UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Item 1. Report to Stockholders.

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

EMBASSY

The Ambassador Fund

(Ticker Symbol: EMPIX)

The Diplomat Fund

(Ticker Symbol: EMWIX)

ANNUAL REPORT

October 31, 2023

Embassy Asset Management Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 6 |

| Schedule of Investments | 8 |

| Statements of Assets and Liabilities | 17 |

| Statements of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Statement of Cash Flows | 21 |

| Financial Highlights | 22 |

| Notes to Financial Statements | 24 |

| Report of Independent Registered Public Accounting Firm | 39 |

| Supplemental Information | 41 |

| Expense Examples | 49 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Embassy Asset Management Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.embassyfunds.com

October 31, 2023

The Ambassador Fund focuses on insurance-linked securities (ILS). These securities are linked to the occurrence and severity of various insurable catastrophes such as hurricanes and earthquakes. ILS are often sponsored by insurance and re-insurance companies as a way for these companies to diversify their insurance and reinsurance capital bases. They are structured to create minimal credit and duration risk. Purchasers of these securities are essentially selling reinsurance to the reinsurance companies. Certain forms of ILS, such as catastrophe bonds (cat bonds) are traded in the secondary market, while others, such as industry loss warranties and quota shares are non-tradeable, and are referred to generally as private ILS.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-771-7731.

Most cat bonds are issued under SEC Rule 144A and investors in these securities must qualify as Qualified Institutional Buyers (QIBs) to purchase them1. The Ambassador Fund achieved QIB status in mid-March 2023 and began investing in cat bonds shortly thereafter. The Fund was fully invested by the end of April 2023. The Ambassador Fund had a net return of 11.94% for the period from October 31, 2022 through October 31, 2023. The Swiss Re Global Cat Bond Total Return Index2 (the Index) returned 21.52%3 over the same period. The Ambassador Fund underperformed the Index in fiscal year 2023 because it was only invested in cat bonds for the last 6 months of the fiscal year.

In our opinion, market conditions for cat bonds remain very attractive. Recent natural catastrophe activity has caused pricing to improve. In addition, we believe cat bond issuance will continue to increase as reinsurers seek alternative sources of capital.

As of October 31, 2023, the fund had approximately $127.5 MM in net assets. The portfolio consisted of over 60 cat bonds from a variety of issuers, as well as other ILS securities and a small position in US Treasury Bills.

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results. Index performance is not illustrative of Fund performance. The Fund is newly organized and has limited operating history.

| 1 | Cat Bonds and some other insurance-linked securities in which the Fund seeks to invest substantially all of its assets are typically only available to “qualified institutional buyers” (or “QIBs”), as defined in Rule 144A under the 1933 Act. To qualify as a QIB, the Fund generally must have at least $100 million in assets or qualify under another provision of the QIB definition under Rule 144A. The Fund may fail to qualify as a QIB at some point in the future. For any period during which the Fund does not qualify as a QIB, it will not be able to purchase Cat Bonds or other insurance-linked securities under Rule 144A, which may prevent the Fund from achieving its investment objective. |

| 2 | The Swiss Re Global Cat Bond Total Return Index (Bloomberg: SRGLTRR <Index>) is a market value-weighted basket of natural catastrophe bonds tracked by Swiss Re Capital Markets, calculated on a weekly basis. |

| 3 | The Swiss Re Global Cat Bond Total Return Index does not have any fees or expenses. One cannot invest directly in an index. |

1

Adviser makes no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data provided. All market prices, data and other information may not be audited information. All information is subject to change.

The performance quoted represents past performance and does not guarantee future results. The performance shown assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted. Additional brokerage commissions will further reduce returns. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted.

Index returns are for illustrative purposes. The indices presented are unmanaged, and you can’t invest directly in an index. SRGLTRR index returns do not reflect any management fees, transaction costs or expenses. Past performance does not guarantee future results. The Swiss Re Global Cat Bond Total Return Index (Bloomberg: SRGLTRR <Index>) is a market value-weighted basket of natural catastrophe bonds tracked by Swiss Re Capital Markets, calculated on a weekly basis. The Fund achieved QIB status in March 2023. In the current fiscal year ended October 31, 2023, prior to March 2023, the Fund invested in different securities than those tracked by SRGLTRR because of the aforementioned QIB issue. When the Fund achieved QIB status in March 2023, the Fund’s portfolio included a subset of the securities tracked by SRGLTRR. The volatility of the index may be materially different from the individual performance attained by a specific investor. In addition, your holdings may differ significantly from the securities that comprise the indices. The indices have not been selected to represent an appropriate benchmark to compare an investors’ performance, but rather are disclosed to allow for comparison of the investors’ performance to that of well-known and widely recognized indices.

Mutual fund investing involves risk; Principal loss is possible. The principal risk of an investment in an insurance-linked security is that a triggering event(s) (e.g., (i) natural events, such as a hurricane, earthquake, or a tornado of a particular severity that causes a threshold level of insured loss in a designated geographic area; or (ii) certain non-natural events) will occur and the Fund will lose all or a significant portion of the principal it has invested in the security and the right to additional interest payments with respect to the security. If multiple triggering events occur that impact a significant portion of the Fund’s portfolio, the Fund could suffer substantial losses and an investor may lose money. A majority of the Fund’s assets will typically be invested in insurance-linked securities tied to natural events and/or non-natural disasters and there is inherent uncertainty as to whether, when or where such events will occur. There is no way to accurately predict whether a triggering event will occur, and, because of this uncertainty, insurance-linked securities carry a high degree of risk. The Fund may have exposure, without limitation, to insurance-linked securities that are rated below investment grade or that are unrated but are judged by the Sub-Advisor to be of comparable quality. Cat Bonds carry significant uncertainties and major risk exposures to adverse conditions. Because Cat Bonds cover “catastrophe” events that, if they occur, will result in significant losses, they carry a high degree of risk of loss.

Any third-party information contained herein has been obtained from sources believed to be reliable; however, no assurance can be given that all external information is correct. All market prices, data and other information are not warranted as to completeness or accuracy, may not be audited information and are subject to change without notice.

Statements in this commentary that are not historical facts are forward-looking statements based on the investment team’s current expectations and assumptions of economic and other future conditions and forecasts of future events, circumstance, and results. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements.

The forecasts and opinions in this piece are provided for informational purposes only and may not actually come to pass. The views and opinions expressed above are those of the portfolio management team at the time of writing and are subject to market, economic and other conditions that may change at any time, and, therefore, actual results may differ materially from those expected. They should not be construed as recommendations to buy or sell securities in the asset classes discussed. The financial instruments described may not be suitable for all investors. All investments contain associated inherent risks including possible loss of principal.

The analysis provided should not be relied upon as the sole factor in an investment decision, but as illustrations of broader economic themes. We assume no obligation to update any forward-looking statement made by us as a result of new information, future events or other factors.

2

This material does not constitute a recommendation to the suitability of any product or security and does not constitute an offer to buy or sell any financial instrument or to participate in any trading strategy. All data presented is as of October 31, 2023 unless otherwise stated.

IMST Distributors, LLC, distributor.

3

October 31, 2023

The Diplomat Fund (“Fund”) seeks to provide total return. The Fund is invested in a portfolio of 7-10y U.S. Treasury Notes, overlaid with long or short interest rate futures contracts. The Fund is for long-term investors only.

The Diplomat Fund is guided by a proprietary quantitative model that consists of a combination of macroeconomic, valuation and technical factors used to predict the direction and magnitude of U.S. interest rate movements over an approximately 30-day period. The core of the Fund’s portfolio is US Treasury Notes with maturities of 7 -10 years. Based on the model’s output, the Fund invests in US Treasury futures to increase or decrease the Fund’s total duration to a target level of duration generated by the model. By using interest rate futures contracts to actively manage total duration, the Fund attempts to outperform a passively managed portfolio of 7-10 year Treasury Notes, in the long run.

The Diplomat Fund had a net return of 3.19% for the period from October 31, 2022 through October 31, 2023. This compares favorably to the ICE Data Services 7-10 Year Treasury Index, which returned -2.39% over the same period. During the year, the model correctly predicted the direction of bond yields 7 of 12 times. The relevant period has seen historic volatility in bond yields as the market digested the Fed’s rate hiking cycle and assessed various geopolitical events as well as the likelihood of a recession in the US and abroad. The Fund’s annualized outperformance was 5.58% during the relevant period which is attributable to the futures overlay.

