UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

FOR THE FISCAL YEAR ENDED

For the transition period from ____________to _____________

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer Identification Number) | |

| incorporation or organization) |

| (Address of principal executive offices, Zip Code) | ||

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| The |

Securities registered pursuant to Section 12(g) of the Act:

| None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| |

☒ | Smaller reporting company | |

| Emerging growth company | |

||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark if the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7362(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

The aggregate market value of the voting and

non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or

the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed

second fiscal quarter was $

There were shares of the Registrant’s $0.0001 par value Class A common stock outstanding as of August 27, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the 2021 definitive Proxy Statement are incorporated by reference into Part III of this Form 10-K.

BIOVIE INC.

FORM 10-K INDEX

-i-

BIOVIE INC.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, and Section 27A of the Securities Act of 1933. Any statements contained in this report that are not statements of historical fact may be forward-looking statements. When we use the words “intends,” “estimates,” “predicts,” “potential,” “continues,” “anticipates,” “plans,” “expects,” “believes,” “should,” “could,” “may,” “will” or the negative of these terms or other comparable terminology, we are identifying forward-looking statements. Forward-looking statements involve risks and uncertainties, which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. These factors include our research and development activities, distributor channel; compliance with regulatory impositions; and our capital needs. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in this report as a result of new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should carefully review and consider the various disclosures we make in this report and our other reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks, uncertainties and other factors that may affect our business.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law. When used in this report, the terms “BioVie”, “Company”, “we”, “our”, and “us” refer to BioVie, Inc.

-1-

PART I

| ITEM 1. | BUSINESS |

BioVie Inc. is a clinical-stage company developing innovative drug therapies to overcome unmet medical needs in chronic debilitating conditions.

In liver disease, our orphan drug candidate BIV201 (continuous infusion terlipressin) is being developed as a future treatment option for patients suffering from ascites and other life-threatening complications of advanced liver cirrhosis caused by NASH, hepatitis, and alcoholism. The initial target for BIV201 therapy is refractory ascites. These patients suffer from frequent life-threatening complications, generate more than $5 billion in annual treatment costs, and have an estimated 50% mortality rate within 6 to 12 months. The FDA has never approved any drugs to treat refractory ascites. A Phase 2a clinical trial of BIV201 was completed in 2019, and a multi-center, randomized and controlled Phase 2b trial is currently underway at several US medical centers including Vanderbilt University, the Mayo Clinic, and University of Pennsylvania (NCT NCT04112199). Top-line results are expected in early 2022, to be followed by a proposed single pivotal Phase 3 trial beginning in 2022. In June 2021, BioVie received written feedback from the FDA in response to a Type B meeting request to conduct a pivotal US Phase 3 clinical trial in HRS-AKI, which is a life-threatening complication of advanced ascites. Based on the guidance received, we are revising certain elements of our proposed study and are planning to initiate this study in late 2021.

In neurodegenerative disease, BioVie acquired the biopharmaceutical assets of NeurMedix, Inc., a privately held clinical-stage pharmaceutical company, in June 2021. The acquired assets include NE3107, a potentially selective inhibitor of inflammatory ERK signaling which, based on animal studies is believed to reduce neuroinflammation. NE3107 is a novel orally administered small molecule that is thought to inhibit inflammation-driven insulin resistance and major pathological inflammatory cascades with a novel mechanism of action. There is emerging scientific consensus that both inflammation and insulin resistance play fundamental roles in the development of Alzheimer’s and Parkinson’s Disease, and NE3107 could, if approved, represent an entirely new medical approach to treating these devastating conditions affecting an estimated 6 million Americans suffering from Alzheimer’s and 1 million from Parkinson’s. The FDA has authorized a potentially pivotal Phase 3 randomized, double-blind, placebo-controlled, parallel group, multicenter study to evaluate NE3107 in subjects who have mild to moderate Alzheimer’s disease (NCT04669028). BioVie is planning to initiate this trial in the second half of 2021 and is targeting primary completion in late 2022. In addition to Alzheimer’s disease, the Company plans to advance NE3107 in Parkinson’s based on promising results from preclinical studies. Inflammation-driven insulin resistance is implicated in a broad range of serious diseases, including multiple myeloma and prostate cancer, and we plan to begin exploring these opportunities in the coming months using NE3107 or related compounds acquired in the NeurMedix asset purchase.

-2-

Pipeline Overview

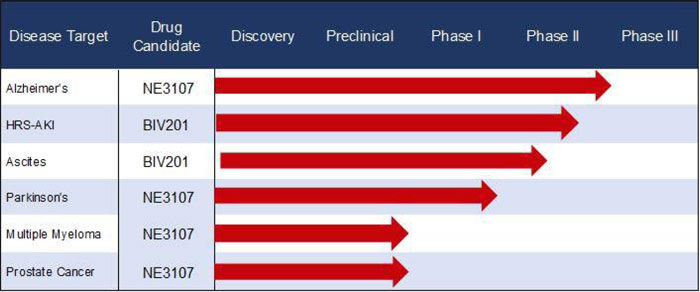

The following diagram shows our clinical development pipeline as of mid- 2021:

Liver Cirrhosis Program

BioVie’s orphan drug candidate BIV201 (continuous infusion terlipressin) represents a novel investigational approach to the treatment of ascites due to chronic liver cirrhosis. BIV201 is based on a drug that is approved in about 40 countries to treat related complications of liver cirrhosis (part of the same disease pathway as ascites), but not yet available in the United States. The active agent in BIV201, terlipressin, is a potent vasoconstrictor and is marketed in multiple foreign countries. The goal of the BIV201 development program is focused on interrupting the ascites disease pathway, thereby halting the cycle of accelerating fluid generation in ascites patients.

