Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1 to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of

The Securities Exchange Act of 1934

Life360, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 26-0197666 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 539 Bryant Street, Suite 402 | ||

| San Francisco, CA | 94107 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

Tel: (415) 484-5244

With copies to:

| Gregory Heibel, Esq. Alice Hsu, Esq. Marsha Mogilevich, Esq. Orrick, Herrington & Sutcliffe LLP The Orrick Building 405 Howard Street San Francisco, California 94105 Telephone: (415) 773-5700 |

Christopher Hulls Chief Executive Officer Life360, Inc. 539 Bryant Street, Suite 402 San Francisco, CA 94107 Telephone: (415) 484-5244 |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

i

Table of Contents

EXPLANATORY NOTE

Life360, Inc. is filing this General Form for Registration of Securities on Form 10 (this “Registration Statement”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to register our common stock, including all shares of common stock underlying our CHESS Depositary Interests (“CDIs”), par value $0.001 per share (the “common stock”), pursuant to Section 12(g) of the Exchange Act. Once this Registration Statement is effective, the Company will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated thereunder, which will require the Company, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and the Company will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act. The Securities and Exchange Commission maintains an Internet website (http://www.sec.gov) that contains the reports mentioned in this section. Information contained on the website does not constitute part of this Registration Statement. We have included our website address in this Registration Statement solely as an inactive textual reference.

In this Registration Statement, unless the context suggests otherwise, the terms:

| • | “we,” “us,” “Life360” and “Company” refer to Life360, Inc., a Delaware corporation, and its subsidiaries; |

| • | “$” or “USD” refers to U.S. Dollar; |

| • | “A$” or “AUD” refers to Australian Dollar; |

| • | “active user” refers to a member who opens the Life360 app after completing their registration; |

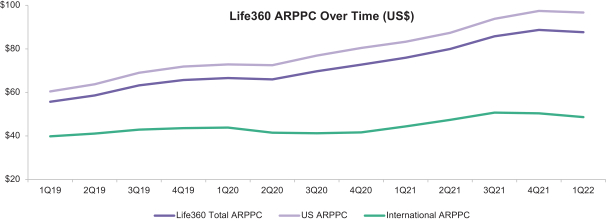

| • | “ARPPC” refers to Average Revenue per Paying Circle which is our revenue for the period presented divided by the Average Paying Circles during the same period; |

| • | “ASX” refers to the Australian Securities Exchange; |

| • | “Average Paying Circles” are calculated based on adding the number of Paying Circles as of the beginning of the period to the number of Paying Circles as of the end of the period, and then dividing by two; |

| • | “Board” refers to the board of directors of Life360, Inc.; |

| • | “Bylaws” refers to the amended and restated bylaws of Life360, Inc.; |

| • | “CDI” refers to CHESS Depositary Interests; |

| • | “CHESS” refers to the Clearing House Electronic Subregister System; |

| • | “Circles” refers to private groups created by members on the Life360 Platform, which allow members to stay connected to other members in the Circle with Circle-specific features such as location sharing, messaging and check-ins; |

| • | “GAAP” refers to generally accepted accounting principles in the United States; |

| • | “Jiobit” refers to Jio, Inc., a Delaware corporation and a wholly-owned subsidiary of Life360, Inc.; |

| • | “Jiobit Acquisition” refers to Life360, Inc.’s acquisition of Jio, Inc. in September 2021; |

| • | “Life360 Platform” refers to the suite of Life360 offerings of products and services including the Life360 mobile application and related third-party services but excluding Tile and Jiobit offerings; |

| • | “Life360 Service” refers to the suite of Life360 offerings of products and services including the Life360, Tile and Jiobit mobile applications and related third-party services; |

| • | “MAUs” refers to monthly active users of the Life360 Platform; |

| • | “member cohort” refers to a group of members that downloads the Life360 app and registers for the Life360 Platform in a given month; |

| • | “members” refers to the users of the applicable Life360 Service; |

| • | “Paying Circles” refers to the Circles covered by a subscription; |

ii

Table of Contents

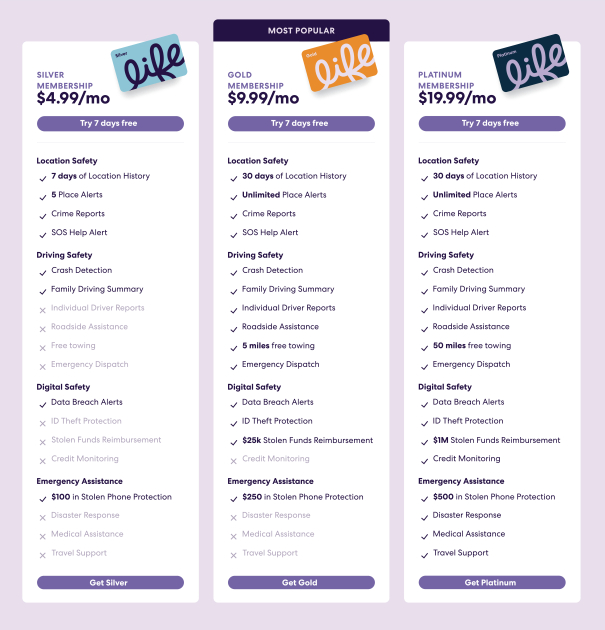

| • | “Premium Memberships” refers to the Life360 Platform’s comprehensive suite of premium services delivered through subscription-based offerings, which include Life360 Silver, Life360 Gold and Life360 Platinum; |

| • | “SEC” refers to the U.S. Securities and Exchange Commission; |

| • | “stockholders” refers to the holders of beneficial interest of the Company’s shares of common stock, including all shares of common stock underlying our CDIs; |

| • | “subscriber” refers to a person who has purchased a subscription to any Life360 Service; |

| • | “subscription” refers to a paid subscription to any Life360 Service; |

| • | “Tile” refers to Tile, Inc., a Delaware corporation and wholly-owned subsidiary of Life360, Inc.; and |

| • | “Tile Acquisition” refers to Life360, Inc.’s acquisition of Tile, Inc. in January 2022. |

iii

Table of Contents

FORWARD-LOOKING STATEMENTS

This Registration Statement contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Some of the statements under “Risk Factors,” “Life360 Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Tile Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this Registration Statement contain forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words.

These statements involve risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Registration Statement, we caution you that these statements are based on a combination of facts and factors currently known by us as of the date of this Registration Statement and our projections of the future, about which we cannot be certain. Forward-looking statements in this Registration Statement include, but are not limited to, statements about:

| • | our ability to further penetrate our existing member base and maintain and expand our member base; |

| • | our expectations regarding future financial performance, including our expectations regarding our revenue, cost of revenue, and operating expenses, and our ability to achieve or maintain future profitability; |

| • | the effects of increased competition in our markets and our ability to compete effectively in our industry; |

| • | our ability to maintain the value and reputation of our brands; |

| • | our business plan and our ability to effectively manage our growth and meet future capital requirements; |

| • | anticipated trends, developments, and challenges in our industry, business and in the markets in which we operate; |

| • | our ability to successfully acquire and integrate companies and assets, including Tile and Jiobit, and to expand and diversify our operations through strategic acquisitions and partnerships; |

| • | our market opportunity, including our total addressable market and serviceable addressable market; |

| • | market acceptance of our location sharing services, tracking products and digital subscription services; |

| • | our ability to anticipate market needs or develop new products and services or enhance existing products and services to meet those needs; |

| • | our ability to increase sales of our products and services; |

| • | our ability to develop new monetization features and improve on existing features; |

