Use these links to rapidly review the document

TABLE OF CONTENTS

FEISHANG ANTHRACITE RESOURCES LIMITED INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

CONTENTS

Table of Contents

Exhibit 15.1

Preliminary and Subject to Completion, dated December 31, 2013

Information Statement dated , 2013

FEISHANG ANTHRACITE RESOURCES LIMITED

Ordinary Shares, par value HK$0.01 per share

China Natural Resources, Inc. ("CHNR") is furnishing this information statement in connection with its spin-off (the "Spin-off") of Feishang

Anthracite Resources Limited ("Feishang Anthracite"). CHNR intends to effect the Spin-off by way of a distribution in specie of the entire issued share capital of Feishang Anthracite to the

holders of the common shares of CHNR (the "Distribution").

Feishang

Anthracite is currently a wholly-owned subsidiary of CHNR. Feishang Anthracite is a producer of anthracite coal based in Guizhou province of the People's Republic of China

(the "PRC") and is primarily engaged in the acquisition, construction and development of anthracite coal mines and the extraction and sale of anthracite coal. After the completion of the

Spin-off, CHNR will no longer hold any shares in Feishang Anthracite.

In

connection with the Spin-off, the ordinary shares of Feishang Anthracite will be distributed on a pro rata basis to holders of record of the common shares of CHNR on

January 13, 2014 (the "Distribution Record Date"). Holders of CHNR common shares ("CHNR Shareholders") will be entitled to receive five Feishang Anthracite ordinary shares for each CHNR

common share held on the Distribution Record Date. CHNR Shareholders will not be required to pay any consideration for the Feishang Anthracite ordinary shares that they will be entitled to receive in

the Distribution or to surrender or exchange CHNR common shares in order to be entitled to receive Feishang Anthracite ordinary shares and do not need to take any other action in connection with the

Spin-off. No CHNR Shareholder approval of the Spin-off or Distribution is required or sought. CHNR is not asking you for a proxy and you are requested not to send CHNR

a proxy.

The

Spin-off is subject to the conditions described under "The Spin-off" in this information statement. Investors who trade in the Feishang Anthracite ordinary shares prior to receipt of

the Feishang Anthracite share certificates do so entirely at their own risk.

Currently,

there is no trading market for Feishang Anthracite ordinary shares. The Feishang Anthracite ordinary shares are expected to be listed on The Stock Exchange of Hong Kong

Limited (the "Hong Kong Stock Exchange") under the stock code "1738" on or around January 22, 2014. Admission to listing and trading is subject to the approval of the Listing Committee

of the Hong Kong Stock Exchange. The Feishang Anthracite ordinary shares will not be listed on any securities exchange in the United States or quoted on any automated inter-dealer quotation

system in the United States. An active trading market for Feishang Anthracite ordinary shares is not expected to develop in the United States.

CHNR

intends to treat the Distribution as a taxable dividend for U.S. Federal income tax purposes. See "Certain Material Tax Consequences" on page IS-29 of this information

statement.

You

should carefully consider the risks described under "Risk Factors Relating to the Distribution" beginning on page IS-17 of this information statement and under "Risk Factors"

beginning on page 37 of the Hong Kong Listing Document.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Feishang Anthracite ordinary

shares or passed upon the accuracy or adequacy of this information statement. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

This information statement is first being mailed to CHNR Shareholders on or about January , 2014.

TABLE OF CONTENTS

Information Statement

IS-i

Table of Contents

ABOUT THIS INFORMATION STATEMENT

This information statement incorporates the listing document (the "Hong Kong Listing Document") for the listing

of the Feishang Anthracite ordinary shares on the Hong Kong Stock Exchange, except for: (a) Appendix I — "Accountants' Report of the Company" to the

Hong Kong Listing Document, which contains our consolidated financial statements as of and for the years ended December 31, 2010, 2011 and 2012 and as of and for the six months ended

June 30, 2013 as audited by Ernst & Young in accordance with Auditing Guideline 3.340 Prospectuses and Reporting Accountant issued

by the Hong Kong Institute of Certified Public Accountants ("HKICPA") and unaudited comparative consolidated financial statements for the six months ended June 30, 2012;

(b) Appendix II — "Accountants' Report of Guizhou Puxin" to the Hong Kong Listing Document, which contains the consolidated financial statements of

Guizhou Puxin Energy Co., Ltd. ("Guizhou Puxin") as of December 31, 2009 and March 17, 2010 and for the 76-day period ended March 17, 2010;

(c) Appendix III — "Competent Person's Report" to the Hong Kong Listing Document, which contains the

independent technical review of our seven coal mines prepared by Behre Dolbear Asia, Inc., a mineral industry expert, certain disclosures relating to our measured, indicated and inferred coal

resources as of July 31, 2013, which was prepared in accordance with Chapter 18 of the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange (the

"Listing Rules") and certain disclosures relating to net present value for the Company and each of its anthracite coal mines as of July 31, 2013 through 2030 and payback periods which

are derived from Appendix III — "Competent Person's Report" to the Hong Kong Listing Document; and (d) a report prepared by Ernst & Young

relating to certain unaudited pro forma financial information included in Appendix VII — "Unaudited Pro Forma Financial Information" to the

Hong Kong Listing Document. Moreover, each of the sections headed "Summary — Non-IFRS Financial Measure — Cash Operating

Costs" and "Business — Non-IFRS Financial Measure — Cash Operating Costs" in the version of the Hong Kong Listing Document

incorporated herein includes a reconciliation of cash operating costs to cost of sales.

In

lieu of the financial statements contained in Appendix I — "Accountants' Report of the Company" to the Hong Kong Listing Document, we have

included in this information statement our consolidated financial statements as of and for the years ended December 31, 2010, 2011 and 2012 and as of and for the six months ended

June 30, 2013, which have been audited by Ernst & Young, and our unaudited comparative consolidated financial statements for the six months ended June 30, 2012. Except for the

auditing standards under which our consolidated financial statements as of and for the years ended 2010, 2011 and 2012 and as of and for the six months ended June 30, 2013 were audited by

Ernst & Young, these financial statements are substantially similar to those contained in Appendix I — "Accountants' Report of the Company" to the

Hong Kong Listing Document. For purposes of this information statement, all references in the Hong Kong Listing Document to "Appendix I — 'Accountants'

Report of the Company"' or "our consolidated financial statements" shall refer to our consolidated financial statements included in this information statement beginning on page F-1. The

consolidated financial statements of Guizhou Puxin contained in Appendix II — "Accountants' Report of Guizhou Puxin" to the Hong Kong Listing Documents

have been included in the Hong Kong Listing Document solely to satisfy the requirements of the Hong Kong Stock Exchange. The financial position and results of operations of Guizhou Puxin have been

consolidated into our consolidated financial statements since March 18, 2010.

Appendix

III — "Competent Person's Report" to the Hong Kong Listing Document, which contains the independent technical review of our seven coal

mines prepared by Behre Dolbear Asia, Inc., a mineral industry expert and certain disclosures relating to our measured, indicated and inferred coal resources as of July 31, 2013, which

was prepared in accordance with Chapter 18 of the Listing Rules, have been omitted from this information statement in order to comply with the requirements of the SEC Industry

Guide 7.

The

unaudited pro forma financial information included in the Hong Kong Listing Document under "Summary — Unaudited Pro Forma

Financial Information", "Financial Information — Unaudited Pro Forma Financial Information" and

Appendix VII — "Unaudited Pro Forma Financial Information" were prepared and included in the Hong Kong Listing Document in accordance with the

requirements of the Hong Kong Stock Exchange and the Listing Rules. Although the form and content of the unaudited pro forma financial information conform to the requirements of the Hong

Kong Stock Exchange and the Listing Rules, they do not meet the requirements of Article 11 of Regulation S-X under the Exchange Act. The unaudited pro forma

IS-1

Table of Contents

financial

information are based upon a number of assumptions and estimates that, while considered by us to be reasonable, are inherently subject to significant business, economic and other

uncertainties and contingencies. You are urged not to place any undue reliance on the unaudited pro forma financial information.

This

information statement should be read in conjunction with the Hong Kong Listing Document, and is qualified in its entirety by the more detailed information contained in the Hong Kong

Listing Document. For the avoidance of doubt, the documents delivered to the Registrar of Companies and available for inspection set forth in Appendix VI to the Hong Kong Listing

Document do not form a part of, and are not incorporated by reference in, this information statement. Terms used but not defined herein shall have the meanings given to them in the Hong Kong

Listing Document incorporated herein.

