|

OMB APPROVAL

|

|

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6

|

|

Investment Company Act file number

|

811-22858

|

|

WST Investment Trust

|

|

(Exact name of registrant as specified in charter)

|

|

150 W. Main Street, Suite 1700 Norfolk, VA

|

23510-1666

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

|

|

(Name and address of agent for service)

|

|

Registrant's telephone number, including area code:

|

(866) 515-4626

|

|

Date of fiscal year end:

|

August 31

|

|

|

Date of reporting period:

|

August 31, 2017

|

| Item 1. |

Reports to Stockholders.

|

WST INVESTMENT TRUST

WSTCM SECTOR SELECT

RISK-MANAGED FUND WSTCM CREDIT SELECT

RISK-MANAGED FUND Annual Report

August 31, 2017

|

|

| Investment Adviser Wilbanks, Smith & Thomas Asset Management, LLC, d/b/a WST Capital Management 150 W. Main, Suite 1700 Norfolk, VA 23510 |

Administrator

Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, Ohio 45246-0707 1-866-515-4626 |

|

WST INVESTMENT TRUST

LETTER TO SHAREHOLDERS |

October 16, 2017

|

|

1

|

The universe excludes ETFs dedicated to Telecommunications and Real Estate, which as of August 31, 2017 are recognized as stand-alone S&P 500 sectors. Real Estate Investment Trusts (REITs) continue to be classified as Financials sector investments.

|

WST Capital Management

a division of Wilbanks, Smith & Thomas Asset Management, LLC

|

WSTCM SECTOR SELECT RISK-MANAGED FUND

PERFORMANCE INFORMATION August 31, 2017 (Unaudited) |

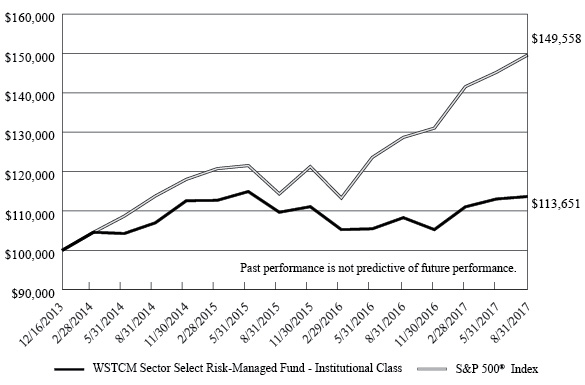

WSTCM Sector Select Risk-Managed Fund -

Institutional Class(a) and the S&P 500® Index

|

Average Annual Total Returns

(for the periods ended August 31, 2017)

|

|||

|

1 Year

|

Since

Inception(c) |

||

|

WSTCM Sector Select Risk-Managed Fund - Institutional Class (b)

|

4.96%

|

3.51%

|

|

|

WSTCM Sector Select Risk-Managed Fund - Investor Class (b)

|

4.69%

|

3.27%

|

|

|

S&P 500® Index

|

16.23%

|

11.47%

|

|

|

(a)

|

The line graph above represents performance of the Institutional Class only, which will vary from the performance of the Investor Class based on the difference in fees paid by shareholders in the different classes.

|

|

(b)

|

Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes dividends or distributions, if any, are reinvested in the shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(c)

|

The Fund commenced operations on December 16, 2013.

|

|

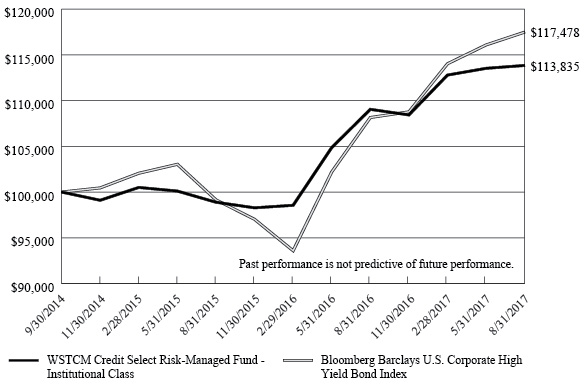

WSTCM CREDIT SELECT RISK MANAGED FUND

PERFORMANCE INFORMATION August 31, 2017 (Unaudited) |

WSTCM Credit Select Risk-Managed Fund - Institutional Class(a) and

the Bloomberg Barclays U.S. Corporate High Yield Bond Index

|

Average Annual Total Returns

(for the periods ended August 31, 2017)

|

|||

|

1 Year

|

Since

Inception(c) |

||

|

WSTCM Credit Select Risk-Managed Fund - Institutional Class (b)

|

4.40%

|

4.54%

|

|

|

WSTCM Credit Select Risk-Managed Fund - Investor Class (b)

|

4.26%

|

4.34%

|

|

|

Bloomberg Barclays U.S. Corporate High Yield Bond Index

|

8.63%

|

5.68%

|

|

|

(a)

|

The line graph above represents performance of the Institutional Class only, which will vary from the performance of the Investor Class based on the difference in fees paid by shareholders in the different classes.

|

|

(b)

|

Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes dividends or distributions, if any, are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(c)

|

The Fund commenced operations on September 30, 2014.

|

|

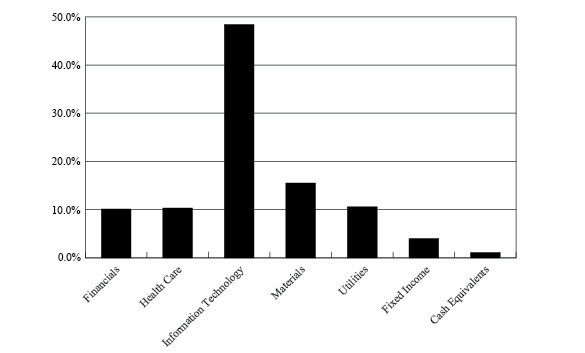

WST INVESTMENT TRUST

PORTFOLIO INFORMATION August 31, 2017 (Unaudited) |

Sector Diversification

(% of Net Assets)

