Exhibit 99.1

1 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, ALL RIGHTS RESERVED Investing in National Security Technology August 20, 2015

2 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED This presentation contains forward - looking statements that involve risks and uncertainties concerning Global Defense & National Security Systems, Inc.’s (“GDEF”) proposed acquisition of STG Group, Inc. (“STG”), STG’s expected financial performance, as well as STG’s strategic and operational plans. Forward - looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Terms such as “anticipate ,” “ believe,” “continue,” “could ,” “ estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “should ,” “ would” and similar expressions may identify forward - looking statements , but the absence of these words does not mean that a statement is not forward - looking. Actual events or results may differ materially from those described in this written communication due to a number of risks and uncertainties. The potential risks and uncertainties include, among others, the possibility that the transaction will not close or that the closing may be delayed; the reaction of customers to the acquisition; general economic conditions; the possibility that GDEF may be unable to obtain stockholder approval as required for the transaction or that the other conditions to the closing of the transaction may not be satisfied; the transaction may involve unexpected costs , liabilities or delays; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement. In addition, please refer to the documents that GDEF file with the SEC on Forms 10 - K, 10 - Q and 8 - K. The filings by GDEF identify and address other important factors that could cause its financial and operational results to differ materially from those contained in the forward - looking statements set forth in this written communication. GDEF is under no duty to update any of the forward - looking statements after the date of this written communication to conform to actual results . References in this presentation to our “sponsor” refer to Global Defense & National Security Holdings LLC, a member of the Global Strategies Group, and references in this presentation to “GLOBAL” refer to Global Strategies Group, a privately held defense and national security business. /// Disclaimer Additional Information and Where to Find It In connection with the proposed acquisition of STG by GDEF pursuant to the terms of a Stock Purchase Agreement by and among STG, GDEF, Global Defense & National Security Holdings, LLC, and each of the stockholders listed thereto, GDEF filed a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”) on August 19, 2015 and will file a definitive proxy statement. Investors are urged to read the preliminary proxy statement and, when it becomes available, the definitive proxy statement, (including all amendments and supplements) because they will contain important information. Investors may obtain free copies of the preliminary proxy statement and, when it becomes available, the definitive proxy statement, as well as other filings containing information about GDEF, without charge, at the SEC’s Internet site (http://www.sec.gov). The definitive proxy statement will be mailed to stockholders of GDEF as of a record date to be established for voting upon the proposed acquisition. These documents may also be obtained for free from GDEF’s Investor Relations web site (http://investor.gdef.com/) or by directing a request to GDEF at: Global Defense & National Security Systems, Inc., 11921 Freedom Drive, Suite 550, Two Fountain Square, Reston, VA 20190. GDEF and its officers and directors may be deemed to be participants in the solicitation of proxies from GDEF’s stockholders. Information about GDEF’s executive officers and directors is set forth in its Annual Report on Form 10 - K, which was filed with the SEC on March 25, 2015. Investors may obtain more detailed information regarding the direct and indirect interests of GDEF and its respective executive officers and directors in the acquisition by reading the preliminary proxy statement regarding the transaction, which has been filed with the SEC, and the definitive proxy statement regarding the transaction, which will be filed with the SEC.

3 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Table of Contents I. Executive Summary II. GDEF Overview III. STG Overview IV. Transaction Overview

4 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED I. Executive Summary © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, ALL RIGHTS RESERVED

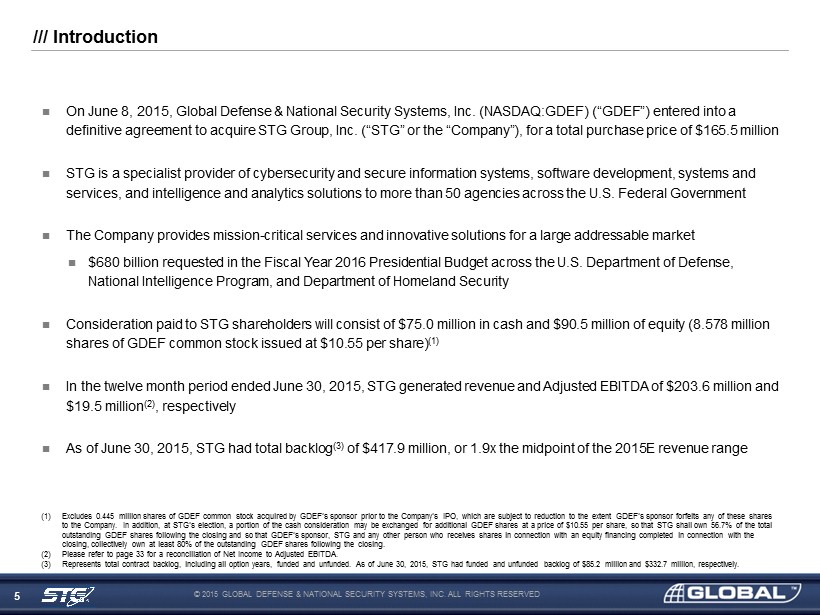

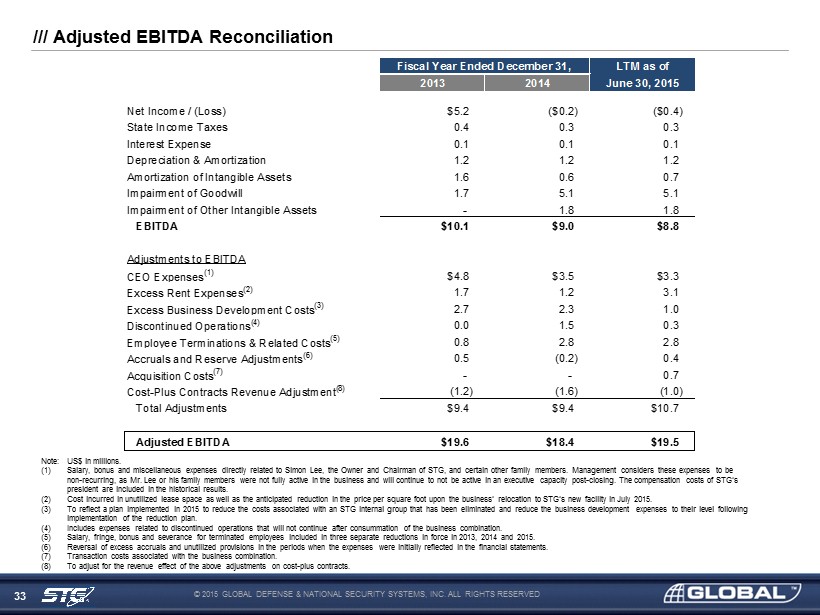

5 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Introduction On June 8, 2015, Global Defense & National Security Systems, Inc. (NASDAQ:GDEF) (“GDEF ”) entered into a definitive agreement to acquire STG Group, Inc. (“STG” or the “Company”), for a total purchase price of $165.5 million STG is a specialist provider of cybersecurity and secure information systems, software development, systems and services, and intelligence and analytics solutions to more than 50 agencies across the U.S. Federal Government The Company provides mission - critical services and innovative solutions for a large addressable market $680 billion requested in the Fiscal Year 2016 Presidential Budget across the U.S . Department of Defense, National Intelligence Program, and Department of Homeland Security Consideration paid to STG shareholders will consist of $75.0 million in cash and $90.5 million of equity (8.578 million shares of GDEF common stock issued at $ 10.55 per share ) (1) In the twelve month period ended June 30, 2015, STG generated revenue and Adjusted EBITDA of $203.6 million and $19.5 million (2) , respectively As of June 30, 2015, STG had total backlog (3) of $417.9 million, or 1 .9x the midpoint of the 2015E revenue range (1) Excludes 0.445 million shares of GDEF common stock acquired by GDEF’s sponsor prior to the Company’s IPO, which are subject t o r eduction to the extent GDEF’s sponsor forfeits any of these shares to the Company. In addition, at STG’s election, a portion of the cash consideration may be exchanged for additional GDEF shar es at a price of $10.55 per share, so that STG shall own 56.7% of the total outstanding GDEF shares following the closing and so that GDEF’s sponsor, STG and any other person who receives shares in connection with an equity financing completed in connection with the closing, collectively own at least 80% of the outstanding GDEF shares following the closing. (2) Please refer to page 33 for a reconciliation of Net Income to Adjusted EBITDA. (3) Represents total contract backlog, including all option years, funded and unfunded . As of June 30, 2015, STG had funded and unfunded backlog of $85.2 million and $332.7 million, respectively.

