UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

OR

For

the fiscal year ended

OR

OR

Commission

File No.:

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

State

of

(Jurisdiction of incorporation or organization)

Tel: +972.4.6230333

(Address of principal executive offices)

Chief Executive Officer

IceCure Medical Inc.

Tel:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| | ||||

| Pre-Funded Warrants to Purchase Ordinary Shares, no par value |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging Growth Company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes

☐ No

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

☒

International Financial Reporting Standards as issued by the International Accounting Standards Board

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes

☐ No

TABLE OF CONTENTS

i

ii

IceCure Medical Ltd.

INTRODUCTION

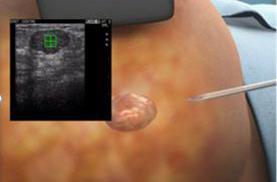

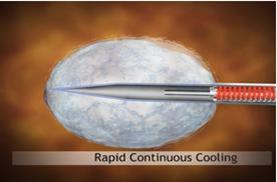

We are a commercial stage medical device company focusing on the research, development and marketing of cryoablation systems and technologies based on liquid nitrogen, or LN2, for treating tumors. Cryoablation is the process by which benign and malignant tumors are ablated (destroyed) through freezing such tumors while in a patient’s body. Our proprietary cryoablation technology is a minimally invasive alternative to surgical intervention, for tumors, including those found in breast, lungs, kidneys, bones and other indications. Our lead commercial cryoablation product is the ProSense system.

In addition to our existing lead product, the ProSense system, a single probe system, we have developed an additional multi probe system that is expected to have the ability to freeze several tumors simultaneously or larger tumors, which we refer to as our MultiSense system, which has not been commercialized. In our continued efforts aimed at improving our core technology, we are currently focusing on developing our next generation MultiSense system, which we intend to commercialize subject to regulatory approvals. We are also in the process of developing our next generation single probe system. While these next generation systems are still in various research and development stages, we expect them to be more efficient and user friendly.

We believe that obtaining regulatory approval for our existing and next generation products for specific indications will help us grow our business. As of December 31, 2021, we have received a broad range of regulatory approvals for our systems to treat tumors in the lungs, kidneys, bones and other indications. In the United States our products are approved as a “single family” known as the “IceCure Family,” which includes the IceSense3, ProSense, and MultiSense (which has not been commercialized) cryoablation systems. Although our existing, “IceCure Family” systems have regulatory approvals from the United States Food and Drug Administration, or the FDA, for commercialization in the United States, we have yet to receive regulatory approval for such systems for treatment of malignant breast tumors, which requires a separate approval from the FDA. The FDA classifies medical devices into one of three classes (Class I, Class II, or Class III) depending on their level of risk and the types of controls that are necessary to ensure device safety and effectiveness. The class assignment is a factor in determining the type of premarketing submission or application, if any, that will be required before marketing products in the United States. If the FDA does not approve 510(k) regulatory pathway for breast cancer, we will request that De Novo classification be accepted for our “IceCure Family” systems. If De Novo classification is needed for our “IceCure Family” systems, we will be required to accept special controls imposed by the FDA, mainly on the production process and post-market monitoring. If a De Novo classification is not approved by the FDA as the regulatory pathway, the FDA will accept only pre-market approval, or PMA, in which case we expect the timeline for marketing approvals would be longer and our costs associated with PMA would be higher compared to 510(k) or De Novo approval.

We are an Israeli corporation based in Caesarea, Israel and were incorporated in Israel in 2006. On February 2, 2011, we became a public company in Israel and our shares were listed for trade on the TASE. On August 26, 2021, our shares were listed for trade on Nasdaq. Our principal executive offices are located at 7 Ha’Eshel St., PO Box 3163, Caesarea, 3079504 Israel. Our telephone number in Israel is +972-4-6230333. Our website address is http://www.icecure-medical.com. The information contained on, or that can be accessed through, our website is not part of this report. We have included our website address in this report solely as an inactive textual reference.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this annual report on Form 20-F may be deemed to be “forward-looking statements,” including some of the statements made under Item 3.D. “Risk Factors,” Item 5 “Operating and Financial Review and Prospects,” “Business” and elsewhere in this annual report constitute forward-looking statements. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “predict,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate

Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| ● | our planned level of revenues and capital expenditures; | |

| ● | our ability to market and sell our products; | |

| ● | our plans to continue to invest in research and development to develop technology for both existing and new products; | |

| ● | our ability to maintain our relationships with suppliers, manufacturers and other partners; | |

| ● | our ability to maintain or protect the validity of our European, U.S. and other patents and other intellectual property; | |

| ● | our ability to retain key executive members; | |

| ● | our ability to internally develop and protect new inventions and intellectual property; | |

| ● | our ability to expose and educate physicians and other medical professionals about the use cases of our products; | |

| ● | our expectations regarding our tax classifications; | |

| ● | interpretations of current laws and the passage of future laws; | |

| ● | the impact of COVID-19 and resulting government actions on us, our manufacturers, suppliers and facilities in which our ProSense system is used or in which our products are undergoing trials; and

| |

| ● | those factors referred to in “Item 3.D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects”, as well as in this annual report on Form 20-F generally. |

iv

Readers are urged to carefully review and consider the various disclosures made throughout this annual report on Form 20-F which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this annual report on Form 20-F are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, the section of this annual report on Form 20-F entitled “Item 4. Information on the Company” contains information obtained from independent industry sources and other sources that we have not independently verified.

Unless otherwise indicated, all references to “we,” “us,” “our,” the “Company” and “IceCure” refer to IceCure Medical Ltd. and its wholly owned subsidiaries, IceCure Medical Inc., a Delaware corporation, IceCure Medical HK Limited a Hong Kong corporation and IceCure (Shanghai) MedTech Co., Ltd., a subsidiary of IceCure Medical HK Limited.

Our reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this report to “NIS” are to New Israeli Shekels, and references to “dollars” or “$” mean U.S. dollars.

