Table of Contents

| Michael K. Rafter Howard S. Hirsch Jonathan H. Talcott Nelson Mullins Riley & Scarborough LLP 201 17 th Street NW, Suite 1700 Atlanta, Georgia 30363 (404) 322-6000 |

Julian T.H. Kleindorfer Lewis W. Kneib Jonathan E. Sarna Latham & Watkins LLP 355 South Grand Avenue, Suite 100 Los Angeles, California 90071-1560 (213) 485-1234 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company | ||||||

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JANUARY 26, 2024

Shares

SMARTSTOP SELF STORAGE REIT, INC.

Common Stock

SmartStop Self Storage REIT, Inc. is an internally-managed real estate investment trust, or REIT, and a premier owner and operator of self storage facilities in the United States and Canada. We are offering shares of our common stock as described in this prospectus. All of the shares of our common stock offered by this prospectus are being sold by us. We currently expect the public offering price to be between $ and $ per share. We intend to apply to have our common stock listed on the New York Stock Exchange, or NYSE, under the symbol “SMST.” Currently, our common stock is not traded on a national securities exchange, and this will be our first listed public offering.

We were formed as a Maryland corporation in January 2013 and have elected to be taxed as a REIT for U.S. federal income tax purposes beginning with our taxable year ended December 31, 2014. Shares of our common stock are subject to ownership limitations that are primarily intended to assist us in maintaining our qualification as a REIT. Our charter contains certain restrictions relating to the ownership and transfer of our common stock, including, subject to certain exceptions, a 9.8% ownership limit of common stock by value or number of shares, whichever is more restrictive. See “Description of Capital Stock—Restrictions on Ownership and Transfer” beginning on page 170 of this prospectus.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 19 of this prospectus.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See the section entitled “Underwriting” for a complete description of the compensation payable to the underwriters. |

We have granted the underwriters the option to purchase an additional shares of our common stock on the same terms and conditions set forth above within 30 days after the date of this prospectus.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock on or about , 2024.

| J.P. Morgan | Wells Fargo Securities | KeyBanc Capital Markets | BMO Capital Markets | Truist Securities |

The date of this prospectus is , 2024

Table of Contents

Table of Contents

TABLE OF CONTENTS

| ii | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| 1 | ||||

| 18 | ||||

| 19 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 58 | ||||

| 60 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

61 | |||

| 90 | ||||

| 100 | ||||

| 123 | ||||

| 132 | ||||

| 156 | ||||

| 157 | ||||

| 162 | ||||

| 165 | ||||

| 170 | ||||

| MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

175 | |||

| CERTAIN PROVISIONS OF MARYLAND LAW AND OF OUR CHARTER AND BYLAWS |

184 | |||

| 191 | ||||

| 194 | ||||

| 215 | ||||

| 218 | ||||

| 223 | ||||

| 223 | ||||

| 223 | ||||

| F-1 |

i

Table of Contents

GENERAL DISCLAIMERS

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

You should assume that the information appearing in this prospectus and in any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates specified in these documents. Our assets, business, cash flows, financial condition, liquidity, results of operations, and prospects may have changed since those dates.

This prospectus describes the specific details regarding this offering and the terms and conditions of our common stock being offered hereby and the risks of investing in our common stock. For additional information, please see the section entitled “Where You Can Find More Information.”

You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

“SmartStop Self Storage” and its logos and other trademarks referred to and included in this prospectus belong to us. Solely for convenience, we refer to our trademarks in this prospectus without the ® or the ™ or symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks.

MARKET, INDUSTRY, AND OTHER DATA

We use market data throughout this prospectus which has generally obtained from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but the accuracy and completeness of the information are not guaranteed. The market data includes forecasts and projections that are based on industry surveys and the preparers’ experiences in the industry, and there is no assurance that any of the projections or forecasts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information.

Unless otherwise indicated, references in this prospectus to information reported by U.S. Listed Self Storage REITs refer to metrics and data publicly reported by the U.S. Listed Self Storage REITs. See “Certain Defined Terms Used in This Prospectus.” The U.S. Listed Self Storage REITs may define or calculate such metrics or data differently than we do. Accordingly, our metrics or data may differ from, or may not be comparable to, the metrics and data of the U.S. Listed Self Storage REITs.

CONVERSION OF CLASS A COMMON STOCK AND CLASS T COMMON STOCK

Our charter provides that, upon the six-month anniversary of the listing of shares of our common stock for trading on a national securities exchange or such earlier date as approved by our Board, each share of Class A common stock and Class T common stock will automatically, and without any stockholder action, convert into a number of shares of our common stock equal to a fraction, the numerator of which is the net asset value of the Company allocable to the shares of Class A common stock and shares of Class T common stock, as applicable, and the denominator of which is the net asset value of the Company allocable to the shares of our common stock, or the Conversion.

ii

Table of Contents

Shares of our common stock issued as a result of the conversion of shares of our Class A common stock and shares of Class T common stock, as described in the preceding paragraph, will be listed on the NYSE upon such conversion, which shall occur upon the six-month anniversary of the listing of shares of our common stock sold in this offering or such earlier date as approved by our Board. We have agreed that, without the prior written consent of the representatives on behalf of the underwriters, we will not approve the conversion of any of the outstanding shares of Class A common stock or shares of Class T common stock into shares of our common stock before the six-month anniversary of the listing of our common stock for trading on a national securities exchange.

iii

Table of Contents

CERTAIN DEFINED TERMS USED IN THIS PROSPECTUS

| adjusted gross margin percentage |

Net operating income divided by gross revenue less revenue from the tenant protection program. |

| Board |

The board of directors of SmartStop. |

| CAGR |

Compound annual growth rate. |

| Code |

The Internal Revenue Code of 1986, as amended. |

| economically stabilized |

Having achieved market rents on a per-unit and overall store basis, without having material in-place discounts or concessions. |

| Exchange Act |

The Securities Exchange Act of 1934, as amended. |

| GAAP |

United States generally accepted accounting principles. |

| GTA |

The Greater Toronto Area of Ontario, Canada. |

| LTIP unit |

A unit of limited partnership interest in our operating partnership issued or to be issued as a form of equity compensation to our executive officers and directors, subject to vesting criteria, with the rights, preferences and other privileges set forth in our operating partnership agreement. |

| Managed REIT platform |

Our platform to sponsor non-traded REITs that will invest in, among other things, non-stabilized, growth-oriented assets, and development projects. |

| Managed REITs |

The various REITs sponsored by SmartStop REIT Advisors, LLC, our indirect subsidiary, which may include in certain contexts one or more of Strategic Storage Trust IV, Inc., Strategic Storage Growth Trust II, Inc., Strategic Storage Trust VI, Inc., Strategic Storage Growth Trust III, Inc., and any future sponsored REITs. |

| MGCL |

Maryland General Corporation Law or any successor statute. |

| NAREIT |

The National Association of Real Estate Investment Trusts. |

| NYSE |

The New York Stock Exchange. |

| operating partnership |

Our operating partnership, SmartStop OP, L.P., a Delaware limited partnership. |

| operating partnership agreement |

The Third Amended and Restated Limited Partnership Agreement of our operating partnership, as amended from time to time. |

| OP unit |

A common unit of limited partnership interest of our operating partnership. |

| physically stabilized |

Assets have achieved greater than 80% occupancy as measured by net rentable square feet. |

iv

Table of Contents

| REIT |

A real estate investment trust within the meaning of Section 856 through 860 of the Code. |

| RentPOF |

Annualized rental revenue net of discounts and concessions, excluding late fees, administrative fees and parking income for the period indicated, divided by the associated occupied square feet of storage for the period indicated. |

| SAM |

Strategic Asset Management I, LLC (f/k/a SmartStop Asset Management, LLC), the former sponsor of SmartStop, SST IV, and SSGT II. |

| same-store |

Assets are included in the same-store pool when we have owned them since January 1 of the prior calendar year and they have been physically stabilized for at least one full year prior to the beginning of the prior calendar year. |

| Securities Act |

The Securities Act of 1933, as amended. |

| self administration transaction |

The self administration transaction that closed in June 2019 in which we acquired the self storage advisory, asset management and property management businesses and certain joint venture interests of SAM, along with certain other assets of SAM. |

| tenant protection program |

Tenant protection plan, tenant insurance plan, and similar arrangements with respect to the protection of customer goods at our properties. |

| U.S. Listed Self Storage REITs |

CubeSmart, Extra Space Storage Inc., National Storage Affiliates Trust and Public Storage. |

As used in this prospectus, unless the context otherwise requires, references to “SmartStop,” “we,” “us,” “our,” the “Company” and similar references refer to SmartStop Self Storage REIT, Inc., a Maryland corporation, together with its consolidated subsidiaries, including its operating partnership.

v

Table of Contents

PROSPECTUS SUMMARY

This summary highlights some of the information in this prospectus. It does not contain all of the information that you should consider before investing in shares of our common stock. You should read carefully the more detailed information set forth under the heading “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements and related notes and the other information included in this prospectus. Unless otherwise indicated, information contained in this prospectus assumes that the underwriters do not exercise their option to purchase additional shares.