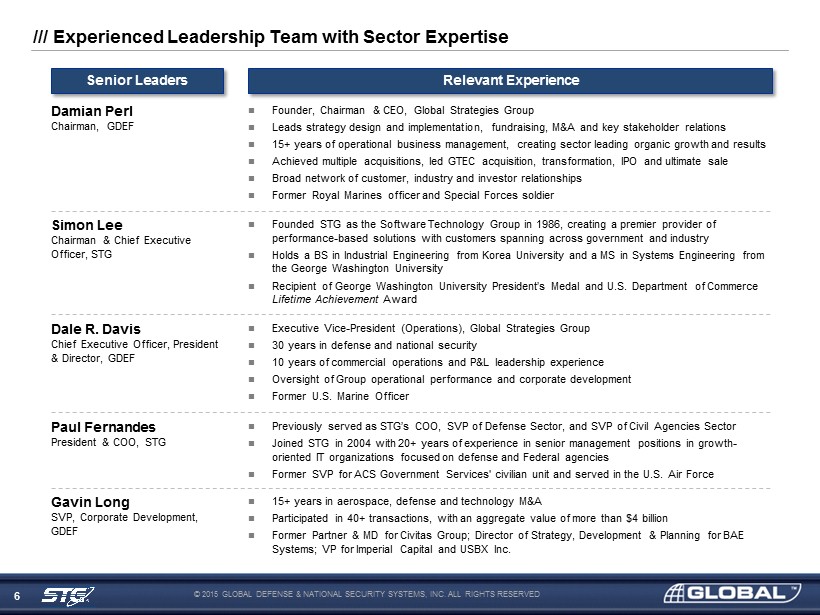

6 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Experienced Leadership Team with Sector Expertise Founder, Chairman & CEO, Global Strategies Group Leads strategy design and implementation, fundraising, M&A and key stakeholder relations 15+ years of operational business management, creating sector leading organic growth and results Achieved multiple acquisitions, led GTEC acquisition, transformation, IPO and ultimate sale Broad network of customer, industry and investor relationships Former Royal Marines officer and Special Forces soldier Executive Vice - President (Operations), Global Strategies Group 30 years in defense and national security 10 years of commercial operations and P&L leadership experience Oversight of Group operational performance and corporate development Former U.S. Marine Officer 15+ years in aerospace, defense and technology M&A Participated in 40+ transactions, with an aggregate value of more than $4 billion Former Partner & MD for Civitas Group; Director of Strategy, Development & Planning for BAE Systems; VP for Imperial Capital and USBX Inc. Senior Leaders Relevant Experience Damian Perl Chairman, GDEF Dale R. Davis Chief Executive Officer, President & Director, GDEF Gavin Long SVP, Corporate Development, GDEF Founded STG as the Software Technology Group in 1986, creating a premier provider of performance - based solutions with customers spanning across government and industry Holds a BS in Industrial Engineering from Korea University and a MS in Systems Engineering from the George Washington University Recipient of George Washington University President’s Medal and U.S. Department of Commerce Lifetime Achievement Award Simon Lee Chairman & Chief Executive Officer, STG Paul Fernandes President & COO, STG Previously served as STG’s COO , SVP of Defense Sector, and SVP of Civil Agencies Sector Joined STG in 2004 with 20+ years of experience in senior management positions in growth - oriented IT organizations focused on defense and Federal agencies Former SVP for ACS Government Services' civilian unit and served in the U.S. Air Force

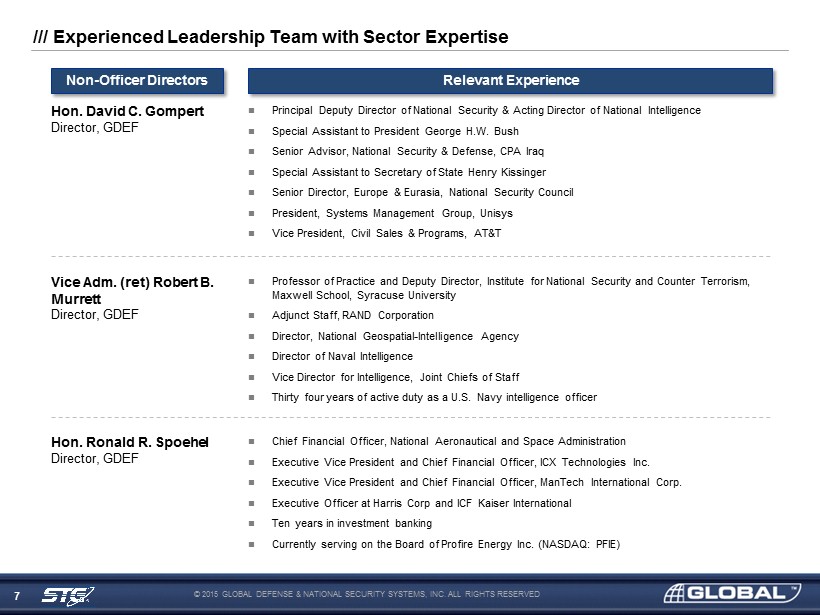

7 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Experienced Leadership Team with Sector Expertise Principal Deputy Director of National Security & Acting Director of National Intelligence Special Assistant to President George H.W. Bush Senior Advisor, National Security & Defense, CPA Iraq Special Assistant to Secretary of State Henry Kissinger Senior Director, Europe & Eurasia, National Security Council President, Systems Management Group, Unisys Vice President, Civil Sales & Programs, AT&T Hon. David C. Gompert Director, GDEF Vice Adm. (ret) Robert B. Murrett Director, GDEF Professor of Practice and Deputy Director, Institute for National Security and Counter Terrorism, Maxwell School, Syracuse University Adjunct Staff, RAND Corporation Director, National Geospatial - Intelligence Agency Director of Naval Intelligence Vice Director for Intelligence, Joint Chiefs of Staff Thirty four years of active duty as a U.S. Navy intelligence officer Hon. Ronald R. Spoehel Director, GDEF Chief Financial Officer, National Aeronautical and Space Administration Executive Vice President and Chief Financial Officer, ICX Technologies Inc. Executive Vice President and Chief Financial Officer, ManTech International Corp. Executive Officer at Harris Corp and ICF Kaiser International Ten years in investment banking Currently serving on the Board of Profire Energy Inc. (NASDAQ: PFIE) Non - Officer Directors Relevant Experience

8 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Mission Critical Capabilities in Key Growth Areas Established, Longstanding Customer Relationships Highly Diverse Contract Base Sustainable, Predictable Revenue Streams Significant Cross - selling Opportunities Substantial Organic & Inorganic Growth Potential Experienced & Proven Leadership Team /// Investment Highlights

9 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED II. GDEF Overview © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, ALL RIGHTS RESERVED

10 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Experience as an investor, operator & mentor in the defense & national security sector Current owner of an international defense, security & intelligence business Ability to create value through synergies, access to global markets, strategic direction & oversight & proven business practices /// GDEF Sponsor - Global Strategies Group A Leading P rovider of Defense & National S ecurity T echnology & Systems Capabilities Current & Previous Performance Locations Significant track record of growth in key national security sectors Proven experience of successfully acquiring & integrating companies Deep understanding of client priorities & extensive relationship networks Leadership with an extensive international & industry network Decades of experience operating, advising, acquiring, financing & selling private & public companies Key source of investment & new business opportunities Deep Domain Experience & Knowledge Acquisition Sourcing Expertise & Extensive Contacts Operational & Business Development Expertise Extensive Current and Previous Client Base

