|

·

|

The shareholders of the Target Fund will be asked to approve a proposal (the “Reorganization”) to reorganize the Target Fund into Vivaldi Multi-Strategy Fund (the “Acquiring Fund”), a series of Investment Managers Series Trust II (“IMST II”) (“proposal 1”). The Acquiring Fund is a newly created series of IMST II that is designed to be substantially similar from an investment perspective to the Target Fund.

|

|

·

|

The shareholders of the Target Fund will be asked to approve the appointment of Vivaldi Asset Management, LLC (“Vivaldi”) as the investment advisor to the Acquiring Fund (“proposal 2”). Vivaldi currently serves as a sub-advisor to the Target Fund.

|

|

·

|

The shareholders of the Target Fund will be asked to approve the appointment of RiverNorth Capital Management, LLC (“RiverNorth”) as a sub-advisor to the Acquiring Fund (“proposal 3”). RiverNorth does not currently serve as a sub-advisor to the Target Fund.

|

|

·

|

The shareholders of the Target Fund will be asked to approve the Acquiring Fund’s use of “manager of managers” exemptive relief, which it intends to seek from the Securities and Exchange Commission (the “SEC”), to allow Vivaldi and the Board of Trustees of IMST II to replace sub-advisors to the Acquiring Fund in the future without the cost and time associated with a shareholder meeting (“proposal 4”). There is no assurance the SEC will grant such relief. Therefore, even if shareholders approve the use of the “manager of managers” exemptive relief, the Acquiring Fund will only be able to utilize it if the SEC also grants such relief.

|

|

·

|

If there are not sufficient votes at the time of the Special Meeting to approve one or more of the proposals listed above, the shareholders of the Target Fund may be asked to approve adjourning the Special Meeting to permit further solicitation of proxies (“proposal 5”).

|

|

|

|

Sincerely,

|

|

||

| Douglas G. Hess | ||

|

|

|

President

|

|

|

|

Advisors Series Trust

|

|

|

|

By Order of the Board of Trustees of Advisors Series Trust

|

|

|

|

|

|

Jeanine M. Bajczyk

|

||

|

|

|

Secretary

|

|

Vivaldi Orinda Macro Opportunities Fund (Target Fund)

|

Vivaldi Multi-Strategy Fund (Acquiring Fund)

|

|

Class A Shares

|

Class A Shares

|

|

Class I Shares

|

Class I Shares

|

|

Target Fund

|

Acquiring Fund

|

|

|

Investment Advisor

|

Orinda Asset Management, LLC

|

Vivaldi Asset Management, LLC

|

|

Sub-Advisors

|

Vivaldi Asset Management. LLC

|

Crescat Portfolio Management, LLC

|

|

Crescat Portfolio Management, LLC

|

RiverNorth Capital Management, LLC

|

|

|

Administrators

|

U.S. Bancorp Fund Services, LLC

|

Mutual Fund Administration, LLC

|

|

UMB Fund Services, Inc.

|

||

|

Fund Accounting

|

U.S. Bancorp Fund Services, LLC

|

UMB Fund Services, Inc.

|

|

Distributor

|

Quasar Distributors, LLC.

|

IMST Distributors, LLC

|

|

Transfer Agent

|

U.S. Bancorp Fund Services, LLC

|

UMB Fund Services, Inc.

|

|

Auditor

|

Tait, Weller & Baker LLP

|

Tait, Weller & Baker LLP

|

|

Custodian

|

U.S. Bank N.A.

|

UMB Bank, n.a.

|

|

·

|

Prospectus and Statement of Additional Information of the Target Fund dated June 28, 2016, as supplemented;

|

|

·

|

Annual Report to Shareholders of the Target Fund dated February 29, 2016; and

|

|

·

|

Semi-Annual Report to Shareholders of the Target Fund dated August 31, 2015.

|

|

I.

|

Proposal I - To Approve the Agreement and Plan of Reorganization |

6

|

|

|

A.

|

Overview |

6

|

|

|

B.

|

Comparison Fee Tables and Examples |

8

|

|

|

C.

|

Comparison of Investment Objectives, Strategies, and Risks |

9

|

|

|

D.

|

Comparison of Investment Restrictions |

21

|

|

|

E.

|

Comparison of Distribution and Purchase and Redemption Procedures |

23

|

|

|

F.

|

Key Information about the Proposals |

29

|

|

|

1.

|

Summary of the Proposed Reorganization

|

29

|

|

|

2.

|

Description of the Acquiring Fund’s Shares

|

30

|

|

|

3.

|

Section 15(f) of the 1940 Act

|

31

|

|

|

4.

|

Board Considerations

|

31

|

|

|

5.

|

Federal Income Tax Consequences

|

33

|

|

|

6.

|

Comparison of Forms of Organization and Shareholder Rights

|

35

|

|

|

7.

|

Capitalization

|

36

|

|

|

G.

|

Additional Information about the Fund |

36

|

|

|

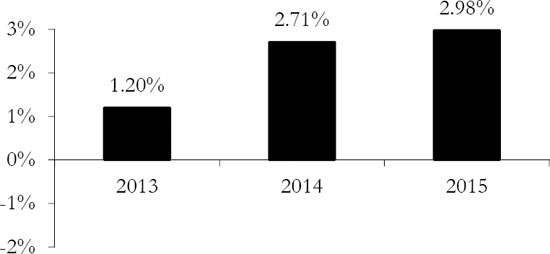

1.

|

Past Performance of the Target Fund

|

36

|

|

|

2.

|

Service Providers

|

38

|

|

|

II.

|

Proposal II - To Approve the Appointment of Vivaldi Asset Management, LLC as Advisor of Acquiring Fund |

42

|

|

|

A.

|

Overview |

42

|

|

|

B.

|

Terms of the Proposed Advisory Agreement |

43

|

|

|

C.

|

Consideration of Proposed Advisory Agreement |

44

|

|

|

D.

|

Information Regarding Vivaldi Asset Management, LLC |

46

|

|

|

III.

|

Proposal III - To Approve the Appointment of RiverNorth Capital Management, LLC as Sub-Advisor of Acquiring Fund |

46

|

|

|

A.

|

Background |

46

|

|

|

B.

|

Terms of the Proposed Sub-Advisory Agreement |

47

|

|

|

C.

|

Consideration of Proposed Sub-Advisory Agreement |

48

|

|

|

D.

|

Information Regarding RiverNorth Capital Management, LLC |

49

|

|

|

IV.

|

Proposal IV - To Approve the Acquiring Fund’s Use of a “Manager of Managers” Arrangement |

50

|

|

|

A.

|

Background |

50

|

|

|

B.

|

Benefits to the Acquiring Fund |

51

|

|

|

C.

|

Effect on Fees and Quality of Advisory Services |

51

|

|

|

D.

|

Conditions for Establishing Manager of Manager Arrangements |

51

|

|

|

V.

|

Voting Information |

51

|

|

|

A.

|

General Information |

52

|

|

|

B.

|

Method and Cost of Solicitation |

53

|

|

|

C.

|

Right to Revoke Proxy |

54

|

|

|

D.

|

Voting Securities and Principal Holders |

54

|

|

|

E.

|

Interest of Certain Persons in the Transaction |

55

|

|

|

VI.

|

Miscellaneous Information |

56

|

|

A.

|

Other Business |

56

|

|

B.

|

Next Meeting of Shareholders |

56

|

|

C.

