| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Introduction

This Management's Discussion and Analysis ("MD&A") is dated as of August 11, 2023 unless otherwise indicated and should be read in conjunction with the unaudited consolidated condensed interim financial statements of GreenPower Motor Company Inc. ("GreenPower", "the Company", "we", "our" or "us") for the three months ended June 30, 2023 and the related notes. This MD&A was written to comply with the requirements of National Instrument 51-102 - Continuous Disclosure Obligations. Results are reported in US dollars, unless otherwise noted. In the opinion of management, all adjustments (which consist only of normal recurring adjustments) considered necessary for a fair presentation have been included. The results presented for the three months ended June 30, 2023 are not necessarily indicative of the results that may be expected for any future period. The consolidated condensed interim financial statements are prepared in compliance with IAS 34 Interim Financial Reporting as issued by the IASB.

For the purposes of preparing this MD&A, management, in conjunction with the Board of Directors, considers the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of the Company's common shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) if it would significantly alter the total mix of information available to investors. Management, in conjunction with the Board of Directors, evaluates materiality with reference to all relevant circumstances, including potential market sensitivity.

Further information about the Company and its operations can be obtained from the offices of the Company or from www.sedar.com.

Cautionary Note Regarding Forward-Looking Information

Certain statements contained in the following MD&A may contain forward-looking statements within the meaning of certain securities laws, including the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements in this MD&A may include, but are not limited to statements involving estimates, assumptions or judgements, and these statements may be identified by words such as "believe", "expect", "expectation", "aim", "achieve", "intend", "commit", "goal", "plan", "strive" and "objective", and similar expressions of future or conditional verbs such as "will", "may", "might", "should", "could" or "would". By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, and that our plans, goals, expectations and objectives will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements.

Non-IFRS Measures and Other Supplementary Performance Metrics

This MD&A includes certain non-IFRS measures and other supplementary performance metrics, which are defined below. These measures do not have any standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and are therefore unlikely to be comparable to similar measures presented by other companies. Investors are cautioned that non-GAAP financial measures should not be construed as an alternative to IFRS measures. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company's results of operations from management's perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company's financial information reported under IFRS. Readers should not rely on any single financial measure to evaluate GreenPower's business.

This MD&A refers to Adjusted EBITDA "Adjusted EBITDA", a non-IFRS measure, which is defined as loss for the year (for annual periods) or loss for the period (for quarterly periods), plus depreciation, plus interest and accretion, plus share-based payments, plus / (less) the allowance / (recovery) for credit losses, plus / (less) the increase / (decrease) in the warranty liability, plus taxes. Adjusted EBITDA is a measure used by management as an indicator of profitability since it excludes the impact of movements in working capital items, certain non-cash charges, and financing costs. Therefore, Adjusted EBITDA gives the investor information as to the profitability of the business. However, Adjusted EBITDA is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Adjusted EBITDA as calculated by GreenPower may not be comparable to Adjusted EBITDA as calculated and reported by other companies. The most comparable IFRS measure to Adjusted EBITDA is net income.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

This MD&A also makes reference to "Total Cash Expenses", a non-IFRS measure, which is defined as sales, general and administrative costs plus interest and accretion, plus/(less) foreign exchange loss/(gain), less depreciation, less share-based payments, less amortization of deferred financing fees, plus/(less) the decrease/(increase) in warranty liability, plus / (less) the (allowance) / recovery for credit losses. Total Cash Expenses is a measure used by management as an indicator of sales, general and administrative, interest and accretion, and foreign exchange costs that excludes the impact of certain non-cash charges. Management believes that Total Cash Expenses provides a measure of cash expenses from the operations of the business. However, Total Cash Expenses is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Total Cash Expenses as calculated by GreenPower may not be comparable to Total Cash Expenses as calculated and reported by other companies.

This MD&A also makes reference to "Vehicle Deliveries", a supplementary performance metric, that management believes provides useful information regarding the business activity of the Company during a quarter or year. Vehicle Deliveries is vehicles that have been sold or leased to a customer during a quarter or a year, as determined by management. The models of vehicles included in Vehicle Deliveries will vary over time, such that Vehicle Deliveries in one period may not be comparable to Vehicle Deliveries in another period. Vehicle Deliveries is not a financial metric, and vehicle deliveries is not an indication of the Company's financial performance in a given period. While management considers Vehicle Deliveries to be a useful supplementary performance metric, users are cautioned to consider other factors to evaluate GreenPower's business.

Description of Business

GreenPower designs, builds and distributes a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, cargo vans and a cab and chassis. GreenPower employs a clean-sheet design to manufacture all-electric buses that are purpose built to be battery powered with zero emissions while integrating global suppliers for key components. This OEM platform allows GreenPower to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements. GreenPower was founded in Vancouver, British Columbia, Canada with primary operational facilities in southern California. Listed on the TSX Venture Exchange since November 2015, GreenPower completed its U.S. IPO and NASDAQ listing in August 2020. For further information go to www.greenpowermotor.com

Operations

The following is a description of GreenPower's business activities during the three months ended June 30, 2023. During the quarter, GreenPower completed the sale of 6 BEAST Type D all-electric school buses, 2 Nano BEAST Type A all-electric school buses, 14 EV Star 22-foot cargo, 10 EV Stars and 99 EV Star Cab and Chassis ("CC's"), and recognized revenue from finance and operating leases, as well as from the sale of parts, and from the operations of Lion Truck Body, GreenPower's truck body manufacturer. GreenPower continued to execute on a number of strategic initiatives during the quarter.

