As filed with the Securities and Exchange Commission on January 21, 2014

Registration No. 333-192252

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Intrawest Resorts Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 7990 | 46-3681098 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification No.) |

(I.R.S. Employer Identification No.) |

1621 18th Street, Suite 300

Denver, Colorado 80202

(303) 749-8200

(Address, Including Zip Code, of Registrant’s Principal Executive Offices)

Joshua B. Goldstein, Esq.

Chief General Counsel

Intrawest Resorts Holdings, Inc.

1621 18th Street, Suite 300

Denver, Colorado 80202

(303) 749-8200

(Name, Address and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Gregory A. Fernicola, Esq.

Joseph A. Coco, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, New York 10036

(212) 735-3000

(212) 735-2000 (facsimile)

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 under the Exchange Act. (check one)

| Large accelerated filer o | Accelerated filer o |

Non-accelerated filer ☒ (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||||||

| Common Stock, $0.01 par value |

17,968,750

| $ |

17.00

| $ |

305,468,750

| $ |

39,345

| |||||

| (1) | Includes 2,343,750 shares which may be sold pursuant to the underwriters’ option to purchase additional shares. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Of this amount, $12,880 has been previously paid. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE AN AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholder may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 21, 2014

PRELIMINARY PROSPECTUS

15,625,000 Shares

Intrawest Resorts Holdings, Inc.

Common Stock

$ per share

This is an initial public offering of common stock of Intrawest Resorts Holdings, Inc. We are offering 3,125,000 shares of our common stock and the selling stockholder, an entity controlled by certain private equity funds managed by an affiliate of Fortress Investment Group LLC, is offering an additional 12,500,000 shares of our common stock. We will not receive any proceeds from the sale of our common stock by the selling stockholder. After this offering, the selling stockholder and its affiliates will beneficially own approximately 65.3% of our common stock.

We expect the public offering price to be between $15.00 and $17.00 per share. Currently, no public market exists for the shares. We have applied to list our shares of common stock on the New York Stock Exchange (“NYSE”) under the symbol “SNOW.”

We are an “emerging growth company” under applicable U.S. securities laws and are eligible for certain reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 20 to read about certain factors you should consider before buying our common stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Per share |

Total |

|||||

| Public offering price | $ | $ | ||||

| Underwriting discount(1) | $ | $ | ||||

| Proceeds to us before expenses | $ | $ | ||||

| Proceeds to the selling stockholder before expenses | $ | $ | ||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting.” |

The selling stockholder has granted the underwriters the right to purchase up to 2,343,750 additional shares of common stock at the public offering price, less the underwriting discount.

The underwriters expect to deliver the shares of common stock against payment on or about February , 2014.

| Goldman, Sachs & Co. | Credit Suisse | Deutsche Bank Securities | BofA Merrill Lynch |

| JMP Securities | KeyBanc Capital Markets | Stephens Inc. | |

The date of this prospectus is , 2014.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf that we have referred you to. We, the selling stockholder and the underwriters have not authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We and the selling stockholder are not making an offer of these securities in any state, country or other jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any free writing prospectus is accurate as of any date other than the date of the applicable document regardless of its time of delivery or the time of any sales of our common stock. Our business, financial condition, results of operations or cash flows may have changed since the date of the applicable document.

We have proprietary rights to our trademarks and tradenames used in this prospectus, many of which are registered under applicable intellectual property laws. Solely for convenience, trademarks and tradenames referred to in this prospectus may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and tradenames. We do not intend our use or display of other companies’ tradenames, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other company. Each trademark, tradename or service mark of any other company appearing in this prospectus is the property of its respective holder.

Until , 2014 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to each dealer’s obligation to deliver a prospectus when acting as underwriter and with respect to its unsold allotments or subscriptions.

i

This summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Unaudited Pro Forma Condensed Consolidated Financial Information” and the financial statements and related notes included elsewhere in this prospectus, before making a decision to purchase our common stock. Some information in this prospectus contains forward-looking statements. See “Forward-Looking Statements.”

Intrawest Resorts Holdings, Inc. (“New Intrawest”) is a newly formed Delaware corporation that had not, prior to the Restructuring (as defined below), conducted any activities other than those incident to its formation and the preparation of the registration statement of which this prospectus forms a part. Unless the context suggests otherwise, references in this prospectus to “Intrawest,” the “Company,” “we,” “us” and “our” refer to Intrawest Cayman L.P. (“Cayman L.P.”) and its consolidated subsidiaries prior to the consummation of the Restructuring, and to New Intrawest and its consolidated subsidiaries after the consummation of the Restructuring. All amounts in this prospectus are expressed in U.S. dollars, except where noted. Our fiscal year ends on June 30 and references in this prospectus to a “fiscal” year refer to the year ended June 30 of the corresponding year. References in this prospectus to “Fortress” refer to the private equity funds managed by an affiliate of Fortress Investment Group LLC that currently control the Initial Stockholders (as defined on page 8 of this prospectus).

Overview

We are a North American mountain resort and adventure company, delivering distinctive vacation and travel experiences to our customers for over three decades. We own interests in seven four-season mountain resorts with more than 11,000 skiable acres and more than 1,150 acres of land available for real estate development. Our mountain resorts are geographically diversified across North America’s major ski regions, including the Eastern United States, the Rocky Mountains, the Pacific Southwest and Canada, which we believe helps reduce our financial exposure to any single geographic area as weather patterns and economic conditions vary across these regions. Our mountain resorts are located within an average of approximately 160 miles of major metropolitan markets with high concentrations of affluent skiers and major airports, including New York City, Boston, Washington D.C., Pittsburgh, Denver, Los Angeles, Montreal and Toronto. During fiscal 2013, our portfolio of resorts received more than six million visitors from all 50 states and more than 100 countries. We also operate an adventure travel business, the cornerstone of which is Canadian Mountain Holidays (“CMH”), the leading heli-skiing adventure company in North America. CMH provides helicopter accessed skiing, mountaineering and hiking to more skiable terrain than all lift accessed mountain resorts in North America combined. Additionally, we operate a comprehensive real estate business through which we manage, market and sell vacation club properties; manage condominium hotel properties; and sell and market residential real estate.

We operate within the leisure industry, with a business that benefits from improvements in the economy and associated increases in consumer discretionary spending. Numerous economic trends support the notion that the health of the general economy is continuing to improve. As the economy continues to improve, we believe that consumers will have more disposable income and a greater inclination to engage in and spend on leisure activities. We also expect recreational adventure and experiential travel to continue to gain in popularity as individuals, including the important “baby boomer” generation, live longer, healthier lives. We intend to capitalize on these favorable trends within the leisure industry to drive growth within our business by increasing visitation at our resorts and at CMH, increasing product pricing and growing the scale of our businesses through targeted growth capital investments and acquisitions. We evaluate acquisition opportunities both domestically and internationally where the opportunity would provide a strategic fit within our existing portfolio of businesses. No material acquisitions are probable at this time.

We generated revenues of $524.4 million and $80.6 million in fiscal 2013 and the three months ended September 30, 2013, respectively. In December 2013 we consummated a series of transactions, through which we reduced our total long-term debt on a pro forma basis to $584.5 million from $2.0 billion as of September 30, 2013. After giving pro forma effect to these transactions, our net income (loss) in fiscal 2013 and for three months ended September 30, 2013 was $5.4 million and $(48.9) million, respectively, as compared to $(296.7) million and $(121.6) million on an actual basis without giving pro forma effect to these transactions. See “Unaudited Pro Forma Condensed Consolidated Financial Information.”

