UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended September 30 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-38720

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices and zip code)

(800 ) 719-0671

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of each exchange on which registered

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Small reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of March 31, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of shares of common stock held by non-affiliates of the registrant was approximately $2.39 billion based upon the closing sale price on the Nasdaq Global Select Market reported for such date. Shares of Common Stock held by each officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the Registrant’s common stock outstanding as of November 23, 2022, was 56,568,420 .

DOCUMENTS INCORPORATED BY REFERENCE

TWIST BIOSCIENCE CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2022

TABLE OF CONTENTS

| Page | ||||||||

Forward-looking statements

This Annual Report on Form 10-K for the fiscal year ended September 30, 2022, or Form 10-K, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to, among other matters, plans for product development and licensing to third parties, plans and timeframe for the commercial development of DNA data storage capabilities, expectations regarding market penetration, anticipated customer conversions to our products, plans to expand in the international markets, identification and development of potential antibody candidates for the treatment of COVID-19 and other diseases, and the anticipated timeframe for remediating the material weakness in internal control over financial reporting. Forward-looking statements are also identified by the words “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “could,” “potentially” and variations of such words and similar expressions. You should not rely upon forward-looking statements as predictions of future events. Such statements are based on management’s expectations as of the date of this filing and involve many risks and uncertainties that could cause our actual results, events or circumstances to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include:

•our ability to increase our revenue and our revenue growth rate;

•our ability to accurately estimate capital requirements and our needs for additional financing; our estimates of the size of our market opportunities;

•our ability to increase DNA production, reduce turnaround times and drive cost reductions for our customers;

•our ability to effectively manage our growth;

•our ability to successfully enter new markets and manage our international expansion;

•our ability to protect our intellectual property, including our proprietary DNA synthesis platform;

•costs associated with defending intellectual property infringement and other claims;

•the effects of increased competition in our business;

•our ability to keep pace with changes in technology and our competitors;

•our ability to successfully identify, evaluate and manage any future acquisitions of businesses, solutions or technologies;

•the success of our marketing efforts;

•a significant disruption in, or breach in security of our information technology systems and resultant interruptions in service and any related impact on our reputation;

•our ability to attract and retain qualified employees and key personnel;

•the effects of natural or man-made catastrophic events such as the COVID-19 pandemic;

•the effectiveness of our internal controls;

•changes in government regulation affecting our business;

•uncertainty as to economic and market conditions and the impact of adverse economic conditions; and

•other risk factors included under the section titled “Risk Factors.”

1

You should not rely upon forward-looking statements as predictions of future events. Such statements are based on management’s expectations as of the date of this filing and involve many risks and uncertainties that could cause our actual results, events or circumstances to differ materially from those expressed or implied in our forward-looking statements.

Readers are urged to carefully review and consider all of the information in this Form 10-K and in other documents we file from time to time with the Securities and Exchange Commission, or SEC. We undertake no obligation to update any forward-looking statements made in this Form 10-K to reflect events or circumstances after the date of this filing or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

When we use the terms “Twist,” “Twist Bioscience,” the “Company,” “we,” “us” or “our” in this report, we are referring to Twist Bioscience Corporation and its consolidated subsidiaries unless the context requires otherwise. Sequence space and the Twist logo are trademarks of Twist Bioscience Corporation. All other company and product names may be trademarks of the respective companies with which they are associated.

* * * * *

2

PART I

Item 1.Business

At Twist Bioscience Corporation, we work in service of customers who are changing the world for the better. In fields such as health care, food/agriculture, industrial chemicals/materials, academic research and data storage, by using our products, our customers are developing ways to better lives and improve the sustainability of the planet. We believe Twist Bioscience is uniquely positioned to help accelerate their efforts and the faster our customers succeed, the better for all of us.

We have developed a disruptive DNA synthesis platform to industrialize the engineering of biology that provides DNA for a wide range of uses and markets. The core of our platform is a proprietary technology that pioneers a new method of manufacturing synthetic DNA by “writing” DNA on a silicon chip. We have miniaturized traditional chemical DNA synthesis reactions to write over one million short pieces of DNA on each silicon chip, approximately the size of a large mobile phone, reducing by 99.8% the amount of chemicals we estimate would be used per gene as compared to plate-based synthesis. We have combined our silicon-based DNA writing technology with proprietary software, scalable commercial infrastructure and an e-commerce platform to create an integrated technology platform that enables us to achieve high levels of quality, precision, automation, and manufacturing throughput at a significantly lower cost than our competitors.

We have applied our unique technology to manufacture a broad range of synthetic DNA-based products, including synthetic genes, tools for next generation sequencing, or NGS, sample preparation, and antibody libraries for drug discovery and development, all designed to enable our customers to conduct research more efficiently and effectively. Leveraging our same platform, we have expanded our footprint beyond DNA synthesis to manufacture synthetic RNA as well as antibody proteins to disrupt and innovate within larger market opportunities, in addition to discovery partnerships for biologic drugs and developing completely new applications for synthetic DNA, such as digital data storage. We sell our products to a global customer base of approximately 3,300 customers across a broad range of industries.

We believe our products enable a broad range of applications that may ultimately improve health and the sustainability of the planet across multiple industries, including:

•healthcare for the identification, prevention, diagnosis and treatment of disease (antibody discovery and optimization technology);

•chemicals/materials for cost-effective and sustainable production of new and existing specialty chemicals and materials, such as spider silk, nylon, rubber, fragrances, food flavors and food additives;

•food/agriculture for more effective and sustainable crop production;

•academic research for a broad range of education and discovery applications; and

•technology for potential use as an alternative long-term data storage medium.

Background

We currently generate revenue through our synthetic biology and NGS tools product lines. In addition, we are leveraging our platform to expand our portfolio to include other products and address additional market opportunities, including vertical market opportunities in biological drug discovery and development and digital data storage.

As part of our synthetic biology continuum offering, we have commercialized a custom DNA library solution which we believe can be leveraged to facilitate other proprietary tools to provide an end-to-end solution in biologics drug discovery and early development, from target to investigational new drug, or IND, application, adding value as a partner to biotechnology and pharmaceutical companies. We are also leveraging this capability for our internal antibody discovery efforts.

In fiscal year 2022 we served approximately 3,300 customers and reported $203.6 million in revenue, including $106.4 million in revenue from the healthcare sector, $57.9 million in revenue from the chemicals/materials sector, $37.1 million in revenue from the academic research sector and $2.2 million in revenue from the food/agriculture sector.

3

Our Markets

Synthetic Biology

Our synthetic biology products serve life sciences researchers across a variety of healthcare applications including drug discovery, disease detection, enzyme engineering, gene editing and basic academic research. In addition, our synthetic biology products are used for chemical and materials applications including development of synthetic spider silk, nylon, rubber, fragrances, flavors and food additives; for food and agricultural applications including improving crop traits such as adding vitamins or improving drought tolerance, and engineering bacteria to deliver nitrogen at the root of plants.