During the quarter, the majority of GreenPower's deliveries of EV Star CC's were made to Workhorse Group, Inc ("Workhorse"), and GreenPower has additional EV Star CC's under construction that are expected to deliver to Workhorse later in Q2 and into Q3 pursuant to its purchase and sale agreement. GreenPower also sold additional CC's during the quarter through its dealer network, which continues to expand nationwide.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

GreenPower continued to see strong demand for its EV Star 22-foot cargo, with sales of 14 vehicles in New Jersey and California. The EV Star 22-foot cargo is a versatile all-electric Class 4 cargo van that provides over 6,000 pounds of payload, over 475 cubic feet of cargo space, and a range of 150 miles on a single charge. GreenPower has continued to expand its commercial dealer network across the United States, with recent announcements of new dealership relationships in New Jersey, West Virginia and North Carolina. GreenPower's sales team remains focused on continued expansion of its dealer network into new markets across the United States.

GreenPower sold 6 BEAST 90 Type D school buses and 2 Type A Nano BEAST school buses during the quarter. These vehicles will be operating at school districts in California and in Portland Oregon. These sales illustrate the Company's expanding sales reach and the importance of the Company's efforts to build out its dealer network across the country. Importantly, GreenPower also announced several orders of school buses both during and after the quarter ended June 30, 2023. These orders include an order for 15 BEAST school buses from Clark County in Nevada, which operates the country's largest owned and operated school bus fleet with over 1,900 buses. In June, GreenPower announced that its California school bus dealer has orders for more than 40 Type D BEAST school buses. As well, GreenPower received an order for 41 Type D BEAST school buses from the state of West Virginia, which was announced in April 2023. These orders represent significant additions to the Company's school bus sales pipeline.

GreenPower achieved strong quarterly results during the three months ended June 30, 2023, achieving record sales, and ending the quarter with a cash balance of approximately $1.5 million, a drawn balance of less than $200,000 on its $8 million operating line of credit, and working capital of $26.4 million. GreenPower has continued to focus on growing its sales pipeline through expansion of its dealer network, attendance at industry events and tradeshows, and through ongoing sales demonstrations and activities with key customers in multiple markets.

Inventory, Property and Equipment

As at June 30, 2023 the Company had:

- Property and equipment on the balance sheet totaling $2.4 million, comprised of several models of GreenPower vehicles used for demonstration and other purposes, company vehicles used for sales, service and operations, tools and equipment, and other business property and equipment;

- Work in process and parts inventory totaling approximately $13.5 million representing EV Star's, EV 250's, BEAST Type D school buses, Nano BEAST Type A school buses and parts inventory, and;

- Finished goods inventory totaling approximately $20.9 million, comprised of EV Star cab and chassis and other EV Star models, and BEAST Type D and Nano BEAST Type A models.

Trends

The Company does not know of any trends, commitments, events, or uncertainty that are expected to have a material effect on the Company's business, financial condition, or results of operations other than as disclosed herein under "Risk Factors".

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Results of Operations

For the three-month period ended June 30, 2023

For the three-month period ended June 30, 2023 the Company recorded revenues of $17,581,008 and cost of sales of $14,790,232 generating a gross profit of $2,790,776 or 15.9% of revenues. The gross profit during the quarter was lower than the same quarter in the prior year due to the impact of higher shipping costs for vehicles sold to customers outside of California, sales of EV Star CC's under a high volume contract with a gross profit margin below the average for the quarter, and sales from Lion Truck Body, which earned a gross profit margin below the total for the quarter, and which was acquired during the second quarter of the prior year. Revenue was generated from the sale of 6 BEAST Type D all-electric school buses, 2 Nano BEAST Type A all-electric school buses, 14 EV Star 22-foot cargo, 10 EV Stars and 99 EV Star Cab and Chassis ("CC's"), as well as from finance and operating leases, from the sale of parts, and from the operations of Lion Truck Body. Operating costs consisted of salaries and administration costs of $1,842,826 relating to salaries, project management, accounting, and administrative services; transportation costs of $53,064 which relate to the use of company vehicles, and shipping of vehicles for non-sales purposes; travel, accommodation, meals and entertainment costs of $205,728 related to travel for project management, demonstration of Company products, and trade shows; product development costs of $812,899; sales and marketing costs of $136,683; insurance expense of $420,181; professional fees of $324,150 consisting of legal and audit fees; and office expense of $366,656 consisting of rent and other office expenses, as well as non-cash expenses including $713,227 of share-based compensation expense and depreciation of $442,767, generating a loss from operations before interest, accretion and foreign exchange of $2,527,414. Interest and accretion of $277,951 and foreign exchange loss of $6,491, resulted in a loss for the period of $2,811,856. Non-cash expenses consisting of depreciation, accretion and accrued interest, share-based payments, warranty accrual, amortization of deferred financing fees and allowance for credit losses of $9 in the three-month period. The consolidated total comprehensive loss for the three-month period was impacted by $23,923 of other comprehensive income as a result of the translation of the entities with a different functional currency than presentation currency.

For the three-month period ended June 30, 2022

For the three-month period ended June 30, 2022 the Company recorded revenues of $3,851,105 and cost of sales of $2,800,101 generating a gross profit of $1,051,004 or 27.3% of revenues. Revenue was generated from the sale of 3 BEAST Type D all-electric school buses, 2 EV Star Plus, 1 EV Star Cargo+, 5 EV Star 22-foot cargo, 6 EV Stars and 4 EV Star Cab and Chassis, as well as revenue from finance and operating leases and other sources. Operating costs consisted of administrative fees of $1,603,891 relating to salaries, project management, accounting, and administrative services; transportation costs of $24,735 which relate to the use of trucks, trailers, contractors as well as other operational costs needed to transport Company products around North America; travel, accommodation, meals and entertainment costs of $162,605 related to travel for project management, demonstration of Company products, and trade shows; product development costs of $245,118; sales and marketing costs of $366,871; insurance expense of $350,534; professional fees of $312,840 consisting of legal and audit fees; and office expense of $117,676 consisting of rent and other office expenses, as well as non-cash expenses including $1,709,175 of share-based compensation expense and depreciation of $195,608, generating a loss from operations before interest, accretion and foreign exchange of $4,067,006. Interest and accretion of $259,636 and a foreign exchange gain of $1,072 resulted in a loss for the period of $4,325,570. The consolidated total comprehensive loss for the three-month period was impacted by $78,100 of other comprehensive loss as a result of the translation of the entities with a different functional currency than presentation currency.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Comparison of Quarterly Results