This

information statement is being furnished solely to provide information to existing CHNR Shareholders who will be entitled to receive Feishang Anthracite ordinary shares in

connection with the Spin-off. This information statement is not an offer to sell or a solicitation of any offer to buy any securities. The Spin-off and listing of the Feishang Anthracite ordinary

shares on the Hong Kong Stock Exchange do not involve any offering of any ordinary shares or any other securities of Feishang Anthracite, and no proceeds will be raised.

The

Feishang Anthracite ordinary shares to be distributed to you by CHNR in connection with the Distribution have not been and will not be registered under the U.S. Securities Act

of 1933, as amended (the "Securities Act"). The Feishang Anthracite ordinary shares are being registered under the U.S. Securities Exchange Act of 1934, as amended (the "Exchange

Act"), pursuant to a registration statement on Form 20-F. You can retrieve a copy of the Form 20-F registration statement from the website of the U.S. Securities and Exchange

Commission (the "SEC") at www.sec.gov.

After

the completion of the Spin-off, we will become subject to periodic reporting and other informational requirements of the Exchange Act as applicable to foreign private issuers. As a

foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our executive officers, directors and

principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we will not be required under the

Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

No

person has been authorized to give any information or to make any representations other than those contained in this information statement and, if given or made, such information or

representations must not be relied upon as having been authorized. The information in this information statement is only accurate as of the date hereof. Nothing in this information statement may be

relied upon as a promise or representation as to future results or events, and the delivery of this information statement does not imply that there has been no change in the affairs of Feishang

Anthracite or CHNR or that the information in this information statement is correct as of any date subsequent to the date hereof.

You

should not construe the contents of this information statement as investment, legal or tax advice and should consult with your own counsel, accountants and other advisors as to

legal, tax, business, financial and related aspects of receiving Feishang Anthracite ordinary shares.

This

information statement has not been and will not be submitted to the British Virgin Islands Registrar of Corporate Affairs, any other authority in the British Virgin Islands or the

Hong Kong Stock Exchange, and may not be distributed to the public in the British Virgin Islands or in Hong Kong.

In

this information statement, unless the context otherwise requires, when we use the terms "we", "us", "our" or "Company", we are referring to Feishang Anthracite and its subsidiaries.

References

in this information statement to "US$" and "U.S. dollars" are to United States dollars and references to "HK$" are to Hong Kong dollars; and all references to

"RMB" or "Renminbi" are to Renminbi, the official currency of the PRC.

Unless

otherwise stated in this information statement, Renminbi amounts have been translated into U.S. dollars at the rate of RMB6.1374 to US$1.00 and Hong Kong dollars have been

translated into U.S. dollars

IS-2

Table of Contents

at

the rate of HK$7.7560 to US$1.00, which were exchange rates as set forth in the H.10 statistical release of the Federal Reserve Board on June 28, 2013. No representation is made that

the U.S. dollar amounts have been, could have been or could be converted to Renminbi, or vice versa, or that the Hong Kong dollar amounts have been, could have been or could be converted to

U.S. dollars, or vice versa, at that rate or at any other rate or at all.

Any

discrepancies in any table or elsewhere in this information statement between totals and sums of amounts listed herein are due to rounding.

The

financial information in this information statement, including the Hong Kong Listing Document, has been prepared in accordance with the International Financial Reporting Standards

("IFRS") issued by the International Accounting Standards Board (the "IASB"), which differ in certain respects from accounting principles generally accepted in certain other countries,

including generally accepted accounting principles in the United States.

SHAREHOLDER INQUIRIES

CHNR Shareholders with questions relating to the Spin-off may contact CHNR at Room 2205, 22/F, West Tower, Shun

Tak Centre, 168-200 Connaught Road Central, Sheung Wan, Hong Kong, email: info@chnr.net, telephone: +852 2810 7205. You may also request copies of this information statement by contacting CHNR

at the above address, email address or telephone number.

ENFORCEABILITY OF CIVIL LIABILITIES

Feishang Anthracite is a company incorporated in and under the laws of the British Virgin Islands with limited

liability, and all of Feishang Anthracite's directors and officers reside outside the United States and all or a substantial portion of the assets of Feishang Anthracite and of such persons are

located outside the United States. As a result, it may not be possible for shareholders to effect service of process within the United States upon Feishang Anthracite or such persons, or

to enforce against Feishang Anthracite or such persons judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the Federal securities

laws of the United States. Feishang Anthracite has been advised by its British Virgin Islands counsel, Maples and Calder, that there is doubt as to the enforceability in the British Virgin

Islands in original actions or in actions for enforcement of judgments of United States courts, or civil liabilities predicated solely upon the Federal securities laws of the

United States or the securities laws of any State or territory within the United States since the British Virgin

Islands does not have treaties with the United States providing for the reciprocal enforcement of civil judgments. Feishang Anthracite has also been advised by its PRC counsel,

Commerce & Finance Law Offices, that there is doubt as to the enforceability in the PRC, in original actions or in actions for enforcement of judgments of United States courts, of civil

liabilities predicated solely upon the Federal securities laws of the United States, since the PRC does not have treaties with the United States providing for the reciprocal recognition

and enforcement of judgment of courts.

IS-3

Table of Contents

FORWARD-LOOKING STATEMENTS

This information statement contains forward-looking statements. All statements other than statements of historical fact

contained in this information statement, including, without limitation, statements relating to our strategies, plans, objectives, goals and targets, our future financial, business or other performance

and development, the future development of our industry, the general economy of our key markets and globally, are intended to identify forward-looking statements. We also use the words "aim",

"anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "going forward", "intend", "may", "plan", "potential", "predict", "project", "ought to", "seek", "should", "will",

"would" and similar expressions to identify forward-looking statements.

These

forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors, some of which are beyond our control. In addition, these

forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Important factors that could materially affect our actual results,

performance or achievements include the risk factors set forth in "Risk Factors" in the Hong Kong Listing Document and the following:

- •

- our liquidity and financial condition;

- •

- our business strategies and plan of operations;

- •

- our future debt levels and capital needs and the availability and costs of bank loans and other forms of financing;

- •

- our capital expenditure plans;

- •

- projects under construction or planning;

- •

- the possibility of project cost overruns or unanticipated costs and expenses;

- •

- our production capacity;

- •

- our operations and business prospects;

- •

- our product mix;

- •

- changes in prices for anthracite coal;

- •

- supply and demand changes in anthracite coal markets;

- •

- changes in the competitive landscape in the anthracite coal industry;

- •

- our ability to reduce production costs;

- •

- our relationship with, and other conditions affecting, our customers;

- •

- risks inherent to coal mining, including accidents;

- •

- estimates of coal reserves;

- •

- our plans and objectives for future operations and expansion;

IS-4

Table of Contents

- •

- our dividend policy;

- •

- the regulatory environment and developments of our industry in general;

- •

- changes in political, economic, legal and social conditions in the PRC, including the PRC government's specific policies

with respect to the coal industries, economic growth, inflation, foreign exchange and the availability of credit; and

- •

- catastrophic losses from fires, floods, windstorms, earthquakes, diseases or other adverse weather-related damage.

These

forward-looking statements are based on current plans and estimates, which speak only as of the date they are made, and numerous assumptions regarding our present and future

business strategy and the environment in which we will operate in the future. Subject to the requirements of applicable laws, rules and regulations, we do not have any obligation to update or

otherwise revise any forward-looking statements in this information statement, whether as a result of new information, future events or otherwise.

Due

to these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this information statement might not occur in the way we expect, or at all.

Accordingly, you should not place undue reliance on any forward-looking information. All forward-looking statements contained in this information statement are qualified by reference to this

cautionary statement.

IS-5

Table of Contents

SUMMARY

The following summary highlights information contained in, and is qualified in its entirety by, the more

detailed information (including our consolidated financial information and the notes thereto) appearing elsewhere in this information statement. Since the following is a summary, it does not contain

all of the information relevant to the Spin-off. Accordingly, you are urged to read the entire information statement, including the Hong Kong Listing Document.