Investment Strategy Allocation

(% of Net Assets)

|

WSTCM SECTOR SELECT RISK-MANAGED FUND

SCHEDULE OF INVESTMENTS August 31, 2017 |

||||||||

|

EXCHANGE-TRADED FUNDS — 98.4%

|

Shares

|

Value

|

||||||

|

Guggenheim S&P 500® Equal Weight Financials ETF

|

41,500

|

$

|

1,631,365

|

|||||

|

Guggenheim S&P 500® Equal Weight Healthcare ETF

|

9,500

|

1,666,870

|

||||||

|

Guggenheim S&P 500® Equal Weight Materials ETF

|

16,400

|

1,645,904

|

||||||

|

Guggenheim S&P 500® Equal Weight Technology ETF

|

59,125

|

7,802,726

|

||||||

|

Guggenheim S&P 500® Equal Weight Utilities ETF

|

19,100

|

1,708,877

|

||||||

|

iShares Core U.S. Aggregate Bond ETF

|

5,875

|

648,894

|

||||||

|

SPDR® Gold Shares (a)

|

6,750

|

849,285

|

||||||

|

Total Exchange-Traded Funds (Cost $15,553,192)

|

$

|

15,953,921

|

||||||

|

|

||||||||

|

MONEY MARKET FUNDS — 1.1%

|

Shares

|

Value

|

||||||

|

Fidelity Institutional Money Market Fund - Government Portfolio - Class I, 0.89% (b)

|

60,914

|

$

|

60,914

|

|||||

|

First American Treasury Obligations Fund - Class Z, 0.87% (b)

|

59,133

|

59,133

|

||||||

|

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Shares, 0.90% (b)

|

59,133

|

59,133

|

||||||

|

Total Money Market Funds (Cost $179,180)

|

$

|

179,180

|

||||||

|

Total Investments at Value — 99.5% (Cost $15,732,372)

|

$

|

16,133,101

|

||||||

|

Assets in Excess of Other Liabilities — 0.5%

|

80,527

|

|||||||

|

Net Assets — 100.0%

|

$

|

16,213,628

|

||||||

|

(a)

|

Non-income producing.

|

|

(b)

|

The rate shown is the 7-day effective yield as of August 31, 2017.

|

|

See accompanying notes to financial statements.

|

|

|

WSTCM CREDIT SELECT RISK-MANAGED FUND

SCHEDULE OF INVESTMENTS August 31, 2017 |

||||||||

|

EXCHANGE-TRADED FUNDS — 42.3%

|

Shares

|

Value

|

||||||

|

iShares iBoxx $ High Yield Corporate Bond ETF

|

181,800

|

$

|

16,107,480

|

|||||

|

PIMCO 0-5 Year High Yield Corporate Bond Index ETF

|

50,000

|

5,083,500

|

||||||

|

PowerShares Fundamental High Yield Corporate Bond Portfolio

|

264,000

|

5,018,640

|

||||||

|

SPDR® Bloomberg Barclays High Yield Bond ETF

|

431,800

|

16,088,868

|

||||||

|

VanEck Vectors Fallen Angel High Yield Bond ETF

|

100,000

|

3,002,000

|

||||||

|

Total Exchange-Traded Funds (Cost $45,001,029)

|

$

|

45,300,488

|

||||||

|

|

||||||||

|

OPEN-END MUTUAL FUNDS — 50.4%

|

Shares

|

Value

|

||||||

|

AB High Income Fund, Inc.

|

639,455

|

$

|

5,735,914

|

|||||

|

American High Income Trust - Class F-2

|

1,051

|

10,963

|

||||||

|

BlackRock High Yield Bond Fund - Institutional Class

|

2,007

|

15,656

|

||||||

|

Dreyfus High Yield Fund - Institutional Class

|

702,805

|

4,441,728

|

||||||

|

Eaton Vance Income Fund of Boston - Class I

|

765,219

|

4,438,269

|

||||||

|

Hartford High Yield Fund (The) - Class I

|

376,266

|

2,821,991

|

||||||

|

Ivy High Income Fund - Class I

|

1,591

|

12,106

|

||||||

|

Janus Henderson High-Yield Fund - Class I

|

549,683

|

4,672,306

|

||||||

|

John Hancock High Yield Fund - Class I

|

1,183,712

|

4,166,665

|

||||||

|

JPMorgan High Yield Fund - Class I

|

681,591

|

5,091,482

|

||||||

|

Lord Abbett High Yield Fund - Class I

|

1,676

|

12,921

|

||||||

|

MFS High Income Fund - Class I

|

1,324,359

|

4,569,040

|

||||||

|

PIMCO High Yield Fund - Institutional Class

|

1,308

|

11,810

|

||||||

|

PIMCO Income Fund - Institutional Class

|

646,720

|

8,038,733

|

||||||

|

Principal High Yield Fund - Institutional Class

|

1

|

6

|

||||||

|

Principal High Yield Fund I - Institutional Class

|

418,306

|

4,166,325

|

||||||

|

Vanguard High-Yield Corporate Fund - Admiral Shares

|

960,789

|

5,735,911

|

||||||

|

Total Open-End Mutual Funds (Cost $53,451,020)

|

$

|

53,941,826

|

||||||

|

See accompanying notes to financial statements.

|

|

WSTCM CREDIT SELECT RISK-MANAGED FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

MONEY MARKET FUNDS — 7.2%

|

Shares

|

Value

|

||||||

|

Fidelity Institutional Money Market Fund - Government Portfolio - Class I, 0.89% (a)

|

2,615,196

|

$

|

2,615,196

|

|||||

|

First American Treasury Obligations Fund - Class Z, 0.87% (a)

|

2,554,560

|

2,554,560

|

||||||

|

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Shares, 0.90% (a)

|

2,554,560

|

2,554,560

|

||||||

|

Total Money Market Funds (Cost $7,724,316)

|

$

|

7,724,316

|

||||||

|

Total Investments at Value — 99.9% (Cost $106,176,365)

|

$

|

106,966,630

|

||||||

|

Assets in Excess of Other Liabilities — 0.1%

|

61,687

|

|||||||

|

Net Assets — 100.0%

|

$

|

107,028,317

|

||||||

|

(a)

|

The rate shown is the 7-day effective yield as of August 31, 2017.

