Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 10-Q

_______________________________________________

|

| |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36353

_______________________________________________

Perrigo Company plc

(Exact name of registrant as specified in its charter)

_______________________________________________

|

| | |

Ireland | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland | | - |

(Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

Large accelerated filer | [X] | | Accelerated filer | [ ] | | Non-accelerated filer | [ ] | | Smaller reporting company | [ ] |

Emerging growth company | [ ] | | | | | | | | | |

| | | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] YES [X] NO

As of May 26, 2017, there were 143,397,295 ordinary shares outstanding.

PERRIGO COMPANY PLC

FORM 10-Q

INDEX

|

| | |

| PAGE NUMBER |

| |

| |

PART I. FINANCIAL INFORMATION | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

1 | | |

| | |

2 | | |

| | |

3 | | |

| | |

4 | | |

| | |

5 | | |

| | |

6 | | |

| | |

7 | | |

| | |

8 | | |

| | |

9 | | |

| | |

10 | | |

| | |

11 | | |

| | |

12 | | |

| | |

13 | | |

| | |

14 | | |

| | |

15 | | |

| | |

16 | | |

| | |

17 | | |

| | |

18 | | |

| | |

| |

| | |

| |

| | |

| |

| | |

PART II. OTHER INFORMATION | |

| | |

| |

| | |

| |

| | |

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our, or our industry’s actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or the negative of those terms or other comparable terminology.

Please see Item 1A of our Form 10-K for the year ended December 31, 2016 for a discussion of certain important risk factors that relate to forward-looking statements contained in this report and Part II, Item 1A of this Form 10-Q. We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control, including: the timing, amount and cost of any share repurchases; future impairment charges; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than we do; pricing pressures from customers and consumers; potential third-party claims and litigation, including litigation relating to our restatement of previously-filed financial information; potential impacts of ongoing or future government investigations and regulatory initiatives; general economic conditions; fluctuations in currency exchange rates and interest rates; the consummation of announced acquisitions or dispositions, and our ability to realize the desired benefits thereof; and the ability to execute and achieve the desired benefits of announced cost-reduction efforts and other initiatives. In addition, we may identify and be unable to remediate one or more material weaknesses in our internal control over financial reporting or may be unable to regain compliance with the NYSE continued listing rules. Furthermore, we and/or our subsidiaries may incur additional tax liabilities in respect of 2016 and prior years as a result of any restatement or may be found to have breached certain provisions of Irish company legislation in respect of prior financial statements and if so may incur additional expenses and penalties. These and other important factors, including those discussed in our Form 10-K for the year ended December 31, 2016 and in this report under “Risk Factors” and in any subsequent filings with the Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This report contains trademarks, trade names and service marks that are the property of Perrigo Company plc, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks, trade names, and service marks referred to in this report appear without the ®, ™ and SM symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

Perrigo Company plc - Item 1

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| April 1,

2017 | | April 2,

2016 |

Net sales | $ | 1,194.0 |

| | $ | 1,347.3 |

|

Cost of sales | 729.6 |

| | 814.2 |

|

Gross profit | 464.4 |

| | 533.1 |

|

| | | |

Operating expenses | | | |

Distribution | 21.1 |

| | 21.8 |

|

Research and development | 39.8 |

| | 45.3 |

|

Selling | 155.0 |

| | 180.8 |

|

Administration | 105.4 |

| | 107.5 |

|

Impairment charges | 12.2 |

| | 403.9 |

|

Restructuring | 38.7 |

| | 5.4 |

|

Other operating income | (36.3 | ) | | — |

|

Total operating expenses | 335.9 |

| | 764.7 |

|

| | | |

Operating income (loss) | 128.5 |

| | (231.6 | ) |

| | | |

Tysabri® royalty stream | (17.1 | ) | | 204.4 |

|

Interest expense, net | 53.3 |

| | 51.2 |

|

Other (income) expense, net | (3.5 | ) | | 2.5 |

|

Loss on extinguishment of debt | — |

| | 0.4 |

|

Income (loss) before income taxes | 95.8 |

| | (490.1 | ) |

Income tax expense | 24.2 |

| | 39.1 |

|

Net income (loss) | $ | 71.6 |

| | $ | (529.2 | ) |

| | | |

Earnings (loss) per share | | | |

Basic | $ | 0.50 |

| | $ | (3.70 | ) |

Diluted | $ | 0.50 |

| | $ | (3.70 | ) |

| | | |

Weighted-average shares outstanding | | | |

Basic | 143.4 |

| | 143.2 |

|

Diluted | 143.6 |

| | 143.2 |

|

| | | |

Dividends declared per share | $ | 0.160 |

| | $ | 0.145 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions)

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| April 1,

2017 | | April 2,

2016 |

Net income (loss) | $ | 71.6 |

| | $ | (529.2 | ) |

Other comprehensive income: | | | |

Foreign currency translation adjustments | 65.4 |

| | 151.4 |

|

Change in fair value of derivative financial instruments, net of tax | 1.6 |

| | (5.7 | ) |

Change in fair value of investment securities, net of tax | (11.4 | ) | | 6.2 |

|

Change in post-retirement and pension liability adjustments, net of tax | (0.1 | ) | | 0.8 |

|

Other comprehensive income, net of tax | 55.5 |

| | 152.7 |

|

Comprehensive income (loss) | $ | 127.1 |

| | $ | (376.5 | ) |

See accompanying Notes to the Condensed Consolidated Financial Statements

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share amounts)

(unaudited)

|

| | | | | | | |

| April 1,

2017 | | December 31,

2016 |

Assets | | | |

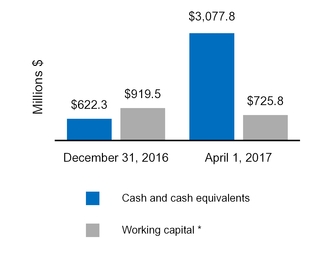

Cash and cash equivalents | $ | 3,077.8 |

| | $ | 622.3 |

|

Accounts receivable, net of allowance for doubtful accounts of $6.0 million and $6.3 million, respectively | 1,050.2 |