|

Legal Matters |

56

|

|

D.

|

Auditors |

56

|

|

E.

|

Information Filed with the SEC |

56

|

| APPENDIX A – Form of Agreement and Plan of Reorganization |

A-1

|

|

|

APPENDIX B – More Information about the Acquiring Fund

|

B-1

|

|

| APPENDIX C – Form of Investment Advisory Agreement |

C-1

|

|

| APPENDIX D – Form of Investment Sub-Advisory Agreement |

D-1

|

|

|

APPENDIX E – Conditions of Manager of Managers Order

|

E-1

|

|

I.

|

Proposal I - To Approve the Agreement and Plan of Reorganization

|

|

A.

|

Overview

|

|

B.

|

Comparison Fee Tables and Examples

|

|

Fees and Expenses

|

||||

|

Target Fund

Class A

|

Acquiring Fund (Pro forma)

Class A

|

Target Fund

Class I

|

Acquiring Fund (Pro forma)

Class I

|

|

|

Share Class

|

||||

|

Shareholder Fees

(fees paid directly from your investment) |

||||

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

5.00%

|

5.00%

|

None

|

None

|

|

Maximum Deferred Sales Charge (Load)

|

None

|

None

|

None

|

None

|

|

Redemption Fee

|

None

|

None

|

None

|

None

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

||||

|

Management Fees

|

1.75%

|

1.60%

|

1.75%

|

1.60%

|

|

Distribution (Rule 12b-1) Fees

|

0.25%

|

0.25%

|

None

|

None

|

|

Other Expenses1

|

2.37%

|

1.65%1

|

2.40%

|

1.60%1

|

|

Shareholder servicing fee

|

0.15%

|

0.15%

|

0.10%

|

0.10%

|

|

Dividend and interest expenses on short sales

|

1.22%

|

1.25%

|

1.27%

|

1.25%

|

|

All other expenses

|

1.00%

|

0.25%

|

1.03%

|

0.25%

|

|

Acquired Fund Fees and Expenses1

|

0.29%

|

0.29%

|

0.29%

|

0.29%

|

|

Total Annual Fund Operating Expenses

|

4.66%

|

3.79%

|

4.44%

|

3.49%

|

|

Fees Waived and/or Expenses Reimbursed2

|

(0.60%)

|

0.00%

|

(0.63%)

|

0.00%

|

|

Total Annual Fund Operating Expenses After Waiving Fees and/or Reimbursing Expenses

|

4.06%

|

3.79%

|

3.81%

|

3.49%

|

| 1 |

“Other expenses” and “Acquired Fund Fees and Expenses” for the Acquiring Fund have been estimated for the Acquiring Fund’s current fiscal year. Actual expenses may differ from estimates.

|

| 2 |

OAM, the Target Fund’s advisor, has contractually agreed to waive a portion or all of its management fees and pay Target Fund expenses in order to ensure that the Target Fund’s total annual fund operating expenses (excluding acquired fund fees and expenses, taxes, interest expense, dividends on securities sold short and extraordinary expenses) do not exceed 2.55% and 2.25% of average daily net assets of the Target Fund’s Class A and Class I shares, respectively (the “Expense Caps”). The Expense Caps will remain in effect through at least June 27, 2017, and may be terminated only by the Trust’s Board of Trustees. The Adviser may request recoupment of previously waived fees and paid expenses from the Fund for three years from the date they were waived or paid, subject to the Expense Caps. Vivaldi, the Acquiring Fund’s advisor, has contractually agreed to waive its fees and/or pay for operating expenses of the Acquiring Fund to ensure that the Acquiring Fund’s total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with SEC Form N-1A), expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 2.25% and 1.95% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until December 16, 2018, and it may be terminated before that date only by the IMST II’s Board of Trustees. Vivaldi is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made to the Fund for a period ending three full fiscal years after the date of the waiver or payment.

|

|

One Year

|

Three Years

|

Five Years

|

Ten Years

|

|

|

Target Fund (Class A Shares)

|

$943

|

$1,835

|

$2,732

|

$5,003

|

|

Acquiring Fund (Class A Shares) (Pro forma)

|

$862

|

$1,600

|

$2,356

|

$4,326

|

|

Target Fund (Class I Shares)

|

$445

|

$1,343

|

$2,251

|

$4,560

|

|

Acquiring Fund (Class I Shares) (Pro forma)

|

$352

|

$1,071

|

$1,812

|

$3,765

|

|

C.

|

Comparison of Investment Objectives, Strategies, and Risks

|

|

Target Fund

|

Acquiring Fund

|

|

The Vivaldi Orinda Macro Opportunities Fund seeks to achieve long-term capital appreciation by pursuing positive absolute returns across market cycles. In pursuing its objective, the Fund seeks to generate attractive long-term returns with low sensitivity to traditional equity and fixed-income indices.

|

The Vivaldi Multi-Strategy Fund seeks to achieve long-term capital appreciation by pursuing positive absolute returns across market cycles. In pursuing its objective, the Fund seeks to generate attractive long-term returns with low sensitivity to traditional equity and fixed-income indices.

|

|

Target Fund

|

Acquiring Fund

|

|

The Advisor seeks to achieve the Fund’s investment objective by delegating the management of a portion of Fund assets to a group of experienced investment managers that utilize a variety of investment strategies and styles (the “Sub-Advisors”) and may manage a portion of the Fund’s assets directly. The Advisor maintains primary responsibility for allocating Fund assets to the Sub-Advisors and from time to time will select and determine the percentage of Fund assets to allocate to each Sub-Advisor. While the Advisor delegates a portion of the day-to-day management of the Fund’s assets to a combination of Sub- Advisors, the Advisor retains overall supervisory responsibility for the general management and investment of the Fund’s securities portfolio. The Advisor may exercise its discretion to manage a portion of Fund assets directly in order to hedge or to modify the Fund’s exposure to a particular investment or market-related risk created by a Sub-Advisor, to invest the Fund’s assets pending allocation to a Sub-Advisor, or to establish positions in securities and strategies it deems appropriate for meeting the Fund’s investment objective. The Advisor may, from time to time, reallocate the Fund’s assets among itself and the Sub-Advisors.

Each Sub-Advisor has complete discretion to invest its portion of the Fund’s assets as it deems appropriate, based on its particular philosophy, style, strategies and views. While each Sub-Advisor is subject to the oversight of the Advisor, the Advisor does not attempt to coordinate or manage the day-to-day investments of the Sub-Advisors.

|

The Advisor seeks to achieve the Fund’s investment objective by delegating the management of a portion of Fund assets to a group of experienced investment managers that utilize a variety of investment strategies and styles (the “Sub-Advisors”). The Advisor will also manage a portion of the Fund’s assets directly.

