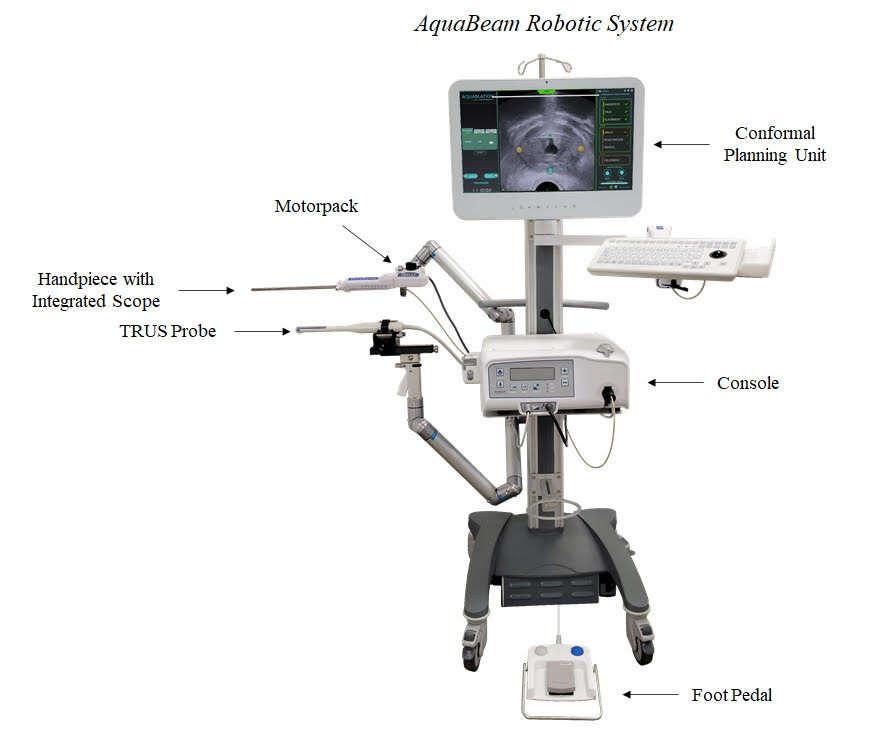

The AquaBeam Robotic System is highly mobile and compact, requiring no retrofitting of the operating room. The main components of the AquaBeam Robotic System are the conformal planning unit, or CPU, console, motorpack and handpiece with integrated scope.

The CPU serves as the primary user interface of the AquaBeam Robotic System, displaying live transrectal ultrasound, or TRUS, video which allows the surgeon to visualize the prostate and surrounding structures, identify key anatomical markers and personalize the resection based on the patient’s unique anatomy. Through an intuitive user interface, the CPU allows the surgeon to map the contour of the prostate and plan the resection pathway by selecting the resection angles, length and depth. During the procedure, the surgeon utilizes the CPU to observe the progress of the resection in real time and has the option to make adjustments to the treatment area as needed.

The console contains a high-pressure pumping system that is responsible for generating the high-velocity waterjet used in Aquablation therapy. The console interfaces with both the CPU and motorpack and handpiece assembly, generating the water flow rates based on instructions received from the CPU. The console is activated by a foot pedal and has a small screen that displays the pump level and procedure mode.

The motorpack is connected to the console with a flexible cable that provides power and control instructions to the motorpack. The motorpack consists of a motor control system that drives the movement and position of the waterjet nozzle in the handpiece. The motorpack has buttons that allow a surgeon to manually increase or decrease the pump power level during resection, if needed.

The handpiece is the sterile, single-use component of the AquaBeam Robotic System that delivers the high-velocity waterjet. The tip of the handpiece is inserted transurethrally into the patient, advanced through the prostatic urethra into the bladder and positioned using both TRUS imaging and cystoscopic guidance from the integrated, reusable scope.

The AquaBeam Robotic System also includes a customized ultrasound set through which ultrasound images are integrated with our system.

Key Benefits of Aquablation Therapy

We believe our Aquablation therapy addresses the compromise between safety and efficacy of alternative surgical interventions, providing the following unique benefits:

•significant and durable symptom relief;

•favorable safety profile compared to other BPH resective procedures;

•outcomes consistent across all prostate sizes and shapes and resection independent of surgeon experience;

•personalized treatment planning and improved decision-making; and

•targeted and controlled resection with consistent resection times.

Our Clinical Results and Studies

A significant body of clinical evidence supports the efficacy, safety and durability of Aquablation therapy across prostate sizes and shapes as well as surgeon experience. This robust body of evidence includes more than 150 peer-reviewed publications in premier journals, such as the Journal of Urology, European Urology and BJU International, as well as nine clinical studies, including our three core studies: WATER, WATER II and OPEN WATER.