Exhibit 99.1

July 2015 Ascend Telecom Holdings Limited ROI Acquisition Corp. II Investor Presentation

1 Disclaimer In connection with the proposed business combination, Ascend Telecom Holdings Limited (“Ascend Holdings”) intends to file a Registration Statement on Form F - 4 (the “Registration Statement”) with the United States Securities and Exchange Commission (“SEC”) which will include the related preliminary proxy statement/prospectus, that is both the proxy sta tem ent to be distributed to holders of ROI’s common stock and public warrants in connection with the solicitation by ROI of proxies for the vote by the stockholders on the transaction and the vote by the warrantholders on the proposed amendment to the warrant agreement, as well as the prospectus covering the registration of the proposed issuance of ordinary shares to be issued in the transaction. ROI will mail a definitive

proxy statement/prospectus a nd other relevant documents to its stockholders and warrantholders . ROI’s stockholders and warrantholders and other interested persons are advised to read, when filed and publicly available, the preliminary proxy statement/prospectus i ncl uded in the Registration Statement, and amendments thereto, and the definitive proxy statement/prospectus because the proxy statement/prospectus will contain important information about Ascend Telecom Infrastructure Private Limited (“ Ascend”), ROI, the proposed transaction and the proposed warrant agreement amendment. The definitive proxy statement/prospectus will be mailed to stockholders and warrantholders of ROI as of a record date to be established for voting on the transaction and the warrant agreement amendment. Stockholders an d warrantholders will also be able to obtain copies of the Registration Statement which includes the proxy statement/prospectus, without charg e, once publicly filed and available, at the SEC's Internet site at http://www.sec.gov or by directing a request to: ROI Acquisition Corp. II, 601 Lexington Avenue, 51st Floor, New York, New York 10022, tel. (212) 825 - 0400, Attention: Joseph A. De Perio. This presentation includes "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Pr iva te Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as "anticipate", "believe", "expect", "estimate", "plan", "outlook", and "project" and other similar expressions t hat predict or indicate future events or trends or that are not statements of historical matters and includes statements regarding future financial and operating performance. Such forward looking statements include statements with respect to fina nci al and operating performance, strategies, prospects and other aspects of the businesses of ROI, Ascend and the combined company after completion of the proposed business combination, and are based on current expectations that are su bje ct to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the oc cur rence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (2) the outcome of any legal proceedings that may

be instituted against ROI, Ascend or others following announceme nt of the merger agreement and transactions contemplated therein; (3) the inability to complete the transactions contemplated by the merger agreement due to the failure to obtain approval of the stockholders of ROI or other c ond itions to closing in the merger agreement; (4) the ability to meet Nasdaq’s listing standards following the merger; (5) the risk that the proposed transaction disrupts current plans and operations as a result of the announcement and con summation of the transactions described herein; (6) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with suppliers and obtain adequate supply of products and retain its management and key employees; (7) costs related to the proposed business combination; (8) changes in app licable laws or regulations; (9) the possibility that Ascend may be adversely affected by other economic, business, and/or competitive factors; and (10) other risks and uncertainties indicated in the Registration Statement, includi ng those under “Risk Factors” therein, and other filings with the SEC by ROI. You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and ROI and Ascend undertake no obligation t o update or revise the forward - looking statements, whether as a result of new information, future events or otherwise. Non - IFRS Financial Measures. This press release also includes forecasted 2016 and reported 2015, 2014 and 2013 EBITDA of Ascend Holdings, which are non - IFRS financial measures. EBITDA is calculated as earnings before interest and taxes plus depreciation and amortization. Ascend’s management uses these non - IFRS measures to compare the Company’s performance to that of prior periods for trend analyses, for p urposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial reports prepared for mana gem ent and Ascend Holdings’ board of directors. Ascend believes that the use of these non - IFRS financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing th e Company’s financial measures with other telecom infrastructure companies, many of which present similar non - IFRS financial measures to investors. Management of Ascend does not consider these non - IFRS measures in isolation or as an a lternative to financial measures determined in accordance with IFRS. The principal limitation of these non - IFRS financial measures is that they exclude significant expenses and income that are required by IFRS to be recorded in the Ascend Holdings’ financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non - IFRS finan cial measures. In order to compensate for these limitations, management presents non - IFRS financial measures in connection with IFRS results. You should review the financial statements and other financial information of Ascen d Holdings’ in the proxy statement / prospectus included in the Registration Statement and not rely on any single financial measure to evaluate Ascend’s business. Please refer to the Appendix for a reconciliation of these non - IFRS financial measures to the most directly comparable IFRS financial measures. Market & Industry Data. The market and industry data contained in this presentation are based on Ascend’s own estimates, internal research, surveys and studies conducted by third parties and industry and general publications and, i n each case, are believed by Ascend’s management to be reasonable estimates. This data is subject to change and cannot always be verified with complete certainty d ue to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market or ind ustry data. As a result, we do not guarantee the accuracy and completeness of this data. Disclaimer . This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall t her e be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be m ade except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Solicitation. ROI and its directors and officers may be deemed participants in the solicitation of proxie s t o ROI’s stockholders with respect to the transaction and ROI’s public unitholders in connection with the proposed amendment to the warrant agreement. A list of the names of those directors and officers and a description of their interests in ROI is contained in ROI’s prospec tus dated September 16, 2013, which was filed with the SEC on September 18, 2013, and will also be contained in the definitive proxy statement/prospectus for the proposed business combination when available. Exchange rate used throughout presentation: 1US$ = INR 63.3 as of 7/10/15. Source: Federal Reserve Statistical Release, Board of Gover nor s of the Federal Reserve System. Historical Financial Information. In this presentation, historical revenue figures were derived from the unaudited Combined Financial Statements of Ascend Telecom Holdings Limited P red ecessor (the “Holdings Financials”), which have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting St andards Board (IASB). The unaudited Holdings Financials should be reviewed together with the audited Holdings Financials to be included in the proxy statement/prospectus included in the Registration Statement.

2 Ascend Management and Board Presenters Vivek Sett Ascend Holdings, Director , Chairman of Finance Committee for the Board Responsible for advising NSR on its investment in Ascend since 2007 Experience includes: ˗ Tata Teleservices, Tata Realty and Infrastructure, CFO ˗ Hughes Telecom, CEO – Acquired by the Tata Group in 2004 ˗ Ispat Industries – Senior Officer, Member of the Board Sanjeev Chachondia NSR India, Operating Partner NSR India Operating Partner since 2009, focused on investments in the telecom sector including the merger of ITIL into Ascend Experience includes: ˗ Loop Mobile India Limited (formerly BPL Mobile Communications Limited), Director & CEO ˗ Essar Telecom Infrastructure Pvt. Ltd., COO (company acquired by American Tower Corporation) ˗ Tata Teleserv

ices, Vice President – Strategy & Corporate Planning ˗ Indian Railway Service, Signal and Telecom Officer Sushil Kumar Chaturvedi Ascend, CEO CEO of Ascend since 2012 Experience includes: ˗ ORG Informatics, Group CEO – Managed Telecom/Satellite Communications business in India/Belgium/Southeast Asia. Awarded President's Medal for distinguished services in Telecom, Awarded Deloitte & Touche “CEO of the Year” for fastest growing company in Asia Pacific – 2008 ˗ GDSS Inc. USA, Vice President – Pioneered and deployed Triple Play services across Africa and Southeast Asia ˗ ITU/TCIL, Telecom Expert – Responsible for Telecom development of Southern African Development Countries (SADC) ˗ Bharat Sanchar Nigam Limited (BSNL), Director ˗ Indian Telecom Services, Government of India (ITS ), Group A, Senior Officer Ascend Telecom Infrastructure Private Limited (“Ascend”) New Silk Route Advisors Private Limited (“NSR India”) ROI Acquisition Corp. II (“ROI”) Thomas J. Baldwin Chairman and CEO, ROI Acquisition Corp. II Experience includes: ˗ Morton’s Restaurant Group (NYSE: MRT ), Chairman , Chief Executive Officer and President ˗ Kraft General Foods, various financial management roles Current Director: Zoe's Kitchen, Inc. (NYSE : ZOES ), Bravo Brio (NASDAQ: BBRG ) and Benihana

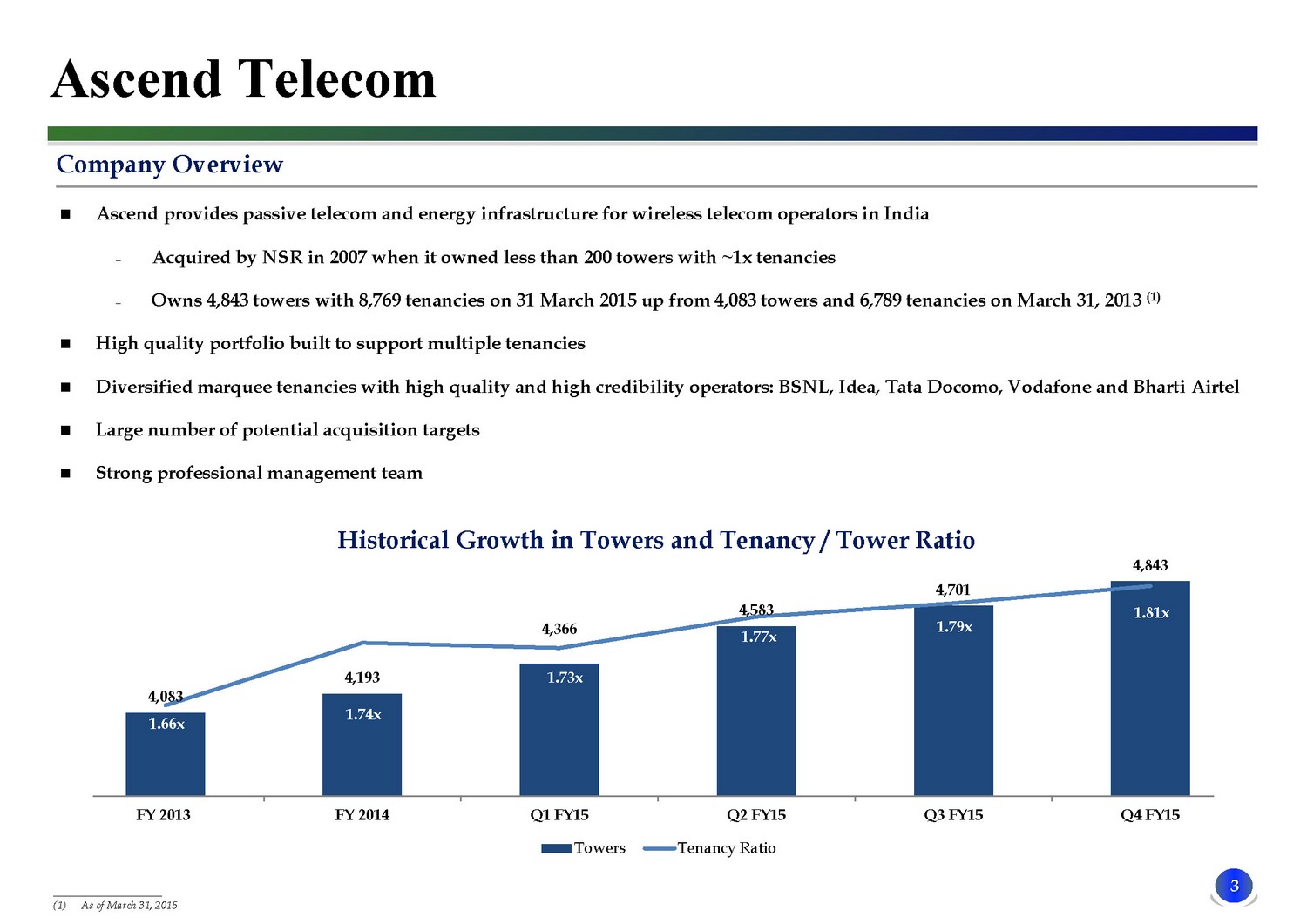

3 Company Overview Ascend provides passive telecom and energy infrastructure for wireless telecom operators in India ˗ Acquired by NSR in 2007 when it owned less than 200 towers with ~1x tenancies ˗ Owns 4,843 towers with 8,769 tenancies on 31 March 2015 up from 4,083 towers and 6,789 tenancies on March 31, 2013 (1) High quality portfolio built to support multiple tenancies Diversified marquee tenancies with high quality and high credibility operators: BSNL, Idea, Tata Docomo , Vodafone and Bharti Airtel Large number of potential acquisition targets Strong professional management team ____________________ (1) As of March 31, 2015 Historical Growth in Towers and Tenancy / Tower Ratio Ascend Telecom 4,083 4,193 4,366 4,583 4,701 4,843 1.66x 1.74x 1.73x 1.77x 1.79x 1.81x 1.55 1

.6 1.65 1.7 1.75 1.8 1.85 3600 3800 4000 4200 4400 4600 4800 5000 FY 2013 FY 2014 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Towers Tenancy Ratio

4 __________________ (1) Circles defined by Telecom Regulatory Authority of India. Circle A includes: Andhra Pradesh, Gujarat, Karnataka, Maharashtra, Tamil Nadu. Circle B includes: Haryana, Kerala, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh (East and West ), West Bengal. Tower concentration and age data as of % of tenancies as of March 31, 2015 (2) % of tenancies as of March 31, 2015 (3)

Bharti Infratel 2014 annual report; Opex includes tower rentals, repairs and maintenance charges and employee expenses; based on average # of towers for the year ende d FY15; For Ascend, Opex based on fiscal year ended 3/31/15 results. Exchange rate used: 1US$ = INR 63.3 Consistent historical organic EBITDA growth of over 30% annually, potential for higher growth through acquisitions Independent (no telecom operator is a shareholder in the Company) decision making has resulted in current portfolio of strategically located towers to support multiple tenancies 75% of towers concentrated in A and B Circles (India is divided into total of 22 circles, defined by Telecom Regulatory Authority of India, which are classified into 4 categories: Metro, A, B, and C ) (1) with high growth potential Young portfolio with 83% of towers less than 8 years age (1) High quality diversified tenancies with the most stable and sizeable operators (no single tenant contributes more than 22% of tenancies) (2) Long - term agreements with operators provide visibility of revenues and cash flows Strong business and customer selection One of the lowest operating cost structures in the Industry – Opex per tower per month of $260 vs. ~$350 for listed domestic India competitor (3) Providing energy management, including green initiatives, is a potential profit stream at owned and managed sites (over 30% reduction in diesel consumption in last three years) Potential incremental revenue streams from installation of cooling units, wind chimneys and solar units Highly experienced professional management team with over 225 years of cumulative relevant industry experience Includes experience with Metro PCS, BSNL, Department of Telecom (Govt. of India), Tata Teleservices, Hutchinson, Essar (now Vodafone) Unique opportunity to own a fully operational growth platform led by highly experienced management team Investment Highlights Efficient Energy Management To Improve Tower Returns Proven Track Record of Operational Excellence Professional Management Team with Strong Industry Experience High Growth Independent Tower Company with Strategically Located Towers Visibility of Future Revenues Through Long Term Contracts with Diversified Tenants Growing middle class, along with a significant increase in rural adoption and internet / broadband penetration Reliance Jio Infocomm Limited’s preparations to enter the India market as a new telecom operator with aggressive expansion plans has resulted in strong tower demand, in addition to increased demand from existing telecom operators Attractive Industry Tailwinds

