UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22888

Wildermuth Endowment Fund

(Exact name of registrant as specified in charter)

818 A1A Hwy, Suite 301

Ponte Vedra Beach, Florida 32082

(Address of principal executive offices) (Zip code)

Daniel Wildermuth

Wildermuth Advisory, LLC

818 A1A Hwy, Suite 301

Ponte Vedra Beach, Florida 32082

(Name and address of agent for service)

COPIES TO:

Karen A. Aspinall

Practus, LLP

3857 Birch St. PMB 2241

Newport Beach, CA 92660

Registrant's telephone number, including area code: (888) 445-6032

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1. (a)The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

ANNUAL REPORT

December 31, 2020

WWW.WILDERMUTHENDOWMENTFUND.COM ● 1-888-445-6032 ●

DISTRIBUTED BY WILDERMUTH SECURITIES, LLC AND

UMB DISTRIBUTION SERVICES, LLC (MEMBERS OF FINRA)

Wildermuth Endowment Fund |

Table of Contents |

|

Letter to Shareholders |

2 |

Portfolio Review |

5 |

Portfolio Composition |

7 |

Schedule of Investments |

8 |

Statement of Assets and Liabilities |

14 |

Statement of Operations |

15 |

Statements of Changes in Net Assets |

16 |

Statement of Cash Flows |

18 |

Financial Highlights |

20 |

Notes to Financial Statements |

23 |

Report of Independent Registered Public Accounting Firm |

42 |

Trustees and Officers |

43 |

Additional Information |

46 |

Privacy Policy |

49 |

Wildermuth Endowment Fund

Letter to Shareholders December 31, 2020 |

Dear Investor:

We are pleased to present this annual report for the Wildermuth Endowment Fund (the “Fund”) covering the 12 months from January 1, 2020, to December 31, 2020. For the one year ended December 31, 2020, fee-waived returns were -1.24% for the Class A shares, -2.03% for the Class C shares and -1.58% for the Fund Class I shares.

The Fund’s performance for the same period trailed the strong positive returns of 14.73% generated by a 60% stock and 40% bond portfolio (as represented by a 60% S&P 500 Index1 and 40% Barclays U.S Aggregate Bond Index2).

COVID-19 created challenges for many of the portfolio holdings as companies faced unprecedented circumstances. Overall, the Fund managed to perform reasonably well within the pandemic environment but trailed both stocks and bonds as nearly all sectors struggled at some level. However, despite the year’s challenges, the Fund’s overall Sortino ratio and beta are still number one within its Morningstar World Allocation category3.

The asset class producing the strongest individual performance on the year was unsurprisingly U.S. equities, followed by international equities. While the exposure to these asset classes was consistently lowered throughout 2020, their strong positive performance provided a welcome boost to overall Fund returns.

The real estate sector produced solid returns via a combination of rental income and capital appreciation. Overall, the performance was weaker in 2020 than in past years, but the sector contributed positively to Fund performance.

The Fund’s largest asset class, private equity, was slightly positive during 2020. Ongoing company growth and development continued essentially across all companies during the year, but valuations within the sector were more varied as revenue targets for many early-stage companies were missed because of the economic shutdown. Companies were particularly impacted by the ban on face-to-face meetings which hurt various organizations attempting to introduce new technologies.

Hedge funds performed quite well during 2020 and provided a smoothing impact on the overall portfolio, although their small allocation limited their impact. The fixed income allocation percentage was negligible, resulting in a limited impact on the positive performing sector.

The primary area of underperformance for 2020 was natural resources. While the small exposure to the sector minimized portfolio impact, losses were still large enough that the sector pushed the Fund into negative returns for the year.

Looking forward to the next decade, we continue to see expanded opportunities within non-traditional asset classes, particularly private equity and real estate. High valuations within today’s equity markets have further muted our expectations for this sector in the immediate to mid-term future. As a result, while we will continue to maintain limited exposure to equities, we intend to act opportunistically across private markets when possible to secure and maintain exposure to attractive private investments and unique asset classes. As we look forward, we believe the Fund is uniquely positioned to potentially benefit from the current investment environment.

Thank you for your continued confidence and support.

Sincerely,

Daniel Wildermuth

President and Chief Executive Officer, and

Chairman and Trustee of the Fund

February 2021

|

1 |

The S&P 500 Index is registered trademark of Standard & Poor’s and is an unmanaged broadly based index of the common stock prices of 500 large U.S. companies that includes the reinvestment of dividends. Unlike mutual funds, indices are not managed, and do not incur fees or expenses. You cannot invest directly in an index. |

|

2 |

The Barclays U.S. Aggregate is an unmanaged, broad based index measuring intermediate term bonds. It is not possible to invest directly in an index. |

|

3 |

Morningstar Direct; Beta and Sortino, based on daily data from 1/1/2015-12/31/2020. For Beta the Fund ranked 406/406 since inception, 452/452 for the 3-year period, and 423/423 for the 5-year period and for Sortino the Fund ranked 1/406 since inception, 165/452 for the 3-year period, and 1/423 for the five-year period for open and closed end funds in the World Allocation category. A Shares; no load. © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. |

2

Wildermuth Endowment Fund

Letter to Shareholders - Continued |

The Wildermuth Endowment Fund is a closed-end interval Fund. The Fund is considered illiquid and not suitable for all investors.

Past performance is not a guarantee of future results. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. This and other important information is contained within the Fund’s Prospectus, which can be obtained by calling (888) 445-6032 or by visiting our website www.widlermuthendowmentfund.com. The Fund’s Prospectus should be read carefully before investing.

Investing in the Fund involves risk, including those summarized below. Endowments have a long-term investment time horizon with low liquidity needs that can take advantage of all of many different asset classes. Investors should consider how closely their investment goals and needs match those of endowments. An investment in the Fund is generally subject to market risk, including the possible loss of the entire principal amount invested. An investment in the Fund represents an indirect investment in the securities owned by the Fund.

|

● |

You should consider the shares to be an illiquid investment. Even though the Fund will make periodic repurchase offers to repurchase a portion of the shares to provide some liquidity to shareholders, only a limited number of shares will be eligible for repurchase by us. Once each quarter, the Fund will offer to repurchase at net asset value (NAV) per share no less than 5% of the outstanding shares of the Fund, unless such offer is suspended or postponed in accordance with regulatory requirements. The Fund may increase the size of these offerings up to a maximum of 25% of the Fund’s outstanding shares, at the sole discretion of the Board, but it is not expected that the Board will do so. |

|

● |

You should consider that you may not have immediate access to the money you invest for an indefinite period of time. An investment in our shares is not suitable for you if you need immediate access to the money you invest. There is no guarantee that you will be able to tender all or any of the requested Fund shares in periodic repurchase offer. |

|

● |

Endowments have a long term investment time horizon with low liquidity needs. Investors should consider how closely their investment goals and needs match those of endowments. |

|

● |

Certain investments in the Fund are illiquid making it difficult to sell these securities and possibly requiring the Fund to sell at an unfavorable time or price. The value of certain Fund investments, in particular, non-traded investment vehicles, will be difficult to determine and the valuations provided will likely vary from the amounts the Fund would receive upon sale or disposition of its investments. |

|

● |

Investors should understand that valuation issues involving the Fund’s investments in the early stages and other private companies have led to delays in the completion of the Fund’s annual audit and the quarterly share repurchase program. A recurrence of this issue would further impact the liquidity of an investor’s shares. |

|

● |

Like all financial instruments, the value of these securities may move up or down, sometimes rapidly and unpredictably. The value of your investment in the Fund at any point in time may be worth less than the value of your original investment, even after taking into account any reinvestment of dividends and distributions. |

|

● |

When the Fund invests in equity securities, the Fund’s investments in those securities are subject to price fluctuations based on a number of reasons for issuer-specific and broader economic or international considerations. They may also decline due to factors which affect a particular industry or industries. In addition, equity securities prices may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. |

|

● |

The Fund may invest in publicly-traded and non-traded REITs or privately offered pooled investment vehicles that hold real estate as well as invest in real estate directly through entities owned or controlled directly or indirectly by the Fund. As a result, the Fund’s portfolio may be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio. |

|

● |

REIT share prices may decline because of adverse developments affecting the real estate industry and real property values. In general, real estate values can be affected by a variety of factors, including supply and demand for properties, the economic health of the country or of different regions, and the strength of specific industries that rent properties. |