The Advisor maintains overall supervisory responsibility for the general management and investment of the Fund’s securities portfolio and is responsible for selecting and determining the percentage of Fund assets to allocate to itself and each Sub-Advisor. Each Sub-Advisor has complete discretion to invest its portion of the Fund’s assets as it deems appropriate, based on its particular philosophy, style, strategies and views. While each Sub-Advisor is subject to the oversight of the Advisor, the Advisor does not attempt to manage the day-to-day investments of the Sub-Advisors.

|

|

Target Fund

|

Acquiring Fund

|

|

The Sub-Advisors implement both fundamentally and technically driven strategies. These strategies may include, without limitation, global macro, opportunistic equity and fixed income, and systematic strategies that invest in different asset classes, securities, and derivative instruments, as discussed below. These strategies seek to target attractive absolute returns. These strategies may exhibit different degrees of volatility, as well as variability of beta to equity, currency, and interest rate markets. The Fund’s Sub- Advisors seek to have diversifying characteristics including lower correlation to market risk factors than traditional equity and fixed income strategies.

|

In seeking the Fund’s investment objectives, the Advisors implement both fundamentally and technically driven strategies. These strategies may include, without limitation, global macro, relative value, and arbitrage strategies that invest in different asset classes, securities, and derivative instruments, as discussed below. These strategies seek to target positive absolute returns and may exhibit different degrees of volatility, as well as exposure to equity, currency, and interest rate markets. Certain strategies used by the Advisors may include exposure to different market risk factors including, but not limited to, value, growth, dividend yield, market cap and volatility.

|

|

Global Macro: Sub-Advisors have a broad investment mandate to invest in liquid asset classes globally, including futures and other derivative contracts.

|

Global Macro: Crescat Portfolio Management, LLC (“Crescat”), one of the Fund’s current sub-advisors, has a broad investment mandate to invest in liquid asset classes globally, including publicly traded equity securities, fixed income securities, exchange-traded funds (“ETFs”), futures and other derivative contracts, with a goal of generating positive absolute returns over a full market cycle. In selecting investments using the Global Macro strategy, Crescat analyzes a variety of macroeconomic factors, including fiscal and monetary policy, historical price data, country specific fundamental economic data, as well as social and demographic trends, and political events.

|

|

Opportunistic: Sub-Advisors can invest globally, long or short, in stocks of companies of any size or market capitalization, government and corporate bonds and other fixed income securities. They may also invest in derivatives either to manage risk or to enhance return.

|

Relative Value: Vivaldi may invest globally, long or short, in stocks of companies of any size or market capitalization, as well as government and corporate bonds and other fixed income securities, with a goal of generating positive risk adjusted returns. Vivaldi may also invest in derivatives to seek either to manage risk or to enhance return. In selecting investments using the Relative Value strategy, Vivaldi seeks to identify securities that are mispriced or undervalued. Vivaldi employs a bottom-up analysis for individual security selection, and/or a top-down approach to capital allocation amongst various asset classes, while employing risk management strategies designed to mitigate downside risk.

|

|

Systematic: Sub-Advisors focus on liquid asset classes globally, including futures and other derivatives with a goal of generating positive total returns over a full market cycle.

|

Arbitrage: Vivaldi and RiverNorth Capital Management, LLC (“RiverNorth”), which will be one of the Fund’s sub-advisers, may seek to take advantage of inefficient pricing in the markets by engaging in certain arbitrage strategies. In particular, Vivaldi utilizes a merger arbitrage strategy, which typically involves purchasing the stock of a target company while shorting the stock of the acquiring company after the announcement of a merger or acquisition. In selecting investments using the Arbitrage strategy, Vivaldi analyzes the attractiveness of the merger or acquisition, the length of time until the proposed transaction closes and the potential downside risk to the portfolio in the event the merger or acquisition does not occur. RiverNorth utilizes a closed-end fund arbitrage strategy, which involves identifying closed-end funds that are trading at a premium or discount to their underlying net-asset values, and taking long and/or short positions accordingly.

|

|

Target Fund

|

Acquiring Fund

|

|

The Fund invests in a wide range of U.S. and non-U.S. publicly traded and privately issued or negotiated securities (securities for which the price is negotiated between private parties) including, but not limited to, equity securities, fixed-income securities, currencies and derivatives. The Fund’s allocation to these various security types and various asset classes will vary over time in response to changing market opportunities.

The Fund may:

|

The Fund invests, both long and short, in a wide range of U.S. and non-U.S. publicly traded securities including, but not limited to, equity securities, fixed-income securities, currencies and derivatives. The Fund’s allocation to these various security types and various asset classes will vary over time in response to changing market opportunities.

The Fund may:

|

|

· Invest without limit in equity securities of issuers of any market capitalization;

|

· Same as Target Fund;

|

|

· Invest in depositary receipts, including American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”) and Global Depositary Receipts (“GDRs”), which are not deemed to be investments in foreign securities for purposes of the Fund’s investment strategy;

|

· Invest in depositary receipts, including American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”) and Global Depositary Receipts (“GDRs”);

|

|

· Invest up to 10% of its net assets in initial public offerings (“IPOs”);

|

· Same as Target Fund;

|

|

· Invest without limit in foreign securities, including up to 50% of its net assets in securities of issuers located in emerging markets;

|

· Invest without limit in foreign securities, including up to 50% of its net assets in securities of issuers located in emerging markets. The Fund’s Advisor defines issuers located in emerging markets as those companies that have a majority of their assets in, or derive a majority of their revenues from, emerging market countries;

|

|

· Invest up to 80% of its net assets in fixed income securities. Such fixed income investments may include high-yield or “junk” bonds and may be of any maturity;

|

· Invest up to 80% of its net assets in fixed income securities of any maturity, including corporate bonds, debt issued by the U.S. Government and its agencies and exchange traded notes. Such fixed income investments may include high-yield or “junk” bonds;

|

|

· Invest up to 85% of its net assets in derivatives including options, futures (including commodities futures), forward currency contracts and swaps, including credit-default swaps. These derivative instruments may be used for investment purposes or to modify or hedge the Fund’s exposure to a particular investment market related risk, as well as to manage the volatility of the Fund;

|

· Same as Target Fund;

|

|

· Invest up to 60% of its net assets in currencies and forward currency contracts;

|

· Same as Target Fund;

|

|

Target Fund

|

Acquiring Fund

|

|

· Utilize leverage (by borrowing against a line of credit for investment purposes) of up to 10% of the Fund’s total assets as part of the portfolio management process;

|

· Same as Target Fund;

|

|

· Invest a significant portion of its assets in the securities of companies in the same sector of the market; and

|

· Same as Target Fund;

|

|

· Sell securities short with respect to 100% of its net assets. A short sale is the sale by the Fund of a security which it does not own in anticipation of purchasing the same security in the future at a lower price to close the short position.

|

· Same as Target Fund;

|

|

For either investment or hedging purposes, certain Sub-Advisors may invest substantially in a broad range of the derivatives instruments described above, particularly futures contracts. The Sub-Advisors may be highly dependent on the use of futures and other derivative instruments, and to the extent that they become unavailable, this may limit a Sub-Advisor from fully implementing its investment strategy.

|

For either investment or hedging purposes, or to manage the volatility of the Fund, the Advisors may invest substantially in a broad range of the derivatives instruments described above, particularly futures contracts. The Advisors may be highly dependent on the use of futures and other derivative instruments, and to the extent that they become unavailable, this may limit an Advisor from fully implementing its investment strategy.

|

|

It is expected that the Fund will have a portfolio turnover in excess of 100% on an annual basis.

|

It is expected that the Fund will have a portfolio turnover significantly in excess of 100% on an annual basis.

