prgo-20211002000158536412/312021Q3FALSEhttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtNoncurrent00015853642021-01-012021-10-02xbrli:shares00015853642021-11-05iso4217:USD00015853642021-07-042021-10-0200015853642020-06-282020-09-2600015853642020-01-012020-09-26iso4217:USDxbrli:shares00015853642021-10-0200015853642020-12-31iso4217:EURxbrli:shares0001585364us-gaap:CommonStockMember2019-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001585364us-gaap:RetainedEarningsMember2019-12-3100015853642019-12-310001585364us-gaap:RetainedEarningsMember2020-01-012020-03-2800015853642020-01-012020-03-280001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-280001585364us-gaap:CommonStockMember2020-01-012020-03-280001585364us-gaap:CommonStockMember2020-03-280001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-280001585364us-gaap:RetainedEarningsMember2020-03-2800015853642020-03-280001585364us-gaap:RetainedEarningsMember2020-03-292020-06-2700015853642020-03-292020-06-270001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-292020-06-270001585364us-gaap:CommonStockMember2020-03-292020-06-270001585364us-gaap:CommonStockMember2020-06-270001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-270001585364us-gaap:RetainedEarningsMember2020-06-2700015853642020-06-270001585364us-gaap:RetainedEarningsMember2020-06-282020-09-260001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-282020-09-260001585364us-gaap:CommonStockMember2020-06-282020-09-260001585364us-gaap:CommonStockMember2020-09-260001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-260001585364us-gaap:RetainedEarningsMember2020-09-2600015853642020-09-260001585364us-gaap:CommonStockMember2020-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001585364us-gaap:RetainedEarningsMember2020-12-310001585364us-gaap:RetainedEarningsMember2021-01-012021-04-0300015853642021-01-012021-04-030001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-04-030001585364us-gaap:CommonStockMember2021-01-012021-04-030001585364us-gaap:CommonStockMember2021-04-030001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-030001585364us-gaap:RetainedEarningsMember2021-04-0300015853642021-04-030001585364us-gaap:RetainedEarningsMember2021-04-042021-07-0300015853642021-04-042021-07-030001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-042021-07-030001585364us-gaap:CommonStockMember2021-04-042021-07-030001585364us-gaap:CommonStockMember2021-07-030001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-030001585364us-gaap:RetainedEarningsMember2021-07-0300015853642021-07-030001585364us-gaap:RetainedEarningsMember2021-07-042021-10-020001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-042021-10-020001585364us-gaap:CommonStockMember2021-07-042021-10-020001585364us-gaap:CommonStockMember2021-10-020001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-020001585364us-gaap:RetainedEarningsMember2021-10-020001585364country:US2021-07-042021-10-020001585364country:US2020-06-282020-09-260001585364country:US2021-01-012021-10-020001585364country:US2020-01-012020-09-260001585364srt:EuropeMember2021-07-042021-10-020001585364srt:EuropeMember2020-06-282020-09-260001585364srt:EuropeMember2021-01-012021-10-020001585364srt:EuropeMember2020-01-012020-09-260001585364prgo:OtherGeographicalAreasMember2021-07-042021-10-020001585364prgo:OtherGeographicalAreasMember2020-06-282020-09-260001585364prgo:OtherGeographicalAreasMember2021-01-012021-10-020001585364prgo:OtherGeographicalAreasMember2020-01-012020-09-260001585364country:IE2021-07-042021-10-020001585364country:IE2021-01-012021-10-020001585364country:IE2020-06-282020-09-260001585364country:IE2020-01-012020-09-260001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:PainandSleepaidsMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:PainandSleepaidsMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:PainandSleepaidsMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:PainandSleepaidsMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareAmericasMemberprgo:OralSelfcareMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareAmericasMemberprgo:OralSelfcareMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareAmericasMemberprgo:OralSelfcareMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareAmericasMemberprgo:OralSelfcareMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareAmericasMemberprgo:HealthyLifestyleMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareAmericasMemberprgo:HealthyLifestyleMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareAmericasMemberprgo:HealthyLifestyleMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareAmericasMemberprgo:HealthyLifestyleMember2020-01-012020-09-260001585364prgo:SkincareandPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:SkincareandPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:SkincareandPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:SkincareandPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:VitaminsMineralsandSupplementsMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:VitaminsMineralsandSupplementsMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:VitaminsMineralsandSupplementsMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:VitaminsMineralsandSupplementsMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:SkincareandPersonalHygieneMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:SkincareandPersonalHygieneMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:SkincareandPersonalHygieneMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:SkincareandPersonalHygieneMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:UpperRespiratoryMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:UpperRespiratoryMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:UpperRespiratoryMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:UpperRespiratoryMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:VitaminsMineralsandSupplementsMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:VitaminsMineralsandSupplementsMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:VitaminsMineralsandSupplementsMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:VitaminsMineralsandSupplementsMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:PainandSleepaidsMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:PainandSleepaidsMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:PainandSleepaidsMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:PainandSleepaidsMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:HealthyLifestyleMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:HealthyLifestyleMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:HealthyLifestyleMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:HealthyLifestyleMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:OralSelfcareMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:OralSelfcareMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:OralSelfcareMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:OralSelfcareMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:DigestiveHealthMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:DigestiveHealthMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:DigestiveHealthMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:DigestiveHealthMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:OtherCSCIMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:OtherCSCIMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMemberprgo:OtherCSCIMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMemberprgo:OtherCSCIMember2020-01-012020-09-260001585364prgo:ConsumerSelfCareInternationalMember2021-07-042021-10-020001585364prgo:ConsumerSelfCareInternationalMember2020-06-282020-09-260001585364prgo:ConsumerSelfCareInternationalMember2021-01-012021-10-020001585364prgo:ConsumerSelfCareInternationalMember2020-01-012020-09-260001585364prgo:ContractManufacturingMember2021-07-042021-10-020001585364prgo:ContractManufacturingMember2021-01-012021-10-020001585364prgo:ContractManufacturingMember2020-06-282020-09-260001585364prgo:ContractManufacturingMember2020-01-012020-09-26iso4217:EUR0001585364prgo:HRAPharmaMembersrt:ScenarioForecastMember2022-01-012022-07-02prgo:brand0001585364prgo:SanofiBrandsMember2020-10-302020-10-300001585364prgo:SanofiBrandsMemberprgo:BrandMember2020-10-302020-10-300001585364prgo:OralCareAssetsofHighRidgeBrandsMember2020-04-012020-04-010001585364prgo:OralCareAssetsofHighRidgeBrandsMember2020-12-312020-12-310001585364prgo:OralCareAssetsofHighRidgeBrandsMember2020-12-310001585364prgo:OralCareAssetsofHighRidgeBrandsMemberprgo:DistributionandLicenseAgreementsandSupplyAgreementsMember2020-12-310001585364prgo:OralCareAssetsofHighRidgeBrandsMemberus-gaap:TechnologyBasedIntangibleAssetsMember2020-12-310001585364us-gaap:CustomerRelatedIntangibleAssetsMemberprgo:OralCareAssetsofHighRidgeBrandsMember2020-12-310001585364prgo:OralCareAssetsofHighRidgeBrandsMemberprgo:TrademarksTradeNamesandBrandsMember2020-12-310001585364prgo:DexsilMemberprgo:BrandMember2020-02-132020-02-130001585364prgo:SteripodMember2020-01-032020-01-030001585364prgo:SteripodMemberprgo:BrandMember2020-01-032020-01-03iso4217:GBP0001585364prgo:RosemontPharmaceuticalsMember2020-06-192020-06-190001585364prgo:RosemontPharmaceuticalsMember2020-01-012020-06-270001585364prgo:RosemontPharmaceuticalsMember2020-03-292020-06-270001585364prgo:RosemontPharmaceuticalsMember2020-06-282020-09-260001585364prgo:RosemontPharmaceuticalsMember2020-09-272020-12-310001585364prgo:ConsumerSelfCareAmericasMember2020-12-310001585364prgo:ConsumerSelfCareAmericasMember2021-10-020001585364prgo:ConsumerSelfCareInternationalMember2020-12-310001585364prgo:ConsumerSelfCareInternationalMember2021-10-020001585364prgo:ConsumerSelfCareAmericasMember2021-07-030001585364prgo:TrademarksTradeNamesandBrandsMember2021-10-020001585364prgo:TrademarksTradeNamesandBrandsMember2020-12-310001585364us-gaap:InProcessResearchAndDevelopmentMember2021-10-020001585364us-gaap:InProcessResearchAndDevelopmentMember2020-12-310001585364us-gaap:LicensingAgreementsMember2021-10-020001585364us-gaap:LicensingAgreementsMember2020-12-310001585364us-gaap:DevelopedTechnologyRightsMember2021-10-020001585364us-gaap:DevelopedTechnologyRightsMember2020-12-310001585364us-gaap:CustomerRelationshipsMember2021-10-020001585364us-gaap:CustomerRelationshipsMember2020-12-310001585364us-gaap:TrademarksAndTradeNamesMember2021-10-020001585364us-gaap:TrademarksAndTradeNamesMember2020-12-310001585364us-gaap:NoncompeteAgreementsMember2021-10-020001585364us-gaap:NoncompeteAgreementsMember2020-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-10-020001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-10-020001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-10-020001585364us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-10-020001585364us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel1Member2021-10-020001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2021-10-020001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2021-10-020001585