3

Wildermuth Endowment Fund

Letter to Shareholders - Continued |

|

● |

Exposure to the commodities markets may subject the Fund to greater volatility than investments in more traditional securities. The value of commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as weather, and international economic, political and regulatory developments. |

|

● |

The Fund may invest in medium- and small-capitalization companies, which may be newly formed or have limited product lines, distribution channels and financial or managerial resources. The risks associated with these investments are generally greater than those associated with investments in the securities of larger, more-established companies. This may cause the Fund’s net asset value to be more volatile when compared to investment companies that focus only on large-capitalization companies. |

|

● |

The Fund is classified as a non-diversified management investment company under the Investment Company Act of 1940, as amended. This means that the Fund may invest a greater portion of its assets in a limited number of issuers than would be the case if the Fund were classified as a diversified management investment company. Accordingly, the Fund may be more sensitive to any single economic, business, political or regulatory occurrence than the value of shares of a diversified investment company. |

|

● |

The shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. |

|

● |

We do not expect a secondary market in the shares to develop. Even if any such market were to develop, closed-end fund shares trade frequently at a discount from net asset value, which creates a risk of loss for investors purchasing shares in the initial public offering. |

4

Wildermuth Endowment Fund

Portfolio Review December 31, 2020 (Unaudited) |

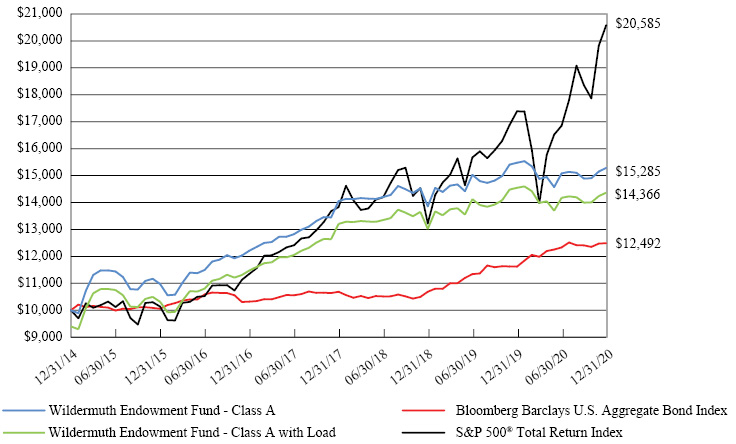

The Fund’s performance figures* for each of the periods ended December 31, 2020, compared to its benchmarks:

|

Five |

Three |

One |

Annualized |

Class A |

6.85% |

2.85% |

(1.24)% |

7.33% |

Class A with Load2 |

5.54% |

0.83% |

(6.92)% |

6.22% |

S&P 500® Total Return Index** |

15.22% |

14.18% |

18.40% |

12.79% |

Bloomberg Barclays U.S. Aggregate Bond Index*** |

4.44% |

5.34% |

7.51% |

3.78% |

|

Three |

One |

Annualized |

Class C |

2.02% |

(2.03)% |

6.41% |

Class C with Sales Charge4 |

2.02% |

(3.00)% |

6.41% |

S&P 500® Total Return Index** |

14.18% |

18.40% |

16.06% |

Bloomberg Barclays U.S. Aggregate Bond Index*** |

5.34% |

7.51% |

4.23% |

|

Three |

One |

Annualized |

Class I |

2.98% |

(1.58)% |

5.34% |

S&P 500® Total Return Index** |

14.18% |

18.40% |

15.38% |

Bloomberg Barclays U.S. Aggregate Bond Index*** |

5.34% |

7.51% |

4.88% |

|

1 |

The Class A inception date was December 31, 2014. |

|

2 |

Calculated using a maximum sales load. The maximum sales load was 6.00% from the Class A inception date through October 19, 2017. Effective October 20, 2017 the maximum sales load is 5.75%. |

|

3 |

The Class C inception date was March 14, 2016. |

|

4 |

Class C shares are subject to a Contingent Deferred Sales Charge of 1.00% on any shares redeemed within 365 days of purchase. |

|

5 |

The Class I inception date was April 28, 2017. |

|

* |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Class A has a total annual operating expense of 3.73%, Class C has a total annual operating expense of 4.48%, and Class I has a total annual operating expense of 3.48%, per the prospectus dated August 31, 2020. |

|

** |

The S&P 500® Total Return Index is an unmanaged market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

|

*** |

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through securities), ABS, and CMBS. Investors cannot invest directly in an index. |

5

Wildermuth Endowment Fund

Portfolio Review - Continued |

Growth of a $10,000 Investment

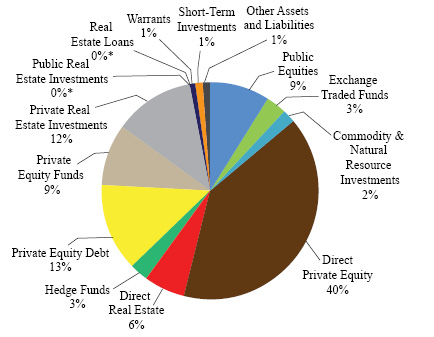

Holdings by type of Investment |

% of |

* Represents less than 0.5% of net assets. |

Public Equities |

9.3% |

|

Exchange Traded Funds |

2.6 |

|

Commodity & Natural Resource Investments |

1.7 |

|

Direct Private Equity |

40.2 |

|

Direct Real Estate |

5.6 |

|

Hedge Funds |

3.6 |

|

Private Equity Debt |

13.1 |

|

Private Equity Funds |

8.8 |

|

Private Real Estate Investments |

11.7 |

|

Public Real Estate Investments |

0.3 |

|

Real Estate Loans |

0.4 |

|

Warrants |

0.8 |

|

Short-Term Investments |

0.8 |

|

Other Assets and Liabilities |

1.1 |

|

100.0% |

Please refer to the Schedule of Investments in this Annual Report for detailed analysis of the Fund’s Holdings.

6

Wildermuth Endowment Fund

Portfolio Composition December 31, 2020 |

Country of Investment |

Value |

% of |

||||||

Australia |

$ | 371,770 | 0.2% | |||||

Belgium |

396,965 | 0.3 | ||||||

Bermuda |

494,463 | 0.3 | ||||||

Canada |

1,240,941 | 0.8 | ||||||

China |

651,644 | 0.4 | ||||||

France |

1,678,950 | 1.0 | ||||||

Germany |

337,530 | 0.2 | ||||||

Ireland |

12,593,420 | 7.8 | ||||||

Japan |

823,034 | 0.5 | ||||||

Luxembourg |

5,991,120 | 3.7 | ||||||

Netherlands |

431,871 | 0.3 | ||||||

New Zealand |

2,033,611 | 1.3 | ||||||

Singapore |

496,084 | 0.3 | ||||||

Switzerland |

545,386 | 0.3 | ||||||

United Kingdom |

425,014 | 0.3 | ||||||

United States |

131,468,535 | 81.2 | ||||||

Other Assets & Liabilities, net |

1,853,926 | 1.1 | ||||||

|

$ | 161,834,264 | 100.0% | |||||

7

Wildermuth Endowment Fund

Schedule of Investments December 31, 2020 |

Interests, |

Fair |

|||||||

PUBLIC EQUITIES — 9.3% |

||||||||

ADVERTISING — 0.4% |

||||||||

| 184,413 | National CineMedia, Inc. |

$ | 686,016 | |||||

AIRLINES — 0.4% |

||||||||

| 16,839 | Delta Air Lines, Inc. |

677,096 | ||||||

BIOTECHNOLOGY — 0.2% |

||||||||

| 1,043 | CSL, Ltd. |

227,916 | ||||||

| 15,000 | Innoviva, Inc.(a) |

185,850 | ||||||

| 413,766 | ||||||||

BUILDING MATERIALS — 0.1% |

||||||||

| 4,422 | LafargeHolcim, Ltd.(a) |

243,210 | ||||||

COMMERCIAL SERVICES — 0.6% |

||||||||

| 1,645 | FleetCor Technologies, Inc.(a) |

448,805 | ||||||

| 15,046 | McMillan Shakespeare, Ltd. |

143,854 | ||||||

| 1,205 | S&P Global, Inc. |

396,120 | ||||||

| 988,779 | ||||||||

DISTRIBUTION/WHOLESALE — 0.3% |

||||||||

| 10,193 | Triton International, Ltd. |

494,462 | ||||||

DIVERSIFIED FINANCIAL SERVICES — 0.1% |

||||||||

| 46,619 | Mitsubishi UFJ Lease & Finance Co., Ltd. |

223,511 | ||||||

ELECTRIC — 0.3% |

||||||||

| 15,000 | Clearway Energy, Inc. - Class A |

443,250 | ||||||

ENERGY-ALTERNATE SOURCES — 0.3% |

||||||||

| 27,642 | TransAlta Renewables, Inc. |

472,127 | ||||||

ENGINEERING & CONSTRUCTION — 0.1% |

||||||||

| 9,400 | HomeServe PLC |

131,698 | ||||||

FOOD — 0.3% |

||||||||

| 5,745 | Sysco Corp. |

426,624 | ||||||

HEALTHCARE-SERVICES — 0.1% |

||||||||

| 3,380 | Fresenius SE & Co. KGaA |

156,490 | ||||||

HOME FURNISHINGS — 0.4% |

||||||||

| 5,930 | Sony Corp., ADR |

599,523 | ||||||

See accompanying notes to financial statements.

