10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended December 31, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission file number 001-36129

ONEMAIN HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 27-3379612 |

(State of incorporation) | (I.R.S. Employer Identification No.) |

| |

601 N.W. Second Street, Evansville, IN | 47708 |

(Address of principal executive offices) | (Zip Code) |

(812) 424-8031

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

| | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity of OneMain Holdings, Inc. held by non-affiliates as of the close of business on June 30, 2015 was $2,604,511,028.

At February 24, 2016, there were 134,743,720 shares of the registrant’s common stock, $.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13, and 14) is incorporated by reference from the registrant’s Definitive Proxy Statement for its 2016 Annual Meeting to be filed with the Securities and Exchange Commission pursuant to Regulation 14A.

TABLE OF CONTENTS

Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent only management’s current beliefs regarding future events. By their nature, forward-looking statements involve inherent risks, uncertainties and other important factors that may cause actual results, performance or achievements to differ materially from those expressed in or implied by such forward-looking statements. We caution you not to place undue reliance on these forward-looking statements that speak only as of the date they were made. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events. Forward-looking statements include, without limitation, statements concerning future plans, objectives, goals, projections, strategies, events or performance, and underlying assumptions and other statements related thereto. Statements preceded by, followed by or that otherwise include the words “anticipates,” “appears,” “are likely,” “believes,” “estimates,” “expects,” “foresees,” “intends,” “plans,” “projects” and similar expressions or future or conditional verbs such as “would,” “should,” “could,” “may,” or “will,” are intended to identify forward-looking statements. Important factors that could cause actual results, performance or achievements to differ materially from those expressed in or implied by forward-looking statements include, without limitation, the following:

| |

• | the inability to obtain, or delays in obtaining, cost savings and synergies from the “OneMain Acquisition”, as defined in “Business Overview” in Item 1 on page 5 of this report, and risks associated with the integration of the companies; |

| |

• | unanticipated expenditures relating to the OneMain Acquisition; |

| |

• | any litigation, fines or penalties that could arise relating to the OneMain Acquisition; |

| |

• | the impact of the OneMain Acquisition on each company’s relationships with employees and third parties; |

| |

• | various risks relating to the proposed sale of branches to Lendmark Financial Services, LLC (the “Lendmark Sale”) in connection with the previously disclosed settlement with the U.S. Department of Justice (the “DOJ”), including the costs and effects of any failure or inability to consummate the Lendmark Sale timely or at all, which could potentially result in a sale of such branches to another buyer on terms less favorable than the proposed Lendmark Sale; |

| |

• | changes in general economic conditions, including the interest rate environment in which we conduct business and the financial markets through which we can access capital and also invest cash flows from our Consumer and Insurance segment; |

| |

• | levels of unemployment and personal bankruptcies; |

| |

• | natural or accidental events such as earthquakes, hurricanes, tornadoes, fires, or floods affecting our customers, collateral, or branches or other operating facilities; |

| |

• | war, acts of terrorism, riots, civil disruption, pandemics, cyber security breaches, or other events disrupting business or commerce; |

| |

• | changes in the rate at which we can collect or potentially sell our finance receivables portfolio; |

| |

• | the effectiveness of our credit risk scoring models in assessing the risk of customer unwillingness or lack of capacity to repay; |

| |

• | changes in our ability to attract and retain employees or key executives to support our businesses; |

| |

• | changes in the competitive environment in which we operate, including the demand for our products, customer responsiveness to our distribution channels, and the strength and ability of our competitors to operate independently or to enter into business combinations that result in a more attractive range of customer products or provide greater financial resources; |

| |

• | shifts in collateral values, delinquencies, or credit losses; |

| |

• | changes in federal, state or local laws, regulations, or regulatory policies and practices, including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) (which, among other things, established the Consumer Financial Protection Bureau, which has broad authority to regulate and examine financial institutions, including us), that affect our ability to conduct business or the manner in which we conduct business, such as licensing requirements, pricing limitations or restrictions on the method of offering products, as well as changes that may result from increased regulatory scrutiny of the sub-prime lending industry; |

| |

• | potential liability relating to real estate and personal loans which we have sold or may sell in the future, or relating to securitized loans, if it is determined that there was a non-curable breach of a representation or warranty made in connection with such transactions; |

| |

• | the costs and effects of any actual or alleged violations of any federal, state or local laws, rules or regulations, including any litigation associated therewith, any impact to our business operations, reputation, financial position, results of operations or cash flows arising therefrom, any impact to our relationships with lenders, investors or other third parties attributable thereto, and the costs and effects of any breach of any representation, warranty or covenant under any of our contractual arrangements, including indentures or other financing arrangements or contracts, as a result of any such violation; |

| |

• | the costs and effects of any fines, penalties, judgments, decrees, orders, inquiries, investigations, subpoenas, or enforcement or other proceedings of any governmental or quasi-governmental agency or authority and any litigation associated therewith; |

| |

• | our continued ability to access the capital markets or the sufficiency of our current sources of funds to satisfy our cash flow requirements; |

| |

• | our ability to comply with our debt covenants; |

| |

• | our ability to generate sufficient cash to service all of our indebtedness; |

| |

• | the effects of any downgrade of our debt ratings by credit rating agencies, which could have a negative impact on our cost of and/or access to capital; |

| |

• | our substantial indebtedness, which could prevent us from meeting our obligations under our debt instruments and limit our ability to react to changes in the economy or our industry, or our ability to incur additional borrowings; |

| |

• | the impacts of our securitizations and borrowings; |

| |

• | our ability to maintain sufficient capital levels in our regulated and unregulated subsidiaries; |

| |

• | changes in accounting standards or tax policies and practices and the application of such new policies and practices to the manner in which we conduct business; |

| |

• | the effect of future sales of our remaining portfolio of real estate loans and the transfer of servicing for these loans; and |

| |

• | other risks described in “Risk Factors” in Item 1A in Part I of this report. |

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this report that could cause actual results to differ before making an investment decision to purchase our common stock. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us.

PART I

Item 1. Business.

BUSINESS OVERVIEW

OneMain Holdings, Inc. (formerly Springleaf Holdings, Inc.) is referred to in this report as “OMH” or, collectively with its subsidiaries, whether directly or indirectly owned, “the Company,” “we,” “us,” or “our”.