| • | the effects of uncertainties with respect to the legal system in the People’s Republic of China (the “PRC”) and in Malaysia, where our primary manufacturer’s facilities are located, and of disruption in the supply chain from Malaysia; |

| • | the effects of seasonal trends on our results of operations; |

| • | our expectations concerning relationships with third parties; |

| • | our ability to maintain, protect, and enhance our intellectual property; |

| • | the effects of an economic downturn or economic uncertainty on consumer discretionary spending and demand for our products and services; |

iv

Table of Contents

| • | our ability to stay in compliance with laws and regulations that currently apply or become applicable to our business both in the United States and internationally, including with respect to data privacy and security, consumer protection, location sharing, item tracking, targeting and children’s privacy protections; |

| • | our ability to identify, recruit, and retain skilled personnel, including key members of senior management; and |

| • | economic and industry trends, projected growth or trend analysis. |

You should refer to the “Risk Factors” section of this Registration Statement for a discussion of other important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Registration Statement will prove to be accurate. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and existing risks and uncertainties may become more material, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Registration Statement.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Registration Statement, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

v

Table of Contents

MARKET AND INDUSTRY DATA

Within this Registration Statement, we reference information and statistics regarding the industry and market within which we compete and our competitive position. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Some data and other information contained in this Registration Statement are also based on management’s estimates and calculations, which are derived from our review and interpretation of internal company research, surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within these industries. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research, surveys and estimates are reliable, such research, surveys and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Forward-Looking Statements.” As a result, you should be aware that market, ranking, and other similar industry data included in this Registration Statement, and estimates and beliefs based on that data may not be reliable. We cannot guarantee the accuracy or completeness of any such information contained in this Registration Statement.

Life360’s market share metric referenced elsewhere in this Registration Statement is a measurement we have developed by comparing the Life360 app to a group of 17 other apps (“Comparable Apps”) offering location sharing, children safety or family location safety services. We used data.ai to obtain information related to global revenue for the Life360 app and each of the Comparable Apps for the period from January 2021 to December 2021. In order to derive the Life360 market share based on revenue, we took the Life360 revenue provided by data.ai (which reflects data.ai’s market estimates which are also applied to the revenue estimates provided by data.ai for the Comparable Apps) as a percentage of the total revenue of the Life360 app plus the 12 apps out of the Comparable Apps that are monetized for the period indicated above. Our revenue-based global market share excludes the apps that are not monetized, as data.ai does not provide revenue information when an app is not monetized. These include: Find My, Glympse, Google Family Link, Verizon FamilyBase and Zenly. The metrics that we receive from data.ai reflect data.ai’s market estimates and are not certified data from the respective app owners, and the market share metric that we provide is based upon calculations, statistics or groupings determined by Life360 using the data provided by data.ai.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We have proprietary rights to trademarks and patents used in this Registration Statement that are important to our business, many of which are registered under applicable intellectual property laws. This Registration Statement also contains trademarks, tradenames, service marks and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks, tradenames, service marks and copyrights referred to in this Registration Statement may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we or their owners will not assert, to the fullest extent possible under applicable law, our rights or their, as applicable, rights to these trademarks, trade names, service marks and copyrights. We do not intend our use or display of other companies’ trademarks, trade names, service marks or copyrights to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

vi

Table of Contents

Overview

Life360 is the leading technology platform, based on market share of the family safety and location sharing app market, to locate the people, pets and things that matter most to families. Life360 is creating a new category at the intersection of family, technology, and safety to help keep families connected and safe. We provide safety services delivered through a mobile-native, subscription-based offering built around location sharing, mobility, driving, and coordination. In 2021, we estimated one in 10 families in the United States used the Life360 Platform and, on average, our U.S. active users and members who have enabled push notifications used the service over 15 times a day to coordinate and communicate. We also provide coverage for the “what ifs” that families worry about most, ranging from driving safety to personal SOS, identity theft protection and more. Nothing is more important than family, and we help provide peace of mind for life’s unpredictable moments for families around the world.

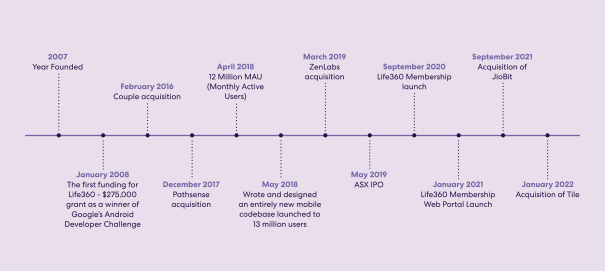

We started Life360 in 2007 with the vision that families would need a dedicated safety membership that incorporates a suite of safety services spanning every life stage of the family. We started by creating one of the first smartphone-based location apps on the Google Android platform. Since then we have consistently expanded our offerings and evolved from an app into a much broader platform. As a result of our innovation, we are the category leader within apps that target the family safety and location sharing app market. We have averaged a top seven ranking in the U.S. Apple App Store for downloads in the social networking category for the last three years.

Today, technology allows families to be more digitally connected than ever before, unlocking tremendous opportunities for the types of services we provide. Our platform provides us with a large audience of members worldwide and a deep understanding of their demographic and needs, including who their family members are, their daily habits and broader needs. This understanding enables us to provide a differentiated value proposition to consumers. Leveraging the trust we have with our members and the insights we collect about their daily lives enables us to build tailored products based on families’ needs, and provide an ever-growing suite of relevant services.

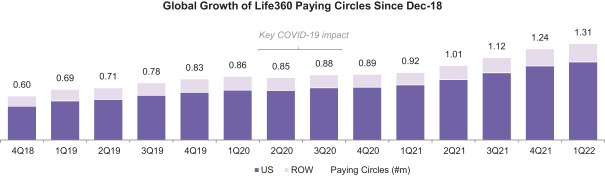

Our goal is to become the dominant digital brand at the center of family safety and location sharing globally. Life360 has approximately 65% and 66% global market share of the family safety and location sharing app market based on revenue for the month ended March 31, 2022 and for the month ended December 31, 2021, respectively, and over 39% and 42% aided brand awareness in the United States among parents with children ages 11 to 22 in the three months ended March 31, 2022 and in the three months ended December 31, 2021. See “Market and Industry Data” for more information on how we calculate market share. As of March 31, 2022, the Life360 Platform had more than 38 million members and over 1.3 million Paying Circles and was available for download in over 170 countries through the Apple App Store and over 130 countries through the Google Play Store, with approximately one in seven U.S. members in a Paying Circle. Additionally, our Tile offering is the leading cross-platform brand in finding items based on market share of the item tracker market as of March 31, 2022, with over 50 million devices sold since its inception and over 478,400 total subscribers for the year ended December 31, 2021.

Our revenue is primarily generated from the sale of subscriptions to access our services across our three brands—Life360, Tile and Jiobit. Our ability to drive value for our subscribers and retain and expand usage across our subscriber base is demonstrated by our net subscriber revenue retention on the Life360 Platform of over 100% based on the average monthly revenue for the six months ended March 31, 2022 as compared to the member cohort who registered before or in September 2021. This increased usage has also enabled us to drive growth in our ARPPC, a measure of our Paying Circles. Between the three months ended March 31, 2022 and 2021 we grew ARPPC to $87.66 from $75.92, an increase of 15%. Between the years ended December 31, 2021 and 2020 we grew ARPPC to $80.22 from $69.14, an increase of 16%. As we continue to grow our product offering, enter new markets, and drive international expansion, we aim to continue to grow our ARPPC.