|

|

See accompanying notes to financial statements.

|

|

|

WST INVESTMENT TRUST

STATEMENTS OF ASSETS AND LIABILITIES August 31, 2017 |

||||||||

|

|

Sector Select

Risk-Managed Fund |

Credit Select

Risk-Managed Fund |

||||||

|

ASSETS

|

||||||||

|

Investments in securities:

|

||||||||

|

At acquisition cost

|

$

|

15,732,372

|

$

|

106,176,365

|

||||

|

At value (Note 2)

|

$

|

16,133,101

|

$

|

106,966,630

|

||||

|

Receivable for capital shares sold

|

—

|

92,564

|

||||||

|

Receivable for securities sold

|

6,144,972

|

—

|

||||||

|

Dividends receivable

|

166

|

61,864

|

||||||

|

Other assets

|

15,103

|

24,631

|

||||||

|

TOTAL ASSETS

|

22,293,342

|

107,145,689

|

||||||

|

LIABILITIES

|

||||||||

|

Payable for capital shares redeemed

|

—

|

25,934

|

||||||

|

Payable for investment securities purchased

|

6,067,787

|

—

|

||||||

|

Payable to Adviser (Note 4)

|

1,334

|

53,498

|

||||||

|

Payable to administrator (Note 4)

|

7,640

|

15,050

|

||||||

|

Accrued distribution fees (Note 4)

|

3

|

5,187

|

||||||

|

Other accrued expenses

|

2,950

|

17,703

|

||||||

|

TOTAL LIABILITIES

|

6,079,714

|

117,372

|

||||||

|

NET ASSETS

|

$

|

16,213,628

|

$

|

107,028,317

|

||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Paid-in capital

|

$

|

15,794,608

|

$

|

101,390,968

|

||||

|

Accumulated net investment income (loss)

|

(16,320

|

)

|

2,205,866

|

|||||

|

Accumulated net realized gains from investments

|

34,611

|

2,641,218

|

||||||

|

Net unrealized appreciation on investments

|

400,729

|

790,265

|

||||||

|

NET ASSETS

|

$

|

16,213,628

|

$

|

107,028,317

|

||||

|

PRICING OF INSTITUTIONAL SHARES

|

||||||||

|

Net assets applicable to Institutional Shares

|

$

|

15,403,542

|

$

|

47,307,583

|

||||

|

Shares of Institutional Shares outstanding (no par value, unlimited number of shares outstanding)

|

1,419,137

|

4,367,387

|

||||||

|

Net asset value, offering and redemption price per share (Note 2)

|

$

|

10.85

|

$

|

10.83

|

||||

|

PRICING OF INVESTOR SHARES

|

||||||||

|

Net assets applicable to Investor Shares

|

$

|

810,086

|

$

|

59,720,734

|

||||

|

Shares of Investor Shares outstanding (no par value, unlimited number of shares outstanding)

|

75,007

|

5,533,372

|

||||||

|

Net asset value, offering and redemption price per share (Note 2)

|

$

|

10.80

|

$

|

10.79

|

||||

|

See accompanying notes to financial statements.

|

|

WST INVESTMENT TRUST

STATEMENTS OF OPERATIONS For Year Ended August 31, 2017 |

||||||||

|

|

Sector Select

Risk-Managed Fund |

Credit Select

Risk-Managed Fund |

||||||

|

INVESTMENT INCOME

|

||||||||

|

Dividends

|

$

|

204,163

|

$

|

4,088,111

|

||||

|

EXPENSES

|

||||||||

|

Investment advisory fees (Note 4)

|

126,170

|

506,865

|

||||||

|

Distribution fees, Investor Class (Note 4)

|

2,228

|

137,189

|

||||||

|

Administration fees (Note 4)

|

30,000

|

84,659

|

||||||

|

Professional fees

|

47,287

|

45,178

|

||||||

|

Fund accounting fees (Note 4)

|

37,690

|

44,235

|

||||||

|

Registration and filing fees

|

30,604

|

35,731

|

||||||

|

Transfer agent fees, Institutional Class (Note 4)

|

12,000

|

12,000

|

||||||

|

Transfer agent fees, Investor Class (Note 4)

|

12,000

|

14,250

|

||||||

|

Postage and supplies

|

7,809

|

17,045

|

||||||

|

Custodian and bank service fees

|

5,555

|

11,110

|

||||||

|

Insurance expense

|

7,525

|

7,525

|

||||||

|

Trustees’ fees (Note 4)

|

6,400

|

6,400

|

||||||

|

Printing of shareholder reports

|

2,292

|

7,498

|

||||||

|

Other expenses

|

7,968

|

24,164

|

||||||

|

TOTAL EXPENSES

|

335,528

|

953,849

|

||||||

|

Fee waivers and expense reimbursements by the Adviser (Note 4)

|

(122,988

|

)

|

—

|

|||||

|

NET EXPENSES

|

212,540

|

953,849

|

||||||

|

NET INVESTMENT INCOME (LOSS)

|

(8,377

|

)

|

3,134,262

|

|||||

|

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS

|

||||||||

|

Net realized gains from investments

|

993,329

|

3,328,542

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

(166,548

|

)

|

(2,957,207

|

)

|

||||

|

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS

|

826,781

|

371,335

|

||||||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

818,404

|

$

|

3,505,597

|

||||

|

See accompanying notes to financial statements.

|

|

WSTCM SECTOR SELECT RISK-MANAGED FUND

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income (loss)

|

$

|

(8,377

|

)

|

$

|

40,946

|

|||

|

Net realized gains (losses) from investments

|

993,329

|

(619,657

|

)

|

|||||

|

Net change in unrealized appreciation (depreciation) on investments

|

(166,548

|

)

|

333,201

|

|||||

|

Net increase (decrease) in net assets resulting from operations

|

818,404

|

(245,510

|

)