Our Company

We are a premier owner and operator of self storage facilities in the United States and Canada. We are internally managed and have built a fully integrated, technology-enabled, data-driven, and scalable platform that is positioned for growth. We operate an institutional quality self storage portfolio that encompasses properties located primarily within top metropolitan statistical areas, or MSAs, throughout the United States and within top census metropolitan areas, or CMAs, in Canada, including the Greater Toronto Area, or GTA. According to the Inside Self Storage Top-Operators List for 2023, we are the tenth largest owner and operator of self storage properties in the United States when adjusted for recent market transactions and according to Colliers, the largest in the GTA based on rentable square footage. As of September 30, 2023, we owned or managed 192 operating stores across 22 states and Canada, comprising approximately 135,000 units and 15.3 million net rentable square feet.

The following table summarizes our owned and managed operating properties in our portfolio as of September 30, 2023:

| Operating Portfolio Snapshot |

# of Stores | Net Rentable Sq. Ft. |

Units | 3Q23 Ending Occupancy |

3Q23 RentPOF |

|||||||||||||||

| Wholly Owned Stores(1) |

153 | 11,813,085 | 102,880 | 92.7 | % | $ | 20.08 | |||||||||||||

| Joint Venture Stores |

8 | 723,200 | 7,500 | 84.1 | % | $ | 17.75 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Owned Stores |

161 | 12,536,285 | 110,380 | 92.2 | % | $ | 19.95 | |||||||||||||

| Managed Stores |

31 | 2,764,980 | 24,620 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Total Stores |

192 | 15,301,265 | 135,000 | |||||||||||||||||

| (1) | Our wholly owned San Gabriel Property was excluded from these statistics, as it only began formal operations in October of 2023. |

We believe the self storage sector has distinguished itself as a core asset class with attractive long-term organic growth characteristics and strong free cash flow generation. We expect long-term self storage drivers, which include population growth, the percentage of renter occupied housing units and self storage supply constraints, to continue to underpin competitive risk adjusted returns relative to the broader real estate sector.

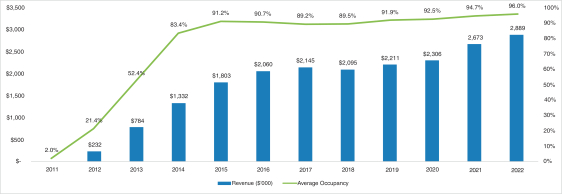

Since our founding, we have built a leading self storage brand in the United States and Canada, growing our total operating portfolio to 192 operating properties as of September 30, 2023. Over the last five years, we have seen meaningful growth in our owned portfolio, growing from 83 stores in 2018 to 161 as of September 30, 2023 (representing a 14% CAGR). We maintain an investment strategy focused on acquiring or developing properties located in high quality sub-markets that offer our customers convenient, affordable and secure access to self storage units. Furthermore, we have created a scalable, leading technology-enabled platform that drives customer acquisition, customer service efficiencies and revenue management capabilities that optimize profitability across the portfolio.

1

Table of Contents

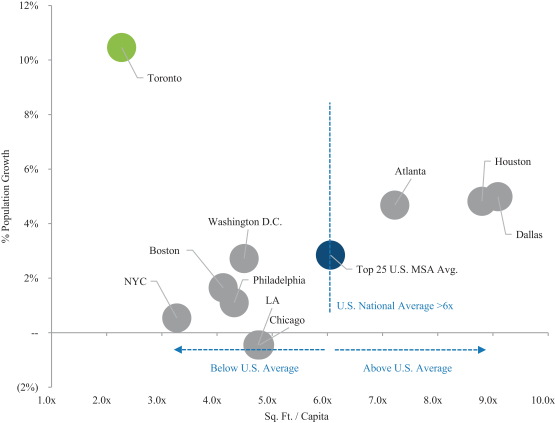

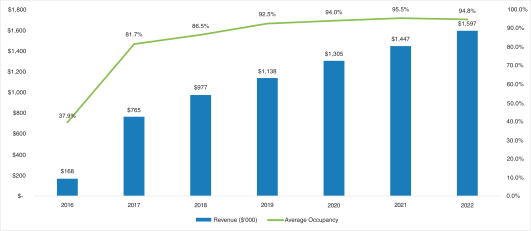

A unique element to our growth story has been the successful expansion of our Canadian portfolio. Upon completion of this offering, we believe we will be the only U.S. listed self storage REIT with an owned portfolio and operating platform in Canada (including in the GTA, one of the fastest growing and undersupplied markets in North America). Supported by strong demographic trends (according to Claritas, SNL Financial, and Statistics Canada, GTA population growth from 2023 through 2028 is expected to be approximately 820 bps greater than the U.S. average), we believe the Canadian market presents a compelling market opportunity, highlighted by low supply per capita (according to Colliers and the 2023 Self-Storage Almanac, the GTA has 2.3x square feet per capita vs. 6.1x in the United States), increasing product utilization, and limited institutional competition. Our joint venture with SmartCentres provides a pipeline of development opportunities at well trafficked locations within demographically advantaged CMAs. As of September 30, 2023, we owned or managed a portfolio of 31 operating properties comprising 2.9 million square feet in the GTA. This number included 13 wholly owned facilities and eight facilities in unconsolidated joint ventures in which we maintain a 50% equity interest. This number also included 10 facilities under management that were wholly owned by the Managed REIT platform.

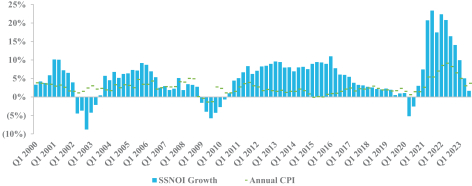

We employ a multi-pronged growth strategy focused on organic and external growth. We aim to grow the cash flow of our existing portfolio by utilizing our revenue management systems to grow revenue and leverage the scalability of our platform to increase expense efficiencies over time. Additionally, we expect to grow externally via acquisitions of newly built properties, ground up developments and strategic acquisitions, all of which we can execute either on-balance sheet or off-balance sheet through our Managed REITs. Our same-store portfolio, which represents 82.8% of our owned operating portfolio as measured by net rentable square feet, has averaged 15.6% NOI growth over the last three years. We have deep acquisition capabilities that allow us to focus on properties across the asset life cycle, from ground-up development to stabilized property acquisitions in many of the top MSAs in the United States and CMAs in Canada. Additionally, through a subsidiary, we also serve as the sponsor of the Managed REITs. Our managed REITs not only generate fees that offset our operating and general and administrative expenses but also enable us to strategically expand our platform off-balance sheet while providing potential future acquisition opportunities. Upon completion of this offering, we expect to have a fortified balance sheet with low leverage and ample liquidity that will position us to take advantage of growth opportunities as they arise.

Our Founder, Chairman and Chief Executive Officer, H. Michael Schwartz, founded our company in 2013, recognizing a market opportunity for a differentiated public self storage REIT focused on high quality self storage assets in high growth markets across the United States and Canada. Mr. Schwartz entered the self storage business in 2005 and has established a successful 19-year track record in the sector. In 2007, Mr. Schwartz founded Strategic Storage Trust, Inc., which became a fully integrated and self-managed self storage company that grew to own and/or operate 169 self storage properties and was ultimately sold to Extra Space Storage, Inc. for $1.4 billion in October 2015. In addition to Mr. Schwartz, we maintain a seasoned and multidisciplined executive management team with over 20 years of storage experience, on average.

We are organized as a Maryland real estate investment trust, or REIT, with operational headquarters in Ladera Ranch, CA. We generally will not be subject to U.S. federal income tax on our REIT taxable income to the extent that we distribute annually 100% of our REIT taxable income (including capital gains and computed without regard to the dividends paid deduction) to our stockholders and maintain our intended qualification as a REIT. We serve as the sole general partner of, and operate our business through, our operating partnership subsidiary, SmartStop OP, L.P., a Delaware limited partnership. Our operating partnership enables us to facilitate additional tax deferred acquisitions using OP units as consideration for these transactions.