While the Fund is still new, Embassy believes this result is evidence that managing the duration of a portfolio of 7-10 year US Treasury securities with a treasury futures overlay can provide attractive risk adjusted returns when compared to holding the US Treasury position alone.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-771-7731.

Must be preceded or accompanied by a prospectus.

Past performance does not guarantee future results. The Fund is newly organized and has limited operating history. There can be no guarantee that any strategy will be successful.

Mutual fund investing involves risk; Principal loss is possible. The Fund invests in U.S. Treasury Securities, generally with maturities of 7 to 10 years and in interest rate futures. The Fund is managed based on a proprietary quantitative model that consists of a combination of macroeconomic, valuation and technical factors. Based on the model’s output (i.e., its predicted interest rate moves), the Fund’s duration is increased or decreased. A principal risk in the Fund is that interest rates rise in a period where the model has predicted interest rates to fall, thereby causing a decrease in the value of the U.S. Treasury Securities and a decrease in the value of the interest rate futures positions. In that case the Fund may lose principal as the futures positions are closed out.

4

The Fund invests in derivatives, including futures contracts, which are often more volatile than other investments and may magnify the Fund’s gains or losses.

Derivatives Risk. The Fund uses futures contracts, which are a type of derivative contract. A derivative refers to any financial instrument whose value is derived, at least in part, from the price of another security or an asset, rate or, in the case of the Fund, a specified benchmark – the 10-year U.S. Treasury Note. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. Changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index. Gains or losses in a derivative may be magnified and may be much greater than the derivative’s original cost.

On October 28, 2020, the SEC adopted Rule 18f-4 (the “Derivatives Rule”) under the Investment Company Act of 1940 (the “1940 Act”) which, following an implementation period, will replace existing SEC and staff guidance with an updated, comprehensive framework for the use of derivatives by registered investment companies, like the Fund. To the extent the Fund uses derivatives, complying with the Derivatives Rule may increase the cost of the Fund’s investments and cost of doing business, which could adversely affect investors. The regulation of the use of derivatives in the United States is a changing area of law and is subject to ongoing modification by government, self-regulatory and judicial action.

Futures Contracts Risk. There may be an imperfect correlation between the changes in market value of the securities or other underlying assets held by the Fund and the prices of futures contracts. When the Fund has an open futures contract position, it is subject to daily variation margin calls that could be substantial in the event of adverse price movements. If the Fund has insufficient cash to meet daily variation margin requirements, it might need to sell securities at a time when such sales are disadvantageous.

Any third-party information contained herein has been obtained from sources believed to be reliable; however, no assurance can be given that all external information is correct. All market prices, data and other information are not warranted as to completeness or accuracy, may not be audited information and are subject to change without notice.

Statements in this commentary that are not historical facts are forward-looking statements based on the investment team’s current expectations and assumptions of economic and other future conditions and forecasts of future events, circumstance, and results. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements.

The forecasts and opinions in this piece are provided for informational purposes only and may not actually come to pass. The views and opinions expressed above are those of the portfolio management team at the time of writing and are subject to market, economic and other conditions that may change at any time, and, therefore, actual results may differ materially from those expected. They should not be construed as recommendations to buy or sell securities in the asset classes discussed. The financial instruments described may not be suitable for all investors. All investments contain associated inherent risks including possible loss of principal.

The analysis provided should not be relied upon as the sole factor in an investment decision, but as illustrations of broader economic themes. We assume no obligation to update any forward-looking statement made by us as a result of new information, future events or other factors.

This material does not constitute a recommendation to the suitability of any product or security and does not constitute an offer to buy or sell any financial instrument or to participate in any trading strategy. All data presented is as of October 31, 2023 unless otherwise stated.

IMST Distributors, LLC, distributor.

5

The Ambassador Fund

FUND PERFORMANCE at October 31, 2023 (Unaudited)

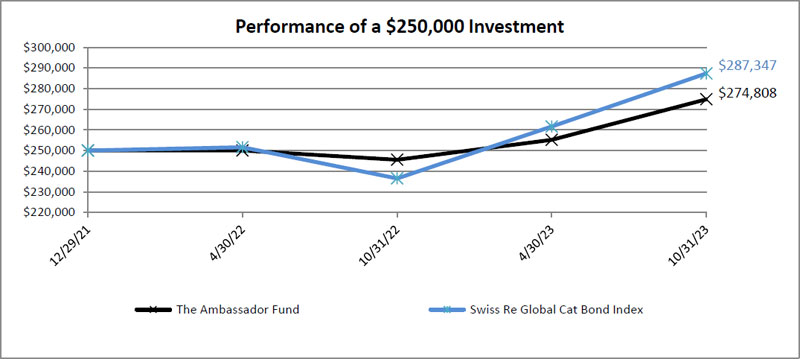

This graph compares a hypothetical $250,000 investment in the Fund, made at is inception, with a similar investment in the Swiss Re Global Cat Bond Index. Results include the reinvestment of all dividends and capital gains.

The Swiss Re Global Cat Bond Index tracks the aggregate performance of all USD, EUR, and JPY denominated cat bonds, capturing all ratings, perils and triggers. This index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| Average Annual Total Returns as of October 31, 2023 | 1 Year |

Since Inception | Inception Date |

| The Ambassador Fund | 11.94% | 5.28% | 12/29/21 |

| Swiss Re Global Cat Bond Index | 21.52% | 7.87% | 12/29/21 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 771-7731.

Gross and net expense ratio for the Fund were 2.56% and 1.42%, respectively, which were the amounts stated in the current prospectus dated March 1, 2023. For the Fund’s current one-year expense ratios, please refer to the Financial Highlights. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.40% of the average daily net assets of the Fund. This agreement is in effect until February 29, 2024, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

The Diplomat Fund

FUND PERFORMANCE at October 31, 2023 (Unaudited)

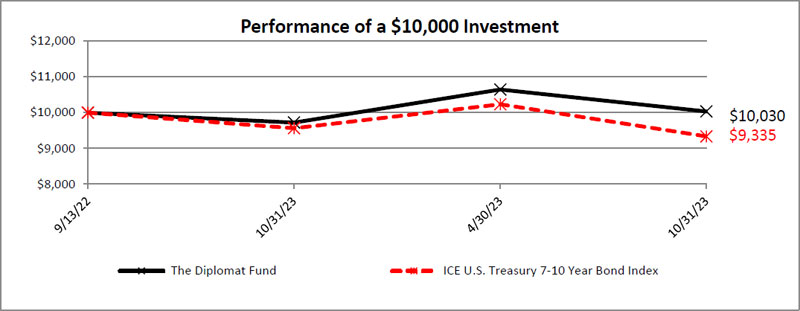

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the ICE U.S. Treasury 7-10 Year Bond Index. Results include the reinvestment of all dividends and capital gains.

The ICE U.S. Treasury 7-10 Year Bond Index is part of a series of indices intended to assess the U.S. Treasury market. The Index is market value weighted and is designed to measure the performance of U.S. dollar-denominated, fixed rate securities with minimum term to maturity greater than seven years and less than or equal to ten years. This index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| Average Annual Total Returns as of October 31, 2023 | 1 Year |

Since Inception | Inception Date |

| The Diplomat Fund | 3.19% | 0.27% | 9/13/22 |

| ICE U.S. Treasury 7-10 Year Bond Index | -2.39% | -5.90% | 9/13/22 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 771-7731.