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS (Note 2)

|

||||||||

|

Institutional Shares

|

||||||||

|

From net investment income

|

(36,318

|

)

|

(25,485

|

)

|

||||

|

From realized capital gains on investments

|

—

|

(545,687

|

)

|

|||||

|

Investor Shares

|

||||||||

|

From net investment income

|

(1,273

|

)

|

(643

|

)

|

||||

|

From realized capital gains on investments

|

—

|

(31,942

|

)

|

|||||

|

Decrease in net assets from distributions to shareholders

|

(37,591

|

)

|

(603,757

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Institutional Shares

|

||||||||

|

Proceeds from shares sold

|

1,214,580

|

1,744,214

|

||||||

|

Net asset value of shares issued in reinvestment of distributions

|

36,318

|

571,172

|

||||||

|

Payments for shares redeemed

|

(3,395,093

|

)

|

(1,679,308

|

)

|

||||

|

Net increase (decrease) in Institutional Shares net assets from capital share transactions

|

(2,144,195

|

)

|

636,078

|

|||||

|

Investor Shares

|

||||||||

|

Proceeds from shares sold

|

1,600

|

21,689

|

||||||

|

Net asset value of shares issued in reinvestment of distributions

|

1,273

|

32,585

|

||||||

|

Payments for shares redeemed

|

(175,894

|

)

|

(61,609

|

)

|

||||

|

Net decrease in Investor Shares net assets from capital share transactions

|

(173,021

|

)

|

(7,335

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(1,536,403

|

)

|

(220,524

|

)

|

||||

|

NET ASSETS

|

||||||||

|

Beginning of year

|

17,750,031

|

17,970,555

|

||||||

|

End of year

|

$

|

16,213,628

|

$

|

17,750,031

|

||||

|

ACCUMULATED NET INVESTMENT INCOME (LOSS)

|

$

|

(16,320

|

)

|

$

|

14,818

|

|||

|

See accompanying notes to financial statements.

|

|

WSTCM SECTOR SELECT RISK-MANAGED FUND

STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

||||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Institutional Shares

|

||||||||

|

Shares sold

|

116,617

|

166,018

|

||||||

|

Shares reinvested

|

3,526

|

54,398

|

||||||

|

Shares redeemed

|

(323,237

|

)

|

(162,457

|

)

|

||||

|

Net increase (decrease) in shares outstanding

|

(203,094

|

)

|

57,959

|

|||||

|

Shares outstanding, beginning of year

|

1,622,231

|

1,564,272

|

||||||

|

Shares outstanding, end of year

|

1,419,137

|

1,622,231

|

||||||

|

Investor Shares

|

||||||||

|

Shares sold

|

149

|

2,051

|

||||||

|

Shares reinvested

|

124

|

3,109

|

||||||

|

Shares redeemed

|

(16,793

|

)

|

(6,117

|

)

|

||||

|

Net decrease in shares outstanding

|

(16,520

|

)

|

(957

|

)

|

||||

|

Shares outstanding, beginning of year

|

91,527

|

92,484

|

||||||

|

Shares outstanding, end of year

|

75,007

|

91,527

|

||||||

|

See accompanying notes to financial statements.

|

|

WSTCM CREDIT SELECT RISK-MANAGED FUND

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$

|

3,134,262

|

$

|

1,356,390

|

||||

|

Net realized gains from investments

|

3,328,542

|

682,024

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

(2,957,207

|

)

|

3,796,799

|

|||||

|

Net increase in net assets resulting from operations

|

3,505,597

|

5,835,213

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS (Note 2)

|

||||||||

|

Institutional Shares

|

||||||||

|

From net investment income

|

(654,035

|

)

|

(10,588

|

)

|

||||

|

Investor Shares

|

||||||||

|

From net investment income

|

(1,608,725

|

)

|

(11,438

|

)

|

||||

|

Decrease in net assets from distributions to shareholders

|

(2,262,760

|

)

|

(22,026

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Institutional Shares

|

||||||||

|

Proceeds from shares sold

|

30,688,289

|

6,110,380

|

||||||

|

Net asset value of shares issued in reinvestment of distributions

|

654,035

|

10,588

|

||||||

|

Payments for shares redeemed

|

(4,765,113

|

)

|

(2,550,927

|

)

|

||||

|

Net increase in Institutional Shares net assets from capital share transactions

|

26,577,211

|

3,570,041

|

||||||

|

Investor Shares

|

||||||||

|

Proceeds from shares sold

|

11,390,126

|

8,222,980

|

||||||

|

Net asset value of shares issued in reinvestment of distributions

|

1,608,280

|

11,438

|

||||||

|

Payments for shares redeemed

|

(3,727,964

|

)

|

(4,020,267

|

)

|

||||

|

Net increase in Investor Shares net assets from capital share transactions

|

9,270,442

|

4,214,151

|

||||||

|

TOTAL INCREASE IN NET ASSETS

|

37,090,490

|

13,597,379

|

||||||

|

NET ASSETS

|

||||||||

|

Beginning of year

|

69,937,827

|

56,340,448

|

||||||

|

End of year

|

$

|

107,028,317

|

$

|

69,937,827

|

||||

|

ACCUMULATED NET INVESTMENT INCOME

|

$

|

2,205,866

|

$

|

1,334,364

|

||||

|

See accompanying notes to financial statements.

