UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the quarterly period ended

For the transition period from __________ to __________

Commission

File Number:

| (Exact name of registrant as specified in its charter) |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| ☒ | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| ☒ | No | ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☐ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes | ☐ | No |

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of August 08, 2024; ordinary shares, par value $ per share, were outstanding.

OXBRIDGE RE HOLDINGS LIMITED

INDEX

| 2 |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Balance Sheets

(expressed in thousands of U.S. Dollars, except per share and share amounts)

| At June 30, 2024 | At December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Investments: | ||||||||

| Equity securities, at fair value (cost: $ | $ | $ | ||||||

| Cash and cash equivalents | ||||||||

| Restricted cash and cash equivalents | ||||||||

| Premiums receivable | ||||||||

| Other Investments | ||||||||

| Loan Receivable | ||||||||

| Due from Related Party | ||||||||

| Deferred policy acquisition costs | ||||||||

| Operating lease right-of-use assets | ||||||||

| Prepayment and other assets | ||||||||

| Property and equipment, net | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities and Shareholders’ Equity | ||||||||

| Notes payable to noteholders | $ | $ | ||||||

| Notes payable to Epsilon/DeltaCat Re Tokenholders | ||||||||

| Unearned Premium Reserve | ||||||||

| Operating lease liabilities | ||||||||

| Accounts payable and other liabilities | ||||||||

| Total liabilities | ||||||||

| Shareholders’ equity: | ||||||||

| Ordinary share capital, (par value $, shares authorized; and shares issued and outstanding) | $ | $ | ||||||

| Additional paid-in capital | ||||||||

| Accumulated Deficit | ( | ) | ( | ) | ||||

| Total shareholders’ equity | ||||||||

| Total liabilities and shareholders’ equity | $ | $ | ||||||

The accompanying Notes to Consolidated Financial Statements are an integral

part of the Consolidated Financial Statements.

| 3 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Operations

(Unaudited)

(expressed in thousands of U.S. Dollars, except per share amounts)

| Three Months Ended June, 30 | Six Months Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | ||||||||||||||||

| Assumed premiums | $ | $ | $ | $ | ||||||||||||

| Change in unearned premiums reserve | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net premiums earned | ||||||||||||||||

| SurancePlus management fee income | ||||||||||||||||

| Net investment and other income | ||||||||||||||||

| Interest and gain on redemption of loan receivable | ||||||||||||||||

| Unrealized (loss) gain on other investments | ( | ) | ( | ) | ||||||||||||

| Change in fair value of equity securities | ( | ) | ( | ) | ||||||||||||

| Total revenue | ( | ) | ||||||||||||||

| Expenses | ||||||||||||||||

| Policy acquisition costs and underwriting expenses | ||||||||||||||||

| General and administrative expenses | ||||||||||||||||

| Total expenses | ||||||||||||||||

| (Loss) Income before income attributable to noteholders and tokenholders | ( | ) | ( | ) | ( | ) | ||||||||||

| Income attributable to noteholders and tokenholders | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net (loss) income | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||

| (Loss) income per share | ||||||||||||||||

| Basic and Diluted | $ | ) | $ | ) | $ | ) | $ | |||||||||

| Weighted-average shares outstanding | ||||||||||||||||

| Basic and Diluted | ||||||||||||||||

The accompanying Notes to Consolidated Financial Statements are an integral

part of the Consolidated Financial Statements.

| 4 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

(expressed in thousands of U.S. Dollars)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Operating activities | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Adjustments to reconcile net(loss) income to net cash used in operating activities: | ||||||||

| Stock-based compensation | ||||||||

| Depreciation and amortization | ||||||||

| SurancePlus management fee income | ( | ) | ( | ) | ||||

| Change in fair value of other investments | ( | ) | ||||||

| Change in fair value of equity securities | ( | ) | ||||||

| Interest and gain on redemption of loan receivable | ( | ) | ||||||

| Change in operating assets and liabilities: | ||||||||

| Accrued interest and dividend receivable | ( | ) | ||||||

| Premiums receivable | ( | ) | ( | ) | ||||

| Due from related party | ( | ) | ||||||

| Deferred policy acquisition costs | ( | ) | ( | ) | ||||

| Prepayment and other assets | ( | ) | ||||||

| Losses payable | ( | ) | ||||||

| Other liablities Cat Re Tokenholders | ( | ) | ||||||

| Unearned premiums reserve | ||||||||

| Accounts payable and other liabilities | ||||||||

| Net cash used in operating activities | $ | ( | ) | $ | ( | ) | ||

| Investing activities | ||||||||

| Purchase of property and equipment | ( | ) | ||||||

| Proceeds from redemption of loan receivable | ||||||||

| Proceeds from sale of equity securities | ||||||||

| Net cash provided by (used in) investing activities | $ | $ | ( | ) | ||||

| Financing activities | ||||||||

| Proceeds from issuance of ordinary shares | ||||||||

| Partial redemption of notes payable to noteholders | ( | ) | ||||||

| Prepaid offering costs | ( | ) | ||||||

| Net proceeds from the issuance of Epsilon/Delta Cat Re tokens | ||||||||

| Net cash provided by financing activities | $ | $ | ||||||

| (continued) | ||||||||

The accompanying Notes to Consolidated Financial Statements are an integral

part of the Consolidated Financial Statements.

| 5 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Cash Flows, continued

(Unaudited)

(expressed in thousands of U.S. Dollars)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash and cash equivalents, and restricted cash and cash equivalents: | ||||||||

| Net change during the period | ( | ) | ||||||

| Balance at beginning of period | ||||||||

| Balance at end of period | $ | $ | ||||||

| Non-cash investing activities | ||||||||

| Right-of-use lease assets obtained in exchange for operating lease liabilities | $ | $ | ||||||

The accompanying Notes to Consolidated Financial Statements are an integral

part of the Consolidated Financial Statements.

| 6 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Changes in Shareholders’ Equity (unaudited)

Three Months and Six Months Ended June 30, 2024 and 2023

(expressed in thousands of U.S. Dollars, except share amounts)

| Ordinary Share Capital | Additional Paid-in | Accumulated | Total Shareholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance at December 31, 2022 | ( | ) | ||||||||||||||||||

| Net income for the period | - | |||||||||||||||||||

| Stock-based compensation | ||||||||||||||||||||

| Issuance of restricted stock | ||||||||||||||||||||

| Balance at March 31, 2023 | ( | ) | ||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||

| Stock-based compensation | ||||||||||||||||||||

| Balance at June 30, 2023 | ( | ) | ||||||||||||||||||

| Balance at December 31, 2023 | ( | ) | ||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||

| Issuance of restricted stock | ||||||||||||||||||||

| Balance at March 31, 2024 | ( | ) | ||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||

| Issuance of ordinary shares | ||||||||||||||||||||

| Balance at June 30, 2024 | ( | ) | ||||||||||||||||||

The accompanying Notes to Consolidated Financial Statements are an integral

part of the Consolidated Financial Statements.

| 7 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

1. ORGANIZATION AND BASIS OF PRESENTATION

(a) Organization

Oxbridge

Re Holdings Limited (the “Company”) was incorporated as an exempted company on April 4, 2013 under the laws of the Cayman

Islands. The Company directly owns

The Company’s ordinary shares and warrants are listed on The NASDAQ Capital Market under the symbols “OXBR” and “OXBRW,” respectively.