BioVie completed a Phase 2a clinical trial of BIV201 in six patients with refractory as cites due to advanced liver cirrhosis at the McGuire Research Institute in Richmond, VA. In April 2019, we announced top-line results for this clinical trial. The following results were observed:

| ● | Continuous infusion of terlipressin via portable infusion pump was maintained for 28 days in three patients with refractory ascites, and all patients remained hemodynamically stable during treatment. |

| ● | The steady state plasma concentration data characterized terlipressin pharmacokinetics (PK) within the predicted PK model concentrations. |

| ● | Four of the six patients treated with BIV201 experienced an increase in the number of days between paracenteses ranging from 71% to 414% compared to prior to initiating therapy. |

In June 2019, we met with representatives of the FDA for a Type C Guidance Meeting to plan our next clinical study in ascites. We discussed our clinical development program with the FDA and proposed safety and efficacy endpoints required for future marketing approval. In September 2019, the FDA granted our Type B meeting request and committed to providing feedback in early 2020 for our proposed clinical trial design. In April 2020, we received the FDA’s written response to our Type B meeting questions which required changes to our clinical trial design. Subsequently we received further guidance from the FDA. Based on this guidance, the Company finalized the clinical trial protocol and began preparing for a randomized 30-patient Phase 2b study. The IND for this study was submitted and has become effective. As of July 2021, seven of nine planned US study centers have been activated and are actively screening patients, and two patients have been enrolled in the study. We plan to follow this study with a larger potentially pivotal Phase 3 clinical trial expected to begin in 2022. The FDA communicated that pending positive Phase 2 study results, a sufficiently large and well-controlled Phase 3 trial, with supportive trend data from the Phase 2b (statistical significance not required), could potentially yield the clinical data needed to apply for BIV201 marketing approval. The Phase 2b clinical trial protocol is summarized on www.clinicaltrials.gov, trial identifier NCT04112199.

-3-

We have invented a proprietary novel liquid formulation of terlipressin that is intended to improve convenience for outpatient administration and avoid potential formulation errors when pharmacists reconstitute the powder version. In November 2019, we announced the completion of quality control testing and released the batch for use in our next clinical trial pending FDA clearance. In March 2020, we submitted a detailed information package to the FDA’s CMC division. In May 2020, we received CMC division clearance to use the new BIV201 prefilled terlipressin syringe in the current Phase 2b trial subject to conducting certain additional standard analytical testing which has been successfully completed. As of June 2021, analytical testing results have confirmed room temperature stability of the prefilled syringe in storage for 18 months, with the potential for up to two years of stability (yet to be confirmed). Room temperature storage presents a key product differentiation versus terlipressin products in countries where the drug is approved. To the best of the Company’s knowledge, all other terlipressin products sold globally must be stored under refrigeration and there is no prefilled syringe format of terlipressin available for treating patients in these countries. BioVie has also filed a Patent Cooperation Treaty (“PCT”) application covering our novel liquid formulations of terlipressin (international patent application PCT/US2020/034269, published as WO2020/237170) and we plan to seek patent protection in at least the United States, Europe, China and Japan.

BIV201 (continuous infusion terlipressin) has the potential to improve the health of thousands of patients suffering from life-threatening complications of liver cirrhosis due to hepatitis, NASH, and alcoholism. The FDA has granted Fast-Track status and Orphan Drug designation for the most common of these complications, ascites, which represents a significant unmet medical need. Patients with cirrhosis and ascites account for an estimated 116,000 U.S. hospital discharges annually, with frequent early readmissions. Those requiring paracentesis (removal of ascites fluid) experience an average hospital stay lasting 8 days incurring over $86,000 in medical costs (HCUP Nationwide Readmissions Database 2016). This translates into a total addressable ascites market size for BIV201 therapy exceeding $650 million based on Company estimates. The FDA has never approved any drug specifically for treating ascites. For patients with refractory ascites the mean one-year survival rate is only 50% (Bureau et al. 2017). BIV201 has also received Orphan Drug designation for hepatorenal syndrome (“HRS”). Patients with refractory ascites often progress to HRS which is the onset of kidney failure and requires emergency hospitalization. About one-half of these patients typically succumb within only 2 to 4 weeks and no drug therapies have been FDA approved specifically to treat HRS.

The BIV201 development program began at LAT Pharma LLC. On April 11, 2016, we acquired LAT Pharma LLC and the rights to its BIV201 development program and currently own all development and marketing rights to the product candidate. We and PharmaIN, LAT Pharma’s former partner focused on the development of new modified product candidates in the same therapeutic field but not including BIV201, have agreed to pay royalties equal to less than 1% of future net sales of each company’s ascites drug development programs, or if such program is licensed to a third party, less than 5% of each company’s net license revenues. On December 24, 2018, we returned our partial ownership rights to the PharmaIN modified terlipressin development program and simultaneously paid the remaining balance due on a related debt. PharmaIN’s rights to our program remain unchanged. We have a pending U.S. patent application 16/379,446 (a continuation application related to the ’945 Patent) for the use of BIV201 for the treatment of patients diagnosed with ascites due to liver cirrhosis in the outpatient setting using ambulatory pump infusion, and have corresponding patent applications pending in Japan, Europe, China and Hong Kong.

About Ascites and Liver Cirrhosis

About 600,000 Americans and millions worldwide suffer from liver cirrhosis. Cirrhosis is the 11th leading cause of death due to disease in the US, killing more than 40,000 people each year. The condition results primarily from hepatitis, alcoholism, and fatty liver disease linked to obesity. Ascites is a common complication of advanced liver cirrhosis, involving kidney dysfunction and the accumulation of large amounts of fluid in the abdominal cavity.

The Need for an Ascites Therapy

With no medications approved by the FDA specifically for treating ascites, an estimated 40% of patients die within two years of diagnosis. Certain drugs approved for other uses such as diuretics may provide initial relief, but patients may fail to respond to treatment as ascites worsens. This represents a critical unmet medical need. U.S. treatment costs for liver cirrhosis, including ascites and other complications, are estimated at more than $5 billion annually.

-4-

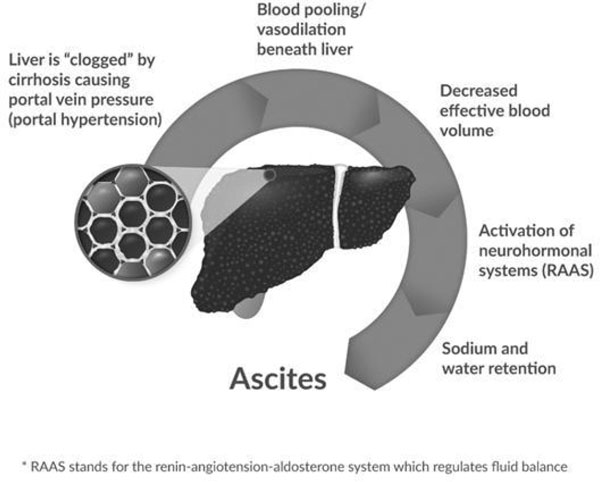

The Ascites Development Pathway

Most experts agree that ascites develops through a sequence of events illustrated by the above diagram. High blood pressure in the vein that supplies blood to the liver, called “portal hypertension,” occurs as increasing liver damage (fibrosis) impedes blood flow through the liver. This causes vasodilation and blood pooling in the central or “splanchnic” region of the body and low blood volume in the arteries. The decrease in effective blood volume activates a signaling pathway (“neurohormonal systems”) which tells the kidneys to retain large amounts of salt and water in an effort to increase blood volume. Ultimately the retention of excess sodium and water leads to the formation of ascites as these substances “weep” from the liver and lymph system and collect in the patient’s abdomen.

