UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

TERRA SECURED INCOME FUND 5, LLC

(Exact Name of Registrant as Specified in its Governing Documents)

| Delaware | 90-0967526 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

| 805 Third Avenue, 8th Floor | |

| New York, New York | 10022 |

| (Address of Principal Executive Offices) | (Zip Code) |

| (212) 753-5100 | |

| (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

Units of Limited Liability Company Interests

(Title of Class)

| WITH COPIES TO: | |

| Jay L. Bernstein, Esq. | Rosemarie A. Thurston |

| Jake Farquharson, Esq. | Martin H. Dozier |

| Clifford Chance US LLP | Alston & Bird LLP |

| 31 W. 52ndStreet | 1201 W. Peachtree Street |

| New York, New York 10019 | Atlanta, Georgia 30309 |

| Tel (212) 878-8000 | Tel (404) 881-7000 |

| Fax (212) 878-8375 | Fax (404) 253-8447 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

| Emerging Growth Company | x | ||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | x | ||

| - i - |

FORWARD-LOOKING STATEMENTS

Various statements contained in this registration statement, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the availability of loan origination and acquisition opportunities, the potential returns from such investment opportunities and the availability of financing. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “plan,” “goal,” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this registration statement speak only as of the date of this registration statement; we disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including those discussed under “Item 1A. Risk Factors” and “Item 2. Financial Information — Management’s Discussion and Analysis of Financial Condition and Results of Operations” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements.

The risks, contingencies and uncertainties associated with our forward-looking statements relate to, among other matters, the following:

| · | our expected financial performance, operating results and our ability to make distributions to our members in the future; |

| · | the availability of attractive risk-adjusted investment opportunities in our target asset class and other real estate-related investments that satisfy our investment objectives and strategies; |

| · | the acquisition of our targeted assets, including the timing of acquisitions; |

| · | volatility in our industry, interest rates and spreads, the debt or equity markets, the general economy or the real estate market specifically, whether the result of market events or otherwise; |

| · | changes in our investment objectives and business strategy; |

| · | the availability of financing on acceptable terms or at all; |

| · | the performance and financial condition of our borrowers; |

| · | changes in interest rates and the market value of our assets; |

| · | borrower defaults or decreased recovery rates from our borrowers; |

| · | changes in prepayment rates on our investments; |

| · | our dependence on our Manager and the availability of its senior management team and other personnel; |

| · | liquidity transactions that may be available to us in the future, including a liquidation of our assets, a sale of our company or an initial public offering and listing of the shares of common stock of our wholly owned real estate investment trust subsidiary, or our REIT subsidiary, on a national securities exchange, and the timing of any such transactions; |

| · | actions and initiatives of the U.S., federal, state and local government and changes to the U.S. federal, state and local government policies and the execution and impact of these actions, initiatives and policies; |

| · | limitations imposed on our business and our ability to satisfy complex rules in order for us to maintain our exclusion from registration under the Investment Company Act of 1940, as amended, or the 1940 Act, and our REIT subsidiary to maintain its qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes; and |

| · | the degree and nature of our competition. |

| - 1 - |

Except where the context suggests otherwise, the terms “we,” “us,” “our,” and “our Fund” refer to Terra Secured Income Fund 5, LLC, a Delaware limited liability company, together with its subsidiaries, including Terra Property Trust, Inc., our indirect wholly-owned subsidiary through which we conduct substantially all of our business and which we refer to as our “REIT subsidiary.” References in this registration statement to “Terra Fund 1” refer to Terra Secured Income Fund, LLC; references to “Terra Fund 2” refer to Terra Secured Income Fund 2, LLC; references to “Terra Fund 3” refer to Terra Secured Income Fund 3, LLC; references to “Terra Fund 4” refer to Terra Secured Income Fund 4, LLC; references to “Fund 5 International” refer to Terra Secured Income Fund 5 International; references to “Terra Fund 6” refer to Terra Income Fund 6, Inc.; references to “Terra International” refer to Terra Income Fund International; references to “Terra Fund 7” refer to Terra Secured Income Fund 7, LLC; references to the “Terra Funds” refer to Terra Fund 1, Terra Fund 2, Terra Fund 3, Terra Fund 4 and our Fund, collectively. Additionally, “units” refer to regular units of limited liability company interest in our Fund which were issued to members in Terra Funds 1 through 4 in the REIT formation transactions (as defined below) and to subscribers in the concurrent private placement and references to “Termination Units” refer to the membership interest in our Fund that were issued to members of Terra Funds 1 through 4 who chose to enter the liquidation phase of their investments.

We are filing this Form 10 to register our units pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We are subject to the registration requirements of Section 12(g) of the Exchange Act because as of December 31, 2016, the aggregate value of our assets exceeded the applicable threshold and our units were held of record by 2,000 or more persons. As a result of the registration of our units pursuant to the Exchange Act, following the effectiveness of this Form 10, we will be subject to the requirements of the Exchange Act and the rules promulgated thereunder. In particular, we will be required to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K and otherwise comply with the disclosure obligations of the Exchange Act applicable to issuers filing registration statements to register a class of securities pursuant to Section 12(g) of the Exchange Act.

Overview

We are a real estate finance company that originates, structures and funds real estate-related loans, including mezzanine loans, first and second mortgage loans, subordinated mortgage loans, bridge loans, preferred equity investments and other loans related to high-quality commercial real estate in the United States, which we collectively refer to as our targeted assets. We were formed as a Delaware limited liability company on April 24, 2013 and commenced operations on August 8, 2013. We make substantially all of our investments and conduct substantially all of our real estate lending business through our REIT subsidiary, which has elected to be taxed as a REIT for U.S. federal income tax purposes commencing with its taxable year ended December 31, 2016. Our objectives are to (i) preserve our members’ capital contributions, (ii) realize income from our investments and (iii) make monthly distributions to our members from cash generated from investments. There can be no assurances that we will be successful in meeting our objectives.

As of December 31, 2016, through our REIT subsidiary, we held a portfolio comprising 38 investments in 15 states with an aggregate current principal balance of $326.0 million, a weighted average interest rate of 12.38%, a weighted average loan-to-value ratio of 73.45% and a weighted average remaining term to maturity of 1.39 years. The portfolio is diversified across loan products, property types and geographies.

We are managed by Terra Income Advisors, LLC, which we refer to herein as Terra Income Advisors or our Manager, a registered investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act. Our REIT subsidiary has entered into a management agreement with the Manager pursuant to which the Manager provides certain services to our REIT subsidiary and our REIT subsidiary pays fees associated with such services. See “Item 5. Directors and Executive Officers — Compensation to Our Manager” for additional details.

We believe there are compelling opportunities available to us in the commercial real estate loan market. Commercial real estate is a capital-intensive business that relies heavily on the availability of credit to develop, acquire, maintain and refinance commercial properties. We believe that the more conservative underwriting standards used by many large commercial banks and traditional providers of commercial real estate capital following the 2008 downturn has and will continue to constrain the lending capacity of these institutions. In the face of this constrained

| - 2 - |

lending capacity, a large volume of commercial real estate loans originated at the market peak will mature over the next several years. The confluence of these two conditions—reduced lending by traditional lenders and an increased volume of maturing loans requiring refinancing proceeds—has created opportunities for alternative lenders such as us.

We believe that we are well positioned to capitalize on these opportunities through our relationship with the Manager and Terra Capital Partners. Our management team maintains extensive relationships within the real estate industry, including real estate developers, institutional real estate sponsors and investors, real estate funds, investment and commercial banks, private equity funds, asset originators and broker-dealers, as well as the capital and financing markets generally. We leverage the many years of experience and well-established contacts of our management team, and use these relationships for the benefit of our members.