| | 1,176.0 |

|

Inventories | 800.2 |

| | 795.0 |

|

Prepaid expenses and other current assets | 185.2 |

| | 212.0 |

|

Total current assets | 5,113.4 |

| | 2,805.3 |

|

Property, plant and equipment, net | 875.3 |

| | 870.1 |

|

Tysabri® royalty stream

| — |

| | 2,350.0 |

|

Goodwill and other indefinite-lived intangible assets | 4,178.0 |

| | 4,163.9 |

|

Other intangible assets, net | 3,341.4 |

| | 3,396.8 |

|

Non-current deferred income taxes | 76.4 |

| | 72.1 |

|

Other non-current assets | 394.9 |

| | 211.9 |

|

Total non-current assets | 8,866.0 |

| | 11,064.8 |

|

Total assets | $ | 13,979.4 |

| | $ | 13,870.1 |

|

Liabilities and Shareholders’ Equity | | | |

Accounts payable | $ | 476.3 |

| | $ | 471.7 |

|

Payroll and related taxes | 146.0 |

| | 115.8 |

|

Accrued customer programs | 348.2 |

| | 380.3 |

|

Accrued liabilities | 281.6 |

| | 263.3 |

|

Accrued income taxes | 57.7 |

| | 32.4 |

|

Current indebtedness | 1,175.4 |

| | 572.8 |

|

Total current liabilities | 2,485.2 |

| | 1,836.3 |

|

Long-term debt, less current portion | 4,618.9 |

| | 5,224.5 |

|

Non-current deferred income taxes | 349.4 |

| | 389.9 |

|

Other non-current liabilities | 458.6 |

| | 461.8 |

|

Total non-current liabilities | 5,426.9 |

| | 6,076.2 |

|

Total liabilities | 7,912.1 |

| | 7,912.5 |

|

Commitments and contingencies - Note 14 | | | |

Shareholders’ equity | | | |

Controlling interest: | | | |

Preferred shares, $0.0001 par value, 10 million shares authorized | — |

| | — |

|

Ordinary shares, €0.001 par value, 10 billion shares authorized | 8,118.1 |

| | 8,135.0 |

|

Accumulated other comprehensive (loss) | (26.3 | ) | | (81.8 | ) |

Retained earnings (accumulated deficit) | (2,024.0 | ) | | (2,095.1 | ) |

Total controlling interest | 6,067.8 |

| | 5,958.1 |

|

Noncontrolling interest | (0.5 | ) | | (0.5 | ) |

Total shareholders’ equity | 6,067.3 |

| | 5,957.6 |

|

Total liabilities and shareholders' equity | $ | 13,979.4 |

| | $ | 13,870.1 |

|

| | | |

Supplemental Disclosures of Balance Sheet Information | | | |

Ordinary shares, issued and outstanding | 143.4 |

| | 143.4 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| April 1,

2017 | | April 2,

2016 |

Cash Flows From (For) Operating Activities | | | |

Net income (loss) | $ | 71.6 |

| | $ | (529.2 | ) |

Adjustments to derive cash flows | | | |

Depreciation and amortization | 109.4 |

| | 109.7 |

|

Share-based compensation | 6.1 |

| | 15.8 |

|

Impairment charges | 12.2 |

| | 403.9 |

|

Tysabri® royalty stream | (17.1 | ) | | 204.4 |

|

Loss on extinguishment of debt | — |

| | 0.4 |

|

Restructuring charges | 38.7 |

| | 5.4 |

|

Deferred income taxes | (46.0 | ) | | (178.3 | ) |

Amortization of debt discount (premium) | (6.4 | ) | | (6.7 | ) |

Other non-cash adjustments | (1.1 | ) | | 1.6 |

|

Subtotal | 167.4 |

| | 27.0 |

|

Increase (decrease) in cash due to: | | | |

Accounts receivable | 50.1 |

| | 17.3 |

|

Inventories | 0.5 |

| | 4.4 |

|

Accounts payable | 2.5 |

| | (3.2 | ) |

Payroll and related taxes | (10.1 | ) | | (37.4 | ) |

Accrued customer programs | (32.7 | ) | | (81.7 | ) |

Accrued liabilities | 2.3 |

| | (12.8 | ) |

Accrued income taxes | 41.4 |

| | 185.7 |

|

Other | (26.9 | ) | | (0.8 | ) |

Subtotal | 27.1 |

| | 71.5 |

|

Net cash from (for) operating activities | 194.5 |

| | 98.5 |

|

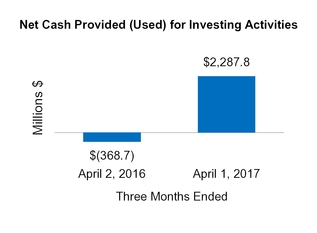

Cash Flows From (For) Investing Activities | | | |

Proceeds from royalty rights - at fair value | 85.3 |

| | 83.4 |

|

Acquisitions of businesses, net of cash acquired | — |

| | (416.4 | ) |

Additions to property and equipment | (22.0 | ) | | (34.7 | ) |

Proceeds from sale of business and other assets | 25.3 |

| | — |

|

Proceeds from sale of the Tysabri® royalty stream | 2,200.0 |

| | — |

|

Other investing | (0.8 | ) | | (1.0 | ) |

Net cash from (for) investing activities | 2,287.8 |

| | (368.7 | ) |

Cash Flows From (For) Financing Activities | | | |

Issuances of long-term debt | — |

| | 1,190.3 |

|

Payments on long-term debt | (13.6 | ) | | (14.3 | ) |

Borrowings (repayments) of revolving credit agreements and other financing, net | 0.3 |

| | (715.9 | ) |

Deferred financing fees | (0.4 | ) | | (1.5 | ) |

Issuance of ordinary shares | — |

| | 3.1 |

|

Cash dividends | (23.0 | ) | | (20.8 | ) |

Other financing | (0.5 | ) | | (3.5 | ) |

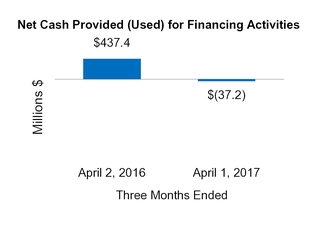

Net cash from (for) financing activities | (37.2 | ) | | 437.4 |

|

Effect of exchange rate changes on cash and cash equivalents | 10.4 |

| | 3.9 |

|

Net increase in cash and cash equivalents | 2,455.5 |

| | 171.1 |

|

Cash and cash equivalents, beginning of period | 622.3 |

| | 417.8 |

|

Cash and cash equivalents, end of period | $ | 3,077.8 |

| | $ | 588.9 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements

Perrigo Company plc - Item 1

Note 1

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General Information

The Company

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013 and became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"). Unless the context requires otherwise, the terms "Perrigo," the "Company," "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries.

We are a leading global healthcare company, delivering value to our customers and consumers by providing Quality Affordable Healthcare Products®. Founded in 1887 as a packager of home remedies, we have built a unique business model that is best described as the convergence of a fast-moving consumer goods company, a high-quality pharmaceutical manufacturing organization and a world-class supply chain network. We are the world's largest manufacturer of over-the-counter (“OTC”) healthcare products and supplier of infant formulas for the store brand market. We also are a leading provider of branded OTC products throughout Europe and the U.S., as well as a leading producer of generic standard topical products such as creams, lotions, gels, as well as inhalants and injections ("extended topical") prescription drugs. We are headquartered in Ireland, and sell our products primarily in North America and Europe, as well as in other markets, including Australia, Israel and China.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles ("GAAP") for interim financial information and with the instructions to Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Financial Statements should be read in conjunction with the consolidated financial statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2016. In the opinion of management, all adjustments (consisting of normal recurring accruals and other adjustments) considered necessary for a fair presentation of the unaudited Condensed Consolidated Financial Statements have been included and include our accounts and the accounts of all majority-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

Perrigo Company plc - Item 1

Note 1

Recent Accounting Standard Pronouncements

Below are recent accounting standard updates that we are still assessing to determine the effect on our consolidated financial statements. We do not believe that any other recently issued accounting standards could have a material effect on our consolidated financial statements. As new accounting pronouncements are issued, we will adopt those that are applicable under the circumstances.

|

| | | | | | |

Recently Issued Accounting Standards Adopted |

Standard | | Description | | Date of adoption | | Effect on the Financial Statements or Other Significant Matters |

Clarifying the Definition of a Business | | This update clarifies the definition of a business and addresses whether transactions should be accounted for as asset acquisitions or business combinations (or divestitures). The guidance includes an initial threshold that an acquired set of assets will not be considered a business if substantially all of the fair value of the assets acquired is concentrated in a single tangible or identifiable intangible asset (or group of similar assets). If the acquired set does not pass the initial threshold, then the guidance requires that, to be a business, the set must include an input and a substantive process that together significantly contribute to the ability to create outputs. Different factors are considered to determine whether the set includes a substantive process, such as the inclusion of an organized workforce. Further, the guidance removes language stating that a business need not include all of the inputs and processes that the seller used in operating the business. | | January 1, 2017 | | We early adopted this new standard and will apply it prospectively when determining whether transactions should be accounted for as asset acquisitions or business combinations (divestitures). During the three months ended April 1, 2017, we applied the new guidance when determining whether certain product divestitures represented sales of assets or businesses. In each case, we determined that the assets sold did not meet the definition of a business under the new rules.