8

Wildermuth Endowment Fund

Schedule of Investments - Continued |

Interests, |

Fair |

|||||||

PUBLIC EQUITIES (CONTINUED) |

||||||||

INTERNET — 1.6% |

||||||||

| 2,800 | Alibaba Group Holding, Ltd., ADR(a) |

$ | 651,644 | |||||

| 481 | Alphabet, Inc. - Class A(a) |

843,020 | ||||||

| 8,070 | eBay, Inc. |

405,518 | ||||||

| 2,408 | Facebook, Inc. - Class A(a) |

657,769 | ||||||

| 2,557,951 | ||||||||

MEDIA — 0.3% |

||||||||

| 30,000 | TEGNA, Inc. |

418,500 | ||||||

MINING — 0.2% |

||||||||

| 14,000 | Kinross Gold Corp. |

102,760 | ||||||

| 39,053 | Yamana Gold, Inc. |

222,993 | ||||||

| 325,753 | ||||||||

PHARMACEUTICALS — 0.8% |

||||||||

| 6,220 | Dechra Pharmaceuticals PLC |

293,316 | ||||||

| 2,627 | Johnson & Johnson |

413,437 | ||||||

| 3,200 | Novartis AG, ADR |

302,176 | ||||||

| 2,491 | UCB SA |

257,482 | ||||||

| 1,266,411 | ||||||||

PIPELINES — 0.3% |

||||||||

| 13,850 | Enbridge, Inc. |

443,061 | ||||||

REAL ESTATE — 0.1% |

||||||||

| 2,000 | Atenor |

139,484 | ||||||

REITS — 1.1% |

||||||||

| 94,117 | Broadstone Net Lease, Inc.(b)(c)(d) |

1,842,811 | ||||||

SEMICONDUCTORS — 1.2% |

||||||||

| 1,133 | Broadcom, Inc. |

496,084 | ||||||

| 8,501 | Intel Corp. |

423,520 | ||||||

| 2,716 | NXP Semiconductors NV |

431,871 | ||||||

| 3,645 | Qorvo, Inc.(a) |

606,054 | ||||||

| 1,957,529 | ||||||||

SOFTWARE — 0.1% |

||||||||

| 1,380 | SAP SE |

181,039 | ||||||

TOTAL PUBLIC EQUITIES (Cost $12,592,065) |

15,089,091 | |||||||

EXCHANGE TRADED FUNDS — 2.6% |

||||||||

DEBT FUNDS — 0.1% |

||||||||

| 1,618 | iShares iBoxx High Yield Corporate Bond |

141,252 | ||||||

See accompanying notes to financial statements.

9

Wildermuth Endowment Fund

Schedule of Investments - Continued |

Interests, |

Fair |

|||||||

EXCHANGE TRADED FUNDS (CONTINUED) |

||||||||

EQUITY FUNDS — 2.5% |

||||||||

| 22,194 | Emerging Markets Internet and Ecommerce |

$ | 1,411,095 | |||||

| 7,469 | iShares MSCI Brazil |

276,876 | ||||||

| 6,930 | iShares MSCI India |

278,725 | ||||||

| 14,425 | iShares MSCI Indonesia |

337,833 | ||||||

| 8,975 | iShares MSCI Malaysia |

258,480 | ||||||

| 7,680 | iShares MSCI Taiwan |

407,654 | ||||||

| 5,202 | VanEck Vectors Russia |

125,628 | ||||||

| 15,300 | WisdomTree China ex-State-Owned Enterprises Fund |

1,006,281 | ||||||

| 4,102,572 | ||||||||

TOTAL EXCHANGE TRADED FUNDS (Cost $2,938,133) |

4,243,824 | |||||||

COMMODITY & NATURAL RESOURCE INVESTMENTS — 1.7% |

||||||||

| 1,000 | Casillas Petroleum Resource Partners, LLC(a)(b)(d) |

504,582 | ||||||

| 1,876,034 | CM Funding, LLC(a)(b)(d)(e)(f)(g) |

713,430 | ||||||

| — | Kayne Anderson Energy Fund VII LP(a)(b)(d)(h) |

730,471 | ||||||

| 182 | Midcon Holdco Partners, LLC(a)(b)(d) |

181,858 | ||||||

| 2,080,000 | Thunder Investment Partners, LLC(a)(b)(d)(e)(f)(g) |

599,872 | ||||||

TOTAL COMMODITY & NATURAL RESOURCE INVESTMENTS (Cost $7,111,492) |

2,730,213 | |||||||

DIRECT PRIVATE EQUITY — 40.2% |

||||||||

| 41,751 | Affinity Beverages, LLC(a)(b)(d)(f) |

174,999 | ||||||

| 684 | Atlas Fintech Holdings Corp. - Class A Share Interests(a)(b)(d)(f)(g) |

3,506,893 | ||||||

| 2,500 | Clear Guide Medical, Inc. - Series A Preferred Stock(a)(b)(d)(e)(f)(g) |

3,931,539 | ||||||

| 134,898 | Clear Guide Medical, Inc. - Series A-2 Preferred Stock(a)(b)(d)(e)(f)(g) |

788,552 | ||||||

| 770,489 | Clear Guide Medical, Inc. - Series A-3 Preferred Stock(a)(b)(d)(e)(f)(g) |

4,283,658 | ||||||

| 1,543,074 | Clearsense, LLC - Class C Preferred Shares(a)(b)(d)(e)(f)(g) |

12,420,172 | ||||||

| 298,200 | Content Management Live, LLC(a)(b)(d)(e)(f)(g) |

120,000 | ||||||

| 5,115,032 | DSI Digital, LLC - Series A Convertible Preferred Units(a)(b)(d)(e)(f)(g) |

15,511,352 | ||||||

| 8,800,000 | GigaPro, Inc. - Common Units(a)(b)(d)(e)(f)(g) |

9,172,932 | ||||||

| 309,150 | GigaPro, Inc. - Series Seed-1 Preferred Units(a)(b)(d)(e)(f)(g) |

447,423 | ||||||

| 1,288,103 | GigaPro, Inc. - Series Seed-2 Preferred Units(a)(b)(d)(e)(f)(g) |

1,864,232 | ||||||

| — | Level ATI HoldCo, LLC - Class A(a)(b)(d)(e)(f)(g) |

2,800,673 | ||||||

| 3,500,000 | Metro Diner, LLC - Series B Units(a)(b)(d)(f)(g) |

2,148,205 | ||||||

| 1,880,968 | Metro Diner, LLC - Series II Common Units(a)(b)(d)(f)(g) |

858,692 | ||||||

| 635,838 | Waratek, Ltd. - Series B-1(a)(b)(d)(e)(f)(g) |

3,013,984 | ||||||

| 756,826 | Waratek, Ltd. - Series B-2(a)(b)(d)(e)(f)(g) |

4,065,792 | ||||||

| — | WG Pitts Caribbean, LLC - Common Units(a)(b)(d)(e)(f)(g) |

— | ||||||

TOTAL DIRECT PRIVATE EQUITY (Cost $40,591,785) |

65,109,098 | |||||||

See accompanying notes to financial statements.