As one of the nation’s largest consumer finance companies, we:

| |

• | provide responsible personal loan products; |

| |

• | offer credit and non-credit insurance; |

| |

• | pursue strategic acquisitions of loan portfolios; and |

| |

• | pursue acquisitions of companies and/or establish joint ventures. |

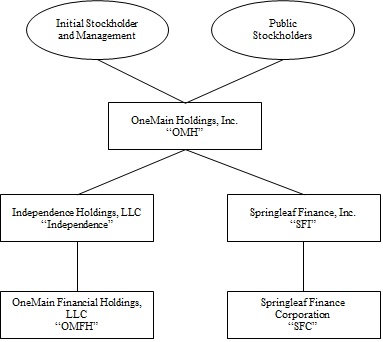

As part of our acquisition strategy, on November 15, 2015, OMH, through its wholly owned subsidiary, Independence Holdings, LLC, (“Independence”) completed its acquisition of OneMain Financial Holdings, LLC (“OMFH”) from CitiFinancial Credit Company (“Citigroup”) for $4.5 billion in cash (the “OneMain Acquisition”). OMFH, collectively with its subsidiaries, is referred to in this report as “OneMain”. OMH and its subsidiaries (other than OneMain) is referred to in this report as “Springleaf”.

The OneMain Acquisition brings together two branch-based consumer finance companies with complementary strategies and locations. OneMain provides personal loans to primarily middle‑income households through a national, community‑based network of 1,139 branches as of December 31, 2015, serving nearly 1.3 million customer accounts across 43 states. Springleaf provides high quality origination, underwriting and servicing of personal loans, primarily to non-prime consumers. Together, with an experienced management team, proven access to the capital markets, and strong demand for consumer credit, we believe we are well positioned for future growth. At December 31, 2015, we had $13.9 billion of combined personal loans due from over 2.3 million customer accounts (including personal loans held for sale of $617 million).

Our combined network of over 1,900 branches as of December 31, 2015 and expert personnel is complemented by our online consumer loan origination business and centralized operations, which allows us to reach customers located outside our branch footprint. In September 2015, we launched a new online consumer loan origination business (“iLoan”) to provide our current and prospective customers the option of obtaining an unsecured personal loan via a digital platform. We also pursue strategic acquisitions of loan portfolios through our Springleaf Acquisitions division, which we service through our centralized operations. We service the loans acquired through a joint venture in which we own a 47% equity interest (the “SpringCastle Portfolio”). In addition, we pursue fee-based opportunities in servicing loans for others in connection with potential strategic portfolio acquisitions through our centralized operations. See “Centralized Operations” for further information on our centralized servicing centers.

In connection with our personal loan business, Springleaf and OneMain insurance subsidiaries offer our customers credit and non-credit insurance policies covering our customers and the property pledged as collateral for our personal loans.

At December 31, 2015, Springleaf Financial Holdings, LLC (the “Initial Stockholder”) owned approximately 58% of OMH’s common stock. The Initial Stockholder is owned primarily by a private equity fund managed by an affiliate of Fortress Investment Group LLC (“Fortress”).

The following chart summarizes our organization structure as a result of the OneMain Acquisition. The chart is provided for illustrative purposes only and does not represent all of OMH’s subsidiaries or obligations.

INDUSTRY AND MARKET OVERVIEW

We operate in the consumer finance industry serving the large and growing population of consumers who have limited access to credit from banks, credit card companies and other lenders. According to the Federal Reserve Bank of New York, as of December 31, 2015, the U.S. consumer finance industry had grown to approximately $3.4 trillion of outstanding borrowings in the form of personal loans, vehicle loans and leases, credit cards, home equity lines of credit, and student loans. Furthermore, difficult economic conditions in recent years have resulted in an increase in the number of non-prime consumers in the United States.

This industry’s traditional lenders have undergone fundamental changes, forcing many to retrench and in some cases to exit the market altogether. Tightened credit requirements imposed by banks, credit card companies, and other traditional lenders that began during the recession of 2008-2009 have further reduced the supply of consumer credit for non-prime borrowers. In addition, we believe that recent regulatory developments create a dis-incentive for these lenders to resume or support these lending activities. As a result, while the number of non-prime consumers in the United States has grown in recent years, the supply of consumer credit to this demographic has contracted. We believe this large and growing number of potential customers in our target market, combined with the decline in available consumer credit, provides an attractive market opportunity for our business model.

We are one of the few remaining national participants in the consumer installment lending industry still serving this large and growing population of non-prime customers. Our centralized operations, combined with the capabilities resident in our national branch system, provide an effective nationwide platform to efficiently and responsibly address this growing market of consumers. We believe we are, therefore, well-positioned to capitalize on the significant growth and expansion opportunity created by the large supply-demand imbalance within our industry.

SEGMENTS

Our segments coincide with how our businesses are managed. At December 31, 2015, our three segments include:

| |

• | Acquisitions and Servicing; and |

Following the OneMain Acquisition, we include OneMain’s operations within the Consumer and Insurance segment.

Management considers Consumer and Insurance, and Acquisitions and Servicing as our “Core Consumer Operations” and Real Estate as our “Non-Core Portfolio.” See Note 23 of the Notes to Consolidated Financial Statements in Item 8 for more information about our segments.

CORE CONSUMER OPERATIONS

Consumer and Insurance

We originate and service secured and unsecured personal loans and offer voluntary credit insurance and related products through our combined branch network, our newly launched iLoan platform, and our centralized operations. Personal loan origination and servicing, along with our insurance products, forms the core of our operations. As a result of the OneMain Acquisition, our combined branch operations include over 1,900 branch offices in 43 states as of December 31, 2015. In addition, our centralized support operations provide underwriting and servicing support to branch operations.

Our insurance business is conducted through Springleaf insurance subsidiaries, Merit Life Insurance Co. (“Merit”) and Yosemite Insurance Company (“Yosemite”), which are both wholly owned subsidiaries of SFC, and OneMain’s insurance subsidiaries, American Health and Life Insurance Company (“AHL”) and Triton Insurance Company (“Triton”). Merit and AHL are life and health insurance companies that write credit life, credit disability, and non-credit insurance. Merit is licensed in 46 states, the District of Columbia, and the U.S. Virgin Islands, and AHL is licensed in 49 states, the District of Columbia, and Canada. Yosemite and Triton are property and casualty insurance companies that write credit-related property and casualty and credit involuntary unemployment insurance. Yosemite is licensed in 46 states, and Triton is licensed in 50 states, the District of Columbia, and Canada.

Products and Services. Our combined personal loan portfolio comprises high yielding assets that have performed well through difficult market conditions. Our personal loans are typically fully amortizing, fixed rate, non-revolving loans secured by titled personal property (such as automobiles), consumer goods, or other personal property or unsecured.

Since mid-2014, our direct auto loan program has further expanded our core product offerings to better serve our customers’ needs. The auto loan product offers a customized solution for our current and prospective customers to finance the purchase of a vehicle, pay off an existing auto loan with another lender, or use the equity in their vehicle to consolidate debt, make home improvements or receive cash. We offer the auto loan product through our branch network and our centralized operations.

