EXHIBIT 10.1

Freddie Mac Loan Number: 708893457

Property Name: Reveal on Cumberland

MULTIFAMILY LOAN AND SECURITY AGREEMENT

(Revised 10-11-2017)

Borrower: | STAR CUMBERLAND, LLC, a Delaware limited liability company |

Lender: | PNC BANK, NATIONAL ASSOCIATION, a national banking association |

Date: | As of November 29, 2017 |

Loan Amount: | $21,810,000.00 |

Reserve Fund Information | ||||||

(See Article IV) | ||||||

Imposition Reserves (fill in “Collect” or “Deferred” as appropriate for each item) | ||||||

Deferred | Insurance | |||||

Collect | Taxes | |||||

Deferred | water/sewer | |||||

N/A | Ground Rents | |||||

Deferred | assessments/other charges | |||||

Repairs & Repair Reserve | Repairs required? | Yes | X | No | ||

If No, is radon testing required? | Yes | X | No | |||

If Yes, is a Reserve required? | Yes | No | ||||

Green Improvement required? | Yes | X | No | |||

If Yes, is a Reserve required? | Yes | No | ||||

If Yes to Repairs and/or Green Improvements, is a Letter of Credit required? | ||||||

______Yes | ______No | |||||

Multifamily Loan and Security Agreement | Page i | |

Replacement Reserve | X | Yes | If Yes: | X | Funded | Deferred | ||||||

No | ||||||||||||

Rental Achievement Reserve | Yes | If Yes: | Cash | Letter of Credit | ||||||||

X | No | |||||||||||

Rate Cap Agreement Reserve | X | Yes | No | |||||||||

Other Reserve(s) | Yes | X | No | |||||||||

If Yes, specify: | ||||||||||||

Lease Up Transaction | Yes | X | No | |||||||||

If Yes, is a Reserve required? | ______ | Yes | ______No | |||||||||

If Yes, is a Letter of Credit required? | ______ | Yes | ______No | |||||||||

Attached Riders

(See Article XIII)

Name of Rider | Date Revised |

Rider to Multifamily Loan and Security Agreement – Replacement Reserve Fund – Immediate Deposits | 7-1-2014 |

Rider to Multifamily Loan and Security Agreement – Cooperation with Rating Agencies | 1-27-2015 |

Rider to Multifamily Loan and Security Agreement – Additional Provisions – Sale or Securitization of Loan | 5-5-2017 |

Rider to Multifamily Loan and Security Agreement – Rate Cap Agreement and Rate Cap Agreement Reserve Fund | 5-5-2017 |

Rider to Multifamily Loan and Security Agreement – Recycled Borrower | 7-12-2016 |

Rider to Multifamily Loan and Security Agreement – Trade Names | 3-1-2014 |

Rider to Multifamily Loan and Security Agreement – Month to Month Leases | 5-1-2015 |

Rider to Multifamily Loan and Security Agreement – Corporate Lease | 5-1-2015 |

Rider to Multifamily Loan and Security Agreement – Termite or Wood Damaging Insect Control | 3-1-2014 |

Multifamily Loan and Security Agreement | Page ii | |

Exhibit B Modifications | |||||||

(See Article XIV) | |||||||

Are any Exhibit B modifications attached? | X | Yes | No | ||||

Multifamily Loan and Security Agreement | Page iii | |

TABLE OF CONTENTS

ARTICLE I | DEFINED TERMS; CONSTRUCTION | |||

1.01 | Defined Terms |

1.02 | Construction |

ARTICLE II | LOAN | |||

2.01 | Loan Terms |

2.02 | Prepayment Premium |

2.03 | Exculpation |

2.04 | Application of Payments |

2.05 | Usury Savings |

2.06 | Floating Rate Mortgage - Third Party Cap Agreement |

ARTICLE III | LOAN SECURITY AND GUARANTY | |||

3.01 | Security Instrument |

3.02 | Reserve Funds |

3.03 | Uniform Commercial Code Security Agreement |

3.04 | Cap Agreement and Cap Collateral Assignment |

3.05 | Guaranty |

3.06 | Reserved |

3.07 | Reserved |

3.08 | Reserved |

3.09 | Reserved |

ARTICLE IV | RESERVE FUNDS AND REQUIREMENTS | |||

4.01 | Reserves Generally |

4.02 | Reserves for Taxes, Insurance and Other Charges |

4.03 | Repairs; Repair Reserve Fund |

4.04 | Replacement Reserve Fund |

4.05 | Rental Achievement Provisions |

4.06 | Debt Service Reserve |

4.07 | Rate Cap Agreement Reserve Fund |

4.08 | through 4.20 are Reserved |

ARTICLE V | REPRESENTATIONS AND WARRANTIES | |||

5.01 | Review of Documents |

5.02 | Condition of Mortgaged Property |

5.03 | No Condemnation |

5.04 | Actions; Suits; Proceedings |

5.05 | Environmental |

5.06 | Commencement of Work; No Labor or Materialmen’s Claims |

5.07 | Compliance with Applicable Laws and Regulations |

5.08 | Access; Utilities; Tax Parcels |

5.09 | Licenses and Permits |

5.10 | No Other Interests |

5.11 | Term of Leases |

Multifamily Loan and Security Agreement | Page iv | |

5.12 | No Prior Assignment; Prepayment of Rents |

5.13 | Illegal Activity |

5.14 | Taxes Paid |

5.15 | Title Exceptions |

5.16 | No Change in Facts or Circumstances |

5.17 | Financial Statements |

5.18 | ERISA – Borrower Status |

5.19 | No Fraudulent Transfer or Preference |

5.20 | No Insolvency or Judgment |

5.21 | Working Capital |

5.22 | Cap Collateral |

5.23 | Ground Lease |

5.24 | Purpose of Loan |

5.25 | Through 5.39 are Reserved |

5.40 Recycled SPE Borrower

5.41 Recycled SPE Equity Owner

5.42 | through 5.50 are Reserved |

5.51 | Survival |

5.52 through 5.57 are Reserved

5.58 Prohibited Parties Lists; Economic Sanctions Laws

5.59 through 5.62 are Reserved

ARTICLE VI | BORROWER COVENANTS | |||

6.01 | Compliance with Laws |

6.02 | Compliance with Organizational Documents |

6.03 | Use of Mortgaged Property |

6.04 | Non-Residential Leases |

6.05 | Prepayment of Rents |

6.06 | Inspection |

6.07 | Books and Records; Financial Reporting |

6.08 | Taxes; Operating Expenses; Ground Rents |

6.09 | Preservation, Management and Maintenance of Mortgaged Property |

6.10 | Insurance |

6.11 | Condemnation |

6.12 | Environmental Hazards |

6.13 | Single Purpose Entity Requirements |

6.14 | Repairs and Capital Replacements |

6.15 | Residential Leases Affecting the Mortgaged Property |

6.16 | Litigation; Government Proceedings |

6.17 | Further Assurances and Estoppel Certificates; Lender’s Expenses |

6.18 | Cap Collateral |

6.19 | Ground Lease |

6.20 | ERISA Requirements |

6.21 | through 6.52 are Reserved |

6.53 Economic Sanctions Laws

6.54 through 6.59 are Reserved

ARTICLE VII | TRANSFERS OF THE MORTGAGED PROPERTY OR INTERESTS | |||

IN BORROWER | ||||

Multifamily Loan and Security Agreement | Page v | |

7.01 | Permitted Transfers |

7.02 | Prohibited Transfers |

7.03 | Conditionally Permitted Transfers |

7.04 | Preapproved Intrafamily Transfers |

7.05 | Lender’s Consent to Prohibited Transfers |

7.06 | SPE Equity Owner Requirement Following Transfer |

7.07 | Additional Transfer Requirements - External Cap Agreement |

7.08 | Reserved |

7.09 | Reserved |

ARTICLE VIII | SUBROGATION | |||

ARTICLE IX | EVENTS OF DEFAULT AND REMEDIES | |||

9.01 | Events of Default |

9.02 | Protection of Lender’s Security; Security Instrument Secures Future Advances |

9.03 | Remedies |

9.04 | Forbearance |

9.05 | Waiver of Marshalling |

ARTICLE X | RELEASE; INDEMNITY | |||

10.01 | Release |

10.02 | Indemnity |

10.03 | Reserved |

ARTICLE XI | MISCELLANEOUS PROVISIONS | |||

11.01 | Waiver of Statute of Limitations, Offsets and Counterclaims |

11.02 | Governing Law; Consent to Jurisdiction and Venue |

11.03 | Notice |

11.04 | Successors and Assigns Bound |

11.05 | Joint and Several (and Solidary) Liability |

11.06 | Relationship of Parties; No Third Party Beneficiary |

11.07 | Severability; Amendments |

11.08 | Disclosure of Information |

11.09 | Determinations by Lender |

11.10 | Sale of Note; Change in Servicer; Loan Servicing |

11.11 | Supplemental Financing |

11.12 | Defeasance |

11.13 | Lender’s Rights to Sell or Securitize |

11.14 | Cooperation with Rating Agencies and Investors |

11.15 | Letter of Credit Requirements |

11.16 | through 11.18 are Reserved |

11.19 | State Specific Provisions |

11.20 | Time is of the Essence |

ARTICLE XII | DEFINITIONS | |||

ARTICLE XIII | INCORPORATION OF ATTACHED RIDERS | |||

Multifamily Loan and Security Agreement | Page vi | |

ARTICLE XIV | INCORPORATION OF ATTACHED EXHIBITS | |||

ARTICLE XV | RESERVED | |||

Multifamily Loan and Security Agreement | Page vii | |

MULTIFAMILY LOAN AND SECURITY AGREEMENT

THIS MULTIFAMILY LOAN AND SECURITY AGREEMENT (“Loan Agreement”) is dated as of the 29th day of November, 2017 and is made by and between STAR CUMBERLAND, LLC, a Delaware limited liability company (“Borrower”), and PNC BANK, NATIONAL ASSOCIATION, a national banking association (together with its successors and assigns, “Lender”).

