10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 27, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-36353

Perrigo Company plc

(Exact name of registrant as specified in its charter)

|

| | |

Ireland | | N/A |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland | | - |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: +353 1 7094000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Ordinary shares, €0.001 par value | | New York Stock Exchange |

Title of each class | | Name of each exchange on which registered |

None

(Title of Class)

|

| | | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | | YES | [X] | NO | [ ] |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. | | YES | [ ] | NO | [X] |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | | YES | [X] | NO | [ ] |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | | YES | [X] | NO | [ ] |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | | | | | [ ] |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. | | | | | |

|

| | | | | | | | | | |

Large accelerated filer | [X] | | Accelerated filer | [ ] | | Non-accelerated filer | [ ] | | Smaller reporting company | [ ] |

|

| | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | | YES | [ ] | NO | [X] |

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of our ordinary shares on December 26, 2014 as reported on the New York Stock Exchange, was $23,365,172,165. Ordinary shares held by each director or executive officer have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of August 7, 2015, the registrant had 146,279,437 outstanding ordinary shares.

Documents incorporated by reference:

The information called for by Part III will be incorporated by reference from the Registrant's definitive Proxy Statement for its Annual Meeting of Shareholders to be filed pursuant to Regulation 14A or will be included in an amendment to this Form 10-K.

PERRIGO COMPANY PLC

FORM 10–K

FISCAL YEAR ENDED JUNE 27, 2015

TABLE OF CONTENTS

|

| | |

| | Page No. |

| |

| | |

Part I. | | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Additional Item. | | |

| | |

Part II. | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

Part III. | | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

Part IV. | | |

Item 15. | | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our, or our industry's, actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or the negative of those terms or other comparable terminology.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, including but not limited to the successful integration of the Omega Pharma Invest N.V. business and future actions that may be taken by Mylan N.V. ("Mylan") in furtherance of its unsolicited proposal to acquire control of us. Further, we are deemed to be in an "offer period" for the purposes of the Irish Takeover Rules, which may restrict our ability to execute our strategy on a timely basis. These and other important factors may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The directors of Perrigo Company plc ("Perrigo") accept responsibility for the information contained in this report. To the best of the knowledge and belief of our directors (who have taken all reasonable care to ensure such is the case), the information contained in this report is in accordance with the facts and does not omit anything likely to affect the import of such information.

A person interested in 1% or more of any class of relevant securities of Perrigo or Mylan may have disclosure obligations under Rule 8.3 of the Irish Takeover Panel Act, 1997, Takeover Rules, 2013.

This report contains trademarks, trade names and service marks that are the property of Perrigo, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks and trade names referred to in this report appear without the ® and ™ symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

Perrigo Company plc - Item 1

Business Overview

PART I.

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013. We became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"), which is discussed further in Item 8. Note 2. Unless the context requires otherwise, the terms "Perrigo", the "Company", "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries.

WHO WE ARE

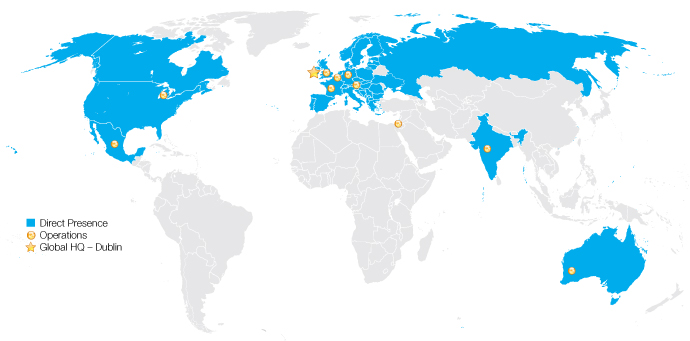

With the acquisition of Omega Pharma Invest N.V. ("Omega"), we are a leading global over-the-counter ("OTC") consumer goods and specialty pharmaceutical company, offering patients and customers high quality products at affordable prices. From our beginning in 1887 as a packager of home remedies, we have grown to become the world's largest manufacturer of OTC healthcare products and supplier of infant formulas for the store brand market. We are also a leading provider of generic extended topical prescription products, and we receive royalties from sales of the multiple sclerosis drug, Tysabri®. We provide “Quality Affordable Healthcare Products®” across a wide variety of product categories and geographies, primarily in North America, Europe and Australia, as well as in other markets, including Israel and China.

MAJOR DEVELOPMENTS IN OUR BUSINESS

Omega Acquisition

On March 30, 2015, we acquired Omega for $3.0 billion in equity and cash and assumed debt of $1.4 billion, for a total of $4.4 billion. Prior to its acquisition, Omega was one of the largest OTC companies in Europe. The Omega acquisition expanded our OTC leadership position across Europe, accelerated our international expansion and geographic diversification through enhanced scale and a broadened footprint, and diversified our revenue and cash flow streams while strengthening our financial profile.

Perrigo Company plc - Item 1

Business Overview

We have already begun utilizing the broader European platform established through the Omega acquisition, entering into an agreement on June 2, 2015 to acquire a portfolio of well-established OTC brands primarily in Europe from GlaxoSmithKline Consumer Healthcare (“GSK”), and an agreement on July 22, 2015 to acquire Naturwohl Pharma, GmbH ("Naturwohl"), with its leading German dietary supplement brand, Yokebe. Additional information on the Omega acquisition and pending GSK and Naturwohl acquisitions can be found in Item 8. Note 2.

Elan Acquisition

On December 18, 2013, we acquired Elan Corporation, plc ("Elan") in a cash and stock transaction totaling $9.5 billion. The acquisition led to our new corporate structure headquartered in Dublin, Ireland. We have utilized this structure to continue to grow in our core markets and to further expand outside of the U.S. The acquisition also provided us with our Tysabri® royalty stream, enhancing our operating cash flows and diversifying our net sales. Additional information on the Elan acquisition can be found in Item 8. Note 2.

Mylan N.V.'s Unsolicited Interest in the Company

The pharmaceutical industry has been intensely acquisitive over the past several years. Mylan N.V. ("Mylan") has made several unsolicited offers to purchase all of our outstanding ordinary shares as described in detail in Item 1A. Risk Factors - Risks Related to Operations.

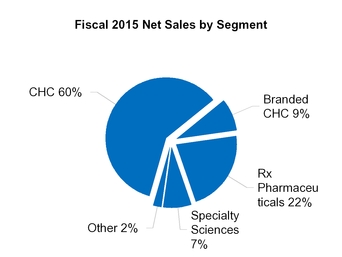

OUR SEGMENTS

In conjunction with the Omega acquisition, we changed our reporting segments in the fourth quarter of fiscal year 2015 to better align with our new organizational structure. These organizational changes were made to optimize our structure to better serve our customers and to reflect the way in which our chief operating decision maker reviews our operating results. Following this change, our reporting segments are as follows:

| |

• | Consumer Healthcare ("CHC"), which includes our former Consumer Healthcare segment, former Nutritionals segment, and former Israel Pharmaceuticals and Diagnostics business, which was previously reported in our “Other” segment; |

| |

• | Branded Consumer Healthcare ("BCH"), which consists of the newly acquired Omega business; |

| |

• | Prescription Pharmaceuticals ("Rx Pharmaceuticals"), which continues to include the Rx Pharmaceuticals business; and |

| |

• | Specialty Sciences, which is comprised primarily of assets focused on the treatment of multiple sclerosis (Tysabri®). |

In addition, we have an Other reporting segment that consists of our former Active Pharmaceutical Ingredients ("API") segment, which does not meet the quantitative threshold required to be a separately reportable segment. All historical segment information has been reclassified to conform to this new reporting segment presentation. Financial information related to our business segments and geographic locations can be found in Item 8. Note 17.

