UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2015

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-36101

RE/MAX Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

|

80-0937145 |

|

(State or other jurisdiction of incorporation or organization) |

|

|

(I.R.S. Employer Identification Number) |

|

5075 South Syracuse Street Denver, Colorado |

|

|

80237 |

|

(Address of principal executive offices) |

|

|

(Zip code) |

(303) 770-5531

(Registrants’ telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Class A Common Stock, par value $0.0001 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is well-known seasoned issuers, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, non-accelerated filer, or smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐ |

|

Accelerated Filer ☒ |

|

Non-Accelerated Filer ☐ |

|

Smaller Reporting Company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2015, the last business day of the registrant’s most recently completed second quarter, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $437.8 million, based on the number of shares held by non-affiliates as of June 30, 2015 and the closing price of the registrant’s common stock on the New York Stock Exchange on June 30, 2015.

The number of outstanding shares of the registrant’s Class A common stock, par value $0.0001 per share, and Class B common stock, par value $0.0001, as of February 19, 2016 was 17,584,351 and 1, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2015.

RE/MAX HOLDINGS, INC.

2015 ANNUAL REPORT ON FORM 10-K

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, forward-looking statements include statements we make relating to:

|

· |

our expectations regarding consumer trends in residential real estate transactions; |

|

· |

our expectations regarding overall economic and demographic trends, including the continued growth of the United States (“U.S.”) residential real estate market; |

|

· |

our expectations regarding our performance during future downturns in the housing sector; |

|

· |

our growth strategy of increasing our agent count; |

|

· |

our ability to expand our network of franchises in both new and existing but underpenetrated markets; |

|

· |

our growth strategy of increasing our number of closed transaction sides and transaction sides per agent; |

|

· |

the continued strength of our brand both in the U.S. and Canada and in the rest of the world; |

|

· |

the pursuit of future reacquisitions of Independent Regions; |

|

· |

our intention to pay dividends; |

|

· |

our future financial performance; |

|

· |

our ability to forecast selling, operating and administrative expenses; |

|

· |

the effects of laws applying to our business; |

|

· |

our ability to retain our senior management and other key employees; |

|

· |

our intention to pursue additional intellectual property protections; |

|

· |

our future compliance with U.S. or state franchise regulations; |

|

· |

other plans and objectives for future operations, growth, initiatives, acquisitions or strategies, including investments in our information technology infrastructure; |

|

· |

the anticipated benefits of our advertising strategy; |

|

· |

our intention to repatriate cash generated by our Canadian operations to the U.S. on a regular basis in order to minimize the impact of mark-to-market gains and losses; and |

|

· |

our expectation that our new cloud-based enterprise resource planning system will enhance our internal controls over financial reporting and function as an important component of our disclosure controls and procedures. |

3

These and other forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed in “Item 1A.—Risk Factors” and in “Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Annual Report on Form 10-K.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

4

We are one of the world’s leading franchisors of real estate brokerage services. Our business strategy is to recruit and retain agents and sell franchises. Our franchisees operate under the RE/MAX brand name, which has held the number one market share in the U.S. and Canada since 1999, as measured by total residential transaction sides completed by our agents. Accordingly, our company slogan is “Nobody sells more real estate than RE/MAX.” The RE/MAX brand has the highest level of unaided brand awareness in real estate in the U.S. and Canada according to a 2015 consumer survey by MMR Strategy Group, and our iconic red, white and blue RE/MAX hot air balloon is one of the most recognized real estate logos in the world.

The RE/MAX brand is built on the strength of our global franchise network, which is designed to attract and retain the best-performing and most experienced agents by maximizing their opportunity to retain a larger portion of their commissions. As a result of this agent-centric approach, we believe that our agents are substantially more productive than the industry average. We consider agent count to be a key measure of our business performance as the majority of our revenue is derived from fixed, contractual fees and dues paid to us based on the number of agents in our franchise network.

RE/MAX was founded in 1973 by David and Gail Liniger with an innovative, entrepreneurial culture affording our agents and franchisees the flexibility to operate their businesses with great independence. This business strategy led to a 33-year period of uninterrupted growth, highlighted in the charts below, as RE/MAX added large numbers of franchises and agents in the U.S., Canada and around the world. Today, the RE/MAX brand operates in more countries than any other real estate brokerage brand in the world.

|

104,826 Agents |

6,986 Offices |

98 Countries |

|

Number of Agents |

Number of Offices |

Number of Countries |

As of December 31, 2015.

We grew our total agent count at a compound annual growth rate of 30% from our founding to a peak of approximately 120,000 agents in 2006. Our agent count declined approximately 26.8% from 2006 through 2011 as real estate transaction activity declined during the U.S. and global real estate downturn and economic recession. We returned to growth starting in 2012, resulting in a net gain of 10,534 agents between 2012 and 2014 (of which 5,953 were in the U.S.). In 2015, we gained 6,816 agents (of which 2,813 were in the U.S.) as the upturn has continued, for a total of 104,826 agents (of which 59,918 were in the United States and 19,668 were in Canada). Approximately 28% of our agents gained in the U.S. during 2015 were from offices newly opened in 2014. We expect that our U.S. agent count will continue to increase as we continue to attract agents who recognize the strength of the RE/MAX brand and our agent-centric value proposition.

5

As approximately 83% of our 2015 revenue came from the U.S., we believe that we have benefitted from improvements in the U.S. housing market. With approximately 12% of our 2015 revenue coming from Canada, where RE/MAX has the leading market share among residential brokerage firms, we also benefitted during periods of generally stable Canadian housing market trends. See “—Market Opportunity—U.S. and Canadian Real Estate Brokerage Industry Overview.”

The RE/MAX network extends to commercial real estate brokerage as well, with approximately 2,800 RE/MAX Commercial® practitioners in over 50 countries. RE/MAX Commercial® is perennially named one of the top 25 commercial brokerage networks by National Real Estate Investor magazine.

As a franchisor, we maintain a low fixed-cost structure, which enables us to generate high margins and helps us drive significant operating leverage through incremental revenue growth.

|

(1) |

Adjusted EBITDA is a non-GAAP measure of financial performance that differs from U.S. Generally Accepted Accounting Principles. See “Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of Adjusted EBITDA and a reconciliation of the differences between Adjusted EBITDA and net income. |

|

(2) |

Excludes adjustments attributable to the non-controlling interest. See "Corporate Structure and Ownership” below. |

In 2015, we operated in two reportable segments, (1) Real Estate Franchise Services and (2) Brokerages. The Real Estate Franchise Services reportable segment comprises the operations of our owned and independent global franchising operations and corporate-wide professional services expenses. The Brokerages reportable segment contains the operations of our owned brokerage offices in the U.S., the results of operations of a mortgage brokerage company in which we owned a non-controlling interest and reflects the elimination of intersegment revenue and other consolidation entities. We started 2015 with 21 owned brokerage offices (which represented less than 1% of RE/MAX brokerages in the U.S.), but sold 18 of our brokerage offices in the Washington, DC and Portland, Oregon metropolitan areas in 2015, and have since sold the remaining three offices, in the Seattle, Washington area. Therefore we will report as a single segment for 2016. Our reportable segments for 2015 represent our operating segments for which separate financial information is available and which is utilized on a regular basis by our management to assess performance and to allocate resources. For additional financial information about our business by segment, see Note 18 to our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

Market Opportunity

We operate in the real estate brokerage franchising industry in nearly 100 countries, including the U.S. and Canada.