|

Improvements to Employee Share-Based Payment Accounting

| | This guidance is intended to simplify several aspects of the accounting for share-based payment award transactions. It will require all income tax effects of awards to be recorded through the income statement when they vest or settle as opposed to certain amounts being recorded in additional paid-in capital. An entity will also have to elect whether to account for forfeitures as they occur or by estimating the number of awards expected to be forfeited and adjusting the estimate when it is likely to change (as currently required). The guidance will also increase the amount an employer can withhold to cover income taxes on awards. | | January 1, 2017 | | We adopted this standard as of January 1, 2017. We elected to estimate the number of awards expected to be forfeited and adjust the estimate when it is likely to change, consistent with past practice. We did not change the amounts that we withhold to cover income taxes on awards. As the requirement to record all income tax effects of vested or settled awards through the income statement is prospective in nature, there was no cumulative effect of adopting the standard on our balance sheet. |

Perrigo Company plc - Item 1

Note 1

|

| | | | | | |

Recently Issued Accounting Standards Not Yet Adopted |

Standard | | Description | | Effective Date | | Effect on the Financial Statements or Other Significant Matters |

Revenue from Contracts with Customers | | The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the following steps: identify the contract(s) with a customer; identify the performance obligations in the contract; determine the transaction price; allocate the transaction price to the performance obligations in the contract; and recognize revenue when (or as) the entity satisfies a performance obligation. This guidance allows for two adoption methods, full retrospective approach or modified retrospective approach. | | January 1, 2018 | | We continue to evaluate the implications of adoption of the new revenue standard on our consolidated financial statements. We have completed an initial assessment of the adoption and are in the process of completing a detailed review of our various customer contracts. Based on our initial analysis, we do not expect there to be a material impact on our revenue recognition practices. We plan to adopt the new revenue standard effective January 1, 2018 using the modified retrospective approach. |

Intra-Entity Asset Transfers of Assets Other Than Inventory | | Under the new guidance, the tax impact to the seller on the profit from the transfers and the buyer’s deferred tax benefit on the increased tax basis would be recognized when the transfers occur, resulting in the recognition of expense sooner than under historical guidance. The guidance excludes intra-entity transfers of inventory. For intra-entity transfers of inventory, the FASB decided to retain current GAAP, which requires an entity to recognize the income tax consequences when the inventory has been sold to an outside party. | | January 1, 2018 | | We are currently evaluating the implications of adoption on our consolidated financial statements and considering whether to early adopt the standard.

|

Leases | | This guidance was issued to increase transparency and comparability among organizations by requiring recognition of lease assets and lease liabilities on the balance sheet and disclosure of key information about leasing arrangements. For leases with a term of 12 months or less, lessees are permitted to make an election to not recognize right-of-use assets and lease liabilities. Upon adoption, lessees will apply the new standard as of the beginning of the earliest comparative period presented in the financial statements, however lessees will be able to exclude leases that expire as of the implementation date. Early adoption is permitted. | | January 1, 2019 | | We are currently evaluating the implications of adoption on our consolidated financial statements.

|

Perrigo Company plc - Item 1

Note 1

|

| | | | | | |

Recently Issued Accounting Standards Not Yet Adopted (continued) |

Standard | | Description | | Effective Date | | Effect on the Financial Statements or Other Significant Matters |

Measurement of Credit Losses on Financial Instruments | | This guidance changes the impairment model for most financial assets and certain other instruments, replacing the current "incurred loss" approach with an "expected loss" credit impairment model, which will apply to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, and off-balance sheet credit exposures such as letters of credit. Early adoption is permitted. | | January 1, 2020 | | We are currently evaluating the new standard for potential impacts on our receivables, debt, and other financial instruments and considering whether to early adopt the standard. |

Intangibles - Goodwill and Other Simplifying the Test for Goodwill | | The objective of this update is to reduce the cost and complexity of subsequent goodwill accounting by simplifying the impairment test by removing the Step 2 requirement to perform a hypothetical purchase price allocation when the carrying value of a reporting unit exceeds its fair value. If a reporting unit’s carrying value exceeds its fair value, an entity would record an impairment charge based on that difference, limited to the amount of goodwill attributed to that reporting unit. The proposal would not change the guidance on completing Step 1 of the goodwill impairment test. The proposed guidance would be applied prospectively with an effective date for Perrigo of January 1, 2020, with early adoption permitted as of January 1, 2017. | | January 1, 2020 | | We are currently evaluating the implications of adoption on our consolidated financial statements and considering whether to early adopt the standard.

|

NOTE 2 – ACQUISITIONS AND DIVESTITURES

All of the below acquisitions, with the exception of the generic Benzaclin™ product purchase, have been accounted for under the acquisition method of accounting based on our analysis of the acquired inputs and processes, and the related assets acquired and liabilities assumed were recorded at fair value as of the acquisition date.

Fair value estimates are based on a complex series of judgments about future events and rely heavily on estimates and assumptions. The judgments used to determine the estimated fair value assigned to each class of assets and liabilities assumed, as well as asset lives, can materially impact our results of operations.

The effects of all of the acquisitions described below were included in the Condensed Consolidated Financial Statements prospectively from the date of each acquisition. Unless otherwise indicated, acquisition costs incurred were immaterial and were recorded in Administration expense.

Perrigo Company plc - Item 1

Note 2

Prior Year Acquisitions

Generic Benzaclin™ Product

On August 2, 2016, we purchased the remaining 60.9% product rights to a generic Benzaclin™ product ("Generic Benzaclin™"), which we had developed and marketed in collaboration with Barr Laboratories, Inc. ("Barr"), a subsidiary of Teva Pharmaceuticals, for $62.0 million in cash. In September 2007, we entered into an initial development, marketing and commercialization agreement with Barr, in which Barr contributed to the product's development costs and we developed and marketed the product in the U.S. and Israel. Under this agreement, we paid Barr a percentage of net income from the product's sales in these territories, adjusted for Barr's contributions to the product's development costs. By purchasing the remaining product rights from Barr, we are now entitled to 100% of income from sales of the product. Operating results attributable to Generic Benzaclin™ are included within our Prescription Pharmaceuticals ("RX ") segment. The intangible asset acquired is a distribution and license agreement with a nine-year useful life.

Tretinoin Product Portfolio

On January 22, 2016, we acquired a portfolio of generic dosage forms and strengths of Retin-A® (tretinoin), a topical prescription acne treatment, from Matawan Pharmaceuticals, LLC, for $416.4 million in cash ("Tretinoin Products"), which further expanded our standard topical products such as creams, lotions, and gels, as well as our inhalants and injections ("extended topicals") portfolio. We were the authorized generic distributor of these products from 2005 to 2013. Operating results attributable to the acquisition are included within our RX segment. The intangible assets acquired included generic product rights valued using the multi-period excess earnings method and assigned a 20-year useful life, and non-compete agreements valued using the lost income method and assigned a five-year useful life. The goodwill acquired is deductible for tax purposes.

Development-Stage Rx Products

In May 2015, we entered into an agreement with a clinical stage biotechnology company for two specialty pharmaceutical products in development ("Development-Stage Rx Products"). We paid $18.0 million for an option to acquire the two products, which was recorded in Research and Development expense. On March 1, 2016, to further invest in our specialty "prescription only" ("Rx") portfolio, we exercised the option for both products, which requires us to make contingent payments if we obtain regulatory approval and achieve certain sales milestones. We are also obligated to make certain royalty payments over periods ranging from seven to ten years from the launch of each product.

We accounted for the option exercise as a business acquisition within our RX segment, recording In Process Research and Development ("IPR&D") and contingent consideration on the balance sheet. The IPR&D was valued using the multi-period excess earnings method and has an indefinite useful life until such time as the research is completed (at which time it will become a definite-lived intangible asset), or is determined to have no future use (at which time it would be impaired). The contingent consideration is an estimate of the future milestone payments and royalties based on probability-weighted outcomes, sensitivity analysis, and discount rates reflective of the risk involved. The amount of contingent consideration recognized was $24.9 million and was recorded in Other non-current liabilities.