CONSUMER HEALTHCARE

Overview

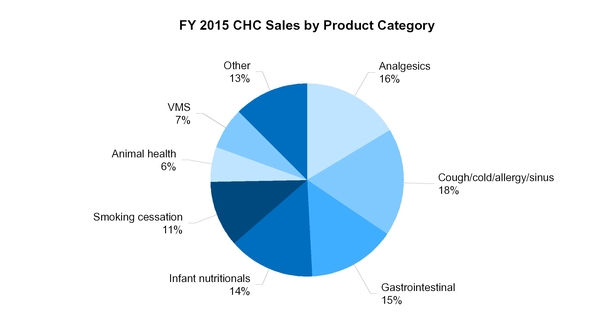

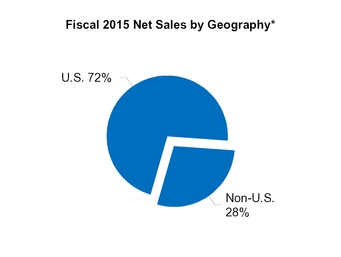

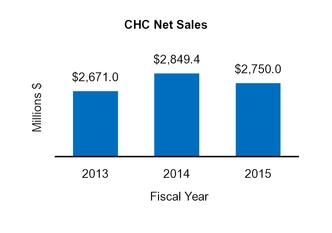

The CHC segment is focused primarily on the sale of OTC store brand products, including cough, cold, and allergy products, analgesics, gastrointestinal products, smoking cessation products, infant formula and foods, vitamins, supplements, animal health products, and diagnostic products. We are a market leader in many geographies, including the U.S., U.K., and Mexico, and we are developing a market leadership position in Australia. We are the leader in OTC store brands, and market share of OTC store brand products has increased in recent years as retailer efforts to promote their own label programs have resulted in greater consumer awareness of the quality and value of store brand OTC products. In fiscal year 2015, our CHC segment contributed 60% to consolidated net sales.

The CHC segment develops, manufactures, and markets products that are comparable in quality and effectiveness to national brands. Store brand products must meet the same U.S. Food and Drug Administration

Perrigo Company plc - Item 1

CHC

("FDA") requirements as national brands. In most instances, our product packaging is designed to attract consumers and to invite and reinforce comparison to national brand products, which communicates store brand value to consumers.

The cost of store brand products to retailers is significantly lower than that of comparable nationally advertised brand-name products. Generally, retailers’ dollar profit per unit of store brand product is greater than the dollar profit per unit of the comparable national brand product. The retailer, therefore, can price a store brand product below the competing national brand product and realize a greater profit margin. The consumer benefits by receiving a high quality product at a price below the comparable national brand product. As a result, our business model results in consumers saving money on their healthcare spending.

We are dedicated to being the leader in developing and marketing new store brand products and have a research and development ("R&D") staff that we believe is one of the most experienced in the industry at developing products comparable in formulation and quality to national brand products. Our R&D team also responds to changes in existing national brand products by reformulating existing products. For example, in the OTC pharmaceutical market, certain new products are the result of changes in product status from "prescription only" ("Rx") to OTC. These “Rx-to-OTC switches” require FDA approval through a process initiated by the drug innovator. The drug innovator usually begins the process by filing a New Drug Application ("NDA"), which is often followed by filing an Abbreviated New Drug Application ("ANDA").

New drugs are also marketed through the FDA's OTC monograph process, which allows for the production of drugs that are generally recognized as safe and effective without pre-market approval. The CHC segment also develops, manufactures, and distributes certain branded products when the strategy is synergistic with our store brand business. Branded products include the Good Sense®, Sergeant's®, Sentry®, Herron®, Bright Beginnings®, and PetArmor® brands.

We manufacture our products at our plants in the U.S., U.K., Mexico, Israel, and Australia, and we source our remaining needs from third parties. We rely on both internal R&D and strategic product development agreements with outside sources to develop new products. In addition, in order to maximize both our capacity and sales of proprietary formulas, we engage in contract manufacturing, which involves producing unique ANDA and monograph products through partnerships with major pharmaceutical and direct-to-consumer companies.

Recent Developments

In the fourth quarter of fiscal year 2015, we acquired Gelcaps Exportadora de Mexico, S.A. de C.V. ("Gelcaps"), the Mexican operations of Durham, North Carolina-based Patheon Inc. for $35.8 million in cash, which strengthened our supply chain and added softgel manufacturing technology capabilities to our business. The acquisition has broadened our presence, product portfolio, and customer network and has solidified our store brand leadership position in Mexico.

Products

Our CHC segment offers products in the following categories:

|

| | |

Product Category | | Description |

Analgesics | | Pain relievers and fever reducers |

Cough/cold/allergy/sinus | | Cough, cold, allergy, and sinus products |

Gastrointestinal | | Antacids, anti-diarrheal, and anti-heartburn products |

Infant nutritionals | | Infant formula and food products |

Smoking cessation | | Gums, lozenges, and other products designed to help users quit smoking |

Animal health | | Pet health and wellness products |

VMS | | Vitamins, minerals, and dietary supplements |

Other | | Feminine hygiene, diabetes care, dermatological care, diagnostic products, and other miscellaneous healthcare products |

Perrigo Company plc - Item 1

CHC

The chart below reflects net sales by product category in the CHC segment for fiscal year 2015.

The CHC segment currently markets over 4,900 store brand and other products, with over 17,800 stock-keeping units ("SKUs"). We consider every different combination of package size, flavor, formulation, strength and dosage form (tablet, liquid, softgel, etc.) of a given item as a separate "product."

We launched a number of new CHC products in fiscal year 2015, most notably the generic versions of Ensure®, Ensure® Plus, and Frontline® Plus. A CHC product is considered new if it was added to our product lines or sold to a new geographic area with different regulatory authorities within 12 months prior to the end of the period for which net sales are being measured. Net sales related to new CHC products totaled $155.2 million, $83.4 million, and $71.6 million for fiscal years 2015, 2014, and 2013, respectively.

We, on our own or in conjunction with partners, received final approval from global health authorities for 156 new products within the CHC segment in fiscal year 2015, and as of June 27, 2015, we had 123 new product applications pending approval.

Sales and Marketing

Our customers include major global, national, and regional retail drug, supermarket, and mass merchandise chains such as Walmart, CVS, Walgreens, Kroger, Target, Dollar General, Rite Aid, Sam’s Club, Costco, Petco, Petsmart, Boots (U.K.), Tesco (U.K.), ASDA (U.K.), Woolworth (Australia), Coles (Australia), and major wholesalers, including McKesson, Cardinal Health, and AmerisourceBergen.

We seek to establish customer loyalty through superior customer service by providing a comprehensive assortment of high-quality, value priced products; timely processing, shipment and delivery of orders; assistance in managing customer inventories; and support in managing and building the customer’s store brand business. The CHC segment employs its own sales force to service larger customers, and it uses industry brokers for other retailers. Field sales employees, with support from marketing and customer service, are assigned to specific customers in order to work most effectively with the customer. They assist customers by developing customized brand management and in-store marketing programs for customers' store brand products and optimize communication of customers’ needs to the rest of the Company.

The primary objective of this store brand management approach is to enable our customers, retailers and wholesalers to increase sales of their own store brand products by communicating store brand quality and value to the consumer and by inviting comparison to national brand products. Our sales and marketing personnel assist

Perrigo Company plc - Item 1

CHC

customers in the development and introduction of new store brand products and in the promotion of customers’ existing store brand products by providing market information; establishing individualized promotions and marketing programs, which may include floor displays, bonus sizes, coupons, rebates, store signs, and promotional packs; and by performing consumer research.

