UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended:

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

| |||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) | |

| |||

(Address of principal executive offices) |

| (Zip code) |

Registrants’ telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is well-known seasoned issuers, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ | Non-Accelerated Filer ☐ | Smaller Reporting Company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the registrant’s common stock held by non-affiliates (based on the closing price on June 30, 2021, as reported on the New York Stock Exchange) was approximately $

On January 31, 2021, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2021 Annual Meeting of Stockholders are incorporated into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2021.

Auditor Name: | Auditor Location: | Auditor Firm ID: |

RE/MAX HOLDINGS, INC.

2021 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements are often identified by the use of words such as “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,” “project,” “anticipate,” “may,” “will,” “would” and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. Forward-looking statements include statements related to:

| ● | our expectations regarding consumer trends in residential real estate transactions; |

| ● | our expectations regarding overall economic and demographic trends, including the health of the United States (“U.S.”) and Canadian residential real estate markets, and how they affect our performance; |

| ● | our strategies for growing our organic revenue and the RE/MAX and Motto Mortgage brands in particular, including (a) increasing RE/MAX agent count, increasing the number of closed transaction sides and transaction sides per RE/MAX agent, and (b) increasing the number of open Motto Mortgage offices; and diversifying and broadening our revenue and growth opportunities; |

| ● | the anticipated benefits of our technology initiatives; |

| ● | the continued strength of our brands both in the U.S. and Canada and in the rest of the world; |

| ● | the pursuit of future acquisitions and the anticipated benefits of past acquisitions, including the future performance of businesses we have acquired; |

| ● | return of capital, including our stock buyback program and our intention to pay dividends; |

| ● | our future financial performance including our ability to appropriately forecast; |

| ● | the effects of laws applying to our business and our future compliance with laws; |

| ● | our ability to retain our senior management and other key employees; |

| ● | other plans and objectives for future operations, growth, initiatives, acquisitions or strategies, including investments in our technology; |

| ● | our ability to effectively implement and account for changes in tax laws; and |

| ● | the anticipated outcome of the Moehrl-related suits, including any risks or uncertainties with regard to any favorable or unfavorable judgements and implications to our industry. |

These and other forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed in “Item 1A.—Risk Factors” and in “Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Annual Report on Form 10-K.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

3

PART I

ITEM 1. BUSINESS

Overview

We are one of the world’s leading franchisors in the real estate industry. We franchise real estate brokerages globally under the RE/MAX brand (“RE/MAX”) and mortgage brokerages in the U.S. under the Motto Mortgage brand (“Motto”). We also sell ancillary products and services, primarily technology, to our franchise networks and, in certain instances, we commercialize those offerings outside our franchise networks. We organize our business based on the services we provide in Real Estate, Mortgage and our collective franchise marketing operations, known as the Marketing Funds. RE/MAX and Motto are 100% franchised—we do not own any of the brokerages that operate under these brands. We focus on enabling our networks’ success by providing powerful technology, quality education, and valuable marketing to build the strength of the RE/MAX and Motto brands. We support our franchisees in growing their brokerages, although, they fund the cost of developing their brokerages. As a result, we maintain a low fixed-cost structure which, combined with our recurring fee-based models, enables us to capitalize on the economic benefits of the franchising model, yielding high margins and significant cash flow.

Our History

RE/MAX was founded in 1973 with an innovative, entrepreneurial culture affording our franchisees and their agents the flexibility to operate their businesses with great independence. In the early years of our expansion in the U.S. and Canada, we accelerated the brand’s growth by selling regional franchise rights to independent owners for certain geographic regions, a practice we still employ in countries outside of the U.S. and Canada. RE/MAX has held the number one market share in the U.S. and Canada combined since 1999, as measured by total residential transaction sides completed by our agents. On June 25, 2013, RE/MAX Holdings, Inc. (“Holdings”) was formed as a Delaware corporation. On October 7, 2013, we completed an initial public offering of our Class A common stock, which trades on the New York Stock Exchange under the symbol “RMAX”. In October 2016, we launched Motto, the first national mortgage brokerage franchise brand in the U.S.

On July 21, 2021, we acquired the operating companies of the North American regions of RE/MAX INTEGRA (“INTEGRA”) for cash consideration of approximately $235 million, allowing us to scale, enhance our ability to deliver value to our affiliates and recapture the value differential of more than 19,000 agents in the U.S. and Canada. See Note 6 Acquisitions to the consolidated financial statements included in “Part II, Item 8.—Financial Statements and Supplementary Data” of this Annual Report on Form 10-K for further information.

Our Brands

RE/MAX. The RE/MAX strategy is to sell franchises and help those franchisees recruit and retain the best agents. The RE/MAX brand is built on the strength of our global franchise network and our unique economic model that helps to attract and retain the best-performing and most experienced agents by maximizing their opportunity to retain a larger portion of their commissions. Some RE/MAX affiliates may also sell luxury real estate under The RE/MAX Collection® brand and commercial real estate under the RE/MAX Commercial® brand. As a result of our unique agent-centric approach, we have established a nearly 50-year track record of helping millions of homebuyers and sellers achieve their goals, creating several competitive advantages in the process:

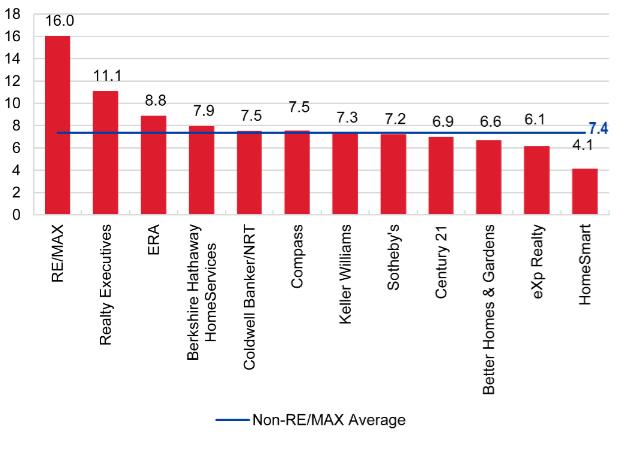

| ● | Leading agent productivity. RE/MAX agents are, on average, substantially more productive than the industry average. RE/MAX agents at large brokerages on average outsell competing agents more than two-to-one in both the 2020 REAL Trends 500 survey of the largest participating U.S. brokerages and the RISMedia 2020 Power Broker Top 1,000 survey. |

4

2020 U.S. Transactions Per Agent |

| |

|

| |

(1) Transaction sides per agent are calculated by RE/MAX based on 2021 REAL Trends 500 data, citing 2020 transaction sides for the 1,753 largest participating U.S. brokerages. | ||

| ● | Technology, Tools and Education. In the U.S., we offer a fully integrated technology platform custom-built for RE/MAX's unique entrepreneurial culture, and in late 2021 we introduced this platform to RE/MAX affiliates in Canada. We expect to continue expanding our technology offerings to RE/MAX affiliates in the U.S. and Canada in 2022, most notably to the acquired INTEGRA regions, and subsequently to the RE/MAX network globally. We are enhancing the platform over time, including securing the location intelligence data that powers the platform with the acquisition of The Gadberry Group (“Gadberry”) in 2020, which has now been combined with RE/MAX data assets and rebranded as G73, and integrating premium offerings to drive enhanced lead generation opportunities with the acquisition of First in 2019. We also provide agents and brokers the tools to help maximize their productivity through approved supplier arrangements and top-quality education. |

| ● | Leading market share. Nobody in the world sells more real estate than RE/MAX, as measured by residential transaction sides. |

| ● | Leading brand awareness. The RE/MAX brand has the highest level of unaided brand awareness in residential real estate in the U.S. and Canada according to a consumer study conducted by MMR Strategy Group. Our iconic red, white and blue RE/MAX hot air balloon is one of the most recognized real estate logos in the world. |

| ● | Leading global presence. We have a growing global presence and our agent count outside the U.S. and Canada continues to increase. Today, the RE/MAX brand has over 140,000 agents in almost 9,000 offices and a presence in over 110 countries and territories—a global footprint bigger than any other real estate brokerage brand in the world. |

5

The following summarize key statistics for the RE/MAX brand:

141,998 Agents | 8,964 Offices | 118 Countries and Territories |

|

|

|

As of December 31, 2021

Motto Mortgage. The Motto Mortgage franchise model offers U.S. real estate brokers, real estate professionals, mortgage professionals and other investors access to the mortgage brokerage business. Motto is highly complementary to our RE/MAX real estate business and is designed to improve the profitability of real estate brokerages by providing Motto franchise owners with diversified revenue and income streams. Motto franchisees offer potential homebuyers an opportunity to find both real estate agents and independent Motto loan originators at offices near each other. Motto loan originators provide homebuyers with financing choices by providing access to a variety of quality loan options from multiple leading wholesale lenders. In addition, Motto provides powerful technology to its franchisees that simplifies the mortgage process and also provides assistance with the compliance with complex mortgage regulations. Motto franchisees are mortgage brokers and not mortgage bankers. Likewise, we franchise the Motto system and are not lenders or brokers.

