Exhibit 99.1

Financial Contact: Mike Knapp Knowles Investor Relations Phone: (630) 238-5236 Email: mike.knapp@knowles.com | |

Knowles Reports Q1 2019 Financial Results and Provides Outlook for Q2 2019

Microphone Sales to Ear & IoT Markets Up More Than 25 Percent Y/Y

Precision Devices Revenues Reach Record Levels for Fifth Consecutive Quarter

Gross Profit Margin Improves 150 Bps Y/Y

ITASCA, Ill., Apr. 24, 2019 - Knowles Corporation (NYSE: KN), a market leader and global provider of advanced micro-acoustic, audio processing, and precision device solutions, today announced results for the quarter ended March 31, 2019.

“In the first quarter, Knowles continued to perform well against the backdrop of a weak handset market. Revenues exceeded the midpoint of our guidance range and were up from the year ago period due to strong demand for Precision Devices, higher than expected Audio sales to Chinese OEMs, and increased microphone demand for Ear and IoT applications,” said Jeffrey Niew, president and CEO of Knowles. “As we enter the second quarter, we believe stabilizing business conditions in mobility, coupled with continued strong demand in non-mobile applications and Precision Devices, will enable us to outperform the end markets we serve.”

“In Audio, macro trends around better performance and edge processing remain favorable and are enabling us to expand our total available market and grow our business. In Precision Devices, sales reached record levels for the fifth consecutive quarter as we continue to execute our playbook and drive strong revenue growth and operating margin improvement, both organically and through tuck in acquisitions. We believe that our strategy to invest in high-value, differentiated solutions and diversify our end markets and customers will drive continued revenue growth with strong operating leverage in 2019,” continued Niew.