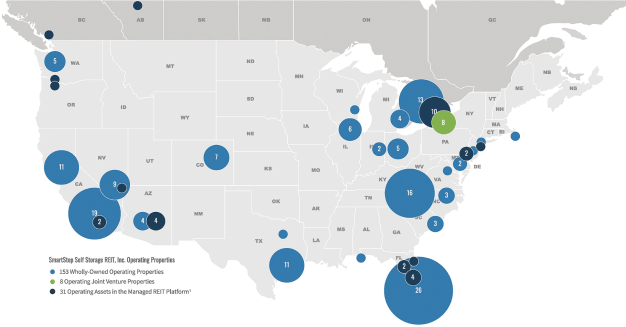

Our Competitive Strengths

High-quality and Diversified Self Storage Portfolio. We own a large, geographically diversified portfolio consisting exclusively of self storage properties. Our portfolio consists of 161 wholly owned and joint venture operating self storage properties located in 19 states and Ontario, Canada. Our largest markets based on square footage owned include: Toronto, ON; Miami–Ft. Lauderdale, FL; Las Vegas, NV; Asheville, NC; Houston, TX;

2

Table of Contents

and Los Angeles, CA. Our properties are primarily located in high quality markets with attractive supply and demand characteristics. Many of these markets exhibit multiple barriers to entry against increased supply, including zoning restrictions that restrict new self storage construction. Furthermore, we believe that our scale and the overall geographic diversification of our portfolio reduces risks associated with specific local or regional economic downturns or natural disasters.

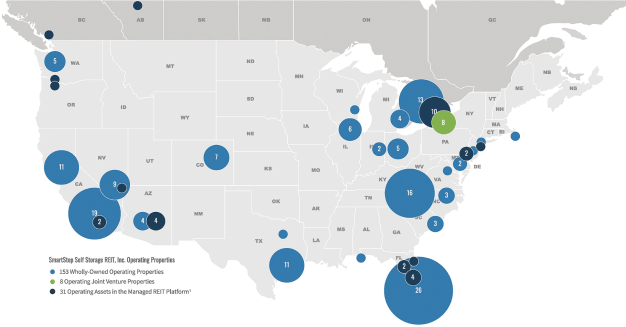

The following map highlights the geographic diversification of our owned and managed operating properties in our portfolio, as of September 30, 2023:

3

Table of Contents

The following table summarizes information about our wholly owned and owned joint venture operating properties in our portfolio by MSA and the census metropolitan area, or CMA, as of September 30, 2023:

| MSA/CMA(1) |

% of Portfolio by NRSF |

Net Rentable Sq. Ft. |

Units | # of Stores |

3Q23 Ending Occupancy |

3Q23 RentPOF |

||||||||||||||||||

| Toronto |

14.6 | % | 1,833,855 | 18,110 | 21 | 89.4 | % | $ | 19.81 | |||||||||||||||

| Miami—Fort Lauderdale |

8.9 | % | 1,121,500 | 9,420 | 11 | 93.3 | % | $ | 25.54 | |||||||||||||||

| Las Vegas |

6.9 | % | 865,000 | 7,160 | 9 | 92.9 | % | $ | 18.56 | |||||||||||||||

| Asheville |

6.8 | % | 851,900 | 6,200 | 14 | 94.4 | % | $ | 16.85 | |||||||||||||||

| Houston |

5.4 | % | 676,800 | 5,130 | 9 | 93.7 | % | $ | 17.98 | |||||||||||||||

| Los Angeles |

5.3 | % | 660,400 | 6,200 | 10 | 92.6 | % | $ | 26.18 | |||||||||||||||

| Tampa |

3.8 | % | 478,100 | 3,890 | 5 | 92.7 | % | $ | 19.72 | |||||||||||||||

| Denver |

3.5 | % | 434,785 | 3,860 | 7 | 93.5 | % | $ | 17.30 | |||||||||||||||

| Chicago |

3.4 | % | 429,500 | 3,785 | 6 | 92.1 | % | $ | 15.38 | |||||||||||||||

| Dayton |

3.1 | % | 392,400 | 3,340 | 7 | 94.0 | % | $ | 12.73 | |||||||||||||||

| Seattle—Tacoma |

3.1 | % | 390,545 | 3,430 | 5 | 92.4 | % | $ | 19.93 | |||||||||||||||

| Phoenix |

2.6 | % | 329,100 | 3,130 | 4 | 92.6 | % | $ | 17.75 | |||||||||||||||

| San Francisco—Oakland |

2.6 | % | 322,600 | 2,920 | 4 | 90.5 | % | $ | 23.92 | |||||||||||||||

| Port St. Lucie |

2.5 | % | 318,900 | 2,610 | 4 | 93.5 | % | $ | 20.48 | |||||||||||||||

| Sacramento |

2.5 | % | 308,100 | 2,895 | 4 | 89.2 | % | $ | 16.93 | |||||||||||||||

| Riverside—SB |

2.4 | % | 306,700 | 2,690 | 5 | 93.2 | % | $ | 21.75 | |||||||||||||||

| Detroit |

2.1 | % | 266,100 | 2,220 | 4 | 94.1 | % | $ | 15.30 | |||||||||||||||

| Myrtle Beach |

1.6 | % | 197,800 | 1,450 | 2 | 91.9 | % | $ | 15.10 | |||||||||||||||

| Other (2) |

18.8 | % | 2,352,200 | 21,940 | 30 | 91.6 | % | $ | 21.10 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Stores(3) |

100.0 | % | 12,536,285 | 110,380 | 161 | 92.2 | % | $ | 19.95 | |||||||||||||||

| (1) | MSAs (Metropolitan Statistical Areas) as defined by the U.S. Census Bureau. Toronto CMA (Census Metropolitan Area) as defined by Statistics Canada. |

| (2) | Other markets include: Baltimore, Charleston, Charlotte, Charlottesville, College Station, Colorado Springs, Dallas, Jacksonville, Milwaukee, Mobile, Nantucket, Naples, New York – Newark, Orlando, Punta Gorda, Raleigh – Cary, San Antonio, San Diego, Santa Maria – Santa Barbara, Santa Rosa – Petaluma, Sarasota, Stockton, Trenton – Princeton and Washington – Arlington. None of these markets represent more than 1.5% of the total portfolio by NRSF. |

| (3) | Joint venture properties owned in our portfolio are included herein as if 100% owned. |

Our portfolio consists of a combination of recently constructed vertical facilities and early-generation facilities. The weighted average age of our portfolio by rentable square feet since initial construction or significant property redevelopment, whichever is more recent, is approximately 20 years. Our properties are designed to cater to the needs of both residential and commercial customers with features such as electronic gate entry, easy access, climate control, high quality security systems, keypad access, large truck accessibility and pest control. Some of our properties also offer outside storage for vehicles, boats and equipment.

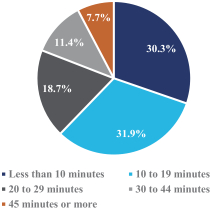

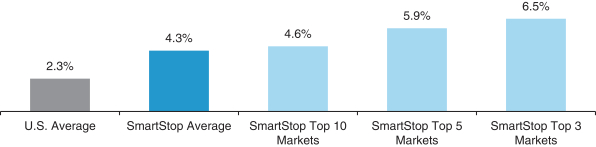

Key Growth Markets and Sub-Markets with Strong Demographics. We seek to own properties that are conveniently located with highly accessible street access in high growth MSAs/CMAs and high growth sub-markets. This includes markets with strong population and household income growth, high levels of population density and supply per capita that is below the national average. Approximately 65% of our portfolio is located in the top 25 MSAs and over 81% is located in the top 100 MSAs, based on net rentable square feet. While we have meaningful concentration in larger markets, we have also targeted specific smaller markets that exhibit underlying fundamentals that we believe are conducive to attractive risk-adjusted returns. We have invested in smaller markets, including Asheville, NC and Dayton, OH, due to a combination of low supply per

4

Table of Contents

capita and limited competition from institutional operators, among other factors. According to statistics from Claritas and S&P Global, population growth for our top 10 markets and total portfolio is expected to grow approximately 150 bps and 100 bps faster (on a weighted average basis by rentable square feet), respectively, than the U.S. average from 2023 to 2028.