U.S. and Canadian Real Estate Brokerage Industry Overview. Based upon U.S. Census Bureau data and existing home sales information from the National Association of Realtors (“NAR”), the U.S. residential real estate industry is an approximately $1.58 trillion market based on 2015 sales volume. Residential real estate represents the largest single asset class in the U.S. with a value of approximately $21.8 trillion, according to the Federal Reserve.

6

Residential real estate brokerages typically realize revenue by charging a commission based on a percentage of the price of the home sold. The real estate brokerage industry generally benefits in periods of rising home prices and transaction activity (with the number of licensed real estate agents generally increasing during such periods), and is adversely impacted in periods of falling prices and home sale transactions (with the number of licensed real estate agents generally decreasing during such periods).

We believe the traditional agent-assisted business model compares favorably to alternative channels of the residential brokerage industry, such as discount brokers and “for sale by owner,” because full-service brokerages are best suited to address many of the key characteristics of real estate transactions, including: (i) the complexity and large monetary value involved in home sale transactions, (ii) the infrequency of home sale transactions, (iii) the high price variability in the home market, (iv) the unique nature of each home and (v) the consumer’s need for a high degree of personalized advice and support in light of these factors. For these reasons, we believe that consumers will continue to use the agent-assisted model for residential real estate transactions. In addition, although listings are available for viewing on a wide variety of real estate websites, we believe an agent’s local market expertise provides the ability to better understand the inventory of for-sale homes and the interests of potential buyers. This knowledge allows the agent to customize the pool of potential homes they show to a buyer, as well as help sellers to present their home professionally to best attract potential buyers. According to NAR, 89% of sellers of existing homes used an agent or broker in 2015 compared to 82% in 2004, and 87% of buyers used an agent or broker in 2015, compared with 77% in 2004.

Cyclical Nature. The residential real estate industry is cyclical in nature, but has shown strong long-term growth. From the second half of 2005 through 2011, the U.S. real estate industry experienced a significant downturn, with existing home sale transactions declining by 40%, and median price declining 24% from 2005 to 2011, according to NAR. A steady, multi-year recovery began in 2012-2014 and continued through 2015, with NAR forecasting a relatively moderate 1.7% increase in transactions and 3.4% increase in median price in 2016.

|

|

|

|

|

|

While this price recovery has meant that home affordability, as indicated by NAR’s Home Affordability Index, has weakened somewhat from record favorable conditions in 2012, home affordability has remained substantially better than its ten- and twenty-year averages. This means homes continue to be affordable for the median consumer. However, in comparison to what is traditionally considered a ‘balanced’ market, with enough inventory on the market to satisfy six months of home sales demand, inventory has remained tight for nearly three and a half years.

7

|

Months Supply of Inventory |

NAR Home Affordability Index |

|

Source: NAR (based on seasonally adjusted home sales) |

Source: NAR |

The extent to which home affordability remains high will depend on the extent of any future interest rate changes, changes in home prices (which may be influenced by the amount of inventory on the market), and changes in the job market and/or wage growth.

In Canada, the downturn from 2005 through 2011 was mild by comparison to that of the U.S. for the same period. Canadian home sales were up 5.1% in 2014 and 5.5% in 2015, but are forecast to decline 1.1% in 2016, according to the Canadian Real Estate Association.

Favorable Long-term Demand. We believe long-term demand for housing in the U.S. is primarily driven by the economic health of the domestic economy, and local factors such as demand relative to supply. We also believe the residential real estate market in the U.S. will benefit from fundamental demographic shifts over the long term. These include an increase in household formations, including as a result of immigration and population growth. We believe there is also pent-up selling demand from generational shifts, such as many retirement age homeowners who are likely to take advantage of improving housing market conditions in order to sell their existing residences and retire in new areas of the country or purchase smaller homes. Similarly, we believe there is also pent-up buying demand among adults in the large millennial generation, driving household formation back to historical levels.

Our Market Position. We attribute our success to our ability to recruit and retain experienced agents and sell franchises. Our approach to sustained agent recruiting and retention and franchise sales depends upon two key elements of our unique business model: (i) creating and maintaining a premier market presence in the real estate brokerage industry worldwide, and (ii) creating and maintaining the unique RE/MAX “growth engine.”

Premier Market Presence. The strength of our brand worldwide in the real estate brokerage industry is the result of our ability to successfully create and maintain “Premier Market Presence.” We believe we offer agents and franchisees a compelling market presence in the real estate brokerage industry through the combination of the following six attributes:

|

· |

leading unaided brand awareness; |

|

· |

highly experienced and productive agents; |

|

· |

unsurpassed market share; |

|

· |

high traffic web presence; |

|

· |

high level of customer satisfaction; and |

|

· |

strong community citizenship. |

We believe our focus on creating and maintaining Premier Market Presence has led to a sustained growth of our global franchise network and the RE/MAX brand.

8

RE/MAX “Growth Engine.” The RE/MAX Growth Engine is a virtuous circle whereby all of the key stakeholders in our franchise network—our franchisees, agents and RE/MAX—benefit from mutual investment and participation in the RE/MAX network, or, as we say in RE/MAX, “Everybody wins.” By building our leading brand around an agent-centric model, we believe we are able to attract and retain highly productive agents and motivated franchisees. As a result, our agents and franchisees help to further enhance our brand and market share, expand our franchise network, and ultimately grow our revenue, as illustrated below:

The RE/MAX Growth Engine leads to the following unique benefits for our franchisees and agents and RE/MAX:

|

RE/MAX Franchisee and Agent Benefits |

|

RE/MAX Benefits |

|

• Affiliation with the best brand in the real estate industry • Entrepreneurial culture • High agent commission split and low franchise fees • Access to our lead referral system which is supported by our high traffic websites • Comprehensive, award-winning training programs |

• Network effect drives brand awareness • Franchise fee structure provides recurring revenue streams • Franchise model—highly profitable with low capital requirements—leads to strong cash flow generation and high margins |

|

|

|

|

|

9

Our Franchise Structure

Franchise Organizational Model. We function under the following franchise organizational model, with nearly all of the RE/MAX branded brokerage office locations being operated by franchisees:

|

Franchise Tier |

|

Description |

|

RE/MAX |

|

Owns the right to the RE/MAX brand and sells franchises and franchising rights. |

|

Regional Franchise Owner |

|

Owns rights to sell brokerage franchises in a specified region. In the U.S. and Canada, as of the end of 2015, RE/MAX owned 12 of 32 regional franchises, representing 55% of our U.S. and Canada agent count. The remaining 20 regional franchises, representing 45% of our U.S. and Canada agent count, are Independent Regions. |

|

Franchisee (or Broker-Owner) |

|

Owns right to operate a RE/MAX-branded brokerage office, list properties and recruit agents. 6,986 offices globally, as of December 31, 2015. |

|

Agent (or Sales Associate) |

|

Branded independent contractors who operate out of local franchise brokerage offices. 104,826 agents globally, as of December 31, 2015. |

In the early years of our expansion in the U.S. and Canada, we sold regional franchise rights to independent owners for certain Independent Regions while retaining rights to other regions. In recent years, we have pursued a strategy to reacquire regional franchise rights, such as the California-Hawaii, Florida and Carolinas regions in 2007, the Mountain States region in 2011, the Texas region in 2012 and the Central Atlantic and Southwest regions in 2013. In February 2016, we re-acquired regional franchise rights for the formerly-independent RE/MAX of New York region, which as of December 31, 2015 represented 1.1% of our U.S. and Canada agent count.