In addition, approximately 16% of our revenue for the three months ended March 31, 2022 and approximately 22% of our revenue for the year ended December 31, 2021 was generated indirectly. Indirect

1

Table of Contents

revenue includes the sale of data insights from our member base and the sale of third-party products and services, including through targeted ads within our platform. For example, we generate revenue through the display of auto insurance products within the Life360 Platform.

The privacy of our members’ data remains at the core of our business. In 2022 we agreed to a new data partnership with Placer.ai (“Placer”) to move toward selling only aggregated data insights. We are in the process of winding down our legacy data sales partnerships and will be transitioning to an aggregated data sales model, in order to enhance privacy protections for our members and reduce risks to the business. We will continue to derive indirect revenues through the sale of third-party products and services, including through ads within our platform. In keeping with our vision and consistent with that aggregated data sales model, we are exploring ways, in the future, to enable members to avail themselves of compelling offers and opportunities by enabling our partners to use their data with members’ explicit, affirmative opt-in consent.

We have recently taken a significant leap forward to achieving our goal of becoming the most trusted family safety brand through our acquisitions of Tile, the platform-agnostic global leader in finding things, and Jiobit, a provider of wearable location devices for young children, pets and seniors. We expect to continue expanding our offering across digital platforms that are rapidly becoming part of daily life, including but not limited to connected devices, wearables, smart assistants, desktops and infotainment systems. As we continue to drive innovation and as digitally native families become the norm, we believe we are well-positioned to become the dominant digital brand for family safety and location sharing around the world. Our long-term vision expands Life360 beyond location-based services into a single hub where families discover, access and buy a broader set of services related to safety, being on the go or daily peace of mind (for example, elder monitoring, insurance and home security).

Our compelling financial profile is characterized by high growth, strong paid member retention, recurring revenue, and efficient customer acquisition, which have driven strong historical growth. We have an efficient go-to-market model, in which organic word-of-mouth drives the majority of our member acquisition. The Life360 Platform operates under a freemium model in which our service is available to members at no charge, while additional features are available via Premium Memberships.

For the three months ended March 31, 2022 and March 31, 2021, Life360 generated:

| • | Total revenue of $51.0 million and $23.0 million, respectively; and |

| • | Net loss of $25.2 million and $3.9 million, respectively. |

For the years ended December 31, 2021 and December 31, 2020, Life360 generated:

| • | Total revenue of $112.6 million and $80.7 million, respectively; and |

| • | Net loss of $33.6 million and $16.3 million, respectively. |

For the year ended December 31, 2021, on a pro forma basis after giving effect to the Tile Acquisition, we generated:

| • | Total revenue of $218.2 million; and |

| • | Net loss of $78.4 million. |

Our Competitive Strengths

| • | Leading Platform for Family Safety and Location Sharing. Life360 is the leader in family safety and location sharing, with approximately 65% and 66% global market share of the family safety and location sharing app market based on revenue for the month ended March 31, 2022 and for the month ended December 31, 2021, respectively. See “Market and Industry Data” for more information on how we calculate market share. In 2021, we estimated approximately one in 10 families in the United States used the Life360 Platform to protect the people, pets and things that matter most to families. As a result of our innovation, we have averaged a top seven ranking in the U.S. Apple App Store for downloads in |

2

Table of Contents

| the social networking category for the last three years. Life360 is one of the highest ranked social networking and lifestyle mobile apps, ranking top seven on the Apple App Store and Google Play Store in the United States, as of March 31, 2022. As app store rankings significantly impact a consumer’s decision to download an app, we believe our high ranking in the app stores drives strong organic member acquisition for Life360. |

| • | Powerful Network Effects. Life360 has built a brand entrusted by over 38 million members on the Life360 Platform and over 1.3 million Paying Circles worldwide, as of March 31, 2022, to keep what matters most—their families—safe. We have built a brand that is synonymous with family safety and location sharing, as demonstrated by over 39% and 42% aided brand awareness in the United States among parents with children ages 11 to 22 for the three months ended March 31, 2022 and for the three months ended December 31, 2021. Our brand awareness and word-of-mouth virality have led to 87% of registrations as organic members in countries where our apps are available for download in the year ended December 31, 2021, low customer acquisition cost, and the ability to grow with minimal paid marketing. We believe we are well positioned to continue driving adoption of our growing suite of services. |

| • | Highly Engaged and Loyal Member Base. We believe our member experience is what has enabled Life360 to become the leading player in family safety and location sharing. Our members are highly engaged with the Life360 Service. On average, our U.S. active users and members who have enabled push notifications engaged with the Life360 Platform over 15 times per day in 2021. Key to our ability to drive member engagement are our deep data insights on our members, which allow us to identify specific life transition points that correlate with purchasing activity. Our member base is highly entrenched in our platform—as more of a member’s family members join the Life360 Platform, they are able to gain increasing insights into the activities of their Circle that are not replicable on any other social network. The combination of these factors contributes to our significant competitive advantage. |

| • | Powerful Flywheel Drives Organic Member Growth and Subscriber Conversion. Our strong brand awareness and trust drive customer acquisition through word-of-mouth, and as members invite new members to our platform, we benefit from strong product virality and loyalty driven by our subscription membership model. Our members on the Life360 Platform grew by a 22% Compound Annual Growth Rate (“CAGR”) from 20.9 million in March 2019 to over 38.3 million in March 2022, and our Paying Circles grew by a 24% CAGR from 0.7 million to over 1.3 million during the same time period. Our net subscriber revenue retention on the Life360 Platform was over 100% based on the average monthly revenue for the six months ended March 31, 2022 as compared to the member cohort who registered before or in September 2021. Our paid conversion reflects subscribers converting to paid subscriptions within the first month following their initial registration with the Life360 Platform. In the United States, our paid conversion has continued to improve to an average of 2.2% paid conversion for the three months ended March 31, 2022, from an average of 1.6% paid conversion for the three months ended March 31, 2021, and 2% paid conversion for the year ended December 31, 2021, from an average of 1.1% paid conversion for the year ended December 31, 2020. As our platform scales to accommodate our growing member base, this growth drives peer-to-peer network effects and data driven insights that further improve our targeted offerings to members. For example, we have insight into one-tenth of all miles driven in the United States, allowing us to better understand driving behavior and suggest tailored insurance offerings based on individual needs. |

| • | Comprehensive Product Suite with Breadth and Depth of Functionality. Since 2016, we have invested over $175 million in research and development into our purpose-built platform for family safety and location sharing. Our unique technology spans a wide range of services, from emergency assistance to identity theft protection to phone insurance, applicable for every member of the family from child to grandparent. We are continually expanding our platform for our families. We believe our acquisitions of Tile and Jiobit will drive further growth and conversion by improving the overall user experience. Our combination of services brings together software and finding capabilities for people, pets and things in a unified platform. |

3

Table of Contents

| • | System- and Device-Agnostic, with Operating System (OS) Neutrality and Interoperability. The Life360 suite of offerings is system- and device-agnostic, offering a unique cross-platform competitive advantage, especially in Android-heavy locales. Our products and services work seamlessly for families, regardless of the different platforms and devices that each family member may elect to use. We believe we will continue to benefit from the increasing proliferation of connected devices with our interoperable approach. |

| • | Scalable Business Model Driven by Recurring Revenue. We believe that we have a highly scalable business model that maximizes our revenues and minimizes our costs. The recurring nature of our subscription business coupled with strong Paying Circle retention provides significant near-term revenue visibility, while our unpaid member base serves as a highly efficient subscriber acquisition funnel. |

| • | Founder-Led, Seasoned Management Team. Life360’s leadership team is composed of highly experienced executives, with a proven track record of scaling consumer technology and subscription businesses, led by our co-founder and Chief Executive Officer, Chris Hulls. We are aligned and focused on our opportunity to build the most trusted brand in technology for families. |