On January 1, 2016, Terra Funds 1 through 4 merged with subsidiaries of our Fund, which in turn contributed the consolidated portfolio of net assets of the Terra Funds to our REIT subsidiary. We elected to engage in the merger transactions, which we refer to as the “REIT formation transactions,” to make our investments through our REIT subsidiary and provide our members with a more broadly diversified portfolio of assets, while at the same time providing us with enhanced access to capital and borrowings, lower operating costs and enhanced opportunities for growth.

Our Manager intends to treat our Fund as a partnership and not as an association or “publicly traded partnership,” or PTP, taxed as a corporation for U.S. federal income tax purposes. Our REIT subsidiary has elected to be taxed as a REIT for U.S. federal income tax purposes commencing with its taxable year ended December 31, 2016. So long as our REIT subsidiary qualifies as a REIT, it generally is not subject to U.S. federal income tax on its net taxable income to the extent that it annually distributes all of its net taxable income to its stockholders. We also operate our business in a manner that will permit us to be excluded from registration as an investment company under the 1940 Act.

The Manager and Terra Capital Partners

Our sole managing member is the Manager, Terra Income Advisors, which is registered as an investment adviser under the Advisers Act.

The Manager is a subsidiary of Terra Capital Partners, a real estate finance and investment firm that focuses on the origination and management of mezzanine and equity investments in all major property types. Terra Capital Partners was formed in 2001 and since the commencement of its operations in 2002 through December 31, 2016, has engaged in the origination and management of debt and equity investments in over 370 properties of all major property types throughout the United States. These investments have been made in 35 states and have been secured by approximately 16.3 million square feet of office properties, 3.4 million square feet of retail properties, 4.2 million square feet of industrial properties, 3,828 hotel rooms and 23,145 apartment units. The value of the properties underlying these investments was approximately $6.7 billion based on appraised values as of the closing dates. Terra Capital Partners and its affiliates have originated all the loans on approximately 331 properties with an appraised value of approximately $5.3 billion held by its previous affiliated funds and have suffered no monetary defaults or foreclosures on these loans.

Terra Capital Partners, led by its Chairman, Simon J. Mildé, and chief executive officer, Bruce D. Batkin, is owned and operated by highly experienced real estate, finance and securities professionals with an average of over 27 years’ experience in global real estate transactions. Members of the Terra Capital Partners management team have broad based, long-term relationships with major financial institutions, property owners and commercial real estate service providers. They have worked together as a team for over 12 years, building on their prior experience in commercial real estate investment, finance, development and asset management. They have held leadership roles at many of the top international real estate and investment banking firms, including Jones Lang Wootton (formerly Jones Lang LaSalle Incorporated and now JLL), Merrill Lynch, Donaldson, Lufkin and Jenrette Securities Corporation (now Credit Suisse (USA) Inc.) and ABN Amro Bank N.V.

Market Opportunity

Commercial real estate is a capital-intensive business that relies heavily on the availability of credit to develop, acquire, maintain and refinance commercial properties. The turmoil in the U.S. mortgage market that commenced in

| - 3 - |

2008 has diminished the availability of credit for commercial real estate from traditional providers of capital to commercial real estate borrowers. Although credit availability has increased over the past several years, we believe that a more risk-averse credit culture, tighter underwriting standards, changes in the regulatory environment and the high number of existing loans on overleveraged properties, many of which were acquired at premium prices prior to the 2008 downturn, will continue to constrain the lending capacity of large commercial banks and traditional providers of capital. Many of these pre-2008 loans have ten-year terms, creating an impending “wall” of maturities that must be refinanced or repaid in the coming years. In the face of this constrained lending capacity, a large volume of commercial real estate loans originated at the market peak will mature over the next several years. The confluence of these two conditions—reduced lending by traditional lenders and an increased volume of maturing loans requiring refinancing proceeds—has created opportunities for alternative lenders such as us.

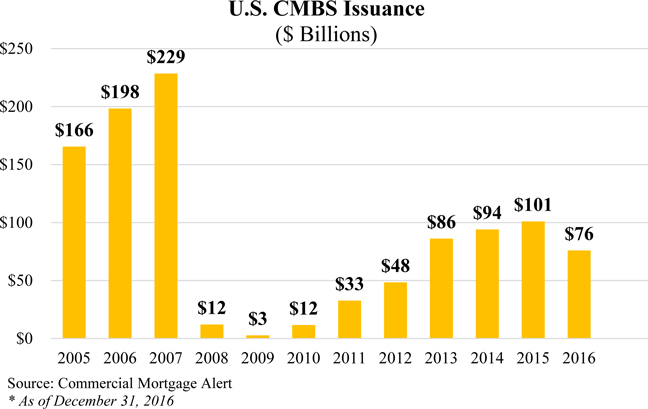

Commercial banks are estimated by the Federal Reserve to hold $1.7 trillion, or 50%, of all commercial mortgages. As a result of the economic crisis, the number of traditional commercial mortgage lenders, such as commercial banks, has declined, as has the number of new commercial mortgage originations, as indicated in the chart labeled “New Commercial Mortgage Origination in the U.S.” below. Those lenders that remain are subject to increased regulations (including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, and the Third Basel Accord of the Basel Committee on Banking Supervision, which imposes requirements for higher bank capital charges on certain types of real estate loans) and adhere to mortgage lending practices that are more conservative than prior to the economic crisis. In addition, enhanced risk-retention requirements for commercial mortgage-backed securities, or CMBS, have increased securitization costs and limited competition from CMBS lenders. This has led to a decrease in CMBS securitizations and issuances that have failed to recover to previous levels, as indicated in the chart labeled “U.S. CMBS Issuance” below. Therefore, those financial institutions still willing to provide capital may not provide sufficient proceeds to meet borrowers’ needs, and many loans that previously would have been provided by a single lender often will require multiple lenders. This provides us, as an alternative lender, with an immediate opportunity to augment loans provided by traditional lenders with subordinated debt and preferred equity, often at lower property valuations, lower loan-to-value ratios and higher returns than prior to the economic crisis. We believe this opportunity will continue for the foreseeable future.

| - 4 - |

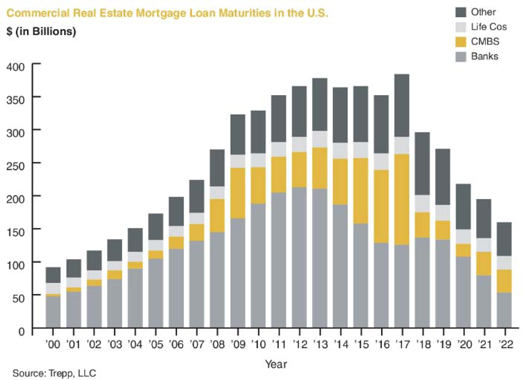

The credit boom that preceded the economic crisis in 2008 and 2009 generated a high volume of commercial real estate loans (originated by securitized and portfolio lenders) that are scheduled to mature each year through 2017. At the same time, there have been reductions in the supply of traditional commercial real estate loans, as illustrated in the chart below labeled “Commercial Real Estate Mortgage Loan Maturities in the U.S.” We believe the reductions in the number of commercial real estate loans are due to the reductions in the value of the mortgages held by traditional lenders. The reduction of the value of these mortgages presents risks of regulatory noncompliance for these lenders, which must adhere to strict capital adequacy requirements. Borrowers’ inability to obtain financing often resulted not from the lack of creditworthiness of the borrower, but because of the constrained ability and willingness of highly regulated traditional commercial banks to lend to these borrowers, even upon favorable terms to these creditworthy borrowers. These factors, along with the failures or retrenchment of many banks and financial institutions that historically satisfied much of the demand for debt financing, as well as current lending practices and underlying standards that are more conservative than those prevailing prior to the economic crisis (despite the recovery in real estate fundamentals), have created a shortage of capital for commercial real estate loans and thus a compelling opportunity to originate attractively structured and priced commercial real estate financing. We believe that markets are likely to face a void of several hundred billion dollars over the next several years that must be filled by new sources of capital since the supply of debt from traditional lending sources is anticipated to be less than the volume necessary to refinance maturing real estate loans. Therefore, well-capitalized investors with expertise and access to deal flow will have significant opportunities to originate new loans to meet this demand and to take advantage of the lack of supply of available credit to command favorable and compelling terms.

