As filed with the Securities and Exchange Commission on September 13, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Akoustis Technologies,

Inc. *

(Exact name of registrant as specified in its charter)

| Delaware | 33-1229046 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

9805 Northcross Center Court, Suite A

Huntersville, North Carolina 28078

(704) 997-5735

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Jeffrey B. Shealy

President and Chief Executive Officer

Akoustis Technologies, Inc.

9805 Northcross Center Court, Suite A

Huntersville, North Carolina 28078

(704) 997-5735

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Sean M. Jones

Coleman Wombwell

K&L Gates LLP

300 South Tryon Street, Suite 1000

Charlotte, North Carolina 28202

(704) 331-7400

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | þ | Smaller reporting company | þ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

* Additional Registrant Guarantor

| Exact name of additional registrant as specified in its charter (1) |

State or other jurisdiction of incorporation or organization |

I.R.S. Employer Identification No. | ||

| Akoustis, Inc. | Delaware | 46-5645617 |

| (1) | The address of the additional registrant guarantor’s principal executive office is 9805 Northcross Center Court, Suite A, Huntersville, North Carolina 28078 and the phone number is (704) 997-5735. |

The information in this prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling security holders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 13, 2022

AKOUSTIS TECHNOLOGIES, INC.

AKOUSTIS, INC.

Prospectus

$44,000,000 of 6.0% Convertible Senior Notes due 2027 for sale by the Selling Security Holders

(fully and unconditionally guaranteed by Akoustis, Inc.)

13,100,000 Shares of Common Stock issuable in respect of the Notes for sale by the Selling Security Holders

This prospectus relates to the sale or other disposition from time to time of up to $44,000,000 aggregate principal amount of our 6.0% Convertible Senior Notes due 2027 (the “Notes”), up to 9,341,825 shares of common stock, par value $0.001 per share (“Common Stock”), that may be issued upon conversion of the Notes, and up to an additional 3,758,175 shares of Common Stock that may be issued, at our election, as payment of accrued interest on the Notes, as make-whole payments made in connection with certain conversions of the Notes or as payments made in connection with qualifying fundamental changes of Akoustis Technologies, Inc. (the “Company”), in each case as further described in the section of this prospectus entitled “Description of Notes” by the persons described in this prospectus, whom we call the “Selling Security Holders,” identified in the section of this prospectus entitled “Selling Security Holders,” or their transferees. The Notes are fully, unconditionally and irrevocably guaranteed (the “Guarantee”) by our wholly-owned subsidiary. We are registering the Notes, the Guarantee, and shares of Common Stock issuable upon conversion and in respect of the Notes as required by the terms of the registration rights agreement among the purchasers in the offering of the Notes, us, and the guarantor party thereto, for the benefit of the Selling Security Holders. Such registration does not mean that the Selling Security Holders will actually offer or sell any of the Notes, the Guarantee or shares of Common Stock issuable upon conversion and in respect of the Notes. We will not receive any of the proceeds from the sale or other disposition of such securities offered by the Selling Security Holders.

The Notes, the Guarantee and shares of Common Stock offered by this prospectus (collectively, the “Securities”) may be sold by the Selling Security Holders from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices. We will not receive any proceeds from the sale of the Securities by the Security Holders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the Selling Security Holders will be borne by them.

Our Common Stock is traded on the Nasdaq Capital Market (“Nasdaq”) under the symbol “AKTS.” On September 9, 2022, the last reported sale price for our Common Stock was $4.43 per share. There is no public market for the Notes and we do not intend to list or quote the Notes on any securities exchange or any quotation system.

Our business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you should read and carefully consider risks described in the “Risk Factors” section beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2022.

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The Selling Security Holders are offering to sell and seeking offers to buy the Securities only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any Securities in any jurisdiction where the offer is not permitted.

TABLE OF CONTENTS

i

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that should be considered before investing in our Securities. Potential investors should read the entire prospectus carefully, including the more detailed information regarding our business provided in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 incorporated herein by reference, the risks of purchasing our Securities discussed under the “Risk Factors” section, and our financial statements and the accompanying notes to the financial statements incorporated herein by reference.

Unless the context indicates or requires otherwise, all references in this registration statement to “Akoustis Technologies,” “Akoustis,” the “Company,” “we,” “us” and “our” refer to Akoustis Technologies, Inc. and its wholly owned consolidated subsidiary, Akoustis, Inc., each a Delaware corporation.

This prospectus includes the trademarks of Akoustis, Inc., Akoustis™ and XBAW™: See “Description of Business − Intellectual Property.” All references to Akoustis and XBAW in this prospectus are intended to include reference to such trademarks.

Our Company

Akoustis® is an emerging commercial product company focused on developing, designing, and manufacturing innovative RF filter solutions for the wireless industry, including for products such as smartphones and tablets, network infrastructure equipment, WiFi Customer Premise Equipment (“CPE”), automotive, industrial and defense applications. Filters are critical in selecting and rejecting signals, and their performance enables differentiation in the functionality of the RF front-end (“RFFE”). Located between the device’s antenna and its digital backend, the RFFE is the circuitry that performs the analog signal processing and contains components such as amplifiers, filters and switches. We have developed a proprietary microelectromechanical system (“MEMS”) based bulk acoustic wave (“BAW”) technology and a unique patented transfer process flow, called XBAWTM to manufacture our filters for use in RFFE modules. Our XBAW filters incorporate optimized high purity piezoelectric materials for high power, high frequency and wide bandwidth operation. We are developing RF filters for 5G, WiFi and defense bands using our proprietary resonator device models and product design kits (PDKs). As we qualify our RF filter products, we engage with target customers to evaluate our filter solutions. Our designs target UHB, (sub-6 GHz) 5G, WiFi and defense bands. More recently, we have engaged multiple customers whom lack access to high performance BAW filters and supply RFFE solutions for mobile applications such as smartphones, PC’s and AR/VR devices, to market and sell our products. Our RF filter solutions address problems (such as loss, bandwidth, power handling, and isolation) created by the growing number of frequency bands in the RFFE of mobile devices, PCs, automotive, infrastructure and premise equipment to support 5G, and WiFi. We prototype, sample and shipped commercial production volume of our single-band and multi-band low loss BAW filter designs for 5G frequency bands and 5 GHz and 6 GHz WiFi bands which are suited to competitive BAW solutions and historically cannot be addressed with low-band, lower power handling surface acoustic wave (“SAW”) technology. We manufacture our high-performance RF filter circuits, using our first generation XBAW wafer process, in our 120,000-square foot wafer- manufacturing facility located in Canandaigua, New York, which we acquired in June 2017. Additionally, through our recent acquisition of RFM Integrated Device, Inc. (“RFMi”), we operate a fabless business whereby we make sales of complementary SAW resonators, RF filters, crystal (Xtal) resonators and oscillators, and ceramic products—addressing opportunities in multiple end markets, such as automotive and industrial applications.

