Table of Contents

As filed with the Securities and Exchange Commission on August 15, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PERRIGO COMPANY PLC

(Exact name of registrant as specified in its charter)

and the other Guarantor Registrants Listed in the Table of Additional Registrant Guarantors Below

| Ireland | 2834 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

Treasury Building

Lower Grand Canal Street

Dublin 2

Ireland

+353 1 7094002

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

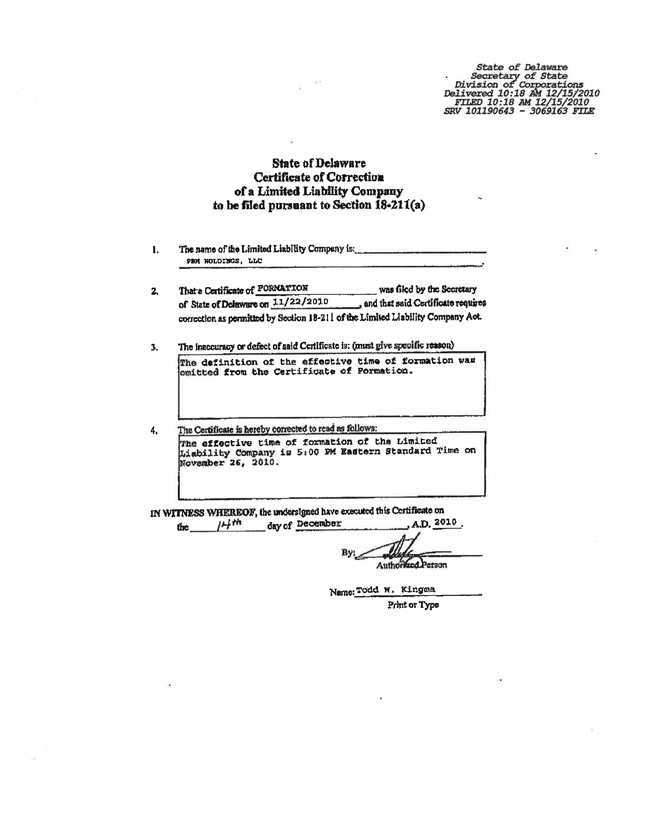

Todd W. Kingma

Executive Vice President, General Counsel and Company Secretary

Perrigo Company plc

515 Eastern Avenue

Allegan, Michigan 49010

Telephone: (269) 686-1941

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Stuart H. Gelfond, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

212-859-8000

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

Table of Contents

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed offering price per unit |

Proposed aggregate price |

Amount of registration | ||||

| 1.30% Senior Notes due 2016 |

$500,000,000 | 100% | $500,000,000 | $64,400 | ||||

| Guarantees of 1.30% Senior Notes due 2016(2) |

— | — | — | (2) | ||||

| 2.30% Senior Notes due 2018 |

$600,000,000 | 100% | $600,000,000 | $77,280 | ||||

| Guarantees of 2.30% Senior Notes due 2018(2) |

— | — | — | (2) | ||||

| 4.00% Senior Notes due 2023 |

$800,000,000 | 100% | $800,000,000 | $103,040 | ||||

| Guarantees of 4.00% Senior Notes due 2023(2) |

— | — | — | (2) | ||||

| 5.30% Senior Notes due 2043 |

$400,000,000 | 100% | $400,000,000 | $51,520 | ||||

| Guarantees of 5.30% Senior Notes due 2043(2) |

— | — | — | (2) | ||||

| Total Registration Fee |

— | — | — | $296,240 | ||||

|

| ||||||||

| (1) | Calculated in accordance with Rule 457(f)(2) under the Securities Act of 1933, as amended, or the “Securities Act.” |

| (2) | No separate consideration will be received for the guarantees, and no separate fee is payable pursuant to Rule 457(n) of the Securities Act. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

| Exact Name of Registrant Guarantor as Specified in its Charter(1) |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number |