The BIV201 Mechanism of Action

BIV201 is being developed with the goal of alleviating the portal hypertension and correcting splanchnic vasodilation, thereby increasing effective blood volume and reducing the signals to the kidneys to retain excess salt and water. If successful, BIV201 could halt the cycle of accelerating fluid generation in ascites patients and reduce the need for the frequent and painful paracentesis procedures many of these patients currently require.

-5-

Future Possible BIV201 Indications

Based on international investigative studies of the active agent in BIV201, terlipressin, our new drug candidate has potential future applications in other life-threatening conditions due to liver cirrhosis, such as those listed below. Securing marketing approvals for any of these new uses will require well-controlled clinical trials to satisfy the FDA and/or other countries’ regulatory requirements, none of which have commenced at this time. The Company may be unable to, or chose not to, pursue the development BIV201 for these indications.

| ● | Bleeding Esophageal Varices (BEV): The bursting of blood vessels lining the esophagus due to high blood pressure (“portal hypertension”) in the vein which supplies blood to the liver resulting as a result of advanced liver cirrhosis. This situation requires emergency treatment to avoid blood loss and death. |

| ● | Hepatorenal Syndrome-Acute Kidney Injury (HR/S-AKI): As liver cirrhosis and ascites progress, the patients’ kidneys may begin to fail, and this deadly condition may set in. It often occurs once a patient no longer responds to (off-label) drugs used to control ascites. Treatment of HRS-AKI requires hospitalization as multiple organ failure and death may occur, typically within 2-4 weeks absent liver transplant. We obtained Orphan Drug designation for BIV201 in the U.S. for the treatment of HRS on November 21, 2018. In May 2021, BioVie submitted a Type B Meeting Package to the FDA seeking to conduct a single pivotal US Phase 3 clinical trial in the treatment of HRS-AKI. In June 2021, we received FDA feedback on the proposed trial design. We are currently finalizing the trial protocol and statistical analysis plan based on their guidance, and plan to commence the trial late this year. |

Neurodegenerative Disease Program

In June 2021, BioVie purchased the assets of NeurMedix, Inc., a privately held clinical-stage biopharmaceutical company focused on developing novel therapeutic products for the treatment of neurodegenerative and neurological disorders and certain cancers. NeurMedix was formed in November 2014 to acquire and commercialize intellectual property and know-how. In December 2014, NeurMedix’s parent entity purchased all the assets related to NE3107 from Harbor Therapeutics, Inc. and these assets were transferred to NeurMedix in February 2015. NE3107 is believed to be a selective inhibitor of inflammatory ERK signaling that reduces neuroinflammation. It is an orally administered potentially first-in-class small molecule that may inhibit inflammation-driven insulin resistance and major pathological inflammatory cascades with a novel mechanism of action. There is emerging scientific consensus that both inflammation and insulin resistance play fundamental roles in the development of Alzheimer’s and Parkinson’s Disease, and NE3107 could, if approved, represent an entirely new medical approach to treating these devastating conditions. The FDA has authorized a potentially pivotal Phase 3 randomized, double-blind, placebo-controlled, parallel group, multicenter study to evaluate NE3107 in subjects who have mild to moderate Alzheimer’s disease (NCT04669028).

Alzheimer’s Disease

Alzheimer’s disease (AD), which affects an estimated 6 million Americans, is a neuroinflammatory and neurodegenerative condition characterized by progressive deterioration of cognitive function and loss of short-term memory and executive function. Cognitive tests quantifying AD severity have been exhaustively developed. Formal diagnosis of AD has historically been dependent on the presence of extraneuronal amyloid beta (Aβ) plaques, which can only be observed at autopsy or with the aid of sophisticated radioimaging techniques. However, diagnostic methods have recently been approved that quantify Aβ in peripheral blood and correlate well with imaging results. Aβ plaques can also be found in people without apparent AD symptoms, which has cast doubt about the role of Aβ as the central mediator of disease pathology.

Scientific investigations in the past twenty years have provided strong evidence that inflammation, type 2 diabetes (T2D), and inflammation-driven insulin resistance (IR) are drivers of AD. The link between these factors and cognitive impairment are described by relatively new terms, type 3 diabetes and metabolic-cognitive syndrome.

-6-

A large body of evidence supports inflammation as a primary driver of pathology in AD. The major inflammation signaling node, NFkB, and the cytokine tumor necrosis factor (TNF) are important initiators of inflammatory signaling in AD pathology. NE3107 is believed to inhibit extracellular signal regulated kinase (ERK)/NFkB activation and TNF production stimulated by inflammatory mediators, such as lipopolysaccharide. Inhibition of NFkB activation and TNF production from this type of stimulation has broad potential implications for reduction of pathological peripheral and central nervous system (CNS) inflammatory signaling in AD, which include reduction of inflammation-driven insulin resistance, decreased inflammatory cell infiltration into the CNS, and decreased microglia activation. Reduction of systemic inflammation and inflammation driven insulin resistance are also predicted to have beneficial effects on hypothalamus-pituitary-adrenal (HPA) axis dysregulation and hippocampal dysregulation of cortisol secretion that are consequences of adipose inflammation and insulin resistance, and known to promote cognitive impairment, and are also forward-feeding for insulin resistance.

Inflammation, insulin resistance, and associated metabolic dysregulation in the brain contribute to Aβ oligomerization and aggregation, phospho-tau formation, reduced neuron survival stimulus, and a forward-feeding cycle of neuronal energy deficit and oxidative stress, causing neuronal dysfunction (cognitive impairment) and neurodegeneration. NE3107’s combination of anti-inflammatory and insulin sensitizing activity has the potential to disrupt this forward-feeding cycle of AD pathology.

Insulin has a major role in metabolic regulation and neuron survival, while insulin resistance and T2D are closely linked to AD pathology. Insulin signaling is involved in synaptic plasticity, learning, and memory. Exogenous insulin enhances cognition in normal and cognitively impaired subjects. Insulin resistance is linked to cognitive impairment.

The multifactorial influence of insulin signaling on neuron survival and cognition suggests that correction of insulin signaling deficits in the target population may provide significant benefits on both cognition and disease progression. Additional rationale for targeting metabolic dysregulation with NE3107 has come from recent work showing peripheral insulin resistance promotes insulin resistance and senescence in the CNS.