We own and/or have filed applications for patents on the core resonator device technology, manufacturing facility and intellectual property (“IP”) necessary to produce our RF filter chips and operate as a “pure-play” RF filter supplier, providing discrete filter solutions direct to Original Equipment Manufacturers (“OEMs”) and aligning with the front- end module manufacturers that seek to acquire high performance filters to expand their module businesses. We believe this business model is the most direct and efficient means of delivering our solutions to the market.

1

Technology. Our device technology is based upon bulk-mode acoustic resonance, which we believe is superior to surface-mode resonance for high-band and ultra-high-band (“UHB”) applications that include 4G/LTE, 5G, WiFi, automotive, industrial and defense applications. Although some of our target customers utilize or manufacture the RFFE module, they may lack access to critical UHB filter technology that we produce, which is necessary to compete in high frequency applications.

Manufacturing. We currently manufacture Akoustis’ high-performance RF filter circuits, using our first generation XBAW® wafer process, in our 120,000-square foot wafer- manufacturing facility located in Canandaigua, New York, which we acquired in June 2017. RFMi products are manufactured by a third party and sold by RFMi either directly to customers or sold and shipped with Akoustis products.

Intellectual Property. As of August 31, 2022, our IP portfolio included 67 patents, including a blocking patent that we have licensed from Cornell University. Additionally, as of August 31, 2022, we have 117 pending patent applications. These patents cover our XBAW® RF filter technology from raw materials through the system architectures.

By designing, manufacturing, and marketing our RF filter products to mobile phone OEMs, defense OEMs, network infrastructure OEMs, and WiFi CPE OEMs, we seek to enable broader competition among the front-end module manufacturers.

Since we own and/or have filed applications for patents on the core technology and control access to our intellectual property, we offer several ways to engage with potential customers. First, we engage with multiple wireless markets, providing standardized filters that we design and offer as standard catalog components. Second, we deliver unique filters to customer-supplied specifications, which we design and fabricate on a customized basis. Finally, we offer our models and design kits for our customers to design their own filters utilizing our proprietary technology.

Plan of Operation

We commercialize our technology by designing and manufacturing single-band and multi-band BAW RF filter solutions in our New York semiconductor chip fabrication facility. Our filter solutions address problems (such as loss, bandwidth, power handling, and isolation) created by the growing number of frequency bands in the RFFE of mobile devices, infrastructure and premise equipment to support 4G/LTE, 5G, and WiFi. We manufacture our single-band low-loss BAW filter designs for 4G/LTE frequency bands, which are dominated by competitive BAW solutions and historically cannot be addressed with low-band, lower power handling surface acoustic wave (“SAW”) technology.

We expect to continue to incur substantial costs for commercialization of our technology on a continuous basis because our business model involves materials and solid state device technology development and engineering of catalog and custom filter design solutions. To succeed across our combined portfolio of Akoustis, XBAW, and RFMi products, we must convince customers in a wide range of industries including mobile phone OEMs, RFFE module manufacturers, network infrastructure OEMs, WiFi CPE OEMs, medical device makers, automotive and defense customers to use our products in their systems and modules. For example, since there are two dominant BAW filter suppliers in the industry that have high-band technology, and both utilize such technology as a competitive advantage at the module level, we expect customers that lack access to high-band filter technology will be open to engage with our company for XBAW filters.

To help drive our XBAW filter business, we plan to continue to pursue RF filter design and R&D development agreements and potentially joint ventures with target customers and other strategic partners, although we cannot guarantee we will be successful in these efforts. These types of arrangements may subsidize technology development costs and qualification, filter design costs, and offer complementary technology and market intelligence and other avenues to revenue. However, we intend to retain ownership of our core XBAW technology, intellectual property, designs, and related improvements. Across our combined portfolio of Akoustis, XBAW, and RFMi products, we expect to continue development of catalog designs for multiple customers and to offer such catalog products in multiple sales channels.

2

About This Offering

This prospectus relates to the public offering by the Selling Security Holders listed in this prospectus of up to $44,000,000 aggregate principal amount of 6.0% Convertible Senior Notes due 2027, including the Guarantee, and up to 13,100,000 shares of Common Stock issuable upon conversion or in respect of the Notes. The Securities offered by this prospectus may be sold by the Selling Security Holders from time to time in the open market, through negotiated transactions or otherwise at market prices prevailing at the time of sale or at negotiated prices or otherwise as described in the section of this prospectus titled “Plan of Distribution.” We will receive no proceeds from the sale of the Securities by the Selling Security Holders or from the issuance of Common Stock in respect of the Notes. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the Selling Security Holders will be borne by them.

Selected Risks Associated with an Investment in the Securities

An investment in the Securities is highly speculative and is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

| ● | We have a limited operating history upon which investors can evaluate our business and future prospects. | |

| ● | We have incurred losses since our inception in May 2014, and will need substantial additional funding to continue our operations and may not achieve or sustain profitability in the future. |

| ● | Servicing the debt represented by the Notes requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial debt. |

| ● | If we are unable to obtain additional financing on acceptable terms, we may have to curtail our growth or cease our development plans and operations. |

| ● | You could lose all of your investment. |

| ● | You may experience dilution of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. Furthermore, the conversion price of the Notes may not be adjusted for all dilutive events, including third-party tender or exchange offers, that may adversely affect the trading price of the Notes or the shares of our common stock issuable upon conversion of the Notes. |

| ● | Our products may not be able to be meet the required specifications of customers and achieve qualification for commercial manufacturing in a timely manner. |

| ● | If we are unable to establish effective marketing and sales capabilities or enter into agreements with third parties to market and sell our RF filters, we may not be able to effectively generate product revenues. |

| ● | If we fail to obtain, maintain and enforce our intellectual property rights, we may not be able to prevent third parties from using our proprietary technologies and may lose access to technologies critical to our products. |

Company Information

Our principal executive offices are located at 9805 Northcross Center Court, Suite A, Huntersville, North Carolina 28078. Our telephone number is (704) 997-5735. Our website address is www.akoustis.com. The information on, or that can be accessed through, our website is not part of this prospectus and is not incorporated by reference in this prospectus.