The following table compares the results of the quarter ended June 30, 2023 with the quarter ended June 30, 2022:

| For the three months ended | Quarter over Quarter Change | |||||||||||

| June 30, 2023 | June 30, 2022 | $ | % | |||||||||

| Revenue | $ | 17,581,008 | $ | 3,851,105 | $ | 13,729,903 | 356.5% | |||||

| Cost of sales | 14,790,232 | 2,800,101 | 11,990,131 | 428.2% | ||||||||

| Gross Profit | 2,790,776 | 1,051,004 | 1,739,772 | 165.5% | ||||||||

| Gross profit margin (Note 1) | 15.9% | 27.3% | -11.4% | |||||||||

| Sales, general and administrative costs | ||||||||||||

| Salaries and administration | 1,842,826 | 1,603,891 | 238,935 | 14.9% | ||||||||

| Depreciation | 442,767 | 195,608 | 247,159 | 126.4% | ||||||||

| Product development costs | 812,899 | 245,118 | 567,781 | 231.6% | ||||||||

| Office expense | 366,656 | 117,676 | 248,980 | 211.6% | ||||||||

| Insurance | 420,181 | 350,534 | 69,647 | 19.9% | ||||||||

| Professional fees | 324,150 | 312,840 | 11,310 | 3.6% | ||||||||

| Sales and marketing | 136,683 | 366,871 | (230,188 | ) | -62.7% | |||||||

| Share-based payments | 713,227 | 1,709,175 | (995,948 | ) | -58.3% | |||||||

| Transportation costs | 53,064 | 24,735 | 28,329 | 114.5% | ||||||||

| Travel, accommodation, meals and entertainment | 205,728 | 162,605 | 43,123 | 26.5% | ||||||||

| Allowance for credit losses | 9 | 28,957 | (28,948 | ) | NM | |||||||

| Total sales, general and administrative costs | 5,318,190 | 5,118,010 | 200,180 | 3.9% | ||||||||

| Loss from operations before interest, accretion and foreign exchange | (2,527,414 | ) | (4,067,006 | ) | 1,539,592 | -37.9% | ||||||

| Interest and accretion | (277,951 | ) | (259,636 | ) | (18,315 | ) | 7.1% | |||||

| Foreign exchange (loss)/gain | (6,491 | ) | 1,072 | (7,563 | ) | -705.5% | ||||||

| Loss for the period | (2,811,856 | ) | (4,325,571 | ) | 1,513,715 | -35.0% | ||||||

| Other comprehensive income / (loss) | ||||||||||||

| Cumulative translation reserve | 23,923 | (78,100 | ) | 102,023 | NM | |||||||

| Total comprehensive loss for the period | $ | (2,787,933 | ) | $ | (4,403,671 | ) | $ | 1,615,738 | NM | |||

| Loss per common share, basic and diluted | $ | (0.11 | ) | $ | (0.19 | ) | $ | 0.08 | -42.8% | |||

| Weighted average number of common shares outstanding, basic and diluted | 24,902,192 | 23,150,353 | 1,751,839 | 7.6% | ||||||||

| Adjusted EBITDA (Note 2) | $ | (821,879 | ) | $ | (2,032,556 | ) | $ | 1,210,677 | -59.6% | |||

(1) - Gross profit margin, a supplementary financial metric, is calculated as gross profit divided by revenue. Gross profit margin is not a defined term under IFRS.

(2) - "Adjusted EBITDA", as reflected above, is a non-IFRS measure, which is defined as loss for the period (for quarterly periods), or loss for the year (for annual periods) plus depreciation, plus interest and accretion, plus share-based payments, plus / (less) the allowance / (recovery) for credit losses, plus / (less) the increase / (decrease) in the warranty liability, plus taxes. Adjusted EBITDA is a measure used by management as an indicator of profitability since it excludes the impact of movements in working capital items, certain non-cash charges, and financing costs. Therefore, Adjusted EBITDA gives the investor information as to the cash generated from the operations of a business. However, Adjusted EBITDA is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Adjusted EBITDA as calculated by GreenPower may not be comparable to Adjusted EBITDA as calculated and reported by other companies. The most comparable IFRS measure to Adjusted EBITDA is net income. See page 9 for the calculation of Adjusted EBITDA for the quarters ended June 30, 2023 to June 30, 2022.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Change in Revenue, Gross Profit, and Gross Profit Margin

The increase in revenue for the quarter ended June 30, 2023 compared to the quarter ended June 30, 2022 was $13,729,903, or 356.5%, and was due to 131 vehicles being delivered in the current quarter compared to 21 vehicle deliveries in the same quarter of the prior year, as well as the revenue contribution from Lion Truck Body, which was acquired in July 2022.

The increase in gross profit for the quarter ended June 30, 2023 compared to the quarter ended June 30, 2022 was $1,739,772 or 165.5% and was due to a 356.5% increase in revenue that was partially offset by a 428.2% increase in cost of sales. This resulted in a gross profit margin of 15.9% for the quarter ended June 30, 2023 compared to a gross profit margin of 27.3% for the quarter ended June 30, 2022. The lower gross profit margin was due to the majority of the current quarter's sales under high volume contracts with lower margins, from increased vehicle shipping costs to customers outside of California and from sales at Lion Truck Body that generated a gross profit margin below the total for the quarter.