Unless derived from our financial statements or otherwise noted, amounts presented in this annual report are translated at the rate of NIS 3.11 = USD 1.00, the exchange rate between the NIS and the U.S. dollar reported by the Bank of Israel as of December 31, 2021.

This report contains trademarks, trade names and service marks, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this report may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

We report our financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

Summary Risk Factors

Our business is subject to numerous risks, as more fully described in “Item 3.D. Risk Factors” immediately following this summary. You should read these risks in full before you invest in our securities. The following is a summary of such risks.

Risks Related to Our Financial Condition and Capital Requirements

| ● | we have a limited operating history and we have incurred significant operating losses since our inception, and anticipate that we will incur continued losses for the foreseeable future; | |

| ● | we have generated minimal revenues from product sales and may never be profitable, even if we receive regulatory approval to commercialize our products in additional geographical territories and indications; | |

| ● | even following the December 2021 public offering, we expect that we will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our commercialization and product development efforts, expansion to new markets, or other activities. |

v

Risks Related to Our Business and Industry

| ● | we are highly dependent on the successful development, obtaining regulatory clearances and marketing and sale of our ProSense and MultiSense systems; | |

| ● | we face business disruption and related risks resulting from the recent outbreak of the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations; | |

| ● | if we fail to maintain existing strategic relationships with Terumo Corporation or are unable to identify additional strategic distributors of our systems, and any future products and technologies, our revenues may decrease; | |

| ● | we are dependent upon third-party manufacturers and suppliers making us vulnerable to supply shortages and problems, increased costs and quality or compliance issues, any of which could harm our business; | |

| ● | we manage our business through a small number of employees and key consultants. We may need to expand our organization and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations; | |

| ● | if we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks; | |

| ● | we face intense competition in the market, and as a result we may be unable to effectively compete in our industry; | |

| ● | our commercial success is very much dependent on third-party payors to provide adequate insurance coverage and reimbursement for the use of our systems, or any future products that we may commercialize; | |

| ● | our management team has limited experience managing a U.S. reporting company; | |

| ● | our business and operations might be adversely affected by security breaches, including any cybersecurity incidents; | |

| ● | we may be exposed to business disruptions and geopolitical risks related to the geopolitical and military tensions between Russia and Ukraine in Europe. |

Risks Related to Product Development and Regulatory Approval

| ● | our, or our partners’ clinical trials may encounter delays, suspensions or other problems; | |

| ● | the results of pre-clinical studies, early-stage clinical trials, data obtained from real-world use, and published third-party studies may not be indicative of results in future clinical trials and we cannot assure you that any clinical trials will yield the results we anticipate, be successful or lead to results sufficient for the necessary regulatory approvals; | |

| ● | we may not receive, or may be delayed in receiving, the necessary clearances or approvals for our current products or future products in order to commercialize these products in specific countries or regions or in a specific indication, and failure to timely obtain necessary clearances or approvals for our existing or future products would adversely affect our ability to grow our business; | |

| ● | preliminary data that we or others announce or publish from time to time with respect to our products may change as more data become available and are subject to audit and verification procedures that could result in material changes in the final data; |

vi

| ● | the misuse or off-label use of our products may harm our reputation in the marketplace, result in injuries that may lead to product liability suits or result in costly investigations, fines or sanctions by regulatory bodies if we are deemed to have engaged in the promotion of these uses, any of which could be costly; | |

| ● | our products may cause or contribute to adverse medical events or be subject to failures or malfunctions that we are required to immediately report to all relevant regulatory authorities, and if we fail to do so, we would be subject to sanctions that could harm our reputation, business, financial condition and results of operations. The discovery of serious safety issues with our products, or a recall of our products either voluntarily or at the direction of the FDA or another governmental authority, could have a negative impact on us; | |

| ● | if we do not obtain and maintain international regulatory registrations, clearances or approvals for our products, we will be unable to market and sell our products; | |

| ● | disruptions at the FDA and other government agencies could hinder their ability to hire, retain or deploy key leadership and other personnel, or otherwise prevent new or modified products from being cleared or approved or commercialized in a timely manner or at all, which could negatively impact our business; |

Risks Related to Our Intellectual Property

| ● | if we are unable to obtain and maintain effective patent rights for our products and services, we may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us; | |

| ● | third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts; |

Risks Related to the Ownership of our Securities

| ● | our principal shareholders, officers and directors currently beneficially own approximately 73.96% of our Ordinary Shares. They will therefore be able to exert significant control over matters submitted to our shareholders for approval; | |

| ● | because we are a “controlled company” within the meaning of the Nasdaq Stock Market rules, our shareholders may not have certain corporate governance protections that are available to shareholders of companies that are not controlled companies; | |

| ● | we may be a “passive foreign investment company,” or PFIC, for U.S. federal income tax purposes in the current taxable year or may become one in any subsequent taxable year. There generally would be negative tax consequences for U.S. taxpayers that are holders of the Ordinary Shares if we are or were to become a PFIC; |

Risks Related to Israeli Law and Our Operations in Israel

| ● | potential political, economic and military instability in the State of Israel, where our headquarters, members of our management team and our research and development facilities are located, may adversely affect our results of operations; | |

| ● | we expect to be exposed to fluctuations in currency exchange rates, which could adversely affect our results of operations; | |

| ● | the termination or reduction of tax and other incentives that the Israeli government provides to Israeli companies may increase our costs and taxes; | |

| ● | we may be required to pay monetary remuneration to our Israeli employees for their inventions, even if the rights to such inventions have been duly assigned to us. We may also not be able to enforce covenants not-to-compete under current Israeli law that might result in added competition for our products; | |