Our Growth Strategies

We intend to pursue the following growth strategies:

| • | Grow Members in New and Existing Markets. Life360 has both a strong foothold in the United States, where we estimated one in 10 families used the Life360 Platform in 2021, and a large and growing international member base. The Life360 app is available for download in over 170 countries through the Apple App Store and more than 130 countries through the Google Play Store as of March 31, 2022. Our members are our best acquisition engine, and we believe that word-of-mouth referrals will continue to drive strong new member growth for Life360. We plan to drive further market penetration through increased investments in international marketing and brand awareness, member acquisition initiatives, and the provision of new features, such as our free data breach alerts, into these regions. In December 2021, we launched the first non-U.S. full-service membership offering of the Life360 Platform in Canada, with plans to continue this rollout in other markets such as the United Kingdom (the “UK”), Australia and Europe. Our acquisition of Tile, which is system- and device-agnostic and derives 16% of its hardware net revenue from outside the United States for the nine months ended December 31, 2021, has the potential to significantly accelerate our international growth roadmap, especially in Android-heavy locales. |

| • | Improve Conversion from Free Members to Paid Subscriptions. As of March 31, 2022, MAUs in U.S. Paying Circles represented approximately 14% of our approximately 25 million U.S. MAUs, and as of December 31, 2021, MAUs in U.S. Paying Circles represented approximately 14% of our approximately 24 million U.S. MAUs, providing a strong runway for additional paid conversion. We understand the deep impact our services have on the daily lives of our members. On average, our U.S. active users and members who have enabled push notifications engaged with the service over 15 times a day in 2021. Our primary strategy for subscriber conversion is to continue to invest in our product offering, meet the high standards of service that will allow our members to rely on us and deepen our engagement with our member base. |

| • | Increase Monetization of Our Subscriber Base. As our members increase their engagement with our services, we see not only higher conversion to paid subscription but also higher average revenue per member as our members move to higher priced subscription tiers. Beyond our free membership, we offer Premium Memberships, which include Life360 Silver, Life360 Gold and Life360 Platinum. Our recent acquisitions of Tile and Jiobit are intended to enhance the value proposition of the Life360 subscription, creating opportunities for increased upsell. Similarly, Life360’s offering drives increased upsell opportunities for Tile and Jiobit’s premium tiers. See “—Our Products—Tile—Tile Subscription Options” and “—Our Products—Jiobit—Jiobit Subscription Options.” We plan to expand our suite of services beyond location and safety, to meet family needs across the life stage continuum—from children to empty nesters, to elder care. |

4

Table of Contents

| • | Pursue Disciplined Expansion in New Use Cases, Including Entering New Verticals. Product innovation lies at the heart of our platform, and as we continue to leverage our core technologies to offer additional services, expand into more life stages of families and enter new verticals, we will strengthen our value proposition to consumers. We leverage the insights we generate from our platform to further enhance our offering. While we primarily monetize via subscriptions today, we intend to expand into new revenue streams by leveraging the trust we have with our members and the insights we collect about their daily lives. For example, we are developing our lead generation which delivers product offerings from partners to members in contextually relevant ways that do not feel like advertisements. Currently, lead generation at Life360 is limited to displaying auto insurance offers in the Life360 Service after the member has indicated they are interested in receiving such offers by clicking on the advertisement within the app. In the future Life360 may consider offering members more third-party solutions beyond auto insurance through lead generation. |

| • | Assess Strategic Acquisition Opportunities. With our acquisitions of Tile and Jiobit, we plan to leverage our platform to bring additional opportunities to enter new verticals for pets, elder care, and the things that matter most to families. These acquisitions have been successful in accelerating our platform vision, driving growth, and delivering value. We may selectively pursue acquisitions to accelerate our platform opportunity in the future, focusing on areas of differentiation that shore up our scale and competitive advantage. |

Our Opportunity

We believe that our market opportunity is supported by several long-term tailwinds driving demand for the Life360 Service.

Industry Trends in Our Favor

| • | Increased Prevalence of Connected Devices. Today, there is a widespread proliferation of connected devices that allows people to stay “always connected” and manage their daily lives. This trend is further accelerated by generational shifts in digital adoption, with children using digital technologies at earlier ages and people using technology across all stages of life. These connected devices have increased the availability of location-based capabilities and enabled new use cases for consumers, including personal and device tracking. |

| • | Shift Towards Mobile App-Based Experiences. Consumers expect user-friendly, on-demand, mobile-first experiences that provide convenience, functionality, safety, and control. According to Allied Market Research, the global mobile application market is projected to grow from $176 billion in 2021 to $407 billion in 2027 at a CAGR of 18%. |

| • | Broader Adoption and Expectation of Location Sharing. Social media apps have helped drive awareness of location-based services and have led to the normalization of location sharing between users for a wide range of consumer applications, such as communication, social coordination, and travel. Growth in location-based services is expected to be further driven by innovation in areas such as location safety, driving safety, digital safety, and emergency assistance. According to Technavio, the global location-based services market is expected to grow from $30 billion in 2021 to $100 billion by 2025, at a CAGR of 35%. |

| • | Increased Focus on Safety and Coordination Post-COVID. As the world moves through COVID-19, families are resuming their normal daily activities, including children returning to school, increased travel, and out-of-home activities and experiences. We believe families are doing so with an increased focus on enhanced safety. Location sharing and tracking provide a way to enhance safety to protect family members, providing peace of mind and coordination even as members of the family are distributed across different locations and activities. |

| • | Growth in Adoption of Digital Subscription-Based Services. Digital subscription-based services have grown in popularity globally, disrupting nearly every industry from retail to media to hospitality. Consumers are embracing subscription services due to the value, convenience, and personalized experiences enabled by these services. |

5

Table of Contents

Addressable Market

With our location-based technology as an anchor and our holistic approach to create the most trusted family safety brand, we have direct entry points into several large global industries.

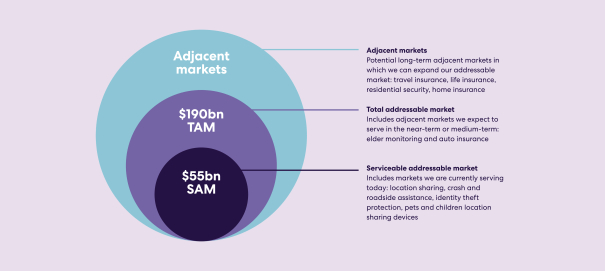

Our current addressable market includes industries we are serving today and in which we are actively growing or investing. We estimate our serviceable addressable market to be $55 billion globally, consisting of verticals in location sharing, crash and roadside assistance, identity theft protection and pets and children location sharing devices, with additional opportunity in item tracking (not currently included in the $55 billion serviceable addressable market):

| • | Location Sharing. Location sharing and associated safety features are a core pillar of our service, providing peace of mind for families through knowing location activity, receiving notifications, coordinating through messaging, and sending emergency alerts. The Life360 Service allows members to access dynamic location data and is part of the estimated $30 billion location-based services market in 2021 that is expected to grow to $100 billion by 2025 at a CAGR of 35%, according to Technavio. |