||||

| Habsont |

Ireland | 98-1143888 | ||||

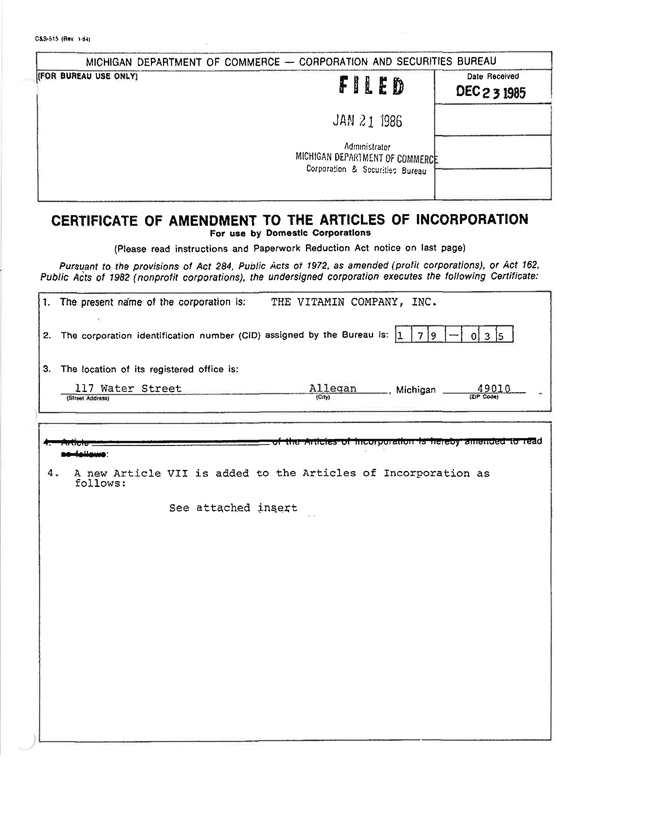

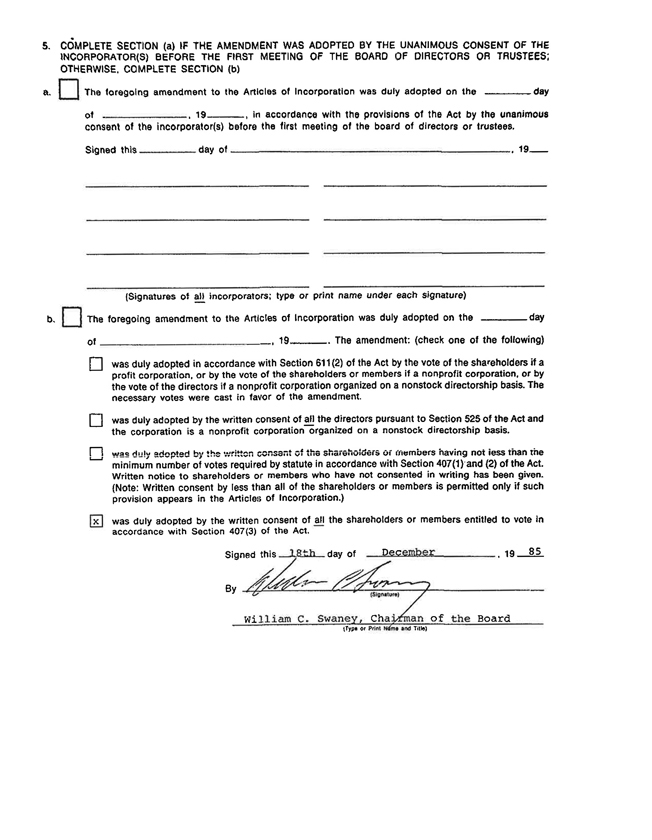

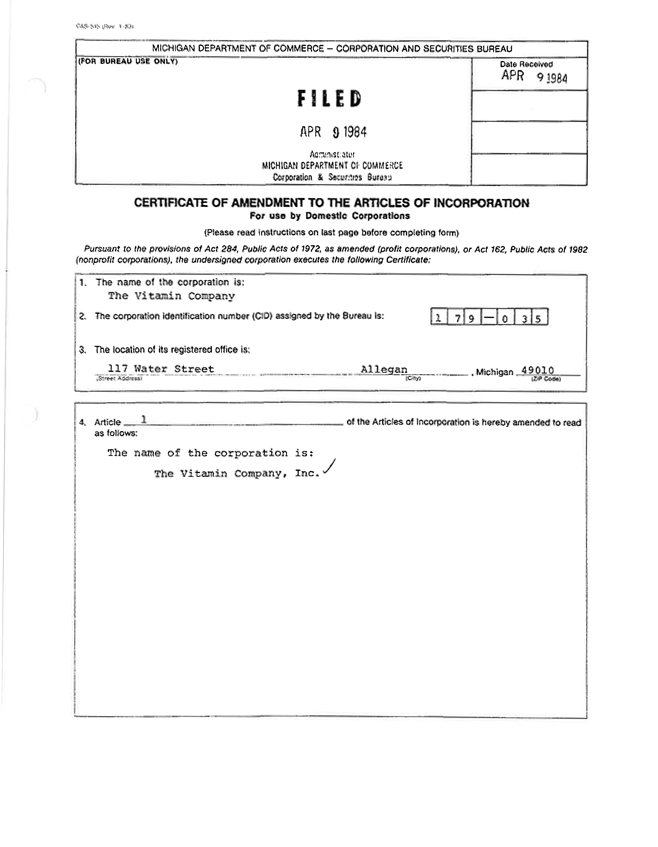

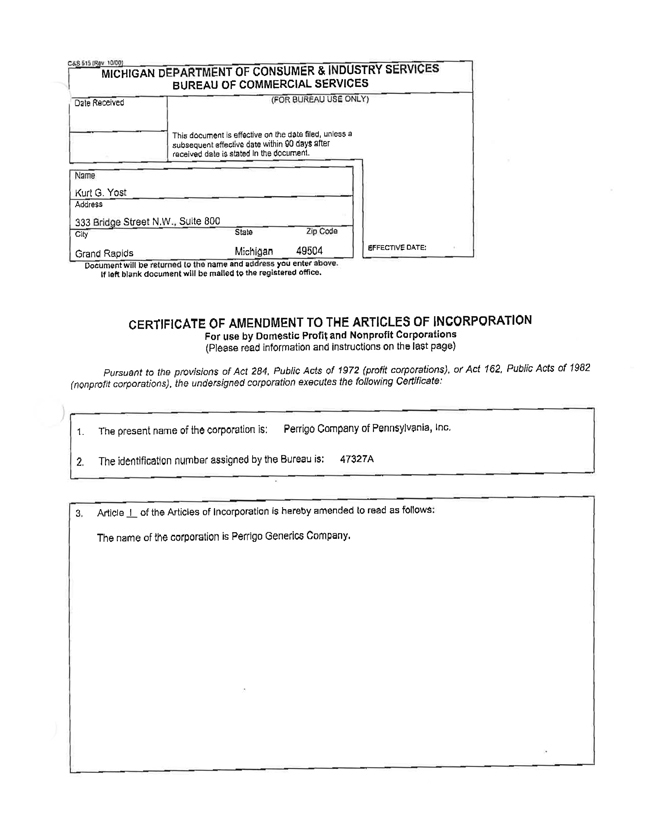

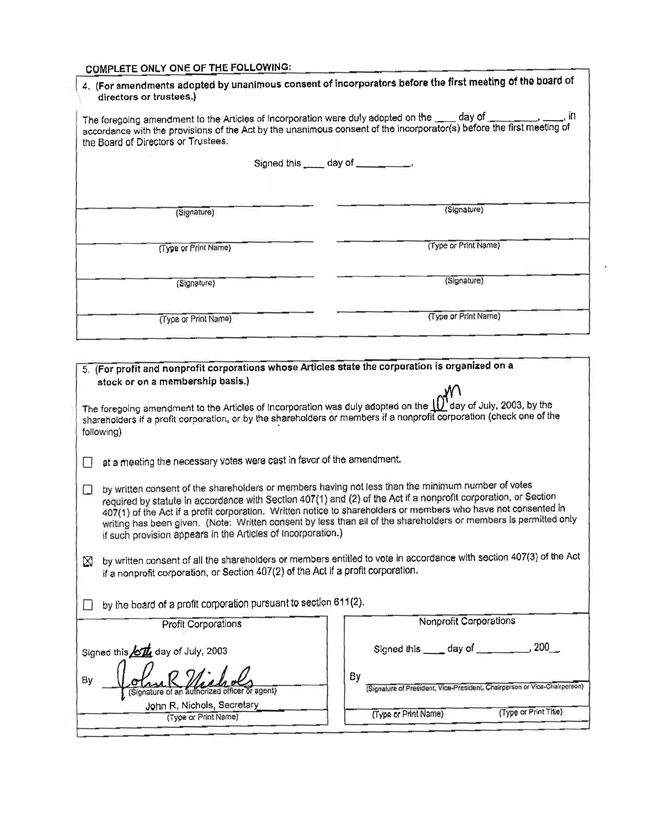

| Perrigo Company |

Michigan | 38-2799573 | ||||

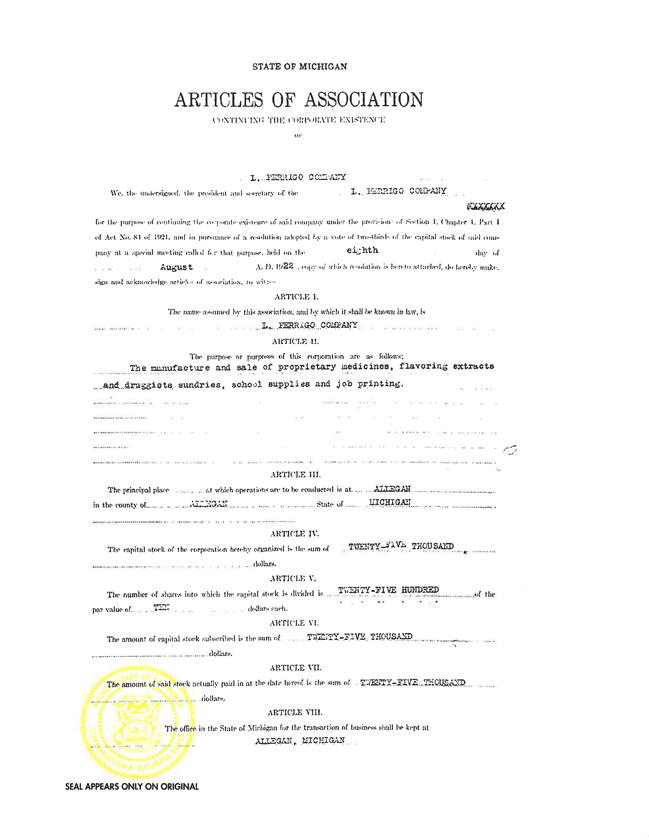

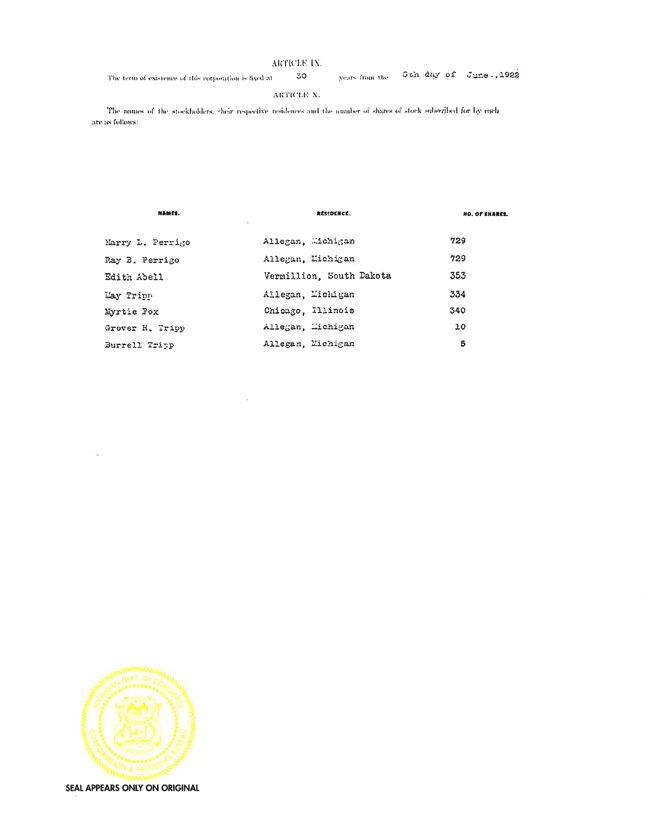

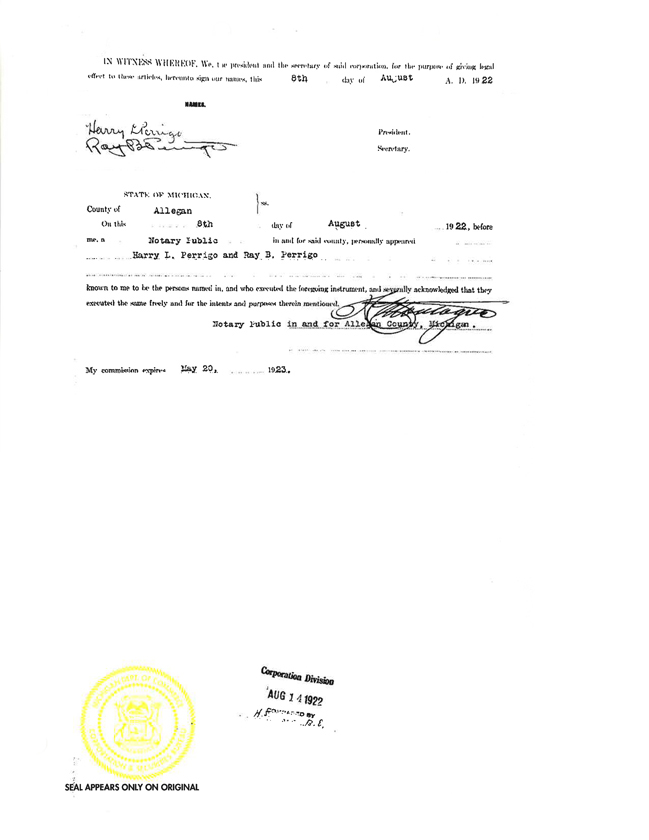

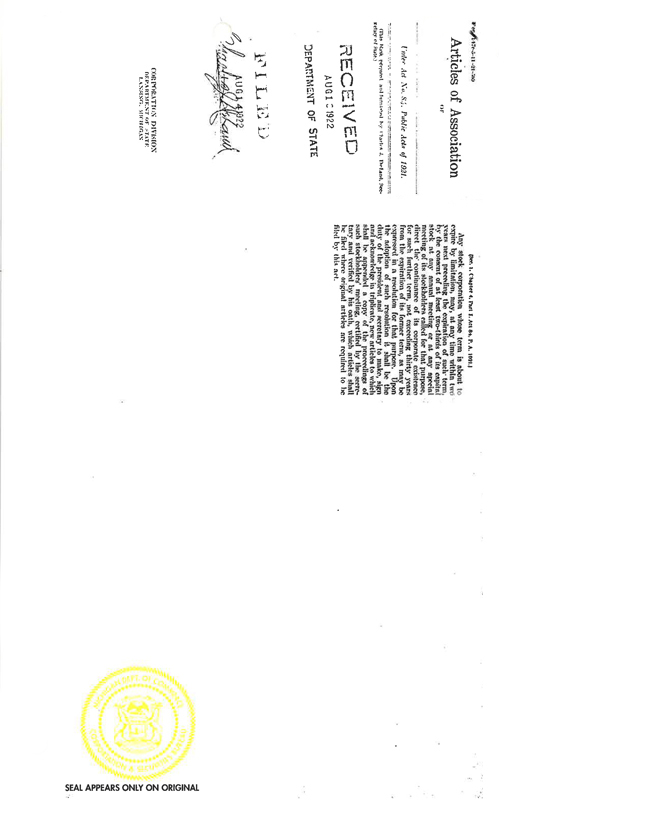

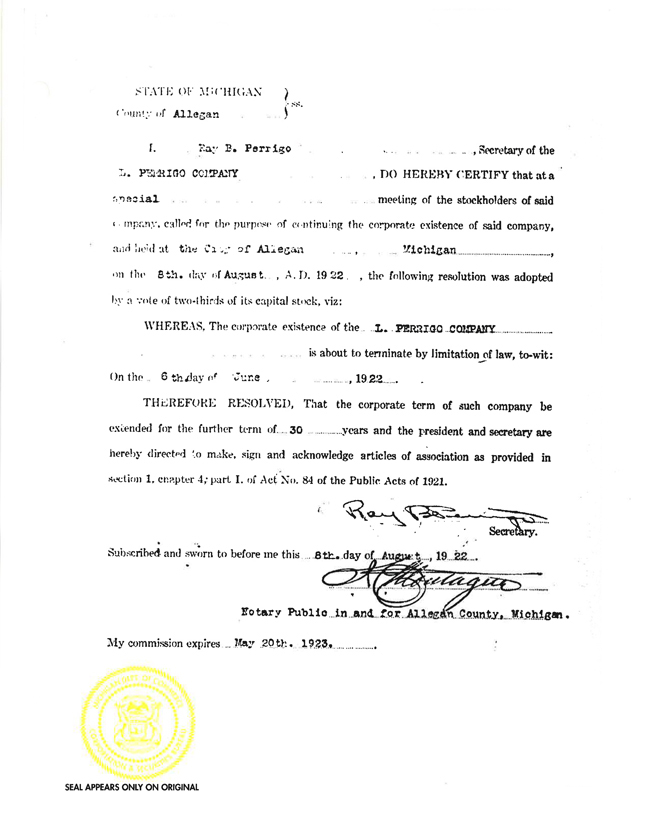

| L. Perrigo Company |

Michigan | 38-0920980 | ||||

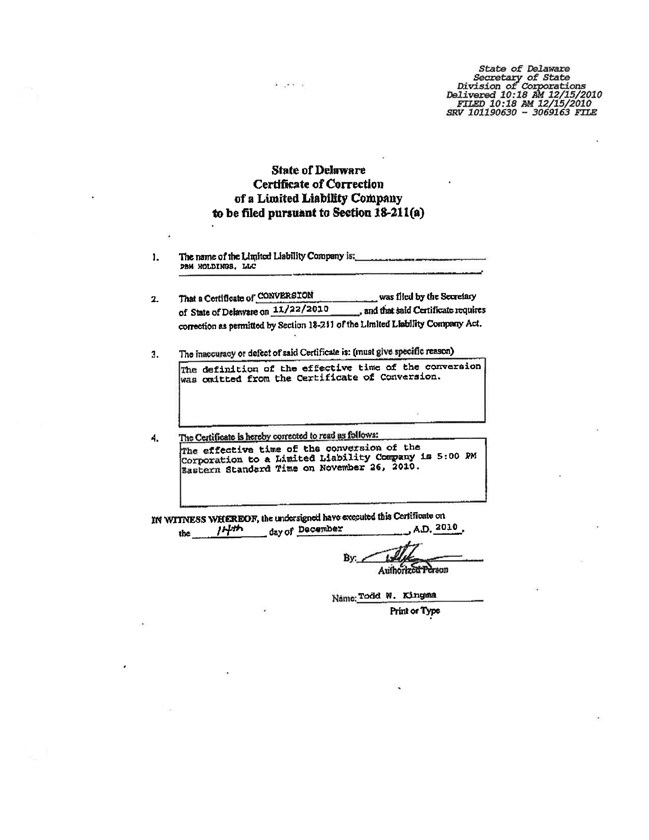

| PBM Nutritionals, LLC |

Delaware | 20-1781050 | ||||

| PBM Products, LLC |

Delaware | 22-3499315 | ||||

| PBM International Holdings, LLC |

Delaware | 20-3220989 | ||||

| PBM Foods, LLC |

Delaware | 54-2090916 | ||||

| PBM China Holdings, LLC |

Delaware | 20-3777774 | ||||

| Paddock Laboratories, LLC |

Delaware | 27-5064915 | ||||

| Perrigo New York, Inc. |

Delaware | 13-3785453 | ||||

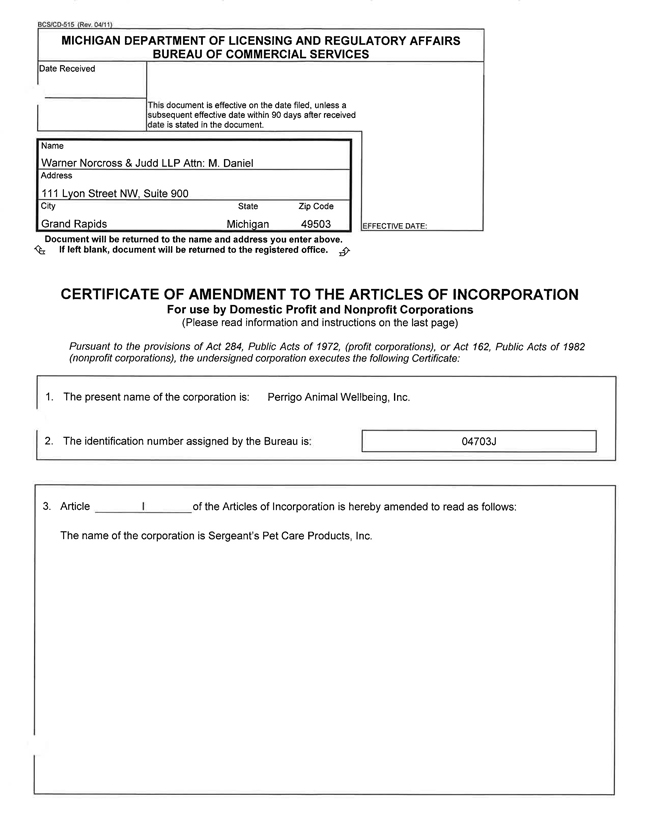

| Sergeant’s Pet Care Products, Inc. |

Michigan | 46-0970417 | ||||

| Velcera, Inc. |

Delaware | 20-3327015 | ||||

| FidoPharmBrands, LLC |

Delaware | 45-4116768 | ||||

| FidoPharm, Inc. |

Delaware | 26-4372483 | ||||

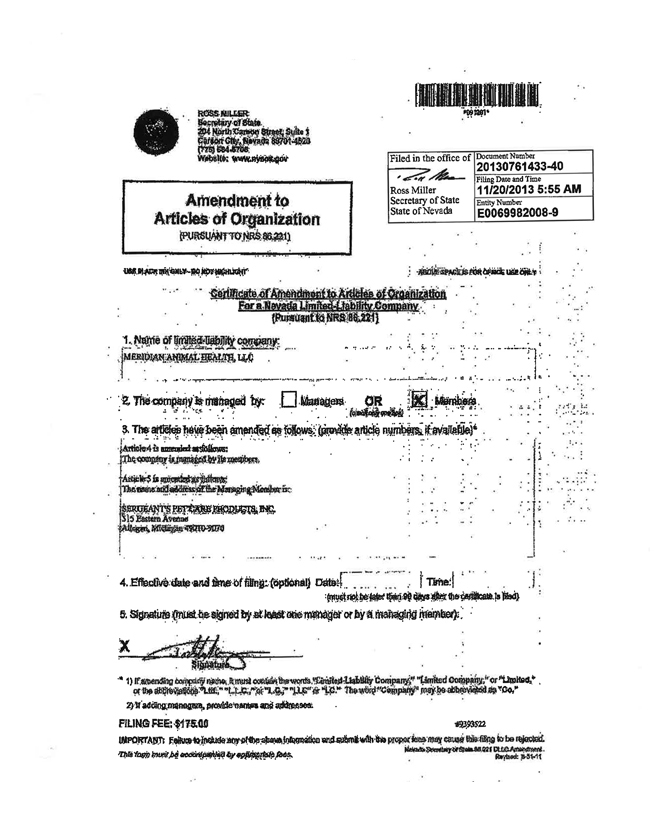

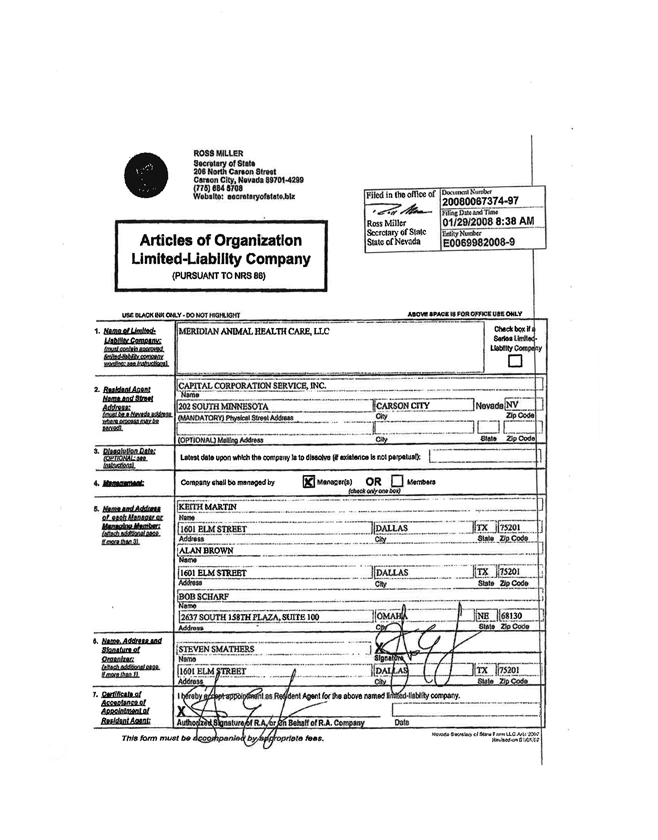

| Meridian Animal Health, LLC |

Nevada | 26-1878136 | ||||

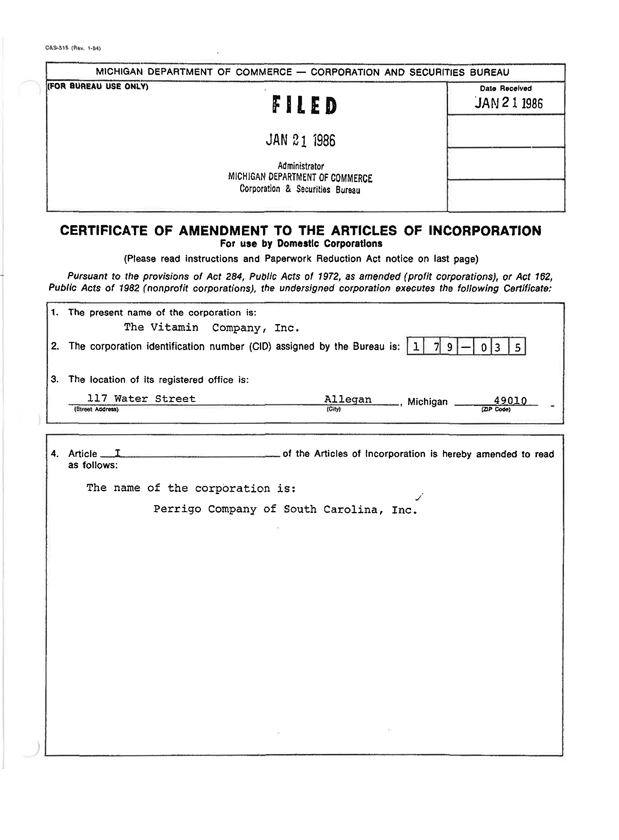

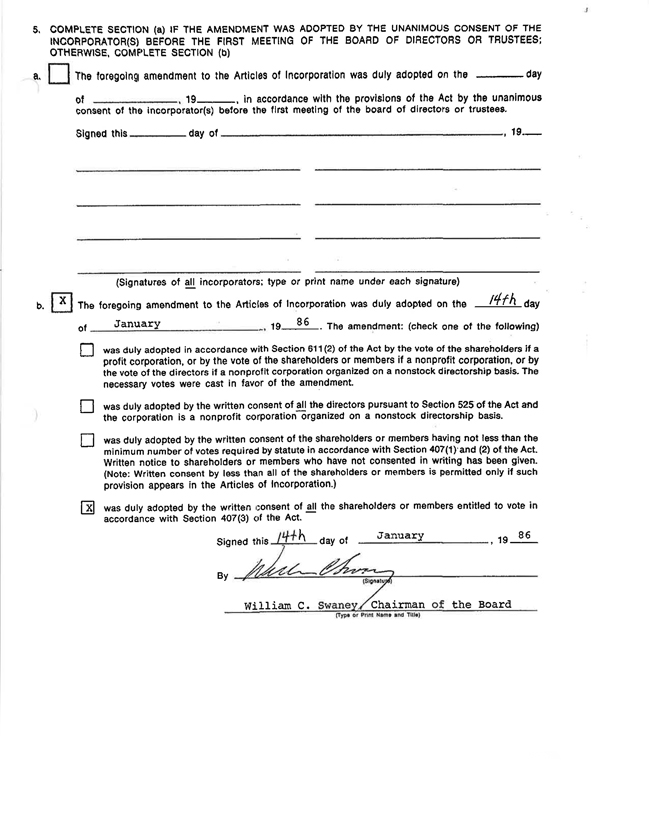

| Perrigo Company of South Carolina, Inc. |

Michigan | 58-1564758 | ||||

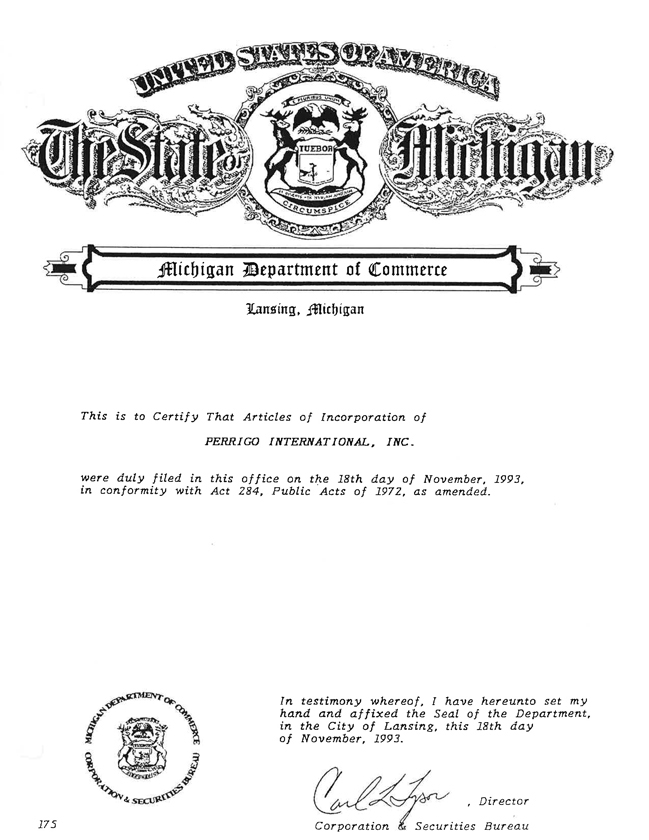