RECITAL

Lender has agreed to make and Borrower has agreed to accept a loan in the original principal amount of $21,810,000.00 (“Loan”). Lender is willing to make the Loan to Borrower upon the terms and subject to the conditions set forth in this Loan Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of these promises, the mutual covenants contained in this Loan Agreement and other good and valuable consideration, the receipt and sufficiency of which are acknowledged, the parties agree as follows:

ARTICLE I DEFINED TERMS; CONSTRUCTION.

1.01 | Defined Terms. Each defined term in this Loan Agreement will have the meaning ascribed to that term in Article XII unless otherwise defined in this Loan Agreement. |

1.02 | Construction. |

(a) | The captions and headings of the Articles and Sections of this Loan Agreement are for convenience only and will be disregarded in construing this Loan Agreement. |

(b) | Any reference in this Loan Agreement to an “Exhibit,” an “Article” or a “Section” will, unless otherwise explicitly provided, be construed as referring, respectively, to an Exhibit attached to this Loan Agreement or to an Article or Section of this Loan Agreement. |

(c) | All Exhibits and Riders attached to or referred to in this Loan Agreement are incorporated by reference in this Loan Agreement. |

(d) | Any reference in this Loan Agreement to a statute or regulation will be construed as referring to that statute or regulation as amended from time to time. |

(e) | Use of the singular in this Loan Agreement includes the plural and use of the plural includes the singular. |

(f) | As used in this Loan Agreement, the term “including” means “including, but not limited to” and the term “includes” means “includes without limitation.” |

(g) | The use of one gender includes the other gender, as the context may require. |

(h) | Unless the context requires otherwise, (i) any definition of or reference to any agreement, instrument or other document in this Loan Agreement will be construed as referring to such agreement, instrument or other document as from time to time amended, supplemented or otherwise modified (subject to any restrictions on such |

Multifamily Loan and Security Agreement | Page 1 | |

amendments, supplements or modifications set forth in this Loan Agreement), and (ii) any reference in this Loan Agreement to any Person will be construed to include such Person’s successors and assigns.

(i) | Any reference in this Loan Agreement to “Lender’s requirements,” “as required by Lender,” or similar references will be construed, after Securitization, to mean Lender’s requirements or standards as determined in accordance with Lender’s and Loan Servicer’s obligations under the terms of the Securitization documents. |

ARTICLE II LOAN.

2.01 | Loan Terms. The Loan will be evidenced by the Note and will bear interest and be paid in accordance with the payment terms set forth in the Note. |

2.02 | Prepayment Premium. Borrower will be required to pay a prepayment premium in connection with certain prepayments of the Indebtedness, including a payment made after Lender’s exercise of any right of acceleration of the Indebtedness, as provided in the Note. |

2.03 | Exculpation. Borrower’s personal liability for payment of the Indebtedness and for performance of the other obligations to be performed by it under this Loan Agreement is limited in the manner, and to the extent, provided in the Note. |

2.04 | Application of Payments. If at any time Lender receives, from Borrower or otherwise, any amount applicable to the Indebtedness which is less than all amounts due and payable at such time, then Lender may apply that payment to amounts then due and payable in any manner and in any order determined by Lender (unless otherwise required by applicable law), in Lender’s sole and absolute discretion. Neither Lender’s acceptance of an amount that is less than all amounts then due and payable, nor Lender’s application of such payment in the manner authorized, will constitute or be deemed to constitute either a waiver of the unpaid amounts or an accord and satisfaction. Notwithstanding the application of any such amount to the Indebtedness, Borrower’s obligations under this Loan Agreement, the Note and all other Loan Documents will remain unchanged. |

2.05 | Usury Savings. If any applicable law limiting the amount of interest or other charges permitted to be collected from Borrower is interpreted so that any charge provided for in any Loan Document, whether considered separately or together with other charges levied in connection with any other Loan Document, violates that law, and Borrower is entitled to the benefit of that law, that charge is reduced to the extent necessary to eliminate that violation. The amounts, if any, previously paid to Lender in excess of the permitted amounts will be applied by Lender to reduce the principal amount of the Indebtedness. For the purpose of determining whether any applicable law limiting the amount of interest or other charges permitted to be collected from Borrower has been violated, all Indebtedness which constitutes interest, as well as all other charges levied in connection with the Indebtedness which constitute interest, will be deemed to be allocated and spread ratably over the stated term of the Note. Unless otherwise required by applicable law, such allocation and spreading will be effected in such a manner that the rate of interest so computed is uniform throughout the stated term of the Note. |

Multifamily Loan and Security Agreement | Page 2 | |

2.06 | Floating Rate Mortgage - Third Party Cap Agreement. If (a) the Note does not provide for interest to accrue at a floating or variable interest rate (other than during any Extension Period, if applicable), and (b) a third party Cap Agreement is not required, then this Section 2.06 and Section 3.04 will be of no force or effect. |

(a) | So long as there is no Event of Default, Lender or Loan Servicer will remit to Borrower each Cap Payment received by Lender or Loan Servicer with respect to any month for which Borrower has paid in full the monthly installment of principal and interest or interest only, as applicable, due under the Note. Alternatively, at Lender’s option, so long as there is no Event of Default, Lender may apply a Cap Payment received by Lender or Loan Servicer with respect to any month to the applicable monthly payment of accrued interest due under the Note if Borrower has paid in full the remaining portion of such monthly payment of principal and interest or interest only, as applicable. |

(b) | Neither the existence of a Cap Agreement nor anything in this Loan Agreement will relieve Borrower of its primary obligation to timely pay in full all amounts due under the Note and otherwise due on account of the Indebtedness. |

ARTICLE III LOAN SECURITY AND GUARANTY.

3.01 | Security Instrument. Borrower will execute the Security Instrument dated of even date with this Loan Agreement. The Security Instrument will be recorded in the applicable land records in the Property Jurisdiction. |

3.02 | Reserve Funds. |

(a) | Security Interest. To secure Borrower’s obligations under this Loan Agreement and to further secure Borrower’s obligations under the Note and the other Loan Documents, Borrower conveys, pledges, transfers and grants to Lender a security interest pursuant to the Uniform Commercial Code of the Property Jurisdiction or any other applicable law in and to all money in the Reserve Funds, as the same may increase or decrease from time to time, all interest and dividends thereon and all proceeds thereof. |

(b) | Supplemental Loan. If this Loan Agreement is entered into in connection with a Supplemental Loan and if the same Person is or becomes both Senior Lender and Supplemental Lender, then: |

(i) | Borrower assigns and grants to Supplemental Lender a security interest in the Reserve Funds established in connection with the Senior Indebtedness as additional security for all of Borrower’s obligations under the Supplemental Note. |

(ii) | In addition, Borrower assigns and grants to Senior Lender a security interest in the Reserve Funds established in connection with the Supplemental Indebtedness as additional security for all of Borrower’s obligations under the Senior Note. |

(iii) | It is the intention of Borrower that all amounts deposited by Borrower in connection with either the Senior Loan Documents, the Supplemental Loan Documents, or both, constitute collateral for the Supplemental Indebtedness secured by the Supplemental Instrument and the Senior Indebtedness secured |

Multifamily Loan and Security Agreement | Page 3 | |

by the Senior Instrument, with the application of such amounts to such Senior Indebtedness or Supplemental Indebtedness to be at the discretion of Senior Lender and Supplemental Lender.