Differentiated Exposure to the Greater Toronto Area. Upon the completion of this offering, we believe we will be the only U.S. listed self storage REIT with an owned portfolio and operating platform in Canada and, more specifically, the GTA. As one of the world’s premier financial centers and sixth largest metro area in North America, the GTA is rapidly expanding its population of younger workers. Professionals are drawn to the GTA by its sustained focus on immigration and high quality, ubiquitous academic resources, which has resulted in the GTA becoming an emerging market for the digital economy. Supported by strong demographic trends (according to Claritas, SNL Financial, and Statistics Canada, GTA population growth from 2023 through 2028 is expected to be approximately 820 bps greater than the U.S. average), we believe the GTA presents a compelling market opportunity, highlighted by low supply per capita (according to Colliers and the 2023 Self-Storage Almanac, the GTA has 2.3x square feet per capita vs. 6.1x in the United States), increasing product utilization, and limited institutional competition. Below we highlight our management team’s history in the market, our existing portfolio and growth initiatives.

| • | Our Canadian Platform. Our management team has over 13 years of experience sourcing, developing, acquiring and operating in the GTA. During that time, we have built the local infrastructure to drive our future growth, with approximately 85 employees based in Canada, an executive vice president, or EVP, of Canada, and multi-lingual agents in our Canadian call center. We are able to combine the institutional front and back office of the SmartStop platform with a unique Canadian-specific offering that includes a country specific website and domain, Canadian versions of the SmartStop branding package at all of our stores, and a dedicated and highly trained Canadian team of onsite professionals, all of whom are based in Canada. |

| • | Our Canadian Portfolio. We own or manage a portfolio of 31 operating properties in the GTA, comprising approximately 2.9 million square feet, which provides meaningful economies of scale within the GTA self storage market. We also manage one property in Edmonton and one property in Vancouver. At September 30, 2023, we had 13 wholly owned operating properties in the GTA accounting for approximately 1.1 million net rentable square feet, which accounted for 9.3% of our total owned portfolio as of September 30, 2023 and 10.7% of our net operating income, or NOI, for the quarter ended September 30, 2023. We have a joint venture with SmartCentres, which owns a diversified portfolio of real estate in Canada and is one of the largest Toronto Stock Exchange-listed REITs. The 50/50 joint venture affords each party a right of first offer to develop self storage facilities in certain CMAs in Canada. We owned 11 joint venture properties with SmartCentres as of September 30, 2023, of which eight were operating self storage properties and two were under development, and an additional property is currently subject to a single tenant industrial lease which we intend to develop into a self storage facility in the future. We have a development pipeline of approximately 1.5 million net rentable square feet, which we believe we are capable of executing on over the next 10 years throughout multiple CMAs in Canada. |

Institutional Quality, Technology-enabled, Data-driven Operations Focused on Customer Service. Over the past decade, we have made significant investments in technology, infrastructure, and human capital to support our operational and digital platforms and enable real-time decision making at scale. Digital tools, resources and enhancements are leveraged across our organization to jointly coordinate marketing and pricing activities, improve the customer experience, grow rental revenue and enhance expense efficiencies. Further, we have multiple data science-driven pricing automation systems that were custom built to fit our operations profile. In 2022, we completed our transition to a new property management system, furthering our management capabilities and facilitating continued property growth. Built on the latest cloud-based technology, the platform

5

Table of Contents

allows us greater flexibility in positioning competitive offerings in our customer pipeline. Aligned with this platform upgrade, SmartStop site managers are now using tablets as the primary tool when engaging with customers on new opportunities. Store managers are no longer confined to the retail office in order to rent units, take payments, conduct lock checks, and conduct other business. We believe this system will help us compete as a top operator and foster continued property growth in the future. Today, our technology-driven operating platform includes:

| • | consistent and recognizable brand across store locations; |

| • | digital brand presence and protection; |

| • | highly sophisticated and responsive user-friendly website with mobile optimization; |

| • | proprietary data warehouse supported by a multitude of internal and external data sources, algorithmically driving pricing changes with over 18 billion data points; |

| • | dedicated, in-house call center; |

| • | ability to transact across a spectrum of mediums, including contactless, online rentals, call center rentals, reservations systems and in person rentals; |

| • | highly trained staff, focused on enhancing the customer experience; and |

| • | automated proprietary digital marketing algorithms driving near real time targeting and spend decisions. |

We are focused on creating a convenient and hassle-free customer experience with an emphasis on the leasing process, regardless of individual customer preferences. Accordingly, we offer website and call center reservations, in person leasing, call center leasing and website leasing, all from a variety of devices, including mobile phones and tablets. In the first nine months of 2023, nearly one third of all rentals were executed in a contactless manner. Meeting the customer at their level has allowed us to bolster our digital marketing efforts, primarily driven by a combination of pay-per-click and search engine optimization campaigns, to continue to maintain attractive returns on invested marketing dollars. The technological backbone of our operating platform is further supported by a dedicated staff of operations professionals, including over 330 store-level employees. Our dedicated staff, institutional technology platform and branding presence led to Newsweek ranking us #1 in the self storage business for Best Customer Service in 2021, 2023, and 2024.

Scalable Platform and Asset Base to Drive Significant Growth. Our technology and human capital investments have resulted in a platform that we believe is capable of supporting a portfolio significantly larger than our existing operating portfolio. We believe that our current back-office infrastructure—including accounting, acquisitions, operations and corporate finance—is well positioned to scale. We believe we can grow our portfolio at a rate significantly faster than our general and administrative expenses, which in turn should generate positive operating leverage and enhanced income growth. Furthermore, with our smaller asset base relative to our publicly traded self storage peers, we believe we have an opportunity to achieve out-sized growth through manageable acquisition volumes.

Proven Acquisition Execution in the Self Storage Space. Our management team has significant experience acquiring self storage facilities across a broad spectrum of opportunities, including stabilized facilities, recently developed facilities in lease up, facilities that have just received a certificate of occupancy, facilities in need of renovation and/or re-development and ground up development. Since 2016, we have acquired over $1.6 billion in self-storage assets either on our balance sheet or on behalf of our managed vehicles. Our dedicated acquisitions team, located in both the United States and Canada, possesses an average of over 15 years of real estate transaction experience and is responsible for executing all of our acquisitions through the use of our proprietary underwriting methodology. More importantly, our acquisitions team has cultivated relationships in the industry that are highly beneficial to our overall deal sourcing. We believe that we maintain a competitive advantage in acquiring facilities given the scale of our business, our experience and the networks of our team.

6

Table of Contents

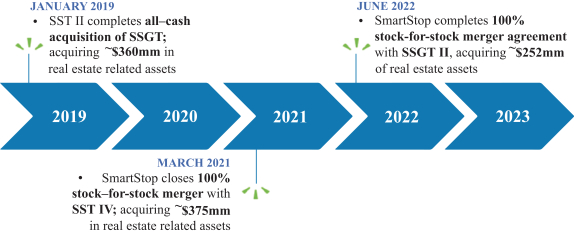

Differentiated Capital Allocation Capability Through Managed REIT Platform Provides Additional Revenues and Potential Acquisition Pipeline. In the short-to-medium term, we plan to utilize our Managed REIT platform to sponsor non-traded REITs that will invest in, among other things, non-stabilized, growth-oriented assets, and development projects. Our management team has an extensive track record of sponsoring and managing non-traded REITs; since inception, our management team has raised approximately $2.2 billion across nine self storage programs. We sponsor and manage two non-traded REITs, Strategic Storage Trust VI, Inc., or SST VI, and Strategic Storage Growth Trust III, Inc., or SSGT III, from which we generate asset management fees, property management fees, acquisition fees, other fees and substantially all of the tenant protection program revenue. We have an acquisition allocation policy pursuant to which we are provided the right of first allocation among us and the Managed REITs. As the assets under management in our Managed REITs grow, we will benefit from the additional management fees as well as the economies of scale that will reduce our operating expenses and improve our margins. Additionally, upon stabilization, our Managed REITs serve as potential accretive acquisition targets to drive our external growth. Since 2019, we have acquired or merged with three affiliated entities. These include the all-cash acquisition of Strategic Storage Growth Trust, Inc., or SSGT, in January 2019 whereby we acquired approximately $360 million in real estate related assets, the 100% stock-for-stock merger with Strategic Storage Trust IV, Inc., or SST IV, in March 2021 whereby we acquired approximately $375 million of real estate related assets, and the 100% stock-for-stock merger with Strategic Storage Growth Trust II, Inc., or SSGT II, in June 2022 whereby we acquired approximately $252 million of real estate related assets. With extensive start-up costs and the lack of established track records creating significant barriers to entry for others with respect to the non-traded REIT, we believe our Managed REIT platform provides us a competitive advantage relative to other U.S. Listed Self Storage REITs, which do not have such a platform.