Perrigo Company plc - Item 1

Note 2

Purchase Price Allocation of Prior Year Acquisitions

The Tretinoin Products, Development-Stage Rx Products and four small product acquisitions (included in "All Other" in the table below) are final.

The below table indicates the purchase price allocation for acquisitions completed during the year ended December 31, 2016 (in millions):

|

| | | | | | | | | | | |

| Tretinoin Products | | Development-Stage Rx Products | | All Other(1) |

Purchase price paid | $ | 416.4 |

| | $ | — |

| | $ | 17.1 |

|

Contingent consideration | — |

| | 24.9 |

| | 26.2 |

|

Total purchase consideration | $ | 416.4 |

| | $ | 24.9 |

| | $ | 43.3 |

|

| | | | | |

Assets acquired: | | | | | |

Cash and cash equivalents | $ | — |

| | $ | — |

| | $ | 3.8 |

|

Accounts receivable | — |

| | — |

| | 4.9 |

|

Inventories | 1.4 |

| | — |

| | 7.1 |

|

Prepaid expenses and other current assets | — |

| | — |

| | 0.1 |

|

Property and equipment | — |

| | — |

| | 1.2 |

|

Goodwill | 1.7 |

| | — |

| | — |

|

Definite-lived intangibles: | | | | | |

Distribution and license agreements, supply agreements | — |

| | — |

| | 1.8 |

|

Developed product technology, formulations, and product rights | 411.0 |

| | — |

| | 18.0 |

|

Customer relationships and distribution networks | — |

| | — |

| | 8.2 |

|

Non-compete agreements | 2.3 |

| | — |

| | — |

|

Indefinite-lived intangibles: | | | | | |

In-process research and development | — |

| | 24.9 |

| | 4.9 |

|

Total intangible assets | $ | 413.3 |

| | $ | 24.9 |

| | $ | 32.9 |

|

Total assets | $ | 416.4 |

| | $ | 24.9 |

| | $ | 50.0 |

|

Liabilities assumed: | | | | | |

Accounts payable | $ | — |

| | $ | — |

| | $ | 2.8 |

|

Accrued liabilities | — |

| | — |

| | 0.1 |

|

Long-term debt | — |

| | — |

| | 3.3 |

|

Net deferred income tax liabilities | — |

| | — |

| | 0.5 |

|

Total liabilities | $ | — |

| | $ | — |

| | $ | 6.7 |

|

Net assets acquired | $ | 416.4 |

| | $ | 24.9 |

| | $ | 43.3 |

|

| |

(1) | Consists of four product acquisitions in our Consumer Healthcare Americas ("CHCA"), Consumer Healthcare International ("CHCI") and RX segments |

Current Year Divestitures

On February 1, 2017, we completed the sale of the Animal Health pet treats plant fixed assets, which were previously classified as held-for sale, and received $7.7 million in proceeds.

Perrigo Company plc - Item 1

Note 2

On January 3, 2017, we sold certain Abbreviated New Drug Applications ("ANDAs") for $15.0 million to a third party, which was recorded in Other operating income on the Condensed Consolidated Statement of Operations.

Prior Year Divestitures

On August 5, 2016, we completed the sale of our U.S. Vitamins, Minerals, and Supplements ("VMS") business within our CHCA segment to International Vitamins Corporation ("IVC") for $61.8 million inclusive of an estimated working capital adjustment. Prior to closing the sale, we determined that the carrying value of the VMS business exceeded its fair value less the cost to sell, resulting in an impairment charge of $6.2 million, which was recorded in Impairment charges on the Condensed Consolidated Statements of Operations during the year ended December 31, 2016.

NOTE 3 – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

Changes in the carrying amount of goodwill, by reportable segment, were as follows (in millions): |

| | | | | | | | | | | | |

Reporting Segments: | | December 31, 2016 | | Currency translation adjustment | | April 1,

2017 |

CHCA | | $ | 1,810.6 |

| | $ | 2.3 |

| | $ | 1,812.9 |

|

CHCI | | 1,070.8 |

| | 14.8 |

| | 1,085.6 |

|

RX | | 1,086.6 |

| | 4.5 |

| | 1,091.1 |

|

Other | | 81.4 |

| | 5.1 |

| | 86.5 |

|

Total goodwill | | $ | 4,049.4 |

| | $ | 26.7 |

| | $ | 4,076.1 |

|

In connection with the preparation of our financial statements for the three-month period ending April 2, 2016, we identified indicators of goodwill impairment for certain of our reporting units, which required us to complete interim goodwill impairment testing. Step one of the goodwill impairment test involves determining the fair value of the reporting unit using a discounted cash flow technique and comparing it to the reporting unit’s carrying value. The main assumptions supporting the cash flow projections used to determine the reporting units’ fair value include revenue growth based on product line extensions, product life cycle strategies, and geographical expansion within the markets in which the reporting unit distributes products, gross margins consistent with historical trends, and advertising and promotion investments largely consistent with the reporting unit's growth plans. If a reporting unit does not pass step one of the goodwill impairment test, step two is completed. The second step of the goodwill impairment test requires that we determine the implied fair value of the reporting unit’s goodwill, which involves determining the value of the reporting unit’s individual assets and liabilities. If the implied fair value of the reporting unit’s goodwill is less than the carrying value of the reporting unit’s goodwill, an impairment charge is recorded to adjust the goodwill carrying value to the implied fair value.

In connection with the preparation of our financial statements for the three months ended April 2, 2016, we identified indicators of impairment for our Branded Consumer Healthcare - Rest of World ("BCH-ROW") reporting unit, which comprises primarily operations attributable to the Omega Pharma Invest N.V. ("Omega") acquisition in all geographic regions except for Belgium. The primary impairment indicators included the decline in our 2016 performance expectations and a reduction in our long-range revenue growth forecast. BCH-ROW did not pass step one of goodwill impairment testing. The change in fair value from previous estimates was due primarily to the changes in the market and performance of the brands such that the evaluation of brand prioritization and product extensions or launches in new regions is being more focused to maximize the potential of all brands in the segment's portfolio. Based on our evaluation and estimates of the fair values of the assets and liabilities and the deficit of the fair value when compared to the related book value, we recorded $130.5 million in impairment charges for the three months ended April 2, 2016 within our CHCI segment.

Perrigo Company plc - Item 1

Note 3

Intangible Assets

Other intangible assets and related accumulated amortization consisted of the following (in millions):

|

| | | | | | | | | | | | | | | |

| April 1, 2017 | | December 31, 2016 |

| Gross | | Accumulated Amortization | | Gross | | Accumulated Amortization |

Definite-lived intangibles: | | | | | | | |

Distribution and license agreements, supply agreements | $ | 307.6 |

| | $ | 132.5 |

| | $ | 305.6 |

| | $ | 120.4 |

|

Developed product technology, formulations, and product rights | 1,428.2 |

| | 562.5 |

| | 1,418.1 |

| | 526.0 |

|

Customer relationships and distribution networks | 1,505.7 |

| | 339.8 |

| | 1,489.9 |

| | 307.5 |

|

Trademarks, trade names, and brands | 1,203.4 |

| | 71.5 |

| | 1,189.3 |

| | 55.3 |

|

Non-compete agreements | 14.5 |

| | 11.7 |

| | 14.3 |

| | 11.2 |

|

Total definite-lived intangibles | $ | 4,459.4 |

| | $ | 1,118.0 |

| | $ | 4,417.2 |

| | $ | 1,020.4 |

|

Indefinite-lived intangibles: | | | | | | | |

Trademarks, trade names, and brands | $ | 50.8 |

| | $ | — |

| | $ | 50.5 |

| | $ | — |

|

In-process research and development | 51.1 |

| | — |

| | 64.0 |

| | — |

|

Total indefinite-lived intangibles | 101.9 |

| | — |

| | 114.5 |

| | — |

|

Total other intangible assets | $ | 4,561.3 |

| | $ | 1,118.0 |

| | $ | 4,531.7 |

| | $ | 1,020.4 |

|

Certain intangible assets are denominated in currencies other than the U.S. dollar; therefore, their gross and accumulated amortization balances are subject to foreign currency movements.