Financial Highlights

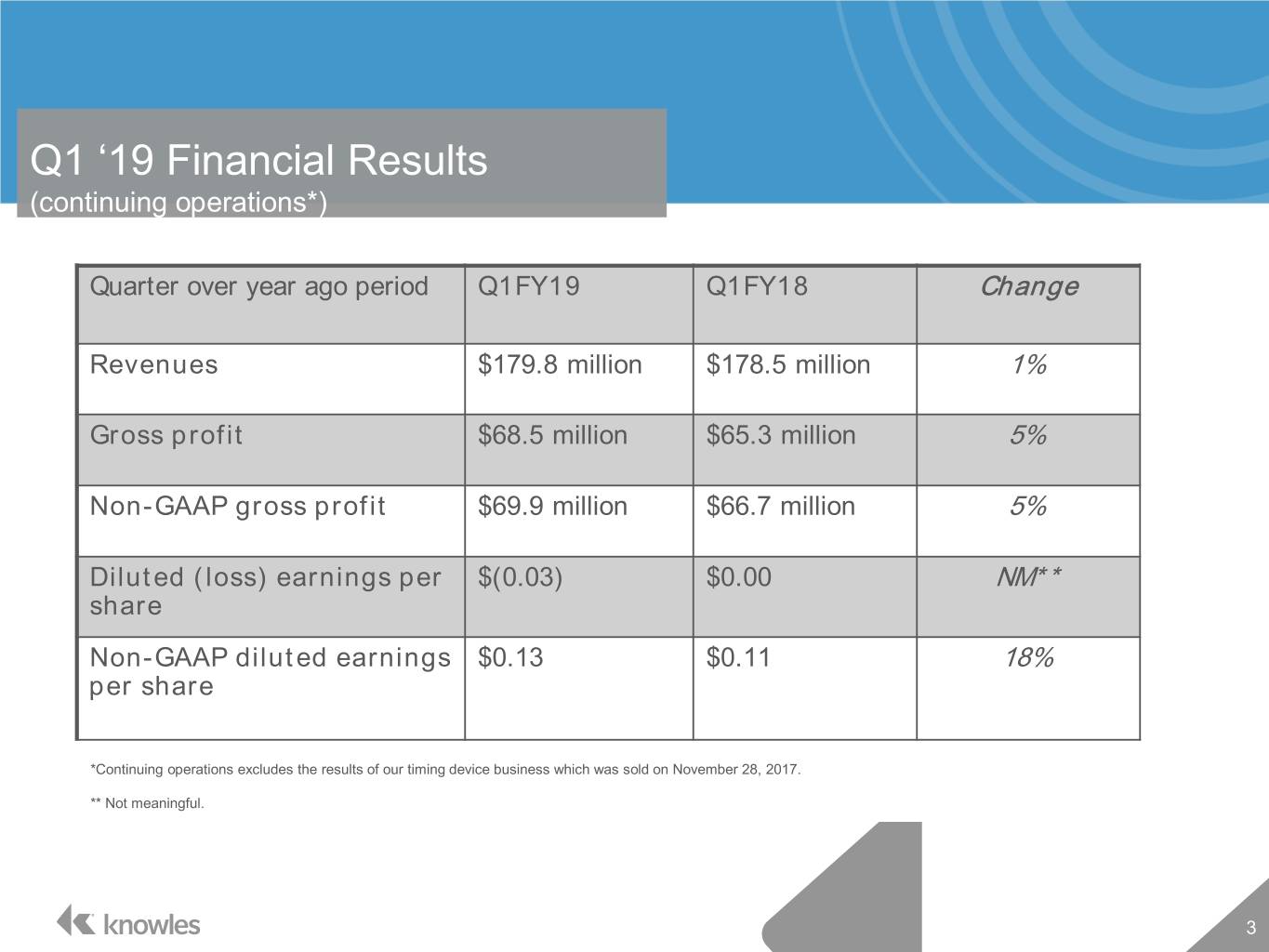

The following table highlights the Company’s financial performance on both a GAAP and non-GAAP basis for continuing operations* (in millions, except per share data):

Q1FY19 | Q4FY18 | Q1FY18 | Year Ago Period Change | |

Revenues | $179.8 | $223.8 | $178.5 | 1% |

Gross profit | $68.5 | $94.3 | $65.3 | 5% |

(as a % of revenues) | 38.1% | 42.1% | 36.6% | |

Non-GAAP gross profit | $69.9 | $95.4 | $66.7 | 5% |

(as a % of revenues) | 38.9% | 42.6% | 37.4% | |

Diluted (loss) earnings per share ** | $(0.03) | $0.87 | $— | NM*** |

Non-GAAP diluted earnings per share | $0.13 | $0.37 | $0.11 | 18% |

* Continuing operations excludes the results of our timing device business which was sold on November 28, 2017.

** Current period results include $6.7 million in stock-based compensation, $2.8 million in restructuring charges and production transfer costs, $2.0 million in other expenses, and $1.8 million in amortization of intangibles.

*** Not meaningful.

1

In addition to the GAAP results included in this press release, Knowles has presented supplemental non-GAAP gross profit, earnings before interest and income taxes, adjusted earnings before interest and income taxes, non-GAAP diluted earnings per share, as well as other metrics on a non-GAAP basis that exclude certain amounts that are included in the most directly comparable GAAP measure to facilitate evaluation of Knowles’ operating performance. Non-GAAP results are not presented in accordance with GAAP. Non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this press release do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles’ performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance including, for example, stock-based compensation, certain intangibles amortization expense, fixed asset impairment charges, restructuring, production transfer costs, and other charges which management considers to be outside our core operating results. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation table accompanying this release.