Investment Grade Balance Sheet Well Positioned for Expansion. Upon completion of this offering, we believe we will be well positioned to grow our portfolio by opportunistically pursuing acquisitions in a disciplined manner, while maintaining an attractive leverage profile and flexible balance sheet. We believe our leverage profile and significant liquidity will position us to pursue attractive external growth opportunities in an accretive and prudently capitalized manner. We believe that becoming a publicly traded REIT will enable us to access multiple forms of equity and debt capital currently not available to us, further enhancing our financial flexibility and external growth. In March 2022, we received an investment grade rating of BBB- with a Stable outlook from Kroll Bond Rating Agency, Inc. (KBRA), which we believe will be further enhanced upon completion of this offering and represents an important step towards our goal of becoming a fully unsecured issuer. KBRA reaffirmed this rating and outlook in April 2023.

Experienced and Aligned Management Team with Extensive Operating Expertise. Our management team has strong insight and operating acumen developed from decades of successfully operating self storage facilities and creating value while navigating through multiple real estate and economic cycles. Our Founder, Chairman and Chief Executive Officer, H. Michael Schwartz, has transacted more than $6.5 billion in commercial real estate, with more than $4.8 billion in the self storage industry. The other six members of our management team have extensive self storage experience with an average of 17 years in self storage roles. We benefit from the significant experience of our management team and its ability to effectively navigate changing market conditions and achieve sustained growth. In addition, we believe the interests of our management team are strongly aligned with our stockholders. As of the completion of this offering, we expect our management team to collectively own approximately % of our outstanding common stock and OP units, which represents $ million at the midpoint of the price range set forth on the front cover of this prospectus.

Our Business Objectives and Growth Strategies

Our primary business objective is to deliver attractive risk-adjusted returns by investing in and operating a portfolio of newer generation self storage facilities and earlier generation self storage facilities, both primarily

7

Table of Contents

located in urban sub-markets. We intend to maximize cash flow to stockholders through both organic and external growth utilizing multiple levers and channels.

Organic Growth Strategies:

Leverage Our Technology-Driven Operating Platform to Drive Optimal Asset Level Performance. We are highly focused on maximizing cash flows at our properties by leveraging the economies of scale provided by our technology-enabled platform and proprietary systems. As we continue to scale, we intend to utilize our revenue management capabilities which include digital marketing algorithms, data warehouse with algorithmic pricing, digital tools and a dedicated call center, among others, to position us to achieve optimal market rents and occupancy, reduce operating expenses and increase the sale of ancillary products and services. Our ability to drive enhanced revenue is highlighted by our three year average same-store revenue growth, which was 12.2%, or approximately 110 bps higher than the U.S. Publicly Listed REITs over the same time period.

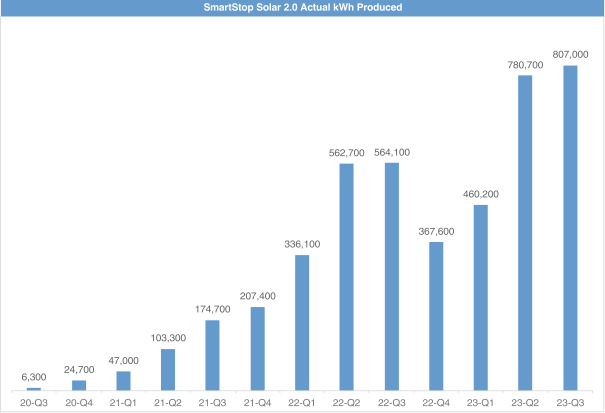

Margin Expansion and Other Ancillary Revenue Opportunities. There is a substantial opportunity to grow our profitability and earnings through margin improvement. The adjusted gross margin percentage of our same-store portfolio were 70.1% for the quarter ended September 30, 2023, 410 basis points below that of the average of the U.S. Listed Self Storage REITs, while the adjusted gross margin percentage for our non-stabilized wholly owned portfolio were 60.8%. Our ability to drive rental rate growth and the maturation of our in-place portfolio (both same-store and non-same-store) will lead to expanded adjusted gross margin percentage at the property level. We have also focused on reducing operating expenses and are utilizing renewable energy to reduce our utility costs. As of September 30, 2023, we have installed solar panels on 47 properties in our owned portfolio and have additional projects underway at 14 of our facilities. Those projects are expected to yield a weighted average return in the mid-teens on our investment. Furthermore, the sale of ancillary products and services that are complementary to our customers’ use of our self storage facilities, including, but not limited to, tenant protection programs, locks, boxes and other packing supplies present an additional area of potential organic net operating income growth. The combination of rental rate growth, general maturation, expense control and ancillary sales should enable both our same-store and non-same-store portfolios to achieve higher adjusted gross margin percentage than they are today.

Maximize Property Level Cash Flow at Non-Stabilized Stores. As of September 30, 2023, approximately 13.2% of our wholly owned stores, as measured by net rentable square feet, were characterized as non-stabilized, or not economically stabilized. This exposure includes certificate of occupancy and lease-up stores, which are generally dilutive to cash flow in the near-term but generally have higher longer-term yield potential than investments in physically stabilized self storage facilities. During the quarter ended September 30, 2023, the average RentPOF for what we consider our non-stabilized wholly owned portfolio was $17.98 as compared to $20.37 for our same-store portfolio. Likewise, the physical occupancy of our non-stabilized wholly owned portfolio was 90.8%, or 200 basis points below that of our same-store portfolio. Further, our adjusted gross margin percentage were 60.8% for our non-stabilized wholly owned portfolio, 9.2% below that of our same-store portfolio and 13.4% below the average of the U.S. Listed Self Storage REITs’ same-store portfolios for the quarter ended September 30, 2023. We believe that by leveraging our operating platform and experience, this non-stabilized portfolio has the potential to produce higher revenue and net operating income growth than our same-store portfolio until economic stabilization.

8

Table of Contents

The following table breaks out our owned operating stores as of September 30, 2023, by stabilized and non-stabilized classifications:

| RentPOF for the Three Months Ended September 30,(1) |

Ending Occupancy as of September 30, |

|||||||||||||||||||||||||||

| Owned Operating Stores |

# of Stores |

Net Rentable Sq. Ft. |

Units | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||

| Same-Store Wholly Owned |

137 | 10,384,940 | 89,270 | $ | 20.37 | $ | 19.39 | 92.8 | % | 94.5 | % | |||||||||||||||||

| Non Same-Store Wholly Owned |

||||||||||||||||||||||||||||

| Historical SMST REIT |

6 | 538,200 | 5,440 | 16.57 | NM | 87.5 | % | NM | ||||||||||||||||||||

| Historical SSGT II Non-Stabilized(3) |

10 | 889,945 | 8,170 | 18.80 | NM | 92.8 | % | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Non Same-Store Wholly Owned |

16 | 1,428,145 | 13,610 | 17.98 | NM | 90.8 | % | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Wholly Owned Operating Stores |

153 | 11,813,085 | 102,880 | 20.08 | NM | 92.7 | % | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Joint Venture Operating Stores |

8 | 723,200 | 7,500 | $ | 17.75 | NM | 84.1 | % | NM | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total All Owned Operating Stores |

161 | 12,536,285 | 110,380 | |||||||||||||||||||||||||

NM: Not meaningful comparison

| (1) | RentPOF defined as annualized rental revenue net of discounts and concessions, excluding late fees, administrative fees and parking income, divided by occupied square feet of storage. |

| (2) | Represents non-stabilized stores that were owned by SmartStop Self Storage REIT, Inc. prior to the merger with Strategic Storage Trust IV, Inc. that closed in March 2021, as well as stores that were acquired in 2021. |

| (3) | Represents stores that were previously owned by Strategic Storage Growth Trust II, Inc. that were acquired by SmartStop Self Storage REIT, Inc. as part of the merger that closed in June 2022. |

External Growth Strategies:

Our portfolio growth will primarily be driven through the acquisition of stabilized facilities, but we also intend to opportunistically acquire facilities in lease up, facilities that have just received a certificate of occupancy, facilities in need of renovation, re-development or expansion and ground up development. As a publicly listed REIT, we believe we will have access to a more favorable cost of capital and broader capital markets solutions to help us execute on our external growth strategy. To date, we have not regularly utilized OP units as consideration for acquisitions; however, we may do so as a listed REIT using an umbrella partnership, or UPREIT, structure.