Franchise Agreements and Relationship Terms. In those regions that are owned by us in the U.S. and Canada, we typically enter into a five-year renewable franchise agreement with franchisees covering a standard set of terms and conditions. For those regions that are independently owned, we enter into a long-term agreement (typically between 15 and 20 years, with up to three renewal periods of equal length) with the Independent Region owner, pursuant to which the regional franchise owner is authorized to enter into franchise agreements with individual franchisees in that region.

In general, the franchisees (or broker-owners) do not receive an exclusive territory except under certain limited circumstances. Prior to opening an office, a franchisee or principal owner is required to attend a four to five day training program at our global headquarters. We maintain a close relationship with our franchisees and provide them with ongoing training via our RE/MAX University® to help them better attract and train agents, market, and operate more effectively. Prospective franchisees, renewing franchisees, and transferees of a franchise are subject to a criminal background check and must meet certain subjective and objective standards, including those related to relevant experience, education, licensing, background, financial capacity, skills, integrity and other qualities of character.

10

Revenue Model

The majority of our revenue is derived from a stable set of fees paid by our agents, franchisees and regional franchise owners.

Revenue Streams. Our revenue streams are illustrated in the following chart:

Revenue Streams as Percentage of 2015 Total Revenue

Continuing Franchise Fees. In the U.S. and Canada, continuing franchise fees are fixed contractual fees paid monthly by regional franchise owners in Independent Regions or franchisees in Company-owned Regions to RE/MAX based on the number of agents in the franchise region or the franchisee’s office.

Annual Dues. Annual dues are the membership fees that agents pay directly to RE/MAX to be a part of the RE/MAX network and use the RE/MAX brand. Annual dues are currently a flat fee of US$400/CA$400 per agent annually for our U.S. and Canadian agents.

Broker Fees. Broker fees are assessed to the broker against real estate commissions paid by customers when an agent sells a home. Agents pay a negotiated percentage of these earned commissions to the broker in whose office they work. Broker-owners in turn pay a percentage of the commission to the regional franchisor. Generally, the amount paid by broker-owners to the regional franchisor, which we refer to as the “broker fee,” is 1% of the total commission on the transaction. The amount of commission collected by brokers is based primarily on the sales volume of RE/MAX agents, home sale prices in such sales and real estate commissions earned by agents on these transactions. Broker fees therefore vary based upon the overall health of the real estate industry and the volume of existing home sales in particular. This revenue stream is based on sales volume and provides us with incremental upside during a real estate market recovery.

Franchise Sales and Other Franchise Revenue. Franchise sales and other franchise revenue primarily comprises:

|

· |

Franchise Sales. Franchise sales revenue consists of revenue from sales and renewals of individual franchises from Company-owned Regions and Independent Regions, as well as regional and country master franchises in global markets outside of North America. We receive only a portion of the revenue from the sales and renewals of individual franchises from Independent Regions. |

11

|

· |

Other Franchise Revenue. Other franchise revenue includes revenue from preferred marketing arrangements and approved supplier programs with third parties, including mortgage lenders and other real estate service providers, as well as event-based revenue from training and other programs, including our annual convention in the U.S. |

Brokerage Revenue. During 2015, brokerage revenue principally represented fees assessed by our owned brokerages for services provided to their affiliated real estate agents. Our owned brokerage offices were solely in the U.S. and represented less than 1% of the 3,500 real estate brokerage offices that operate under the RE/MAX brand name in the U.S. During 2015 and the beginning of 2016, we sold all of our owned brokerages to existing RE/MAX franchisees, and as a result, prospectively, we will no longer earn brokerage revenue.

Revenue per Agent in U.S. and Canada Owned and Independent Regions. We receive a higher amount of revenue per agent in our Company-owned Regions than in our Independent Regions. While both Company-owned Regions and Independent Regions charge relatively similar fees to RE/MAX brokerages and agents, we receive the entire amount of the continuing franchise fee, broker fee and initial franchise and renewal fee in Company-owned Regions, whereas we receive only a portion of these fees in Independent Regions. We generally receive 15%, 20% or 30% of the amount of such fees in Independent Regions, which is a fixed rate in each particular Independent Region established by the terms of the applicable regional franchise agreement. In 2015, the average annual revenue per agent in our Company-owned Regions was approximately $2,451, whereas the average annual revenue per agent in Independent Regions was approximately $821.

Franchise and Agent Fee Increases. Given the low fixed infrastructure cost of our franchise model, modest increases in aggregate fees per agent positively affect our profitability. Although we may pursue future opportunities to increase our aggregate fees per agent over time, our strategic focus is to grow agent count through recruiting programs and retention initiatives.

International Revenue. We base our continuing franchise fees, agent dues and broker fees outside the U.S. and Canada on the same structure as our Independent Regions, except that the aggregate level of such fees is substantially lower in these markets than in the U.S. and Canada.

12

Our revenue and agent count by geography are illustrated in the following charts:

|

Revenue by Geography Percent of 2015 Revenue |

|

Agents by Geography As of Year-end 2015 |

For additional financial information about our business by geographic area, see Note 18 to our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

Our Agent-Centric Approach

We believe that our agent-centric approach enables us to attract and retain highly effective agents and motivated franchisees to our network and drive growth in our business and profitability. We have built a franchise model designed to provide the following unique combination of benefits to our franchisees and agents:

|

· |

Affiliation with the Best Brand in Residential Real Estate. We believe buyers and sellers of real estate are most comfortable doing business with an entity and brand with which they are familiar. We drive brand awareness through transaction activity and visibility in the market. The RE/MAX brand has held number one market share as measured by total residential transaction sides completed by our agents in both the U.S. and Canada since 1999. We reinforce brand awareness through marketing and advertising programs that are supported by promotional campaigns of our franchisees and agents in their local markets. |

|

· |

Entrepreneurial, High Performance Culture. We attract highly driven professionals through our recruiting and franchise sales efforts. We provide our franchisees and agents with a vast array of industry-leading tools, resources and support, but allow them autonomy to run their businesses independently. Our approach gives them the freedom generally to set commission rates and oversee local advertising in order to best meet the needs of their particular markets and circumstances. As we say to our agents, they are “in business for themselves, but not by themselves.” |

|

· |

High Agent Commission Fee Split and Low Franchise Fees. In the RE/MAX franchise network, we recommend to our franchisees an agent-favorable commission split of 95%/5% (with the agent receiving 95%). In exchange for the agent generally retaining a high percentage of commissions, our agents pay the franchise broker a pre-agreed sum to share the overhead and other fixed costs of the brokerage. This model is highly attractive to high-producing agents because it allows them to earn a higher commission compared to traditional brokerages where the broker typically takes 30% to 40% of the agent’s commission. |