The typical size of the auto loan product is $6,000 - $25,000, with a typical maximum term of five years. The auto loan product is secured by the customer’s automobile in all cases, compared to our personal loans, of which 21% were secured by titled personal property (primarily automobiles) at December 31, 2015. We report the auto loan product in our core personal loans, which are included in our Core Consumer Operations. At December 31, 2015, we had over $1.0 billion of auto loans.

We write the following types of credit insurance policies covering our customers and the property pledged as collateral through products that we offer to our customers:

| |

• | Credit life insurance — Insures the life of the borrower in an amount typically equal to the unpaid balance of the finance receivable and provides for payment to the lender of the finance receivable in the event of the borrower’s death. |

| |

• | Credit disability insurance — Provides scheduled monthly loan payments to lender during borrower’s disability due to illness or injury. |

| |

• | Credit involuntary unemployment insurance — Provides scheduled monthly loan payments to the lender during borrower’s involuntary unemployment. |

| |

• | Credit-related property and casualty insurance — Written to protect the value of property pledged as collateral for the finance receivable. |

A borrower’s purchase of credit life, credit disability, credit-related property and casualty, or credit involuntary unemployment insurance is voluntary, with the exception of lender placed property damage coverage for property pledged as collateral for our real estate loans.

We also offer non-credit insurance policies, which are primarily traditional level term life policies with very limited underwriting. The purchase of this coverage is also voluntary.

In addition, we offer home and auto membership plans of an unaffiliated company. We have no risk of loss on these membership plans, and these plans are not considered insurance products. We recognize income from this ancillary product in other revenues — other. The unaffiliated company providing these membership plans is responsible for any required reimbursement to the customer on the ancillary product.

Customer Development. We staff each of our branch offices with local, well-trained personnel who have significant experience in the industry. Our business model revolves around an effective origination, underwriting, and servicing process that leverages each branch office’s local presence in these communities along with the personal relationships developed with our customers. Our combined branch network helps solicit new prospects by facilitating our “high-touch” servicing approach for personal loans due to the geographical proximity that typically exists between our branch offices and our customers. Our customers often develop a relationship with their local office representatives, which we believe not only improves the credit performance of our personal loans but also leads to additional lending opportunities.

During the second quarter of 2015, we launched Springleaf Rewards, a unique digital loyalty program that is designed to encourage credit education, positive customer behavior and brand engagement. The program rewards customers for a range of activities, such as consistently paying their bills on time and interacting with us on social media. Unlike traditional rewards programs, Springleaf Rewards allows members to accrue points for completing tasks that help them establish and build their credit, such as viewing personal financial education videos and budgeting tutorials on line, monitoring their credit score, and submitting bill payments on time. Customers also earn points for enrolling in conveniences like paperless statements and automatic payments. Since its launch in June 2015, more than 75,000 customers have signed up to start earning rewards. Springleaf Rewards members can choose how and when to redeem their points. Points can be exchanged for a variety of gift cards for national retailers, restaurants and other merchants.

Our online consumer loan origination business and our centralized operations allow us to reach customers located outside our branch footprint. We believe this provides us a significant opportunity to grow our customer base, loan portfolio and finance charges. If a customer applies online and is located near an existing branch, we request, though do not require, that the customer visit the branch to meet with one of our employees, who will close and fund the loans. Loans closed in a branch office are serviced by that branch. This approach provides the branches with an additional source of customers who are located close to a branch, but who prefer the convenience of applying online or during hours when the branches are not open. We also believe that this approach will enable us to leverage our branch network to offer additional products and services, including insurance products, and to help maintain the credit quality of the loans we source online.

Our newly launched iLoan platform provides our current and prospective customers the option of obtaining an unsecured personal loan via a digital platform. The new online lending product offers a customized solution for our customers to consolidate debt, make home improvements or receive cash. Our iLoan product leverages our central underwriting and servicing operations in addition to our expertise in analytics, marketing, central operations and internet technology developed to support our branch operations.

We use search engine optimization, banner advertisements and email campaigns to attract new customers through the internet. We also have entered into agreements with other internet loan originators to purchase leads for potential customers seeking loans. Our e-signature capabilities facilitate our online lending products. Customers who are approved for loans through our centralized operations also have the added convenience of receiving the loan funds through an automated clearinghouse (“ACH”) direct deposit into their bank accounts. These loans are serviced by our centralized operations.

We also solicit new prospects, as well as current and former customers, through a variety of direct mail offers. Our data warehouse is a central, proprietary source of information regarding current and former customers. We use this information to tailor offers to specific customers. In addition to internal data, we purchase lists of new potential personal loan borrowers from major list vendors based on predetermined selection criteria. Mail solicitations include invitations to apply for personal loans and pre-qualified offers of guaranteed personal loan credit.

Through our merchant referral program, merchants refer their customers to us and we originate a loan directly to the merchant’s customers to facilitate a retail purchase. We believe this approach allows us to apply our proprietary underwriting standards to these loans rather than relying on the merchant’s underwriting standards. In addition, it gives us direct access to the customer, which gives our branches the opportunity to build a relationship with the customer that could lead to opportunities to offer additional products and services, including insurance products. Our branch employees are actively soliciting new relationships with merchants in their communities, and we believe that this referral program provides us with a significant opportunity to grow our customer base and increase our finance receivables revenue.

We market our insurance products to eligible finance receivable customers through both our branch network and our centralized operations. This allows us to benefit from the customer base underlying our consumer loan business, which significantly reduces the marketing expenses that are typically borne by insurance companies. In addition, the overhead costs of our consumer and insurance businesses are shared.

Credit Risk. Credit quality is driven by our long-standing underwriting philosophy, which takes into account each prospective customer’s household budget, and his or her willingness and capacity to repay the loan. We use credit risk scoring models at the time of the credit application to assess the applicant’s expected willingness and capacity to repay. We develop these models using numerous factors, including past customer credit repayment experience and application data, and periodically revalidate these models based on recent portfolio performance. Our underwriting process in the branches and for loan applications received through our website that are not automatically approved also includes the development of a budget (net of taxes and monthly expenses) for the applicant. We may obtain a security interest in either titled personal property or consumer household goods.

Our customers are primarily considered non-prime and require significantly higher levels of servicing than prime or near-prime customers. As a result, we charge these customers higher interest rates to compensate us for the related credit risks and servicing.

Account Servicing. The account servicing and collection processing for personal loans are generally handled at the branch office where the personal loans were originated, or in our centralized service centers. All servicing and collection activity is conducted and documented on proprietary systems which log and maintain, within our centralized information systems, a permanent record of all transactions and notations made with respect to the servicing and/or collection of a personal loan and are also used to assess a personal loan application. The proprietary systems permit all levels of branch office management to review on a daily basis the individual and collective performance of all branch offices for which they are responsible.