3

| Common Stock currently outstanding | 57,227,947 shares. (1) | |

| Common Stock offered by the Company | None. | |

| Notes currently outstanding | $44,000,000 aggregate principal amount. | |

| Notes offered by the Company | None. | |

| Notes offered by the Selling Security Holders | Up to $44,000,000 aggregate principal amount. | |

| Common stock offered by the Selling Security Holders | Up to 13,100,000 shares. | |

| Use of proceeds | We will not receive any of the proceeds from the sales of the Securities by the Selling Security Holders or upon the issuance of Common Stock in respect of the Notes. | |

| Nasdaq symbol for Common Stock | AKTS. | |

| Risk factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 7 of this prospectus before deciding whether or not to invest in the Notes or shares of our Common Stock. |

(1) As of September 9, 2022. This number excludes:

| ● | warrants to purchase 41,103 shares of Common Stock, all of which are currently exercisable |

| ● | options to purchase 3,009,139 shares of Common Stock (including options currently exercisable to purchase up to 1,851,702 shares of Common Stock), |

| ● | unvested restricted stock units for 2,773,835 shares of Common Stock, and |

| ● | shares issuable in respect of the Notes. |

4

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This prospectus and documents we have filed with the SEC that are incorporated by reference herein and therein contain forward-looking statements that relate to our plans objectives, estimates, and goals within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, from time to time we or our representatives have made or will make forward-looking statements in various other filings that we make with the U.S. Securities and Exchange Commission (the “SEC”) or in other documents, including press releases or other similar announcements. Any and all statements contained in this prospectus supplement and the accompanying prospectus that are not statements of historical fact may be deemed to be forward-looking statements. Terms such as “may,” “will,” “might,” “would,” “should,” “could,” “project,” “estimate,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “seek,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this prospectus and documents we have filed with the SEC that are incorporated by reference herein and therein may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable radio frequency (“RF”) filters, (ii) projections of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in the management’s discussion and analysis of financial condition or in the results of operations included pursuant to the rules and regulations of the SEC, (iv) our ability to efficiently utilize cash and cash equivalents to support our operations for a given period of time, (v) our ability to engage customers while maintaining ownership of our intellectual property, and (vi) the assumptions underlying or relating to any statement described in (i), (ii), (iii), (iv) or (v) above.

Forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which are beyond our control. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

| ● | our limited operating history, | |

| ● | our inability to generate revenues or achieve profitability, | |

| ● | the impact of the COVID-19 pandemic, Russian-Ukrainian conflict and other sources of volatility on our operations, financial condition and the worldwide economy, | |

| ● | increases in prices for raw materials, labor, and fuel caused by rising inflation, | |

| ● | our inability to obtain adequate financing and sustain our status as a going concern, | |

| ● | the results of our research and development (“R&D”) activities, | |

| ● | our inability to achieve acceptance of our products in the market, | |

| ● | general economic conditions, including upturns and downturns in the industry, | |

| ● | existing or increased competition, | |

| ● | our inability to successfully scale our New York semiconductor chip fabrication facility and related operations while maintaining quality control and assurance and avoiding delays in output, |

5

| ● | contracting with customers and other parties with greater bargaining power and agreeing to terms and conditions that may adversely affect our business, | |

| ● | the possibility that the anticipated benefits from our business acquisitions (including the acquisition of RFM Integrated Device, Inc. (“RFMi”)) will not be realized in full or at all or may take longer to realize than expected, |

| ● | the possibility that costs or difficulties related to the integration of acquired businesses’ (including RFMi’s) operations will be greater than expected and the possibility of disruptions to our business during integration efforts and strain on management time and resources; | |

| ● | risks related to doing business in foreign countries, | |

| ● | any security breaches or other disruptions compromising our proprietary information and exposing us to liability, | |

| ● | our limited number of patents, | |

| ● | failure to obtain, maintain and enforce our intellectual property rights, | |

| ● | claims of infringement, misappropriation or misuse of third-party intellectual property, including the lawsuit filed by Qorvo, Inc. in October 2021, that, regardless of merit, could result in significant expense and negatively impact our business results, | |

| ● | our inability to attract and retain qualified personnel, | |

| ● | results of any arbitration or litigation that may arise, | |

| ● | our reliance on third parties to complete certain processes in connection with the manufacture of our products, | |

| ● | product quality and defects, | |

| ● | our ability to market and sell our products, | |

| ● | our failure to innovate or adapt to new or emerging technologies, including in relation to our competitors, | |

| ● | our failure to comply with regulatory requirements, | |

| ● | stock volatility and illiquidity, | |

| ● | our failure to implement our business plans or strategies, | |

| ● | our failure to maintain effective internal control over financial reporting, | |

| ● | our failure to obtain and maintain a Trusted Foundry accreditation of our New York fabrication facility, and | |

| ● | shortages in supplies needed to manufacture our products, or needed by our customers to manufacture devices incorporating our products. |

A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this prospectus appears in the section captioned “Risk Factors” as well as the risk factors described under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for our most recent fiscal year (together with any material changes thereto contained in subsequent filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) and those contained in our other filings with the SEC, which are incorporated by reference in this prospectus and elsewhere in this prospectus. Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. The forward-looking statements in this prospectus speak only as of the date hereof and, except as may be required by law, we do not undertake any obligation to update the forward-looking statements contained in this prospectus to reflect any new information or future events or circumstances or otherwise.

6

Investing in our Securities involves a high degree of risk. Before purchasing our Securities, you should read and consider carefully the following risk factors as well as the risk factors described under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for our most recent fiscal year (together with any material changes thereto contained in subsequent filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) and those contained in our other filings with the SEC, which are incorporated by reference in this prospectus supplement and the accompanying prospectus, together with the other information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus, including our consolidated financial statements and the related notes. Each of these risk factors, either alone or taken together, could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our Securities. There may be additional risks that we do not presently know of or that we currently believe are immaterial, which could also impair our business and financial position. If any of the events described below were to occur, our financial condition, our ability to access capital resources, our results of operations and/or our future growth prospects could be materially and adversely affected and the value of our Securities could decline. As a result, you could lose some or all of any investment you may make in our Securities.

Risks Related to the Notes

Servicing our debt requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial debt.

Our ability to make scheduled payments of the principal of the Notes depends on our future performance, which is subject to economic, financial, competitive and other factors beyond our control. Our business may not generate cash flow from operations in the future sufficient to service our debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to repay our debt will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations.

Our ability to pay interest on, and make certain other payments with respect to, the Notes with our common stock is subject to a maximum number of shares unless we obtain shareholder approval in accordance with the listing requirements of the Nasdaq Capital Market or such other national securities exchange on which our common stock is listed.