In summary, the two primary drivers that create the favorable opportunities that we believe exist and will continue to exist in the commercial real estate loan market during the period in which we are making investments are (i) the reduced amount of credit available from traditional lending sources to commercial real estate borrowers and (ii) a consistent, historically high annual volume of commercial real estate loan maturities. Specifically:

| · | The availability of mortgage financing is down significantly from the peak year of 2007. |

| · | Approximately $1.4 trillion of commercial real estate debt has matured or is set to mature from 2016 to 2019, much of which originated at the peak of the past market cycle. |

| - 5 - |

| · | There is and will likely continue to be a substantial shortfall between the amount of maturing debt and the amount of new first mortgage debt available. |

| · | Therefore, a large volume of maturing commercial real estate debt will require some form of restructuring or gap financing over the next several years. |

In addition to the opportunities available to refinance existing mortgage loans, as a result of tightened lending policies, newly originated first mortgage loans are often being underwritten at reduced loan-to-value ratios, thereby often necessitating additional equity or mezzanine financing. A loan-to-value ratio indicates the percentage of a property’s value that a lender is willing to provide in financing. Prior to the credit crisis, most traditional commercial real estate lenders required a loan-to-value ratio of approximately 65% to 75%, which meant that mezzanine loans were often used to finance a portion of the remaining capital structure, from approximately 75% to 95% of underlying property value. Today, however, mezzanine loans are often used to finance the portion of the capital structure from approximately 65% to 85% of today’s lower underlying property value, which indicates the decreased willingness of traditional commercial real estate lenders to provide credit at pre-2008 loan-to-value ratios. Therefore, mezzanine loans and preferred equity investments today are financing portions of the real estate capital structure previously funded by lower cost senior mortgage financing. We believe the opportunity to generate attractive risk-adjusted returns through investment in mezzanine loans and preferred equity investments, as well as certain first mortgage loans and bridge loans, will continue for the foreseeable future, given the prospect of impending mortgage maturities and relatively limited sources of mortgage financing.

Due to the subordinate position of many of our loans or the expected use of the proceeds of such loans to renovate or refurbish the underlying properties, we expect that borrowers will be willing to pay us interest rates that are generally above the rates charged by conventional lenders. In other words, because the types of loans that we intend to make may be perceived as riskier than conventional loans, and due to the risk aversion of many conventional lenders, we will charge interest rates that are higher than the rates charged, for example, by banks, insurance companies and securitized lenders. We may also purchase existing loans that were originated by unrelated third-party lenders.

Although the loans we intend to make may be perceived as riskier by traditional commercial real estate lenders, we believe we are able to evaluate the creditworthiness of a borrower to facilitate repayment due to our management team’s experience gained through multiple commercial real estate cycles. One of our competitive advantages relative

| - 6 - |

to many existing real estate investment vehicles is our management team’s sale of 100% of its investment management interests in June 2007, prior to the credit crisis. Thus, neither Terra Capital Partners nor any of its affiliates is burdened by a pre-credit crisis legacy portfolio of lower-return or problem assets. In comparison, management teams with a pre-credit crisis legacy portfolio are often distracted by asset management, workouts, foreclosures and litigation. We believe this competitive advantage, along with our management team’s experience, track record, judgment and capabilities, will facilitate our ability to execute our investment strategy and benefit from the market opportunities.

As indicated in the chart below labeled ‘‘Interest Rates 2004-2016,’’ the interest rates for commercial real estate mezzanine loans have not correlated with the rates for some other credit instruments. We believe the decrease in the number of lenders of capital for commercial real estate mezzanine loans and the resulting lack of competition have helped produce the relative lack of correlation with other interest rates.

Interest Rates 2004 – 2016

| - 7 - |

Our Loan Portfolio

The following tables set forth certain information with respect to our assets, as of December 31, 2016.

| Property Type | Location | Fully Committed Balance (1)(2) | Current Gross Balance | Obligations Under Participaiton Agreements | Net Investment Balance | Contractual Interest Rate (3) | Loan-to- value Ratio (4) | |||||||||||||||||||||

| Mezzanine Loans | ||||||||||||||||||||||||||||

| 1100 Biscayne Boulevard | Hotel | Miami, FL | $ | 16,000,000 | $ | 14,500,000 | $ | 2,735,384 | $ | 11,764,616 | 15.00 | % | 67.5 | % | ||||||||||||||

| 30 Warren Street | Multifamily | Manhattan, NY | 19,050,000 | 15,207,664 | - | 15,207,664 | 12.00 | % | 69.2 | % | ||||||||||||||||||

| 302 East 96th Street | Multifamily | Manhattan, NY | 17,050,000 | 4,075,585 | - | 4,075,585 | 13.00 | % | 71.8 | % | ||||||||||||||||||

| 42-50 24th Street | Land | Long Island City, NY | 12,500,000 | 12,500,000 | 3,834,087 | 8,665,913 | 14.00 | % | 80.5 | % | ||||||||||||||||||

| 55 Miracle Mile | Mixed Use | Coral Gables, FL | 3,400,000 | 3,400,000 | 1,078,189 | 2,321,811 | 14.00 | % | 79.3 | % | ||||||||||||||||||

| AHF Portfolio | Multifamily | Various, TX | 2,689,038 | 2,689,038 | - | 2,689,038 | 14.00 | % | 69.9 | % | ||||||||||||||||||

| Ball State Student Housing Portfolio | Student Housing | Muncie, IN | 2,700,000 | 2,700,000 | - | 2,700,000 | 13.00 | % | 84.8 | % | ||||||||||||||||||

| Mayo Portfolio | Multifamily | Boston, MA | 4,000,000 | 4,000,000 | - | 4,000,000 | 12.00 | % | 72.0 | % | ||||||||||||||||||

| BPG Hotel Portfolio | Hotel | King of Prussia, PA | 1,800,000 | 1,800,000 | 540,000 | 1,260,000 | 13.00 | % | 81.3 | % | ||||||||||||||||||

| BPG Office Portfolio | Office | Wilmington, DE | 10,000,000 | 10,000,000 | 3,000,000 | 7,000,000 | 13.50 | % | 85.9 | % | ||||||||||||||||||

| Hilton Brooklyn | Hotel | Brooklyn, NY | 15,000,000 | 15,000,000 | 7,500,000 | 7,500,000 | 12.00 | % | 78.7 | % | ||||||||||||||||||

| Clemson Student Housing Portfolio | Student Housing | Clemson, SC | 3,000,000 | 3,000,000 | - | 3,000,000 | 13.00 | % | 77.3 | % | ||||||||||||||||||

| CSRA Credit Facility | Multi-Asset | Multi-State | 1,565,850 | 1,565,850 | - | 1,565,850 | 13.00 | % | N/A | |||||||||||||||||||

| DoubleTree by Hilton Greensboro | Hotel | Greensboro, NC | 3,500,000 | 3,500,000 | - | 3,500,000 | 14.00 | % | 77.9 | % | ||||||||||||||||||

| Encino Courtyard | Retail | Encino, CA | 2,500,000 | 2,500,000 | - | 2,500,000 | 13.50 | % | 76.8 | % | ||||||||||||||||||

| Georgia Multifamily Portfolio | Multifamily | Various, GA | 4,250,000 | 4,250,000 | - | 4,250,000 | 14.00 | % | 76.7 | % | ||||||||||||||||||

| Holiday Inn Midtown | Hotel | Austin, TX | 3,500,000 | 3,500,000 | 1,050,000 | 2,450,000 | 12.50 | % | 81.8 | % | ||||||||||||||||||