10

Wildermuth Endowment Fund

Schedule of Investments - Continued |

Interests, |

Fair |

|||||||

DIRECT REAL ESTATE — 5.6% |

||||||||

| — | Brookwood SFL Investor Co-Investment Vehicle, LLC(a)(b)(d) |

$ | 1,545,782 | |||||

| 439,716 | Dog Wood Park of Northeast Florida, LLC(b)(d)(e)(f)(g) |

755,484 | ||||||

| 1,800,000 | LaGrange Senior Living, LLC - Class A Interests(b)(d)(e)(f)(g) |

1,977,774 | ||||||

| — | Polara Builder II, LLC(b)(d)(e)(f)(g) |

4,742,316 | ||||||

TOTAL DIRECT REAL ESTATE (Cost $7,150,372) |

9,021,356 | |||||||

HEDGE FUNDS — 3.6% |

||||||||

| — | Altegris Millennium Fund LP(a)(b)(d)(h)(i) |

1,361,913 | ||||||

| — | CRC Bond Opportunity Trading Fund LP(a)(b)(d)(h)(i) |

2,962,128 | ||||||

| — | EJF Trust Preferred Fund LP(a)(b)(d)(h)(i) |

714,739 | ||||||

| — | Rosebrook Opportunities Fund LP(a)(b)(d)(e)(h)(i) |

771,174 | ||||||

TOTAL HEDGE FUNDS (Cost $5,247,428) |

5,809,954 | |||||||

PRIVATE EQUITY DEBT — 13.1% |

||||||||

| $ | 1,500,000 | Clearsense, LLC - Convertible Note, 8.00%, 10/30/2022(b)(d)(e)(f)(g)(k) |

1,755,000 | |||||

| 264,412 | EJF Trust Preferred Master Fund LP, 16.00%, 4/16/2022(b)(d)(f) |

264,412 | ||||||

| 1,875,000 | GigaPro, Inc. - Convertible Note, 12.00%, 10/1/2022(b)(d)(e)(f)(k) |

1,875,000 | ||||||

| 7,174 | Reef Capital Partners, LLC - Series A Preferred Units, 8.00%, 12/28/2022(b)(d)(f) |

7,173,809 | ||||||

| 2,098,889 | Sequin, Inc. - Convertible Note, 8.00%, 7/20/2023(b)(d)(f)(k) |

2,098,889 | ||||||

| 2,033,611 | The Work Shop Limited T/A RIP Global - Convertible Note, 12.00%, 1/20/2023(b)(d)(f)(k) |

2,033,611 | ||||||

| 3,191,374 | Waratek, Ltd. - Convertible Note, 12.00%, 3/25/2021(a)(b)(d)(e)(f)(g)(k) |

4,289,342 | ||||||

| 2,623,158 | WG Pitts Caribbean, LLC - Promissory Note, 12.00%, 3/31/2023(b)(d)(e)(f)(g) |

1,649,049 | ||||||

TOTAL PRIVATE EQUITY DEBT (Cost $19,973,327) |

21,139,112 | |||||||

PRIVATE EQUITY FUNDS — 8.8% |

||||||||

| — | Abbott Secondary Opportunities LP(a)(b)(d)(h)(i) |

1,273,334 | ||||||

| — | Auda Capital SCS SICAV SIF - Auda Asia Secondary Fund(a)(b)(d)(h)(i) |

2,371,917 | ||||||

| — | Committed Advisors Secondary Fund III(a)(b)(d)(h)(i) |

1,678,950 | ||||||

| — | EJF Sidecar Fund, Series LLC - Small Financial Equities Series(a)(b)(d)(h)(i) |

1,001,944 | ||||||

| 10 | GPB Automotive Portfolio LP(a)(b)(d)(f)(g)(h) |

113,142 | ||||||

| — | Gravity Ranch Fund I LP(a)(b)(d)(f)(g)(h)(i) |

67,065 | ||||||

| — | Greenspring Opportunities V LP(a)(b)(d)(h)(i) |

714,498 | ||||||

| — | Madryn Health Partners LP(a)(b)(d)(h)(i) |

2,275,303 | ||||||

| — | PineBridge Secondary Partners IV SLP(a)(b)(d)(h)(i) |

1,286,216 | ||||||

| — | Star Mountain Diversified Credit Income Fund III LP(a)(b)(d)(h)(i) |

2,429,147 | ||||||

| — | Star Mountain Diversified Small Business Access Fund II LP(a)(b)(d)(h)(i) |

970,628 | ||||||

TOTAL PRIVATE EQUITY FUNDS (Cost $12,909,659) |

14,182,144 | |||||||

PRIVATE REAL ESTATE INVESTMENTS — 11.7% |

||||||||

| 95,075 | ARCTRUST, Inc.(b)(d)(h) |

1,211,259 | ||||||

| 3,197,572 | Carlyle Europe Realty Fund, S.C.Sp.(a)(b)(d)(h)(i) |

3,619,203 | ||||||

| 157,812 | Cottonwood Residential II, Inc.(b)(d)(h) |

3,378,755 | ||||||

| — | Cygnus Property Fund V, LLC(a)(b)(d)(h) |

2,842,114 | ||||||

| — | Harbert Seniors Housing Fund I LP(a)(b)(d)(h) |

1,486,431 | ||||||

See accompanying notes to financial statements.

11

Wildermuth Endowment Fund

Schedule of Investments - Continued |

Interests, |

Fair |

|||||||

PRIVATE REAL ESTATE INVESTMENTS (CONTINUED) |

||||||||

| — | Harbert Seniors Housing Fund II LP(a)(b)(d)(h) |

$ | 1,074,651 | |||||

| 858 | PRISA III Fund LP(a)(b)(d)(h) |

1,803,886 | ||||||

| — | RRA Credit Opportunity Fund LP(a)(b)(d)(e)(h) |

1,940,879 | ||||||

| 56 | Shopoff Land Fund III LP(a)(b)(d)(h) |

33,053 | ||||||

| 702,851 | Stonehill Strategic Hotel Credit Opportunity Fund II LP(a)(b)(d)(h) |

1,021,141 | ||||||

| — | Walton Street Real Estate Fund VIII LP(a)(b)(d)(h) |

586,516 | ||||||

TOTAL PRIVATE REAL ESTATE INVESTMENTS (Cost $15,863,889) |

18,997,888 | |||||||

PUBLIC REAL ESTATE INVESTMENTS — 0.3% |

||||||||

| 136,771 | Highlands REIT, Inc.(a)(b)(d) |

38,296 | ||||||

| 153,283 | Inventrust Properties Corp.(b)(d) |

442,988 | ||||||

| 3,330 | Phillips Edison & Company, Inc.(b)(d) |

29,136 | ||||||

TOTAL PUBLIC REAL ESTATE INVESTMENTS (Cost $388,349) |

510,420 | |||||||

REAL ESTATE LOANS — 0.4% |

||||||||

| $ | 679,962 | Park City (PCG), 12.00%, 1/1/2021(b)(d)(e)(f)(j) |

679,962 | |||||

TOTAL REAL ESTATE LOANS (Cost $625,565) |

679,962 | |||||||

WARRANTS — 0.8% |

||||||||

| 100 | Atlas Fintech Holdings Corp., Exercise Price $13,000, Expiration Date, 12/30/2021(a)(b)(d)(f) |

— | ||||||

| 44 | Atlas Fintech Holdings Corp., Exercise Price $14,950, Expiration Date, 12/30/2022(a)(b)(d)(f) |

— | ||||||

| 475 | Atlas Fintech Holdings Corp., Exercise Price $8,000, Expiration Date, 12/30/2021(a)(b)(d)(f) |

— | ||||||

| 1,442 | Schweizer RSG, LLC, Exercise Price $112.50, Expiration Date, 1/21/2028(a)(b)(d)(f)(g) |

1,846 | ||||||

| 646,328 | Waratek, Ltd., Exercise Price 0.01 Euro, Expiration Date, 1/22/2028(a)(b)(d)(e)(f)(g) |

1,224,302 | ||||||

TOTAL WARRANTS (Cost $0) |

1,226,148 | |||||||

See accompanying notes to financial statements.

12

Wildermuth Endowment Fund

Schedule of Investments - Continued |

Interests, |

Fair |

|||||||

SHORT-TERM INVESTMENTS — 0.8% |

||||||||

| 1,241,128 | Fidelity Institutional Government Portfolio - Institutional Class, 0.01%(l) |

$ | 1,241,128 | |||||

TOTAL SHORT-TERM INVESTMENTS (Cost $1,241,128) |

1,241,128 | |||||||

TOTAL INVESTMENTS — 98.9% (Cost $126,633,192) |

159,980,338 | |||||||

Other assets less liabilities — 1.1% |

1,853,926 | |||||||

TOTAL NET ASSETS — 100.0% |

$ | 161,834,264 | ||||||

ADR – American Depositary Receipt

LLC – Limited Liability Company

LP – Limited Partnership

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

SLP – Special Limited Partnership

|

(a) |

Non-income Producing |

|

(b) |

Illiquid Security. As of December 31, 2020 these securities amounted to $141,249,106 representing 87.28% of total net assets. |

|

(c) |

On September 16, 2020, common stock shares of the company were registered with the Securities and Exchange Commission. This issue is subject to a 180 day lock-up period after which it will be listed on the New York Stock Exchange and will be freely tradeable. |

|

(d) |

Restricted Security. As of December 31, 2020 these securities amounted to $141,249,106 representing 87.28% of total net assets. Please refer to Note 7, Investments in Restricted Securities, in the Notes to the Financial Statements. |

|

(e) |

Denotes an investment in an affiliated entity. Please refer to Note 8, Investments in Affiliated Issuers, in the Notes to the Financial Statements. |

|

(f) |

Level 3 security in accordance with fair value hierarchy. |

|

(g) |

Security fair valued using method determined in good faith by the Fair Value Committee designated by the Board of Trustees. As of December 31, 2020 these securities amounted to $82,822,721 representing 51.18% of total net assets. |

|

(h) |

Private Fund. As of December 31, 2020 these securities amounted to $39,720,457 representing 24.54% of total net assets. |

|

(i) |

Private Investment Company. As of December 31, 2020 these securities amounted to $23,498,159 representing 14.52% of total net assets. |

|

(j) |

Security is in default. |

|

(k) |

Payment-in-kind (PIK) security is a security in which the issuer makes interest payments in the form of additional securities, as opposed to cash payouts. These additional securities generally have the same terms as the original holdings. |

|

(l) |

Represents the current rate as of December 31, 2020. |

See accompanying notes to financial statements.