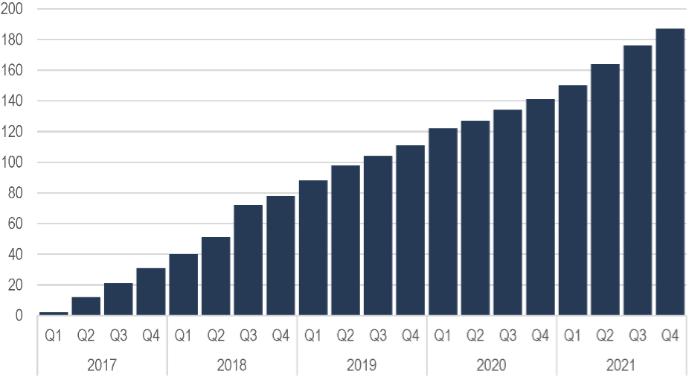

Motto Mortgage has grown to over 185 offices across more than 35 states and we expect Motto to continue to grow. We also continue to roll out the wemlo platform, an innovative fintech solution, the first cloud service for mortgage brokers, combining third-party loan processing with an all-in-one digital platform to add to our mortgage value proposition.

Number of Open Motto Offices (1)

| (1) | only includes full physical Motto offices; excludes virtual offices and Branchises (as defined below) |

wemlo. We acquired wemlo in 2020 to add to our mortgage value proposition via its combination of third-party loan processing services and all-in-one digital platform.

6

Industry Overview and Trends

With approximately 95% of our revenue coming from our real estate franchising operations in the U.S. and Canada, and 100% of our Mortgage revenues being in the U.S., macro developments in the U.S. and Canadian real estate markets significantly influence our business.

The U.S. and Canadian Real Estate Industries are Large Markets. The residential real estate markets in the U.S. and Canada are approximately $2.5 trillion and $0.5 trillion, respectively, based on 2021 sales volume data from the National Association of Realtors (“NAR”), the U.S. Census Bureau and the Canadian Real Estate Association (“CREA”).

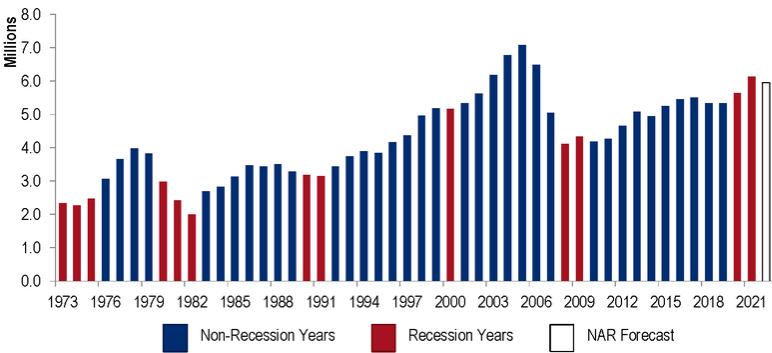

The Residential Real Estate Industry is Cyclical in Nature. The residential real estate industry is cyclical in nature but has shown strong long-term growth. As illustrated below, the number of existing home sales transactions in the U.S. and Canada has generally increased during periods of economic growth:

U.S. Existing Home Sales

U.S. Housing Trends. As we entered 2021, the U.S. housing market remained strong and carried over the same growth in home sales transactions from late 2020, despite ongoing constraints related to shrinking inventory and affordability. Although the strength of the U.S. housing market will continue, 2022 is expected to normalize as NAR’s February 2022 forecast has called for existing home sales to decrease by 2.8% in 2022 compared to 2021.

Canadian Existing Home Sales

Canadian Housing Trends. Similar to the U.S. in the Canadian housing market during the second half of 2020, the number and pace of existing home sales accelerated. This strength of the Canadian housing market continued in 2021; however, ongoing inventory shortages continue to present challenges for homebuyers and put upward pressure on home prices. CREA projects the average residential sale price for Canada will increase 7.6% in 2022, which indicates that the desire for home ownership remains strong and according to the 2022 RE/MAX Canadian Housing Market Outlook Report, 49% of Canadians see real estate as one of the best investment options in 2022.

7

Favorable Long-Term Demand. We believe long-term demand for housing in the U.S. and Canada is driven by many factors including the economic health of the domestic economy, demographic trends, affordability, interest rates and local factors such as demand relative to supply. We also believe the residential real estate market in the U.S. and Canada will benefit from fundamental demographic shifts over the long term, including:

| ● | An increase in demand from rising household formations, including as a result of immigration, population growth, wealth accumulation and wage growth of minorities. According to The State of the Nation’s Housing Report 2021 compiled by the Joint Center for Housing Studies of Harvard University (the “JCHS Report”), U.S. household formations are projected to reach 10.4 million between 2018 and 2028. Likewise, the U.S. Census Bureau projects that the U.S. will continue to experience long-term population growth and predicts net immigration of 25 million individuals from 2016 to 2060. In addition, the U.S. Census Bureau projects the U.S. total population to grow by more than 81 million people from 2016 to 2060. And in Canada, Statistics Canada reports that Canada has the highest annual population growth rate of G7 nations and expects the nation’s population to grow to more than 40 million people by 2068 even in its low-growth scenario. |

| ● | An increase in demand from lifestyle and generational shifts. Some industry experts believe shifts in the way people live and work could support housing demand longer term. Also, the millennial generation continues to move through their prime home-buying years as they form households just as many retirement age homeowners from the “baby boom” generation may be likely to take advantage of improved housing market conditions in order to sell their existing residences and retire in new areas of the country or purchase smaller homes. |

| ● | Pent-up demand from supply shortages. Supplies of single-family homes for sale remain relatively scarce, particularly at the lower-cost end of the spectrum. Single family construction that continues to lag demand and ongoing decline in residential mobility rates are likely contributors to the low level of supply, according to the JCHS Report. Additionally, while affordability pressures have eased, the JCHS Report notes this issue remains widespread, a long-term trend which has not been solved. Canada is faced with similar challenges with Statistics Canada noting more than 5% or more than 700,000 households are in housing that is not suitable for their needs and nearly 20% of households do not report being satisfied with their housing. Should these supply constraints be remedied, we believe the real estate industry would see a substantial benefit. |

Notable Real Estate Trends. Notable trends impacting residential real estate brokers and agents include:

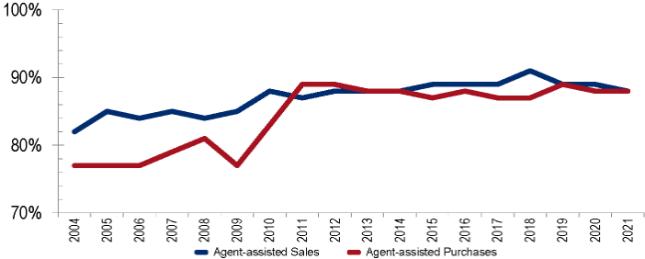

| ● | Almost 90% of all U.S. homebuyers and sellers use an agent – About 88% of sellers and purchasers were represented by a real estate agent in 2021, according to NAR data. These figures have climbed over the last decade and a half—a period of time during which technology has materially changed the typical home-buying or selling transaction: |

Percentage of Home Buyers and Sellers Using an Agent

Source: NAR Profile of Home Buyers and Sellers

| ● | Competition for agents and listings remains fierce – Competition for agents and listings has always been fierce, and today is no different—especially highly productive agents. Franchisors and brokers are continually refining and fine-tuning their offerings in order to craft what they believe to be the most compelling value proposition in order to attract and retain the most productive agents. The year 2021 remained heated in this regard as many well-financed competitors continued to offer a wide variety of business models. See Competition for additional discussion. |

8

| ● | The importance of technology continues to increase – We believe industry market participants will continue to focus on technology investments as evidenced by increased capital flowing into the industry. We believe mobile platforms, artificial intelligence and predictive analytics are increasingly becoming a point of focus as the industry looks to use technology to simplify and streamline the process of lead cultivation and completing transactions. In response, many established brokers are favoring proprietary technology as opposed to purchasing it from third parties. |

| ● | Competitive new business models increase amid high level of investment in new residential real estate strategies – While the majority of home buyers and sellers still use agents, the number of business models continues to expand, including iBuyers, discounters, national brokerage models, and technology driven platforms. Furthermore, investments into these models continue to increase. This trend has continued due to the strength of the overall sellers’ market. |

The Long-Term Value Proposition for Real Estate Brokerage Services. We believe the traditional agent-assisted business model, especially those supported by professional and highly productive agents, compares favorably to alternative models of the residential brokerage industry. We believe full-service brokerages are best suited to address many of the key characteristics of real estate transactions, including:

| (i) | the complexity and large monetary value involved in home sale transactions, |

| (ii) | the infrequency of home sale transactions, |

| (iii) | the high price variability in the home market, |

| (iv) | the intimate local knowledge necessary to advise clients in a fiduciary capacity in general and as it relates to unique neighborhood characteristics, |

| (v) | the unique nature of each particular home, and |

| (vi) | the consumer’s need for a high degree of personalized advice and support in light of these factors. |

For these reasons, we believe that consumers will continue to favor the full-service agent model for residential real estate transactions. In addition, although listings are available for viewing on a wide variety of real estate websites, we believe an agent’s local market expertise provides the ability to better understand the inventory of for-sale homes and the interests of potential buyers. This knowledge allows the agent to customize the pool of potential homes they show to a buyer, as well as help sellers to present their home professionally to best attract potential buyers.