| Kingsport Multifamily Portfolio | Multifamily | Kingsport, TN | 3,000,000 | 3,000,000 | - | 3,000,000 | 13.00 | % | 76.9 | % | ||||||||||||||||||

| Museo Apartments | Multifamily | Austin, TX | 4,000,000 | 4,000,000 | - | 4,000,000 | 12.00 | % | 83.5 | % | ||||||||||||||||||

| Pine Tree Drive | Office | Miami Beach, FL | 5,000,000 | 5,000,000 | 1,548,125 | 3,451,875 | 14.00 | % | 85.7 | % | ||||||||||||||||||

| Portland Airport Hotel Portfolio | Hotel | Portland, OR | 5,000,000 | 5,000,000 | - | 5,000,000 | 13.00 | % | 72.9 | % | ||||||||||||||||||

| Ramada Resort Fort Walton Beach | Hotel | Fort Walton Beach, FL | 4,500,000 | 4,500,000 | - | 4,500,000 | 13.00 | % | 68.8 | % | ||||||||||||||||||

| UBS Tower | Office | Nashville, TN | 6,225,000 | 6,225,000 | - | 6,225,000 | 15.00 | % | 66.2 | % | ||||||||||||||||||

| Urbanea | Multifamily | Miami, FL | 5,750,000 | 5,750,000 | - | 5,750,000 | 13.00 | % | 74.1 | % | ||||||||||||||||||

| Mezzanie Loan Subtotal/Weighted Average | $ | 155,979,888 | $ | 137,663,137 | $ | 21,285,785 | $ | 116,377,352 | 13.29 | % | 75.0 | % | ||||||||||||||||

| Preferred Equity | ||||||||||||||||||||||||||||

| 302 East 96th Street | Multifamily | Manhattan, NY | $ | 1,600,000 | $ | 1,303,583 | $ | - | $ | 1,303,583 | 13.00 | % | 71.83 | % | ||||||||||||||

| Arbor Station Apartments | Multifamily | Montgomery, AL | 2,100,000 | 2,100,000 | - | 2,100,000 | 15.00 | % | 85.61 | % | ||||||||||||||||||

| CSRA Credit Facility | Multi-Asset | Multi-State | 12,395,108 | 12,395,108 | - | 12,395,108 | 13.00 | % | N/A | |||||||||||||||||||

| DoubleTree by Hilton San Diego | Hotel | San Diego, CA | 6,000,000 | 6,000,000 | 800,000 | 5,200,000 | 12.00 | % | 64.21 | % | ||||||||||||||||||

| Hilton Garden Inn Fort Washigton | Hotel | Ft. Washington, PA | 3,742,000 | 3,742,000 | - | 3,742,000 | 13.00 | % | 69.28 | % | ||||||||||||||||||

| Marriott Warner Center | Hotel | Los Angeles, CA | 22,000,000 | 20,000,000 | 3,750,000 | 16,250,000 | 13.25 | % | 83.91 | % | ||||||||||||||||||

| Mystic Hotel | Hotel | San Francisco, CA | 4,325,000 | 4,325,000 | - | 4,325,000 | 12.00 | % | 68.36 | % | ||||||||||||||||||

| Stratford Apartments | Multifamily | Montgomery, AL | 1,600,000 | 1,600,000 | - | 1,600,000 | 15.00 | % | 86.35 | % | ||||||||||||||||||

| Urbanea | Multifamily | Miami, FL | 500,000 | 500,000 | - | 500,000 | 13.00 | % | 74.15 | % | ||||||||||||||||||

| Preferred Equity Subtotal/Weighted Average | $ | 54,262,108 | $ | 51,965,690 | $ | 4,550,000 | $ | 47,415,690 | 13.04 | % | 77.13 | % | ||||||||||||||||

| First Mortgage | ||||||||||||||||||||||||||||

| 144 South Harrison Street | Multifamily | East Orange, NJ | $ | 22,639,955 | $ | 22,639,955 | $ | - | $ | 22,639,955 | 12.00 | % | 66.39 | % | ||||||||||||||

| 1733 Ocean Avenue | Office | Santa Monica, CA | 54,000,000 | 50,450,061 | - | 50,450,061 | 13.70 | % | 83.08 | % | ||||||||||||||||||

| Wynwood | Land | Miami, FL | 21,360,000 | 19,620,000 | - | 19,620,000 | 12.00 | % | 69.35 | % | ||||||||||||||||||

| Millennium IV | Land | Conshohocken, PA | 13,980,000 | 13,980,000 | - | 13,980,000 | 12.00 | % | 50.47 | % | ||||||||||||||||||

| Uptown Newport | Land | Newport Beach, CA | 18,000,000 | 18,000,000 | 6,800,000 | 11,200,000 | 12.00 | % | 59.21 | % | ||||||||||||||||||

| First Mortgage Subtotal/Weighted Average | $ | 129,979,955 | $ | 124,690,016 | $ | 6,800,000 | $ | 117,890,016 | 12.73 | % | 71.45 | % | ||||||||||||||||

| Other (5) | ||||||||||||||||||||||||||||

| CSRA Credit Facility | Multi-Asset | Multi-State | $ | 1,539,043 | $ | 1,539,043 | $ | - | $ | 1,539,043 | 13.00 | % | N/A | |||||||||||||||

| Nelson Brothers Credit Facility | Multi-Asset | Multi-State | 8,000,000 | 8,000,000 | - | 8,000,000 | 13.00 | % | N/A | |||||||||||||||||||

| Other Subtotal/Weighted Average | $ | 9,539,043 | $ | 9,539,043 | $ | - | $ | 9,539,043 | 13.00 | % | N/A | |||||||||||||||||

| Total/Weighted Average | $ | 349,760,993 | $ | 323,857,886 | $ | 32,635,785 | $ | 291,222,101 | 13.01 | % | 73.74 | % | ||||||||||||||||

| (1) | Fully committed balance represents our maximum potential funding requirement. |

| (2) | Amount excludes paid-in-kind interest, or PIK. |

| (3) | Certain of our investments provide for PIK interest provisions. The interest rates presented are inclusive of the PIK interest provision. |

| (4) | Loan-to-value Ratio is generally based upon the fully committed balance less capital improvement reserves held by the lender and unfunded commitments divided by the associated property's appraised value at origination, unless a more recent appraisal was obtained. |

| (5) | Other represents the unfunded cash from two credit facilities. |

| December 31, 2016 | ||||||||||||

| Portfolio Summary | Fixed Rate | Floating Rate(1) | Total | |||||||||

| Number of investments | 37 | 1 | 38 | |||||||||

| Principal balance | $ | 275,554,910 | $ | 50,450,061 | $ | 326,004,971 | ||||||

| Weighted-average interest rate | 12.98 | % | 9.19 | % | 12.38 | % | ||||||

| Weighted-average remaining terms (year)(2) | 1.42 | 1.19 | 1.39 | |||||||||

| (1) | This investment pays an annual interest rate of London Interbank Offered Rate, or LIBOR, plus 8.5%. LIBOR cannot be lower than 0.5%. Interest rate shown was determined using the applicable annual interest rate as of December 31, 2016. |

| (2) | Reflects the current maturity dates, some of which were extended subsequent to December 31, 2016 and before the issuance of the combined consolidated financial statements. |