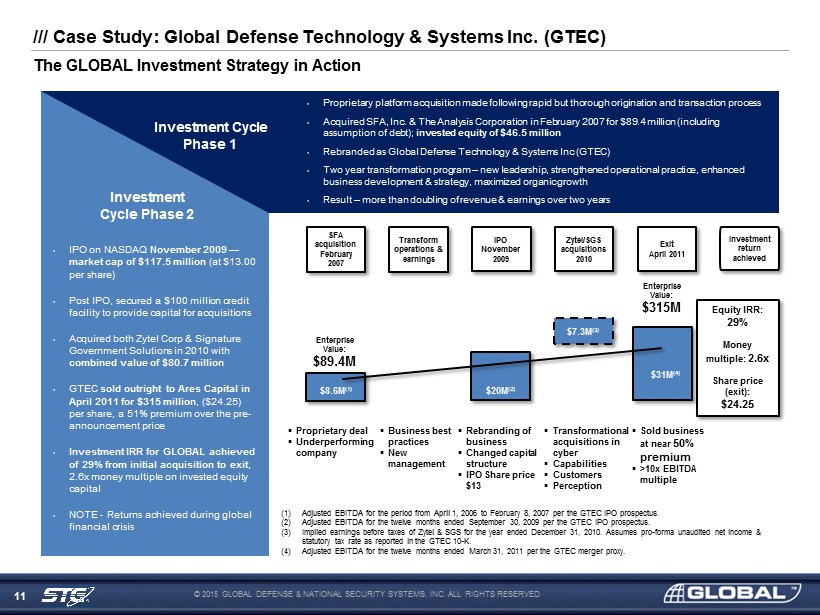

11 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Investment Cycle Phase 1 Investment Cycle Phase 2 • IPO on NASDAQ November 2009 — market cap of $117.5 million (at $13.00 per share) • Post IPO, secured a $100 million credit facility to provide capital for acquisitions • Acquired both Zytel Corp & Signature Government Solutions in 2010 with combined value of $80.7 million • GTEC sold outright to Ares Capital in April 2011 for $315 million , ($24.25) per share, a 51% premium over the pre - announcement price • Investment IRR for GLOBAL achieved of 29 % from initial acquisition to exit , 2.6x money multiple on invested equity capital • NOTE - Returns achieved during global financial crisis • Proprietary platform acquisition made following rapid but thorough origination and transaction process • Acquired SFA, Inc. & The Analysis Corporation in February 2007 for $ 89 .4 million (including assumption of debt); invested equity of $46.5 million • Rebranded as Global Defense Technology & Systems Inc (GTEC ) • Two year transformation program – new leadership , strengthened operational practice , enhanced business development & strategy , maximized organic growth • Result – more than doubling of revenue & earnings over two years SFA acquisition February 2007 Transform operations & earnings IPO November 2009 Zytel/SGS acquisitions 2010 Exit April 2011 Investment return achieved Equity IRR : 29% Money multiple: 2.6x Share price (exit): $24.25 Enterprise Value: $315M $7.3M (3) $ 20M (2) $8 .6 M (1) Enterprise Value: $ 89.4 M $31M (4) ▪ Proprietary deal ▪ Underperforming company ▪ Business best practices ▪ New management ▪ Rebranding of business ▪ Changed capital structure ▪ IPO Share price $13 ▪ Transformational acquisitions in cyber ▪ Capabilities ▪ Customers ▪ Perception ▪ Sold business at near 50% premium ▪ >10x EBITDA multiple (1) Adjusted EBITDA for the period from April 1, 2006 to February 8, 2007 per the GTEC IPO prospectus. (2) Adjusted EBITDA for the twelve months ended September 30, 2009 per the GTEC IPO prospectus. (3) Implied earnings before taxes of Zytel & SGS for the year ended December 31, 2010. Assumes pro - forma unaudited net income & statutory tax rate as reported in the GTEC 10 - K. (4) Adjusted EBITDA for the twelve months ended March 31, 2011 per the GTEC merger proxy. /// Case Study : Global Defense Technology & Systems Inc. (GTEC) The GLOBAL Investment Strategy in Action

12 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// The Opportunity To Realize Value by Positioning GDEF at the Center of U.S. National Security Priorities Growth Areas Prioritized for Investment Data Collection , Management and Analysis Cybersecurity and Secure Information S ystems Mission Critical S ystems and Support S ervices Modernization of Current Systems and Platforms State - on - State Conventional, Regional Conflicts, CBRNE/Proliferation Asymmetric Terrorism, Insurgency, Narco - criminality Cyber Cyber - terrorism, Espionage, Cyber - crime

13 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED III. STG Overview © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, ALL RIGHTS RESERVED

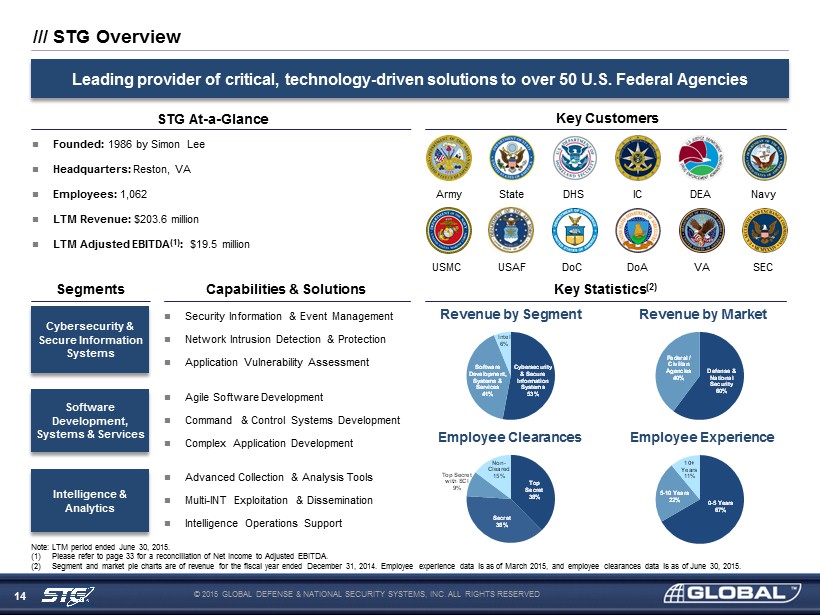

14 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Leading provider of critical, technology - driven solutions to over 50 U.S. Federal Agencies /// STG Overview Cybersecurity & Secure Information Systems Intelligence & Analytics Software Development, Systems & Services STG At - a - Glance Founded: 1986 by Simon Lee Headquarters: Reston, VA Employees: 1,062 LTM Revenue: $203.6 million LTM Adjusted EBITDA (1) : $19.5 million Key Customers Employee Experience Note: LTM period ended June 30, 2015. (1) Please refer to page 33 for a reconciliation of Net Income to Adjusted EBITDA. (2) Segment and market pie charts are of revenue for the fiscal year ended December 31, 2014. Employee experience data is as of M arc h 2015, and employee clearances data is as of June 30, 2015. Employee Clearances Revenue by Segment Revenue by Market Capabilities & Solutions Security Information & Event Management Network Intrusion Detection & Protection Application Vulnerability Assessment Agile Software Development Command & Control Systems Development Complex Application Development Advanced Collection & Analysis Tools Multi - INT Exploitation & Dissemination Intelligence Operations Support Key Statistics (2) Segments Army State DHS IC DEA Navy USMC VA DoC DoA SEC USAF Federal / Civilian Agencies 40% Defense & National Security 60% 0 - 5 Years 67% 10+ Years 11% 5 - 10 Years 22% Cybersecurity & Secure Information Systems 53% Software Development, Systems & Services 41% Intel 6% Top Secret with SCI 9% Top Secret 38% Secret 38% Non - Cleared 15%