|

|

WSTCM CREDIT SELECT RISK-MANAGED FUND

STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

||||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Institutional Shares

|

||||||||

|

Shares sold

|

2,867,195

|

599,515

|

||||||

|

Shares reinvested

|

62,828

|

1,097

|

||||||

|

Shares redeemed

|

(445,048

|

)

|

(256,050

|

)

|

||||

|

Net increase in shares outstanding

|

2,484,975

|

344,562

|

||||||

|

Shares outstanding, beginning of year

|

1,882,412

|

1,537,850

|

||||||

|

Shares outstanding, end of year

|

4,367,387

|

1,882,412

|

||||||

|

Investor Shares

|

||||||||

|

Shares sold

|

1,068,132

|

806,492

|

||||||

|

Shares reinvested

|

154,940

|

1,185

|

||||||

|

Shares redeemed

|

(349,255

|

)

|

(407,012

|

)

|

||||

|

Net increase in shares outstanding

|

873,817

|

400,665

|

||||||

|

Shares outstanding, beginning of year

|

4,659,555

|

4,258,890

|

||||||

|

Shares outstanding, end of year

|

5,533,372

|

4,659,555

|

||||||

|

See accompanying notes to financial statements.

|

|

WSTCM SECTOR SELECT RISK-MANAGED FUND

INSTITUTIONAL SHARES FINANCIAL HIGHLIGHTS |

||||||||||||||||

|

Per Share Data for a Share Outstanding Throughout Each Period

|

||||||||||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

Year Ended

August 31, 2015 |

Period Ended

August 31, 2014(a) |

||||||||||||

|

Net asset value at beginning of period

|

$

|

10.36

|

$

|

10.85

|

$

|

10.68

|

$

|

10.00

|

||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||

|

Net investment income (loss) (b)

|

(0.01

|

)

|

0.03

|

0.01

|

0.01

|

|||||||||||

|

Net realized and unrealized gains (losses) on investments

|

0.52

|

(0.16

|

)

|

0.26

|

0.69

|

|||||||||||

|

Total from investment operations

|

0.51

|

(0.13

|

)

|

0.27

|

0.70

|

|||||||||||

|

Less distributions:

|

||||||||||||||||

|

From net investment income

|

(0.02

|

)

|

(0.02

|

)

|

(0.03

|

)

|

(0.02

|

)

|

||||||||

|

From net realized gains

|

—

|

(0.34

|

)

|

(0.07

|

)

|

—

|

||||||||||

|

Total distributions

|

(0.02

|

)

|

(0.36

|

)

|

(0.10

|

)

|

(0.02

|

)

|

||||||||

|

Net asset value at end of period

|

$

|

10.85

|

$

|

10.36

|

$

|

10.85

|

$

|

10.68

|

||||||||

|

Total return (c)

|

4.96

|

%

|

(1.26

|

%)

|

2.51

|

%

|

6.97

|

%(d)

|

||||||||

|

Net assets at end of period (000’s)

|

$

|

15,404

|

$

|

16,805

|

$

|

16,969

|

$

|

11,034

|

||||||||

|

Ratios/supplementary data:

|

||||||||||||||||

|

Ratio of total expenses to average net assets (e)

|

1.82

|

%

|

1.74

|

%

|

1.84

|

%

|

2.85

|

%(f)

|

||||||||

|

Ratio of net expenses to average net assets (e)(g)

|

1.25

|

%

|

1.25

|

%

|

1.25

|

%

|

1.25

|

%(f)

|

||||||||

|

Ratio of net investment income (loss) to average

net assets (b)(g) |

(0.04

|

%)

|

0.24

|

%

|

0.04

|

%

|

0.03

|

%(f)

|

||||||||

|

Portfolio turnover rate

|

346

|

%

|

472

|

%

|

150

|

%

|

348

|

%(d)

|

||||||||

|

(a)

|

Represents the period from the commencement of operations (December 16, 2013) through August 31, 2014.

|

|

(b)

|

Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests.

|

|

(c)

|

Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

|

(d)

|

Not annualized.

|

|

(e)

|

Ratio does not include expenses of the investment companies in which the Fund invests.

|

|

(f)

|

Annualized.

|

|

(g)

|

Ratio was determined after advisory fee waivers and expense reimbursements (Note 4).

|

|

See accompanying notes to financial statements.

|

|

|

WSTCM SECTOR SELECT RISK-MANAGED FUND

INVESTOR SHARES FINANCIAL HIGHLIGHTS |

||||||||||||||||

|

Per Share Data for a Share Outstanding Throughout Each Period

|

||||||||||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

Year Ended

August 31, 2015 |

Period Ended

August 31, 2014(a) |

||||||||||||

|

Net asset value at beginning of period

|

$

|

10.33

|

$

|

10.83

|

$

|

10.68

|

$

|

10.00

|

||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||

|

Net investment loss (b)

|

(0.04

|

)

|

(0.00

|

)(c)

|

(0.01

|

)

|

(0.01

|

)

|

||||||||

|

Net realized and unrealized gains (losses) on investments

|

0.52

|

(0.15

|

)

|

0.24

|

0.70

|

|||||||||||

|

Total from investment operations

|

0.48

|

(0.15

|

)

|

0.23

|

0.69

|

|||||||||||

|

Less distributions:

|

||||||||||||||||

|

From net investment income

|

(0.01

|

)

|

(0.01

|

)

|

(0.01

|

)

|

(0.01

|

)

|

||||||||

|

From net realized gains

|

—

|

(0.34

|

)

|

(0.07

|

)

|

—

|

||||||||||

|

Total distributions

|

(0.01

|

)

|

(0.35

|

)

|

(0.08

|

)

|

(0.01

|

)

|

||||||||

|

Net asset value at end of period

|

$

|

10.80

|

$

|

10.33

|

$

|

10.83

|

$

|

10.68

|

||||||||

|

Total return (d)

|

4.69

|

%

|

(1.44

|

%)

|

2.16

|

%

|

6.86

|

%(e)

|

||||||||

|

Net assets at end of period (000’s)

|

$

|

810

|

$

|

945

|

$

|

1,002

|

$

|

410

|

||||||||

|

Ratios/supplementary data:

|

||||||||||||||||

|

Ratio of total expenses to average net assets (f)

|

5.06

|

%

|

4.50

|

%

|

5.96

|

%

|

15.21

|

%(g)

|

||||||||

|

Ratio of net expenses to average net assets (f) (h)

|

1.50

|

%

|

1.50

|

%

|

1.50

|

%

|

1.50

|

%(g)

|

||||||||

|

Ratio of net investment loss to average net assets (b) (h)

|

(0.28

|

%)

|

(0.01

|

%)

|

(0.23

|

%)

|

(0.28

|

%)(g)

|

||||||||

|

Portfolio turnover rate

|

346

|

%

|

472

|

%

|

150

|

%

|

348

|

%(e)

|

||||||||

|

(a)

|

Represents the period from the commencement of operations (December 16, 2013) through August 31, 2014.