Change in sales, general and administrative costs

For the quarter ended June 30, 2023 compared to the quarter ended June 30, 2022, sales, general and administrative costs increased by $200,180 or 3.9%. Costs including salaries and administration, depreciation, product development costs, office expense, insurance, transportation costs, travel, accommodation, meals and entertainment increased due to the expansion of the Company's operations in the current quarter. Increases in these costs were largely offset by a reduction in share-based payments expense associated with employee stock options, as well as a reduction in sales and marketing expense in the current quarter compared to the prior year.

Change in loss for the period, loss per common share, and Adjusted EBITDA

The loss for the quarter ended June 30, 2023 decreased by $1,513,715, or 35.0% compared to the same quarter in the prior year due to an increase in the Company's gross profit, which more than offset increases in the Company's selling, general and administrative costs and other expenses.

Loss per common share for the quarter ended June 30, 2023 decreased by $0.08 per share, or 42.8%, due to the reduction in the loss for the year and the increase in the weighted average number of shares outstanding.

The Adjusted EBITDA loss for the quarter ended June 30, 2023 decreased by $1,210,677, or 59.6% compared to the same quarter in the prior year. The decrease was primarily due to a decrease in the loss combined with increases in depreciation, interest and accretion, and increases in the warranty liability in the quarter ended June 30, 2023 that were partially offset by higher share based payments and allowance for credit losses in the quarter ended June 30, 2022.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Summary of Quarterly Results

A summary of selected information for each of the last eight quarters is presented below:

| Three Months Ended | |||||||||||||

| June 30, | March 31, | December 31, | September 30, | ||||||||||

| 2023 | 2023 | 2022 | 2022 | ||||||||||

| Financial results | |||||||||||||

| Revenues | $ | 17,581,008 | $ | 15,304,288 | $ | 12,803,038 | $ | 7,737,459 | |||||

| Loss for the period | (2,811,856 | ) | (3,859,919 | ) | (3,376,204 | ) | (3,482,163 | ) | |||||

| Basic and diluted earnings/(loss) per share | $ | (0.11 | ) | $ | (0.16 | ) | $ | (0.14 | ) | $ | (0.15 | ) | |

| Balance sheet data | |||||||||||||

| Working capital (Note 1) | 26,452,106 | 27,655,892 | 25,660,309 | 26,643,011 | |||||||||

| Total assets | 54,059,697 | 63,525,183 | 65,936,534 | 61,920,873 | |||||||||

| Shareholders' equity | 26,204,408 | 27,662,006 | 27,302,791 | 29,104,670 | |||||||||

| Three Months Ended | |||||||||||||

| June 30, | March 31, | December 31, | September 30, | ||||||||||

| 2022 | 2022 | 2021 | 2021 | ||||||||||

| Financial results | |||||||||||||

| Revenues | $ | 3,851,105 | $ | 4,313,964 | $ | 5,313,352 | $ | 4,629,371 | |||||

| Loss for the period | (4,325,570 | ) | (7,076,553 | ) | (2,958,456 | ) | (2,713,288 | ) | |||||

| Basic and diluted earnings/(loss) per share | $ | (0.19 | ) | $ | (0.32 | ) | $ | (0.13 | ) | $ | (0.12 | ) | |

| Balance sheet data | |||||||||||||

| Working capital (Note 1) | 28,331,760 | 31,581,470 | 29,385,551 | 31,327,058 | |||||||||

| Total assets | 56,671,910 | 49,606,932 | 42,244,573 | 40,864,596 | |||||||||

| Shareholders' equity | 31,699,459 | 34,385,193 | 35,372,237 | 36,700,920 | |||||||||

1) - Working capital defined as Total Current Assets minus Total Current Liabilities

Changes in Quarterly Results

GreenPower's revenue compared to the prior quarter increased in each of the last four quarters ending June 30, 2023. The quarterly increase in revenues was largely driven by quarter over quarter increases in Vehicle Deliveries, and was also impacted by the acquisition of Lion Truck Body during the quarter ended September 30, 2022. During the eight quarters ended June 30, 2023 GreenPower's loss ranged between ($2,713,288) and ($7,076,553) and loss per share ranged from ($0.11) to ($0.32). Improvements in these two metrics was largely driven by increases in gross profit and reductions in these metrics often occurred during quarters with high non-cash share-based payments costs, which can vary significantly from quarter to quarter due to the Black Scholes valuation of employee stock options and the associated recognition of these costs according to the vesting schedule of employee stock options.

GreenPower's total assets declined from $63.5 million as at March 31, 2023 to $54.1 million as at June 30, 2023. The reduction in assets over the quarter was primarily due to the collection of Accounts Receivable and sales of Inventory, and the repayment of approximately $6.5 million on the Company's operating line of credit. Increase in assets in the quarters ending at March 31, 2023 was largely the result of increases in inventory and accounts receivable, both of which were driven by higher vehicle production and revenues over the same period.

During the four quarters ended June 30, 2023 GreenPower's working capital ranged between a low of $25.7 million as at December 31, 2022 and a high of $27.7 million as at March 31, 2023, compared to higher levels of working capital in each of the four quarters of the prior year. The lower working capital levels in the current year compared to the prior year was largely the result of higher current liabilities in the current year compared to the prior year, which more than offset increases in current assets in the current year compared to the prior year.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

The following table summarizes vehicle deliveries pursuant to vehicle leases and vehicle sales for the last four quarters:

| For the three months ended | ||||

| June 30, | March 31, | December 31, | September 30, | |

| 2023 | 2023 | 2022 | 2022 | |

| Vehicle Sales | ||||

| EV Star (Note 1) | 123 | 120 | 100 | 50 |

| Nano BEAST and BEAST school bus | 8 | 1 | 1 | 4 |

| EV 250 | 0 | 2 | 0 | 0 |

| Vehicle Deliveries (Note 2) | 131 | 123 | 101 | 54 |

1) Includes various models of EV Stars

2) "Vehicle Deliveries", as reflected above, is a supplementary performance metric, that management believes provides useful information regarding the business activity of the Company during a quarter or year. Vehicle Deliveries is vehicles that have been sold or leased to a customer during a quarter or a year, as determined by management. The models of vehicles included in Vehicle Deliveries will vary over time, such that Vehicle Deliveries in one period may not be comparable to Vehicle Deliveries in another period. Vehicle Deliveries is not a financial metric, and vehicle deliveries is not an indication of the Company's financial performance in a given period. While management considers Vehicle Deliveries to be a useful supplementary performance metric, users are cautioned to consider other factors to evaluate GreenPower's business.