In contrast with national brand manufacturers, which incur considerable advertising and marketing expenditures targeted directly to the end user or consumer, the CHC segment’s primary marketing efforts are channeled through retailers and wholesalers and reach the consumer through our customers’ in-store marketing programs and through our digital media programs. Because the retail profit margin for store brand products is generally higher than for national brand products, retailers and wholesalers often commit funds for additional promotions.

Our animal health category, which has a greater emphasis on value-branded products, promotes product awareness through direct-to-consumer advertising including television commercials, on-line advertising, in-store display vehicles, and social media. In addition to in-store marketing programs, our infant formula category markets directly to consumers and healthcare professionals.

Competition

The markets for OTC pharmaceuticals, nutritional products, and infant formula are highly competitive. Our primary competitors include manufacturers, such as LNK International, Inc., PL Developments, and Dr. Reddy's Labs, and brand-name pharmaceutical and consumer product companies such as Johnson & Johnson, Pfizer, Bayer AG, Eli Lilly, Nestle S.A. (Gerber), Abbott Nutrition, and Mead Johnson Nutrition Co. The competition is highly fragmented in terms of geographic market coverage and product categories, such that a competitor generally does not compete across all product lines. However, some competitors do have larger sales volumes in certain of our categories. Additionally, national brand companies tend to have more resources committed to marketing their products and could in the future manufacture store brands of their products at lower prices than their national brand products. Competition is based on a variety of factors, including price, quality, assortment of products, customer service, marketing support, and approvals for new products. See Item 1A. Risk Factors - Risks Related to Operations for additional information and risks associated with competition.

BRANDED CONSUMER HEALTHCARE

Overview

We established the BCH segment in the fourth quarter of fiscal year 2015, and it is comprised primarily of branded OTC sales attributable to Omega. The BCH segment develops, manufactures, markets, and distributes some of Europe's most well-known OTC brands in the natural health and Vitamins, Minerals and Supplements ("VMS"), cough, cold and allergy, personal care and derma-therapeutics, lifestyle, and anti-parasite categories. In addition, the segment leverages its broad regulatory, sales, and distribution infrastructure to in-license and sell non-owned brands and generic pharmaceutical products. The BCH segment distributes these products through an extensive network of pharmacies in 36 countries, primarily in Europe. Many BCH products are top sellers in the markets in which they compete. In fiscal year 2015, our BCH segment contributed 9% to consolidated net sales. In the future, we expect BCH to represent a larger portion of our consolidated net sales as fiscal year 2015 only included three months of Omega operations.

Through continued investment in R&D and new technologies, the BCH segment strives to offer high-quality products that meet consumers' needs. The combination of internal R&D, in-licensing, acquisitions, and partnerships support the product pipeline, both in terms of brand expansion and product improvement. Currently, most R&D is performed by external partners with oversight by our teams. The segment has seven plants dedicated to manufacturing certain of its products, but over 70% of its production is outsourced to third parties. We plan to bring some of the segment's R&D and manufacturing in-house as we integrate Omega into Perrigo operations.

Unlike the CHC segment, which develops and markets store brand products, the BCH segment focuses on building brands. In many non-U.S. markets brand marketing strategy can be more effective due to regulatory constraints, the absence of large mass merchandisers or pharmacy chains, and developing acceptance of store brand products. While the BCH segment sells products from over 300 brands both on its own and through third

Perrigo Company plc - Item 1

Branded CHC

parties, it focuses its resources on its "Top 20 brands", which are selected on the basis of their growth potential in the OTC market. Additional resources are allocated to these brands to build strong positions in the largest, most highly profitable categories in the OTC market, such as analgesics, cough, cold and allergy, and VMS, while maintaining leadership in smaller branded categories, such as head lice and wart treatments.

Recent Developments

Subsequent to year end, we agreed to acquire Naturwohl, with its leading German dietary supplement brand, Yokebe, for €130.0 million in cash. The acquisition will build on the segment's leading OTC product portfolio and European commercial infrastructure. The transaction is expected to close in the third quarter of calendar year 2015.

In the fourth quarter of fiscal year 2015, we announced that we had entered into an agreement to acquire a portfolio of established OTC brands from GSK for €200.0 million in cash. The acquisition of this portfolio will build upon the global platform we established through the Omega acquisition and will help us expand our market share in the European OTC market. The portfolio includes smoking cessation products, cold and flu treatments, pain relief products, nasal decongestants, and cold sore management products sold primarily in Europe. The acquisition is expected to close in the third quarter of calendar year 2015.

Products

Below are the categories in which the BCH segment competes and some of the top brands in each category.

|

| | | | |

Product Category | | Description | | Top Brands |

Natural Health and VMS | | Vitamins, minerals, supplements, and various other natural remedies.

| | Davitamon®/Etixx®, Biover®/Abtei®, Granufink®/Bional®

|

| |

Cough, Cold, and Allergy | | Products that address respiratory symptoms, including traditional medications and alternative treatments such as aromatherapy and homeopathic solutions. | | Bittner®/Aflubin®, Prevalin®/Beconase®, Physiomer®/Libenar®, Phytosun®, Bronchenolo® |

| |

| |

Personal Care and Derma-Therapeutics | | Products for the face and body, including sun care products, baby-specific products, feminine hygiene products, and solutions for various skin conditions and allergies such as eczema, psoriasis and rosacea.

| | Bodysol/Galenco®, ACO, Lactacyd®, Dermalex®(Repair), Wartner® |

| |

| |

| | |

Lifestyle | | Weight management, pregnancy and fertility kits, pain relief, sleep management, and eye care. | | XLS (Medical)®, Predictor®, Solpadeine®/Antigrippine®, Silence®, Nytol® |

| |

| |

Anti-Parasite | | Products focused on the elimination of parasites in both humans and pets including lice treatment and insect repellent. | | Paranix®, Jungle Formula®, Paravet®/Clément-Thékan®

|

| |

| |

The BCH segment currently markets over 5,200 products, with over 7,400 SKUs. We consider every different combination of package size, flavor, formulation, strength, and dosage form (tablet, liquid, softgel, etc.) of an item as a separate "product." Certain brands are considered "combination brands", as they are marketed under different names depending on the market in which they are sold. For these combination brands, we select the most appropriate products from each product line for the country where they will be marketed, then adopt the brand name that best matches local consumer preference.

The segment has recently launched a number of new products, including a new ACO skin care line in the Nordic region, XLS (Medical)® Max Strength in key markets, and a new dual action cough line in six new markets. Over the next six months, the BCH segment plans to roll out a Men's Health Vitamins line in the U.K. in partnership with Men's Health magazine, the Granufink® urological product line beginning in the U.K. under the brand name Urostemol, and create a new self-care category in collaboration with the pharmacy chain Boots. At June 27, 2015, the BCH segment had more than 50 strategic new product developments in five product categories, with each of its Top 20 brands having a five-year innovation master plan.

Perrigo Company plc - Item 1

Branded CHC

Sales and Marketing

Our customers include pharmacies, drug, and grocery stores located primarily in Europe, including Boots, ASDA, Tesco, DM, Rossmann, ETOS, and Kruidvat. The BCH segment sells its products through an established pharmacy sales force and an extensive network of pharmacists. Our sales representatives visit pharmacists daily, ensuring strong in-store visibility of our brands and facilitating pharmacist education programs. Our sales, marketing, and regulatory teams use training/merchandising teams to work in conjunction with base sales representatives to identify, implement, and defend healthcare claims for key products. We attract and retain key talent personnel from leading OTC, fast moving consumer goods ("FMCG"), and Rx companies to build strong local teams throughout the countries in which the BCH segment operates.