There is also extensive literature on the complex role of adipose tissue inflammation in systemic inflammation, insulin resistance, hypothalamus-pituitary-adrenal axis (HPA) dysregulation and chronic cortisol excess in cognitive impairment in AD. Obesity and inflammation are closely linked in expanding adipose tissue, where the production of inflammatory cytokines and increased cortisol are driven though up-regulation of 11β-hydroxysteroid dehydrogenase type 1 and adipocyte mineralocorticoid receptor activation. Inflamed adipose tissue interacts with the HPA axis and hippocampus to increase systemic cortisol, and promote hippocampal inflammation through chronically elevated cortisol, which freely penetrates the blood-brain barrier. Hyperglycemia (secondary to insulin resistance) exacerbates adrenal cortisol production and promotes forward feeding of inflammation and HPA-hippocampal dysregulation.

Systemic inflammation from inflamed adipose and associated mononuclear cells, promotes CNS inflammation with associated cognitive decline and neurodegeneration. A therapy with anti-inflammatory activity against systemic/adipose inflammation and factors that dysregulate cortisol secretion, such as hyperglycemia, has the potential to decrease cognitive impairment and neurodegenerative mechanisms that have been linked to cortisol excess.

Parkinson’s Disease

Neuroinflammation and activation of brain microglia, leading to increased proinflammatory cytokines (particularly tumor necrosis factor (TNF)) play a pivotal role in Parkinson’s Disease (PD), which affects an estimated 1 million Americans. Daily administration of levodopa (converted to dopamine in the brain) is the current standard of care treatment for this movement disorder, but prolonged daily administration often leads to side effects of uncontrolled movements called levodopa-induced dyskinesia, commonly referred to as LID. Recent evidence demonstrates that daily administration of levodopa further increases neuroinflammation, microglia activation, and TNF inflammatory damage in neurons.

We have observed that in a mouse model of PD, NE3107 decreased inflammation and TNF in the brain and increased neuron survival (Nicoletti, 2012 Parkinson’s Disease 969418.) In this neurotoxin induced model, NE3107 decreased clinical signs of disease and neuronal death compared to placebo treated mice.

-7-

An unpublished study in a neurotoxin induced marmoset model of Parkinson’s disease reported that administration of NE3107 decreased movement abnormalities that are the clinical signs of the disease. In the same study, NE3107 in combination with levodopa had a stronger effect on clinical signs of disease than levodopa or NE3107 alone, while marmosets treated with NE3107 developed less LID. NE3107-treated monkeys also exhibited neuroprotective activity that promoted the survival of twice as many neurons in the substantia nigra (primary region of the brain that degenerates to cause parkinsonism) as monkeys treated with placebo. The results from the marmoset study suggest that NE3107 may decrease clinical signs of disease in humans (improve motor function), which if true could enable a straightforward clinical development strategy to test NE3107 in PD patients needing promotoric therapy.

If approved as a promotoric agent, NE3107 could provide a non-dopaminergic alternative to Parkinson’s patients, and an opportunity to significantly delay the need to start levodopa therapy. This could represent a first step toward supplanting levodopa as the primary PD therapy, and in addition to delaying the emergence of LID, could also imply a slowing of disease progression, the most important and still unmet objective of PD drug development.

Oncology

In certain types of cancers, inflammatory cell signaling is at the heart of disease progression. NE3107 has been observed to decrease inflammatory cell signaling in vitro, in animal models and in human clinical trials. Recently, evidence has developed that cancers are dependent on inflammatory cell signaling, not only in the tumor cells, but also in immune, stromal and hematopoietic cells in the tumor microenvironment.

The inflammatory pathways that have been elucidated in non-cancerous cells in the tumor microenvironment are similar to those NE3107 decrease in inflammatory cells in metabolic disorders and neurodegeneration. BioVie is developing clinical trial-enabling data for Multiple Myeloma and Prostate cancers.

Intellectual Property

BioVie relies on a combination of patent, trade secret, other intellectual property laws (such as FDA data exclusivity), nondisclosure agreements, and other measures to protect our proposed products. We require our employees, consultants, and advisors to execute confidentiality agreements and to agree to disclose and assign to us all inventions conceived during the workday, using our property, or which relate to our business. Despite any measures taken to protect our intellectual property (IP), unauthorized parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary.

BIV201 was awarded Orphan Drug Designations in the U.S. for the treatment of hepatorenal syndrome (received November 21, 2018) and treatment of ascites due to all etiologies except cancer (received September 8, 2016). We also filed a PCT application covering our novel liquid formulations of terlipressin (international patent application PCT/US2020/034269, published as WO2020/237170) and we will seek patent protection in at least the United States, Europe, China and Japan. In April 2020, we elected certain claims in our pending U.S. patent application 16/379,446 (a continuation application related to the ’945 Patent, which was canceled pursuant to an inter partes review proceeding, discussed above). In addition, we have applied for patent coverage for a method of treating ascites with BIV201 in Japan, Europe, China and Hong Kong.

-8-

As of August 5, 2021, we have fifteen (15) issued U.S. patents, one (1) pending U.S. patent application, one (1) pending U.S. provisional application (provisional application filed May 18, 2021) and six (6) issued foreign patents directed to protecting NE3107 and related compounds and methods of making and using thereof. The U.S. patents and pending patent applications and their expiration dates are provided below.

| Title | Patent Application Number |

Patent Number |

Expiration Date |

| Steroids Having 7-Oxygen and 17-Heteroaryl Substitution | 13/095,528 14/027,825 14/027,842 |

8,569,275 9,102,702 9,115,168 |

2/14/2024 3/28/2024 3/28/2024 |

| Unsaturated Steroid Compounds | 13/030,326 | 8,586,770 | 6/2/2026 |

| Solid State Forms of a Pharmaceutical | 12/418,559 | 8,252,947* | 4/18/2030 |

| Crystalline Anhydrate Forms of a Pharmaceutical | 14/459,528 15/348,107 16/598,694 17/240,728 |

9,555,046 9,850,271 10,995,112 pending |

4/3/2029 4/3/2029 4/3/2029 — |

| Pharmaceutical Solid State Forms | 12/370,510 | 8,518,922 | 9/24/2031 |

| Methods of Preparing Pharmaceutical Solid State Forms | 13/919,593 | 9,314,471 | 6/28/2029 |

| Steroid Tetrol Solid State Forms | 12/272,767 | 8,486,926 | 1/10/2030 |

| Drug Identification and Treatment Method | 11/941,936 | 8,354,396 | 7/7/2031 |

| Method For Preparing Substituted 3,7-Dihydroxy Steroids | 13/664,304 14/886,738 |

9,163,059** 9,994,608 |

6/5/2029 6/5/2029 |

| Treatment Methods Using Pharmaceutical Solid State Forms | 14/459,493 | 9,877,972 | 4/3/2029 |

| Compositions for Treatment of Neurodegenerative Conditions | 63/189,880 | provisional | — |

| * | Foreign counterparts issued in Australia, Canada, Europe and South Korea expire 4/3/2029. |

| ** | Foreign counterparts issued in Europe and Japan expire 6/5/2029. |

Government Regulation

Government authorities in the United States, at the federal, state and local level, and in other countries extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of products such as those we are developing. Any pharmaceutical candidate that we develop must be approved by the FDA before it may be legally marketed in the United States and by the appropriate foreign regulatory agency before it may be legally marketed in foreign countries.