We recorded amortization expense of $85.5 million and $85.3 million for the three months ended April 1, 2017 and April 2, 2016, respectively.

We recorded an impairment charge of $12.2 million on certain IPR&D assets during the three months ended April 1, 2017 due to changes in the projected development and regulatory timelines for various projects. During the three months ended April 1, 2017, we recorded a decrease in the contingent consideration liability associated with certain IPR&D assets in Other operating income on the Condensed Consolidated Statement of Operations. Refer to Note 6 for additional information.

We identified indicators of impairment associated with certain indefinite-lived intangible assets acquired in conjunction with the Omega acquisition. The primary impairment indicators included the decline in our 2016 performance expectations and a reduction in our long-range revenue growth forecast. The assessment utilized the excess earnings method to determine fair value and resulted in an impairment charge of $273.4 million in Impairment charges on the Condensed Consolidated Statements of Operations within our CHCI segment, which represented the difference between the carrying amount of the intangible assets and their estimated fair value. The change in fair value from previous estimates was due primarily to the changes in the market and performance of the brands such that the evaluation of brand prioritization and product extensions or launches in new regions is being more focused to maximize the potential of all brands in the segment's portfolio. The main assumptions supporting the fair value of these assets and cash flow projections included revenue growth based on product line extensions, product life cycle strategies, and geographical expansion within the markets in which the CHCI segment distributes products, gross margins consistent with historical trends, and advertising and promotion investments largely consistent with the segment's growth plans.

In addition, due to reprioritization of certain brands in the CHCI segment and change in performance expectations for the cough/cold/allergy, anti-parasite, personal care, lifestyle, and natural health brands, on April 3, 2016, we reclassified $364.5 million of indefinite-lived assets to definite-lived assets with a useful life of 20 years. We began amortizing the assets in the second quarter of 2016.

Perrigo Company plc - Item 1

Note 4

NOTE 4 - ACCOUNTS RECEIVABLE FACTORING

We have multiple accounts receivable factoring arrangements with non-related third-party financial institutions (the “Factors”). Pursuant to the terms of the arrangements, we sell to the Factors certain of our accounts receivable balances on a non-recourse basis for credit approved accounts. An administrative fee ranging from 0.14% to 0.15% per invoice is charged on the gross amount of accounts receivables assigned to the Factors, and interest is calculated at the applicable EUR LIBOR rate plus 70 basis points. The total amount factored on a non-recourse basis and excluded from accounts receivable was $19.3 million and $50.7 million at April 1, 2017 and December 31, 2016, respectively.

NOTE 5 – INVENTORIES

Major components of inventory were as follows (in millions):

|

| | | | | | | |

| April 1,

2017 | | December 31,

2016 |

Finished goods | $ | 449.3 |

| | $ | 431.1 |

|

Work in process | 151.7 |

| | 165.7 |

|

Raw materials | 199.2 |

| | 198.2 |

|

Total inventories | $ | 800.2 |

| | $ | 795.0 |

|

NOTE 6 – FAIR VALUE MEASUREMENTS

Fair value is the price that would be received upon sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The following fair value hierarchy is used in selecting inputs, with the highest priority given to Level 1, as these are the most transparent or reliable.

| |

Level 1: | Quoted prices for identical instruments in active markets. |

| |

Level 2: | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets. |

| |

Level 3: | Valuations derived from valuation techniques in which one or more significant inputs are not observable. |

Perrigo Company plc - Item 1

Note 6

The following table summarizes the valuation of our financial instruments carried at fair value and measured at fair value on a recurring and non-recurring basis by the above pricing categories (in millions):

|

| | | | | | | | | | |

| | | | Fair Value |

| | Fair Value Hierarchy | | April 1,

2017 | | December 31,

2016 |

Measured at fair value on a recurring basis: | | | | | | |

Assets: | | | | | | |

Investment securities | | Level 1 | | $ | 22.8 |

| | $ | 38.2 |

|

| | | | | | |

Foreign currency forward contracts | | Level 2 | | $ | 6.5 |

| | $ | 3.8 |

|

Funds associated with Israeli severance liability | | Level 2 | | 17.1 |

| | 15.9 |

|

Total level 2 assets | | | | $ | 23.6 |

| | $ | 19.7 |

|

| | | | | | |

Royalty Pharma contingent milestone payments | | Level 3 | | $ | 184.5 |

| | $ | — |

|

Tysabri® royalty stream | | Level 3 | | — |

| | 2,350.0 |

|

Total level 3 assets | | | | $ | 184.5 |

| | $ | 2,350.0 |

|

| | | | | | |

Liabilities: | | | | | | |

Foreign currency forward contracts | | Level 2 | | $ | 2.5 |

| | $ | 5.0 |

|

| | | | | | |

Contingent consideration | | Level 3 | | $ | 52.0 |

| | $ | 69.9 |

|

| | | | | | |

Measured at fair value on a non-recurring basis: | | | | | | |

Assets: | | | | | | |

Goodwill(1) | | Level 3 | | $ | — |

| | $ | 1,148.4 |

|

Indefinite-lived intangible assets(2) | | Level 3 | | 13.8 |

| | 0.3 |

|

Definite-lived intangible assets(3) | | Level 3 | | — |

| | 758.0 |

|

Assets held for sale, net | | Level 3 | | 11.0 |

| | 18.2 |

|

Total level 3 assets | | | | $ | 24.8 |

| | $ | 1,924.9 |

|

| |

(1) | As of December 31, 2016, goodwill with a carrying amount of $2.2 billion was written down to its implied fair value of $1.1 billion. |

| |

(2) | As of April 1, 2017, indefinite-lived intangible assets with a carrying amount of $26.0 million were written down to a fair value of $13.8 million, resulting in a total impairment charge of $12.2 million. As of December 31, 2016, indefinite-lived intangible assets with a carrying amount of $0.7 million were written down to a fair value of $0.3 million. |

| |

(3) | As of December 31, 2016, definite-lived intangible assets with a carrying amount of $2.3 billion were written down to a fair value of $758.0 million resulting in a total impairment charge of $1.5 billion. Included in this balance are indefinite-lived intangible assets with fair value of $364.5 million and $674.2 million that were reclassified to definite-lived assets at April 3, 2016 and October 2, 2016, respectively. |

There were no transfers among Level 1, 2, and 3 during the three months ended April 1, 2017 or the year ended December 31, 2016. Our policy regarding the recording of transfers between levels is to record any such transfers at the end of the reporting period. See Note 7 for information on our investment securities. See Note 8 for a discussion of derivatives.

Foreign currency forward contracts

The fair value of foreign currency forward contracts is determined using a market approach, which utilizes values for comparable derivative instruments.

Perrigo Company plc - Item 1

Note 6

Funds Associated with Israel Severance Liability

Israeli labor laws and agreements require us to pay benefits to employees dismissed or retiring under certain circumstances. Severance pay is calculated on the basis of the most recent employee salary levels and the length of employee service. Our Israeli subsidiaries also provide retirement bonuses to certain managerial employees. We make regular deposits to retirement funds and purchase insurance policies to partially fund these liabilities. The funds are determined using prices for recently traded financial instruments with similar underlying terms, as well as directly or indirectly observable inputs, such as interest rates and yield curves, that are observable at commonly quoted intervals.