While BCH products have a higher average gross margin than products sold by the CHC segment, selling and administrative expenses are significantly higher for our BCH products due to the sales force mentioned above, as well as targeted advertising and promotional spending to enhance brand equity. Key marketing communication tools include TV commercials, consumer leaflets, product websites, and targeted promotional campaigns.

Competition

The competitive landscape of the European OTC market is highly fragmented, as local companies often hold leadership positions in individual product segments in particular countries. As a result, the relevant competition in each of the BCH segment's markets is mostly local, with Reckitt Benckiser, Boehringer Ingelheim, Novartis, and Johnson & Johnson as additional regional competitors. We believe our key advantage lies in our unique combination of best practices in sales, marketing, and product development from FMCG and OTC/Rx, while embracing the pharmacy channel to drive self-care. See Item 1A. Risk Factors - Risks Related to Operations for additional information and risks associated with competition.

PRESCRIPTION PHARMACEUTICALS

Overview

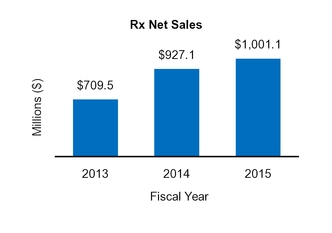

The Rx Pharmaceuticals segment develops, manufactures, and markets a portfolio of generic and specialty pharmaceutical prescription drugs primarily for the U.S. and U.K. markets. We define this portfolio as predominantly "extended topical" and "specialty" as it encompasses a broad array of topical dosage forms such as creams, ointments, lotions, gels, shampoos, foams, suppositories, sprays, liquids, suspensions, solutions, and powders. The portfolio also includes select controlled substances, injectables, hormones, women's health products, oral solid dosage forms, and oral liquid formulations. In fiscal year 2015, Rx Pharmaceuticals contributed 22% to consolidated net sales.

Our current development areas include other delivery systems such as oral liquids, metered dose inhalers, injectables, and transdermal products, some of which we are developing with third parties. Our other areas of expertise include our production capabilities for controlled substance and hormonal products. In the U.S., R&D efforts focus on complex formulations, many of which require costly clinical endpoint trials. In the U.K., R&D focuses on oral liquid formulations for the branded Rx products for which liquid formulations are not available.

We manufacture our topical, specialty, and oral products in the U.S., Israel, and U.K., and also source from various FDA-inspected third parties. Rx Pharmaceuticals are manufactured, labeled, and packaged in facilities that comply with strict regulatory standards and meet customers’ stringent requirements.

In addition, the Rx Pharmaceuticals segment offers OTC products through the prescription channel (referred to as "ORx® ", these products are marketed using the Perrigo name). ORx® products are OTC products that are available for pharmacy fulfillment and healthcare reimbursement when prescribed by a physician. We offer numerous ORx® products that are reimbursable through many health plans and the U.S. Medicaid and Medicare programs.

Perrigo Company plc - Item 1

Rx Pharmaceuticals

We actively collaborate with other pharmaceutical companies to develop, manufacture, and market certain products or groups of products. These types of agreements are common in the pharmaceutical industry. We may choose to enter into these types of agreements to, among other things, leverage our or our collaborators' scientific R&D expertise or utilize our extensive marketing and distribution resources. See Item 8. Note 1 for more information regarding our method for recognizing revenue and expenses related to collaboration agreements, as well as Item 8. Note 15 for more information regarding our current collaboration agreements.

Recent Developments

During fiscal year 2015 we acquired a portfolio of products from Lumara Health, Inc. ("Lumara"), a privately-held, Chesterfield, Missouri-based specialty pharmaceutical company, for cash consideration of $83.0 million. This acquisition further expanded our women's healthcare product offerings. Lumara products are marketed and sold as branded products by a small specialty sales force.

Products

The Rx Pharmaceuticals segment currently markets approximately 800 generic prescription and ORx® products with more than 1,400 SKUs. A SKU for a generic prescription product is a unique combination of the product’s package size, ingredient strength and dosage form (tablet, syrup, cream, foam, ointment, gel, etc.). We generally hold the ANDA or product application for the drugs that we manufacture or enter into an arrangement with the application holder for the manufacture and/or marketing of certain products.

Listed below are some of the generic prescription products, including authorized generic and ORx® products, that we manufacture and/or distribute:

|

| | |

Generic Name (1) | | Comparative Brand-Name Drug |

Adapalene cream | | Differin® |

Bacitracin ophthalmic ointment | | N/A |

Clindamycin phosphate and benzoyl peroxide gel | | Duac® |

Clobetasol foam, lotion and shampoo | | Olux®, Olux-E®, Clobex® |

Desonide cream, ointment | | Desonate®, Tridesilon® |

Halobetasol ointment and cream | | Ultravate® |

Mupirocin ointment | | Bactroban® |

Nystatin topical powder | | Mycostatin® |

Permethrin cream | | Elimite® |

Testosterone cypionate injection | | Depo®, Testosterone |

Triamcinolone acetonide nasal spray | | Nasacort® AQ |

Testosterone 1% Gel (2) | | Androgel |

Triamcinolone cream/ointment (2) | | Triderm/Kenalog |

Tacrolimus (2) | | Protopic |

Clobetasol Spray (2) | | Clobex |

Hydrocorisone Suppositories | | Hydrocorisone Suppositories |

Dihydroergotamine Injection | | D.H.E. 45 |

Clindamycin Foam | | Evoclin |

(1) Contains the same active ingredients present in the same dosage form as the comparable brand-name drug

(2) New product launched in fiscal year 2015

Net sales related to new products were approximately $119.0 million, $106.4 million, and $48.6 million for fiscal years 2015, 2014, and 2013, respectively. An Rx Pharmaceutical product is considered new if it was added to our product lines or sold to a new geographic area with different regulatory authorities within 12 months prior to the end of the period for which net sales are being measured.

In fiscal year 2015, we, on our own or in collaboration with partners, received final approval from the FDA for 24 Rx drug applications. As of June 27, 2015, we, on our own or in collaboration with partners, had 10 Rx drug applications pending approval with the FDA.

Perrigo Company plc - Item 1

Rx Pharmaceuticals

Sales and Marketing

Our customers include major wholesalers, including Cardinal Health, McKesson, and AmerisourceBergen; national and regional retail drug, supermarket and mass merchandise chains, including Walgreens, Walmart, CVS, Rite Aid, Kroger, and Safeway; hospitals; and pharmacies. ORx® products are sold to the consumer through the pharmacy counter of predominantly the same retail outlets as our OTC pharmaceutical and nutritional products. In addition, we have a small specialty sales force consisting of representatives who visit healthcare professionals to educate them on the unique clinical characteristics and benefits of our branded products. We plan to continue to grow this sales force in the near future.

Competition

The market for Rx pharmaceuticals is subject to intense competition from other generic drug manufacturers, brand-name pharmaceutical companies launching their own generic version of their branded products (known as an authorized generics), manufacturers of branded drug products that continue to produce those products after patent expirations, and manufacturers of therapeutically similar drugs. Among our generic drug manufacturer competitors are Actavis plc, Apotex Corp., Glenmark Generics Inc., Impax Laboratories, Inc., Mylan, Prasco, LLC, Sandoz, Sun Pharmaceuticals, Taro Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Triax Pharmaceuticals, LLC, and Zydus Pharmaceuticals, Inc.

We believe that one of our primary competitive advantages is our ability to introduce difficult to develop and/or manufacture topical and other specialty generic versions to brand-name drug products. Generally, these products are exposed to less competition due to the relatively longer and more expensive development, clinical trial, and approval processes. In addition, we believe we have a favorable competitive position due primarily to our efficient distribution systems, topical production economies of scale, customer service, and overall reputation. See Item 1A. Risk Factors - Risks Related to Operations for more information and risks associated with competition.