13

|

· |

Lead Referral Systems Supported by High Traffic Websites. We provide an attractive lead referral system to our agents free of referral fees. We believe that no other national real estate brand provides their real estate agents comparable access to free leads. Our websites, including remax.com, global.remax.com, theremaxcollection.com and remaxcommercial.com, collectively were visited over 85.0 million times in 2015, and our flagship site, remax.com, was the most visited real estate franchise website during 2015, according to Experian Hitwise Marketing Services data. In addition, the traffic across our websites provides listed properties additional exposure to potential buyers. When a prospective buyer inquires about a property displayed on our websites, or the websites of certain of our regions, offices, and agents, a RE/MAX agent receives this lead through our lead referral system, LeadStreet®, without a referral fee. Our LeadStreet® system has sent over 15.0 million free leads to our agents since 2006. Our expansive global network of agents also generates traditional agent-to-agent leads, such as when a relocating home seller wants their RE/MAX agent’s referral for an agent to help them buy in their new area, or a customer’s business needs the specialized assistance of a RE/MAX Commercial® practitioner. |

|

· |

RE/MAX University® Training Programs. RE/MAX has been an industry leader in providing comprehensive education programs for franchisees and agents since 1994, when RE/MAX created the revolutionary RE/MAX Satellite Network, which was the only real estate related educational and training system of its kind for over a decade. RE/MAX agents and brokers have enrolled in more than 90,000 professional designations, certifications or other courses through our proprietary education systems. In 2007, RE/MAX introduced RE/MAX University®, or RU, which offers worldwide, 24/7, on-demand access to the latest information on key industry topics and is aimed at helping our global network of agents deliver the best service possible to their existing and potential new customers. RE/MAX University further offers agents advanced training in areas such as distressed properties, luxury properties, senior clients, buyer agency and many other specialty areas of real estate. In 2014, we began our proprietary Momentum® training program, a comprehensive training, development and recruiting program for RE/MAX brokers and agents (the “Momentum Program”). The Momentum Program is specifically designed to educate our broker owners on how to manage their business more effectively and profitably, and plan for future success by recruiting and training more agents. Since the program began, over 1,600 broker owners and managers have taken the Momentum Program—over 1,150 of them broker owners or managers in our Company-owned Regions. |

Value Creation and Growth Strategy

We intend to leverage our market leadership in the residential real estate brokerage industry in the U.S. and Canada to drive shareholder value through: a) organic growth, building on our network of over 100,000 agents in nearly 100 countries; b) growth catalysts through acquisitions; and c) return of capital to shareholders.

Organic Growth by Increasing Our Agent Count. The residential real estate market in the U.S. continues to improve and we are well positioned to capitalize on this trend due, in large part, to our leading brand and the quality of our agent and franchise network. Based on our experience, we believe gradually improving market conditions in the U.S. will enable us to continue to sell franchises and recruit and retain agents, increasing our revenue and profitability. We experienced agent losses during the downturn, but we returned to a period of net agent growth in 2012 and our year-over-year growth in agent count accelerated in 2013, 2014 and 2015. As the housing market continues to improve, we expect that our organic agent count growth will continue.

14

Agent Count

Number of Agents at Quarter-End

We sold 929 office franchises in 2015 (as well as 17 international region and sub-region franchises) and intend to continue adding franchises in new and existing markets, and as a result, increase our global market share and brand awareness.

Office Franchise Sales

We intend to continue to focus on recruiting and retaining agents, because each incremental agent leverages our existing infrastructure, allowing us to drive additional revenue at little incremental cost. We are committed to reinvesting in the business to enhance our value proposition and through a range of new and existing programs and tools, including increasingly targeted marketing and promotional efforts, improved training and development programs for franchisees and agents, and benefits to both agents and franchisees from our network infrastructure such as our high-traffic websites and lead referral system.

Growth Catalysts through Acquisitions. We intend to continue to pursue reacquisitions of the regional RE/MAX franchise rights in a number of Independent Regions in the U.S. and Canada, as well as other acquisitions in related areas that build on our core competencies in franchising and real estate brokerage support.

The reacquisition of a regional franchise substantially increases our revenue per agent and provides an opportunity for us to drive enhanced profitability, as we receive a higher amount of revenue per agent in our Company-owned Regions than in our Independent Regions. For example, we can establish operational efficiencies and improvements in financial performance of a reacquired region by leveraging our existing infrastructure and experience. As discussed above, our average annual revenue per agent in our Company-owned Regions is substantially higher than in Independent Regions because, while both Company-owned Regions and Independent Regions charge relatively similar fees to their brokerages and agents, we only receive a percentage of the continuing franchise fee, broker fee and initial franchise and renewal fee in Independent Regions. By reacquiring regional franchise rights, we can capture 100% of these fees and substantially increase the average revenue per agent for agents in the reacquired region, which, as a result of our low fixed-cost structure, further increases our overall margins.

15

|

|

Recent History of Re-Acquiring Independent Regional Rights |

|||||||||

|

|

Year* |

|

Region |

|||||||

|

|

1998 |

|

Western Canada |

|||||||

|

|

1999 |

|

Pennsylvania / Delaware |

|||||||

|

|

2007 |

|

California & Hawaii |

|||||||

|

|

2007 |

|

Florida |

|||||||

|

|

2007 |

|

Carolinas |

|||||||

|

|

2011 |

|

Mountain States |

|||||||

|

|

2012 |

|

Texas |

|||||||

|

|

2013 |

|

Central Atlantic |

|||||||

|

|

2013 |

|

Southwest |

|||||||

|

|

2016 |

|

New York |

|||||||

|

|

* Year of Acquisition |

|||||||||

|

Owned Regions |

13 regions |

56% |

of US/CA agents |

|||||||

|

Independent Regions |

19 regions |

44% |

||||||||

The regions in which we have re-acquired franchise rights since 2007 represented 37% of our agents in the U.S. and Canada as of December 31, 2015, with the result that the Company-owned Regions in which we franchise directly represented 56% of our agents in the U.S. and Canada. This includes our acquisition of the New York region in February 2016. The remaining 44% of our U.S. and Canada combined agent count operate in Independent Regions.