The following table summarizes cash expenses for the last four quarters:

| For the three months ended | |||||||||||||

| June 30, | March 31, | December 31, | September 30, | ||||||||||

| 2023 | 2023 | 2022 | 2022 | ||||||||||

| Total sales, general and administrative costs | $ | 5,318,190 | $ | 5,490,422 | $ | 5,208,592 | $ | 4,718,257 | |||||

| Plus: | |||||||||||||

| Interest and accretion | 277,951 | 437,284 | 465,188 | 387,661 | |||||||||

| Foreign exchange loss/(gain) | 6,491 | 30,861 | - | 1,108 | |||||||||

| Less: | |||||||||||||

| Depreciation | (442,767 | ) | (402,673 | ) | (330,522 | ) | (290,420 | ) | |||||

| Share-based payments | (713,227 | ) | (468,444 | ) | (500,933 | ) | (967,341 | ) | |||||

| Amortization of deferred financing fees | - | - | - | - | |||||||||

| (Increase)/decrease in warranty liability | (556,023 | ) | (318,063 | ) | (377,218 | ) | (239,847 | ) | |||||

| (Allowance) / recovery for credit losses | (9 | ) | 114,842 | (235,032 | ) | 53,994 | |||||||

| Total Cash Expenses (Note 1) | $ | 3,890,606 | $ | 4,884,229 | $ | 4,230,075 | $ | 3,663,412 | |||||

1) "Total Cash Expenses", as reflected above, is a non-IFRS measure which is defined as sales, general and administrative costs plus interest and accretion, plus/(less) foreign exchange loss/(gain), less depreciation, less share-based payments less amortization of deferred financing fees, plus/(less) the decrease/(increase) in warranty liability, plus / (less) the (allowance) / recovery for credit losses. Total Cash Expenses is a measure used by management as an indicator of sales, general and administrative, interest and accretion, and foreign exchange costs that excludes the impact of certain non-cash charges. Management believes that Total Cash Expenses provides a measure of cash expenses from the operations of the business. However, Total Cash Expenses is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Total Cash Expenses as calculated by GreenPower may not be comparable to Total Cash Expenses as calculated and reported by other companies.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

The following table summarizes Adjusted EBITDA for the last five quarters:

| For the three months ended | |||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||

| 2023 | 2023 | 2022 | 2022 | 2022 | |||||||||||

| Loss for the period | $ | (2,811,856 | ) | $ | (3,859,919 | ) | $ | (3,376,204 | ) | $ | (3,482,163 | ) | $ | (4,325,571 | ) |

| Plus: | |||||||||||||||

| Depreciation | 442,767 | 402,673 | 330,522 | 290,420 | 195,608 | ||||||||||

| Interest and accretion | 277,951 | 437,284 | 465,188 | 387,661 | 259,636 | ||||||||||

| Share-based payments | 713,227 | 468,444 | 500,933 | 967,341 | 1,709,175 | ||||||||||

| Allowance / (recovery) for credit losses | 9 | (114,842 | ) | 235,032 | (53,994 | ) | 28,957 | ||||||||

| Increase/(decrease) in warranty liability | 556,023 | 318,063 | 377,218 | 239,847 | 99,639 | ||||||||||

| Adjusted EBITDA (Note 1) | $ | (821,879 | ) | $ | (2,348,297 | ) | $ | (1,467,311 | ) | $ | (1,650,888 | ) | $ | (2,032,556 | ) |

1) "Adjusted EBITDA", as reflected above, is a non-IFRS measure, which is defined as loss for the period (for quarterly periods), or loss for the year (for annual periods) plus depreciation, plus interest and accretion, plus share-based payments, plus / (less) the allowance / (recovery) for credit losses, plus / (less) the increase / (decrease) in the warranty liability, plus taxes. Adjusted EBITDA is a measure used by management as an indicator of profitability since it excludes the impact of movements in working capital items, certain non-cash charges, and financing costs. Therefore, Adjusted EBITDA gives the investor information as to the cash generated from the operations of a business. However, Adjusted EBITDA is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Adjusted EBITDA as calculated by GreenPower may not be comparable to Adjusted EBITDA as calculated and reported by other companies. The most comparable IFRS measure to Adjusted EBITDA is net income.

Liquidity and Capital Resources

At June 30, 2023 the Company had a cash balance of $1,452,642 working capital, defined as current assets less current liabilities, of $26,452,106. The Company's line of credit has a maximum credit limit of up to $8,000,000 and amounts available on the line of credit in excess of $5,000,000 are subject to margining requirements, and as at June 30, 2023 the Line of Credit had a drawn balance of $162,927. The Company manages its capital structure and makes adjustments to it based on available funds to the Company. The Company may continue to rely on additional financings and the sale of its inventory to further its operations and meet its capital requirements to manufacture EV vehicles, expand its production capacity and further develop its sales, marketing, engineering, and technical resources. The Company's ability to achieve its business objectives is subject to material uncertainty which casts substantial doubt upon the Company's ability to continue as a going concern. The Company will continue to rely on additional financings to further its operations and meet its capital requirements.