SPECIALTY SCIENCES

Overview

The Specialty Sciences segment is comprised primarily of assets focused on the treatment of multiple sclerosis, specifically in connection with the drug Tysabri®. We are entitled to royalty payments from Biogen Idec Inc. ("Biogen") based on its Tysabri® sales in all indications and geographies. We received royalties of 12% on worldwide Biogen sales of Tysabri® from December 18, 2013 through April 30, 2014. Beginning on May 1, 2014 we received, and going forward we will receive, royalties of 18% on annual worldwide Biogen sales of Tysabri® up to $2.0 billion and 25% on sales above $2.0 billion. In fiscal year 2015, Specialty Sciences contributed 7% to consolidated net sales.

Competition

Tysabri® is a complex biological product, patent protected through 2024, and is administered under a strict Risk and Evaluation Mitigation Strategy ("REMS") program. In the event that the patent is invalidated or is infringed upon or if a biosimilar is introduced, the financial performance of our Specialty Sciences segment would be materially adversely affected. Tysabri® competes with many companies that are working to develop successful new therapies or alternative formulations of products for multiple sclerosis. If any of these competing products have a similar or more attractive profile in terms of efficacy, convenience, or safety, future sales of Tysabri® could be limited. However, the competition may be limited in its product development as Tysabri® is administered under an FDA-approved REMS. See Item 1A. Risk Factors - Risks Related to Operations for related risks.

Perrigo Company plc - Item 1

Other

OTHER

Overview

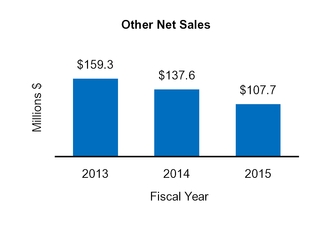

We have an Other segment that is comprised of API products, which does not meet the quantitative threshold required to be a separately reportable segment. We develop, manufacture, and market API products, which are used worldwide by both generic and branded pharmaceutical companies. Certain of these ingredients are used in our own pharmaceutical products. The manufacturing of API occurs primarily in India and Israel.

API development is focused on the synthesis of less common molecules for the U.S., European, and other global markets. We commercialize API that are critical to our pharmaceutical customers’ existing portfolios and future product launches, working closely with these customers on development processes. We are also focusing manufacturing and development activities on the synthesis of molecules for use in our own OTC and Rx pipeline products. This vertical integration may enable us to be more competitive in the pricing of our product lines.

Because our API customers depend on high-quality supply and regulatory support, we focus on rigorous quality assurance, quality control, and regulatory compliance as part of our strategic positioning. Our quality system is designed to comply with the regulatory requirements of the FDA, the European Medicines Agency ("EMA"), and other regulatory agencies such as the Australian Therapeutic Goods Administration ("TGA"). We are regularly inspected by various regulatory authorities and customers.

Competition

Since other manufacturers of API typically do not offer all of the same product lines or serve all of the same markets as we do, the business competes on a product-by-product basis with a number of different competitors. Our API category is subject to increased price competition from other manufacturers of API located mostly in India, China, and Europe. This competition may result in the loss of API clients and/or decreased profitability. See Item 1A. Risk Factors - Risks Related to Operations for information and risks associated with competition.

INFORMATION APPLICABLE TO ALL REPORTABLE SEGMENTS

Research and Development

Research and development is a key component of our business strategy and, while managed centrally, is performed in various locations in the countries in which we operate. While we conduct a significant amount of our own R&D, we also enter into strategic alliance agreements to obtain the rights to manufacture and/or distribute new products.

R&D spending was $187.8 million, $152.5 million, and $115.2 million for fiscal years 2015, 2014, and 2013, respectively. In addition, we wrote off in-process research and development ("IPR&D") from previous acquisitions totaling $6.0 million during fiscal 2014 and $9.0 million during fiscal 2013 due to changes in the projected development and regulatory timelines for various projects.

Fiscal year 2015 included incremental R&D expense due to the Omega acquisition, as well as entry into a collaboration arrangement and an R&D contractual arrangement under which we funded a total of $28.0 million of R&D. Fiscal year 2014 included incremental research and development expense attributable to the Sergeant's Pet Care Products, Inc. ("Sergeant's") and Velcera Inc. ("Velcera") acquisitions that closed during fiscal year 2014, as well as research and development expense related to the ELND005 Phase 2 clinical program in collaboration with Transition Therapeutics, Inc. ("Transition") we acquired from Elan. We ended our collaboration with Transition during the third quarter of fiscal year 2014 and are no longer responsible for ongoing development activities and costs associated with ELND005. Fiscal year 2013 included incremental R&D expenses attributable to the acquisition of Sergeant's, Velcera, and Rosemont Pharmaceuticals Ltd. See Item 8. Note 2 and Item 8. Note 15 for more information on the acquisitions, collaboration arrangement, and R&D contractual arrangement noted above.

We anticipate that R&D expenditures will increase above fiscal year 2015 levels in dollar terms but will remain relatively flat to slightly higher as a percentage of net sales for the foreseeable future as we continue to

Perrigo Company plc - Item 1

Trademarks and Patents

While we own certain trademarks and patents, neither our business as a whole, nor any of our segments, is materially dependent upon our ownership of any one trademark or patent or group of trademarks or patents.

Materials Sourcing

Affordable high quality raw materials and packaging components are essential to all of our business units due to the nature of the products we manufacture. Raw materials and packaging components are generally available from multiple suppliers. Supplies of certain raw materials, bulk tablets, and components are limited, or are available from one or only a few suppliers. While we have the ability to manufacture and supply certain API materials for our OTC and Rx pharmaceutical products, an increasing number of components and finished goods are purchased rather than manufactured because of temporary production limitations, FDA restrictions, economic conditions, or other factors.

Historically, we have been able to react effectively to situations that require alternate sourcing. Should alternate sourcing be necessary, FDA requirements placed on products approved through the ANDA or NDA process could substantially lengthen the approval of an alternate source and adversely affect financial results. We believe we have good, cooperative working relationships with substantially all of our suppliers and have historically been able to capitalize on economies of scale in the purchase of materials and supplies due to our volume of purchases. See Item 1A. Risk Factors - Risks Related to Operations for risks associated with materials sourcing.

Manufacturing and Distribution

Our primary manufacturing facilities are in the U.S. and Israel. We also have secondary manufacturing facilities in the U.K., Belgium, France, Germany, Mexico, Australia, and India, along with a joint venture in China. See Item 1A. Risk Factors - Risks Related to Operations for risks associated with our manufacturing facilities. We supplement our production capabilities with the purchase of products from outside sources. The capacity of some facilities may be fully utilized at certain times for various reasons, such as customer demand, the seasonality of the cough/cold/flu, allergy, or flea and tick seasons, and new product launches. We may utilize available capacity by performing contract manufacturing for other companies. We have logistics facilities in the U.S., Israel, Mexico, Australia, and numerous locations throughout Europe. We use contract freight and common carriers to deliver our products.

Significant Customers

Our primary customer base aligns with the concentration of large drug retailers in the current global retail drug industry marketplace. Walmart is our largest customer and accounted for 15% of consolidated net sales in fiscal year 2015 and 19% in fiscal years 2014 and 2013. Sales to Walmart are primarily in the CHC segment. While we do not anticipate a change in the foreseeable future, should our current relationship with Walmart change adversely, the resulting loss of business could have a material adverse impact on our consolidated and CHC segment operating results and financial position. In addition, while no other customer individually comprises more than 10% of total net sales, we do have other significant customers. We believe we generally have good relationships with all of our customers. See Item 1A. Risk Factors - Risks Related to Operations for risks associated with customers.