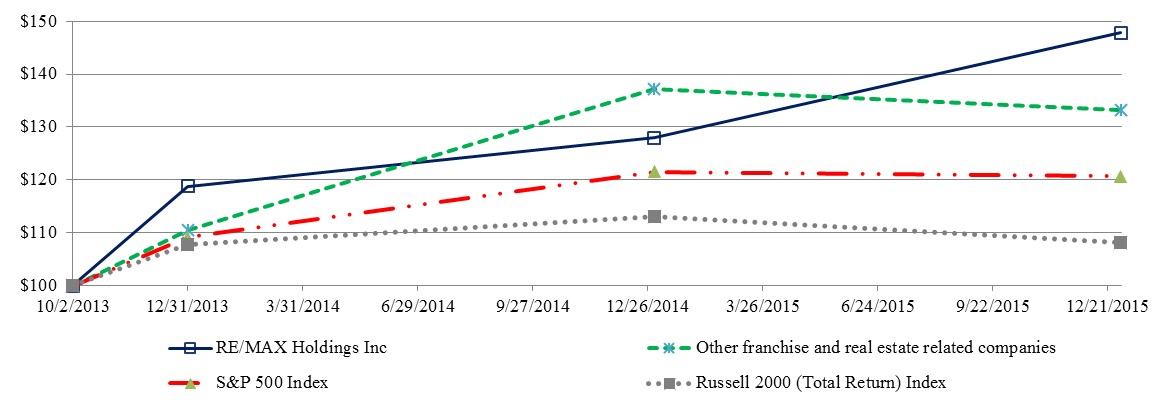

Return of Capital to Shareholders. We are committed to returning capital to shareholders as part of our value creation strategy. We have paid quarterly dividends since April of 2014, the first quarter after our October 7, 2013 initial public offering, when we began paying quarterly dividends of $0.0625 per share. We increased our quarterly dividend to $0.125 per share in March 2015 and to $0.15 per share in February 2016. Including the special dividend also announced in March 2015, we distributed approximately $59.5 million to our shareholders and unitholders in 2015. Our disciplined approach to capital allocation allows us to return capital to shareholders and, as a result, generate shareholder value.

Competition

The real estate brokerage franchise business is highly competitive. We primarily compete against other real estate franchisors seeking to grow their franchise system. Our largest national competitors in the U.S. and Canada include the brands operated by Realogy Holdings Corp. (which include Century 21, Coldwell Banker, ERA, Sothebys and Better Homes and Gardens), Berkshire Hathaway Home Services, Keller Williams Realty, Inc. and Royal LePage. In most markets, we also compete against regional chains, independent, non-franchise brokerages and Internet-based and other brokers offering deeply discounted commissions. Our efforts to target consumers and connect them with a RE/MAX agent via our websites also face competition from major real estate portals. We believe that competition in the real estate brokerage franchise business is based principally upon the reputational strength of the brand, the quality of the services offered to franchises, and the amount of franchise-related fees to be paid by franchisees.

16

The ability of our franchisees to compete with other real estate brokerages, both franchised and unaffiliated, is an important aspect of our growth strategy. A franchisee’s ability to compete may be affected by a variety of factors, including the quality of the franchisee’s independent agents, the location of the franchisee’s offices and the number of competing offices in the area. A franchisee’s success may also be affected by general, regional and local housing conditions, as well as overall economic conditions.

Preferred Marketing and Supplier Arrangements

We have entered into preferred marketing arrangements providing various third parties, including mortgage lenders and other real estate service providers, with the opportunity to market their products and services to our franchisees and agents. Through these arrangements, we receive additional revenue in the form of fees paid for marketing access to our network of franchisees and agents.

In addition, with the collective buying power of company-owned and franchised brokerages, we have established a network of preferred suppliers whose products may be purchased directly by franchisees and agents. These relationships provide group discount prices, marketing materials that have been pre-vetted to comply with RE/MAX brand standards and higher quality materials that may not be cost-effective to procure on an individual office basis.

Marketing and Promotion

We believe that the strength of the RE/MAX brand and our iconic red, white and blue RE/MAX hot air balloon logo help to drive brand awareness. RE/MAX advertising, marketing and promotion campaigns increase the strength of our brand and generate leads for our agents. We believe the widespread recognition of our brand is a key aspect of our value proposition to agents and franchisees.

A variety of programs build our brand, including leading websites such as remax.com, advertising campaigns using television, print, billboards and signs, flyers, advertising inserts, Internet, email, social media and mobile applications. Event-based marketing programs, sponsorships, sporting activities and other similar functions also promote our brand. These include our support, since 1992 for Children's Miracle Network Hospitals in the U.S. and Children's Miracle Network in Canada, to help sick and injured children. Through the Miracle Home® program, participating RE/MAX agents make a donation to Children's Miracle Network Hospitals once a home sale transaction is complete.

Nearly all of the advertising, marketing and promotion to support the RE/MAX brand is funded by our agents and franchisees. In the U.S. and Canada, there are two primary levels of advertising and promotion of our brand based on the source of funding for the activity: (i) regional advertising funds build and maintain brand awareness and drive real estate consumers to use RE/MAX agents through regional activities and media buys, including placement of RE/MAX’s advertising on a regional or pan-regional basis, and (ii) local campaigns that are paid for directly by agents and franchisees within their local markets. The regional advertising funds are funded by our agents through fees that our brokers collect and pay to the regional advertising funds.

|

· |

Regional Advertising Funds. Regional advertising funds primarily support advertising campaigns focused on building and maintaining brand awareness at the regional level. These regional advertising funds in Company-owned Regions are corporations owned by our controlling stockholder as trustee for RE/MAX agents. Their activities are directed by our Company-owned Regions. For the regional advertising funds’ fiscal year ended January 31, 2016, franchisee contributions to the regional advertising funds that promote the RE/MAX brand in Company-owned Regions were $43.8 million. The RE/MAX brand is promoted in Independent Regions by other regional advertising funds. On occasion, the advertising funds in Company-owned Regions, together with some or all of the advertising funds in Independent Regions, may contribute to national or pan-regional creative development and media purchases. |

17

|

· |

Local Campaigns. Our franchisees and agents engage in extensive promotional efforts within their local markets to attract customers and drive agent and brand awareness within the local market. These programs are subject to brand guidelines and quality standards that we establish for use of the RE/MAX brand, but we allow our franchisees and agents substantial flexibility to create advertising, marketing and promotion programs that are tailored to local market conditions. We believe the marketing, advertising and promotion expenditures by our agents and franchisees at the local level substantially exceed the amounts allocated to the national and regional advertising funds each year. |

|

· |

Pan-Regional Campaigns. In late 2014, we and Independent Regions adopted a change in strategy to focus our advertising efforts in the U.S. on regional and local advertising and, beginning in January 2015, both Company-owned and Independent Regions in the U.S. shifted advertising expenditures away from our national advertising fund to our respective regional advertising funds. In 2016, funds previously allocated to the RE/MAX national advertising fund will be managed and invested by the separate RE/MAX regional advertising funds. These regional advertising funds will continue to be funded by our agents through fees that our brokers collect and pay to the regional advertising funds. The advertising funds in Company-owned Regions, together with some or all of the advertising funds in Independent Regions, may contribute to national or pan-regional creative development and media purchases, to promote a consistent brand message and achieve economies of scale in the purchase of advertising. |

Intellectual Property

We protect the RE/MAX brand through a combination of trademarks and copyrights. We have registered “RE/MAX” as a trademark in the U.S., Canada, and over 150 other countries and territories, and have registered various versions of the RE/MAX balloon logo and real estate yard sign design in numerous countries and territories as well. We also have filed other trademark applications in the U.S. and certain other jurisdictions, and will pursue additional trademark registrations and other intellectual property protection to the extent we believe it would be beneficial and cost effective. We also are the registered holder of a variety of domain names that include “remax” and similar variations.