9

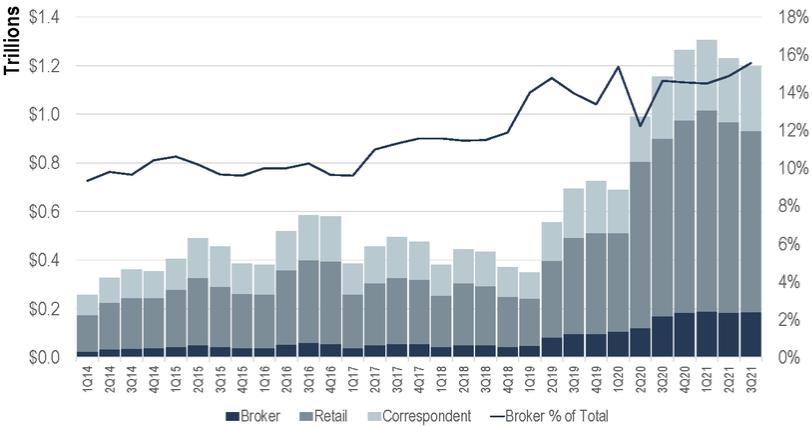

The Long-Term Value Proposition for Mortgage Brokerage Services. Likewise, we believe mortgage brokers provide choice and a valuable “concierge” service for consumers. Mortgage brokers are familiar with the latest loan programs and choices available through various wholesale lenders. A professional mortgage broker can introduce consumers to loan programs from several lenders, providing choice and information that consumers may be unlikely to locate on their own. In 2021, the percentage of mortgage originations handled by mortgage brokerages continued to grow but remained below the average levels from 2000 thru 2007 which ranged from over 29% to over 35% during that time, which we believe shows potential for continued growth in the mortgage brokerage channel. As interest rates fell to historic lows in 2020, refinance volumes across the mortgage industry and within the mortgage brokerage channel soared. As demand for refinance activity wanes in 2022, increased demand in purchase originations could occur given the potential for strong housing demand, which we believe would benefit the mortgage brokerage channel.

Total Mortgage Originations

Source: Inside Mortgage Finance Publications, Inc. Copyright © 2022 Used with permission.

Purchase-money mortgage originations (loans that arise during the purchase of a property) correlate to the overall number of home sales and home prices. Home purchases are driven primarily by the buyer’s personal and professional circumstances, whereas refinances depend mainly upon interest rates.

According to Federal Home Loan Mortgage Corporation (known as “Freddie Mac”), purchase-money originations are expected to increase gradually in the next few years. As compared to competitors, Motto has a significantly higher ratio of purchase-money mortgage originations to refinances. We believe that the expected increase in purchase-money originations could provide a growth opportunity for Motto franchisees.

10

Purchase Mortgage Originations

Our Franchise Model and Offering

Introduction to Franchising. Franchising is a distributed model for licensing the use of the franchisor’s brand and technology, tools, and educational resources. In return, the franchisee retains ownership and sole responsibility for the local business and its risks, and therefore a substantial portion of the profits it generates. The successful franchisor provides its franchisees: i) a unique product or service offering; ii) a distinctive brand name, and, as the system gains market share, the favorable consumer recognition that brand comes to symbolize; and iii) technology, tools and educational resources to help franchisees operate their business effectively, efficiently and successfully. Because franchising involves principally the development and licensing of intellectual property, and the costs of retail space and employees are borne by the individual unit owner, it has a low fixed-cost structure typified by high gross margins, allowing the franchisor to focus on innovation, franchisee education and support, and marketing to grow brand reputation.

How Brokerages Make Money. Residential real estate brokerages typically realize revenue by charging a commission based on a percentage of the price of the home sold and/or by charging their agents, who are independent contractors, fees for services rendered. The real estate brokerage industry generally benefits in periods of rising home prices and transaction activity (with the number of licensed real estate agents generally increasing during such periods) and is typically adversely impacted in periods of falling prices and home sale transactions (with the number of licensed real estate agents generally decreasing during such periods).

Residential mortgage brokerages typically realize revenue by charging fees for their service, which are based on a percentage of the mortgage loan amount. The mortgage brokerage industry generally benefits from periods of increasing home sales activity and rising home prices, as this generally results in increased purchase-money mortgage originations and periods when homeowners refinance to take advantage of lower interest rates. The mortgage brokerage industry is usually adversely impacted in periods of decreasing home sales activity, as this results in fewer purchase-money mortgage originations, and periods of less favorable interest rates, making homeowners less likely to refinance.

The RE/MAX “Agent-Centric” Franchise Offering. We believe that our “agent-centric” approach is a compelling offering in the real estate brokerage industry, and it enables us to attract and retain highly productive agents and motivated franchisees to our network and drives growth in our business and profitability. Our model maximizes our agents’ productivity by providing the following combination of benefits to our franchisees and agents:

| ● | High Agent Commission Split and Low Franchise Fees. The RE/MAX high commission split concept is a cornerstone of our model and, although not unique, differentiates us in the industry. That differentiation is most evident when our brand advantages and services are factored in as part of the concept. We recommend to our franchisees an agent-favorable commission split of 95%/5%, in exchange for the agent paying fixed fees to share the overhead and other costs of the brokerage. This model allows high-producing agents to earn a higher commission compared to traditional brokerages where the broker often takes 20% to 30% of the agent’s commission, and it provides brokers with the resources to offer key services and support to their agents. |

| ● | Affiliation with the Leading Brand in Residential Real Estate. With number one market share in the U.S. and Canada combined as measured by total residential transaction sides completed by RE/MAX agents, and leading unaided brand awareness in the U.S. and Canada, according to a consumer study by MMR Strategy Group, we reinforce brand awareness through marketing and advertising campaigns that are supported by our franchisees’ and agents’ local marketing. |

11

| ● | Entrepreneurial, High-Performance Culture. Our brand and the economics of our model generally attract driven, professional, entrepreneurially minded franchisees, and we allow them autonomy to run their businesses independently, including the freedom to set commission rates and oversee local advertising aligned with RE/MAX standards. |

| ● | Technology and Marketing Tools. We believe we offer competitive technology, which is highlighted by our proprietary technology platform, First mobile app, and our enhanced consumer facing app and remax.com website. Our technology platform integrates a suite of digital products that empower high-producing agents, brokers and teams to proactively establish, manage and grow client relationships. With Customer Relationship Management (“CRM”) at the core of this ecosystem, our technology platform utilizes deal management and lead cultivation tools to streamline the work of agents from lead generation to post-close nurturing and beyond, while integrating key partnerships that are widely adopted across the industry. The First mobile app leverages data science, machine learning and human interaction to help real estate professionals better leverage the value of their personal network. Additional revenue opportunities for sales outside our traditional customer base now exist with G73 which synergizes existing RE/MAX data with data from our 2020 acquisition of Gadberry Group to create new data products. |

| ● | RE/MAX University® Educational Programs. In 2021, we launched a comprehensive reinvention of our RE/MAX University® platform, an exclusive-to-RE/MAX learning hub designed to help each agent increase their professional expertise. Built on intuitive new technology that leverages artificial intelligence, RE/MAX University offers affiliates a modern, simplified experience as they access relevant educational resources via desktop or mobile devices. RE/MAX University offers on-demand access to thousands of educational videos, downloadable resources, webinars and more. |

| ● | RE/MAX Marketing and Promotion. We believe the widespread recognition of the RE/MAX brand and our iconic red, white and blue RE/MAX hot air balloon logo and property signs is a key aspect of our value proposition to agents and franchisees. Representing the majority of our Marketing Funds activities, a variety of advertising, marketing and promotion programs build our brand and generate leads for our agents, including leading websites such as remax.com, advertising campaigns using television, digital marketing, social media, print, billboards and signs, and appearances of the well-known RE/MAX hot air balloon. |

Event-based marketing programs, sponsorships, sporting activities and other similar functions also promote our brand. These include our support, since 1992, for Children's Miracle Network Hospitals® in the U.S. and Children's Miracle Network® in Canada, to help sick and injured children. Through the Miracle Home® program, participating RE/MAX agents donate to Children's Miracle Network Hospitals once a home sale transaction is complete.