Perrigo Company plc - Item 1

Seasonality

We historically have been impacted by seasonal demand and consumer dynamics in the retail environment in which our customers operate. Sales of OTC pharmaceutical products in the CHC segment are typically subject to seasonal demands for cough/cold/flu products in our second and third fiscal year quarters and allergy products in our first and fourth fiscal year quarters. Our BCH sales are also impacted by seasonality and tend to peak in the fourth fiscal year quarter due to increased demand for seasonal health and wellness products. In addition, our animal health products are subject to seasonal demand for flea and tick products that typically peaks during the warmer weather months, which occurs during our fourth fiscal year quarter. Our Rx Pharmaceutical, Specialty Sciences, and Other segments' sales are not generally impacted by seasonal conditions.

Environmental

We are subject to various environmental laws and regulations. We have made, and continue to make, expenditures necessary to comply with applicable environmental laws, but do not believe that the costs for complying with such laws and regulations will be material to our business. We do not have any material remediation liabilities outstanding.

While we believe that climate change could present risks to our business, including increased operating costs due to additional regulatory requirements, physical risks to our facilities, water limitations, and disruptions to our supply chain, we do not believe these risks are material to our business in the near term.

Corporate Social Responsibility

We are committed to doing business in an ethical manner. We also have a long history of environmentally sound and efficient operations, safe and healthy working conditions, and active participation in the communities where we are located. As reflected in our Corporate Social Responsibility Commitment Statement, we remain committed to:

| |

• | Helping consumers access safe, effective and affordable healthcare products; |

| |

• | Complying with regulatory and legal requirements; |

| |

• | Demonstrating environmental stewardship; |

| |

• | Continuously improving packaging sustainability; |

| |

• | Protecting human rights of our global employees and challenging our partners to do the same; |

| |

• | Providing a safe and healthy work environment for our employees; and |

| |

• | Establishing effective community partnerships. |

Through these efforts, we strive to minimize our impact on the environment, drive responsible business practices, and ensure the welfare of our employees now and into the future.

GOVERNMENT REGULATION AND PRICING

The manufacturing, processing, formulation, packaging, labeling, testing, storing, distributing, advertising, and sale of our products are subject to regulation by a variety of agencies in the localities in which our products are sold. In addition, we manufacture and market certain of our products in accordance with standards set by various organizations. We believe that our policies, operations, and products comply in all material respects with existing regulations to which we are subject. See Item 1A. Risk Factors - Risks Related to Operations for related risks.

United States Regulation

U.S. Food and Drug Administration

The FDA has jurisdiction over our ANDA, NDA, Drug Efficacy Implementation ("DESI drug"), and OTC monograph drug products, infant formulas, dietary supplements, food products, and medical devices. The FDA’s jurisdiction extends to the manufacturing, testing, labeling, packaging, storage, distribution, and promotion of these products. We are committed to consistently providing our customers with high-quality products that adhere to "Current Good Manufacturing Practices" ("cGMP") regulations promulgated by the FDA .

Perrigo Company plc - Item 1

Regulation

OTC and Rx Pharmaceuticals

All facilities where Rx and OTC drugs are manufactured, tested, packaged, stored, or distributed for the U.S. market must comply with FDA cGMPs and regulations promulgated by competent authorities in the countries, states and localities where the facilities are located. All of our drug products are manufactured, tested, packaged, stored, and distributed according to cGMP regulations. The FDA performs periodic audits to ensure that our facilities remain in compliance with all appropriate regulations.

Many of our OTC pharmaceutical products are regulated under the OTC monograph system and subject to certain FDA regulations. Under this system, selected OTC drugs are generally recognized as safe and effective and do not require the submission and approval of an ANDA or NDA prior to marketing. Drug products marketed under the OTC monograph system must conform to specific quality, formula, and labeling requirements, including permitted indications, required warnings and precautions, allowable combinations of ingredients, and dosage levels. It is generally less costly to develop and bring to market a product regulated under the OTC monograph system.

We also market generic prescription drugs and other products that have switched from prescription to OTC status. Prior to commercial marketing, these products require approval by the FDA of an ANDA or NDA that provides information on chemistry, manufacturing controls, clinical safety, efficacy and/or bioequivalence, packaging, and labeling. While the development process for a generic drug generally requires less time and expense than the development process for a new drug, the size and duration of required studies can vary greatly. The current average ANDA approval time is approximately 48 months from the date an ANDA is submitted. NDA approvals are typically achieved in 16 months or less. Changes to a product marketed under an ANDA or NDA are governed by specific FDA regulations and guidelines that define when proposed changes can be implemented and whether prior FDA notice and/or approval is required.

Under the Federal Food, Drug and Cosmetic Act ("FFDCA"), as amended, a company submitting an NDA can obtain a three-year period of marketing exclusivity for a prescription or OTC product if it performs a clinical study that is essential to FDA approval. Longer periods of exclusivity are possible for new chemical entities, orphan drugs (those designated under section 526 of the FFDCA) and drugs under the Generating Antibiotic Incentives Now Act. During this exclusivity period, the FDA cannot approve any ANDAs for a similar or equivalent generic product, which can preclude us from marketing a similar product during this period. A company may obtain an additional six months of exclusivity if it conducts pediatric studies requested by the FDA on the product. This exclusivity can delay both the FDA approval and sales of certain products.

A company may be entitled to a 180-day generic exclusivity period for certain products. This exclusivity period often follows a patent certification and litigation process whereby the product innovator may sue for infringement. The legal action does not ordinarily result in material damages, but it generally triggers a statutorily mandated delay in FDA approval of the ANDA for a period of up to 30 months from when the innovator was notified of the patent challenge.

The Food and Drug Administration Safety and Innovation Act ("FDASIA") was signed into law on July 9, 2012. The law established, among other things, new user fee statutes for generic drugs and biosimilars, FDA authority concerning drug shortages, changes to enhance the FDA's inspection authority of the drug supply chain, and a limited extension of the 30-month stay provision described above. The FDASIA also reduced the time required for FDA responses to generic-blocking citizen petitions. We implemented new systems and processes to comply with the new facility self-identification and user fee requirements of the FDASIA, and we monitor facility self-identification and fee payment compliance to mitigate the risk of potential supply chain interruptions or delays in regulatory approval of new applications.

Infant Formula and Foods

The FDA’s Center for Food Safety and Applied Nutrition ("CFSAN") is responsible for the regulation of infant formula. The Office of Nutrition, Labeling and Dietary Supplements ("ONLDS") has labeling responsibility for infant formula, while the Office of Food Additive Safety ("OFAS") has program responsibility for food ingredients and packaging. The ONLDS evaluates whether an infant formula manufacturer has met the requirements under the

Perrigo Company plc - Item 1

Regulation

FFDCA and consults with the OFAS regarding the safety of ingredients in infant formula and of packaging materials for infant formula.

All manufacturers of pediatric nutrition products must begin with safe food ingredients, which are either generally recognized as safe or approved as food additives. The Infant Formula Act provides specific requirements for infant formula to ensure the safety and nutrition of infant formulas, including minimum and, in some cases, maximum levels of specified nutrients.

Before marketing a particular infant formula, the manufacturer must provide regulatory agencies assurance of the nutritional quality of that particular formulation consistent with the FDA’s labeling, nutrient content, and manufacturer quality control requirements. A manufacturer must notify the FDA 90 days before the marketing of any infant formula that differs fundamentally in processing or in composition from any previous formulation produced by the manufacturer. We actively monitor this process and make the appropriate adjustments to remain in compliance with recent FDA rules regarding cGMP, quality control procedures, quality factors, notification requirements, and reports and records for the production of infant formulas.