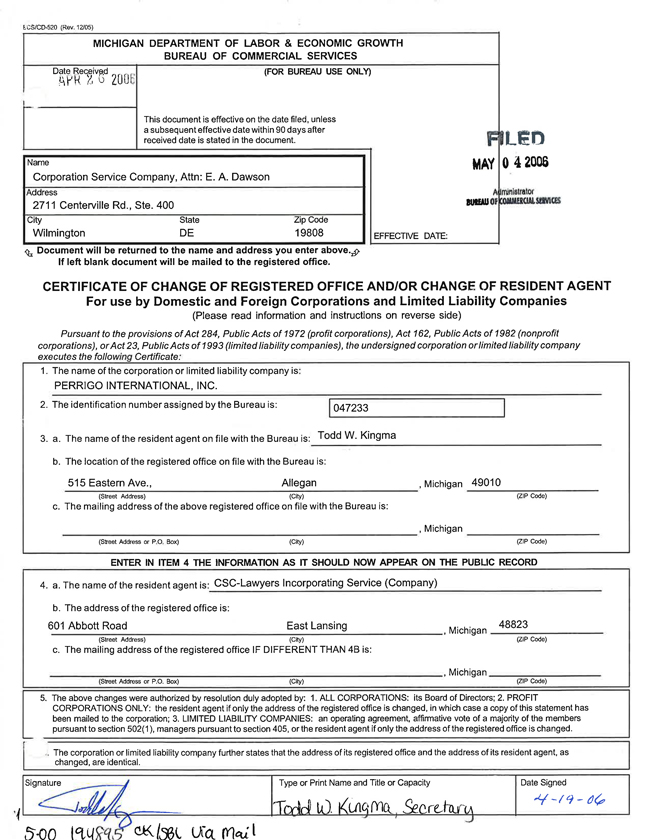

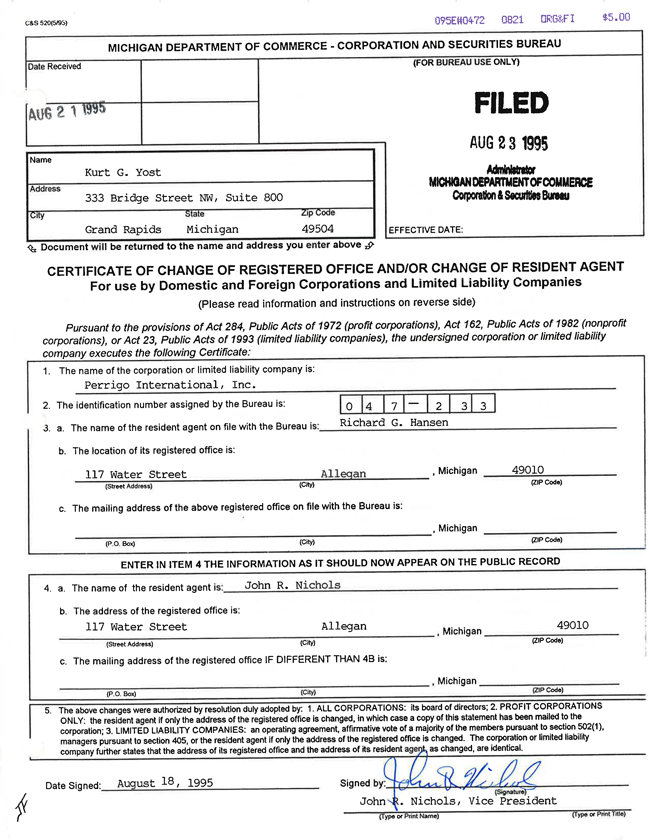

| Perrigo International, Inc. |

Michigan | 38-3144353 | ||||

| Perrigo API USA, Inc. |

Delaware | 06-1594919 | ||||

| Perrigo Diabetes Care, LLC |

Delaware | 45-4047338 | ||||

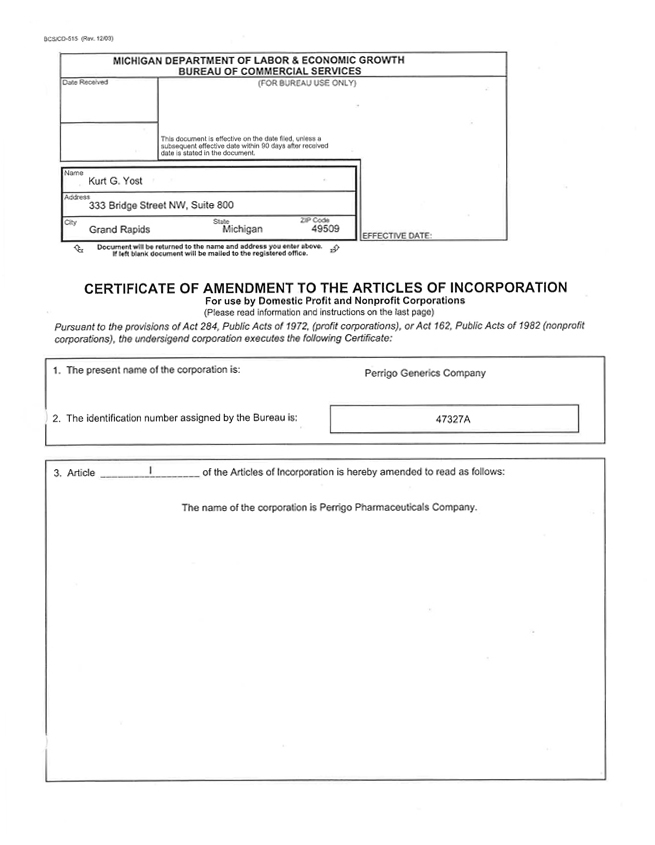

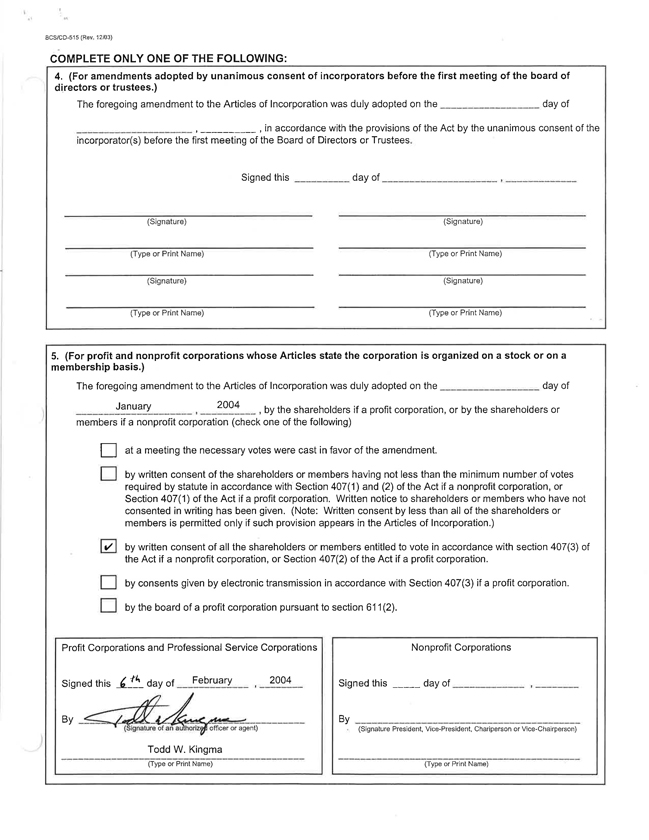

| Perrigo Pharmaceuticals Company |

Michigan | 20-0240361 | ||||

| Perrigo Florida, Inc. |

Florida | 65-0336176 | ||||

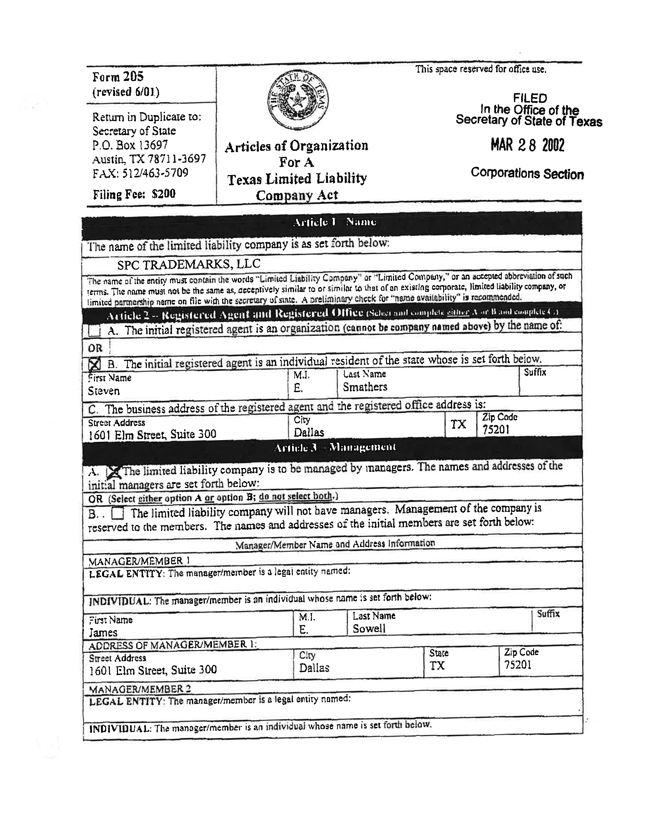

| SPC Trademarks, LLC |

Texas | 03-0416478 | ||||

| Pet Logic, L.L.C. |

Delaware | 00-0000000 | ||||

| LoradoChem, Inc. |

Colorado | 20-0912038 | ||||

| Perrigo Sourcing Solutions, Inc. |

Michigan | 27-0717739 | ||||

| Perrigo Sales Corporation |

Michigan | 38-3233149 | ||||

| Perrigo Research & Development Company |

Michigan | 82-0541583 | ||||

| P2C, Inc. |

Michigan | 30-0754547 | ||||

| Perrigo Company of Tennessee Inc. |

Tennessee | 62-0634170 | ||||

| Cobrek Pharmaceuticals, Inc. |

Delaware | 26-2609916 | ||||

| PBM Holdings, LLC |

Delaware | 52-2196322 | ||||

| PBM Canada Holdings, LLC |

Delaware | 20-3220996 | ||||

| Elan Corporation Limited |

Ireland | 98-0487435 | ||||

| Elan Holdings Limited |

Ireland | 98-0112748 | ||||

| Elan Pharma International Limited |

Ireland | 98-0551187 | ||||

| Elan Regulatory Holdings Limited |

Ireland | 00-0000000 | ||||

| Elan Science Five Limited |

Ireland | 00-0000000 | ||||

| Keavy Finance Limited |

Ireland | 00-0000000 | ||||

| The Institute of Biopharmaceutics Limited |

Ireland | 00-0000000 | ||||