Our relative size is a key differentiator between us and the U.S. Listed Self Storage REITs. Our portfolio consists of 161 owned self storage facilities, encompassing 12.5 million net rentable square feet. By comparison, the average owned portfolio of the U.S. Listed Self Storage REITs is approximately 1,800 facilities, encompassing over 129 million net rentable square feet as of September 30, 2023. We believe this dynamic will allow us to be more nimble and selective in our external growth strategy, while capitalizing on economies of scale as we grow. We intend to execute our external growth strategy in our existing markets and target markets that have comparably strong demographic and competitive trends.

| • | On-balance Sheet Acquisitions. We expect to acquire stabilized and non-stabilized properties on-balance sheet in the United States and Canada in an accretive manner to FFO, as adjusted. In Canada specifically, we believe our scale and experience competitively positions us to capitalize on acquisition opportunities in a highly fragmented market that has relatively less sophisticated and smaller operators than are in the United States. |

| • | Canadian Platform Provides Growth Opportunities with Less Institutional Competition. According to Colliers, we are currently the fifth largest self storage operator in Canada based on rentable square footage |

9

Table of Contents

| and believe we will be the only U.S. Listed Self Storage REIT with an owned portfolio and operating platform in Canada. The percentage of self storage assets operated by sophisticated institutions is significantly lower in Canada than in the United States. This dynamic allows for a relatively lower level of operating competition while offering a range of acquisition opportunities. Our portfolio in Canada accounts for 14.6% of our total owned portfolio as measured by rentable square feet and is exclusively in the GTA. We intend to target investments in other CMAs in Canada, including, but not limited to, Vancouver, Montreal, Edmonton, Calgary, and Ottawa. As of September 30, 2023, we have a 50% interest in a joint venture, along with SmartCentres, which owns a property in the Vancouver CMA that is currently leased pursuant to a single tenant industrial lease. The joint venture intends to develop this property into a self storage facility in the future. Also, as of September 30, 2023, the Managed REITs own an operating property in Vancouver, an operating property in Edmonton, and one property in development in Montreal. |

| • | Joint Ventures. We have a joint venture with SmartCentres, which owns a diversified portfolio of real estate in Canada and is one of the largest TSX-listed REITs. The 50/50 joint venture affords each party a right of first offer to develop self storage facilities in certain CMAs in Canada. Through this joint venture, we have a development pipeline of approximately 1.3 million net rentable square feet, representing approximately 13,900 units across multiple CMAs in Canada. We expect to continue to utilize the joint venture to develop and redevelop in Canada. |

| • | Strategic Combinations of Affiliated Funds. With our management of the Managed REITs and our demonstrated track record of acquiring or merging with previous Managed REITs, we believe our Managed REIT platform provides a potential future pipeline of relatively large portfolio acquisitions for us, serving to enhance our external growth and cash flow to stockholders. |

| • | Redevelopment. Our team of seasoned professionals identifies opportunities to unlock additional value at our properties through selectively redeveloping certain properties. We plan to actively reinvest in our portfolio going forward. |

| • | Third-Party Management Platform. According to Colliers, the top ten operators in Canada, as determined by square footage, account for only 20% of all self storage facilities across the country. The percentage of self storage assets operated by owners with only one or two stores in Canada is estimated at approximately 70% according to Colliers. We intend to capitalize on the nascent institutional competitive landscape by establishing a market leading third-party management platform in Canada, in which we manage and operate self storage properties owned by third parties in exchange for fees. While the U.S. Listed Self Storage REITs have a strong presence in this business in the United States, we believe there are few operators in Canada that are capable of professional third-party management. We believe we can establish our third-party management platform with nominal incremental investment. |

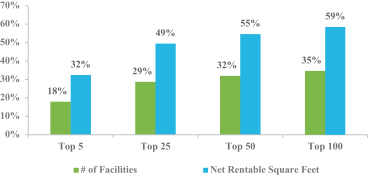

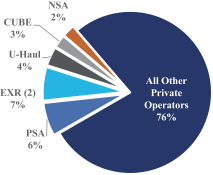

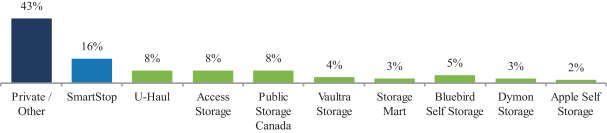

Self Storage Industry Overview and Market Opportunity

The self storage industry is highly fragmented, with owners and operators ranging from individual property owners to blue chip institutional investors and large, publicly traded REITs. According to the 2023 Self-Storage Almanac published by Mini-Storage Messenger and MiniCo Publishing, or the 2023 Self-Storage Almanac, there are approximately 51,200 primary self storage facilities in the United States representing a total of 2.0 billion rentable square feet. The largest 100 operators manage approximately 59% of net rentable square footage, but only 35% of all U.S.-based self storage properties. The U.S. Listed Self Storage REITs and AMERCO (NASDAQ: UHAL) operate approximately 21.9% of all U.S.-based self storage properties. Similar to the U.S. self storage market, the self storage market in Canada exhibits highly fragmented ownership, albeit to a much greater extent. Colliers estimates that approximately 70% of all self storage facilities in Canada are owned by individuals with only one or two stores. The top 10 operators in Canada, as determined by square footage,

10

Table of Contents

account for only 20% of all self storage facilities across the country. With the majority of the existing supply operated locally by non-institutional groups in the United States and Canada, there is a significant market opportunity to acquire existing facilities and increase revenue and profitability through professional management, technological platforms and physical expansion projects.

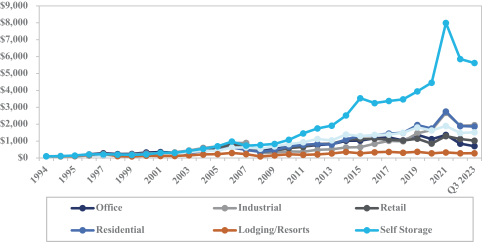

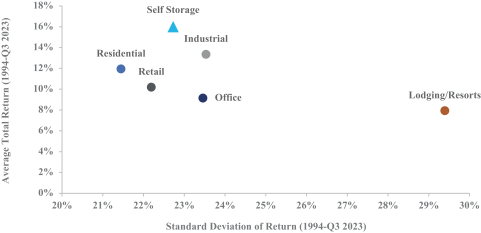

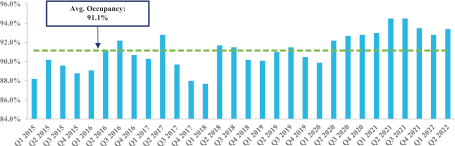

The combination of attractive fundamentals and superior operating performance has driven self storage to outperform other real estate sectors in both the private and public markets. According to NAREIT, the self storage sector has been one of the best performing REIT sectors since 1994. While past performance is not indicative of future results, a $100 investment in the self storage sector in 1994 would have yielded $6,941 through 2023, an approximately 6,900% total return. The second best performing NAREIT real estate sub-sector, residential, would have yielded a value of $2,036 over the same period, while a $100 investment in lodging / resorts would have only yielded $345. Furthermore, the self storage sector was the best performing real estate sector in 2021 and was the fifth best performing real estate sector in 2023.

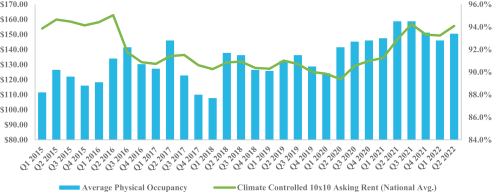

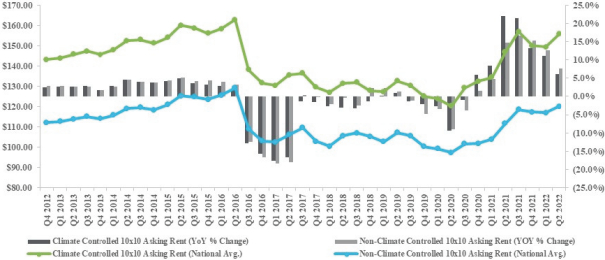

More recently, strength in housing markets and the ability for employees to work remotely has fueled demand for storage, leading to a record year of operating performance across the industry in 2021 and 2022. High occupancy levels, supply constraints and inelasticity in pricing, coupled with underlining demand drivers, position the sector for continued rent growth and accelerating profitability. These drivers allowed the self storage sector to achieve outsized rent growth relative to other REIT sectors in 2021 and 2022. While the work from home environment remains elevated over pre-COVID-19 pandemic levels, this trend began to wane in 2023, which we believe has led to elevated move-outs. As a result, occupancy, same-store growth and overall results have been normalizing. Further, the broader economy has been experiencing elevated levels of inflation, higher interest rates, tightening monetary policies and a slowdown in home price appreciation and home sales. This could result in less discretionary spending, weakening consumer balance sheets and reduced demand for self storage. Additionally, a prolonged period of elevated inflation and/or higher interest rates could result in a further contraction of self storage demand. However, demand for the self storage sector is dynamic, with drivers that function in a multitude of economic environments, both cyclically and counter-cyclically. Demand for self storage tends to be needs-based, with numerous factors that lead customers to renting and maintaining storage units. We believe the nimble rate and leasing strategies that sophisticated operators have executed on, coupled with the improving supply environment, should position self storage favorably to achieve incremental growth in a variety of economic environments, including an inflationary environment.