In addition, the FFDCA requires infant formula manufacturers to test product composition during production and shelf-life; to keep records on production, testing, and distribution of each batch of infant formula; to use cGMP and quality control procedures; and to maintain records of all complaints and adverse events, some of which may reveal the possible existence of a health hazard. The FDA conducts yearly inspections of all facilities that manufacture infant formula, inspects new facilities during early production runs, and collects and analyzes samples of infant formula.

Our infant and toddler foods are subject to the Food Safety Modernization Act ("FSMA"), which protects the safety of U.S. foods by mandating comprehensive, prevention-based controls within the food industry. Under FSMA, the FDA has mandatory recall authority for all food products and greater authority to inspect food producers and is taking steps toward product tracing to enable more efficient product source identification in the event of a safety issue.

Dietary Supplements Manufactured in the U.S.

The Dietary Supplement Health and Education Act of 1994 ("DSHEA") amended the FFDCA to, among other things:

| |

• | Define dietary supplements and dietary ingredients; |

| |

• | Require ingredient and nutrition labeling for dietary supplements; |

| |

• | Permit "structure/function" statements for dietary supplements; |

| |

• | Permit the display of certain published literature where supplements are sold; |

| |

• | Authorize the FDA to establish GMPs specifically for dietary supplements, which it did in 2007; and |

| |

• | Require the submission of New Dietary Ingredient notifications to the FDA. |

Under DSHEA, the FDA specified that all supplements must bear a "Supplement Facts" box, which lists all of the supplement’s dietary ingredients using FDA-specified nomenclature. DSHEA also permits dietary supplements to bear statements:

| |

• | Claiming a benefit related to a classical nutrient deficiency disease, provided the prevalence of the disease in the U.S. is disclosed; |

| |

• | Describing the role of a nutrient or dietary ingredient intended to affect the structure or function in humans; |

| |

• | Characterizing the documented mechanism by which a nutrient or dietary ingredient acts to maintain such structure or function; and |

| |

• | Describing general well-being from consumption of a nutrient or dietary ingredient. |

We are subject to regulations published by the FDA clarifying the types of "structure function" statements permissible in dietary supplement labeling. Such statements cannot expressly or implicitly state that a dietary supplement has any effect on a "disease." As with foods in general, dietary supplement labeling may include a "health claim," which characterizes the role of a nutrient to a disease or health-related condition.

Perrigo Company plc - Item 1

Regulation

The DSHEA requires that the FDA be notified at least 75 days in advance of the introduction of a dietary supplement that contains a new dietary ingredient that was not marketed before October 15, 1994. The notification must provide information establishing that the dietary supplement containing the dietary ingredient will be reasonably expected to be safe.

We continue to invest in our dietary supplement operations and quality systems to ensure that we comply with current interpretation of the regulations. Our U.S. dietary supplement facilities have been inspected by the FDA and are operating in compliance with dietary supplement cGMP’s.

Active Pharmaceutical Ingredients

We develop and manufacture active pharmaceutical ingredients in Israel and India for export to the U.S. and other global markets. Before active pharmaceutical ingredients can be commercialized in the U.S., we must submit a drug master file ("DMF") that provides the proprietary information related to the manufacturing process. The FDA inspects the manufacturing facilities to assess cGMP compliance, and the facilities and procedures must be cGMP compliant before API may be exported to the U.S.

The facilities and products are subject to regulation by the applicable regulatory bodies in the place of manufacture as well as the regulatory agency in the country from which the product is exported. Our Israeli facility has been approved by the U.S. FDA, Israel Ministry of Health ("IMOH"), Federal Commission for the Protection against Sanitary Risks of Mexico, Pharmaceutical and Medical Devices Agency of Japan, and the Korean Food and Drug Administration and has received GMP certification from IMOH. Our India facility has been inspected by the U.S. FDA and has received GMP certification from the Indian FDA.

For API exported to European markets, we submit a European DMF and, where applicable, obtain a certificate of suitability from the European Directorate for the Quality of Medicines. The manufacturing facilities and production procedures for API marketed in Europe must meet EU-GMP and European Pharmacopeia standards.

U.S. Department of Agriculture

The Organic Foods Production Act enacted under Title 21 of the 1990 Farm Bill established uniform national standards for the production and handling of foods labeled as "organic." Our infant formula manufacturing sites in Vermont and Ohio adhere to the standards of the U.S. Department of Agriculture ("USDA") National Organic Program for the production, handling, and processing to maintain the integrity of organic products. Our infant formula manufacturing sites in Vermont and Ohio are USDA-certified, enabling them to produce and label organic products for U.S. and Canadian markets.

U.S. Environmental Protection Agency

The U.S. Environmental Protection Agency ("EPA") is the main regulatory body in the United States for veterinary pesticides. The EPA's Office of Pesticide Programs is responsible for the regulation of pesticide products applied to animals. All manufacturers of animal health pesticides must show that their products will not cause “unreasonable adverse effects to man or the environment” as stated in the Federal Insecticide, Fungicide, and Rodenticide Act. Within the United States, pesticide products that are approved by the EPA must also be approved by individual state pesticide authorities before distribution in that state. Post-approval monitoring of products is required, with reports provided to the EPA and some state regulatory agencies.

U.S. Drug Enforcement Administration

The U.S. Drug Enforcement Administration ("DEA") regulates certain drug products containing controlled substances, such as morphine, hydromorphone, opium, and List I chemicals, such as pseudoephedrine, pursuant to the federal Controlled Substances Act ("CSA"). The CSA and DEA regulations impose registration, security, record keeping, reporting, storage, manufacturing, distribution, importation and other requirements upon legitimate handlers under the oversight of the DEA. The DEA categorizes controlled substances into Schedules I, II, III, IV, or V, with varying qualifications for listing in each schedule. We are subject to the requirements regarding the controlled substances in Schedules II - V and the List I chemicals. Our facilities that manufacture, distribute, import, or export any controlled substances must register annually with the DEA.

Perrigo Company plc - Item 1

Regulation

The DEA inspects all manufacturing facilities to review security, record keeping, reporting, and handling prior to issuing a controlled substance registration, and it also periodically inspects facilities for compliance with the CSA and its regulations. Failure to maintain compliance with applicable requirements, particularly as manifested in the loss or diversion of controlled substances, can result in enforcement action, such as civil penalties, refusal to renew necessary registration, or the initiation of proceedings to revoke those registrations. In certain circumstances, violations could lead to criminal prosecution. We are also subject to state legislation regulating the manufacture and distribution of certain products.

Medicaid Drug Rebate Program and Other Drug Pricing Programs

U.S. law requires that a pharmaceutical manufacturer, as a condition of having federal funds being made available for the manufacturer’s drugs under Medicaid and Medicare Part B, enter into a rebate agreement with the U.S. government to pay rebates to state Medicaid programs for the manufacturer’s covered outpatient drugs that are dispensed to Medicaid beneficiaries and paid for by a state Medicaid program. We have such a rebate agreement in effect. The Centers for Medicare and Medicaid Services ("CMS") is responsible for administering the Medicaid rebate agreements. We pay rebates on the utilization under fee-for-service arrangements as well as through Medicaid managed care organizations.

A Medicaid rebate agreement provides that the drug manufacturer will remit rebates to each state Medicaid agency on a quarterly basis based on pricing data reported by the manufacturer to CMS, including Average Manufacturer Price ("AMP") and, in the case of innovator products, Best Price ("BP"). We report AMP on a monthly and quarterly basis and Best Price on a quarterly basis. The minimum rebate amounts due are as follows: for noninnovator products, in general generic drugs marketed under ANDAs, the rebate amount is 13% of the AMP for the quarter; for innovator products, in general brand-name products marketed under NDAs, the rebate amount is the greater of 23.1% of the AMP for the quarter or the difference between such AMP and the Best Price for that same quarter. Manufacturers also pay an additional rebate on innovator drugs where price increases since launch have outpaced inflation.