Gross and net expense ratios for the Fund were 1.06% and 1.00%, respectively, which were stated in the current prospectus dated March 1, 2023. For the Fund’s current period expense ratios, please refer to the Financial Highlights of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.00% of the average daily net assets of the Fund. This agreement is in effect until February 29, 2024, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

The Ambassador Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2023

| Principal Amount1 | Value | |||||||

| EVENT LINKED BONDS — 87.3% | ||||||||

| EUROPE — 4.7% | ||||||||

| WINDSTORM — 4.7% | ||||||||

| 3,750,000 | Eiffel Re Ltd. 3-Month Euribor + 325.00 basis points, 1/19/20272,3 | $ | 3,940,853 | |||||

| 2,000,000 | Randolph Re 6/15/20243 | 2,012,062 | ||||||

| 5,952,915 | ||||||||

| GLOBAL — 20.7% | ||||||||

| MULTI-PERIL — 20.7% | ||||||||

| 3,500,000 | 2001 Cat RE Ltd. 3-Month U.S. Treasury Bill + 1,266.00 basis points, 1/8/20242,3 | 3,489,500 | ||||||

| Bowline Re Ltd. Series 2022-1 | ||||||||

| 500,000 | 3-Month U.S. Treasury Bill + 775.00 basis points, 5/23/20252,3 | 505,600 | ||||||

| 3,500,000 | 3-Month U.S. Treasury Bill + 1,618.00 basis points, 5/23/20252,3,4 | 3,594,500 | ||||||

| 4,250,000 | Hypatia Ltd. 3-Month U.S. Treasury Bill + 950.00 basis points, 4/8/20262,3 | 4,385,575 | ||||||

| Kilimanjaro III Re Ltd. | ||||||||

| 1,425,000 | 3-Month U.S. Treasury Bill + 991.00 basis points, 12/19/20242,3,4 | 1,429,275 | ||||||

| 1,250,000 | 3-Month U.S. Treasury Bill + 456.00 basis points, 4/21/20252,3,4 | 1,229,875 | ||||||

| 1,000,000 | 3-Month U.S. Treasury Bill + 525.00 basis points, 6/25/20252,3 | 1,000,500 | ||||||

| 250,000 | 3-Month U.S. Treasury Bill + 456.00 basis points, 4/20/20262,3,4 | 239,900 | ||||||

| 3,625,000 | Matterhorn Re Ltd. SOFR Rate + 525.00 basis points, 3/24/20252,3 | 3,534,375 | ||||||

| 1,750,000 | Montoya Re Ltd. 1-Month U.S. Treasury Bill + 675.00 basis points, 4/7/20252,3,4 | 1,761,025 | ||||||

| Mystic Re IV Ltd. | ||||||||

| 250,000 | 3-Month U.S. Treasury Bill + 613.00 basis points, 1/8/20252,3,4 | 242,125 | ||||||

| 1,050,000 | 3-Month U.S. Treasury Bill + 925.00 basis points, 1/8/20262,3,4 | 1,075,200 | ||||||

| 2,000,000 | Sakura Re Ltd. 3-Month U.S. Treasury Bill + 225.00 basis points, 4/7/20252,3 | 1,992,800 | ||||||

| 1,750,000 | Vista RE Ltd. 3-Month U.S. Treasury Bill + 675.00 basis points, 5/21/20242,3,4 | 1,748,250 | ||||||

| 250,000 | Wrigley Re Ltd. 3-Month U.S. Treasury Bill + 650.00 basis points, 8/7/20262,3,4 | 250,375 | ||||||

| 26,478,875 | ||||||||

| JAPAN — 6.7% | ||||||||

| EARTHQUAKE — 3.9% | ||||||||

| Nakama Re Ltd. | ||||||||

| 1,000,000 | 3-Month U.S. Treasury Bill + 220.00 basis points, 1/14/20252,3 | 997,100 | ||||||

| 2,000,000 | 3-Month Term SOFR + 250.00 basis points, 5/9/20282,3 | 1,989,800 | ||||||

| 2,000,000 | Nakama Re Pte Ltd. 3-Month U.S. Treasury Bill + 205.00 basis points, 10/13/20262,3 | 1,981,000 | ||||||

| 4,967,900 | ||||||||

8

The Ambassador Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2023

| Principal Amount1 | Value | |||||||

| TYPHOON — 2.8% | ||||||||

| 3,650,000 | Tomoni Re Pte Ltd. 3-Month U.S. Treasury Bill + 200.00 basis points, 4/7/20262,3 | $ | 3,595,615 | |||||

| 8,563,515 | ||||||||

| UNITED STATES — 55.2% | ||||||||

| EARTHQUAKE — 10.5% | ||||||||

| 500,000 | Logistics Re Ltd. 3-Month U.S. Treasury Bill + 388.00 basis points, 12/20/20242,3 | 490,550 | ||||||

| 500,000 | Sierra Ltd. 3-Month U.S. Treasury Bill + 270.00 basis points, 1/31/20242,3,4 | 495,750 | ||||||

| 1,500,000 | Torrey Pines Re Ltd. 3-Month U.S. Treasury Bill + 500.00 basis points, 6/5/20262,3,4 | 1,512,450 | ||||||

| Ursa Re II Ltd. | ||||||||

| 4,500,000 | 3-Month U.S. Treasury Bill + 394.00 basis points, 12/7/20232,3 | 4,486,500 | ||||||

| 500,000 | 3-Month U.S. Treasury Bill + 700.00 basis points, 12/6/20252,3,4 | 518,150 | ||||||

| 4,000,000 | Ursa Re Ltd. 3-Month U.S. Treasury Bill + 550.00 basis points, 12/6/20252,3,4 | 4,033,600 | ||||||

| 1,500,000 | Veraison Re Ltd. 1-Month U.S. Treasury Bill + 650.00 basis points, 3/9/20263,5 | 1,579,800 | ||||||

| 250,000 | Wrigley Re Ltd. 3-Month U.S. Treasury Bill + 700.00 basis points, 8/7/20262,3,4 | 253,000 | ||||||

| 13,369,800 | ||||||||

| MULTI-PERIL — 15.1% | ||||||||

| 250,000 | Aquila Re I Ltd. 3-Month U.S. Treasury Bill + 525.00 basis points, 6/8/20262,3,4 | 253,450 | ||||||

| 750,000 | Finca RE Ltd. 3-Month U.S. Treasury Bill + 775.00 basis points, 6/6/20252,3,4 | 771,375 | ||||||

| Herbie Re Ltd. | ||||||||

| 250,000 | 3-Month U.S. Treasury Bill + 930.00 basis points, 7/8/20242,3,4 | 253,500 | ||||||

| 6,175,000 | 3-Month U.S. Treasury Bill + 673.00 basis points, 1/8/20252,3,4 | 6,057,675 | ||||||

| 1,000,000 | 3-Month U.S. Treasury Bill + 972.00 basis points, 1/8/20252,3,4 | 995,800 | ||||||

| 250,000 | Long Point Re IV Ltd. 3-Month U.S. Treasury Bill + 425.00 basis points, 6/1/20262,3,4 | 248,625 | ||||||

| 750,000 | Matterhorn Re Ltd. SOFR Rate + 575.00 basis points, 12/8/20252,3 | 691,800 | ||||||

| 250,000 | Mayflower Re Ltd. 1-Month U.S. Treasury Bill + 450.00 basis points, 7/8/20262,3 | 253,350 | ||||||

| 4,500,000 | Merna Reinsurance II Ltd. 3-Month U.S. Treasury Bill + 775.00 basis points, 7/7/20262,3,6 | 4,578,750 | ||||||

| 250,000 | Residential Reinsurance 2020 Ltd. 3-Month U.S. Treasury Bill + 651.00 basis points, 12/6/20242,3 | 247,425 | ||||||

| 1,000,000 | Residential Reinsurance 2022 Ltd. 3-Month U.S. Treasury Bill + 400.00 basis points, 6/6/20262,3 | 949,400 | ||||||

| 1,000,000 | Sanders Re III Ltd. 3-Month U.S. Treasury Bill + 625.00 basis points, 4/7/20272,3 | 1,004,600 | ||||||