Our franchisees and their agents fund nearly all the advertising, marketing and promotion supporting the RE/MAX brand, which, in the U.S. and Canada, occurs primarily on two levels:

| ● | Marketing Fund Regional, Pan-Regional and Local Marketing Campaigns. Funds are collected from franchisees by our Marketing Funds entities in Company-Owned Regions to support both regional and pan-regional marketing campaigns to build brand awareness and to support the Company’s agent and broker technology. The use of the fund balances is restricted by the terms of our franchise agreements. Independent Regions may contribute to national or pan-regional creative and/or media campaigns to achieve economies of scale in the purchase of advertising but are generally responsible for any regional advertising in their respective areas. |

| ● | Agent Sponsored Local Campaigns. Our franchisees and agents engage in extensive promotional efforts within their local markets to attract customers and drive agent and brand awareness locally. These programs are subject to our brand standards for use of the RE/MAX brand, but we allow our franchisees and agents substantial flexibility to create advertising, marketing and promotion programs that are tailored to local market conditions. |

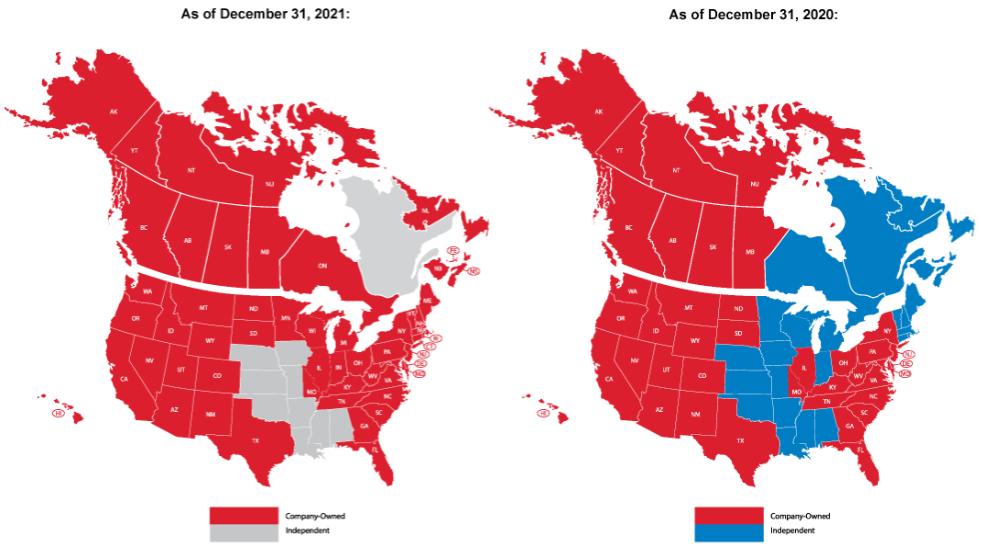

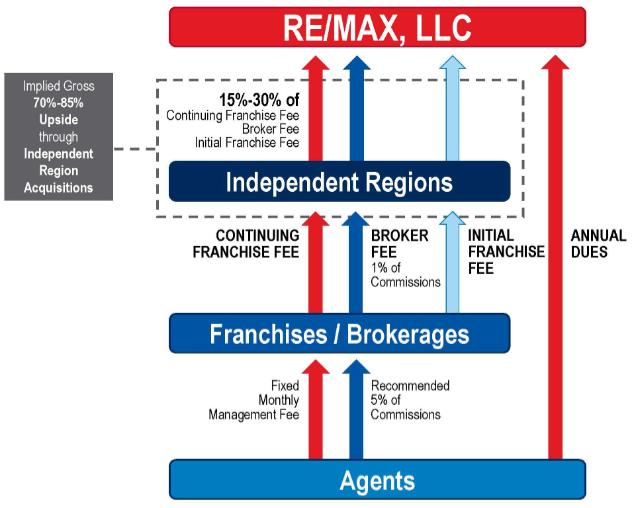

RE/MAX Four-Tier Franchise Structure. RE/MAX is a 100% franchised business, with all of the RE/MAX branded brokerage office locations being operated by franchisees. We franchise directly in the U.S. and Canada, in what we call “Company-Owned Regions.” Brokerage offices, in turn, enter into independent contractor relationships with real estate sales agents who represent real estate buyers and sellers. In the early years of our expansion in the U.S. and Canada, we sold regional franchise rights to independent owners for certain geographic regions (“Independent Regions”), pursuant to which those Independent Regions have the exclusive right to sell franchises in those regions. We have pursued a strategy

12

to acquire those regional franchise rights from Independent Regions in the U.S. and Canada.

The following depicts our franchise structure and the location of our Company-Owned versus Independent Regions:

Tier | Description | Services | |||

Franchisor (RE/MAX, LLC) | Owns the right to the RE/MAX brand and sells franchises and franchising rights. | ● Brand ● Technology ● Marketing ● Educational resources & tools | |||

| Independent Regional Franchise Owner

| Owns rights to sell brokerage franchises in a specified region. Typically, 20-year agreement with up to three renewal options. RE/MAX, LLC franchises directly in Company-Owned Regions, in the rest of the U.S. and Canada. | ● Local Services ● Regional Advertising ● Franchise Sales In Company-Owned Regions in the U.S. and Canada, RE/MAX, LLC performs these services. | ||

Franchisee (Broker-Owner) | Operates a RE/MAX-branded brokerage office, lists properties and recruits agents. Typically, 5-year agreement. | ● Office Infrastructure ● Sales Tools / Management ● Development & Coaching ● Broker of Record | |||

Agent | Branded independent contractors who operate out of local franchise brokerage offices. | ● Represents real estate buyer or seller ● Typically sets own commission rate | |||

In general, the franchisees (or broker-owners) do not receive an exclusive territory in the U.S. except under certain limited circumstances. Prior to opening an office, a franchisee or principal owner is required to attend a four-to-five-day educational program at our global headquarters or virtually.

13

The Motto Mortgage Franchise Offering. Through our Motto business, we are a mortgage brokerage franchisor, not a lender or mortgage brokerage. Our franchisees are brokers, not lenders, and so neither we nor our franchisees fund or service any loans. As a franchisor, we help our Motto franchisees establish independent mortgage brokerage companies, with a model designed to comply with complex regulations, essentially providing a "mortgage brokerage in a box". This model not only creates an ancillary business opportunity for current real estate brokerage firms, but also offers opportunities for mortgage professionals seeking to open their own businesses and other independent investors interested in financial services. The Motto Mortgage model offers value to our franchisees by offering:

| ● | Setup Guidance. We guide owners through every step of the setup process. |

| ● | Compliance, Education, and Support. We provide robust compliance support, including examination assistance and a system built with transparency in mind. To help each franchise owner, we provide support structures that allow them to spend their time getting more business. |

| ● | Access to multiple lenders. Motto Mortgage franchisees work with a pre-vetted group of wholesale lenders to streamline the shopping process and to provide customers with competitive choices. |

| ● | Technology. We’ve seamlessly integrated industry leading systems into one, time-saving technological ecosystem including best in class mortgage origination, CRM and marketing platforms. The 2020 acquisition of wemlo combined third-party loan processing capabilities with an all-in-one digital loan processing platform, which is being tailored to the exacting needs of loan originators operating in the mortgage brokerage channel and will eventually replace the existing mortgage origination technology offering. |

| ● | Franchising Expertise. As a member of a family of companies with over 45 years of franchising experience, we provide best practices to franchisees. |

Our Motto Mortgage brokerage franchisor, Motto Franchising, LLC, offers seven-year agreements with franchisees. Motto sells franchises directly throughout the U.S. as there are no regional franchise rights in the Motto system. Our customers are both RE/MAX and non-RE/MAX real estate brokers, real estate professionals, independent mortgage professionals and other investors seeking access to the mortgage brokerage business. We also offer supplemental franchising models in which Motto offers brokers with an existing Motto franchise the ability to expand their physical and/or virtual presence for a reduced contractual fee (aka “Branchise”). The aim of these new models is to give franchisees the flexibility to expand their business to places where it would not have been feasible to support a full additional franchise while keeping offices compliant with state branch regulations. These alternative models are not included in our count of open Motto offices. Motto is the first national mortgage brokerage franchise brand in the U.S.