Unless we obtain the requisite approval of our shareholders pursuant to the applicable Nasdaq Marketplace rule or listing requirements of the relevant stock exchange, the number of shares we may deliver in respect of the Notes, including those delivered in lieu of cash interest, in connection with an interest make-whole payment, or as a qualifying fundamental change payment, will not exceed 19.99% of our Common Stock outstanding (as adjusted for stock splits, reverse stock splits, stock combinations, reclassifications and reorganizations) as of the close of the trading day immediately preceding the date of the indenture that governs the Notes, or an aggregate of 13,100,000 shares of Common Stock. The number of shares of Common Stock issued to pay any portion of interest or certain other payments in respect of the Notes will be based on the average trading price of our Common Stock over the ten consecutive trading days preceding payment. Therefore, if the trading price of our Common Stock decreases, we would need to issue a greater number of shares of Common Stock in payment of a particular dollar amount. However, since the maximum number of shares we may issue in respect of the Notes without obtaining stockholder approval is limited, we may lose the ability to make these payments in shares of our Common Stock and may not have sufficient cash to service the debt in cash, which could result in a default on our debt obligations.

7

We may incur additional debt which could affect our ability to make payments on the Notes when due.

Subject to certain conditions and limitations in the indenture governing the Notes, we and our subsidiaries may be able to incur substantial additional debt in the future, some of which may be secured debt. Except for the limitation described under “Description of Notes—Limitation on Incurrence of Additional Indebtedness” with respect the incurrence of additional indebtedness, we and our subsidiaries will not be restricted under the terms of the indenture governing the Notes from incurring additional debt, securing existing or future debt, recapitalizing our debt or taking a number of other actions that are not limited by the terms of the indenture governing the Notes that could have the effect of diminishing our ability to make payments on the Notes when due.

Recent and future regulatory actions and other events may adversely affect the trading price and liquidity of the Notes.

We expect that many investors in, and potential purchasers of, the Notes will employ, or seek to employ, a convertible arbitrage strategy with respect to the Notes. Investors would typically implement such a strategy by selling short our Common Stock underlying the Notes and dynamically adjusting their short position while continuing to hold the Notes. Investors may also implement this type of strategy by entering into swaps on our Common Stock in lieu of or in addition to short selling the Common Stock.

The Securities Exchange Commission (the “SEC”) and other regulatory and self-regulatory authorities have implemented various rules and taken certain actions, and may in the future adopt additional rules and take other actions, that may impact those engaging in short selling activity involving equity securities (including our Common Stock). Such rules and actions include Rule 201 of SEC Regulation SHO, the adoption by the Financial Industry Regulatory Authority, Inc. and the national securities exchanges of a “Limit Up-Limit Down” program, the imposition of market-wide circuit breakers that halt trading of securities for certain periods following specific market declines, and the implementation of certain regulatory reforms required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Any governmental or regulatory action that restricts the ability of investors in, or potential purchasers of, the Notes to effect short sales of our Common Stock, borrow our Common Stock or enter into swaps on our Common Stock could adversely affect the trading price and the liquidity of the Notes.

We cannot assure you that an active trading market will develop for the Notes.

There is no active trading market for the Notes, and we do not intend to apply to list the Notes on any securities exchange or to arrange for quotation on any automated dealer quotation system. Any market-making activities relating to the Notes may cease at any time without notice. In addition, the liquidity of the trading market in the Notes, and the market price quoted for the Notes, may be adversely affected by changes in the overall market for this type of security and by changes in our financial performance or prospects or in the prospects for companies in our industry generally. As a result, we cannot assure you that an active trading market will develop for the Notes. If an active trading market does not develop or is not maintained, the market price and liquidity of the Notes may be adversely affected. In that case you may not be able to sell your Notes at a particular time or you may not be able to sell your Notes at a favorable price.

Because the Notes are held in book-entry form, holders must rely on DTC’s procedures to receive communications relating to the Notes and exercise their rights and remedies.

We initially issued the Notes in the form of one or more global notes registered in the name of Cede & Co., as nominee of The Depository Trust Company (“DTC”). As a result, beneficial interests in global notes are shown on, and transfers of global notes will be effected only through, the records maintained by DTC. Except in limited circumstances, we will not issue certificated notes. See “Description of Notes—Book-Entry; Settlement and Clearance.” Accordingly, if you own a beneficial interest in a global note, then you will not be considered a record owner or holder of the Notes. Instead, DTC or its nominee will be the sole holder of the Notes. Unlike persons who have certificated Notes registered in their names, owners of beneficial interests in global notes will not have the direct right to act on our solicitations for consents or requests for waivers or other actions from holders. Instead, those beneficial owners will be permitted to act only to the extent that they have received appropriate proxies to do so from DTC or, if applicable, a DTC participant. The applicable procedures for the granting of these proxies may not be sufficient to enable owners of beneficial interests in global notes to vote on any requested actions on a timely basis. In addition, notices and other communications relating to the Notes will be sent to DTC. We expect DTC to forward any such communications to DTC participants, which in turn would forward such communications to indirect DTC participants. But we can make no assurances that you timely receive any such communications.

8

Volatility in the market price and trading volume of our Common Stock could adversely impact the trading price of the Notes.

The stock market in recent years has experienced significant price and volume fluctuations that have often been unrelated to the operating performance of companies. In addition, the market price of our Common Stock historically has been volatile. The market price of our Common Stock could fluctuate significantly for many reasons, including in response to the risks described in this section or our most recent annual report on Form 10-K or subsequently filed quarterly reports on Form 10-Q or elsewhere in this prospectus for reasons unrelated to our operations, such as reports by industry analysts, investor perceptions or negative announcements by our customers, competitors or suppliers regarding their own performance, as well as industry conditions and general financial, economic and political instability. A decrease in the market price of our Common Stock would likely adversely impact the trading price of the Notes. The market price of our Common Stock could also be affected by possible sales of our Common Stock by investors who view the Notes as a more attractive means of equity participation in us and by hedging or arbitrage trading activity that may develop involving our Common Stock. This trading activity could, in turn, affect the trading price of the Notes. This volatility in the market price of our Common Stock may affect the price at which you could sell the shares of our Common Stock you receive upon conversion of your Notes, if any, and the sale of substantial amounts of our Common Stock could adversely affect the price of our Common Stock and the value of your Notes.

Any adverse rating of the Notes may cause their market price to fall.

We do not intend to seek a rating on the Notes. However, if a rating service were to rate the Notes and if such rating service were to lower its rating on the Notes below the rating initially assigned to the Notes or otherwise announce its intention to put the Notes on credit watch, the trading price of the Notes could decline.

You may be subject to tax attributable to interest paid on the Notes even though you do not receive a corresponding cash payment.

The Notes permit us, at our option, to make certain payments in freely tradable shares of Common Stock in lieu of cash. You may be subject to tax attributable to such payments even if they are not paid in cash.