United States Drug Development Process

In the United States, the FDA regulates drugs under the Federal Food, Drug and Cosmetic Act, or FDCA, and implementing regulations. Drugs are also subject to other federal, state and local statutes and regulations. Biologics are subject to regulation by the FDA under the FDCA, the Public Health Service Act, or the PHSA, and related regulations, and other federal, state and local statutes and regulations. Biological products include, among other things, viruses, therapeutic serums, vaccines and most protein products. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Failure to comply with the applicable United States requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial sanctions. FDA sanctions could include refusal to approve pending applications, withdrawal of an approval, a clinical hold, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

The process required by the FDA before a drug or biological product may be marketed in the United States generally involves the following:

| ● | Completion of preclinical laboratory tests, animal studies and formulation studies according to Good Laboratory Practices or other applicable regulations; |

| ● | Submission to the FDA of an Investigational New Drug Application, or an IND, which must become effective before human clinical trials may begin; |

-9-

| ● | Performance of adequate and well-controlled human clinical trials according to the FDA’s current good clinical practices, or GCPs, to establish the safety and efficacy of the proposed drug or biologic for its intended use; |

| ● | Submission to the FDA of a New Drug Application, or an NDA, for a new drug product, or a Biologics License Application, or a BLA, for a new biological product; |

| ● | Satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the drug or biologic is to be produced to assess compliance with the FDA’s current good manufacturing practice standards, or cGMP, to assure that the facilities, methods and controls are adequate to preserve the drug’s or biologic’s identity, strength, quality and purity; |

| ● | Potential FDA audit of the nonclinical and clinical trial sites that generated the data in support of the NDA or BLA; and |

| ● | FDA review and approval of the NDA or BLA. |

The lengthy process of seeking required approvals and the continuing need for compliance with applicable statutes and regulations require the expenditure of substantial resources. There can be no certainty that approvals will be granted.

Clinical trials involve the administration of the drug or biological candidate to healthy volunteers or patients having the disease being studied under the supervision of qualified investigators, generally physicians not employed by or under the trial sponsor’s control. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety. Each protocol must be submitted to the FDA as part of the IND. Clinical trials must be conducted in accordance with the FDA’s good clinical practices requirements. Further, each clinical trial must be reviewed and approved by an independent institutional review board, or IRB, at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of trial participants and considers such items as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the informed consent form that must be provided to each clinical trial subject or his or her legal representative and must monitor the clinical trial until it is completed.

Human clinical trials prior to approval are typically conducted in three sequential phases that may overlap or be combined:

| ● | Phase 1. The drug or biologic is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients having the specific disease. |

| ● | Phase 2. The drug or biologic is evaluated in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance, optimal dosage and dosing schedule for patients having the specific disease. |

| ● | Phase 3. Clinical trials are undertaken to further evaluate dosage, clinical efficacy and safety in an expanded patient population at geographically dispersed clinical trial sites. These clinical trials, which usually involve more subjects than earlier trials, are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product labeling. Generally, at least two adequate and well-controlled Phase 3 clinical trials are required by the FDA for approval of an NDA or BLA. |

Post-approval studies, or Phase 4 clinical trials, may be conducted after initial marketing approval. These studies are used to gain additional experience from the treatment of patients in the intended therapeutic indication and may be required by the FDA as part of the approval process.

-10-

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and written IND safety reports must be submitted to the FDA by the investigators for serious and unexpected adverse events or any finding from tests in laboratory animals that suggests a significant risk for human subjects. Phase 1, Phase 2 and Phase 3 clinical trials may not be completed successfully within any specified period, if at all. The FDA or the sponsor or its data safety monitoring board may suspend a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug or biologic has been associated with unexpected serious harm to patients.

Concurrent with clinical trials, companies usually complete additional animal studies and develop additional information about the chemistry and physical characteristics of the drug or biologic as well as finalize a process for manufacturing the product in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the drug or biological candidate and, among other things, must include methods for testing the identity, strength, quality and purity of the final drug or biologic. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the drug or biological candidate does not undergo unacceptable deterioration over its shelf life.

U.S. Review and Approval Processes

The results of product development, preclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests conducted on the chemistry of the drug or biologic, proposed labeling and other relevant information are submitted to the FDA as part of an NDA or BLA requesting approval to market the product. The submission of an NDA or BLA is subject to the payment of substantial user fees; a waiver of such fees may be obtained under certain limited circumstances.

The FDA reviews all NDAs and BLAs submitted before it accepts them for filing and may request additional information rather than accepting an NDA or BLA for filing. Once the submission is accepted for filing, the FDA begins an in-depth review of the NDA or BLA.

After the NDA or BLA submission is accepted for filing, the FDA reviews the NDA to determine, among other things, whether the proposed product is safe and effective for its intended use, and whether the product is being manufactured in accordance with cGMP to assure and preserve the product’s identity, strength, quality and purity. The FDA reviews a BLA to determine, among other things, whether the product is safe, pure and potent and the facility in which it is manufactured, processed, packaged or held meets standards designed to assure the product’s continued safety, purity and potency. In addition to its own review, the FDA may refer applications for novel drug or biological products or drug or biological products which present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. During the approval process, the FDA also will determine whether a risk evaluation and mitigation strategy, or REMS, is necessary to assure the safe use of the drug or biologic. If the FDA concludes that a REMS is needed, the sponsor of the NDA or BLA must submit a proposed REMS; the FDA will not approve the NDA or BLA without a REMS, if required.

Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is to be manufactured. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA or BLA, the FDA will typically inspect one or more clinical sites to assure compliance with cGMP. If the FDA determines the application, manufacturing process or manufacturing facilities are not acceptable it will outline the deficiencies in the submission and often will request additional testing or information.