OVERVIEW

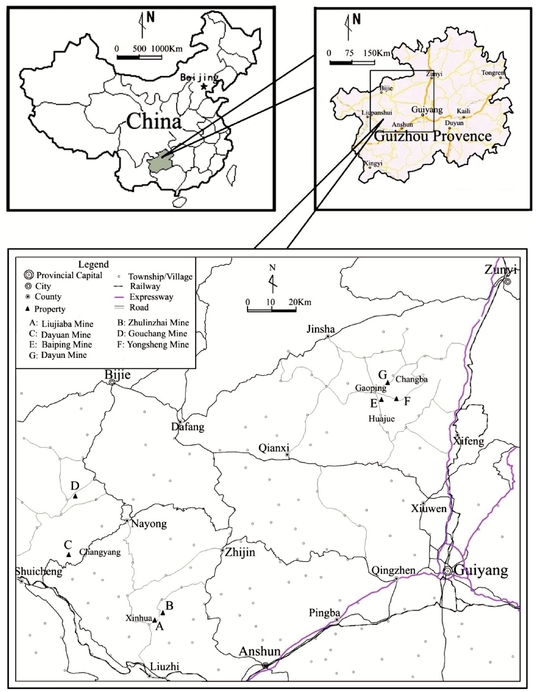

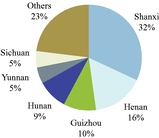

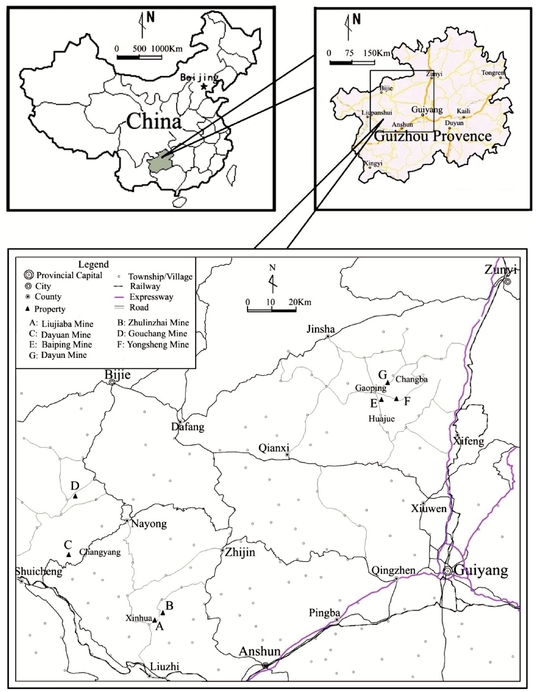

We are a producer of anthracite coal based in Guizhou province of the PRC. We are primarily engaged in the acquisition, construction

and development of anthracite coal mines and the extraction and sale of anthracite coal. Our mining assets consist of seven underground anthracite coal mines in Guizhou province, of which five have

commenced commercial production, one is undergoing its pilot run phase and one is under construction. All of our anthracite coal mines are accessible by road and located in Guizhou province, which,

according to the SAWS and Fenwei, had the largest anthracite coal resources among the provinces in Southwest China as of December 31, 2012. The following table sets forth certain information

regarding our seven anthracite coal mines as of the date of the Hong Kong Listing Document, other than information regarding the total proved and probable reserves and the estimated mine lives of our

anthracite coal mines, which were as of July 31, 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anthracite Coal Mine

|

|

Stage of Production |

|

Date of

Initial/Expected

Commercial Production |

|

Total

Proved and

Probable

Reserves

(in million

tonnes) |

|

Permitted

Annual

Production

Capacity

(in tonnes)(1) |

|

Estimated

Mine

Life(2) (in years) |

|

Baiping Coal Mine |

|

Commercial production |

|

June 2009 |

|

|

22.48 |

|

|

150,000 |

|

|

37 |

|

Liujiaba Coal Mine |

|

Commercial production |

|

December 2012 |

|

|

13.60 |

|

|

300,000 |

|

|

23 |

|

Zhulinzhai Coal Mine |

|

Commercial production |

|

April 2012 |

|

|

9.56 |

|

|

300,000 |

|

|

21 |

|

Gouchang Coal Mine |

|

Commercial production (suspended)(3) |

|

April 2011 |

|

|

5.72 |

|

|

90,000 |

|

|

52 |

|

Yongsheng Coal Mine |

|

Pilot run |

|

March 2014 |

|

|

51.96 |

|

|

600,000 |

|

|

29 |

|

Dayuan Coal Mine |

|

Commercial production |

|

November 2013 |

|

|

8.26 |

|

|

300,000 |

|

|

18 |

|

Dayun Coal Mine |

|

Construction |

|

July 2015 |

|

|

97.29 |

|

|

600,000 |

|

|

54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

208.87 |

|

|

2,340,000 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

- (1)

- Represents

the annual production capacity as permitted under the relevant mining rights permits.

- (2)

- Mine

life estimates are calculated by dividing proved and probable reserves by the optimized annual production capacity, which takes into account the

planned future increases in production capacity still in the design phase.

- (3)

- Operations

have been suspended at Gouchang Coal Mine since March 2013 pending the acquisition by us of a nearby coal mine and Gouchang Coal Mine

achieving certain production capacity targets in accordance with Guizhou province's coal mine consolidation policy. See "Business — Our Anthracite Coal

Mines — Mines in Commercial Production — Gouchang Coal Mine" on page 110 of the Hong Kong Listing Document.

As of July 31, 2013, we had total proved and probable coal reserves of approximately 208.87 million tonnes and total permitted

annual production capacity of 2.34 million tonnes. In 2010, 2011, 2012 and the six months ended June 30, 2012 and 2013, we sold 166,362 tonnes, 314,058 tonnes,

437,010 tonnes, 148,539 tonnes and 187,432 tonnes of anthracite coal, respectively, and had revenues of RMB38.7 million, RMB105.2 million, RMB141.9 million,

RMB55.2 million and RMB54.7 million, respectively. In 2010, 2011, 2012 and the six months ended June 30, 2012 and 2013, the average selling price of the anthracite coal we

produced was RMB232.4, RMB296.4, RMB323.6, RMB360.3 and RMB291.9 per tonne, respectively.

IS-6

Table of Contents

During

the Track Record Period, we derived our revenue primarily from the sale of coal we produced. From time to time, we also engaged in coal trading activities by selling coal that we

purchased from third party suppliers. In 2011, 2012 and the six months ended June 30, 2012 and 2013, revenue from sales of third party coal was RMB33.1 million, RMB1.1 million,

RMB1.1 million and nil, respectively, representing 31.5%, 0.8%, 2.0% and nil, respectively, of our total revenue. We did not engage in any coal trading activities in 2010, and we do not intend

to engage in any significant coal trading activities in the future.

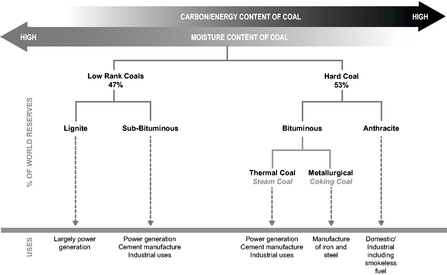

In

the PRC, end users generally characterize anthracite coal as thermal coal, chemical coal or PCI coal. Thermal coal is generally used in the electric power industry for power

generation and in the construction industry for cement production. Chemical coal is generally used for the production of synthetic ammonia and methanol, and PCI coal is generally used for sintering,

smelting and injection purposes in the pulverized coal injection process in iron production. Prior to 2011, we sold substantially

all of the coal produced from our mines as thermal coal. In 2011, 2012 and the six months ended June 30, 2013, we derived approximately 5%, 5% and 1.2% of our revenue from the sale of chemical

coal we produced, respectively, while our remaining revenue in each of these years was derived from the sale of thermal coal we produced and coal sourced from third parties. Subject to market

conditions and the Guizhou government's annual guidance on supply of thermal coal to power plants, we intend to significantly increase our sales of chemical coal in the future and begin selling PCI

coal in 2014. Our ability to sell chemical coal or PCI coal during the Track Record Period has been constrained as our annual production levels were determined based in large part on the Guizhou

government's annual guidance relating to the provision of certain minimum amounts of thermal coal to power plants operating in Guizhou, which has taken up a significant portion of our production

capacity. We generally price our anthracite coal based on the prevailing market prices in Guizhou, the anthracite coal type and quality, our sales volume and the length of our relationship with

the customer.

In

order to increase our production capacity, we plan to optimize all of our currently operating anthracite coal mines by improving mine layout and upgrading mine infrastructure and

equipment. We expect that our optimization plans will begin in 2015 and, after their expected completion in December 2018, we expect to be able to achieve an aggregate annual production

capacity of 5.81 million tonnes. The estimated costs of our optimization plans are RMB807.5 million.