9

The Ambassador Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2023

| Principal Amount1 | Value | |||||||

| MULTI-PERIL (Continued) | ||||||||

| 2,035,000 | Titania Re Ltd. 1-Month U.S. Treasury Bill + 650.00 basis points, 12/27/20242,3 | $ | 1,973,340 | |||||

| 1,000,000 | Yosemite Re Ltd. 3-Month U.S. Treasury Bill + 997.80 basis points, 6/6/20252,3 | 1,022,500 | ||||||

| 19,301,590 | ||||||||

| WINDSTORM — 29.6% | ||||||||

| 1,000,000 | Alamo Re Ltd. 1-Month U.S. Treasury Bill + 850.00 basis points, 6/7/20262,3 | 1,002,700 | ||||||

| Cape Lookout Re Ltd. | ||||||||

| 1,175,000 | 1-Month U.S. Treasury Bill + 370.00 basis points, 3/22/20242,3 | 1,169,125 | ||||||

| 2,000,000 | 1-Month U.S. Treasury Bill + 650.00 basis points, 4/28/20262,3 | 2,040,600 | ||||||

| 3,250,000 | Catahoula II Re Pte Ltd. 1-Month U.S. Treasury Bill + 1,025.00 basis points, 6/16/20252,3 | 3,250,000 | ||||||

| 2,000,000 | Citrus Re Ltd. 3-Month U.S. Treasury Bill + 900.00 basis points, 6/7/20262,3,4 | 2,017,200 | ||||||

| 1,500,000 | Commonwealth RE Ltd. 3-Month U.S. Treasury Bill + 400.00 basis points, 7/8/20262,3,4 | 1,519,950 | ||||||

| 3,750,000 | Everglades Re II Ltd. 1-Month U.S. Treasury Bill, 1/16/20243 | 3,637,500 | ||||||

| 750,000 | Gateway Re II Ltd. 3-Month U.S. Treasury Bill + 950.00 basis points, 4/27/20262,3,4 | 764,175 | ||||||

| Gateway Re Ltd. | ||||||||

| 500,000 | 3-Month U.S. Treasury Bill, 1/9/20243 | 491,000 | ||||||

| 500,000 | 1-Month U.S. Treasury Bill + 1,300.00 basis points, 2/24/20262,3,4 | 527,850 | ||||||

| 250,000 | 1-Month U.S. Treasury Bill + 1,000.00 basis points, 7/8/20262,3,4 | 254,025 | ||||||

| 3,500,000 | Hestia Re Ltd. 1-Month U.S. Treasury Bill + 975.00 basis points, 4/7/20262,3,4 | 3,628,800 | ||||||

| 8,750,000 | Lightning Re Series 3-Month U.S. Treasury Bill + 1,100.00 basis points, 3/31/20262,3,4 | 9,177,000 | ||||||

| 1,000,000 | Lower Ferry Re Ltd. 1-Month U.S. Treasury Bill + 425.00 basis points, 7/8/20262,3,4 | 1,007,100 | ||||||

| Merna Reinsurance II Ltd. | ||||||||

| 1,500,000 | 3-Month U.S. Treasury Bill + 725.00 basis points, 7/7/20252,3 | 1,518,000 | ||||||

| 500,000 | 3-Month U.S. Treasury Bill + 1,025.00 basis points, 7/7/20262,3 | 520,750 | ||||||

| 5,125,000 | Queen Street 2023 Re DAC 3-Month U.S. Treasury Bill + 750.00 basis points, 12/8/20252,3,4 | 5,248,512 | ||||||

| 37,774,287 | ||||||||

| 70,445,677 | ||||||||

| TOTAL EVENT LINKED BONDS | ||||||||

| (Cost $110,284,395) | 111,440,982 | |||||||

10

The Ambassador Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2023

| Principal Amount1 | Value | |||||||

| PREFERRED NOTES — 6.5% | ||||||||

| UNITED STATES — 6.5% | ||||||||

| MULTI-PERIL — 6.5% | ||||||||

| 3,400,000 | Consulate Re 2023-1A 3.792%, 1/5/20247,8 | $ | 3,396,940 | |||||

| 5,000,000 | Consulate Re 2023-2A 5.166%, 6/5/20247,8 | 4,964,500 | ||||||

| 8,361,440 | ||||||||

| TOTAL PREFERRED NOTES | ||||||||

| (Cost $8,361,520) | 8,361,440 | |||||||

| U.S. TREASURY BILLS — 4.9% | ||||||||

| United States Treasury Bill | ||||||||

| 3,000,000 | 0.000%, 11/7/2023* | 2,997,360 | ||||||

| 3,250,000 | 0.000%, 11/14/2023* | 3,243,792 | ||||||

| TOTAL U.S. TREASURY BILLS | ||||||||

| (Cost $6,241,214) | 6,241,152 | |||||||

| Number of Shares | ||||||||

| SHORT-TERM INVESTMENTS — 3.9% | ||||||||

| 5,005,587 | Fidelity Investments Money Market Government Portfolio - Institutional Class 5.16%9 | 5,005,587 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $5,005,586) | 5,005,587 | |||||||

| TOTAL INVESTMENTS — 102.6% | ||||||||

| (Cost $129,892,715) | 131,049,161 | |||||||

| Liabilities in Excess of Other Assets — 2.6% | (3,333,141 | ) | ||||||

| TOTAL NET ASSETS — 100.0% | $ | 127,716,020 | ||||||

| * | Non-income producing security. |

| 1 | Local currency. |

| 2 | Floating rate security. Floating rate security. Reference rates as of October 31, 2023 are as follows: 1-Month U.S. Treasury Bill 5.56%, 3-Month U.S. Treasury Bill 5.59%, Secured Overnight Financing Rate (SOFR) 5.35%, and 3-Month Term SOFR 5.34%. Actual reference rates may vary based on the reset date of the security. |

| 3 | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $111,440,982, which represents 87.3% of total net assets of the Fund. |

| 4 | Callable. |

| 5 | Variable rate security. Rate shown is the rate in effect as of October 31, 2023. |

| 6 | All or a portion of this security is segregated as collateral for forward contracts. The market value of the securities pledged as collateral was $2,238,500, which represents 1.8% of total net assets of the Fund. |

| 7 | Level 3 securities fair valued under procedures established by the Advisor, represents 6.5% of Total Net Assets. The total value of these securities is $8,361,440. |

| 8 | Restricted security, represents 6.5% of Total Net Assets. The total value of this security is $8,361,440. See Note 9. |

| 9 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

11

The Ambassador Fund

SUMMARY OF INVESTMENTS

As of October 31, 2023

| Security Type/Geography/Peril | Percent of Total Net Assets | |||

| Event Linked Bonds | ||||

| United States | ||||

| Windstorm | 29.6 | % | ||

| Multi-Peril | 15.1 | % | ||

| Earthquake | 10.5 | % | ||

| Total United States | 55.2 | % | ||

| Global | ||||

| Multi-Peril | 20.7 | % | ||

| Total Global | 20.7 | % | ||

| Japan | ||||

| Earthquake | 3.9 | % | ||

| Typhoon | 2.8 | % | ||

| Total Japan | 6.7 | % | ||

| Europe | ||||

| Windstorm | 4.7 | % | ||

| Total Europe | 4.7 | % | ||

| Total Event Linked Bonds | 87.3 | % | ||

| Preferred Notes | 6.5 | % | ||

| U.S. Treasury Bills | 4.9 | % | ||

| Short-Term Investments | 3.9 | % | ||

| Total Investments | 102.6 | % | ||

| Liabilities in Excess of Other Assets | (2.6 | )% | ||

| Net Assets | 100.0 | % | ||

See accompanying Notes to Financial Statements.

12

The Ambassador Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2023

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| Sale Contracts | Counterparty | Currency Exchange | Setlement Date | Currency Amount Sold | Value At Settlement Date | Value At October 31, 2023 | Unrealized Appreciation (Depreciation) | |||||||||||||||

| Euro | UMB Bank NA | EUR per USD | 6/14/2024 | (3,750,000) | $ | (4,129,875 | ) | $ | (4,012,670 | ) | $ | 117,205 | ||||||||||

| Euro | UMB Bank NA | EUR per USD | 11/22/2023 | (1,848,000) | (2,011,548 | ) | (1,957,201 | ) | 54,347 | |||||||||||||

| TOTAL FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS | $ | (6,141,423 | ) | $ | (5,969,871 | ) | $ | 171,552 | ||||||||||||||

EUR – Euro

See accompanying Notes to Financial Statements.