-11-

The NDA or BLA review and approval process is lengthy and difficult and the FDA may refuse to approve an NDA or BLA if the applicable regulatory criteria are not satisfied or may require additional clinical data or other data and information. Even if such data and information is submitted, the FDA may ultimately decide that the NDA or BLA does not satisfy the criteria for approval. Data obtained from clinical trials are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA will issue a “complete response” letter if the agency decides not to approve the NDA or BLA. The complete response letter usually describes all of the specific deficiencies in the NDA or BLA identified by the FDA. The deficiencies identified may be minor, for example, requiring labeling changes, or major, for example, requiring additional clinical trials. Additionally, the complete response letter may include recommended actions that the applicant might take to place the application in a condition for approval. If a complete response letter is issued, the applicant may either resubmit the NDA or BLA, addressing all of the deficiencies identified in the letter, or withdraw the application.

If a product receives regulatory approval, the approval may be limited to specific diseases and dosages or the indications for use may otherwise be limited, which could restrict the commercial value of the product. Further, the FDA may require that certain contraindications, warnings or precautions be included in the product labeling. In addition, the FDA may require Phase 4 testing which involves clinical trials designed to further assess a product’s safety and effectiveness and may require testing and surveillance programs to monitor the safety of approved products that have been commercialized.

Orphan Drug Designation

Under the Orphan Drug Act, the FDA may grant orphan designation to a drug or biological product intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making a drug or biological product available in the United States for this type of disease or condition will be recovered from sales of the product. Orphan product designation must be requested before submitting an NDA or BLA. After the FDA grants orphan product designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. Orphan product designation does not convey any advantage in or shorten the duration of the regulatory review and approval process.

If a product that has Orphan designation subsequently receives the first FDA approval for the disease or condition for which it has such designation, the product is entitled to orphan product exclusivity, which means that the FDA may not approve any other applications to market the same drug or biological product for the same indication for seven years, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity. Competitors, however, may receive approval of different products for the indication for which the Orphan product has exclusivity or obtain approval for the same product but for a different indication for which the Orphan product has exclusivity. Orphan product exclusivity also could block the approval of one of our products for seven years if a competitor obtains approval of the same drug or biological product as defined by the FDA or if our drug or biological candidate is determined to be contained within the competitor’s product for the same indication or disease. If a drug or biological product designated as an orphan product receives marketing approval for an indication broader than what is designated, it may not be entitled to orphan product exclusivity. Orphan Drug status in the European Union has similar but not identical benefits in the European Union.

Expedited Development and Review Programs

The FDA has a Fast Track program that is intended to expedite or facilitate the process for reviewing new drug and biological products that meet certain criteria. Specifically, new drug and biological products are eligible for Fast Track designation if they are intended to treat a serious or life-threatening condition and demonstrate the potential to address unmet medical needs for the condition. Fast Track designation applies to the combination of the product and the specific indication for which it is being studied. Unique to a Fast Track product, the FDA may consider for review sections of the NDA or BLA on a rolling basis before the complete application is submitted, if the sponsor provides a schedule for the submission of the sections of the NDA or BLA, the FDA agrees to accept sections of the NDA or BLA and determines that the schedule is acceptable, and the sponsor pays any required user fees upon submission of the first section of the NDA or BLA.

-12-

Any product submitted to the FDA for marketing approval, including those submitted to a Fast Track program, may also be eligible for other types of FDA programs intended to expedite development and review, such as priority review and accelerated approval. Any product is eligible for priority review if it has the potential to provide safe and effective therapy where no satisfactory alternative therapy exists or a significant improvement in the treatment, diagnosis or prevention of a disease compared with marketed products. The FDA will attempt to direct additional resources to the evaluation of an application for a new drug or biological product designated for priority review in an effort to facilitate the review. Additionally, a product may be eligible for accelerated approval. Drug or biological products studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit over existing treatments may receive accelerated approval, which means that they may be approved on the basis of adequate and well-controlled clinical studies establishing that the product has an effect on a surrogate endpoint that is reasonably likely to predict a clinical benefit, or on the basis of an effect on a clinical endpoint other than survival or irreversible morbidity. As a condition of approval, the FDA generally requires that a sponsor of a drug or biological product receiving accelerated approval perform adequate and well-controlled post-marketing clinical studies to establish safety and efficacy for the approved indication. Failure to conduct such studies or conducting such studies that do not establish the required safety and efficacy may result in revocation of the original approval. In addition, the FDA currently requires as a condition for accelerated approval pre-approval of promotional materials, which could adversely impact the timing of the commercial launch or subsequent marketing of the product. Fast Track designation, priority review and accelerated approval do not change the standards for approval but may expedite the development or approval process.

Post-Approval Requirements

Any drug or biological products for which we receive FDA approvals are subject to continuing regulation by the FDA, including, among other things, record-keeping requirements, reporting of adverse experiences with the product, providing the FDA with updated safety and efficacy information on an annual basis or as required more frequently for specific events, product sampling and distribution requirements, complying with certain electronic records and signature requirements and complying with FDA promotion and advertising requirements, which include, among others, standards for direct-to-consumer advertising, prohibitions against promoting drugs and biologics for uses or in patient populations that are not described in the drug’s or biologic’s approved labeling (known as “off-label use”), rules for conducting industry-sponsored scientific and educational activities, and promotional activities involving the internet. Failure to comply with FDA requirements can have negative consequences, including the immediate discontinuation of noncomplying materials, adverse publicity, enforcement letters from the FDA, mandated corrective advertising or communications with doctors, and civil or criminal penalties. Although physicians may prescribe legally available drugs and biologics for off-label uses, manufacturers may not market or promote such off-label uses.

We will need to rely, on third parties for the production of our product candidates. Manufacturers of our product candidates are required to comply with applicable FDA manufacturing requirements contained in the FDA’s cGMP regulations. cGMP regulations require among other things, quality control and quality assurance as well as the corresponding maintenance of comprehensive records and documentation. Drug and biologic manufacturers and other entities involved in the manufacture and distribution of approved drugs and biologics are also required to register their establishments and list any products made there with the FDA and comply with related requirements in certain states, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP and other laws. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain cGMP compliance. Discovery of problems with a product after approval may result in serious and extensive restrictions on a product, manufacturer, or holder of an approved NDA or BLA, including suspension of a product until the FDA is assured that quality standards can be met, continuing oversight of manufacturing by the FDA under a “consent decree,” which frequently includes the imposition of costs and continuing inspections over a period of many years, and possible withdrawal of the product from the market. In addition, changes to the manufacturing process generally require prior FDA approval before being implemented and other types of changes to the approved product, such as adding new indications and additional labeling claims, are also subject to further FDA review and approval.

The FDA also may require post-marketing testing, known as Phase 4 testing, risk minimization action plans and surveillance to monitor the effects of an approved product or place conditions on an approval that could otherwise restrict the distribution or use of the product.