1

Our Business

We manage our business through three reportable segments:

| • | Mountain ($339.0 million, or 65.5%, of fiscal 2013 reportable segment revenue): Our Mountain segment includes our mountain resort and lodging operations at Steamboat Ski & Resort, Winter Park Resort, Mont Tremblant Resort, Stratton Mountain Resort and Snowshoe Mountain Resort. We also hold a 50% interest in Blue Mountain Ski Resort within our Mountain segment. |

| • | Adventure ($113.6 million, or 22.0%, of fiscal 2013 reportable segment revenue): The cornerstone of our Adventure segment is CMH. Within our Adventure segment, we also own and operate aviation businesses that support CMH and provide services to third parties. |

| • | Real Estate ($64.7 million, or 12.5%, of fiscal 2013 reportable segment revenue): Our Real Estate segment includes our real estate development activities, as well as our real estate management, marketing and sales businesses, including Intrawest Resort Club Group (“IRCG”), Intrawest Hospitality Management (“IHM”) and Playground. We currently own core entitled land surrounding the base of our resorts totaling more than 1,150 acres, much of which is located adjacent or proximate to the ski trails at our resorts, including ski-in and ski-out parcels. As of December 31, 2013, this land had an appraised value of $153.4 million. |

Our mountain resorts offer a breadth of activities for individuals of all ages that combine outdoor adventure and fitness with a wide variety of resort-based services and amenities, including retail, equipment rental, dining, lodging, ski school, spa services, golf, mountain biking and other summer activities. We own or manage many of these services and amenities, which allows us to capture a larger proportion of customer spending as well as ensure product and service quality at our resorts. The following table summarizes key statistics relating to each of our resorts as of September 30, 2013.

Resort |

Location |

Year Opened |

Average Snowfall(1) |

Maximum Vertical Drop |

Skiable Terrain |

Snowmaking Coverage |

# of Trails |

# of Lifts |

Lodging Units Under Mgmt. |

Food & Beverage Outlets Operated |

Retail & Rental Outlets Operated |

||||||||||||||||||||

| (inches) | (feet) | (acres) | (acres) | ||||||||||||||||||||||||||||

| Steamboat | Colorado | 1963 | 363 | 3,668 | 2,965 | 375 | 165 | 18 | 317 | 18 | 16 | ||||||||||||||||||||

| Winter Park | Colorado | 1939 | 322 | 3,060 | 3,081 | 313 | 143 | 25 | 348 | 14 | 11 | ||||||||||||||||||||

| Tremblant | Quebec | 1939 | 163 | 2,116 | 654 | 465 | 95 | 14 | 896 | 11 | 20 | ||||||||||||||||||||

| Stratton | Vermont | 1961 | 151 | 2,003 | 624 | 474 | 94 | 11 | 415 | 11 | 10 | ||||||||||||||||||||

| Snowshoe | West Virginia | 1974 | 166 | 1,500 | 251 | 251 | 57 | 14 | 1,149 | 16 | 13 | ||||||||||||||||||||

| Blue Mountain (50%) | Ontario | 1941 | 78 | 720 | 281 | 236 | 36 | 14 | 1,027 | 9 | 9 | ||||||||||||||||||||

| Mammoth Mountain (15%) | California | 1955 | 418 | 3,100 | 3,500 | 700 | 164 | 28 | 608 | 22 | 18 | ||||||||||||||||||||

| (1) | Based on the eight-year historical average of snowfall during the 2005/2006 ski season through the 2012/2013 ski season. Blue Mountain data is based on the seven-year historical average of snowfall during the 2006/2007 ski season through the 2012/2013 ski season (comparable data is not available for the 2005/2006 ski season). |

Steamboat Ski & Resort (operating since 1963) is located in the Colorado Rocky Mountains, 157 miles northwest of Denver, with access via direct flights from New York, Los Angeles, Chicago, Houston, Atlanta, Minneapolis, Seattle, Dallas and Denver. The town of Steamboat Springs, Colorado, where Steamboat is located, has a strong heritage of winter sports, as evidenced by the 79 winter Olympians that have trained in the town. With the potential to add an additional 403 acres of skiable terrain, the resort features a combination of high-end customer services (such as a full service spa and fine dining restaurants), an 1880’s western atmosphere and some of the most consistent snowfall in the Rocky Mountain region. The resort receives an average of approximately 363 inches of light, dry powder snow each ski season, which we refer to in our marketing materials as Champagne Powder® snow. Average snowfall at Steamboat is 25% more than the historical Rocky Mountain regional resort average of 290 inches. For the 2013/2014 ski season, Steamboat has added night skiing and has opened a new on-mountain lodge with a seating capacity of over 250 in the main dining area.

Steamboat Ski & Resort (operating since 1963) is located in the Colorado Rocky Mountains, 157 miles northwest of Denver, with access via direct flights from New York, Los Angeles, Chicago, Houston, Atlanta, Minneapolis, Seattle, Dallas and Denver. The town of Steamboat Springs, Colorado, where Steamboat is located, has a strong heritage of winter sports, as evidenced by the 79 winter Olympians that have trained in the town. With the potential to add an additional 403 acres of skiable terrain, the resort features a combination of high-end customer services (such as a full service spa and fine dining restaurants), an 1880’s western atmosphere and some of the most consistent snowfall in the Rocky Mountain region. The resort receives an average of approximately 363 inches of light, dry powder snow each ski season, which we refer to in our marketing materials as Champagne Powder® snow. Average snowfall at Steamboat is 25% more than the historical Rocky Mountain regional resort average of 290 inches. For the 2013/2014 ski season, Steamboat has added night skiing and has opened a new on-mountain lodge with a seating capacity of over 250 in the main dining area.

2

Winter Park Resort (operating since 1939) is located in the Colorado Rocky Mountains, 67 miles west of Denver, and is one of the closest resorts to the Denver metropolitan area’s nearly three million residents. The resort, which is comprised of Winter Park Mountain, Mary Jane Mountain, Vasquez Cirque and Vasquez Ridge, is the longest operating mountain resort in Colorado and has long been referred to in our marketing materials as Colorado’s Favorite®. The resort receives an average snowfall during the ski season of approximately 322 inches and features six terrain parks and “world-class” mogul skiing, as described by Powder Magazine. Winter Park has the option to add an additional 837 acres, which would expand our skiable terrain by approximately 27%. Each summer, Winter Park transforms into a mountain biking destination, with one of the largest bike parks in the United States. Winter Park has recently expanded its mountain biking terrain and has added tubing to its slate of winter activities.

Winter Park Resort (operating since 1939) is located in the Colorado Rocky Mountains, 67 miles west of Denver, and is one of the closest resorts to the Denver metropolitan area’s nearly three million residents. The resort, which is comprised of Winter Park Mountain, Mary Jane Mountain, Vasquez Cirque and Vasquez Ridge, is the longest operating mountain resort in Colorado and has long been referred to in our marketing materials as Colorado’s Favorite®. The resort receives an average snowfall during the ski season of approximately 322 inches and features six terrain parks and “world-class” mogul skiing, as described by Powder Magazine. Winter Park has the option to add an additional 837 acres, which would expand our skiable terrain by approximately 27%. Each summer, Winter Park transforms into a mountain biking destination, with one of the largest bike parks in the United States. Winter Park has recently expanded its mountain biking terrain and has added tubing to its slate of winter activities.

Mont Tremblant Resort (operating since 1939) is located in Quebec, within a two hour drive from the Montreal metropolitan area’s nearly four million residents and the Ottawa metropolitan area’s nearly 1.2 million residents. The resort is consistently ranked as one of the top ski resorts in Eastern North America by Ski Magazine. With 2,116 feet of vertical drop and snowmaking on 77% of trails, Tremblant offers customers the opportunity to ski down one of the biggest vertical drops in eastern Canada. In the summer, customers can play golf on two 18-hole golf courses, mountain bike, enjoy the pedestrian village and attractions or take in Tremblant’s free outdoor concerts.

Mont Tremblant Resort (operating since 1939) is located in Quebec, within a two hour drive from the Montreal metropolitan area’s nearly four million residents and the Ottawa metropolitan area’s nearly 1.2 million residents. The resort is consistently ranked as one of the top ski resorts in Eastern North America by Ski Magazine. With 2,116 feet of vertical drop and snowmaking on 77% of trails, Tremblant offers customers the opportunity to ski down one of the biggest vertical drops in eastern Canada. In the summer, customers can play golf on two 18-hole golf courses, mountain bike, enjoy the pedestrian village and attractions or take in Tremblant’s free outdoor concerts.

Stratton Mountain Resort (operating since 1961) is located in Southern Vermont, approximately 220 miles north of New York City and approximately 150 miles northwest of Boston, whose metropolitan areas have a combined population of more than 23 million residents. Situated on one of the tallest peaks in New England, Stratton is widely considered the birthplace of snowboarding. Stratton features a vertical drop of 2,003 feet and snowmaking on 93% of trails. Stratton’s summer amenities feature 27 holes of golf, a 22-acre golf school and a sports and tennis complex. Winter and summer customers are also able to enjoy Stratton’s pedestrian village. Recent capital improvements at Stratton include a remodeled hotel and additional food and beverage outlets.

Stratton Mountain Resort (operating since 1961) is located in Southern Vermont, approximately 220 miles north of New York City and approximately 150 miles northwest of Boston, whose metropolitan areas have a combined population of more than 23 million residents. Situated on one of the tallest peaks in New England, Stratton is widely considered the birthplace of snowboarding. Stratton features a vertical drop of 2,003 feet and snowmaking on 93% of trails. Stratton’s summer amenities feature 27 holes of golf, a 22-acre golf school and a sports and tennis complex. Winter and summer customers are also able to enjoy Stratton’s pedestrian village. Recent capital improvements at Stratton include a remodeled hotel and additional food and beverage outlets.

Snowshoe Mountain Resort (operating since 1974) is located in West Virginia and is one of the largest ski resorts in the Southeast region of the United States. Snowshoe primarily draws customers from the Baltimore-Washington D.C. and Pittsburgh metropolitan area’s combined 11.7 million residents, as well as the Southeastern United States. The 251 acre resort has the biggest vertical drop in the region (1,500 feet) and receives an average snowfall during the ski season of approximately 166 inches while also enjoying 100% snowmaking coverage. The resort’s mountaintop village offers a variety of nightlife, dining and retail options. Snowshoe was named #1 Overall Ski Resort and #1 for Nightlife in the Mid-Atlantic by OnTheSnow.com, a popular skiing website, in 2012. Recent capital improvements at Snowshoe include upgraded snowmaking capabilities as well as a spa and a zipline located in the village. We have 640 additional acres of land available at Snowshoe for terrain expansion.

Snowshoe Mountain Resort (operating since 1974) is located in West Virginia and is one of the largest ski resorts in the Southeast region of the United States. Snowshoe primarily draws customers from the Baltimore-Washington D.C. and Pittsburgh metropolitan area’s combined 11.7 million residents, as well as the Southeastern United States. The 251 acre resort has the biggest vertical drop in the region (1,500 feet) and receives an average snowfall during the ski season of approximately 166 inches while also enjoying 100% snowmaking coverage. The resort’s mountaintop village offers a variety of nightlife, dining and retail options. Snowshoe was named #1 Overall Ski Resort and #1 for Nightlife in the Mid-Atlantic by OnTheSnow.com, a popular skiing website, in 2012. Recent capital improvements at Snowshoe include upgraded snowmaking capabilities as well as a spa and a zipline located in the village. We have 640 additional acres of land available at Snowshoe for terrain expansion.

Blue Mountain Ski Resort (operating since 1941), of which we own a 50% equity interest, is located in Ontario, approximately 90 miles northwest of Toronto’s approximately 5.6 million residents. With 281 skiable acres and snowmaking on 93% of trails, Blue Mountain is both the largest and most popular resort in Ontario. Blue Mountain also operates a year round conference center and offers a suite of

Blue Mountain Ski Resort (operating since 1941), of which we own a 50% equity interest, is located in Ontario, approximately 90 miles northwest of Toronto’s approximately 5.6 million residents. With 281 skiable acres and snowmaking on 93% of trails, Blue Mountain is both the largest and most popular resort in Ontario. Blue Mountain also operates a year round conference center and offers a suite of

3

summer amenities, including an 18-hole golf course, an open-air gondola, a mountain biking facility and a waterfront park. Recent capital improvements include a conference center, a mountain roller coaster and terrain expansion, including six new trails with snowmaking coverage.

We are party to a shareholders’ agreement with Blue Mountain Resorts Holdings Inc. (“Blue Mountain Holdings”), the owner of the other 50% interest in Blue Mountain Resorts Limited, the entity that owns Blue Mountain. The agreement provides for a call option in our favor on the equity interest held by Blue Mountain Holdings at 110% of fair market value and a put option in favor of Blue Mountain Holdings which would require us to purchase up to all of the equity interests held by Blue Mountain Holdings at 90% of fair market value. See “Our Business—Business Operations—Mountain.”

Mammoth Mountain (operating since 1955), of which we own a 15% equity interest, is located south of Yosemite National Park in California and primarily draws customers from Southern California’s approximately 22.0 million residents. With the highest summit of any California resort, an average snowfall during the ski season of approximately 418 inches and 3,500 skiable acres, Mammoth Mountain is the fourth most popular mountain resort in North America and has one of the longest ski seasons in North America. We also own a 50% equity interest in Mammoth Hospitality Management, LLC, which runs the hospitality and lodging operations at Mammoth. Our other business interests at Mammoth include managing the commercial village as well as the Westin Monache Resort at Mammoth Lakes, California.

Mammoth Mountain (operating since 1955), of which we own a 15% equity interest, is located south of Yosemite National Park in California and primarily draws customers from Southern California’s approximately 22.0 million residents. With the highest summit of any California resort, an average snowfall during the ski season of approximately 418 inches and 3,500 skiable acres, Mammoth Mountain is the fourth most popular mountain resort in North America and has one of the longest ski seasons in North America. We also own a 50% equity interest in Mammoth Hospitality Management, LLC, which runs the hospitality and lodging operations at Mammoth. Our other business interests at Mammoth include managing the commercial village as well as the Westin Monache Resort at Mammoth Lakes, California.

We also operate an adventure travel business, the cornerstone of which is CMH. Through our CMH operations, we have developed expertise in marketing adventure travel to the affluent as well as expertise in coordinating complex adventure travel experiences and hospitality. We believe that we will be able to leverage our core expertise to grow our adventure travel offerings both within heli-skiing and in other adventure travel areas.

Canadian Mountain Holidays is North America’s premier heli-skiing adventure company and has been providing heli-skiing trips for the past 50 years. CMH currently provides helicopter-accessed skiing, mountaineering and hiking on 3.1 million powder-filled acres of terrain in British Columbia, which amounts to more skiable terrain than all lift accessed mountain resorts in North America combined. In addition to providing what we believe is an unparalleled skiing and backcountry experience in North America, CMH provides accommodation, service and dining at its 11 lodges, nine of which are owned by us. During fiscal 2013, CMH earned approximately $1,700 of revenue per customer night, with repeat visitors accounting for the majority of CMH’s customers. In support of CMH’s skiing, guiding and hospitality operations, we own 40 helicopters and operate a helicopter maintenance, repair and overhaul (“MRO”) business. Each ski season, we lease our fleet of helicopters to Alpine Helicopters, Inc. (“Alpine Helicopters”), which acts as the exclusive provider of flight services to CMH. CMH’s integrated operating model enables us to scale the business and increase customer visits with limited reliance on third party providers. In addition, to more efficiently utilize our aircraft and CMH pilots year round, we provide heli-hiking, fire suppression and utility services during the summer months. By utilizing the same pilots each ski season who have an average of over 7,000 hours of experience flying in the high alpine and who possess extensive knowledge of the terrain, we believe CMH is able to provide a more consistent customer experience.