13

The Diplomat Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2023

Principal | Value | |||||||

| U.S. TREASURY BILLS — 1.0% | ||||||||

| United States Treasury Bill | ||||||||

| $ | 105,700 | 0.000%, 11/30/2023 | $ | 105,249 | ||||

| TOTAL U.S. TREASURY BILLS | ||||||||

| (Cost $105,258) | 105,249 | |||||||

| U.S. TREASURY NOTES — 94.4% | ||||||||

| United States Treasury Note | ||||||||

| 4,624,100 | 2.750%, 8/15/20321 | 3,911,702 | ||||||

| 3,370,700 | 3.500%, 2/15/2033 | 3,017,302 | ||||||

| 836,000 | 3.375%, 5/15/2033 | 739,207 | ||||||

| 2,725,100 | 3.875%, 8/15/2033 | 2,508,370 | ||||||

| TOTAL U.S. TREASURY NOTES | ||||||||

| (Cost $11,048,274) | 10,176,581 | |||||||

Number | ||||||||

| SHORT-TERM INVESTMENTS — 2.0% | ||||||||

| 220,901 | Fidelity Investments Money Market Government Portfolio - Institutional Class 5.164%2 | 220,901 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | ||||||||

| (Cost $220,901) | 220,901 | |||||||

| TOTAL INVESTMENTS — 97.4% | ||||||||

| (Cost $11,374,433) | 10,502,731 | |||||||

| Other Assets in Excess of Liabilities — 2.6% | 280,014 | |||||||

| TOTAL NET ASSETS — 100.0% | $ | 10,782,745 | ||||||

| 1 | All or a portion of this security is segregated as collateral for initial futures margin. The market value of the securities pledged as collateral was $356,563, which represents 3.3% of total net assets of the Fund. |

| 2 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

14

The Diplomat Fund

SUMMARY OF INVESTMENTS

As of October 31, 2023

| Security Type/Sector | Percent

of Total Net Assets | |||

| U.S. Treasury Notes | 94.4 | % | ||

| U.S. Treasury Bills | 1.0 | % | ||

| Short-Term Investments | 2.0 | % | ||

| Total Investments | 97.4 | % | ||

| Other Assets in Excess of Liabilities | 2.6 | % | ||

| Total Net Assets | 100.0 | % | ||

See accompanying Notes to Financial Statements.

15

The Diplomat Fund

SCHEDULE OF INVESTMENTS - Continued

As of October 31, 2023

FUTURES CONTRACTS

| Number of Contracts Long (Short) | Description | Expiration Date | Notional Value | Value/ Unrealized Appreciation (Depreciation) | ||||||||

| (153) | U.S. 10 Year Treasury Note | December 2023 | $ | (16,320,235 | ) | $ | 75,938 | |||||

| TOTAL FUTURES CONTRACTS | $ | (16,320,235 | ) | $ | 75,938 | |||||||

See accompanying Notes to Financial Statements.

16

Embassy Asset Management Funds

STATEMENTS OF ASSETS AND LIABILITIES

As of October 31, 2023

The

Ambassador | The

Diplomat | |||||||

| Assets: | ||||||||

| Investments, at value (cost $129,892,715 and 11,374,433, respectively) | $ | 131,049,161 | $ | 10,502,731 | ||||

| Cash | 14,101 | - | ||||||

| Cash deposited with brokers for futures contracts | - | 137,996 | ||||||

| Receivables: | ||||||||

| Variation margin on futures contracts | - | 75,938 | ||||||

| Unrealized appreciation on forward foreign currency exchange contracts | 171,552 | - | ||||||

| Fund shares sold | 244,155 | - | ||||||

| Dividends and interest | 908,655 | 88,858 | ||||||

| Due from Advisor | - | 6,175 | ||||||

| Prepaid expenses | 38,677 | 21,583 | ||||||

| Total assets | 132,426,301 | 10,833,281 | ||||||

| Liabilities: | ||||||||

| Payables: | ||||||||

| Investment securities purchased | 4,524,767 | - | ||||||

| Fund shares redeemed | 10,015 | - | ||||||

| Advisory fees | 111,810 | - | ||||||

| Fund administration and fund accounting fees | 10,286 | 6,978 | ||||||

| Transfer agent fees and expenses | 7,459 | 1,488 | ||||||

| Auditing fees | 15,818 | 16,000 | ||||||

| Legal fees | 5,569 | 6,779 | ||||||

| Trustees' deferred compensation (Note 3) | 5,567 | 3,152 | ||||||

| Chief Compliance Officer fees | 4,227 | 5,145 | ||||||

| Trustees' fees and expenses | 1,169 | 1,126 | ||||||

| Custody fees | 807 | 2,075 | ||||||

| Commitment fees payable (Note 9) | - | 275 | ||||||

| Accrued other expenses | 12,787 | 7,518 | ||||||

| Total liabilities | 4,710,281 | 50,536 | ||||||

| Commitments and contingencies (Note 3) | ||||||||

| Net Assets | $ | 127,716,020 | $ | 10,782,745 | ||||

| Components of Net Assets: | ||||||||

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | $ | 124,570,884 | $ | 11,163,700 | ||||

| Total distributable earnings (accumulated deficit) | 3,145,136 | (380,955 | ) | |||||

| Net Assets | $ | 127,716,020 | $ | 10,782,745 | ||||

| Shares of beneficial interest issued and outstanding | 12,526,750 | 1,108,483 | ||||||

| Offering and redemption price per share | $ | 10.20 | $ | 9.73 | ||||

See accompanying Notes to Financial Statements.

17

Embassy Asset Management Funds

STATEMENTS OF OPERATIONS

For the Year Ended October 31, 2023

The

Ambassador | The

Diplomat | |||||||

| Investment income: | ||||||||

| Interest | $ | 8,156,711 | $ | 249,084 | ||||

| Total investment income | 8,156,711 | 249,084 | ||||||

| Expenses: | ||||||||

| Advisory fees | 905,151 | 60,987 | ||||||

| Fund administration and accounting fees | 77,907 | 43,904 | ||||||

| Transfer agent fees and expenses | 22,222 | 9,136 | ||||||

| Interest expense on margin loan (Note 9) | 156,521 | - | ||||||

| Commitment fees (Note 9) | 50,408 | 43,700 | ||||||

| Legal fees | 43,865 | 23,466 | ||||||

| Registration fees | 28,222 | 28,222 | ||||||

| Chief Compliance Officer fees | 23,000 | 25,600 | ||||||

| Auditing fees | 15,909 | 16,000 | ||||||

| Miscellaneous | 12,949 | 7,405 | ||||||

| Trustees' fees and expenses | 11,168 | 9,501 | ||||||

| Shareholder reporting fees | 10,757 | 10,829 | ||||||

| Offering costs | 7,216 | 9,095 | ||||||

| Custody fees | 7,081 | 5,099 | ||||||

| Insurance fees | 3,000 | 3,000 | ||||||

| Total expenses | 1,375,376 | 295,944 | ||||||

| Advisory fees (waived) | (162,846 | ) | (60,987 | ) | ||||

| Other expenses (absorbed) | - | (167,195 | ) | |||||

| Net expenses | 1,212,530 | 67,762 | ||||||

| Net investment income (loss) | 6,944,181 | 181,322 | ||||||

| Realized and Unrealized Gain (Loss): | ||||||||

| Net realized gain (loss) on: | ||||||||

| Investments | 227,275 | 510 | ||||||

| Futures contracts | - | 407,703 | ||||||

| Foreign currency transactions | 20,579 | - | ||||||

| Net realized gain (loss) | 247,854 | 408,213 | ||||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||

| Investments | 2,061,939 | (787,055 | ) | |||||

| Futures contracts | - | 60,688 | ||||||

| Forward contracts | 171,552 | - | ||||||

| Foreign currency translations | (3 | ) | - | |||||

| Net change in unrealized appreciation (depreciation) | 2,233,488 | (726,367 | ) | |||||

| Net realized and unrealized gain (loss) | 2,481,342 | (318,154 | ) | |||||

| Net Increase (Decrease) in Net Assets from Operations | $ | 9,425,523 | $ | (136,832 | ) | |||

See accompanying Notes to Financial Statements.