364us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-12-310001585364prgo:MexicoAndBrazilBasedOverTheCounterBusinessesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-07-042021-10-020001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberprgo:RoyaltyPharmaContingentMilestonePaymentsMember2020-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberprgo:RoyaltyPharmaContingentMilestonePaymentsMember2020-06-270001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberprgo:RoyaltyPharmaContingentMilestonePaymentsMember2019-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberprgo:RoyaltyPharmaContingentMilestonePaymentsMember2020-06-282020-09-260001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberprgo:RoyaltyPharmaContingentMilestonePaymentsMember2020-01-012020-09-260001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberprgo:RoyaltyPharmaContingentMilestonePaymentsMember2020-09-26xbrli:pure0001585364prgo:RoyaltyPharmaMember2020-06-282020-09-260001585364us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberprgo:PublicBondsandPrivatePlacementMember2021-10-020001585364us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberprgo:PublicBondsandPrivatePlacementMember2020-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:PublicBondsandPrivatePlacementMember2021-10-020001585364us-gaap:FairValueInputsLevel1Memberprgo:PublicBondsandPrivatePlacementMember2020-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberprgo:PrivatePlacementNoteMember2021-10-020001585364us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberprgo:PrivatePlacementNoteMember2020-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:PrivatePlacementNoteMember2021-10-020001585364us-gaap:FairValueInputsLevel2Memberprgo:PrivatePlacementNoteMember2020-12-310001585364us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-10-020001585364us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001585364us-gaap:OtherNoncurrentAssetsMember2021-10-020001585364us-gaap:OtherNoncurrentAssetsMember2020-12-310001585364prgo:OtherExpenseIncomeNetMember2021-07-042021-10-020001585364prgo:OtherExpenseIncomeNetMember2020-06-282020-09-260001585364prgo:OtherExpenseIncomeNetMember2021-01-012021-10-020001585364prgo:OtherExpenseIncomeNetMember2020-01-012020-09-260001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-07-060001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-07-062021-07-0600015853642021-07-062021-07-060001585364us-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-10-020001585364us-gaap:OtherOperatingIncomeExpenseMember2021-07-042021-10-020001585364us-gaap:SalesMember2021-07-042021-10-020001585364us-gaap:SalesMember2021-01-012021-10-020001585364prgo:RXBusinessMember2021-01-012021-10-020001585364prgo:RXBusinessMember2021-07-042021-10-020001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-01-012021-10-020001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-07-042021-10-020001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2020-06-282020-09-260001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2020-01-012020-09-2600015853642015-05-152015-05-150001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2020-12-312020-12-310001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-03-082021-03-080001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2020-12-310001585364prgo:MexicoAndBrazilBasedOverTheCounterBusinessesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-07-032021-07-030001585364prgo:MexicoAndBrazilBasedOverTheCounterBusinessesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-10-022021-10-020001585364prgo:MexicoAndBrazilBasedOverTheCounterBusinessesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberprgo:CurrentAssetsHeldForSaleMember2021-10-020001585364prgo:CurrentLiabilitiesHeldForSaleMemberprgo:MexicoAndBrazilBasedOverTheCounterBusinessesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-10-02prgo:derivative0001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2021-09-300001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-07-042021-10-020001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2021-10-020001585364us-gaap:CurrencySwapMember2021-10-020001585364us-gaap:ForeignExchangeForwardMember2020-06-190001585364currency:EURus-gaap:ForeignExchangeForwardMember2021-10-020001585364currency:EURus-gaap:ForeignExchangeForwardMember2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:GBP2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:GBP2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:ILS2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:ILS2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:DKK2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:DKK2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:SEK2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:SEK2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:CNY2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:CNY2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:USD2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:USD2020-12-310001585364currency:PLNus-gaap:ForeignExchangeForwardMember2021-10-020001585364currency:PLNus-gaap:ForeignExchangeForwardMember2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:CAD2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:CAD2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:NOK2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:NOK2020-12-310001585364currency:CHFus-gaap:ForeignExchangeForwardMember2021-10-020001585364currency:CHFus-gaap:ForeignExchangeForwardMember2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:TRY2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:TRY2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:AUD2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:AUD2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:RON2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:RON2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:MXN2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:MXN2020-12-310001585364us-gaap:ForeignExchangeForwardMembercurrency:XXX2021-10-020001585364us-gaap:ForeignExchangeForwardMembercurrency:XXX2020-12-310001585364us-gaap:ForeignExchangeForwardMember2021-10-020001585364us-gaap:ForeignExchangeForwardMember2020-12-310001585364us-gaap:ForeignExchangeForwardMember2021-01-012021-10-020001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-10-020001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-020001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-020001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001585364us-gaap:DesignatedAsHedgingInstrumentMember2021-10-020001585364us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001585364us-gaap:NondesignatedMember2021-10-020001585364us-gaap:NondesignatedMember2020-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-020001585364us-gaap:ForeignExchangeForwardMemberus-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001585364us-gaap:CurrencySwapMemberus-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-020001585364us-gaap:CurrencySwapMemberus-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherLiabilitiesMember2021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherLiabilitiesMember2020-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2021-07-042021-10-020001585364us-gaap:InterestExpenseMember2021-07-042021-10-020001585364us-gaap:ForeignExchangeForwardMember2021-07-042021-10-020001585364us-gaap:SalesRevenueNetMember2021-07-042021-10-020001585364us-gaap:CostOfSalesMember2021-07-042021-10-020001585364us-gaap:CurrencySwapMember2021-07-042021-10-020001585364us-gaap:CurrencySwapMemberus-gaap:InterestExpenseMember2021-07-042021-10-020001585364us-gaap:TreasuryLockMemberus-gaap:InterestExpenseMember2021-01-012021-10-020001585364us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2021-01-012021-10-020001585364us-gaap:InterestExpenseMember2021-01-012021-10-020001585364us-gaap:SalesRevenueNetMember2021-01-012021-10-020001585364us-gaap:CostOfSalesMember2021-01-012021-10-020001585364us-gaap:CurrencySwapMember2021-01-012021-10-020001585364us-gaap:CurrencySwapMemberus-gaap:InterestExpenseMember2021-01-012021-10-020001585364us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2020-06-282020-09-260001585364us-gaap:InterestExpenseMember2020-06-282020-09-260001585364us-gaap:ForeignExchangeForwardMember2020-06-282020-09-260001585364us-gaap:SalesRevenueNetMember2020-06-282020-09-260001585364us-gaap:CostOfSalesMember2020-06-282020-09-260001585364us-gaap:CurrencySwapMember2020-06-282020-09-260001585364us-gaap:CurrencySwapMemberus-gaap:InterestExpenseMember2020-06-282020-09-260001585364us-gaap:TreasuryLockMemberus-gaap:InterestExpenseMember2020-01-012020-09-260001585364us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2020-01-012020-09-260001585364us-gaap:InterestExpenseMember2020-01-012020-09-260001585364us-gaap:ForeignExchangeForwardMember2020-01-012020-09-260001585364us-gaap:SalesRevenueNetMember2020-01-012020-09-260001585364us-gaap:CostOfSalesMember2020-01-012020-09-260001585364us-gaap:CurrencySwapMember2020-01-012020-09-260001585364us-gaap:CurrencySwapMemberus-gaap:InterestExpenseMember2020-01-012020-09-260001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-07-042021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-06-282020-09-260001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-01-012021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-01-012020-09-260001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:InterestExpenseMember2021-07-042021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:InterestExpenseMember2020-06-282020-09-260001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:InterestExpenseMember2021-01-012021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:InterestExpenseMember2020-01-012020-09-260001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2021-07-042021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-06-282020-09-260001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2021-01-012021-10-020001585364us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-01-012020-09-260001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-06-282020-09-260001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-01-012021-10-020001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-01-012020-09-260001585364us-gaap:InterestRateSwapMemberus-gaap:SalesRevenueNetMember2021-07-042021-10-020001585364us-gaap:InterestRateSwapMemberus-gaap:CostOfSalesMember2021-07-042021-10-020001585364us-gaap:InterestRateSwapMemberprgo:OtherExpenseIncomeNetMember2021-07-042021-10-020001585364us-gaap:SalesRevenueNetMemberus-gaap:TreasuryLockMember2021-01-012021-10-020001585364us-gaap:CostOfSalesMemberus-gaap:TreasuryLockMember2021-01-012021-10-020001585364prgo:OtherExpenseIncomeNetMemberus-gaap:TreasuryLockMember2021-01-012021-10-020001585364us-gaap:InterestRateSwapMemberus-gaap:SalesRevenueNetMember2021-01-012021-10-020001585364us-gaap:InterestRateSwapMemberus-gaap:CostOfSalesMember2021-01-012021-10-020001585364us-gaap:InterestRateSwapMemberprgo:OtherExpenseIncomeNetMember2021-01-012021-10-020001585364us-gaap:InterestRateSwapMemberus-gaap:SalesRevenueNetMember2020-06-282020-09-260001585364us-gaap:InterestRateSwapMemberus-gaap:CostOfSalesMember2020-06-282020-09-260001585364us-gaap:InterestRateSwapMemberprgo:OtherExpenseIncomeNetMember2020-06-282020-09-260001585364us-gaap:SalesRevenueNetMemberus-gaap:TreasuryLockMember2020-01-012020-09-260001585364us-gaap:CostOfSalesMemberus-gaap:TreasuryLockMember2020-01-012020-09-260001585364prgo:OtherExpenseIncomeNetMemberus-gaap:TreasuryLockMember2020-06-282020-09-260001585364us-gaap:InterestRateSwapMemberus-gaap:SalesRevenueNetMember2020-01-012020-09-260001585364us-gaap:InterestRateSwapMemberus-gaap:CostOfSalesMember2020-01-012020-09-260001585364us-gaap:InterestRateSwapMemberprgo:OtherExpenseIncomeNetMember2020-01-012020-09-260001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2021-10-020001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2020-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2021-10-020001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2020-12-310001585364us-gaap:MaterialReconcilingItemsMember2021-10-020001585364us-gaap:MaterialReconcilingItemsMember2020-12-310001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Member2021-10-020001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Member2020-12-310001585364prgo:A5.105SeniornotedueJuly282023Member2021-10-020001585364prgo:A5.105SeniornotedueJuly282023Member2021-01-012021-10-020001585364prgo:A5.105SeniornotedueJuly282023Member2020-12-310001585364prgo:A4.00UnsecuredSeniorNotesdueNovember152023Member2021-10-020001585364prgo:A4.00UnsecuredSeniorNotesdueNovember152023Member2021-01-012021-10-020001585364prgo:A4.00UnsecuredSeniorNotesdueNovember152023Member2020-12-310001585364prgo:A3.9seniornotedue2024Member2021-10-020001585364prgo:A3.9seniornotedue2024Member2021-01-012021-10-020001585364prgo:A3.9seniornotedue2024Member2020-12-310001585364prgo:A4.375seniornotedueMarch152026Member2021-10-020001585364prgo:A4.375seniornotedueMarch152026Member2021-01-012021-10-020001585364prgo:A4.375seniornotedueMarch152026Member2020-12-310001585364prgo:A3.150SeniorNotesdueJune152030Member2021-10-020001585364prgo:A3.150SeniorNotesdueJune152030Member2021-01-012021-10-020001585364prgo:A3.150SeniorNotesdueJune152030Member2020-12-310001585364prgo:A5.30UnsecuredSeniorNotesdueNovember152043Member2021-10-020001585364prgo:A5.30UnsecuredSeniorNotesdueNovember152043Member2021-01-012021-10-020001585364prgo:A5.30UnsecuredSeniorNotesdueNovember152043Member2020-12-310001585364prgo:A4.9SeniorLoandue2044Member2021-10-020001585364prgo:A4.9SeniorLoandue2044Member2021-01-012021-10-020001585364prgo:A4.9SeniorLoandue2044Member2020-12-310001585364prgo:A2018RevolverMember2018-03-080001585364prgo:A2018RevolverMember2020-12-310001585364prgo:A2018RevolverMember2021-10-020001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Member2019-08-150001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Member2021-01-012021-10-020001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Member2021-07-042021-10-020001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Membersrt:ScenarioForecastMember2021-10-032021-12-310001585364prgo:A2019EuroDenominatedTermLoandueAugust152022Membersrt:ScenarioForecastMember2022-01-012022-04-020001585364prgo:A3.150SeniorNotesdueJune152030Member2020-06-190001585364prgo:A3.150SeniorNotesdueJune152030Member2021-06-192021-06-190001585364prgo:A3.150SeniorNotesdueJune152030Membersrt:ScenarioForecastMember2021-12-150001585364prgo:A3.500UnsecuredSeniornotesdueMarch152021Member2020-07-062020-07-060001585364prgo:A3.500UnsecuredSeniornotesdueMarch152021Member2020-07-060001585364prgo:A3.5SeniornotedueDecember152021Member2020-07-062020-07-060001585364prgo:A3.5SeniornotedueDecember152021Member2020-07-060001585364prgo:A2018EuroDenominatedTermLoandueMarch82020Member2020-06-282020-09-260001585364prgo:KazmiraLLCMember2020-06-17prgo:promissoryNote0001585364prgo:NotedueNovember2020Memberprgo:KazmiraLLCMember2020-06-170001585364prgo:NotedueMay2021Memberprgo:KazmiraLLCMember2020-06-170001585364prgo:KazmiraLLCMemberprgo:NotedueNovember2021Member2020-06-170001585364prgo:NotedueNovember2020Memberprgo:KazmiraLLCMember2020-12-082020-12-080001585364prgo:NotedueMay2021Memberprgo:KazmiraLLCMember2021-06-072021-06-0700015853642018-10-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001585364us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-10-020001585364us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-10-020001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-10-020001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-10-020001585364us-gaap:AccumulatedTranslationAdjustmentMember2021-10-020001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-10-02prgo:year0001585364us-gaap:InternalRevenueServiceIRSMember2021-01-012021-10-0200015853642009-01-012009-12-3100015853642010-01-012010-12-3100015853642011-01-012011-12-3100015853642012-01-012012-12-3100015853642017-08-152017-08-1500015853642021-01-132021-01-130001585364srt:MinimumMember2021-01-132021-01-130001585364srt:MaximumMember2021-01-132021-01-1300015853642021-01-1300015853642020-05-072020-05-0700015853642021-05-032021-05-0300015853642020-12-192020-12-190001585364prgo:TaxYears20132015Member2021-02-262021-02-260001585364us-gaap:TaxYear2020Member2021-01-012021-10-0200015853642019-04-260001585364us-gaap:RevenueCommissionersIrelandMember2013-01-012013-12-310001585364us-gaap:RevenueCommissionersIrelandMember2018-11-290001585364us-gaap:RevenueCommissionersIrelandMember2021-07-090001585364us-gaap:RevenueCommissionersIrelandMember2021-09-292021-09-290001585364us-gaap:SubsequentEventMemberus-gaap:RevenueCommissionersIrelandMember2021-10-052021-10-050001585364us-gaap:IsraelTaxAuthorityMember2020-12-290001585364us-gaap:IsraelTaxAuthorityMember2021-01-012021-10-020001585364us-gaap:IsraelTaxAuthorityMember2021-10-020001585364prgo:StatesMay2019CaseAllegingConspiracywhichdoesnotNamePerrigoaDefendantMember2020-07-14prgo:manufacturerprgo:classprgo:complaint0001585364prgo:OverarchingConspiracyClassActionsMember2019-04-30prgo:genericPrescriptionPharmaceuticalprgo:pharmaceuticalProductprgo:case0001585364prgo:OverarchingConspiracyClassActionsMember2020-07-140001585364prgo:PriceFixingLawsuitSupermarketChainsMember2018-01-22prgo:supermarket0001585364prgo:PriceFixingLawsuitSupermarketChainsAmendedComplaintMember2018-12-210001585364prgo:PricefixingLawsuitManagedCareOrganizationMember2018-08-030001585364prgo:PricefixingLawsuitHealthInsuranceCarrierMember2019-01-16prgo:defendant0001585364prgo:PricefixingLawsuitHealthInsuranceCarrierMember2019-01-162019-01-16prgo:healthPlan0001585364prgo:PricefixingLawsuitHealthPlansMember2019-07-18prgo:individual0001585364prgo:PricefixingLawsuitHealthcareServiceCompanyMember2019-12-110001585364prgo:PricefixingLawsuitMedicareAdvantageClaimsRecoveryCompanyMember2019-12-160001585364prgo:PricefixingLawsuitSeveralCountiesinNewYorkMember2019-12-230001585364prgo:PricefixingLawsuitHealthcareManagementOrganizationMember2019-12-270001585364prgo:PricefixingLawsuitHarrisCountyofTexasMember2020-03-010001585364prgo:PricefixingLawsuitHealthPlansMember2020-05-310001585364prgo:PricefixingLawsuitHealthInsuranceCarrierMember2020-06-09prgo:pharmaceuticalCompany0001585364prgo:PriceFixingLawsuitDrugstoreChainMember2020-07-090001585364prgo:PriceFixingLawsuitSuffolkCountyofNewYorkMember2020-08-270001585364prgo:PriceFixingLawsuitDrugWholesalerandDistributorMember2020-09-040001585364prgo:PriceFixingLawsuitDrugstoreChainMember2020-12-110001585364prgo:PriceFixingLawsuitSupermarketChainsMember2020-12-140001585364prgo:PriceFixingLawsuitDrugstoreChainMember2020-12-150001585364prgo:PricefixingLawsuitSeveralCountiesinNewYorkMember2020-12-150001585364prgo:PriceFixingLawsuitWestchesterCountyNYMember2021-08-300001585364prgo:PriceFixingLawsuitPennsylvaniaStateCourtMemberus-gaap:SubsequentEventMember2021-10-08prgo:plaintiffGroup0001585364prgo:StateAttorneyGeneralComplaintMember2020-06-10prgo:employee0001585364prgo:CanadianClassActionComplaintMember2020-12-3100015853642017-06-2100015853642019-11-14prgo:lawsuit0001585364prgo:HighfieldsCapitalILPetal.v.PerrigoCompanyplcetal.Member2021-10-020001585364prgo:CarmignacFirstManhattanandSimilarCasesMember2021-10-020001585364prgo:FirstManhattanandSimilarCasesMember2021-10-020001585364prgo:MasonCapitalPentwaterandSimilarCasesMember2021-10-020001585364prgo:HarelInsuranceandTIAACREFFCasesMember2021-10-020001585364prgo:HarelInsuranceandTIAACREFFCasesMember2021-01-012021-10-020001585364prgo:HarelInsuranceandTIAACREFFCasesMember2018-07-310001585364prgo:OtherCasesRelatedtoEventsin20152017Member2017-06-300001585364prgo:BlackrockGlobalComplaintMember2021-10-020001585364prgo:InIsraelCasesRelatedToEventsIn20152017Member2018-12-310001585364prgo:InIsraelCasesRelatedToEventsIn20152017Member2018-01-012018-03-310001585364prgo:InIsraelCasesRelatedToEventsIn20152017Member2019-01-012019-03-300001585364prgo:IsraelElec.Corp.EmployeesEduc.Fundv.PerrigoCompanyplcetal.Member2017-06-28iso4217:ILS0001585364prgo:IsraelElec.Corp.EmployeesEduc.Fundv.PerrigoCompanyplcetal.Member2017-06-282017-06-28iso4217:USDiso4217:ILS0001585364prgo:InTheUnitedStatesCasesRelatedToIrishTaxEventsMember2019-05-312019-05-310001585364prgo:InIsraelCasesRelatedtoIrishTaxEventsMember2020-01-012020-06-270001585364prgo:ClaimArisingFromTheOmegaAcquisitionMemberprgo:DamagesAwardedMemberus-gaap:JudicialRulingMember2021-08-270001585364us-gaap:SubsequentEventMemberprgo:TalcumPowderLitigationMember2021-10-152021-10-15prgo:tender0001585364prgo:RanitidineLitigationMember2021-09-302021-09-30prgo:claim0001585364us-gaap:SubsequentEventMemberprgo:RanitidineLitigationMember2021-11-052021-11-050001585364prgo:AcetaminophenLitigationMember2020-09-262020-09-26prgo:retailer0001585364us-gaap:FairValueInputsLevel3Member2017-12-310001585364us-gaap:FairValueInputsLevel3Member2021-10-020001585364us-gaap:FairValueInputsLevel3Member2020-12-31prgo:policyPeriod00015853642021-05-310001585364us-gaap:DiscontinuedOperationsHeldforsaleMember2021-10-020001585364us-gaap:DiscontinuedOperationsHeldforsaleMember2020-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2021-07-042021-10-020001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2020-06-282020-09-260001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2021-07-042021-10-020001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2020-06-282020-09-260001585364us-gaap:MaterialReconcilingItemsMember2021-07-042021-10-020001585364us-gaap:MaterialReconcilingItemsMember2020-06-282020-09-260001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2021-01-012021-10-020001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2020-01-012020-09-260001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2021-01-012021-10-020001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2020-01-012020-09-260001585364us-gaap:MaterialReconcilingItemsMember2021-01-012021-10-020001585364us-gaap:MaterialReconcilingItemsMember2020-01-012020-09-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 10-Q