Canadian Mountain Holidays is North America’s premier heli-skiing adventure company and has been providing heli-skiing trips for the past 50 years. CMH currently provides helicopter-accessed skiing, mountaineering and hiking on 3.1 million powder-filled acres of terrain in British Columbia, which amounts to more skiable terrain than all lift accessed mountain resorts in North America combined. In addition to providing what we believe is an unparalleled skiing and backcountry experience in North America, CMH provides accommodation, service and dining at its 11 lodges, nine of which are owned by us. During fiscal 2013, CMH earned approximately $1,700 of revenue per customer night, with repeat visitors accounting for the majority of CMH’s customers. In support of CMH’s skiing, guiding and hospitality operations, we own 40 helicopters and operate a helicopter maintenance, repair and overhaul (“MRO”) business. Each ski season, we lease our fleet of helicopters to Alpine Helicopters, Inc. (“Alpine Helicopters”), which acts as the exclusive provider of flight services to CMH. CMH’s integrated operating model enables us to scale the business and increase customer visits with limited reliance on third party providers. In addition, to more efficiently utilize our aircraft and CMH pilots year round, we provide heli-hiking, fire suppression and utility services during the summer months. By utilizing the same pilots each ski season who have an average of over 7,000 hours of experience flying in the high alpine and who possess extensive knowledge of the terrain, we believe CMH is able to provide a more consistent customer experience.

Certain of our mountain resorts and CMH operate on federal or Crown land or land owned by other governmental entities pursuant to the terms of governmental permits, leases or other agreements. See “Our Business— Properties.” Alpine Helicopters employs all of the pilots who fly the helicopters in the CMH land tenures. We own a 20% equity interest in Alpine Helicopters, but consolidate Alpine Helicopters in our financial statements because Alpine Helicopters is substantially dependent on us as a result of leasing its entire helicopter fleet from us. See “Our Business—Business Operations—Adventure.”

We also have a portfolio of more than 1,150 acres of development parcels surrounding the bases of our Steamboat, Winter Park, Tremblant, Stratton and Snowshoe resorts, much of which is located adjacent or proximate to the ski trails, including ski-in ski-out parcels. As of December 31, 2013, this land had an appraised value of $153.4 million. We refer to this land throughout this prospectus as our core entitled land or core development parcels. See “Our Business—Business Operations—Real Estate.” We believe that our real estate platform and expertise will enable us to capitalize on improving economic conditions related to commercial and residential real estate through the potential future development of our core entitled land. We are currently working with consultants and architects to develop strategies for future development of this land in concert with planning for on-mountain and base village

4

improvements. In addition to our core land holdings and development planning, we maintain the capability to manage, market and sell real estate through our vacation club business, our condominium hotel property management company with operations in Maui, Hawaii and in Mammoth Lakes, California and our residential real estate sales and marketing business. See “Risk Factors—Risks Related to Our Business—Our real estate development strategy may not be successful.”

Our Strengths

Geographically Diversified Market Leading Mountain Resort Company. We are one of the largest mountain resort companies in North America based on skier visits. Our portfolio of mountain resorts offers what we believe are distinctive experiences at some of North America’s most popular destinations. We have invested heavily in the development of lifts, trails, snowmaking capabilities and pedestrian villages with a large bed base and a variety of retail and dining options at our mountain resorts. We believe that these investments have established our resorts, in each of our markets, as having some of the best skiing, amenities and experiences. Our mountain resorts are dispersed throughout North America, with locations in the Eastern United States, the Rocky Mountains, the Pacific Southwest and Canada. During fiscal 2013, no single resort accounted for more than 16% of our total revenue. In addition, our resorts are located within an average of approximately 160 miles of large metropolitan areas with high concentrations of affluent skiers and major airports, such as New York City, Boston, Washington D.C., Pittsburgh, Denver, Los Angeles, Montreal and Toronto. This provides us a strong base of regional and destination visitors, which we believe helps reduce our financial exposure to any single geographic region as weather patterns and economic conditions can vary across regions. We believe that this is a differentiating factor from our competitors, many of which have more geographically concentrated businesses.

North America’s Premier Mountain Adventure Company. The cornerstone of our adventure business is CMH, the largest heli-skiing business in North America. CMH’s operating area encompasses 3.1 million acres of high alpine terrain across British Columbia, which we believe offers an unparalleled skiing and backcountry experience. Repeat visitors accounted for the majority of CMH’s customers during fiscal 2013. With its global brand, portfolio of terrain, collection of 11 lodges and integrated aviation support, CMH is North America’s leading heli-skiing platform and is positioned to further grow within the adventure travel industry. Through our CMH operations, we have also developed expertise in marketing adventure travel to the affluent as well as expertise in coordinating complex adventure travel experiences and hospitality. We believe that we will be able to leverage these core competencies to grow our adventure travel offerings both within heli-skiing and in other areas.

Strong Competitive Position with High Barriers to Entry. We operate or have an ownership interest in three of the top 10 mountain resorts in the United States as measured by skier visits. We also operate or have an ownership interest in what we believe are two of the top three mountain resorts in Canada as measured by skier visits. There are significant barriers to entry to new ski resort development in North America resulting from the limited number of remaining suitable sites, the difficulty in obtaining necessary government permits and the significant capital required for development and construction. As a result, no major ski resorts have been developed in the past 30 years. We believe these competitive dynamics have supported the ski industry’s ability to raise Effective Ticket Price (“ETP”) by a 2.7% compound annual growth rate (“CAGR”) over the past five years, despite high unemployment and fragile economic conditions.

Customer Base with Significant Discretionary Income. We generally attract a more affluent customer than many other leisure activities. In fiscal 2013, the average household income of customers at our mountain resorts was more than $135,000. Given the quality of our assets and our affluent customer base, we believe that there is a long-term opportunity to increase revenues through cross-selling and upselling our customers. We maintain a database of more than 2.2 million past resort customers and are able to use this database to cross-sell and upsell new experiences within our portfolio of resorts and at CMH to our customers, season pass holders, second home owners and vacation club members.

Significant and Expanding Base of Season Pass Holders. We have loyal customers who visit our resorts frequently every year. Many of these customers purchase season passes or frequency products and either own real estate at our resorts or are potential future buyers of vacation real estate. Season pass and frequency product revenue contributed $42.5 million, $45.2 million and $47.0 million to lift revenues for fiscal 2011, 2012 and 2013, respectively, and represented 30.7%, 34.4% and 32.5% of our lift revenues during these respective years. While there can be no assurance that the number of season pass holders at our mountain resorts will remain constant or increase in future years, season pass and frequency product revenue has grown at a CAGR of 5.2% over the three year period

5

ended June 30, 2013. Moreover, 69.8% of our fiscal 2013 season pass holders owned season passes at our resorts during prior ski seasons, representing a strong source of recurring cash flow. This source of recurring and stable revenue reduces our sensitivity to economic conditions and weather, and provides a base line of predictability that allows us to focus on pursuing growth and value creating opportunities for our businesses.

Experienced Management Team. Our management team, which is comprised of professionals with wide ranging experience in resort, real estate and leisure operations, has significant experience managing mountain resorts. We believe our management team has demonstrated its ability to adapt and adjust to varying economic conditions. In addition, our management team has extensive experience in identifying and evaluating businesses for acquisition, performing in-depth due diligence, negotiating with owners and management, and structuring, financing and closing acquisition transactions. We have also attracted qualified and dedicated resort chiefs who have an average of 11 years of service with us and 26 years of experience in the ski industry. We believe that the experience of our management team and resort chiefs is a significant contributor to our operating performance.