| - 8 - |

| December 31, 2016 | ||||||||||||

| Asset Type | Principal | Carrying Value | %

of Total | |||||||||

| Mezzanine loans | $ | 139,810,222 | $ | 142,489,036 | 43.1 | % | ||||||

| First mortgages | 124,690,016 | 125,863,391 | 38.0 | % | ||||||||

| Preferred equity investments | 51,965,691 | 52,896,500 | 16.0 | % | ||||||||

| Other(1) | 9,539,042 | 9,626,616 | 2.9 | % | ||||||||

| Total | $ | 326,004,971 | $ | 330,875,543 | 100.0 | % | ||||||

| (1) | Other represents the unused cash from two credit facilities. |

| December 31, 2016 | ||||||||||||

| Property Type | Principal | Carrying Value | %

of Total | |||||||||

| Hotel | $ | 82,726,671 | $ | 84,133,273 | 25.4 | % | ||||||

| Multifamily | 83,510,933 | 85,021,199 | 25.7 | % | ||||||||

| Office | 74,054,158 | 74,747,026 | 22.6 | % | ||||||||

| Land | 64,380,220 | 64,992,725 | 19.6 | % | ||||||||

| Student housing | 5,700,000 | 6,125,635 | 1.9 | % | ||||||||

| Mixed use | 3,593,947 | 3,619,217 | 1.1 | % | ||||||||

| Other(1) | 12,039,042 | 12,236,468 | 3.7 | % | ||||||||

| Total | $ | 326,004,971 | $ | 330,875,543 | 100.0 | % | ||||||

| (1) | Other includes $2.5 million of retail properties and $9.5 million of unused cash from two credit facilities. |

| December 31, 2016 | ||||||||||||

| Geographic Location | Principal | Carrying Value | %

of Total | |||||||||

| United States | ||||||||||||

| California | $ | 101,275,061 | $ | 102,699,779 | 31.1 | % | ||||||

| Florida | 54,484,022 | 54,927,914 | 16.6 | % | ||||||||

| New York | 48,367,052 | 48,746,769 | 14.7 | % | ||||||||

| New Jersey | 22,639,955 | 22,865,291 | 6.9 | % | ||||||||

| Pennsylvania | 19,522,000 | 19,703,355 | 6.0 | % | ||||||||

| Texas | 10,189,038 | 10,420,209 | 3.1 | % | ||||||||

| Delaware | 10,000,000 | 10,082,308 | 3.1 | % | ||||||||

| Tennessee | 9,877,843 | 10,179,485 | 3.1 | % | ||||||||

| Virginia | 6,675,510 | 6,737,238 | 2.0 | % | ||||||||

| Arizona | 5,719,598 | 5,772,487 | 1.7 | % | ||||||||

| Oregon | 5,000,000 | 5,356,923 | 1.6 | % | ||||||||

| North Carolina | 4,921,404 | 4,985,576 | 1.5 | % | ||||||||

| Georgia | 4,250,000 | 4,604,941 | 1.4 | % | ||||||||

| Massachusetts | 4,000,000 | 4,112,275 | 1.2 | % | ||||||||

| Alabama | 3,844,445 | 3,928,742 | 1.2 | % | ||||||||

| Other(1) | 15,239,043 | 15,752,251 | 4.8 | % | ||||||||

| Total | $ | 326,004,971 | $ | 330,875,543 | 100.0 | % | ||||||

| (1) | Other includes $2.7 million of properties in Indiana, $3.0 million of properties in South Carolina and $9.5 million of unused cash from two credit facilities. |

Objective and Strategy

Our primary investment objectives are to:

| · | preserve our members’ capital contributions; |

| · | realize income from our investments; and |

| · | make monthly distributions to our members from cash generated by investments. |

We have created and maintain a portfolio of investments that we believe generates a low volatility income stream of attractive and consistent cash distributions. Our focus on originating debt and debt-like instruments emphasizes the payment of current returns to investors and the preservation of invested capital.

We may deploy modest amounts of leverage as part of our operating strategy not in excess of 30%. In addition, if the borrower in one of our mezzanine, second mortgage or subordinated mortgage loans defaults on the senior loan,

| - 9 - |

we may incur leverage to service and/or purchase the senior loan and avoid a default on that senior loan to which our loan would be subject, or to pay miscellaneous expenses incurred in curing the default. See “— Our Financing Strategy” for additional information about our leverage strategy.

The management team of the Manager has extensive experience in originating, managing and disposing of real estate-related loans. The Manager seeks to:

| · | focus on the origination of new loans; |

| · | invest in loans expected to be realized within one to five years; |

| · | maximize current income; |

| · | lend to creditworthy borrowers; |

| · | lend on properties leased to high-quality tenants; |

| · | maximize diversification by property type, geographic location, tenancy and borrower; |

| · | source off-market transactions; |

| · | focus on small to mid-sized loans of approximately $3 million to $20 million; |

| · | invest in loans not exceeding 80% of the current value of the underlying property; and |

| · | hold investments until maturity unless, in the Manager’s judgment, market conditions warrant earlier disposition. |

Our Financing Strategy

We may deploy moderate amounts of leverage as part of our operating strategy, which may consist of borrowings under first mortgage financings, warehouse facilities, repurchase agreements and other credit facilities. Although we are not required to maintain any particular leverage ratio or leverage limitation, we expect that our leverage will not to exceed 30% of the value of our total assets on a portfolio basis. As of December 31, 2016, we did not have outstanding borrowings. As of December 31, 2016, our REIT subsidiary had an aggregate of approximately $66.6 million outstanding indebtedness, including borrowings under a mortgage loan with an outstanding principal amount of approximately $34 million and obligations under participation agreements with an aggregate outstanding principal amount of approximately $32.6 million. For additional information concerning our indebtedness, see “Item 2. Financial Information —Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

In addition, if the borrower in one of our mezzanine, second mortgage or subordinated mortgage loans defaults on the senior loan, we may incur leverage to service and/or purchase the senior loan and avoid a default on that senior loan to which our loan would be subject, or to pay miscellaneous expenses incurred in curing the default. We intend for the use of such leverage to be defensive and primarily to mitigate the adverse effects to us in the event of a default by the borrower under a senior loan. In such cases, we may use leverage in an amount not to exceed 60% of the balance of the defaulted loan.

Targeted Assets

Real Estate-Related Loans

We originate, acquire, fund and structure real estate-related loans, including first and second mortgage loans, mezzanine loans, bridge loans, convertible mortgages and other loans related to high-quality commercial real estate in the United States. We also acquire some equity participations in the underlying collateral of such loans. We structure, underwrite and originate most if not all of our investments. We use what we consider to be conservative underwriting criteria, and our underwriting process involves comprehensive financial, structural, operational and legal due diligence to assess the risks of investments so that we can optimize pricing and structuring. By originating loans

| - 10 - |

directly, we are able to structure and underwrite loans that satisfy our standards, establish a direct relationship with the borrower and utilize our own documentation. Described below are some of the types of loans we own and may originate.

Mezzanine Loans. These are loans secured by ownership interests in an entity that owns commercial real estate and generally finance the acquisition, refinancing, rehabilitation or construction of commercial real estate. Mezzanine loans may be either short-term (one-to-five year) or long-term (up to 10-year) and may be fixed or floating rate. We may originate mezzanine loans backed by high-quality properties in the United States that fit our investment strategy. We may own such mezzanine loans directly or we may hold a participation in a mezzanine loan or a sub-participation in a mezzanine loan. These loans are predominantly current-pay loans (although there may be a portion of the interest that accrues) and may provide for participation in the value or cash flow appreciation of the underlying property as described below. We invest in mezzanine loans with loan-to-value ratios ranging from 60% to 80%. With the credit market disruption and resulting dearth of capital available in this part of the capital structure, we believe that the opportunities to both directly originate and to buy mezzanine loans from third-parties on favorable terms will continue to be attractive. As of December 31, 2016, we owned mezzanine loans with total principal amount of $139.8 million, which constituted 42.9% of our portfolio.

Preferred Equity Investments. These are investments in preferred membership interests in an entity that owns commercial real estate and generally finance the acquisition, refinancing, rehabilitation or construction of commercial real estate. These investments are expected to have similar characteristics to and returns as mezzanine loans. As of December 31, 2016, we owned preferred equity investments with total principal amount of $52.0 million, which constituted 15.9% of our portfolio.