Acquisitions and Servicing

The SpringCastle Portfolio consists of unsecured loans and loans secured by subordinate residential real estate mortgages (which we service as unsecured loans due to the fact that the liens are subordinated to superior ranking security interests) and includes both closed-end accounts and open-end lines of credit. These loans are in a liquidating status and vary in form and substance from our originated loans. At December 31, 2015, the SpringCastle Portfolio included over 232,000 of acquired loans, representing $1.6 billion in net finance receivables.

NON-CORE PORTFOLIO

Since we ceased real estate lending in January 2012, our real estate loans are in a liquidating status. In 2014, we entered into a series of transactions relating to the sales of our beneficial interests in our non-core real estate loans, the related servicing of these loans, and the sales of certain performing and non-performing real estate loans, which substantially completed our plan to liquidate our non-core real estate loans. At December 31, 2015, our real estate loans held for investment totaled $524 million and comprised less than 4% of our net finance receivables. Real estate loans held for sale totaled $179 million at December 31, 2015.

CENTRALIZED OPERATIONS

We continually seek to identify functions that could be more effective if centralized to achieve reduced costs or free our lending specialists to service our customers and market our products. Our centralized operational functions support the following:

| |

• | mail and telephone solicitations; |

| |

• | originating “out of footprint” loans; |

| |

• | servicing of delinquent real estate loans and certain personal loans; |

| |

• | bankruptcy process for Chapter 7, 11, 12 and 13 loans; |

| |

• | litigation requests for wage garnishments and other actions against borrowers; |

| |

• | collateral protection insurance tracking; |

| |

• | repossessing and re-marketing of titled collateral; and |

| |

• | charge-off recovery operations. |

We currently have servicing facilities in Mendota Heights, Minnesota, Tempe, Arizona, and London, Kentucky, and in connection with the OneMain Acquisition, we acquired three additional servicing facilities in Fort Mill, South Carolina, Fort

Worth, Texas, and Irving, Texas. We believe these facilities, along with the offices in Evansville, Indiana, position us for additional portfolio purchases or fee-based servicing, as well as additional flexibility in the servicing of our lending products.

OPERATIONAL CONTROLS

We control and monitor our businesses through a variety of methods including the following:

| |

• | Our operational policies and procedures standardize various aspects of lending and collections. |

| |

• | Our branch finance receivable systems control amounts, rates, terms, and fees of our customers’ accounts; create loan documents specific to the state in which the branch office operates or to the customer’s location if the loan is made electronically through our centralized operations; and control cash receipts and disbursements. |

| |

• | Our headquarters accounting personnel reconcile bank accounts, investigate discrepancies, and resolve differences. |

| |

• | Our credit risk management system reports allow us to track individual branch office performance and to monitor lending and collection activities. |

| |

• | Our executive information system is available to headquarters and field operations management to review the status of activity through the close of business of the prior day. |

| |

• | Our branch field operations management structure is designed to control a large, decentralized organization with succeeding levels of supervision staffed with more experienced personnel. |

| |

• | Our field operations compensation plan aligns the operating activities and goals with corporate strategies by basing the incentive portion of field personnel compensation on profitability and credit quality. |

| |

• | Our compliance department assesses our compliance with federal and state laws and regulations, as well as our compliance with our internal policies and procedures; oversees compliance training to ensure employees have a sufficient level of understanding of the laws and regulations that impact their job responsibilities; and manages our regulatory examination process. |

| |

• | Our executive office of customer care maintains our consumer complaint resolution and reporting process. |

| |

• | Our internal audit department audits our business for adherence to operational policy and procedure and compliance with federal and state laws and regulations. |

Currently, OneMain’s operations are being harmonized with Springleaf’s operations in connection with the integration of the two businesses.

REGULATION

Federal Laws

Various federal laws and regulations govern loan origination, servicing and collections, including:

| |

• | the Equal Credit Opportunity Act (prohibits discrimination against creditworthy applicants) and the Consumer Financial Protection Bureau’s (“CFPB”) Regulation B, which implements this Act; |

| |

• | the Fair Credit Reporting Act (governs the accuracy and use of credit bureau reports); |

| |

• | the Truth in Lending Act (governs disclosure of applicable charges and other finance receivable terms) and the CFPB’s Regulation Z, which implements this Act; |

| |

• | the Fair Debt Collection Practices Act; |

| |

• | the Gramm-Leach-Bliley Act (governs the handling of personal financial information) and CFPB Regulation P, which implements this Act; |

| |

• | the Servicemembers Civil Relief Act, which can impose limitations on the servicer’s ability to collect on a loan originated with an obligor who is on active duty status and up to nine months thereafter; |

| |

• | the Real Estate Settlement Procedures Act and the CFPB’s Regulation X (both of which regulate the making and servicing of certain loans secured by real estate); |

| |

• | the Federal Trade Commission’s Consumer Claims and Defenses Rule, also known as the “Holder in Due Course” Rule; and |

| |

• | the Federal Trade Commission Act. |

The Dodd-Frank Act and the regulations promulgated thereunder are likely to affect our operations in terms of increased oversight of financial services products by the CFPB and the imposition of restrictions on the terms of certain loans. Among regulations the CFPB has promulgated are mortgage servicing regulations that became effective January 10, 2014 and are applicable to the remaining real estate loan portfolio serviced by or for Springleaf. The CFPB has significant authority to implement and enforce federal consumer finance laws, including the new protections established in the Dodd-Frank Act, as

well as the authority to identify and prohibit unfair, deceptive, and abusive acts and practices. In addition, under the Dodd-Frank Act, securitizations of loan portfolios are subject to certain restrictions and additional requirements, including requirements that the originator retain a portion of the credit risk of the securities sold and the reporting of buyback requests from investors. We also utilize third-party debt collectors and will continue to be responsible for oversight of their procedures and controls.

The CFPB has supervisory, examination and enforcement authority with respect to various federal consumer protection laws for some providers of consumer financial products and services, such as any nonbank that it has reasonable cause to determine has engaged or is engaging in conduct that poses risks to consumers with regard to consumer financial products or services. In addition to the authority to bring nonbanks under the CFPB’s supervisory authority based on risk determinations, the CFPB also has authority under the Dodd-Frank Act to supervise nonbanks, regardless of size, in certain specific markets, such as mortgage companies (including, mortgage originators, brokers and servicers) and payday lenders. Currently, the CFPB has supervisory authority over us with respect to mortgage servicing and mortgage origination, which allows the CFPB to conduct an examination of our mortgage servicing practices and our prior mortgage origination practices. The Dodd-Frank Act also gives the CFPB supervisory authority over entities that are designated as “larger participants” in certain financial services markets, including consumer installment loans and related products. The CFPB has not yet promulgated regulations that designate “larger participants” for consumer finance companies. If we are designated as a “larger participant” for this market, we also will be subject to supervision and examination by the CFPB with respect to our consumer loan business. We expect to be designated as a “larger participant.” On June 30, 2015, the CFPB published regulations for “larger participants” in the market of auto finance. With the adoption of these regulations, we are a larger participant in the market of auto finance and are subject to examination by the CFPB for our auto finance lending, including loans that are secured by autos and refinances of loans secured by autos that were for the purchase of autos.