Growth Strategies

Consumer discretionary spending has increased as the economy has improved and, as the economy continues to improve, we believe that consumers will have more disposable income and a greater inclination to increase spending on leisure activities, such as skiing and adventure travel. We also expect recreational adventure and experiential travel to continue to gain in popularity as individuals, including the important “baby boomer” generation, live longer, healthier lives. In light of these trends, we intend to employ the following strategies to drive growth within our businesses:

Increase Revenues.

| • | Increase prices at our mountain resorts and CMH. During the past five years, despite high unemployment and fragile economic conditions over much of that period, the mountain resort industry has increased Effective Ticket Price at a CAGR of 2.7%, outpacing core inflation of 1.6%. As the economy continues to improve, we believe that consumers will have more disposable income and a greater inclination to increase spending on leisure activities, such as skiing and adventure travel. We believe that these trends, combined with growth capital investments to improve the customer experience, will provide us with the opportunity to increase prices without impacting our customers’ perception of the value of our products. |

| • | Grow visitation at our mountain resorts and CMH. There are four components of our strategy to grow visitor volume. First, we intend to leverage our existing customer database of 2.2 million skiers and adventure travelers to cross-sell existing customers on new experiences within our portfolio of properties. Second, we are investing in new websites, e-commerce platforms and customer relationship management systems. In combination, these tools provide our sales and marketing team with greater insight into the preferences and purchasing patterns of existing and prospective customers, enabling us to make customized vacation offers and increase the likelihood of purchase. Third, we are developing new products that target previously underserved market segments. Examples include a new season pass product available for young professionals and the addition of new small group and private trip options at CMH to meet demand from affluent CMH customers. Fourth, we are investing in revenue management systems to optimize our variable pricing strategy. These systems provide us with real-time demand data, enabling us to effectively raise prices for vacations and ticket products during periods of peak demand and lower prices to increase visitor volume during periods of off-peak demand. |

| • | Targeted growth capital investments. We believe there is a significant opportunity to further increase revenues, visitation as well as utilization of our assets during off-peak periods by developing new activities and improved amenities at our mountain resorts and CMH. Examples of recent growth capital projects include investments in lifts, snow-making capabilities and terrain expansion at Blue Mountain, a new on-mountain dining facility and night skiing at Steamboat, a snow tubing hill and expanded mountain biking terrain at Winter Park, a spa facility at Snowshoe, and renovated lodging facilities at Stratton and our CMH operations. We expect that our resort improvements will attract new customers and increase the average amount of money that customers spend per day at our properties. We believe we have the opportunity to profitably execute similar resort improvement projects in the future. |

6

Continue to Improve Operating Efficiency and Margins. We continue to focus on driving financial improvement and operational synergies. We believe that, as a multi-resort operator, we have significant opportunities to benefit from our scale of operations through centralization of key functions such as sales and marketing, human resources, accounting, finance, legal, procurement, insurance and technology. Our Denver headquarters provides a platform for further centralization of these key areas where there is an opportunity to benefit from economies of scale and leverage the skills of our senior management team. We believe that these operating efficiencies will enable us to grow our margins. In addition, a significant portion of the operating costs at our mountain resorts is variable and can be rapidly adjusted in response to fluctuations in our business. For example, during the 2011/2012 ski season, our management team was able to adjust operating costs at our resorts by reducing seasonal personnel in response to the lowest amount of natural snowfall in North America in 20 years.

Pursue Strategic Acquisitions and Operating Relationships. The North American ski industry is highly fragmented, with approximately 753 ski areas in North America, of which fewer than 10% are owned by operators that operate four or more ski resorts. As a result of the advantages that we enjoy as a multi-resort operator, we believe we will have the opportunity to acquire complementary resorts in the future at attractive valuations, although there can be no assurance that we will be able to effect such acquisitions. Such acquisitions could involve expansion outside of North America. We evaluate the strategic fit of potential acquisitions based on the opportunity to enhance product offerings, such as multi-resort pass products, achieve operational synergies and expand our operating footprint. As a multi-resort operator, we believe we can generate substantial revenue and cost synergies through strategic acquisitions by leveraging our existing customer database of 2.2 million contacts for cross-resort marketing, by offering customers multi-resort products and by taking advantage of economies of scale in administration and pooled purchasing.

Through our CMH operations, we have developed expertise in marketing adventure travel to the affluent as well as expertise in coordinating complex adventure travel experiences and hospitality. We expect adventure travel to gain in popularity and believe that we will be able to leverage our core competencies to improve the revenues and operating efficiency of strategic acquisitions within the adventure travel industry.

We also intend to evaluate “capital light” opportunities such as managing third-party resort assets and entering into real estate development partnerships.

Monetization of Real Estate. We own more than 1,150 acres of land available for development at our mountain resorts, much of which is adjacent or proximate to the ski trails at the resorts, including ski-in and ski-out parcels. As the “home team” operator in our resort communities, we have a competitive advantage relative to other developers at our resorts because we are uniquely able to add additional value to real estate by bundling it with amenities and products at our resorts that we control. We also own or lease commercial properties within the villages at our resorts, which provides us with the opportunity to control the mix of activities and food, beverage and retail outlets in order to create an atmosphere that makes our resort communities more attractive to potential home buyers. With improvement in the second home and vacation home markets, we believe that we can generate significant profits from the future development of our core entitled land at our resorts. Additionally, although we cannot guarantee that incremental visitor growth at our resorts will occur, to the extent that future development increases the number of units and beds at our resorts, we believe that the extra lodging capacity will support incremental visitor growth and profits.