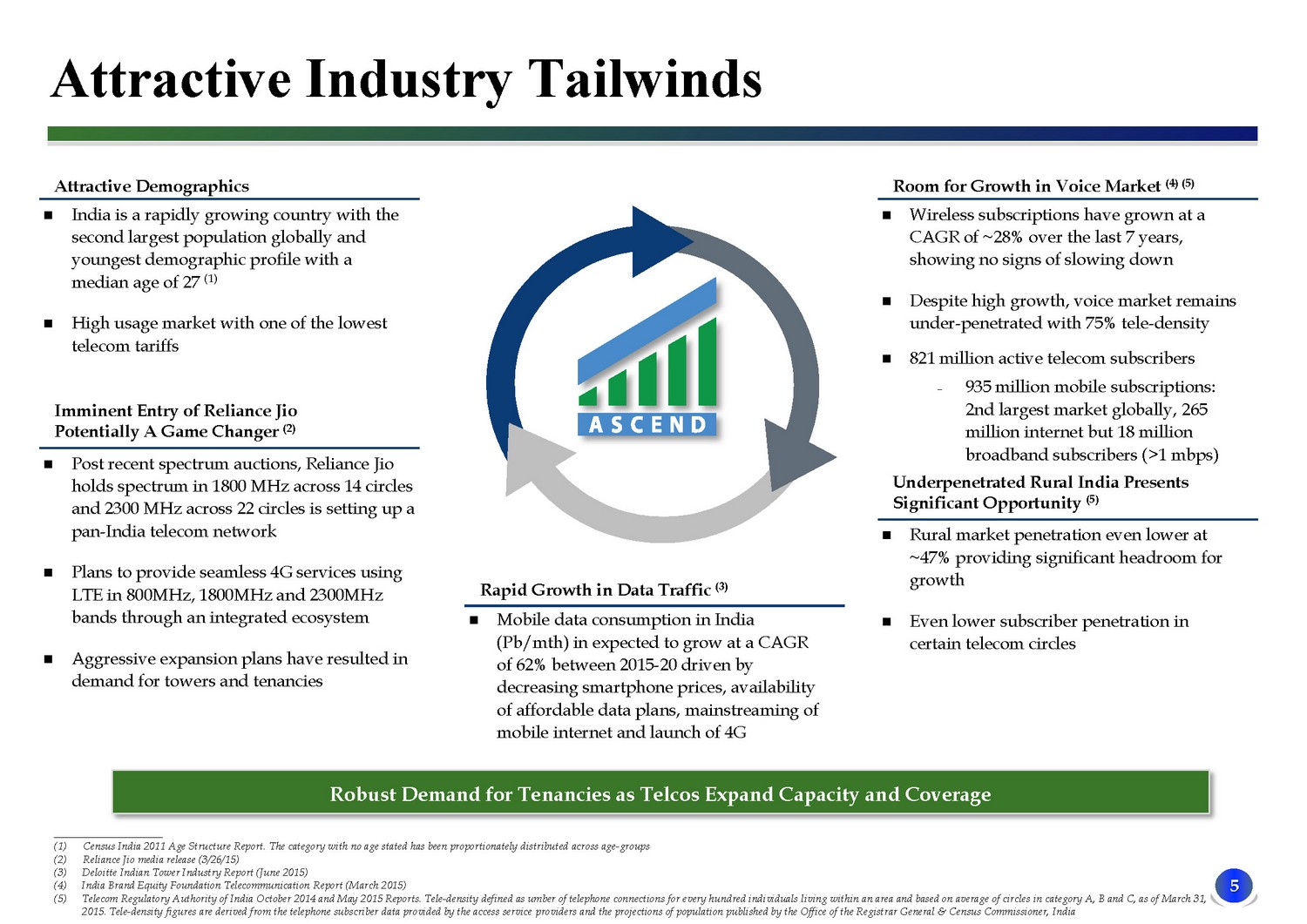

5 ____________________ (1) Census India 2011 Age Structure Report. The category with no age stated has been proportionately distributed across age - groups ( 2) Reliance Jio media release (3/26/15) (3) Deloitte Indian Tower Industry Report (June 2015) (4) India Brand Equity Foundation Telecommunication Report (March 2015) (5) Telecom Regulatory Authority of India October 2014 and May 2015 Reports. Tele - density defined as umber of telephone connections for every hundred individuals living within an area and based on average of circles in category A, B and C, as of March 31, 2015. Tele - density figures are derived from the telephone subscriber data provided by the access service providers and the projections of population published by the Office of the Registrar General & Census Commissioner

, India Robust Demand for Tenancies as Telcos Expand Capacity and Coverage Attractive Demographics India is a rapidly growing country with the second largest population globally and youngest demographic profile with a median age of 27 (1) High usage market with one of the lowest telecom tariffs Room for Growth in Voice Market (4) (5) Wireless subscriptions have grown at a CAGR of ~28% over the last 7 years, showing no signs of slowing down Despite high growth, voice market remains under - penetrated with 75% tele - density 821 million active telecom subscribers ˗ 935 million mobile subscriptions: 2nd largest market globally, 265 million internet but 18 million broadband subscribers (>1 mbps ) Underpenetrated Rural India Presents Significant Opportunity (5) Rural market penetration even lower at ~47% providing significant headroom for growth Even lower subscriber penetration in certain telecom circles Rapid Growth in Data Traffic (3) Mobile data consumption in India ( Pb / mth ) in expected to grow at a CAGR of 62% between 2015 - 20 driven by decreasing smartphone prices, availability of affordable data plans, mainstreaming of mobile internet and launch of 4G Imminent Entry of Reliance Jio Potentially A Game Changer (2) Post recent spectrum auctions, Reliance Jio holds spectrum in 1800 MHz across 14 circles and 2300 MHz across 22 circles is setting up a pan - India telecom network Plans to provide seamless 4G services using LTE in 800MHz, 1800MHz and 2300MHz bands through an integrated ecosystem Aggressive expansion plans have resulted in demand for towers and tenancies Attractive Industry Tailwinds

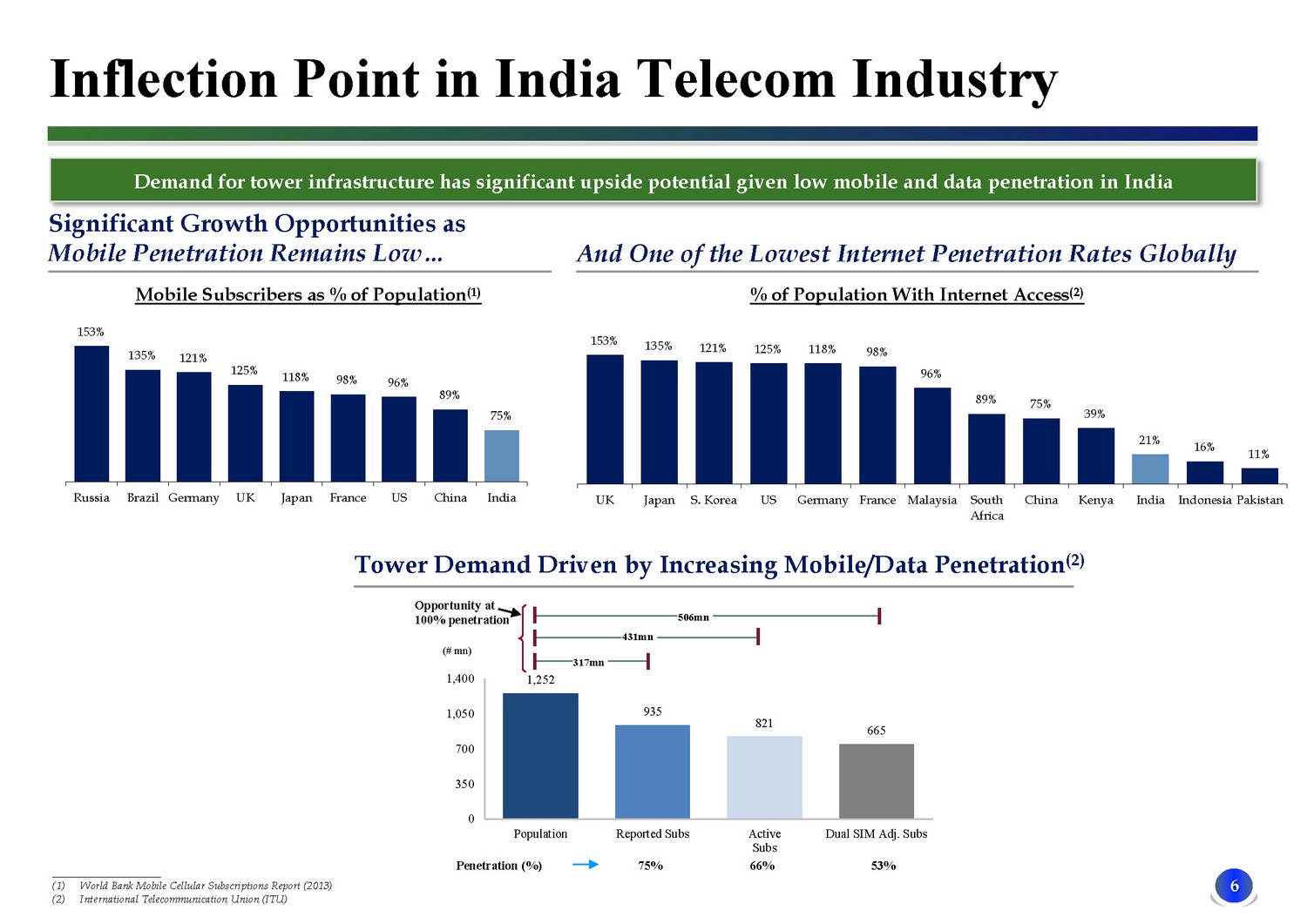

6 ____________________ (1) World Bank Mobile Cellular Subscriptions Report (2013) (2) International Telecommunication Union (ITU) Significant Growth Opportunities as Mobile Penetration Remains Low… Mobile Subscribers as % of Population (1) 153% 135% 121% 125% 118% 98% 96% 89% 75% Russia Brazil Germany UK Japan France US China India Inflection Point in India Telecom Industry And One of the Lowest Internet Penetration Rates Globally % of Population With Internet Access (2) 153% 135% 121% 125% 118% 98% 96% 89% 75% 39% 21% 16% 11% UK Japan S. Korea US Germany France Malaysia South Africa China Kenya India Indonesia Pakistan 1,252 935 821 665 0 350 700 1,050 1,400 Population Reported Subs Active Subs Dual SIM Adj. Subs Penetration (%) 75% 66% 53% Opportunity at 100%

penetration 317mn 431mn 506mn (# mn ) Tower Demand Driven by Increasing Mobile/Data Penetration (2) Demand for tower infrastructure has significant upside potential given low mobile and data penetration in India

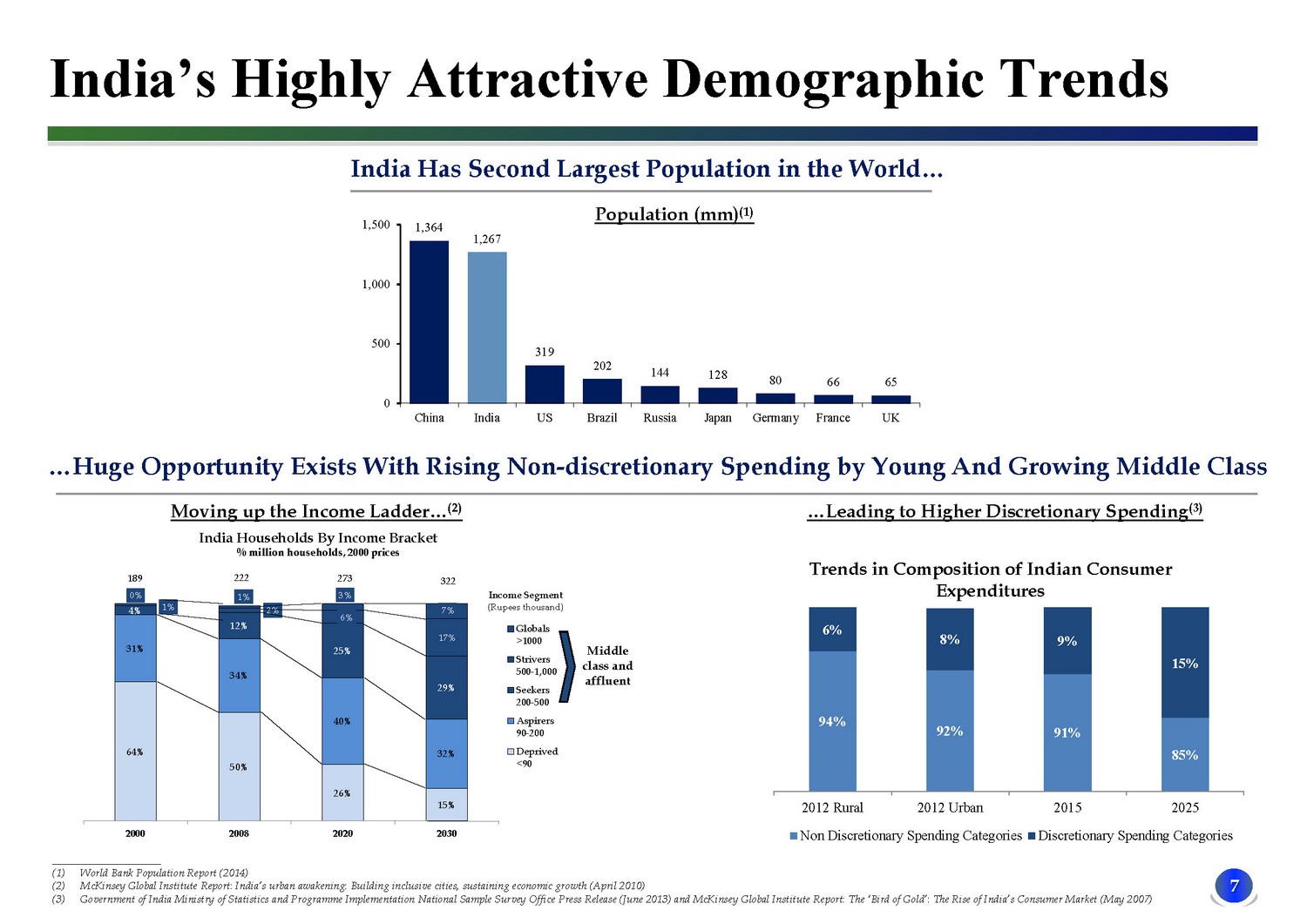

7 1,364 1,267 319 202 144 128 80 66 65 0 500 1,000 1,500 China India US Brazil Russia Japan Germany France UK ____________________ (1) World Bank Population Report (2014) (2) McKinsey Global Institute Report : India’s urban awakening: Building inclusive cities, sustaining economic growth (April 2010) (3) Government of India Ministry of Statistics and Programme Implementation National Sample Survey Office Press Release (June 2013) and McKinsey Global Institute Report: The ‘Bird of Gold’: The Rise of India’s Consumer Market (May 2007) India Has Second Largest Population in the World… …Huge Opportunity Exists With Rising Non - discretionary Spending by Young And Growing Middle Class …Leading to Higher Discretionary Spending (3) Moving up the Income Ladder… (2) Population (mm) (1) I

ndia’s Highly Attractive Demographic Trends 64% 50% 26% 15% 31% 34% 40% 32% 4% 12% 25% 29% 1% 2% 6% 17% 0% 1% 3% 7% 2000 2008 2020 2030 India Households By Income Bracket % million households, 2000 prices Globals >1000 Strivers 500-1,000 Seekers 200-500 Aspirers 90-200 Deprived <90 Income Segment (Rupees thousand) 189 322 273 222 Middle class and affluent 94% 92% 91% 85% 6% 8% 9% 15% 2012 Rural 2012 Urban 2015 2025 Trends in Composition of Indian Consumer Expenditures Non Discretionary Spending Categories Discretionary Spending Categories