Synthetic DNA is the fundamental building block that allows researchers to engineer biology. Researchers at a wide range of institutions can design synthetic DNA to regulate the production of proteins and other molecules to achieve a specific functional purpose. While synthetic DNA has been produced for more than 40 years, the complexities of biology and the production constraints inherent in legacy processes have historically limited the applications and market opportunities for DNA synthesis.

Next-Generation Sequencing

Our NGS tools play an integral role in the way our customers prepare their patient samples to be sequenced. NGS has transformed many markets in recent years by changing the landscape of diagnosing disease and disorders and offers a path to prevent or treat disease. Some of the markets impacted by NGS include oncology, reproductive health, food/agriculture, consumer genomics, infectious disease research and drug discovery. As NGS technology improves and the cost of sequencing declines, new emerging markets that were once considered impractical, such as population-scale sequencing, liquid biopsy (a test that detects multiple types of cancer from a single blood sample), minimal residual disease testing and single cell sequencing, have become major areas of interest and investment.

Historically, a significant constraint in many NGS applications has been the high cost and long turnaround time of oligonucleotide production. Highly accurate and reproducible oligonucleotide production is required to produce high quality target enrichment data. Traditionally, the lack of options for oligonucleotide production forced researchers to choose between using less precise methods or reducing the number of samples in their study.

The ability of the Twist DNA synthesis platform to precisely manufacture target enrichment probes at large scale has dramatically increased the types of projects that can now be addressed using NGS technologies. Our platform has unlocked new applications, improved data quality, and dramatically expanded the types of scientific questions that can be answered using NGS. In addition, the speed of our DNA synthesis platform enables customers to quickly deploy NGS technologies to applications where the time to answer is critical.

Our Platform

We developed the Twist Bioscience DNA synthesis platform to address the limitations of throughput, scalability, and cost inherent in legacy DNA synthesis methods. Our platform stems from extensive analyses and improvements to the existing gene synthesis and assembly workflows. Our core technologies combine expertise in silicon, software, fluidics, chemistry, and motion and vision control to miniaturize thousands of parallel chemical reactions on silicon and write thousands of strands of DNA in parallel.

Enzymatic Synthesis

Several companies are pursuing an emerging gene synthesis process that uses enzymatic chemistry rather than phosphoramidite chemistry. While the promise of enzymatic synthesis to deliver longer genes in a shorter timeframe provides excitement for the industry, this technology is at the proof-of-concept stage and has not yet been proven to be scalable or commercially viable. We have developed our own, differentiated approach for enzymatic synthesis that we believe is scalable and commercially viable that we expect to implement for our enterprise DNA data storage solution.

4

Our Products

We have developed multiple products derived from synthetic DNA and our versatile DNA synthesis technology. Our current offering consists of two primary product lines, synthetic biology tools and NGS tools, that address different needs of our customers across a variety of applications. In addition to DNA, we now offer RNA and protein products.

Synthetic Biology Products

Synthetic genes and gene fragments

Synthetic genes are manufactured strands of DNA. Customers (biotech, pharma, industrial chemical, agricultural companies as well as academic labs) order our synthetic genes to conduct a wide range of research, including product development for therapeutics, diagnostics, chemicals/materials, food/agriculture, data storage as well as a multitude of emerging applications within academic research. Virtually all research and development of this type requires trial and error, and our customers require many variations of genes to find the DNA sequence that achieves their objectives.

We offer two primary categories of synthetic genes: genes of perfect quality, clonal genes, in a vehicle also called a vector to carry the DNA, and genes, that customers can place in their own vector, such as near-perfect quality and non-clonal genes or fragments. Within these two categories, customers can order different lengths of DNA depending on their required final gene construct. Customers can order longer genes or shorter genes and can stitch genes together to create longer or shorter constructs if desired.

Currently, we manufacture genes of up to 5,000 base pairs in length, yielding a clonally perfect piece of DNA that our customers can immediately use for their research. We offer non-clonal genes of up to 1,800 base pairs in length, which we believe addresses the vast majority of demand for non-clonal genes. We also offer larger quantities of DNA for customers who require it for their development efforts.

Oligonucleotide, or Oligo pools

Oligo pools, or high diversity collections of oligonucleotides, are utilized in many applications, including targeted NGS, CRISPR gene editing, mutagenesis experiments, DNA origami (the nanoscale folding of DNA to create two- and three-dimensional shapes at the nanoscale), DNA computing and data storage in DNA, among others. Our oligo pools are also used for high-throughput reporter assays that are used to study cell signaling pathways, gene regulation, and the structure of cell regulatory elements. For these applications, we provide customers with accurate and uniform synthetic oligos to precisely match their required designs.

We sell a diverse, customizable set of oligo pools, ranging from a few hundred oligos to over one million, and offer oligonucleotides of up to 300 nucleotides in length, with an error rate of 1:2000 nucleotides.

IgG proteins

Pairing the automation in our synthetic biology platform along with our expertise in antibody discovery, we introduced an immunoglobulin G (IgG) protein offering for our customers focused on the pursuit of drug discovery and development. In the process of antibody discovery, antibody fragments (Fab, small chain fragment variable (scFv) or VHH) must be reformatted to full IgGs. Leveraging our silicon-based synthesis platform, we provide customers with a high throughput IgG capability, removing this bottleneck from the antibody discovery process.

NGS tools

Building from our DNA synthesis platform, we have developed products to enable next-generation sequencing. In particular, we are focused on addressing the demand for better sample preparation products that improve sequencing workflow, increase sequencing accuracy, and reduce downstream sequencing costs. Using our silicon-based DNA synthesis platform, we are able to synthesize exact sequences of interest. In the target enrichment process, our synthetic DNA probes bind to the sequence of interest within the sample, acting like a magnet to isolate and physically extract the targeted segment of DNA.

Our NGS products are primarily used within diagnostic tests for various indications including rare disease, SARS-CoV-2 and cancer through liquid biopsy. In addition, customers use our NGS tools for population genetics research and biomarker discovery, translational research, microbiology and applied markets research. Our customers are primarily diagnostic companies and hospitals, research institutions, agricultural biotechnology companies, and consumer genetics companies conducting diagnostic tests for a wide range of applications.

5

We offer a wide variety of NGS tools for our customers including library preparation kits, human exome kits, fixed and custom panels as well as Alliance panels. Alliance panels are customer-curated content sold through Twist. In addition, we offer specific workflow solutions including a methylation detection kit for cancer, rare and inherited disease study, as well as a fast hybridization solution (FastHyb), which allows researchers to go from sample to sequencer in a single day.

Synthetic viral controls, infectious disease research tools

Leveraging our DNA synthesis platform, we launched a new product line of synthetic viral controls in response to the rapid spread of COVID-19. We offer fully synthetic SARS-CoV-2 RNA reference sequences as positive controls for the development of both NGS and reverse transcription-polymerase chain reaction (RT-PCR) assays. Our SARS-CoV-2 controls are now included on the U.S. Food and Drug Administration website as reference materials.