| • | Item Tracking. Tile is a pioneer in the rapidly growing smart tracker industry. The market has seen strong growth in recent years as customers increasingly rely on this technology for more use cases in their daily lives, such as: finding lost keys; reminding them if they have left for work without their laptop; locating lost luggage; or keeping track of a child’s jacket, among others. At a time when daily life is becoming more hectic, the smart tracker market helps address the everyday pain point of losing or misplacing the things that matter most to families. |

| • | Crash and Roadside Assistance. Life360 Service’s Crash Detection service can sense collisions and deploy emergency response; additionally, we aid with roadside issues, including towing and jumpstarts. According to Technavio, the vehicle roadside assistance market was estimated to be $15 billion globally in 2021 and is expected to grow to $18 billion by 2025 at a CAGR of 6%. |

| • | Identity Theft Protection. Increased credit card, employment, and bank fraud has driven a need for identity theft protection services. According to Magna Intelligence, the identity theft protection market was estimated to be $7 billion in 2021, growing to $21 billion by 2028 at a CAGR of 16%. Life360 developed a platform through which we leverage our aggregated data to offer proactive protection, notify about potential threats, and assist in remediation. |

| • | Pets and Children Location Sharing Devices. Our acquisition of Jiobit adds a new pillar to our business, allowing us to cater to consumers with pets and children five to 10 years old through |

6

Table of Contents

| wearable devices. According to Global Market Insights, the pet wearables market was estimated to be $3 billion in 2021 and expected to grow to $10 billion by 2027 at a CAGR of 22%. |

As part of our growth roadmap, we expect to leverage our core experience to drive growth in adjacent markets, expand our addressable market, and integrate Life360 into all life stages. Our total addressable market consists of adjacent markets which we believe we can reach over the near- to mid-term and present an additional combined $190 billion global market opportunity in auto insurance and elder monitoring, with additional opportunity in family financial services (not currently included in the $190 billion total addressable market):

| • | Auto Insurance. Today, the Life360 Service tracks 10% of all miles driven in the United States, giving us unique insights into driving habits. We believe we can leverage this contextualized driving data and partner with insurance underwriters to offer bespoke plans, disrupting the insurance agent and broker distribution channel in the consumer auto insurance industry. According to Allied Market Research, the personal auto insurance industry for insurance agents and brokers is expected to grow from approximately $187 billion in 2021 to $267 billion in 2027 at a CAGR of 6%. |

| • | Elder Monitoring. The elder monitoring market includes a range of wearables, smart home technology and other monitoring devices that provide location and health tracking, incident alerts and other communication services for elderly users, their caregivers and families. We have the opportunity to enter this market because hardware-based elder monitoring devices are used similarly to how Life360 is used today. We may also be able to implement software-based functionality into Life360 that tracks an elder’s activity, such as falls, leaving the home or leaving a geo-fenced area. According to Research and Markets, the mobile personal emergency response systems market was approximately $4 billion in 2021, growing to $6 billion by 2027 at a CAGR of 8%. |

| • | Family Financial Services. As we continue to deliver on a complete suite of family membership services, we can leverage the trust we have built with families to offer unique services for children and teenagers. With our core location platform and insights about families, we believe we can drive innovation in this rapidly expanding industry by building partnerships with the leading players in the space. |

Our Value Proposition to Consumers

Our platform provides the following key benefits to family members at all family life stages:

| • | Secure Location Sharing and Coordination. Location sharing and coordination underpin our platform, providing security and peace of mind to Life360 Service members. Using our location platform and location-based insights as a foundation, we expect to continue building innovative safety services and adding value to consumers in adjacent areas built upon location and safety. |

| • | Comprehensive Platform for Safety. Life360 provides a suite of services that span every life stage of the family. |

| • | People, Pets, and Things. We provide the full breadth of location-based offerings for people, pets, and things in a single solution set. We believe this combined offering is a key differentiator for us, enabling us to cover all life stages and use cases for our member base. |

| • | Physical, Digital, and Driving Safety. The Life360 Platform combines key safety solutions and incorporates them into a single membership within a single mobile app. We started with a focus on physical family safety and have recently expanded into digital family safety to help families as they face digital safety challenges. Life360 Platform subscribers get access to trained third-party emergency response operators who can offer real-time help 24/7 in situations that range from minor annoyances such as getting a flat tire and everyday challenges such as basic medical advice, to critical emergencies such as car accidents and stalking. |

| • | Ease of Use. We designed our platform for broad adoption across individuals and families. We have focused on a well-designed member experience that provides peace of mind with intuitive, frictionless |

7

Table of Contents

| tools for members. The simplicity and ease of adopting our products create a seamless, worry-free experience for members. |

| • | Leading Innovation. Life360 is focused on continuously developing new features and expanding our offerings to drive value for our members. Our long-term vision expands Life360 into a hub where families discover, access and buy a broader set of services related to safety. To date, we have expanded from location sharing to a wide range of adjacent services, such as driver safety, identity theft protection, and disaster and travel assistance, among many others. We expect to continue leveraging our insights on member needs to continue expanding our offering into new industries, such as insurance and elder monitoring. Tile also focuses on continuous innovation. For example, Tile offers an industry-first “Item Reimbursement” service, providing reimbursement for a lost item if Tile is unable to locate the item. Tile also designs numerous form factors to ensure there is a device for every use case. |

| • | Large and Engaged Member Base Driving Value Creation. The scale and high engagement of our member base drives powerful network effects, attracting more members to our platform. Our scale gives confidence in our solutions and enables us to derive critical insights on member habits, needs and preferences to further enhance our product offerings and improve the member experience. This ability to leverage data through scale results in a continuous cycle of value creation. |

| • | Flexibility and Interoperability. Our system- and device-agnostic approach enables OS interoperability, making it seamless for members to stay connected across operating systems and devices. Life360 gives families the choice and flexibility to use the options that work best for their family; each family member can select the right device and be a part of Life360. |

| • | Bundled Membership Provides Compelling Value to Consumers. Life360’s bundled membership provides a cost-effective solution at a fraction of the cost for consumers compared to incumbents in the safety, security, and insurance industries. Most of our features are software-based, with the advantage of very low setup and support costs, making the marginal cost of onboarding incremental new members very low. For example, Life360 Platinum offers roadside assistance, nurse help line, stolen phone reimbursement, crash detection, location sharing, and more, at less than one-tenth the cost of the same package purchased piecemeal from competitors. |

| • | Partner Ecosystem Enhancing Platform Functionality. Our scale has allowed us to build unique partnerships that expand the value and reach of our offering. Tile devices are embedded in products with over 30 partners, such as Bose, HP, Skullcandy, and Dell. This network of partners helps broaden our location sharing functionality and allows members to benefit from Life360’s technology across the devices and use cases that best fit their lifestyle. |

Our Products

Life360

Life360 provides a one-stop solution for family safety and location sharing through the Life360 Platform’s vertically-integrated mobile app and our Tile and Jiobit location sharing devices. Although presently the Life360, Tile and Jiobit platforms are not yet integrated, we plan to integrate them before the end of 2022.

Life360 Platform

We currently offer four key product features that combined make up the Life360 Platform: (i) location coordination and safety, (ii) driving safety, (iii) digital safety, and (iv) emergency assistance. Each of these features keeps members connected to the important people in their lives by organizing them into Circles. A member selects who to invite to their Circle and what information a Circle receives. Any individual invited to a Circle must accept the invitation on their own device by installing the Life360 mobile app, creating an account, and giving permission for others to locate them by joining the Circle. Members of a Circle will receive information about other members in their Circle consistent with the services available based on their subscription plan and what a member chooses to share with their Circle.