Financial Model

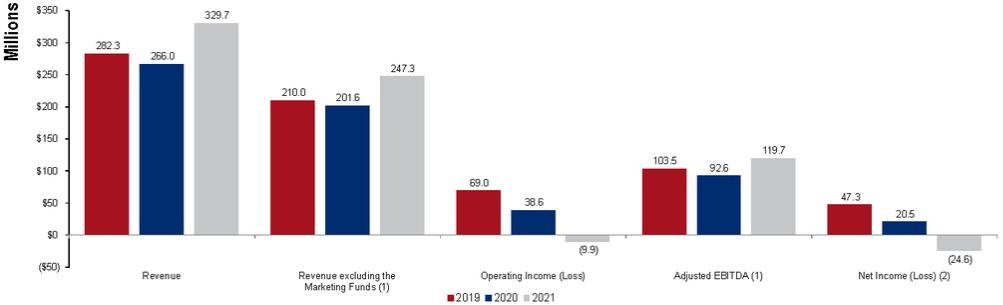

As a franchisor, we maintain a low fixed-cost structure. In addition, our stable, fee-based model derives a majority of our revenue from recurring fees paid by our RE/MAX and Motto franchisees, RE/MAX Independent Region franchise owners and RE/MAX agents. This combination helps us drive significant operating leverage through incremental revenue growth, yielding healthy margins and significant cash flow.

| (1) | Revenue excluding the Marketing Funds and Adjusted EBITDA are non-GAAP measures of financial performance that differs from U.S. Generally Accepted Accounting Principles. Revenue excluding the Marketing Funds is calculated directly from our consolidated financial statements as Total revenue less Marketing Funds fees. See “Item 7.—Management’s Discussion and Analysis of |

14

| Financial Condition and Results of Operations” for further discussion of Adjusted EBITDA and a reconciliation of the differences between Adjusted EBITDA and net income (loss). |

| (2) | Excludes adjustments attributable to the non-controlling interest. See "Corporate Structure and Ownership” below. |

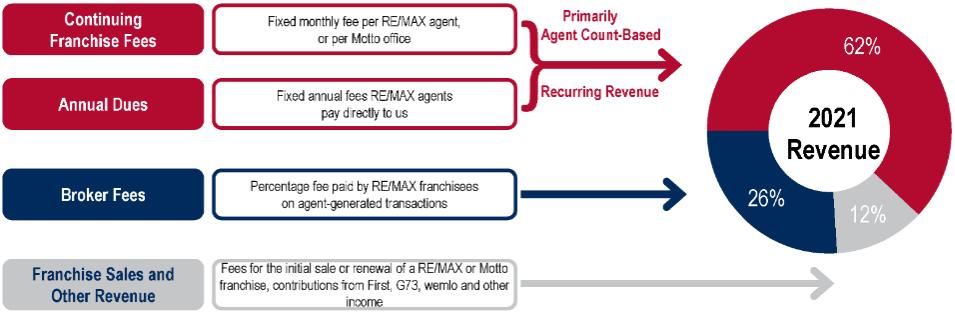

The chart below illustrates our consolidated revenue streams excluding the Marketing Funds.

Holdings Revenue Streams as Percentage of 2021 Total Revenue

Segment Revenue and Profit

We have three reportable segments: Real Estate, Mortgage and Marketing Funds. Real Estate comprises our real estate brokerage franchising operations under the RE/MAX brand name, corporate-wide shared services expenses and G73. Mortgage is comprised of our mortgage brokerage franchising operations under the Motto Mortgage brand and mortgage loan processing software and services under the wemlo brand. Marketing Funds represents our marketing campaigns designed to build and maintain brand awareness for both of our franchise brands and the development and operation of agent marketing technology. Other contains all other operations which are quantitatively insignificant. The majority of our revenue is recurring in nature and driven by the number of agents in the RE/MAX network and the number of open offices in the Motto network. Our recurring revenue streams include continuing franchise fees, which are fixed contractual fees paid monthly by RE/MAX and Motto franchisees, and annual dues, which are paid annually by RE/MAX agents. For the years ended December 31, 2021, 2020 and 2019, these recurring revenue streams accounted for 62.3%, 62.1% and 64.4% of our revenue excluding the Marketing Funds, respectively. Broker fees are a variable revenue stream and represents a percentage, generally 1%, of the real estate commissions paid by customers when a RE/MAX agent buys or sells a home. For the years ended December 31, 2021, 2020 and 2019, Broker fees accounted for 26.5%, 24.8% and 21.9% of our revenue excluding the Marketing Funds, respectively. The remainder of our revenue is derived from franchise sales and renewals, preferred marketing arrangements, event-based revenue, data service and technology product subscription revenue, and mortgage loan processing revenue. We evaluate the operating results of our segments based on revenue and adjusted earnings before interest, the provision for income taxes, depreciation and amortization and other non-cash and non-recurring cash charges or other items (“Adjusted EBITDA”). See Note 16, Segment Information, included in “Part II, Item 8.—Financial Statements and Supplementary Data” for further disclosures about segments and descriptions of Adjusted EBITDA.

Real Estate

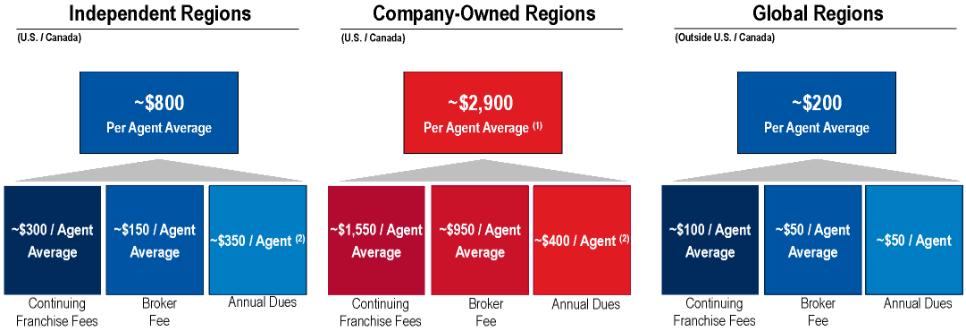

The amount of revenue recognized varies significantly depending on whether RE/MAX affiliates are located in Company-Owned Regions in the U.S. and Canada, Independent Regions in the U.S. and Canada, or Global Regions outside of the U.S. and Canada, with the greatest amounts in Company-Owned Regions.

Revenue per Agent in Owned versus Independent RE/MAX Regions. We receive a higher amount of revenue per agent in our Company-Owned Regions than in our Independent Regions in the U.S. and Canada, and more in Independent Regions in the U.S. and Canada than in Global Regions. We receive the entire amount of the continuing franchise fee, broker fee and initial franchise and renewal fee in Company-Owned Regions, whereas we receive only a portion of these fees in Independent Regions. We generally receive 15% or 30% of the amount of such fees in Independent Regions, which is a fixed rate in each particular Independent Region established by the terms of the applicable regional franchise agreement. We base our continuing franchise fees, annual dues and broker fees outside the U.S. and Canada on the

15

same structure as our Independent Regions, except that the aggregate level of such fees is substantially lower in these markets. For the year, the average annual revenue per agent (excluding the Marketing Funds fees) was as follows:

| (1) | In Company-Owned Regions we receive approximately $600 less per agent in Canada than we do for agents in the U.S. primarily due to different Broker Fees structures and as a result of foreign exchange differences between the U.S. dollar and the Canadian dollar. |

| (2) | Annual dues are currently a flat fee of US$410/CA$410 per agent annually for our U.S. and Canadian agents. The average per agent for the year ended December 31, 2021 in both Independent Regions and Company-Owned Regions reflects the impact of foreign currency movements related to revenue received from Canadian agents. The ratio of U.S. agents to Canadian agents in Independent Regions has increased as a result of the INTEGRA Independent Region acquisition. |

Mortgage

Our revenue is derived in the U.S. from fixed monthly fees, franchise sales and renewals, and mortgage loan processing.

Marketing Funds

Our revenue is derived primarily from franchisees in Company-Owned Regions based on the number of RE/MAX agents in the respective franchise, with smaller contributions by Independent Region owners and the number of Motto open offices.

See Note 2, Summary of Significant Accounting Policies, included in “Part II, Item 8.—Financial Statements and Supplementary Data” for further disclosures about our various revenue streams.

Value Creation and Growth Strategy

As a franchisor, we generate favorable margins and healthy amounts of cash flow, which facilitate our value creation and growth strategy. As a leading franchisor in the residential real estate and mortgage industries in the U.S., Canada and globally, we create shareholder value by:

| a) | growing organically primarily by growing and monetizing our RE/MAX network of almost 9,000 offices and over 140,000 agents and our Motto network of over 185 open offices; |

| b) | catalyzing growth by reacquiring regional RE/MAX franchise rights and acquiring other businesses complementary to our RE/MAX and Motto franchises; and |

| c) | returning capital to shareholders. |

Organic Growth. We believe we have multiple opportunities to grow organically, including:

| a) | RE/MAX agent count growth, particularly in Company-Owned Regions in the U.S. and Canada; |

| b) | Expansion of our mortgage segment including both Motto open offices and wemlo loan processing and technology services; |

| c) | pricing; |

16

| d) | increases in agent productivity and higher home prices; and |

| e) | Other opportunities like growing our First and G73 offerings. |

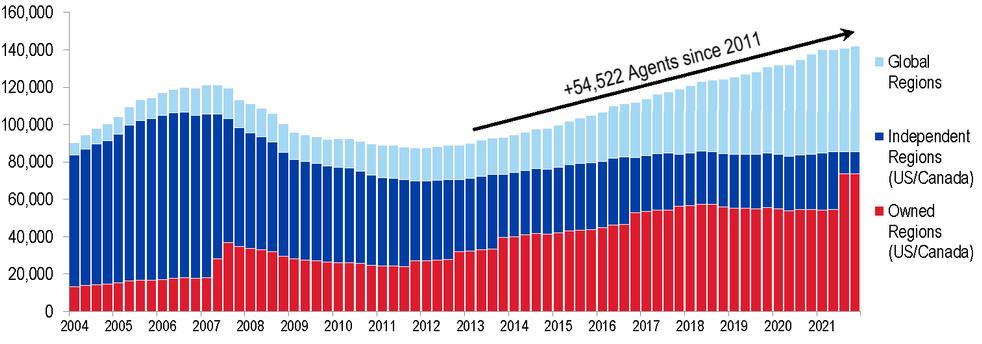

RE/MAX Agent Count Growth. We returned to a period of net global agent growth in 2012, and our total year-over-year growth in agent count has continued through 2021.