In July, we launched synthetic monkeypox controls. In addition, we offer a wide range of respiratory viral controls, including for influenzas, respiratory syncytial virus (RSV), rhinoviruses, SARS, MERS and coronaviruses. These controls can be used to provide quality control for the development, verification and ongoing validation of diagnostic tests and allow researchers to develop tests safely and effectively, without working with live virus samples.

We also offer SARS-CoV-2 Research Panels, the Twist Respiratory Virus Panel and the Pan-Viral Research Panel, for the detection of disease in a research setting. All products can be used for environmental monitoring and surveillance testing, while also providing insight into the full sequence information to monitor viral evolution and strain origin.

Drug and Target Discovery Solutions

Precision DNA libraries

Our platform allows customers to customize every antibody sequence variation and construct a precise library systematically to target the entire region of interest. We can create single-site libraries in which we change a single amino acid (which is encoded by a group of three DNA nucleobases) within the sequence or single-site saturation libraries in which we change every amino acid within the sequence for a more comprehensive approach. We can also generate combinatorial libraries in which we introduce changes to multiple sites within the same gene in specific ratios and combinations. These libraries can be used for antibody engineering, affinity maturation, and humanization, which simplifies downstream screening and identifies more lead molecules. Our libraries are explicitly developed for a specific area of the genome or tailored to a specific disease, with antibody compounds evenly represented across all desired areas of the genome.

We have also developed a comprehensive antibody optimization solution to enable simultaneous optimization of multiple characteristics of a given antibody. We have developed custom software for the optimization of antibody hits, antibody compounds that meet pre-specified criteria for therapeutic development. We have added our high throughput and hyper-variant antibody library capabilities to create a comprehensive antibody optimization solution for potential partners. We are now using this solution to design, build and test hyper-variant, tightly controlled antibody libraries that follow the rules of the human repertoire and mitigate the pitfalls associated with traditional optimization methods. By following the rules of the human repertoire, which means including only DNA sequences known to occur in humans, we have created a “Library of Libraries” made up of many different individual libraries. These libraries are natural in composition and are expected to generate better drug development candidates. The libraries also have a large degree of synthetic variation, enabling simultaneous optimization of several antibody characteristics and the discovery of antibodies with high affinity and specificity to drug targets.

Partnerships with leading companies

We believe we have several avenues available to monetize our antibody discovery program. In general, partnerships for our antibody development platform require us to provide rapid, on-demand (high affinity) antibodies based on one or more targets provided by the customer. These agreements typically have three elements with respect to the program:

•We license and also utilize our “Library of Libraries,” a panel of synthetic antibody phage display libraries derived only from sequences that exist in the human body.

•We work to discover, validate and optimize new antibody candidates against a specific target.

•The customers pay Twist annual technology licensing fees, and increasingly, we expect to receive contractually obligated project milestones for completion of various Twist activities and development milestones as our customers progress and commercialize the products. In many cases, we may also receive royalties on any products coming out of the partnerships.

6

Customers can design and purchase libraries, and we work with partners that bring us a target, to discover antibody leads against that target. These partnerships generate revenue in up-front fees, through the license of libraries and service revenue. In addition, many of our partnerships include success-based milestones for key clinical, regulatory and commercial achievements and/or royalties on any product sales resulting from our collaboration.

In addition, for our internal development efforts, we have selected several promising targets and have identified antibody leads to these targets. We intend to out-license these compounds at later stages of preclinical development to optimize both the up-front revenue and potential success-based milestones and royalties. By out-licensing antibody leads to experts in development and commercialization of biotechnology products, we can continue to focus on improving health through our proprietary platform. To date, we have generated antibody leads to multiple biological targets and these antibody leads are in various stages of early discovery and development.

As of September 30, 2022, we had signed 59 revenue-generating partnerships. Through these partnerships, we had 83 completed programs and 50 active programs with 59 of the programs including milestones and/or royalties as of September 30, 2022. Some of our partners include Boehringer Ingelheim GmbH, Takeda Pharmaceutical Company Limited, Adicet Bio, Kyowa Kirin, Invetx, Inc., Astellas Pharma Inc. and Neogene Therapeutics, Inc. In addition, we collaborate with companies that bring complementary technologies to expand our opportunities and reach.

In vivo antibody discovery

Through our acquisition of Abveris in 2021, we added in vivo antibody discovery services to our capabilities. Our ability to induce an immune response in our proprietary, genetically engineered hyperimmune DiversimAb™ mouse strains allows us to generate antibodies against desired targets of interest previously unavailable through this discovery method. In addition, we have developed a specialized way to screen immune system B cells to enable the discovery of large, diverse sets of monoclonal antibodies (mAbs) for our partners. As of September 30, 2022, the Boston team had 62 active programs underway.

Our growth strategy

Our objective is to be the leading provider of synthetic DNA and DNA-based products worldwide and to leverage our platform to build a leadership position in other life sciences markets in which we have a competitive advantage. We intend to accomplish this objective by executing on the following:

•maintain and expand our position as the provider of choice for high-quality, affordable synthetic genes and DNA, RNA and proteins to customers across multiple industries;

•become a leading supplier of NGS sample preparation products;

•conduct antibody therapeutic discovery and optimization for our current customers and future partners;

•continue to explore development of DNA as a digital data storage medium through internal research and government and industry partnerships; and

•expand our global presence.

Beyond these opportunities, we are working with industry partners to create new markets for our products by leveraging our platform.

Sales and marketing

We have built a versatile and scalable commercial platform that enables us to reach a diverse customer base that we estimate consists of over 100,000 synthetic DNA users, and many additional potential customers of our NGS library preparation products today. In order to address this diverse customer base, we have employed a multi-channel strategy comprised of a direct sales force targeting synthetic DNA customers, a direct sales force focusing on the NGS market and an e-commerce platform that serves both commercial channels. Our sales force is focused on customer acquisition, support, and management across industries, and is highly trained on both the technical aspects of our platform and how synthetic DNA can be used in a wide range of industries. Our easy-to-use e-commerce platform allows customers to design, validate, and place on-demand orders of customized DNA online, and enables them to receive real-time customized quotes for their products and track their order status through the manufacturing and delivery process. This is a critical part of our strategy to address our large market and diverse customer base, as well as drive commercial productivity, enhance the customer experience, and promote loyalty. We target customers of our NGS products through a direct sales team focused on the NGS tools market, which is separate from our synthetic DNA sales force. Our direct NGS sales representatives are focused on

7

supporting our early adopters and providing a high level of service in order to familiarize customers with our product offerings.

We sell our products through a worldwide commercial organization that includes direct sales personnel, commercial consultants in Europe and Asia, an e-commerce platform and distributors. As of September 30, 2022, we employed 224 people in sales, marketing and customer support.