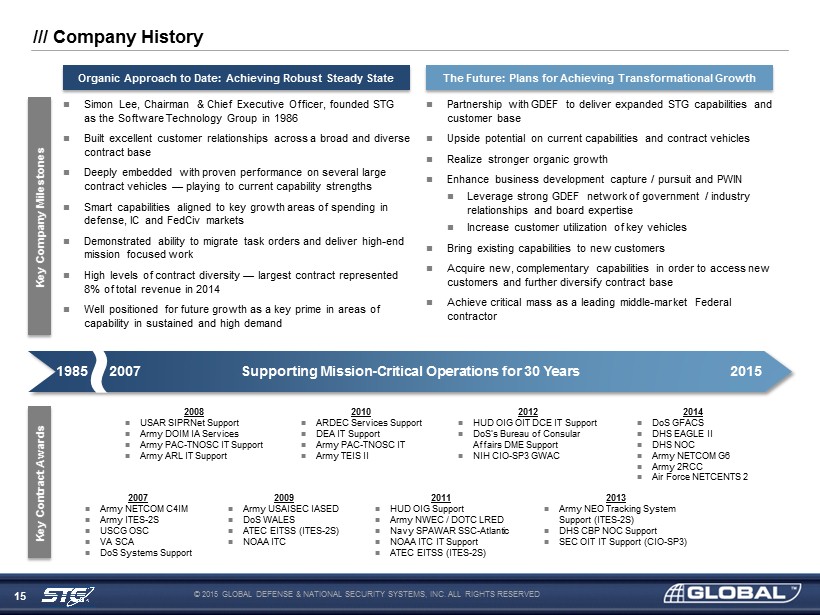

15 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED ~ 1985 2015 Supporting Mission - Critical Operations for 30 Years 2007 2007 Army NETCOM C4IM Army ITES - 2S USCG OSC VA SCA DoS Systems Support 2014 DoS GFACS DHS EAGLE II DHS NOC Army NETCOM G6 Army 2RCC Air Force NETCENTS 2 Key Company Milestones Key Contract Awards 2012 HUD OIG OIT DCE IT Support DoS’s Bureau of Consular Affairs DME Support NIH CIO - SP3 GWAC 2013 Army NEO Tracking System Support (ITES - 2S) DHS CBP NOC Support SEC OIT IT Support (CIO - SP3) 2011 HUD OIG Support Army NWEC / DOTC LRED Navy SPAWAR SSC - Atlantic NOAA ITC IT Support ATEC EITSS (ITES - 2S) 2010 ARDEC Services Support DEA IT Support Army PAC - TNOSC IT Army TEIS II 2009 Army USAISEC IASED DoS WALES ATEC EITSS (ITES - 2S) NOAA ITC 2008 USAR SIPRNet Support Army DOIM IA Services Army PAC - TNOSC IT Support Army ARL IT Support Organic Approach to Date: Achieving Robust Steady State The Future: Plans for Achieving Transformational Growth /// Company History Partnership with GDEF to deliver expanded STG capabilities and customer base Upside potential on current capabilities and contract vehicles Realize stronger organic growth Enhance business development capture / pursuit and PWIN Leverage strong GDEF network of government / industry relationships and board expertise Increase customer utilization of key vehicles Bring existing capabilities to new customers Acquire new, complementary capabilities in order to access new customers and further diversify contract base Achieve critical mass as a leading middle - market Federal contractor Simon Lee, Chairman & Chief Executive Officer, founded STG as the Software Technology Group in 1986 Built excellent customer relationships across a broad and diverse contract base Deeply embedded with proven performance on several large contract vehicles — playing to current capability strengths Smart capabilities aligned to key growth areas of spending in defense, IC and FedCiv markets Demonstrated ability to migrate task orders and deliver high - end mission focused work High levels of contract diversity — largest contract represented 8% of total revenue in 2014 Well positioned for future growth as a key prime in areas of capability in sustained and high demand

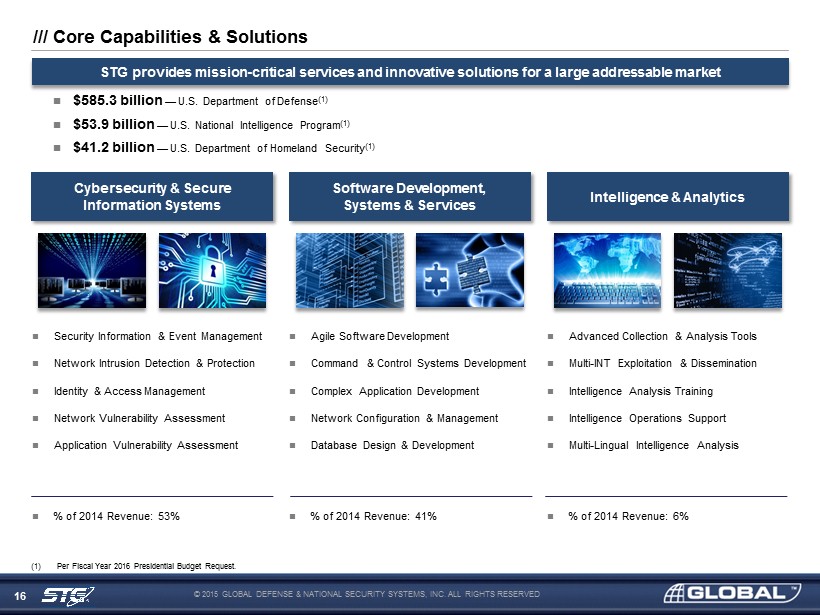

16 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED STG provides mission - critical services and innovative solutions for a large addressable market /// Core Capabilities & Solutions Cybersecurity & Secure Information Systems Intelligence & Analytics Software Development, Systems & Services % of 2014 Revenue: 53% Security Information & Event Management Network Intrusion Detection & Protection Identity & Access Management Network Vulnerability Assessment Application Vulnerability Assessment Agile Software Development Command & Control Systems Development Complex Application Development Network Configuration & Management Database Design & Development Advanced Collection & Analysis Tools Multi - INT Exploitation & Dissemination Intelligence Analysis Training Intelligence Operations Support Multi - Lingual Intelligence Analysis % of 2014 Revenue: 41% % of 2014 Revenue: 6% (1) Per Fiscal Year 2016 Presidential Budget Request. $ 585.3 billion — U.S . Department of Defense (1) $53.9 billion — U.S . National Intelligence Program (1) $41.2 billion — U.S . Department of Homeland Security (1)

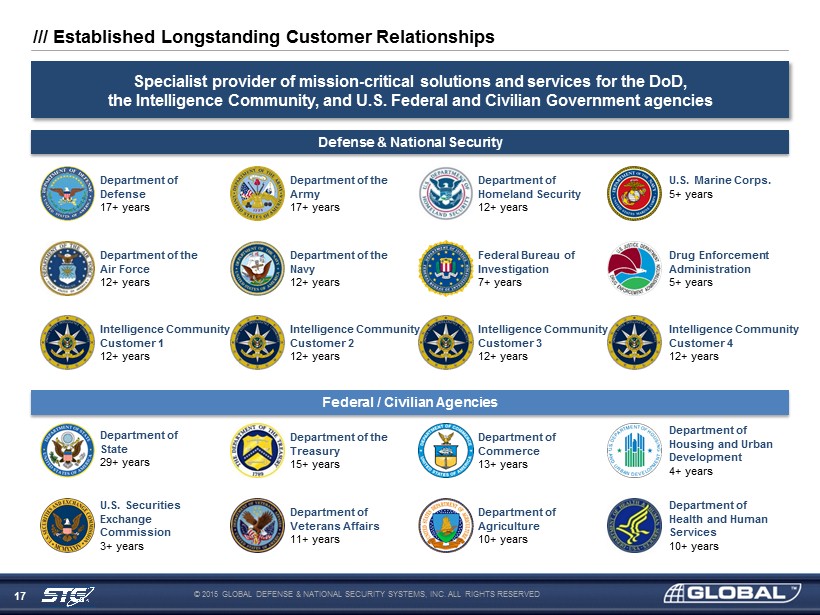

17 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Specialist provider of mission - critical solutions and services for the DoD , the Intelligence Community, and U.S. Federal and Civilian Government agencies /// Established Longstanding Customer Relationships Defense & National Security Department of the Navy 12+ years Federal Bureau of Investigation 7 + years Drug Enforcement Administration 5 + years U.S. Marine Corps. 5 + years Department of Homeland Security 12+ years Department of Defense 17+ years Department of the Air Force 12+ years Department of the Army 17+ years Intelligence Community Customer 1 12+ years Federal / Civilian Agencies Department of State 29+ years U.S. Securities Exchange Commission 3 + years Department of the Treasury 15+ years Department of Commerce 13+ years Department of Housing and Urban Development 4+ years Department of Agriculture 10+ years Department of Health and Human Services 10+ years Department of Veterans Affairs 11+ years Intelligence Community Customer 2 12+ years Intelligence Community Customer 4 12+ years Intelligence Community Customer 3 12+ years

18 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Securing highly sensitive, mission critical national security networks /// Cybersecurity & Secure Information Systems U.S. Department of Homeland Security, Customs and Border Protection (CBP) Secure network oversight and monitoring for one of DHS’ largest, most complex agencies Managing network security information for over 65,000 users, including some of the most critical department components U.S. Army NETCOM, U.S. Army Cyber Command Defending the Army’s Computer Network — comprehensive network management and cybersecurity for NETCOM Overseeing network management and security for 450,000+ end users , including LandWarNet technology infrastructure for platforms, sensors, combat applications and SATCOM transport Intelligence Community Customer Providing cybersecurity engineering and analysis STG remains a trusted provider to this intelligence community customer after more than 12 years; this customer’s operations contain some of the nation’s most important and sensitive information