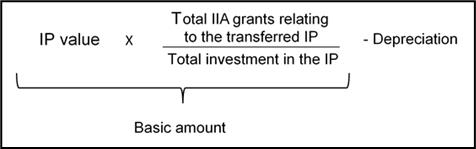

| ● | we received Israeli government grants for certain of our research and development activities, the terms of which may require us to pay royalties and to satisfy specified conditions in order to manufacture products and transfer technologies outside of Israel. If we fail to satisfy these conditions, we may be required to pay penalties and refund grants previously received; | |

| ● | provisions of Israeli law and our articles of association may delay, prevent or otherwise impede a merger with, or an acquisition of, us, which could prevent a change of control, even when the terms of such a transaction are favorable to us and our shareholders; | |

| ● | it may be difficult to enforce a judgment of a U.S. court against us, our executive officers and directors named in this this annual report on Form 20-F in Israel or the United States, to assert U.S. securities laws claims in Israel or to serve process on our executive officers and directors and these experts; and | |

| ● | your rights and responsibilities as a shareholder will be governed in key respects by Israeli laws, which differs in some material respects from the rights and responsibilities of shareholders of U.S. companies |

vii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | Selected Financial Data. |

[Reserved]

| B. | Capitalization and Indebtedness. |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

| D. | Risk Factors. |

Our business faces significant risks. You should carefully consider the risks described below, together with all of the other information in this annual report on Form 20-F. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of these risks actually occurs, our business and financial condition could suffer and the price of our Ordinary Shares could decline. This report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this report and our other SEC filings. See “Cautionary Note Regarding Forward-Looking Statements” above.

Risks Related to Our Financial Condition and Capital Requirements

We have a limited operating history and we have incurred significant operating losses since our inception and anticipate that we will incur continued losses for the foreseeable future.

We are a medical device company with a limited operating history. To date, we have focused on developing our first commercial product for cryoablating tumors, the ProSense system, collecting clinical data, obtaining regulatory approvals in different geographical territories and indications and initiated our commercialization effort. We have funded our operations to date primarily through raising capital on TASE, private offerings, minimal sales of our ProSense system and its components, including affiliated needles, or Probes, guiding needles, or Introducers and other products, which we collectively refer to as disposables, loans, convertible loans and royalty-bearing grants that we received from the Israeli Innovation Authority, or the IIA, formerly known as the Office of the Chief Scientist of the Ministry of Economy and Industry.

We have only a limited operating history upon which you can evaluate our business and prospects. In addition, we have limited experience and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the medical device industry. To date, we have generated minimal revenues from the sale of our ProSense system and its disposables (see “Item 5. Operating and Financial Review and Prospects” for additional information). We have incurred losses in each year since our inception, including operating losses of $9,724 thousand and $4,142 thousand for the years ended December 31, 2021 and 2020, respectively. As of December 31, 2021, we had an accumulated deficit of $58,431 thousand. Substantially all of our operating losses resulted from costs incurred in connection with our development of our technology, business development and commercialization and from general and administrative costs associated with our operations.

1

Until we can generate significant revenues, if ever, we expect to satisfy our future cash needs through debt or equity financing. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the scope of, or eliminate research or development plans for, or commercialization efforts with respect to our products.

We expect our research and development expenses to increase in connection with our planned expanded research and development efforts, including those conducted in connection with the development of our next generation single Probe and MultiSense systems, and as we seek to receive approval from applicable regulatory authorities to commence commercialization of our ProSense system for treatment in breast cancer and other indications. In addition, if we obtain marketing approval for our ProSense system for the treatment of breast cancer and other indications in different countries across the world, including the United States, and for our next generation single Probe and MultiSense systems, we will likely incur significant sales, marketing and outsourced manufacturing expenses. In addition, although we have certain regulatory approvals, these only allow us to conduct minimal commercialization of our products, and therefore we will need to seek additional regulatory approvals in order to initiate commercialization, in scale, that has the potential to generate significant revenues for us. Even if we were to receive marketing approval for our ProSense and MultiSense systems, we expect that we will continue to incur significant research and development expenses as we seek to improve our technology and effectively compete with our competitors and as we seek additional approvals for their use in different indications and marketing and commercialization costs.

Furthermore, in addition to such operating expenses, we expect to incur additional costs associated with operating as a public company subject to the rules and regulations of the SEC, which we estimate will be at least one million dollars annually. As a result, we expect to continue to incur significant and increasing operating losses for the foreseeable future. Because of the numerous risks and uncertainties associated with developing a medical device, we are unable to predict the extent of any future losses or when we will become profitable, if at all.

The regulatory marketing approvals that we currently have are insufficient to generate significant revenue. Therefore, we expect to continue to incur significant losses until we are able to meaningfully commercialize our ProSense system or our next generation single Probe and MultiSense systems, which we may not be successful in achieving. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the research and development of our technology; | |

| ● | discover that there are robust technology changes in our field; | |

| ● | seek regulatory and marketing approvals for our medical devices, and more specifically, our ProSense system for treatment of breast cancer; | |

| ● | subject to the receipt of the applicable regulatory approvals, establish and expand a sales, marketing, and distribution infrastructure to commercialize our current ProSense system and our future next generation single Probe and MultiSense systems, and its disposables; | |

| ● | seek to identify, assess, acquire, license, and/or develop other medical devices companies and subsequent generations of our current medical devices; | |

| ● | seek to maintain, protect, and expand our intellectual property portfolio; | |

| ● | seek to attract and retain skilled personnel; | |

| ● | create additional infrastructure to support our operations as a public company and our product development and planned future commercialization efforts; and | |

| ● | experience any delays or encounter issues with respect to any of the above, including, but not limited to, failed studies, complex results, safety issues or other regulatory challenges that require longer follow-up of existing studies or additional supportive studies in order to pursue marketing approval. |

2

The amount of any future operating losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through sales, equity or debt financings, strategic collaborations or grants. Even if we obtain regulatory approval to market our ProSense system or any future products, including the next generation single Probe and MultiSense systems, our future revenues will depend on the market size (geographic and indication-specific) in which any such product receives approval and our ability to achieve sufficient market acceptance, competition, pricing, reimbursement from third-party payors for our ProSense and next generation single Probe and MultiSense systems or any future product candidates. Further, the operating losses that we incur may fluctuate significantly from quarter to quarter and year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance. Other unanticipated costs may also arise.