In addition to its supervision and examination authority, the CFPB is authorized to conduct investigations to determine whether any person is engaging in, or has engaged in, conduct that violates federal consumer financial protection laws, and to initiate enforcement actions for such violations, regardless of its direct supervisory authority. Investigations may be conducted jointly with other regulators.

The CFPB also has enforcement authority and is authorized to conduct investigations to determine whether any person is engaging in, or has engaged in, conduct that violates federal consumer financial protection laws, and to initiate enforcement actions for such violations, regardless of its direct supervisory authority. Investigations may be conducted jointly with other regulators. In furtherance of its regulatory and supervisory powers, the CFPB has the authority to impose monetary penalties for violations of applicable federal consumer financial laws, require remediation of practices and pursue administrative proceedings or litigation for violations of applicable federal consumer financial laws (including the CFPB’s own rules). The CFPB has the authority to obtain cease and desist orders (which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief) and monetary penalties ranging from $5,000 per day for ordinary violations of federal consumer financial laws to $25,000 per day for reckless violations and $1 million per day for knowing violations. Also, where a company has violated Title X of the Dodd-Frank Act or CFPB regulations implemented thereunder, the Dodd-Frank Act empowers state attorneys general and state regulators to bring civil actions to remedy violations of state law. If the CFPB or one or more states attorneys general or state regulators believe that we have violated any of the applicable laws or regulations, they could exercise their enforcement powers in ways that could have a material adverse effect on us or our business. The CFPB has actively utilized this enforcement authority against financial institutions and financial service providers, including the imposition of significant monetary penalties and orders for restitution and orders requiring mandatory changes to compliance policies and procedures, enhanced oversight and control over affiliate and third-party vendor agreements and services and mandatory review of business practices, policies and procedures by third-party auditors and consultants. If, as a result of an examination, the CFPB were to conclude that our loan origination or servicing activities violate applicable law or regulations, we could be subject to a formal or informal enforcement action. Formal enforcement actions are generally made public, which carries reputational risk. We have not been notified of any planned examinations or enforcement actions by the CFPB.

The Dodd-Frank Act also may adversely affect the securitization market because it requires, among other things, that a securitizer generally retain not less than 5% of the credit risk for certain types of securitized assets that are created, transferred, sold, or conveyed through issuance of asset-backed securities with an exception for securitizations that are wholly composed of “qualified residential mortgages.” The final rules implementing the risk retention requirements of Section 941 of the Dodd Frank Act became effective on February 23, 2015. Compliance with the rule with respect to asset-backed securities collateralized by residential mortgages was required beginning December 24, 2015. Compliance with the rule with regard to all other classes of asset-backed securities is required beginning December 24, 2016. The risk retention requirement may limit our ability to securitize loans and impose on us additional compliance requirements to meet origination and servicing criteria for qualified residential mortgages. The impact of the risk retention rule on the asset-backed securities market remains uncertain. Furthermore, the Securities and Exchange Commission (the “SEC”) adopted significant revisions to Regulation AB, imposing

new requirements for asset-level disclosures for asset-backed securities backed by real estate related assets, auto related assets, or backed by debt securities. This could result in sweeping changes to the commercial and residential mortgage loan securitization markets, as well as to the market for the re-securitization of mortgage-backed securities.

State Laws

Various state laws and regulations also govern personal loans and real estate secured loans. Many states have laws and regulations that are similar to the federal laws referred to above, but the degree and nature of such laws and regulations vary from state to state. While federal law preempts state law in the event of certain conflicts, compliance with state laws and regulations is still required in the absence of conflicts.

These additional state laws and regulations, under which we conduct a substantial amount of our lending business, generally:

| |

• | provide for state licensing and periodic examination of lenders and loan originators, including state laws adopted or amended to comply with licensing requirements of the federal Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (the “SAFE Act”) (which, in some states, requires licensing of individuals who perform real estate loan modifications); |

| |

• | require the filing of reports with regulators; |

| |

• | impose maximum term, amount, interest rate, and other charge limitations; |

| |

• | regulate whether and under what circumstances we may offer insurance and other ancillary products in connection with a lending transaction; and |

| |

• | provide for additional consumer protections. |

There is a clear trend of increased state regulation on loan origination, servicing and collection, as well as more detailed reporting, more detailed examinations, and coordination of examinations among the states.

State authorities also regulate and supervise our insurance business. The extent of such regulation varies by product and by state, but relates primarily to the following:

| |

• | conduct of business, including marketing and sales practices; |

| |

• | periodic financial and market conduct examination of the affairs of insurers; |

| |

• | form and content of required financial reports; |

| |

• | limitations on the payment of dividends and other affiliate transactions; |

| |

• | types of products offered; |

| |

• | approval of policy forms and premium rates; |

| |

• | formulas used to calculate any unearned premium refund due to an insured customer; |

| |

• | permissible investments; |

| |

• | reserve requirements for unearned premiums, losses, and other purposes; and |

With respect to the insurance made available to borrowers through a third party Canadian lender, the Canadian Federal and Provincial Insurance Regulators regulate and supervise this insurance business. Their regulation and supervision relates primarily to the following:

| |

• | conduct of business, including marketing and sales practices; |

| |

• | periodic financial and market conduct examination of the affairs of insurers; |

| |

• | form and content of required financial reports; |

| |

• | limitations on the payment of dividends and other affiliate transactions; |

| |

• | types of products offered; and |

| |

• | reserve requirements for unearned premiums, losses, and other purposes. |

COMPETITION

We operate primarily in the consumer installment lending industry focusing on the non-prime customer. As of December 31, 2015, OMH maintained a national footprint (defined as 500 or more branches and receivables over $2 billion) of brick and

mortar branches. As a result of the OneMain Acquisition, the combined company has over 2.4 million customer accounts and over 1,900 branch offices as of December 31, 2015.

In addition, there are a large number of local, regional and internet competitors in the consumer installment lending industry serving the large and growing population of non-prime customers. We also compete with a large number of other types of financial institutions within our geographic footprint and over the internet, including community banks and credit unions, that offer similar products and services. We believe that competition between consumer installment lenders occurs primarily on the basis of price, speed of service, flexibility of loan terms offered, and the quality of customer service provided.