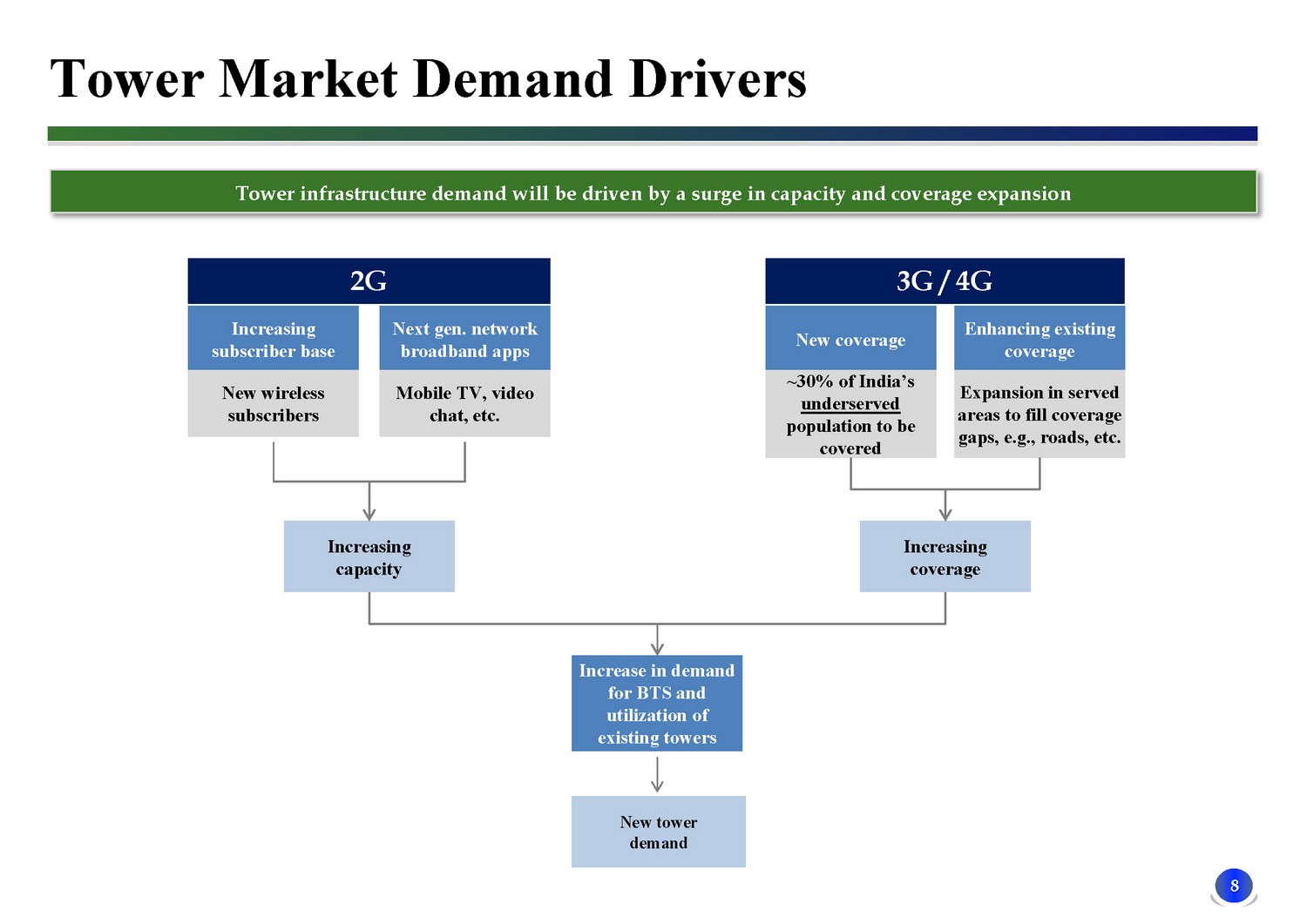

8 Tower Market Demand Drivers Increasing subscriber base New wireless subscribers Next gen. network broadband apps Mobile TV, video chat, etc. New coverage ~30% of India’s underserved population to be covered Enhancing existing coverage Expansion in served areas to fill coverage gaps, e.g., roads, etc. Increasing capacity Increasing coverage New tower demand Increase in demand for BTS and utilization of existing towers 2G 3G / 4G Tower infrastructure demand will be driven by a surge in capacity and coverage expansion

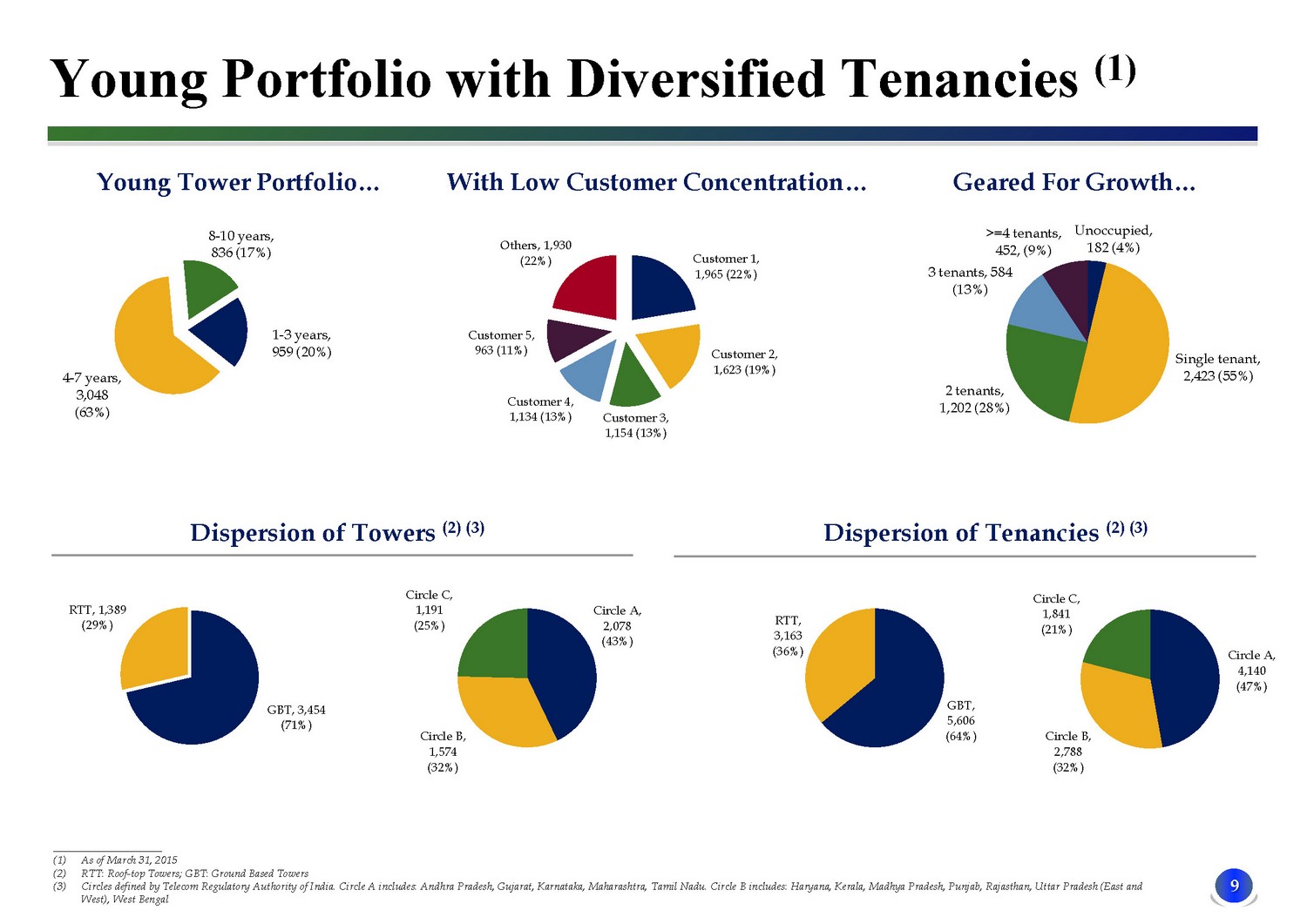

9 Customer 1, 1,965 (22%) Customer 2, 1,623 (19%) Customer 3, 1,154 (13%) Customer 4, 1,134 (13%) Customer 5, 963 (11%) Others, 1,930 (22%) Unoccupied, 182 (4%) Single tenant, 2,423 (55%) 2 tenants, 1,202 (28%) 3 tenants, 584 (13%) >=4 tenants, 452, (9%) 1 - 3 years, 959 (20%) 4 - 7 years, 3,048 (63%) 8 - 10 years, 836 (17%) Young Tower Portfolio… With Low Customer Concentration… Geared For Growth… GBT, 5,606 (64%) RTT, 3,163 (36%) Circle A, 4,140 (47%) Circle B , 2,788 (32%) Circle C, 1,841 (21%) Circle A, 2,078 (43%) Circle B, 1,574 (32%) Circle C, 1,191 (25%) GBT, 3,454 (71%) RTT, 1,389 (29%) Dispersion of Towers (2) (3) Dispersion of Tenancies (2) (3) Young Portfolio with Diversified Tenancies (1) ____________________ (1) As of March 31, 2015 (2) RTT: Roof - top Tow

ers; GBT: Ground Based Towers (3) Circles defined by Telecom Regulatory Authority of India. Circle A includes: Andhra Pradesh, Gujarat, Karnataka, Maharashtra, Ta mil Nadu. Circle B includes: Haryana, Kerala, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh (East and West), West Bengal

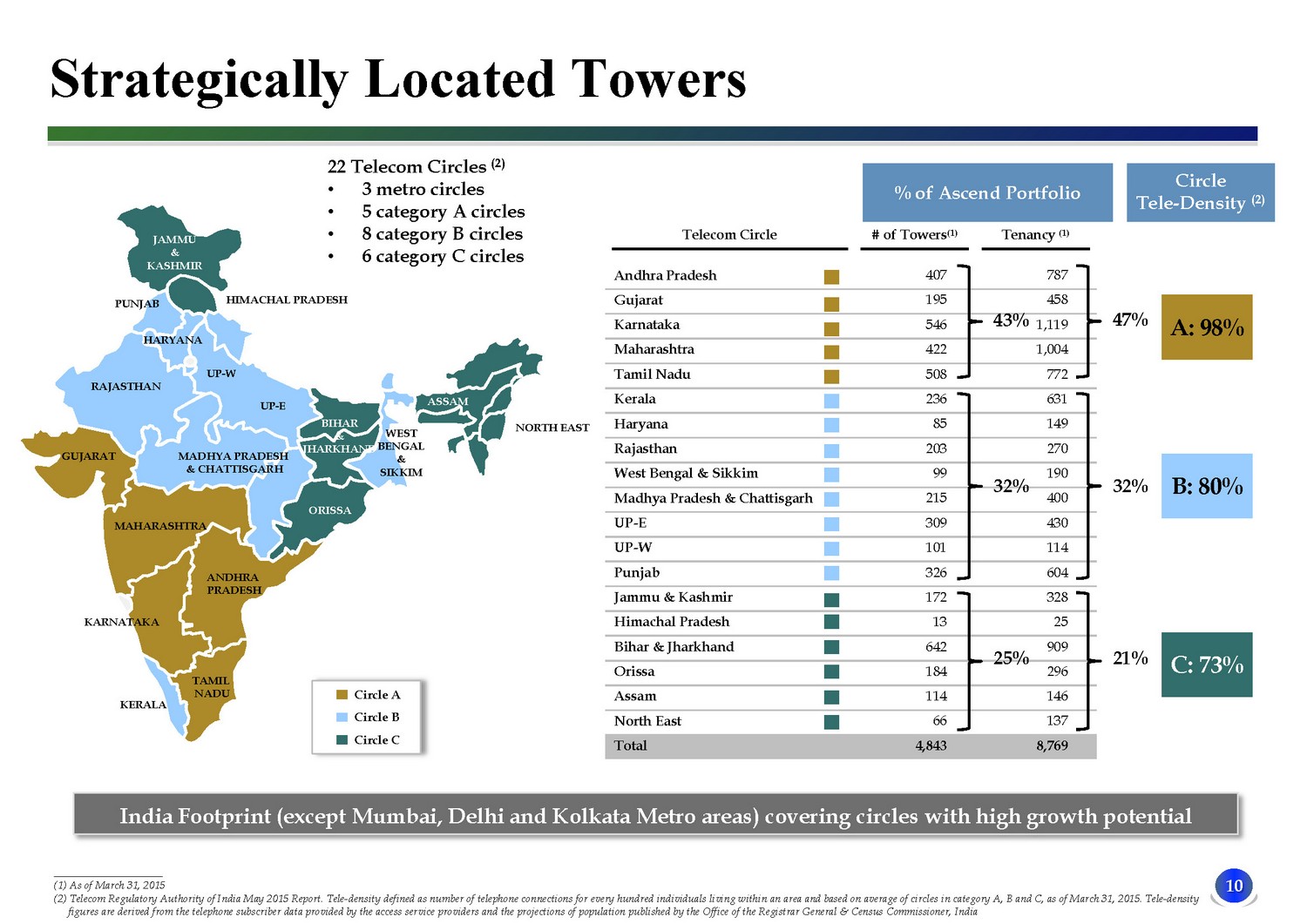

10 India Footprint (except Mumbai, Delhi and Kolkata Metro areas) covering circles with high growth potential ____________________ (1) As of March 31, 2015 (2) Telecom Regulatory Authority of India May 2015 Report. Tele - density defined as number of telephone connections for every hundred individuals living within an area and based on average of circles in category A, B and C, as of March 31, 2015. Tele - density figures are derived from the telephone subscriber data provided by the access service providers and the projections of population published by the Office of the Registrar General & Census Commissioner, India WEST BENGAL & SIKKIM ORISSA ASSAM NORTH EAST BIHAR & JHARKHAND UP - E UP - W JAMMU & KASHMIR HIMACHAL PRADESH PUNJAB HARYANA RAJASTHAN GUJARAT MADHYA PRADESH & CHAT