_______________________________________________

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: October 2, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to Commission file number 001-36353

_______________________________________________

Perrigo Company plc

(Exact name of registrant as specified in its charter)

_______________________________________________

| | | | | | | | |

| Ireland | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

The Sharp Building, Hogan Place, Dublin 2, Ireland D02 TY74

+353 1 7094000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary shares | PRGO | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | | | | | | | |

| | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

As of November 5, 2021, there were 133,773,881 ordinary shares outstanding.

PERRIGO COMPANY PLC

FORM 10-Q

INDEX

| | | | | | | | |

| PAGE NUMBER |

| |

| |

| PART I. FINANCIAL INFORMATION | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| 1 | | |

| | |

| 2 | | |

| | |

| 3 | | |

| | |

| 4 | | |

| | |

| | |

| | |

| 5 | | |

| | |

| 6 | | |

| | |

| 7 | | |

| | |

| 8 | | |

| | |

| 9 | | |

| | |

| 10 | | |

| | |

| 11 | | |

| | |

| 12 | | |

| | |

| 13 | | |

| | |

| 14 | | |

| | |

| 15 | | |

| | |

| 16 | | |

| | |

| | |

| | |

| 17 | | |

| | |

| 18 | | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| |

| | |

| PART II. OTHER INFORMATION | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our, or our industry’s actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” "forecast," “predict,” “potential” or the negative of those terms or other comparable terminology.

The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, including: the effect of the novel coronavirus (COVID-19) pandemic and the associated supply chain impacts on the Company’s business; general economic, credit, and market conditions; future impairment charges; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than the Company does; pricing pressures from customers and consumers; resolution of uncertain tax positions, including the Company’s appeal of the draft and final Notices of Proposed Assessment (“NOPAs”) issued by the U.S. Internal Revenue Service and the impact that an adverse result in any such proceedings would have on operating results, cash flows, and liquidity; pending and potential third-party claims and litigation, including litigation relating to the Company’s restatement of previously-filed financial information and litigation relating to uncertain tax positions, including the NOPAs; potential impacts of ongoing or future government investigations and regulatory initiatives; potential costs and reputational impact of product recalls or sales halts; the impact of tax reform legislation and healthcare policy; the timing, amount and cost of any share repurchases; fluctuations in currency exchange rates and interest rates; the Company’s ability to achieve the benefits expected from the sale of its Rx business and the risk that potential costs or liabilities incurred or retained in connection with the transaction may exceed the Company’s estimates or adversely affect the Company’s business or operations; the consummation and success of the proposed acquisition of HRA and the ability to achieve the expected benefits thereof, including the risk that the parties fail to obtain the required regulatory approvals or to fulfill the other conditions to closing on the expected timeframe or at all, the occurrence of any other event, change or circumstance that could delay the transaction or result in the termination of the securities sale agreement or the risks that the Company’s synergy estimates are inaccurate or that the Company faces higher than anticipated integration or other costs in connection with the proposed acquisition; the consummation and success of other announced acquisitions or dispositions, and the Company’s ability to realize the desired benefits thereof; and the Company’s ability to execute and achieve the desired benefits of announced cost-reduction efforts and strategic and other initiatives. An adverse result with respect to the Company’s appeal of any material outstanding tax assessments or pending litigation, including securities or drug pricing matters, could ultimately require the use of corporate assets to pay such assessments, damages from third-party claims, and related interest and/or penalties, and any such use of corporate assets would limit the assets available for other corporate purposes. These and other important factors, including those discussed in our Form 10-K for the year ended December 31, 2020, this report under “Risk Factors” and in any subsequent filings with the United States Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This report contains trademarks, trade names and service marks that are the property of Perrigo Company plc, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks, trade names, and service marks referred to in this report appear without the ®, ™ and SM symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

Perrigo Company plc - Item 1

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | October 2,

2021 | | September 26,

2020 | | October 2,

2021 | | September 26,

2020 |

| Net sales | $ | 1,042.7 | | | $ | 1,003.0 | | | $ | 3,033.8 | | | $ | 3,035.0 | |

| Cost of sales | 706.3 | | | 633.3 | | | 1,980.0 | | | 1,924.5 | |

| Gross profit | 336.4 | | | 369.7 | | | 1,053.8 | | | 1,110.5 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Distribution | 23.3 | | | 22.5 | | | 69.0 | | | 62.4 | |

| Research and development | 27.6 | | | 30.4 | | | 91.7 | | | 88.7 | |

| Selling | 129.7 | | | 130.1 | | | 405.0 | | | 389.0 | |

| Administration | 130.6 | | | 111.3 | | | 368.1 | | | 345.2 | |

| Impairment charges | 3.5 | | | — | | | 162.1 | | | — | |

| Restructuring | 1.0 | | | 0.8 | | | 11.8 | | | 1.5 | |

| Other operating expense (income) | (417.6) | | | (3.9) | | | (417.6) | | | (3.9) | |

| Total operating expenses | (101.9) | | | 291.2 | | | 690.1 | | | 882.9 | |

| | | | | | | |

| Operating income | 438.3 | | | 78.5 | | | 363.7 | | | 227.6 | |

| | | | | | | |

| Change in financial assets | — | | | (22.2) | | | — | | | (25.9) | |

| Interest expense, net | 30.9 | | | 33.3 | | | 94.5 | | | 94.3 | |

| Other (income) expense, net | 18.5 | | | (1.0) | | | 20.4 | | | 17.9 | |

| Loss on extinguishment of debt | — | | | 20.0 | | | — | | | 20.0 | |

| Income (loss) from continuing operations before income taxes | 388.9 | | | 48.4 | | | 248.8 | | | 121.3 | |

| Income tax expense (benefit) | 442.8 | | | 22.0 | | | 411.8 | | | 24.9 | |

| Income (loss) from continuing operations | (53.9) | | | 26.4 | | | (163.0) | | | 96.4 | |

| Income (loss) from discontinued operations, net of tax | (5.0) | | | (181.0) | | | 84.5 | | | (84.0) | |

| Net income (loss) | $ | (58.9) | | | $ | (154.6) | | | $ | (78.5) | | | $ | 12.4 | |

| | | | | | | |

Earnings (loss) per share | | | | | | | |

| Basic | | | | | | | |

| Continuing operations | $ | (0.40) | | | $ | 0.19 | | | $ | (1.22) | | | $ | 0.71 | |

| Discontinued operations | (0.04) | | | (1.32) | | | 0.63 | | | (0.62) | |

| Basic earnings per share | $ | (0.44) | | | $ | (1.13) | | | $ | (0.59) | | | $ | 0.09 | |

| Diluted | | | | | | | |

| Continuing operations | $ | (0.40) | | | $ | 0.19 | | | $ | (1.22) | | | $ | 0.70 | |

| Discontinued operations | (0.04) | | | (1.31) | | | 0.63 | | | (0.61) | |

| Diluted earnings per share | $ | (0.44) | | | $ | (1.12) | | | $ | (0.59) | | | $ | 0.09 | |

| | | | | | | |

| Weighted-average shares outstanding | | | | | | | |

| Basic | 133.8 | | | 136.5 | | | 133.5 | | | 136.3 | |

| Diluted | 133.8 | | | 137.6 | | | 133.5 | | | 137.5 | |

See accompanying Notes to the Condensed Consolidated Financial Statements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| October 2,