| (1) | The address for each of the additional registrant guarantors is c/o Perrigo Company plc, Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 15, 2014

PROSPECTUS

Perrigo Company plc

Exchange Offer for

$500,000,000 1.30% Senior Notes due 2016

$600,000,000 2.30% Senior Notes due 2018

$800,000,000 4.00% Senior Notes due 2023

$400,000,000 5.30% Senior Notes due 2043

Perrigo Company plc, a public limited company incorporated under the laws of Ireland, or the “Issuer”, is offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, $500,000,000 of its outstanding 1.30% Senior Notes due 2016, $600,000,000 of its outstanding 2.30% Senior Notes due 2018, $800,000,000 of its outstanding 4.00% Senior Notes due 2023 and $400,000,000 of its outstanding 5.30% Senior Notes due 2043, which were issued on November 8, 2013 and which are collectively referred to herein as the initial notes, for a like aggregate amount of the Issuer’s registered 1.30% Senior Notes due 2016, 2.30% Senior Notes due 2018, 4.00% Senior Notes due 2023 and 5.30% Senior Notes due 2043, which are collectively referred to herein as the exchange notes. The exchange notes will be issued under an indenture dated as of November 8, 2013.

Terms of the exchange offer

The exchange offer will expire at 5:00 p.m., New York City time, on , 2014, unless we extend it.

If all the conditions to this exchange offer are satisfied, the Issuer will exchange all of the initial notes that are validly tendered and not validly withdrawn for the exchange notes.

You may withdraw your tender of initial notes at any time before the expiration of this exchange offer.