19 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Software Development, Systems & Services U.S. Department of State, Global Foreign Affairs Compensation System (GFACS) Designed a software system to underpin highly complex compensation system — achieving significant cost reductions by migrating from disparate, legacy applications GFACS serves 65,000 employees across 180 countries, dealing with 150 + currencies and fluctuating exchange rates all in accordance with 500 + compensation plans tailored to region - specific laws and regulations U.S. Department of State, DME Passport Providing agile software development, modernization, and enhancement for the Department’s passport, visa, and overseas citizen application processing systems Consular systems are installed at 260+ processing facilities world - wide for a user base of ~7,000 — central components to the core Departmental mission of protecting U.S. citizens while overseas and ensuring proper U.S. entry of foreign nationals U.S. Army, Distributed Common Ground System (DCGS) System design and prototype for U.S. Army Analysis Control Team - Enclave (ACT - E), including the latest intelligence processing capabilities of the Distributed Common Ground System - Army (DCGS - A) Creating a scalable environment for collaboration and intelligence production from over 600 sources Solving complex problems in mission - critical environments

20 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Intelligence & Analytics Intelligence Community Customer Conducts complex threat intelligence analysis by combining data from disparate, non - compliant sources with data from traditional intelligence sources Employs highly specialized, difficult - to - recruit cleared personnel to provide threat intelligence reporting in 46 languages U.S. Department of State , Consular Lookout and Support System (CLASS) Creating and supporting decision - support software for DoS Consular Lookout and Support System (CLASS) — enabling officials to identify, scrutinize and act on problematic visa and passport applicants CLASS receives data from 12 U.S. Government agencies and provides lookout intelligence to four agencies Intelligence Community Customer Analyzes and solves complex cryptographic problems for mission - critical operations Iterations of this program have continued for more than 12 years Providing actionable intelligence from multiple data sources, across multiple contexts

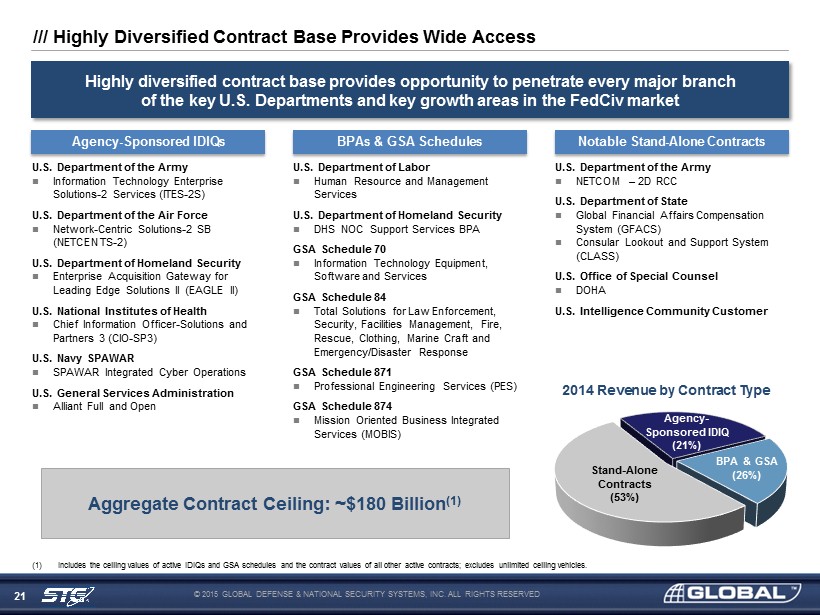

21 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Highly diversified contract base provides opportunity to penetrate every major branch of the key U.S. Departments and key growth areas in the FedCiv market /// Highly Diversified Contract Base Provides Wide Access U.S. Department of the Army Information Technology Enterprise Solutions - 2 Services (ITES - 2S) U.S. Department of the Air Force Network - Centric Solutions - 2 SB (NETCENTS - 2) U.S. Department of Homeland Security Enterprise Acquisition Gateway for Leading Edge Solutions II (EAGLE II) U.S . National Institutes of Health Chief Information Officer - Solutions and Partners 3 (CIO - SP3 ) U.S . Navy SPAWAR SPAWAR Integrated Cyber Operations U.S. General Services Administration Alliant Full and Open Agency - Sponsored IDIQs U.S . Department of Labor Human Resource and Management Services U.S. Department of Homeland Security DHS NOC Support Services BPA GSA Schedule 70 Information Technology Equipment, Software and Services GSA Schedule 84 Total Solutions for Law Enforcement, Security, Facilities Management, Fire, Rescue, Clothing, Marine Craft and Emergency/Disaster Response GSA Schedule 871 Professional Engineering Services (PES) GSA Schedule 874 Mission Oriented Business Integrated Services (MOBIS) BPAs & GSA Schedules U.S. Department of the Army NETCOM – 2D RCC U.S. Department of State Global Financial Affairs Compensation System (GFACS ) Consular Lookout and Support System (CLASS) U.S. Office of Special Counsel DOHA U.S. Intelligence Community Customer Notable Stand - Alone Contracts 2014 Revenue by Contract Type Agency - Sponsored IDIQ (21%) BPA & GSA (26%) Stand - Alone Contracts (53%) (1) Includes the ceiling values of active IDIQs and GSA schedules and the contract values of all other active contracts; excludes unlimited ceiling vehicles. Aggregate Contract Ceiling: ~$180 Billion (1)

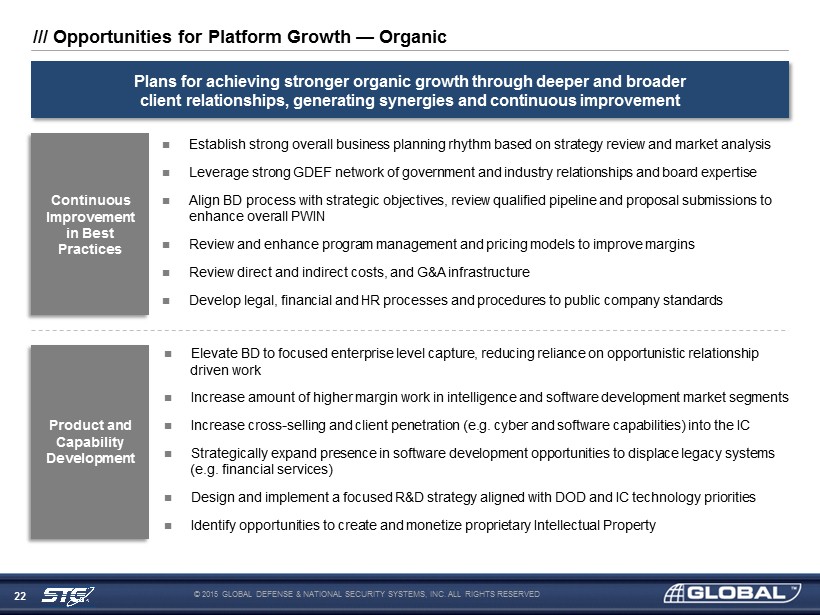

22 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Plans for achieving stronger organic g rowth t hrough d eeper and broader client r elationships , g enerating s ynergies and c ontinuous i mprovement /// Opportunities for Platform Growth — Organic Product and Capability Development Continuous Improvement in Best Practices Establish strong overall business planning rhythm based on strategy review and market analysis Leverage strong GDEF network of government and industry relationships and board expertise Align BD process with strategic objectives, review qualified pipeline and proposal submissions to enhance overall PWIN Review and enhance program management and pricing models to improve margins Review direct and indirect costs, and G&A infrastructure Develop legal , financial and HR processes and procedures to public company standards Elevate BD to focused enterprise level capture, reducing reliance on opportunistic relationship driven work Increase amount of higher margin work in intelligence and software development market segments Increase cross - selling and client penetration (e.g. cyber and software capabilities) into the IC Strategically expand presence in software development opportunities to displace legacy systems (e.g. financial services) Design and implement a focused R&D strategy aligned with DOD and IC technology priorities Identify opportunities to create and monetize proprietary Intellectual Property