13

Wildermuth Endowment Fund

Statement of Assets and Liabilities As of December 31, 2020 |

Assets: |

||||

Investments in unaffiliated issuers at fair value (cost $70,542,102) |

$ | 78,586,445 | ||

Investments in affiliated issuers at fair value (cost $56,091,090) |

81,393,893 | |||

Cash deposited with broker for written options contracts |

37,283 | |||

Receivables: |

||||

Dividends and interest |

1,411,262 | |||

Fund shares sold |

29,922 | |||

Prepaid expenses |

22,674 | |||

Other assets |

665,163 | |||

Total assets |

162,146,642 | |||

Liabilities: |

||||

Payables: |

||||

Fund shares redeemed |

29,922 | |||

Investment Advisory fees |

8,635 | |||

Professional fees |

88,497 | |||

Shareholder servicing fees |

28,000 | |||

Transfer agent fees and expenses |

14,121 | |||

Fund accounting and administration fees |

25,068 | |||

Custody fees |

4,363 | |||

Distribution fees |

35,683 | |||

Accrued other liabilities |

78,089 | |||

Total liabilities |

312,378 | |||

Commitments and contingencies (Note 10) |

||||

Net Assets |

$ | 161,834,264 | ||

Net Assets Consist of: |

||||

Paid in capital (unlimited shares authorized, 25,000,000 shares registered, no par value) |

$ | 129,631,827 | ||

Total distributable earnings |

32,202,437 | |||

Net Assets |

$ | 161,834,264 | ||

Net Assets: |

||||

Class A |

$ | 76,418,348 | ||

Class C |

56,451,235 | |||

Class I |

28,964,681 | |||

Net Assets |

$ | 161,834,264 | ||

Shares of Beneficial Interest Issued and Outstanding: |

||||

Class A shares |

5,652,706 | |||

Class C shares |

4,337,622 | |||

Class I shares |

2,130,448 | |||

Total Shares Outstanding |

12,120,776 | |||

Net Asset Value, Offering Price and Redemption Proceeds Per Share:(1) |

||||

Class A |

$ | 13.52 | ||

Class C(2) |

$ | 13.01 | ||

Class I |

$ | 13.60 | ||

Class A - Maximum offering price per share (Net asset value per share divided by 0.9425)(3) |

$ | 14.34 |

|

(1) |

Redemptions made within 90 days of purchase may be assessed a redemption fee of 2.00%. |

|

(2) |

Class C Shares of the Fund are subject to a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on any shares sold within 365 days of purchase. |

|

(3) |

Reflects a maximum sales charge of 5.75%. |

See accompanying notes to financial statements.

14

Wildermuth Endowment Fund

Statement of Operations For the year ended December 31, 2020 |

Investment Income: |

||||

Interest from unaffiliated issuers |

$ | 715,549 | (1) | |

Dividends from affiliated issuers |

694,815 | |||

Interest from affiliated issuers |

638,001 | (2) | ||

Dividends from unaffiliated issuers (net of foreign withholding taxes of $17,955) |

553,345 | |||

Other income |

255,772 | |||

Total investment income |

2,857,482 | |||

Expenses: |

||||

Investment Advisory fees (see Note 4) |

2,602,318 | |||

Legal fees |

638,892 | |||

Distribution fees - Class C |

414,915 | |||

Shareholder servicing fees - Class A & Class C |

342,320 | |||

Transfer agent fees |

312,943 | |||

Accounting and administration servicing fees |

303,493 | |||

Pricing and valuation service fees |

299,186 | |||

Audit fees |

284,100 | |||

Printing and postage expenses |

142,183 | |||

Trustees’ fees |

94,500 | |||

Chief compliance officer fees |

80,825 | |||

Registration fees |

72,461 | |||

Chief financial officer fees |

63,094 | |||

Miscellaneous expenses |

28,417 | |||

Custodian fees |

25,364 | |||

Insurance expense |

24,694 | |||

Total expenses |

5,729,705 | |||

Expenses waived by Adviser (see Note 4) |

(1,068,993 | ) | ||

Net expenses |

4,660,712 | |||

Net investment loss |

(1,803,230 | ) | ||

Realized and Unrealized Gain (Loss) on Investments, written options, and foreign currency: |

||||

Net realized gain (loss) on: |

||||

Investments in unaffiliated issuers |

174,355 | |||

Investments in affiliated issuers |

(133,542 | ) | ||

Written options contracts |

37,861 | |||

Foreign currency transactions |

(13,196 | ) | ||

Total net realized gain |

65,478 | |||

Net change in unrealized appreciation (depreciation) on: |

||||

Investments in unaffiliated issuers |

(700,052 | ) | ||

Investments in affiliated issuers |

410,566 | |||

Foreign currency translations |

4,275 | |||

Total net change in unrealized depreciation |

(285,211 | ) | ||

Net realized and unrealized loss on investments, written options, and foreign currency |

(219,733 | ) | ||

Net Decrease in Net Assets from Operations |

$ | (2,022,963 | ) |

|

(1) |

Includes payment-in-kind interest of $188,808. |

|

(2) |

Includes payment-in-kind interest of $110,889. |

See accompanying notes to financial statements.

15

Wildermuth Endowment Fund

Statements of Changes in Net Assets |

For the |

For the |

|||||||

Increase/(Decrease) in Net Assets From: |

||||||||

Operations: |

||||||||

Net investment loss |

$ | (1,803,230 | ) | $ | (1,247,938 | ) | ||

Net realized gain (loss) on investments, written options contracts, and foreign currency |

65,478 | (8,622,913 | ) | |||||

Net change in unrealized appreciation (depreciation) on investments and foreign currency |

(285,211 | ) | 24,547,091 | |||||

Net increase (decrease) in net assets resulting from operations |

(2,022,963 | ) | 14,676,240 | |||||

Distributions to Shareholders: |

||||||||

Distributions: |

||||||||

Class A |

(548,704 | ) | — | |||||

Class C |

(367,569 | ) | — | |||||

Class I |

(259,509 | ) | — | |||||

Total: |

(1,175,782 | ) | — | |||||

From other sources (tax return of capital): |

||||||||

Class A |

— | (2,301,159 | ) | |||||

Class C |

— | (1,288,847 | ) | |||||

Class I |

— | (822,680 | ) | |||||

Total: |

— | (4,412,686 | ) | |||||

Total distributions to shareholders |

(1,175,782 | ) | (4,412,686 | ) | ||||

See accompanying notes to financial statements.

16

Wildermuth Endowment Fund

Statements of Changes in Net Assets - Continued |

For the |

For the |

|||||||

Capital Share Transactions: |

||||||||

Net proceeds from Class A shares sold |

$ | 9,432,390 | $ | 34,124,083 | ||||

Net proceeds from Class C shares sold |

7,073,200 | 17,098,216 | ||||||

Net proceeds from Class I shares sold |

6,223,460 | 27,493,959 | ||||||

Reinvestment of distributions from Class A shares |

— | 1,090,416 | ||||||

Reinvestment of distributions from Class C shares |

— | 1,088,395 | ||||||

Reinvestment of distributions from Class I shares |

— | 661,696 | ||||||

Cost of Class A shares redeemed |

(12,559,239 | ) | (30,119,763 | ) | ||||

Cost of Class C shares redeemed |

(4,075,284 | ) | (2,590,991 | ) | ||||

Cost of Class I shares redeemed |

(14,857,991 | ) | (3,395,157 | ) | ||||

Redemption fees |

7,243 | 16,452 | ||||||

Capital contribution from affiliate (Note 4) |

280,320 | 663,313 | ||||||

Net increase (decrease) from capital share transactions |

(8,475,901 | ) | 46,130,619 | |||||

Net change in net assets |

(11,674,646 | ) | 56,394,173 | |||||

Net Assets: |

||||||||

Beginning of year |

173,508,910 | 117,114,737 | ||||||

End of year |

$ | 161,834,264 | $ | 173,508,910 | ||||

Share Activity: |

||||||||

Issuance of Class A shares |

731,889 | 2,524,088 | ||||||

Issuance of Class C shares |

568,061 | 1,302,018 | ||||||

Issuance of Class I shares |

482,244 | 1,999,921 | ||||||

Class A shares reinvested |

— | 80,385 | ||||||

Class C shares reinvested |

— | 82,487 | ||||||

Class I shares reinvested |

— | 47,928 | ||||||

Class A shares redeemed |

(935,430 | ) | (2,197,236 | ) | ||||

Class C shares redeemed |

(314,287 | ) | (194,887 | ) | ||||

Class I shares redeemed |

(1,099,207 | ) | (245,199 | ) | ||||

Net increase (decrease) in shares of beneficial interest outstanding |

(566,730 | ) | 3,399,505 | |||||

See accompanying notes to financial statements.