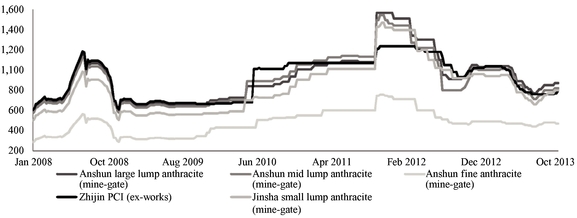

Anthracite

coal production in Guizhou has historically exceeded local consumption and this trend is expected to continue. Anthracite coal prices in Guizhou are also highly cyclical. For

example, anthracite coal prices in Guizhou declined significantly in the second quarter of 2012 and, after a brief period of recovery, declined significantly again in the first half of 2013. There

could be further declines in anthracite coal prices in Guizhou in the future. See "Risk Factors — Risks relating to PRC's Coal

Industry — Our business, financial condition and results of operations are susceptible to the cyclical nature of the PRC anthracite coal market and vulnerable to

fluctuations in anthracite coal prices" on page 49 of the Hong Kong Listing Document.

IS-7

Table of Contents

Under

PRC law, each coal mine in the PRC must obtain certain permits prior to commencing commercial production, including a mining right permit, a safe production permit and a coal

production permit. The following table sets forth certain information regarding our mining right permits, safe production permits and coal production permits as of the Latest Practicable Date:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining Right Permit |

|

Safe Production Permit |

|

Coal Production Permit(5) |

Mine

|

|

Holder/permit number |

|

Permit date

(month/year) |

|

Expiration

date

(month/year) |

|

Permit date

(month/year) |

|

Expiration

date

(month/year) |

|

Permit date

(month/year) |

|

Expiration

date

(month/year) |

Baiping Coal Mine(1) |

|

Baiping Mining/ C5200002011111120121064 |

|

November

2011 |

|

August 2014 |

|

May 2012 |

|

May 2015 |

|

June 2009 |

|

June 2020 |

Liujiaba Coal Mine |

|

Xinsong Coal/ C5200002009091120036374(2) |

|

March 2011 |

|

September

2019 |

|

November

2012 |

|

November

2015 |

|

December

2012 |

|

December

2037 |

Zhulinzhai Coal Mine |

|

Linjiaao Coal/ C5200002011031120108782 |

|

April 2011 |

|

July 2018 |

|

March 2012 |

|

March 2015 |

|

April 2012 |

|

April 2031 |

Gouchang Coal Mine |

|

Gouchang Coal/ C5200002009121120048406 |

|

April 2011 |

|

April 2017 |

|

April 2011 |

|

April 2014 |

|

April 2011 |

|

April 2045 |

Yongsheng Coal Mine |

|

Guizhou Yongfu/ C5200002012021120124117(3) |

|

February

2012 |

|

November

2027 |

|

— |

|

— |

|

— |

|

— |

Dayuan Coal Mine |

|

Dayuan Coal/ 5200002011051120118585 |

|

March 2013 |

|

March 2023 |

|

November

2013 |

|

November

2016 |

|

— |

|

— |

Dayun Coal Mine |

|

Guizhou Dayun/ C5200002011031120112455(4) |

|

March 2011 |

|

March 2031 |

|

— |

|

— |

|

— |

|

— |

- (1)

- In

2011 and 2012, the actual production output of Baiping Coal Mine exceeded its permitted annual production capacity under its mining right permit and coal

production permit. See "Business — Our Anthracite Coal Mines — Mines in Commercial

Production — Baiping Coal Mine" on page 108 of the Hong Kong Listing Document. We have applied for a mining right permit with an annual production capacity

of 300,000 tonnes for Baiping Coal Mine and we expect to obtain such permit in 2014.

- (2)

- The

mining right has been pledged to China Minsheng Bank.

- (3)

- The

mining right has been pledged to China Minsheng Bank and Bank of China.

- (4)

- The

mining right has been pledged to China Merchants Bank.

- (5)

- The

National People's Congress Standing Committee passed certain amendments to the Coal Law, which became effective on June 29, 2013, including

removing the requirement of obtaining coal production permits.

Each of our anthracite coal mines currently utilizes manual longwall mining, semi-mechanical longwall mining or mechanical longwall mining methods

to extract coal. Longwall mining refers to extracting coal from long rectangular blocks of coal seams. Manual longwall mining refers to drilling holes in the mining face, placing explosives and

detonating the explosives to extract the coal. Mechanical and semi-mechanical longwall mining involve using a mechanical shearer in coal extraction. In mechanical longwall mining, the mine roof is

held up during the extraction process by automatic hydraulic roof supports, while in semi-mechanical longwall mining, the mine roof is held up hydraulic roof supports that are operated manually. The

following table sets forth the current extraction method of each of our anthracite coal mines:

|

|

|

Anthracite Coal Mine

|

|

Extraction Method |

Baiping Coal Mine |

|

Manual longwall |

Liujiaba Coal Mine |

|

Semi-mechanical longwall |

Zhulinzhai Coal Mine |

|

Manual longwall |

Gouchang Coal Mine |

|

Manual longwall |

Dayun Coal Mine |

|

Mechanical longwall |

Yongsheng Coal Mine |

|

Mechanical longwall |

Dayuan Coal Mine |

|

Semi-mechanical longwall |

IS-8

Table of Contents

CAPITAL EXPENDITURE

Our capital expenditures were RMB219.7 million, RMB341.5 million, RMB360.2 million, RMB202.9 million and

RMB139.3 million in 2010, 2011, 2012 and the six months ended June 30, 2012 and 2013, respectively. Our capital expenditures primarily related to the construction of our coal mines,

purchase of mining-related equipment and machinery and pre-payments for land use rights for our coal mines. We expect to pay approximately an aggregate of RMB636.5 million in 2013 and 2014 for

capital expenditures. We expect to fund these capital expenditures through interest-bearing bank loans and other borrowings. In the past, we have financed a significant portion of our cash

requirements with non-interest bearing loans from companies controlled by Mr. Li Feilie, our chairman and chief executive officer. In March 2013, we repaid a significant portion of the

non-interest bearing loans from companies controlled by Mr. Li with interest-bearing bank and other borrowings. We do not anticipate receiving additional non-interest bearing loans from our

related parties after the Listing. Accordingly, we expect our finance costs to increase significantly in the future. See "Financial Information — Indebtedness" to

the Hong Kong Listing Document.

OUR STRENGTHS

We believe our principal strengths include the following:

- •

- anthracite is a relatively scarce and valuable resource;

- •

- our high quality coal reserves;

- •

- we are located in Guizhou province, which has one of the largest anthracite coal resources in the PRC;

- •

- we are well-positioned to capitalize on industry consolidation opportunities in Guizhou; and

- •

- experienced management team.

BUSINESS STRATEGIES

We aim to grow our business by focusing on the following strategies:

- •

- achieve profitability through sales of higher margin chemical and PCI coal and increasing our production output;

- •

- strengthen our sales and marketing networks;

- •

- create a more vertically integrated business;

- •

- enhance our operational efficiency and cost control;

- •

- enhance the environmental and occupational health and safety standards of our operations; and

- •

- increase our anthracite coal production capacity in the long-term through mine optimization plans and acquisitions of high

quality anthracite coal mines.