Corporate Structure and Ownership

We are a holding company incorporated in Delaware and our only business is to act as the sole manager of RMCO, LLC, or “RMCO”. In that capacity, we operate and control all of the business and affairs of RMCO. As of December 31, 2015, we own 58.33% of the common units in RMCO, while RIHI, Inc. (“RIHI”) owns the remaining 41.67% of common units in RMCO. RIHI is majority owned and controlled by David Liniger, our Chief Executive Officer, Chairman and Co-Founder, and by Gail Liniger, our Vice Chair and Co-Founder. Daryl Jesperson, one of our directors, holds a minority ownership interest in RIHI.

18

The diagram below depicts our organizational structure:

The holders of our Class A common stock collectively own 100% of the economic interests in RE/MAX Holdings, Inc., while RIHI owns 100% of the outstanding shares of our Class B common stock. The shares of Class B common stock have no economic rights but entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes on matters presented to stockholders of RE/MAX Holdings, Inc. that is equal to two times the aggregate number of common units of RMCO held by such holder. As a result of RIHI’s ownership of shares of our Class B common stock, it holds effective control of a majority of the voting power of our outstanding common stock and we constitute a “controlled company” under the corporate governance standards of the New York Stock Exchange and therefore are not required to comply with certain corporate governance requirements.

Due to RIHI’s ownership interest in RMCO, our results reflect a significant non-controlling interest and our pre-tax income excludes RIHI’s proportionate share of RMCO’s net income. Our only source of cash flow from operations is in the form of distributions from RMCO and management fees paid by RMCO pursuant to a management services agreement between us and RMCO.

19

In November and December of 2015, RIHI executed a secondary offering of shares that it owned, and this sale reduced RIHI’s ownership in RMCO to 41.67%. However, RIHI retains a controlling vote in RE/MAX Holdings, Inc. through its ownership of 12,559,600 common units in RMCO and its Class B share of RE/MAX Holdings, Inc. This balance of economic interest and voting power is illustrated below:

RIHI’s voting rights will be reduced to equal the aggregate number of RMCO common units held—and RIHI would therefore be expected to lose its controlling vote of RE/MAX Holdings, Inc.—after the occurrence of any of the following events: (i) October 7, 2018; (ii) the death of the Company’s Chief Executive Officer, Chairman and Co-Founder, David Liniger; or (iii) at such time as RIHI’s ownership of RMCO common units falls below 5,320,380 common units.

Employees

As of December 31, 2015, we had approximately 311 employees, including 21 employees located in Western Canada, 275 in our corporate headquarters and 15 in our owned brokerage offices that we have subsequently sold (which included office staff, but not independent contractor sales associates affiliated with our owned brokerages). Other than with respect to our owned brokerage offices, our franchisees are independent businesses and their employees and independent contractor sales associates are therefore not included in our employee count. None of our employees are represented by a union. We believe our relations with our employees are good.

Seasonality

The residential housing market is seasonal with transactional activity in the U.S. and Canada peaking in the second and third quarter of each year. Our results of operations are somewhat affected by these seasonal trends. Our Adjusted EBITDA margins are often lower in the first and fourth quarters due primarily to the impact of lower broker fees and other revenue as a result of lower overall sales volume, as well as higher selling, operating and administrative expenses in the first quarter for expenses incurred in connection with our annual convention.

20

Government Regulation

Franchise Regulation. The sale of franchises is regulated by various state laws, as well as by the Federal Trade Commission (“FTC”). The FTC requires that franchisors make extensive disclosure to prospective franchisees but does not require registration. A number of states require registration or disclosure by franchisors in connection with franchise offers and sales. Several states also have “franchise relationship laws” or “business opportunity laws” that limit the ability of the franchisor to terminate franchise agreements or to withhold consent to the renewal or transfer of these agreements. The states with relationship or other statutes governing the termination of franchises include Arkansas, California, Connecticut, Delaware, Hawaii, Illinois, Indiana, Iowa, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, Virginia, Washington and Wisconsin. Some franchise relationship statutes require a mandated notice period for termination; some require a notice and cure period; and some require that the franchisor demonstrate good cause for termination. Although we believe that our franchise agreements comply with these statutory requirements, failure to comply with these laws could result in our company incurring civil liability. In addition, while historically our franchising operations have not been materially adversely affected by such regulation, we cannot predict the effect of any future federal or state legislation or regulation.

Real Estate Regulation. The Real Estate Settlement Procedures Act (“RESPA”) and state real estate brokerage laws restrict payments which real estate brokers and other service providers in the real estate industry may receive or pay in connection with the sales of residences and referral of settlement services, such as mortgages, homeowners insurance and title insurance. Such laws may to some extent restrict our preferred vendor programs.

Available Information

RE/MAX Holdings is a Delaware corporation and its principal executive offices are located at 5075 South Syracuse Street, Denver, Colorado 80237, telephone (303) 770-5531. The Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge through the “Investor Relations” portion of the Company’s website, www.remax.com, as soon as reasonably practical after they are filed with the Securities and Exchange Commission (“SEC”). The content of the Company’s website is not incorporated into this report. The SEC maintains a website, www.sec.gov, which contains reports, proxy and information statements, and other information filed electronically with the SEC by the Company.

21

RE/MAX Holdings, Inc. and its consolidated subsidiaries (collectively, the “Company,” “we,” “our” or “us”) could be adversely impacted by various risks and uncertainties. An investment in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as all of the other information contained in this Annual Report on Form 10-K, including our audited consolidated financial statements and the related notes thereto before making an investment decision. If any of these risks actually occur, our business, financial condition, operating results, cash flow and prospects may be materially and adversely affected. As a result, the trading price of our Class A common stock could decline and you could lose some or all of your investment.

We have grouped our risks according to:

|

· |

Risks Related to Our Business and Industry; |

|

· |

Risks Related to Our Organizational Structure; and |

|

· |

Risks Related to Ownership of Our Class A Common Stock. |

Risks Related to Our Business and Industry

The residential real estate market is cyclical and we are negatively impacted by downturns in this market and general global economic conditions.

The residential real estate market tends to be cyclical and typically is affected by changes in general economic conditions which are beyond our control. These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets, levels of unemployment, consumer confidence and the general condition of the U.S. and the global economy. The residential real estate market also depends upon the strength of financial institutions, which are sensitive to changes in the general macroeconomic and regulatory environment. Lack of available credit or lack of confidence in the financial sector could impact the residential real estate market, which in turn could materially and adversely affect our business, financial condition and results of operations.

