Exhibit 5.1

|

A&L Goodbody | Dublin | ||||||

| International Financial Services Centre | Belfast | |||||||

| 25-28 North Wall Quay, Dublin 1 | London | |||||||

| D01 H104 | New York | |||||||

| T: +353 1 649 2000 | San Francisco | |||||||

| DX: 29 Dublin | www.algoodbody.com | Palo Alto |

| Date | | 6 November 2019 | |

| Our ref | | 01416925 | |

| Your ref | | |

Perrigo Company plc

The Sharp Building

Hogan Place

Dublin 2

Ireland

Perrigo Company plc (the Company)

Dear Sirs

We are acting as Irish counsel to the Company, a public limited company incorporated under the laws of Ireland (registered number 529592), in connection with the proposed registration by the Company of 3,000,000 ordinary shares of the Company, par value €0.001 per share (the Shares), pursuant to a Registration Statement on Form S-8 (the Registration Statement) to be filed by the Company under the Securities Act of 1933, as amended.

The Shares are issuable under the Perrigo Company plc 2019 Long Term Incentive Plan (the Plan), which was adopted and assumed by the Company’s shareholders on 22 November 2013 and further amended and restated by shareholder approval on 26 April 2019.

In connection with this opinion, we have reviewed copies of such corporate records of the Company as we have deemed necessary as a basis for the opinions hereinafter expressed. In rendering this opinion, we have examined, and have assumed the truth and accuracy of the contents of, such documents and certificates of officers of the Company and of public officials as to factual matters and have conducted such searches, as of the date hereof, in public registries in Ireland as we have deemed necessary or appropriate for the purposes of this opinion but have made no independent investigation regarding such factual matters. In our examination we have assumed the (continued) truth and accuracy of the information contained in such documents, the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified or photostatic copies and the authenticity of the originals of such documents.

We have further assumed that none of the resolutions and authorities of the shareholders or directors of the Company upon which we have relied have been varied, amended or revoked in any respect or have expired and that the Shares will be issued in accordance with such resolutions and authorities and the terms of the Plan.

We have assumed the absence of fraud on the part of the Company and its respective officers, employees, agents and advisers.

Having made such further investigation and reviewed such other documents as we have considered requisite or desirable, subject to the foregoing and to the within additional qualifications and assumptions, and provided that the Registration Statement, as finally amended, has become effective, we are of the opinion that:

| 1 | the Shares have been duly authorised and when issued in accordance with the Registration Statement, the Plan and the options or other equity awards granted or to be granted thereunder, will be validly issued, fully paid and not subject to calls for any additional payments (“non-assessable’’) (except for Shares issued pursuant to deferred payment arrangements, which shall be fully paid upon the satisfaction of such payment obligations); and |

| 2 | in any proceedings taken in Ireland for the enforcement of the Plan, the choice of the laws of the State of Michigan as the governing law of the contractual rights and obligations of the parties under the applicable Plan would be upheld by the Irish Courts unless it were considered contrary to public policy, illegal, or made in bad faith. |

In rendering this opinion, we have confined ourselves to matters of Irish law. We express no opinion on any laws other than the laws of Ireland (and the interpretation thereof) in force as at the date hereof.

We hereby consent to the filing of this opinion with the Securities and Exchange Commission as an exhibit to the Registration Statement.

This opinion is being delivered to you and may not be relied upon or distributed to any other person without our prior written consent.

The opinion is governed by and construed in accordance with the laws of Ireland.

Yours faithfully

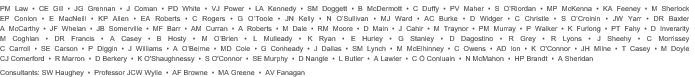

A&L Goodbody

2