IS-9

Table of Contents

THE SPIN-OFF

The following is a brief summary of certain information contained elsewhere in this information statement and the Hong Kong Listing

Document. This summary is qualified in its entirety by the more detailed information set forth in this information statement and the Hong Kong Listing Document.

|

|

|

| Distributed Company |

|

Feishang Anthracite Resources Limited, a company incorporated in the British Virgin Islands with limited liability on January 6, 2010 and a wholly-owned subsidiary of CHNR immediately prior to the

Distribution. |

Distributing Company |

|

China Natural Resources, Inc., a company incorporated in the British Virgin Islands on December 14, 1993 and the sole shareholder of Feishang Anthracite immediately prior to the

Distribution. |

Listing and Trading of Feishang Anthracite Ordinary Shares |

|

There is currently no public market for Feishang Anthracite ordinary shares. Feishang Anthracite ordinary shares are expected to be listed on the Hong Kong Stock Exchange under the stock code "1738"

on or around January 22, 2014. The proposed listing does not involve an offering of new shares or any other securities and no proceeds will be raised pursuant to the Listing. Admission to listing and trading is subject to the approval of the

Listing Committee of the Hong Kong Stock Exchange. Feishang Anthracite ordinary shares will not be listed on any securities exchange in the United States or quoted on any automated inter-dealer quotation system in the

United States. |

The Distribution and Spin-off |

|

On December 31, 2013, the board of directors of CHNR declared a conditional special interim dividend to the CHNR Shareholders to be satisfied by way of a distribution in specie of the entire

issued share capital of Feishang Anthracite, being an aggregate of 124,554,580 ordinary shares, to all CHNR Shareholders in proportion to their respective shareholdings in CHNR on the Distribution Record Date. |

|

|

CHNR Shareholders will be entitled to receive five Feishang Anthracite ordinary shares for each CHNR common share held on the Distribution Record Date. CHNR Shareholders will not be required to pay

any consideration for the Feishang Anthracite ordinary shares that they will be entitled to receive in the Distribution or to surrender or exchange CHNR common shares in order to be entitled to receive Feishang Anthracite ordinary shares and do not

need to take any other action in connection with the Distribution. After the completion of the Distribution, CHNR will no longer hold any shares in Feishang Anthracite. |

|

|

The listing of and dealing in Feishang Anthracite ordinary shares on the Hong Kong Stock Exchange is expected to commence on January 22, 2014. |

IS-10

Table of Contents

|

|

|

| |

|

Trades on the Hong Kong Stock Exchange are required to be settled between exchange participants (as defined in the Listing Rules of the Hong Kong Stock Exchange) through CCASS on the second

Business Day after any trading day. CCASS is the central depository of share certificates and provides a computerized book-entry settlement of share transactions between its participants. All activities under CCASS are subject to the General Rules of

CCASS and CCASS Operational procedures in effect from time to time. In order to facilitate the trading of Feishang Anthracite ordinary shares upon the Listing, we and CHNR have put in place arrangements where any holders of record of CHNR common

shares (the "Record CHNR Shareholders") on the Distribution Record Date will be provided with the following three options to receive Feishang Anthracite ordinary shares: |

|

|

Option 1 — Request the Share Certificate to be issued in the name of the relevant stockbroker in Hong Kong and have the Feishang Anthracite ordinary shares deposited into CCASS

for credit to the designated CCASS Participant's stock account of such stockbroker in Hong Kong |

|

|

Prior to January 13, 2014, a Record CHNR Shareholder may contact his/her/its stockbroker outside Hong Kong and request for confirmation that it has custodial and nominee arrangements with, and is

able to trade on the Hong Kong Stock Exchange through, a stockbroker in Hong Kong. If the Record CHNR Shareholders' stockbroker outside Hong Kong is able to do so, the Record CHNR Shareholder may, either himself/herself/itself or through such

stockbroker, request that the Share Certificate be issued in the name of the the relevant stockbroker in Hong Kong and have the Feishang Anthracite ordinary shares be deposited into CCASS for credit to the designated CCASS Participant's account of

that stockbroker in Hong Kong. Record CHNR Shareholders should consult his/her/its stockbroker regarding the timing, cost and procedures of having the Shares deposited into CCASS. |

|

|

Option 2 — Request the Share Certificate to be issued in the name of a stockbroker in Hong Kong and have the Feishang Anthracite ordinary shares deposited into CCASS for credit to

the designated CCASS Participant's account of such stockbroker |

|

|

If the Record CHNR Shareholder has a brokerage account with a stockbroker in Hong Kong and wishes to hold his/her/its Feishang Anthracite ordinary shares through such account following the Listing,

he/she/it may, prior to January 13, 2014 and either himself/herself/itself or through such stockbroker in Hong Kong, request that the Share Certificate be issued in the name of the relevant stockbroker in Hong Kong and have the Feishang

Anthracite ordinary shares deposited into CCASS for credit to the designated CCASS Participant's stock account of such stockbroker in Hong Kong. Record CHNR Shareholders should consult his/her/its stockbroker regarding the timing, cost and procedures

of having the Shares deposited into CCASS. |

IS-11

Table of Contents

|

|

|

| |

|

Option 3 — Request the Share Certificate to be sent to the Record CHNR Shareholder directly (default option if no action is taken or no option is selected) |

|

|

If the Record CHNR Shareholder wishes to receive the Share Certificate in his/her/its own name and have the Share Certificate sent to his/her/its address that appears on the register of members of

CHNR on the Distribution Record Date, he/she/it may, prior to January 13, 2014 and either himself/herself/itself or through his/her/its stockbroker, request that the Share Certificate be issued in his/her/its own name and be posted to

his/her/its address on January 21, 2014, the Business Day before the Listing Date. Share Certificates will be posted on the same day to the address that appears on the register of members of CHNR on the Distribution Record

Date for Record CHNR Shareholders who (i) do not take any action or (ii) make no option selection by January 13, 2014. However, as the Share Certificate will only be posted on the Business Day before the Listing

Date, it may not arrive by the Listing Date due to delivery time and the Feishang Anthracite ordinary shares may not be deposited into CCASS in time for settlement of trades conducted on the Hong Kong Stock Exchange on the Listing

Date. |

|

|

If a CHNR Shareholder wishes to trade the Feishang Anthracite ordinary shares on the Hong Kong Stock Exchange on or shortly after the Listing Date, we strongly recommend the CHNR Shareholder to

select option 1 or 2 above. Under option 3, the CHNR Shareholder will receive Share Certificates which will be posted only on the Business Day before the Listing Date. This may result in a lengthy period of time after the Listing before the

CHNR Shareholder can trade such Shares on the Stock Exchange. |

|

|

The share certificates will only become valid if the Distribution becomes unconditional. In the event the Distribution does not become unconditional, dealings in the shares on the Hong Kong Stock

Exchange will not commence on January 22, 2014. In such event, we will make an announcement of the above and, if necessary, of a revised timetable. Investors who trade in Feishang Anthracite ordinary shares prior to the receipt of the share

certificates do so entirely at their own risk. |

IS-12

Table of Contents

|

|

|

| |

|

Note for Beneficial CHNR Shareholders |

|

|

CHNR Shareholders who are holding CHNR common shares through a bank, broker, dealer, financial institution or other custodian or nominee ("Beneficial CHNR Shareholders") are not registered holders of

CHNR common shares and therefore do not appear on the register of members of CHNR. As Feishang Anthracite ordinary shares will be distributed under the Distribution only to those Record CHNR Shareholders on the Distribution

Record Date, there is no assurance that Beneficial CHNR Shareholders will be able to receive Feishang Anthracite ordinary shares on or prior to the Listing Date, because the timing and manner of delivery of the Feishang Anthracite ordinary shares

will depend on specific arrangements with their respective intermediaries. Beneficial CHNR Shareholders should therefore contact their respective intermediaries (i) to coordinate the delivery of Feishang Anthracite ordinary shares under the

Distribution or (ii) if they wish to become Record CHNR Shareholders to facilitate the receipt of Feishang Anthracite ordinary shares in the Distribution under their own names or for credit to their designated CCASS Participant's stock

account. |

|

|

For further information, see "The Spin-off" in the Hong Kong Listing Document. |

Conditions to the Distribution |

|

The Distribution is conditional on the Listing Committee of the Hong Kong Stock Exchange granting listing of, and permission to deal in, Feishang Anthracite ordinary shares in issue on the Main Board

of the Hong Kong Stock Exchange. |

Distribution Record Date |

|

January 13, 2014 |

|

|

In order to be entitled to receive Feishang Anthracite ordinary shares in the Distribution, CHNR Shareholders must be holders of record of CHNR common shares on the Distribution Record Date. See

"Expected Timetable" in the Hong Kong Listing Document. |

Risks Associated with the Distribution and Feishang Anthracite |

|

There are certain risks associated with the Distribution and Feishang Anthracite. See "Risk Factors Relating to the Distribution" beginning on page IS-17 of this information statement and "Risk

Factors" beginning on page 37 of the Hong Kong Listing Document. |

No CHNR Shareholder Approval Required |

|

No CHNR Shareholder approval of the Distribution is required or sought. CHNR is not asking you for a proxy and you are requested not to send CHNR a proxy. |

No Appraisal Rights |

|

CHNR Shareholders have no appraisal rights in connection with the Distribution. |