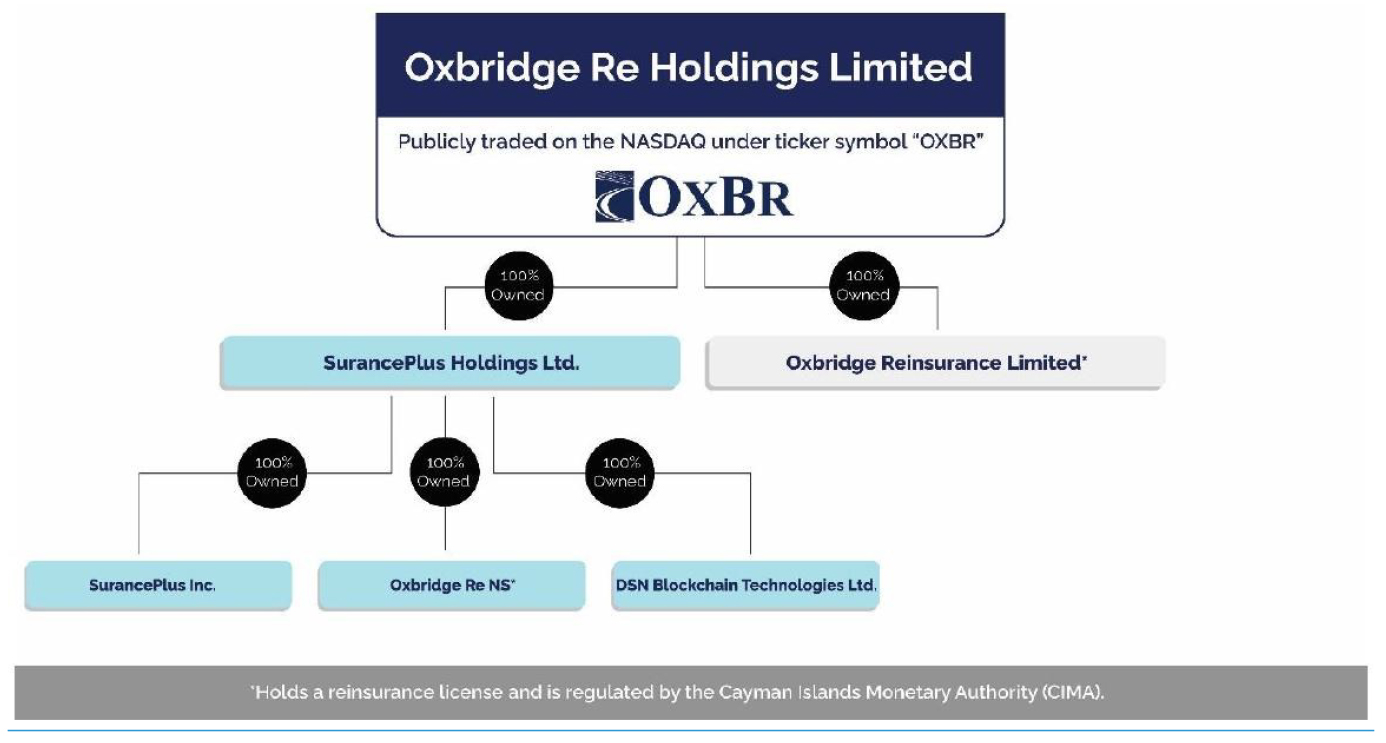

Below is an organizational chart of the Company.

(b) Basis of Presentation and Consolidation

The accompanying unaudited, consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information, and the Securities and Exchange Commission (“SEC”) rules for interim financial reporting. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with GAAP have been omitted pursuant to such rules and regulations. However, in the opinion of management, the accompanying interim consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the Company’s consolidated financial position as of June 30, 2024 and the consolidated results of operations and cash flows for the periods presented. The consolidated results of operations for interim periods are not necessarily indicative of the results of operations to be expected for any subsequent interim period or for the fiscal year ended December 31, 2024. The accompanying unaudited consolidated financial statements and notes thereto should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2023 included in the Company’s Form 10-K, which was filed with the SEC on March 26, 2024.

Uses of Estimates: In preparing the interim unaudited consolidated financial statements, management was required to make certain estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses and related disclosures at the financial reporting date and throughout the periods being reported upon. Certain of the estimates result from judgments that can be subjective and complex and consequently actual results may differ from these estimates, which would be reflected in future periods.

Material estimates that are particularly susceptible to significant change in the near-term relate to the determination of the reserve for losses and loss adjustment expenses (if any), which may include amounts estimated for claims incurred but not yet reported. The Company uses various assumptions and actuarial data it believes to be reasonable under the circumstances to make these estimates. In addition, accounting policies specific to valuation of investments involve significant judgments and estimates material to the Company’s consolidated financial statements. Although considerable variability is likely to be inherent in these estimates, management believes that the amounts provided are reasonable. These estimates are continually reviewed and adjusted if necessary. Such adjustments are reflected in current operations.

The Company consolidates in these consolidated financial statements the results of operations and financial position of all voting interest entities (“VOE”) in which the Company has a controlling financial interest and all variable interest entities (“VIE”) in which the Company is considered to be the primary beneficiary. The consolidation assessment, including the determination as to whether an entity qualifies as a VIE or VOE, depends on the facts and circumstances surrounding each entity.

All significant intercompany balances and transactions have been eliminated.

| 8 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

2. SIGNIFICANT ACCOUNTING POLICIES

Revenue Recognition

SurancePlus Inc’s incentive, technology, origination and management (“ITOM”) fee income represents fee income related to the completion of the EpsilonCat tokenized reinsurance securities as well as placement of the underlying insurance policies. The Company recognizes the associated revenue at the time of the placement of the underlying insurance policies as the performance obligation is satisfied at that time.

Cash and cash equivalents: Cash and cash equivalents are comprised of cash and short- term investments with original maturities of three months or less.

Restricted cash and cash equivalents: Restricted cash and cash equivalents represent funds held in accordance with the Company’s trust agreements with ceding insurers and trustees, which requires the Company to maintain collateral with a market value greater than or equal to the limit of liability, less unpaid premium.

Investments: The Company from time to time invests in fixed-maturity debt securities and equity securities, and for which its fixed-maturity debt securities are classified as available-for-sale. The Company’s available for sale debt investments are carried at fair value with changes in fair value included as a separate component of accumulated other comprehensive income (loss) in shareholders’ equity. For the Company’s investment in equity securities, and for the Company’s investment in Jet.AI classified as “other investments”, the changes in fair value are recorded within the consolidated statements of operations. At June 30, 2024 and December 31, 2023 the Company did not own any fixed maturity debt securities.

Unrealized gains or losses are determined by comparing the fair market value of the securities with their cost or amortized cost. Realized gains and losses on investments are recorded on the trade date and are included in the consolidated statements of operations. The cost of securities sold is based on the specified identification method. Investment income is recognized as earned and discounts or premiums arising from the purchase of debt securities are recognized in investment income using the interest method over the remaining term of the security.

Fair value measurement: GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under GAAP are as follows:

| Level 1 | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date; |

| Level 2 | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; and |

| Level 3 | Inputs that are unobservable. |

| 9 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Fair value measurement (cont’d)

Inputs are used in applying the various valuation techniques and broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. For fixed maturity debt securities, inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, broker quotes for similar securities and other factors. The fair value of investments in stocks and exchange-traded funds is based on the last traded price. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Company’s investment custodians and management. The investment custodians consider observable data to be market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant markets.

Deferred policy acquisition costs (“DAC”): Policy acquisition costs consist of brokerage fees, federal excise taxes and other costs related directly to the successful acquisition of new or renewal insurance contracts and are deferred and amortized over the terms of the reinsurance agreements to which they relate. The Company evaluates the recoverability of DAC by determining if the sum of future earned premiums and anticipated investment income is greater than the expected future claims and expenses. If a loss is probable on the unexpired portion of policies in force, a premium deficiency loss is recognized.