The exchange notes that the Issuer will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights.

The exchange notes that the Issuer will issue you in exchange for your initial notes are new securities with no established market for trading.

The initial notes are listed on the Irish Stock Exchange. The Issuer intends to apply to the Irish Stock Exchange for the exchange notes to be admitted to the Official List and to trading on its Global Exchange Market. There can be no assurance that the exchange notes will be admitted to listing or trading.

Before participating in this exchange offer, please refer to the section in this prospectus entitled “Risk Factors” commencing on page 8.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Table of Contents

Each broker-dealer that receives exchange notes for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for initial notes where such initial notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that we will make this propectus available to any broker-dealer for use in connection with any such resale until the earlier of 180 days after the closing of this exchange offer or the date on which each such broker-dealer has resold all of the new exchange notes acquired by it in this exchange offer. See “Plan of Distribution.”

The date of this prospectus is , 2014.

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 16 | ||||

| 17 | ||||

| 26 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

Nothing contained in or incorporated by reference into this prospectus is, or shall be relied upon as, a promise or representation as to past or future performance.

In making a decision whether to participate in the exchange offer, you must rely on your own examination of the Issuer and the terms of the exchange offer and the exchange notes, including the merits and risks involved. You should not consider any information in or incorporated by reference into this prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding participation in the exchange offer and an investment in the exchange notes.

The Issuer makes no representation or warranty, express or implied, as to the accuracy or completeness of the information obtained from third party sources set forth herein or incorporated by reference into this prospectus, and nothing contained in this prospectus or incorporated by reference herein is, or shall be relied upon as, a promise or representation, whether as to past or future performance and may be filed as exhibits to the Issuer’s public filings.

This offer may be withdrawn at any time prior to the closing of the offering, and the offering is subject to the terms of this prospectus.

Laws in certain jurisdictions may restrict the distribution of this prospectus and the offer and sale or exchange of the exchange notes. You must comply with all applicable laws and regulations in force in any jurisdiction in which you purchase, offer or sell the exchange notes and must obtain any consent, approval or permission required for your purchase, offer or sale of the exchange notes under the laws and regulations in force in any jurisdiction to which you are subject or in which you make such purchases, offers or sales, and the Issuer shall have no responsibility therefor.

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus and in the documents incorporated herein are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and are subject to the safe harbor created thereby. These statements relate to future events or the Company’s future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or the negative of those terms or other comparable terminology.

Please see Item 1A of the Form 10-K of the Issuer for the year ended June 28, 2014 for a discussion of certain important risk factors that relate to forward-looking statements contained in or incorporated by reference into this prospectus. The Issuer has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Issuer believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Issuer’s control. These and other important factors may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this prospectus are made only as of the date hereof or as of the date of the document incorporated by reference, and unless otherwise required by applicable securities laws, the Issuer disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

Table of Contents

This summary provides an overview of selected information and does not contain all the information you should consider. Before making a decision to participate in this exchange offer, you should carefully read the following summary together with the more detailed information appearing elsewhere in this prospectus, as well as the financial statements and related notes thereto and other information included in or incorporated by reference into this prospectus.

Unless otherwise indicated or as the context otherwise requires, in this prospectus:, (i) the “Issuer” refers to Perrigo Company plc, a public limited company incorporated under the laws of Ireland, the issuer of the notes; (ii) the “Predecessor” refers to Perrigo Company, a Michigan corporation; and (iii) the “Company,” “Perrigo,” the “Successor,” “we,” “us” and “our” refer to the Issuer and its consolidated subsidiaries.

The term “initial notes” refers to the 1.30% Senior Notes due 2016, 2.30% Senior Notes due 2018, 4.00% Senior Notes Due 2023 and 5.30% Senior Notes due 2043 that were issued on November 8, 2013 in a private offering. The term “exchange notes” refers to the 1.30% Senior Notes due 2016, 2.30% Senior Notes due 2018, 4.00% Senior Notes Due 2023 and 5.30% Senior Notes due 2043 offered with this prospectus. The term “notes” refers to the initial notes and the exchange notes, collectively. The exchange notes will be issued under an indenture dated as of November 8, 2013.

The Company

Perrigo Company plc (formerly known as Perrigo Company Limited, and prior thereto, Blisfont Limited), was incorporated under the laws of Ireland on June 28, 2013, and became the successor registrant of Perrigo Company on December 18, 2013 in connection with the consummation of the acquisition of Elan Corporation, plc (“Elan”), which is discussed further below. From its beginnings as a packager of home remedies in 1887, Perrigo has grown to become a leading global healthcare supplier. Perrigo develops, manufactures and distributes over-the-counter (“OTC”) and generic prescription (“Rx”) pharmaceuticals, nutritional products and active pharmaceutical ingredients (“API”), and has a specialty sciences business comprised of assets focused predominantly on the treatment of Multiple Sclerosis (Tysabri®). The Company is the world’s largest manufacturer of OTC healthcare products for the store brand market. Perrigo’s mission is to offer uncompromised “Quality Affordable Healthcare Products®”, and it does so across a wide variety of product categories primarily in the United States, United Kingdom, Mexico, Israel and Australia, as well as many other key markets worldwide, including Canada, China and Latin America.

The Company operates through several wholly owned subsidiaries. In the United States, its operations are conducted primarily through L. Perrigo Company, Perrigo Company of South Carolina, Inc., Perrigo New York, Inc., PBM Products, LLC, PBM Nutritionals, LLC, Paddock Laboratories, LLC, Perrigo Diabetes Care, LLC, Sergeant’s Pet Care Products, Inc. and Fidopharm, Inc. Outside the United States, its operations are conducted primarily through Elan Pharma International Limited, Perrigo Israel Pharmaceuticals Ltd., Perrigo API Ltd., Quimica y Farmacia S.A. de C.V., Laboratorios Diba, S.A., Wrafton Laboratories Limited, Galpharm Healthcare Ltd., Orion Laboratories Pty Ltd and Rosemont Pharmaceuticals Ltd. As used herein, references to the “Company” mean Perrigo Company plc, its subsidiaries and all predecessors of Perrigo Company plc and its subsidiaries.

Corporate Information

Our principal executive offices are located at Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland, and our telephone number at that address is +353 1 7094002. Our corporate website address is http://www.perrigo.com. The content of our website is not incorporated in, or otherwise to be regarded as part of, this prospectus.

Perrigo Company plc is a holding company, and substantially all of our operations are conducted by wholly-owned subsidiaries.

1

Table of Contents

Summary of the Exchange Offer

The following summary contains basic information about the exchange offer and the exchange notes. It does not contain all the information that is important to you. For a more complete understanding of the exchange notes, please refer to the sections of this prospectus entitled “The Exchange Offer” and “Description of Exchange Notes.” In this subsection, “we”, “us” and “our” refer only to Perrigo Company plc, a public limited company incorporated under the laws of Ireland, as the issuer of the notes, exclusive of our subsidiaries.

| Exchange Offer |

We are offering to exchange up to $2,300,000,000 aggregate principal amount of our exchange notes for a like aggregate principal amount of our initial notes. |

| In order to exchange your initial notes, you must properly tender them and we must accept your tender. We will exchange all outstanding initial notes that are validly tendered and not validly withdrawn. |

| Expiration Date |

This exchange offer will expire at 5:00 p.m., New York City time, on , 2014, unless we decide to extend it. |

| Conditions to the Exchange Offer |

The only condition to completing the exchange offer is that the exchange offer does not violate applicable law or any applicable interpretation of the staff of the SEC. Please refer to the section in this prospectus entitled “The Exchange Offer—Conditions to the Exchange Offer.” |

| Procedures for Tendering Initial Notes |

To participate in this exchange offer, you must complete, sign and date the letter of transmittal or its facsimile and transmit it, together with your initial notes to be exchanged and all other documents required by the letter of transmittal, to Wells Fargo Bank, National Association, as exchange agent, at its address indicated under “The Exchange Offer—Exchange Agent.” In the alternative, you can tender your initial notes by book-entry delivery following the procedures described in this prospectus. For more information on tendering your initial notes, please refer to the section in this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes.” |

| Special Procedures for Beneficial Owners |

If you are a beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your initial notes in the exchange offer, you should contact the registered holder promptly and instruct that person to tender on your behalf. |

| Guaranteed Delivery Procedures |

If you wish to tender your initial notes and you cannot get the required documents to the exchange agent on time, you may tender your notes by using the guaranteed delivery procedures described under the section of this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes—Guaranteed Delivery Procedure.” |

2

Table of Contents

| Withdrawal Rights |

You may withdraw the tender of your initial notes at any time before 5:00 p.m., New York City time, on the expiration date of the exchange offer. To withdraw, you must send a written or facsimile transmission notice of withdrawal to the exchange agent at its address indicated under “The Exchange Offer—Exchange Agent” before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

| Acceptance of Initial Notes and Delivery of Exchange Notes |

If all the conditions to the completion of this exchange offer are satisfied, we will accept any and all initial notes that are properly tendered in this exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return any initial note that we do not accept for exchange to you without expense promptly after the expiration date. We will deliver the exchange notes to you promptly after the expiration date and acceptance of your initial notes for exchange. Please refer to the section in this prospectus entitled “The Exchange Offer—Acceptance of Initial Notes for Exchange; Delivery of Exchange Notes.” |

| Material United States Federal Income Tax Consequences |

The exchange of initial notes for exchange notes in the exchange offer will not be a taxable event for United States federal income tax purposes. See “Material United States Federal Income Tax Consequences”. |

| Exchange Agent |

Wells Fargo Bank, National Association is serving as exchange agent in the exchange offer. |

| Fees and Expenses |

We will pay all expenses related to this exchange offer. Please refer to the section of this prospectus entitled “The Exchange Offer—Fees and Expenses.” |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the exchange notes. We are making this exchange offer solely to satisfy certain of our obligations under our registration rights agreement entered into in connection with the offering of the initial notes. |

| Consequences to Holders Who Do Not Participate in the Exchange Offer |

Any initial notes that are not tendered or that are tendered but not accepted will remain subject to the restrictions on transfer set forth in the initial notes and the indenture. Since the initial notes have not been registered under the federal securities laws, they may bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon completion of the Exchange Offer, we will have no further obligation to register, and currently we do not anticipate that we will register, the initial notes under the Securities Act except in limited circumstances with respect to specific types of holders of initial notes. Please refer to the section |

3

Table of Contents

| of this prospectus entitled “The Exchange Offer—Your Failure to Participate in the Exchange Offer Will Have Adverse Consequences.” |

| Resales |

It may be possible for you to resell the notes issued in the exchange offer without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to the conditions described under “Plan of Distribution.” |

| To tender your initial notes in this exchange offer and resell the exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act, you must make the following representations: |

| • | you are authorized to tender the initial notes and to acquire exchange notes, and that we will acquire good and unencumbered title thereto; |

| • | the exchange notes acquired by you are being acquired in the ordinary course of business; |

| • | you have no arrangement or understanding with any person to participate in a distribution of the exchange notes and are not participating in, and do not intend to participate in, the distribution of such exchange notes; |

| • | you are not an “affiliate,” as defined in Rule 405 under the Securities Act, of ours, or you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable; |

| • | if you are not a broker-dealer, you are not engaging in, and do not intend to engage in, a distribution of exchange notes; and |

| • | if you are a broker-dealer, initial notes to be exchanged were acquired by you as a result of market-making or other trading activities and you will deliver a prospectus in connection with any resale, offer to resell or other transfer of such exchange notes. |

| Please refer to the sections of this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes—Proper Execution and Delivery of Letters of Transmittal,” “Risk Factors—Risks Related to the Exchange Offer—Some persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes” and “Plan of Distribution.” |

4

Table of Contents

Summary of Terms of the Exchange Notes

The summary below describes the principal terms of the exchange notes. Some of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the notes.