3.03 | Uniform Commercial Code Security Agreement. This Loan Agreement is also a security agreement under the Uniform Commercial Code for any of the Mortgaged Property which, under applicable law, may be subjected to a security interest under the Uniform Commercial Code, for the purpose of securing Borrower’s obligations under this Loan Agreement and to further secure Borrower’s obligations under the Note, Security Instrument and other Loan Documents, whether such Mortgaged Property is owned now or acquired in the future, and all products and cash and non-cash proceeds thereof (collectively, “UCC Collateral”), and by this Loan Agreement, Borrower grants to Lender a security interest in the UCC Collateral. |

3.04 | Cap Agreement and Cap Collateral Assignment. Reserved. |

3.05 | Guaranty. Borrower will cause each Guarantor (if any) to execute a Guaranty of all or a portion of Borrower’s obligations under the Loan Documents effective as of the date of this Loan Agreement. |

3.06 Reserved.

3.07 Reserved.

3.08 Reserved.

3.09 Reserved.

ARTICLE IV RESERVE FUNDS AND REQUIREMENTS.

4.01 | Reserves Generally. |

(a) | Establishment of Reserve Funds; Investment of Deposits. Unless otherwise provided in Section 4.03 and/or Section 4.04, each Reserve Fund will be established on the date of this Loan Agreement and each of the following will apply: |

(i) | All Reserve Funds will be deposited in an Eligible Account at an Eligible Institution or invested in “permitted investments” as then defined and required by the Rating Agencies. |

(ii) | Lender will not be obligated to open additional accounts or deposit Reserve Funds in additional institutions when the amount of any Reserve Fund exceeds the maximum amount of the federal deposit insurance or guaranty. Borrower acknowledges and agrees that it will not have the right to direct Lender as to any specific investment of monies in any Reserve Fund. Lender will not be responsible for any losses resulting from investment of monies in any Reserve Fund or for obtaining any specific level or percentage of earnings on such investment. |

(b) | Interest on Reserve Funds; Trust Funds. Unless applicable law requires, Lender will not be required to pay Borrower any interest, earnings or profits on the Reserve Funds. Any amounts deposited with Lender under this Article IV will not be trust funds, nor will they operate to reduce the Indebtedness, unless applied by Lender for that purpose pursuant to the terms of this Loan Agreement. |

Multifamily Loan and Security Agreement | Page 4 | |

(c) | Use of Reserve Funds. Each Reserve Fund will, except as otherwise provided in this Loan Agreement, be used for the sole purpose of paying, or reimbursing Borrower for payment of, the item(s) for which the applicable Reserve Fund was established. Borrower acknowledges and agrees that, except as specified in this Loan Agreement, monies in one Reserve Fund will not be used to pay, or reimburse Borrower for, matters for which another Reserve Fund has been established. |

(d) | Termination of Reserve Funds. Upon the payment in full of the Indebtedness, Lender will pay to Borrower all funds remaining in any Reserve Funds. |

(e) | Reserved. |

4.02 | Reserves for Taxes, Insurance and Other Charges. |

(a) | Deposits to Imposition Reserve Deposits. Borrower will deposit with Lender on the day monthly installments of principal or interest, or both, are due under the Note (or on another day designated in writing by Lender), until the Indebtedness is paid in full, an additional amount sufficient to accumulate with Lender the entire sum required to pay, when due, the items marked “Collect” below. Except as provided in Section 4.02(e), Lender will not require Borrower to make Imposition Reserve Deposits with respect to the items marked “Deferred” below. |

[Deferred] | Property Insurance premiums or premiums for other Insurance required by Lender under Section 6.10 |

[Collect] | Taxes and payments in lieu of taxes |

[Deferred] | water and sewer charges that could become a Lien on the Mortgaged Property |

[N/A] | Ground Rents |

[Deferred] | assessments or other charges that could become a Lien on the Mortgaged Property, including home owner association dues |

The amounts deposited pursuant to this Section 4.02(a) are collectively referred to in this Loan Agreement as the “Imposition Reserve Deposits.” The obligations of Borrower for which the Imposition Reserve Deposits are required are collectively referred to in this Loan Agreement as “Impositions.” The amount of the Imposition Reserve Deposits must be sufficient to enable Lender to pay each Imposition before the last date upon which such payment may be made without any penalty or interest charge being added. Lender will maintain records indicating how much of the monthly Imposition Reserve Deposits and how much of the aggregate Imposition Reserve Deposits held by Lender are held for the purpose of paying Taxes, Insurance premiums, Ground Rent (if applicable) and each other Imposition.

(b) | Disbursement of Imposition Reserve Deposits. Lender will apply the Imposition Reserve Deposits to pay Impositions so long as no Event of Default has occurred and is continuing. Lender will pay all Impositions from the Imposition Reserve Deposits held by Lender upon Lender’s receipt of a bill or invoice for an Imposition. If Borrower holds a ground lessee interest in the Mortgaged Property and Imposition Reserve Deposits are collected for Ground Rent, then Lender will pay the monthly or other periodic installments of Ground Rent from the Imposition Reserve Deposits, whether or not Lender receives a bill or invoice for such installments. Lender will |

Multifamily Loan and Security Agreement | Page 5 | |

have no obligation to pay any Imposition to the extent it exceeds the amount of the Imposition Reserve Deposits then held by Lender. Lender may pay an Imposition according to any bill, statement or estimate from the appropriate public office, Ground Lessor (if applicable) or insurance company without inquiring into the accuracy of the bill, statement or estimate or into the validity of the Imposition.

(c) | Excess or Deficiency of Imposition Reserve Deposits. If at any time the amount of the Imposition Reserve Deposits held by Lender for payment of a specific Imposition exceeds the amount reasonably deemed necessary by Lender, the excess will be credited against future installments of Imposition Reserve Deposits. If at any time the amount of the Imposition Reserve Deposits held by Lender for payment of a specific Imposition is less than the amount reasonably estimated by Lender to be necessary, Borrower will pay to Lender the amount of the deficiency within 15 days after Notice from Lender. |

(d) | Delivery of Invoices. Borrower will promptly deliver to Lender a copy of all notices of, and invoices for, Impositions. |

(e) | Deferral of Collection of Any Imposition Reserve Deposits; Delivery of Receipts. If Lender does not collect an Imposition Reserve Deposit with respect to an Imposition either marked “Deferred” in Section 4.02(a) or pursuant to a separate written deferral by Lender, then on or before the earlier of the date each such Imposition is due, or the date this Loan Agreement requires each such Imposition to be paid, Borrower will provide Lender with proof of payment of each such Imposition. Upon Notice to Borrower, Lender may revoke its deferral and require Borrower to deposit with Lender any or all of the Imposition Reserve Deposits listed in Section 4.02(a), regardless of whether any such item is marked “Deferred” (i) if Borrower does not timely pay any of the Impositions, (ii) if Borrower fails to provide timely proof to Lender of such payment, (iii) at any time during the existence of an Event of Default or (iv) upon placement of a Supplemental Loan in accordance with Section 11.11. |

(f) | through (i) are Reserved. |

4.03 | Repairs; Repair Reserve Fund. Reserved. |

4.04 | Replacement Reserve Fund. Reserved. |

4.05 | Rental Achievement Provisions. Reserved. |

4.06 Debt Service Reserve. Reserved.

4.07 Rate Cap Agreement Reserve Fund. Reserved.

4.08 through 4.20 are Reserved.

ARTICLE V REPRESENTATIONS AND WARRANTIES.

Borrower represents and warrants to Lender as follows as of the date of this Loan Agreement:

5.01 | Review of Documents. Borrower has reviewed: (a) the Note, (b) the Security Instrument, (c) the Commitment Letter, and (d) all other Loan Documents. |

Multifamily Loan and Security Agreement | Page 6 | |

5.02 | Condition of Mortgaged Property. Except as Borrower may have disclosed to Lender in writing in connection with the issuance of the Commitment Letter, the Mortgaged Property has not been damaged by fire, water, wind or other cause of loss, or any previous damage to the Mortgaged Property has been fully restored. |

5.03 | No Condemnation. No part of the Mortgaged Property has been taken in Condemnation or other like proceeding, and, to the best of Borrower’s knowledge after due inquiry and investigation, no such proceeding is pending or threatened for the partial or total Condemnation or other taking of the Mortgaged Property. |

5.04 | Actions; Suits; Proceedings. |

(a) | There are no judicial, administrative, mediation or arbitration actions, suits or proceedings pending or, to the best of Borrower’s knowledge, threatened in writing against or affecting Borrower (and, if Borrower is a limited partnership, any of its general partners or if Borrower is a limited liability company, any member of Borrower) or the Mortgaged Property which, if adversely determined, would have a Material Adverse Effect. |

(b) Reserved.