Our Restructuring and Refinancing

The Restructuring

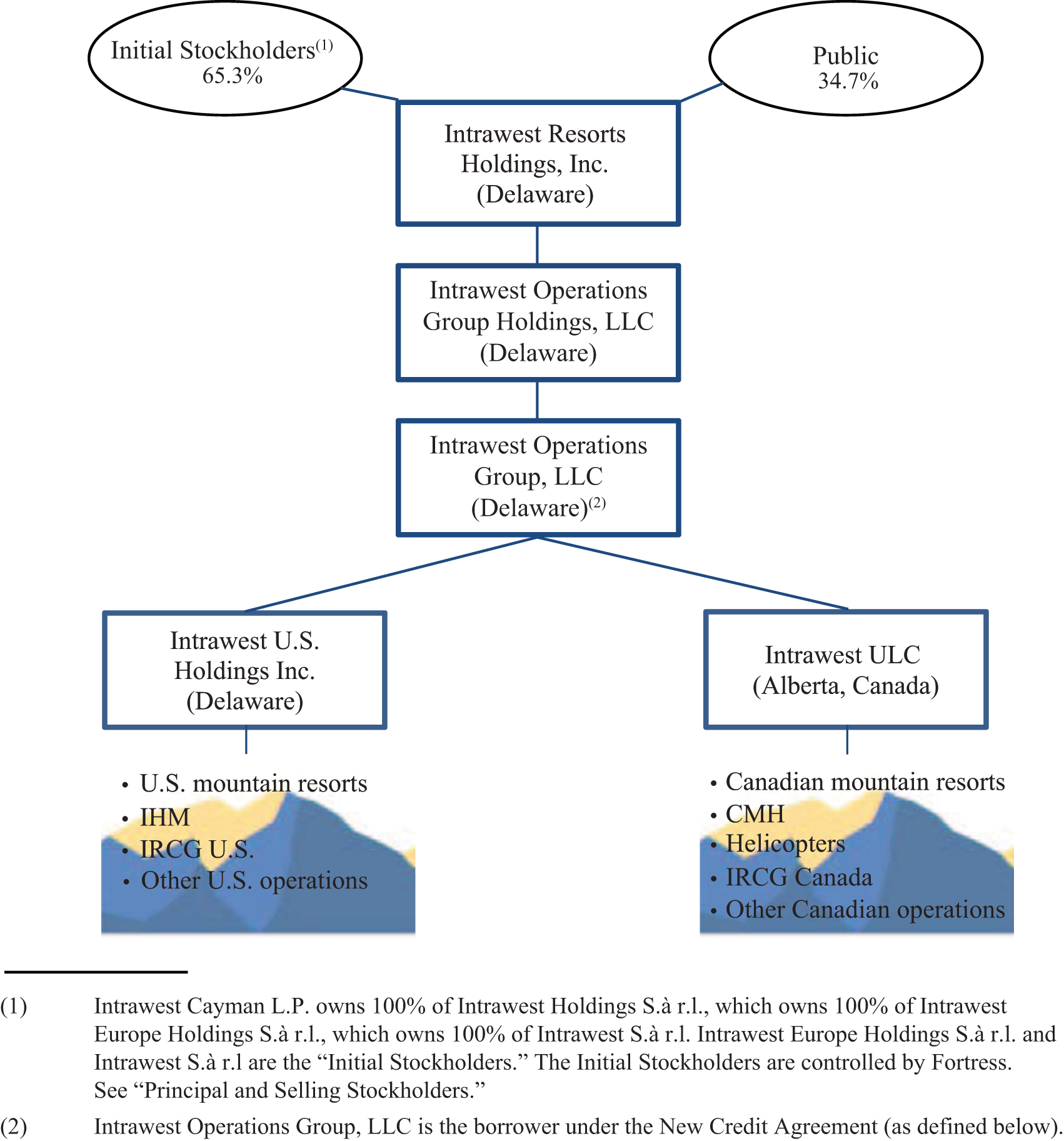

We conduct our U.S. operations through Intrawest U.S. Holdings Inc., a Delaware corporation (“Intrawest U.S.”), and our Canadian operations through Intrawest ULC, an unlimited liability company organized under the laws of the Province of Alberta (“Intrawest Canada”). In December 2013, through a series of restructuring transactions, Cayman L.P. caused its indirect subsidiaries to contribute 100% of the equity interests in both Intrawest U.S. and Intrawest Canada to an indirect subsidiary of Intrawest Resorts Holdings, Inc., the issuer of the common stock offered hereby. In connection with these restructuring transactions, we issued an aggregate of 42,999,900 shares (or 41,881,903 shares after giving effect to the 0.974-for-1 reverse stock split described below) of our common stock to the Initial Stockholders and we were released as an obligor with respect to all of our debt owed to affiliates (approximately $1.4 billion as of September 30, 2013). The transactions described in this paragraph form part of the “Restructuring” described under “Unaudited Pro Forma Condensed Consolidated Financial Information.” See also “Description of Certain Indebtedness—Notes Payable to Affiliates.”

7

The chart below summarizes our corporate structure after giving effect to the consummation of the Restructuring and this offering.

Intrawest Resorts Holdings, Inc. was incorporated in Delaware on August 30, 2013 for the purpose of effecting this offering.

8

The Refinancing

As of September 30, 2013, we had outstanding $446.6 million of borrowings under a first lien credit agreement with a syndicate of lenders. As of September 30, 2013, we also had outstanding $125.0 million of borrowings under a second lien credit agreement with a syndicate of lenders.

On December 9, 2013, we entered into a new first lien credit agreement (the “New Credit Agreement”) and an affiliate of Fortress contributed $48.3 million to us. Borrowings under the New Credit Agreement, together with cash on hand and the funds contributed to us by an affiliate of Fortress, were used to refinance and replace the borrowings under the first lien credit agreement and the second lien credit agreement (the “Refinancing”). For a description of the New Credit Agreement, see “Description of Certain Indebtedness—Third-Party Long-Term Debt—New Credit Agreement.”

As of September 30, 2013, our total indebtedness on an actual and a pro forma basis after giving effect to the Restructuring and the Refinancing (we refer to these transactions, as described under “Unaudited Pro Forma Condensed Consolidated Financial Information,” as the Pro Forma Transactions) was $2,033.9 million and $584.5 million, respectively. See “Unaudited Pro Forma Condensed Consolidated Financial Information” and “Description of Certain Indebtedness—Third-Party Long-Term Debt.”

Recent Financial and Operating Results

The following information reflects our preliminary results based on currently available information. We have provided ranges, rather than specific amounts, for certain of the financial and operating information below, primarily because our closing procedures for the related periods are not yet complete and, as a result, we expect that our final results upon completion of our closing procedures may vary from the currently available preliminary results. In addition, financial and operating information for the three and six months ended December 31, 2013 and for the 2013/14 season-to-date period is not necessarily indicative of performance trends for the full ski season, which may be unfavorably affected by adverse events, including unfavorable changes in weather conditions or the overall economic environment.

Preliminary Financial Results for the Three and Six Months Ended December 31, 2013

Although our financial results presented for the three and six months ended December 31, 2013 are preliminary and subject to fiscal quarter end adjustments, we estimate that our financial results will fall within the following ranges:

Three Months Ended December 31,

|

Six Months Ended December 31, |

|||||||||||||||||

| 2012 | 2013 | 2012 | 2013 | |||||||||||||||

Actual

|

Low

|

High

|

Actual

|

Low |

High |

|||||||||||||

| (in thousands) | ||||||||||||||||||

| Total revenue | $ |

104,269

| $ |

99,553

| $ |

102,106

| $ |

183,464

| $ |

180,115

| $ |

182,667

| ||||||

| Net loss attributable to the Company | $ |

(108,978)

| $ |

(112,546)

| $ |

(109,801)

| $ |

(236,253)

| $ |

(234,560)

| $ |

(231,815)

| ||||||

| Mountain revenue | $ |

72,038

| $ |

74,091

| $ |

75,991

| $ |

105,298

| $ |

107,396

| $ |

109,296

| ||||||

| Adventure revenue | $ |

13,079

| $ |

11,249

| $ |

11,537

| $ |

42,126

| $ |

33,865

| $ |

34,154

| ||||||

| Real Estate revenue | $ |

17,144

| $ |

13,574

| $ |

13,922

| $ |

32,291

| $ |

26,824

| $ |

27,172

| ||||||

| Mountain Adjusted EBITDA | $ |

1,234

| $ |

3,132

| $ |

3,212

| $ |

(18,354)

| $ |

(19,459)

| $ |

(19,378)

| ||||||

| Adventure Adjusted EBITDA | $ |

(6,036)

| $ |

(3,160)

| $ |

(3,083)

| $ |

1,117

| $ |

496

| $ |

573

| ||||||

| Real Estate Adjusted EBITDA | $ |

4,801

| $ |

1,622

| $ |

1,664

| $ |

6,870

| $ |

3,099

| $ |

3,141

| ||||||

Preliminary Key Business Metrics Evaluated by Management for the Three Months Ended December 31, 2013

Although our operating results presented for the three months ended December 31, 2013 are preliminary and subject to fiscal quarter end adjustments, we estimate that our operating results will fall within the following ranges. For operating results for the three months ended September 30, 2012 and 2013, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Key business metrics are not presented for the six months ended December 31, 2012 and 2013 because none of our mountain resorts were open for skiing during the three months ended September 30, 2012 and 2013.

9

Three Months Ended December 31,

|

|||||||||

2012

|

2013

|

||||||||

Actual

|

Low

|

High

|

|||||||

|

Mountain |

|||||||||

| Skier Visits(1) |

660,443

|

723,730

|

742,287

| ||||||

| Mountain Segment Revenue Per Visit(2) | $ |

109.08

| $ |

99.81

| $ |

102.37

| |||

| ETP(3) | $ |

45.25

| $ |

41.11

| $ |

42.17

| |||

|

Adventure |

|||||||||

| CMH Guest Nights(4) |

4,360

|

4,580

|

4,697

| ||||||

| CMH RevPGN(5) | $ |

1,209

| $ |

1,017

| $ |

1,043

| |||

| (1) | A Skier Visit represents an individual’s use of a paid or complimentary ticket, frequency card or season pass to ski or snowboard at our Steamboat, Winter Park, Tremblant, Stratton and Snowshoe resorts for any part of one day. |

| (2) | Mountain Segment Revenue Per Visit is defined as total revenue of our Mountain segment for a given period divided by total Skier Visits during such period. |

| (3) | Effective ticket price, or ETP, is calculated by dividing lift revenue for a given period by total Skier Visits during such period. |

| (4) | CMH Guest Nights represents the number of paid nights skiing or hiking customers spend at our CMH lodges for a given period. |

| (5) | CMH RevPGN is total CMH revenue for a given period divided by the total number of CMH Guest Nights during such period. |

The following variance explanations compare the three months ended December 31, 2012 and 2013. For variance explanations related to the three months ended September 30, 2012 and 2013, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Total revenue. We expect to report that total revenue decreased from $104.3 million for the three months ended December 31, 2012 to between $99.6 million and $102.1 million for the three months ended December 31, 2013.