|

|

(b)

|

Recognition of net investment loss by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests.

|

|

(c)

|

Amount rounds to less than $0.01 per share.

|

|

(d)

|

Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

|

(e)

|

Not annualized.

|

|

(f)

|

Ratio does not include expenses of the investment companies in which the Fund invests.

|

|

(g)

|

Annualized.

|

|

(h)

|

Ratio was determined after advisory fee waivers and expense reimbursements (Note 4).

|

|

See accompanying notes to financial statements.

|

|

|

WSTCM CREDIT SELECT RISK-MANAGED FUND

INSTITUTIONAL SHARES FINANCIAL HIGHLIGHTS |

||||||||||||

|

Per Share Data for a Share Outstanding Throughout Each Period

|

||||||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

Period Ended

August 31, 2015(a) |

|||||||||

|

Net asset value at beginning of period

|

$

|

10.71

|

$

|

9.72

|

$

|

10.00

|

||||||

|

Income (loss) from investment operations:

|

||||||||||||

|

Net investment income (b)

|

0.33

|

0.21

|

0.16

|

|||||||||

|

Net realized and unrealized gains (losses) on investments

|

0.13

|

0.79

|

(0.27

|

)

|

||||||||

|

Total from investment operations

|

0.46

|

1.00

|

(0.11

|

)

|

||||||||

|

Less distributions:

|

||||||||||||

|

From net investment income

|

(0.34

|

)

|

(0.01

|

)

|

(0.15

|

)

|

||||||

|

From net realized gains

|

—

|

—

|

(0.00

|

)(c)

|

||||||||

|

Return of capital

|

—

|

—

|

(0.02

|

)

|

||||||||

|

Total distributions

|

(0.34

|

)

|

(0.01

|

)

|

(0.17

|

)

|

||||||

|

Net asset value at end of period

|

$

|

10.83

|

$

|

10.71

|

$

|

9.72

|

||||||

|

Total return (d)

|

4.40

|

%

|

10.27

|

%

|

(1.11

|

%)(e)

|

||||||

|

Net assets at end of period (000’s)

|

$

|

47,308

|

$

|

20,152

|

$

|

14,951

|

||||||

|

Ratios/supplementary data:

|

||||||||||||

|

Ratio of total expenses to average net assets (f)

|

0.97

|

%

|

1.04

|

%

|

1.11

|

%(g)

|

||||||

|

Ratio of net investment income to average net assets (b)

|

3.84

|

%

|

2.50

|

%

|

1.89

|

%(g)

|

||||||

|

Portfolio turnover rate

|

414

|

%

|

326

|

%

|

890

|

%(e)

|

||||||

|

(a)

|

Represents the period from the commencement of operations (September 30, 2014) through August 31, 2015.

|

|

(b)

|

Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. The ratio of net investment income to average net assets does not include net investment income or loss of the investment companies in which the Fund invests.

|

|

(c)

|

Amount rounds to less than $0.01 per share.

|

|

(d)

|

Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

|

(e)

|

Not annualized.

|

|

(f)

|

Ratio does not include expenses of the investment companies in which the Fund invests.

|

|

(g)

|

Annualized.

|

|

See accompanying notes to financial statements.

|

|

|

WSTCM CREDIT SELECT RISK-MANAGED FUND

INVESTOR SHARES FINANCIAL HIGHLIGHTS |

||||||||||||

|

Per Share Data for a Share Outstanding Throughout Each Period

|

||||||||||||

|

|

Year Ended

August 31, 2017 |

Year Ended

August 31, 2016 |

Period Ended

August 31, 2015(a) |

|||||||||

|

Net asset value at beginning of period

|

$

|

10.68

|

$

|

9.72

|

$

|

10.00

|

||||||

|

Income (loss) from investment operations:

|

||||||||||||

|

Net investment income (b)

|

0.37

|

0.21

|

0.14

|

|||||||||

|

Net realized and unrealized gains (losses) on investments

|

0.07

|

0.75

|

(0.26

|

)

|

||||||||

|

Total from investment operations

|

0.44

|

0.96

|

(0.12

|

)

|

||||||||

|

Less distributions:

|

||||||||||||

|

From net investment income

|

(0.33

|

)

|

(0.00

|

)(c)

|

(0.14

|

)

|

||||||

|

From net realized gains

|

—

|

—

|

(0.00

|

)(c)

|

||||||||

|

Return of capital

|

—

|

—

|

(0.02

|

)

|

||||||||

|

Total distributions

|

(0.33

|

)

|

(0.00

|

)(c)

|

(0.16

|

)

|

||||||

|

Net asset value at end of period

|

$

|

10.79

|

$

|

10.68

|

$

|

9.72

|

||||||

|

Total return (d)

|

4.26

|

%

|

9.91

|

%

|

(1.22

|

%)(e)

|

||||||

|

Net assets at end of period (000’s)

|

$

|

59,721

|

$

|

49,785

|

$

|

41,389

|

||||||

|

Ratios/supplementary data:

|

||||||||||||

|

Ratio of total expenses to average net assets (f)

|

1.21

|

%

|

1.24

|

%

|

1.27

|

%(g)

|

||||||

|

Ratio of net investment income to average net assets (b)

|

3.63

|

%

|

2.22

|

%

|

1.69

|

%(g)

|

||||||

|

Portfolio turnover rate

|

414

|

%

|

326

|

%

|

890

|

%(e)

|

||||||

|

(a)

|

Represents the period from the commencement of operations (September 30, 2014) through August 31, 2015.