RE/MAX Agent Count

Number of Agents at Quarter-End (1)

| (1) | When we acquire an Independent Region, agents in that region are moved from the Independent Region agent count to the Company-Owned Region agent count during the quarter of the acquisition. As a result, the shift in the third quarter of 2021 from Independent Region agents to Company-owned Region agents in the graph above is primarily the result of the acquisition of INTEGRA. |

RE/MAX Agent Count Year-Over-Year Growth Rate by Geography

From time to time, we use recruitment programs to increase agent count growth, including some that incentivize recruitment through temporary waivers of fees for new agents.

Pricing. Given the low fixed costs of our franchise model, modest increases in aggregate fees per agent should positively affect our profitability. We may occasionally increase our aggregate fees per agent in our Company-Owned Regions as we enhance the value we offer to our network. We are judicious with respect to the timing and amount of increases in

17

aggregate fees per agent and our strategic focus remains on growing agent count through franchise sales, recruiting programs and retention initiatives. Following are the annualized average price increases for the previous five years, reflected in the year in which the increase was effective.

2017 | 2018 | 2019 | 2020 | 2021 | ||||||

Continuing Franchise Fees | ||||||||||

Company-Owned Regions - U.S. | — | — | — | — | 3.8% | |||||

Company-Owned Regions - Canada | 1.9% | — | — | — | — | |||||

Annual Dues | ||||||||||

Company-Owned Regions - U.S. | 2.5% | — | — | — | — | |||||

Company-Owned Regions - Canada | 2.5% | — | — | — | — |

Organic Growth from Global Regions. We have a growing global presence with our agent count outside the U.S. and Canada growing almost 6% in 2021 and 22% over the past two years combined and now surpasses 56,000 agents. Over the last two decades, the size of the RE/MAX network outside of the U.S. and Canada has grown to represent over a third of total RE/MAX agent count. However, we earn substantially more of our revenue in the U.S. and Canada than in other countries as a result of the higher average revenue per agent. In Global Regions our technology platform is not included with our core technology offerings to franchisees, and we believe offering our technology platform internationally is a long-term growth opportunity.

RE/MAX Agents by Geography As of Year-end 2021 |

| Real Estate Revenue by Geography (a) Percent of 2021 Revenue |

| (a) | Excludes revenues from the Marketing Funds, Mortgage and Other. |

RE/MAX and Motto Franchise Sales. We intend to continue adding franchises in new and existing markets, and as a result, increase our global market share and brand awareness. Each incremental franchise leverages our existing infrastructure, allowing us to drive additional revenue at little incremental cost. We are committed to reinvesting in the business to enhance our value proposition through a range of new and existing programs and tools.

Growth Catalysts through Acquisitions. We intend to continue to pursue acquisitions of regional RE/MAX franchise rights in a number of Independent Regions, as well as other acquisitions in related areas that build on or support our core competencies in franchising and real estate, that are complementary to our RE/MAX and Motto businesses and that diversify and expand our revenue and growth opportunities.

Independent Region Acquisitions. The acquisition of an Independent Region franchise substantially increases our revenue per agent, provides an opportunity for us to enhance profitability and enables us to deliver our affiliates a consistent value proposition. While both Company-Owned Regions and Independent Regions charge relatively similar fees to their brokerages and agents, we only receive a percentage of the continuing franchise fee, broker fee and initial franchise and

18

renewal fee in Independent Regions. By acquiring regional franchise rights, we can capture 100% of these fees and substantially increase the average revenue per agent for agents in the acquired region, which, as a result of our low fixed-cost structure, further increases our overall margins. In addition, we believe we can establish operational efficiencies and improvements in financial performance of an acquired region by leveraging our existing infrastructure and experience.

Flow through Independent Regions

Other Acquisitions. We may pursue other acquisitions, either of other brands, or of other businesses related to our core competencies of real estate, mortgage and franchising that we believe can help enhance the value proposition that we provide to our affiliates and can diversify and enhance our revenue and growth opportunities. Our acquisition of First and wemlo highlight our focus on investing in the value proposition for our franchisees by providing them with enhanced technology offerings and unique services. First’s proprietary algorithm and machine-learning capabilities helps U.S. agents predict who within their sphere of influence is more likely to list a home for sale in the next six to twelve months. By leveraging First’s proprietary technology, RE/MAX agents can further capitalize on their industry leading productivity per agent. Our acquisition of wemlo was completed to provide quality, dependable and secure mortgage loan processing services. Wemlo’s loan processing services combined with its all-in-one digital loan processing platform has been uniquely developed to suit the needs of professionals in the mortgage brokerage channel. We continue to enhance the data capabilities across our organization and securing the location intelligence data that powers our core RE/MAX technology platform with the acquisition of The Gadberry Group (“Gadberry”) in 2020, which has now been rebranded as G73, and is integral to our future revenue and growth diversification opportunities.

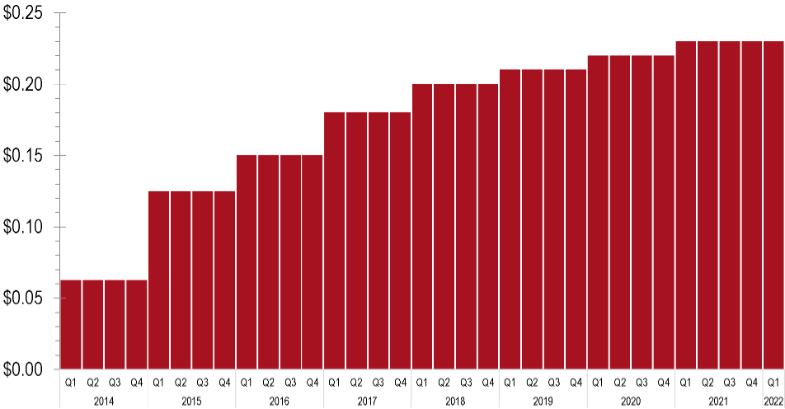

Return of Capital to Shareholders. We are committed to returning capital to shareholders, either through the payment of dividends or through the repurchase of shares of our Class A common stock, as part of our value creation strategy. We have paid quarterly dividends since the completion of our first full fiscal quarter as a publicly traded company, or April of 2014. On February 22, 2022, we announced that our Board of Directors approved a quarterly dividend of $0.23 per share.

19

Quarterly Dividends

On January 11, 2022, our Board of Directors authorized a common stock repurchase program of up to $100 million. Our disciplined capital allocation approach allows us to return capital to shareholders while investing to drive future organic growth and catalyzing growth through acquisitions.

Competition

RE/MAX. The residential real estate brokerage business is fragmented and highly competitive. We compete against many different types of competitors - traditional real estate brokerages; non-traditional real estate brokerages, including some that offer deeply discounted commissions to consumers, and other entrants, including iBuyers. We compete in different ways for franchisees, for agents, and for consumers.

The majority of brokerages are independent, with the best-known being regional players. At the individual office level, oftentimes our most formidable competition is that of a local, independent brokerage. Brokerages affiliated with franchises tend to be larger, on average, than independents and are part of a national network. Our largest national competitors in the U.S. and Canada include the brands operated by Realogy Holdings Corp. (including Century 21, Coldwell Banker, ERA, Sotheby’s, Corcoran and Better Homes and Gardens), Berkshire Hathaway Home Services, Keller Williams Realty, Inc. and Royal LePage. Our franchisees also compete to attract and retain agents against real estate franchisors which offer 100% commissions and low fees to agents. These competitors include HomeSmart and Realty ONE Group.

We also compete against non-traditional real estate brokerages in the U.S. and Canada such as Redfin that offer deeply discounted commissions to consumers. Even among competitors with traditional models, there are variations such as the “hybrid” classification of Compass (a national bricks-and-mortar brokerage emphasizing a focus on technology), and the virtual brokerage (no brokerage offices) platform of eXp Realty.

Another emerging category of competition is made up of mortgage companies that have established inhouse brokerages with their own agents, including Rocket Mortgage and Better Mortgage.