2021 | | September 26,

2020 | | October 2,

2021 | | September 26,

2020 |

| Net income (loss) | $ | (58.9) | | | $ | (154.6) | | | $ | (78.5) | | | $ | 12.4 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments | (228.3) | | | 86.5 | | | (307.5) | | | 81.0 | |

| Change in fair value of derivative financial instruments, net of tax | (23.8) | | | (2.3) | | | (31.1) | | | (12.4) | |

| | | | | | | |

| Change in post-retirement and pension liability, net of tax | (0.8) | | | (1.2) | | | (2.2) | | | (4.3) | |

| Other comprehensive income (loss), net of tax | (252.9) | | | 83.0 | | | (340.8) | | | 64.3 | |

| Comprehensive income (loss) | $ | (311.8) | | | $ | (71.6) | | | $ | (419.3) | | | $ | 76.7 | |

See accompanying Notes to the Condensed Consolidated Financial Statements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | |

| October 2,

2021 | | December 31,

2020 |

| Assets | | | |

| | | |

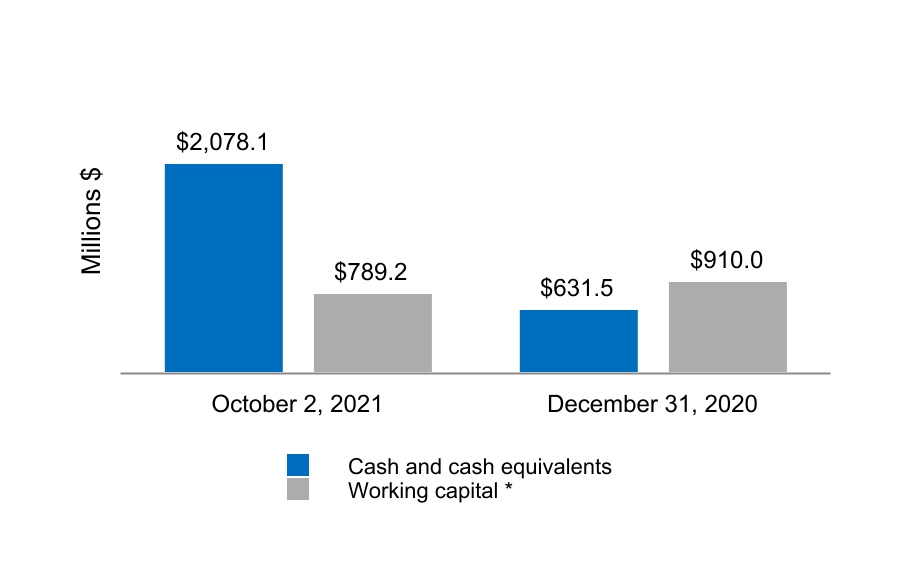

| Cash and cash equivalents | $ | 2,078.1 | | | $ | 631.5 | |

| | | |

Accounts receivable, net of allowance for credit losses of $7.6 and $6.5, respectively | 686.2 | | | 593.5 | |

| Inventories | 1,092.5 | | | 1,059.4 | |

| | | |

| Prepaid expenses and other current assets | 355.7 | | | 182.2 | |

| Current assets held for sale | 13.4 | | | 666.9 | |

| Total current assets | 4,225.9 | | | 3,133.5 | |

| | | |

| Property, plant and equipment, net | 842.8 | | | 864.6 | |

| Operating lease assets | 170.6 | | | 154.7 | |

| | | |

| Goodwill and indefinite-lived intangible assets | 3,036.9 | | | 3,102.7 | |

| Definite-lived intangible assets, net | 2,226.2 | | | 2,481.5 | |

| Deferred income taxes | 40.2 | | | 40.6 | |

| Non-current assets held for sale | — | | | 1,364.0 | |

| Other non-current assets | 373.3 | | | 346.8 | |

| Total non-current assets | 6,690.0 | | | 8,354.9 | |

| Total assets | $ | 10,915.9 | | | $ | 11,488.4 | |

| Liabilities and Shareholders’ Equity | | | |

| | | |

| Accounts payable | $ | 405.6 | | | $ | 451.6 | |

| Payroll and related taxes | 106.6 | | | 152.9 | |

| Accrued customer programs | 140.1 | | | 128.5 | |

| Other accrued liabilities | 339.9 | | | 183.1 | |

| Accrued income taxes | 353.0 | | | 9.0 | |

| | | |

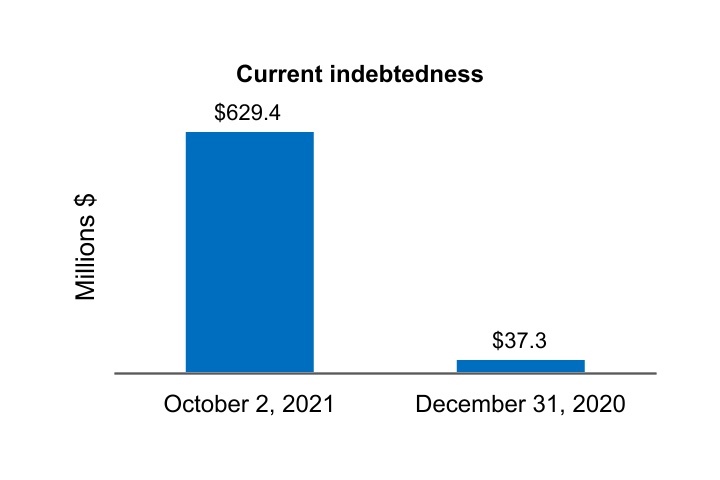

| Current indebtedness | 629.4 | | | 37.3 | |

| Current liabilities held for sale | 29.2 | | | 419.6 | |

| Total current liabilities | 2,003.8 | | | 1,382.0 | |

| | | |

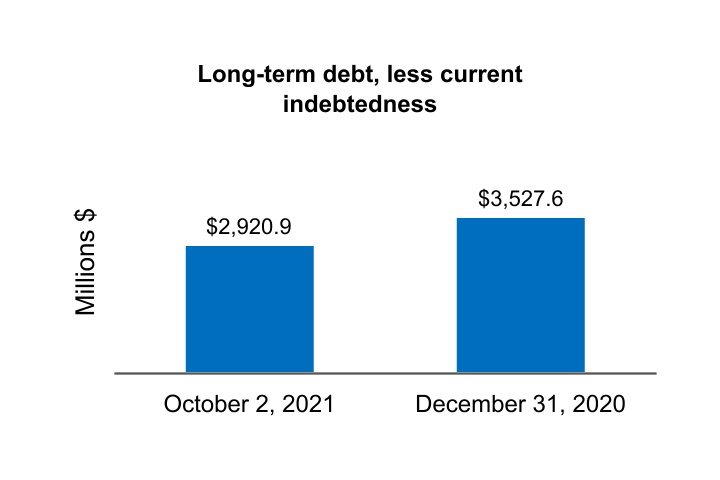

| Long-term debt, less current portion | 2,920.9 | | | 3,527.6 | |

| Deferred income taxes | 243.0 | | | 276.2 | |

| Non-current liabilities held for sale | — | | | 108.3 | |

| Other non-current liabilities | 565.8 | | | 539.2 | |

| Total non-current liabilities | 3,729.7 | | | 4,451.3 | |

| Total liabilities | 5,733.5 | | | 5,833.3 | |

| Commitments and contingencies - Refer to Note 16 | | | |

| Shareholders’ equity | | | |

| Controlling interests: | | | |

Preferred shares, $0.0001 par value per share, 10 shares authorized | — | | | — | |

Ordinary shares, €0.001 par value per share, 10,000 shares authorized | 7,064.8 | | | 7,118.2 | |

| Accumulated other comprehensive income | 54.2 | | | 395.0 | |

| Retained earnings (accumulated deficit) | (1,936.6) | | | (1,858.1) | |

| | | |

| | | |

| Total shareholders’ equity | 5,182.4 | | | 5,655.1 | |

| Total liabilities and shareholders' equity | $ | 10,915.9 | | | $ | 11,488.4 | |

| | | |

| Supplemental Disclosures of Balance Sheet Information | | | |

Preferred shares, issued and outstanding | — | | | — | |

Ordinary shares, issued and outstanding | 133.7 | | | 133.1 | |

See accompanying Notes to the Condensed Consolidated Financial Statements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Ordinary Shares