In addition to using AMP information to calculate rebates, CMS is preparing to use AMPs to calculate a type of U.S. federal ceiling on reimbursement rates to pharmacies for multiple source drugs under the Medicaid program, known as the federal upper limit ("FUL"), and has been publishing draft FULs based on reported AMPs. CMS also has begun surveying and publishing retail community pharmacy acquisition cost and consumer price information to provide state Medicaid agencies with a basis for comparing their own reimbursement and pricing methodologies and rates.

U.S. law also requires that a company that participates in the Medicaid rebate program report average sales price ("ASP") information to CMS for certain categories of drugs that are paid under Part B of the Medicare program. CMS uses these submissions to determine payment rates for drugs under Medicare Part B.

Pricing and rebate calculations are governed by statutory and regulatory requirements that are complex, vary among products and programs, can change over time, and are subject to interpretation by us, governmental or regulatory agencies, and the courts. In the case of the Medicaid rebate program, if we become aware of errors in our prior price submissions, or a prior Best Price ("BP") submission needs to be updated due to late arriving data, we must resubmit the updated data for a period not to exceed 12 quarters from the quarter in which the data originally was due. Such restatements and recalculations increase our cost of compliance with the Medicaid rebate program, and corrections can result in an overage or underage of our rebate liability for past quarters, depending on the nature of the correction.

U.S. law requires any company that participates in the Medicaid rebate program also participate in the Public Health Service’s 340B drug pricing program in order for federal funds to be available for the manufacturer’s drugs under Medicaid and Medicare Part B. The 340B drug pricing program requires participating manufacturers to agree to charge statutorily-defined covered entities no more than the 340B “ceiling price” for the manufacturer’s covered outpatient drugs. The ceiling price is derived from the data the manufacturer reports under the Medicaid rebate program and therefore any changes to statutory or regulatory requirements applicable to the Medicaid price figures may impact the 340B ceiling price calculation as well. 340B covered entities include a variety of community

Perrigo Company plc - Item 1

Regulation

health clinics and other entities that receive health services grants from the Public Health Service, as well as hospitals that serve a disproportionate share of low-income patients.

U.S. law also requires any company that participates in the Medicaid rebate program and Medicare Part B and that wants its covered drugs paid for by certain federal agencies and grantees participate in the Department of Veterans Affairs ("VA") Federal Supply Schedule (“FSS”) pricing program. Accordingly, we must enter into an FSS contract with the VA, whereby our "covered drugs" are available to the VA, the Department of Defense ("DoD"), the Public Health Service, and the Coast Guard (collectively the “Big Four”) at pricing that is capped pursuant to a statutory Federal Ceiling Price (“FCP”).

In addition to the Veterans Health Care Act of 1992 requirements, FSS contracts include extensive disclosure and certification requirements and standard government terms and conditions with which we must comply. We also have a Section 703 Agreement under which we pay rebates on covered drug prescriptions dispensed to TRICARE beneficiaries by TRICARE network retail pharmacies. See Item 1A. Risk Factors - Risks Related to Operations for risks related to the above-mentioned programs.

Other U.S. Regulations and Organizations

We are subject to various other national, state, non-governmental, and local agency rules and regulations. Compliance with the laws and regulations regarding the manufacture and sale of our current products and the discovery, development, and introduction of new products requires substantial effort, expense and capital investment. Other regulatory agencies, organizations and legislation that may impact our business include, but are not limited to:

| |

• | Physician Payment Sunshine Act - This act requires certain pharmaceutical manufacturers to engage in extensive tracking of payments or transfers of value to physicians and teaching hospitals, maintenance of a payment database and public reporting of the payment data. |

| |

• | Foreign Corrupt Practices Act of 1977 ("FCPA") - This act and other similar anti-bribery laws prohibit companies and their intermediaries from providing money or anything of value to officials of foreign governments, foreign political parties or international organizations with the intent to obtain or retain business or seek a business advantage. |

| |

• | Federal Trade Commission ("FTC") - This agency oversees the advertising and other promotional practices of consumer products marketers. The FTC considers whether a product’s claims are substantiated, truthful and not misleading. The FTC also reviews mergers and acquisitions of companies exceeding specified thresholds and investigates certain business practices relevant to the healthcare industry. |

| |

• | NSF International ("NSF") - The NSF is an independent, not-for-profit, non-governmental organization that provides risk management services for public health and safety. Many of our dietary supplement products are certified under NSF/ANSI Standard 173. |

| |

• | International Organization for Standardization ("ISO") - The ISO Standards specify requirements for a Quality Management System that demonstrates the ability to consistently provide products that meet customer and applicable regulatory standards and includes processes to ensure continuous improvement. Our infant formula manufacturing sites are ISO 9001-2008 Certified for Quality Management Systems. ISO inspections are conducted at least annually. |

| |

• | United States Pharmacopeial Convention, Inc. ("USP") - The USP is a non-governmental, standard-setting organization. By reference, the FFDCA incorporates the USP quality and testing standards and monographs as the standard that must be met for the listed drugs, unless compliance with those standards is specifically disclaimed on the product’s labeling. USP standards exist for most Rx and OTC pharmaceuticals and many nutritional supplements. The FDA typically requires USP compliance as part of cGMP compliance. |

Perrigo Company plc - Item 1

Regulation

| |

• | Health Insurance Portability and Accountability Act ("HIPAA") - We could be subject to criminal penalties if we knowingly obtain individually identifiable health information from a covered entity in a manner that is not authorized or permitted by HIPAA or for aiding and abetting the violation of HIPAA. |

| |

• | Consumer Product Safety Commission ("CPSC") - The CPSC has published regulations requiring child resistant packaging on certain products including pharmaceuticals and dietary supplements. The manufacturer of any product that is subject to any CPSC rule, ban, standard or regulation must certify that, based on a reasonable testing program, the product complies with CPSC requirements. |

| |

• | Other State Agencies - We are subject to regulation by numerous other state health departments, insurance departments, boards of pharmacy, state controlled substance agencies, state consumer health and safety regulations, and other comparable state agencies, each of which have license requirements and fees that vary by state. |

Regulation Outside the U.S.

We develop and manufacture products in a number of countries outside the U.S., including many European countries, Israel, India, Mexico and Australia, each of which has its own regulatory environment. Following the Omega acquisition, our business has expanded significantly into non-U.S. markets, subjecting us to increased regulation in those markets. In addition, we export many of our products to other countries. In the U.S., exporting requirements are regulated by the FDA and, where appropriate, DEA laws. Outside the U.S., each individual country has its own requirements for the importation of products. Each country requires approval of products by that country's regulatory agencies through a registration process. Registration requirements include the manufacturing process, formula, packaging, testing, labeling, advertising, and marketing of the products. Each country regulates what is required and may be represented to the public on labeling and promotional material. Approval for the sale of our products by these regulatory agencies may be subject to delays. We believe that our policies, operations and products comply in all material respects with existing regulations to which our operations are subject. See below for more information on regulation within the significant regions in which we operate.

European Union

The European pharmaceutical industry is highly regulated and much of the legislative and regulatory framework is driven by the European Parliament and the European Commission. This has many benefits, including the potential to harmonize standards across the complex European market, but it also has the potential to create difficulties affecting the whole European market.

Some elements of the European Falsified Medicines Directive (the “Directive”) were enacted into national laws during 2013. The provisions of the Directive are intended to reduce the risk of counterfeit medicines entering the supply chain and also to ensure the quality of API manufactured outside of the European Union ("EU").