IS-13

Table of Contents

|

|

|

| Certain Relationships Among Mr. Li Feilie, CHNR and Feishang Anthracite After the Distribution |

|

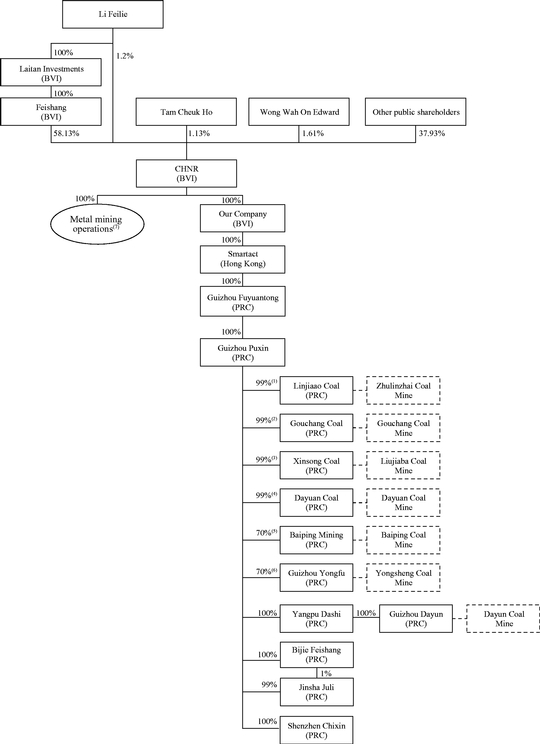

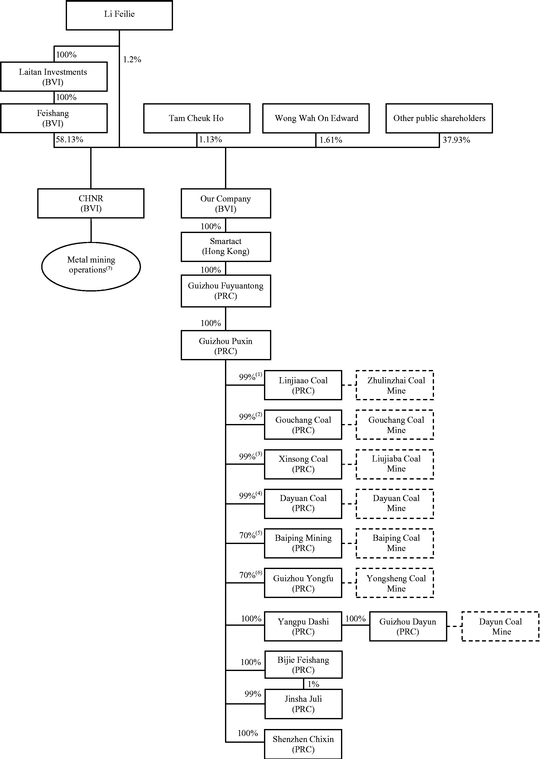

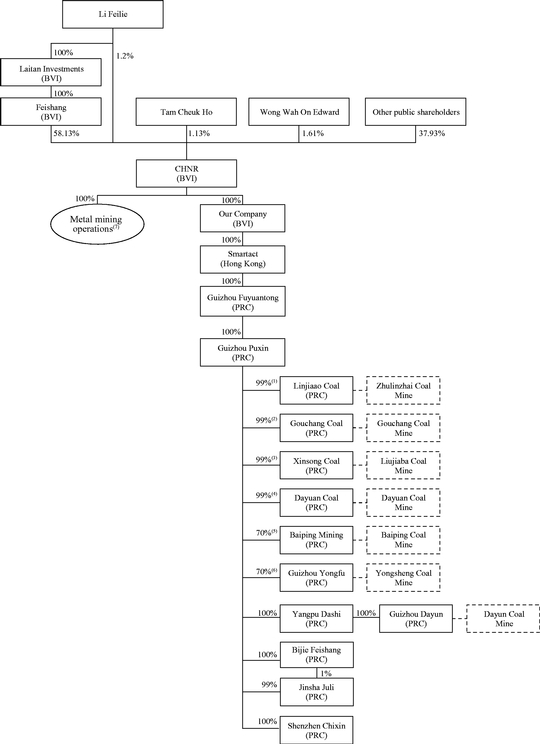

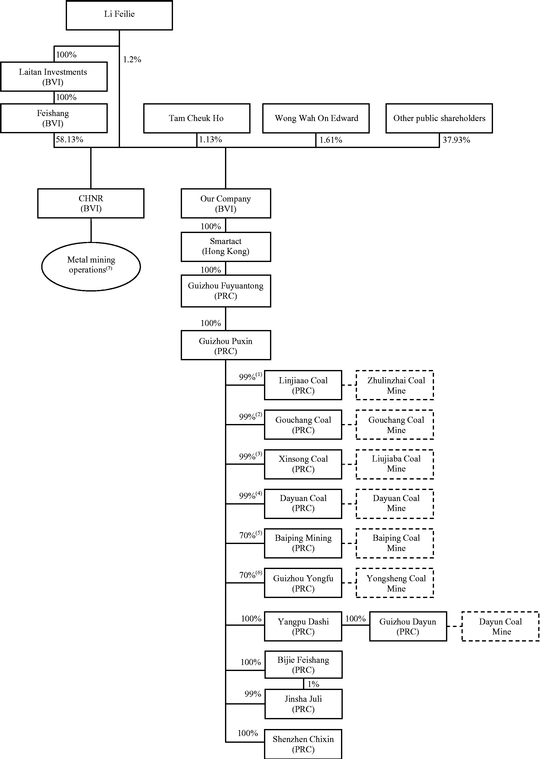

Immediately after the Distribution, Mr. Li Feilie will directly and indirectly own approximately 59.33% of the ordinary shares of Feishang Anthracite. For a discussion of certain continuing

relationships among Mr. Li Feilie, CHNR and Feishang Anthracite, see "Relationship with Our Controlling Shareholders" and "Connected Transactions" in the Hong Kong Listing Document. |

Certain Material Tax Consequences |

|

The Distribution will not be subject to British Virgin Islands or Hong Kong tax, but CHNR intends to treat the Distribution as a taxable dividend for U.S. Federal income tax purposes. CHNR may be

subject to PRC withholding tax on the Distribution. For a discussion of certain material income tax consequences, see "Certain Material Tax Consequences" in this information statement. |

IS-14

Table of Contents

SELECTED HISTORICAL FINANCIAL INFORMATION

The following selected historical consolidated income statements for the years ended December 31, 2010, 2011 and 2012 and the

six months ended June 30, 2012 and 2013, and the selected consolidated statements of financial position as of December 31, 2010, 2011 and 2012 and June 30, 2013 are derived from

our consolidated financial statements, including the notes thereto, beginning on page F-1 of this information statement. We have not included the selected financial data

for 2008 and 2009 because certain subsidiaries which we acquired in 2009 did not have any financial statements prior to their acquisition by us, and reconstructing this historical financial formation

would involve unreasonable effort and expense. You should read the summary historical consolidated financial statements set forth below in conjunction with our consolidated financial statements

beginning on page F-1 of this information statement together with the accompanying notes, which have been prepared in accordance with IFRS as issued by the IASB.

Selected Consolidated Income Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, |

|

Six months ended June 30, |

|

|

|

2010 |

|

2011 |

|

2012 |

|

2012 |

|

2013 |

|

2013 |

|

|

|

RMB

|

|

RMB

|

|

RMB

|

|

RMB

|

|

RMB

|

|

US$

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

(in thousands, except number of shares)

|

|

Revenue |

|

|

38,668 |

|

|

105,211 |

|

|

141,939 |

|

|

55,156 |

|

|

54,716 |

|

|

8,915 |

|

Gross profit |

|

|

13,215 |

|

|

30,922 |

|

|

46,050 |

|

|

24,760 |

|

|

14,763 |

|

|

2,405 |

|

Operating Loss |

|

|

(54,545 |

) |

|

(22,985 |

) |

|

(36,602 |

) |

|

(11,270 |

) |

|

(231,685 |

) |

|

(37,750 |

) |

Profit/(Loss) Before Income Tax |

|

|

562,134 |

|

|

(55,150 |

) |

|

(82,266 |

) |

|

(32,921 |

) |

|

(273,224 |

) |

|

(44,518 |

) |

Income tax (expense)/benefit |

|

|

(6,141 |

) |

|

(9,750 |

) |

|

15,210 |

|

|

(5,784 |

) |

|

50,468 |

|

|

8,223 |

|

Profit/(Loss) for the Year |

|

|

555,993 |

|

|

(64,900 |

) |

|

(67,056 |

) |

|

(38,705 |

) |

|

(222,756 |

) |

|

(36,295 |

) |

Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

|

562,432 |

|

|

(64,165 |

) |

|

(75,312 |

) |

|

(40,861 |

) |

|

(221,947 |

) |

|

(36,163 |

) |

Non-controlling interests |

|

|

(6,439 |

) |

|

(735 |

) |

|

8,256 |

|

|

2,156 |

|

|

(809 |

) |

|

(132 |

) |

Earnings (losses) per share attributable to owners of the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