8

Table of Contents

Our location coordination and safety features include real-time location, location history and smart notifications such as location-specific alerts, driving alerts, crash alerts and crime reports. The Life360 Platform provides members with a custom map that shows the real-time location of the members in their Circles and additional context around their location data, such as street address and battery level. The device location data and information members elect to share with the platform enable us to efficiently capture accurate, real-time location data while the app is running in the background, which ensures that the member’s map is always up to date and visible to other members of their Circle, even if the member does not open the app. Members have the option to disable location sharing at any time for a specific Circle and to customize location sharing through a feature called “bubbles,” which only shares approximate location with Circle members while all safety and messaging features remain on. Additionally, our location history feature enables members to see the location history for each member in their Circle for the past two to 30 days based on their subscription plan. Parents can retrace their family members’ steps to get an ongoing timeline of their family’s past trips. Smart notifications, such as place alerts, drive alerts and crime reports, allow members across a Circle to coordinate when and where they arrive without having to send a single text. Place alerts automatically alert members when a Circle member enters or leaves a location designated by a Circle member. The Life360 Platform also provides crime alerts when crimes occur near members in order to promote greater safety and facilitate smarter decisions.

Our driving safety features include crash detection, roadside assistance, family driving summaries and individual driver reports. Our crash detection feature senses any collision that occurs at a speed over 25 miles per hour and immediately alerts the member’s Circle and emergency contacts if the member does not respond to the crash detection’s initial outreach. Outside of crash detection, we offer 24/7 roadside assistance to help with jumpstarts, towing, lockouts, refueling and other needs. During a drive, the Life360 Platform analyzes phone location and movement activity to determine potentially unsafe driving behaviors such as high speed, hard braking and rapid acceleration. When a member enables the Drive Detection feature, other members of the driver’s Circle are able to view a summary of each drive that is at least half a mile long and hits a speed over 15 miles per hour. Our family driving summary provides members with weekly snapshots of a Circle’s driving insights including top speed, phone usage, high speed, rapid acceleration and hard braking.

Our digital safety features include data breach alerts, identity theft protection, stolen funds reimbursement and credit monitoring. Data breach alerts attempt to identify theft by notifying the Circle if a Circle member’s

9

Table of Contents

data is stolen and found on the dark web. If identity theft occurs, specialists are available to assist Life360 Gold and Life360 Platinum members with gathering information, restoring the member’s identity and completing the necessary paperwork. Our third-party partner provides Life360 Gold members with stolen funds reimbursement of up to $25,000 for costs associated with out-of-pocket expenses related to identity theft and, for Life360 Platinum members, stolen funds reimbursement of up to $1,000,000 for costs associated with out-of-pocket expenses related to identity theft. Life360 Platinum members also receive third-party credit monitoring which notifies Life360 Platinum members if new accounts are opened in their name or if there is a change in their credit report.

Our emergency assistance features include SOS with emergency dispatch, disaster response, medical assistance and travel support. We offer SOS alerts with emergency dispatch that send alerts to a member’s Circle and request an ambulance in the event Life360 detects a car crash. We expand on these services for our Life360 Platinum members with disaster response that provides access to trained third-party agents who can provide assistance in the following cases: evacuation support in the event of natural disasters, active shooter events, emergency evacuation due to political or military events and other emergency situations including real-time information and expert resources about infectious disease outbreaks. We also provide medical assistance features, through a third-party partner, to Life360 Platinum members, including an on-call 24/7 nurse hotline, medical advice, and referrals for pharmacies and specialists. The travel support feature equips Life360 Platinum members with assistance with the following: emergency travel arrangements, lost or stolen travel documents, lost luggage, access to a translator, interpreter referrals and pre-trip planning such as assistance with visa, passport and inoculation requirements.

Life360 Subscription Options

The Life360 app is available for download in more than 170 countries through the Apple App Store and more than 130 countries through the Google Play Store as of March 31, 2022. We operate under a freemium model in which the Life360 Platform is available at no charge and includes a number of safety features for the everyday family. Beyond our free membership, we offer a comprehensive suite of premium safety services through Premium Memberships, which include Life360 Silver, Life360 Gold and Life360 Platinum. Pricing for

10

Table of Contents

the Premium Memberships of the Life360 Platform currently ranges from $4.99 to $19.99 per month depending on the chosen subscription option.

Premium Memberships are available in the United States and Canada. Outside of these two markets, Life360 offers the free membership and a single paid membership option (“Life360 Premium”), which is priced at $4.99 per month in local currency equivalent and offers unlimited place alerts, 30-day location history and individual driver reports.

Tile

As of March 31, 2022, Tile was the leading cross-platform brand in finding things based on market share of the item tracker market. We acquired Tile in January 2022 to create a comprehensive cross-platform solution that enables location-based tracking of people, pets and things.

Tile Product Line

Tile’s platform helps people find the things that matter the most to them, locating millions of unique items every day. Tile’s products come in various shapes, sizes and price points for different use cases. We expect that Tile’s network will become more robust when it leverages the Life360 member base to broaden its Tile network, generating even higher confidence that we can locate lost devices of Tile customers. Tile devices are sold through retail channels such as Best Buy, Target and Amazon as well as directly via Tile.com. Single Tile devices have a range of U.S. manufacturer’s suggested retail prices from $19.99 to $34.99 with additional bundles at higher price points. Tile devices are available in 50 countries at locally relevant prices.

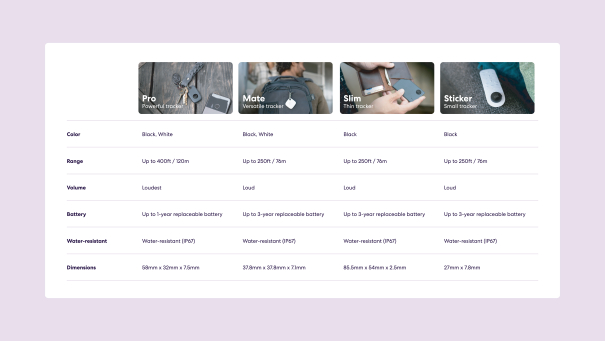

We offer Tile in a range of form factors, designed to offer flexibility for different use cases. The Tile product line includes Pro, Mate, Slim and Sticker. The Tile Pro is our most powerful tracker with a range of up to 400 feet and offers a replaceable battery with a lifespan of up to one year. The Tile Mate is our most versatile tracker with a range of up to 250 feet and offers a non-replaceable battery with a lifespan of up to three years. The Tile Slim is our thinnest tracker that can fit inside a wallet, has a range of up to 250 feet, and offers a non-replaceable battery with a lifespan of up to three years. The Tile Sticker is a small tracker with an adhesive backing that can be attached to other devices. The Tile Sticker has a range of up to 250 feet and offers a non-replaceable battery with a lifespan of up to three years.

11

Table of Contents

Tile Subscription Options

Tile offers a free service as well as two paid subscription options: Premium and Premium Protect. The Premium subscription offers smart alerts to proactively notify a member who has left Tile devices behind, free battery replacements for Tile devices with replaceable batteries, a warranty for Tile devices with defects or accidental damage, unlimited location sharing, location history for the past 30 days and access to Tile’s Premium customer care team. Premium is available for $2.99 per month or $29.99 per year. Premium Protect offers all the benefits of Premium, plus up to $1,000 item reimbursement per year and is available for $99.99 per year.

12

Table of Contents

Tile Partner Network

Tile works with over 30 partners, including Bose, HP, Skullcandy, and Dell and is embedded in over 50 partner products across audio, travel, wearables and personal computer categories.