-13-

Employees

Our business is managed by our officers. The Company’s Chairman, Terren Peizer, served as Chief Executive Officer from July 2018 and devoted his part-time efforts to the Company’s activities through April 27, 2021. On April 27, 2021, the board of directors appointed Cuong Do as Chief Executive Officer & President. Mr. Do; Wendy Kim, our Chief Financial Officer and Corporate Secretary; Jonathan Adams, who previously served as President and Chief Operating Officer, serving as our Company’s Executive Vice President – Liver Cirrhosis Programs; and Penelope Markham, PhD, Executive Vice President - Liver Cirrhosis R&D; devote their full-time efforts to the Company activities. Chris Reading, PhD, Executive Vice President - Neuroscience R&D; and Clarence Alhem, Executive Vice President - Neuroscience Product Development began their employment with the Company on July 1, 2021 and devotes their full-time efforts to the Company’s Neuroscience programs. We also rely on a team of highly experienced scientific, medical, and regulatory consultants to conduct its product development activities.

| ITEM 1A. | RISK FACTORS |

Our business, financial condition, operating results and prospects are subject to the following risks. Additional risks and uncertainties not presently foreseeable to us may also impair our business operations. If any of the following risks or the risks described elsewhere in this report actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in the shares of our common stock.

This Form 10-K contains forward-looking statements that involve risks and uncertainties. These statements can be identified by the use of forward-looking terminology such as “believes,” “expects,” “intends,” “plans,” “may,” “will,” “should,” “predict” or “anticipation” or the negative thereof or other variations thereon or comparable terminology. Actual results could differ materially from those discussed in the forward- looking statements as a result of certain factors, including those set forth below and elsewhere in this Form 10-K.

Risks Relating to Our Business and Industry

We have no products approved for commercial sale, have never generated any revenues and may never achieve revenues or profitability, which could cause us to cease operations.

We have no products approved for commercial sale and, to date, we have not generated any revenue. Our ability to generate revenue depends heavily on (a) successful completion of one or more development programs demonstrating in human clinical trials that BIV201 and NE3107, our product candidates, are safe and effective; (b) our ability to seek and obtain regulatory approvals, including, without limitation, with respect to the indications we are seeking; (c) successful commercialization of our product candidates; and (d) market acceptance of our products. There are no assurances that we will achieve any of the forgoing objectives. Furthermore, our product candidates are in the development stage, and have not been fully evaluated in human clinical trials. If we do not successfully develop and commercialize our product candidates we will not achieve revenues or profitability in the foreseeable future, if at all. If we are unable to generate revenues or achieve profitability, we may be unable to continue our operations.

We are a development stage company with a limited operating history, making it difficult for you to evaluate our business and your investment.

BioVie Inc. was incorporated on April 10, 2013. We are a development stage biopharmaceutical company with potential therapies that have not been fully evaluated in clinical trials, and our operations are subject to all of the risks inherent in the establishment of a new business enterprise, including but not limited to the absence of an operating history, the lack of commercialized products, insufficient capital, expected substantial and continual losses for the foreseeable future, limited experience in dealing with regulatory issues, the lack of manufacturing experience and limited marketing experience, possible reliance on third parties for the development and commercialization of our proposed products, a competitive environment characterized by numerous, well-established and well capitalized competitors and reliance on key personnel.

-14-

Since inception, we have not established any revenues or operations that would provide financial stability in the long term, and there can be no assurance that we will realize our plans on our projected timetable in order to reach sustainable or profitable operations.

Investors are subject to all the risks incident to the creation and development of a new business and each investor should be prepared to withstand a complete loss of his, her or its investment. Furthermore, the accompanying financial statements have been prepared assuming that we will continue as a going concern. We have not emerged from the development stage, and may be unable to raise further equity. These factors raise substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Because we are subject to these risks, you may have a difficult time evaluating our business and your investment in our Company. Our ability to become profitable depends primarily on our ability to develop drugs, to obtain approval for such drugs, and if approved, to successfully commercialize our drugs, our research and development (“R&D”) efforts, including the timing and cost of clinical trials; and our ability to enter into favorable alliances with third-parties who can provide substantial capabilities in clinical development, regulatory affairs, sales, marketing and distribution.

Even if we successfully develop and market BIV201 and/or NE3107, we may not generate sufficient or sustainable revenue to achieve or sustain profitability, which could cause us to cease operations and cause you to lose all of your investment.

If the FDA or comparable foreign regulatory authorities approve generic versions of any of our product candidates that receive marketing approval, or such authorities do not grant our products sufficient, or any, periods of exclusivity before approving generic versions of our products, the sales of our products could be adversely affected.

Once a new drug application (“NDA”) is approved, the product covered thereby becomes a “reference listed drug” or RLD, in the FDA’s publication, “Approved Drug Products with Therapeutic Equivalence Evaluations,” commonly known as the Orange Book. Other manufacturers may seek approval of generic versions of reference listed drugs through submission of abbreviated new drug applications (“ANDAs”) in the United States. In support of an ANDA, a generic manufacturer need not conduct clinical trials. Rather, the applicant generally must show that its product has the same active ingredient(s), dosage form, strength, route of administration and conditions of use or labeling as the reference listed drug and that the generic version is bioequivalent to the reference listed drug, meaning it is absorbed in the body at the same rate and to the same extent as the RLD. Generic products may be significantly less costly to bring to market than the reference listed drug and companies that produce generic products are generally able to offer them at lower prices. Moreover, generic versions of RLDs are often automatically substituted for the RLD by pharmacies when dispensing a prescription written for the RLD. Thus, following the introduction of a generic drug, a significant percentage of the sales of any branded product or reference listed drug is typically lost to the generic product.

The FDA may not approve an ANDA for a generic product until any applicable period of non-patent exclusivity for the reference listed drug has expired. The United States Federal Food, Drug, and Cosmetic Act (“FDCA”) provides a period of five years of non-patent exclusivity for a new drug containing a new chemical entity (“NCE”). An NCE is an active ingredient that has not previously been approved by FDA in any other NDA. Specifically, in cases where such exclusivity has been granted, an ANDA may not be submitted to the FDA until the expiration of five years unless the submission is accompanied by a Paragraph IV certification that a patent covering the reference listed drug is either invalid or will not be infringed by the generic product, in which case the applicant may submit its application four years following approval of the reference listed drug. If an ANDA is submitted to FDA with a Paragraph IV Certification, the generic applicant must also provide a “Paragraph IV Notification” to the holder of the NDA for the RLD and to the owner of the listed patent(s) being challenged by the ANDA applicant, providing a detailed written statement of the basis for the ANDA applicant’s position that the relevant patent(s) is invalid or would not be infringed. If the patent owner brings a patent infringement lawsuit against the ANDA applicant within 45 days of the Paragraph IV Notification, FDA approval of the ANDA will be automatically stayed for 30 months, or until 7-1/2 years after the NDA approval if the generic application was filed between 4 years and 5 years after the NDA approval. Any such stay will be terminated earlier if the court rules that the patent is invalid or would not be infringed.