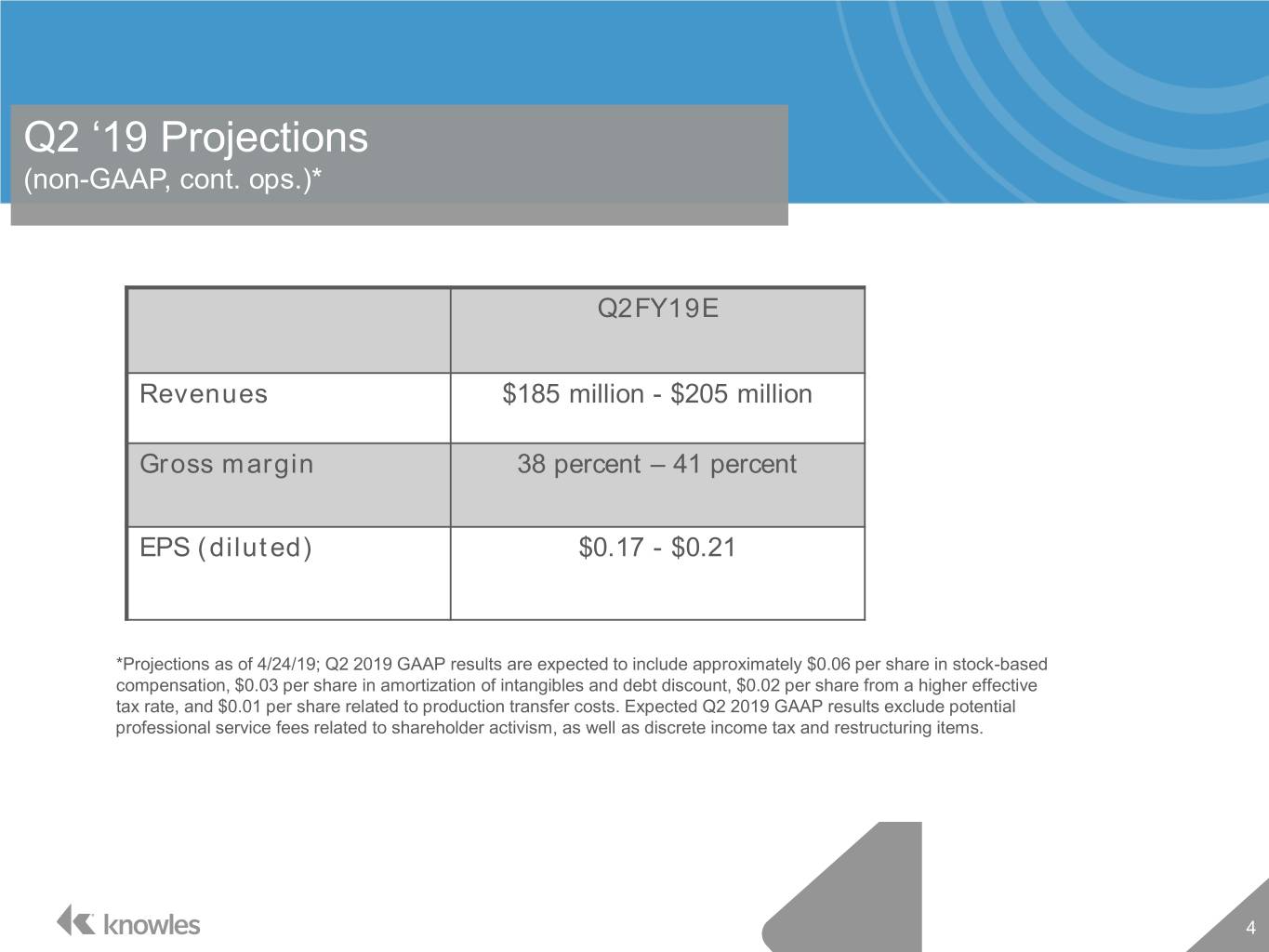

Second Quarter 2019 Outlook

The forward looking guidance for the quarter ending June 30, 2019 is as follows:

GAAP | Adjustments | Non-GAAP | |

Revenues | $185 to $205 million | — | $185 to $205 million |

Gross Profit Margin | 37 to 40% | 1% | 38 to 41% |

EPS | $0.05 to $0.09 | $0.12 | $0.17 to $0.21 |

Q2 2019 GAAP results are expected to include approximately $0.06 per share in stock-based compensation, $0.03 per share in amortization of intangibles and debt discount, $0.02 per share from a higher effective tax rate, and $0.01 per share related to production transfer costs. Expected Q2 2019 GAAP results exclude potential professional service fees related to shareholder activism, as well as discrete income tax and restructuring items.

Webcast and Conference Call Information

Investors can listen to a live or replay webcast of the Company’s quarterly financial conference call at http://investor.knowles.com. The live webcast will begin today at 3:30 p.m. Central time. The webcast replay will be available after 7:00 p.m. Central time today.

Investors can also listen to the conference call at 3:30 p.m. Central time today by calling (844) 589-0917 (United States) or (647) 253-8649 (International). The conference call replay will be available after 7:00 p.m. Central time today through 11:59 p.m. Central time on May 1, 2019 at (800) 585-8367 (United States) or (416) 621-4642 (International). The access code is 3297175.

About Knowles

Knowles Corporation (NYSE: KN) is a market leader and global provider of advanced micro-acoustic, audio processing, and precision device solutions, serving the mobile consumer electronics, communications, medical, defense, automotive, and industrial markets. Knowles uses its leading position in MEMS (micro-electro-mechanical systems) microphones and strong capabilities in audio processing technologies to optimize audio systems and improve the user experience in mobile, ear, and IoT applications. Knowles is also the leader in acoustic components, high-end capacitors, and mmWave RF solutions for a diverse set of markets. Knowles’ focus on the customer, combined with unique technology, proprietary manufacturing techniques, rigorous testing, and global scale, enables it to deliver innovative solutions that optimize the user experience. Founded in 1946 and headquartered in Itasca, Illinois, Knowles is a global organization with employees in 11 countries. The company was spun out from Dover Corporation in 2014 and has been focused on reshaping its business portfolio and investing in high value solutions to diversify its revenue and increase exposure to high-growth markets. For more information, visit knowles.com.