|

|

The Advisor and Sub-Advisors invest in the securities described above based upon their belief that the securities have a strong appreciation potential (long investing, or actually owning a security) or potential to decline in value (short investing, or borrowing a security from a broker and selling it, with the understanding that it must later be bought back and returned to the broker). The Fund sells (or closes a position in) a security when the Advisor or a Sub-Advisor determines that a particular security has achieved its investment expectations or the reasons for maintaining that position are no longer valid, including: (1) if the Sub-Advisor’s view of the business fundamentals or management of the underlying company changes; (2) if a more attractive investment opportunity is found; (3) if general market conditions trigger a change in the Sub-Advisor’s assessment criteria; or (4) for other portfolio management reasons.

|

Same as Target Fund.

|

|

The Advisor may also invest up to 100% of the Fund’s total assets in cash, money-market instruments, bank obligations and other high-quality debt securities for temporary defensive purposes.

|

Temporary Defensive Strategy. When adverse market, economic, political or other conditions dictate a more defensive investment strategy, the Fund may, on a temporary basis, hold cash or invest a portion or all of its assets in money market instruments including obligations of the U.S. government, its agencies or instrumentalities, obligations of foreign sovereignties, or other high-quality debt securities, including prime commercial paper, repurchase agreements and bank obligations, such as bankers’ acceptances and certificates of deposit. Under normal market conditions, the potential for capital appreciation on these securities will tend to be lower than the potential for capital appreciation on other securities that may be owned by the Fund. In taking such a defensive position, the Fund would temporarily not be pursuing its principal investment strategies and may not achieve its investment objective.

|

|

Target Fund

|

Acquiring Fund

|

|

Market risk. The value of the Fund’s shares will fluctuate as a result of the movement of the overall stock market or of the value of the individual securities held by the Fund, and you could lose money.

|

Market risk. The market price of a security or instrument may decline, sometimes rapidly or unpredictably, due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic or political conditions throughout the world, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. The market value of a security or instrument also may decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry.

|

|

Management risk. The skill of the Advisor and Sub-Advisors will play a significant role in the Fund’s ability to achieve its investment objective. The Fund’s ability to achieve its investment objective depends on the investment skill and ability of the Advisor and Sub-Advisors and on their ability to correctly identify economic trends. Additionally, there can be no assurance that the Advisor will be able to allocate the Fund’s assets among the Sub-Advisors in a manner that is beneficial to the Fund.

|

Management and strategy risk. The value of your investment depends on the judgment of the Fund’s Advisors about the quality, relative yield, value or market trends affecting a particular security, industry, sector or region, which may prove to be incorrect. Investment strategies employed by the Fund’s Advisors may not result in an increase in the value of your investment or in overall performance equal to other investments.

|

|

No corresponding risk factor.

|

Equity risk. The value of the equity securities held by the Fund may fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests.

|

|

Multi-style management risk. As portions of the Fund’s assets are managed by different Sub-Advisors using different styles, the Fund could experience overlapping security transactions. Certain Sub-Advisors may be purchasing securities at the same time other Sub-Advisors may be selling those same securities which may lead to higher transaction expenses compared to the Fund using a single investment management style.

|

Multi-style management risk. Because portions of the Fund’s assets are managed by different advisors using different styles, the Fund could enter into overlapping securities transactions. For example, one advisor may be purchasing securities at the same time another advisor may be selling those same securities, which may lead to higher transaction expenses than a fund managed by one advisor.

|

|

Target Fund

|

Acquiring Fund

|

|

Depositary receipt risk. Depositary receipts may be purchased through “sponsored” or “unsponsored” facilities. A sponsored facility is established jointly by the issuer of the underlying security and a depositary, whereas a depositary may establish an unsponsored facility without participation by the issuer of the depositary security. Holders of unsponsored depositary receipts generally bear all the costs of such facilities and the depositary of an unsponsored facility frequently is under no obligation to distribute shareholder communications received from the issuer of the deposited security or to pass through voting rights to the holders of such receipts of the deposited securities. In addition, investments in ADRs, EDRs, and GDRs, may be less liquid than the underlying shares in their primary trading market.

|

Foreign investment risk. The prices of foreign securities may be more volatile than the prices of securities of U.S. issuers because of economic and social conditions abroad, political developments, and changes in the regulatory environments of foreign countries. In addition, changes in exchange rates and interest rates may adversely affect the values of the Fund’s foreign investments. Foreign companies are generally subject to different legal and accounting standards than U.S. companies, and foreign financial intermediaries may be subject to less supervision and regulation than U.S. financial firms. Foreign securities include American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). Unsponsored ADRs and GDRs are organized independently and without the cooperation of the foreign issuer of the underlying securities, and involve additional risks because U.S. reporting requirements do not apply and the issuing bank will recover shareholder distribution costs from changes in share prices and payment of dividends.

|

|

Foreign and emerging market securities risk. Foreign investments may carry risks associated with investing outside the United States, such as currency fluctuation, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. Those risks are increased for investments in emerging markets.

|

Emerging market risk. Many of the risks with respect to foreign investments are more pronounced for investments in issuers in developing or emerging market countries. Emerging market countries tend to have more government exchange controls, more volatile interest and currency exchange rates, less market regulation, and less developed economic, political and legal systems than those of more developed countries. In addition, emerging market countries may experience high levels of inflation and may have less liquid securities markets and less efficient trading and settlement systems.

|

|

Currency risk. Changes in foreign currency exchange rates will affect the value of what the Fund owns and the Fund’s share price. Generally, when the U.S. dollar rises in value against a foreign currency, an investment in that country loses value because that currency is worth fewer U.S. dollars. Devaluation of a currency by a country’s government or banking authority also will have a significant impact on the value of any investments denominated in that currency. Currency markets generally are not as regulated as securities markets.

|

Currency risk. The values of investments in securities denominated in foreign currencies increase or decrease as the rates of exchange between those currencies and the U.S. Dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls, and speculation.

|

|

Derivatives risk. The Fund’s use of derivatives (which may include options, futures, swaps and forward foreign currency contracts) may reduce the Fund’s returns and/or increase volatility. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate perfectly with the overall securities markets.

|

Derivatives risk. Derivatives include instruments and contracts that are based on and valued in relation to one or more underlying securities, financial benchmarks, indices, or other reference obligations or measures of value. Major types of derivatives include futures, options, swaps and forward contracts. Depending on how the Fund uses derivatives and the relationship between the market value of the derivative and the underlying instrument, the use of derivatives could increase or decrease the Fund’s exposure to the risks of the underlying instrument. Using derivatives can have a leveraging effect and increase fund volatility. A small investment in derivatives could have a potentially large impact on the Fund’s performance. Derivatives transactions can be highly illiquid and difficult to unwind or value, and changes in the value of a derivative held by the Fund may not correlate with the value of the underlying instrument or the Fund’s other investments. Many of the risks applicable to trading the instruments underlying derivatives are also applicable to derivatives trading. However, additional risks are associated with derivatives trading that are possibly greater than the risks associated with investing directly in the underlying instruments. These additional risks include, but are not limited to, illiquidity risk and counterparty credit risk. For derivatives that are required to be cleared by a regulated clearinghouse, other risks may arise from the Fund’s relationship with a brokerage firm through which it would submit derivatives trades for clearing, including in some cases from fellow clearing customers of the brokerage firm. The Fund would also be exposed to counterparty risk with respect to the clearinghouse. Financial reform laws have changed many aspects of financial regulation applicable to derivatives. Once implemented, new regulations, including margin, clearing, and trade execution requirements, may make derivatives more costly, may limit their availability, may present different risks or may otherwise adversely affect the value or performance of these instruments. The extent and impact of these regulations are not yet fully known and may not be known for some time.