We have generated minimal revenues from product sales and may never be profitable, even if we receive regulatory approval to commercialize our products in additional geographical territories and indications.

Our system and its disposables are approved for marketing in a limited number of jurisdictions and for use in treatment of certain indications. In order to generate significant revenue, we will need to obtain additional regulatory approvals in jurisdictions within which we already have certain regulatory approvals and also in jurisdictions in which we currently have no regulatory approvals to market our products. Even if our ProSense or MultiSense systems or any future products are approved for marketing and sale, we anticipate incurring significant incremental costs associated with commercializing such products.

Our ProSense system, and its disposables, has regulatory approvals that allow us to market our system or its disposables in certain geographical areas and for specific indications. However, even with these regulatory approvals in place, we have yet to generate significant revenues and we plan to seek for additional regulatory approvals covering additional clinical indications, to allow us to increase clinical acceptance of our products by the medical community, obtain reimbursement coverage, and partner with distributors, all in order to increase commercialization efforts (see “Item 4.B. Business Overview - Government Regulation” for additional information). However, there can be no assurance that we will obtain regulatory approvals for all indications we have applied, or intend to apply for, or at all.

In addition to our dependency on receiving adequate regulatory approvals to market our products to our target market (geographic and indication-specific), our ability to generate significant revenues and achieve profitability also depends on our success in many areas, including but not limited to:

| ● | complete research and development of our MultiSense and ProSense systems and any future products in a timely and successful manner; | |

| ● | obtain market acceptance, if and when approved, of our ProSense and MultiSense systems and any future products from the medical community, patients and third-party payors; | |

| ● | enter into agreements with commercial partners; | |

| ● | obtain sufficient clinical evidence from our trials and commercial procedures, and publish such data; | |

| ● | maintain and enhance a commercially viable, sustainable, scalable, reproducible and transferable manufacturing process for our ProSense and next generation single Probe and MultiSense systems and any future product candidates that is compliant with current good manufacturing practices, or cGMPs, or any other applicable regulations or standards; | |

| ● | establish and maintain supply and, if applicable, manufacturing relationships with third parties that can provide, in both amount and quality, adequate products to support development and the market demand for our ProSense and next generation single Probe and MultiSense systems and any future products, if and when approved for marketing by regulators; | |

| ● | maintain sufficient average selling price for our products and the revenues margin that we generate; | |

| ● | launch and commercialize any products for which we obtain regulatory and marketing approval, either directly by establishing a sales force, marketing and distribution infrastructure, and/or with collaborators or distributors; | |

| ● | accurately identifying demand for our ProSense and next generation single Probe and MultiSense systems or any future products; | |

| ● | ensure our products are approved for reimbursement from governmental agencies, health care providers and insurers in jurisdictions where they have been approved for marketing; | |

| ● | address any competing technological and market developments that impact our technology or its prospective usage by medical professionals; | |

| ● | negotiate favorable terms in any collaboration, licensing or other arrangements into which we may enter and perform our obligations under such collaborations; | |

| ● | attract, hire and retain qualified personnel; and | |

| ● | locate and lease or acquire suitable facilities to support our clinical development, manufacturing facilities and commercial expansion. |

In addition, even if we were to receive all of the regulatory approvals that we may seek to receive, our expenses could increase beyond expectations if we are required by the FDA, or other regulatory agencies, domestic or foreign, to change our manufacturing processes or assays or to perform studies in addition to those that we currently anticipate.

3

Further, if we are not able to generate significant revenues from the sale of our approved products, we may be forced to curtail or cease our operations. Due to the numerous risks and uncertainties involved in product development, it is difficult to predict the timing or amount of increased expenses, or when, or if, we will be able to achieve or maintain profitability.

Even following the December 2021 public offering, we expect that we will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our commercialization and product development efforts, expansion to new markets, or other activities.

As of December 31, 2021, our cash and cash equivalents and deposits were approximately $25.6 million, and we had a working capital of $26,302 thousand and an accumulated deficit of $58,431 thousand. We expect that our existing cash and cash equivalents will be sufficient for the next 12 months of operations. We expect that we will require substantial additional capital to commercialize our ProSense system and to develop and commercialize our next generation single Probe and MultiSense systems. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future funding requirements will depend on many factors, including but not limited to:

| ● | the cost, timing and outcomes of regulatory review of ProSense system and any future products; | |

| ● | the costs of maintaining our own commercial-scale cGMP manufacturing facility, including costs related to obtaining and maintaining regulatory compliance, and/or engaging third-party manufacturers therefor; | |

| ● | the scope, progress, results and costs of product development, testing, manufacturing, preclinical development and, if applicable, clinical trials for any other products that we may develop or otherwise obtain in the future; | |

| ● | the cost of our future activities, including establishing sales, marketing and distribution capabilities for any products in any particular geography where we receive marketing approval for such products; | |

| ● | the terms and timing of any collaborative, licensing and other arrangements that we may establish; | |

| ● | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims; and | |

| ● | the level of revenues received from commercial sales of any product candidates for which we receive marketing approval. |

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our ProSense and next generation single Probe and MultiSense systems and any future product candidates. We cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all, during or after the COVID-19 pandemic. In addition, our ability to raise capital could be affected by various factors, including clinical adverse events. Moreover, the terms of any financing may adversely affect the holdings or the rights of holders of our securities and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

4

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the development or commercialization of our ProSense or next generation single Probe and MultiSense systems or any other products or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and share price.