Subordinated Mortgage Loans or “B-notes.” These include structurally subordinated first mortgage loans and junior participations in first mortgage loans or participations in these types of assets (commonly referred to as B-notes). Like first mortgage loans, these loans generally finance the acquisition, refinancing, rehabilitation or construction of commercial real estate. Subordinated mortgage loans or B-notes may be either short-term (one-to-five year) or long-term (up to 10-year), may be fixed or floating rate and are predominantly current-pay loans. We may originate current-pay subordinated mortgage loans or B-notes backed by high-quality properties in the United States that fit our investment strategy. We may create subordinated mortgage loans by tranching our directly originated first mortgage loans generally through syndications of senior first mortgages, or buy such assets directly from third-party originators. Due to the current credit market disruption and resulting dearth of capital available in this part of the capital structure, we believe that the opportunities to both directly originate and to buy subordinated mortgage investments from third-parties on favorable terms will continue to be attractive.

Investors in subordinated mortgage loans are compensated for the increased risk of such assets from a pricing perspective but still benefit from a lien on the related property. Investors typically receive principal and interest payments at the same time as senior debt unless a default occurs, in which case these payments are made only after any senior debt is made whole. Rights of holders of subordinated mortgage loans are usually governed by participation and other agreements that, subject to certain limitations, typically provide the holders of subordinated positions of the mortgage loan with the ability to cure certain defaults and control certain decisions of holders of senior debt secured by the same properties (or otherwise exercise the right to purchase the senior debt), which provides for additional downside protection and higher recoveries. As of December 31, 2016, we did not own B-notes.

Bridge Loans. We offer bridge financing products to borrowers who are typically seeking short-term capital to be used in an acquisition, development or refinancing of a given property. From the borrower’s perspective, shorter term bridge financing is advantageous because it allows time to improve the property value through repositioning without encumbering it with restrictive long-term debt. The terms of these loans generally do not exceed three years. Bridge loans may be structured as mezzanine loans, preferred equity or first mortgages. As of December 31, 2016, we did not own bridge loans.

First Mortgage Loans. These loans generally finance the acquisition, refinancing, rehabilitation or construction of commercial real estate. First mortgage loans may be either short-term (one-to-five year) or long-term (up to 10-year), may be fixed or floating rate and are predominantly current-pay loans. We originate current-pay first mortgage loans backed by high-quality properties in the United States that fit our investment strategy. We selectively syndicate portions of these loans, including senior or junior participations that will effectively provide permanent financing or optimize returns which may include retained origination fees.

| - 11 - |

First mortgages provide for a higher recovery rate and lower defaults than other debt positions due to the lender’s senior position. However, such loans typically generate lower returns than subordinate debt such as mezzanine loans or B-notes. As of December 31, 2016, we owned first mortgage loans with total principal amount of $124.7 million, which constituted 38.3% of our portfolio.

Convertible Mortgages. Convertible mortgages are similar to equity participations (as described below). We may invest in or originate a convertible mortgage if the Manager concludes that we may benefit from the cash flow or any appreciation in the value of the subject property. As of December 31, 2016, we did not own convertible mortgages.

Equity Participations. In connection with our loan origination activities, we may pursue equity participation opportunities, or interests in the projects being financed, in instances when we believe that the risk-reward characteristics of the loan merit additional upside participation because of the possibility of appreciation in value of the underlying assets securing the loan. Equity participations can be paid in the form of additional interest, exit fees or warrants in the borrower. Equity participation can also take the form of a conversion feature, permitting the lender to convert a loan or preferred equity investment into equity in the borrower at a negotiated premium to the current net asset value of the borrower. We expect to be able to obtain equity participations in certain instances where the loan collateral consists of an asset that is being repositioned, expanded or improved in some fashion which is anticipated to improve future cash flow. In such case, the borrower may wish to defer some portion of the debt service or obtain higher leverage than might be merited by the pricing and leverage level based on historical performance of the underlying asset. We generate additional revenues from these equity participations as a result of excess cash flows being distributed or as appreciated properties are sold or refinanced. As of December 31, 2016, we did not own equity participations.

Other Real Estate-Related Investments. The Manager has the right to invest in other real estate-related investments, which may include CMBS or other real estate debt or equity securities, so long as such investments do not constitute more than 15% of our assets. Certain of our real estate-related loans require the borrower to make payments of principal on the fully committed principal amount of the loan regardless of whether the full loan amount is outstanding, and as of December 31, 2016 we had unused cash of $9.5 million from two such credit facilities under which we act as lender, which constituted 2.9% of our portfolio.

Investment Guidelines

Our REIT subsidiary’s board of directors has adopted investment guidelines relating to the criteria to be used by the Manager’s senior management team to evaluate specific investments as well as our overall portfolio composition. Our REIT subsidiary’s board of directors will review its compliance with the investment guidelines periodically and receive an investment report at each quarter-end in conjunction with the review of our REIT subsidiary’s quarterly results by its board of directors.

Our REIT subsidiary’s investment guidelines are as follows:

| · | no acquisition shall be made that would cause our REIT subsidiary to fail to qualify as a REIT; |

| · | no acquisition shall be made that would cause our REIT subsidiary or any of its subsidiaries to be required to register as an investment company under the 1940 Act; and |

| · | until appropriate investments can be identified, our REIT subsidiary may invest the proceeds of any future offerings of its equity or debt securities in interest-bearing, short-term investments, including money market accounts and/or funds, that are consistent with our REIT subsidiary’s intention to qualify as a REIT. |

These investment guidelines may be changed from time to time by a majority of our REIT subsidiary’s board of directors without the approval of our REIT subsidiary’s stockholders.

Disposition Policies

The period we hold our investments in real estate-related loans varies depending on the type of asset, interest rates and other factors. The Manager has developed a well-defined exit-strategy for each investment we make. The Manager

| - 12 - |

continually performs a hold-sell analysis on each asset in order to determine the optimal time to hold the asset and generate a strong return to our members. Economic and market conditions may influence us to hold investments for different periods of time. We may sell an asset before the end of the expected holding period if we believe that market conditions have maximized its value to us or the sale of the asset would otherwise be in our best interests. We intend to make any such dispositions in a manner consistent with our REIT subsidiary’s qualification as a REIT and our desire to avoid being subject to the “prohibited transaction” penalty tax.

Term and Liquidity

Our amended and restated operating agreement provides that our existence will continue until December 31, 2023, unless sooner terminated. However, we expect that prior to such date we will consummate a liquidity transaction, which may include an orderly liquidation of our assets or an alternative liquidity event such as a sale of our company or an IPO and listing of our REIT subsidiary’s shares of common stock on a national securities exchange. Our Manager would pursue an alternative liquidity event only if it believes such a transaction would be in the best interests of our members.

Operating and Regulatory Structure

REIT Qualification

Our REIT subsidiary has elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, or the Code, commencing with its taxable year ended December 31, 2016. We believe that our REIT subsidiary has been organized and has operated in conformity with the requirements for qualification and taxation as a REIT under the Internal Revenue Code, and that its manner of operation will enable it to continue to meet the requirements for qualification and taxation as a REIT. To qualify as a REIT, it must meet on a continuing basis, through its organization and actual investment and operating results, various requirements under the Code relating to, among other things, the sources of its gross income, the composition and values of its assets, its distribution levels and the diversity of ownership of shares of its stock. If our REIT subsidiary fails to qualify as a REIT in any taxable year and does not qualify for certain statutory relief provisions, it will be subject to U.S. federal income tax at regular corporate rates and may be precluded from qualifying as a REIT for the subsequent four taxable years following the year during which it failed to qualify as a REIT. Even if our REIT subsidiary qualifies for taxation as a REIT, it may be subject to some U.S. federal, state and local taxes on its income or property. In addition, subject to maintaining its qualification as a REIT, a portion of its business may be conducted through, and a portion of its income may be earned with respect to, its taxable REIT subsidiaries, or TRSs, should it decide to form TRSs in the future, which are subject to corporate income tax. Any distributions paid by our REIT subsidiary generally will not be eligible for taxation at the preferential U.S. federal income tax rates that currently apply to certain distributions received by individuals from taxable corporations, unless such distributions are attributable to qualified dividends received by our REIT subsidiary from a TRS, should it decide to form a TRS in the future.