| Issuer |

Perrigo Company plc, a public limited company incorporated under the laws of Ireland. |

| Securities |

$500,000,000 principal amount of 1.30% Senior Notes due 2016 (the “2016 Notes”), |

| $600,000,000 principal amount of 2.30% Senior Notes due 2018 (the “2018 Notes”), |

| $800,000,000 principal amount of 4.00% Senior Notes due 2023 (the “2023 Notes”), and |

| $400,000,000 principal amount of 5.30% Senior Notes due 2043 (the “2043 Notes”). |

| Maturity Dates |

The 2016 Notes will mature on November 8, 2016, |

| the 2018 Notes will mature on November 8, 2018, |

| the 2023 Notes will mature on November 15, 2023, and |

| the 2043 Notes will mature on November 15, 2043. |

| Interest Payment Dates |

Interest on the 2016 Notes will be payable in cash semi-annually on April 24 and October 24 of each year and will accrue at a rate of 1.30% per annum, |

| interest on the 2018 Notes will be payable in cash semi-annually on April 24 and October 24 of each year and will accrue at a rate of 2.30% per annum, |

| interest on the 2023 Notes will be payable in cash semi-annually on May 15 and November 15 of each year and will accrue at a rate of 4.00% per annum, and |

| interest on the 2043 Notes will be payable in cash semi-annually on May 15 and November 15 of each year and will accrue at a rate of 5.30% per annum, |

| Guarantees |

The exchange notes will be fully and unconditionally guaranteed on a senior unsecured basis by the Company’s subsidiaries that guarantee the $1.0 billion Term Loan Agreement, dated September 6, 2013 (the “Term Loan”) and $600.0 million Revolving Credit Agreement, dated September 6, 2013 (the “Revolver”) with Barclays Bank PLC as Administration Agent, HSBC Bank USA, N.A. as Syndication Agent, |

5

Table of Contents

| Bank of America, N.A., JPMorgan Chase Bank, N.A. and Wells Fargo Bank, N.A. as Documentation Agents and certain other participant banks (together, the “Permanent Credit Facilities”). |

| Any guarantee of the exchange notes by a Guarantor shall provide by its terms that it shall be automatically, permanently and unconditionally released and discharged, upon among other reasons, the release or discharge of the guarantee by such Guarantor of indebtedness under the Permanent Credit Facilities. |

| Ranking |

The exchange notes and guarantees will constitute our and the Guarantors’ unsecured senior obligations and will: |

| • | rank equally with all of our and the Guarantors’ existing and future unsecured, unsubordinated indebtedness; |

| • | be effectively subordinated to any of our and the Guarantors’ existing and future secured obligations; |

| • | be senior in right of payment to any of our and the Guarantors’ obligations that are by their terms expressly subordinated or junior in right of payment to the exchange notes and the guarantees; and |

| • | will be structurally subordinated to the existing and future obligations of our subsidiaries that do not guarantee the exchange notes. |

| As of June 28, 2014, we had $3,234 million of indebtedness on a consolidated basis, including the exchange notes. As of June 28, 2014, our direct and indirect subsidiaries that do not guarantee the exchange notes had outstanding indebtedness of approximately $7 million (excluding trade payables) and all of the indebtedness of such subsidiaries would have been structurally senior to the exchange notes. |

| Optional Redemption |

We may redeem the exchange notes of any series, in whole or in part, at any time or from time to time at the applicable make-whole premium redemption price as described under “Description of the Exchange Notes—Optional Redemption.” In addition, the Issuer may redeem all or part of the 2023 Notes on or after August 15, 2023 (three months prior to their maturity date) and the 2043 Notes on or after May 15, 2043 (six months prior to their maturity date), in each case, at a redemption price equal to 100% of the aggregate principal amount of the exchange notes of the applicable series being redeemed plus, in each case, accrued and unpaid interest. |

| Change of Control |

Upon the occurrence of a “change of control triggering event” (as defined below) with respect to the exchange notes, unless we have exercised our option to redeem the exchange notes by notifying the holders to that effect, we will be required to offer to repurchase such exchange notes at the price described in this offering memorandum. See “Description of the Exchange Notes—Change of Control Offer.” |

6

Table of Contents

| No Prior Market |

The exchange notes will constitute a new issue of securities with no established trading market. The Issuer does not intend to list the exchange notes on any national securities exchange or automated quotation system. Accordingly, we cannot assure you that an active public or other market will develop for the exchange notes or as to the liquidity of the trading market for the exchange notes. If a trading market does not develop or is not maintained, holders of the exchange notes may experience difficulty in reselling the exchange notes or may be unable to sell them at all. If a market for the exchange notes develops, any such market may be discontinued at any time. Accordingly, you may have to bear the financial risks of investing in the exchange notes for an indefinite period of time. The Issuer does not intend to apply for a listing of the exchange notes on any securities exchange or automated dealer quotation system. See “Plan of Distribution.” |

| Use of Proceeds |

The issuer will not receive any proceeds from the issuance of the exchange notes pursuant to the Exchange Offer. The Issuer will pay all of its expenses incident to the Exchange Offer. See “Use of Proceeds.” |

| Risk Factors |

You should consider carefully the information set forth in the section entitled “Risk Factors” and all other information contained in or incorporated by reference into this prospectus before deciding to participate in the exchange offer. |

| Authorized Denomination |

Minimum denominations of $200,000 and integral multiples of $1,000 in excess of $200,000. |

| Trustee |

Wells Fargo Bank, National Association |

| Governing Law |

New York |

7

Table of Contents

Before making a decision to participate in the exchange offer, you should carefully consider the following risk factors described below and all of the information included in or incorporated by reference into this prospectus. The risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition and results of operations would suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements” in this prospectus. The risks associated with our business can be found in our Annual Report on Form 10-K for the fiscal year ended June 28, 2014, which is incorporated by reference into this prospectus. See “Incorporation of Certain Documents by Reference.”

Risks Related to the Exchange Offer

If you fail to exchange your initial notes for exchange notes, you will continue to hold notes subject to transfer restrictions.

We will not accept your initial notes for exchange notes if you do not follow the exchange offer procedures. We will issue exchange notes as part of this exchange offer only after timely receipt of your initial notes, a properly completed and duly executed letter of transmittal and all other required documents or if you comply with the guaranteed delivery procedures for tendering your initial notes. Therefore, if you want to tender your initial notes, please allow sufficient time to ensure timely delivery. If we do not receive your initial notes, letter of transmittal, and all other required documents by the expiration date of the exchange offer, or you do not otherwise comply with the guaranteed delivery procedures for tendering your initial notes, we will not accept your initial notes for exchange. Neither we nor the exchange agent is required to notify you of defects or irregularities with respect to the tenders of initial notes for exchange. If there are defects or irregularities with respect to your tender of initial notes, we will not accept your initial notes for exchange unless we decide in our sole discretion to waive such defects or irregularities.

If you do not exchange your initial notes for new exchange notes in this exchange offer, the initial notes you hold will continue to be subject to the existing transfer restrictions. In general, you may not offer or sell the initial notes except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not plan to register the initial notes form resale under the Securities Act. If you continue to hold any initial notes after this exchange offer is completed, you may have trouble selling them because of these restrictions on transfer.

The issuance of the exchange notes may adversely affect the market for the initial notes.

To the extent the initial notes are tendered and accepted in the exchange offer, the trading market for the untendered, and tendered but unaccepted, initial notes could be adversely affected. Because we anticipate that most holders of the initial notes will elect to exchange their initial notes for exchange notes due to the absence of restrictions on the resale of exchange notes under the Securities Act, we anticipate that the liquidity of the market for any initial notes remaining after the completion of this exchange offer may be substantially limited. Please refer to the section in this prospectus entitled “The Exchange Offer—Your Failure to Participate in the Exchange Offer Will Have Adverse Consequences.”

Some persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes.

Based on interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1983), we believe that you may offer for resale, resell or otherwise transfer the

8

Table of Contents

exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act. However, in some instances described in this prospectus under “Plan of Distribution,” you will remain obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer your exchange notes. In these cases, if you transfer any exchange note without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes under the Securities Act, you may incur liability under this act. We do not and will not assume, or indemnify you against, this liability.

Risks Related to the Exchange Notes

The Issuer’s indebtedness and debt service obligations could adversely affect its business.

The Issuer’s indebtedness as of June 28, 2014, was approximately $3,234 million.

The degree to which the Issuer is leveraged could have important consequences to the Issuer, including, but not limited to:

| • | increasing the Issuer’s vulnerability to, and reducing its flexibility to respond to, general adverse economic and industry conditions; |

| • | requiring the dedication of a substantial portion of the Issuer’s cash flow from operations to the payment of principal of, and interest on, indebtedness, thereby reducing the availability of such cash flow to fund working capital, capital expenditures, acquisitions, joint ventures, product research and development or other general corporate purposes; |

| • | limiting the Issuer’s flexibility in planning for, or reacting to, changes in the Issuer’s business and the competitive environment and the industry in which the Issuer operates; |

| • | placing the Issuer at a competitive disadvantage as compared to its competitors, to the extent that they are not as highly leveraged; and |

| • | limiting the Issuer’s ability to borrow additional funds and increasing the cost of any such borrowing. |

The Issuer and its subsidiaries may incur significantly more indebtedness, which could further increase the risks associated with their indebtedness and affect their credit ratings.

The Issuer and its subsidiaries may be able to incur significant additional indebtedness in the future. The indenture does not contain significant restrictions on the ability of the Issuer and its subsidiaries to incur additional indebtedness, and subject to compliance with applicable financial covenants in the Permanent Credit Facilities, the Issuer and its subsidiaries will be permitted to incur additional indebtedness and such additional indebtedness could be substantial. If new indebtedness is added to the debt levels of the Issuer and its subsidiaries, the related risks would be increased, and the Issuer and its subsidiaries may not be able to meet all of their debt obligations, including repayment of the exchange notes, in whole or in part.

The incurrence of additional indebtedness could also affect the Issuer’s credit ratings. Credit ratings are continually revised. Any downgrade in the Issuer’s credit rating could adversely affect the trading price of the exchange notes or the trading markets for the exchange notes to the extent trading markets for the exchange notes develop.

Claims of holders will be structurally subordinated to claims of creditors of subsidiaries of the Issuer that do not guarantee the exchange notes and the exchange notes will not have the benefit of any guarantees following the occurrence of the Guarantor Release Date.

The exchange notes will rank equally in right of payment with the Issuer’s and the Guarantors’ existing and future senior indebtedness and will rank senior to all of the Issuer’s and the Guarantors’ existing and future

9

Table of Contents

subordinated indebtedness, if any. The exchange notes will not be guaranteed by certain of the Issuer’s subsidiaries. In addition, any guarantee of the exchange notes by a Guarantor shall provide by its terms that it shall be automatically, permanently and unconditionally released and discharged, among other reasons, upon the release or discharge of the guarantee by such Guarantor of indebtedness under the Permanent Credit Facilities. The terms of the credit agreements governing the Permanent Credit Facilities, as in effect on the issue date of the exchange notes, will provide that each Guarantor will be permanently and unconditionally released and discharged from its guarantee of the Permanent Credit Facilities on the initial date (such date, the “Guarantor Release Date”) on or after the second anniversary of the Acquisition Closing Date (as defined therein) on which no default shall have occurred or be continuing and the issued ratings for the senior unsecured long-term debt of the Issuer that is not guaranteed or subject to other credit enhancement are either (x) BBB or better from Standard & Poor’s and Baa3 or better from Moody’s or (y) BBB- or better from Standard & Poor’s and Baa2 or better from Moody’s. Accordingly, we expect that the Guarantors would be permanently released and discharged from their guarantee of the exchange notes following the occurrence of the Guarantor Release Date. See “Description of the Exchange Notes—Guarantees.”

Accordingly, claims of holders of the exchange notes will be structurally subordinated to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. All obligations of these subsidiaries will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise, to the Issuer or its creditors, including the holders of the exchange notes.