TISGARH MAHARASHTRA KERALA KARNATAKA TAMIL NADU ANDHRA PRADESH Telecom Circle # of Towers (1) Tenancy (1) Andhra Pradesh 407 787 Gujarat 195 458 Karnataka 546 1,119 Maharashtra 422 1,004 Tamil Nadu 508 772 Kerala 236 631 Haryana 85 149 Rajasthan 203 270 West Bengal & Sikkim 99 190 Madhya Pradesh & Chattisgarh 215 400 UP-E 309 430 UP-W 101 114 Punjab 326 604 Jammu & Kashmir 172 328 Himachal Pradesh 13 25 Bihar & Jharkhand 642 909 Orissa 184 296 Assam 114 146 North East 66 137 Total 4,843 8,769 Circle A Circle B Circle C Circle Tele - Density (2) 32% 25% Strategically Located Towers 43% A: 98% B: 80% C: 73% 32% 21% 47% % of Ascend Portfolio 22 Telecom Circles (2) • 3 metro circles • 5 category A circles • 8 category B circles • 6 category C circles

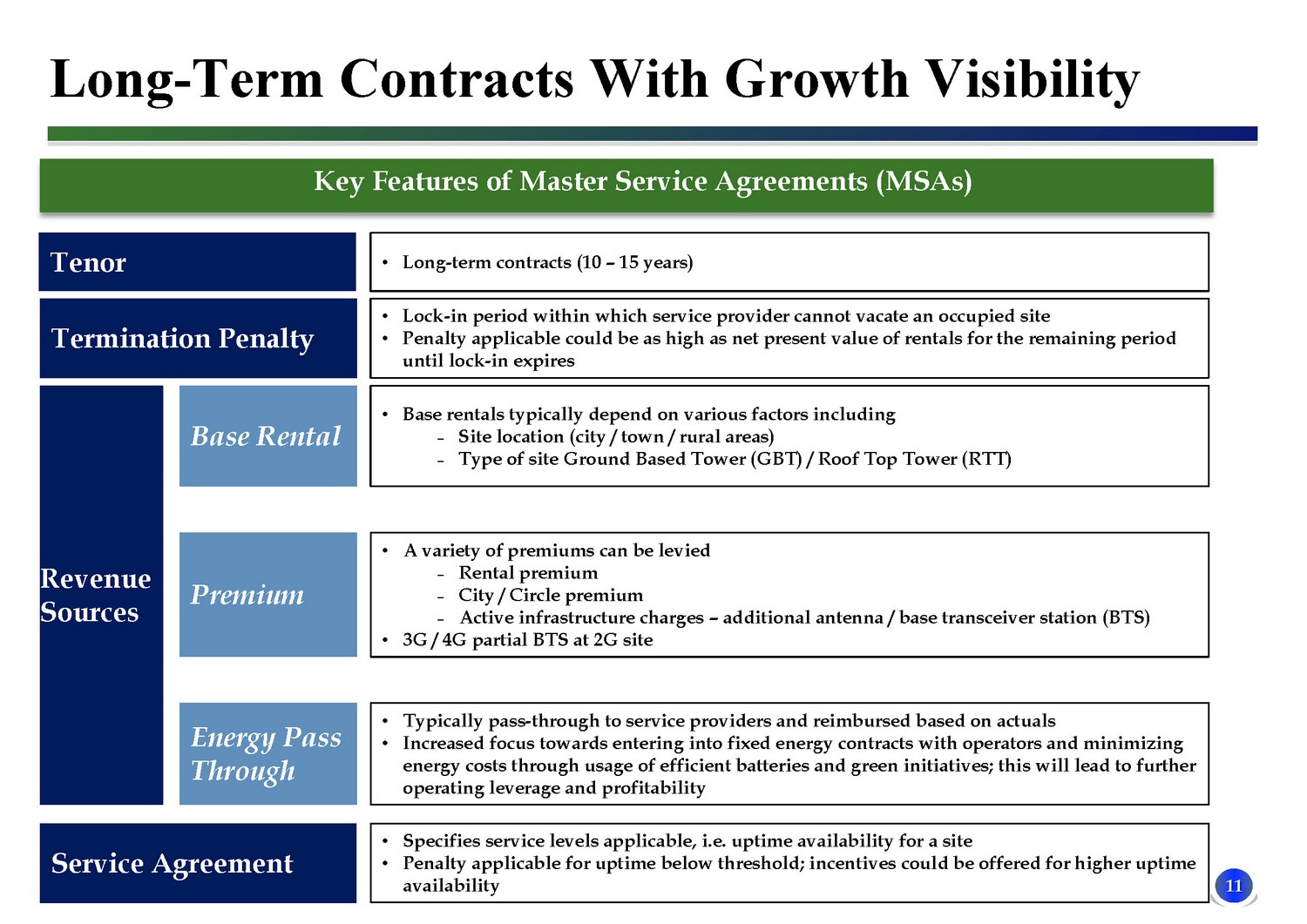

11 3 Long - Term Contracts With Growth Visibility x Key Features of Master Service Agreements (MSAs) Tenor Termination Penalty Revenue Sources Base Rental Premium Energy Pass Through Service Agreement • Long - term contracts (10 – 15 years) • Lock - in period within which service provider cannot vacate an occupied site • Penalty applicable could be as high as net present value of rentals for the remaining period until lock - in expires • Base rentals typically depend on various factors including ˗ Site location (city / town / rural areas) ˗ Type of site Ground Based Tower (GBT) / Roof Top Tower (RTT) • A variety of premiums can be levied ˗ Rental premium ˗ City / Circle premium ˗ Active infrastructure charges – additional antenna / base transceiver station (BTS ) • 3G / 4G partial BTS at

2G site • Typically pass - through to service providers and reimbursed based on actuals • Increased focus towards entering into fixed energy contracts with operators and minimizing energy costs through usage of efficient batteries and green initiatives; this will lead to further operating leverage and profitability • Specifies service levels applicable, i.e. uptime availability for a site • Penalty applicable for uptime below threshold; incentives could be offered for higher uptime availability

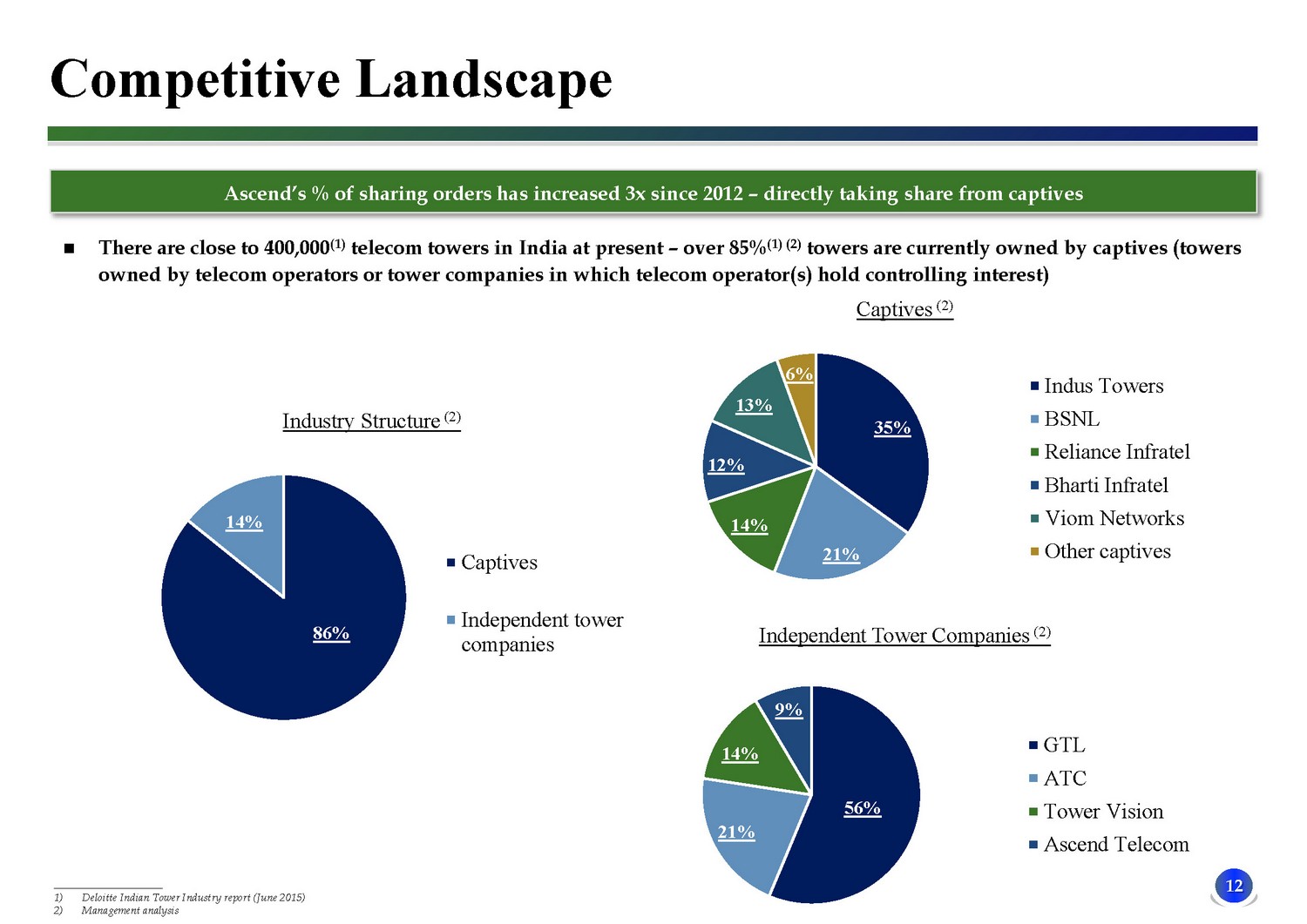

12 86% 14% Industry Structure (2) Captives Independent tower companies Competitive Landscape There are close to 400,000 (1) telecom towers in India at present – over 8 5 % (1) (2) towers are currently owned by captives (towers owned by telecom operators or tower companies in which telecom operator(s) hold controlling interest) ____________________ 1) Deloitte Indian Tower Industry report (June 2015) 2) Management analysis Ascend’s % of sharing orders has increased 3x since 2012 – directly taking share from captives 56% 21% 14% 9% Independent Tower Companies (2) GTL ATC Tower Vision Ascend Telecom 35% 21% 14% 12% 13% 6% Captives (2) Indus Towers BSNL Reliance Infratel Bharti Infratel Viom Networks Other captives

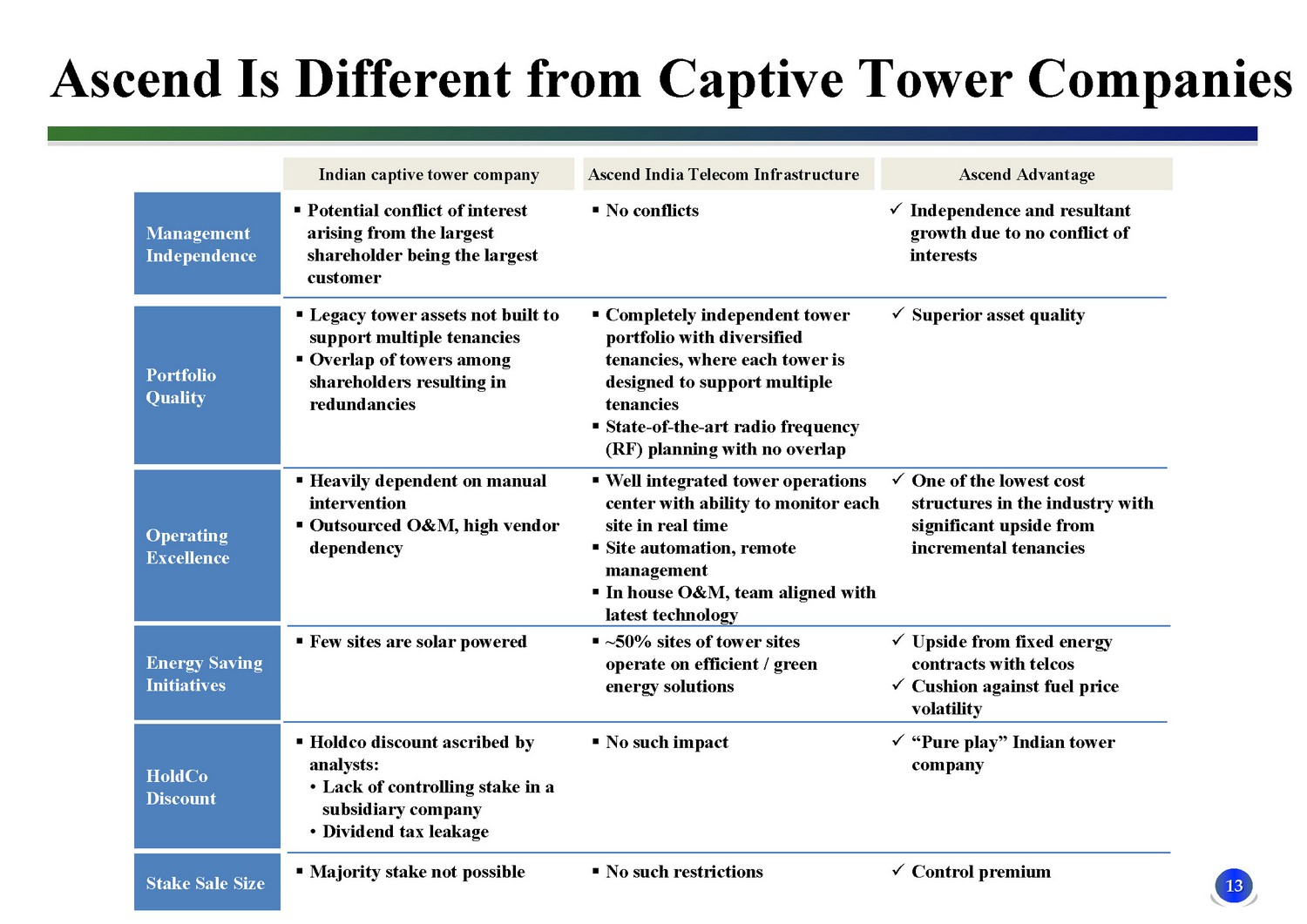

13 Ascend Is Different from Captive Tower Companies Management Independence Portfolio Quality Operating Excellence Energy Saving Initiatives Indian captive tower company Ascend India Telecom Infrastructure Ascend Advantage ▪ Potential conflict of interest arising from the largest shareholder being the largest customer ▪ No conflicts x Independence and resultant growth due to no conflict of interests ▪ Legacy tower assets not built to support multiple tenancies ▪ Overlap of towers among shareholders resulting in redundancies ▪ Completely independent tower portfolio with diversified tenancies, where each tower is designed to support multiple tenancies ▪ State - of - the - art radio frequency (RF) planning with no overlap x Superior asset quality ▪ Heavily dependent on manual intervention ▪ Out

sourced O&M, high vendor dependency x One of the lowest cost structures in the industry with significant upside from incremental tenancies ▪ Well integrated tower operations center with ability to monitor each site in real time ▪ Site automation, remote management ▪ In house O&M, team aligned with latest technology ▪ Few sites are solar powered ▪ ~50% sites of tower sites operate on efficient / green energy solutions x Upside from fixed energy contracts with telcos x Cushion against fuel price volatility HoldCo Discount Stake Sale Size ▪ Holdco discount ascribed by analysts: • Lack of controlling stake in a subsidiary company • Dividend tax leakage x “Pure play” Indian tower company ▪ No such impact ▪ Majority stake not possible ▪ No such restrictions x Control premium