Offering

Expenses:. During the six-month period ended June 30, 2024, the Company recognized in the consolidated statements of operations

$

In

accordance with the terms of the equity distribution agreement with Maxim, we intend to offer and sell ordinary shares having an aggregate

offering price of up to $

Reserves for losses and loss adjustment expenses: The Company determines its reserves for losses and loss adjustment expenses, if any, on the basis of the claims reported by the Company’s ceding insurers and for losses incurred but not reported (“IBNR”), management uses the assistance of an independent actuary. The reserves for losses and loss adjustment expenses represent management’s best estimate of the ultimate settlement costs of all losses and loss adjustment expenses. Management believes that the amounts are adequate; however, the inherent impossibility of predicting future events with precision, results in uncertainty as to the amount which will ultimately be required for the settlement of losses and loss expenses, and the differences could be material. Adjustments are reflected in the consolidated statements of operations in the period in which they are determined.

Loss experience refund payable: Certain contracts may include retrospective provisions that adjust premiums or result in profit commissions in the event losses are minimal or zero. In accordance with GAAP, the Company will recognize a liability in the period in which the absence of loss experience obligates the Company to pay cash or other consideration under the contracts. On the contrary, the Company will derecognize such liability in the period in which a loss experience arises. Such adjustments to the liability, which accrue throughout the contract terms, will reduce the liability should a catastrophic loss event covered by the Company occur.

| 10 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Premiums assumed: The Company records premiums assumed, net of loss experience refunds, as earned pro-rata over the terms of the reinsurance agreements, or period of risk, where applicable, and the unearned portion at the consolidated balance sheet date is recorded as unearned premiums reserve. A reserve is made for estimated premium deficiencies to the extent that estimated losses and loss adjustment expenses exceed related unearned premiums. Investment income is not considered in determining whether or not a deficiency exists.

Subsequent adjustments of premiums assumed, based on reports of actual premium by the ceding companies, or revisions in estimates of ultimate premium, are recorded in the period in which they are determined. Such adjustments are generally determined after the associated risk periods have expired; in which case the premium adjustments are fully earned when assumed.

Certain contracts allow for reinstatement premiums in the event of a full limit loss prior to the expiration of the contract. A reinstatement premium is not due until there is a full limit loss event and therefore, in accordance with GAAP, the Company records a reinstatement premium as written only in the event that the reinsured incurs a full limit loss on the contract and the contract allows for a reinstatement of coverage upon payment of an additional premium. For catastrophe contracts which contractually require the payment of a reinstatement premium equal to or greater than the original premium upon the occurrence of a full limit loss, the reinstatement premiums are earned over the original contract period. Reinstatement premiums that are contractually calculated on a pro-rata basis of the original premiums are earned over the remaining coverage period.

Unearned Premiums Ceded: The Company may reduce the risk of future losses on business assumed by reinsuring certain risks and exposures with other reinsurers (retrocessionaires). The Company remains liable to the extent that any retrocessionaire fails to meet its obligations and to the extent that the Company does not hold sufficient security for their unpaid obligations.

Ceded premiums are written during the period in which the risk is incepted and are expensed over the contract period in proportion to the period of protection. Unearned premiums ceded consist of the unexpired portion of the reinsurance obtained. There were no unearned premiums ceded at June 30, 2024 or December 31,2023.

Uncertain Income Tax Positions: The authoritative GAAP guidance on accounting for, and disclosure of, uncertainty in income tax positions requires the Company to determine whether an income tax position of the Company is more likely than not to be sustained upon examination by the relevant tax authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. For income tax positions meeting the more likely than not threshold, the tax amount recognized in the consolidated financial statements, if any, is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority. The application of this authoritative guidance has had no effect on the Company’s consolidated financial statements because the Company had no uncertain tax positions at June 30, 2024.

| 11 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Additionally, the Company uses the guidance in the SEC’s Staff Accounting Bulletin No. 107 to determine the estimated life of options issued and has assumed no forfeitures during the life of the options.

The Company uses the straight-line attribution method for all grants that include only a service condition. Compensation expenses related to all awards is included in general and administrative expenses.

Accounting Updates:

From time to time, new accounting pronouncements are issued by the FASB or other standard-setting bodies that are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the effect of recently issued standards that are not yet effective will not have a material effect on its consolidated financial position or results of operations upon adoption.

Segment Information: Under GAAP, operating segments are based on the internal information that management uses for allocating resources and assessing performance as the source of the Company’s reportable segments. The Company manages its business on the basis of one operating segment, Property and Casualty Reinsurance, in accordance with the qualitative and quantitative criteria established under GAAP.

Reclassifications: Any reclassifications of prior period amounts have been made to conform to the current period presentation.

3. CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AND CASH EQUIVALENTS

| At June 30, | At December 31, | |||||||

| 2024 | 2023 | |||||||

| (in thousands) | ||||||||

| Cash on deposit | $ | $ | ||||||

| Restricted cash held in trust | ||||||||

| Total | $ | $ | ||||||

Cash and cash equivalents are held by large and reputable counterparties in the United States of America and in the Cayman Islands. Restricted cash held in trust is custodied with Truist Bank, and is held in accordance with the Company’s trust agreements with the ceding insurers and trustees, which require that the Company provide collateral having a market value greater than or equal to the limit of liability, less unpaid premium.

| 12 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

4. INVESTMENTS

The Company from time to time invests in fixed-maturity debt securities and equity securities, with its fixed-maturity debt securities classified as available-for-sale. At June 30, 2024 and December 31, 2023, the Company did not hold any available-for-sale securities.

There were no sales of equity securities for three months ended June 30, 2024, nor for the three and six month periods ended June 30, 2023. Proceeds received, and the gross realized gains and losses from sale of equity securities, for the six month period ended June 30, 2024 are as follows:

| Gross | Gross | Gross | ||||||||||

| proceeds | Realized | Realized | ||||||||||

| from sales | Gains | Losses | ||||||||||

| ($ in thousands) | ||||||||||||

| Six Months Ended June 30, 2024 | ||||||||||||

| Equity securities | $ | $ | $ | |||||||||

Other Investments

On August 7, 2023, OXAC held an extraordinary general meeting at which the business combination with Jet Token, Inc. was approved by OXAC shareholders. In conjunction with the business combination, OXAC was redomesticated as a Delaware entity, and changed its name to Jet.AI Inc. The business combination was closed on August 10, 2023, and on August 11, 2023, OXAC common stock and warrants began trading on the Nasdaq Global Market under the new ticker symbols JTAI and JTAIW.

The Company’s beneficial interests in Jet. AI’s ordinary shares, public warrants and Extension Loan are recorded at fair value and are classified in “Other Investments” on the consolidated balance sheets. The fair value calculation of the Company’s beneficial interest in Jet.AI’s ordinary shares and public warrants is dependent on the observable trading prices of JetAI’s Class A shares and public warrants. The fair value calculation of the Company’s beneficial interest in the Extension Loan is estimated to be the pro-rata original principal amount of the Extension Loan due to the short-term nature.