|

|

Target Fund

|

Acquiring Fund

|

|

Commodity-linked derivatives risk. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and the value of commodity-linked derivative instruments may be affected by changes in overall market movements, volatility of the underlying benchmark, changes in interest rates, or factors affecting a particular industry or commodity. Investments in commodity-linked derivatives may be subject to greater volatility than non-derivative based investments. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the values of debt securities.

|

No corresponding risk factor.

|

|

No corresponding risk factor.

|

Large-cap company risk. Larger, more established companies may be unable to attain the high growth rates of successful, smaller companies during periods of economic expansion.

|

|

ETF and mutual fund risk. When the Fund invests in an ETF or mutual fund, it will bear additional expenses based on its pro rata share of the ETF’s or mutual fund’s operating expenses, including the potential duplication of management fees. The risk of owning an ETF or mutual fund generally reflects the risks of owning the underlying securities the ETF or mutual fund holds. The Fund also will incur brokerage costs when it purchases ETFs. ETFs may not track their underlying indices. Inverse ETFs are subject to the risk that their performance will fall as the value of their benchmark indices rises. Leveraged ETFs will amplify losses because they are designed to produce returns that are a multiple of the index to which they are linked. Most leveraged ETFs "reset" daily. Due to the effect of compounding, their performance over longer periods of time can differ significantly from the performance of their underlying index or benchmark during the same period of time.

|

ETF risk. Investing in an ETF will provide the Fund with exposure to the securities comprising the index on which the ETF is based and will expose the Fund to risks similar to those of investing directly in those securities. Shares of ETFs typically trade on securities exchanges and may at times trade at a premium or discount to their net asset values. In addition, an ETF may not replicate exactly the performance of the benchmark index it seeks to track for a number of reasons, including transaction costs incurred by the ETF, the temporary unavailability of certain index securities in the secondary market or discrepancies between the ETF and the index with respect to the weighting of securities or the number of securities held. Investing in ETFs, which are investment companies, may involve duplication of advisory fees and certain other expenses. The Fund will pay brokerage commissions in connection with the purchase and sale of shares of ETFs.

|

|

Target Fund

|

Acquiring Fund

|

|

Fixed income securities risk. The market value of fixed income securities changes in response to interest rate changes and other factors. Generally, the price of fixed income securities will increase as interest rates fall and decrease as interest rates rise. If there is less governmental action in the future to maintain low interest rates, there may be swift and significant interest rate increases which will have a negative impact on fixed income securities. Credit risk is the risk that an issuer will not make timely payments of principal and interest. The degree of credit risk depends on the issuer’s condition and on the terms of the securities. There is also the risk that an issuer may “call,” or repay, its high yielding bonds before their maturity dates. Fixed income securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. Limited trading opportunities for certain fixed income securities may make it more difficult to sell or buy a security at a favorable price or time.

|

Fixed income securities risk. The prices of fixed income securities respond to economic developments, particularly interest rate changes, as well as to changes in an issuer’s credit rating or market perceptions about the creditworthiness of an issuer. Generally, fixed income securities decrease in value if interest rates rise and increase in value if interest rates fall, and longer-term and lower rated securities are more volatile than shorter-term and higher rated securities.

|

|

Government-sponsored entities risk. Securities issued by government-sponsored entities may not be backed by the full faith and credit of the United States.

|

Government-sponsored entities risk. The Fund’s investment in U.S. government obligations may include securities issued or guaranteed as to principal and interest by the U.S. government, or its agencies or instrumentalities. Payment of principal and interest on U.S. government obligations may be backed by the full faith and credit of the United States or may be backed solely by the issuing or guaranteeing agency or instrumentality itself. There can be no assurance that the U.S. government would provide financial support to its agencies or instrumentalities (including government-sponsored enterprises) where it is not obligated to do so.

|

|

High-yield securities risk. Fixed income securities that are rated below investment grade (i.e., “junk bonds”) are subject to additional risk factors due to the speculative nature of these securities, such as increased possibility of default liquidation of the security, and changes in value based on public perception of the issuer.

|

High yield (“junk”) bond risk. High yield bonds are debt securities rated below investment grade (often called “junk bonds”). Junk bonds are speculative, involve greater risks of default, downgrade, or price declines and are more volatile and tend to be less liquid than investment-grade securities. Companies issuing high yield bonds are less financially strong, are more likely to encounter financial difficulties, and are more vulnerable to adverse market events and negative sentiments than companies with higher credit ratings.

|

|

Target Fund

|

Acquiring Fund

|

|

No corresponding risk factor.

|

Interest rate risk. Generally fixed income securities decrease in value if interest rates rise and increase in value if interest rates fall. For example, the price of a security with a three-year duration would be expected to drop by approximately 3% in response to a 1% increase in interest rates. Generally, the longer the maturity and duration of a bond or fixed rate loan, the more sensitive it is to this risk. Falling interest rates also create the potential for a decline in the Fund’s income. Changes in governmental policy and general economic developments, among other factors, could cause interest rates to increase and could have a substantial and immediate effect on the values of the Fund’s investments. These risks are greater during periods of rising inflation. In addition, a potential rise in interest rates may result in periods of volatility and increased redemptions that might require the Fund to liquidate portfolio securities at disadvantageous prices and times.

|

|

No corresponding risk factor.

|

Credit risk. If an issuer or guarantor of a debt security held by the Fund, or a counterparty to a financial contract with the Fund, defaults or is downgraded or is perceived to be less creditworthy, or if the value of the assets underlying a security declines, the value of the Fund’s portfolio will typically decline.

|

|

Exchange-traded note (“ETN”) risk. The value of an ETN may be influenced by time to maturity, level of supply and demand for the ETN, volatility and lack of liquidity in the underlying securities’ markets, changes in the applicable interest rates, changes in the issuer’s credit rating and economic, legal, political or geographic events that affect the referenced index. In addition, the notes issued by ETNs and held by the Fund are unsecured debt of the issuer.

|

ETN risk. ETNs are debt securities that combine certain aspects of ETFs and bonds. ETNs are not investment companies and thus are not regulated under the 1940 Act. ETNs, like ETFs, are traded on stock exchanges and generally track specified market indices, and their value depends on the performance of the underlying index and the credit rating of the issuer. ETNs may be held to maturity, but unlike bonds there are no periodic interest payments.

|

|

No corresponding risk factor.

|

Closed-end funds (“CEFs”) risk. The Fund may invest in shares of CEFs. Investments in CEFs are subject to various risks, including reliance on management’s ability to meet a CEF’s investment objective and to manage a CEF’s portfolio, and fluctuation in the market value of a CEF’s shares compared to the changes in the value of the underlying securities that the CEF owns. In addition, the Fund bears a pro rata share of the management fees and expenses of each underlying CEF in addition to the Fund’s management fees and expenses, which results in the Fund’s shareholders being subject to higher expenses than if they invested directly in the CEFs.

|

|

Target Fund

|

Acquiring Fund

|

|

No corresponding risk factor.