Off-Balance Sheet Arrangements

As of the date of this filing, the Company does not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the results of operations or financial condition of the Company including, without limitation, such considerations as liquidity and capital resources that have not previously been discussed.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Related Party Transactions

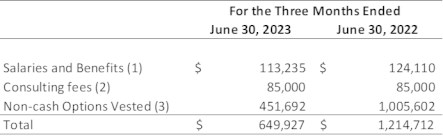

A summary of compensation and other amounts paid to directors, officers and key management personnel is as follows:

1) Salaries and benefits incurred with directors and officers are included in Salaries and administration on the Consolidated Condensed Interim Statements of Operations and Comprehensive Loss.

2) Consulting fees included in Salaries and administration on the Consolidated Condensed Interim Statements of Operations and Comprehensive Loss are paid to the Chairman and CEO for management consulting services, as well as Director's Fees paid to GreenPower's four independent directors.

3) Amounts recognized for related party stock-based compensation are included in Share-based payments on the Consolidated Condensed Interim Statements of Operations and Comprehensive Loss.

Accounts payable and accrued liabilities at June 30, 2023 included $184,182 (March 31, 2023 - $208,215) owed to officers, directors, and companies controlled by officers and directors, and shareholders, which is non-interest bearing, unsecured and has no fixed terms of repayment.

During the year ended March 31, 2023, the Company received loans totaling CAD$3,670,000 and US$25,000 from a company that is beneficially owned by the CEO and Chairman of the Company, and CAD$250,000 was loaned to the Company from a company beneficially owned by a Director of the Company. The loans bear interest at 12.0% per annum plus such additional bonus interest, if any, as may be agreed to and approved by GreenPower's Board of Directors at a later date. During the three months ended June 30, 2023 no additional related party loans were received by the Company, and the CAD $250,000 loan plus accrued interest from a company beneficially owned by a Director of the Company was repaid. The loans from a company that is beneficially owned by the CEO and Chairman of the Company matured on March 31, 2023, however the principal balance is outstanding as at June 30, 2023. During the three months ended June 30, 2023, $82,515 of interest was expensed on related party loans (June 30, 2022 - $9,670). The Company has agreed to grant the lenders a general security assignment on the assets of GreenPower Motor Company Inc., which will be subordinated to any security assignment of senior lenders. A director of the Company and the Company's CEO and Chairman have each provided personal guarantees of $2,510,000, or $5,020,000 in total to support the Company's $8 million operating line of credit.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

New and Amended Standards

Adoption of accounting standards

Amendments Certain new accounting standards have been published by the IASB or the IFRS Interpretations Committee that are effective for annual reporting periods beginning on or after January 1, 2023, as follows:

- IFRS 17 - Insurance Contracts

- IAS 1 - Presentation of Financial Statements and IFRS Practice Statement 2 (Disclosure of Accounting Policies)

- IAS 8 - Accounting policies, Changes in Accounting Estimates and Errors (Definition of Accounting Estimates)

- IAS 12 - Income taxes (Deferred tax related to assets and liabilities arising from a single transaction)

Amendments to these standards did not cause a change to the Company's financial statements.

Future accounting pronouncements

Certain new accounting standards and interpretations have been published by the IASB or the IFRS Interpretations Committee that are not mandatory for the June 30, 2023 reporting period. The Company has reviewed new and revised accounting pronouncements that have been issued but are not yet effective. The Company has not early adopted any of these standards and is currently evaluating the impact, if any, that these standards might have on its consolidated condensed interim financial statements.

Critical Accounting Estimates

Management has made certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Actual outcomes could differ from these estimates. The impacts of such estimates may require accounting adjustments based on future occurrences. Revisions to critical accounting estimates are recognized in the period in which the estimate is revised and future periods if the revision affects both current and future periods. These estimates are based on historical experience, current and future economic conditions, and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

Critical accounting judgements

i. The determination of the functional currency the Company and of each entity within the consolidated Company

ii. The Company's ability to achieve its business objectives is subject to material uncertainty which casts substantial doubt upon the Company's ability to continue as a going concern

Critical accounting estimates and assumptions

i. The determination of the discount rates used to discount the promissory note receivable, term loan, the deferred benefit of government assistance, finance lease receivable and lease liabilities

ii. The estimated accrual rate for the warranty provision on the sale of all-electric vehicles

iii. The classification of leases as either financial leases or operating leases

iv. The determination that the Company is not involved in any legal matters that require a provision

v. The determination of an allowance for doubtful accounts on the Company's trade receivables

vi. The valuation of tangible assets and financial liabilities acquired in the Lion Truck Body (LTB) Inc. transaction

vii. The estimate of the useful life of equipment

viii. The estimate of the net realizable value of inventory

ix. The estimated value of the deferred benefit of government assistance

x. Estimates underlying the recognition of proceeds from government vouchers and grants

xi. Estimates underlying the determination of the carrying value of the West Virginia lease liability and right of use asset

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

xii. Estimates underlying the calculation of deferred income tax assets and deferred income tax recovery

xiii. The determination of overheads to be allocated to inventory and charged to cost of sales

Financial Instruments

The Company's financial instruments consist of cash and restricted cash, accounts receivable, promissory note receivable, finance lease receivables, restricted deposit, line of credit, loans payable to related parties, term loan, accounts payable and accrued liabilities, other liabilities and lease liabilities.

The Company has exposure to the following financial instrument related risks.

Credit risk

The Company's exposure to credit risk is on its cash, accounts receivable, promissory note receivable, and on its finance lease receivables and restricted deposit. The maximum exposure to credit risk is their carrying amounts in the consolidated statement of Financial Position.

The Company's cash is comprised of cash bank balances, and the Company's restricted deposit is an interest-bearing term deposit, all of which is held in major financial institutions in Canada and the United States with a high credit quality and therefore the Company is exposed to minimal credit risk on these assets. The Company assesses the credit risk of its account receivable and finance lease receivables and promissory note receivable at each reporting period end and on an annual basis. As at June 30, 2023 the Company recognized an allowance for credit losses of $139,390, against its accounts receivable (March 31, 2023 - $139,370).