Research and development

We are engaged in ongoing research and development efforts focused on enhancements to existing products and the development of new products. Currently, we are pursuing research and development projects with respect to the following:

•process development for highest quality oligos;

•optimizing our massively parallel fast turnaround time SynBio pipeline;

•silicon process and chemistry development for our data storage initiative;

•buildout of a massively parallel screening facility for our biopharma initiatives that allows us to screen thousands of antibodies per week;

•expansion of our product offerings for oligo, gene, synthetic controls, NGS library preparation and target enrichment, and DNA Libraries products; and,

•develop new products including mRNA and proteins.

Research and development activities are conducted in collaboration with manufacturing activities to help expedite new products from the development phase to manufacturing and to more quickly implement new process technologies. From time to time, our research and development efforts have included participation in technology collaborations with universities and research institutions.

As of September 30, 2022, we employed 303 people in our research and development team.

Patents and other intellectual property rights

As of September 30, 2022, we owned 39 issued U.S. patents and 29 issued international patents; four in China, three in Europe, eight in South Korea, four in Taiwan, five in Japan, one in Eurasia, one in Singapore, one in Israel, one in Hong Kong, and one in Australia. There are 342 pending patent applications, including 103 in the United States, 216 international applications, and 23 applications filed under the Patent Cooperation Treaty. Additionally, we have exclusively licensed a patent portfolio containing 12 issued patents, including one U.S. patent and 11 international patents, and 11 pending applications, including three in the U.S. and eight international applications. We have also licensed a patent portfolio containing 11 pending applications, including one in the U.S. and ten international applications. We have further licensed another patent portfolio containing two issued U.S. patents, four international patents, and five pending applications (one in the U.S. and four international applications). Our policy is to file patent applications to protect technology, inventions and improvements that are important to our business. Individual patent terms extend for varying periods of time, depending upon the date of filing of the patent application, the date of patent issuance, and the legal term of patents in the countries in which they are obtained.

Manufacturing and facilities

The production of our products is a highly complex and precise process. We currently manufacture all of our products and multiple sub-assemblies at our manufacturing facility in South San Francisco, California. We expect to begin manufacturing products for revenue generation in our Wilsonville facility as of January 2023. We consider our long-lived assets to be ready for their intended use when they are first capable of producing a unit of product that is saleable or internally usable, at which point depreciation of the asset commences. We also outsource some of our sub-assemblies to third party manufacturers. All of our products originate from synthetic DNA obtained from nanostructured clusters fabricated on our proprietary silicon technology platform. Due to its on-demand nature, the gene synthesis business requires manufacturing operations to be in operation 24 hours a day, seven days a week, 365 days per year. For synthetic genes, we have built a highly scalable gene production process with what we believe is industry-leading capacity to address the growing demand of scalable, high-quality, affordable synthetic genes. As of September 30, 2022, we employed 331 people in our manufacturing and operations team.

8

In addition to synthetic genes, we manufacture oligo pools. The pooling process has been fully automated through a mixture of custom proprietary and over-the-counter liquid handling equipment. We have the capacity to make many millions of high-quality oligos per month that can be used to make genes and gene fragments of various lengths, oligo pools of various sizes, DNA libraries and NGS tools products. We intend to increase our shipments to leverage our production capacity through our e-commerce platform, which we believe will expand both our market opportunity and our customer base.

The manufacturing process for our NGS tools is highly flexible given the efficiency of our production capability. We have automated the entire workflow using proprietary and over-the-counter laboratory equipment. We have built dedicated production capabilities for our NGS products.

ISO certification

In 2018, we certified our Quality Management System (QMS) to the ISO 9001:2015 (Quality Management Systems—Requirements) standard and ISO 13485:2016 standard (Medical devices—Quality management systems—Requirements for regulatory purposes). ISO is a global network of national standards with over 18,000 standards for nearly every aspect of technology and business. ISO has standard bodies in 163 countries. ISO Surveillance Audits are carried out twice within a three-year period by the registrar (certification body) to ensure we maintain our system in compliance with ISO standards. Recertification is required every three years and we have been successfully recertified since obtaining our original ISO certification. Most recently, we were registered with the FDA as a manufacturer of “Reagents, 2019-novel coronavirus nucleic acid”.

In 2020, our quality management systems for manufacturing our NGS Target Enrichment Panels in our South San Francisco offices were certified to ISO 13485:2016.

Supply chain

We have historically purchased many of the components and raw materials used in our products from numerous suppliers worldwide. For reasons of quality assurance, sole source availability or cost effectiveness, certain components and raw materials used in the manufacture of our products are available only from one supplier. We have worked closely with our suppliers to develop contingency plans to assure continuity of supply while maintaining high quality and reliability, and in some cases, we have established long-term supply contracts with our suppliers. In response to the COVID-19 pandemic, we increased our supply of several materials and sourced additional suppliers for key materials to mitigate supply chain disruptions and ensure ongoing operations.

Competition

The synthetic biology industry is intensely competitive and is characterized by price competition, technological change, international competition, product turnaround time and manufacturing yield problems. The competitive factors in the market for our products include:

•price;

•product quality, reliability and accuracy;

•product offerings & complexity;

•turnaround time;

•breadth of product line;

•design and introduction of new products;

•market acceptance of our products and those of our customers;

•throughput and scale; and

•technical support and service.

We face competition from a broad range of providers of core synthetic biology products such as GenScript Biotech Corporation, DNA Script, Inc., GENEWIZ (owned by Azenta), Integrated DNA Technologies, Inc. (owned by Danaher Corporation), DNA 2.0 Inc. d/b/a/ ATUM, GeneArt (owned by Thermo Fisher Scientific Inc.), Eurofins Genomics LLC,

9

Sigma-Aldrich Corporation (owned by Charles River Laboratories, Inc.) (an indirect wholly owned subsidiary of Merck & Company), Promega Corporation, OriGene Technologies, Inc., Blue Heron Biotech, LLC and others. Additionally, we compete with both large and emerging providers in the life sciences tools and diagnostics industries focused on sample preparation for NGS such as Thermo Fisher Scientific Inc., Illumina, Inc., Integrated DNA Technologies, Inc., and Agilent. In the antibody discovery market, we compete with clinical research organizations, such as Curia, GenScript, and Genovac (formerly part of Aldevron, LLC), and antibody discovery biotechnology companies, such as Fair Journey/Iontas, Adimab, Zymeworks, Distributed Bio (owned by Charles River), Ablexis, Specifica, OmniAb and AbCellera Biologics Inc. In the emerging field of DNA digital data storage, we compete with Catalog Technologies, Inc., Helixworks, Iridia, Inc., Roswell, Seagate, Microsoft, Genscript, Molecular Assemblies, Ansa Biotechnologies, various academic institutions, and other emerging competitors.

Environmental, social, governance (ESG) and human capital

We are at the forefront of the synthetic biology revolution, and our products are increasingly being used to empower our customers, which consist of diagnostic, therapeutic and healthcare companies, agricultural biotech companies, chemical companies, academic institutions and government entities, around the world to address large societal challenges. All of our work supports our mission to provide synthetic DNA and DNA products to improve health and sustainability.