We believe that we possess several competitive strengths that position us to capitalize on the significant growth and expansion opportunity created by the large supply-demand imbalance within our industry, and to compete effectively with other lenders in our industry. The capabilities resident in our national branch system provide us with a proven distribution channel for our personal loan and insurance products, allowing us to provide same-day fulfillment to approved customers and giving us a distinct competitive advantage over many industry participants who do not have—and cannot replicate without significant investment—a similar footprint. Our newly launched iLoan platform and our centralized operations also enhance our nationwide footprint by allowing us to serve customers that reside outside of our branch footprint. We believe our deep understanding of local markets and customers, together with our proprietary underwriting process, data analytics, and decisioning tools allow us to price, manage and monitor risk effectively through changing economic conditions. In addition, our high-touch relationship-based servicing model is a major contributor to our superior loan performance, and distinguishes us from our competitors.

SEASONALITY

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality” in Item 7 for discussion of our seasonal trends.

EMPLOYEES

As of December 31, 2015, we had approximately 11,400 employees.

AVAILABLE INFORMATION

OMH files annual, quarterly, and current reports, proxy statements, and other information with the SEC. The SEC’s website, www.sec.gov, contains these reports and other information that registrants (including OMH) file electronically with the SEC. Readers may also read and copy any document that OMH files at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

These reports are also available free of charge through our website, www.springleaf.com (posted on the “Company Information — Investor Relations — Financial Information — SEC Filings” section), as soon as reasonably practicable after we file them with, or furnish them to, the SEC.

In addition, our Code of Business Conduct and Ethics (the “Code of Ethics”), our Code of Ethics for Principal Executive and Senior Financial Officers (the “Financial Officers’ Code of Ethics”), our Corporate Governance Guidelines and the charters of the committees of our Board of Directors are posted on the “Company Information — Investor Relations — Corporate Governance” section of our website at www.springleaf.com and printed copies are available upon request. We intend to disclose any amendments to and waivers of our Code of Ethics and Financial Officers’ Code of Ethics on our website within four business days of the date of any such amendment or waiver in lieu of filing a Form 8-K pursuant to Item 5.05 thereof.

The information on our website is not incorporated by reference into this report. The website addresses listed above are provided for the information of the reader and are not intended to be active links.

Item 1A. Risk Factors.

We face a variety of risks that are inherent in our business. Accordingly, you should carefully consider the following discussion of risks in addition to the other information regarding our business provided in this report and in other documents we file with the SEC. These risks are subject to contingencies which may or may not occur, and we are not able to express a view on the likelihood of any such contingency occurring. New risks may emerge at any time, and we cannot predict those risks or estimate the extent to which they may affect our business or financial performance.

RISKS RELATED TO OUR BUSINESS

Our consolidated results of operations and financial condition and our borrowers’ ability to make payments on their loans have been, and may in the future be, adversely affected by economic conditions and other factors that we cannot control.

Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets and a general decline in the value of real property, historically have created a difficult operating environment for our businesses and other companies in our industries. Many factors, including factors that are beyond our control, may impact our consolidated results of operations or financial condition and/or affect our borrowers’ willingness or capacity to make payments on their loans. These factors include: unemployment levels, housing markets, energy costs and interest rates; events such as natural disasters, acts of war, terrorism, catastrophes, major medical expenses, divorce or death that affect our borrowers; and the quality of the collateral underlying our receivables. If we experience an economic downturn or if the U.S. economy is unable to continue or sustain its recovery from the most recent economic downturn, or if we become affected by other events beyond our control, we may experience a significant reduction in revenues, earnings and cash flows, difficulties accessing capital and a deterioration in the value of our investments. We may also become exposed to increased credit risk from our customers and third parties who have obligations to us.

Moreover, our customers are primarily non-prime borrowers. Accordingly, such borrowers have historically been, and may in the future become, more likely to be affected, or more severely affected, by adverse macroeconomic conditions. If our borrowers default under a finance receivable held directly by us, we will bear a risk of loss of principal to the extent of any deficiency between the value of the collateral, if any, and the outstanding principal and accrued but unpaid interest of the finance receivable, which could adversely affect our cash flow from operations. In addition, foreclosure of a real estate loan (part of our legacy real estate portfolio) is an expensive and lengthy process that can negatively affect our anticipated return on the foreclosed loan. The cost to service our loans may also increase without a corresponding increase in our finance charge income.

Also, certain geographic concentrations of our loan portfolio may occur or increase as we adjust our risk and loss tolerance and strategy to achieve our profitability goals. Any geographic concentration may expose us to an increased risk of loss if that geographic region experiences higher unemployment rates than average, natural disasters, weak economic conditions, or other adverse economic factors that disproportionately affect that region. See Note 5 of the Notes to Consolidated Financial Statements in Item 8 for quantification of our largest concentrations of net finance receivables.

If aspects of our business, including the quality of our finance receivables portfolio or our borrowers, are significantly affected by economic changes or any other conditions in the future, we cannot be certain that our policies and procedures for underwriting, processing and servicing loans will adequately adapt to such changes. If we fail to adapt to changing economic conditions or other factors, or if such changes affect our borrowers’ willingness or capacity to repay their loans, our results of operations, financial condition and liquidity would be materially adversely affected.

There are risks associated with the acquisition of large loan portfolios, including the possibility of increased delinquencies and losses, difficulties with integrating the loans into our servicing platform and disruption to our ongoing business, which could have a material adverse effect on our results of operations, financial condition and liquidity.

We may acquire large portfolios of finance receivables in the future either through the direct purchase of such assets or the purchase of the equity of a company with such a portfolio. Since we will not have originated or serviced the loans we acquire, we may not be aware of legal or other deficiencies related to origination or servicing, and our review of the portfolio prior to purchase may not uncover those deficiencies. Further, we may have limited recourse against the seller of the portfolio.

The ability to integrate and successfully service newly acquired loan portfolios will depend in large part on the success of our development and integration of expanded servicing capabilities, including additional personnel. We may fail to realize some or all of the anticipated benefits of the transaction if the integration process takes longer, or is more costly, than expected. Our failure to meet the challenges involved in successfully integrating the acquired portfolios with our current business or otherwise to realize any of the anticipated benefits of the transaction, could impair our operations. In addition, the integration of future large portfolio acquisitions are complex, time-consuming and expensive processes that, without proper planning and effective and timely implementation, could significantly disrupt our business.

Potential difficulties we may encounter during the integration process with future acquisitions include, but are not limited to, the following:

| |

• | the integration of the portfolio into our information technology platforms and servicing systems; |

| |

• | the quality of servicing during any interim servicing period after we purchase a portfolio but before we assume servicing obligations from the seller or its agents; |

| |

• | the disruption to our ongoing businesses and distraction of our management teams from ongoing business concerns; |

| |

• | incomplete or inaccurate files and records; |

| |

• | the retention of existing customers; |

| |

• | the creation of uniform standards, controls, procedures, policies and information systems; |

| |

• | the occurrence of unanticipated expenses; and |

| |

• | potential unknown liabilities associated with the transactions, including legal liability related to origination and servicing prior to the acquisition. |

For example, in some cases loan files and other information (including servicing records) may be incomplete or inaccurate. If our employees are unable to access customer information easily, or if we are unable to produce originals or copies of documents or accurate information about the loans, collections could be affected significantly, and we may not be able to enforce our right to collect in some cases. Similarly, collections could be affected by any changes to our collection practices, the restructuring of any key servicing functions, transfer of files and other changes that would result from our assumption of the servicing of the acquired portfolios.