The

Sponsor holds ordinary shares, Series A-1 preferred shares with purchase price of $ each, along with the

As

a result of the re-measurement of our investment in Jet.AI, we recognized for the three and six months ended June 30, 2024, an

unrealized losses of $

Other investments as of June 30, 2024 and December 31, 2023 consist of the following (in thousands):

| June 30, 2024 | December 31, 2023 | |||||||

| Jet.AI. Series A-1 Preferred Shares | $ | $ | ||||||

| Jet.AI common stock | ||||||||

| Total | $ | $ | ||||||

| Beginning of year | ||||||||

| Unrealized loss on investment in affiliate | ( | ) | ( | ) | ||||

| End of year | $ | $ | ||||||

| 13 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

4. INVESTMENTS (continued)

Assets Measured at Estimated Fair Value on a Recurring Basis

The following table presents information about the Company’s financial assets measured at estimated fair value on a recurring basis that is reflected in the consolidated balance sheets at carrying value. The table indicates the fair value hierarchy of the valuation techniques utilized by the Company to determine such fair value as of June 30, 2024 and December 31, 2023:

| Fair Value Measurements Using | ||||||||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | |||||||||||||

| As of June 30, 2024 | ($ in thousands) | |||||||||||||||

| Financial Assets: | ||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | $ | ||||||||||||

| Restricted cash and cash equivalents | $ | $ | $ | $ | ||||||||||||

| Other investments | $ | $ | $ | $ | ||||||||||||

| Equity securities | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| Fair Value Measurements Using | ||||||||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | |||||||||||||

| As of December 31, 2023 | ($ in thousands) | |||||||||||||||

| Financial Assets: | ||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | $ | ||||||||||||

| Restricted cash and cash equivalents | $ | $ | $ | $ | ||||||||||||

| Other investments | $ | $ | $ | $ | ||||||||||||

| Equity securities | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

There were no transfers between Levels 1, 2 or 3 during the three and six months ended June 30, 2024 and 2023.

The following table provides a reconciliation of changes in fair value of the beginning and ending balances for the other investments classified as Level 3:

| Other | ||||

| Investments | ||||

| (in thousands) | ||||

| Fair value of Level 3 other investment at January 1, 2024 | $ | |||

| Investment in affiliate | ||||

| Change in valuation inputs or other assumptions | ||||

| Fair value of Level 3 other investment at June 30, 2024 | $ | |||

| 14 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

5. TAXATION

Under current Cayman Islands law, no corporate entity, including the Company and the subsidiaries, is obligated to pay taxes in the Cayman Islands on either income or capital gains. The Company and Oxbridge Reinsurance Limited have an undertaking from the Governor-in-Cabinet of the Cayman Islands, pursuant to the provisions of the Tax Concessions Law, as amended, that, in the event that the Cayman Islands enacts any legislation that imposes tax on profits, income, gains or appreciations, or any tax in the nature of estate duty or inheritance tax, such tax will not be applicable to the Company and Oxbridge Reinsurance Limited or their operations, or to the ordinary shares or related obligations, until April 23, 2033 and May 17, 2033, respectively.

The Company and its subsidiaries intend to conduct substantially all of their operations in the Cayman Islands in a manner such that they will not be engaged in a trade or business in the U.S. However, because there is no definitive authority regarding activities that constitute being engaged in a trade or business in the U.S. for federal income tax purposes, the Company cannot assure that the U.S. Internal Revenue Service will not contend, perhaps successfully, that the Company or its subsidiary is engaged in a trade or business in the U.S. A foreign corporation deemed to be so engaged would be subject to U.S. federal income tax, as well as branch profits tax, on its income that is treated as effectively connected with the conduct of that trade or business unless the corporation is entitled to relief under an applicable tax treaty.

6. VARIABLE INTEREST ENTITIES

Oxbridge Re NS. On December 22, 2017, the Company established Oxbridge Re NS, a Cayman domiciled and licensed special purpose insurer, formed to provide additional collateralized capacity to support Oxbridge Reinsurance Limited’s reinsurance business. In respect of the debt issued by Oxbridge Re NS to investors, Oxbridge Re NS has entered into a retrocession agreement with Oxbridge Reinsurance Limited effective September 1, 2020. Under this agreement, Oxbridge Re NS receives a quota share of Oxbridge Reinsurance Limited’s catastrophe business. Oxbridge Re NS is a non-rated insurer and the risks have been fully collateralized by way of funds held in trust for the benefit of Oxbridge Reinsurance Limited. Oxbridge Re NS is able to provide investors with access to natural catastrophe risk backed by the distribution, underwriting, analysis and research expertise of Oxbridge Re.

The

Company has determined that Oxbridge Re NS meets the definition of a VIE as it does not have sufficient equity capital to finance its

activities. The Company concluded that it is the primary beneficiary and has consolidated the subsidiary upon its formation, as it owns

Upon issuance of a series of participating notes by Oxbridge Re NS, all of the proceeds from the issuance are deposited into collateral accounts, to fund any potential obligation under the reinsurance agreements entered into with Oxbridge Reinsurance Limited underlying such series of notes. The outstanding principal amount of each series of notes generally is expected to be returned to holders of such notes upon the expiration of the risk period underlying such notes, unless an event occurs which causes a loss under the applicable series of notes, in which case the amount returned is expected to be reduced by such noteholder’s pro rata share of such loss, as specified in the applicable governing documents of such notes. In addition, holders of such notes are generally entitled to interest payments, payable annually, as determined by the applicable governing documents of each series of notes.

In addition, holders of such notes are generally entitled to interest payments, payable annually, as determined by the applicable governing documents of each series of notes.

The Company receives an origination and structuring fee in connection with the formation, operation and management of Oxbridge Re NS.

| 15 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

6. VARIABLE INTEREST ENTITIES (continued)

Notes Payable to Series 2020-1 noteholders

Oxbridge

Re NS entered into a retrocession agreement with Oxbridge Reinsurance Ltd on June 1, 2020 and issued $

The

income from Oxbridge Re NS operations that are attributable to the participating notes noteholders for the six-months ended June 30,

2024 and 2023 was $

SurancePlus Inc.

SurancePlus Inc., a indirect subsidiary of Oxbridge Re Holdings Limited, was incorporated as a British Virgin Islands Business Company on December 19, 2022 for the purposes of tokenizing reinsurance contracts underwritten by its affiliated licensed reinsurer, Oxbridge Re NS.

On March 27, 2023, the Company and SurancePlus Inc. (“SurancePlus”), issued a press release announcing the commencement of an offering by SurancePlus of DeltaCat tokenized reinsurance securities (the “Tokens”), which represent Series DeltaCat Preferred Shares of SurancePlus (“Preferred Shares”, and together with the Tokens, the “Securities”). Each digital security or token, which will have a purchase price of $ per Token, will represent one Preferred Share of SurancePlus.

On

June 27, 2023, SurancePlus Inc. completed its private placement (the “Private Placement”) of Series DeltaCat Re Preferred

Shares represented by DeltaCat Re Tokens (the “Securities”). On June 27, 2023, SurancePlus entered into subscription agreements

with accredited investors and non-U.S. persons in the Private Placement with respect to of the Securities at a purchase price

of $ per token for aggregate gross proceeds of $

| 16 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

6. VARIABLE INTEREST ENTITIES (continued)

On March 18, 2024, Oxbridge Re Holdings Limited (the “Company”) and its indirect wholly owned subsidiary SurancePlus Inc. (“SurancePlus”), a British Virgin Islands Business Company, announced the commencement of an offering by SurancePlus of Participation Shares (the “Securities”) represented by digital tokens to be issued under a 3-year Participation Share Investment Contract (the “PSIC”). The Participation Shares are not shares in SurancePlus and shall have no preemptive right or conversion rights. The Participation Shares solely confer contractual rights against SurancePlus as contained in the PSIC. At the offering’s commencement, up to one million () Participation Shares will be issued, represented by digital tokens labelled “EpsilonCat Re”. The quantity of Participation Shares to be issued in subsequent years of 2025, and 2026, shall be disclosed prior to their issuances. At the start of the offering, the Participation Shares will be offered at an initial price of $ per Participation Share.