|

Futures risk. The value of a futures contract tends to increase and decrease in correlation with the value of the underlying instrument. Risks of futures contracts may arise from an imperfect correlation between movements in the price of the futures and the price of the underlying instrument. The Fund’s use of futures contracts (and related options) exposes the Fund to leverage risk because of the small margin requirements relative to the value of the futures contract. A relatively small market movement will have a proportionately larger impact on the funds that the Fund has deposited or will have to deposit with a broker to maintain its futures position. Leverage can lead to large losses as well as gains. While futures contracts are generally liquid instruments, under certain market conditions they may become illiquid. Futures exchanges may impose daily or intraday price change limits and/or limit the volume of trading. Additionally, government regulation may further reduce liquidity through similar trading restrictions. As a result, the Fund may be unable to close out its futures contracts at a time that is advantageous. The price of futures can be highly volatile; using them could lower total return, and the potential loss from futures could exceed the Fund’s initial investment in such contracts.

|

|

Leverage and short sales risk. Leverage is the practice of borrowing money to purchase securities. If the securities decrease in value, the Fund will suffer a greater loss than would have resulted without the use of leverage. A short sale will be successful if the price of the shorted security decreases, however, if the underlying security goes up in price during the period in which the short position is outstanding, the Fund will realize a loss. The risk on a short sale is unlimited because the Fund must buy the shorted security at the higher price to complete the transaction. Therefore, short sales may be subject to greater risks than investments in long positions.

|

Leveraging risk. Certain Fund transactions, including entering into futures contracts and taking short positions in financial instruments, may give rise to a form of leverage. Leverage can magnify the effects of changes in the value of the Fund’s investments and make the Fund more volatile. Leverage creates a risk of loss of value on a larger pool of assets than the Fund would otherwise have had. The Fund may also have to sell assets at inopportune times to satisfy its obligations in connection with such transactions.

|

|

Growth stock risk. Growth style companies may lose value or move out of favor. Growth style companies also may be more sensitive to changes in current or expected earnings than the prices of other stocks.

|

Growth-oriented investment strategies risk. Growth funds generally focus on stocks of companies believed to have above-average potential for growth in revenue and earnings. Growth securities typically are very sensitive to market movements because their market prices frequently reflect projections of future earnings or revenues, and when it appears that those expectations will not be met, the prices of growth securities typically fall.

|

|

Value stock risk. Value style investing as a strategy may be out of favor in the market for an extended period. Value stocks can perform differently from the market as a whole and from other types of stocks.

|

Value-oriented investment strategies risk. Value stocks are those that are believed to be undervalued in comparison to their peers due to adverse business developments or other factors. Value investing is subject to the risk that the market will not recognize a security’s inherent value for a long time or at all, or that a stock judged to be undervalued may actually be appropriately priced or overvalued. In addition, during some periods (which may be extensive) value stocks generally may be out of favor in the markets. Therefore the Fund is most suitable for long-term investors who are willing to hold their shares for extended periods of time through market fluctuations and the accompanying changes in share prices.

|

|

Target Fund

|

Acquiring Fund

|

|

Initial public offering (“IPO”) risk. The risk exists that the market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk.

|

IPO risk. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk.

|

|

Sector risk. To the extent the Fund invests a significant portion of its assets in the securities of companies in the same sector of the market, the Fund is more susceptible to economic, political, regulatory and other occurrences influencing those sectors.

|

Sector focus risk. The Fund may invest a larger portion of its assets in one or more sectors than many other mutual funds, and thus will be more susceptible to negative events affecting those sectors.

|

|

Portfolio turnover risk. A high portfolio turnover rate (100% or more) increases the Fund’s transaction costs (including brokerage commissions and dealer costs), which would adversely impact the Fund’s performance. Higher portfolio turnover may result in the realization of more short-term capital gains than if the Fund had lower portfolio turnover.

|

Portfolio turnover risk. Active and frequent trading of the Fund’s portfolio securities may lead to higher transaction costs and may result in a greater number of taxable transactions than would otherwise be the case, which could negatively affect the Fund’s performance. A high rate of portfolio turnover is 100% or more.

|

|

Mortgage-backed securities risk. In addition to the general risks associated with fixed income securities as described above, the structure of certain mortgage-backed securities may make their reaction to interest rates and other factors difficult to predict, which may cause their prices to be more volatile than other fixed income securities.

|

No corresponding risk factor.

|

|

Small and medium companies risk. Investing in securities of small and medium capitalization companies may involve greater volatility than investing in larger and more established companies because small and medium capitalization companies can be subject to more abrupt or erratic share price changes than larger, more established companies.

|

Micro-cap, small-cap and mid-cap company risk. The securities of micro-capitalization, small-capitalization and mid-capitalization companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger, more established companies or market averages in general. In addition, such companies typically are more likely to be adversely affected than large capitalization companies by changes in earning results, business prospects, investor expectations or poor economic or market conditions.

|

|

No corresponding risk factor.

|

Merger arbitrage transactions risk. The Fund may invest or take short positions in securities of companies that are the subject of an acquisition. When the Advisor or Sub-Advisor determines that it is probable that an acquisition will be consummated, the Fund may seek to purchase securities at prices below the anticipated value to be paid or exchanged for such securities in the merger, exchange offer or cash tender offer (and above the price at which such securities traded immediately prior to the announcement of the merger, exchange offer or cash tender offer). Likewise, when the Advisor or Sub-Advisor believes it is likely that a transaction will not be consummated, the Fund may take short positions in such securities in order to seek to capture the difference attributable to the perceived market overvaluation of the acquisition target. In the case of an investment in a potential acquisition target, if the proposed merger, exchange offer or cash tender offer appears likely not to be consummated, in fact is not consummated, or is delayed, the market price of the security to be tendered or exchanged will usually decline sharply, resulting in a loss to the Fund.

|

|

Target Fund

|

Acquiring Fund

|

|

No corresponding risk factor.

|

Short sales risk. A short sale is a transaction in which the Fund sells a security it does not own in anticipation that the market price of that security will decline. In connection with a short sale of a security or other instrument, the Fund is subject to the risk that instead of declining, the price of the security or other instrument sold short will rise. If the price of the security or other instrument sold short increases between the date of the short sale and the date on which the Fund replaces the security or other instrument borrowed to make the short sale, the Fund will experience a loss, which is theoretically unlimited since there is a theoretically unlimited potential for the market price of a security or other instrument sold short to increase.

|

|

Target Fund

|

Acquiring Fund

|

|

Fundamental Limitations

The Target Fund may not with respect to 75% of its total assets, invest more than 5% of its total assets in securities of a single issuer or hold more than 10% of the voting securities of such issuer. (Does not apply to investments in the securities of other investment companies or securities of the U.S. Government, its agencies or instrumentalities.)

|

Fundamental Limitations

The Acquiring Fund may not with respect to 75% of the Acquiring Fund’s total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities) if, as a result, (a) more than 5% of the Acquiring Fund’s total assets would be invested in the securities of that issuer, or (b) the Acquiring Fund would hold more than 10% of the outstanding voting securities of that issuer.

|

|

Target Fund

|

Acquiring Fund

|

|

The Target Fund may not issue senior securities, except as permitted under the 1940 Act.