Liquidity risk

The Company tries to ensure that there is sufficient capital in order to meet short-term business requirements, after taking into account the Company's cash balances and available liquidity on the Company's $8 million operating line of credit. The Company's cash is invested in bank accounts at major financial institutions in Canada and the United States and is available on demand. The continuation of the Company as a going concern is dependent on future cash flows from operations including the successful sale and manufacture of electric vehicles to achieve a profitable level of operations and obtaining necessary financing to fund ongoing operations. The Company's ability to achieve its business objectives is subject to material uncertainty which casts substantial doubt upon the Company's ability to continue as a going concern. The Company will continue to rely on additional financings to further its operations and meet its capital requirements.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Market risks

Market risk is the risk of loss that may arise from changes in market factors such as interest rates and foreign exchange. The Company is exposed to interest rate risk with respect to its Line of Credit.

The Company is exposed to foreign exchange risk as it conducts business in both the United States and Canada. Management monitors its foreign currency balances, but the Company does not engage in any hedging activities to reduce its foreign currency risk.

At June 30, 2023, the Company was exposed to currency risk through the following financial assets and liabilities in CDN Dollars:

The CDN/USD exchange rate as at June 30, 2023 was $0.7553 (March 31, 2023 - $0.7389). Based on the net exposure and assuming all other variables remain constant, a 10% change in the appreciation or depreciation of the Canadian dollar relative to the US dollar would result in a change of approximately $259,000 to other comprehensive income/loss.

Capital Management

The Company's capital management objective is to obtain sufficient capital to develop new business opportunities for the benefit of its shareholders. To meet these objectives, management monitors the Company's ongoing capital requirements on specific business opportunities on a case-by-case basis. The capital structure of the Company consists of cash, operating line of credit, the term loan, loans from related parties and equity attributable to common shareholders, consisting of issued share capital and deficit. The line of credit has one financial covenant, to maintain a current ratio greater than 1.2:1, for which the Company is currently in compliance. On September 16, 2022 the Company established an at the market equity program (the ATM program) under which the company may issue, at its discretion, up to $20 million of common shares from treasury to the public through the Nasdaq stock exchange. During the three months ended June 30, 2023, the Company sold 188,819 common shares of the Company under the ATM program raising gross proceeds of $520,892. The ATM offering remains open and future shares may be issued up to the total remaining offering amount, at management's discretion. As at June 30, 2023, the Company had a cash balance of $1,452,642 defined as current assets less current liabilities, of $26,161,221, accumulated deficit of ($63,552,735) and shareholder's equity of $26,201,383. Subject to market conditions and other factors the Company may raise additional capital in the future to fund and grow its business for the benefit of shareholders. There has been no change to the Company's approach to financial management during the quarter.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Outlook

For the immediate future, the Company plans to:

-

Complete production and delivery of several models of EV Stars and BEAST school buses currently in various stages of production;

-

Deliver the remaining vehicles in finished goods inventory;

-

Complete the setup of the West Virginia school bus manufacturing facility and begin production of all-electric school buses in the new facility;

-

Continue to develop and expand its dealer network in order to generate new sales opportunities and increase sales backlog;

-

Further develop its sales and marketing, engineering and technical resources and capabilities.

Capitalization and Outstanding Security Data

The total number of common shares issued and outstanding is 24,948,305 as of June 30, 2023. There are no preferred shares issued and outstanding.

An incentive stock option plan was established for the benefit of directors, officers, employees and consultants of the Company. As of June 30, 2023, there are 2,084,512 options granted and outstanding.

As at August 11, 2023 the Company had 24,948,305 issued shares and 2,069,512 options outstanding.

Disclosure of Internal Controls

Management is responsible for establishing and maintaining disclosure controls and procedures in order to provide reasonable assurance that material information relating to the Company is made known to them in a timely manner and that information required to be disclosed is reported within time periods prescribed by applicable securities legislation. There are inherent limitations to the effectiveness of any system of disclosure controls and procedures, including the possibility of human error and the circumvention or overriding of the controls and procedures. Accordingly, even effective disclosure controls and procedures can only provide reasonable assurance of achieving their control objectives.

As previously reported in our annual MD&A, in preparing our consolidated financial statements as of March 31, 2023 and 2022 and for the fiscal years ended March 31, 2023, 2022 and 2021 we determined that the ineffectiveness of the Company's internal control over financial reporting was due to the following material weaknesses in internal control over financial reporting:

- We did not design and maintain effective controls over revenues or the bank reconciliation process.

- We did not design and maintain effective controls to account for transactions related to inventory and capital asset assets and to ensure that transactions were recorded in the correct period.

- We did not design and maintain effective controls over the accounting treatment relating to complex transactions and for business combinations.

Management is in the process of implementing changes and controls to ensure the control deficiencies contributing to the material weaknesses will be remediated. The remediation actions include designing, implementing and improving internal controls over the areas identified. The Company has engaged an external financial controls consultant to assist in this process and is in the process of hiring additional qualified accounting resources and professionals to manage the implementation of improved controls over financial reporting. During the quarter ended June 30, 2023, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Risk Factors

Investing in the common shares of the Company involves risk. Prospective investors should carefully consider the risks described below, together with all of the other information included in this MD&A before making an investment decision. If any of the following risks actually occurs, the business, financial condition or results of operations of the Company could be harmed. In such an event, the trading price of the common shares could decline and prospective investors may lose part or all of their investment.