18

The Ambassador Fund

STATEMENTS OF CHANGES IN NET ASSETS

For

the | For

the | |||||||

| Increase (Decrease) in Net Assets from: | ||||||||

| Operations: | ||||||||

| Net investment income (loss) | $ | 6,944,181 | $ | 353,373 | ||||

| Net realized gain (loss) on investments and foreign currency transactions | 247,854 | 24,062 | ||||||

| Net change in unrealized appreciation (depreciation) on investments and foreign currency translations | 2,233,488 | (905,493 | ) | |||||

| Net increase (decrease) in net assets resulting from operations | 9,425,523 | (528,058 | ) | |||||

| Distributions to Shareholders: | ||||||||

| Total distributions to shareholders | (5,486,955 | ) | (286,880 | ) | ||||

| Capital Transactions: | ||||||||

| Net proceeds from shares sold | 105,469,785 | 32,191,968 | ||||||

| Reinvestment of distributions | 5,303,400 | 286,880 | ||||||

| Cost of shares redeemed | (14,432,203 | ) | (4,227,440 | ) | ||||

| Net increase (decrease) in net assets from capital transactions | 96,340,982 | 28,251,408 | ||||||

| Total increase (decrease) in net assets | 100,279,550 | 27,436,470 | ||||||

| Net Assets: | ||||||||

| Beginning of period | 27,436,470 | - | ||||||

| End of period | $ | 127,716,020 | $ | 27,436,470 | ||||

| Capital Share Transactions: | ||||||||

| Shares sold | 10,618,893 | 3,220,934 | ||||||

| Shares reinvested | 532,607 | 29,333 | ||||||

| Shares redeemed | (1,448,012 | ) | (427,006 | ) | ||||

| Net increase (decrease) in capital share transactions | 9,703,488 | 2,823,261 | ||||||

| * | Commencement of operations on December 29, 2021. |

See accompanying Notes to Financial Statements.

19

The Diplomat Fund

STATEMENTS OF CHANGES IN NET ASSETS

For

the | For

the | |||||||

| Increase (Decrease) in Net Assets from: | ||||||||

| Operations: | ||||||||

| Net investment income (loss) | $ | 181,322 | $ | (1,134 | ) | |||

| Net realized gain (loss) on investments and futures contracts | 408,213 | 20,703 | ||||||

| Net change in unrealized appreciation (depreciation) on investments and futures contracts | (726,367 | ) | (69,397 | ) | ||||

| Net increase (decrease) in net assets resulting from operations | (136,832 | ) | (49,828 | ) | ||||

| Distributions to Shareholders: | ||||||||

| Total distributions to shareholders | (196,460 | ) | - | |||||

| Capital Transactions: | ||||||||

| Net proceeds from shares sold | 10,364,483 | 1,789,010 | ||||||

| Reinvestment of distributions | 196,460 | - | ||||||

| Cost of shares redeemed | (1,184,088 | ) | - | |||||

| Net increase (decrease) in net assets from capital transactions | 9,376,855 | 1,789,010 | ||||||

| Total increase (decrease) in net assets | 9,043,563 | 1,739,182 | ||||||

| Net Assets: | ||||||||

| Beginning of period | 1,739,182 | - | ||||||

| End of period | $ | 10,782,745 | $ | 1,739,182 | ||||

| Capital Share Transactions: | ||||||||

| Shares sold | 1,026,211 | 178,951 | ||||||

| Shares reinvested | 19,363 | - | ||||||

| Shares redeemed | (116,042 | ) | - | |||||

| Net increase (decrease) in capital share transactions | 929,532 | 178,951 | ||||||

| * | Commencement of operations on September 13, 2022. |

See accompanying Notes to Financial Statements.

20

The Ambassador Fund

STATEMENT OF CASH FLOWS

For the Year Ended October 31, 2023

| Increase (Decrease) in Cash: | ||||

| Cash flows provided by (used for) operating activities: | ||||

| Net increase (decrease) in net assets resulting from operations | $ | 9,425,523 | ||

| Adjustments to reconcile net increase (decrease) in net assets from operations to net cash provided by (used for) operating activities: | ||||

| Purchases of long-term investments | (158,760,674 | ) | ||

| Sales of long-term investments | 78,518,237 | |||

| Purchases/Sales of short-term investments, net | (17,082,739 | ) | ||

| Net amortization on investments | (2,148,190 | ) | ||

| Net realized (gain) loss | (227,275 | ) | ||

| Net change in unrealized appreciation/depreciation | (2,233,491 | ) | ||

| (Increase) Decrease in Assets: | ||||

| Dividends and interest | (761,191 | ) | ||

| Prepaid expenses and other assets | 9,802 | |||

| Increase (Decrease) in Liabilities: | ||||

| Investment securities purchased payable | 2,542,059 | |||

| Advisory fees payable | 100,256 | |||

| Accrued expenses | 11,897 | |||

| Total Cash flows provided by (used for) operating activities: | (90,605,786 | ) | ||

| Cash flows provided by (used for) financing activities: | ||||

| Proceeds from margin loan | 23,000,000 | |||

| Payments for margin loan | (23,000,000 | ) | ||

| Proceeds from shares sold | 105,225,630 | |||

| Cost of shares redeemed | (14,422,188 | ) | ||

| Dividends paid to shareholders, net of reinvestments | (183,555 | ) | ||

| Total Cash flows provided by (used for) financing activities: | 90,619,887 | |||

| Net increase (decrease) in cash | 14,101 | |||

| Cash and cash equivalents: | ||||

| Beginning cash balance | — | |||

| Total beginning cash and cash equivalents | — | |||

| Ending cash balance | 14,101 | |||

| Total ending cash and cash equivalents | $ | 14,101 | ||

| Non-cash financing activities from reinvestment of distributions | 5,303,400 | |||

| Interest payments on margin loan | 156,521 | |||

See accompanying Notes to Financial Statements.

21

The Ambassador Fund

FINANCIAL HIGHLIGHTS

Per share operating performance.

For a capital share outstanding throughout each period.

For the Year Ended | For

the | |||||||

| Net asset value, beginning of period | $ | 9.72 | $ | 10.00 | ||||

| Income from Investment Operations: | ||||||||

| Net investment income (loss)1 | 0.92 | 0.17 | ||||||

| Net realized and unrealized gain (loss) | 0.21 | (0.35 | ) | |||||

| Total from investment operations | 1.13 | (0.18 | ) | |||||

| Less Distributions: | ||||||||

| From net investment income | (0.64 | ) | (0.10 | ) | ||||

| From net realized gain | (0.01 | ) | - | |||||

| Total distributions | (0.65 | ) | (0.10 | ) | ||||

| Net asset value, end of period | $ | 10.20 | $ | 9.72 | ||||

| Total return2 | 11.94 | % | (1.80 | )%3 | ||||

| Ratios and Supplemental Data: | ||||||||

| Net assets, end of period (in thousands) | $ | 127,716 | $ | 27,436 | ||||

| Ratio of expenses to average net assets (including interest expense and commitment fees): | ||||||||

| Before fees waived and expenses absorbed4 | 1.83 | % | 2.54 | %5 | ||||

| After fees waived and expenses absorbed4 | 1.61 | % | 1.29 | %5,6 | ||||

| Ratio of net investment income (loss) to average net assets (including interest expense and commitment fees): | ||||||||

| Before fees waived and expenses absorbed | 8.99 | % | 0.76 | %5 | ||||

| After fees waived and expenses absorbed | 9.21 | % | 2.01 | %5 | ||||

| Portfolio turnover rate | 145 | % | 61 | %3 | ||||

| * | Commencement of operations on December 29, 2021. |

| 1 | Based on average shares outstanding during the period. |

| 2 | Total returns would have been lower had certain expenses not been waived or absorbed by the Advisor. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| 3 | Not annualized. |

| 4 | If interest expense had been excluded, the expense ratios would have been lowered by 0.21% for the year ended October 31, 2023. If commitment fees had been excluded, the expense ratios would have been lowered by 0.17% for the period ended October 31, 2022. |

| 5 | Annualized. |

| 6 | For the period December 29, 2021 through April 30, 2022, the Advisor has voluntarily agreed to waive all its fees and absorb operating expenses of the Fund. (See Note 3.) |

See accompanying Notes to Financial Statements.

22

The Diplomat Fund

FINANCIAL HIGHLIGHTS

Per share operating performance.

For a capital share outstanding throughout each period.