17

Wildermuth Endowment Fund

Statement of Cash Flows |

For the |

||||

Cash flows from operating activities: |

||||

Net decrease in net assets from operations |

$ | (2,022,963 | ) | |

Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided from operating activities: |

||||

Purchases of investments |

(53,217,813 | ) | ||

Sales of short term investments, net |

2,380,847 | |||

Proceeds from sales of investments |

61,539,781 | |||

Proceeds from written options |

44,685 | |||

Closed written options |

(6,824 | ) | ||

Net realized gain from investments |

(40,813 | ) | ||

Net realized gain from written options contracts |

(37,861 | ) | ||

Net realized loss from foreign currency transactions |

13,196 | |||

Net unrealized depreciation on investments |

289,486 | |||

Net unrealized appreciation on foreign currency translations |

(4,275 | ) | ||

Return of capital and non-income distributions |

(160,117 | ) | ||

Changes in assets and liabilities |

||||

(Increase)/Decrease in assets: |

||||

Due from Investment Adviser |

681,549 | |||

Dividend and interest receivable |

(423,425 | ) | ||

Return of capital receivable |

449,580 | |||

Receivable for investment securities sold |

55,556 | |||

Other assets |

115,055 | |||

Prepaid expenses |

(12,103 | ) | ||

Increase/(Decrease) in liabilities: |

||||

Payable to Investment Adviser |

8,635 | |||

Payable for professional fees |

(33,064 | ) | ||

Payable for shareholder servicing fees |

(591 | ) | ||

Payable for fund accounting and administration fees |

(1,285 | ) | ||

Payable for custody fees |

(1,200 | ) | ||

Payables for transfer agent fees and expenses |

(12,769 | ) | ||

Payable for distribution fees |

409 | |||

Accrued other liabilities |

(11,863 | ) | ||

Net cash provided from operating activities |

9,591,813 | |||

Cash flows from financing activities: |

||||

Proceeds from shares sold |

22,835,124 | |||

Cost of shares redeemed, net of redemption fees |

(31,485,271 | ) | ||

Cash distributions paid, net of reinvestment |

(1,175,782 | ) | ||

Capital contributions from affiliates |

280,320 | |||

Net cash used by financing activities |

(9,545,609 | ) | ||

Effects of foreign currency exchange rate changes in cash |

(8,921 | ) | ||

Net change in cash |

37,283 | |||

See accompanying notes to financial statements.

18

Wildermuth Endowment Fund

Statement of Cash Flows - Continued |

For the |

||||

Cash and cash equivalents |

||||

Cash at beginning of year |

$ | — | ||

Cash held at brokers at beginning of year |

— | |||

Total cash and cash equivalents at beginning of year |

— | |||

Cash held at end of year |

— | |||

Cash held at brokers at end of year |

37,283 | |||

Total ending cash and cash equivalents at end of year |

$ | 37,283 | ||

Supplemental disclosure of non-cash activity: |

||||

Reinvestment of distributions |

$ | — | ||

See accompanying notes to financial statements.

19

Wildermuth Endowment Fund

Financial Highlights – Class A |

Per share income and capital changes for a share outstanding throughout each period.

|

For the |

For the |

For the |

For the |

For the |

|||||||||||||||

Net asset value, beginning of period |

$ | 13.78 | $ | 12.69 | $ | 13.21 | $ | 11.81 | $ | 10.79 | ||||||||||

Income from Investment Operations: |

||||||||||||||||||||

Net investment income (loss)(2) |

(0.12 | ) | (0.08 | ) | 0.06 | (0.04 | ) | 0.01 | ||||||||||||

Net realized and unrealized gain (loss) on investments |

(0.05 | ) | 1.55 | (0.23 | ) | 1.80 | 1.19 | |||||||||||||

Total from investment operations |

(0.17 | ) | 1.47 | (0.17 | ) | 1.76 | 1.20 | |||||||||||||

Less Distributions: |

||||||||||||||||||||

From return of capital |

— | (0.38 | ) | (0.32 | ) | (0.18 | ) | (0.18 | ) | |||||||||||

From net realized gains |

(0.09 | ) | — | (0.03 | ) | (0.18 | ) | — | ||||||||||||

Total distributions |

(0.09 | ) | (0.38 | ) | (0.35 | ) | (0.36 | ) | (0.18 | ) | ||||||||||

Net asset value, end of period |

$ | 13.52 | $ | 13.78 | $ | 12.69 | $ | 13.21 | $ | 11.81 | ||||||||||

Total return(3) |

(1.24 | )%(4) | 11.65 | %(5) | (1.38 | )% | 15.07 | % | 11.27 | % | ||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||

Net assets, end of period (in thousands) |

$ | 76,418 | $ | 80,692 | $ | 69,143 | $ | 61,568 | $ | 31,686 | ||||||||||

Ratio of gross expenses to average net assets(6)(7) |

3.12 | % | 2.97 | % | 3.21 | % | 3.32 | % | 4.73 | % | ||||||||||

Ratio of net expenses to average net assets(6)(8) |

2.50 | % | 2.50 | % | 2.50 | % | 2.50 | % | 2.50 | % | ||||||||||

Ratio of net investment income (loss) to average net assets(6)(9) |

(0.85 | )% | (0.63 | )% | 0.45 | % | (0.35 | )% | 0.07 | % | ||||||||||

Portfolio turnover rate |

32 | % | 29 | % | 31 | % | 51 | % | 55 | % | ||||||||||

|

(1) |

Redemption fees consisted of per share amounts of less than $0.01. |

|

(2) |

Per share amounts calculated using the average shares method. |

|

(3) |

Total returns would have been lower had certain expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of a maximum sales load or offering price. If the sales charge was included total returns would be lower. The maximum sales load in 2016 was 6.00% of offering price. Effective October 20, 2017 the maximum sales load was changed to 5.75% of offering price. |

|

(4) |

Total return would have been (1.39)% absent the Capital Contribution from the Adviser (see Note 4). |

|

(5) |

Total return would have been 11.24% absent the Capital Contribution from the Adviser (see Note 4 in the annual report to shareholders dated December 31,2019). |

|

(6) |

The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

|

(7) |

Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements. |

|

(8) |

Represents the ratio of expenses to average net assets inclusive of fee waivers and/or expense reimbursements by the Adviser. |

|

(9) |

Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

20

Wildermuth Endowment Fund

Financial Highlights – Class C |

Per share income and capital changes for a share outstanding throughout each period.

|

For the |

For the |

For the |

For the |

For the |

|||||||||||||||

Net asset value, beginning of period |

$ | 13.37 | $ | 12.40 | $ | 13.02 | $ | 11.73 | $ | 10.68 | ||||||||||

Income from Investment Operations: |

||||||||||||||||||||

Net investment loss(3) |

(0.21 | ) | (0.18 | ) | (0.02 | ) | (0.13 | ) | (0.07 | ) | ||||||||||

Net realized and unrealized gain (loss) on investments |

(0.06 | ) | 1.50 | (0.25 | ) | 1.78 | 1.25 | |||||||||||||

Total from investment operations |

(0.27 | ) | 1.32 | (0.27 | ) | 1.65 | 1.18 | |||||||||||||

Less Distributions: |

||||||||||||||||||||

From return of capital |

— | (0.35 | ) | (0.32 | ) | (0.18 | ) | (0.13 | ) | |||||||||||

From net realized gains |

(0.09 | ) | — | (0.03 | ) | (0.18 | ) | — | ||||||||||||

Total distributions |

(0.09 | ) | (0.35 | ) | (0.35 | ) | (0.36 | ) | (0.13 | ) | ||||||||||

Net asset value, end of period |

$ | 13.01 | $ | 13.37 | $ | 12.40 | $ | 13.02 | $ | 11.73 | ||||||||||

Total return(4) |

(2.03 | )%(5) | 10.74 | %(6) | (2.18 | )% | 14.23 | % | 11.10 | %(7) | ||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||