Our Structure

Share Classes and Conversion

Our charter authorizes us to issue up to 900,000,000 shares of stock, of which 700,000,000 shares are designated as common stock at $0.001 par value per share and 200,000,000 shares are designated as preferred stock at $0.001 par value per share. Of the 700,000,000 shares of common stock authorized, shares are classified as Class A common stock, shares are classified as Class T common stock, and shares are unclassified common stock.

Upon the six-month anniversary of the listing of shares of our common stock for trading on a national securities exchange or such earlier date as approved by our Board, each share of Class A common stock and Class T common stock will automatically, and without any stockholder action, convert into a number of shares of our common stock equal to a fraction, the numerator of which is the net asset value of the Company allocable to the shares of Class A common stock and shares of Class T common stock, as applicable, and the denominator of which is the net asset value of the Company allocable to the shares of our common stock, or the Conversion.

11

Table of Contents

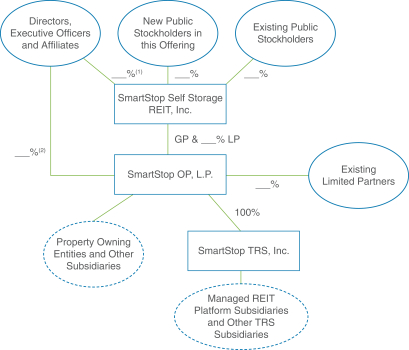

Our Operating Partnership

Substantially all of our business is conducted through our operating partnership. We will contribute the net proceeds received by us from this offering to our operating partnership in exchange for OP units. Our interest in our operating partnership generally entitles us to share in cash distributions from, and in the profits and losses of, our operating partnership in proportion to our percentage ownership. As the sole general partner of our operating partnership, we have the exclusive power to manage and conduct the business of our operating partnership. We conduct certain activities through SmartStop TRS, Inc., or other taxable REIT subsidiaries, which are directly or indirectly wholly owned subsidiaries of our operating partnership. After giving effect to this offering, we would own or control % of the OP units and our executive officers would own or control % of the OP units, each as of , 2024.

Beginning on and after the date that is one year after the issuance of OP units to a limited partner, such limited partner has the right to require the operating partnership to redeem all or part of such OP units for cash, based upon the value of an equivalent number of shares of our common stock at the time of the redemption, or, at our election, shares of our common stock on a one-for-one basis, subject to certain adjustments and the restrictions on ownership and transfer of our stock set forth in our charter and described under the section entitled “Description of Capital Stock—Restrictions on Ownership and Transfer.” See “Our Operating Partnership Agreement” for more information.

Organizational Chart

The following chart sets forth information about our Company, the operating partnership and certain related parties upon completion of this offering. Ownership percentages below assume that the underwriters’ option to purchase additional shares of our common stock is not exercised. This chart is for illustrative purposes only and does not represent all legal entities affiliated with the entities depicted.

| (1) | Includes (i) shares of unvested time-based restricted stock and (ii) shares of Class A common stock owned by Strategic 1031, LLC, a subsidiary of SAM, which shares are indirectly owned and controlled by Mr. Schwartz. Excludes (i) shares of stock underlying unvested performance-based restricted stock |

12

Table of Contents

| (such number of shares assumes that we issue shares of common stock underlying such unvested performance-based awards at target levels for the performance conditions that have not yet been achieved; to the extent that performance conditions are higher or lower than target levels, the actual number of shares issued could be more or less than the amount reflected above) and (ii) shares of our common stock available for future issuance under our 2022 Long-Term Incentive Plan (the “Incentive Plan”). |

| (2) | Includes (i) unvested time-based LTIP units, (ii) vested LTIP units and (iii) OP units and Class A-1 Units owned by subsidiaries of SAM, with certain units owned indirectly and controlled by Mr. Schwartz and other units owned by current and former employees and other current and former affiliates of SAM. Excludes unvested performance-based LTIP units (such number of LTIP units assumes that such unvested performance-based awards vest at maximum levels for the performance conditions that have not yet been achieved; to the extent that performance does not meet maximum levels, the actual number of OP units which vest under those awards could be less than the amount reflected above). OP units are redeemable for cash or, at our election, shares of our common stock on a one-for-one basis, subject to adjustment in certain circumstances. For purposes of the foregoing, LTIP units are long-term equity incentive awards in the form of limited partnership units of the operating partnership that vest over time or based on performance. Upon the occurrence of certain events described in the operating partnership agreement, LTIP units may convert into an equal number of OP units. |

Our Tax Status

We elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2014. To maintain REIT status, we must meet a number of organizational and operational requirements, including a requirement that we make distributions each taxable year equal to at least 90% of our REIT taxable income (excluding capital gains and computed without regard to the dividends paid deduction). See “Federal Income Tax Considerations.”

Distribution Policy

We intend to make distributions to holders of shares of our common stock offered in this offering, when, as and if authorized by our Board out of legally available funds, based on a distribution rate of $ per share of common stock beginning the first full month following this offering. On an annualized basis, this would be $ per share of common stock, or an annualized distribution rate of % based on the public offering price of $ per share, which is the midpoint of the price range set forth on the front cover of this prospectus. We estimate that this annual distribution rate will represent approximately % of our estimated cash available for distribution to stockholders for the 12 months ending , 2024, assuming that the underwriters do not exercise their option to purchase up to an additional shares to cover overallotments, if any. We do not intend to reduce the annualized distribution per share of common stock if the underwriters exercise their option to purchase additional shares.

We cannot assure you that our estimated distributions will be made or sustained or that our Board will not change our distribution policy in the future. Any distributions will be at the sole discretion of our Board, and their form, timing and amount, if any, will depend upon a number of factors, including our actual and projected results of operations, FFO, FFO, as adjusted, liquidity, cash flows and financial condition, the revenue we actually receive from our properties, our operating expenses, our debt service requirements, our capital expenditures, prohibitions and other limitations under our financing arrangements, our REIT taxable income, the annual REIT distribution requirements, applicable law, including restrictions on distributions under Maryland law, and such other factors as our Board deems relevant.

Restrictions on Ownership and Transfer of Shares of our Common Stock

We may prohibit certain acquisitions and transfers of shares so as to ensure our continued qualification as a REIT under the Code. However, we cannot assure stockholders that this prohibition will be effective. Because we

13

Table of Contents

believe it is essential for us to qualify and continue to qualify as a REIT, our charter provides (subject to certain exceptions) that no stockholder may own, or be deemed to own by virtue of the attribution provisions of the Code, more than 9.8% in value of the outstanding shares of our stock or more than 9.8% of the number or value (whichever is more restrictive) of the outstanding shares of our common stock.

Our Board, in its sole discretion, may waive this ownership limit (prospectively or retroactively) if evidence satisfactory to our Board, including certain representations and undertakings required by our charter, is presented that such ownership will not then or in the future jeopardize our status as a REIT. Also, these restrictions on transferability and ownership will not apply if our Board determine that it is no longer in our best interests to continue to qualify as a REIT or that compliance is no longer required in order for us to qualify as a REIT. See “Description of Capital Stock—Restrictions on Ownership and Transfer.”

Corporate Information

SmartStop was formed as a Maryland corporation in January 2013. Our principal executive office is located at 10 Terrace Rd, Ladera Ranch, California 92694. Our telephone number is (866) 418-5144. We maintain a website at www.smartstopselfstorage.com. Information contained on, or accessible through, our website is not incorporated by reference into and does not constitute a part of this prospectus.