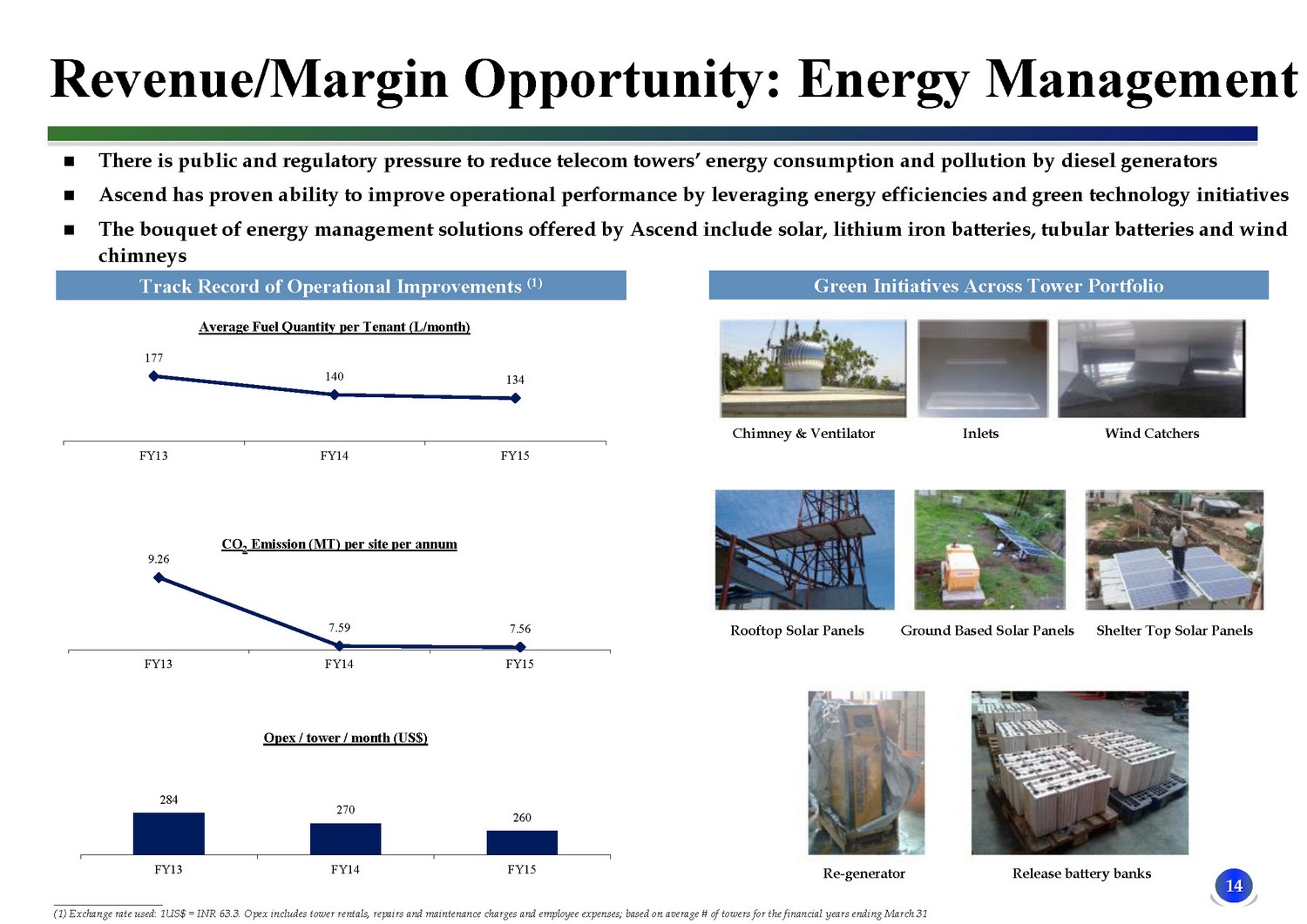

14 177 140 134 FY13 FY14 FY15 Average Fuel Quantity per Tenant (L/month) 9.26 7.59 7.56 FY13 FY14 FY15 CO 2 Emission (MT) per site per annum 284 270 260 FY13 FY14 FY15 Opex / tower / month (US$) Rooftop Solar Panels Ground Based Solar Panels Shelter Top Solar Panels Chimney & Ventilator Inlets Wind Catchers Re - generator Release battery banks Revenue/Margin Opportunity: Energy Management There is public and regulatory pressure to reduce telecom towers’ energy consumption and pollution by diesel generators Ascend has proven ability to improve operational performance by leveraging energy efficiencies and green technology initiatives The bouquet of energy management solutions offered by Ascend include solar, lithium iron batteries, tubular batteries and win d chimneys Green Init

iatives Across Tower Portfolio Track Record of Operational Improvements (1) ____________________ (1) Exchange rate used: 1US$ = INR 63.3. Opex includes tower rentals, repairs and maintenance charges and employee expenses; based on average # of towers for the financial years ending March 31

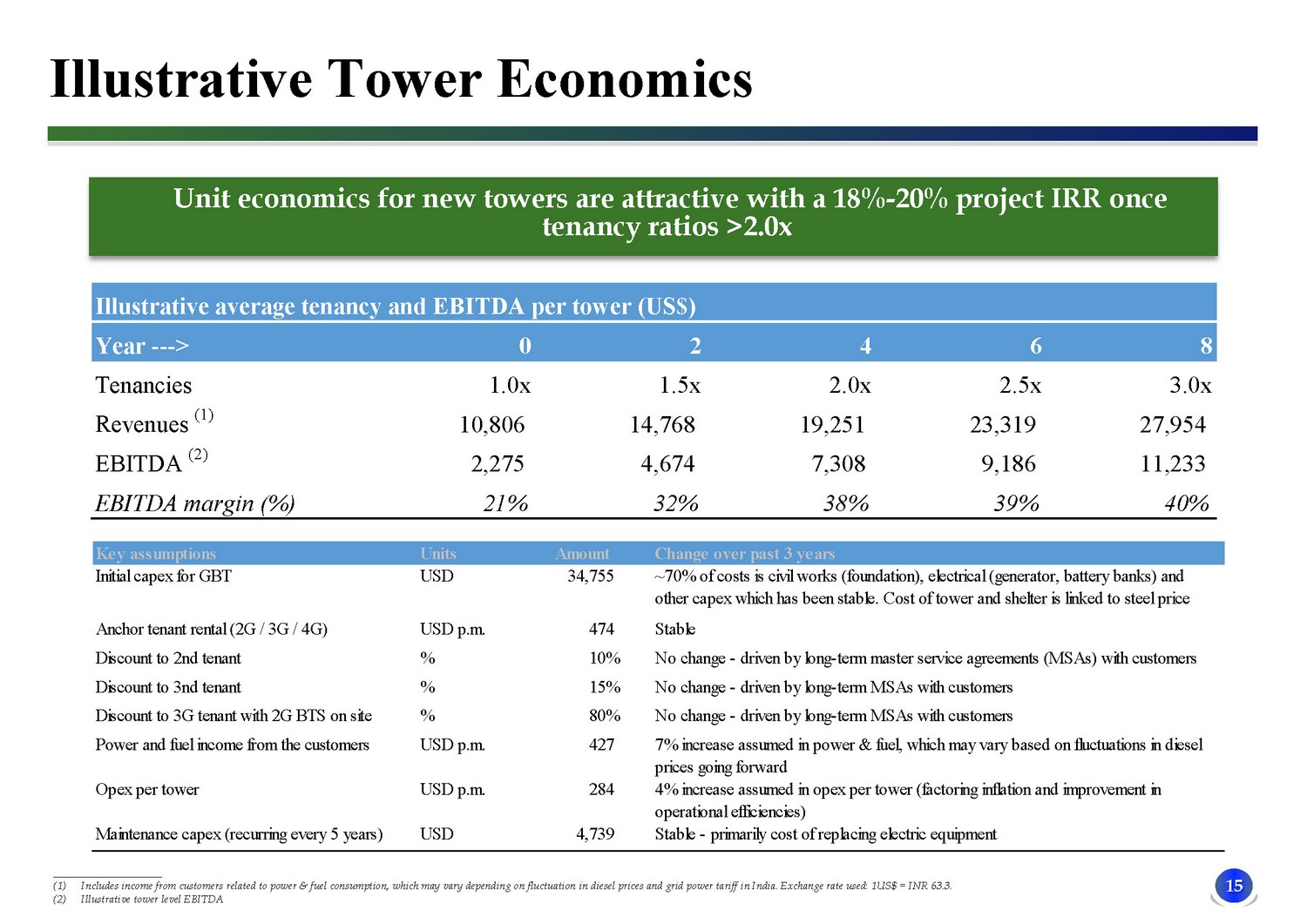

15 x Unit economics for new towers are attractive with a 18% - 20% project IRR once tenancy ratios >2.0x Illustrative Tower Economics ____________________ (1) Includes income from customers related to power & fuel consumption, which may vary depending on fluctuation in diesel prices and grid power tariff in India. Exchange rate used: 1US$ = INR 63.3. (2) Illustrative tower level EBITDA Illustrative average tenancy and EBITDA per tower (US$) Year ---> 0 2 4 6 8 Tenancies 1.0x 1.5x 2.0x 2.5x 3.0x Revenues (1) 10,806 14,768 19,251 23,319 27,954 EBITDA (2) 2,275 4,674 7,308 9,186 11,233 EBITDA margin (%) 21% 32% 38% 39% 40% Key assumptions Units Amount Change over past 3 years Initial capex for GBT USD 34,755 ~70% of costs is civil works (foundation), electrical (generator, battery banks)

and other capex which has been stable. Cost of tower and shelter is linked to steel price Anchor tenant rental (2G / 3G / 4G) USD p.m. 474 Stable Discount to 2nd tenant % 10% No change - driven by long-term master service agreements (MSAs) with customers Discount to 3nd tenant % 15% No change - driven by long-term MSAs with customers Discount to 3G tenant with 2G BTS on site % 80% No change - driven by long-term MSAs with customers Power and fuel income from the customers USD p.m. 427 7% increase assumed in power & fuel, which may vary based on fluctuations in diesel prices going forward Opex per tower USD p.m. 284 4% increase assumed in opex per tower (factoring inflation and improvement in operational efficiencies) Maintenance capex (recurring every 5 years) USD 4,739 Stable - primarily cost of replacing electric equipment

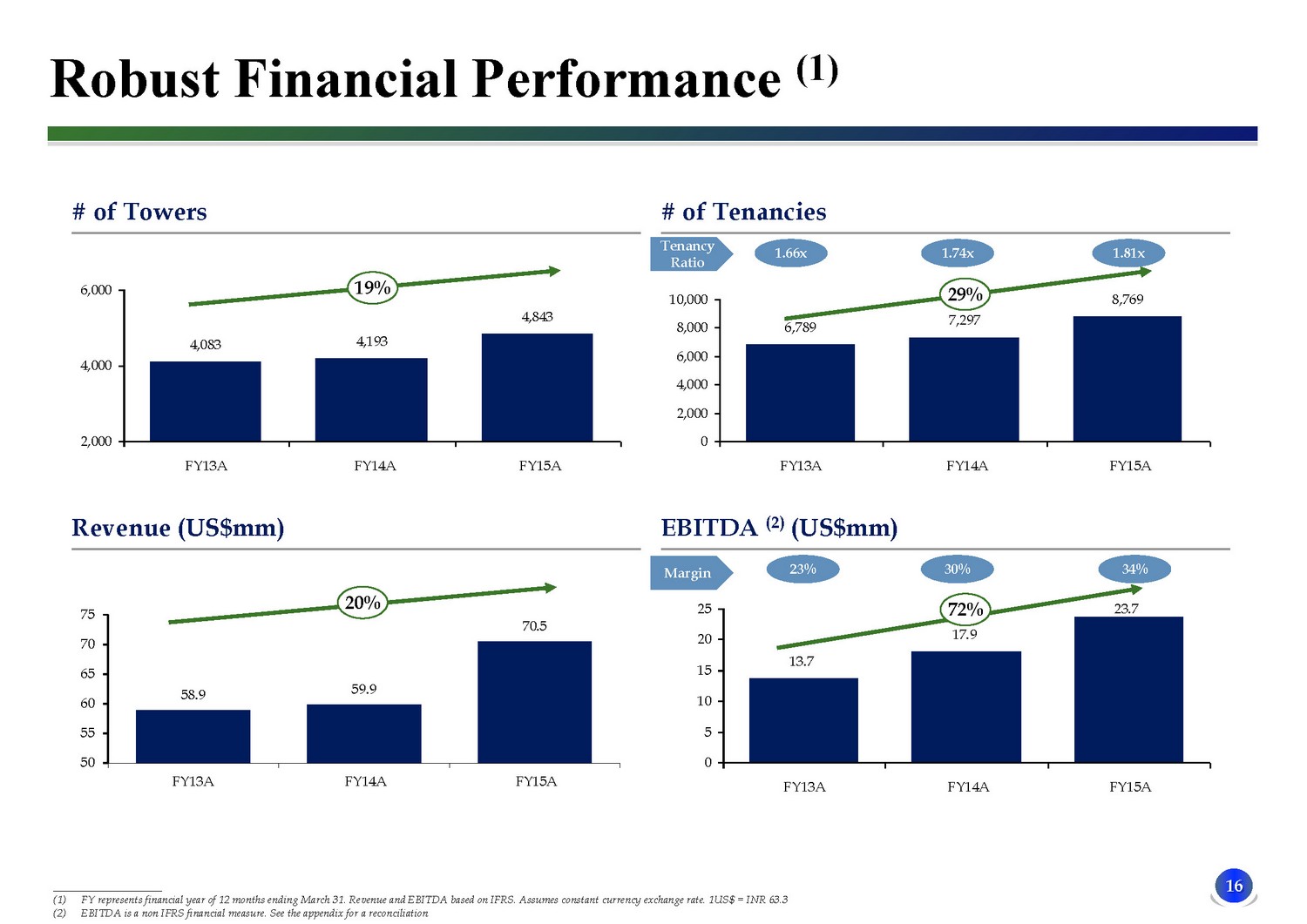

16 ____________________ (1) FY represents financial year of 12 months ending March 31. Revenue and EBITDA based on IFRS. Assumes constant currency exchange rate. 1US $ = INR 63.3 (2) EBITDA is a non IFRS financial measure. See the appendix for a reconciliation # of Tenancies 4,083 4,193 4,843 2,000 4,000 6,000 FY13A FY14A FY15A # of Towers 6,789 7,297 8,769 0 2,000 4,000 6,000 8,000 10,000 FY13A FY14A FY15A EBITDA (2) (US$mm) Revenue (US$mm) 58.9 59.9 70.5 50 55 60 65 70 75 FY13A FY14A FY15A 1.66x 1.81x Tenancy Ratio 13.7 17.9 23.7 0 5 10 15 20 25 FY13A FY14A FY15A 23% 34% Margin 19% 29% 20% 72% 1.74x 30% Robust Financial Performance (1)