On July 11, 2024,

SurancePlus completed its private placement (the “Private Placement”) of Participation Shares (the “Securities”) represented

by digital tokens issued under a 3-year Participation Share Investment Contract (the “PSIC”). On July 11, 2024, SurancePlus

entered into subscription agreements with accredited investors and non-U.S. persons in the Private Placement with respect to

The Securities have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state or other securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or a transaction not subject to the registration requirements of the Securities Act or any state or other securities laws. The Securities were sold in a transaction exempt from registration under the Securities Act and were sold only to persons reasonably believed to be accredited investors in the United States under SEC Rule 506(c) under the Securities Act and outside the United States only to non-U.S. persons in accordance with Regulation S under the Securities Act.

The selected unconsolidated historical financial information and other data presented below is derived from SurancePlus’ standalone unaudited financial statements for the three and six months ended June 30, 2024 and the balance sheet data as of June 30, 2024.

| Statement of Operations Data: | For Three Months Ended | For Six Months Ended | ||||||

| June 30, 2024 | June 30, 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Management fee income | $ | $ | ||||||

| Underwriting related income | ||||||||

| Net Investment and Other Income | ||||||||

| Total revenue | $ | $ | ||||||

| Expenses | $ | ( | ) | $ | ( | ) | ||

| Income attributable to tokenholders | $ | ( | ) | $ | ( | ) | ||

| Net income | ||||||||

| Balance Sheet Data: | At June 30, 2024 | |||

| (Unaudited) | ||||

| (In thousands) | ||||

| Total assets | $ | |||

| Amounts due to Cat Re Tokenholders* | ||||

| Total shareholder’s equity | ||||

| * |

| 17 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

7. RESERVE FOR LOSSES AND LOSS ADJUSTMENT EXPENSES

The following table summarizes the Company’s loss and loss adjustment expenses (“LAE”) and the reserve for loss and LAE reserve movements for the six-month periods ending June 30, 2024 and 2023:

| At June 30, | At June 30, | |||||||

| 2024 | 2023 | |||||||

| (in thousands) | ||||||||

| Balance, beginning of period | $ | $ | ||||||

| Incurred related to: | ||||||||

| Current period | ||||||||

| Prior period | ||||||||

| Total incurred | ||||||||

| Paid related to: | ||||||||

| Current period | ( | ) | ||||||

| Prior period | ||||||||

| Total paid | ( | ) | ||||||

| Balance, end of period | $ | $ | ||||||

When losses occur, the reserves for losses and LAE are typically comprised of case reserves (which are based on claims that have been reported) and IBNR reserves (which are based on losses that are believed to have occurred but for which claims have not yet been reported and include a provision for expected future development on existing case reserves). The Company typically suffers limit losses in the event of a Category 3 or above hurricane making landfall in a populated area where the Company has catastrophe risk exposure. For the six-month periods ended June 30, 2024 and 2023, the Company has recorded it’s reserves for losses and LAE based on the contractual maximum loss the Company can suffer under the affected contracts.

The uncertainties inherent in the reserving process and potential delays by cedants and brokers in the reporting of loss information, together with the potential for unforeseen adverse developments, may result in the reserve for losses and LAE ultimately being significantly greater or less than the reserve provided at the end of any given reporting period. The degree of uncertainty is further increased when a significant loss event takes place near the end of a reporting period. Reserve for losses and LAE estimates are reviewed periodically on a contract-by-contract basis and updated as new information becomes known. Any resulting adjustments are reflected in income in the period in which they become known.

The Company’s reserving process is highly dependent on the timing of loss information received from its cedants and related brokers.

There were no losses incurred during the six-month periods ended June 30, 2024 and 2023.

| 18 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Numerator: | ||||||||||||||||

| Net (loss) income | $ | ( | ) | ( | ) | $ | ( | ) | ||||||||

| Denominator: | ||||||||||||||||

| Weighted average shares - basic | ||||||||||||||||

| Weighted average shares - diluted | ||||||||||||||||

| (Loss) earnings per share - basic | $ | ( | ) | ( | ) | $ | ( | ) | ||||||||

| (Loss) earnings per share - diluted | $ | ( | ) | ( | ) | $ | ( | ) | ||||||||

For the three-month periods ended June 30, 2024 and 2023 and for the six month period ended June 30, 2024 options to purchase ordinary shares and warrants to purchase an aggregate of ordinary shares were anti-dilutive due to the net loss during this period.

For the six-month period ended June 30, 2023, options to purchase ordinary shares and warrants to purchase an aggregate of ordinary shares were anti-dilutive due to the exercise price of these securities, including unrecognized compensation expense, exceeded the average market price of the Company’s ordinary shares during the period ended June 30, 2023.

GAAP requires the Company to use the two-class method in computing basic (loss) earnings per share since holders of the Company’s restricted stock have the right to share in dividends, if declared, equally with common shareholders. These participating securities effect the computation of both basic and diluted (loss) earnings per share during periods of net (loss) income.

9. WARRANTS

There

were

10. DIVIDENDS

For the period ended June 30, 2024, none of the Company’s retained earnings were restricted from payment of dividends to the company’s shareholders. However, since most of the Company’s capital and retained earnings may be invested in its subsidiaries, a dividend from the subsidiaries would likely be required in order to fund a dividend to the Company’s shareholders and would require notification to the Cayman Islands Monetary Authority (“CIMA”).

Under Cayman Islands law, the use of additional paid-in capital is restricted, and the Company will not be allowed to pay dividends out of additional paid-in capital if such payments result in breaches of the prescribed and minimum capital requirement.

| 19 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

The Company currently has outstanding stock-based awards granted under the 2014 Omnibus Incentive Plan (the “2014 Plan”) and the 2021 Omnibus Incentive Plan (the “2021 Plan”) (hereinafter collectively referred to as “the Plans”). Under each of the Plans, the Company has discretion to grant equity and cash incentive awards to eligible individuals, including the issuance of up to of the Company’s ordinary shares. During the period ended June 30, 2024, the Company granted restricted stock to directors, officers and employees under the 2021 Plan. At June 30, 2024, there were shares and shares available for grant under the 2021 Plan and the 2014 Plan, respectively.

Stock options

Stock options granted and outstanding under the Plan vests quarterly over four years and are exercisable over the contractual term of .

| Weighted- | ||||||||||||||||

| Weighted- | Average | |||||||||||||||

| Number | Average | Remaining | Aggregate | |||||||||||||

| of | Exercise | Contractual | Intrinsic | |||||||||||||

| Options | Price | Term | Value | |||||||||||||

| Outstanding at January 1, 2023 | years | |||||||||||||||

| Forfeited | ( | ) | $ | |||||||||||||

| Outstanding at March 31, 2023 | $ | years | ||||||||||||||

| Exercisable at March 31, 2023 | $ | years | ||||||||||||||

| Outstanding at June 30, 2023 | $ | years | $ | |||||||||||||

| Exercisable at June 30, 2023 | $ | years | $ | |||||||||||||

| Outstanding at January 1, 2024 | $ | years | $ | |||||||||||||

| Outstanding at March 31, 2024 | $ | years | $ | |||||||||||||

| Exercisable at March 31, 2024 | $ | years | $ | |||||||||||||

| Outstanding at June 30, 2024 | $ | years | $ | |||||||||||||

| Exercisable at June 30, 2024 | $ | years | $ | |||||||||||||

Compensation expense recognized for the three-month periods ended June 30, 2024 and 2023 totaled $and $and for the six-month periods ended June 30, 2024 and 2023 totaled $and $.Compensation expense is included in general and administrative expenses. At June 30, 2024 and 2023, there was approximately $and $, respectively, of total unrecognized compensation expense related to non-vested stock options granted under the Plans. The Company expects to recognize the remaining compensation expense over a weighted-average period of six (6) months.