You may be subject to tax if we make or fail to make certain adjustments to the conversion rate of the Notes even though you do not receive a corresponding cash distribution.

The conversion rate of the Notes is subject to adjustment in certain circumstances, including the payment of cash dividends. If the conversion rate is adjusted as a result of a cash dividend paid to our common stockholders, you may be deemed to have received a dividend subject to U.S. federal income tax without the receipt of any cash. In addition, a failure to adjust (or to adjust adequately) the conversion rate after an event that increases your proportionate interest in us could be treated as a deemed taxable dividend to you. If you are a non-U.S. holder (as defined in “Material U.S. Federal Income Tax Considerations”), any deemed dividend would be subject to U.S. federal withholding tax at a 30% rate, or such lower rate as may be specified by an applicable treaty, and if you are a U.S. holder (as defined in “Material U.S. Federal Income Tax Considerations”), any deemed dividend may be subject to federal backup withholding tax at a 24% rate, which, in each case, may be withheld from subsequent payments on the Notes or other amounts received by you. See “Material U.S. Federal Income Tax Considerations.”

9

We intend to take the position that the Notes are not contingent payment debt instruments, which position is not free from doubt.

We may be required to make additional payments on Notes that are converted in certain circumstances, including settlement of the interest make-whole payment described in “Description of Notes—Conversion Rights—Interest Make-Whole Payment upon Certain Conversions.” Due to a lack of relevant authority regarding certain of these payments, the applicability to the Notes of Treasury Regulations governing contingent payment debt instruments is uncertain. In particular, the effect of the interest make-whole payment on the tax treatment of the Notes is unclear. Although the matter is not free from doubt, we intend to take the position for U.S. federal income tax purposes that the Notes are not contingent payment debt instruments. Our position that the Notes should not be treated as contingent payment debt instruments is binding on the holders of the Notes unless a contrary position is disclosed to the Internal Revenue Service (the “IRS”) (but is not binding on the IRS). If the IRS were to successfully challenge our position, and the Notes were treated as contingent payment debt instruments, U.S. noteholders would be required, among other potential adverse consequences, to accrue interest income at a rate substantially higher than the stated interest rate on the Notes (regardless of such U.S. holder’s regular method of accounting for U.S. federal income tax purposes), and to treat as ordinary income, rather than capital gain, any gain recognized on a sale, exchange or redemption of a Note. In addition, conversion of the Notes would be a taxable event, and any gain realized upon conversion would be required to be treated as ordinary income.

Investors are urged to consult with their own tax advisors regarding the tax consequences of purchasing, owning and disposing of the Notes and the Common Stock that may be received upon conversion of the Notes. See “Material U.S. Federal Income Tax Considerations.”

Future sales of our Common Stock in the public market could lower the market price for our Common Stock and adversely impact the trading price of the Notes.

In the future, we may sell additional shares of our Common Stock to raise capital, including pursuant to our ATM Sales Agreement with Oppenheimer & Co. Inc., Craig-Hallum Group LLC and Roth Capital Partners, LLC. In addition, a substantial number of shares of our Common Stock are reserved for issuance upon the exercise of stock options and upon conversion of the Notes. We cannot predict the size of future issuances or the effect, if any, that they may have on the market price for our Common Stock. The issuance and sale of substantial amounts of Common Stock, or the perception that such issuances and sales may occur, could adversely affect the trading price of the Notes and the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities.

Holders of Notes are not entitled to any rights with respect to our Common Stock, but they will be subject to all changes made with respect to our Common Stock to the extent our conversion obligation includes shares of our Common Stock.

Holders of Notes are not entitled to any rights with respect to our Common Stock (including, without limitation, voting rights and rights to receive any dividends or other distributions on our Common Stock) prior to the conversion date relating to such Notes, but holders of Notes will be subject to all changes affecting our Common Stock. For example, if an amendment is proposed to our certificate of incorporation or bylaws requiring stockholder approval and the record date for determining the stockholders of record entitled to vote on the amendment occurs prior to the conversion date related to a holder’s conversion of its Notes, such holder will not be entitled to vote on the amendment, although such holder will nevertheless be subject to any changes affecting our Common Stock.

Upon conversion of the Notes, you may receive less valuable consideration than expected because the value of our Common Stock may decline after you exercise your conversion right but before we settle our conversion obligation.

Under the Notes, a converting holder will be exposed to fluctuations in the value of our Common Stock during the period from the date such holder surrenders Notes for conversion until the date we settle our conversion obligation, which may be two trading days following the relevant conversion date. Accordingly, if the price of our Common Stock decreases during this period, the value of the shares that you receive will be adversely affected and would be less than the conversion value of the Notes on the conversion date.

10

The qualifying fundamental change payment for Notes converted in connection with a qualifying fundamental change may not adequately compensate you for any lost value of your Notes as a result of such transaction.

Following the occurrence of a qualifying fundamental change, as described in “Description of Notes—Conversion Rights—Qualifying Fundamental Change Payment Upon Conversion in Connection With a Qualifying Fundamental Change,” we will, under certain circumstances, increase the conversion rate by an additional number of shares of Common Stock (“qualifying fundamental payment additional shares”). The number of qualifying fundamental change additional shares will be based on the effective date of the qualifying fundamental change and the price paid per share of the common stock in the qualifying fundamental change. We will have the option to pay any portion of the qualifying fundamental change additional shares in cash and/or by delivering freely tradeable Common Stock (the “qualifying fundamental change payment”). The qualifying fundamental change payment for Notes converted in connection with a qualifying fundamental change may not adequately compensate you for any lost value of your Notes as a result of such transaction.

Our obligation to make a qualifying fundamental change payment for Notes converted in connection with a qualifying fundamental change could be considered a penalty, in which case the enforceability thereof would be subject to general principles of reasonableness and equitable remedies.

Federal and state statutes allow courts, under specific circumstances, to void subsidiary guarantees and require holders of the Notes to return payments received from guarantors.

Our wholly-owned subsidiary guarantees our obligations under the Notes. Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a subsidiary guarantee could be voided or claims in respect of a subsidiary guarantee could be subordinated to all other debts of that subsidiary guarantor. A court might do so if it found that when the subsidiary entered into its guarantee or, in some states, when payments became due under the guarantee, the subsidiary received less than reasonably equivalent value or fair consideration and either:

| ● | was insolvent or rendered insolvent by reason of the incurrence; |

| ● | was engaged in a business or transaction for which its remaining assets constituted unreasonably small capital; or |

| ● | intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

The court might also void a subsidiary guarantee, without regard to the above factors, if the court found that the subsidiary entered into its guarantee with the actual intent to hinder, delay or defraud its creditors.