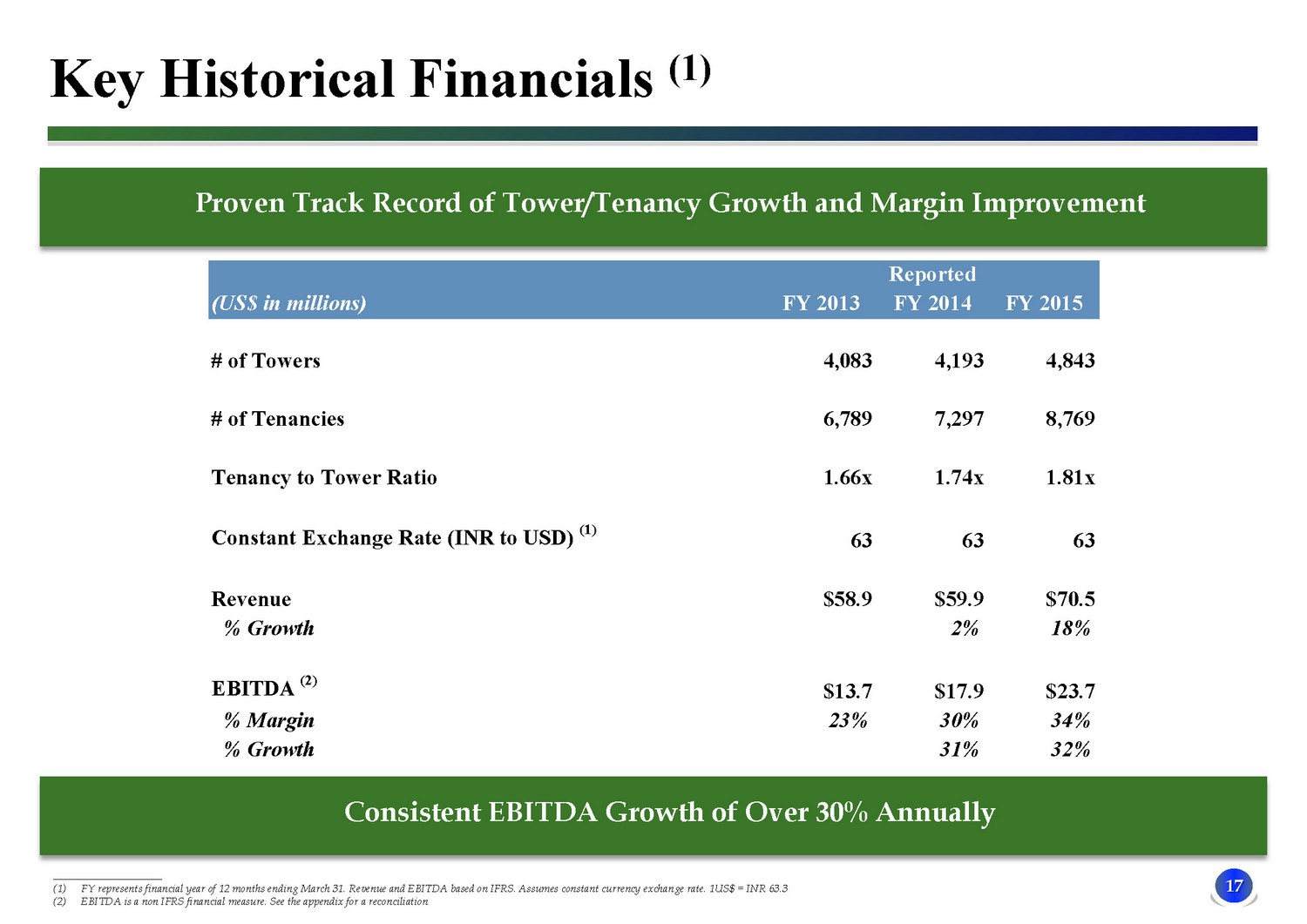

17 3 Key Historical Financials (1) ____________________ (1) FY represents financial year of 12 months ending March 31. Revenue and EBITDA based on IFRS. Assumes constant currency exchan ge rate. 1US$ = INR 63.3 (2) EBITDA is a non IFRS financial measure. See the appendix for a reconciliation x Proven Track Record of Tower/Tenancy Growth and Margin Improvement x Consistent EBITDA Growth of Over 30% Annually Reported (US$ in millions) FY 2013 FY 2014 FY 2015 # of Towers 4,083 4,193 4,843 # of Tenancies 6,789 7,297 8,769 Tenancy to Tower Ratio 1.66x 1.74x 1.81x Constant Exchange Rate (INR to USD) (1) 63 63 63 Revenue $58.9 $59.9 $70.5 % Growth 2% 18% EBITDA (2) $13.7 $17.9 $23.7 % Margin 23% 30% 34% % Growth 31% 32%

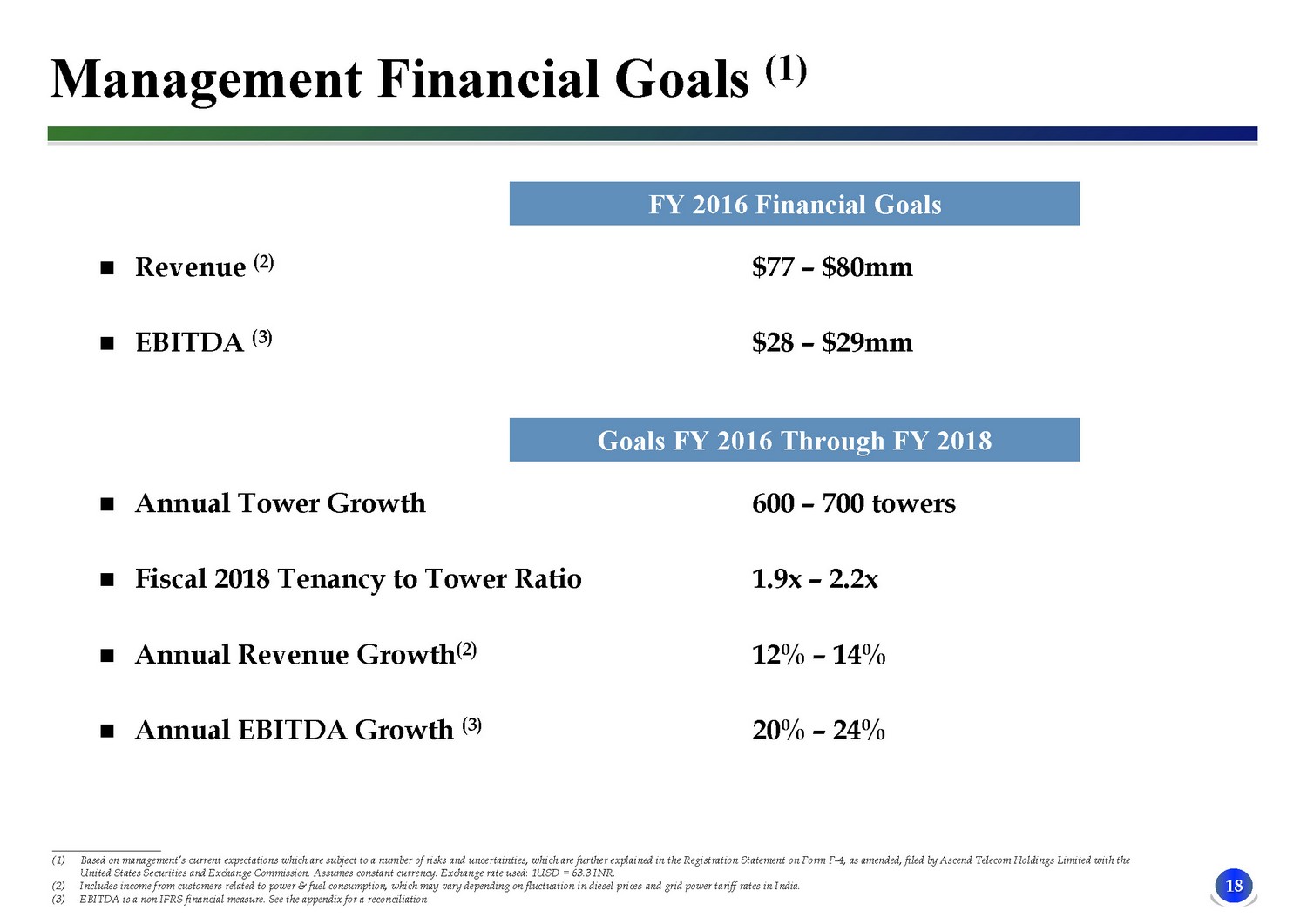

18 Management Financial Goals (1) Revenue (2) EBITDA (3) FY 2016 Financial Goals $77 – $80mm $28 – $29mm Annual Tower Growth Fiscal 2018 Tenancy to Tower Ratio Annual Revenue Growth (2) Annual EBITDA Growth (3) Goals FY 2016 Through FY 2018 600 – 700 towers 1.9x – 2.2x 12% – 14% 20% – 24% ____________________ (1) Based on management’s current expectations which are subject to a number of risks and uncertainties, which are further explai ned in the Registration Statement on Form F - 4, as amended, filed by Ascend Telecom Holdings Limited with the United States Securities and Exchange Commission. Assumes constant currency. Exchange rate used: 1USD = 63.3 INR. (2) Includes income from customers related to power & fuel consumption, which may vary depending on fluc

tuation in diesel prices and grid power tariff rates in India. (3) EBITDA is a non IFRS financial measure. See the appendix for a reconciliation

Transaction Overview

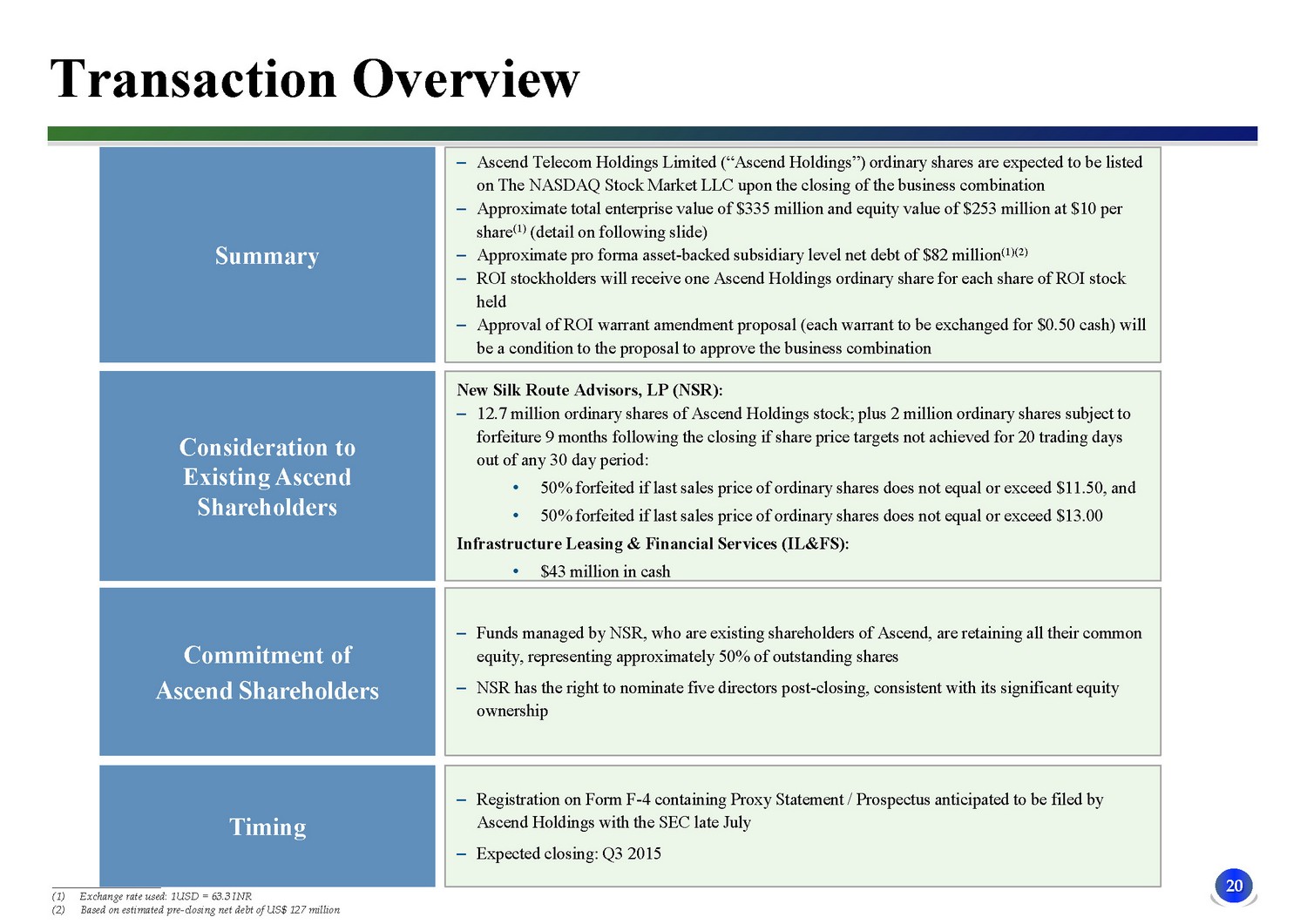

20 3 Transaction Overview Summary – Ascend Telecom Holdings Limited (“Ascend Holdings”) ordinary shares are expected to be listed on The NASDAQ Stock Market LLC upon the closing of the business combination – Approximate total enterprise value of $335 million and equity value of $253 million at $10 per share (1 ) (detail on following slide) – Approximate pro forma asset - backed subsidiary level net debt of $82 million (1)(2) – ROI stockholders will receive one Ascend Holdings ordinary share for each share of ROI stock held – Approval of ROI warrant amendment proposal (each warrant to be exchanged for $0.50 cash) will be a condition to the proposal to approve the business combination New Silk Route Advisors, LP ( NSR): – 12.7 million ordinary shares of Ascend Holdings stock ; plus 2 milli

on ordinary shares subject to forfeiture 9 months following the closing if share price targets not achieved for 20 trading days out of any 30 day period: • 50 % forfeited if last sales price of ordinary shares does not equal or exceed $11.50, and • 50 % forfeited if last sales price of ordinary shares does not equal or exceed $ 13.00 Infrastructure Leasing & Financial Services (IL&FS): • $43 million in cash – Funds managed by NSR, who are existing shareholders of Ascend, are retaining all their common equity, representing approximately 50% of outstanding shares – NSR has the right to nominate five directors post - closing, consistent with its significant equity ownership – Registration on Form F - 4 containing Proxy Statement / Prospectus anticipated to be filed by Ascend Holdings with the SEC late July – Expected closing: Q3 2015 Consideration to Existing Ascend Shareholders Commitment of Ascend Shareholders Timing ____________________ (1) Exchange rate used: 1USD = 63.3 INR (2) Based on estimated pre - closing net debt of US$ 127 million