Restricted Stock Awards

The Company may grant restricted stock awards to eligible individuals in connection with their service to the Company. The terms of the Company’s outstanding restricted stock grants may include service, performance and market-based conditions. The fair value of the awards with market-based conditions is determined using a Monte Carlo simulation method, which calculates many potential outcomes for an award and then establishes fair value based on the most likely outcome. The determination of fair value with respect to the awards with only performance or service-based conditions is based on the value of the Company’s stock on the grant date.

| 20 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

11. SHARE-BASED COMPENSATION (cont’d)

Restricted stock awards (continued)

During the six-month periods ended June 30, 2024 and 2023, the Company granted and shares of restricted stock, respectfully to directors and employees under the 2021 Plan. Information with respect to the activity of unvested restricted stock awards during the periods ended June 30, 2024 and 2023 is as follows (share amounts not in thousands):

| Weighted- | ||||||||

| Number of | Weighted- | |||||||

| Restricted | Average | |||||||

| Stock | Grant Date | |||||||

| Awards | Fair Value | |||||||

| Nonvested at January 1, 2024 | $ | |||||||

| Granted | $ | |||||||

| Vested | ( | ) | $ | |||||

| Nonvested at June 30, 2024 | ||||||||

Compensation expense recognized for the three and six-month periods ended June 30, 2024 totaled $ and $, respectively and is included in general and administrative expenses. Compensation expense for the three- and six-month periods ended June 30, 2023 totaled $ and $, respectively. At June 30, 2024, there was approximately $ unrecognized compensation expense related to non-vested restricted stock granted under the Plan, which the Company expects to recognize over a weighted-average period of eight (8) months.

Subsidiary Equity Plan

On March 25, 2024, SurancePlus Holdings Ltd. (“SPH”), a Cayman Islands exempted company and indirectly owned subsidiary of the Company, adopted and approved the SurancePlus Holdings Ltd. 2024 Equity Incentive Plan (the “SPH Equity Incentive Plan”), which authorizes SPH to grant restricted SPH shares, restricted share units, incentive share options, non-qualified share options, and other share-based awards to officers, directors, employees, and consultants of SPH in order to incentivize and align their interests with the interests of SPH and other shareholders in SPH. The SPH Equity Incentive Plan authorizes the grant of incentive awards with respect to up to shares of SPH Ordinary Shares, subject to customary adjustments. The SPH Equity Incentive Plan is administered by the board of directors of SPH (the “SPH Board”) or any committee of SPH directors appointed by the SPH Board. The SPH Equity Incentive Plan contains various other customary terms and conditions, and unless terminated earlier, the SPH Equity Incentive Plan will terminate on the 10th anniversary of the effective date of the SPH Equity Incentive Plan. The Company, as the initial sole shareholder of SPH, also approved the SPH Equity Incentive Plan on March 25, 2024, by action of the Company’s board of directors.

On March 25, 2024, the SPH Board granted to SPH employees an aggregate of SPH Ordinary Shares pursuant to a form of Restricted Share Award Agreement (the “SPH Restricted Share Agreement”) that vest ratably over a period of 1 to 2 years. The SPH Board also granted options to purchase SPH Ordinary Shares pursuant to a form of Option Award Agreement (the “SPH Option Award Agreement”) which vest in quarterly increments over a period of 4 years and has an exercise price of $ per share. The restricted shares and option grants are subject to the holder of the restricted shares and options remaining continuously employed by the Company or its subsidiaries through and as of the applicable vesting date. Upon a change of control of SPH (as defined in the SPH Equity Incentive Plan), any unvested restricted shares and options shall immediately vest.

12. NET WORTH FOR REGULATORY PURPOSES

The

subsidiaries are subject to a minimum and prescribed capital requirement as established by CIMA.

At

June 30, 2024, the Oxbridge Reinsurance Limited’s net worth of $

At

June 30, 2024, the Oxbridge Re NS’ net worth of $

The Subsidiaries are not required to prepare separate statutory financial statements for filing with CIMA, and there were no material differences between the Subsidiaries’ GAAP capital, surplus and net (loss) income, and its statutory capital, surplus and net (loss) income as of June 30, 2024 or for the period then ended.

| 21 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

13. FAIR VALUE AND CERTAIN RISKS AND UNCERTAINTIES)

Fair values

With the exception of balances in respect of insurance contracts (which are specifically excluded from fair value disclosures under GAAP) and investment securities as disclosed in Note 4 of these consolidated financial statements, the carrying amounts of all other financial instruments, which consist of cash and cash equivalents, restricted cash and cash equivalents, accrued interest and dividends receivable, premiums receivable and other assets, notes payable and accounts payable and other liabilities, approximate their fair values due to their short-term nature.

Concentration of underwriting risk

A substantial portion of the Company’s current reinsurance business ultimately relates to the risks of a limited number of entities; accordingly, the Company’s underwriting risks are not significantly diversified.

Concentrations of Credit and Counterparty Risk

The Company markets retrocessional and reinsurance policies worldwide through its brokers. Credit risk exists to the extent that any of these brokers may be unable to fulfill their contractual obligations to the Company. For example, the Company is required to pay amounts owed on claims under policies to brokers, and these brokers, in the Company. In some jurisdictions, if a broker fails to make such a payment, the Company might remain liable to the ceding company for the deficiency. In addition, in certain jurisdictions, when the ceding company pays premiums for these policies to brokers, these premiums are considered to have been paid and the ceding insurer is no longer liable to the Company for those amounts, whether or not the premiums have actually been received.

The Company remains liable for losses it incurs to the extent that any third-party reinsurer is unable or unwilling to make timely payments under reinsurance agreements. The Company would also be liable in the event that its ceding companies were unable to collect amounts due from underlying third-party reinsurers.

The Company mitigates its concentrations of credit and counterparty risk by using reputable and several counterparties which decreases the likelihood of any significant concentration of credit risk with any one counterparty.

Market risk

Market risk exists to the extent that the values of the Company’s monetary assets fluctuate as a result of changes in market prices. Changes in market prices can arise from factors specific to individual securities or their respective issuers, or factors affecting all securities traded in a particular market. Relevant factors for the Company are both volatility and liquidity of specific securities and markets in which the Company holds investments. The Company has established investment guidelines that seek to mitigate significant exposure to market risk.

| 22 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

14. LEASES

Operating lease right-of-use assets and operating lease liabilities are disclosed as line in the consolidated balance sheets. We determine if a contract contains a lease at inception and recognize operating lease right-of-use assets and operating lease liabilities based on the present value of the future minimum lease payments at the commencement date. As our leases do not provide an implicit rate, we use our incremental borrowing rate based on the information available at the commencement date in determining the present value of future payments. Lease agreements that have lease and non-lease components, are accounted for as a single lease component. Lease expense is recognized on a straight-line basis over the lease term.