Summary Risk Factors

Investing in our common stock involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading “Risk Factors” included elsewhere in this prospectus may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or party of our strategy. The following list of risks and uncertainties is only a summary of some of the most important risks related to SmartStop, its operations, and the offering and is not intended to be exhaustive. This risk factor summary should be read together with the more detailed discussion of risks and uncertainties set forth under “Risk Factors.”

Risks Related to an Investment in SmartStop Self Storage REIT, Inc.

| • | Our future results may suffer as a result of the effect of recent affiliated mergers, acquisitions and other strategic transactions. |

| • | Certain of our officers and key personnel will face competing demands relating to their time and will face conflicts of interest related to the positions they hold with affiliated entities, which could cause our business to suffer. |

| • | Revenue and earnings from the Managed REIT platform are uncertain. |

Risks Related to the Self Storage Industry

| • | Because we are focused on the self storage industry, our rental revenues will be significantly influenced by demand for self storage space generally, and a decrease in such demand would likely have a greater adverse effect on our rental revenues than if we owned a more diversified real estate portfolio. |

| • | We may be unable to promptly re-let units within our facilities at satisfactory rental rates. |

Risks Related to Investments in Real Estate

| • | A high concentration of our properties in a particular geographic area would magnify the effects of downturns in that geographic area. |

14

Table of Contents

| • | Our real estate assets may decline in value and be subject to significant impairment losses, which may reduce our net income. |

| • | Our inability to sell a property when we desire to do so could adversely impact our business and financial condition, and our inability to sell our properties at a price equal to, or greater than, the price for which we purchased such properties may lead to a decrease in the value of our assets. |

| • | Our joint venture investments could be adversely affected by our lack of sole decision-making authority. |

| • | Property taxes and insurance premiums may increase, which would adversely affect our net operating income and cash available for distributions. |

| • | Changes in the Canadian Dollar/USD exchange rate could have a material adverse effect on our operating results and value of the investment of our stockholders. |

Risks Associated with Debt Financing

| • | We have incurred and intend to continue to incur, mortgage indebtedness and other borrowings, which may increase our business risks. |

| • | We are party to loans that are subject to variable interest rates. The rise in overall interest rates has increased our variable rate borrowing costs and our overall cost of capital, resulting in an increase in net interest expense, which may limit our ability to make accretive acquisitions of self storage properties, negatively impact our profitability, and affect our ability to comply with certain financial covenants. |

| • | If we or the other parties to our loans or secured notes payable, as applicable, breach covenants thereunder, such loan or loans or secured notes payable could be deemed in default, which could accelerate our repayment date and materially adversely affect the value of our stockholders’ investment in us. |

Federal Income Tax Risks

| • | Failure to continue to qualify as a REIT would adversely affect our operations and our ability to continue to pay distributions at our current level as we will incur additional tax liabilities. |

| • | If any of our partnerships fails to maintain its status as a partnership for federal income tax purposes, its income would be subject to taxation and our REIT status would be terminated. |

Risks Related to this Offering

| • | The estimated net asset value per share, or Estimated Per Share NAV, of our common stock is based on a number of assumptions that may not be accurate or complete and may not reflect the price at which shares of our common stock will trade when listed on a national securities exchange or the price a third party would pay to acquire us. |

| • | The market price and trading volume of shares of our common stock may be volatile. |

| • | Because we have a large number of stockholders and shares of our common stock have not been listed on a national securities exchange prior to this offering, there may be significant pent-up demand to sell shares of our common stock. Significant sales of shares of our common stock, or the perception that significant sales of such shares could occur, may cause the price of shares of our common stock to decline significantly. |

| • | We may be unable to raise additional capital needed to grow our business. |

| • | We have no operating history as a publicly traded company and may not be able to successfully operate as a publicly traded company. |

15

Table of Contents

THE OFFERING

| Common stock offered by us |

shares (or shares if the underwriters exercise in full their option to purchase additional shares) |

| Total common stock (including Class A common stock and Class T common stock) to be outstanding upon completion of this offering(1)(2) |

shares (or shares if the underwriters exercise in full their option to purchase additional shares) |

| Common stock(1) |

shares |

| Class A common stock(2) |

shares |

| Class T common stock(2) |

shares |

| Total common stock (including Class A common stock and Class T common stock)(1)(2) and OP units(3) to be outstanding upon completion of this offering |

shares and OP units (or shares and OP units if the underwriters exercise in full their option to purchase additional shares) |

| Conversion of Class A common stock and Class T common stock |

Upon the six-month anniversary of the listing of shares of our common stock for trading on a national securities exchange or such earlier date as approved by our Board, each share of Class A common stock and Class T common stock will automatically, and without any stockholder action, convert into a number of shares of our common stock equal to a fraction, the numerator of which is the net asset value of the Company allocable to the shares of Class A common stock and shares of Class T common stock, as applicable, and the denominator of which is the net asset value of the Company allocable to the shares of our common stock. |

| Distributions |

We intend to make regular distributions to holders of shares of our common stock. Holders of our common stock, our Class A common stock and our Class T common stock will share equally in any dividends authorized by our Board and declared by us. |

| Any distributions we make will be at the discretion of our Board. We cannot assure you that we will make any distributions to our stockholders. For more information, see “Distribution Policy.” |

| Voting rights |

Each share of our common stock, Class A common stock and Class T common stock will entitle its holder to one vote per share. |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $ million, or approximately $ million if the |

16

Table of Contents

| underwriters’ option to purchase additional shares is exercised in full, after deducting the underwriting discount and estimated expenses of this offering payable by us. |

| We will use the net proceeds from the offering to redeem 100% of our issued and outstanding Series A Preferred Stock, pay down existing debt under our revolving credit facility, or our Credit Facility, fund external growth with property acquisitions, and fund other general corporate uses. See “Use of Proceeds” and “Underwriting – Other Relationships.” |

| Proposed ticker symbol |

“SMST” |

| Risk factors |

An investment in shares of our common stock involves various risks. Before purchasing shares of our common stock, you should carefully consider the risk factors set forth under the heading “Risk Factors” beginning on page 19 of this prospectus together with all of the other information included in this prospectus. |

| Restrictions on ownership and transfer |

To help ensure our continued qualification as a REIT under the Code, our charter provides (subject to certain exceptions) that no stockholder may own, or be deemed to own by virtue of the attribution provisions of the Code, more than 9.8% in value of the outstanding shares of our stock or more than 9.8% of the number or value (whichever is more restrictive) of the outstanding shares of our common stock. |

| (1) | As of , 2024. Includes shares of unvested time-based restricted stock. Excludes (i) up to shares of our common stock that may be issued by us upon exercise of the underwriters’ option to purchase additional shares, (ii) shares of our common stock (or LTIP units) available for future issuance under the Incentive Plan, and (iii) shares of common stock that may be acquired by redeeming OP units. |

| (2) | As of , 2024. Includes shares of unvested time-based Class A restricted stock. Excludes shares of Class A common stock underlying unvested performance-based restricted stock (such number of shares assumes that we issue shares of common stock underlying such unvested performance-based awards at target levels for the performance conditions that have not yet been achieved; to the extent that performance conditions are higher or lower than target levels, the actual number of shares issued could be more or less than the amount reflected above). |

| (3) | As of , 2024. Includes (i) unvested time-based LTIP units and (ii) vested LTIP units. Excludes (x) OP units held directly or indirectly by us and (y) unvested performance-based LTIP units (such number of LTIP units assumes that such unvested performance-based awards vest at maximum levels for the performance and market conditions that have not yet been achieved; to the extent that performance or market conditions do not meet maximum levels, the actual number of OP units which vest under those awards could be less than the amount reflected above). OP units are redeemable for cash or, at our election, shares of our common stock on a one-for-one basis, subject to adjustment in certain circumstances. For purposes of the foregoing, LTIP units are long-term equity incentive awards in the form of limited partnership units of the operating partnership that vest over time or based on performance. Upon the occurrence of certain events described in the operating partnership agreement, LTIP units may convert into an equal number of OP units. |

17

Table of Contents

SUMMARY SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

Our summary selected consolidated financial and other data as of and for the nine months ended September 30, 2023 and 2022 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus, and our summary selected consolidated financial and other data as of and for the years ended December 31, 2022, 2021 and 2020 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our consolidated balance sheet data as of December 31, 2020 has been derived from our consolidated financial statements not included in this prospectus. Our summary selected consolidated financial and other data set forth below and elsewhere in this prospectus are not necessarily indicative of our future performance.