For example, the U.S. residential real estate market has shown signs of recovery in recent years after having been in a significant and prolonged downturn, which began in the second half of 2005 and continued through 2011. Based on our experience, we believe gradually improving market conditions in the U.S. will enable us to recruit and retain higher numbers of agents, increasing our revenue and profitability. To the extent the U.S. housing market recovery continues, we expect the growth in our agent count to continue. However, competition for qualified and effective agents is intense, and we may be unable to recruit and retain enough qualified and effective agents to satisfy our growth strategies.

Due to the cyclicality of the real estate market, we cannot predict whether the recovery will continue or if and when the market and related economic forces will return the U.S. residential real estate industry to a period of sustained growth. If the residential real estate market or the economy as a whole does not continue to improve, we may experience adverse effects on our business, financial condition and liquidity, including our ability to access capital and grow our business.

Any of the following could cause a decline in the housing market and have a material adverse effect on our business by causing periods of lower growth or a decline in the number of home sales and/or home prices which, in turn, could adversely affect our revenue and profitability:

|

· |

an increase in the unemployment rate; |

|

· |

a decrease in the affordability of homes due to changes in interest rates, home sale prices, and rates of wage and job growth; |

|

· |

slow economic growth or recessionary conditions; |

|

· |

weak credit markets; |

|

· |

a low level of consumer confidence in the economy and/or the residential real estate market; |

|

· |

instability of financial institutions; |

22

|

· |

legislative, tax or regulatory changes that would adversely impact the residential real estate market, including but not limited to potential reform relating to Fannie Mae, Freddie Mac and other government sponsored entities (“GSEs”) that provide liquidity to the U.S. housing and mortgage markets; |

|

· |

increasing mortgage rates and down payment requirements and/or constraints on the availability of mortgage financing, including but not limited to the potential impact of various provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) or other legislation and regulations that may be promulgated thereunder relating to mortgage financing, including restrictions imposed on mortgage originators as well as retention levels required to be maintained by sponsors to securitize certain mortgages; |

|

· |

excessive or insufficient regional home inventory levels; |

|

· |

high levels of foreclosure activity, including but not limited to the release of homes already held for sale by financial institutions; |

|

· |

adverse changes in local or regional economic conditions; |

|

· |

the inability or unwillingness of homeowners to enter into home sale transactions due to negative equity in their existing homes; |

|

· |

a decrease in household formations; |

|

· |

a slowing rate of immigration or population growth; |

|

· |

a change in local, state and federal laws or regulations that affect residential real estate transactions or encourage ownership, including but not limited to tax law changes, such as limiting or eliminating the deductibility of certain mortgage interest expense, the application of the alternative minimum tax, and real property taxes and employee relocation expense; |

|

· |

a decrease in home ownership rates, declining demand for real estate and changing social attitudes toward home ownership; and/or |

|

· |

acts of nature, such as hurricanes, earthquakes and other natural disasters that disrupt local or regional real estate markets. |

The failure of the U.S. residential real estate market recovery to be sustained or a prolonged decline in the number of home sales and/or home sale prices could adversely affect our revenue and profitability.

The U.S. residential real estate market has been experiencing a recovery since 2011 after having been in a prolonged period of downturn, which began in the second half of 2005. However, not all U.S. markets have participated to the same extent in the recovery, and we do not know if this recovery will continue in the future or the extent to which the recovery will be limited to certain markets or will spread to other markets, or if and when the market and related economic forces will return the U.S. residential real estate industry to a period of sustained growth. A lack of a continued or widespread recovery or a prolonged decline in existing home sales, a decline in home sale prices or a decline in commission rates charged by our franchisees/brokers could adversely affect our results of operations by reducing the recurring fees we receive from our franchisees, our agents and our company-owned brokerages and reduce the management fees charged by our company-owned brokerages.

A lack of financing for homebuyers in the U.S. residential real estate market at favorable rates and on favorable terms could have a material adverse effect on our financial performance and results of operations.

Our business is significantly impacted by the availability of financing at favorable rates or on favorable terms for homebuyers, which may be affected by government regulations and policies. Certain potential reforms such as the U.S. federal government’s conservatorship of Fannie Mae and Freddie Mac, proposals to reform the U.S. housing market, attempts to increase loan modifications for homeowners with negative equity, monetary policy of the U.S. government, any rising interest rate environment and the Dodd-Frank Act may adversely impact the housing industry, including homebuyers’ ability to finance and purchase homes.

23

The monetary policy of the U.S. government, and particularly the Federal Reserve Board, which regulates the supply of money and credit in the U.S., significantly affects the availability of financing at favorable rates and on favorable terms, which in turn affects the domestic real estate market. Policies of the Federal Reserve Board can affect interest rates available to potential homebuyers. Further, we are affected by any rising interest rate environment. Changes in the Federal Reserve Board’s policies, the interest rate environment and mortgage market are beyond our control, are difficult to predict and could restrict the availability of financing on reasonable terms for homebuyers, which could have a material adverse effect on our business, results of operations and financial condition. Additionally, the possibility of the elimination of the mortgage interest deduction could have an adverse effect on the housing market by reducing incentives for buying or refinancing homes and negatively affecting property values. On December 16, 2015, the Federal Open Market Committee of the Federal Reserve Board announced its decision to raise the target range for federal funds by 25 basis points, which marks the end of a seven year period in which the US federal funds rate was held near zero. The pace of future increases in the federal funds rate is uncertain although the Federal Open Market Committee has indicated it expects additional increases to occur. Historically, changes in the federal funds rate have led to changes in interest rates for other loans but the extent of the impact of the December 2015 policy change on the future availability and price of mortgage financing cannot be predicted with certainty.

In addition, the reduction in government support for home financing, including the possible winding down of Fannie Mae and Freddie Mac, further reduces the availability of financing for homebuyers in the U.S. residential real estate market. In connection with the U.S. federal government’s conservatorship of Fannie Mae and Freddie Mac, it has provided billions of dollars of funding to these entities in the form of preferred stock investments to backstop shortfalls in their capital requirements. The U.S. Treasury has indicated it may accelerate the winding down of these entities, but no consensus has emerged in Congress concerning a successor, if any. Given the current uncertainty with respect to the current and further potential reforms relating to Fannie Mae and Freddie Mac, we cannot predict either the short or long term effects of such regulation and its impact on homebuyers’ ability to finance and purchase homes. In an effort to assist recovery of the housing market, the U.S. government has also attempted to increase loan modifications for homeowners with negative equity, but there can be no assurance that such measures will be effective.

Furthermore, in the wake of the recent downturn in the housing industry, many lenders have significantly tightened their underwriting standards, and many subprime and other alternative mortgage products are no longer common in the marketplace. If these trends continue and mortgage loans continue to be difficult to obtain, including in the jumbo mortgage markets, the ability and willingness of prospective buyers to finance home purchases or to sell their existing homes will be adversely affected, which will adversely affect our operating results.