Our efforts to target consumers and connect them with a RE/MAX agent via our websites also face competition from major real estate portals, such as Zillow and Realtor.com.

We also compete for home sales against iBuyers, which offer to buy homes directly from homeowners, often at below-market rates, in exchange for speed and convenience, and then resell them shortly thereafter at market prices. Our largest national competitors in the U.S. in this category include Opendoor, Offerpad, and Redfin. Some traditional brokerages have begun to adapt to iBuyers by either partnering their agents with an iBuyer directly or by launching their own iBuyer program. Agents most often interact with iBuyers by evaluating iBuyer offers for home sellers (comparing to what the seller might receive by selling their home on the MLS), referring home sellers to an iBuyer for a referral fee or

20

listing homes that are owned by iBuyers. Several of these iBuyers – Opendoor and Offerpad – have opened inhouse brokerages to not only handle their own properties, but to also list homes on the MLS for homeowners who are not using their iBuyer services.

Likewise, the support services we provide to RE/MAX franchisees and agents also face competition from various providers of educational, back-office management, marketing, social integration and lead generation services. We believe that competition in the real estate brokerage franchise business is based principally upon the reputational strength of the brand, the quality of the services offered to franchisees, and the amount of franchise-related fees to be paid by franchisees.

The ability of our franchisees to compete with other real estate brokerages, both franchised and unaffiliated, is an important aspect of our growth strategy. A franchisee’s ability to compete may be affected by a variety of factors, including the number and quality of the franchisee’s independent agents and the presence and market span of the franchisee’s offices. A franchisee’s success may also be affected by general, regional and local housing conditions, as well as overall economic conditions.

Motto. Motto does not originate loans, and therefore does not compete in the mortgage origination business. The mortgage origination business in which Motto franchisees participate is highly competitive and competition for talented loan originators and loan processors has increased as a result of the current interest rate environment in the U.S. While there are no national mortgage brokerage franchisors in the United States at the present time other than Motto, the mortgage origination business is characterized by a variety of business models. While real estate brokerage owners are our core market for the purchase of Motto franchises, such owners may form independent, non-franchised mortgage brokerages or correspondent lenders. They may enter into joint ventures with lenders for mortgage originations, and they may elect not to enter the mortgage origination business themselves, but instead earn revenue from providing marketing and other services to mortgage lenders.

Intellectual Property

We regard our RE/MAX trademark, balloon logo and yard sign design trademarks as having significant value and as being important factors in the marketing of our brand. We protect the RE/MAX and Motto brands through a combination of trademarks and copyrights. We have registered “RE/MAX” as a trademark in the U.S., Canada, and over 150 other countries and territories, and have registered various versions of the RE/MAX balloon logo and real estate yard sign design in numerous countries and territories as well. We have registered "Motto" and "Motto Mortgage" as trademarks in the U.S. and registered "Motto" as a trademark in other countries as well. We also are the registered holder of a variety of domain names that include “remax,” “motto,” and similar variations, including addresses that we offer to our Global Regions to use as their primary internet address.

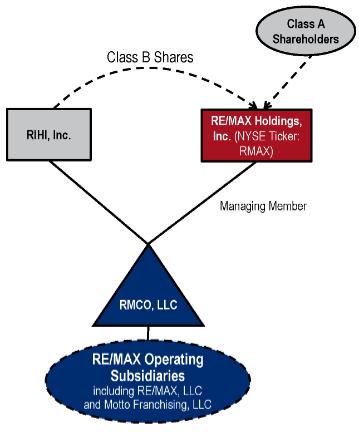

Corporate Structure and Ownership

Holdings is a holding company incorporated in Delaware and its only business is to act as the sole manager of RMCO, LLC (“RMCO”). In that capacity, Holdings operates and controls all of the business and affairs of RMCO. RMCO is a holding company that is the direct or indirect parent of all of our operating businesses, including RE/MAX, LLC and Motto Franchising, LLC. As of December 31, 2021, Holdings owns 60.0% of the common units in RMCO, while RIHI, Inc. (“RIHI”) owns the remaining 40.0% of common units in RMCO. RIHI, Inc. is majority owned and controlled by David Liniger, our Chairman and Co-Founder, and by Gail Liniger, our Vice Chair and Co-Founder.

21

The diagram below depicts our organizational structure:

The holders of Holdings Class A common stock collectively own 100% of the economic interests in Holdings, while RIHI owns 100% of the outstanding shares of Holdings Class B common stock.

Pursuant to the terms of the Company’s Certificate of Incorporation, RIHI, as holder of all of Holdings’ Class B common stock is entitled to a number of votes on matters presented to Holdings’ stockholders equal to the number of RMCO common units that RIHI holds. Through its ownership of the Class B common stock, RIHI holds 40.0% of the voting power of the Company’s stock as of December 31, 2021. Mr. Liniger also owns Class A common stock with an additional 1.1% of the voting power of the Company’s stock as of December 31, 2021.

Holdings ownership of RMCO and Tax Receivable Agreements

Holdings has twice acquired significant portions of the ownership in RMCO; first in October 2013 at the time of IPO when Holdings acquired its initial 11.5 million common units of RMCO and, second, in November and December 2015 when it acquired 5.2 million additional common units. Holdings issued Class A common stock, which it exchanged for these common units of RMCO. RIHI then sold the Class A common stock to the market.

When Holdings acquired common units in RMCO, it received a step-up in tax basis on the underlying assets held by RMCO. The step-up is principally equivalent to the difference between (1) the fair value of the underlying assets on the date of acquisition of the common units and (2) their tax basis in RMCO, multiplied by the percentage of units acquired. The majority of the step-up in basis relates to intangible assets, primarily franchise agreements and goodwill, and the step-up is often substantial. These assets are amortizable under IRS rules and result in deductions on our tax return for many years and, consequently, Holdings receives a future tax benefit. These future benefits are reflected within deferred tax assets on our consolidated balance sheets.

If Holdings acquires additional common units of RMCO from RIHI, the percentage of Holdings’ ownership of RMCO will increase, and additional deferred tax assets will be created as additional tax basis step-ups occur.

In connection with the initial sale of RMCO common units in October 2013, Holdings entered into Tax Receivable Agreements (“TRAs”) which require that Holdings make annual payments to the TRA holders equivalent to 85% of any tax benefits realized on each year’s tax return from the additional tax deductions arising from the step-up in tax basis. We believe 85% is common for tax receivable agreements. The TRA holders as of December 31, 2021 are RIHI and Parallaxes Rain Co-Investment, LLC (“Parallaxes”). TRA liabilities were established for the future cash obligations expected to be paid under the TRAs and are not discounted. Similar to the deferred tax assets, the TRA liabilities would increase if Holdings acquires additional common units of RMCO from RIHI. The deferred tax assets and related TRA liabilities are valued, in part, based on the enacted U.S. and state corporate tax rates.

22

Human Capital Management

The majority of our 639 full-time employees are located in Denver, Colorado, with the remainder spread throughout the U.S. and Canada. As a franchisor, we refer to ourselves as “A business that builds businesses,” and our franchisees are all independently operated. Their employees and independent contractor agents are therefore not included in our employee count. None of our employees are represented by a union. The following table summarizes our employee makeup by function at December 31 of each year:

2021 | 2020 | % change | ||||

Employee function | ||||||

Technology | 35% | 39% | (4)% | |||

Sales and franchise development | 28% | 26% | 2% | |||

Marketing, education and events | 15% | 14% | 1% | |||

Shared services | 22% | 21% | 1% | |||

Total | 100% | 100% |

When searching for new employees, we look for bright, forward-thinking individuals who want to help entrepreneurs build their businesses. Our mission is to be the worldwide leader in real estate, achieving our goals by helping others achieve theirs. To achieve this, we hire individuals who reflect our M.O.R.E. core values:

| ● | Deliver to the Max. You stay hungry and are never satisfied, pushing yourself to maximum heights. You bring maximum energy and enthusiasm to everything you do, moving the ball forward as far as you can. You actively learn, listen, improve and evolve. Your growth never stops. |

| ● | Customer Obsessed. You put customers first, obsessing on their needs and exceeding their expectations. You know the company is built on relationships, and you’re serious about maintaining them. You think big, delivering a service that is far beyond the norm. |

| ● | Do the Right Thing. You act with integrity, honesty and transparency, every day. You hold yourself to a higher standard in performance, ethics, accountability and decision quality. You own your actions and outcomes, taking smart risks with confidence and decisiveness while keeping an enterprise perspective. |

| ● | Together Everybody Wins. You collaborate and communicate, contributing to an environment in which everybody wins. You lead by example, helping others develop their talents and reach their goals. You show gratitude and respect. Everybody’s voice matters. You strive to use resources efficiently, for everybody’s greater good. |

Employee wellness and engagement. The safety of our employees is a top priority. Our investments in technology allow for a remote working strategy when appropriate, with only limited numbers of employees whose duties are facility-dependent still coming into our facilities during times of concern. We have continued to invest in new collaboration tools and technology to allow our workforce to effectively work remotely.