Net loss. We expect to report that net loss increased from $(109.0) million for the three months ended December 31, 2012 to between $(112.5) million and $(109.8) million for the three months ended December 31, 2013. The Restructuring and the Refinancing were consumated in December 2013. As a result, our interest expense will be significantly reduced in future periods as a result of the Refinancing and the Restructuring. See “—Our Restructuring and Refinancing.”

Mountain revenue. We expect to report that our Mountain revenue increased from $72.0 million for the three months ended December 31, 2012 to between $74.1 million and $76.0 million for the three months ended December 31, 2013. The increase in Mountain revenue is primarily due to an increase in Skier Visits during the three months ended December 31, 2013, which increased lift revenue as well as ski-related revenue. The increase in Skier Visits was driven by improved snowfall and conditions. We expect the increase in Skier Visits to exceed the increase in Mountain revenue, in percentage terms, principally as a result of increased season pass usage. A higher mix of season pass holders puts downward pressure on ETP as season pass holders increase their usage. As of January 5, 2014, sales of season pass and frequency products have increased 23.1% relative to the prior season-to-date period.

Mountain Adjusted EBITDA. We expect to report that our Mountain Adjusted EBITDA increased from $1.2 million for the three months ended December 31, 2012 to between $3.1 million and $3.2 million for the three months ended December 31, 2013. The increase in Mountain Adjusted EBITDA is due to increased Mountain revenue.

Adventure revenue. We expect to report that our Adventure revenue decreased from $13.1 million for the three months ended December 31, 2012 to between $11.2 million and $11.5 million for the three months ended December 31, 2013. We expect revenue from ancillary services to decrease primarily due to a decrease in fire suppression activities and lower revenue from our MRO operations. While we expect CMH Guest Nights to increase, we expect CMH RevPGN to decrease as a result of unfavorable foreign currency translation and promotional rates that we offered to customers as a result of reduced snowfall in the Canadian Rocky Mountain region during the three months ended December 31, 2013.

Adventure Adjusted EBITDA. We expect to report that our Adventure Adjusted EBITDA improved from a loss of $(6.0) million for the three months ended December 31, 2012 to a loss of between $(3.1) million and $(3.2) million for the three months ended December 31, 2013. Adventure Adjusted EBITDA improved due to a decrease in Adventure operating expenses attributable to reduced firefighting and MRO activity and removal of the negative Adjusted EBITDA attributable to non-controlling interest in Alpine Helicopters in the fiscal 2013 period as a result of the restructuring in January 2013. These items were partially offset by lower Adventure revenue.

10

Real Estate revenue. We expect to report that our Real Estate revenue decreased from $17.1 million for the three months ended December 31, 2012 to between $13.6 million and $13.9 million for the three months ended December 31, 2013. The decrease in Real Estate revenue is primarily due to a one-time acceleration of commissions relating to the exit in December 2012 of our brokerage engagement at Honua Kai Resort and Spa in Maui.

Real Estate Adjusted EBITDA. We expect to report that our Real Estate Adjusted EBITDA decreased from $4.8 million for the three months ended December 31, 2012 to between $1.6 million and $1.7 million for the three months ended December 31, 2013. The decrease in Real Estate Adjusted EBITDA is primarily due to the one-time acceleration of commissions referred to above.

We expect to report that we had cash and cash equivalents of $42.0 million and total long-term debt of $579.3 million as of December 31, 2013.

Preliminary Ski Season-to-Date Growth Data

The following table presents ski season data for each season-to-date period relative to the comparable period in the prior fiscal year. For purposes of this table, the 2012/13 season-to-date period runs through January 6, 2013 and the 2013/14 season-to-date period runs through January 5, 2014. Each season-to-date period begins on the date that our first mountain resort opened for skiing in the respective ski season, which is typically in mid-November.

2012/13

|

2013/14

|

|||||

| Skier Visits |

8.5

| % |

8.0

| % |

||

| Lift revenue |

6.1

| % |

4.7

| % |

||

|

Ancillary revenue |

||||||

| Ski school revenue |

22.7

| % |

7.7

| % |

||

| Food and beverage revenue |

43.4

| % |

8.4

| % |

||

| Retail and rental revenue |

31.9

| % |

4.5

| % |

||

Inclusion of Preliminary Financial and Operating Information

The preliminary financial and operating information included in this prospectus reflects management’s estimates based solely upon information available to us as of the date of this prospectus and is the responsibility of management. The preliminary financial information presented above is not a comprehensive statement of our financial results for the three and six months ended December 31, 2013 and has not been audited, reviewed or compiled by our independent registered public accounting firm, KPMG LLP. Accordingly, KPMG LLP does not express an opinion or any other form of assurance with respect thereto. The preliminary information presented above is subject to the completion of our financial closing procedures, which have not yet been completed.

Our actual results for the three and six months ended December 31, 2013 and the 2013/14 season-to-date period will not be finalized until after this offering is completed and may differ materially from the above estimates. Accordingly, you should not place undue reliance upon these preliminary results. For example, during the course of the preparation of the applicable financial statements and related notes, additional items that would require material adjustments to be made to the preliminary estimated information presented above may be identified. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control. See “Risk Factors” and “Forward-Looking Statements.”

Our Principal Stockholders

Immediately following the completion of this offering, the Initial Stockholders will beneficially own approximately 65.3% of our outstanding common stock, or 60.1% if the underwriters’ option to purchase additional shares is fully exercised. This level of share ownership is sufficient to control the vote on matters and transactions requiring stockholder approval. The Initial Stockholders are controlled by Fortress. See “Risk Factors—Risks Related to Our Organization and Structure” and “Principal and Selling Stockholders.” Pursuant to the Stockholders Agreement (as defined below), Fortress may designate directors for nomination and election to our board of directors. Pursuant to these provisions, Fortress has the ability to appoint up to a majority of the members of our board of directors, plus two directors, for so long as the Initial Stockholders, certain of their permitted transferees and affiliates of Fortress beneficially own, directly or indirectly, at least 30% of our issued and outstanding common stock and certain other conditions are met. See “Certain Relationships and Related Party Transactions—Designation and Election of Directors.”

11

Risk Factors

There are a number of risks that you should carefully consider before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary. These risks include, but are not limited to:

| • | a prolonged weakness in general economic conditions; |

| • | the failure of recreational adventure and experiential travel to gain in popularity; |

| • | lack of adequate snowfall and unfavorable weather conditions; |

| • | adverse events that occur during our peak operating periods combined with the seasonality of our business; |

| • | the occurrence of natural disasters; |

| • | the high fixed cost structure of our business; |

| • | risks associated with not owning all of the land on which we conduct our operations, including the loss of, or inability to renew, our governmental permits and leases; |

| • | risks related to the fact that we are not the sole property manager at certain of our real estate developments and risks related to the fact that fewer condominium owners have been using our rental management services in recent years; |

| • | our inability to complete real estate development projects and achieve the anticipated financial benefits from such projects; |

| • | our inability to successfully remediate material weaknesses in our internal control over financial reporting and the expected costs associated with doing so; |

| • | competition with similar businesses owned by Fortress and its affiliates; and |

| • | risks related to the corporate opportunity provisions in our restated certificate of incorporation, which do not require Fortress or its affiliates, including the Initial Stockholders, or any of their officers, directors or employees, to offer us potential transactions or corporate opportunities of which they are aware. |

As a result of these risks and the other risks discussed in the section entitled “Risk Factors,” there is no guarantee that we will experience growth and improving profitability in the future. Similarly, there can be no assurance that the number of visitors to our mountain resorts and CMH, including season pass holders at our mountain resorts, will remain constant or increase in future years.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified exemptions from various requirements that are otherwise applicable generally to public companies in the United States. These provisions include:

| • | reduced compensation disclosure requirements; |

| • | an exemption to include in an initial public offering registration statement less than five years of selected financial data; and |

| • | an exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting. |

12

The JOBS Act also permits an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies, and exempts an emerging growth company such as us from Section 14A(a) and (b) of the Securities Exchange Act of 1934 (the “Exchange Act”), which require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation.