Due to diminished cash reserves, the Federal Housing Administration (“FHA”) has, in recent years, been increasing mortgage insurance premium and loan guarantee fees. This has likely contributed to a significant decline in FHA loan applications. Fannie Mae and Freddie Mac, the guarantors of many home loans, have considered similar fee increases. If implemented, such increases could lead to lower demand for certain mortgages, which could have a negative effect on our operating results.

The Dodd-Frank Act, which was passed to more closely regulate the financial services industry, created the Consumer Financial Protection Bureau (“CFPB”), an independent federal bureau, which enforces consumer protection laws, including mortgage finance. The Dodd-Frank Act also established new standards and practices for mortgage originators, including determining a prospective borrower’s ability to repay their mortgage, removing incentives for higher cost mortgages, prohibiting prepayment penalties for non-qualified mortgages, prohibiting mandatory arbitration clauses, requiring additional disclosures to potential borrowers and restricting the fees that mortgage originators may collect. Rules enacted under the Dodd Frank Act relating to borrowers’ ability to repay loans took effect in January 2014. These rules create protection from liability for mortgages that meet the requirements for “qualified mortgages.” The rules place several restrictions on qualified mortgages, including caps on certain closing costs. These rules and other rules promulgated by the CFPB could have a significant impact on the availability of home mortgages. In addition, the Dodd-Frank Act contained provisions that require GSEs, including Fannie Mae and Freddie Mac, to retain an interest in the credit risk arising from the assets they securitize. This may serve to reduce GSEs’ interest in or demand for mortgage loans, which could have a material adverse effect on the mortgage industry, which may reduce the availability of mortgages to certain borrowers.

24

While we are continuing to evaluate all aspects of the current state of legislation, regulations and policies affecting the domestic real estate market, we cannot predict whether or not such legislation, regulation and policies may result in increased down payment requirements, increased mortgage costs, and result in increased costs and potential litigation for housing market participants, any of which could have a material adverse effect on our financial condition and results of operations.

We may fail to execute our strategies to grow our business, which could have a material adverse effect on our financial performance and results of operations.

We intend to pursue a number of different strategies to grow our revenue and earnings and to deploy the cash generated by our business. We constantly strive to increase the value proposition for our agents and brokers. If we do not reinvest in our business in ways that support our agents and brokers and make the RE/MAX network attractive to agents and brokers, we may become less competitive. Additionally, we are exploring opportunities to acquire other businesses, including select RE/MAX independent regional franchises, or other businesses in the U.S. and Canada that are complementary to our core business. If we fail to develop, execute, or focus on our business strategy, fail to make good business decisions, fail to enforce a disciplined management process to ensure that our investment of resources aligns with our strategic plan and our core management and franchising competencies or fail to properly focus resources or management attention on strategic areas, any of these could negatively impact the overall value of the Company. If we are unable to execute our business strategy, for these or any other reasons, our prospects, financial condition and results of operations may be harmed and our stock price may decline.

We may be unable to reacquire regional franchise rights in independent RE/MAX regions in the U.S. and Canada.

We are also pursuing a key growth strategy of reacquiring select RE/MAX independent regional franchises in the U.S. and Canada. The reacquisition of a regional franchise increases our revenue and provides an opportunity for us to drive enhanced profitability. This growth strategy depends on our ability to find regional franchisees willing to sell the franchise rights in their regions on favorable terms, as well as our ability to finance and complete these transactions. We may have difficulty finding suitable regional franchise acquisition opportunities at an acceptable price. Further, in the event we acquire a regional franchise, we may not be able to achieve the expected returns on our acquisition after we integrate the reacquired region into our business.

Integrating acquired regions involves complex operational and personnel-related challenges and we may encounter higher than expected integration costs associated with the reacquisitions of Independent Regions.

Future acquisitions may present other challenges and difficulties, including:

|

· |

the possible departure of a significant number of key employees; |

|

· |

regulatory constraints and costs of executing our growth strategy may vary by geography; |

|

· |

the possible defection of franchisees and agents to other brands or independent real estate companies; |

|

· |

the disruption of our respective ongoing business; |

|

· |

problems we may discover post-closing with the operations, including the internal controls and procedures of the regions we reacquire; |

|

· |

the failure to maintain important business relationships and contracts of the selling region; |

|

· |

impairment of acquired assets; |

|

· |

legal or regulatory challenges or litigation post-acquisition, which could result in significant costs; |

|

· |

unanticipated expenses related to integration; and |

|

· |

potential unknown liabilities associated with acquired businesses. |

25

A prolonged diversion of management’s attention and any delays or difficulties encountered in connection with the integration of any acquired region or region that we may acquire in the future could prevent us from realizing anticipated cost savings and revenue growth from our acquisitions.

We may not be able to manage growth successfully.

In order to successfully expand our business, we must effectively recruit, develop and motivate new franchisees, and we must maintain the beneficial aspects of our corporate culture. We may not be able to hire new employees necessary to manage our growth quickly enough to meet our needs. If we fail to effectively manage our hiring needs and successfully develop our franchisees, our franchisee and employee morale, productivity and retention could suffer, and our brand and results of operations could be harmed. Effectively managing our potential growth could require significant capital expenditures and place increasing demands on our management. We may not be successful in managing or expanding our operations or in maintaining adequate financial and operating systems and controls. If we do not successfully manage these processes, our brand and results of operations could be adversely affected.

The failure to attract and retain highly qualified franchisees could compromise our ability to pursue our growth strategy.

Our most important asset is our people, and the success of our franchisees depends largely on the efforts and abilities of franchisees to attract and retain high quality agents. If our franchisees fail to attract and retain agents, they may fail to generate the revenue necessary to pay the contractual fees owed to us.

Additionally, although we believe our relationship with our franchisees and agents is open and strong, the nature of such relationships can give rise to conflict. For example, franchisees or agents may become dissatisfied with the amount of contractual fees and dues owed under franchise or other applicable arrangements, particularly in the event that we decide to further increase fees and dues. They may disagree with certain network-wide policies and procedures, including policies such as those dictating brand standards or affecting their marketing efforts. They may also be disappointed with any marketing campaigns designed to develop our brand. There are a variety of reasons why our franchisor-franchisee relationship can give rise to conflict. If we experience any conflicts with our franchisees on a large scale, our franchisees may file lawsuits against us or they may seek to disaffiliate with us, which could also result in litigation. These events may, in turn, materially and adversely affect our business and operating results.

Our financial results are affected by the ability of our franchisees to attract and retain agents.

Our financial results are heavily dependent upon the number of agents in our global network. The majority of our revenue is derived from recurring dues paid by our agents and contractual fees paid by our franchisees or regional franchise owners based on the number of agents within the franchisee’s or regional franchise owner’s network. If our franchisees are not able to attract and retain agents (which is not within our direct control), our revenue may decline. In addition, our competitors may attempt to recruit the agents of our franchisees.

26

Competition in the residential real estate franchising business is intense, and we may be unable to grow our business organically, including increasing by our agent count, expanding our network of franchises and agents, and increasing franchise and agent fees, which could adversely affect our brand, our financial performance, and results of operations.