Issued | | Accumulated

Other

Comprehensive

Income | | Retained

Earnings

(Accumulated Deficit) | | Total |

| | Shares | | Amount |

| Balance at December 31, 2019 | 136.1 | | | $ | 7,359.9 | | | $ | 139.4 | | | $ | (1,695.5) | | | $ | 5,803.8 | |

| | | | | | | | | |

| Net income | — | | | — | | | — | | | 106.4 | | | 106.4 | |

| Other comprehensive loss | — | | | — | | | (103.5) | | | — | | | (103.5) | |

| | | | | | | | | |

| Restricted stock plan | 0.3 | | | — | | | — | | | — | | | — | |

| Compensation for stock options | — | | | 0.8 | | | — | | | — | | | 0.8 | |

| Compensation for restricted stock | — | | | 15.4 | | | — | | | — | | | 15.4 | |

Cash dividends, $0.23 per share | — | | | (30.9) | | | — | | | — | | | (30.9) | |

| Shares withheld for payment of employees' withholding tax liability | (0.1) | | | (5.6) | | | — | | | — | | | (5.6) | |

| | | | | | | | | |

| Balance at March 28, 2020 | 136.3 | | | $ | 7,339.6 | | | $ | 35.9 | | | $ | (1,589.1) | | | $ | 5,786.4 | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | — | | | — | | | — | | | 60.6 | | | 60.6 | |

| Other comprehensive income | — | | | — | | | 84.8 | | | — | | | 84.8 | |

| | | | | | | | | |

Restricted stock plan | 0.3 | | | — | | | — | | | — | | | — | |

| Compensation for stock options | — | | | 0.4 | | | — | | | — | | | 0.4 | |

| Compensation for restricted stock | — | | | 13.1 | | | — | | | — | | | 13.1 | |

Cash dividends, $0.23 per share | — | | | (31.0) | | | — | | | — | | | (31.0) | |

| Shares withheld for payment of employees' withholding tax liability | (0.1) | | | (3.9) | | | — | | | — | | | (3.9) | |

| | | | | | | | | |

| Balance at June 27, 2020 | 136.5 | | | $ | 7,318.2 | | | $ | 120.7 | | | $ | (1,528.5) | | | $ | 5,910.4 | |

| | | | | | | | | |

| | | | | | | | | |

| Net loss | — | | | — | | | — | | | (154.6) | | | (154.6) | |

| Other comprehensive income | — | | | — | | | 83.0 | | | — | | | 83.0 | |

| | | | | | | | | |

| | | | | | | | | |

| Compensation for stock options | — | | | 0.4 | | | — | | | — | | | 0.4 | |

| Compensation for restricted stock | — | | | 13.8 | | | — | | | — | | | 13.8 | |

Cash dividends, $0.23 per share | — | | | (31.1) | | | — | | | — | | | (31.1) | |

| Shares withheld for payment of employees' withholding tax liability | — | | | (0.5) | | | — | | | — | | | (0.5) | |

| Minority share purchase | — | | | (1.1) | | | — | | | — | | | (1.1) | |

| Balance at September 26, 2020 | 136.5 | | | $ | 7,299.7 | | | $ | 203.7 | | | $ | (1,683.1) | | | $ | 5,820.3 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (CONTINUED)

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Ordinary Shares

Issued | | Accumulated

Other

Comprehensive

Income | | Retained

Earnings

(Accumulated Deficit) | | Total |

| | Shares | | Amount |

| Balance at December 31, 2020 | 133.1 | | | $ | 7,118.2 | | | $ | 395.0 | | | $ | (1,858.1) | | | $ | 5,655.1 | |

| | | | | | | | | |

| Net income | — | | | — | | | — | | | 38.1 | | | 38.1 | |

| Other comprehensive loss | — | | | — | | | (118.3) | | | — | | | (118.3) | |

| | | | | | | | | |

| Restricted stock plan | 0.6 | | | — | | | — | | | — | | | — | |

| Compensation for stock options | — | | | 0.4 | | | — | | | — | | | 0.4 | |

| Compensation for restricted stock | — | | | 24.6 | | | — | | | — | | | 24.6 | |

Cash dividends, $0.24 per share | — | | | (32.6) | | | — | | | — | | | (32.6) | |

| Shares withheld for payment of employees' withholding tax liability | (0.2) | | | (9.3) | | | — | | | — | | | (9.3) | |

| Balance at April 3, 2021 | 133.5 | | | $ | 7,101.3 | | | $ | 276.7 | | | $ | (1,820.0) | | | $ | 5,558.0 | |

| | | | | | | | | |

| | | | | | | | | |

| Net loss | — | | | — | | | — | | | (57.7) | | | (57.7) | |

| Other comprehensive income | — | | | — | | | 30.4 | | | — | | | 30.4 | |

| | | | | | | | | |

Restricted stock plan | 0.1 | | | — | | | — | | | — | | | — | |

| Compensation for stock options | — | | | 0.2 | | | — | | | — | | | 0.2 | |

| Compensation for restricted stock | — | | | 13.9 | | | — | | | — | | | 13.9 | |

Cash dividends, $0.24 per share | — | | | (32.5) | | | — | | | — | | | (32.5) | |

| Shares withheld for payment of employees' withholding tax liability | — | | | (1.2) | | | — | | | — | | | (1.2) | |

| | | | | | | | | |

| Balance at July 3, 2021 | 133.6 | | | $ | 7,081.7 | | | $ | 307.1 | | | $ | (1,877.7) | | | $ | 5,511.1 | |

| | | | | | | | | |

| | | | | | | | | |

| Net loss | — | | | — | | | — | | | (58.9) | | | (58.9) | |

| Other comprehensive loss | — | | | — | | | (252.9) | | | — | | | (252.9) | |

| | | | | | | | | |

Restricted stock plan | 0.2 | | | — | | | — | | | — | | | — | |

| Compensation for stock options | — | | | 0.2 | | | — | | | — | | | 0.2 | |

| Compensation for restricted stock | — | | | 18.5 | | | — | | | — | | | 18.5 | |

Cash dividends, $0.24 per share | — | | | (32.7) | | | — | | | — | | | (32.7) | |

| Shares withheld for payment of employees' withholding tax liability | (0.1) | | | (2.9) | | | — | | | — | | | (2.9) | |

| | | | | | | | | |

| Balance at October 2, 2021 | 133.7 | | | $ | 7,064.8 | | | $ | 54.2 | | | $ | (1,936.6) | | | $ | 5,182.4 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

See accompanying Notes to the Condensed Consolidated Financial Statements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended |

| | October 2,

2021 | | September 26,

2020 |

| Cash Flows From (For) Operating Activities | | | |

| Net income (loss) | $ | (78.5) | | | $ | 12.4 | |

| Adjustments to derive cash flows: | | | |

| Depreciation and amortization | 238.8 | | | 284.7 | |

| Loss (Gain) on sale of business | (63.9) | | | 18.6 | |

| Share-based compensation | 50.2 | | | 43.9 | |

| Impairment charges | 162.1 | | | 202.4 | |

| | | |

| Change in financial assets | — | | | (25.9) | |

| Loss on extinguishment of debt | — | | | 20.0 | |

| Restructuring charges | 11.8 | | | 1.9 | |

| Deferred income taxes | (24.0) | | | 25.7 | |

| Amortization of debt premium | (2.7) | | | (1.7) | |

| Other non-cash adjustments, net | 9.2 | | | (12.0) | |

| Subtotal | 303.0 | | | 570.0 | |

| Increase (decrease) in cash due to: | | | |

| Accounts receivable | (182.3) | | | 106.4 | |

| Inventories | (70.2) | | | (93.2) | |

| Prepaid expenses | (1.8) | | | (23.8) | |

| Accounts payable | (10.4) | | | 15.2 | |

| Payroll and related taxes | (60.6) | | | (2.2) | |

| Accrued customer programs | 13.4 | | | (35.5) | |

| Accrued liabilities | (5.8) | | | (16.0) | |

| Accrued income taxes | 313.2 | | | (9.0) | |

| | | |

| Other, net | (36.8) | | | 13.9 | |

| Subtotal | (41.3) | | | (44.2) | |

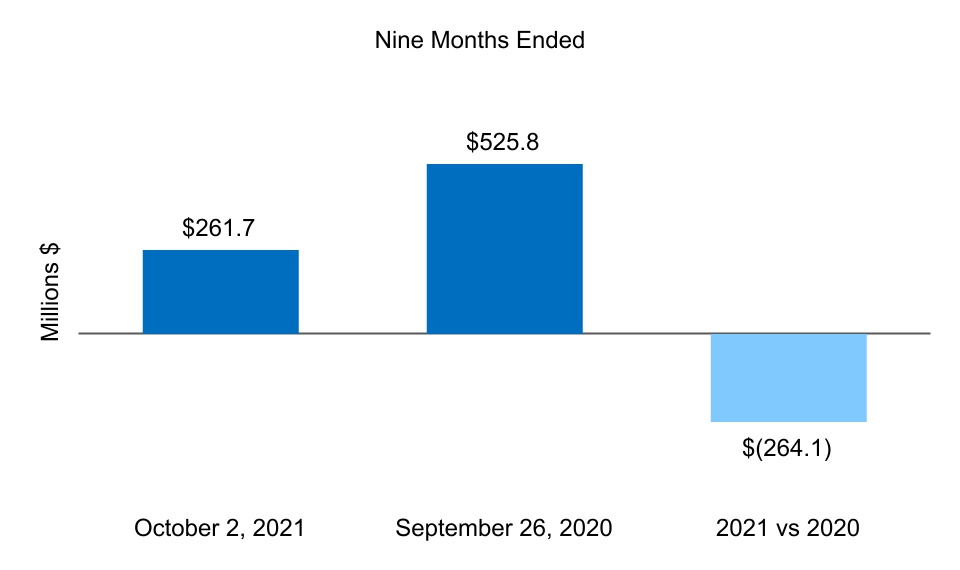

| Net cash from (for) operating activities | 261.7 | | | 525.8 | |

| Cash Flows From (For) Investing Activities | | | |

| Proceeds from royalty rights | 2.8 | | | 3.2 | |

| Purchase of equity method investment | — | | | (15.0) | |

| Acquisitions of businesses, net of cash acquired | — | | | (106.0) | |

| | | |

| Asset acquisitions | (70.6) | | | (34.1) | |

| Additions to property, plant and equipment | (110.4) | | | (104.3) | |

| Net proceeds from sale of business | 1,493.1 | | | 187.8 | |

| | | |

| Other investing, net | 2.8 | | | 8.1 | |

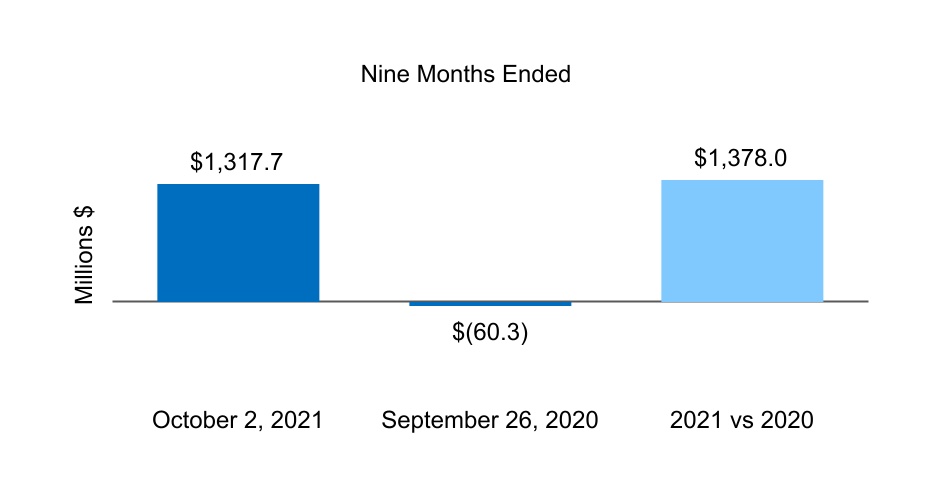

| Net cash from (for) investing activities | 1,317.7 | | | (60.3) | |

| Cash Flows From (For) Financing Activities | | | |

| Issuances of long-term debt | — | | | 743.8 | |

| Payments on long-term debt | — | | | (590.0) | |

| Borrowings (repayments) of revolving credit agreements and other financing, net | (5.8) | | | 0.1 | |

| Deferred financing fees | — | | | (6.7) | |

| Premiums on early debt retirement | — | | | (19.0) | |

| | | |

| | | |

| | | |

| | | |

| Cash dividends | (97.8) | | | (93.0) | |

| | | |

| Other financing, net | (17.1) | | | (14.9) | |

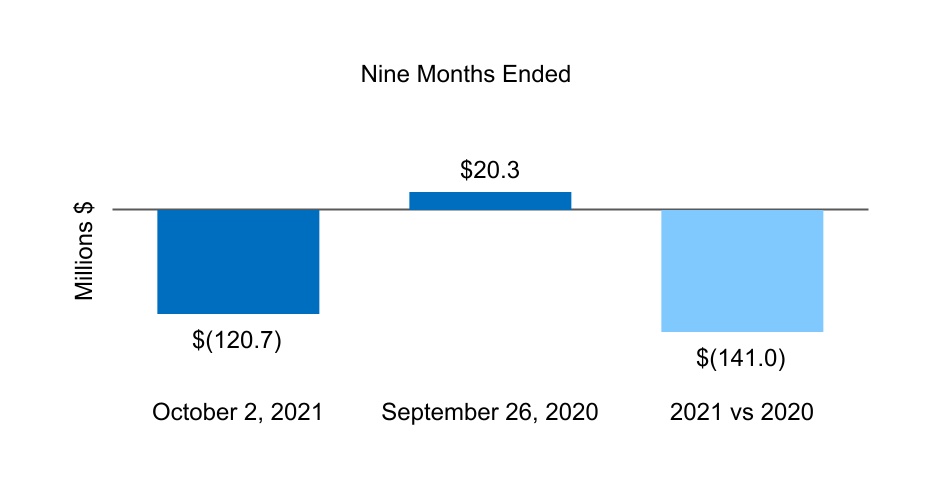

| Net cash from (for) financing activities | (120.7) | | | 20.3 | |

| Effect of exchange rate changes on cash and cash equivalents | (12.0) | | | 9.3 | |

| Net increase (decrease) in cash and cash equivalents | 1,446.7 | | | 495.1 | |

| Cash and cash equivalents of continuing operations, beginning of period | 631.5 | | | 344.5 | |

| Cash and cash equivalents held for sale, beginning of period | 10.0 | | | 9.8 | |

| Less cash and cash equivalents held for sale, end of period | (10.1) | | | (9.2) | |

| Cash and cash equivalents of continuing operations, end of period | $ | 2,078.1 | | | $ | 840.2 | |

See accompanying Notes to the Condensed Consolidated Financial Statements.

Perrigo Company plc - Item 1

Note 1

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General Information

The Company

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013 and became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"). Unless the context requires otherwise, the terms "Perrigo," the "Company," "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries.

Our vision is to make lives better by bringing Quality, Affordable Self-Care Products that consumers trust everywhere they are sold. We are a leading provider of over-the-counter ("OTC") health and wellness solutions that enhance individual well-being by empowering consumers to proactively prevent or treat conditions that can be self-managed.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles ("GAAP") for interim financial information and with the instructions to Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Financial Statements should be read in conjunction with the Consolidated Financial Statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2020. In the opinion of management, all adjustments (consisting of normal recurring accruals and other adjustments) considered necessary for a fair presentation of the unaudited Condensed Consolidated Financial Statements have been included and include our accounts and the accounts of all majority-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

On March 1, 2021, we announced a definitive agreement to sell our generic RX Pharmaceuticals business ("RX business") to Altaris Capital Partners, LLC ("Altaris"). On July 6, 2021, we completed the sale of the RX business. The financial results of our RX business, which were previously reported in our Prescription Pharmaceuticals ("RX") segment, have been classified as discontinued operations in the Condensed Consolidated Statements of Operations for all periods presented. The assets and liabilities of our RX business are reflected as assets and liabilities held for sale in the Condensed Consolidated Balance Sheets for all periods presented prior to the sale. Refer to Note 8 for additional information regarding discontinued operations. Unless otherwise noted, amounts and disclosures throughout the Notes to the unaudited Condensed Consolidated Financial Statements relate to our continuing operations.

Segment Reporting

Our reporting and operating segments are as follows:

•Consumer Self-Care Americas ("CSCA") comprises our consumer self-care business (OTC, infant formula, and oral self-care categories, and contract manufacturing) in the U.S., Mexico and Canada.

•Consumer Self-Care International ("CSCI") comprises our consumer self-care business primarily branded in Europe and Australia, our store brand business in the United Kingdom and parts of Europe and Asia, and our liquid licensed products business in the United Kingdom until it was disposed on June 19, 2020.

Allowance for Credit Losses

Expected credit losses on trade receivables and contract assets are measured collectively by geographic location. The estimate of expected credit losses considers historical credit loss information that is adjusted for current conditions and for reasonable and supportable forecasts. Historical credit loss experience provides the primary basis for estimation of expected credit losses. Adjustments to historical loss information may be made for

Perrigo Company plc - Item 1

Note 1

significant changes in a geographic location’s economic conditions. Receivables that do not share risk characteristics are evaluated on an individual basis. These receivables are not included in the collective evaluation.

The allowance for credit losses is a valuation account that is deducted from the instruments’ cost basis to present the net amount expected to be collected. Trade receivables and contract assets are charged off against the allowance when the balance is no longer deemed collectible.