Tysabri® Royalty Stream

On December 18, 2013, we acquired Elan, which had a royalty agreement with Biogen Idec Inc. ("Biogen"), whereby Biogen conveyed the right to receive royalties that are typically payable on sales revenue generated by the sale, distribution or other use of the drug Tysabri®. Pursuant to the royalty agreement, we were entitled to royalty payments from Biogen based on its Tysabri® sales in all indications and geographies. We received royalties of 12% on worldwide Biogen sales of Tysabri® from December 18, 2013 through April 30, 2014. From May 1, 2014, we received royalties of 18% on annual worldwide Biogen sales of Tysabri® up to $2.0 billion and 25% on annual sales above $2.0 billion.

We accounted for the Tysabri® royalty stream as a financial asset and had elected to use the fair value option model. We made the election to account for the Tysabri® financial asset using the fair value option as we believed this method was most appropriate for an asset that did not have a par value, a stated interest stream, or a termination date. The financial asset acquired represented a single unit of accounting. The fair value of the financial asset acquired was determined by using a discounted cash flow analysis related to the expected probability weighted future cash flows to be generated by the royalty stream. The financial asset was classified as a Level 3 asset within the fair value hierarchy, as our valuation utilized significant unobservable inputs, including industry analyst estimates for global Tysabri® sales, probability weighted as to the timing and amount of future cash flows along with certain discount rate assumptions. Cash flow forecasts included the estimated effect and timing of future competition, considering patents in effect for Tysabri® through 2024 and contractual rights to receive cash flows into perpetuity. The discounted cash flows were based upon the expected royalty stream forecasted into perpetuity using a 20-year discrete period with a declining rate terminal value.

In the first quarter of 2016, a competitor's pipeline product, Ocrevus®, received breakthrough therapy designation from the FDA. Breakthrough therapy designation is granted when a drug intended alone or in combination with one or more other drugs to treat a serious or life threatening disease or condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. In June 2016, the FDA granted priority review with a target action date in December 2016. A priority review is a designation when the FDA will direct overall attention and resources to the evaluation of applications for drugs that, if approved, would be significant improvements in the safety or effectiveness of the treatment, diagnosis, or prevention of serious conditions when compared to standard applications. The product was approved in the first quarter of 2017. The product is expected to compete with Tysabri®, and we expected it to have a significant negative impact on the Tysabri® royalty stream. Although the product has not launched, industry analysts believe that, based on released clinical study information, Ocrevus® will compete favorably against Tysabri® in the relapsing, remitting multiple sclerosis market segment due to its high efficacy and convenient dosage form.

Given the new market information for Ocrevus®, using industry analyst estimates we reduced our first ten year growth forecasts from an average of growth of approximately 3.4% in the fourth calendar quarter of 2015 to an average decline of approximately minus 2.0% in the third and fourth calendar quarters of 2016. In November 2016, we announced we were evaluating strategic alternatives for the Tysabri® asset. As of December 31, 2016, the financial asset was adjusted based on the strategic review and sale process. These effects, combined with the change in discount rate each quarter, led to a reduction in fair value of $204.4 million, $910.8 million, $377.4 million and $1.1 billion in the first, second, third and fourth quarters of 2016, respectively.

Perrigo Company plc - Item 1

Note 6

On March 27, 2017, we announced the completed divestment of our Tysabri® royalty stream to Royalty Pharma for up to $2.85 billion, which consists of $2.2 billion in cash and up to $250.0 million and $400.0 million in milestone payments if the royalties on global net sales of Tysabri® that are received by Royalty Pharma meet specific thresholds in 2018 and 2020, respectively. As a result of this transaction, we transferred the entire financial asset to Royalty Pharma and recorded a $17.1 million gain during the three months ended April 1, 2017. We elected the fair value option for the contingent milestone payments, and these were recorded at an estimated fair value of $184.5 million as of April 1, 2017. We elected to account for the Royalty Pharma contingent milestone payments using the fair value option as we believe that this will provide investors with the expected value we could potentially receive under the two contingent milestones receivable which would help them understand the potential future cash flows we might receive in future periods. We valued the contingent milestone payments using a modified Black-Scholes Option Pricing Model ("BSOPM"). Key inputs in the BSOPM are the estimated volatility and rate of return of royalties on global net sales of Tysabri® that are received by Royalty Pharma over time until payment of the contingent milestone payments is completed. Volatility and the estimated fair value of the milestones have a positive relationship such that higher volatility translates to a higher estimated fair value of the contingent milestone payments. We assumed volatility of 30.0% and a rate of return of 8.05% in the valuation of contingent milestone payments performed as of April 1, 2017. We will reassess volatility and rate of return inputs quarterly by analyzing certain market volatility benchmarks and the risk associated with Royalty Pharma achieving the underlying projected royalties.

In addition, included in our accounts receivable balance at December 31, 2016 was $84.4 million related to the Tysabri® royalty stream.

Interest Rate Swaps

The fair values of interest rate swaps are determined using a market approach, which utilizes values for comparable swap instruments.

Contingent Consideration

Contingent consideration represents milestone payment obligations obtained through product acquisitions, which are valued using estimates based on probability-weighted outcomes, sensitivity analysis, and discount rates reflective of the risk involved. The estimates are updated quarterly and the liabilities are adjusted to fair value depending on a number of assumptions, including the competitive landscape and regulatory approvals that may impact the future sales of a product. Purchases or additions for the three months ended April 2, 2016 included contingent consideration associated with one transaction. We reduced a contingent consideration liability associated with certain IPR&D assets, and recorded a corresponding gain of $16.5 million in the three months ended April 1, 2017. The liability decrease relates to a reduction of the probability of achievement assumptions and anticipated cash flows. Refer to Note 3 for additional information. This gain was offset by net realized losses of $2.1 million.

The table below presents a reconciliation for liabilities measured at fair value on a recurring basis using significant unobservable inputs (Level 3) (in millions). Net realized (gains) losses in the table were recorded in Other (income) expense, net.

|

| | | | | | | |

| Three Months Ended |

| April 1,

2017 | | April 2,

2016 |

Contingent Consideration | | | |

Beginning balance | $ | 69.9 |

| | $ | 17.9 |

|

Net realized (gains) losses | (14.4 | ) | | 0.3 |

|

Purchases or additions | — |

| | 29.5 |

|

Foreign currency effect | (0.1 | ) | | 0.3 |

|

Settlements | (3.4 | ) | | — |

|

Ending balance | $ | 52.0 |

| | $ | 48.0 |

|

Perrigo Company plc - Item 1

Note 6

Non-recurring fair value measurements

The non-recurring fair values represent only those assets whose carrying values were adjusted to fair value during the reporting period. See Note 3 for a more detailed discussion of the impaired goodwill and indefinite-lived intangible assets and the valuation methods used, and Note 9 for information on the impaired assets held for sale, net.

Goodwill and Indefinite Lived Intangible Assets

We have seven reporting units for which we assess the goodwill for impairment. We utilize a comparable company market approach, weighted equally with a discounted cash flow analysis, to determine the fair value of the reporting units. We utilize either a relief from royalty method or a multi-period excess earnings method ("MPEEM") to value our indefinite-lived intangible assets. We use a consistent set of projected financial information for the goodwill and indefinite-lived asset impairment tests. The discounted cash flow analysis that we prepared for goodwill impairment testing purposes for the year ended December 31, 2016 included long-term growth rates ranging from 2.0% to 3.0%. We also utilized discount rates ranging from 7.0% to 14.5%, which were deemed to be commensurate with the required investment return and risk involved in realizing the projected free cash flows of each reporting unit. In addition, we burdened projected free cash flows with the capital spending deemed necessary to support the cash flows of each reporting unit, and applied the tax rates that were applicable to the jurisdictions represented within each reporting unit. We recorded Impairment charges on the Condensed Consolidated Statements of Operations related to Goodwill and indefinite lived intangible assets of $130.5 million and $273.4 million, respectively, for the three months ended April 2, 2016. See Note 3 for additional detail on impaired goodwill and indefinite-lived intangible assets.