Our employees are a key factor in our ability to serve our customers. The ability to hire and retain highly skilled professionals remains key to our success in the marketplace. To attract develop and motivate our employees, we offer a challenging work environment, ongoing skills development initiatives, attractive career advancement, opportunities and a culture that rewards entrepreneurial initiative and exceptional execution.

Guiding Principles and Business Ethics

Our guiding principles of grit, impact, service and trust serve as our guiding principles. Our guiding principles set the tone for how we work together, provide a framework for giving feedback and increase the power of our brand. Service is at the core of our business and our interactions with one another. We relentlessly focus on exceeding internal and external customer needs.

Diversity, equity, inclusion and belonging

Diversity is in our DNA all the way from the top of the organization down to the individual employee. Our board adopted a Board Diversity Statement in January 2022 to provide informed decisions on diversity, equity and inclusion. Our employees come from numerous countries and bring diversity to our workplace across many critical categories. We believe our company is stronger because of the variety of experiences and backgrounds our employees bring to their work every day. 63% of our employees identify as people of color.

We are committed to creating and maintaining a diverse, inclusive and safe work environment where our employees can bring their best selves to work each day. Our commitment to diversity extends through our recruitment, retention, learning and engagement and community partnerships. As part of our diversity, equity, inclusion and belonging strategy, we made an active decision to pursue opportunities for learning and engagement that bring people from different backgrounds together into conversation. We have initiated monthly Culture Conversations where we explore identities and systems of power using an intersectional lens each month. Past topics include: disability, LGBTQIA+, ageism, Latin identity, and more. Our objective is to appreciate each other as individuals with unique lived experiences, rather than define one another by a single trait such as race, sexual orientation or geographical location. To assess our efforts toward building a diverse workforce, we have included questions in our engagement survey to measure employee perception of inclusive culture.

In addition, we mandate training for all employees and managers to prevent workplace and sexual harassment. The course equips leaders and employees with the tools they need to identify and address unwelcome conduct in non-adversarial, respectful terms.

10

Recruiting

We believe that our employees are our most important asset. Beginning with the pre-recruitment process, we provide internship opportunities for students interested in biotechnology and the science, technology, engineering and mathematics (STEM) fields in both scientific and non-scientific departments. We engage with local communities to provide expert speakers sharing nontraditional career pathways for the biotechnology field. We partner with community colleges, historically black colleges and universities and Hispanic-focused institutions to build our brand within diverse communities as a source of diverse, high-quality candidates for every role with the goal of identifying the best possible candidate to fill open positions within the company. We implemented a remote work policy which has resulted in a broader applicant pool because they aren’t limited to geographic location.

We actively engage with future scientists through organizations including the International Genetically Engineered Machine (iGEM), a non-profit organization dedicated to furthering the field of synthetic biology. In addition, we have provided internships through the Gloucester Biotechnology Academy, a hands-on training program prepares students for careers as entry-level technicians in cutting-edge laboratories; and Eastside Preparatory Academy, a high school dedicated to serving students historically underrepresented in higher education. We have engaged with several organizations in the Portland area including Portland Community College, Partnerships in Diversity, Oregon State University, Oregon Biosciences Association and others.

With an active program in place for our employees, we are striving to further support our female and underrepresented employees in advancing their careers while continuing to focus on hiring diverse talent, particularly at more senior positions.

Compensation and benefits, health and wellness

We strive to provide pay, comprehensive benefits and services that help meet the varying needs of our employees. Our generous total rewards package includes above-market pay; fully covered healthcare benefits for employees, with family member healthcare benefits covered at 90%; a health savings account that is fully funded for individuals and their families; approximately four weeks of paid vacation; a minimum of sixteen weeks of parental leave for all employees globally; flexible work schedules; and onsite services. In addition, we offer every full-time employee, both exempt and non-exempt, the benefit of equity ownership in the company through stock option grants and our employee stock purchase plan.

We have an expert-built educational platform to assist employee’s fertility & family building needs with the help of treatment, fostering or adopting, plus dedicated resources for egg freezers, egg donation, LGBTQIA+ families, and solo parents.

We have increased our well-being benefits, by offering programs that help workers monitor and reduce their stress levels, providing apps to support sleep and relaxation. We have further addressed employees’ emotional health and well-being by providing meditation sessions and using telehealth programs to offer mental health counseling.

COVID-19 employee safety and benefits

Many of our customers require our synthetic DNA products to provide critical tools for global health. Twist continues to take precautions to reduce the risk of virus exposure for all employees. We require all U.S. employees to be vaccinated. As a benefit for all employees, we provide COVID and flu vaccines for the employee and their family.

Employee health and safety

We remain steadfast in our commitment to promote the health and safety of our employees. We require annual workplace safety training to reinforce workplace safety procedures that may be useful in the event of emergency situations and to assist our employees in helping to prevent workplace accidents. Our Employee Safety Committee, which is comprised of numerous cross-departmental members meets on a regular basis (at least quarterly) to review workplace safety and adherence to safety policies. As part of our efforts, all employees and managers complete workplace harassment and sexual harassment training that includes details on how to report any violation of these policies.

11

Conduct and ethics

Our Board of Directors adopted and regularly reviews the Code of Conduct, which applies to all of our employees, directors and officers. We believe it is imperative that the board of directors and senior management strongly support a no-tolerance stance for workplace harassment, biases and unethical behavior. All employees are required to abide by, review and confirm compliance to the company’s Code of Business Conduct and Ethics Policy, our Anti-Money Laundering Policy, our Anti-Corruption Policy. We have established a reporting hotline and email address that enables employees to anonymously report any suspected violations of the Code of Conduct.

In addition, because synthetic DNA is considered to be a dual use technology, we invest substantial financial and human resources in biosecurity to help ensure that our products are used for responsible research. We endeavor to abide by all local, national and international regulations as well as trade compliance requirements and are an active member of the International Gene Synthesis Consortium and the Australia Group. We maintain an active relationship with the governing body for synthetic DNA within the U.S. Department of Homeland Security.

Growth and development

We invest significant financial and support resources to develop the talent we need to remain at the cutting edge of innovation to ensure Twist Bioscience is an employer of choice. Our performance management system is aimed at supporting our culture, maintaining consistency with our guiding principles and to focusing on continuous learning and development. Our success in the market depends on employees understanding and embracing how their job contributes to the company’s overall strategy. We encourage cross team communication as well as integrated departmental communication. We believe this broadens our employee’s skill set and provides opportunity for growth and advancement. We invest in our next generation of leaders through a one-year leadership program for mid-level managers. In addition, we offer tuition reimbursement aimed at growth and career development.

We have made a significant investment in an online learning platform with on-demand, video-based content. Employees have the opportunity to refine or develop professional skills, learn new software, and explore as they plan their career growth. The platform also offers tremendous potential for managers and employees to create development plans as part of the performance review process.