Operational Risk

The Company is exposed to many types of operational risks that affect all companies. Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and/or systems. Operational risk is present in all of the Company's business activities, and incorporates exposure relating to fiduciary breaches, product liability claims, product recalls, regulatory compliance failures, legal disputes, business disruption, technology failures, business integration, damage to physical assets, employee safety, dependence on suppliers, foreign exchange fluctuations, insurance coverage and rising insurance costs. Such risks also include the risk of misconduct, theft or fraud by employees or others, unauthorized transactions by employees, operational or human error or not having sufficient levels or quality of staffing resources to successfully achieve the Company's strategic or operational objectives. The occurrence of an event caused by an operational risk that is material could have a material adverse effect on the Company's business, financial condition, liquidity and operating results.

Reliance on Management

The Company is relying solely on the past business success of its directors and officers. The success of the Company is dependent upon the efforts and abilities of its directors, officers and employees. The loss of any of its directors, officers or employees could have a material adverse effect upon the business and prospects of the Company.

Competition in the industry

The Company faces competition from a number of existing manufacturers of all-electric medium and heavy-duty vehicles and buses, as well as manufacturers of traditional medium and heavy-duty vehicles. The Company competes in the zero-emission, or alternative fuel segment of this market. Several of the company's competitors, both publicly listed and privately owned, have raised or have access to a significant amount of capital to invest in the growth and development of their businesses which has increased the competitive threat from several well-capitalized competitors. In addition to existing competitors in various market segments, there is the potential for future competitors to enter the market.

No Dividend Payment History

The Company has not paid any dividends and may not produce earnings or pay dividends in the immediate or foreseeable future.

Reliance on Key Suppliers

Our products contain numerous purchased parts which we source globally directly from suppliers, some of which are single-source suppliers, although we attempt to qualify and obtain components from multiple sources whenever feasible. Any significant increases in our production may require us to procure additional components in a short amount of time, and in the past we have also replaced certain suppliers because of their failure to provide components that met our quality control standards or our timing requirements. There is no assurance that we will be able to secure additional or alternate sources of supply for our components or develop our own replacements in a timely manner, if at all. If we encounter unexpected difficulties with key suppliers, and if we are unable to fill these needs from other suppliers, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our products.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Provision for Warranty Costs

The Company offers warranties on the medium and heavy duty vehicles and buses it sells. Management estimates the related provision for future warranty claims based on historical warranty claim information as well as recent trends that might suggest past cost information may differ from future claims. Factors that could impact future warranty claims include the success of the Company's productivity and quality initiatives as well as parts and labour costs. Actual warranty expense could differ from the provisions which are estimated by management, and these differences could be material and may negatively impact the company's financial results and financial position.

Sales, Marketing, Government Grants and Subsidies

Presently, the initial price of the Company's products are higher than a traditional diesel bus and certain grants and subsidies are available to offset these higher prices. These grants and subsidies include but are not limited to the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project ("HVIP") from the California Air Resources Board ("CARB") in partnership with Calstart, the New Jersey Zero Emission Incentive Program ("NJZIP") operated by the New Jersey Economic Development Authority (NJEDA), the Specialty-Use Vehicle Incentive ("SUVI") Program funded by the Province of British Columbia, Canada, the Incentives for Medium and Heavy Duty Zero Emission Vehicles ("iMHZEV") program operated by the Canadian federal government, the clean trucks NYSERDA program and the New York Voucher Incentive Program in the state of New York, the South Coast AQMD funding in California, Federal Transit Authority funding for eligible transit properties across the US, and VW Mitigation Trust Funds allocated to programs throughout the US. The ability for potential purchasers to receive funding from these programs is subject to the risk of the programs being funded by governments, and the risk of the delay in the timing of advancing funds to the specific programs. To the extent that program funding is not approved, or if the funding is approved but timing of advancing of funds is delayed, subject to cancellation, or is otherwise uncertain, this could have a material adverse effect on our business, financial condition, operating results and prospects.

Current requirements and regulations may change or become more onerous

The Company's products must comply with local regulatory and safety requirements in order to be allowed to operate within the relevant jurisdiction or to qualify for funding. These requirements are subject to change and one regulatory environment is not indicative of another.

Litigation and Legal Proceedings

As of the date of this report the Company is not currently a party to any litigation or legal proceedings which are material, either individually or in the aggregate. The Company has filed a civil claim against the prior CEO and Director of the Company in the Province of British Columbia, and the prior CEO and Director of the Company has filed a response with a counterclaim for wrongful dismissal in the Province of British Columbia. The prior CEO and Director of the Company also filed a similar claim in the state of California in regards to this matter, and this claim has been stayed pending the outcome of the claim in British Columbia. There has not been a resolution on the British Columbia claim or counterclaim, or the California claim as at June 30, 2023. In addition, a company owned and controlled by a former employee who provided services to a subsidiary company of GreenPower until August 2013 filed a claim for breach of confidence against GreenPower in July 2020, and this claim has not been resolved as at June 30, 2023. The Company has not booked a provision for the claims or the counterclaim as it does not believe there is a probable or estimable material financial impact as at June 30, 2023. During April 2023 the Company repossessed 27 EV Stars and 10 EV Star CC's which were previously on lease, after the leases were terminated following a notice of default that was not cured. In addition, the Company repossessed 1 EV Star from the same customer due to non-payment. During May 2023 this customer filed a claim in the state of California against the Company and a subsidiary of the Company, and the Company is evaluating its response to this claim.

| GreenPower Motor Company Inc. Management’s Discussion and Analysis For the period ended June 30, 2023 Discussion dated: as of August 11, 2023 |

Reliance on Shipping

We rely on global shipping for vehicles that we produce at contract manufacturers, and for certain parts and components sourced from our global network of suppliers. We have experienced an increase in shipping costs and have experienced delays of deliveries of parts and components from our global suppliers, and on vehicles arriving from our contract manufacturers. While these delays and cost increases are not currently at a level that they have caused a material disruption or negative impact to our profitability, these delays and costs may increase to a point that they may negatively impact our financial results and ability to grow our business.

Events after the reporting period

Subsequent to the end of the quarter 15,000 stock options with a weighted average exercise price of CAD$16.98 were forfeited.