The anticipated benefits and synergies of our future acquisitions will assume a successful integration, and will be based on projections, which are inherently uncertain, as well as other assumptions. Even if integration is successful, anticipated benefits and synergies may not be achieved.

There are risks associated with our ability to expand our centralized loan servicing capabilities through integration of the Springleaf and OneMain servicing facilities, which could have a material adverse effect on our results of operations, financial condition and liquidity.

A key part of our efforts to expand our centralized loan servicing capacity will depend in large part on the success of management’s efforts to integrate the Springleaf and OneMain servicing facilities. We may fail to realize some or all of the anticipated benefits of these facilities if the integration process takes longer, or is more costly, than expected. Our failure to meet the challenges involved in successfully integrating these facilities with our current business or otherwise to realize any of the anticipated benefits could impair our operations. In addition, the integration is a complex, time-consuming and expensive process that, without proper planning and effective and timely implementation, could significantly disrupt our business. Potential difficulties we may encounter during the integration process may include, but are not limited to, the following:

| |

• | the integration of the personnel with certain of our management teams, strategies, operations, products and services; |

| |

• | the integration of the physical facilities with our information technology platforms and servicing systems; and |

| |

• | the disruption to our ongoing businesses and distraction of our management teams from ongoing business concerns. |

If our estimates of finance receivable losses are not adequate to absorb actual losses, our provision for finance receivable losses would increase, which would adversely affect our results of operations.

We maintain an allowance for finance receivable losses. To estimate the appropriate level of allowance for finance receivable losses, we consider known and relevant internal and external factors that affect finance receivable collectability, including the total amount of finance receivables outstanding, historical finance receivable charge-offs, our current collection patterns, and economic trends. Our methodology for establishing our allowance for finance receivable losses is based on the guidance in Accounting Standards Codification (“ASC”) 450 and, in part, on our historic loss experience. If customer behavior changes as a result of economic conditions and if we are unable to predict how the unemployment rate, housing foreclosures, and general

economic uncertainty may affect our allowance for finance receivable losses, our provision may be inadequate. Our allowance for finance receivable losses is an estimate, and if actual finance receivable losses are materially greater than our allowance for finance receivable losses, our results of operations could be adversely affected. Neither state regulators nor federal regulators regulate our allowance for finance receivable losses. Additional information regarding our allowance for finance receivable losses is included in the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Allowance for Finance Receivable Losses.”

Our risk management efforts may not be effective.

We could incur substantial losses and our business operations could be disrupted if we are unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, prepayment risk, liquidity risk, and other market-related risks, as well as operational risks related to our business, assets and liabilities. To the extent our models used to assess the creditworthiness of potential borrowers do not adequately identify potential risks, the valuations produced would not adequately represent the risk profile of the borrower and could result in a riskier finance receivable profile than originally identified. Our risk management policies, procedures, and techniques, including our scoring technology, may not be sufficient to identify all of the risks we are exposed to, mitigate the risks we have identified or identify concentrations of risk or additional risks to which we may become subject in the future.

Our branch loan approval process is decentralized, which may result in variability of loan structures, and could adversely affect our results of operations, financial condition and liquidity.

Our branch finance receivable origination process is decentralized. We train our employees individually on-site in the branch to make loans that conform to our underwriting standards. Such training includes critical aspects of state and federal regulatory compliance, cash handling, account management and customer relations. In certain circumstances, subject to approval by district managers and/or directors of operations in certain cases, our branch officers have the authority to approve and structure loans within broadly written underwriting guidelines rather than having all loan terms approved centrally. As a result, there may be variability in finance receivable structure (e.g., whether or not collateral is taken for the loan) and loan portfolios among branch offices or regions, even when underwriting policies are followed. Moreover, we cannot be certain that every loan is made in accordance with our underwriting standards and rules and we have in the past experienced some instances of loans extended that varied from our underwriting standards. The nature of our approval process could adversely affect our operating results and variances in underwriting standards and lack of supervision could expose us to greater delinquencies and charge-offs than we have historically experienced, which could adversely affect our results of operations, financial condition and liquidity.

Changes in market conditions, including rising interest rates, could adversely affect the rate at which our borrowers prepay their loans and the value of our finance receivables portfolio, as well as increase our financing cost, which could negatively affect our results of operations, financial condition and liquidity.

Changing market conditions, including but not limited to, changes in interest rates, the availability of credit, the relative economic vitality of the area in which our borrowers and their assets are located, changes in tax laws, other opportunities for investment available to our customers, homeowner mobility, and other economic, social, geographic, demographic, and legal factors beyond our control, may affect the rates at which our borrowers prepay their loans. Generally, in situations where prepayment rates have slowed, the weighted-average life of our finance receivables has increased. Any increase in interest rates may further slow the rate of prepayment for our finance receivables, which could adversely affect our liquidity by reducing the cash flows from, and the value of, the finance receivables we hold for sale or utilize as collateral in our secured funding transactions.

Moreover, the vast majority of our finance receivables are fixed-rate finance receivables, which generally decline in value if interest rates increase. As such, if changing market conditions cause interest rates to increase substantially, the value of our fixed-rate finance receivables could decline. In addition, rising interests rates will increase our cost of capital. Accordingly, any increase in interest rates could negatively affect our results of operations, financial condition and liquidity.

We may be required to indemnify, or repurchase finance receivables from, purchasers of finance receivables that we have sold or securitized, or which we will sell or securitize in the future, if our finance receivables fail to meet certain criteria or characteristics or under other circumstances, which could adversely affect our results of operations, financial condition and liquidity.

We have sold $6.4 billion of our legacy real estate portfolio in 2014 and have securitized $11.4 billion of our consumer loan portfolio and all of the SpringCastle Portfolio at December 31, 2015. The documents governing our finance receivable sales

and securitizations contain provisions that require us to indemnify the purchasers of securitized finance receivables, or to repurchase the affected finance receivables, under certain circumstances. While our sale and securitization documents vary, they generally contain customary provisions that may require us to repurchase finance receivables if:

| |

• | our representations and warranties concerning the quality and characteristics of the finance receivable are inaccurate; |

| |

• | there is borrower fraud; and |

| |

• | we fail to comply, at the individual finance receivable level or otherwise, with regulatory requirements in connection with the origination and servicing of the finance receivables. |

As a result of the current market environment, we believe that many purchasers of real estate loans (including through securitizations) are particularly aware of the conditions under which originators must indemnify purchasers or repurchase finance receivables, and would benefit from enforcing any repurchase remedies that they may have. At its extreme, our exposure to repurchases or our indemnification obligations under our representations and warranties could include the current unpaid balance of all finance receivables that we have sold or securitized and which are not subject to settlement agreements with purchasers.