Communications and engagement

We employ a variety of tools to facilitate open and direct communication including open forums with executives, employee surveys and engagement through focus groups, forums and committees. We endeavor to further refine our employee programs through our employee engagement survey as well as follow up quarterly pulse surveys. Based on the most recent survey conducted in May 2022 where 87% of our employees responded:

•93% of employees understand Twist’s mission

•92% understand how they contribute to the mission of the company

•94% understand how their goals contribute to Twist

We hold All Hands meetings twice per month as well as a monthly managers meeting for all people managers.

In October 2022, we were named a Great Place to Work for the second year in a row in the United States, and for the first time in China, Germany, Singapore and the UK.

Community engagement, social and relationship capital

We are endeavoring to develop relationships, give back to our communities and engage in corporate social responsibility and sustainability initiatives. We provide all employees with eight fully paid hours each year to give back to the community at an organization of their choice. We are working to engage with the local community organizations to provide volunteer opportunities for our employees. As we grow our employee base, we will extend our efforts in these areas.

Employee population

As of September 30, 2022, we had 989 employees, which includes our team of 39 dedicated commercial consultants. Of these employees, 303 were primarily engaged in engineering as well as research and development activities; 224 were primarily engaged in marketing, sales and customer support; 131 were primarily engaged in general and administrative activities; and 331 were primarily engaged in operations and manufacturing, of which there are 318 full-time employees

12

dedicated to manufacturing our synthetic genes, oligo pools, NGS tools and DNA libraries. None of our employees is represented by a labor union, and we consider our employee relations to be good.

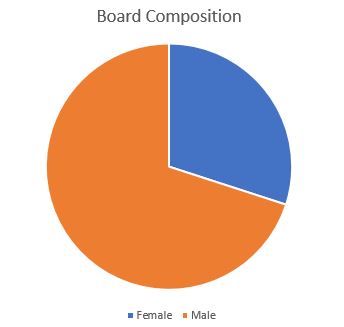

Board of Directors

| Board Member | Gender |  | ||||||

| Nicolas Barthelemy | Male | |||||||

| Nelson C. Chan | Male | |||||||

| Robert Chess | Male | |||||||

| Keith Crandell | Male | |||||||

| Jan Johannessen | Male | |||||||

| Xiaoying Mai | Female | |||||||

| Robert Ragusa | Male | |||||||

| Melissa A. Starovasnik | Female | |||||||

| Emily Leproust | Female | |||||||

| William Banyai | Male | |||||||

| Female | 30 | % | ||||||

| Male | 70 | % | ||||||

| Total | 10 | |||||||

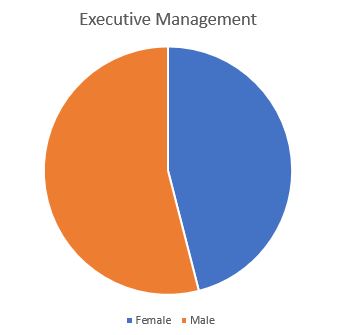

Executives

| Executive Team Member | Gender |  | ||||||

| Emily Leproust | Female | |||||||

| Jim Thorburn | Male | |||||||

| Bill Banyai | Male | |||||||

| Angela Bitting | Female | |||||||

| Siyuan Chen | Male | |||||||

| Dennis Cho | Male | |||||||

| Patrick Finn | Male | |||||||

| Paula Green | Female | |||||||

| Steffen Hellmold | Male | |||||||

| Tracey Mullen | Female | |||||||

| Nimisha Srivastava | Female | |||||||

| Aaron Sato | Male | |||||||

| Erin Smith | Female | |||||||

| Female | 46 | % | ||||||

| Male | 54 | % | ||||||

| Total | 13 | |||||||

13

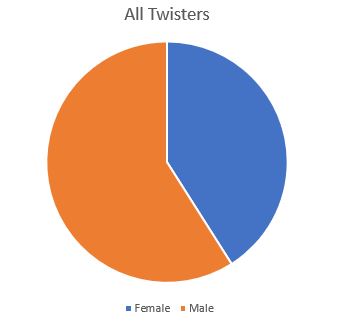

All Twisters (inclusive of executives)

| Gender | Percent of all Twisters |  | ||||||

| Female | 41 | % | ||||||

| Male | 59 | % | ||||||

| Total | 989 | |||||||

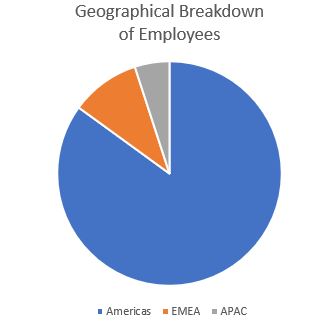

| Region | Percent of all Twisters |  | ||||||

| Americas | 85 | % | ||||||

| EMEA | 10 | % | ||||||

| APAC | 5 | % | ||||||

| Total | 989 | |||||||

14

Environmental management

Many gene synthesis companies rely on oligonucleotide, or oligo (short pieces of DNA) synthesis on a plastic 96-well plate format. The 96-well plate allows researchers to create 96 oligos in parallel, one in each well. While this process can successfully achieve DNA synthesis, it requires high volumes of phosphoramidites, an expensive raw material, as well as other ancillary chemical reagents such as activator, wash, deblock, oxidizer and capping reagents, many of which are toxic and environmentally harmful. The reagent consumption levels vary depending on the DNA synthesizer and its setup.

At Twist, we developed an ultra-high-throughput DNA synthesis platform to address the limitations of throughput, scalability, and cost inherent in legacy DNA synthesis methods like that described above. With a footprint that is similar to the size of a 96-well plate that produces 96 oligos or 1 or 2 genes, we are able to produce approximately 1,000,000 oligos or 9,600 genes in parallel.

With the Twist ultra-high-throughput DNA synthesizer, we believe we are able to achieve at least a 99.8% volume reduction (when compared to a standard manufacturer of oligos) in chemical consumption compared to legacy oligo synthesis. For the more expensive chemical reagents (e.g., phosphoramidite and activator reagents), we have achieved nearly a 1,000,000-fold volume reduction. This drastic volume reduction is achieved through various engineering breakthroughs, including using of inkjet printing to deliver phosphoramidites and activator reagents (10 picoliter per droplet), and the development of proprietary flow cell chambers and reagent recipes, among other proprietary developments.

In addition, the legacy oligo synthesis process often produces significantly more oligos than is typically required for most subsequent processes. In contrast, the Twist system includes a fully-integrated and miniaturized molecular biology workflow to assemble genes using nearly 100% of the oligos we produced, yielding nearly zero wasted synthesized oligos and reducing the usage of molecular biology reagents (e.g., polymerase and other enzymes, and dNTP).

Overall, Twist’s process to synthesize DNA significantly reduces the quantity of chemicals used, overproduced product and waste, for a more sustainable production process.