A court would likely find that a subsidiary guarantor did not receive reasonably equivalent value or fair consideration for its guarantee if the subsidiary guarantor did not substantially benefit directly or indirectly from the issuance of the Notes. If a court were to void a subsidiary guarantee, holders of the Notes would no longer have a claim against the guarantor. Sufficient funds to repay the Notes may not be available from other sources, including the remaining subsidiary guarantor, if any. In addition, the court might direct holders of the Notes to repay any amounts that they already received from the guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a subsidiary guarantor would be considered insolvent if:

| ● | the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all of its assets; |

| ● | the present fair saleable value of its assets were less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| ● | it could not pay its debts as they become due. |

The Guarantee contains a provision intended to limit the guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under the Guarantee to be a fraudulent transfer. This provision may not be effective to protect the Guarantee from being voided under fraudulent transfer law.

Some significant restructuring transactions may not constitute a fundamental change, in which case we would not be obligated to offer to repurchase the Notes.

If a fundamental change occurs at any time prior to the maturity date, subject to certain conditions, holders of the Notes will have the right, at their option, to require us to repurchase for cash all or part of each holder’s Notes. However, the fundamental change provisions will not afford protection to holders of Notes in the event of other transactions that could adversely affect the Notes. For example, transactions such as leveraged recapitalizations, refinancings, restructurings, or acquisitions initiated by us may not constitute a fundamental change requiring us to repurchase the Notes. In the event of any such transaction, the holders would not have the right to require us to repurchase the Notes, even though each of these transactions could increase the amount of our indebtedness, or otherwise adversely affect our capital structure or any credit ratings, thereby adversely affecting the holders of Notes.

11

The conversion price of the Notes may not be adjusted for all dilutive events, including third-party tender or exchange offers, that may adversely affect the trading price of the Notes or the shares of our Common Stock issuable upon conversion of the Notes.

The conversion price of the Notes is subject to adjustment upon specified events, including the issuance of stock dividends on our Common Stock, the issuance of rights or warrants, subdivisions, combination, distributions of capital stock, indebtedness or assets, cash dividends and issuer tender or exchange offers. The conversion price will not be adjusted for other events, such as third-party tender or exchange offers or the sale of our equity securities or equity-related securities to third parties or so-called price protection provisions (other than to a limited extent under certain circumstances), that may adversely affect the trading price of the Notes or Common Stock issuable upon conversion of the Notes.

The terms of the Notes contain limited covenants and other protections.

The indenture governing the Notes contains covenants restricting our ability to take certain actions. However, each of these covenants contains specified exceptions. In addition, these covenants do not protect holders of the Notes and Common Stock issuable upon conversion of the Notes from all events that could have a negative effect on the creditworthiness of the Notes and the secondary market value of the Notes and Common Stock issuable upon conversion of the Notes.

We face several risks regarding holders’ potential rights to require us to repurchase the Notes upon a fundamental change.

Holders of the Notes will have the right, at their option, to require us to repurchase for cash all or part of each holder’s Notes upon a fundamental change prior to maturity. We may not have sufficient future cash flow from operations to make any required repurchase in cash at any later time or the ability to arrange additional financing, if necessary, on acceptable terms. In addition, our ability to repurchase the Notes in cash may be limited by law or the terms of other agreements relating to our debt outstanding at the time. If we fail to repurchase the Notes in cash as required by the indenture governing the Notes, it would constitute an event of default under the indenture, which, in turn, could also constitute an event of default under our then existing debt instruments.

If you hold Notes, you are not entitled to any rights with respect to our Common Stock, but you are subject to all changes made with respect to our Common Stock.

If you hold Notes, you are not entitled to any rights with respect to our Common Stock (including, without limitation, voting rights and rights to receive any dividends or other distributions on our Common Stock), but you are subject to all changes affecting the Common Stock. You will only be entitled to rights on the Common Stock if and when we deliver shares of Common Stock to you in exchange for your Notes and in limited cases under the anti-dilution adjustments of the Notes. For example, in the event that an amendment is proposed to our certificate of incorporation or by-laws requiring securityholder approval and the record date for determining the securityholders of record entitled to vote on the amendment occurs prior to delivery of the Common Stock, you will not be entitled to vote on the amendment, although you will nevertheless be subject to any changes in the powers, preferences or special rights of our Common Stock.

Certain provisions in the Notes and the indenture could delay or prevent an otherwise beneficial takeover or takeover attempt of us and, therefore, the ability of holders to exercise their rights associated with a fundamental change.

Certain provisions in the Notes and the indenture could make it more difficult or more expensive for a third party to acquire us. For example, if an acquisition event constitutes a fundamental change, we are required to offer to repurchase each holder’s Notes in cash. In addition, if an acquisition event constitutes a qualifying fundamental change, we may be required to make a qualifying fundamental change payment to holders who convert their Notes in connection with such qualifying fundamental change. Accordingly, our obligations under the Notes and the indenture as well as provisions of our organizational documents and other agreements could increase the cost of acquiring us or otherwise discourage a third party from acquiring us or removing incumbent management.

12

This prospectus covers the resale from time to time by the Selling Security Holders identified in the first table below of up to $44,000,000 aggregate principal amount of our 6.0% Convertible Senior Notes due 2027, including the Guarantee, as well as up to 9,341,825 shares of Common Stock that may be issued upon conversion of the Notes and up to an additional 3,758,175 shares of Common Stock that may be issued, at our election, as payment of accrued interest on the Notes, as make-whole payments made in connection with certain conversions of the Notes or as payments made in connection with qualifying fundamental changes of the Company.

The Selling Security Holders identified in the table below may from time to time offer and sell under this prospectus any or all of the Notes, including the Guarantee issuable in respect thereof, described under the column “Principal Amount of Notes Registered Hereby,” as well as any or all of the shares of Common Stock issuable upon conversion or in respect thereof, described under the column “Shares of Common Stock Registered Hereby,” in such table below.

The table below have been prepared based upon the information furnished to us by the Selling Security Holders and/or our transfer agent as of the date of this prospectus. The Selling Security Holders identified below may have converted, sold, transferred or otherwise disposed of some or all of their Notes or shares of Common Stock since the date on which the information in the following table is presented. Information concerning the Selling Security Holders may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly. We cannot give an estimate as to the principal amount of Notes or number of shares of Common Stock that will actually be held by the Selling Security Holders upon termination of this offering because the Selling Security Holders may offer some or all of their Notes or Common Stock, as applicable, under the offering contemplated by this prospectus or may acquire additional shares of Common Stock. The aggregate principal amount of Notes and total number of shares of Common Stock that may be sold hereunder will not exceed the aggregate principal amount of Notes or number of shares of Common Stock offered hereby. Please read the section entitled “Plan of Distribution” in this prospectus.