1940 Act Exclusion

Neither we nor our REIT subsidiary are registered as an investment company under the 1940 Act. If we or our REIT subsidiary were obligated to register as an investment company, we or our REIT subsidiary would have to comply with a variety of substantive requirements under the 1940 Act that impose, among other things:

| · | limitations on our capital structure or the use of leverage; |

| · | restrictions on specified investments; |

| · | prohibitions on transactions with affiliates; and |

| · | compliance with reporting, record keeping, and other rules and regulations that would significantly change our and our REIT subsidiary’s operations. |

We conduct our operations so that we are not required to register as an investment company under the 1940 Act. Section 3(a)(1)(A) of the 1940 Act defines an investment company as any issuer that is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the 1940 Act

| - 13 - |

defines an investment company as any issuer that is “engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. Excluded from the term “investment securities,” among other things, are U.S. government securities and securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on the exemption from the definition of investment company set forth in Section 3(c)(1) or Section 3(c)(7) of the 1940 Act. Because we are organized as a holding company and conduct our business primarily through our REIT subsidiary, the value of the “investment securities” held by us must be less than 40% of the value of our total assets on an unconsolidated basis (exclusive of U.S. government securities and cash items). In addition, we conduct our operations so that we will not be considered an investment company under Section 3(a)(1)(A) of the 1940 Act, as we are not engaged primarily nor do we hold ourselves out as being engaged primarily in the business of investing, reinvesting or trading in securities. Rather, through our REIT subsidiary, we are primarily engaged in the non-investment company businesses of our REIT subsidiary.

Our REIT subsidiary relies on the exclusion from the definition of an investment company under Section 3(c)(5)(C) of the 1940 Act, or any other exclusions available to our REIT subsidiary. Section 3(c)(5)(C) of the 1940 Act is available for entities “primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” This exclusion generally requires that at least 55% of our REIT subsidiary’s portfolio must be comprised of “qualifying real estate” assets and at least 80% of our REIT subsidiary’s portfolio must be comprised of “qualifying real estate” assets and “real estate-related” assets (and no more than 20% comprised of miscellaneous assets) as determined in accordance with the 1940 Act and the rules and regulations promulgated thereunder. For purposes of the exclusion provided by Section 3(c)(5)(C) of the 1940 Act, our REIT subsidiary classifies its investments based in large measure on no-action letters issued by the SEC staff and other SEC interpretive guidance and, in the absence of SEC guidance, on our view of what constitutes a “qualifying real estate” asset and a “real estate-related” asset. These no-action positions were issued in accordance with factual situations that may be substantially different from the factual situations our REIT subsidiary may face, and a number of these no-action positions were issued more than ten years ago. Pursuant to this guidance, and depending on the characteristics of the specific investments, certain mortgage loans, participations in mortgage loans, mortgage-backed securities, mezzanine loans, joint venture investments and the equity securities of other entities may not constitute qualifying real estate assets and therefore investments in these types of assets may be limited. No assurance can be given that the SEC or its staff will concur with our classification of the assets held by our REIT subsidiary. Future revisions to the 1940 Act or further guidance from the SEC or its staff may cause us to lose our exclusion from registration or force us to re-evaluate our portfolio held through our REIT subsidiary and our investment strategy. Such changes may prevent us from operating our business successfully.

In order to maintain an exclusion from registration under the 1940 Act, we may be unable to sell assets that we would otherwise want to sell and may need to sell assets we would otherwise wish to retain. In addition, we may have to acquire additional income or loss generating assets that we might not otherwise have acquired or may have to forgo opportunities to acquire assets that we would otherwise want to acquire and would be important to its strategy.

Although we monitor the portfolio of our REIT subsidiary periodically and prior to each acquisition and disposition, our REIT subsidiary may not be able to maintain an exclusion from registration as an investment company. If our REIT subsidiary were required to register as an investment company, but failed to do so, our REIT subsidiary would be prohibited from engaging in its business, and legal proceedings could be instituted against our REIT subsidiary. In addition, the contracts of our REIT subsidiary may be unenforceable, and a court could appoint a receiver to take control of our REIT subsidiary and liquidate its business, all of which would have an adverse effect on our business.

Emerging Growth Company Status

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and as such we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation

| - 14 - |

and stockholder approval of any golden parachute payments not previously approved. A number of these exemptions are not relevant to us, and in any event we do not currently intend to take advantage of any of these exemptions.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can use the extended transition period provided in Section 13(a) of the Exchange Act for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to take advantage of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

We will remain an emerging growth company until the earliest to occur of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date on which we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period, and (iv) the end of the year in which the 5 year anniversary of our initial public offering of our common stock occurs.

Licensing

We may be required to be licensed to originate our real estate-related loans in various jurisdictions in which we conduct our business. We believe our REIT subsidiary and its wholly owned subsidiaries are in compliance with all such material licensing requirements necessary in order to conduct our business.

Competition

We compete with REITs, numerous regional and community banks, specialty finance companies, savings and loan associations and other entities, and we expect that others may be organized in the future. The effect of the existence of additional REITs and other institutions may be increased competition for the available supply of our targeted assets suitable for purchase, which may cause the price for such assets to rise.

In the face of this competition, we expect to have access to the Manager’s professionals and their industry expertise, which may provide us with a competitive advantage in sourcing transactions and help us assess origination and acquisition risks and determine appropriate pricing for potential assets. The more conservative underwriting standards used by many large commercial banks and traditional providers of commercial real estate capital following the 2008 downturn has and, and we believe, will continue to constrain the lending capacity of these institutions. However, we may not be able to achieve our business goals or expectations due to the competitive risks that we face. For additional information concerning these competitive risks, see “Item 1A. Risk Factors — New entrants in the market for commercial loan originations and acquisitions could adversely impact our ability to originate and acquire real estate-related loans at attractive risk-adjusted returns.”

Staffing

Our sole managing member is the Manager. We conduct substantially all of our business through our REIT subsidiary, which is supervised by its board of directors consisting of three directors. Our REIT subsidiary has entered into a management agreement with the Manager pursuant to which certain services are provided by the Manager and paid for by our REIT subsidiary. The Manager is not obligated under the management agreement to dedicate any of its personnel exclusively to us, nor is it or its personnel obligated to dedicate any specific portion of its or their time to our business. Accordingly, our executive officers are not required to devote any specific amount of time to our business. We are responsible for the costs of our own employees; however, we do not currently have any employees and do not currently expect to have any employees. See “Item 5. Directors and Executive Officers.”

| - 15 - |

Investing in our units involves a high degree of risk. Investors should carefully consider the following risk factors and all other information contained in this registration statement before acquiring our units. If any of the following risks occur, our business, financial condition, liquidity and results of operations could be materially and adversely affected. In that case, the value of our units could decline, and members may lose some or all of their investment. Some statements in this section constitute forward-looking statements. See “Forward-Looking Statements.”

Risks Related to Our Business

Changes in national, regional or local economic, demographic or real estate market conditions may adversely affect our results of operations and returns to our investors.

We will be subject to risks incident to the ownership of real estate-related assets including: changes in national, regional or local economic, demographic or real estate market conditions; changes in supply of, or demand for, similar properties in an area; increased competition for real estate assets targeted by our investment strategy; bankruptcies, financial difficulties or lease defaults by property owners and tenants; changes in interest rates and availability of financing; and changes in government rules, regulations and fiscal policies, including changes in tax, real estate, environmental and zoning laws. Any increase in mortgage defaults in the residential market may have a negative impact on the credit markets generally as well as on economic conditions generally. We are unable to predict future changes in national, regional or local economic, demographic or real estate market conditions. These conditions, or others we cannot predict, may adversely affect our results of operations, cash flow and returns to our investors.