The

Company has two operating lease obligations namely for the Company’s office facilities located at Suite 201, 42 Edward Street Grand

Cayman, Cayman Islands and residential space at Turnberry Villas in Grand Cayman, Cayman Islands. The office lease has a remaining lease

term of approximately thirty-two (

The components of lease expense and other lease information as of and during the six-month periods ended June 30, 2024 and 2023 are as follows:

| For the Six- Month Period | For the Six- Month Period | |||||||

| (in thousands) | Ended June 30, 2024 | Ended June 30, 2023 | ||||||

| Operating Lease Cost (1) | $ | $ | ||||||

| Cash paid for amounts included in the measurement of lease liabilities | ||||||||

| Operating cash flows from operating leases | $ | $ | ||||||

| (1) |

| (in thousands) | At June 30, 2024 | At December 31, 2023 | ||||||

| Operating lease right-of-use assets | $ | $ | ||||||

| Operating lease liabilities | $ | $ | ||||||

| Weighted-average remaining lease term - operating leases | ||||||||

| Weighted-average discount rate - operating leases | % | |||||||

Future minimum lease payments under non-cancellable leases as of June 30, 2024 and December 31, 2023, reconciled to our discounted operating lease liability presented on the consolidated balance sheet are as follows:

| (in thousands) | At June 30, 2024 | At December 31, 2023 | ||||||

| Remainder of 2024 | $ | $ | ||||||

| 2025 | ||||||||

| 2026 | ||||||||

| Thereafter | ||||||||

| Total future minimum lease payments | $ | $ | ||||||

| Less imputed interest | ( | ) | ||||||

| Total operating lease liability | $ | $ | ||||||

| 23 |

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Notes to Consolidated Financial Statements (unaudited)

June 30, 2024

15. RELATED PARTY TRANSACTIONS

Epsilon Re Tokens

During

the six-month period ended June 30, 2024, Mr. Jay Madhu, a director and officer of the Company and its subsidiaries, entered into subscription

agreement to purchase a total of Series Epsilon Cat Re tokens at a purchase price of $ per token for aggregate gross proceeds

of $

TypTap Insurance Company (“TypTap”) Contract

During

the three-month and six-month periods ended June 30, 2024 the Company entered into a reinsurance agreement with TypTap, an insurance

subsidiary of HCI Group, Inc., which is a related entity through common directorship. At June 30, 2024, included within premium receivable,

deferred acquisition costs and unearned premiums on the condensed consolidated balance sheets are amounts equal to $

Bridge Loan with Affiliate

On

September 11, 2023, the Company, along with seven (7) other investors, entered into a binding term sheet (“Bridge Agreement”)

with Jet.AI to provide Jet.AI with an aggregate sum of $

The

Bridge Agreement provides for the issuance of Notes in an aggregate principal amount of $

An event of default under the Notes includes failing to redeem the Notes as provided above and other typical bankruptcy events of Jet.AI. In an event of default, the outstanding principal amount of the Notes will increase by 120%, and the company may convert its Note into shares of common stock of Jet.AI at the conversion price set forth in the Bridge Agreement with registration rights associated with those shares.

The

Company invested the sum of $

16. SUBSEQUENT EVENTS

We evaluate all subsequent events and transactions for potential recognition or disclosure in our consolidated financial statements.

On

July 11, 2024, SurancePlus Inc. (“SurancePlus”), an indirect wholly owned subsidiary of Oxbridge Re Holdings Limited

(“Oxbridge”), completed its private placement (the “Private Placement”) of Participation Shares (the

“Securities”) represented by digital tokens issued under a 3-year Participation Share Investment Contract (the

“PSIC”). On July 11, 2024, SurancePlus entered into subscription agreements with accredited investors and non-U.S.

persons in the Private Placement with respect to

The Securities were issued pursuant to the exemptions from registration contained in Rule 506(c) of Regulation D and Regulation S of the Securities Act of 1933, as amended (the “Securities Act”). SurancePlus relied, in part, upon representations made in the subscription agreements by each subscriber that the subscriber was an accredited investor as defined in Regulation D under the Securities Act or was not a U.S. Person as defined under Rule 902 of Regulation S. The issuance involved general solicitation in connection with the offering as permitted by Rule 506(c) of Regulation D. No underwriting discounts or commissions were or will be paid with respect to such sales.

ATM Facility

Subsequent to

June 30, 2024, and through the date of issuance of these financial statements, we sold an additional

ordinary shares under the ATM program for gross proceeds of $

Warrant Conversion

On July 29, 2024, the Company’s warrants were converted into of Jet.AI’s common stock in accordance with Jet.AI’s Tender Offer Statement (as amended) as filed with the Securities and Exchange Commission on July 23, 2024.

| 24 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

Certain statements in this Quarterly Report on Form 10-Q, including in this Management’s Discussion and Analysis, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements generally are identified by the words “believe,” “project,” “predict,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” contained in our Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 26, 2024. We undertake no obligation to publicly update or revise any forward -looking statements, whether as a result of new information, future events, or otherwise. Readers are cautioned not to place undue reliance on the forward -looking statements which speak only to the dates on which they were made.

GENERAL

The following is a discussion and analysis of our results of operations for the three and six-month periods ended June 30, 2024 and 2023 and our financial condition as of June 30, 2024 and December 31, 2023. The following discussion should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q and in our Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 26, 2024. References to “we,” “us,” “our,” “our company,” or “the Company” refer to Oxbridge Re Holdings Limited and its wholly-owned subsidiaries, Oxbridge Reinsurance Limited and Oxbridge Re NS, unless the context dictates otherwise.

Overview and Trends

We are a Cayman Islands specialty property and casualty reinsurer that provides reinsurance solutions through our reinsurance subsidiaries, Oxbridge Reinsurance Limited and Oxbridge Re NS. We focus on underwriting fully collateralized reinsurance contracts primarily for property and casualty insurance companies in the Gulf Coast region of the United States, with an emphasis on Florida. We specialize in underwriting medium frequency, high severity risks, where we believe sufficient data exists to analyze effectively the risk/return profile of reinsurance contracts. Oxbridge Re NS functions as a reinsurance sidecar which increases the underwriting capacity of Oxbridge Reinsurance Limited. Oxbridge Re NS issues participating notes to third party investors, the proceeds of which are utilized to collateralize Oxbridge Reinsurance Limited’s reinsurance obligations.

In addition to our historical reinsurance business operations, in 2023, our new subsidiary SurancePlus developing, offering, and selling a tokenized reinsurance security representing fractionalized interests in reinsurance contracts, with each token representing an interest in participating notes issued by Oxbridge Re NS. These efforts culminated in the development, launch, and issuance of our first tokenized reinsurance security, the DeltaCat Re Token, which we believe is the first “on-chain” reinsurance security of its kind to be developed by a subsidiary of a public company. Following the issuance of the DeltaCat Re Token, we intend to develop, launch, and issue additional series of tokenized reinsurance securities representing fractional interests in reinsurance contracts, and we are also using our tokenization experience and activities as a foundation for developing Web3-focused business offerings and products relating to the tokenization of other real-world assets (RWAs), including RWAs held or being acquired by third parties. Our tokenization business will be conducted through SurancePlus and through other subsidiaries of our wholly owned subsidiary, SurancePlus Holdings Ltd. (“SurancePlus Holdings”), [a Cayman Islands exempted company] that we have organized to serve as a holding company for subsidiaries that will operate our developing Web3-focused business operations.

| 25 |

In our historical reinsurance business operations, we underwrite reinsurance contracts on a selective and opportunistic basis as opportunities arise based on our goal of achieving favorable long-term returns on equity for our shareholders. Our goal is to achieve long-term growth in book value per share by writing business that generates attractive underwriting profits relative to the risk we bear. Additionally, we intend to complement our underwriting profits with investment profits on an opportunistic basis. Our underwriting business focus is on fully collateralized reinsurance contracts for property catastrophes, primarily in the Gulf Coast region of the United States. Within that market and risk category, we attempt to select the most economically attractive opportunities across a variety of property and casualty insurers. As we attempt to grow our capital base, we expect that we will consider further growth opportunities in other geographic areas and risk categories.

Our level of profitability is primarily determined by how adequately our premiums assumed and investment income cover our costs and expenses, which consist primarily of acquisition costs and other underwriting expenses, claim payments and general and administrative expenses. One factor leading to variation in our operational results is the timing and magnitude of any follow-on offerings we undertake (if any), as we are able to deploy new capital to collateralize new reinsurance treaties and consequently, earn additional premium revenue. In addition, our results of operations may be seasonal in that hurricanes and other tropical storms typically occur during the period from June 1 through November 30. Further, our results of operations may be subject to significant variations due to factors affecting the property and casualty insurance industry in general, which include competition, legislation, regulation, general economic conditions, judicial trends, and fluctuations in interest rates and other changes in the investment environment.