The global economy, including credit and financial markets, has experienced extreme volatility and disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, increases in inflation rates and uncertainty about economic stability. For example, the COVID-19 pandemic resulted in widespread unemployment, economic slowdown and extreme volatility in the capital markets. Similarly, the current conflict between Ukraine and Russia has created extreme volatility in the global capital markets and is expected to have further global economic consequences, including disruptions of the global supply chain and energy markets. Any such volatility and disruptions may have adverse consequences on us or the third parties on whom we rely. If the equity and credit markets deteriorate, including as a result of political unrest or war, it may make any necessary debt or equity financing more difficult to obtain in a timely manner or on favorable terms, more costly or more dilutive. Inflation can adversely affect us by increasing our costs. Any significant increases in inflation and related increase in interest rates could have a material adverse effect on our business, results of operations and financial condition.

Risks Related to Our Business and Industry

We are highly dependent on the successful development, obtaining regulatory clearances and marketing and sale of our ProSense and next generation single Probe and MultiSense systems.

Our ProSense system, our second generation cryoablation system, is the basis of our business. As a result, the success of our business plan is highly dependent on our ability to manufacture our ProSense at a large scale, and commercialize our ProSense system for the treatment of breast cancer, and other intended uses in the field of interventional oncology (including kidney cancer, lung cancer, liver cancer and bone cancer) and our failure to do so could cause our business to fail. Successful production and commercialization of medical devices is a complex and uncertain process, dependent on the efforts of management, manufacturers, local operators, integrators, medical professionals, third-party payors, as well as general economic conditions, among other factors. Any factor that adversely impacts the production and commercialization of our ProSense system, will have a negative impact on our business, financial condition, results of operations and prospects. We have limited experience in commercializing our ProSense system and we may face several challenges with respect to our commercialization efforts, including, among others, that:

| ● | we may not have adequate financial or other resources to complete the development of our next generation single Probe and MultiSense systems or any future products; |

| ● | we may not be able to manufacture our ProSense system in commercial quantities, at an adequate quality or at an acceptable cost; |

| ● | we may not be able to establish adequate sales, marketing and distribution channels for our products; |

| ● | healthcare professionals, medical providers and patients may not accept our products; |

| ● | we may not be aware of possible complications from the continued use of our ProSense system since we have limited clinical experience with respect to the actual use of our ProSense system; |

5

| ● | technological breakthroughs solutions in the ablation of tissues may reduce the demand for our ProSense system; |

| ● | third-party payors may not agree to reimburse sufficiently, or at all patients or healthcare providers for any or all of the procedures conducted with our ProSense system, which may adversely affect medical providers, and patients’ willingness to use our ProSense system; |

| ● | we may face third-party claims of intellectual property infringement; |

| ● | we may fail to obtain or maintain regulatory clearance or approvals in our target markets (geographic and indication-specific) or may face adverse regulatory or legal actions even if regulatory approval is obtained; |

| ● | prices may adversely affect patients’ willingness to use our ProSense system; and |

| ● | guidelines published by the medical community may not recommend the use of our ProSense and next generation single Probe and MultiSense systems or any future products for certain indications, which may adversely affect healthcare users willingness to use our ProSense and next generation single Probe and MultiSense systems or any future products. |

If we are unable to meet any one or more of these challenges successfully, our ability to effectively commercialize our products could be limited, which in turn could have a material adverse effect on our business, financial condition and results of operations.

We face business disruption and related risks resulting from the recent outbreak of the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations.

We have been impacted by the COVID-19 pandemic, and we cannot predict the future impacts the COVID-19 pandemic, including the emergence of new strains such as the Omicron or Delta variant, may have on its business, results of operations and financial condition. While COVID-19 is still spreading and the final implications of the pandemic are difficult to estimate at this stage, it is clear that it has affected the lives of a large portion of the global population. At this time, the pandemic has caused states of emergency to be declared in various countries, travel restrictions imposed globally, quarantines established in certain jurisdictions and various institutions and companies being closed. Numerous government regulations and public advisories, as well as shifting social behaviors, temporarily and from time to time limited or closed non-essential transportation, government functions, business activities and person-to-person interactions, and the duration of such trends is difficult to predict. In particular, in November 2021, the Ministry of Health in the State of Israel issued guidelines requiring a Green Pass evidencing vaccination status for indoor gatherings of more than 50 people. Employers (including us) are also required to prepare and increase as much as possible the capacity and arrangement for employees to work remotely. While certain COVID-19 mitigation actions have since been relaxed, no assurance can be made that such actions, or other measures, will not be reimposed in the future. In addition, the U.S. government has restricted travel to the United States from foreign nationals who have not been vaccinated against COVID-19. Although to date these restrictions have not materially impacted our operations other than the ability to travel which resulted within some delays in our trials, demonstrations and installations, the effect on our business, from the spread of COVID-19 and the COVID-19 mitigation actions implemented by the governments of the State of Israel, the United States and other countries, may worsen over time.

6

Authorities around the world have and may continue implementing similar restrictions on business and individuals in their jurisdictions. To date, we have taken action to enable our employees to work remotely from home but there can be no assurance that these measures will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular. COVID-19 infection of our workforce could result in a temporary disruption in our business activities, including manufacturing, and other functions. During this uncertain time, our critical priorities are the health and safety of our employees and contractors, all of whom began working from home and reduced travel to essential business needs. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state, local authorities and any other relevant jurisdiction, or that we determine are in the best interests of our employees. In that regard, while we continued to operate almost fully including carrying out our studies in compliance with all applicable Israeli rules and guidelines, our employees worked remotely when full lockdowns were enforced. In addition, the closure of borders and state mandated quarantines, have made it difficult for us to assist in the installation and maintenance of our ProSense system and providing clinical hands-on support and were required to provide such services remotely.