As of June 28, 2014, the Issuer and the guarantors that will guarantee the exchange notes had outstanding indebtedness of approximately $3,227 million (excluding trade payables).

Payment on the exchange notes, including under the guarantees, will be effectively subordinated to claims of secured creditors.

The exchange notes will be the Issuer’s unsecured general obligations. Accordingly, any of the Issuer’s secured creditors will have claims that are superior to the claims of holders of the exchange notes to the extent of the value of the assets securing that other indebtedness. Similarly, the guarantees will effectively rank junior to any secured debt of the Guarantors to the extent of the value of the assets securing the debt. In the event of any distribution or payment of the Issuer’s or the Guarantors’ assets in any foreclosure, dissolution, winding-up, liquidation, examination, reorganization or other bankruptcy proceeding, the Issuer’s creditors, or the secured creditors of the Guarantors, respectively, will have a superior claim to their collateral. If any of the foregoing events occur, we cannot assure you that there will be sufficient assets to pay amounts due on the exchange notes. Holders of the exchange notes will participate ratably with all holders of the Issuer’s unsecured senior indebtedness, and with all of the Issuer’s other general senior creditors, based upon the respective amounts owed to each holder or creditor, in the Issuer’s remaining assets. As a result, holders of exchange notes may receive less, ratably, than the Issuer’s secured creditors. As of June 28, 2014, we had no secured indebtedness outstanding.

The limited covenants in the indenture for the exchange notes and the terms of the exchange notes do not provide protection against some types of important corporate events and may not protect your investment.

The indenture for the exchange notes will not:

| • | require the Issuer to maintain any financial ratios or specific levels of net worth, revenues, income, cash flow or liquidity and, accordingly, and will not protect holders of the exchange notes in the event that the Issuer experiences significant adverse changes in its financial condition or results of operations; |

| • | limit the ability of the Issuer’s subsidiaries’ (including subsidiaries that will not be Guarantors of the exchange notes) to issue securities or otherwise incur indebtedness, which could (in the case of non-guarantor subsidiaries) rank structurally senior to the exchange notes; |

10

Table of Contents

| • | limit the Issuer’s ability to incur indebtedness that is equal in right of payment to the exchange notes; |

| • | restrict the Issuer’s ability to repurchase or prepay its securities; or |

| • | restrict the Issuer’s ability to make investments or to repurchase or pay dividends or make other payments in respect of its common stock or other securities ranking junior to the exchange notes. |

Furthermore, the indenture governing the exchange notes contains only limited protections in the event of a change in control. We could engage in many types of transactions, such as certain acquisitions, refinancings or recapitalizations that could substantially affect the Issuer’s capital structure and the value of the exchange notes.

The Issuer has financial and operating restrictions in its debt instruments that may have an adverse effect on its operations.

The Permanent Credit Facilities contain covenants that limit the Issuer’s ability to incur additional indebtedness, to create liens or other encumbrances, to make certain payments and investments, including dividend payments, and to sell or otherwise dispose of assets and merge or consolidate with other entities. The Issuer’s Permanent Credit Facilities also require it to meet certain financial ratios. Agreements the Issuer enters into in the future governing indebtedness could also contain significant financial and operating restrictions. A failure to comply with the obligations contained in the Issuer’s current or future credit facilities or indentures could result in an event of default or an acceleration of debt under other instruments that may contain cross-acceleration or cross-default provisions. The Issuer cannot be certain that it would have, or be able to obtain, sufficient funds to make these accelerated payments.

The Issuer may not have the ability to raise the funds necessary to finance the offer to repurchase the exchange notes upon a change of control triggering event.

Upon the occurrence of a change of control triggering event, the Issuer will be required to offer to repurchase all outstanding exchange notes at the purchase price described in this prospectus. See “Description of the Exchange Notes-Offer to Purchase Upon Change of Control Triggering Event.” The Issuer cannot assure you that the Issuer will have sufficient funds available to make any required repurchases of the exchange notes upon a change of control triggering event. In addition, the change of control that triggers the change of control triggering event may also result in a default under the Issuer’s Permanent Credit Facilities. Any failure to purchase tendered exchange notes would constitute a default under the indenture for the exchange notes. A default could result in the declaration of the principal and interest on all the exchange notes to be due and payable.

You may not be able to determine when a change of control triggering event has occurred.

The definition of change of control, which is a condition precedent to a change of control triggering event, includes a phrase relating to the sale, transfer, or conveyance of “all or substantially all” of the Issuer’s assets and the assets of its subsidiaries taken as a whole. There is no precisely established definition of the phrase “substantially all” under applicable law. Accordingly, your ability to require the Issuer to repurchase your exchange notes as a result of a sale, transfer, or conveyance of less than all of its assets to another individual, group or entity may be uncertain.

As an Irish incorporated company, the Issuer (and each Irish incorporated company which becomes a guarantor) is subject to Irish insolvency law under which certain categories of preferential debts could be paid in priority to the claims of holders of the exchange notes upon liquidation.

As an Irish incorporated company, the Issuer (and each Irish incorporated company which becomes a guarantor) may be wound up under Irish law. On a liquidation of an Irish company, the claims of those holding certain categories of preferential debts will take priority over the claims of both secured and unsecured creditors; the claims of secured creditors will rank in priority after the claims of those categories of preferential creditors

11

Table of Contents

but before the claims of unsecured creditors. Such preferential debts would comprise, among other things, any amounts owed in respect of local rates and certain amounts owed to the Irish Revenue Commissioners for income/corporation/capital gains tax, value added tax, employee taxes, social security and pension scheme contributions and remuneration, salary and wages of employees and certain contractors and the expenses of liquidation and examinership (if any).

The holders of the exchange notes are unsecured creditors of the Issuer (or an Irish guarantor) and rank in priority after the claims of preferential creditors and secured creditors and on a pari passu basis with other unsecured creditors of the Issuer (or an Irish guarantor). As a consequence, the holders’ return on their exchange notes may be delayed or reduced and they may suffer a loss (including a total loss) on their investment in the event of a default or insolvency of the Issuer (or an Irish guarantor).

Section 286 of the Irish Companies Act, 1963 (as amended)

Under Irish company law, a liquidator of the Issuer (or an Irish guarantor) could apply to court to have set aside certain transactions entered into by the Issuer (or that Irish guarantor) before the commencement of liquidation. Section 286 of the Irish Companies Act, 1963(as amended) provides that any conveyance, mortgage, delivery of goods, payment, execution or other act relating to property made or done by or against a company which is unable to pay its debts as they become due, to any creditor, within six months of the commencement of a winding up of the company, with a view to giving such creditor (or any surety or guarantor of the debt due to such creditor) a preference over its other creditors shall, if the company is at the time of the commencement of the winding-up unable to pay its debts (taking into account the contingent and prospective liabilities), be deemed a fraudulent preference of its creditors and be invalid accordingly. Where the conveyance, mortgage, delivery of goods, payment, execution or other action is in favour of a connected person the six month period is extended to two years. In addition, any such act in favour of a connected person is deemed to be a fraudulent preference and invalid accordingly, unless the contrary is shown.

Section 139 of the Irish Companies Act, 1990

Under section 139 of the Irish Companies Act, 1990, if it can be shown on the application of a liquidator, creditor or contributory of a company which is being wound up to the satisfaction of the Irish High Court that any property of such company was disposed of and the effect of such a disposal was to “perpetrate a fraud” on the company, its creditors or members, the Irish High Court may, if it deems it just and equitable, order any person who appears to have “use, control or possession” of such property or the proceeds of the sale or development thereof to deliver it or pay a sum in respect of it to the liquidator on such terms as the Irish High Court sees fit. In deciding whether it is just and equitable to make an order under section 139, the Irish High Court must have regard to the rights of persons who have bona fide and for value acquired an interest in the property the subject of the application.

Examinership

Examinership is a court procedure available under the Irish Companies (Amendment) Act, 1990, as amended, to facilitate the survival of Irish companies in financial difficulties. An Irish company which is in financial difficulties, its directors, its shareholders holding, at the date of presentation of the petition, not less than one-tenth of its voting share capital, or a contingent, prospective or actual creditor, are each entitled to petition the Irish High Court for the appointment of an examiner. During the period of examinership, the relevant company is under court protection and rights of creditors are suspended so that no enforcement action or other legal proceedings can be commenced against such company without the approval of the examiner or the relevant Irish court, as the case may be. In particular, the rights of secured creditors are largely suspended and, accordingly, if an examiner is appointed to the Issuer prior to consummation of the Transactions/Special Mandatory Redemption, the holders of the exchange notes would be precluded from enforcing the Noteholders’ security interest.

12

Table of Contents

Furthermore, the subject company cannot make any payment by way of satisfaction or discharge of the whole or a part of any liability incurred by it before presentation of a petition except in certain strictly defined circumstances. The examiner, once appointed, has the power, in certain circumstances, to avoid a negative pledge given by the company prior to this appointment and to sell assets the subject of a fixed charge. During the period of protection, the examiner will compile proposals for a compromise or scheme of arrangement to assist in the survival of the company or the whole or any part of its undertaking as a going concern. A scheme of arrangement may be approved by the Irish High Court if at least one class of creditors, whose interests are impaired under the proposals, has voted in favour of the proposals and the Irish High Court is satisfied that such proposals are fair and equitable in relation to any class of members or creditors who have not accepted the proposals and whose interests would be impaired by the implementation of the scheme of arrangement and the proposals are not unfairly prejudicial to any interested party.

If, for any reason, an examiner was appointed to the Issuer (or any Irish guarantor) while any amounts due by the Issuer under the exchange notes were unpaid, it is likely that secured and unsecured creditors would form separate classes of creditors. The primary risks to the holders of the exchange notes if an examiner was to be appointed to the Issuer (or any Irish guarantor) are as follows:

(i) the Trustee, on behalf of the holders of the exchange notes, would not be able to take proceeding to enforce rights under the Issuer (or against an Irish guarantor) during the period of examinership;

(ii) a scheme of arrangement may be approved involving the writing down of the debt due by the Issuer (or any Irish guarantor) to the holders of the exchange notes irrespective of their views, whether such debt was secured by the Noteholders’ Security or not;

(iii) an examiner may seek to set aside any negative pledge given by the Issuer (or any Irish guarantor) prohibiting the creation of security or the incurring of borrowings by the Issuer (or such Irish guarantor) to enable the examiner to borrow to fund the Issuer (or such Irish guarantor) during the protection period; and

(iv) in the event that a scheme of arrangement is not approved and the Issuer (or such Irish guarantor) subsequently goes into liquidation, the examiner’s remuneration and expenses (including certain borrowings incurred by the examiner on behalf of the Issuer (or such Irish guarantor) and approved by the Irish High Court) and the claims of certain other creditors referred to above (including the Irish Revenue Commissioners for certain unpaid taxes) will take priority over the amounts due by the Issuer (or such Irish guarantor) to the holders of the exchange notes.

Furthermore, the Irish High Court may order that an examiner shall have any of the powers of a liquidator appointed by the Irish High Court would have, which could include the power to apply to have transactions set aside under section 286 of the Irish Companies Act, 1963 (as amended) or section 139 of the Irish Companies Act, 1990.

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require note holders to return payments received from Guarantors.

The Guarantors’ creditors could challenge the issuance of the guarantees as fraudulent conveyances or on other grounds. Under U.S. federal bankruptcy law and comparable provisions of state fraudulent transfer laws, insolvency, fraudulent transfer or similar laws, the delivery of the guarantees could be found to be a fraudulent transfer and declared void. In the case of U.S. federal bankruptcy laws, if a court determined that the applicable Guarantor, at the time it incurred the indebtedness evidenced by its guarantee, as applicable, (1) delivered the guarantee with the intent to hinder, delay or defraud its existing or future creditors; or (2) received less than reasonably equivalent value or did not receive fair consideration for the delivery of the guarantee, and any of the following three conditions apply:

| • | such Guarantor was insolvent or rendered insolvent by reason of issuing or delivering the guarantee; |

13

Table of Contents

| • | such Guarantor was engaged in a business or transaction for which the Guarantor’s remaining assets constituted unreasonably small capital; or |

| • | such Guarantor intended to incur, or believed that it would incur, debts beyond its ability to pay such debts at maturity. |

In addition, any payment by such Guarantor pursuant to its guarantee could be voided and required to be returned to the Guarantor, or to a fund for the benefit of the creditors of the Guarantor. In any such case, the right of noteholders to receive payments in respect of the exchange notes from any such Guarantor would be effectively subordinated to all indebtedness and other liabilities of that Guarantor.