The following table sets forth the name of each Selling Security Holder, the aggregate principal amount of Notes and number of shares of our Common Stock beneficially owned by such noteholder before this offering, the aggregate principal amount of Notes to be offered for such noteholder’s account and the principal amount or number and (if one percent or more) the percentage of the class of stock to be beneficially owned by such noteholder after completion of the offering. The principal amount of Notes and number of shares of Common Stock owned are those beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, the Selling Security Holders’ beneficial ownership includes any shares of our Common Stock as to which a person has sole or shared voting power or investment power and any shares of Common Stock which the person has the right to acquire within 60 days after September 9, 2022 (as used in this section, the “Determination Date”), through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person.

Unless otherwise set forth below, based upon the information furnished to us, (a) the persons and entities named in the table have sole voting and sole investment power with respect to the Notes or shares set forth opposite the Selling Security Holder’s name, subject to community property laws, where applicable, (b) no Selling Security Holder had any position, office or other material relationship within the past three years with us or with any of our predecessors or affiliates, and (c) no Selling Security Holder is a broker-dealer or an affiliate of a broker-dealer. The principal amount of Notes or number of shares of Common Stock shown as beneficially owned before the offering is based on information furnished to us or otherwise based on information available to us at the timing of the filing of the registration statement of which this prospectus forms a part.

13

| Selling Security Holder |

Principal Amount of Notes Beneficially Owned Prior to this Offering |

Percentage of Outstanding Notes |

Principal Amount of Notes Registered Hereby |

Principal Amount of Notes Beneficially Owned upon Completion of this Offering (1) |

Shares of Common Stock Beneficially Owned Prior to this Offering (2) |

Shares of Common Stock Registered Hereby (3) |

Shares of Common Stock Beneficially Owned upon Completion of this Offering (4) |

Percentage of Common Stock Beneficially Owned upon Completion of this Offering (5) |

||||||||||||||||||||||||

| Nineteen77 Global Multi-Strategy Alpha Master Limited (6) | $ | 22,000,000 | 50.0 | % | $ | 22,000,000 | $ | 0 | 0 | 6,550,000 | 0 | * | ||||||||||||||||||||

| Blackwell Partners LLC - Series B (7) | $ | 6,500,000 | 14.8 | % | $ | 6,500,000 | $ | 0 | 847,450 | 1,935,227 | 847,450 | * | ||||||||||||||||||||

| Silverback Convertible Master Fund Limited (8) | $ | 2,250,000 | 5.1 | % | $ | 2,250,000 | $ | 0 | 0 | 669,886 | 0 | * | ||||||||||||||||||||

| Silverback Opportunistic Credit Master Fund Limited (9) | $ | 3,500,000 | 8.0 | % | $ | 3,500,000 | $ | 0 | 476,970 | 1,042,046 | 476,970 | * | ||||||||||||||||||||

| KASAD 2, L.P. (10) | $ | 9,750,000 | 22.2 | % | $ | 9,750,000 | $ | 0 | 0 | 2,902,841 | 0 | * | ||||||||||||||||||||

| * | Less than 1% |

| (1) | Assumes all of the Notes to be registered on the registration statement of which this prospectus is a part are sold in the offering and that no additional Notes are purchased or otherwise acquired. |

| (2) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock underlying options or warrants currently exercisable, or exercisable within 60 days of the Determination Date, are deemed outstanding for purposes of computing the beneficial ownership of the person holding such options or warrants but are not deemed outstanding for computing the beneficial ownership of any other person. Except where we had knowledge of such ownership, the number presented in this column may not include shares held in street name or through other entities over which the selling stockholder has voting and dispositive power. Includes shares issuable upon conversion of the Notes, subject to the Beneficial Ownership Limitation (defined below). The Notes are convertible on or after December 9, 2022. |

| (3) | Assumes (i) the issuance of the maximum number of shares issuable upon conversion of or in respect of the Notes (including shares issuable as payment of accrued interest, as make-whole payments, or in connection with qualifying fundamental changes) and (ii) no fractional shares of our Common Stock will be issued upon conversion of Notes. Pursuant to the terms of the Notes, none of the holders may convert any Notes that it beneficially owns, or receive shares of Common Stock in respect of such Notes, to the extent that such conversions or receipt would result in such holder and its affiliates, together with any other persons whose beneficial ownership would be aggregated for purposes of Section 13(d) of the Exchange Act, beneficially owning in excess of 4.9% of the outstanding shares of our Common Stock (as determined in accordance with Section 13(d) of the Exchange Act) (the “Beneficial Ownership Limitation”). Amounts registered for sale hereby do not give effect to this limitation on conversions and receipt of shares of Common Stock. |

| (4) | Assumes all of the shares of Common Stock to be registered on the registration statement of which this prospectus is a part are sold in the offering, that shares of Common Stock beneficially owned by the Selling Security Holders but not being offered pursuant to this prospectus (if any) are not sold, and that no additional shares of Common Stock are purchased or otherwise acquired. |

| (5) | Percentages are based on the 57,227,947 shares of Common Stock issued and outstanding as of the Determination Date. Shares of our Common Stock subject to options, warrants or conversion rights that are currently exercisable or convertible, or exercisable or convertible within 60 days of the Determination Date, are deemed to be outstanding for the purpose of computing the percentage ownership of the person holding those options, warrants or conversion rights, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

14

| (6) | UBS O’Connor LLC (“O’Connor”) is the investment manager of Nineteen77 Global Multi-Strategy Alpha Master Limited (“Nineteen77”) and accordingly has voting control and investment discretion over the securities described herein held by Nineteen77. Kevin Russell (“Mr. Russell”), the Chief Investment Officer of O’Connor, also has voting control and investment discretion over the securities described herein held by Nineteen77. As a result, each of O’Connor and Mr. Russell may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended) of the securities described herein held by Nineteen77. |

| (7) | Voting or investment control over the securities held by Blackwell Partners LLC - Series B is held by Elliot Bossen (“Mr. Bossen”), CEO of Silverback Asset Management, trading advisor of Blackwell Partners LLC - Series B. |

| (8) | Voting or investment control over the securities held by Silverback Convertible Master Fund Limited is held by Mr. Bossen, CEO of Silverback Asset Management, trading advisor of Silverback Convertible Master Fund Limited. |

| (9) | Voting or investment control over the securities held by Silverback Opportunities Credit Master Fund Limited is held by Mr. Bossen, CEO of Silverback Asset Management, trading advisor of Silverback Opportunities Credit Master Fund Limited. | |

| (10) | Voting or investment control over the securities held by KASAD 2, L.P. is held by Mr. Bossen, CEO of Silverback Asset Management, trading advisor of KASAD 2. L.P. |

15

We will not receive proceeds from sales of Notes or Common Stock made under this prospectus by the Selling Security Holders, or any proceeds from the issuance of Common Stock in respect of the Notes.