The following table presents the allowance for credit losses activity (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| October 2,

2021 | | September 26,

2020 | | October 2,

2021 | | September 26,

2020 |

| Beginning balance | $ | 7.7 | | | $ | 5.5 | | | $ | 6.5 | | | $ | 6.0 | |

| Provision for credit losses, net | 0.1 | | | 0.6 | | | 3.7 | | | 1.1 | |

| Receivables written-off | — | | | (0.4) | | | (0.7) | | | (1.5) | |

| | | | | | | |

| Transfer to held for sale | — | | | — | | | (1.4) | | | — | |

| Currency translation adjustment | (0.2) | | | 0.1 | | | (0.5) | | | 0.2 | |

| Ending balance | $ | 7.6 | | | $ | 5.8 | | | $ | 7.6 | | | $ | 5.8 | |

NOTE 2 – REVENUE RECOGNITION

Revenue is recognized when or as a customer obtains control of promised products. The amount of revenue recognized reflects the consideration we expect to be entitled to receive in exchange for these products.

Disaggregation of Revenue

We generated net sales in the following geographic locations(1) (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| October 2,

2021 | | September 26,

2020 | | October 2,

2021 | | September 26,

2020 |

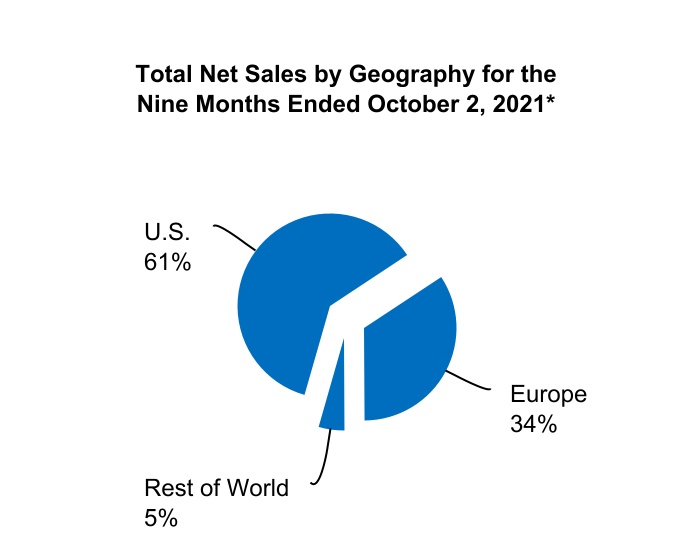

| U.S. | $ | 657.4 | | | $ | 638.7 | | | $ | 1,859.0 | | | $ | 1,913.4 | |

Europe(2) | 334.5 | | | 326.6 | | | 1,037.6 | | | 1,011.0 | |

All other countries(3) | 50.8 | | | 37.7 | | | 137.2 | | | 110.6 | |

| Total net sales | $ | 1,042.7 | | | $ | 1,003.0 | | | $ | 3,033.8 | | | $ | 3,035.0 | |

(1) Derived from the location of the entity that sells to a third party.

(2) Includes Ireland net sales of $7.6 million and $17.4 million for the three and nine months ended October 2, 2021 respectively, and $10.8 million and $22.3 million for the three and nine months ended September 26, 2020, respectively.

(3) Includes net sales generated primarily in Mexico, Australia and Canada.

Perrigo Company plc - Item 1

Note 2

Product Category

The following is a summary of our net sales by category (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| October 2,

2021 | | September 26,

2020 | | October 2,

2021 | | September 26,

2020 |

CSCA(1) | | | | | | | |

| Upper respiratory | $ | 121.9 | | | $ | 117.1 | | | $ | 345.8 | | | $ | 397.2 | |

| Digestive health | 110.6 | | | 111.8 | | | 344.0 | | | 339.9 | |

| Pain and sleep-aids | 108.4 | | | 102.6 | | | 292.9 | | | 325.7 | |

| Nutrition | 105.3 | | | 100.3 | | | 293.3 | | | 291.5 | |

| Oral self-care | 76.7 | | | 81.9 | | | 227.4 | | | 202.5 | |

| Healthy lifestyle | 72.9 | | | 86.9 | | | 214.9 | | | 256.2 | |

| Skincare and personal hygiene | 56.0 | | | 51.4 | | | 165.9 | | | 145.4 | |

| Vitamins, minerals, and supplements | 8.1 | | | 6.3 | | | 24.3 | | | 19.1 | |

| | | | | | | |

Other CSCA(2) | 34.3 | | | 5.7 | | | 48.5 | | | 14.7 | |

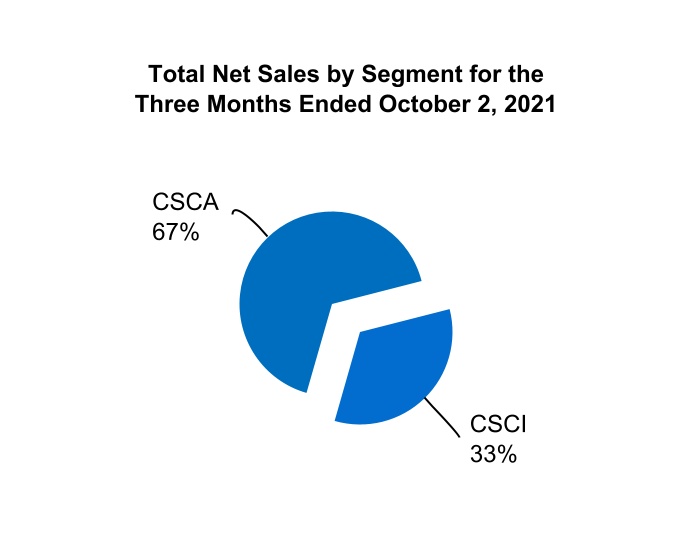

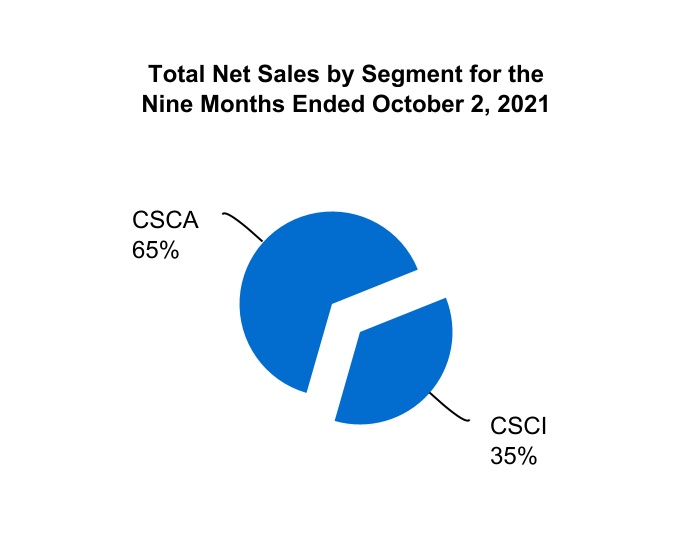

| Total CSCA | 694.2 | | | 664.0 | | | 1,957.0 | | | 1,992.2 | |

| CSCI | | | | | | | |

| Skincare and personal hygiene | 88.5 | | | 83.1 | | | 307.9 | | | 275.4 | |

| Upper respiratory | 58.7 | | | 62.3 | | | 144.2 | | | 191.9 | |

| Vitamins, minerals, and supplements | 54.7 | | | 52.9 | | | 162.8 | | | 139.9 | |

| Pain and sleep-aids | 52.1 | | | 49.0 | | | 148.4 | | | 136.0 | |

| Healthy lifestyle | 42.2 | | | 40.6 | | | 140.5 | | | 124.7 | |

| Oral self-care | 24.4 | | | 25.2 | | | 72.4 | | | 68.8 | |

| Digestive health | 10.1 | | | 6.8 | | | 28.3 | | | 17.9 | |

Other CSCI(3) | 17.8 | | | 19.1 | | | 72.3 | | | 88.2 | |

| Total CSCI | 348.5 | | | 339.0 | | | 1,076.8 | | | 1,042.8 | |

| | | | | | | |

| Total net sales | $ | 1,042.7 | | | $ | 1,003.0 | | | $ | 3,033.8 | | | $ | 3,035.0 | |

(1) Includes net sales from our OTC contract manufacturing business.

(2) Consists primarily of diagnostic and other miscellaneous or otherwise uncategorized product lines and markets, none of which is greater than 10% of the segment net sales.

(3) Consists primarily of our distribution business and other miscellaneous or otherwise uncategorized product lines and markets, none of which is greater than 10% of the segment net sales.

While the majority of revenue is recognized at a point in time, certain of our product revenue is recognized on an over time basis. Predominately, over time customer contracts exist in contract manufacturing arrangements, which occur in both the CSCA and CSCI segments. Contract manufacturing revenue was $80.8 million and $213.7 million for the three and nine months ended October 2, 2021, respectively and $76.3 million and $190.0 million for the three and nine months ended September 26, 2020, respectively.

We also recognize a portion of the store brand OTC product revenues in the CSCA segment on an over time basis; however, the timing difference between over time and point in time revenue recognition for store brand contracts is not significant due to the short time period between the customization of the product and shipment or delivery.

Contract Balances

The following table provides information about contract assets from contracts with customers (in millions):

| | | | | | | | | | | | | | | | | |

| Balance Sheet Location | | October 2,

2021 | | December 31,

2020 |

| Short-term contract assets | Prepaid expenses and other current assets | | $ | 42.2 | | | $ | 19.7 | |

Perrigo Company plc - Item 1

Note 3

NOTE 3 – ACQUISITIONS AND DIVESTITURES

Acquisitions During the Nine Months Ended October 2, 2021