The Target Fund may not borrow money, except as permitted under the 1940 Act.

|

The Acquiring Fund may not issue senior securities, borrow money or pledge its assets, except that (i) the Acquiring Fund may borrow from banks in amounts not exceeding one-third of its net assets (including the amount borrowed); and (ii) this restriction shall not prohibit the Acquiring Fund from engaging in options transactions or short sales or investing in financial futures, swaps, when-issued or delayed delivery securities, or reverse repurchase agreements.

|

|

The Target Fund may not engage in the business of underwriting securities, except to the extent that the Target Fund may be considered an underwriter within the meaning of the Securities Act of 1933 in the disposition of restricted securities.

|

The Acquiring Fund may not act as underwriter, except to the extent the Acquiring Fund may be deemed to be an underwriter in connection with the sale of securities in its investment portfolio.

|

|

The Target Fund may not invest 25% or more of its total assets in the securities of companies engaged in any one industry. (Does not apply to investments in the securities of other investment companies or securities of the U.S. Government, its agencies or instrumentalities.)

|

The Acquiring Fund may not invest 25% or more of its total assets, calculated at the time of purchase and taken at market value, in any one industry or group of industries (other than securities issued by the U.S. Government, its agencies or instrumentalities).

|

|

The Target Fund may not purchase or sell real estate, which term does not include securities of companies which deal in real estate and/or mortgages or investments secured by real estate, or interests therein, except that the Target Fund reserves freedom of action to hold and to sell real estate acquired as a result of the Target Fund’s ownership of securities.

|

The Acquiring Fund may not purchase or sell real estate or interests in real estate or real estate limited partnerships (although the Acquiring Fund may purchase and sell securities which are secured by real estate and securities of companies which invest or deal in real estate, such as real estate investment trusts (REITs)).

|

|

The Target Fund may not make loans to others, except as permitted under the 1940 Act.

|

The Acquiring Fund may not make loans of money, except (a) for purchases of debt securities consistent with the investment policies of the Acquiring Fund, (b) by engaging in repurchase agreements or, (c) through the loan of portfolio securities in an amount up to 33 1/3% of the Acquiring Fund’s net assets.

|

|

The Target Fund may not purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments. This limitation shall not prevent the Target Fund from purchasing, selling, or entering into futures contracts, or acquiring securities or other instruments and options thereon backed by, or related to, physical commodities.

|

The Acquiring Fund may not purchase or sell commodities or commodity futures contracts (although the Acquiring Fund may invest in financial futures and in companies involved in the production, extraction, or processing of agricultural, energy, base metals, precious metals, and other commodity-related products).

|

|

Non-Fundamental Limitations

The Target Fund may not hold, in the aggregate, more than 15% of its nets assets in illiquid securities.

|

Non-Fundamental Limitations

The Acquiring Fund may not invest, in the aggregate, more than 15% of its net assets in securities with legal or contractual restrictions on resale, securities that are not readily marketable and repurchase agreements with more than seven days to maturity.

|

|

Target Fund

|

Acquiring Fund

|

|

The Target Fund may not invest in any issuer for purposes of exercising control or management.

|

The Acquiring Fund does not have a corresponding non-fundamental limitation.

|

|

The Target Fund may not invest in securities of other investment companies, except as permitted under the 1940 Act.

|

The Acquiring Fund does not have a corresponding non-fundamental limitation.

|

| E. |

Comparison of Distribution and Purchase and Redemption Procedures

|

|

Target Fund

|

Acquiring Fund

|

|

Quasar Distributors, LLC is the Distributor (also known as the principal underwriter) of the shares of the Target Fund.

|

IMST Distributors, LLC is the Distributor (also known as the principal underwriter) of the shares of the Acquiring Fund.

|

|

The Trust has adopted a plan pursuant to Rule 12b-1 of the 1940 Act (the “12b-1 Plan”) for the Target Fund’s Class A shares that allows the Target Fund to pay fees for the sale, distribution and servicing of its Class A shares. The plan provides for a distribution and servicing fee of up to 0.25% of the Class A shares’ average daily net assets.

|

IMST II has adopted a plan on behalf of the Acquiring Fund pursuant to Rule 12b-1 of the 1940 Act (the “12b-1 Plan”) which allows the Acquiring Fund to pay distribution fees for the sale and distribution of its Class A shares and/or shareholder liaison service fees in connection with the provision of personal services to shareholders of Class A shares and the maintenance of their shareholder accounts. The 12b-1 Plan provides for the payment of such fees at the annual rate of up to 0.25% of average daily net assets attributable to Class A shares.

|

|

The Board has approved the implementation of a Shareholder Servicing Plan (the “Servicing Plan”) under which OAM will provide, or arrange for others to provide, certain specified shareholder services. As compensation for the provision of shareholder services, the Target Fund will pay OAM a monthly fee at an annual rate of up to 0.15% of the Class A shares’ average daily net assets and up to 0.10% of the Class I shares’ average daily net assets. OAM will pay certain banks, trust companies, broker-dealers and other financial intermediaries (each, a “Participating Organization”) out of the fees OAM receives from the Target Fund under the Servicing Plan to the extent that the Participating Organization performs shareholder servicing functions for the Target Fund’s shares owned by its customers.

|

The Acquiring Fund may pay a fee at an annual rate of up to 0.15% and 0.10% of its average daily net assets attributable to Class A shares and Class I shares, respectively, to shareholder servicing agents. Shareholder servicing agents provide non-distribution administrative and support services to their customers, which may include establishing and maintaining accounts and records relating to shareholders, processing dividend and distribution payments from the Acquiring Fund on behalf of shareholders, forwarding communications from the Acquiring Fund, providing sub-accounting with respect to Acquiring Fund shares, and other similar services.

Vivaldi or the Sub-Advisors may pay service fees to intermediaries such as banks, broker-dealers, financial advisors or other financial institutions, some of which may be affiliates, for sub-administration, sub-transfer agency and other shareholder services associated with shareholders whose shares are held of record in omnibus accounts, other group accounts or accounts traded through registered securities clearing agents.

|

|

OAM, out of its own resources, and without additional cost to the Target Fund or its shareholders, may provide additional cash payments or non-cash compensation to intermediaries who sell shares of the Target Fund. Such payments and compensation are in addition to Rule 12b-1 and service fees paid by the Target Fund. These additional cash payments are generally made to intermediaries that provide shareholder servicing, marketing support and/or access to sales meetings, sales representatives and management representatives of the intermediary. Cash compensation may also be paid to intermediaries for inclusion of the Target Fund on a sales list, including a preferred or select sales list, in other sales programs or as an expense reimbursement in cases where the intermediary provides shareholder services to the Target Fund’s shareholders. The Adviser may also pay cash compensation in the form of finder’s fees that vary depending on the Target Fund and the dollar amount of the shares sold.

|

Vivaldi out of its own resources, and without additional cost to the Acquiring Fund or its shareholders, may provide additional cash payments or non-cash compensation to broker-dealers or intermediaries that sell shares of the Acquiring Fund. These additional cash payments are generally made to intermediaries that provide shareholder servicing, marketing support and/or access to sales meetings, sales representatives and management representatives of the intermediary. Vivaldi may pay cash compensation for inclusion of the Acquiring Fund on a sales list, including a preferred or select sales list, or in other sales programs, or may pay an expense reimbursement in cases where the intermediary provides shareholder services to the Acquiring Fund’s shareholders.

|

|

Target Fund

|

Acquiring Fund

|

|

|

Investment Minimum:

|

The initial investment for Class A shares must be at least $5,000. The initial investment for Class I shares must be at least $100,000.

The Target Fund’s minimum investment requirements may be waived from time to time by OAM, and for the following types of shareholders, including among others: current and retired employees, directors/trustees and officers of the Trust, OAM, sub-Advisor and its affiliates and certain family members of each of them (i.e., spouse, domestic partner, child, parent, sibling, grandchild and grandparent, in each case including in-law, step and adoptive relationships).

|

Same as Target Fund.