DETERMINATION OF OFFERING PRICE

There is no public market for our Notes and currently a limited public market for our Common Stock. The conversion price of the Notes was negotiated with the initial purchasers of the Notes and factors considered in connection therewith included, in addition to prevailing market conditions and the trading price of our common stock as traded on the Nasdaq, our historical financial and operating performance, estimates of our business potential and earnings prospects and those of our industry in general, an assessment of our management and the consideration of the above factors in relation to market valuation of companies in related businesses.

The Selling Security Holders will determine at what price they may sell the offered Securities, and such sales may be made at prevailing market prices or at privately negotiated prices. See “Plan of Distribution” below for more information.

16

The Notes and the Guarantee were issued under an indenture dated as of June 9, 2022 among us, Akoustis, Inc. and The Bank of New York Mellon Trust Company, N.A., as trustee. The following description is a summary of the material provisions of the Notes, the Guarantee, and the indenture and does not purport to be complete. This summary is subject to and is qualified by reference to all of the provisions of the Notes, the Guarantee, and the indenture, including the definitions of certain terms used in the Notes, the Guarantee, and the indenture. We urge you to read these documents because they, and not this description, define your rights as a holder of the Notes.

For purposes of this description, references to “we,” “our” and “us” refer only to Akoustis Technologies, Inc. and not to its subsidiary, Akoustis, Inc.

General

The Notes:

| ● | are our senior general unsecured obligations and rank equal in right to all of our existing and future unsecured indebtedness. The Notes will rank junior to secured indebtedness that we may incur as described below in “—Limitation on Incurrence of Additional Indebtedness”; |

| ● | bear interest payable from the date of issuance at an annual rate of 6.0% payable at our option in cash and/or freely tradable shares of our Common Stock, subject to certain limitations, on June 15 and December 15 of each year, beginning on December 15, 2022; |

| ● | mature on June 15, 2027 (the “maturity date”), unless earlier converted or repurchased; |

| ● | are subject to repurchase by us at the option of a holder following a fundamental change (as defined below under “—Fundamental Change Permits Holders to Require Us to Repurchase Notes”), at a price equal to 100% of the principal amount of the Notes to be repurchased, plus (1) a “qualifying fundamental change payment” with respect to such converted Notes based on a make-whole table set forth in the Indenture, or (2) if greater, the amount of any interest make-whole payment due in respect of the converted Notes; |

| ● | become redeemable by us after June 9, 2023 as follows: (1) one-third of the aggregate principal amount of the Notes on June 9, 2023; (2) two-thirds of the aggregate principal amount of the Notes on June 9, 2024; and (3) all of the aggregate principal amount of the Notes on June 9, 2025 so long as (A) the closing sale price per share of our Common Stock is greater than 150% of the then-effective conversion price for each of 20 days of any 30 consecutive trading day period immediately preceding our optional redemption notice, and (B) a registration statement registering the resale of all shares of common stock into which the principal amount of the Notes is convertible and all shares of common stock issuable as interest or as interest make-whole payments upon conversion or redemption of any Notes is effective and a current prospectus related thereto remains available throughout the period from the date the redemption notice is delivered to the holders to and including the redemption date, as described below under “—Optional Redemption”; |

| ● | include a limitation on our ability and the ability of our subsidiaries to incur additional indebtedness, other than permitted debt (as defined below under “—Limitation on Incurrence of Additional Indebtedness”); |

| ● | include a limitation on our ability and the ability of our subsidiaries to make certain payments, including the repurchase of our securities and the payment of dividends as described below under “—Limitation on Certain Payments;” |

| ● | include a limitation on our ability to restrict our subsidiaries from making dividend and other payments as described below under “—Limitation on Dividend and Other Payment Restrictions;” |

17

| ● | include a limitation on our ability and the ability of our subsidiaries to sell assets as described below under “—Limitation on Asset Sales;” |

| ● | include a limitation on our ability and the ability of our subsidiaries to engage in certain transactions with our affiliates as described under “—Limitation on Transactions with Affiliates;” |

| ● | include a limitation on liens, other than permitted liens as described under “—Limitation on Liens;” |

| ● | require us and our subsidiaries to maintain our properties and insurance to the extent described under “—Maintenance of Properties and Insurance;” |

| ● | include a limitation on the issuance or sale of our subsidiaries’ capital stock as described under “—Issuance or Sale of Subsidiary Stock;” |

| ● | include a limitation on the businesses in which we and our subsidiaries engage other than permitted businesses and require us and our subsidiaries to keep our existence, licenses and franchises to the extent described under “—Line of Business; Corporate Existence;” |

| ● | were issued in denominations of $1,000 and integral multiples of $1,000; and |

| ● | are represented by one or more registered Notes in global form, but in certain limited circumstances may be represented by Notes in definitive form. See “Book-Entry, Settlement and Clearance.” |

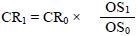

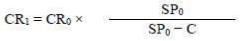

Subject to satisfaction of certain conditions, the Notes may be converted at an initial conversion rate of 212.3142 into shares of Common Stock per $1,000 principal amount of Notes (equivalent to an initial conversion price of approximately $4.71 per share of Common Stock). The conversion rate is subject to adjustment if certain events occur as described under “—Conversion Rights—Conversion Rate Adjustments.”

Upon conversion of a Note, we will deliver shares of our Common Stock, together with a cash payment in lieu of delivering any fractional share, as described under “Conversion Rights—Settlement upon Conversion” and an interest make-whole payment, if applicable. Holders will not receive any separate cash payment for interest, if any, accrued and unpaid to the conversion date except under the limited circumstances described below under “—Conversion Rights—General.”

If a holder surrenders its Notes for conversion at any time on or after December 9, 2022 and the close of business on June 9, 2025 (the “Interest Make-Whole Date”), we will make an interest make-whole payment equal to the remaining scheduled interest payments that would have been made on the Notes converted had such Notes remained outstanding through the Interest Make-Whole Date to the converting holder as described under “—Conversion Rights—Interest Make-Whole Payment upon Certain Conversions.” At our option, make-whole payments may be paid in cash and/or freely tradable shares of our Common Stock, subject to certain limitations described under “—Conversion Rights—Share Limitation,” valued at 95% of the volume weighted average price of the common stock for the ten trading days ending on and including the trading day immediately preceding the conversion date. See “—Conversion Rights—Interest Make-Whole Payment upon Certain Conversions.”