The spread of an infectious disease, including COVID-19, may also result in the inability of our manufacturers to deliver components or finished products on a timely basis and may also result in the inability of our suppliers to deliver the parts required by our manufacturers to complete manufacturing of components or finished products, increase in components pricing and in shipping costs. Since March 2020, we have experienced delays in supply of some components of our products from abroad and an increase in prices of components and shipping costs. While we were able to overcome such delays by planning ahead and making additional orders of our necessary components, we may not be able to do so if the future. In addition, governments and medical service providers may divert spending from other budgeted resources as they seek to reduce and/or stop the spread of an infectious disease, such as COVID-19. Such events may result in a period of business and manufacturing disruption, and in reduced operations, any of which could materially affect our business, financial condition and results of operations. New COVID-19 variants, and potentially increasing infection rates make the current COVID-19 related environment highly volatile and uncertain. We anticipate that the continuation of the pandemic and related restrictions and safety measures will likely result in continued fluctuations in sales of our products, and potentially enrollments in our studies, for the upcoming periods. The extent to which COVID-19 impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others.

If we fail to maintain existing strategic relationships with Terumo Corporation or are unable to identify additional distributors of our products or any future products and technologies, our revenues may decrease.

We currently derive a significant amount of our revenues through our strategic relationships and exclusive distribution agreements with Terumo Corporation (including its affiliates). If our relationships with Terumo Corporation are terminated or impaired for any reason and we are unable to replace these relationships with other means of distribution, we could suffer a material decrease in revenues.

We may need, or decide it is otherwise advantageous to us, to obtain the assistance of additional distributors to market and distribute our future products and technologies, as well as to market and distribute our existing ProSense and next generation single Probe and MultiSense systems, to existing or new markets or geographical areas. We may not be able to find additional distributors who will agree to and are able to successfully market and distribute our systems and technologies on commercially reasonable terms, if at all. If we are unable to establish additional distribution relationships on favorable terms, our revenues may decline. In addition, our distributors may choose to favor the products of our competitors over ours and give preference to them.

Also, our financial results are dependent upon the service efforts of Terumo Corporation. If Terumo Corporation is unsuccessful in adequately servicing our products, our sales could significantly decrease and our business, financial condition, results of operations and prospects may be adversely impacted.

Pursuant to our agreements with Terumo Corporation, we are also dependent on Terumo Corporation’s efforts to obtain regulatory approval for the marketing and sale and the reimbursement of our products in Japan and other territories in which it seeks to commercialize our ProSense system, such as Thailand. If Terumo Corporation fails to obtain such approvals, it might adversely impact our future plans for sales in Japan and other regions.

7

Medical device development is costly and involves continual technological change which may render our current or future products obsolete.

The market for medical device technologies and products is characterized by factors such as rapid technological change, medical advances, changing consumer requirements, short device lifecycles, changing regulatory requirements and evolving industry standards. Any one of these factors could reduce the demand for our devices or require substantial resources and expenditures for, among other things, research, design and development, to avoid technological or market obsolescence.

Our success will depend on our ability to enhance our current technology and develop or acquire new technologies to keep pace with technological developments and evolving industry standards, while responding to changes in customer needs. A failure to adequately develop or acquire device enhancements or new devices that will address changing technologies and customer requirements adequately, or to introduce such devices on a timely basis, may have a material adverse effect on our business, financial condition and results of operations.

We might have insufficient financial resources to improve our ProSense system or complete the development of our next generation single Probe and MultiSense systems, and any other future products, and advance technologies and develop new devices at competitive prices. Technological advances by one or more competitors or future entrants into the field may result in our present services or devices becoming non-competitive or obsolete, which may decrease revenues and profits and adversely affect our business and results of operations.

We may encounter significant competition across our product lines and in each market in which we will sell our products and services from various companies, some of which may have greater financial and marketing resources than we do. Our competitors may include any companies engaged in the research, development, manufacture, and marketing of non-invasive or minimal invasive solutions and technologies to treat tumors, as well as a wide range of medical device companies that sell a single or limited number of competitive products and services or participate in only a specific market segment.

We will be dependent upon success in our customer acquisition strategy.

Our business will be dependent upon success in our customer acquisition strategy. If we fail to maintain a high quality of device technology, we may fail to retain or add new customers. If we fail, our revenue, financial results and business may be significantly harmed. Our future success depends upon expanding our commercial operations in the United States, Europe and South East Asia, as well as entering additional markets (geographic and indication-specific) to commercialize our next generation single Probe and MultiSense systems and any other future products. We believe that our expanded growth will depend on the further development, regulatory approval(s) and commercialization of our ProSense and next generation single Probe and MultiSense systems. If we fail to commercialize our products in a timely manner and across a range of indications, including breast cancer, we may not be able to expand our markets or to grow our revenue, and our business and financial condition may be adversely impacted. If medical practitioners do not perceive our products to be useful and reliable, we may not be able to attract or retain new customers. A decrease in sales growth could cause us to enter into sales or distribution agreements on terms less favorable to us or cause us to license our technology on unfavorable and unexpected terms, which may have a material and adverse impact on our revenue, business, reputation, financial condition and results of operations.

We are dependent upon third-party manufacturers and suppliers making us vulnerable to supply shortages and problems, increased component and shipping costs and quality or compliance issues, any of which could harm our business.

We rely on third parties to manufacture and supply us with proprietary custom components. We rely on a limited number of suppliers who provide us materials and components as well as manufacture and assemble certain components of our products. Our suppliers may encounter problems during manufacturing for a variety of reasons, including, for example, failure to follow specific protocols and procedures, failure to comply with applicable legal and regulatory requirements, equipment malfunction and environmental factors, failure to properly conduct their own business affairs, infringement of third-party intellectual property rights, and as a result of the COVID-19 pandemic and the resulting government restrictions, any of which could delay or impede their ability to meet our requirements. Our reliance on these third-party suppliers also subjects us to other risks that could harm our business, including:

| ● | we are not currently a major customer of many of our suppliers, and these suppliers may therefore give other customers’ needs higher priority than ours; |