Government regulation

Our synthetic DNA products are intended for “Research Use Only” (RUO). We sell and promote these products for non-diagnostic and non-clinical purposes to academic institutions, life sciences and research laboratories, and biopharmaceutical and biotechnology companies. Our products are intended to be used as research tools that enable our customers to develop a wide spectrum of commercial products. However, in the future we may be subject to a variety of specialized regulatory requirements, including potential regulation by the U.S. Food and Drug Administration, or the FDA. For example, in December 2010, the Presidential Commission for the Study of Bioethical Issues recommended that the federal government oversee, but not regulate, synthetic biology research. The Presidential Commission also recommended that the federal government lead an ongoing review of developments in the synthetic biology field and that the federal government conduct a reasonable risk assessment before the field release of synthetic organisms.

Aside from certain labeling requirements, we believe that our products, as currently marketed, are largely unregulated by governmental bodies, including the FDA. As we expand our product development to include products for clinical applications, we may be subject to a variety of specialized regulatory requirements, including regulation by the FDA, any of which could have a material effect on the business.

RUO is a term applicable to our target enrichment products for the next-generation sequencing (NGS) market and is applied to kits sold to this market segment. It is intended to restrict use of the kits to non-in vitro diagnostic purposes. Our NGS target enrichment and library preparation products are used in a more comprehensive workflow for next generation sequencing for research purposes only. In the future, we may develop this larger workflow as an in vitro diagnostic, for which we will obtain prior authorization from FDA or other applicable regulatory authorities before commercialization.

15

FDA

Pursuant to its authority under the Federal Food, Drug, and Cosmetic Act, or the FDC Act, the FDA has jurisdiction over medical devices. The FDA regulates, among other things, the research, testing, manufacturing, safety, labeling, storage, recordkeeping, premarket clearance or approval, marketing and promotion and sales and distribution of medical devices in the United States to ensure that medical products distributed domestically are safe and effective for their intended uses. In addition, the FDA regulates the import and export of medical devices.

Medical device regulation in general

The FDC Act classifies medical devices into one of three categories based on the risks associated with the device and the level of control necessary to provide reasonable assurance of safety and effectiveness. Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to previously 510(k) cleared devices are generally categorized as Class III. These devices typically require submission and approval of a Premarket Approval Application, or PMA. However, FDA can reclassify or use “de novo classification” for a device that meets the FDC Act standards for a class II device, permitting the device to be marketed without PMA approval. Devices deemed to pose lower risk are categorized as either Class I or II. Class II classification usually requires the manufacturer to submit to the FDA a premarket notification submission requesting clearance of the device for commercial distribution in the United States pursuant to Section 510(k) of the FDC Act, referred to as 510(k) clearance. Most Class I devices are exempt from this requirement, as are some lower risk Class II devices. When a 510(k) is required, the manufacturer must submit to the FDA a premarket notification submission demonstrating that the device is “substantially equivalent” to: (i) a device that was legally marketed prior to May 28, 1976, for which PMA approval is not required, (ii) a legally marketed device that has been reclassified from Class III to Class II or Class I, or (iii) another legally marketed, similar device that has been cleared through the 510(k) process.

All clinical studies of investigational medical devices to determine safety and effectiveness must be conducted in accordance with FDA’s investigational device exemption (IDE) regulations, including the requirement for the study sponsor to submit an IDE application to FDA, unless exempt, which must become effective prior to commencing human clinical studies. PMA reviews generally last between one and two years, although they can take longer. Both the 510(k) and the PMA processes can be expensive and lengthy and may not result in clearance or approval. If we are required to submit our products for pre-market review by the FDA, we may be required to delay marketing and commercialization while we obtain premarket clearance or approval from the FDA. There would be no assurance that we could ever obtain such clearance or approval.

All medical devices, including in vitro diagnostics, or IVDs, that are regulated by the FDA are also subject to the Quality System Regulation. Obtaining the requisite regulatory approvals, including the FDA quality system inspections that are required for PMA approval, can be expensive, may involve delay, and could conclude without such products being approved by the FDA. Changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time during the development or marketing of our products. This may negatively affect our ability to obtain or maintain FDA or comparable regulatory clearance or approval of our products in the future.

IVDs are a category of medical devices that include reagents, instruments, and systems intended for use in diagnosis of disease or other conditions, including a determination of the state of health, in order to cure, mitigate, treat, or prevent disease or its sequelae. IVDs are intended for use in the collection, preparation, and examination of specimens taken from the human body. A RUO IVD product is an IVD product that is in the laboratory research phase of development. As such, an RUO IVD is not intended for use in clinical investigations or in clinical practice. Such RUO products do not require premarket clearance or approval from the FDA, provided that they be labeled “For Research Use Only. Not For Use In Diagnostic Procedures” pursuant to FDA regulations.

As noted above, although our products are currently intended for research purposes only, the regulatory requirements related to marketing, selling, and supporting such products could be uncertain and depend on the totality of circumstances. This uncertainty exists even if such use by our customers occurs without our consent. If the FDA or other regulatory authorities assert that any of our RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

According to the FDA, merely including the RUO labeling statement will not necessarily render the device exempt from FDA premarket clearance, approval, or other regulatory requirements if the totality of circumstances surrounding the distribution of the product indicate that the manufacturer intended its IVDs for diagnostic use. Such circumstances may include, but are not limited to, the product’s advertising, labeling, or promotion, or the manufacturer’s assistance of a clinical laboratory in validating or verifying a test that incorporates products labeled RUO. This uncertainty exists even if such use by our customers occurs without our consent. If the FDA or other regulatory authorities assert that any of our

16

RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

EU Regulation

In the European Union (EU), the new In Vitro Diagnostic Device Regulation (EU) 2017/746, or IVDR, imposes stricter requirements for the marketing and sale of applicable medical devices, including in the area of clinical evaluation requirements, quality systems and post-market surveillance. Some of the IVDR requirements such as general safety and performance requirements became effective in May 2022 while the complete enforcement of the entirety of IVDR will not happen until May 2028. We likely will be impacted by this new regulation, either directly as a manufacturer of IVDs, or indirectly as a supplier to customers who are placing IVDs in the EU market for clinical or diagnostic use. Complying with the IVDR requirements may require us to incur significant expenditures. Failure to meet these requirements could adversely impact our business in the EU and other regions that tie their product registrations to the EU requirements.

FSAP

The Federal Centers for Disease Control and Prevention (CDC) and the Animal and Plant Health Inspection Service (APHIS) administer requirements of the Federal Select Agent Program, or FSAP. FSAP requirements govern possession, use, and transfer of select agents and toxins consisting of biological materials that have the potential to pose a severe threat to public, animal or plant health or to animal or plant products. The FSAP currently lists approximately 67 select agents and toxins, and approximately 247 entities were registered under FSAP to possess a select agent or toxin. The registered entities primarily consist of academic, federal and non-federal government, commercial, and private facilities that conduct research studies or diagnostic activities. We are not a registered entity under FSAP and it is our policy generally not to produce or otherwise work with any biological material that is subject to FSAP license requirements. To the extent that we may possess, use, or transfer any material considered a select agent or toxin under FSAP prospectively, we would seek to register with FSAP and obtain all necessary permits for possession, transfer, importation, or any other regulated activity.