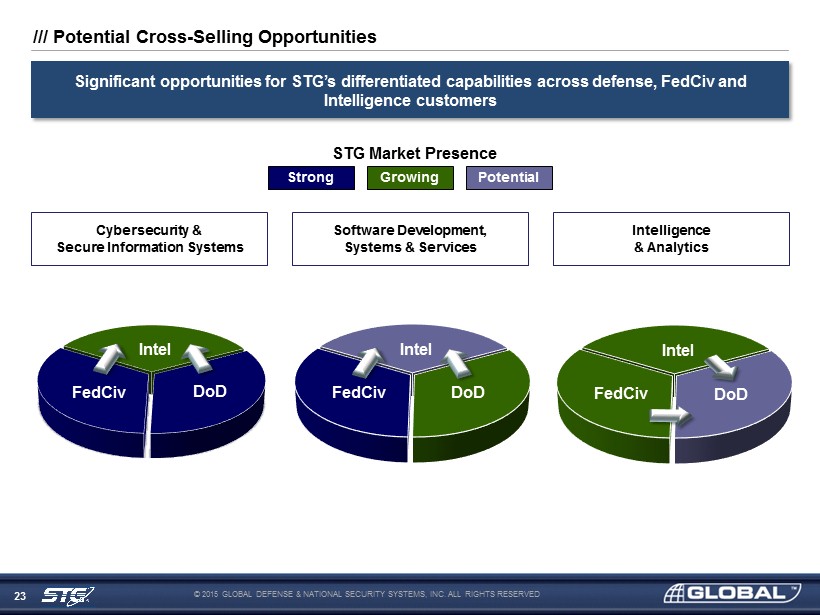

23 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED FedCiv DoD Intel Significant opportunities for STG’s differentiated capabilities across defense , FedCiv and Intelligence customers Cybersecurity & Secure Information Systems Intelligence & Analytics Software Development, Systems & Services Strong Growing Potential STG Market Presence /// Potential Cross - Selling Opportunities FedCiv DoD Intel FedCiv DoD Intel

24 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Plan to accelerate growth t hrough a cquisition of differentiated c apabilities and new customer penetration /// Opportunities for Platform Growth — Inorganic Utilize free cash flow and debt financing to fund M&A activity Exploit GDEF M&A pipeline with 40+ acquisition targets with revenue of $40 - 100 million and EBITDA of $5 - 15 million Large set of target opportunities to accelerate growth — more than 350 companies serving the U.S. Federal Government with estimated revenues ranging from $20 million to $150 million (1) Target M&A opportunities with Intellectual Property and differentiated capabilities complementary to the platform — high - end technology that will scale and command premium valuations: Mobile application development Mobile technology systems Agile software development environments Advanced data analytics Acquire key new customers and contract vehicles Potential to position business at the nexus of government and commercial sectors (1) Source: GovWin; includes companies with an industry classification of Information Technology and revenue between $20 million and $150 million.

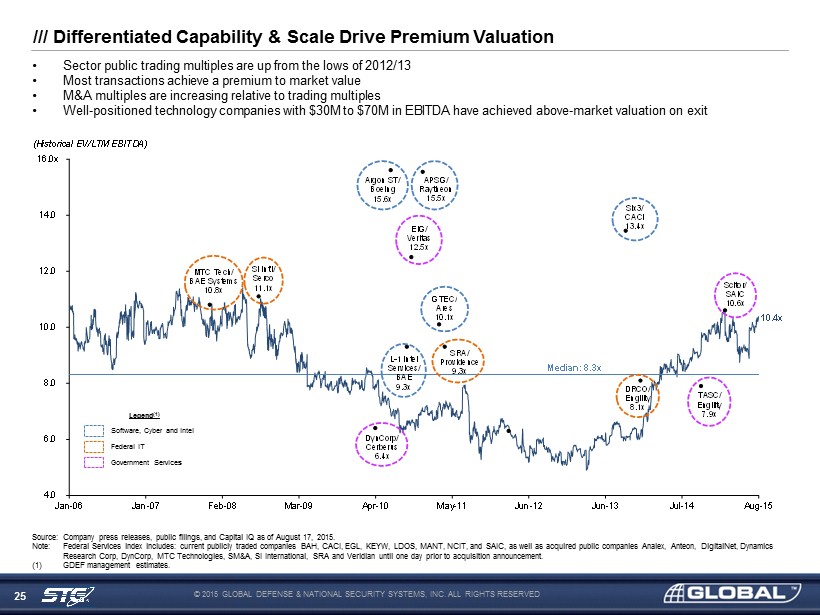

25 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Differentiated Capability & Scale Drive Premium Valuation • Sector public trading multiples are up from the lows of 2012/13 • Most transactions achieve a premium to market value • M&A multiples are increasing relative to trading multiples • Well - positioned technology companies with $30M to $70M in EBITDA have achieved above - market valuation on exit Source: Company press releases, public filings, and Capital IQ as of August 17, 2015. Note: Federal Services index includes: current publicly traded companies BAH, CACI, EGL, KEYW, LDOS, MANT, NCIT, and SAIC, as we ll as acquired public companies Analex, Anteon, DigitalNet, Dynamics Research Corp, DynCorp, MTC Technologies, SM&A, SI International, SRA and Veridian until one day prior to acquisition announc eme nt. (1) GDEF management estimates. Software, Cyber and Intel Government Services Federal IT Legend (1) 4.0 6.0 8.0 10.0 12.0 14.0 16.0x Jan-06 Jan-07 Feb-08 Mar-09 Apr-10 May-11 Jun-12 Jun-13 Jul-14 Aug-15 (Historical EV/LTM EBITDA) 10.4x MTC Tech/ BAE Systems 10.8x SI Int'l/ Serco 11.1x L - 1 Intel Services/ BAE 9.3x GTEC/ Ares 10.1x Six3/ CACI 13.4x Scitor/ SAIC 10.6x Argon ST/ Boeing 15.6x APSG/ Raytheon 15.5x EIG/ Veritas 12.5x SRA/ Providence 9.3x DynCorp/ Cerberus 6.4x DRCO/ Engility 8.1x TASC/ Engility 7.9x Median: 8.3x

26 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED IV. Transaction Overview © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, ALL RIGHTS RESERVED

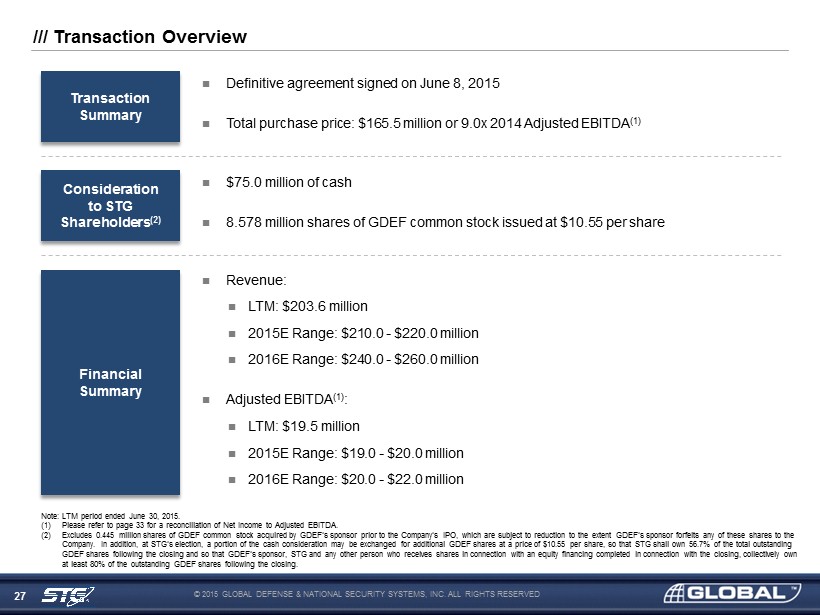

27 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Transaction Overview D efinitive agreement signed on J une 8 , 2015 Total purchase price: $165.5 million or 9.0x 2014 Adjusted EBITDA (1) Transaction Summary Financial Summary Revenue: LTM: $203.6 million 2015E Range: $210.0 - $220.0 million 2016E Range: $240.0 - $260.0 million Adjusted EBITDA (1) : LTM: $19.5 million 2015E Range: $19.0 - $20.0 million 2016E Range: $20.0 - $22.0 million Consideration to STG Shareholders (2) $ 75.0 million of cash 8.578 million shares of GDEF common stock issued at $ 10.55 per share Note: LTM period ended June 30, 2015. (1) Please refer to page 33 for a reconciliation of Net Income to Adjusted EBITDA. (2) Excludes 0.445 million shares of GDEF common stock acquired by GDEF’s sponsor prior to the Company’s IPO, which are subject to reduction to the extent GDEF ’s sponsor forfeits any of these shares to the Company. In addition, at STG’s election, a portion of the cash consideration may be exchanged for additional GDEF shares at a pr ice of $10.55 per share, so that STG shall own 56.7% of the total outstanding GDEF shares following the closing and so that GDEF’s sponsor, STG and any other person who receives shares in connection with an equity financing completed in connection with the closing, col lec tively own at least 80% of the outstanding GDEF shares following the closing.