8

| ● | third parties may threaten or enforce their intellectual property rights against our suppliers, which may cause disruptions or delays in shipment, or may force our suppliers to cease conducting business with us; |

| ● | we may not be able to obtain an adequate supply in a timely manner or on commercially reasonable terms; | |

| ● | our suppliers, especially new suppliers, may make errors in manufacturing that could negatively affect the efficacy or safety of our products or cause delays in shipment; | |

| ● | we may have difficulty locating and qualifying alternative suppliers; | |

| ● | the costs of shipping components has increased and we may not be able to pass along such increased costs to our customers; | |

| ● | switching components or suppliers may require product redesign, validation or verification processes and possibly submission to the FDA or other similar foreign regulatory agencies, which could significantly impede or delay our commercial activities; | |

| ● | one or more of our suppliers may be unwilling or unable to supply components of our products; | |

| ● | the occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers may affect their ability to deliver products to us in a timely manner; and | |

| ● | our suppliers may encounter financial or other business hardships unrelated to our demand, which could inhibit their ability to fulfill our orders and meet our requirements. |

In addition, the product development process of Cryoablation systems based on the liquid nitrogen coolant material is complex and requires unique specialists and technology for design and manufacture systems core modules and elements. We, or our partners, may experience delays in design solutions and verifications activities due to liquid nitrogen physical properties, which influences the complexity in handling, storage, and flowing of liquid nitrogen.

We consistently monitor our inventory levels and maintain recovery plans to address potential disruptions that we may encounter from our suppliers. However, we may not be able to quickly establish additional or alternative suppliers if necessary, in part because we may need to undertake additional activities to establish such suppliers as required by the regulatory approval process. Any interruption or delay in obtaining products from our third-party suppliers, or our inability to obtain products from qualified alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to switch to competing products. Given our reliance on certain suppliers, we may be susceptible to supply shortages while looking for alternate suppliers (see “Item 4.B. Business Overview – Production and Manufacturing” for additional information).

We may not be able to replace our current manufacturing capabilities in a timely manner.

If our contract manufacturing facility or our in-house facility suffers any type of prolonged interruption, whether caused by regulator action, equipment failure, critical facility services failure, fire, natural disaster or any other event that causes the cessation of manufacturing activities, such as COVID-19, we may be exposed to long-term loss of sales and profits. There are limited facilities which are capable of contract manufacturing some of our products and product candidates. Replacement of our current manufacturing capabilities may have a material adverse effect on our business and financial condition.

9

We are dependent upon third-party service providers. If such third-party service providers fail to maintain a high quality of service, the utility of our products could be impaired, which could adversely affect the penetration of our products, our business, operating results and reputation.

The success of certain services and products that we provide are dependent upon third-party service providers. Such service providers include manufacturers of proprietary custom components for our ProSense and next generation single Probe and MultiSense systems. As we expand our commercial activities, an increased burden will be placed upon the quality of such third-party providers. If third-party providers fail to maintain a high quality of service, our products, business, reputation and operating results could be adversely affected. In addition, poor quality of service by third-party service providers could result in liability claims and litigation against us for damages or injuries.

If we are not able to attract and retain highly skilled managerial, scientific, technical and marketing personnel, we may not be able to implement our business model successfully.

Our success depends in part on our continued ability to attract, retain and motivate highly qualified management, clinical and scientific personnel. We are highly dependent upon our senior management as well as other employees, consultants and scientific and medical collaborators. Our management team must be able to act decisively to apply and adapt our business model in the rapidly changing markets in which we will compete. In addition, we will rely upon technical and scientific employees or third-party contractors to effectively establish, manage and grow our business. Consequently, we believe that our future viability will depend largely on our ability to attract and retain highly skilled managerial, sales, scientific and technical personnel. In order to do so, we may need to pay higher compensation or fees to our employees or consultants than currently expected and such higher compensation payments may have a negative effect on our operating results. Competition for experienced, high-quality personnel in the medical device field is intense. We may not be able to hire or retain the necessary personnel to implement our business strategy. Our failure to hire and retain quality personnel on acceptable terms could impair our ability to develop new products and services and manage our business effectively.

We may need to expand our organization and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations.

As our development and commercialization plans and strategies develop and because we are leanly staffed, we may need additional managerial, development, regulatory, operational, sales, marketing, financial, legal and other resources. The competition for qualified personnel in the medical device industry is intense. Due to this intense competition, we may be unable to attract and retain qualified personnel necessary for the development of our business or to recruit suitable replacement personnel.

Our management may need to divert its attention away from our day-to-day activities and devote a substantial amount of time to managing these growth activities. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, operational mistakes, loss of business opportunities, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of additional medical device products. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and/or grow revenues could be reduced and we may not be able to implement our business strategy. Our future financial performance and our ability to commercialize medical device products and services and compete effectively will depend, in part, on our ability to effectively manage any future growth.

10

If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks.

We may evaluate various acquisition opportunities and strategic partnerships, including licensing or acquiring complementary products, intellectual property rights, technologies or businesses. Any potential acquisition or strategic partnership may entail numerous risks, including:

| ● | increased operating expenses and cash requirements; |

| ● | the assumption of additional indebtedness or contingent liabilities; |

| ● | the issuance of our equity securities; |

| ● | assimilation of operations, intellectual property and products of an acquired company, including difficulties associated with integrating new personnel; |

| ● | the diversion of our management’s attention from our existing product programs and initiatives in pursuing such a strategic merger or acquisition; |

| ● | retention of key employees, the loss of key personnel and uncertainties in our ability to maintain key business relationships; |

| ● | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates and marketing approvals; and |

| ● | our inability to generate revenues from acquired technology and/or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

We are subject to certain U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations. We can face serious consequences for violations.

Among other matters, U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations, which are collectively referred to as Trade Laws, prohibit companies and their employees, agents, clinical research organizations, legal counsel, accountants, consultants, contractors and other partners from authorizing, promising, offering, providing, soliciting or receiving, directly or indirectly, corrupt or improper payments or anything else of value to or from recipients in the public or private sector. Violations of Trade Laws can result in substantial criminal fines and civil penalties, imprisonment, the loss of trade privileges, debarment, tax reassessments, breach of contract and fraud litigation, reputational harm, and other consequences. We have direct or indirect interactions with officials and employees of government agencies or government-affiliated hospitals, universities and other organizations. We also expect our non-U.S. activities to increase over time. We plan to engage third parties for clinical trials and/or to obtain necessary permits, licenses, patent registrations and other regulatory approvals, and we can be held liable for the corrupt or other illegal activities of our personnel, agents or partners, even if we do not explicitly authorize or have prior knowledge of such activities.