Net assets, end of period (in thousands) |

$ | 56,451 | $ | 54,614 | $ | 35,888 | $ | 18,435 | $ | 4,951 | ||||||||||

Ratio of gross expenses to average net assets(8)(9) |

3.87 | % | 3.72 | % | 3.96 | % | 4.07 | % | 5.63 | %(10) | ||||||||||

Ratio of net expenses to average net assets(8)(11) |

3.25 | % | 3.25 | % | 3.25 | % | 3.25 | % | 3.25 | %(10) | ||||||||||

Ratio of net investment loss to average net assets(8)(12) |

(1.59 | )% | (1.40 | )% | (0.20 | )% | (1.08 | )% | (0.77 | )%(10) | ||||||||||

Portfolio turnover rate |

32 | % | 29 | % | 31 | % | 51 | % | 55 | %(7) | ||||||||||

|

(1) |

Redemption fees consisted of per share amounts of less than $0.01. |

|

(2) |

Reflects operations for the period from March 14, 2016 (inception date) to December 31, 2016. |

|

(3) |

Per share amounts calculated using the average shares method. |

|

(4) |

Total returns would have been lower had certain expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on any shares sold within 365 days of purchase. If the sales charge was included total returns would be lower. |

|

(5) |

Total return would have been (2.18)% absent the Capital Contribution from the Adviser (see Note 4). |

|

(6) |

Total return would have been 10.33% absent the Capital Contribution from the Adviser (see Note 4 in the annual report to shareholders dated December 31,2019). |

|

(7) |

Not annualized. |

|

(8) |

The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

|

(9) |

Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements. |

|

(10) |

Annualized. |

|

(11) |

Represents the ratio of expenses to average net assets inclusive of fee waivers and/or expense reimbursements by the Adviser. |

|

(12) |

Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

21

Wildermuth Endowment Fund

Financial Highlights – Class I |

Per share income and capital changes for a share outstanding throughout each period.

For the |

For the |

For the |

For the |

|||||||||||||

Net asset value, beginning of period |

$ | 13.91 | $ | 12.79 | $ | 13.27 | $ | 12.26 | ||||||||

Income from Investment Operations: |

||||||||||||||||

Net investment income (loss)(3) |

(0.09 | ) | (0.06 | ) | 0.17 | 0.02 | ||||||||||

Net realized and unrealized gain (loss) on investments |

(0.13 | ) | 1.58 | (0.31 | ) | 1.30 | ||||||||||

Total from investment operations |

(0.22 | ) | 1.52 | (0.14 | ) | 1.32 | ||||||||||

Less Distributions: |

||||||||||||||||

From return of capital |

— | (0.41 | ) | (0.32 | ) | (0.13 | ) | |||||||||

From net realized gains |

(0.09 | ) | — | (0.03 | ) | (0.18 | ) | |||||||||

Total distributions |

(0.09 | ) | (0.41 | ) | (0.35 | ) | (0.31 | ) | ||||||||

Redemption Fees: |

— | 0.01 | 0.01 | — | ||||||||||||

Net asset value, end of period |

$ | 13.60 | $ | 13.91 | $ | 12.79 | $ | 13.27 | ||||||||

Total return |

(1.58 | )%(4) | 12.06 | %(5) | (1.07 | )% | 10.87 | %(6) | ||||||||

Ratios and Supplemental Data: |

||||||||||||||||

Net assets, end of period (in thousands) |

$ | 28,965 | $ | 38,203 | $ | 12,084 | $ | 283 | ||||||||

Ratio of gross expenses to average net assets(7)(8) |

2.87 | % | 2.72 | % | 2.96 | % | 3.24 | %(9) | ||||||||

Ratio of net expenses to average net assets(7)(10) |

2.25 | % | 2.25 | % | 2.25 | % | 2.25 | %(9) | ||||||||

Ratio of net investment income (loss) to average net assets(7)(11) |

(0.63 | )% | (0.42 | )% | 1.27 | % | 0.26 | %(9) | ||||||||

Portfolio turnover rate |

32 | % | 29 | % | 31 | % | 51 | %(6) | ||||||||

|

(1) |

Redemption fees consisted of per share amounts of less than $0.01. |

|

(2) |

Reflects operations for the period from April 28, 2017 (inception date) to December 31, 2017. |

|

(3) |

Per share amounts calculated using the average shares method. |

|

(4) |

Total return would have been (1.80)% absent the Capital Contribution from the Adviser (see Note 4). |

|

(5) |

Total return would have been 11.58% absent the Capital Contribution from the Adviser (see Note 4 in the annual report to shareholders dated December 31,2019). |

|

(6) |

Not annualized. |

|

(7) |

The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

|

(8) |

Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements. |

|

(9) |

Annualized. |

|

(10) |

Represents the ratio of expenses to average net assets inclusive of fee waivers and/or expense reimbursements by the Adviser. |

|

(11) |

Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

22

Wildermuth Endowment Fund

Notes to Financial Statements December 31, 2020 |

1. ORGANIZATION

Wildermuth Endowment Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company that is operated as an interval fund. The Fund was organized as a Delaware statutory trust on August 28, 2013, and did not have any operations from that date until December 31, 2014, other than those relating to organizational matters and registration of its shares under applicable securities law. The Fund commenced operations on January 2, 2015. The Fund’s investment objective is to seek total return through a combination of long-term capital appreciation and income generation. The Fund will pursue its objective by investing in assets that Wildermuth Advisory, LLC (the “Adviser”) believes provide favorable long-term capital appreciation and risk-adjusted return potential, as well as in income-producing assets that the Adviser believes will provide consistent income generation and liquidity.

The Fund is engaged in a continuous offering, up to a maximum of 25 million shares of beneficial interest, and operates as an interval fund that offers to make quarterly repurchases of shares at the Fund’s net asset value (“NAV”). The Fund currently offers three different classes of shares: Class A, Class C, and Class I shares.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“US GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and follows the accounting and reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards (“ASC”) Topic 946, Financials Services – Investment Companies.

Investment Valuation – For purposes of determining the NAV of the Fund, and as applicable, readily marketable portfolio securities listed on the NYSE are valued, except as indicated below, at the last sale price reflected on the consolidated tape at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day or if market prices may be unreliable because of events occurring after the close of trading, then the security is valued by such method as the Fair Value Committee shall determine in good faith to reflect its fair market value. Readily marketable securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a like manner. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the consolidated tape at the close of the exchange representing the principal market for such securities. Securities trading on NASDAQ are valued at the closing price, or, in the case of securities not reported by NASDAQ, a comparable source, as the Fair Value Committee deems appropriate to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day, or if no asked price is available, at the bid price. However, certain debt securities may be valued on the basis of prices provided by a pricing service based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity.

The “last reported” trade price or sale price or “closing” bid price of a security on any trading day shall be deemed to be: (a) with respect to securities traded primarily on the NYSE, the American Stock Exchange or NASDAQ, the last reported trade price or sale price, as the case may be, as of 4:00 p.m., Eastern Time, on that day, and (b) for securities listed, traded or quoted on any other exchange, market, system or service, the market price as of the end of the “regular hours” trading period that is generally accepted as such by such exchange, market, system or service. If, in the future, the benchmark times generally accepted in the securities industry for determining the market price of a stock as of a given trading day shall change from those set forth above, the fair market value of a security shall be determined as of such other generally accepted benchmark times.

Non-U.S. dollar denominated securities, if any, are valued as of the close of the NYSE at the closing price of such securities in their principal trading market, but may be valued at fair value if subsequent events occurring before the computation of NAV have materially affected the value of the securities. Trading may take place in foreign issues held by the Fund, if any, at times when the Fund is not open for business. As a result, the Fund’s NAV may change at times when it is not possible to purchase or sell shares of the Fund.

23

Wildermuth Endowment Fund

Notes to Financial Statements - Continued |

If market quotations are not readily available, securities are valued at fair values as determined in good faith by the Board of Trustees (the “Board”). The Board has delegated the day-to-day responsibility for determining these fair values, in accordance with the policies it has approved, to the Fair Value Committee, subject to Valuation Committee and ultimately Board oversight. The Fair Value Committee will provide the Board with periodic reports, no less frequently than quarterly, that discuss the functioning of the valuation process, if applicable to that period, and that identify issues and valuation problems that have arisen, if any. As appropriate, the Valuation Committee and the Board will review any securities valued by the Fair Value Committee in accordance with the Fund’s valuation policies during these periodic reports.