Definite Lived Intangible Assets

When assessing our definite-lived assets for impairment, we utilize either a multi-period excess earnings method or a relief from royalty method to determine the fair value of the asset and use the forecasts that are consistent with those used in the reporting unit analysis. Below is a summary of the various metrics used in our valuations:

|

| | | | | | | | | |

| Year Ended |

| December 31, 2016 |

| Omega - Lifestyle | | Omega - XLS | | Entocort® - Branded Products | | Entocort® - AG Products | | Herron Trade names and Trademarks |

5-year average growth rate | 2.5% | | 3.2% | | (31.7)% | | (30.4)% | | 4.6% |

Long-term growth rates | 2.0% | | NA | | (10.0)% | | (4.7)% | | 2.5% |

Discount rate | 9.3% | | 9.5% | | 13.0% | | 10.5% | | 10.8% |

Royalty rate | NA | | 4.0% | | NA | | NA | | 11.0% |

Valuation method | MPEEM | | Relief from Royalty | | MPEEM | | MPEEM | | Relief from Royalty |

Assets Held for sale

When a group of assets is classified as held-for-sale, the book value is evaluated and adjusted to the lower of its carrying amount or fair value less the cost to sell. See Note 9 for additional information on the impaired assets held for sale, net.

Fixed Rate Long-term Debt

As of April 1, 2017 and December 31, 2016, our fixed rate long-term debt consisted of public bonds, a private placement notes, and retail bonds. As of April 1, 2017, the public bonds and private placement note had a carrying value and a fair value of $4.6 billion, based on quoted market prices (Level 1). As of December 31, 2016, the public bonds and private placement notes had a carrying value and fair value of $4.6 billion, based on quoted market prices (Level 1). As of April 1, 2017, our retail bonds and private placement notes had a carrying value of $783.2 million (excluding a premium of $43.4 million) and a fair value of $833.0 million. As of December 31, 2016, our retail bonds and private placement notes had a carrying value of $773.1 million (excluding a premium of $49.8

Perrigo Company plc - Item 1

Note 6

million) and a fair value of $825.0 million. The fair value of our retail bonds for both periods was based on interest rates offered for borrowings of a similar nature and remaining maturities (Level 2).

The carrying amounts of our other financial instruments, consisting of cash and cash equivalents, accounts receivable, accounts payable, short-term debt and variable rate long-term debt, approximate their fair value.

NOTE 7 – INVESTMENTS

Available for Sale Securities

Our available for sale securities are reported in Prepaid expenses and other current assets. Unrealized investment gains (losses) on available for sale securities were as follows (in millions):

|

| | | | | | | |

| April 1,

2017 | | December 31, 2016 |

Equity securities, at cost less impairments | $ | 15.5 |

| | $ | 16.5 |

|

Gross unrealized gains | 7.3 |

| | 21.7 |

|

Estimated fair value of equity securities | $ | 22.8 |

| | $ | 38.2 |

|

The factors affecting the assessment of impairments include both general financial market conditions and factors specific to a particular company. During the year ended December 31, 2016, we recorded an impairment charge of $1.8 million, related to other-than-temporary impairments of marketable equity securities due to prolonged losses incurred on each of the investments.

During the three months ended April 1, 2017 and the year ended December 31, 2016, we sold a number of our investment securities and recorded gains of $1.6 million and $1.0 million, respectively. The gains were reclassified out of Accumulated Other Comprehensive Income (loss) ("AOCI") and into earnings.

Cost Method Investments

Our cost method investments totaled $6.9 million at April 1, 2017, and December 31, 2016, and are included in Other non-current assets.

Equity Method Investments

Our equity method investments totaled $4.8 million and $4.6 million at April 1, 2017 and December 31, 2016, respectively, and are included in Other non-current assets. We recorded a net gain of $0.1 million and a net loss of $2.4 million during the three months ended April 1, 2017 and April 2, 2016, respectively, for our proportionate share of the equity method investment earnings or losses. The gains and losses were recorded in Other expense, net.

During the three months ended April 2, 2016, one of our equity method investments became publicly traded. As a result, we transferred the $15.5 million investment to available for sale and recorded an $8.7 million unrealized gain, net of tax in Other Comprehensive Income ("OCI").

NOTE 8 – DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

We enter into certain derivative financial instruments, when available on a cost-effective basis, to mitigate our risk associated with changes in interest rates and foreign currency exchange rates as follows:

Interest rate risk management - We are exposed to the impact of interest rate changes through our cash investments and borrowings. We utilize a variety of strategies to manage the impact of changes in interest rates including using a mix of debt maturities along with both fixed-rate and variable-rate debt. In addition, we may enter into treasury-lock agreements and interest rate swap agreements on certain investing and borrowing transactions to manage our exposure to interest rate changes and our overall cost of borrowing.

Perrigo Company plc - Item 1

Note 8

Foreign currency exchange risk management - We conduct business in several major currencies other than the U.S. dollar and are subject to risks associated with changing foreign exchange rates. Our objective is to reduce cash flow volatility associated with foreign exchange rate changes on a consolidated basis to allow management to focus its attention on business operations. Accordingly, we enter into various contracts that change in value as foreign exchange rates change to protect the value of existing foreign currency assets and liabilities, commitments, and anticipated foreign currency sales and expenses.

All derivative instruments are managed on a consolidated basis to efficiently net exposures and thus take advantage of any natural offsets. Gains and losses related to the derivative instruments are expected to be offset largely by gains and losses on the original underlying asset or liability. We do not use derivative financial instruments for speculative purposes.

All of our designated derivatives were classified as cash flow hedges as of April 1, 2017 and December 31, 2016. Designated derivatives meet hedge accounting criteria, which means the fair value of the hedge is recorded in shareholders’ equity as a component of OCI, net of tax. The deferred gains and losses are recognized in income in the period in which the hedged item affects earnings. Any ineffective portion of the change in fair value of the derivative is immediately recognized in earnings. All of our designated derivatives are assessed for hedge effectiveness quarterly.

We also have economic non-designated derivatives that do not meet hedge accounting criteria. These derivative instruments are adjusted to current market value at the end of each period through earnings. Gains or losses on these instruments are offset substantially by the remeasurement adjustment on the hedged item.

Interest Rate Swaps and Treasury Locks

Interest rate swap agreements are contracts to exchange floating rate for fixed rate payments (or vice versa) over the life of the agreement without the exchange of the underlying notional amounts. The notional amounts of the interest rate swap agreements are used to measure interest to be paid or received and do not represent the amount of exposure to credit loss. The differential paid or received on the interest rate swap agreements is recognized as an adjustment to interest expense.

During the six months ended December 31, 2015, we entered into a forward interest rate swap to hedge against changes in the benchmark interest rate between the date the interest rate swap was entered into and the date of expected future debt issuance. The interest rate swap was designated as a cash flow hedge and had a notional amount totaling $200.0 million. The interest rate swap was settled upon the issuance of an aggregate $1.2 billion principal amount of senior notes on March 7, 2016 for a cumulative after-tax loss of $7.0 million in OCI during the three months ended April 2, 2016.

Foreign Currency Derivatives

We enter into foreign currency forward contracts, both designated and non-designated, in order to manage the impact of foreign exchange fluctuations on expected future purchases and related payables denominated in a foreign currency, as well as to hedge the impact of foreign exchange fluctuations on expected future sales and related receivables denominated in a foreign currency. Both types of forward contracts have a maximum maturity date of 18 months. The total notional amount for these contracts was $469.3 million and $533.5 million as of April 1, 2017 and December 31, 2016, respectively.

Effects of Derivatives on the Financial Statements

The below tables indicate the effects of all derivative instruments on the Condensed Consolidated Financial Statements. All amounts exclude income tax effects and are presented in millions.