Our real estate-related loans may be impacted by unfavorable real estate market conditions, which could decrease the value of our investments.

The real estate-related loans we make or invest in are at risk of defaults caused by many conditions beyond its control, including local and other economic conditions affecting real estate values and interest rate levels. We do not know whether the values of the property securing the real estate-related loans will remain at the levels existing on the dates of origination of such loans. If the values of the underlying properties drop, our risks will increase and the value of its investments may decrease.

The lack of liquidity of our assets may adversely affect our business, including our ability to value and sell our assets.

A portion of the real estate-related loans and other assets we originate or acquire may be subject to legal and other restrictions on resale or will otherwise be less liquid than publicly-traded securities. The illiquidity of our assets may make it difficult for us to sell such assets if the need or desire arises. In addition, if we are required to liquidate all or a portion of our portfolio quickly, we may realize significantly less value than the value at which we have previously recorded our assets. As a result, our ability to vary our portfolio in response to changes in economic and other conditions may be relatively limited, which could adversely affect our results of operations and financial condition.

Our due diligence of potential real estate-related loans and other commercial real estate assets may not reveal all of the liabilities associated with such assets and may not reveal other weaknesses in our assets, which could lead to investment losses.

Before making an investment, the Manager calculates the level of risk associated with the real estate-related loans and other commercial real estate assets to be originated or acquired based on several factors which include the following: top-down reviews of both the current macroeconomic environment generally and the real estate and commercial real estate loan market specifically; detailed evaluation of the real estate industry and its sectors; bottom-up reviews of each individual investment’s attributes and risk/reward profile relative to the macroeconomic environment; and quantitative cash flow analysis and impact of the potential investment on our portfolio. In making the assessment and otherwise conducting customary due diligence, we employ standard documentation requirements and require appraisals prepared by local independent third-party appraisers selected by us. Additionally, we seek to have borrowers or sellers provide representations and warranties on loans we originate or acquire, and if we are unable to obtain representations and warranties, we factor the increased risk into the price we pay for such loans. Despite our

| - 16 - |

review process, there can be no assurance that our due diligence process will uncover all relevant facts or that any investment will be successful.

If the Manager underestimates the credit analysis and the expected risk-adjusted return relative to other comparable investment opportunities, we may experience losses.

The Manager values our real estate-related loans based on an initial credit analysis and the investment’s expected risk-adjusted return relative to other comparable investment opportunities available to us, taking into account estimated future losses on the loans, and the estimated impact of these losses on expected future cash flows. The Manager’s loss estimates may not prove accurate, as actual results may vary from estimates. In the event that the Manager underestimates the losses relative to the price we pay for a particular investment, we may experience losses with respect to such investment.

The use of underwriting guideline exceptions in the loan origination process may result in increased delinquencies and defaults.

Although we generally underwrite loans in accordance with pre-determined loan underwriting guidelines, from time to time and in the ordinary course of business, we make exceptions to these guidelines. On a case by case basis, we may determine that a prospective borrower that does not strictly qualify under our underwriting guidelines warrants an underwriting exception, based upon compensating factors. Compensating factors may include a lower loan-to-value ratio, a higher debt coverage ratio, experience as a real estate owner or investor, higher borrower net worth or liquidity, longer length of time in business and length of time owning the property. Loans originated with exceptions may result in a higher number of delinquencies and defaults, which could have a material and adverse effect on our business, results of operations and financial condition.

Deficiencies in appraisal quality in the mortgage loan origination process may result in increased principal loss severity.

During the loan underwriting process, appraisals are generally obtained on the collateral underlying each prospective loan. The quality of these appraisals may vary widely in accuracy and consistency. The appraiser may feel pressure from the broker or lender to provide an appraisal in the amount necessary to enable the originator to make the loan, whether or not the value of the property justifies such an appraised value. Inaccurate or inflated appraisals may result in an increase in the severity of losses on the loans, which could have a material and adverse effect on our business, results of operations and financial condition.

The Manager utilizes analytical models and data in connection with the valuation of our real estate-related loans and other commercial real estate assets, and any incorrect, misleading or incomplete information used in connection therewith would subject us to potential risks.

As part of the risk management process the Manager uses detailed proprietary models, including loan level non-performing loan models, to evaluate collateral liquidation timelines and price changes by region, along with the impact of different loss mitigation plans. Additionally, the Manager uses information, models and data supplied by third-parties. Models and data are used to value potential targeted assets. In the event models and data prove to be incorrect, misleading or incomplete, any decisions made in reliance thereon expose us to potential risks. For example, by relying on incorrect models and data, especially valuation models, the Manager may be induced to buy certain targeted assets at prices that are too high, to sell certain other assets at prices that are too low or to miss favorable opportunities altogether. Similarly, any hedging based on faulty models and data may prove to be unsuccessful.

Changes in interest rates could adversely affect the demand for our target loans, the value of our loans and CMBS assets and the availability and yield on our targeted assets.

We invest in real estate-related loans and other commercial real estate assets, which are subject to changes to interest rates. Interest rates are highly sensitive to many factors, including governmental monetary and tax policies, domestic and international economic and political considerations and other factors beyond our control. Rising interest rates generally reduce the demand for mortgage loans due to the higher cost of borrowing. A reduction in the volume of mortgage loans originated may affect the volume of our targeted assets available to us, which could adversely affect our ability to originate and acquire assets that satisfy our investment objectives. Rising interest rates may also cause

| - 17 - |

our targeted assets that were issued prior to an interest rate increase to provide yields that are below prevailing market interest rates. If rising interest rates cause us to be unable to originate or acquire a sufficient volume of our targeted assets with a yield that is above our borrowing cost, our ability to satisfy our investment objectives and to generate income and make distributions may be materially and adversely affected. Conversely, if interest rates decrease, we will be adversely affected to the extent that real estate-related loans are prepaid, because we may not be able to make new loans at the previously higher interest rate.

The relationship between short-term and longer-term interest rates is often referred to as the “yield curve.” Ordinarily, short-term interest rates are lower than longer-term interest rates. If short-term interest rates rise disproportionately relative to longer-term interest rates (a flattening of the yield curve), our borrowing costs may increase more rapidly than the interest income earned on our assets. Because our loans and CMBS assets generally will bear, on average, interest based on longer-term rates than our borrowings, a flattening of the yield curve would tend to decrease our net income and the fair market value of our net assets. Additionally, to the extent cash flows from loans and CMBS assets that return scheduled and unscheduled principal are reinvested, the spread between the yields on the new loans and CMBS assets and available borrowing rates may decline, which would likely decrease our net income. It is also possible that short-term interest rates may exceed longer-term interest rates (a yield curve inversion), in which event our borrowing costs may exceed our interest income and we could incur operating losses.

The values of our loans and CMBS assets may decline without any general increase in interest rates for a number of reasons, such as increases or expected increases in defaults, or increases or expected increases in voluntary prepayments for those loans and CMBS assets that are subject to prepayment risk or widening of credit spreads.

In addition, in a period of rising interest rates, our operating results will depend in large part on the difference between the income from our assets and our financing costs. We anticipate that, in most cases, the income from such assets will respond more slowly to interest rate fluctuations than the cost of our borrowings. Consequently, changes in interest rates, particularly short-term interest rates, may significantly influence our net income. Increases in these rates will tend to decrease our net income.

Recent market conditions may make it more difficult for us to analyze potential investment opportunities or our portfolio of assets.

Our success depends, in part, on our ability to effectively analyze potential acquisition and origination opportunities in order to assess the level of risk-adjusted returns that we should expect from any particular investment. To estimate the value of a particular asset, we may use historical assumptions that may or may not be appropriate during the recent unprecedented downturn in the real estate market and general economy. To the extent that we use historical assumptions that are inappropriate under current market conditions, we may overpay for an asset or acquire an asset that we otherwise might not acquire, which could have a material and adverse effect on our results of operations and our ability to make distributions to our members.