As a general matter, the fair value of the Fund’s interest in Investment Funds that are Commodity and Natural Resource Investments, Direct Real Estate, Hedge Funds, Private Equity Funds, Private Real Estate Investments, and Public Real Estate Investments (“Non-Traded Funds”), will represent the amount that the Fund could reasonably expect to receive from the Non-Traded Fund if the Fund’s interest was redeemed at the time of valuation, based on information reasonably available at the time the valuation is made and that the Fund believes to be reliable. Investments in Non-Traded Funds are recorded at fair value, using the Non-Traded Fund’s net asset value as a practical expedient. Based on guidance provided by FASB, investments for which fair value is measured using the net asset value practical expedient are not required to be categorized in the fair value hierarchy. In the event a Non-Traded Fund does not report a value to the Fund on a timely basis, the Fair Value Committee, acting under the Valuation Committee and ultimately the Board’s supervision and pursuant to policies implemented by the Board, will determine the fair value of the Fund’s investment based on the most recent value reported by the Non-Traded Fund, as well as any other relevant information available at the time the Fund values its investments. Following procedures adopted by the Board, in the absence of specific transaction activity in a particular investment fund, the Fair Value Committee will consider whether it is appropriate, in light of all relevant circumstances, to value the Fund’s investment at the NAV reported by the Non-Traded Fund at the time of valuation or to adjust the value to reflect a fair value.

Securities for which market quotations are not readily available (including restricted securities and private placements, if any) are valued at their fair value as determined in good faith under consistently applied procedures approved by the Board. Methodologies and factors used to fair value securities may include, but are not limited to, the analysis of current debt to cash flow, information of any recent sales, the analysis of the company’s financial statements, quotations or evaluated prices from broker-dealers, information obtained from the issuer or analysts and the nature of the existing market for securities with characteristics similar to such obligations. Valuations may be derived following a review of pertinent data (EBITDA, Revenue, etc.) from company financial statements, relevant market valuation multiples for comparable companies in comparable industries, recent transactions, and management assumptions. Investments private equity debt instruments initially will be valued at cost (purchase price plus all related acquisition costs and expenses, such as legal fees and closing costs) and thereafter will be revalued quarterly at fair value based on payment history, market conditions, collateral of underlying debt and credit quality of borrower. The Fund may use fair value pricing for foreign securities if a material event occurs that may affect the price of a security after the close of the foreign market or exchange (or on days the foreign market is closed) but before the Fund prices its portfolio, generally at 4:00 p.m. Eastern Time. Fair value pricing may also be used for securities acquired as a result of corporate restructurings or reorganizations, as reliable market quotations for such issues may not be readily available. For securities valued in good faith, the value of an investment used to determine the Fund’s net asset value may differ from published or quoted prices for the same investment. The valuations for these good faith securities are monitored and reviewed in accordance with the methodologies described above by the Fund’s Fair Value Committee on an ongoing basis as information becomes available but are evaluated at least quarterly. The good faith security valuations and fair value methodologies are reviewed and approved by the Fund’s Board on a quarterly basis. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time which the Fund determines its net asset value per share.

US GAAP defines fair value, establishes a three-tier framework for measuring fair value based on a hierarchy of inputs, and expands disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly and how that information must be incorporated into a fair value measurement. The hierarchy distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

|

● |

Level 1 – unadjusted quoted prices in active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value. |

24

Wildermuth Endowment Fund

Notes to Financial Statements - Continued |

|

● |

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc. and quoted prices for identical or similar assets in markets that are not active.) Inputs that are derived principally from or corroborated by observable market data. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

|

● |

Level 3 – significant unobservable inputs, including the Fund’s own assumptions in determining the fair value of investments. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the valuation inputs, representing 100% of the Fund’s investments, used to value the Fund’s assets and liabilities as of December 31, 2020:

Fair Value Measurements at the |

||||||||||||||||||||

Investment in Securities |

Practical |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||||

Security Type |

||||||||||||||||||||

Public Equities* |

$ | — | $ | 15,089,091 | $ | — | $ | — | $ | 15,089,091 | ||||||||||

Exchange Traded Funds* |

— | 4,243,824 | — | — | 4,243,824 | |||||||||||||||

Commodity & Natural Resource Investments |

1,416,911 | (1)(7)(8) | — | — | 1,313,302 | 2,730,213 | ||||||||||||||

Direct Private Equity |

— | — | — | 65,109,098 | 65,109,098 | |||||||||||||||

Direct Real Estate |

1,545,782 | (2)(7)(8) | — | — | 7,475,574 | 9,021,356 | ||||||||||||||

Hedge Funds |

5,809,954 | (3)(7)(8) | — | — | — | 5,809,954 | ||||||||||||||

Private Equity Debt |

— | — | — | 21,139,112 | 21,139,112 | |||||||||||||||

Private Equity Funds |

14,001,937 | (4)(7)(9) | — | — | 180,207 | 14,182,144 | ||||||||||||||

Private Real Estate Investments |

18,997,888 | (5)(7)(10) | — | — | — | 18,997,888 | ||||||||||||||

Public Real Estate Investments |

510,420 | (6)(7)(8) | — | — | — | 510,420 | ||||||||||||||

Real Estate Loans |

$ | — | $ | — | $ | — | $ | 679,962 | $ | 679,962 | ||||||||||

Warrants |

— | — | — | 1,226,148 | 1,226,148 | |||||||||||||||

Short Term Investments |

— | 1,241,128 | — | — | 1,241,128 | |||||||||||||||

Total |

$ | 42,282,892 | $ | 20,574,043 | $ | — | $ | 97,123,403 | $ | 159,980,338 | ||||||||||

|

* |

All sub-categories within the security type represent their respective evaluation status. For a detailed breakout by industry, please refer to the Schedule of Investments. |

|

** |

Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Schedule of Investments. |

25

Wildermuth Endowment Fund

Notes to Financial Statements - Continued |

The following footnotes represent the Fund’s investments, valued using net asset value as a practical expedient, and their attributes as of December 31, 2020. The investments listed are grouped by security type.

(1) |

Security |

Value |

Unfunded Commitments |

Withdrawals Permitted |

Redemption Notice Period |

Investment Objective |

Investment Strategy |

Lock Up Period |

Remaining Life |

Redemption Terms and Restrictions |

Casillas Petroleum Resource Partners, LLC |

504,582 |

— |

Not Applicable |

Not Applicable |

Capital Gains |

Operating oil and gas company |

N/A |

Until Asset is Sold |

No redemption rights |

|

Kayne Anderson Energy Fund VII LP |

730,471 |

220,319 |

Not Applicable |

Not Applicable |

Capital Gains |

Purchase oil and gas companies; extraction and production companies. |

N/A |

Up to 8 years |

Up to 8 years |

|

Midcon Holdco Partners, LLC |

181,858 |

— |

Not Applicable |

Not Applicable |

Capital Gains |

Operating oil and gas company |

N/A |

Until Asset is Sold |

No redemption rights |

|

(2) |

Security |

Value |

Unfunded Commitments |

Withdrawals Permitted |

Redemption Notice Period |

Investment Objective |

Investment Strategy |

Lock Up Period |

Remaining Life |

Redemption Terms and Restrictions |

Brookwood SFL Investor Co-Investment Vehicle, LLC |

1,545,782 |

— |

Not Applicable |

Not Applicable |

Capital Gains and Current Income |

Real Estate |

N/A |

Until Asset is Sold |

No redemption rights |

|

(3) |

Security |

Value |

Unfunded Commitments |

Withdrawals Permitted |

Redemption Notice Period |

Investment Objective |

Investment Strategy |

Lock Up Period |

Remaining Life |

Redemption Terms and Restrictions |

Altegris Millennium Fund LP |

1,361,913 |

— |

Quarterly |

Not Applicable |

Capital Gains and Income |

Multistrategy hedge fund |

N/A |

Open Ended |

5% quarterly tenders at the fund level with 90 days notice |

|

CRC Bond Opportunity Trading Fund LP |

2,962,128 |

— |

Monthly |

90 days |

Capital Gains and Income |

Opportunistic, event-driven credit fund focused on subordinated debt, preferred equity, and additional Tier 1 capital of banks and financial firms. |

12 months |

Open Ended |

Monthly redepemptions with 90 days notice |

|

Security |

Value |

Unfunded Commitments |

Withdrawals Permitted |

Redemption Notice Period |

Investment Objective |

Investment Strategy |

Lock Up Period |

Remaining Life |

Redemption Terms and Restrictions |

|

EJF Trust Preferred Fund LP |

714,739 |

— |

Not Applicable |

Not Applicable |

Capital Gains and Income |

Event driven with focus on financials |

3 years |

Up to 3 years |

Up to 3 years |

|

Rosebrook Opportunities Fund LP |

771,174 |

747,568 |

Quarterly |

Not Applicable |

Capital Appreciation |

Buying distressed hedge fund assets |

N/A |

Up to 5 years |

Up to 5 years |

26