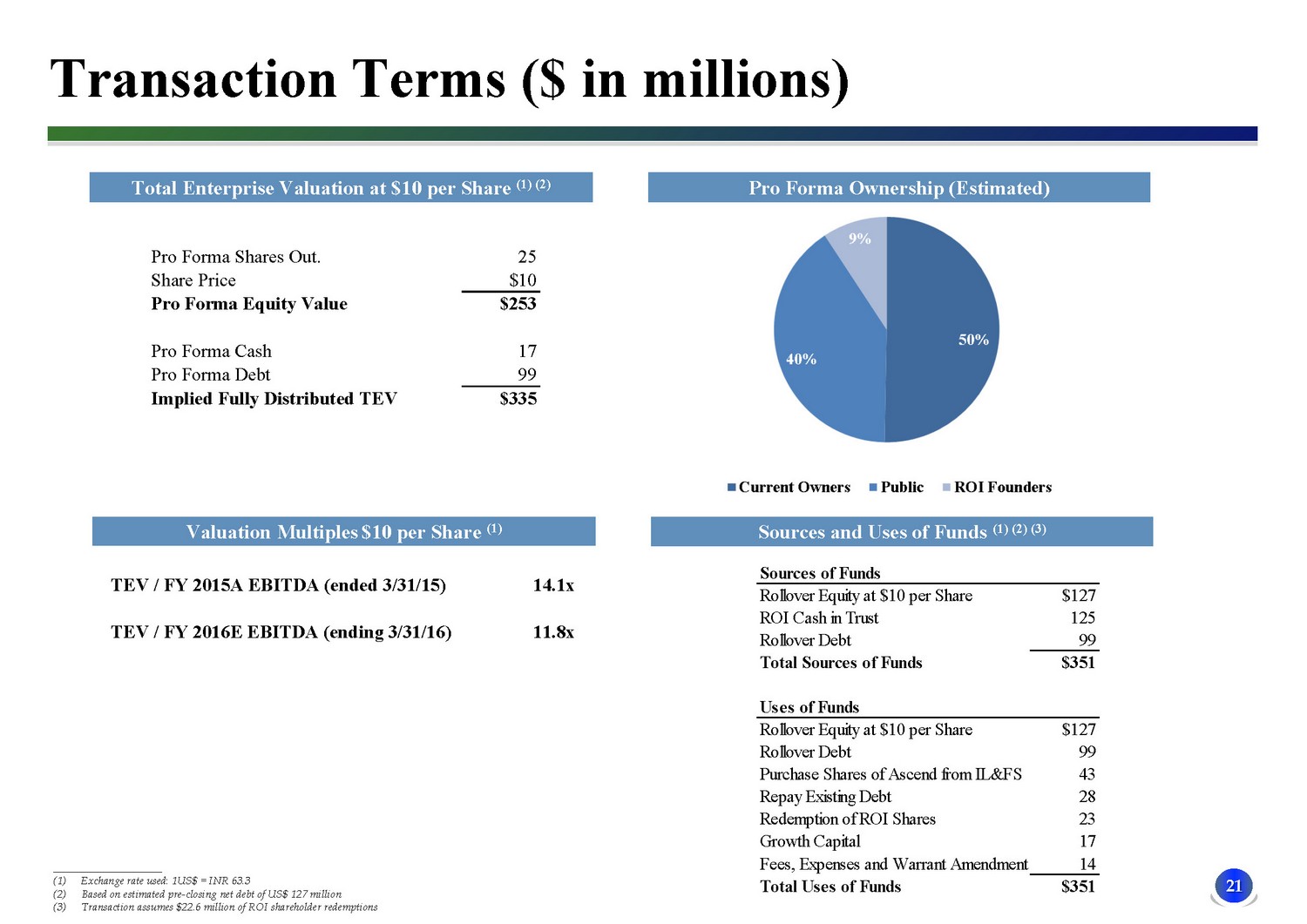

21 Transaction Terms ($ in millions) Total Enterprise Valuation at $10 per Share (1) (2) Pro Forma Ownership (Estimated) Valuation Multiples $10 per Share ( 1 ) Sources and Uses of Funds (1) (2) (3) ____________________ (1) Exchange rate used: 1US$ = INR 63.3 (2) Based on estimated pre - closing net debt of US$ 127 million (3) Transaction assumes $22.6 million of ROI shareholder redemptions TEV / FY 2015A EBITDA (ended 3/31/15) 14.1x TEV / FY 2016E EBITDA (ending 3/31/16) 11.8x Pro Forma Shares Out. 25 Share Price $10 Pro Forma Equity Value $253 Pro Forma Cash 17 Pro Forma Debt 99 Implied Fully Distributed TEV $335 Sources of Funds Rollover Equity at $10 per Share $127 ROI Cash in Trust 125 Rollover Debt 99 Total Sources of Funds $351 Uses of Funds Rollover Equity at $10 per Share $127 Rol

lover Debt 99 Purchase Shares of Ascend from IL&FS 43 Repay Existing Debt 28 Redemption of ROI Shares 23 Growth Capital 17 Fees, Expenses and Warrant Amendment 14 Total Uses of Funds $351

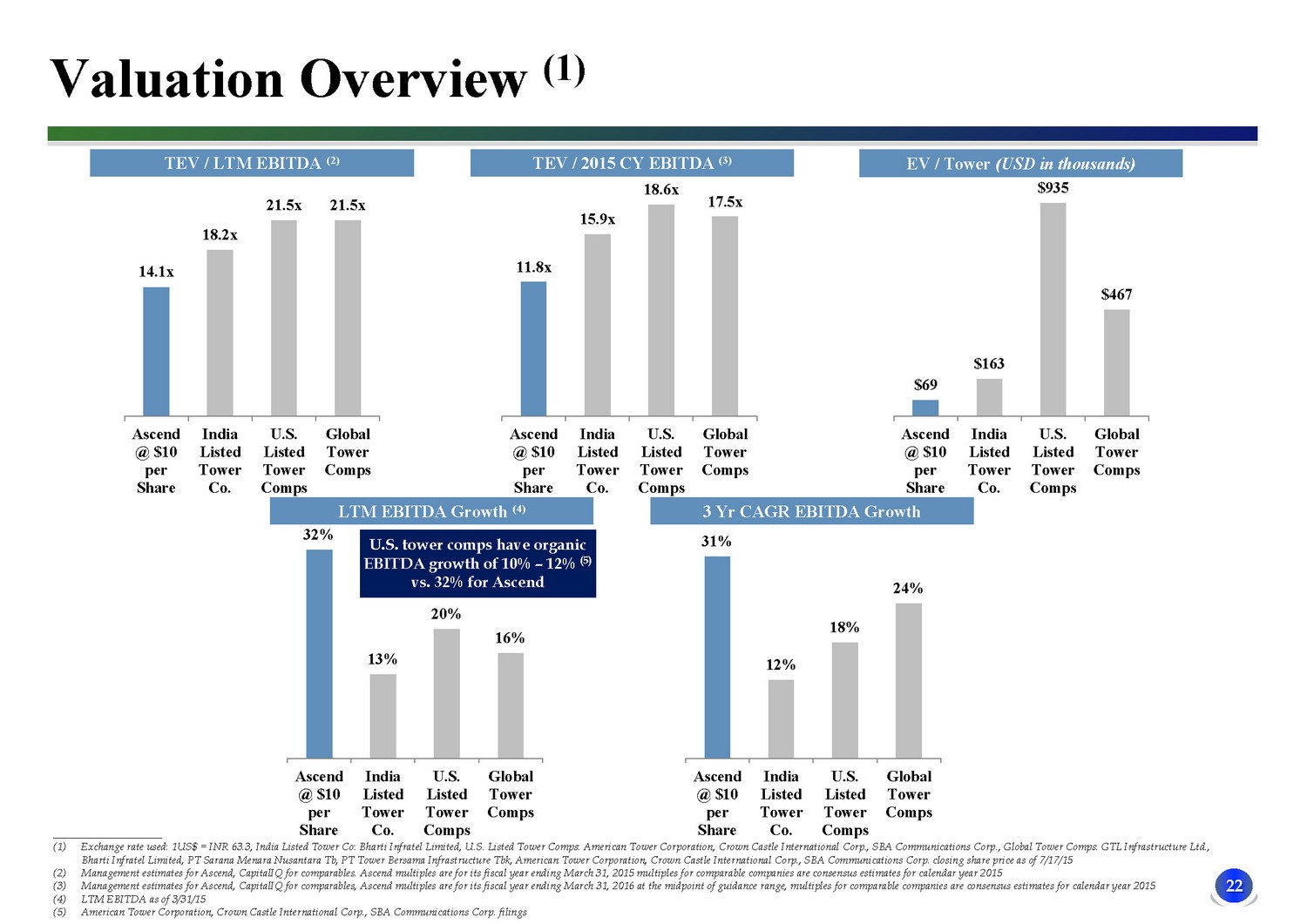

22 32% 13% 20% 16% Ascend @ $10 per Share India Listed Tower Co. U.S. Listed Tower Comps Global Tower Comps Valuation Overview (1) LTM EBITDA Growth (4) 3 Yr CAGR EBITDA Growth TEV / LTM EBITDA (2) TEV / 2015 CY EBITDA (3) EV / Tower (USD in thousands) ____________________ (1) Exchange rate used: 1US$ = INR 63.3, India Listed Tower Co: Bharti Infratel Limited, U.S. Listed Tower Comps: American Tower Corporation, Crown Castle International Corp., SBA Communications Corp ., Global Tower Comps: GTL Infrastructure Ltd., Bharti Infratel Limited, PT Sarana Menara Nusantara Tb, PT Tower Bersama Infrastructure Tbk , American Tower Corporation, Crown Castle International Corp., SBA Communications Corp. closing share price as of 7/17/15 (2) Management estimates for Ascend, CapitalIQ for com

parables . Ascend multiples are for its fiscal year ending March 31, 2015 multiples for comparable companies are consensus estimates for ca lendar year 2015 (3) Management estimates for Ascend, CapitalIQ for comparables , Ascend multiples are for its fiscal year ending March 31, 2016 at the midpoint of guidance range, multiples for comparable companies are consensus estimates for calendar year 2015 (4) LTM EBITDA as of 3/31/15 (5) American Tower Corporation, Crown Castle International Corp., SBA Communications Corp . filings U.S. tower comps have organic EBITDA growth of 10% – 12% (5) vs. 32% for Ascend 14.1x 18.2x 21.5x 21.5x Ascend @ $10 per Share India Listed Tower Co. U.S. Listed Tower Comps Global Tower Comps 11.8x 15.9x 18.6x 17.5x Ascend @ $10 per Share India Listed Tower Co. U.S. Listed Tower Comps Global Tower Comps $69 $163 $935 $467 Ascend @ $10 per Share India Listed Tower Co. U.S. Listed Tower Comps Global Tower Comps 31% 12% 18% 24% Ascend @ $10 per Share India Listed Tower Co. U.S. Listed Tower Comps Global Tower Comps

Appendix

24 EBITDA Reconciliation (1) ____________________ (1) Assumes constant currency exchange rate . 1US$ = INR 63.3 (2) EBITDA is a non IFRS financial measure (US$ in millions) EBITDA Reconciliation FY 2013 FY 2014 FY 2015 Profit / (Loss) After Tax (20.1) (14.7) (9.6) Income Tax Expense (1.8) 0.0 0.0 Interest Expense, Net 17.1 18.4 18.3 Depreciation and Amortization 18.6 14.2 14.9 EBITDA (2) 13.7 17.9 23.7