You may make an initial investment in an amount greater than the minimum amounts and the Acquiring Fund may, from time to time, reduce or waive the minimum initial investment amounts. The minimum initial investment amount is automatically waived for Acquiring Fund shares purchased by Trustees of IMST II and current or retired directors and employees of Vivaldi and its affiliates.

|

|

Purchases:

|

You may purchase shares of the Target Fund by check, by wire transfer, via electronic funds transfer through the Automated Clearing House (“ACH”) network or through a bank, or through one or more brokers authorized by the Target Fund to receive purchase orders. Shares of the Fund are sold at NAV per share, plus any applicable sales charge, which is calculated as of the close of regular trading (generally, 4:00 p.m., Eastern Time) on each day that the New York Stock Exchange (“NYSE”) is open for unrestricted business.

The Target Fund reserves the right to reject any purchase order. For example, a purchase order may be refused if, in OAM’s opinion, it is so large that it would disrupt the management of the Target Fund. Orders may also be rejected from persons believed by the Target Fund to be “market timers.”

|

Shares of the Acquiring Fund may be purchased by check, by wire transfer of funds via a bank or through an approved financial intermediary (i.e., a supermarket, investment advisor, financial planner or consultant, broker, dealer or other investment professional and their agents) authorized by the Acquiring Fund to receive purchase orders. The purchase price you will pay for the Acquiring Fund’s shares will be the next NAV (plus any sales charge, as applicable) calculated after the Transfer Agent or your authorized financial intermediary receives your request in good order.

The Acquiring Fund reserves the right to reject any purchase request for any reason (generally the Acquiring Fund does this if the purchase is disruptive to the efficient management of the Acquiring Fund due to the timing of the investment or an investor’s history of excessive trading).

|

|

Target Fund

|

Acquiring Fund

|

|

|

Sales Charges:

|

Class A shares of the Target Fund are sold at the public offering price, which is the NAV plus an initial maximum sales charge of 5.00%. If a shareholder invests at least $1 million in Class A shares, no front-end sales charge is applied.

|

Class A shares of the Acquiring Fund are subject to a maximum front-end sales load of 5.00%. If a shareholder invests at least $1 million in Class A shares, no front-end sales charge is applied. The sales load may be reduced or waived by the Acquiring Fund. Target Fund shareholders will not be subject to any front-end sales charge in connection with the Reorganization.

|

|

Contingent Deferred Sales Charge:

|

Class A shares do not have a contingent deferred sales charge.

|

Same as Target Fund.

|

|

Redemptions:

|

You may sell (redeem) your Target Fund shares on any day the Target Fund and the NYSE are open for business either directly to the Target Fund or through your financial intermediary. Redemption requests are priced based on the next NAV per share calculated, plus any applicable sales charges after receipt of such requests. Payment of your redemption proceeds will be made promptly, but not later than seven days after the receipt of your written request in good order.

|

Same as Target Fund.

|

|

Exchanges:

|

The Target Fund allows shareholder to exchange shares of the Target Fund for shares of the Orinda Income Opportunities Fund, which is offered in a separate prospectus. Exchanges may only be made between like share classes.

|

The Acquiring Fund allows shareholders to exchange shares of the Acquiring Fund into shares of another fund managed by the advisor which is offered in a separate prospectus. Exchanges may only be made between like share classes.

|

|

Target Fund

|

Acquiring Fund

|

|

|

Share Conversion Feature:

|

Class A shares of the Target Fund that have been purchased by a financial intermediary may be converted into Class I shares of the Target Fund. The minimum initial investment requirement for Class I shares may be waived by OAM for existing clients. Any such conversion will be effected at net asset value without the imposition of any fee or other charges by the Target Fund.

|

Share conversions can occur between each share class of the Acquiring Fund. Generally, share conversions occur when a shareholder becomes eligible for another share class of the Acquiring Fund or no longer meets the eligibility criteria of the share class owned by the shareholder (and another class exists for which the shareholder would be eligible). All share conversion requests must be approved by Vivaldi. The Acquiring Fund reserves the right to automatically convert shareholders from one class to another if they either no longer qualify as eligible for their existing class or if they become eligible for another class.

|

|

Redemption Fees:

|

The Target Fund does not charge redemption fees.

|

Same as Target Fund.

|

|

Small Accounts:

|

The Target Fund may redeem the shares in your account if the value of your account is less than $2,000 as a result of redemptions you have made. This does not apply to retirement plan or Uniform Gifts or Transfers to Minors Act accounts. You will be notified that the value of your account is less than $2,000 before the Target Fund makes an involuntary redemption. You will then have 30 days in which to make an additional investment to bring the value of your account to at least $5,000 before the Target Fund takes any action. The Target Fund will not require you to redeem shares if the value of your account drops below the investment minimum due to fluctuations of NAV.

|

The Acquiring Fund may redeem all of the shares held in your account if your balance falls below the Acquiring Fund’s minimum initial investment amount due to your redemption activity. In these circumstances, the Acquiring Fund will notify you in writing and request that you increase your balance above the minimum initial investment amount within 30 days of the date of the notice. If, within 30 days of the Acquiring Fund’s written request, you have not increased your account balance, your shares will be automatically redeemed at the current NAV. The Acquiring Fund will not require that your shares be redeemed if the value of your account drops below the investment minimum due to fluctuations of the Acquiring Fund’s NAV.

|

|

Redemption In-Kind:

|

The Target Fund reserves the right to pay redemption proceeds to you in whole or in part by a distribution of securities from the Target Fund’s portfolio (a “redemption in-kind”).

|

Same as Target Fund.

|

|

Dividends and Distributions:

|

The Target Fund intends to make distributions of dividends and capital gains, if any, at least annually, typically in December. The Target Fund may make an additional payment of dividends or distributions of capital gains if it deems it desirable at any other time of the year.

|

The Acquiring Fund will make distributions of net investment income and net capital gains, if any, at least annually, typically in December. The Acquiring Fund may make additional payments of dividends or distributions if it deems it desirable at any other time during the year.

|

|

Target Fund

|

Acquiring Fund

|

|

|

Frequent Trading:

|

The Target Fund discourages excessive, short-term trading and other abusive trading practices that may disrupt portfolio management strategies and harm the Target Fund’s performance. The Target Fund takes steps to reduce the frequency and effect of these activities in the Target Fund. These steps include monitoring trading practices and using fair value pricing. The Target Fund monitors selected trades in an effort to detect excessive short-term trading activities. If, as a result of this monitoring, the Target Fund believes that a shareholder has engaged in excessive short-term trading, it may, in its discretion, ask the shareholder to stop such activities or refuse to process purchases in the shareholder’s accounts.

|

IMST II discourages excessive, short-term trading and other abusive trading practices that may disrupt portfolio management strategies and harm the Acquiring Fund’s performance. IMST II takes steps to reduce the frequency and effect of these activities in the Acquiring Fund. These steps may include monitoring trading activity and using fair value pricing. In addition, IMST II may take action, which may include using its best efforts to restrict a shareholder’s trading privileges in the Acquiring Fund, if that shareholder has engaged in four or more “round trips” in the Acquiring Fund during a 12-month period.

|

|

Net Asset Value (“NAV”):

|