Non-U.S. governments often impose strict price controls, which may adversely affect our future profitability.

We may be subject to rules and regulations in the United States and non-U.S. jurisdictions relating to our ProSense and MultiSense systems or any future products. In some countries, including countries of the European Union, or the EU, Japan, or China each of which has developed its own rules and regulations, pricing may be subject to governmental control under certain circumstances. In these countries, pricing negotiations with governmental agencies can take considerable time after the receipt of marketing approval for a medical device candidate. To obtain reimbursement or pricing approval in some countries, we may be required to conduct a clinical trial that compares the cost-effectiveness of our product to other available products. If reimbursement of our products is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, we may be unable to achieve or sustain profitability.

11

We manage our business through a small number of employees and key consultants.

As of December 31, 2021, we had 55 full-time employees, nine part time employees, two independent contractors and two consultants. Our future growth and success depend to a large extent on the continued services of members of our current management including, in particular, our VP Research and Development and our Chief Executive Officer. Any of our employees and consultants may leave our company at any time, subject to certain notice periods. The loss of the services of any of our executive officers or any key employees or consultants may adversely affect our ability to execute our business plan and harm our operating results. Our operational success will substantially depend on the continued employment of senior executives, technical staff and other key personnel, especially given the intense competition for qualified personnel. The loss of key personnel may have an adverse effect on our operations and financial performance

International expansion of our business exposes us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States or Israel.

Other than our headquarters and other operations which are located in Israel (as further described below), our business strategy incorporates significant international expansion, particularly in anticipated expansion of regulatory approvals of our products. Doing business internationally involves a number of risks, including but not limited to:

| ● | multiple, conflicting and changing laws and regulations such as privacy regulations, tax laws, export and import restrictions, employment laws, regulatory requirements and other governmental approvals, permits and licenses; | |

| ● | failure by us to obtain regulatory approvals for the use of our products and services in various countries; | |

| ● | additional potentially relevant third-party patent rights; | |

| ● | complexities and difficulties in obtaining protection and enforcing our intellectual property; |

| ● | difficulties in staffing and managing foreign operations; | |

| ● | complexities associated with managing multiple regulatory, governmental and reimbursement regimes; | |

| ● | limits in our ability to penetrate international markets; | |

| ● | financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the impact of local and regional financial crises on demand and payment for our products and exposure to foreign currency exchange rate fluctuations; | |

| ● | natural disasters, political and economic instability, including wars, terrorism and political unrest, outbreak of disease, boycotts, curtailment of trade and other business restrictions; | |

| ● | certain expenses including, among others, expenses for travel, translation and insurance; and | |

| ● | regulatory and compliance risks that relate to maintaining accurate information and control over sales and activities that may fall within the purview of the U.S. Foreign Corrupt Practices Act, or the FCPA, its books and records provisions or its anti-bribery provisions. |

Any of these factors could significantly harm our future international expansion and operations and, consequently, our results of operations.

We face intense competition in the market, and as a result we may be unable to effectively compete in our industry.

The major market players within the cancer cryoablation care market and our primary competitors in the United States and abroad include Boston Scientific and Siemens Healthineers. Some of these companies hold significant market share. Their dominant market position and significant control over the market could significantly limit our ability to introduce or effectively market and generate sales and capture market share.

12

Many of our competitors have long histories and strong reputations within the industry. They have significantly greater brand recognition, financial and human resources than we do. They also have more experience and capabilities in researching and developing medical devices, obtaining and maintaining regulatory clearances, manufacturing and marketing those products and other resources, than we do. There is a significant risk that we may be unable to overcome the advantages held by our competition, and our inability to do so could lead to the failure of our business and the loss of your investment. In addition, we may be unable to develop additional products in the future or to keep pace with developments and innovations in the market and lose market share to our competitors.

Competition in the medical devices and cancer treatment market is intense, and can lead to, among other things, price reductions, longer selling cycles, lower product margins, loss of market share and additional working capital requirements. To succeed, we must, among other critical matters, gain consumer acceptance for our ProSense and next generation single Probe and MultiSense systems, as compared to other solutions currently available in the market for the treatment of tumors and potential future medical devices incorporating our principal technology or offering other advanced cryoablation, heat ablation or other non or minimal invasive solutions. For example, since the currently accepted treatment for breast cancer is surgery, we will need to invest resources in educating the medical community and consumers, and establish strategic collaborations before we will be able to gain market acceptance for our ProSense system as a treatment to breast cancer. If our competitors offer significant discounts on certain products and solutions, we may need to lower our prices or offer other favorable terms in order to compete successfully. Moreover, any broad-based changes to our prices and pricing policies could make it difficult to generate revenues or cause our revenues to decline. Moreover, if our competitors develop and commercialize products and solutions that are more effective or desirable than products and solutions that we may develop, we may not convince our customers to use our products and solutions. Any such changes would likely reduce our commercial opportunity and revenues potential and could materially adversely impact our operating results.

Our commercial success is very much dependent on third-party payors to provide adequate insurance coverage and reimbursement for the use of our systems, or any future products that we may commercialize.

Our ProSense and next generation single Probe and MultiSense systems, and any other product in our development pipeline, is not yet approved for third-party payor coverage or reimbursement in some of the geographical markets in which we operate, or plan to operate in the future. Such reimbursement may vary based on the particular device used in providing services and is based on the identity of the third-party. Our ability to maintain a leading position in the medical device market, and specifically in the cancer care market, depends on our relationships with private third parties.