The indenture governing the exchange notes will limit the liability of each Guarantor on its guarantee to the maximum amount that such Guarantor can incur without risk that its guarantee will be subject to avoidance as a fraudulent transfer or conveyance. The Issuer cannot assure you that this limitation will protect such guarantees from fraudulent transfer challenges or, if it does, that the remaining amount due and collectible under the guarantees would suffice, if necessary, to pay the exchange notes in full when due.

If a court declares the guarantees to be void, or if the guarantees must be limited or voided in accordance with their terms, any claim a noteholder may make against the applicable Guarantors for amounts payable on the exchange notes would be subordinated to the indebtedness of such Guarantors, including trade payables. The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a Guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

The credit ratings assigned to the exchange notes may not reflect all risks of an investment in the exchange notes.

The credit ratings assigned to the exchange notes reflect the rating agencies’ assessments of the Issuer’s ability to make payments on the exchange notes when due. Consequently, actual or anticipated changes in these credit ratings will generally affect the market value of the exchange notes. These credit ratings, however, may not reflect the potential impact of risks related to structure, market or other factors related to the value of the exchange notes.

If an active trading market does not develop for the exchange notes, you may be unable to sell the new notes or to sell them at a price you deem sufficient.

The exchange notes will be securities for which there is no established trading market. While the Issuer intends to apply to the Irish Stock Exchange for the exchange notes to be admitted to the Official List and to trading on its Global Exchange Market, there can be no assurance that the exchange notes will be admitted to listing or trading or, if listed, a market for the exchange notes will develop on such exchange. The Issuer gives no assurance as to:

| • | the liquidity of any trading market that may develop; |

| • | the ability of holders to sell their exchange notes; or |

| • | the price at which holders would be able to sell their exchange notes. |

14

Table of Contents

Even if a trading market develops, the exchange notes may trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including:

| • | prevailing interest rates; |

| • | the number of holders of the exchange notes; |

| • | the interest of securities dealers in making a market for the exchange notes; |

| • | the market for similar debt securities; and |

| • | the Company’s financial performance. |

15

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratio of earnings to fixed charges for the periods indicated. For purposes of computing the ratio of earnings to fixed charges, earnings consist of income (loss) before income taxes plus fixed charges. Fixed charges consist of interest expense and the portion of rent expense that management believes is representative of the interest component of rental expense.

| Predecessor | Successor | |||||||||||||||||||||

| Year Ended | Year Ended | |||||||||||||||||||||

| 6/26/10 | 6/25/11 | 6/30/12 | 6/29/13 | 6/28/14 | ||||||||||||||||||

| Ratio of Earnings to Fixed Charges |

9.7x | 9.8x | 8.1x | 8.7x | 3.3x | |||||||||||||||||

16

Table of Contents

In this subsection, “we”, “us”, and “our” refer only to Perrigo Company plc, a public limited company incorporated under the laws of Ireland, as issuer of the notes, exclusive of its subsidiaries.

Terms of the Exchange Offer

We are offering to exchange our exchange notes for a like aggregate principal amount of our initial notes.

The exchange notes that we propose to issue in this exchange offer will be substantially identical to our initial notes except that, unlike our initial notes, the exchange notes will have no transfer restrictions or registration rights. You should read the description of the exchange notes in the section in this prospectus entitled “Description of Exchange Notes.”

We reserve the right in our sole discretion to purchase or make offers for any initial notes that remain outstanding following the expiration or termination of this exchange offer and, to the extent permitted by applicable law, to purchase initial notes in the open market or privately negotiated transactions, one or more additional tender or exchange offers or otherwise. The terms and prices of these purchases or offers could differ significantly from the terms of this exchange offer.

Expiration Date; Extensions; Amendments; Termination

This exchange offer will expire at 5:00 p.m., New York City time, on , 2014, unless we extend it in our reasonable discretion. The expiration date of this exchange offer will be at least 20 business days after the commencement of the exchange offer in accordance with Rule 14e-1(a) under the Exchange Act.

We expressly reserve the right to extend or terminate this exchange offer and not accept any initial notes that we have not previously accepted if any of the conditions described below under “—Conditions to the Exchange Offer” have not been satisfied or waived by us. Consequently, in the event we extend the period the exchange offer is open, we may delay acceptance of any initial notes. We will notify the exchange agent of any extension or delay by oral notice promptly confirmed in writing or by written notice. We will also notify the holders of the initial notes by a press release or other public announcement communicated before 9:00 a.m., New York City time, on the next business day after the previously scheduled expiration date unless applicable laws require us to do otherwise.

We also expressly reserve the right to amend the terms of this exchange offer in any manner. If we make any material change, we will promptly disclose this change in a manner reasonably calculated to inform the holders of our initial notes of the change including providing public announcement or giving oral or written notice to these holders. A material change in the terms of this exchange offer could include a change in the timing of the exchange offer, a change in the exchange agent and other similar changes in the terms of this exchange offer. If we make any material change to this exchange offer, we will disclose this change by means of a post-effective amendment to the registration statement which includes this prospectus and will distribute an amended or supplemented prospectus to each registered holder of initial notes. In addition, we will extend this exchange offer for an additional five to ten business days as required by the Exchange Act, depending on the significance of the amendment, if the exchange offer would otherwise expire during that period. We will promptly notify the exchange agent by oral notice, promptly confirmed in writing, or written notice of any delay in acceptance, extension, termination or amendment of this exchange offer.

17

Table of Contents

Procedures for Tendering Initial Notes

Proper Execution and Delivery of Letters of Transmittal

To tender your initial notes in this exchange offer, you must use one of the three alternative procedures described below:

(1) Regular delivery procedure: Complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal. Have the signatures on the letter of transmittal guaranteed if required by the letter of transmittal. Mail or otherwise deliver the letter of transmittal or the facsimile together with the certificates representing the initial notes being tendered and any other required documents to the exchange agent on or before 5:00 p.m., New York City time, on the expiration date.

(2) Book-entry delivery procedure: Send a timely confirmation of a book-entry transfer of your initial notes, if this procedure is available, into the exchange agent’s account at The Depository Trust Company in accordance with the procedures for book-entry transfer described under “—Book-Entry Delivery Procedure” below, on or before 5:00 p.m., New York City time, on the expiration date.

(3) Guaranteed delivery procedure: If time will not permit you to complete your tender by using the procedures described in (1) or (2) above before the expiration date and this procedure is available, comply with the guaranteed delivery procedures described under “—Guaranteed Delivery Procedure” below.

The method of delivery of the initial notes, the letter of transmittal and all other required documents is at your election and risk. Instead of delivery by mail, we recommend that you use an overnight or hand-delivery service. If you choose the mail, we recommend that you use registered mail, properly insured, with return receipt requested. In all cases, you should allow sufficient time to assure timely delivery. You should not send any letters of transmittal or initial notes to us. You must deliver all documents to the exchange agent at its address provided below. You may also request your broker, dealer, commercial bank, trust company or nominee to tender your initial notes on your behalf.

Only a holder of initial notes may tender initial notes in this exchange offer. A holder is any person in whose name initial notes are registered on our books or any other person who has obtained a properly completed bond power from the registered holder.

If you are the beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your notes, you must contact that registered holder promptly and instruct that registered holder to tender your notes on your behalf. If you wish to tender your initial notes on your own behalf, you must, before completing and executing the letter of transmittal and delivering your initial notes, either make appropriate arrangements to register the ownership of these notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time.

You must have any signatures on a letter of transmittal or a notice of withdrawal guaranteed by:

(1) a member firm of a registered national securities exchange or of the National Association of Securities Dealers, Inc.;

(2) a commercial bank or trust company having an office or correspondent in the United States; or

(3) an eligible guarantor institution within the meaning of Rule 17Ad-15 under the Exchange Act, unless the initial notes are tendered:

(a) by a registered holder or by a participant in The Depository Trust Company whose name appears on a security position listing as the owner, who has not completed the box entitled “Special Issuance Instructions” or “Special Delivery Instructions” on the letter of transmittal and only if the exchange notes are being issued directly to this registered holder or deposited into this participant’s account at The Depository Trust Company; or

18

Table of Contents

(b) for the account of a member firm of a registered national securities exchange or of the Financial Industry Regulatory Authority, Inc., a commercial bank or trust company having an office or correspondent in the United States or an eligible guarantor institution within the meaning of Rule 17Ad-15 under the Exchange Act.

If the letter of transmittal or any bond powers are signed by:

(1) the recordholder(s) of the initial notes tendered: the signature must correspond with the name(s) written on the face of the initial notes without alteration, enlargement or any change whatsoever.

(2) a participant in The Depository Trust Company: the signature must correspond with the name as it appears on the security position listing as the holder of the initial notes.

(3) a person other than the registered holder of any initial notes: these initial notes must be endorsed or accompanied by bond powers and a proxy that authorize this person to tender the initial notes on behalf of the registered holder, in satisfactory form to us as determined in our sole discretion, in each case, as the name of the registered holder or holders appears on the initial notes.

(4) trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity: these persons should so indicate when signing. Unless waived by us, evidence satisfactory to us of their authority to so act must also be submitted with the letter of transmittal.

To tender your initial notes in this exchange offer, you must make the following representations:

(1) you are authorized to tender, sell, assign and transfer the initial notes tendered and to acquire exchange notes issuable upon the exchange of such tendered initial notes, and that we will acquire good and unencumbered title thereto, free and clear of all liens, restrictions, charges and encumbrances and not subject to any adverse claim when the same are accepted by us;

(2) any exchange notes acquired by you pursuant to the exchange offer are being acquired in the ordinary course of business, whether or not you are the holder;

(3) you or any other person who receives exchange notes, whether or not such person is the holder of the exchange notes, has no arrangement or understanding with any person to participate in a distribution of such exchange notes within the meaning of the Securities Act and is not participating in, and does not intend to participate in, the distribution of such exchange notes within the meaning of the Securities Act;

(4) you or such other person who receives exchange notes, whether or not such person is the holder of the exchange notes, is not an “affiliate,” as defined in Rule 405 of the Securities Act, of ours, or if you or such other person is an affiliate, you or such other person will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable;

(5) if you are not a broker-dealer, you represent that you are not engaging in, and do not intend to engage in, a distribution of exchange notes; and

(6) if you are a broker-dealer that will receive exchange notes for your own account in exchange for initial notes, you represent that the initial notes to be exchanged for the exchange notes were acquired by you as a result of market-making or other trading activities and acknowledge that you will deliver a prospectus in connection with any resale, offer to resell or other transfer of such exchange notes.

You must also warrant that the acceptance of any tendered initial notes by the issuers and the issuance of exchange notes in exchange therefor shall constitute performance in full by the issuers of its obligations under the registration rights agreement relating to the initial notes.

To effectively tender notes through The Depository Trust Company, the financial institution that is a participant in The Depository Trust Company will electronically transmit its acceptance through the Automatic

19

Table of Contents

Tender Offer Program. The Depository Trust Company will then edit and verify the acceptance and send an agent’s message to the exchange agent for its acceptance. An agent’s message is a message transmitted by The Depository Trust Company to the exchange agent stating that The Depository Trust Company has received an express acknowledgment from the participant in The Depository Trust Company tendering the notes that this participant has received and agrees to be bound by the terms of the letter of transmittal, and that we may enforce this agreement against this participant.

Book-Entry Delivery Procedure