Jiobit

Jiobit is a leading platform-agnostic wearable location device for young children, pets and seniors. Jiobit has developed and patented a new way to resolve location based on Bluetooth, Wi-Fi, and multiple GPS systems. We acquired Jiobit in September 2021 to create a comprehensive cross-platform solution.

Jiobit Product Line

Currently, Jiobit is offered exclusively in the United States. Customers purchase a Jiobit device at the current U.S. manufacturer’s suggested retail price of $129.99 and a monthly subscription to access Jiobit location tracking services. The Jiobit device is built on a 5G-compatible, low-power network that is faster and more available in rural and previously low-coverage and dead-zone areas. Jiobit technology uses a combination of GPS, cellular, Wi-Fi and Bluetooth to ensure the device is always connected. The device comes with a rechargeable battery that can last a full week between charges for elder and children location sharing, and up to 20 days for use on pets. The device has a modular design to allow for multiple wearing options with a focus on discretion and secure attachment, weighing less than an AA battery and being smaller than a tea bag in size. The device is both slip and water resistant. Additional accessories and attachment options are available to meet specific member needs.

13

Table of Contents

Jiobit Subscription Options

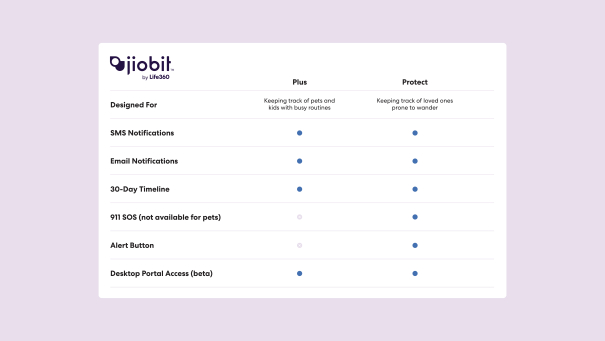

The Jiobit device requires a monthly subscription plan to stay connected to the Jiobit services. Subscription prices vary based on the duration of the contract and range from $8.99 per month with a two-year commitment to $14.99 per month with no commitment. Each monthly contract can be upgraded with a premium subscription add-on—Jiobit Plus and Jiobit Protect. The Plus subscription add-on offers (i) a 30-day timeline feature that stores 30 days of location history, SMS and email notifications in addition to push notifications and (ii) access to the Jiobit desktop portal to provide greater access to all Jiobit features and devices. The Protect subscription add-on offers all of the Plus subscription features and also includes (i) SOS notifications for emergency response to the location of a Jiobit device and (ii) alert button notifications which allow the device wearer to send help alerts to the Jiobit app. Each premium subscription add-on is available for $6.00 per month or $8.00 per month for Plus and Protect, respectively, which is in addition to a subscriber’s monthly subscription for a total monthly contract price of between $16.99 and $20.99 with add-ons.

Our Jiobit offering will be rebranded and integrated into our Tile operations to support our comprehensive cross-platform solution that enables location-based tracking of people, pets and things.

14

Table of Contents

Our Technology Platform

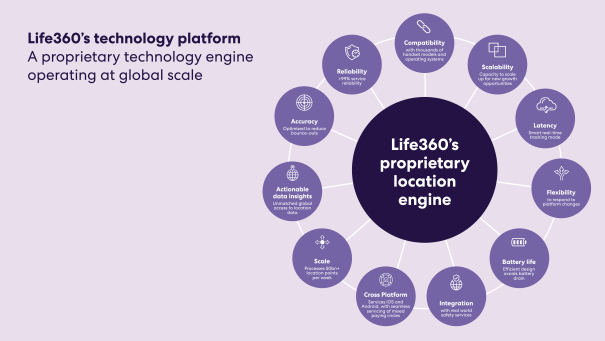

To help families stay connected and safe we have developed a scalable mobile-first technology platform that supports our business while protecting our operational integrity, security and performance. Technology is at the core of everything we do. We continuously invest in innovation and the integration of new features to drive our competitive advantage, and today, approximately 60% of our employees work in research and development. With over a decade of industry knowledge, we have built a strong advantage around our key technology tenets: accuracy, timeliness and battery life.

Highlights of our technology platform include a robust location engine design, scalable and modern technology infrastructure, seamless third-party integration, reliable service and shared infrastructure across products and services.

Location Engine Design

Our location engine is at the core of the Life360 Platform. We have designed an end-to-end location technology solution that allows us to deliver real-time location-based experiences and includes functionality such as storage, processing and communication of events, locations, drives, maps, places, networking and visualization of device characteristics for people, pets and things. Our refined location engine provides high accuracy, increased consistency, low latency and long battery life. The Life360 Platform collects raw sensor data from all available sensors on a member’s phone, including GPS, Wi-Fi, accelerometer, gyroscope and magnetometer and Bluetooth in various configurations, to optimize for reliability, accuracy, latency and power consumption. These optimizations are available for all of our major hardware platforms as well as the corresponding smartphone apps. Combined with our scalable backend architecture, this enables us to process billions of location-related activities daily from millions of devices worldwide and continuously improve our member services. The collected data is processed by our internal software to filter out low accuracy points and signals and is further clustered for use in our features and stored to provide long-term insights to each member.

15

Table of Contents

Scalable and Modern Technology Infrastructure

We maintain a scalable, modern technology infrastructure which allows us to focus on running and scaling our Life360 Platform rather than building our own infrastructure. We primarily utilize Amazon Web Services (“AWS”) for our backend platform and infrastructure to connect to our apps and custom hardware devices. We additionally use the Google Cloud Platform (“GCP”) for some of our functionality. Using these services grants us access to a highly distributed, scalable, reliable and secure architecture for global delivery.

Third-Party Integration

To extend the features and functionality of our platform, we integrate third-party software into our products where applicable. We provide members with various safety and support services provided by third-party partners including: 24/7 emergency dispatch, roadside assistance, identity theft protection, medical and travel triage and planning assistance which includes disaster response services, security transportation services, medical assistance services, emergency travel support, travel assistance services and parental verification consent mechanisms.

Our platform seamlessly integrates with our partnership offerings with several Software-as-a-Service vendors. This enhances our offerings with capabilities and features such as contextual auto insurance ads, identity theft protection, data breach alerts, and voice service integrations. These integrations are done through a collection of application programming interfaces (“APIs”) and are weaved into seamless experiences for customers. These APIs can be further extended to other third-party services for map overlays, insurance and automotive use cases through services such as notifications and account linking based on the product roadmap and market requirements. To ensure greater service reliability, we use a third-party information technology security and analytics firm to perform penetration testing services, simulate attacks on our networks, apps, devices and members, and identify the security level of our key systems and infrastructure. Additionally, we have testing and monitoring processes for software and infrastructure changes with structured releases of updates and containment barriers to enhance the quality of the Life360 Platform.

Our newly acquired Tile product line will be able to share and take advantage of our extensive infrastructure to enhance its own offering once the initial integration is complete. Tile will leverage the established Life360 infrastructure by connecting its devices to the Life360 Platform, leading to increased reliability and accuracy. This integration will allow members and Circles to keep track of their things and connect with each other through one seamless Life360 Platform.

Competition

Life360 is the market-leading safety platform, according to market share of the family safety and location sharing app market based on revenue, to locate the people, pets and things that matter most to families. See “Market and Industry Data” for more information on how we calculate market share. We were a pioneer in location sharing and have expanded our offerings to provide a comprehensive suite of safety services, delivered through a mobile-native, subscription-based offering.