|

|

(b)

|

Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. The ratio of net investment income to average net assets does not include net investment income or loss of the investment companies in which the Fund invests.

|

|

(c)

|

Amount rounds to less than $0.01 per share.

|

|

(d)

|

Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

|

(e)

|

Not annualized.

|

|

(f)

|

Ratio does not include expenses of the investment companies in which the Fund invests.

|

|

(g)

|

Annualized.

|

|

See accompanying notes to financial statements.

|

|

NOTES TO FINANCIAL STATEMENTS

August 31, 2017

NOTES TO FINANCIAL STATEMENTS (Continued)

|

●

|

Level 1 – quoted prices in active markets for identical securities

|

|

●

|

Level 2 – other significant observable inputs

|

|

●

|

Level 3 – significant unobservable inputs

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

WSTCM Sector Select Risk-Managed Fund

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Exchange-Traded Funds

|

$

|

15,953,921

|

$

|

—

|

$

|

—

|

$

|

15,953,921

|

||||||||

|

Money Market Funds

|

179,180

|

—

|

—

|

179,180

|

||||||||||||

|

Total

|

$

|

16,133,101

|

$

|

—

|

$

|

—

|

$

|

16,133,101

|

||||||||

|

WSTCM Credit Select Risk-Managed Fund

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Exchange-Traded Funds

|

$

|

45,300,488

|

$

|

—

|

$

|

—

|

$

|

45,300,488

|

||||||||

|

Open-End Mutual Funds

|

53,941,826

|

—

|

—

|

53,941,826

|

||||||||||||

|

Money Market Funds

|

7,724,316

|

—

|

—

|

7,724,316

|

||||||||||||

|

Total

|

$

|

106,966,630

|

$

|

—

|

$

|

—

|

$

|

106,966,630

|

||||||||

NOTES TO FINANCIAL STATEMENTS (Continued)

|

Years Ended

|

Ordinary

Income |

Long-Term

Capital Gains

|

Total

Distributions |

|||||||||

|

WSTCM Sector Select Risk-Managed Fund

|

||||||||||||

|

Institutional Shares

|

||||||||||||

|

August 31, 2017

|

$

|

21,991

|

$

|

14,327

|

$

|

36,318

|

||||||

|

August 31, 2016

|

$

|

264,870

|

$

|

306,302

|

$

|

571,172

|

||||||

|

Investor Shares

|

||||||||||||

|

August 31, 2017

|

$

|

771

|

$

|

502

|

$

|

1,273

|

||||||

|

August 31, 2016

|

$

|

14,656

|

$

|

17,929

|

$

|

32,585

|

||||||

|

WSTCM Credit Select Risk-Managed Fund

|

||||||||||||

|

Institutional Shares

|

||||||||||||

|

August 31, 2017

|

$

|

654,035

|

$

|

—

|

$

|

654,035

|

||||||

|

August 31, 2016

|

$

|

10,588

|

$

|

—

|

$

|

10,588

|

||||||

|

Investor Shares

|

||||||||||||

|

August 31, 2017

|

$

|

1,608,725

|

$

|

—

|

$

|

1,608,725

|

||||||

|

August 31, 2016

|

$

|

11,438

|

$

|

—

|

$

|

11,438

|

||||||

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

WSTCM

Sector Select Risk-Managed Fund |

WSTCM

Credit Select Risk-Managed Fund |

||||||

|

Tax cost of portfolio investments

|

$

|

15,752,281

|

$

|

106,327,793

|

||||

|

Gross unrealized appreciation

|

$

|

388,614

|

$

|

647,683

|

||||

|

Gross unrealized depreciation

|

(7,794

|

)

|

(8,846

|

)

|

||||

|

Net unrealized appreciation on investments

|

380,820

|

638,837

|

||||||

|

Undistributed ordinary income

|

—

|

4,977,754

|

||||||

|

Undistributed long-term capital gains

|

54,520

|

20,758

|

||||||

|

Accumulated capital and other losses

|

(16,320

|

)

|

—

|

|||||

|

Accumulated earnings

|

$

|

419,020

|

$

|

5,637,349

|

||||

|

Accumulated net investment loss

|

$

|

14,830

|

||

|

Accumulated net realized gains from investments

|

$

|

(14,830

|

)

|

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

WST Investment Trust

Cleveland, Ohio

October 27, 2017

ABOUT YOUR FUNDS’ EXPENSES (Unaudited)

ABOUT YOUR FUNDS’ EXPENSES (Unaudited) (Continued)

|

WSTCM Sector Select

Risk-Managed Fund |

Beginning

Account Value March 1, 2017 |

Ending

Account Value August 31, 2017 |

Net Expense

Ratio(a) |

Expenses

Paid During Period(b) |

|

Institutional Class

|

||||

|

Based on Actual Fund Return

|

$1,000.00

|

$1,023.60

|

1.25%

|

$6.38

|

|

Based on Hypothetical 5% Return (before expenses)

|

$1,000.00

|

$1,018.90

|

1.25%

|

$6.36

|

|

Investor Class

|

||||

|

Based on Actual Fund Return

|

$1,000.00

|

$1,022.70

|

1.50%

|

$7.65

|

|

Based on Hypothetical 5% Return (before expenses)

|

$1,000.00

|

$1,017.64

|

1.50%

|

$7.63

|

|

WSTCM Credit Select

Risk-Managed Fund |

Beginning

Account Value March 1, 2017 |

Ending

Account Value August 31, 2017 |

Expense

Ratio(a) |

Expenses

Paid During Period(b) |

|

Institutional Class

|

||||

|

Based on Actual Fund Return

|

$1,000.00

|

$1,009.30

|

0.94%

|

$4.76

|

|

Based on Hypothetical 5% Return (before expenses)

|

$1,000.00

|

$1,020.47

|

0.94%

|

$4.79

|

|

Investor Class

|

||||

|

Based on Actual Fund Return

|

$1,000.00

|

$1,008.40

|

1.18%

|

$5.97

|

|

Based on Hypothetical 5% Return (before expenses)

|

$1,000.00

|

$1,019.26

|

1.18%

|

$6.01

|

|

(a)

|

Annualized, based on the Fund's most recent one-half year expenses.