The risk of loss on the finance receivables that we have securitized is recognized in our allowance for finance receivable losses since all of our consumer loan securitizations are recorded on-balance sheet. If we are required to indemnify purchasers or repurchase finance receivables that we sell that result in losses that exceed our reserve for sales recourse, or recognize losses on securitized finance receivables that exceed our recorded allowance for finance receivable losses associated with our securitizations, this could adversely affect our results of operations, financial condition and liquidity.

Our insurance operations are subject to a number of risks and uncertainties, including claims, catastrophic events, underwriting risks and dependence on a primary distribution channel.

Insurance claims and policyholder liabilities are difficult to predict and may exceed the related reserves set aside for claims (losses) and associated expenses for claims adjudication (loss adjustment expenses). Additionally, events such as hurricanes, tornados, earthquakes, pandemic disease, cyber security breaches and other types of catastrophes, and prolonged economic downturns, could adversely affect our financial condition or results of operations. Other risks relating to our insurance operations include changes to laws and regulations applicable to us, as well as changes to the regulatory environment. Examples include changes to laws or regulations affecting capital and reserve requirements; frequency and type of regulatory monitoring and reporting; consumer privacy, use of customer data and data security; benefits or loss ratio requirements; insurance producer licensing or appointment requirements; required disclosures to consumers; and collateral protection insurance (i.e., insurance some of our lender companies purchase, at the customer’s expense, on that customer’s loan collateral for the periods of time the customer fails to adequately, as required by his loan, insure his collateral). Because our customers do not affirmatively consent to collateral protection insurance at the time it is purchased and hence, do not directly agree to the amount charged for it, regulators may in the future prohibit our insurance companies from providing this insurance to our lending operations. Moreover, our insurance companies are predominately dependent on our lending operations as the primary source of business and product distribution. If our lending operations discontinue offering insurance products, including as a result of regulatory requirements, our insurance operations would basically have no method of distribution for their products.

We are a party to various lawsuits and proceedings which, if resolved in a manner adverse to us, could materially adversely affect our results of operations, financial condition and liquidity.

In the normal course of business, from time to time, we have been named as a defendant in various legal actions, including arbitrations, class actions and other litigation, arising in connection with our business activities. Certain of the legal actions include claims for substantial compensatory and/or punitive damages, or claims for indeterminate amounts of damages. Some of these proceedings are pending in jurisdictions that permit damage awards disproportionate to the actual economic damages alleged to have been incurred. The continued occurrences of large damage awards in general in the United States, including large punitive damage awards in certain jurisdictions that bear little or no relation to actual economic damages incurred by plaintiffs, create the potential for an unpredictable result in any given proceeding. A large judgment that is adverse to us could cause our reputation to suffer, encourage additional lawsuits against us and have a material adverse effect on our results of operations, financial condition and liquidity.

If we lose the services of any of our key management personnel, our business could suffer.

Our future success significantly depends on the continued service and performance of our key management personnel. Competition for these employees is intense and we may not be able to attract and retain key personnel. We do not maintain any “key man” or other related insurance. The loss of the service of members of our senior management or key team members, or the inability to attract additional qualified personnel as needed, could materially harm our business.

Employee misconduct could harm us by subjecting us to monetary loss, significant legal liability, regulatory scrutiny and reputational harm.

Our reputation is critical to maintaining and developing relationships with our existing and potential customers and third parties with whom we do business. There is a risk that our employees could engage in misconduct that adversely affects our business. For example, if an employee were to engage—or be accused of engaging—in illegal or suspicious activities including fraud or theft, we could suffer direct losses from the activity, and in addition we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial condition, customer relationships, and ability to attract future customers. Employee misconduct could prompt regulators to allege or to determine based upon such misconduct that we have not established adequate supervisory systems and procedures to inform employees of applicable rules or to detect and deter violations of such rules. It is not always possible to deter employee misconduct, and the precautions we take to detect and prevent misconduct may not be effective in all cases. Misconduct by our employees, or even unsubstantiated allegations of misconduct, could result in a material adverse effect on our reputation and our business.

Current and proposed regulations relating to consumer privacy, data protection and information security could increase our costs.

We are subject to a number of federal and state consumer privacy, data protection, and information security laws and regulations. For example, we are subject to the federal Gramm-Leach-Bliley Act, which governs the use of personal financial information by financial institutions. Moreover, various federal and state regulatory agencies require us to notify customers in the event of a security breach. Federal and state legislators and regulators are increasingly pursuing new guidance, laws, and regulation. Compliance with current or future customer privacy, data protection, and information security laws and regulations could result in higher compliance, technology or other operating costs. Any violations of these laws and regulations may require us to change our business practices or operational structure, and could subject us to legal claims, monetary penalties, sanctions, and the obligation to indemnify and/or notify customers or take other remedial actions.

Significant disruptions in the operation of our information systems could have a material adverse effect on our business.

Our business relies heavily on information systems to deliver products and services to our customers, and to manage our ongoing operations. These systems may encounter service disruptions due to system, network or software failure, security breaches, computer viruses, natural disasters or other reasons. There can be no assurance that our policies and procedures addressing these issues will adequately address the disruption. A disruption could impair our ability to offer and process consumer loans, provide customer service, perform collections activities or perform other necessary business activities, which could result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability.

Security breaches in our information systems, in the information systems of third parties or in our branches, central servicing facilities, or our internet lending platform could adversely affect our reputation and could subject us to significant costs and regulatory penalties.

Our operations rely heavily on the secure processing, storage and transmission of confidential customer and other information in our computer systems and networks. Our branch offices and centralized servicing centers, as well as our administrative and executive offices, are part of an electronic information network that is designed to permit us to originate and track finance receivables and collections, and perform several other tasks that are part of our everyday operations. Our computer systems, software, and networks may be vulnerable to breaches, unauthorized access, misuse, computer viruses, or other malicious code that could result in disruption to our business, or the loss or theft of confidential information, including customer information. Any failure, interruption, or breach in our cyber security, including any failure of our back-up systems or failure to maintain adequate security surrounding customer information, could result in reputational harm, disruption in the management of our customer relationships, or the inability to originate, process and service our finance receivable products. Further, any of these cyber security and operational risks could result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to lawsuits by customers for identity theft or other damages resulting from the misuse of their personal information and possible financial liability, any of which could have a material adverse effect on our results of operations, financial