5.05 | Environmental. Except as previously disclosed by Borrower to Lender in writing (which written disclosure may be in certain environmental assessments and other written reports accepted by Lender in connection with the funding of the Indebtedness and dated prior to the date of this Loan Agreement), each of the following is true: |

(a) | Borrower has not at any time engaged in, caused or permitted any Prohibited Activities or Conditions on the Mortgaged Property. |

(b) | To the best of Borrower’s knowledge after due inquiry and investigation, no Prohibited Activities or Conditions exist or have existed on the Mortgaged Property. |

(c) | The Mortgaged Property does not now contain any underground storage tanks, and, to the best of Borrower’s knowledge after due inquiry and investigation, the Mortgaged Property has not contained any underground storage tanks in the past. If there is an underground storage tank located on the Mortgaged Property that has been previously disclosed by Borrower to Lender in writing, that tank complies with all requirements of Hazardous Materials Laws. |

(d) | To the best of Borrower’s knowledge after due inquiry and investigation, Borrower has complied with all Hazardous Materials Laws, including all requirements for notification regarding releases of Hazardous Materials. Without limiting the generality of the foregoing, all Environmental Permits required for the operation of the Mortgaged Property in accordance with Hazardous Materials Laws now in effect have been obtained and all such Environmental Permits are in full force and effect. |

(e) | To the best of Borrower’s knowledge after due inquiry and investigation, no event has occurred with respect to the Mortgaged Property that constitutes, or with the passage of time or the giving of notice, or both, would constitute noncompliance with the terms of any Environmental Permit. |

(f) | There are no actions, suits, claims or proceedings pending or, to the best of Borrower’s knowledge after due inquiry and investigation, threatened in writing |

Multifamily Loan and Security Agreement | Page 7 | |

that involve the Mortgaged Property and allege, arise out of, or relate to any Prohibited Activity or Condition.

(g) | Borrower has received no actual or constructive notice of any written complaint, order, notice of violation or other communication from any Governmental Authority with regard to air emissions, water discharges, noise emissions or Hazardous Materials, or any other environmental, health or safety matters affecting the Mortgaged Property or any property that is adjacent to the Mortgaged Property. |

5.06 | Commencement of Work; No Labor or Materialmen’s Claims. Except as set forth on Exhibit E, prior to the recordation of the Security Instrument, no work of any kind has been or will be commenced or performed upon the Mortgaged Property, and no materials or equipment have been or will be delivered to or upon the Mortgaged Property, for which the contractor, subcontractor or vendor continues to have any rights including the existence of or right to assert or file a mechanic’s or materialmen’s Lien. If any such work of any kind has been commenced or performed upon the Mortgaged Property, or if any such materials or equipment have been ordered or delivered to or upon the Mortgaged Property, then prior to the execution of the Security Instrument, Borrower has satisfied each of the following conditions: |

(a) | Borrower has fully disclosed in writing to both the Lender and the title company issuing the mortgagee title insurance policy insuring the Lien of the Security Instrument that work has been commenced or performed on the Mortgaged Property, or materials or equipment have been ordered or delivered to or upon the Mortgaged Property. |

(b) | Borrower has obtained and delivered to Lender and the title company issuing the mortgagee title insurance policy insuring the Lien of the Security Instrument Lien waivers from all contractors, subcontractors, suppliers or any other applicable party, pertaining to all work commenced or performed on the Mortgaged Property, or materials or equipment ordered or delivered to or upon the Mortgaged Property. |

Borrower represents and warrants that all parties furnishing labor and materials for which a Lien or claim of Lien may be filed against the Mortgaged Property have been paid in full and, except for such Liens or claims insured against by the policy of title insurance to be issued in connection with the Loan (which Borrower has disclosed pursuant to Section 5.06(a) and which are identified on Exhibit E), there are no mechanics’, laborers’ or materialmen’s Liens or claims outstanding for work, labor or materials affecting the Mortgaged Property, whether prior to, equal with or subordinate to the Lien of the Security Instrument.

5.07 | Compliance with Applicable Laws and Regulations. |

(a) | To the best of Borrower’s knowledge after due inquiry and investigation, each of the following is true: |

(i) | All Improvements and the use of the Mortgaged Property comply with all applicable statutes, rules and regulations, including all applicable statutes, rules and regulations pertaining to requirements for equal opportunity, anti-discrimination, fair housing, environmental protection, zoning and land use (“legal, non-conforming” status with respect to uses or structures will be considered to comply with zoning and land use requirements for the purposes of this representation). |

Multifamily Loan and Security Agreement | Page 8 | |

(ii) | The Improvements comply with applicable health, fire, and building codes. |

(iii) | There is no evidence of any illegal activities relating to controlled substances on the Mortgaged Property. |

(b) Reserved.

(c) Reserved.

5.08 | Access; Utilities; Tax Parcels. The Mortgaged Property: (a) has ingress and egress via a publicly dedicated right of way or via an irrevocable easement permitting ingress and egress, (b) is served by public utilities and services generally available in the surrounding community or otherwise appropriate for the use in which the Mortgaged Property is currently being utilized, and (c) constitutes one or more separate tax parcels. |

5.09 | Licenses and Permits. |

(a) | Borrower and any operator of the Mortgaged Property, if applicable, and to the best of Borrower’s knowledge, any commercial tenant of the Mortgaged Property is in possession of all material licenses, permits and authorizations required for use of the Mortgaged Property, which are valid and in full force and effect as of the date of this Loan Agreement. |

(b) | through (i) are Reserved. |

5.10 | No Other Interests. To the best of Borrower’s knowledge after due inquiry and investigation, no Person has (a) any possessory interest in the Mortgaged Property or right to occupy the Mortgaged Property except under and pursuant to the provisions of existing Leases by and between tenants and Borrower (a form of residential lease having been previously provided to Lender together with the material terms of any and all Non-Residential Leases at the Mortgaged Property), or (b) an option to purchase the Mortgaged Property or an interest in the Mortgaged Property, except as has been disclosed to and approved in writing by Lender. |

5.11 | Term of Leases. All Leases for residential units with respect to the Mortgaged Property satisfy each of the following conditions: |

(a) | They are on forms that are customary for similar multifamily properties in the Property Jurisdiction. |

(b) | They are for initial terms of at least 6 months and not more than 2 years (unless otherwise approved in writing by Lender). |

(c) | They do not include any Corporate Leases (unless otherwise approved in writing by Lender). |

(d) | They do not include options to purchase. |

5.12 | No Prior Assignment; Prepayment of Rents. Borrower has (a) not executed any prior assignment of Rents (other than an assignment of Rents securing any prior indebtedness that is being assigned to Lender, or that is being paid off and discharged with the proceeds of the Loan evidenced by the Note or, if this Loan Agreement is entered into in connection with a Supplemental Loan, other than an assignment of Rents securing any Senior |

Multifamily Loan and Security Agreement | Page 9 | |

Indebtedness), and (b) not performed any acts and has not executed, and will not execute, any instrument which would prevent Lender from exercising its rights under any Loan Document. At the time of execution of this Loan Agreement, unless otherwise approved by Lender in writing, there has been no prepayment of any Rents for more than 2 months prior to the due dates of such Rents other than the last month’s rent, if collected at the time a tenant enters into a Lease.

5.13 | Illegal Activity. No portion of the Mortgaged Property has been or will be purchased with the proceeds of any illegal activity. |

5.14 | Taxes Paid. Borrower has filed all federal, state, county and municipal tax returns required to have been filed by Borrower, and has paid all Taxes which have become due pursuant to such returns or to any notice of assessment received by Borrower, and Borrower has no knowledge of any basis for additional assessment with respect to such Taxes. To the best of Borrower’s knowledge after due inquiry and investigation, there are not presently pending any special assessments against the Mortgaged Property or any part of the Mortgaged Property. |

5.15 | Title Exceptions. To the best of Borrower’s knowledge after due inquiry and investigation, none of the items shown in the schedule of exceptions to coverage in the title policy issued to and accepted by Lender contemporaneously with the execution of this Loan Agreement and insuring Lender’s interest in the Mortgaged Property will have a Material Adverse Effect on the (a) ability of Borrower to pay the Loan in full, (b) ability of Borrower to use all or any part of the Mortgaged Property in the manner in which the Mortgaged Property is being used on the Closing Date, except as set forth in Section 6.03, (c) operation of the Mortgaged Property, or (d) value of the Mortgaged Property. |

5.16 | No Change in Facts or Circumstances. |

(a) | All information in the application for the Loan submitted to Lender, including all financial statements for the Mortgaged Property, Borrower, and any Borrower Principal, and all Rent Schedules, reports, certificates, and any other documents submitted in connection with the application (collectively, “Loan Application”) is complete and accurate in all material respects as of the date such information was submitted to Lender. |

(b) | There has been no change in any fact or circumstance since the Loan Application was submitted to Lender that would make any information submitted as part of the Loan Application materially incomplete or inaccurate. |