|

|

(b)

|

Expenses are equal to each Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

OTHER INFORMATION (Unaudited)

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited)

|

Name and

Year of Birth |

Length

of Time Served |

Position(s)

Held with Trust |

Principal

Occupation(s) During Past 5 Years |

Number

of Funds in Trust Overseen by Trustee |

Directorships of

Public Companies Held by Trustee During Past 5 Years |

|

Interested Trustees:

|

|||||

|

Wayne F. Wilbanks*

Year of Birth: 1960 |

Since July 2013

|

Trustee and President

|

Managing Principal and Chief Investment Officer of Wilbanks, Smith & Thomas, LLC (1990 to present)

|

2

|

None

|

|

Independent Trustees:

|

|||||

|

Thomas G. Douglass

Year of Birth: 1956 |

Since June 2013

|

Trustee

|

Principal, Douglass and Douglass, Attorneys

|

2

|

Independent Trustee of Centaur Mutual Funds Trust for its one series.

|

|

James H. Speed, Jr.

Year of Birth: 1953 |

Since June 2013

|

Trustee

|

President and CEO of NC Mutual Life Insurance Company.

|

2

|

Independent Trustee of Centaur Mutual Funds Trust for its one series, Hillman Capital Management Investment Trust for its one series, Brown Capital Management Funds for its three series, and Starboard Investment Trust for its twenty-eight series (all registered investment companies); Director of NC Mutual Life Insurance Company; Director of M&F Bancorp; Director of Investors Title Company.

|

|

*

|

Mr. Wilbanks is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act because he is an employee of the Adviser.

|

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued)

|

Name and

Year of Birth |

Length

of Time Served |

Position(s)

Held with Trust |

Principal Occupation(s)

During Past 5 Years |

|

Executive Officers:

|

|||

|

Matthew A. Swendiman, CFA

Year of Birth: 1973 |

Since March 2017

|

Chief Compliance Officer

|

Attorney of Graydon Head and Ritchey LLP (September 2012 to present) and Chief Executive Officer of Graydon Compliance Solutions, LLC (February 2014 to present).

|

|

Roger H. Scheffel, Jr.

Year of Birth: 1968 |

Since September 2013

|

Vice President

|

Portfolio manager of the Adviser since 2009.

|

|

Robert G. Dorsey

Year of Birth: 1957 |

Since September 2013

|

Vice President

|

Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (1999 to present).

|

|

Stephen L. Preston

Year of Birth: 1966 |

Since September 2013

|

AML Compliance Officer

|

Vice President and Chief Compliance Officer of Ultimus Fund Distributors, LLC and Assistant Vice President of Ultimus Fund Solutions, LLC since 2011.

|

|

Simon Berry

Year of Birth: 1971 |

Since April 2017

|

Secretary

|

Senior Attorney at Ultimus Fund Solutions, LLC (2016 to present); Staff Attorney Supervisor, Kentucky Department of Financial Institutions (2009 to 2016).

|

|

Theresa M. Bridge

Year of Birth: 1969 |

Since September 2013

|

Treasurer (Principal Financial Officer)

|

Director of Financial Administration of Ultimus Fund Solutions, LLC since 2000.

|

| Item 2. |

Code of Ethics.

|

| Item 3. |

Audit Committee Financial Expert.

|

| Item 4. |

Principal Accountant Fees and Services.

|

| (a) |

Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $27,000 and $27,000 with respect to the registrant’s fiscal years ended August 31, 2017 and 2016, respectively.

|

| (b) |

Audit-Related Fees. No fees were billed in either of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item.

|

| (c) |

Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $6,000 and $5,000 with respect to the registrant’s fiscal years ended August 31, 2017 and 2016, respectively. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns.

|

| (d) |

All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item.

|

|

(e)(1)

|

The audit committee has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

|

|

(e)(2)

|

None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

|

| (f) |

Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

|

| (g) |

With respect to the fiscal years ended August 31, 2017 and 2016, aggregate non-audit fees of $6,000 and $5,000, respectively, were billed by the registrant’s principal accountant for services rendered to the registrant. No non-audit fees were billed in either of the last two fiscal years by the registrant’s principal accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant.

|

| (h) |

The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant.

|

| Item 5. |

Audit Committee of Listed Registrants.

|

| Item 6. |

Schedule of Investments.

|

| (a) |

See Schedule I (Investments in securities of unaffiliated issuers)

|

| (b) |

Not applicable

|

| Item 7. |

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

|

| Item 8. |

Portfolio Managers of Closed-End Management Investment Companies.

|

| Item 9. |

Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

|

| Item 10. |

Submission of Matters to a Vote of Security Holders.

|

| Item 11. |

Controls and Procedures.

|

| Item 12. |

Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

|

| Item 13. |

Exhibits.

|

|

Exhibit 99.CODE ETH

|

Code of Ethics

|

|

Exhibit 99.CERT

|

Certifications required by Rule 30a-2(a) under the Act

|

|

Exhibit 99.906CERT

|

Certifications required by Rule 30a-2(b) under the Act

|

|

(Registrant)

|

WST Investment Trust

|

||

|

By (Signature and Title)*

|

/s/ Wayne F. Wilbanks

|

||

|

Wayne F. Wilbanks, President

|

|||

|

Date

|

November 9, 2017

|

||

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|||

|

By (Signature and Title)*

|

/s/ Wayne F. Wilbanks

|

||

|

Wayne F. Wilbanks, President

|

|||

|

Date

|

November 9, 2017

|

||

|

By (Signature and Title)*

|

/s/ Theresa M. Bridge

|

||

|

Theresa M. Bridge, Treasurer and Principal Accounting Officer

|

|||

|

Date

|

November 9, 2017

|

||

|

*

|

Print the name and title of each signing officer under his or her signature.

|