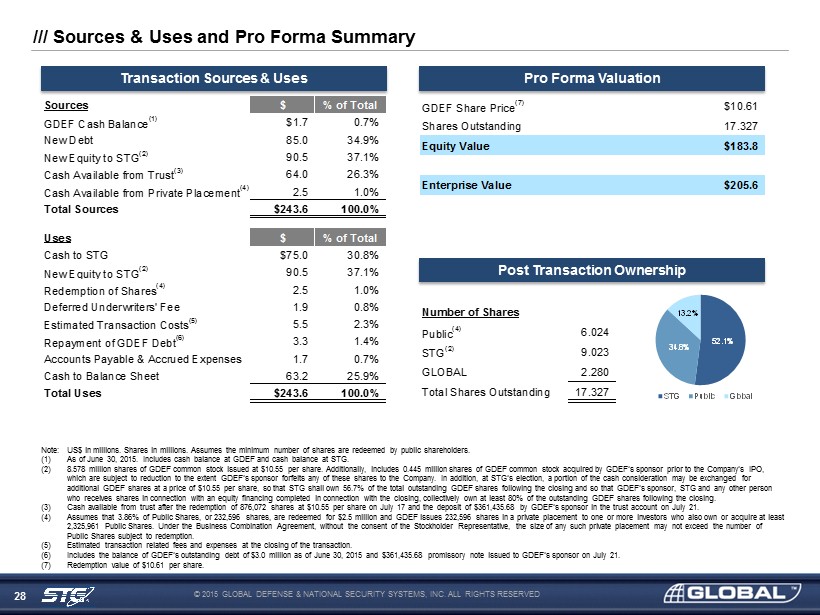

28 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Sources & Uses and Pro Forma Summary Transaction Sources & Uses Pro Forma Valuation Post Transaction Ownership Note: US $ in millions . Shares in m illions. Assumes the minimum number of shares are redeemed by public shareholders. (1) As of June 30, 2015. Includes cash balance at GDEF and cash balance at STG. (2) 8.578 million shares of GDEF common stock issued at $ 10.55 per share. Additionally, includes 0.445 million shares of GDEF common stock acquired by GDEF’s sponsor prior to the Company’s IPO, which are subject to reduction to the extent GDEF’s sponsor forfeits any of these shares to the Company. In addition, at STG’ s e lection, a portion of the cash consideration may be exchanged for additional GDEF shares at a price of $10.55 per share, so that STG shall own 56.7% of the total outstanding GDEF shares follo win g the closing and so that GDEF’s sponsor, STG and any other person who receives shares in connection with an equity financing completed in connection with the closing, collectively own at leas t 8 0% of the outstanding GDEF shares following the closing . (3) Cash available from trust after the redemption of 876,072 shares at $10.55 per share on July 17 and the deposit of $361,435.68 by GDEF’s sponsor in the trust account on July 21. (4) Assumes that 3.86% of Public Shares, or 232,596 shares, are redeemed for $2.5 million and GDEF issues 232,596 shares in a private placement to one or more investors who also own or acquire at least 2,325,961 Public Shares. Under the Business Combination Agreement, without the consent of the Stockholder Representative, the size of a ny such private placement may not exceed the number of Public Shares subject to redemption . (5) Estimated transaction related fees and expenses at the closing of the transaction. (6) Includes the balance of GDEF’s outstanding debt of $3.0 million as of June 30, 2015 and $361,435.68 promissory note issued to GD EF’s sponsor on July 21. (7) Redemption value of $ 10.61 per share. 52.1% 34.8% 13.2% STG Public Global Number of Shares Public (4) 6.024 STG (2) 9.023 GLOBAL 2.280 Total Shares Outstanding 17.327 Sources $ % of Total GDEF Cash Balance (1) $1.7 0.7% New Debt 85.0 34.9% New Equity to STG (2) 90.5 37.1% Cash Available from Trust (3) 64.0 26.3% Cash Available from Private Placement (4) 2.5 1.0% Total Sources $243.6 100.0% Uses $ % of Total Cash to STG $75.0 30.8% New Equity to STG (2) 90.5 37.1% Redemption of Shares (4) 2.5 1.0% Deferred Underwriters' Fee 1.9 0.8% Estimated Transaction Costs (5) 5.5 2.3% Repayment of GDEF Debt (6) 3.3 1.4% Accounts Payable & Accrued Expenses 1.7 0.7% Cash to Balance Sheet 63.2 25.9% Total Uses $243.6 100.0% GDEF Share Price (7) $10.61 Shares Outstanding 17.327 Equity Value $183.8 Enterprise Value $205.6

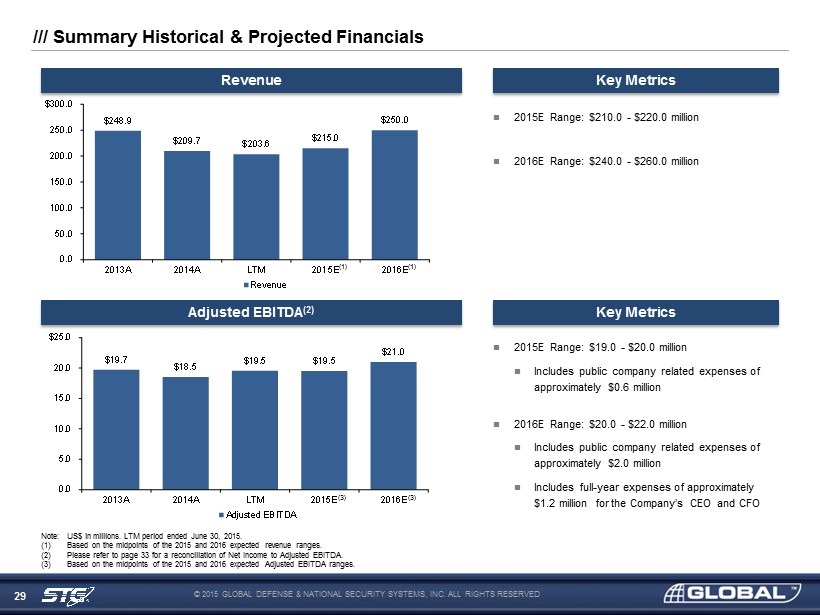

29 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED $248.9 $209.7 $203.6 $215.0 $250.0 0.0 50.0 100.0 150.0 200.0 250.0 $300.0 2013A 2014A LTM 2015E 2016E Revenue $19.7 $18.5 $19.5 $19.5 $21.0 0.0 5.0 10.0 15.0 20.0 $25.0 2013A 2014A LTM 2015E 2016E Adjusted EBITDA /// Summary Historical & Projected Financials Revenue Key Metrics Adjusted EBITDA (2) Key Metrics (1) (1) (3) (3) 2015E Range: $210.0 - $220.0 million 2016E Range: $240.0 - $260.0 million 2015E Range: $19.0 - $20.0 million Includes public company related expenses of approximately $0.6 million 2016E Range: $20.0 - $22.0 million Includes public company related expenses of approximately $2.0 million Includes full - year expenses of approximately $1.2 million for the Company’s CEO and CFO Note : US $ in millions . LTM period ended June 30, 2015. (1) Based on the midpoints of the 2015 and 2016 expected revenue ranges. (2) Please refer to page 33 for a reconciliation of Net Income to Adjusted EBITDA. (3) Based on the midpoints of the 2015 and 2016 expected Adjusted EBITDA ranges.