Because we employ an opportunistic underwriting and investment philosophy, period-to-period comparisons of our underwriting results may not be meaningful. In addition, our historical investment results may not necessarily be indicative of future performance. Due to the nature of our reinsurance and investment strategies, our operating results will likely fluctuate from period to period.

Compared to most of our competitors, we are small and have low overhead expenses. We believe that our expense efficiency, agility and existing relationships support our competitive position and allows us to profitably participate in lines of business that fit within our strategy. Over time we expect our expense advantage to erode as the industry acts to reduce frictional costs.

Recent Developments

Formation of SurancePlus

SurancePlus, an indirect wholly-owned subsidiary of the Company, was incorporated as a British Virgin Islands Business Company on December 19, 2022 for the purpose of tokenizing reinsurance contracts underwritten by its affiliated licensed reinsurer, Oxbridge Re NS.

On March 27, 2023, we, through SurancePlus, issued a press release announcing the commencement of an offering by SurancePlus of up to $5.0 million of DeltaCat Re Tokens with a purchase price of $10.00 per DeltaCat Re Token and representing one share of Series DeltaCat Re Preferred Shares per DeltaCat Re Token (the “Private Placement”).

On June 27, 2023, SurancePlus completed the Private Placement. The aggregate amount raised in the Private Placement was $2,447,760 for the issuance of 244,776 DeltaCat Re Tokens, of which approximately $1,280,000 was received from third-party investors and approximately $1,167,000 was received from Oxbridge Re Holdings Limited.

On September 11, 2023, the DeltaCat Re tokens were reclassified as tokenized interests carrying rights equivalent to the DeltaCat Re Preferred Shares in accordance with the provisions of British Virgin Islands law.

On March 18, 2024, Oxbridge Re Holdings Limited (the “Company”) and its indirect wholly owned subsidiary SurancePlus Inc. (“SurancePlus”), a British Virgin Islands Business Company, announced the commencement of an offering by SurancePlus of Participation Shares (the “Securities”) represented by digital tokens to be issued under a 3-year Participation Share Investment Contract (the “PSIC”). The Participation Shares are not shares in SurancePlus and shall have no preemptive right or conversion rights. The Participation Shares solely confer contractual rights against SurancePlus as contained in the PSIC. At the offering’s commencement, up to one million (1,000,000) Participation Shares were issued, represented by digital tokens labelled “EpsilonCat Re”. The quantity of Participation Shares to be issued in subsequent years of 2025, and 2026, shall be disclosed prior to their issuances. At the start of the offering, the Participation Shares were offered at an initial price of $10.00 per Participation Share.

| 26 |

The net proceeds from the offer and sale of the Participation Shares were used by SurancePlus to purchase one or more participating notes of Oxbridge Re NS, an affiliated Cayman Islands licensed reinsurance entity, and the proceeds from the sale of such participating notes were invested in collateralized reinsurance contracts to be underwritten by Oxbridge Re NS. The holders of the Participation Shares are generally be entitled to proceeds from the payment of the participating notes in the amount of a preferred return equal to the initial Participation Share price, plus 20%, and then 80% of any proceeds in excess of the amount necessary to pay the preferred return.

On July 11, 2024, SurancePlus Inc. (“SurancePlus”), an indirect wholly owned subsidiary of Oxbridge Re Holdings Limited (“Oxbridge”), completed its private placement (the “Private Placement”) of Participation Shares (the “Securities”) represented by digital tokens issued under a 3-year Participation Share Investment Contract (the “PSIC”). On July 11, 2024, SurancePlus entered into subscription agreements with accredited investors and non-U.S. persons in the Private Placement with respect to 287,705 of the Participation Shares represented by the digital tokens, EpsilonCat Re at a purchase price of $10.00 per Participation Share for aggregate gross proceeds of $2,878,048 which approximately $1,469,000 was received from third-party investors and approximately $1,409,000 from Oxbridge Re Holdings Limited. Approximately $312,000 and $299,000 of management fees were deducted from the gross proceeds from the third-party investors and Oxbridge Re Holdings Limited, respectively, The tokens were issued on the Avalanche blockchain. Ownership of EpsilonCat Re tokenized Participation Shares indirectly confers fractionalized interests in reinsurance contracts underwritten by Oxbridge Re’s reinsurance subsidiary, Oxbridge Re NS, for the 2024-2025 treaty year. The Participation Shares are not shares in SurancePlus and shall have no preemptive right or conversion rights. The Participation Shares solely confer contractual rights against SurancePlus as contained in the PSIC.

Oxbridge Acquisition Corp.

On February 28, 2023, the Company announced in a press release that Oxbridge Acquisition filed a Current Report on Form 8-K with the Securities and Exchange Commission in connection with Oxbridge Acquisition’s business combination with Jet Token Inc. (“Jet”), a Delaware based company. Upon the closing of the transaction, the combined company will be named Jet.AI Inc. Jet offers fractional aircraft ownership, jet card, aircraft brokerage and charter service through its fleet of private aircraft and those of Jet’s Argus Platinum operating partner. Jet’s charter app enables travelers to look, book and fly. The funding and capital markets access from this transaction is expected to enable Jet to continue its growth strategy of AI software development and fleet expansion. The business combination was completed on August 10, 2023.

The Company’s wholly-owned licensed reinsurance subsidiary, Oxbridge Reinsurance Limited (“Oxbridge Reinsurance”), is the lead investor in Oxbridge Acquisition’s sponsor and at June 30, 2024, held the equivalent of 1,423,827 of Jet.AI Inc’s common stock (NASDAQ: JTAI) and 3,094,999 of Jet.AI Inc’s warrants (NASDAQ: JTAIW). On July 29, 2024, the Company’s 3,094,999 warrants were converted into 945,211 of Jet.AI’s common stock in accordance with Jet.AI’s Tender Offer Statement (as amended) as filed with the Securities and Exchange Commission on July 23, 2024.

Bridge Loan with Affiliate

On September 11, 2023, the Company, along with seven (7) other investors, entered into a binding term sheet (“Bridge Agreement”) with Jet.AI to provide Jet.AI with an aggregate sum of $500,000 of short-term bridge financing pending its receipt of funds from its other existing financing arrangements. During the month of September 2023, and prior to the Bridge Agreement, Jet.AI had engaged in discussions with numerous third parties to secure short-term bridge funding but was not offered terms it found acceptable.

The Bridge Agreement provides for the issuance of Notes in an aggregate principal amount of $625,000, reflecting a 20% original issue discount. The Notes bear interest at 5% per annum and mature on March 11, 2024. Jet.AI is required to redeem the Notes with 100% of the proceeds of any equity or debt financing at a redemption premium of 110% of the principal amount of the Notes. Jet.AI anticipates redeeming the Notes in full with proceeds expected to be received over the next several months from existing financing arrangements.

An event of default under the Notes includes failing to redeem the Notes as provided above and other typical bankruptcy events of Jet.AI. In an event of default, the outstanding principal amount of the Notes will increase by 120%, and the company may convert its Note into shares of common stock of Jet.AI at the conversion price set forth in the Bridge Agreement with registration rights associated with those shares.

The Company invested the sum of $100,000 in the Notes and was previously recorded as “Loan Receivable” on the consolidated balance sheets at cost. On March 11, 2024, the Notes matured and were redeemed by Jet.AI in accordance with the Bridge Agreement. The Company received an aggregate of $141,000 upon the redemption of the Notes.

| 27 |

ATM Facility