For the Year Ended | For

the | |||||||

| Net asset value, beginning of period | $ | 9.72 | $ | 10.00 | ||||

| Income from Investment Operations: | ||||||||

| Net investment income (loss)1 | 0.27 | (0.01 | ) | |||||

| Net realized and unrealized gain (loss) | 0.05 | (0.27 | ) | |||||

| Total from investment operations | 0.32 | (0.28 | ) | |||||

| Less Distributions: | ||||||||

| From net investment income | (0.23 | ) | - | |||||

| From net realized gain | (0.08 | ) | - | |||||

| Total distributions | (0.31 | ) | - | |||||

| Net asset value, end of period | $ | 9.73 | $ | 9.72 | ||||

| Total return2 | 3.19 | % | (2.80 | )%3 | ||||

| Ratios and Supplemental Data: | ||||||||

| Net assets, end of period (in thousands) | $ | 10,783 | $ | 1,739 | ||||

| Ratio of expenses to average net assets (including commitment fees): | ||||||||

| Before fees waived and expenses absorbed | 4.37 | % | 19.44 | %4,5 | ||||

| After fees waived and expenses absorbed | 1.00 | % | 3.93 | %4,5 | ||||

| Ratio of net investment income (loss) to average net assets (including commitment fees): | ||||||||

| Before fees waived and expenses absorbed | (0.69 | )% | (16.02 | )%4 | ||||

| After fees waived and expenses absorbed | 2.68 | % | (0.51 | )%4 | ||||

| Portfolio turnover rate | 6 | % | - | %3 | ||||

| * | Commencement of operations on September 13, 2022. |

| 1 | Based on average shares outstanding during the period. |

| 2 | Total returns would have been lower had certain expenses not been waived or absorbed by the Advisor. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| 3 | Not annualized. |

| 4 | Annualized. |

| 5 | If commitment fees had been excluded, the expense ratios would have been lowered by 2.93% for the period ended October 31, 2022. |

See accompanying Notes to Financial Statements.

23

Embassy Asset Management Funds

NOTES TO FINANCIAL STATEMENTS

October 31, 2023

Note 1 – Organization

The Ambassador Fund is organized as a non-diversified series and The Diplomat Fund is organized as a diversified series of Investment Managers Series Trust II, a Delaware statutory trust (the “Trust”) which is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Ambassador Fund’s primary investment objective is to seek current income and pursues its investment objective by investing primarily in "catastrophe" or "cat" bonds ("Cat Bonds"). The Ambassador Fund commenced investment operations on December 29, 2021. The Diplomat Fund’s primary investment objective is to seek total return and pursues its investment objective by investing primarily in debt securities of the U.S. Government and interest rate futures contracts related to debt securities (“Interest Rate Futures”). The Diplomat Fund commenced investment operations on September 13, 2022.

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies”.

Note 2 – Accounting Policies

The following is a summary of the significant accounting policies consistently followed by the Funds in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

(a) Valuation of Investments

The Funds value investments in open-end investment companies at the daily closing net asset value of the respective investment company. Debt securities are valued by utilizing a price supplied by independent pricing service providers. The independent pricing service providers may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. These models generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions. If a price is not readily available for a portfolio security, the security will be valued at fair value (the amount which the Funds might reasonably expect to receive for the security upon its current sale). The Board of Trustees has designated the Advisor as the Funds’ valuation designee (the “Valuation Designee”) to make all fair value determinations with respect to the Funds’ portfolio investments, subject to the Board’s oversight. As the Valuation Designee, the Advisor has adopted and implemented policies and procedures to be followed when the Funds must utilize fair value pricing. Prior to September 8, 2022, securities were valued at fair value as determined in good faith by the Fund’s advisor, subject to review and approval by the Valuation Committee, pursuant to procedures adopted by the Board of Trustees. The actions of the Valuation Committee were subsequently reviewed by the Board at its next regularly scheduled board meeting. The Valuation Committee met as needed. The Valuation Committee was comprised of all the Trustees, but action may had been taken by any one of the Trustees.

(b) Investment Transactions, Investment Income and Expenses

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis. Discounts on debt securities are accreted or amortized to interest income over the lives of the respective securities using the effective interest method. Premiums for callable debt securities are amortized to the earliest call date, if the call price was less than the purchase price. If the call price was not at par and the security was not called, the security is amortized to the next call price and date. Expenses incurred by the Trust with respect to more than one fund are allocated in proportion to the net assets of each fund except where allocation of direct expenses to each Fund or an alternative allocation method can be more appropriately made.

24

Embassy Asset Management Funds

NOTES TO FINANCIAL STATEMENTS - Continued

October 31, 2023

The Ambassador Fund incurred offering costs of approximately $35,690, which were amortized over a one-year period from December 29, 2021 (commencement of operations).

The Diplomat Fund incurred offering costs of approximately $10,380, which were amortized over a one-year period from September 13, 2022 (commencement of operations).

(c) Federal Income Taxes

The Funds intend to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of their net investment income and any net realized gains to their shareholders. Therefore, no provision is made for federal income or excise taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Funds.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Funds to analyze tax positions taken in the prior three open tax years, if any, and tax positions expected to be taken in the Funds’ current tax year, as defined by the IRS statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of October 31, 2023, and during all open tax years, the Funds did not have a liability for any unrecognized tax benefits. The Funds have no examinations in progress and are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(d) Distributions to Shareholders

The Funds will make distributions of net investment income quarterly and net capital gains, if any, at least annually. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain (loss) items for financial statement and tax purposes.

(e) Illiquid Securities

Pursuant to Rule 22e-4 under the 1940 Act, the Funds have adopted a Liquidity Risk Management Program (“LRMP”) that requires, among other things, that the Funds limit their illiquid investments that are assets to no more than 15% of net assets. An illiquid investment is any security which may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. If the Advisor, at any time determines that the value of illiquid securities held by a Fund exceeds 15% of its net asset value, the Advisor will take such steps as it considers appropriate to reduce them as soon as reasonably practicable in accordance with the Funds’ written LRMP.

25

Embassy Asset Management Funds

NOTES TO FINANCIAL STATEMENTS - Continued

October 31, 2023

(f) Corporate Debt Securities

Corporate debt securities are fixed-income securities issued by businesses to finance their operations, although corporate debt instruments may also include bank loans to companies. Notes, bonds, bank loans, debentures and commercial paper are the most common types of corporate debt securities, with the primary difference being their maturities and secured or unsecured status. Commercial paper has the shortest term and is usually unsecured. The broad category of corporate debt securities includes debt issued by domestic or foreign companies of all kinds, including those with small-, mid- and large-capitalizations. Corporate debt may be rated investment grade or below investment grade and may carry variable or floating rates of interest.

Corporate debt securities carry credit risk, interest rate risk and prepayment risk. Credit risk is the risk that a fund could lose money if the issuer of a corporate debt security is unable to pay interest or repay principal when it is due. Some corporate debt securities that are rated below investment grade are generally considered speculative because they present a greater risk of loss, including default, than higher quality debt securities. The credit risk of a particular issuer’s debt security may vary based on its priority for repayment.

Interest rate risk is the risk that the value of certain corporate debt securities will tend to fall when interest rates rise. In general, corporate debt securities with longer terms tend to fall more in value when interest rates rise than corporate debt securities with shorter terms. Prepayment risk occurs when issuers prepay fixed rate debt securities when interest rates fall, forcing the Fund to invest in securities with lower interest rates. Issuers of debt securities are also subject to the provisions of bankruptcy, insolvency and other laws affecting the rights and remedies of creditors that may restrict the ability of the issuer to pay, when due, the principal of and interest on its debt securities.

(g) Insurance-Linked Securities Risk

The principal risk of an investment in an insurance-linked security is that a triggering event(s) (e.g., (i) natural events, such as hurricanes, earthquakes, tornadoes, pandemics, fires and floods; or (ii) certain non-natural events resulting from human activity such as commercial and industrial accidents or business interruptions), will occur and a Fund will lose all or a significant portion of the principal it has invested in the security and the right to additional interest payments with respect to the security. For example, major natural disasters or commercial and industrial accidents can result in significant losses and investors in insurance-linked securities tied to such exposures may also experience substantial losses. If the likelihood and severity of natural and other large disasters increase, the risk of significant losses to reinsurers may increase. Typically, one significant triggering event (even in a major metropolitan area) will not result in financial failure to a reinsurer. However, a series of major triggering events could cause the failure of a reinsurer. Similarly, to the extent a Fund invests in insurance-linked securities for which a triggering event occurs, losses associated with such event will result in losses to the Fund and a series of major triggering events affecting a large portion of the insurance-linked securities held by the Fund will result in substantial losses to the Fund. A majority of The Ambassador Fund’s assets will typically be invested in insurance-linked securities tied to natural events and/or non-natural disasters and there is inherent uncertainty as to whether, when or where such events will occur. There is no way to accurately predict whether a triggering event will occur and, because of this uncertainty, insurance-linked securities carry a high degree of risk.