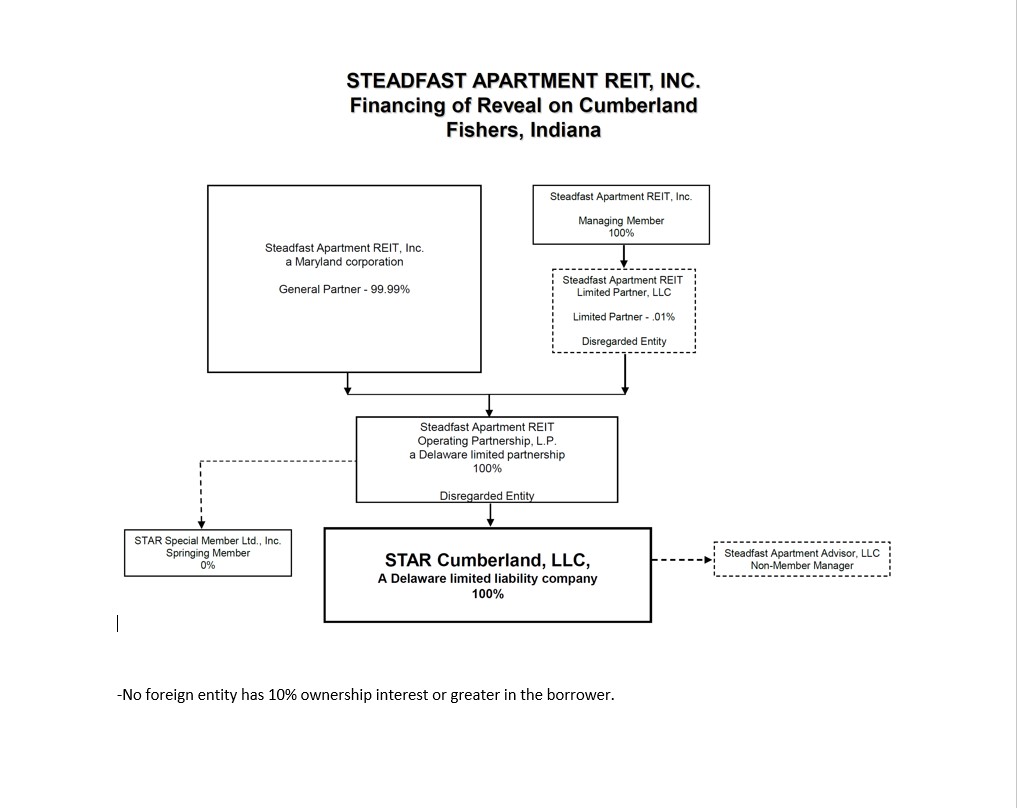

(c) | The organizational structure of Borrower is as set forth in Exhibit H. |

5.17 | Financial Statements. The financial statements of Borrower and each Borrower Principal furnished to Lender as part of the Loan Application reflect in each case a positive net worth as of the date of the applicable financial statement. |

5.18 | ERISA – Borrower Status. Borrower represents as follows: |

(a) | Borrower is not an “investment company,” or a company under the Control of an “investment company,” as such terms are defined in the Investment Company Act of 1940, as amended. |

Multifamily Loan and Security Agreement | Page 10 | |

(b) | Borrower is not an “employee benefit plan,” as defined in Section 3(3) of ERISA, which is subject to Title I of ERISA or a “plan” to which Section 4975 of the Tax Code applies, and the assets of Borrower do not constitute “plan assets” of one or more such plans within the meaning of 29 C.F.R. Section 2510.3-101, as modified by Section 3(42) of ERISA. |

(c) | Borrower is not a "governmental plan" within the meaning of Section 3(32) of ERISA, and is not subject to state statutes regulating investments or fiduciary obligations with respect to governmental plans. |

5.19 | No Fraudulent Transfer or Preference. No Borrower or Borrower Principal (a) has made, or is making in connection with and as security for the Loan, a transfer of an interest in the property of Borrower or Borrower Principal to or for the benefit of Lender or otherwise as security for any of the obligations under the Loan Documents which is or could constitute a voidable preference under federal bankruptcy, state insolvency or similar applicable creditors’ rights laws, or (b) has made, or is making in connection with the Loan, a transfer (including any transfer to or for the benefit of an insider under an employment contract) of an interest of Borrower or any Borrower Principal in property which is or could constitute a voidable preference under federal bankruptcy, state insolvency or similar applicable creditors’ rights laws, or (c) has incurred, or is incurring in connection with the Loan, any obligation (including any obligation to or for the benefit of an insider under an employment contract) which is or could constitute a fraudulent transfer under federal bankruptcy, state insolvency, or similar applicable creditors’ rights laws. |

5.20 | No Insolvency or Judgment. |

(a) | No Pending Proceedings or Judgments. No Borrower or Borrower Principal is (i) the subject of or a party to (other than as a creditor) any completed or pending bankruptcy, reorganization or insolvency proceeding, or (ii) the subject of any judgment unsatisfied of record or docketed in any court located in the United States. |

(b) | Insolvency. Borrower is not presently insolvent, and the Loan will not render Borrower insolvent. As used in this Section, the term “insolvent” means that the total of all of a Person’s liabilities (whether secured or unsecured, contingent or fixed, or liquidated or unliquidated) is in excess of the value of all of the assets of the Person that are available to satisfy claims of creditors. |

5.21 | Working Capital. After the Loan is made, Borrower intends to have sufficient working capital, including cash flow from the Mortgaged Property or other sources, not only to adequately maintain the Mortgaged Property, but also to pay all of Borrower’s outstanding debts as they come due (other than any balloon payment due upon the maturity of the Loan). Lender acknowledges that no members or partners of Borrower or any Borrower Principal will be obligated to contribute equity to Borrower for purposes of providing working capital to maintain the Mortgaged Property or to pay Borrower’s outstanding debts except as may otherwise be required under their organizational documents. |

5.22 Cap Collateral. Reserved.

5.23 | Ground Lease. Reserved. |

Multifamily Loan and Security Agreement | Page 11 | |

5.24 | Purpose of Loan. The purpose of the Loan is as indicated by the checked boxes below: |

x | Refinance Loan: The Loan is a refinancing of existing indebtedness and, except to the extent specifically required by Lender, there is to be no change in the ownership of either the Mortgaged Property or Borrower Principals. The intended use of any cash received by Borrower from Lender, to the extent applicable, in connection with the refinancing has been fully disclosed to Lender. |

o | Acquisition Loan – Mortgaged Property: All of the consideration given or received or to be given or received in connection with the acquisition of the Mortgaged Property has been fully disclosed to Lender. The Mortgaged Property was or will be purchased from _________________________________ (“Property Seller”). No Borrower or Borrower Principal has or had, directly or indirectly (through a family member or otherwise), any interest in the Property Seller and the acquisition of the Mortgaged Property is an arm’s-length transaction. To the best of Borrower’s knowledge after due inquiry and investigation, the purchase price of the Mortgaged Property represents the fair market value of the Mortgaged Property and Property Seller is not or will not be insolvent subsequent to the sale of the Mortgaged Property. |

o | Acquisition Loan – Membership Interests: All of the consideration given or received or to be given or received in connection with the acquisition of 100% of the membership interests of the Borrower (“Membership Interests”) has been fully disclosed to Lender. The Membership Interests were or will be purchased from _________________________________ (“Membership Interests Seller”). No Borrower Principal has or had, directly or indirectly (through a family member or otherwise), any interest in the Membership Interests Seller and the acquisition of the Membership Interests is an arm’s-length transaction. To the best of Borrower’s knowledge after due inquiry and investigation, the purchase price of the Membership Interests represents the fair market value of the Membership Interests and Membership Interest Seller is not or will not be insolvent subsequent to the sale of the Membership Interest. |

o | Supplemental Loan: The Loan is a Supplemental Loan and, except to the extent specifically required or approved by Lender, there has been no change in the ownership of either the Mortgaged Property or Borrower Principals since the date of the Senior Note. The intended use of any cash received by Borrower from Lender, to the extent applicable, in connection with the Supplemental Loan has been fully disclosed to Lender. |

o | Cross-Collateralized/Cross-Defaulted Loan Pool: The Loan is part of a cross-collateralized/cross-defaulted pool of loans described as follows: |

____ | being simultaneously made to Borrower and/or Borrower’s Affiliates |

____ | made previously to Borrower and/or Borrower’s Affiliates |

The intended use of any cash received by Borrower from Lender, to the extent applicable, in connection with the Loan and the other loans comprising the cross-collateralized/cross-defaulted loan pool has been fully disclosed to Lender.

5.25 | through 5.39 are Reserved. |

5.40 Recycled SPE Borrower. Reserved.

Multifamily Loan and Security Agreement | Page 12 | |

5.41 Recycled SPE Equity Owner. Reserved.

5.42 | through 5.50 are Reserved. |

5.51 | Survival. The representations and warranties set forth in this Loan Agreement will survive until the Indebtedness is paid in full; however, the representations and warranties set forth in Section 5.05 will survive beyond repayment of the entire Indebtedness, to the extent provided in Section 10.02(i). |

5.52 through 5.57 are Reserved.