562,432 |

|

|

(64,165 |

) |

|

(75,312 |

) |

|

(40,861 |

) |

|

(221,947 |

) |

|

(36,163 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

562,432 |

|

|

(64,165 |

) |

|

(75,312 |

) |

|

(40,861 |

) |

|

(221,947 |

) |

|

(36,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

IS-15

Table of Contents

Selected Consolidated Statements of Financial Position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

As of June 30, |

|

|

|

2010 |

|

2011 |

|

2012 |

|

2013 |

|

2013 |

|

|

|

RMB

|

|

RMB

|

|

RMB

|

|

RMB

|

|

US$

|

|

|

|

(in thousands, except number of shares)

|

|

Non-current assets |

|

|

1,824,292 |

|

|

2,125,475 |

|

|

2,477,108 |

|

|

2,451,243 |

|

|

399,394 |

|

Current assets |

|

|

107,222 |

|

|

179,085 |

|

|

285,754 |

|

|

245,852 |

|

|

40,058 |

|

Total assets |

|

|

1,931,514 |

|

|

2,304,560 |

|

|

2,762,862 |

|

|

2,697,095 |

|

|

439,452 |

|

Current liabilities |

|

|

544,306 |

|

|

811,181 |

|

|

1,315,865 |

|

|

1,200,957 |

|

|

195,678 |

|

Net current liabilities |

|

|

437,084 |

|

|

632,096 |

|

|

1,030,111 |

|

|

955,105 |

|

|

155,620 |

|

Total liabilities |

|

|

1,300,550 |

|

|

1,739,091 |

|

|

2,255,267 |

|

|

2,407,524 |

|

|

392,271 |

|

Equity attributable to owners of the Company |

|

|

554,831 |

|

|

479,784 |

|

|

413,654 |

|

|

196,439 |

|

|

32,007 |

|

Non-controlling interests |

|

|

76,133 |

|

|

85,685 |

|

|

93,941 |

|

|

93,132 |

|

|

15,174 |

|

Total equity |

|

|

630,964 |

|

|

565,469 |

|

|

507,595 |

|

|

289,571 |

|

|

47,181 |

|

Key Financial Ratios

The table below sets forth our key financial ratios as of the dates or for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or for the year

ended December 31, |

|

As of or for the six months ended June 30, |

|

|

|

2010 |

|

2011 |

|

2012 |

|

2012 |

|

2013 |

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

Inventory turnover days(1) |

|

|

49 |

|

|

26 |

|

|

31 |

|

|

45 |

|

|

59 |

|

Average trade and bill payable turnover days(2) |

|

|

660 |

|

|

362 |

|

|

325 |

|

|

428 |

|

|

451 |

|

Average trade and bill receivable turnover days(3) |

|

|

29 |

|

|

61 |

|

|

101 |

|

|

75 |

|

|

157 |

|

Gearing ratio(4) |

|

|

47.5 |

% |

|

60.4 |

% |

|

68.8 |

% |

|

66.6 |

% |

|

86.5 |

% |

Debt to equity ratio(5) |

|

|

90.5 |

% |

|

152.4 |

% |

|

220.0 |

% |

|

199.8 |

% |

|

641.2 |

% |

Gross margin(6) |

|

|

34.2 |

% |

|

29.4 |

% |

|

32.4 |

% |

|

44.9 |

% |

|

27.0 |

% |

- (1)

- Inventory

turnover days are calculated by dividing the arithmetic mean of the opening and closing balances of inventories for the year by cost of sales in

that year and multiplying by 360 days. As we did not have any commercial production until March 18, 2010, inventory turnover days in 2010 is calculated by dividing the arithmetic mean of

the balance of inventories as of March 18 and December 31, 2010 by cost of sales for the period beginning on March 18, 2010 and ending on December 31, 2010, and multiplying

by 280 days.

- (2)

- The

average trade and bill payable turnover days are calculated by dividing the arithmetic mean of opening and ending balance of trade and bill payables for

the year by cost of sales in the year and then multiplying by 360 days. As we did not have any commercial production until March 18, 2010, the average trade and bill payables turnover

days in 2010 is calculated by dividing the arithmetic mean of the balance of trade and bill payables as of March 18 and December 31, 2010 by cost of sales for the period beginning on

March 18, 2010 and ending on December 31, 2010, and multiplying by 280 days.

- (3)

- The

average trade and bill receivable turnover days are calculated by dividing the arithmetic mean of opening and ending balance of trade and bill

receivables for the year by revenue in that year and then multiplying by 360 days. As we did not have any commercial production until March 18, 2010, the average trade and bill

receivables turnover days in 2010 is calculated by dividing the arithmetic mean of the balance of trade and bill receivables as of March 18 and December 31, 2010 by revenue for the

period beginning on March 18, 2010 and ending on December 31, 2010, and multiplying by 280 days.

- (4)

- Gearing

ratio is calculated by dividing total interest-bearing debt by total capital at the end of the year and multiplying by 100%. Interest-bearing debt

includes interest-bearing bank and other borrowings and mining rights payables. Capital includes total equity and interest-bearing debt.

- (5)

- Debt

to equity ratio is calculated by dividing total interest-bearing debt by total equity (based on book value without any revaluation) at the end of the

year and multiplying by 100%. Interest-bearing debt includes interest-bearing bank and other borrowings and mining rights payables.

- (6)

- Gross

margin is calculated by dividing gross profit by revenue at the end of the year and multiplying by 100%.

IS-16

Table of Contents

RISK FACTORS RELATING TO THE DISTRIBUTION

You should carefully consider the risks described below and under "Risk Factors" beginning on page 36 in the Hong Kong Listing

Document.

The combined market value of CHNR common shares and Feishang Anthracite ordinary shares after the Spin-off may be less than the market value of CHNR common shares prior to

the Spin-off.

CHNR currently has two business segments: base metals exploration and mining; and anthracite coal exploration and mining, which is

operated through Feishang Anthracite. After the completion of the Distribution, CHNR will no longer hold any Feishang Anthracite ordinary shares and, accordingly, it will only retain its base metals

exploration mining business. Until the market has fully evaluated the business of CHNR without Feishang Anthracite, as well as the business of Feishang Anthracite on a stand-alone basis, the trading

price of the common shares of CHNR and the ordinary shares of Feishang Anthracite may fluctuate significantly. In particular, the combined market value of CHNR common shares and Feishang Anthracite

ordinary shares after the Spin-off may be significantly less than the market value of CHNR common shares prior to the Spin-off.

CHNR intends to treat the Distribution as a taxable dividend for U.S. Federal income tax purposes.

It is not clear whether the Distribution would qualify as a tax-free spin-off under Section 355 of the U.S. Internal

Revenue Code of 1986, as amended (the "Code"). If CHNR is required to report the Distribution to the IRS, CHNR intends to treat the Distribution as a taxable dividend to its Shareholders for

U.S. Federal income tax purposes. Under this treatment, as explained in "Certain Material Tax Consequences — United States Federal Income Taxation"

in this information statement, U.S. holders of CHNR common shares would be subject to tax on the fair market value of the Feishang Anthracite ordinary shares they receive. Holders should consult their own tax advisers

concerning the U.S. federal, state, local and other tax consequences of the Distribution in light of their particular

circumstances.

Holders of the Feishang Anthracite ordinary shares located in the United States may not be able to participate in rights offerings or elect to receive dividends in

the form of Feishang Anthracite ordinary shares and may experience dilution of their holdings.

We may, from time to time, distribute rights to our shareholders, including rights to acquire securities. We may not offer or sell

securities in the United States unless we register those securities under the Securities Act or an exemption from the registration requirements of the Securities Act is available. We cannot

assure you that we will be able to establish an exemption from registration under the Securities Act, and we are under no obligation to file a registration statement with respect to these

rights or underlying securities or to endeavor to have a registration statement declared effective. Accordingly, holders of the Feishang Anthracite ordinary shares located in the United States

may be unable to participate in rights offerings and may experience dilution of their holdings as a result.