2

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this news release are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. These risks and uncertainties include, but are not limited to: unforeseen changes in MEMS microphone demand from our largest customers, in particular, two North American, a Korean, and Chinese OEM customers; the success and rate of multi-microphone and smart microphone adoption and proliferation of our “intelligent audio” solutions, including our audio edge processors, to high volume platforms; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability including the recent economic slowdown in China; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; risks associated with shareholder activism, including proxy contests; our ability to achieve continued reductions in our operating expenses; our ability to obtain, enforce, defend or monetize our intellectual property rights; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; and changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

3

INVESTOR SUPPLEMENT - FIRST QUARTER 2019

KNOWLES CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(in millions, except share and per share amounts)

(unaudited)

Quarter Ended | |||||||||||

March 31, 2019 | December 31, 2018 | March 31, 2018 | |||||||||

Revenues | $ | 179.8 | $ | 223.8 | $ | 178.5 | |||||

Cost of goods sold | 110.8 | 129.2 | 113.2 | ||||||||

Restructuring charges - cost of goods sold | 0.5 | 0.3 | — | ||||||||

Gross profit | 68.5 | 94.3 | 65.3 | ||||||||

Research and development expenses | 24.7 | 25.2 | 24.8 | ||||||||

Selling and administrative expenses | 37.6 | 35.1 | 35.8 | ||||||||

Restructuring charges | 1.8 | 0.3 | 0.4 | ||||||||

Operating expenses | 64.1 | 60.6 | 61.0 | ||||||||

Operating earnings | 4.4 | 33.7 | 4.3 | ||||||||

Interest expense, net | 3.5 | 3.9 | 4.0 | ||||||||

Other expense (income), net | 1.0 | 0.2 | (0.1 | ) | |||||||

(Loss) earnings before income taxes and discontinued operations | (0.1 | ) | 29.6 | 0.4 | |||||||

Provision for (benefit from) income taxes | 2.6 | (49.8 | ) | 0.8 | |||||||

(Loss) earnings from continuing operations | (2.7 | ) | 79.4 | (0.4 | ) | ||||||

Earnings from discontinued operations, net | — | 0.2 | 0.1 | ||||||||

Net (loss) earnings | $ | (2.7 | ) | $ | 79.6 | $ | (0.3 | ) | |||

(Loss) earnings per share from continuing operations: | |||||||||||

Basic | $ | (0.03 | ) | $ | 0.88 | $ | — | ||||

Diluted | $ | (0.03 | ) | $ | 0.87 | $ | — | ||||

Earnings per share from discontinued operations: | |||||||||||

Basic | $ | — | $ | — | $ | — | |||||

Diluted | $ | — | $ | — | $ | — | |||||

Net (loss) earnings per share: | |||||||||||

Basic | $ | (0.03 | ) | $ | 0.88 | $ | — | ||||

Diluted | $ | (0.03 | ) | $ | 0.87 | $ | — | ||||

Weighted-average common shares outstanding: | |||||||||||

Basic | 90,535,188 | 90,220,173 | 89,718,318 | ||||||||

Diluted | 90,535,188 | 91,592,320 | 89,718,318 | ||||||||

4

KNOWLES CORPORATION

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES (1)

(in millions, except share and per share amounts)

(unaudited)

Quarter Ended | |||||||||||

March 31, 2019 | December 31, 2018 | March 31, 2018 | |||||||||

Gross profit | $ | 68.5 | $ | 94.3 | $ | 65.3 | |||||

Gross profit as % of revenues | 38.1 | % | 42.1 | % | 36.6 | % | |||||

Stock-based compensation expense | 0.4 | 0.4 | 0.4 | ||||||||

Restructuring charges | 0.5 | 0.3 | — | ||||||||

Production transfer costs (2) | 0.5 | 0.4 | 0.8 | ||||||||

Other (3) | — | — | 0.2 | ||||||||

Non-GAAP gross profit | $ | 69.9 | $ | 95.4 | $ | 66.7 | |||||

Non-GAAP gross profit as % of revenues | 38.9 | % | 42.6 | % | 37.4 | % | |||||

Research and development expenses | $ | 24.7 | $ | 25.2 | $ | 24.8 | |||||

Stock-based compensation expense | (2.1 | ) | (1.9 | ) | (2.0 | ) | |||||

Production transfer costs (2) | — | — | (0.2 | ) | |||||||

Non-GAAP research and development expenses | $ | 22.6 | $ | 23.3 | $ | 22.6 | |||||