5.58 | Prohibited Parties Lists; Economic Sanctions Laws. To the best of Borrower’s knowledge, after due inquiry and investigation, none of (a) Borrower, (b) any Borrower Principal, (c) any Person with a collective equity interest (whether direct or indirect) in Borrower of 25% or more, or (d) any Non-U.S. Equity Holder, is presently listed or at any time has been listed on any Prohibited Parties List. |

5.59 through 5.62 are Reserved.

ARTICLE VI BORROWER COVENANTS.

6.01 | Compliance with Laws. Borrower will comply with all laws, ordinances, rules, regulations and requirements of any Governmental Authority having jurisdiction over the Mortgaged Property and all licenses and permits and all recorded covenants and agreements relating to or affecting the Mortgaged Property, including all laws, ordinances, regulations, requirements and covenants pertaining to health and safety, construction of improvements on the Mortgaged Property, Repairs, Capital Replacements, fair housing, disability accommodation, zoning and land use, applicable building codes, special use permits and environmental regulations, Leases and the maintenance and disposition of tenant security deposits. Borrower will take appropriate measures to prevent, and will not engage in or knowingly permit, any illegal activities at the Mortgaged Property, including those that could endanger tenants or visitors, result in damage to the Mortgaged Property, result in forfeiture of the Mortgaged Property, or otherwise materially impair the Lien created by the Security Instrument or Lender’s interest in the Mortgaged Property. Borrower will at all times maintain records sufficient to demonstrate compliance with the provisions of this Section 6.01. |

6.02 | Compliance with Organizational Documents. Borrower will at all times comply with all laws, regulations and requirements of any Governmental Authority relating to Borrower’s formation, continued existence and good standing in its state of formation and, if different, in the Property Jurisdiction. Borrower will at all times comply with its organizational documents, including its partnership agreement (if Borrower is a partnership), its by-laws (if Borrower is a corporation or housing cooperative corporation or association) or its operating agreement (if Borrower is a limited liability company or tenancy-in-common). If Borrower is a housing cooperative corporation or association, Borrower will at all times maintain its status as a “cooperative housing corporation” as such term is defined in Section 216(b) of the Internal Revenue Code of 1986, as amended, or any successor statute thereto. |

Multifamily Loan and Security Agreement | Page 13 | |

6.03 | Use of Mortgaged Property. |

(a) | Unless required by applicable law, without the prior written consent of Lender, Borrower will not take any of the following actions: |

(i) | Allow changes in the use for which all or any part of the Mortgaged Property is being used at the time this Loan Agreement is executed. |

(ii) | Convert any individual dwelling units or common areas to commercial use. |

(iii) | Initiate a change in the zoning classification of the Mortgaged Property or acquiesce to a change in the zoning classification of the Mortgaged Property. |

(iv) | Establish any condominium or cooperative regime with respect to the Mortgaged Property beyond any which may be in existence on the date of this Loan Agreement. |

(v) | Combine all or any part of the Mortgaged Property with all or any part of a tax parcel which is not part of the Mortgaged Property. |

(vi) | Subdivide or otherwise split any tax parcel constituting all or any part of the Mortgaged Property. |

(vii) | Add to or change any location at which any of the Mortgaged Property is stored, held or located unless Borrower (A) gives Notice to Lender within 30 days after the occurrence of such addition or change, (B) executes and delivers to Lender any modifications of or supplements to this Loan Agreement that Lender may require, and (C) authorizes the filing of any financing statement which may be filed in connection with this Loan Agreement, as Lender may require. |

(viii) | Convert, in whole or in part, any non-residential income producing units to non-income producing units. |

(b) | Reserved. |

(c) | Notwithstanding anything contained in this Section to the contrary, if Borrower is a housing cooperative corporation or association, Lender acknowledges and consents to Borrower’s use of the Mortgaged Property as a housing cooperative. |

6.04 | Non-Residential Leases. |

(a) | Prohibited New Non-Residential Leases or Modified Non-Residential Leases. Except as set forth in Section 6.04(b), Borrower will not enter into any New Non-Residential Lease, enter into any Modified Non-Residential Lease or terminate any Non-Residential Lease (including any Non-Residential Lease in existence on the date of this Loan Agreement) without the prior written consent of Lender. |

(b) | New Non-Residential Leases or Modified Non-Residential Leases for which Lender’s Consent is Not Required. Lender’s consent will not be required for Borrower to enter into a Modified Non-Residential Lease or a New Non-Residential Lease, provided that the Modified Non-Residential Lease or New Non-Residential Lease satisfies each of the following requirements: |

Multifamily Loan and Security Agreement | Page 14 | |

(i) | The tenant under the New Non-Residential Lease or Modified Non-Residential Lease is not an Affiliate of Borrower or any Guarantor. |

(ii) | The terms of the New Non-Residential Lease or Modified Non-Residential Lease are at least as favorable to Borrower as those customary in the applicable market at the time Borrower enters into the New Non-Residential Lease or Modified Non-Residential Lease. |

(iii) | The Rents paid to Borrower pursuant to the New Non-Residential Lease or Modified Non-Residential Lease are not less than 90% of the rents paid to Borrower pursuant to the Non-Residential Lease, if any, for that portion of the Mortgaged Property that was in effect prior to the New Non-Residential Lease or Modified Non-Residential Lease. |

(iv) | The term of the New Non-Residential Lease or Modified Non-Residential Lease, including any option to extend, is 10 years or less. |

(v) | Any New Non-Residential Lease must provide that the space may not be used or operated, in whole or in part, for any of the following: |

(A) | The operation of a so-called “head shop” or other business devoted to the sale of articles or merchandise normally used or associated with illegal or unlawful activities such as, but not limited to, the sale of paraphernalia used in connection with marijuana or controlled drugs or substances. |

(B) | A gun shop, shooting gallery or firearms range. |

(C) | A so-called massage parlor or any business which sells, rents or permits the viewing of so-called “adult” or pornographic materials such as, but not limited to, adult magazines, books, movies, photographs, sexual aids, sexual articles and sex paraphernalia. |

(D) | Any use involving the sale or distribution of any flammable liquids, gases or other Hazardous Materials. |

(E) | An off-track betting parlor or arcade. |

(F) | A liquor store or other establishment whose primary business is the sale of alcoholic beverages for off-site consumption. |

(G) | A burlesque or strip club. |

(H) | Any illegal activity. |

(vi) | The aggregate of the income derived from the space leased pursuant to the New Non-Residential Lease accounts for less than 20% of the gross income of the Mortgaged Property on the date that Borrower enters into the New Non-Residential Lease. |

Multifamily Loan and Security Agreement | Page 15 | |

(vii) | Such New Non-Residential Lease is not an oil or gas lease, pipeline agreement or other instrument related to the production or sale of oil or natural gas. |

(c) | Executed Copies of Non-Residential Leases. Borrower will, without request by Lender, deliver a fully executed copy of each Non-Residential Lease to Lender promptly after such Non-Residential Lease is signed. |

(d) | Subordination and Attornment Requirements. All Non-Residential Leases entered into after the date of this Loan Agreement, regardless of whether Lender’s consent or approval is required, will specifically include the following provisions: |

(i) | The tenant will attorn to Lender and any purchaser at a foreclosure sale, such attornment to be self-executing and effective upon acquisition of title to the Mortgaged Property by any purchaser at a foreclosure sale or by Lender in any manner. |

(ii) | The tenant agrees to execute such further evidences of attornment as Lender or any purchaser at a foreclosure sale may from time to time request. |

(iii) | The tenant will, upon receipt of a written request from Lender following the occurrence of and during the continuance of an Event of Default, pay all Rents payable under the Lease to Lender. |

(iv) Reserved.

(v) Reserved.

6.05 | Prepayment of Rents. Borrower will not receive or accept Rent under any Lease (whether a residential Lease or a Non-Residential Lease) for more than 2 months in advance. |

6.06 | Inspection. |

(a) | Right of Entry. Subject to the rights of tenants under Leases, Borrower will permit Lender, its agents, representatives and designees and any interested Governmental Authority to make or cause to be made entries upon and inspections of the Mortgaged Property to inspect, among other things: (i) Repairs, (ii) Capital Replacements, (iii) Restorations, (iv) Property Improvement Alterations, and (v) any other Improvements, both in process and upon completion (including environmental inspections and tests performed by professional inspection engineers) during normal business hours, or at any other reasonable time, upon reasonable Notice to Borrower if the inspection is to include occupied residential units (which Notice need not be in writing). During normal business hours, or at any other reasonable time, Borrower will also permit Lender to examine all books and records and contracts and bills pertaining to the foregoing. Notice to Borrower will not be required in the case of an emergency, as determined in Lender’s Discretion, or when an Event of Default has occurred and is continuing. |

(b) | Inspection of Mold. If Lender determines that Mold has or may have developed as a result of a water intrusion event or leak, Lender, at Lender’s Discretion, may require that a professional inspector inspect the Mortgaged Property to confirm whether Mold has developed and, if so, thereafter as frequently as Lender determines is necessary until any issue with Mold and its cause(s) are resolved to Lender’s |

Multifamily Loan and Security Agreement | Page 16 | |

satisfaction. Such inspection will be limited to a visual and olfactory inspection of the area that has experienced the Mold, water intrusion event or leak. Borrower will be responsible for the cost of each such professional inspection and any remediation deemed to be necessary as a result of the professional inspection. After any issue with Mold is remedied to Lender’s satisfaction, Lender will not require a professional inspection any more frequently than once every 3 years unless Lender otherwise becomes aware of Mold as a result of a subsequent water intrusion event or leak.