(h) Catastrophe Bonds

Catastrophe Bonds (“Cat Bonds”), a type of event-linked bond, carry significant uncertainties and major risk exposures to adverse conditions. If a trigger event occurs, as defined within the terms of a Cat Bond, a Fund may lose a portion or all of its investment in such security, including accrued interest and/or principal invested in such security. Because Cat Bonds cover “catastrophe” events that, if they occur, will result in significant losses, they carry a high degree of risk of loss and are considered “high yield” or “junk bonds.” The rating of a Cat Bond, if any, primarily reflects the rating agency’s calculated probability that a pre-defined trigger event will occur. Thus, lower-rated bonds have a greater likelihood of a triggering event occurring, resulting in potential loss to a Fund. A majority of The Ambassador Fund's assets will typically be invested in Cat Bonds.

26

Embassy Asset Management Funds

NOTES TO FINANCIAL STATEMENTS - Continued

October 31, 2023

(i) Futures Contracts

The Funds may enter into futures contracts (including contracts relating to foreign currencies, interest rates, commodities securities and other financial indexes and other commodities), and purchase and write (sell) related options traded on exchanges designated by the Commodity Futures Trading Commission (“CFTC”) or, consistent with CFTC regulations, on foreign exchanges. The Funds intend primarily to invest in positions on U.S. Treasury Futures contracts. A futures contract provides for the future sale by one party and purchase by another party of a specified quantity of the security or other financial instrument at a specified price and time. A futures contract on an index is an agreement pursuant to which two parties agree to take or make delivery of an amount of cash equal to the difference between the value of the index at the close of the last trading day of the contract and the price at which the index contract originally was written. The clearing house of the exchange on which a futures contract is entered into becomes the counterparty to each purchaser and seller of the futures contract.

A futures contract held by a Fund is valued daily at the official settlement price on the exchange on which it is traded. Each day a futures contract is held, the Fund pays or receives cash, called “variation margin,” equal to the daily change in value of the futures contract. Variation margin does not represent borrowing or a loan by the Fund but is instead a settlement between the Fund and the broker of the amount one would owe the other if the futures contract expired. The Fund also is required to deposit and to maintain margin with respect to put and call options on futures contracts written by it. Such margin deposits will vary depending on the nature of the underlying futures contract (and the related initial margin requirements), the current market value of the option and other futures positions held by the Fund. Although some futures contracts call for making or taking delivery of the underlying assets, generally these obligations are closed out prior to delivery by offsetting purchases or sales of matching futures contracts (involving the same exchange, underlying security or index and delivery month). If an offsetting purchase price is less than the original sale price, a Fund realizes a capital gain, or if it is more, the Fund realizes a capital loss. Conversely, if an offsetting sale price is more than the original purchase price, a Fund realizes a capital gain, or if it is less, the Fund realizes a capital loss. The transaction costs also must be included in these calculations. As discussed below, however, the Funds may not always be able to make an offsetting purchase or sale. In the case of a physically settled futures contract, this could result in the Funds being required to deliver, or receive, the underlying physical commodity, which could be adverse to the Funds.

At any time prior to the expiration of a futures contract, a Fund may seek to close the position by seeking to take an opposite position, which would operate to terminate the Fund’s existing position in the contract. Positions in futures contracts and options on futures contracts may be closed out only on the exchange on which they were entered into (or through a linked exchange). No secondary market for such contracts exists. Although the Funds may enter into futures contracts only if there is an active market for such contracts, there is no assurance that an active market will exist at any particular time. Most futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the day. It is possible that futures contract prices could move to the daily limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions at an advantageous price and subjecting the Fund to substantial losses. In such event, and in the event of adverse price movements, the Fund would be required to make daily cash payments of variation margin. In such situations, if the Fund had insufficient cash, it might have to sell assets to meet daily variation margin requirements at a time when it would be disadvantageous to do so. In addition, if the transaction is entered into for hedging purposes, in such circumstances the Fund may realize a loss on a futures contract or option that is not offset by an increase in the value of the hedged position. Losses incurred in futures transactions and the costs of these transactions will affect the Fund’s performance.

27

Embassy Asset Management Funds

NOTES TO FINANCIAL STATEMENTS - Continued

October 31, 2023

(j) Forward Foreign Currency Exchange Contracts

The Funds may utilize forward foreign currency exchange contracts (“forward contracts”) under which they are obligated to exchange currencies on specified future dates at specified rates, and are subject to the translations of foreign exchange rates fluctuations. All contracts are “marked-to-market” daily and any resulting unrealized gains or losses are recorded as unrealized appreciation or depreciation on foreign currency translations. The Funds record realized gains or losses at the time the forward contract is settled. Counter parties to these forward contracts are major U.S. financial institutions.

Note 3 – Investment Advisory and Other Agreements

The Trust, on behalf of the Funds, entered into an Investment Advisory Agreement (the “Agreement”) with Embassy Asset Management LP (the “Advisor”). Under the terms of the Agreement, the Funds pay a monthly investment advisory fee to the Advisor based on each Fund’s average daily net assets. The annual rates are listed by Fund in the table below. The Advisor has engaged Tangency Capital Investment Advisory Ltd. to manage The Ambassador Fund, and RichBrook Advisors, LP (the “Sub-Advisors”) to manage The Diplomat Fund, and pays the Sub-Advisors from its advisory fees. The Advisor has contractually agreed to waive its fees and/or pay for operating expenses (excluding any Rule 12b-1 fees, shareholder servicing fees, interest on borrowings other than commitment fees associated with borrowing arrangements, expenses incurred with respect to the acquisition and disposition of portfolio securities and the execution of portfolio transactions, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with SEC Form N-1A), other expenditures which are capitalized in accordance with generally accepted accounting principles, expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) in order to limit total annual operating expenses of each Fund. Prior to October 31, 2022, commitment fees were excluded from the agreement. This agreement is effective until February 29, 2024 for the Funds, and it may be terminated before that date only by the Trust's Board of Trustees. The table below contains the annual investment advisory fees and expense cap by Fund.

Investment Advisory Fees |

Total Limit on Annual Operating Expenses† | |

| The Ambassador Fund | 1.20% | 1.40% |

| The Diplomat Fund | 0.90% | 1.00% |

| † | The total limit on annual operating expenses is calculated based on each Fund’s average daily net assets. |

For the year ended October 31, 2023, the Advisor waived a portion of its advisory fees and absorbed other expenses totaling $162,846 for The Ambassador Fund and $228,182 for The Diplomat Fund. The Advisor is permitted to seek reimbursement from the Funds, subject to certain limitations, of fees waived or payments made to the Funds for a period ending three years after the date of the waiver or payment. This reimbursement may be requested from the Funds if the reimbursement will not cause the Funds’ annual expense ratio to exceed the lesser of (a) the expense limitation amount in effect at the time such fees were waived or payments made, or (b) the expense limitation amount in effect at the time of the reimbursement. The potential recoverable amounts are noted as “Commitments and contingencies” as reported on the Statements of Assets and Liabilities. The Advisor may recapture all or a portion of this amount no later than October 31 of the years stated below:

28

Embassy Asset Management Funds

NOTES TO FINANCIAL STATEMENTS - Continued

October 31, 2023

| The Ambassador Fund | The Diplomat Fund | ||||||||

| 2025 | $ | 167,725 | $ | 34,755 | |||||

| 2026 | 162,846 | 228,182 | |||||||

| Total | $ | 330,571 | $ | 262,937 | |||||

UMB Fund Services, Inc. (“UMBFS”) serves as the Funds’ fund accountant, transfer agent and co-administrator; and Mutual Fund Administration, LLC (“MFAC”) serves as the Funds’ other co-administrator. UMB Bank, n.a., (“UMB Bank”) an affiliate of UMBFS, serves as the Funds’ custodian. The Funds’ allocated fees incurred for fund accounting, fund administration, transfer agency and custody services for the year ended October 31, 2023, are reported on the Statements of Operations.

IMST Distributors, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (d/b/a ACA Group), serves as the Funds’ distributor (the “Distributor”). The Distributor does not receive compensation from the Funds for its distribution services; the Advisor pays the Distributor a fee for its distribution-related services.

Certain trustees and officers of the Trust are employees of UMBFS or MFAC. The Funds do not compensate trustees and officers affiliated with the Fund’s co-administrators. For the year ended October 31, 2023, the Funds’ allocated fees incurred to Trustees who are not affiliated with the Funds’ co-administrators are reported on the Statements of Operations.