We

may offer, from time to time, a share dividend election to all our shareholders, subject to applicable securities laws, in respect of future dividends. We will, however, not

permit our shareholders to exercise such election unless the issuance of our ordinary shares pursuant to such election is either exempt from registration under the Securities Act

or registered under the provisions of the Securities Act. There can be no assurance that we will be able to establish an exemption from registration under the Securities

Act, and we are under no obligation to file a registration statement with respect to shares issuable pursuant to these elections or to endeavor to have a registration

IS-17

Table of Contents

statement

declared effective under the Securities Act. In addition, we may choose not to offer such election to some shareholders, and may instead offer those shareholders dividends in the form of

cash only. Accordingly, our shareholders may be unable to elect to receive dividends in the form of our ordinary shares rather than cash and, as a result may experience dilution of

their holdings.

CHNR faces uncertainties with respect to the applicability of PRC withholding tax on the Distribution.

Pursuant to the Notice on Strengthening Administration of Enterprise Income Tax for Share Transfers by Non-PRC Resident Enterprises (

) ("SAT Circular 698") issued by the State Administration of Taxation ("SAT") on December 10, 2009 with retroactive effect from January 1, 2008, if

a non-PRC resident enterprise transfers its indirect equity interests in a PRC resident enterprise by disposing of its equity interests in an overseas holding company ("Indirect Transfer"), and such

overseas holding company is located in a tax jurisdiction that has an effective tax rate of less than 12.5% or does not tax foreign income of its residents, the non-PRC resident enterprise, as the

transferor, is required to report the Indirect Transfer to the relevant PRC tax authorities. Using a "substance over form" principle, the PRC tax authorities may disregard the existence of the

overseas holding company if it lacks a reasonable commercial purpose and was established for the purpose of avoiding PRC tax, in which case the gains derived from such "Indirect Transfer" may be

subject to PRC withholding tax at a rate of up to 10%. SAT Circular 698 also provides that, if a non-PRC resident enterprise transfers its equity interests in a PRC resident enterprise to its

related parties at a price lower than the fair market value, the relevant PRC tax authorities have the authority to make reasonable adjustments to the taxable income of the transaction.

) ("SAT Circular 698") issued by the State Administration of Taxation ("SAT") on December 10, 2009 with retroactive effect from January 1, 2008, if

a non-PRC resident enterprise transfers its indirect equity interests in a PRC resident enterprise by disposing of its equity interests in an overseas holding company ("Indirect Transfer"), and such

overseas holding company is located in a tax jurisdiction that has an effective tax rate of less than 12.5% or does not tax foreign income of its residents, the non-PRC resident enterprise, as the

transferor, is required to report the Indirect Transfer to the relevant PRC tax authorities. Using a "substance over form" principle, the PRC tax authorities may disregard the existence of the

overseas holding company if it lacks a reasonable commercial purpose and was established for the purpose of avoiding PRC tax, in which case the gains derived from such "Indirect Transfer" may be

subject to PRC withholding tax at a rate of up to 10%. SAT Circular 698 also provides that, if a non-PRC resident enterprise transfers its equity interests in a PRC resident enterprise to its

related parties at a price lower than the fair market value, the relevant PRC tax authorities have the authority to make reasonable adjustments to the taxable income of the transaction.

There

is uncertainty as to the application of SAT Circular 698. For example, while the term "Indirect Transfer" is not clearly defined, it is understood that the relevant PRC tax

authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with the PRC. In addition, there is no formal declaration with regard to

how to determine whether an overseas holding company lacks a "reasonable commercial purpose" or was "established for the purpose of avoiding PRC tax". As a result, there is a risk that the PRC tax

authorities would regard the Distribution as an "Indirect Transfer" by CHNR of our PRC subsidiaries to CHNR's shareholders subject to SAT Circular 698. If SAT Circular 698 were

determined to be applicable to the Distribution by the PRC tax authorities, CHNR could be required to withhold taxes at a rate of up to 10% on any gains derived from the Distribution, which may be

deemed as the difference between the fair value of our ordinary shares at the time of the Distribution and CHNR's tax basis in our ordinary shares.

We are a British Virgin Islands company and, because the rights of shareholders under British Virgin Islands differ from those under U.S. law, you may have difficulty

protecting your shareholder rights.

We are a company incorporated under the laws of the British Virgin Islands, and substantially all of our assets are located outside the

United States. In addition, all of our directors and executive officers are nationals or residents of jurisdictions other than the United States and all or a substantial portion of their

assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon our directors or

executive officers, or enforce judgments obtained in the United States courts against our directors or executive officers.

IS-18

Table of Contents

Our

corporate affairs are governed by our amended and restated memorandum and articles of association, The BVI Business Companies Act, 2004, of the British Virgin Islands and the common

law of the British Virgin Islands. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary responsibilities of our directors under British

Virgin Islands law are to a large extent governed by The BVI Business Companies Act, 2004, and the common law of the British Virgin Islands. The common law of the British Virgin Islands is derived in

part from comparatively limited judicial precedent in the British Virgin Islands as well as from English common law, which has persuasive, but not binding, authority on a court in the British Virgin

Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are not as clearly established as they would be under statutes or judicial

precedent in some jurisdictions in the United States. In particular, the British Virgin Islands has a less developed body of securities laws as compared to the United States, and some

states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law. In addition, British Virgin Islands companies may not have standing to initiate a shareholder

derivative action in a federal court of the United States.

The

British Virgin Islands courts are also unlikely:

- •

- to recognize or enforce against us judgments of courts of the United States based on certain civil liability

provisions of U.S. Federal securities laws; and

- •

- to impose liabilities against us, in original actions brought in the British Virgin Islands, based on certain civil

liability provisions of U.S. Federal securities laws that are penal in nature.

There

is no statutory recognition in the British Virgin Islands of judgments obtained in the United States, although the courts of the British Virgin Islands will generally

recognize and enforce a non-penal final and conclusive monetary judgment of a foreign court of competent jurisdiction without retrial on the merits.

As

a result of all of the above, public shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors

or controlling shareholders than they would as shareholders of a U.S. company.

IS-19

Table of Contents

EXCHANGE RATE INFORMATION

The PRC

The People's Bank of China ("PBOC") sets and publishes daily a base exchange rate with reference primarily to the supply and demand of

Renminbi against a basket of currencies in the markets during the prior day. The PBOC also takes into account other factors such as the general conditions existing in the international foreign

exchange market. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of Renminbi to that of the U.S. dollar. Under the policy, Renminbi is permitted

to fluctuate within a narrow and managed band against a basket of certain foreign currencies determined by the PBOC. On May 18, 2007, the PBOC increased the floating band of Renminbi trading

prices against the U.S. dollar in the interbank spot foreign currency exchange market from 0.3% to 0.5%. This allows the Renminbi to fluctuate against the U.S. dollar by up to 0.5% above

or below the central parity rate published by the PBOC. On June 19, 2010, the PBOC announced that it intends to further reform the Renminbi exchange rate regime by allowing greater flexibility

in the Renminbi exchange rate. According to this announcement, the exchange rate floating bands will remain the same as previously announced, but the PBOC will place more emphasis on reflecting market

supply and demand with reference to a basket of currencies. The floating band was further widened to 1.0% since April 16, 2012. The PRC government in the future may make further adjustments to

the exchange rate system. The PBOC authorized the China Foreign Exchange Trading Center, effective since January 4, 2006, to announce the central parity exchange rate of certain foreign

currencies against the Renminbi at 9:15 a.m. each business day. This rate is set as the central parity for the trading against the Renminbi in the inter-bank foreign exchange spot market and

the over the counter exchange rate for that business day.

The

following table sets forth the exchange rates between Renminbi and U.S. dollar for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange rate(1) |

|

Period

|

|

Period end |

|

Average(2) |

|

High |

|

Low |

|

|

|

(RMB per US$1.00)

|

|

2008 |

|

|

6.8225 |

|

|

6.9193 |

|

|

7.2946 |

|

|

6.7800 |

|

2009 |

|

|

6.8259 |

|

|

6.8295 |

|

|

6.8470 |

|

|

6.8176 |

|

2010 |

|

|

6.6000 |

|

|

6.7603 |

|

|

6.8330 |

|

|

6.6000 |

|

2011 |

|

|

6.2939 |

|

|

6.4475 |

|

|

6.6364 |

|

|

6.2939 |

|

2012 |

|

|