(c) | Certification in Lieu of Inspection. If Lender or Loan Servicer determines not to conduct an annual inspection of the Mortgaged Property, and in lieu thereof Lender requests a certification, Borrower will provide to Lender a factually correct certification, each year that the annual inspection is waived, to the following effect: |

Borrower has not received any written complaint, notice, letter or other written communication from any tenant, Property Manager or governmental authority regarding mold, fungus, microbial contamination or pathogenic organisms (“Mold”) or any activity, condition, event or omission that causes or facilitates the growth of Mold on or in any part of the Mortgaged Property or, if Borrower has received any such written complaint, notice, letter or other written communication, that Borrower has investigated and determined that no Mold activity, condition or event exists or alternatively has fully and properly remediated such activity, condition, event or omission in compliance with the Moisture Management Plan for the Mortgaged Property.

If Borrower is unwilling or unable to provide such certification, Lender may require a professional inspection of the Mortgaged Property at Borrower’s expense.

6.07 Books and Records; Financial Reporting.

(a) | Delivery of Books and Records. |

(i) | Borrower will keep and maintain at all times at the Mortgaged Property, Borrower’s main business office, or the Property Manager’s office, and upon Lender’s request will make available at the Mortgaged Property (or, at Borrower’s option, at the Property Manager’s office), complete and accurate books of account and records (including copies of supporting bills and invoices) adequate to reflect correctly the operation of the Mortgaged Property and copies of all written contracts, Leases, and other instruments which affect the Mortgaged Property. The books, records, contracts, Leases and other instruments will be subject to examination and inspection by Lender at any reasonable time (“Books and Records”). |

(ii) | Borrower will keep the Books and Records in accordance with one of the following accounting methods, consistently applied, and Borrower will promptly provide Lender Notice of any change in Borrower’s accounting methods: |

(A) | Generally accepted accounting principles (GAAP). |

(B) | Tax method of accounting, if under the tax method of accounting, the accrual basis is used for interest expense, real estate taxes and |

Multifamily Loan and Security Agreement | Page 17 | |

insurance expense, and the cash basis is used for all other items, including income, prepaid rent, utilities and payroll expense. Financial statements may exclude depreciation and amortization.

(C) | Such other method that is acceptable to Lender. |

(b) | Delivery of Statement of Income and Expenses; Rent Schedule and Other Statements. Borrower will furnish to Lender each of the following: |

(i) | Within 25 days after the end of each calendar quarter prior to Securitization and within 35 days after each calendar quarter after Securitization, each of the following: |

(A) | A Rent Schedule dated no earlier than the date that is 5 days prior to the end of such quarter. |

(B) | A statement of income and expenses for Borrower that is either of the following: |

(1) | For the 12 month period ending on the last day of such quarter. |

(2) | If at the end of such quarter Borrower or any Affiliate of Borrower has owned the Mortgaged Property for less than 12 months, for the period commencing with the acquisition of the Mortgaged Property by Borrower or its Affiliate, and ending on the last day of such quarter. |

(C) | When requested by Lender, a balance sheet showing all assets and liabilities of Borrower as of the end of that fiscal quarter. |

(ii) | Within 90 days after the end of each fiscal year of Borrower, each of the following: |

(A) | An annual statement of income and expenses for Borrower for that fiscal year. |

(B) | A balance sheet showing all assets and liabilities of Borrower as of the end of that fiscal year. |

(C) | An accounting of all security deposits held pursuant to all Leases, including the name of the institution (if any) and the names and identification numbers of the accounts (if any) in which such security deposits are held and the name of the person to contact at such financial institution, along with any authority or release necessary for Lender to access information regarding such accounts. |

(iii) | Within 30 days after the date of filing, copies of all tax returns filed by Borrower. |

(c) | Delivery of Borrower Financial Statements Upon Request. Borrower will furnish to Lender each of the following: |

Multifamily Loan and Security Agreement | Page 18 | |

(i) | Upon Lender’s request, in Lender’s sole and absolute discretion prior to a Securitization, and thereafter upon Lender’s request in Lender’s Discretion, a monthly Rent Schedule and a monthly statement of income and expenses for Borrower, in each case within 25 days after the end of each month. |

(ii) | Upon Lender’s request in Lender’s sole and absolute discretion prior to a Securitization, and thereafter upon Lender’s request in Lender’s Discretion, within 10 days after such a request from Lender, each of the following: |

(A) | A statement that identifies all owners of any interest in Borrower and any Designated Entity for Transfers and the interest held by each (unless Borrower or any Designated Entity for Transfers is a publicly-traded entity, in which case such statement of ownership will not be required), and if Borrower or a Designated Entity for Transfers is a corporation, then all officers and directors of Borrower and the Designated Entity for Transfers, and if Borrower or a Designated Entity for Transfers is a limited liability company, then all non-member Managers. |

(B) | To the extent not included in the statement provided under Section 6.07(c)(ii)(A), a statement that identifies (1) all Persons with a collective equity interest (whether direct or indirect) of 25% or more in Borrower, and (2) all Non-U.S. Equity Holders. |

(iii) | Upon Lender’s request in Lender’s Discretion, such other financial information or property management information (including information on tenants under Leases to the extent such information is available to Borrower, copies of bank account statements from financial institutions where funds owned or controlled by Borrower are maintained, and an accounting of security deposits) as may be required by Lender from time to time, in each case within 30 days after such request. |

(iv) | Upon Lender’s request in Lender’s Discretion, a monthly property management report for the Mortgaged Property, showing the number of inquiries made and rental applications received from tenants or prospective tenants and deposits received from tenants and any other information requested by Lender within 30 days after such request. However, Lender will not require the foregoing more frequently than quarterly except when there has been an Event of Default and such Event of Default is continuing, in which case Lender may require Borrower to furnish the foregoing more frequently. |

(d) | Form of Statements; Audited Financials. A natural person having authority to bind Borrower (or the SPE Equity Owner or Guarantor, as applicable), acting in his or her capacity as a manager, general partner or an officer of Borrower, SPE Equity Owner, or Guarantor and not in his or her individual capacity, will certify each of the statements, schedules and reports required by Sections 6.07(b), 6.07(c) and 6.07(f) to be complete and accurate. Each of the statements, schedules and reports required by Sections 6.07(b), 6.07(c) and 6.07(f) will be in such form and contain such detail as Lender may reasonably require. Lender also may require that any of the statements, schedules or reports listed in Sections 6.07(b), 6.07(c) and 6.07(f) be audited at Borrower’s expense by independent certified public accountants acceptable to Lender, at any time when an Event of Default has occurred and is |

Multifamily Loan and Security Agreement | Page 19 | |

continuing or at any time that Lender, in its reasonable judgment, determines that audited financial statements are required for an accurate assessment of the financial condition of Borrower or of the Mortgaged Property.

(e) | Failure to Timely Provide Financial Statements. If Borrower fails to provide in a timely manner the statements, schedules and reports required by Sections 6.07(b), 6.07(c) and 6.07(f), Lender will give Notice to Borrower specifying the statements, schedules and reports required by Sections 6.07(b), 6.07(c) and 6.07(f) that Borrower has failed to provide. If Borrower has not provided the required statements, schedules and reports within 10 Business Days following such Notice, then (i) Borrower will pay a late fee of $500 for each late statement, schedule or report, plus an additional $500 per month that any such statement, schedule or report continues to be late, and (ii) Lender will have the right to have Borrower’s books and records audited, at Borrower’s expense, by independent certified public accountants selected by Lender in order to obtain such statements, schedules and reports, and all related costs and expenses of Lender will become immediately due and payable and will become an additional part of the Indebtedness as provided in Section 9.02. Notice to Borrower of Lender’s exercise of its rights to require an audit will not be required in the case of an emergency, as determined in Lender’s Discretion, or when an Event of Default has occurred and is continuing. |

(f) | Delivery of Guarantor and SPE Equity Owner Financial Statements. Borrower will cause Guarantor and/or SPE Equity Owner to deliver each of the following to Lender within 10 Business Days following Lender’s request: |

(i) | Guarantor’s or SPE Equity Owner’s (as applicable) balance sheet and profit and loss statement (or if such party is a natural person, such party’s personal financial statements) as of the end of (A) the quarter that ended at least 30 days prior to the due date of the requested items, and/or (B) the fiscal year that ended at least 90 days prior to the due date of the requested items. |