Selling and administrative expenses | $ | 37.6 | $ | 35.1 | $ | 35.8 | |||||

Stock-based compensation expense | (4.2 | ) | (3.9 | ) | (4.6 | ) | |||||

Intangibles amortization expense | (1.8 | ) | (1.6 | ) | (1.6 | ) | |||||

Other (3) | (2.0 | ) | (0.2 | ) | (0.1 | ) | |||||

Non-GAAP selling and administrative expenses | $ | 29.6 | $ | 29.4 | $ | 29.5 | |||||

Operating expenses | $ | 64.1 | $ | 60.6 | $ | 61.0 | |||||

Stock-based compensation expense | (6.3 | ) | (5.8 | ) | (6.6 | ) | |||||

Intangibles amortization expense | (1.8 | ) | (1.6 | ) | (1.6 | ) | |||||

Restructuring charges | (1.8 | ) | (0.3 | ) | (0.4 | ) | |||||

Production transfer costs (2) | — | — | (0.2 | ) | |||||||

Other (3) | (2.0 | ) | (0.2 | ) | (0.1 | ) | |||||

Non-GAAP operating expenses | $ | 52.2 | $ | 52.7 | $ | 52.1 | |||||

(Loss) earnings from continuing operations | $ | (2.7 | ) | $ | 79.4 | $ | (0.4 | ) | |||

Interest expense, net | 3.5 | 3.9 | 4.0 | ||||||||

Provision for (benefit from) income taxes | 2.6 | (49.8 | ) | 0.8 | |||||||

Earnings from continuing operations before interest and income taxes | 3.4 | 33.5 | 4.4 | ||||||||

Earnings from continuing operations before interest and income taxes as % of revenues | 1.9 | % | 15.0 | % | 2.5 | % | |||||

Stock-based compensation expense | 6.7 | 6.2 | 7.0 | ||||||||

Intangibles amortization expense | 1.8 | 1.6 | 1.6 | ||||||||

Restructuring charges | 2.3 | 0.6 | 0.4 | ||||||||

Production transfer costs (2) | 0.5 | 0.4 | 1.0 | ||||||||

Other (3) | 2.0 | 0.2 | 0.3 | ||||||||

Adjusted earnings from continuing operations before interest and income taxes | $ | 16.7 | $ | 42.5 | $ | 14.7 | |||||

Adjusted earnings from continuing operations before interest and income taxes as % of revenues | 9.3 | % | 19.0 | % | 8.2 | % | |||||

5

Quarter Ended | |||||||||||

March 31, 2019 | December 31, 2018 | March 31, 2018 | |||||||||

Interest expense, net | $ | 3.5 | $ | 3.9 | $ | 4.0 | |||||

Interest expense, net non-GAAP reconciling adjustments (4) | 1.7 | 1.6 | 1.5 | ||||||||

Non-GAAP interest expense | $ | 1.8 | $ | 2.3 | $ | 2.5 | |||||

Provision for (benefit from) income taxes | $ | 2.6 | $ | (49.8 | ) | $ | 0.8 | ||||

Income tax effects of non-GAAP reconciling adjustments (5) | 0.5 | 55.1 | 0.7 | ||||||||

Non-GAAP provision for income taxes | $ | 3.1 | $ | 5.3 | $ | 1.5 | |||||

(Loss) earnings from continuing operations | $ | (2.7 | ) | $ | 79.4 | $ | (0.4 | ) | |||

Non-GAAP reconciling adjustments (6) | 13.3 | 9.0 | 10.3 | ||||||||

Interest expense, net non-GAAP reconciling adjustments (4) | 1.7 | 1.6 | 1.5 | ||||||||

Income tax effects of non-GAAP reconciling adjustments (5) | 0.5 | 55.1 | 0.7 | ||||||||

Non-GAAP net earnings | $ | 11.8 | $ | 34.9 | $ | 10.7 | |||||

Diluted (loss) earnings per share from continuing operations | $ | (0.03 | ) | $ | 0.87 | $ | — | ||||