Perrigo Company plc - Item 1

Note 8

The balance sheet location and gross fair value of our outstanding derivative instruments were as follows:

|

| | | | | | | | | |

| Asset Derivatives |

| Balance Sheet Location | | Fair Value |

| | | April 1,

2017 | | December 31, 2016 |

Designated derivatives: | | | | | |

Foreign currency forward contracts | Other current assets | | $ | 3.0 |

| | $ | 3.1 |

|

Non-designated derivatives: | | | | | |

Foreign currency forward contracts | Other current assets | | $ | 3.5 |

| | $ | 0.7 |

|

|

| | | | | | | | | |

| Liability Derivatives |

| Balance Sheet Location | | Fair Value |

| | | April 1,

2017 | | December 31, 2016 |

Designated derivatives: | | | | | |

Foreign currency forward contracts | Accrued liabilities | | $ | 1.9 |

| | $ | 3.0 |

|

Non-designated derivatives: | | | | | |

Foreign currency forward contracts | Accrued liabilities | | $ | 0.6 |

| | $ | 2.0 |

|

The gains (losses) recorded in OCI for the effective portion of our designated cash flow hedges were as follows:

|

| | | | | | | | |

| | Amount of Gain/(Loss) Recorded in OCI

(Effective Portion) |

| | Three Months Ended |

Designated Cash Flow Hedges | | April 1,

2017 | | April 2,

2016 |

Interest rate swap agreements | | $ | — |

| | $ | (9.0 | ) |

Foreign currency forward contracts | | 2.5 |

| | 1.6 |

|

Total | | $ | 2.5 |

| | $ | (7.4 | ) |

The gains (losses) reclassified from AOCI into earnings for the effective portion of our designated cash flow hedges were as follows:

|

| | | | | | | | | | |

| | | | Amount of Gain/(Loss) Reclassified from AOCI to Income

(Effective Portion) |

| | | | Three Months Ended |

Designated Cash Flow Hedges | | Income Statement Location | | April 1,

2017 | | April 2,

2016 |

Interest rate swap agreements | | Interest expense, net | | $ | (0.6 | ) | | $ | (0.5 | ) |

Foreign currency forward contracts | | Net sales | | 0.2 |

| | 0.5 |

|

| | Cost of sales | | 0.7 |

| | 0.3 |

|

| | Interest expense, net | | (0.6 | ) | | (0.4 | ) |

| | Other (income) expense, net | | (0.5 | ) | | 0.2 |

|

Total | | | | $ | (0.8 | ) | | $ | 0.1 |

|

Perrigo Company plc - Item 1

Note 8

The gains (losses) recognized against earnings for the ineffective portion of our designated cash flow hedges were as follows:

|

| | | | | | | | | | |

| | | | Amount of Gain/(Loss) Recognized in Income

(Ineffective Portion) |

| | | | Three Months Ended |

Designated Cash Flow Hedges | | Income Statement Location | | April 1,

2017 | | April 2,

2016 |

Interest rate swap agreements | | Other (income) expense, net | | $ | — |

| | $ | (0.1 | ) |

Foreign currency forward contracts | | Net sales | | — |

| | (0.1 | ) |

| | Cost of sales | | — |

| | 0.1 |

|

| | Other (income) expense, net | | 0.9 |

| | — |

|

Total | | | | $ | 0.9 |

| | $ | (0.1 | ) |

The effects of our non-designated derivatives on the Condensed Consolidated Statements of Operations were as follows:

|

| | | | | | | | | | |

| | | | Amount of Gain/(Loss) Recognized in Income |

| | | | Three Months Ended |

Non-Designated Derivatives | | Income Statement Location | | April 1,

2017 | | April 2,

2016 |

Foreign currency forward contracts | | Other (income) expense, net | | $ | (8.9 | ) | | $ | (6.9 | ) |

| | Interest expense, net | | (0.4 | ) | | 0.1 |

|

Total | | | | $ | (9.3 | ) | | $ | (6.8 | ) |

NOTE 9 – ASSETS HELD FOR SALE

During the six months ended December 31, 2015, management committed to a plan to sell our India Active Pharmaceutical Ingredients ("API") businesses. As a result, the net assets attributable to the business were classified as held-for-sale beginning at December 31, 2015. As described in Note 18, we completed the sale of our India API business on April 6, 2017.

When a group of assets is classified as held-for-sale, the book value is evaluated and adjusted to the lower of its carrying amount or fair value less the cost to sell. At December 31, 2015, we determined that the carrying value of the India API business exceeded its fair value less cost to sell, resulting in an impairment charge of $29.0 million. We recorded additional impairment charges totaling $6.3 million during the year ended December 31, 2016. The API business is reported primarily in our Other segment.

During the three months ended October 1, 2016, management committed to a plan to sell certain fixed assets associated with our Animal Health pet treats plant. Such assets were classified as held-for-sale beginning at October 1, 2016. As described in Note 2, on February 1, 2017, we completed the sale of the Animal Health pet treats plant fixed assets.

At October 1, 2016, we determined that the carrying value of the fixed assets associated with our Animal Health pet treats plant exceeded the fair value less the cost to sell. We recorded impairment charges totaling $3.7 million during the year ended December 31, 2016. The assets associated with our Animal Health pet treats plant are reported in our CHCA segment.

Perrigo Company plc - Item 1

Note 9

The assets held-for-sale were reported within Prepaid expenses and other current assets and liabilities held-for-sale were reported in Accrued liabilities. The amounts consisted of the following (in millions):

|

| | | | | | | | | | | | | | | |

| April 1,

2017 | | December 31,

2016 |

| CHCA | | Other | | CHCA | | Other |

Assets held for sale | | | | | | | |

Current assets | $ | — |

| | $ | 4.2 |

| | $ | — |

| | $ | 5.1 |

|

Goodwill | — |

| | 5.5 |

| | — |

| | 5.5 |

|

Property, plant and equipment | 2.7 |

| | 33.0 |

| | 13.5 |

| | 33.2 |

|

Other assets | — |

| | 3.2 |

| | — |

| | 3.8 |

|

Less: impairment reserves | — |

| | (34.5 | ) | | (3.7 | ) | | (35.3 | ) |

Total assets held for sale | $ | 2.7 |

| | $ | 11.4 |

| | $ | 9.8 |

| | $ | 12.3 |

|

Liabilities held for sale | | | | | | | |

Current liabilities | $ | 0.1 |

| | $ | 1.0 |

| | $ | 0.1 |

| | $ | 1.9 |

|

Other liabilities | — |

| | 2.0 |

| | — |

| | 1.9 |

|

Total liabilities held for sale | $ | 0.1 |

| | $ | 3.0 |

| | $ | 0.1 |

| | $ | 3.8 |

|

NOTE 10 – INDEBTEDNESS

Total borrowings outstanding are summarized as follows (in millions):

|

| | | | | | | | | | | |

| | | | | April 1,

2017 | | December 31,

2016 |

Term loans | | | | | |

* | 2014 Term loan due December 5, 2019 | $ | 412.9 |

| | $ | 420.7 |

|

Notes and Bonds | | | | | |

| Coupon | Due | | | | | |

* | 4.500% | May 23, 2017 | (3) | | 191.8 |

| | 189.3 |

|

* | 5.125% | December 12, 2017 | (3) | | 319.7 |

| | 315.6 |

|

| 2.300% | November 8, 2018 | (2)(5) | | 600.0 |

| | 600.0 |

|

* | 5.000% | May 23, 2019 | (3) | | 127.9 |

| | 126.2 |

|

| 3.500% | March 15, 2021 | (4) | | 500.0 |

| | 500.0 |

|

| 3.500% | December 15, 2021 | (1) | | 500.0 |

| | 500.0 |

|

* | 5.105% | July 19, 2023 | (3) | | 143.8 |

| | 142.0 |

|

| 4.000% | November 15, 2023 | (2) | | 800.0 |