Our competitors include both large competitors with various product and service offerings and smaller competitors, including (i) direct competitors with location sharing products that target family safety, (ii) competitors providing location sharing platforms that are not focused on family safety, (iii) competitors in the item tracking technology market and (iv) competitors that have, or may in the future have, overlapping offerings (for example, companies in industries related to roadside assistance and crash detection, identity theft protection, phone insurance and travel, disaster and medical assistance).

While our industry is becoming increasingly competitive both domestically and abroad, we believe that we will continue to compete successfully due to our leading market position, superior value proposition, brand recognition, ability to leverage our member base, our comprehensive suite of offerings and economies of scale. In addition, our data-driven insights on families’ habits, needs and preferences enable us to continuously enhance our product offerings and improve the member experience, reinforcing our competitive differentiation.

16

Table of Contents

We believe that our competitive position depends primarily on the following factors:

| • | our ability to continue to increase social and technological acceptance and adoption of location sharing and tracking products and digital subscription services; |

| • | continued growth in internet access and smartphone adoption in certain regions of the world, particularly emerging markets; |

| • | our ability to increase our organic growth through word-of-mouth; |

| • | our ability to maintain the value and reputation of our brands; |

| • | the scale, growth and engagement of our member community relative to those of our competitors; |

| • | our ability to introduce new, and improve on existing, features, products and services in response to competition, member sentiment, online, market and industry trends, the ever-evolving technological landscape and the ever-changing regulatory landscape; and |

| • | our ability to continue developing new monetization features and improving on existing features. |

Go-to-Market Strategy

Life360’s member base has historically grown primarily organically through word-of-mouth referral and virality from our Circle-based model. We continue to make investments in our go-to-market strategies to supplement our organic growth model and to enhance our service offerings to existing and new members. Key elements of our strategy include:

| • | Brand Marketing. We drive awareness of the Life360 Service via brand marketing, PR and organic social media efforts focused primarily on families with children ages 11 to 22. We reach our target audience via online and offline campaigns that drive press coverage, social sharing and more word-of-mouth. We primarily focus on high-reach channels like streaming TV, online video, Facebook, TikTok and online search. We recently invested in a brand refresh, allowing us to expand from location sharing, to add key dimensions of safety and family, such as crash detection, emergency response and identity theft protection. We believe that our products and services enable families to live life fully while staying connected and protected. In 2021, we created the Family Advisory Council to bring together well-known celebrities and influencers to help shape Life360’s future product direction and marketing. |

| • | Freemium Model. We invest heavily in the free member experience. Our Life360 Platform operates under a freemium model in which our app is available to members at no charge, while Premium Memberships with additional features are available via paid subscriptions. This model has allowed us to scale to over 38 million MAUs on the Life360 Platform as of March 31, 2022. The Life360 app is available for download in more than 170 countries through the Apple App Store and more than 130 countries through the Google Play Store as of March 31, 2022, creating a massive base of members who help to provide word-of-mouth referrals and drive virality for our product. This viral model of members joining our freemium offering and introducing and inviting new members lowers our customer acquisition costs. Further, the data and insights generated by our large member base enable us to drive targeted product enhancements that strengthen our competitive advantage. |

| • | Paid Acquisition. We complement and accelerate our organic member acquisition with strategic and targeted paid marketing spend. Our paid acquisition strategy is focused on targeting high quality member segments via streaming TV, mobile, paid social, and paid search marketing. We continue to test into and launch new and creative marketing channels to further scale spend and drive efficiencies. We use our paid acquisition on a limited basis and are not reliant on it for our member growth. Additionally, our paid marketing also leads to organic growth, due to the viral nature of our product. |

| • | Geographic Expansion. In markets where our organic awareness is relatively low and opportunity for growth is strong, we plan to hire experienced local marketing managers and engage in localized social |

17

Table of Contents

| media and influencer-led campaigns, app store optimization, and paid advertising to generate interest in our products and drive new member growth. With the membership model now operating successfully in the U.S. market, we are looking to drive international expansion. The Life360 app is available for download in over 170 countries through the Apple App store and over 130 countries through the Google Play Store and the Life360 app is available in 14 languages as of March 31, 2022. In December 2021, we launched the first full-service membership offering of the Life360 Platform outside of the United States in Canada with stated plans to continue this rollout in other markets such as the UK, Australia and Europe. |

Employees and Culture

Life360’s core values are designed to create a culture that supports our vision of an ambitious, professionally driven organization that can simplify safety so families can live fully:

| • | Think Long-Term. We make strategic decisions focused on the long-term growth of our company and employees. |

| • | Take Ownership. We focus on outcomes over output and look for high-agency people that make things happen. |

| • | Quality and Craftsmanship. We train our employees with a focus on quality and on doing things the right way. Lives depend on it. |

| • | Communicate Directly. We resist the urge to avoid discomfort and intentionally lean into tough conversations. |

| • | Be a Good Person. We foster an environment that promotes respect for one another and maintain a high sense of integrity. |

As of March 31, 2022, we had approximately 400 full-time employees, the majority of whom have the flexibility to work remotely or out of our San Francisco, San Diego, San Mateo and Chicago offices. Life360 aims to provide a work environment in which all its people can excel regardless of race, religion, age, disability, gender, sexual preference or marital status. The company’s Diversity Policy reflects a strong commitment to diversity, and a recognition of the value of attracting people with different backgrounds, knowledge, experience and abilities. We believe that diversity contributes to our business success, and benefits all of our stakeholders. As of March 31, 2022, approximately 36% of Life360 employees were female and 52% were people of color. We are committed to implementing further initiatives to increase the diversity of our workforce.

We view the quality of our products and services as our key long-term strategic differentiator, and as such, we are committed to providing continuous learning and development opportunities for our people. We provide peer training, including our standing Thursday “deep-dives” where our people can learn from the expertise of their colleagues. We also provide full day and full week-long courses in “best practices” and broad and specialist business training to further promote personal and professional growth.

18

Table of Contents

Environmental, Social and Corporate Governance

During 2021, we progressed our environmental, social and governance (“ESG”) initiatives, including the development of an ESG Policy to reflect our commitments to the communities we serve. We advanced our environmental commitments by achieving carbon neutrality across Scope 1, 2 and 3 emissions (as defined below) for 2020. Our core mission is the social good of simplifying safety for families through ESG initiatives based on four key areas: people, environment, community and governance.

People

We believe that different ideas, perspectives and backgrounds create a stronger and more creative work environment that delivers better results. Together, we continue to build an inclusive culture that encourages, supports, and celebrates the diverse voices of our employees. This fuels our innovation and connects us closer to our customers and the communities we serve. We strive to create a workplace that reflects the communities we serve and where everyone feels empowered to bring their authentic best selves to work. Our workplace culture is supported by a range of policies adopted by our Board that reflect our beliefs, including a Diversity Policy, Anti-Bribery and Corruption Policy, Whistleblowing Policy and Modern Slavery Statement.

Environment

We recognize that climate change will have an increasingly significant impact on all aspects of society. In 2021 we committed to quantifying the environmental footprint of our business operations by measuring the following emissions: direct greenhouse emissions that occur from sources that are controlled or owned by us (“Scope 1 emissions”), indirect greenhouse emissions associated with the purchase of electricity, steam, heat or cooling (“Scope 2 emissions”) and results of activities from assets not owned or controlled by us, but that indirectly impact in our value chain (“Scope 3 emissions”). By quantifying our impact, we will be able to implement an emission reduction plan that targets the greatest contributors to our carbon footprint.