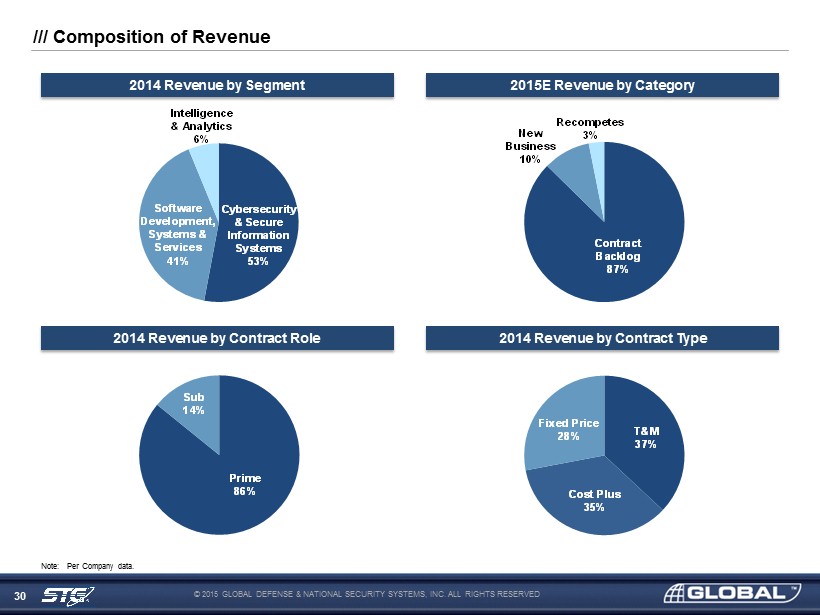

30 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Composition of Revenue 2014 Revenue by Segment 2015E Revenue by Category 2014 Revenue by Contract Role 2014 Revenue by Contract Type Cost Plus 35% Fixed Price 28% T&M 37% Note : Per Company data. Prime 86% Sub 14% Cybersecurity & Secure Information Systems 53% Software Development, Systems & Services 41% Intelligence & Analytics 6% Contract Backlog 87% Recompetes 3% New Business 10%

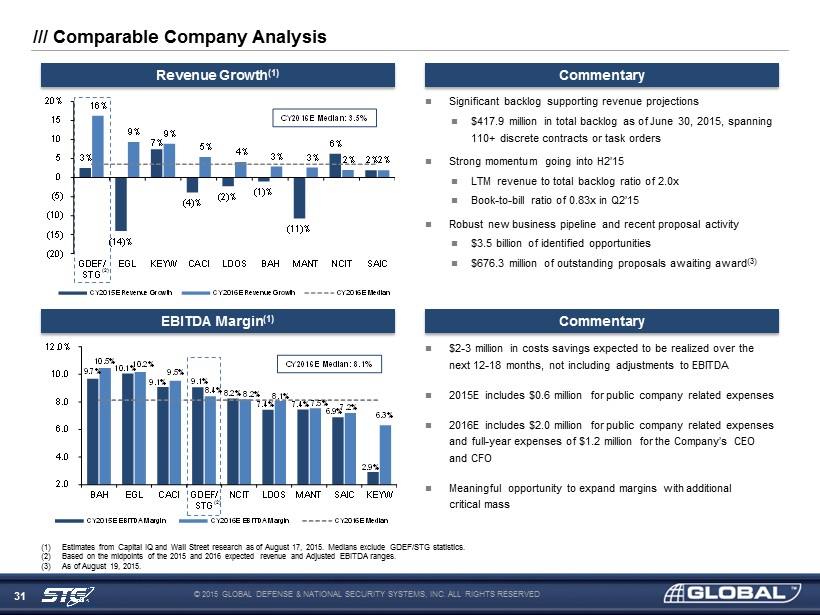

31 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Comparable Company Analysis Revenue Growth (1) Commentary Significant backlog supporting revenue projections $417.9 million in total backlog as of June 30, 2015, spanning 110+ discrete contracts or task orders Strong momentum going into H2’15 LTM revenue to total backlog r atio of 2.0x $33 million of new contract awards in H1’15 B ook - to - bill ratio of 0.83x in Q2’15 Robust new business pipeline and recent proposal activity $3.5 billion of identified opportunities $676.3 million of outstanding proposals awaiting award (3) EBITDA Margin (1) Commentary $2 - 3 million in costs savings expected to be realized over the next 12 - 18 months, not including adjustments to EBITDA 2015E includes $ 0.6 million for public company related expenses 2016E includes $ 2.0 million for public company related expenses and full - year expenses of $ 1.2 million for the Company’s CEO and CFO Meaningful opportunity to expand margins with additional critical mass (1) Estimates from Capital IQ and Wall Street research as of August 17, 2015. Medians exclude GDEF/STG statistics. (2) Based on the midpoints of the 2015 and 2016 expected revenue and Adjusted EBITDA ranges. (3) As of August 19, 2015. (2) (2) 3% (14)% 7% (4)% (2)% (1)% (11)% 6% 2% 16% 9% 9% 5% 4% 3% 3% 2% 2% (20) (15) (10) (5) 0 5 10 15 20% GDEF/ STG EGL KEYW CACI LDOS BAH MANT NCIT SAIC CY2015E Revenue Growth CY2016E Revenue Growth CY2016E Median CY2016E Median: 3.5% 9.7% 10.1% 9.1% 9.1% 8.2% 7.4% 7.4% 6.9% 2.9% 10.5% 10.2% 9.5% 8.4% 8.2% 8.1% 7.5% 7.2% 6.3% 2.0 4.0 6.0 8.0 10.0 12.0% BAH EGL CACI GDEF/ STG NCIT LDOS MANT SAIC KEYW CY2015E EBITDA Margin CY2016E EBITDA Margin CY2016E Median CY2016E Median: 8.1%

32 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Comparable Company Analysis (Cont .) Enterprise Value / EBITDA Multiples (1) (1) Estimates from Capital IQ and Wall Street research as of August 17, 2015. (2) Based on the midpoints of the 2015 and 2016 expected revenue and Adjusted EBITDA ranges. 9.0x 10.5x 11.0x 10.5x 10.4x 10.9x 9.5x 7.2x 11.0x 9.8x 9.9x 9.5x 9.4x 21.2x 9.7x 9.1x 7.1x 10.3x 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0x CY2015E Comparable Companies Median: 10.5x CY2016E Comparable Companies Median: 9.6x ~ ~ 22.0x NM 21.0 STG at Purchase GDEF / STG (2) BAH CACI EGL KEYW LDOS MANT NCI SAIC CY2016E Revenue Growth 16.3% 16.3% 2.9% 5.4% 9.4% 8.9% 4.1% 2.7% 2.0% 2.0% CY2016E EBITDA Margin 8.8% 8.4% 10.5% 9.5% 10.2% 6.3% 8.1% 7.5% 8.2% 7.2%

33 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED /// Adjusted EBITDA Reconciliation Note : US $ in millions. (1) Salary, bonus and miscellaneous expenses directly related to Simon Lee, the Owner and Chairman of STG, and certain other family members. Management considers these expenses to be non - recurring, as Mr. Lee or his family members were not fully active in the business and will continue to not be active in an executive capacity post - closing . The compensation costs of STG’s president are included in the historical results. (2) Cost incurred in unutilized lease space as well as the anticipated reduction in the price per square foot upon the business ’ relocation to STG’s new facility in July 2015 . (3) To reflect a plan implemented in 2015 to reduce the costs associated with an STG internal group that has been eliminated and reduce the business development expenses to their level following implementation of the reduction plan. (4) Includes expenses related to discontinued operations that will not continue after consummation of the business combination. (5) Salary, fringe, bonus and severance for terminated employees included in three separate reductions in force in 2013, 2014 and 2015. (6) Reversal of excess accruals and unutilized provisions in the periods when the expenses were initially reflected in the financial statements . (7) Transaction costs associated with the business combination. (8) To adjust for the revenue effect of the above adjustments on cost - plus contracts . Fiscal Year Ended December 31, LTM as of 2013 2014 June 30, 2015 Net Income / (Loss) $5.2 ($0.2) ($0.4) State Income Taxes 0.4 0.3 0.3 Interest Expense 0.1 0.1 0.1 Depreciation & Amortization 1.2 1.2 1.2 Amortization of Intangible Assets 1.6 0.6 0.7 Impairment of Goodwill 1.7 5.1 5.1 Impairment of Other Intangible Assets - 1.8 1.8 EBITDA $10.1 $9.0 $8.8 Adjustments to EBITDA CEO Expenses (1) $4.8 $3.5 $3.3 Excess Rent Expenses (2) 1.7 1.2 3.1 Excess Business Development Costs (3) 2.7 2.3 1.0 Discontinued Operations (4) 0.0 1.5 0.3 Employee Terminations & Related Costs (5) 0.8 2.8 2.8 Accruals and Reserve Adjustments (6) 0.5 (0.2) 0.4 Acquisition Costs (7) - - 0.7 Cost-Plus Contracts Revenue Adjustment (8) (1.2) (1.6) (1.0) Total Adjustments $9.4 $9.4 $10.7 Adjusted EBITDA $19.6 $18.4 $19.5

34 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED Mission Critical Capabilities in Key Growth Areas Established, Longstanding Customer Relationships Highly Diverse Contract Base Sustainable, Predictable Revenue Streams Significant Cross - selling Opportunities Substantial Organic & Inorganic Growth Potential Experienced & Proven Leadership Team /// Investment Highlights

35 © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, INC. ALL RIGHTS RESERVED © 2015 GLOBAL DEFENSE & NATIONAL SECURITY SYSTEMS, ALL RIGHTS RESERVED Investing in National Security Technology August 20, 2015