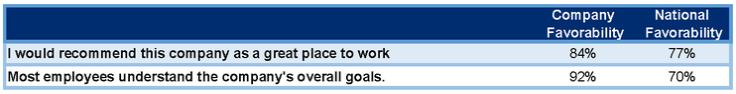

We conduct regular confidential surveys of our employees to determine employee satisfaction and to identify areas of employee engagement that require management attention. Two fundamental questions that senior leadership weighs heavily and their results compared to U.S. national averages (per our engagement survey vendor) are as follows:

Leadership compensation and retention. Our philosophy is that compensation should aim to align the goals of management with the interests of the Company and its stockholders and attract and retain talented people with the skills to help the Company achieve its goals. Toward these ends, we seek to provide a competitive level of compensation that balances rewards for both short-term performance and longer-term value creation, promotes accountability, incentivizes and rewards both corporate and individual performance without encouraging imprudent risk taking. This philosophy drives all aspects of officer compensation, including our base pay guidelines, annual incentives, and grants of long-term equity-based compensation awards. A substantial portion of each of our executive officer’s compensation is at risk. Annual succession planning for senior leadership is overseen by our Board of Directors, including development plans for the next level of our senior leaders. Annual talent reviews focus on both high performers as well as those with high potential to keep our pipeline of tomorrow’s leaders full.

Diversity and inclusion. As a franchisor, human capital development and opportunity are foundational elements of our business model. Diversity and inclusion permeate our networks as we offer motivated entrepreneurs in over 110 countries

23

and territories the opportunity to be successful small business owners in real estate. Moreover, we have been a leader in expanding opportunities for women within real estate since our founding almost 50 years ago. In our early days, one of the keys to our initial success was an intentional decision to target women to join our RE/MAX network as real estate agents, which helped create professional opportunities for women in a persistently male-dominated industry at the time. Through the years, we have made leadership opportunities for women a priority within our organization. For example, in the history of the Company, two of our five CEOs were women, and today, two of our five executive officers and five of our 11 board members are female. Globally, approximately 47% of our RE/MAX franchises have at least one female owner and 52% of our agents are women, as of December 31, 2021. We have an ongoing commitment to diversity and inclusion and continue to expand our efforts around this important topic. To ensure our affiliates as well as our employees are informed, educated and engaged, we infuse education on diversity and inclusion at key Company events and routinely promote available educational resources. RE/MAX has partnered with multiple industry advocacy groups that promote diversity and equality in homeownership. These partnerships include providing financial support in their efforts, participating in panel discussions at their events, attending national and chapter educational sessions, and much more.

Seasonality

The residential housing market is seasonal, with transactional activity in the U.S. and Canada typically peaking in the second and third quarter of each year. Our results of operations are somewhat affected by these seasonal trends. Our Adjusted EBITDA margins are often lower in the first and fourth quarters due primarily to the impact of lower broker fees and other revenue as a result of lower overall sales volume, as well as higher selling, operating and administrative expenses in the first quarter for expenses incurred in connection with the RE/MAX annual agent convention.

Government Regulation

Franchise Regulation. The sale of franchises is regulated by various state laws, as well as by the Federal Trade Commission (“FTC”). The FTC requires that franchisors make extensive disclosures to prospective franchisees but does not require registration. A number of states require registration or disclosure by franchisors in connection with franchise offers and sales. Several states also have “franchise relationship laws” or “business opportunity laws” that limit the ability of the franchisor to terminate franchise agreements or to withhold consent to the renewal or transfer of these agreements. The states with relationship or other statutes governing the termination of franchises include Arkansas, California, Connecticut, Delaware, Hawaii, Illinois, Indiana, Iowa, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, Virginia, Washington and Wisconsin. Some franchise relationship statutes require a mandated notice period for termination; some require a notice and cure period; and some require that the franchisor demonstrate good cause for termination. Although we believe that our franchise agreements comply with these statutory requirements, failure to comply with these laws could result in our company incurring civil liability. In addition, while historically our franchising operations have not been materially adversely affected by such regulation, we cannot predict the effect of any future federal or state legislation or regulation.

Real Estate and Mortgage Regulation. The Real Estate Settlement Procedures Act (“RESPA”) and state real estate brokerage laws and mortgage regulations restrict payments which real estate brokers, mortgage brokers, and other service providers in the real estate industry may receive or pay in connection with the sales of residences and referral of settlement services, such as real estate brokerage, mortgages, homeowners’ insurance and title insurance. Such laws affect the terms that we may offer in our franchise agreements with Motto franchisees and may to some extent restrict preferred vendor programs, both for Motto and RE/MAX. Federal, state and local laws, regulations and ordinances related to the origination of mortgages, may affect other aspects of the Motto business, including the extent to which we can obtain data on Motto franchisees’ compliance with their franchise agreements. These laws and regulations include (i) the Federal Truth in Lending Act of 1969 (“TILA”), and Regulation Z (“Reg Z”) thereunder; (ii) the Federal Equal Credit Opportunity Act ("ECOA'') and Regulation B thereunder; (iii) the Federal Fair Credit Reporting Act and Regulation V thereunder; (iv) RESPA, and Regulation X thereunder; (v) the Fair Housing Act; (vi) the Home Mortgage Disclosure Act; (vii) the Gramm-Leach-Bliley Act and its implementing regulations; (viii) the Consumer Financial Protection Act and its implementing regulations; (ix) the Fair and Accurate Credit Transactions Act-FACT ACT and its implementing regulations; and (x) the Do Not Call/Do Not Fax Act and other state and federal laws pertaining to the solicitation of consumers.

Available Information

RE/MAX Holdings, Inc. is a Delaware corporation and its principal executive offices are located at 5075 South Syracuse Street, Denver, Colorado 80237, telephone (303) 770-5531. The Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge through the “Investor Relations” portion of the Company’s website, www.remaxholdings.com, as soon as reasonably

24

practical after they are filed with the Securities and Exchange Commission (“SEC”). The content of the Company’s website is not incorporated into this report. The SEC maintains a website, www.sec.gov, which contains reports, proxy and information statements, and other information filed electronically with the SEC by the Company.

ITEM 1A. RISK FACTORS

RE/MAX Holdings, Inc. and its consolidated subsidiaries (collectively, the “Company,” “we,” “our” or “us”) could be adversely impacted by various risks and uncertainties. An investment in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as all of the other information contained in this Annual Report on Form 10-K, including our audited consolidated financial statements and the related notes thereto before making an investment decision. If any of these risks actually occur, our business, financial condition, operating results, cash flow and prospects may be materially and adversely affected. As a result, the trading price of our Class A common stock could decline, and you could lose some or all of your investment.

We have grouped our risks according to:

| ● | Risks Related to Our Business; |

| ● | Risks Related to Our Industry; |

| ● | Risks Related to Our Legal and Capital Structure; |

| ● | Risks Related to Governmental Regulations; and |

| ● | General Risks. |

Risks Related to Our Business

We may fail to execute our strategies to grow our business, which could have a material adverse effect on our financial performance and results of operations.

We intend to pursue a number of strategies to grow our revenue and earnings and to deploy the cash generated by our business. We constantly strive to increase the value proposition for our franchisees, agents and loan originators. If we do not reinvest in our business in ways that make our networks attractive to franchisees, agents and loan originators, we may become less competitive. Additionally, we are exploring opportunities to acquire other businesses, including RE/MAX Independent Regional franchises, or other businesses that are complementary to our core businesses, particularly those offering differentiated technology. If we fail to develop, execute, or focus on our business strategy, fail to make good business decisions, fail to enforce a disciplined management process to ensure that our investment of resources aligns with our strategic plan and our core management and franchising competencies or fail to properly focus resources or management attention on strategic areas, any of these could negatively impact the overall value of the Company.

Our business is heavily reliant on technology and product development for certain key aspects of our operations. We may fail to roll out technology platforms as expected or their effectiveness in attracting or retaining agents, loan originators and franchisees may be more limited than anticipated.

Our systems may not perform as desired or we may experience cost overages, delays, or other factors that may distract our management from our business, which could have an adverse impact on our results of operations. Further, we may not be able to obtain future new technologies and systems, or to replace or introduce new technologies and systems as quickly as our competitors or in a cost-effective manner. Also, we may not achieve the benefits anticipated or required from any new technology or system, including those related to our recent technology acquisitions.

Recent technology acquisitions were made to bolster our value proposition and ultimately assist in attracting and retaining agents, loan originators and franchisees. If these technology platforms are delivered later than expected, do not create a distinct competitive edge for agents, loan originators and franchisees, or have a poorer than expected adoption rate by agents, loan originators and franchisees, the introduction of such platforms may not be effective in attracting or retaining agents, loan originators and franchisees.

Failing to attract and retain highly qualified franchisees could compromise our ability to maintain or expand the RE/MAX and Motto networks.