Export controls

Some sequences and synthetic controls we produce may be subject to licensing requirements for export outside of the United States under the U.S. Export Administration Regulations (EAR). Given the evolving nature of our industry, legislative bodies or regulatory authorities may adopt additional regulation or expand existing regulation to include our service. Changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time, and we may be unable to obtain or maintain comparable regulatory approval or clearance of our service, if required. These regulations and restrictions may materially and adversely affect our business, financial condition, and results of operations.

Available information

Our corporate website address is www.twistbioscience.com. We use the investor relations page of our website for purposes of compliance with Regulation FD and as a routine channel for distribution of important information, including news releases, analyst presentations, financial information and corporate governance practices. Our filings with the SEC are posted on our website and available free of charge as soon as reasonably practical after they are electronically filed with, or furnished to, the SEC. The SEC’s website, www.sec.gov, contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Form 10-K is not incorporated by reference in this Form 10-K unless expressly noted. Further, the Company’s references to website URLs are intended to be inactive textual references only.

Item 1A.Risk factors

Risk Factor Summary

Investing in our common stock involves a high degree of risk. You should carefully consider all information in the Annual Report on Form 10-K and in subsequent reports we file with SEC prior to investing in our common stock. These risks are discussed more fully in the section titled “Risk Factors.” These risks and uncertainties include, but are not limited to, the following:

•We are subject to risks associated with COVID-19;

•We have incurred net losses in every period to date, and we expect to continue to incur significant losses as we develop our business and may never achieve profitability;

17

•We may require additional financing to achieve our goals, and a failure to obtain this necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product manufacturing and development and other operations;

•If we are unable to maintain adequate revenue growth or do not successfully manage such growth, our business and growth prospects will be harmed;

•Rapidly changing technology and extensive competition in synthetic biology could make the products we are developing and producing obsolete or non-competitive unless we continue to develop and manufacture new and improved products and pursue new market opportunities;

•The continued success of our business relies heavily on our disruptive technologies and products and our position in the market as a leading provider of synthetic DNA using a silicon chip;

•If we are unable to expand our DNA synthesis manufacturing capacity, we could lose revenue and our business could be harmed.

•We depend on one single-source supplier for a critical component for our DNA synthesis process. The loss of this supplier or its failure to supply us with the necessary component on a timely basis, could cause delays in the future capacity of our DNA synthesis process and adversely affect our business;

•We depend on the continuing efforts of our senior management team and other key personnel. If we lose members of our senior management team or other key personnel or are unable to successfully retain, recruit and train qualified researchers, engineering and other personnel, our ability to develop our products could be harmed, and we may be unable to achieve our goals;

•We may engage in strategic transactions, including acquisitions and divestitures that could disrupt our business, cause dilution to our stockholders, reduce our financial resources, or prove not to be successful;

•Our products could in the future be subject to additional regulation by the U.S. Food and Drug Administration or other domestic and international regulatory agencies, which could increase our costs and delay our commercialization efforts, thereby materially and adversely affecting our business and results of operations;

•If we fail to maintain proper and effective internal controls, our ability to produce accurate financial statements on a timely basis could be impaired, which would adversely affect our business;

•Our ability to protect our intellectual property and proprietary technology through patents and other means is uncertain; and

•If we are unable to obtain, maintain and enforce intellectual property protection, others may be able to make, use, or sell products and technologies substantially the same as ours, which could adversely affect our ability to compete in the market.

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding other statements in this Annual Report on Form 10-K. The following information should be read in conjunction with Part II, Item 7, “Management’s discussion and analysis of financial condition and results of operations” and the consolidated financial statements and related notes in Part II, Item 8, “Consolidated financial statements and supplementary data” of this Form 10-K. The risks and uncertainties described below are not the only ones we face. Additional risk and uncertainties not presently known to us or that we presently deem less significant may also impair our business operations. If any of the events or circumstances described in the following risk factors actually occur, our business, operating results, financial condition, cash flows, and prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Our business, financial condition and operating results can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly, cause our actual financial condition and operating results to vary materially from past, or from anticipated future, financial condition and operating results. Any of these factors, in whole or in part, could materially and adversely affect our business, financial condition, operating results and stock price.

18

Because of the following factors, as well as other factors affecting our financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks related to our business

We are subject to risks associated with COVID-19.

As discussed below, our global operations expose us to risks associated with COVID-19. While our financial results for the fiscal year 2022 have not been significantly affected by COVID-19 outbreaks due to variants of the virus that continue to appear, impacts from COVID-19 may, in the future, adversely affect our operations, supply chains, distribution systems and customer demand, including as a result of impacts associated with preventive and precautionary measures that we, other businesses and governments have taken and may take in the future. Some of the risks we have experienced and/or may experience in the future as a result of impacts from COVID-19 include:

•A decline in sales activities and customer orders or cancellations of existing orders, depending on the severity and duration of any future COVID-19 outbreaks and the extent of mitigation and containment measures that may be undertaken by governments and businesses.

•Remote working, which we, similar to many other companies, implemented in response to the initial outbreak of COVID-19, and which continues even as COVID-19 outbreaks generally subside, could cause challenges for the effective operation of our internal controls, increase the risk of a security breach of our information technology systems, create data accessibility issues, and increase the risk for communication disruptions.

•The unanticipated loss or unavailability of key employees due to the COVID-19 outbreaks could harm our ability to operate or execute our business strategy. We may not be successful in finding and integrating suitable successors in the event of key employee loss or unavailability.

•Supply chain disruptions may result in the lack of raw materials or component shortages, delay in the release of new products or deliveries of products or compressed margins due to an increase in material costs. Due to these impacts and measures, we may experience significant and unpredictable reductions in demand for our products and our customers may postpone or cancel their existing orders.

•The effectiveness of our sales teams may be negatively impacted by the lack of or reduction in travel resulting in their reduced ability to engage with decision-makers.

•In addition to travel restrictions, while countries in general have re-opened their borders to U.S. travelers, some countries still have quarantine requirements, and, in the future, countries may again impose or expand travel restrictions and impose or resume prolonged quarantines if there is a resurgence of COVID-19 cases, which would significantly impact our ability to support our business operations and customers in those locations and the ability of our employees to access their places of work to produce products, or significantly hamper our products from moving through the supply chain.

As a result, given the uncertainty of the evolving nature of the virus and how quickly mitigation measures, such as vaccines, will be widely available and adopted by the public, the COVID-19 outbreaks may continue and may negatively affect our revenue growth, and it is uncertain how materially COVID-19 will affect our global operations if we experience any one or a combination of these impacts over an extended period of time. Any of these impacts would have an adverse effect on our business, financial condition and results of operations. In addition, our ability to raise capital in the future may also be negatively affected.

We have incurred net losses in every period to date, and we expect to continue to incur significant losses as we develop our business and may never achieve profitability.