(ii) | Other Guarantor or SPE Equity Owner (as applicable) financial statements as Lender may reasonably require. |

(iii) | Written updates on the status of all litigation proceedings that Guarantor or SPE Equity Owner (as applicable) disclosed or should have disclosed to Lender as of the Closing Date. |

(iv) | If an Event of Default has occurred and is continuing, copies of Guarantor’s or SPE Equity Owner’s (as applicable) most recent filed state and federal tax returns, including any current tax return extensions. |

(g) | Reporting Upon Event of Default. If an Event of Default has occurred and is continuing, Borrower will deliver to Lender upon written demand all books and records relating to the Mortgaged Property or its operation. |

(h) | Credit Reports. Borrower authorizes Lender to obtain a credit report on Borrower at any time. |

(i) | Reserved. |

(j) | Reserved. |

Multifamily Loan and Security Agreement | Page 20 | |

6.08 | Taxes; Operating Expenses; Ground Rents. |

(a) | Payment of Taxes and Ground Rent. Subject to the provisions of Sections 6.08(c) and (d), Borrower will pay or cause to be paid (i) all Taxes when due and before the addition of any interest, fine, penalty or cost for nonpayment, and (ii) if Borrower’s interest in the Mortgaged Property is as a Ground Lessee, then the monthly or other periodic installments of Ground Rent before the last date upon which each such installment may be made without penalty or interest charges being added. |

(b) | Payment of Operating Expenses. Subject to the provisions of Section 6.08(c), Borrower will (i) pay the expenses of operating, managing, maintaining and repairing the Mortgaged Property (including utilities, Repairs and Capital Replacements) before the last date upon which each such payment may be made without any penalty or interest charge being added, and (ii) pay Insurance premiums prior to the expiration date of each policy of Insurance, unless applicable law specifies some lesser period. |

(c) | Payment of Impositions and Reserve Funds. If Lender is collecting Imposition Reserve Deposits pursuant to Article IV, then so long as no Event of Default exists, Borrower will not be obligated to pay any Imposition for which Imposition Reserve Deposits are being collected, whether Taxes, Insurance premiums, Ground Rent (if applicable) or any other individual Impositions, but only to the extent that sufficient Imposition Reserve Deposits are held by Lender for the purpose of paying that specific Imposition and Borrower has timely delivered to Lender any bills or premium notices that it has received with respect to that specific Imposition (other than Ground Rent). Lender will have no liability to Borrower for failing to pay any Impositions to the extent that: (i) any Event of Default has occurred and is continuing, (ii) insufficient Imposition Reserve Deposits are held by Lender at the time an Imposition becomes due and payable, or (iii) Borrower has failed to provide Lender with bills and premium notices as provided in this Section. |

(d) | Right to Contest. Borrower, at its own expense, may contest by appropriate legal proceedings, conducted diligently and in good faith, the amount or validity of any Imposition other than Insurance premiums and Ground Rent (if applicable), if: (i) Borrower notifies Lender of the commencement or expected commencement of such proceedings, (ii) the Mortgaged Property is not in danger of being sold or forfeited, (iii) if Borrower has not already paid the Imposition, Borrower deposits with Lender reserves sufficient to pay the contested Imposition, if requested by Lender, and (iv) Borrower furnishes whatever additional security is required in the proceedings or is reasonably requested by Lender, which may include the delivery to Lender of reserves established by Borrower to pay the contested Imposition. |

6.09 | Preservation, Management and Maintenance of Mortgaged Property. |

(a) | Maintenance of Mortgaged Property; No Waste. Borrower will keep the Mortgaged Property in good repair, including the replacement of Personalty and Fixtures with items of equal or better function and quality. Borrower will not commit waste or permit impairment or deterioration of the Mortgaged Property. |

(b) | Abandonment of Mortgaged Property. Borrower will not abandon the Mortgaged Property. |

(c) | Preservation of Mortgaged Property. |

Multifamily Loan and Security Agreement | Page 21 | |

(i) | Borrower will restore or repair promptly, in a good and workmanlike manner, any damaged part of the Mortgaged Property to the equivalent of its original condition, or such other condition as Lender may approve in writing, whether or not Insurance proceeds or Condemnation awards are available to cover any costs of such Restoration or repair; provided, however, that Borrower will not be obligated to perform such Restoration or repair if (A) no Event of Default has occurred and is continuing, and (B) Lender has elected to apply any available Insurance proceeds and/or Condemnation awards to the payment of Indebtedness pursuant to Section 6.10(l) or Section 6.11(d). |

(ii) | Borrower will give Notice to Lender of and, unless otherwise directed in writing by Lender, will appear in and defend any action or proceeding purporting to affect the Mortgaged Property, Lender’s security or Lender’s rights under this Loan Agreement. |

(d) | Property Management. Borrower will provide for professional management of the Mortgaged Property by the Property Manager at all times under a property management agreement approved by Lender in writing. Borrower will not surrender, terminate, cancel, modify, renew or extend its property management agreement, or enter into any other agreement relating to the management or operation of the Mortgaged Property with Property Manager or any other Person, or consent to the assignment by the Property Manager of its interest under such property management agreement, in each case without the consent of Lender, which consent will not be unreasonably withheld. |

(i) | If at any time Lender consents to the appointment of a new Property Manager, such new Property Manager and Borrower will, as a condition of Lender’s consent, execute an Assignment of Management Agreement in a form acceptable to Lender. |

(ii) | If any such replacement Property Manager is an Affiliate of Borrower, and if a nonconsolidation opinion was delivered on the Closing Date, Borrower will deliver to Lender an updated nonconsolidation opinion in form and substance satisfactory to Lender with regard to nonconsolidation. |

(iii) | Reserved. |

(e) | Alteration of Mortgaged Property. Borrower will not (and will not permit any tenant or other Person to) remove, demolish or alter the Mortgaged Property or any part of the Mortgaged Property, including any removal, demolition or alteration occurring in connection with a rehabilitation of all or part of the Mortgaged Property, except that each of the following is permitted: |

(i) | Repairs or Capital Replacements in accordance with the terms and conditions of this Loan Agreement. |

(ii) | Any repairs or replacements made in connection with the replacement of tangible Personalty. |

(iii) | If Borrower is a cooperative housing corporation or association, repairs or replacements to the extent permitted with respect to individual dwelling units under the form of a proprietary lease or occupancy agreement. |

Multifamily Loan and Security Agreement | Page 22 | |

(iv) | Any repairs or replacements in connection with making an individual unit ready for a new occupant or pursuant to Sections 6.09(a) and (c). |

(v) | Property Improvement Alterations, provided that each of the following conditions is satisfied: |

(A) | At least 30 days prior to the commencement of any Property Improvement Alterations, Borrower must submit to Lender a Property Improvement Notice. The Property Improvement Notice must include all of the following information: |

(1) | The expected start date and completion date of the Property Improvement Alterations. |

(2) | A description of the anticipated Property Improvement Alterations to be made. |

(3) | The projected budget of the Property Improvement Alterations and the source of funding. |

If any changes to Property Improvement Alterations as described in the Property Improvement Notice are made that extend beyond the overall scope and intent of the Property Improvement Alterations set forth in the Property Improvement Notice (e.g., renovations changed to renovate common areas but Property Improvement Notice only described renovations to the residential unit bathrooms), then Borrower must submit a new Property Improvement Notice to Lender in accordance with this Section 6.09(e)(v)(A).

(B) | The Property Improvement Alterations may not be commenced within 12 months prior to the Maturity Date without prior written consent of the Lender and must be completed at least 6 months prior to the Maturity Date. |

(C) | Neither the performance nor completion of the Property Improvement Alterations may result in any of the following: |

(1) An adverse effect on any Major Building System.

(2) | A change in residential unit configurations on a permanent basis. |

(3) | An increase or decrease in the total number of residential units. |

(4) | The demolition of any existing Improvements. |

(5) | A permanent obstruction of tenants’ access to units or a temporary obstruction of tenants’ access to units without a reasonable alternative access provided during the period of renovation which causes the obstruction. |

(D) | Reserved. |

Multifamily Loan and Security Agreement | Page 23 | |

(E) | The Leases used to calculate Minimum Occupancy for use in Section 6.09(e)(v)(I) must meet all of the following conditions: |

(1) | The Leases are with tenants that are not Affiliates of Borrower or Guarantor (except as otherwise expressly agreed by Lender in writing). |

(2) | The Leases are on arms’ length terms and conditions. |

(3) | The Leases otherwise satisfy the requirements of the Loan Documents. |

(F) | The Property Improvement Alterations must be completed in accordance with Section 6.14 and any reference to Repairs in Sections 6.06 and 6.14 will be deemed to include Property Improvement Alterations. |

(G) | Upon completion of the applicable Property Improvement Alterations, Borrower must provide all of the following to the Lender: |