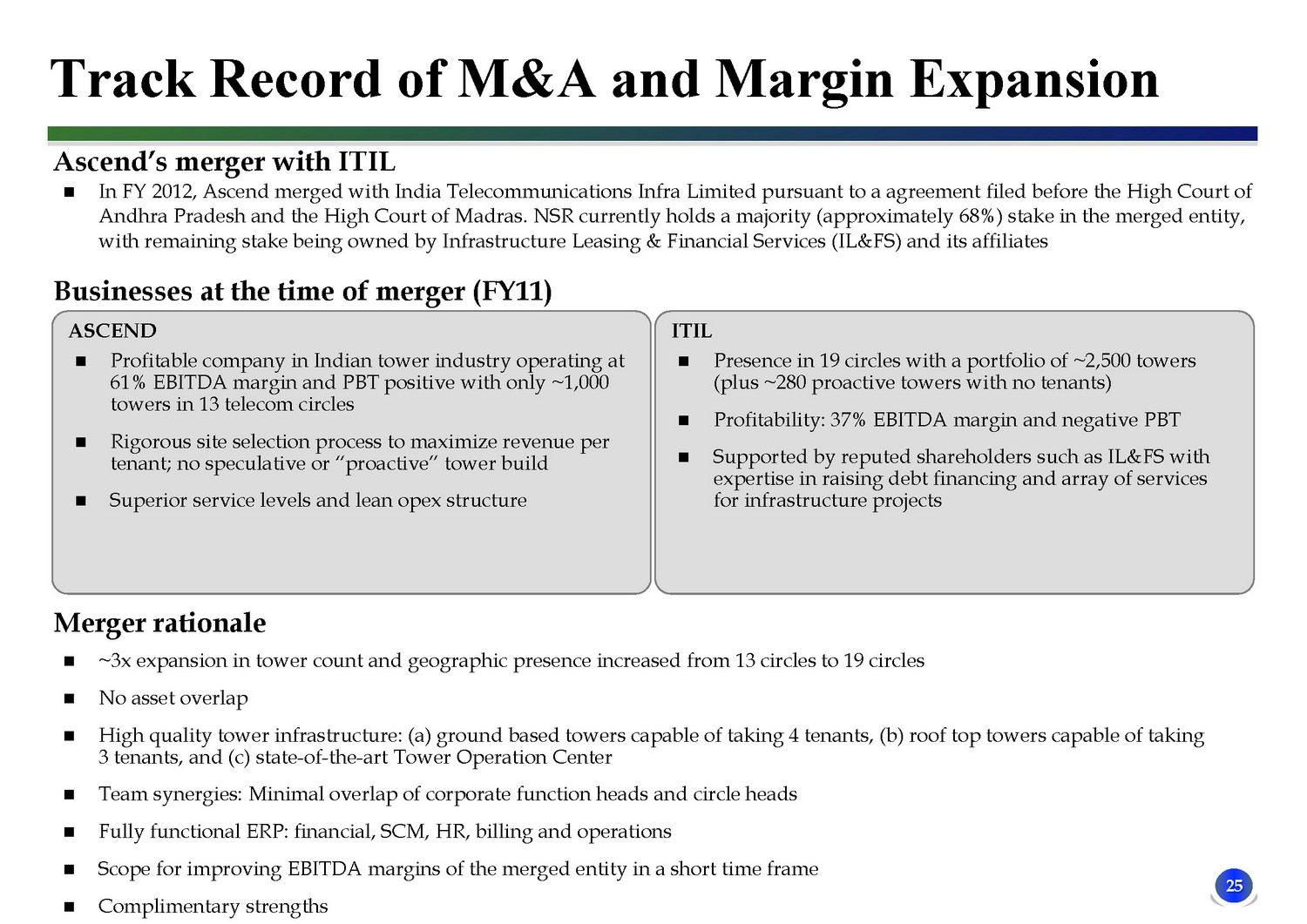

25 Track Record of M&A and Margin Expansion Ascend’s merger with ITIL ASCEND Profitable company in Indian tower industry operating at 61% EBITDA margin and PBT positive with only ~1,000 towers in 13 telecom circles Rigorous site selection process to maximize revenue per tenant; no speculative or “proactive” tower build Superior service levels and lean opex structure In FY 2012 , Ascend merged with India Telecommunications Infra Limited pursuant to a agreement filed before the High Court of Andhra Pradesh and the High Court of Madras . NSR currently holds a majority (approximately 68%) stake in the merged entity, with remaining stake being owned by Infrastructure Leasing & Financial Services (IL&FS) and its affiliates Businesses at the time of merger (FY11) ITIL Pre

sence in 19 circles with a portfolio of ~2,500 towers (plus ~280 proactive towers with no tenants) Profitability: 37% EBITDA margin and negative PBT Supported by reputed shareholders such as IL&FS with expertise in raising debt financing and array of services for infrastructure projects Merger rationale ~3x expansion in tower count and geographic presence increased from 13 circles to 19 circles No asset overlap High quality tower infrastructure: (a) ground based towers capable of taking 4 tenants, (b) roof top towers capable of taking 3 tenants, and (c) state - of - the - art Tower Operation Center Team synergies: Minimal overlap of corporate function heads and circle heads Fully functional ERP: financial, SCM, HR, billing and operations Scope for improving EBITDA margins of the merged entity in a short time frame Complimentary strengths

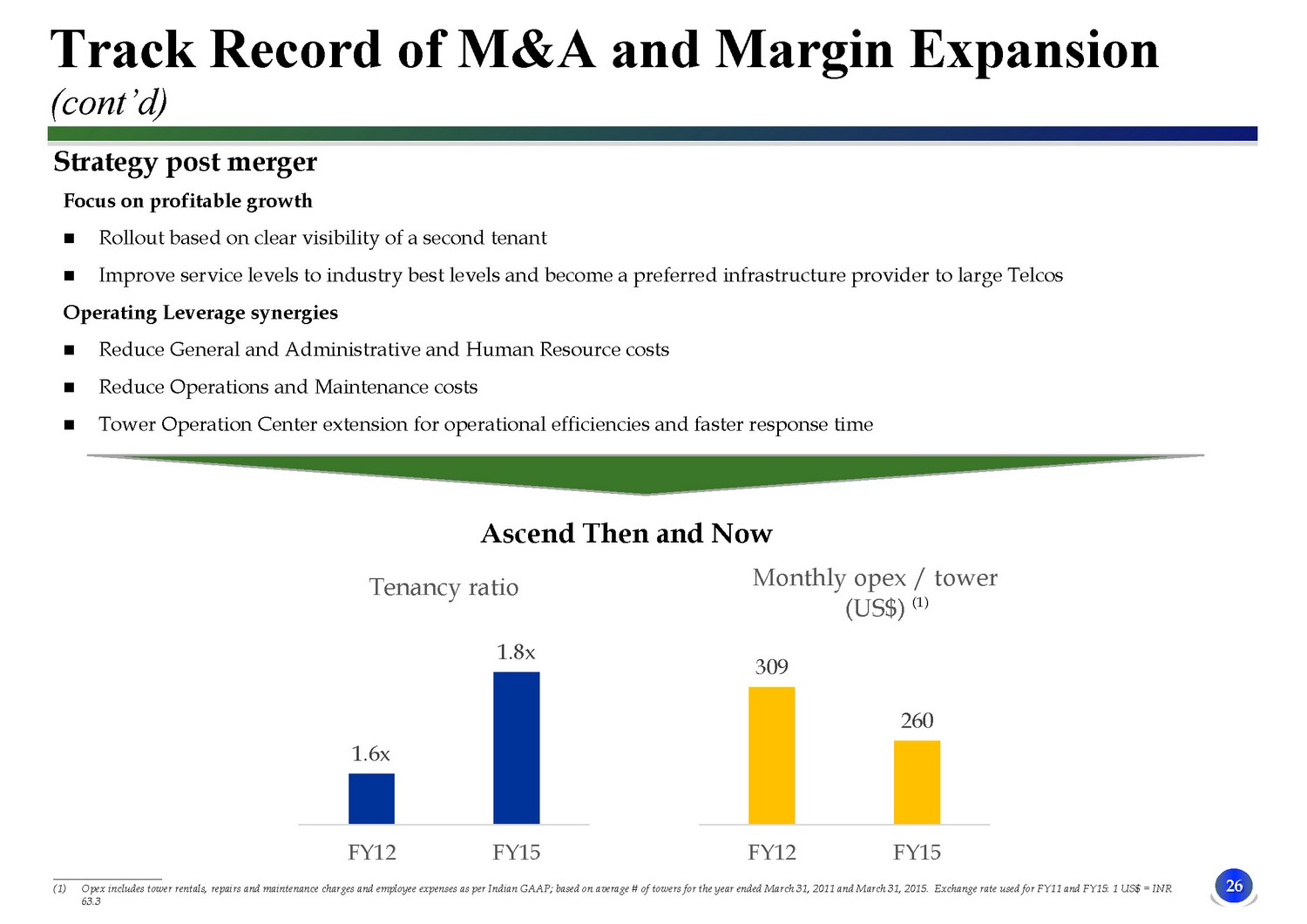

26 Strategy post merger Focus on profitable growth Rollout based on clear visibility of a second tenant Improve service levels to industry best levels and become a preferred infrastructure provider to large Telcos Operating Leverage synergies Reduce General and Administrative and Human Resource costs Reduce Operations and Maintenance costs Tower Operation Center extension for operational efficiencies and faster response time Ascend Then and Now Track Record of M&A and Margin Expansion (cont’d) 1.6x 1.8x FY12 FY15 Tenancy ratio 309 260 FY12 FY15 Monthly opex / tower (US$) (1) ____________________ (1) Opex includes tower rentals, repairs and maintenance charges and employee expenses as per Indian GAAP; based on average # of tow ers for the year ended March 31, 2011 and March 3

1, 2015. Exchange rate used for FY11 and FY15: 1 US$ = INR 63.3

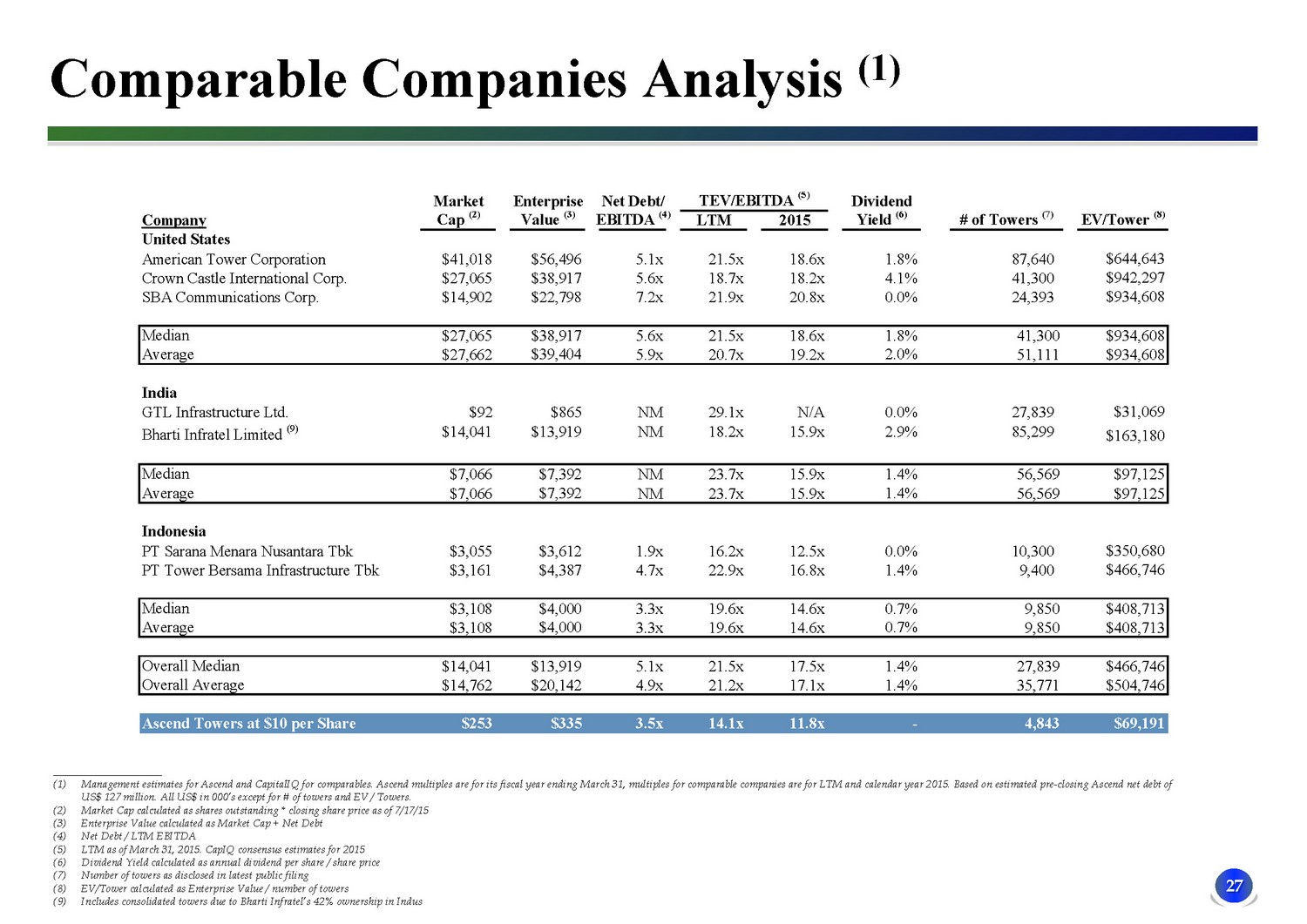

27 Comparable Companies Analysis (1) ____________________ (1) Management estimates for Ascend and CapitalIQ for comparables. Ascend multiples are for its fiscal year ending March 31, multiples for comparable companies are for LTM and c alendar year 2015. Based on estimated pre - closing Ascend net debt of US$ 127 million. All US$ in 000’s except for # of towers and EV / Towers. (2) Market Cap calculated as shares outstanding * closing share price as of 7/17/15 (3) Enterprise Value calculated as Market Cap + Net Debt (4) Net Debt / LTM EBITDA (5) LTM as of March 31, 2015. CapIQ consensus estimates for 2015 (6) Dividend Yield calculated as annual dividend per share / share price (7) Number of towers as disclosed in latest public filing (8) EV/Tower calculated as Enterprise Value / num

ber of towers (9) Includes consolidated towers due to Bharti Infratel’s 42% ownership in Indus Market Enterprise Net Debt/ TEV/EBITDA (5) Dividend Company Cap (2) Value (3) EBITDA (4) LTM 2015 Yield (6) # of Towers (7) EV/Tower (8) United States American Tower Corporation $41,018 $56,496 5.1x 21.5x 18.6x 1.8% 87,640 $644,643 Crown Castle International Corp. $27,065 $38,917 5.6x 18.7x 18.2x 4.1% 41,300 $942,297 SBA Communications Corp. $14,902 $22,798 7.2x 21.9x 20.8x 0.0% 24,393 $934,608 Median $27,065 $38,917 5.6x 21.5x 18.6x 1.8% 41,300 $934,608 Average $27,662 $39,404 5.9x 20.7x 19.2x 2.0% 51,111 $934,608 India GTL Infrastructure Ltd. $92 $865 NM 29.1x N/A 0.0% 27,839 $31,069 Bharti Infratel Limited (9) $14,041 $13,919 NM 18.2x 15.9x 2.9% 85,299 $163,180 Median $7,066 $7,392 NM 23.7x 15.9x 1.4% 56,569 $97,125 Average $7,066 $7,392 NM 23.7x 15.9x 1.4% 56,569 $97,125 Indonesia PT Sarana Menara Nusantara Tbk $3,055 $3,612 1.9x 16.2x 12.5x 0.0% 10,300 $350,680 PT Tower Bersama Infrastructure Tbk $3,161 $4,387 4.7x 22.9x 16.8x 1.4% 9,400 $466,746 Median $3,108 $4,000 3.3x 19.6x 14.6x 0.7% 9,850 $408,713 Average $3,108 $4,000 3.3x 19.6x 14.6x 0.7% 9,850 $408,713 Overall Median $14,041 $13,919 5.1x 21.5x 17.5x 1.4% 27,839 $466,746 Overall Average $14,762 $20,142 4.9x 21.2x 17.1x 1.4% 35,771 $504,746 Ascend Towers at $10 per Share $253 $335 3.5x 14.1x 11.8x - 4,843 $69,191