Earnings (loss) per share non-GAAP reconciling adjustment | 0.16 | (0.50 | ) | 0.11 | |||||||

Non-GAAP diluted earnings per share | $ | 0.13 | $ | 0.37 | $ | 0.11 | |||||

Diluted average shares outstanding | 90,535,188 | 91,592,320 | 89,718,318 | ||||||||

Non-GAAP adjustment (7) | 3,185,581 | 1,687,972 | 3,389,994 | ||||||||

Non-GAAP diluted average shares outstanding (7) | 93,720,769 | 93,280,292 | 93,108,312 | ||||||||

Notes:

(1) In addition to the GAAP financial measures included herein, Knowles has presented certain non-GAAP financial measures that exclude certain amounts that are included in the most directly comparable GAAP measures. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles' performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles' opinion, do not reflect its core operating performance. Knowles believes that its presentation of non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance.

(2) Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in Asia. These amounts are included in the corresponding Gross profit and Earnings from continuing operations before interest and income taxes for each period presented.

(3) | In 2019, Other expenses of $1.5 million represent professional service fees related to shareholder activism and the remaining Other expenses relate to the acquisition of DITF Interconnect Technology, Inc. by the Precision Devices segment. In 2018, Other expenses in Gross profit and Operating expenses represent expenses related to acquisitions. |

(4) | Under GAAP, certain convertible debt instruments that may be settled in cash (or other assets) upon conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s nonconvertible debt borrowing rate. Accordingly, for GAAP purposes we are required to recognize imputed interest expense on the Company’s $172.5 million of convertible senior notes due 2021 that were issued in a private placement in May 2016. The imputed interest rate is 8.12% for the convertible notes due 2021, while the actual coupon interest rate of the notes was 3.25%. The difference between the imputed interest expense and the coupon interest expense is excluded from management’s assessment of the Company’s operating performance because management believes that this non-cash expense is not indicative of its core, ongoing operating performance. |

(5) | Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. Adjustments are also made to exclude certain impacts of the Tax Reform Act and the resulting consequences that were accounted for as uncertain tax positions. |

(6) | The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings from continuing operations before interest and income taxes to Adjusted earnings from continuing operations before interest and income taxes. |

(7) | The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. |

6

KNOWLES CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share amounts)

(unaudited)

March 31, 2019 | December 31, 2018 | ||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 41.3 | $ | 73.5 | |||

Receivables, net of allowance of $0.6 | 130.5 | 140.3 | |||||

Inventories, net | 159.3 | 140.1 | |||||

Prepaid and other current assets | 13.8 | 11.1 | |||||

Total current assets | 344.9 | 365.0 | |||||

Property, plant, and equipment, net | 216.1 | 211.7 | |||||

Goodwill | 891.1 | 887.9 | |||||

Intangible assets, net | 58.3 | 56.7 | |||||

Operating lease right-of-use assets | 39.3 | — | |||||

Other assets and deferred charges | 25.3 | 26.6 | |||||

Total assets | $ | 1,575.0 | $ | 1,547.9 | |||

Current liabilities: | |||||||

Accounts payable | $ | 71.7 | $ | 77.2 | |||

Accrued compensation and employee benefits | 22.9 | 40.2 | |||||

Operating lease liabilities | 8.9 | — | |||||

Other accrued expenses | 20.3 | 20.1 | |||||

Federal and other taxes on income | 3.6 | 4.3 | |||||

Total current liabilities | 127.4 | 141.8 | |||||

Long-term debt | 170.0 | 158.1 | |||||

Deferred income taxes | 2.1 | 2.1 | |||||

Long-term operating lease liabilities | 30.1 | — | |||||

Other liabilities | 28.9 | 34.3 | |||||

Commitments and contingencies | |||||||

Stockholders' equity: | |||||||

Preferred stock - $0.01 par value; 10,000,000 shares authorized; none issued | — | — | |||||

Common stock - $0.01 par value; 400,000,000 shares authorized; 90,864,952 and 90,212,779 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | 0.9 | 0.9 | |||||

Additional paid-in capital | 1,548.7 | 1,545.9 | |||||

Accumulated deficit | (226.9 | ) | (224.2 | ) | |||

Accumulated other comprehensive loss | (106.2 | ) | (111.0 | ) | |||

Total stockholders' equity | 1,216.5 | 1,211.6 | |||||

Total liabilities and stockholders' equity | $ | 1,575.0 | $ | 1,547.9 | |||

7