We will remain an emerging growth company until the earliest of:

| • | the last day of our fiscal year during which we have total annual gross revenues of at least $1.0 billion; |

| • | the last day of our fiscal year following the fifth anniversary of the completion of this offering; |

| • | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or |

| • | the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter. |

We have availed ourselves in this prospectus of the reduced reporting requirements described above with respect to compensation disclosure requirements and selected financial data. As a result, the information that we provide stockholders may be less comprehensive than what you might receive from other public companies. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above. We have not elected to avail ourselves of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards. This election is irrevocable.

Corporate Information

Our executive offices are located at 1621 18th Street, Suite 300, Denver, Colorado 80202, and our telephone number is (303) 749-8200. Our website address is www.intrawest.com. The information on our website is not a part of this prospectus.

13

Summary Historical and Unaudited Pro Forma Condensed

Consolidated Financial and Operating Information

The following summary historical consolidated financial information for the years ended June 30, 2011, 2012 and 2013 and as of June 30, 2012 and 2013 has been derived from the audited consolidated financial statements of Cayman L.P. included elsewhere in this prospectus.

The following summary historical consolidated financial information for the three months ended September 30, 2012 and 2013 and as of September 30, 2013 has been derived from the unaudited interim consolidated financial statements of Cayman L.P. included elsewhere in this prospectus. In our opinion, such unaudited interim consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements of Cayman L.P. and reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results of operations and financial position of Cayman L.P. Results as of and for the three months ended September 30, 2013 are not necessarily indicative of results that may be expected for the entire year.

The following unaudited pro forma condensed consolidated financial information for the year ended June 30, 2013 and as of and for the three months ended September 30, 2013 gives effect to the Pro Forma Transactions. The unaudited pro forma condensed consolidated financial information is based on available information and assumptions that we believe are reasonable, is for illustrative and informational purposes only and should not be considered representative of our future financial condition or results of operations. See “Unaudited Pro Forma Condensed Consolidated Financial Information” for a description of the adjustments reflected in the pro forma condensed consolidated financial information.

Prior to the collapse in the housing markets in late 2007 and the global financial crisis that followed, we were actively engaged in large scale development and sales of resort real estate, primarily in North America. In light of the then prevailing market conditions, we ceased new development activities in late 2009. As a result, we were left with a portfolio of real estate assets, high leverage levels and litigation initiated by purchasers of resort real estate seeking to rescind their purchase obligations or otherwise mitigate their losses. This confluence of factors had a material impact on our consolidated financial results for the fiscal periods presented below. Through a series of debt refinancings, cost saving initiatives and divestitures of non-core assets, we believe we have streamlined our operations. As of September 30, 2013, we have divested substantially all of our legacy real estate assets and have settled the majority of litigation claims stemming from our pre-2010 development and sales activities. Although the effects of our pre-2010 legacy real estate development and sales activities on our consolidated financial results will continue in future periods, we expect that these effects will continue to diminish over time. After giving effect to the Refinancing and the Restructuring, we believe our financial results in future periods will be materially different from those reflected in the historical consolidated financial information of Cayman L.P. appearing in this prospectus.

You should read the following summary historical and unaudited pro forma condensed consolidated financial and operating information in conjunction with the information appearing under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Unaudited Pro Forma Condensed Consolidated Financial Information” in this prospectus, and in conjunction with the consolidated financial statements of Cayman L.P. and the related notes appearing elsewhere in this prospectus.

Historical |

Pro Forma |

Historical |

Pro Forma |

||||||||||||||||||

Year Ended June 30, |

Year Ended June 30, 2013 |

Three Months Ended September 30, |

Three Months Ended September 30, 2013 |

||||||||||||||||||

2011(1) |

2012 |

2013 |

2012 |

2013 |

|||||||||||||||||

| (in thousands) | |||||||||||||||||||||

| Statement of Operations Data: |

|||||||||||||||||||||

| Revenues |

|||||||||||||||||||||

| Mountain | $ | 322,194 | $ | 310,765 | $ | 339,003 | $ | 33,259 | $ | 33,305 | |||||||||||

| Adventure | 96,693 | 109,496 | 113,622 | 29,047 | 22,617 | ||||||||||||||||

| Real Estate | 61,165 | 61,439 | 64,726 | 15,148 | 13,250 | ||||||||||||||||

| Total reportable segment revenues | 480,052 | 481,700 | 517,351 | 77,454 | 69,172 | ||||||||||||||||

| Legacy, non-core and other(2) | 79,471 | 31,747 | 7,056 | 1,741 | 11,389 | ||||||||||||||||

| Total revenues | 559,523 | 513,447 | 524,407 | $ | 523,979 | 79,195 | 80,561 | $ | 80,561 | ||||||||||||

| Operating expenses(2) | 504,005 | 453,187 | 448,944 | 446,848 | 101,179 | 104,196 | 103,563 | ||||||||||||||

| Depreciation and amortization | 76,371 | 57,655 | 58,342 | 58,340 | 14,653 | 13,145 | 13,145 | ||||||||||||||

14

Historical |

Pro Forma |

Historical |

Pro Forma |

||||||||||||||||||

Year Ended June 30, |

Year Ended June 30, 2013 |

Three Months Ended September 30, |

Three Months Ended September 30, 2013 |

||||||||||||||||||

2011(1) |

2012 |

2013 |

2012 |

2013 |

|||||||||||||||||

| (in thousands, except operating statistics) | |||||||||||||||||||||

| Statement of Operations Data: |

|||||||||||||||||||||

| Loss (gain) on disposal of assets(1) | $ | 26,196 | $ | 9,443 | $ | 12,448 | $ | 10,525 | $ | 1,210 | $ | (236 | ) |

$ | (337 | ) |

|||||

| Impairment of long-lived assets | 12,140 | 782 | 143 | 143 | — | — | — | ||||||||||||||

| Impairment of real estate | 73,230 | 8,137 | 1,052 | 403 | 62 | 633 | 633 | ||||||||||||||

| Goodwill impairment | 64,097 | 3,575 | — | — | — | — | — | ||||||||||||||

| Income (loss) from operations | (196,516 | ) |

(19,332 | ) |

3,478 | 7,720 | (37,909 | ) |

(37,177 | ) |

(36,443 | ) |

|||||||||

| Interest income | 9,162 | 7,467 | 6,630 | 6,583 | 1,637 | 1,632 | 1,606 | ||||||||||||||

| Interest expense on third party debt | (143,463 | ) |

(135,929 | ) |

(98,437 | ) |

(48,189)

| (35,006 | ) |

(16,464 | ) |

(11,663)

| |||||||||

| Interest expense on notes payable to affiliates | (160,943 | ) |

(195,842 | ) |

(236,598 | ) |

— | (55,371 | ) |

(67,105 | ) |

— | |||||||||

| Earnings (loss) from equity method investments(3) | 8,299 | 538 | (5,147 | ) |

(5,147 | ) |

(91 | ) |

(1,591 | ) |

(1,591 | ) |

|||||||||