-15-

While we believe that BIV201 contains an active ingredient, terlipressin, that would be treated as an NCE by the FDA and, therefore, if it is the first terlipressin drug product to be approved, should be afforded NCE exclusivity, the FDA may disagree with that conclusion and may approve generic products after a period that is less than five years. If the FDA were to award NCE exclusivity to someone who receives approval of a terlipressin drug product before us, we believe that we could still be awarded a different type of exclusivity protection from generic competition, which is awarded when an NDA or supplemental NDA for a new use of a drug contains reports of new clinical investigations (other than bioavailability studies) conducted or sponsored by an applicant and which FDA deems to have been essential for approval of the application or supplement. Such exclusivity prevents FDA approval of a generic version of the RLD for three years from the date of the RLD approval. Manufacturers may seek to launch generic products following the expiration of any applicable marketing exclusivity period, even if we still have patent protection for our product and no 30-month stay is in effect. If we do not maintain patent protection and regulatory exclusivity for our product candidates, our business may be materially harmed.

Competition that our products may face from generic versions of our products could materially and adversely impact our future revenue, profitability and cash flows and substantially limit our ability to obtain a return on the investments we have made in those product candidates.

If we fail to obtain or maintain Orphan Drug exclusivity for BIV201, we will have to rely on other potential marketing exclusivity, and on our intellectual property rights, which may reduce the length of time that we can prevent competitors from selling generic versions of BIV201.

We have obtained two Orphan Drug Designations for BIV201 (terlipressin) in the U.S., one for the treatment of hepatorenal syndrome (received November 21, 2018) and another for treatment of ascites due to all etiologies except cancer (received September 8, 2016). Under the Orphan Drug Act, the FDA may designate a product as an Orphan Drug if it is a drug intended to treat a rare disease or condition, defined, in part, as a patient population of fewer than 200,000 in the U.S. In the EU, Orphan Drug designation may be granted to drugs intended to treat, diagnose or prevent a life-threatening or chronically debilitating disease having a prevalence of no more than five in 10,000 people in the EU, and which meet other specified criteria. The company that first obtains FDA approval for a designated Orphan Drug for the associated rare disease may receive a seven year period of marketing exclusivity during which time FDA may not approve another application for the same drug for the same orphan disease or condition. Orphan Drug Exclusivity does not prevent FDA approval of another application for the same drug for a different disease or condition, or of an application for a different drug for the same rare disease or condition. Orphan Drug exclusive marketing rights may be lost under several circumstances, including a later determination by the FDA that the request for designation was materially defective or if the manufacturer is unable to assure sufficient quantity of the drug. Similar regulations are available in the EU with a ten-year period of market exclusivity.

Even though BioVie has obtained two Orphan Drug Designations for its lead product candidate, terlipressin, for treatment of ascites and for treatment of hepatorenal syndrome, and may seek other Orphan Drug Designations for BIV201, and Orphan Drug Designation for other product candidates, there is no assurance that BioVie will be the first to obtain marketing approval for any particular rare indication. Further, even though BioVie has obtained Orphan Drug Designations for its lead product candidate, or even if BioVie obtains Orphan Drug Designation for other potential product candidates, such designation may not effectively protect BioVie from competition because different drugs can be approved for the same condition and competing versions of the same drug can be approved for different conditions and potentially used off-label in the Orphan indication. Even after an Orphan Drug is approved, the FDA can subsequently approve another competing drug with the same active ingredient for the same condition for several reasons, including, if the FDA concludes that the later drug is clinically superior due to being safer or more effective or because it makes a major contribution to patient care. Orphan Drug Designation neither shortens the development time or regulatory review time of a drug, nor gives the drug any advantage in the regulatory review or approval process.

-16-

In addition, other companies have received Orphan Drug designations for terlipressin. Mallinckrodt Hospital Products IP Limited received Orphan Drug designation in 2004 for terlipressin for the treatment of Hepatorenal Syndrome. Mallinckrodt has already filed an NDA for its product, and the FDA convened an advisory committee meeting to discuss that application in 2020. FDA then issued a complete response letter declining to approved the NDA as filed based on safety concerns. Mallinckrodt has reported that it has met twice with FDA since the complete response letter, in October 2020 and January 2021 and plans to continue to engage FDA to seek a viable path to approval. PharmaIN Corporation received Orphan Drug Designation in 2012 for PGC-C12E-terlipressin for treatment of ascites due to all etiologies except cancer. In addition, Ferring Pharmaceuticals Inc. received Orphan Drug designation in 1986 for terlipressin for the treatment of bleeding esophageal varices. If one of those or any other company with Orphan Drug Designation for the same drug as ours for the same proposed disease or condition receives FDA approval and Orphan Drug Exclusivity before our product is approved, approval of our drug(s) for the orphan indication may be blocked for seven years by the other company’s Orphan Exclusivity and they may obtain a competitive advantage even after the exclusivity period expires associated with being the first to market.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms, which could have a materially adverse effect on our business.

Developing biopharmaceutical products, including conducting pre-clinical studies and clinical trials and establishing manufacturing capabilities, requires substantial funding. On June 10, 2021, the Company closed its Asset Purchase with NeurMedix, and Acuitas, which are related party affiliates, to acquire certain assets from NeurMedix and assume certain liabilities of NeurMedix, in exchange for the consideration of cash and common stock of the Company. At the close the Company issued 8,361,308 shares of its common stock and made cash payments of $2.3 million to the seller. Other related cash expenditures for expenses such as the due diligence, legal fees and the fairness opinion totaling $4 million was also paid. These expenditures have a significant impact on the Company’s cash position and the funding of its future operations over the next 12 months, raising substantial doubt about its ability to meet its financial cash flow requirements. Additional financing will be required to fund the research and development of our product candidates. We have not generated any product revenues, and do not expect to generate any revenues until, and only if, we develop, and receive approval to sell our product candidates from the FDA and other regulatory authorities for our product candidates.

We may not have the resources to complete the development and commercialization of any of our proposed product candidates. We will require additional financing to further the clinical development of our product candidates. In the event that we cannot obtain the required financing, we will be unable to complete the development necessary to file an NDA with the FDA for BIV201 or NE3107. This will delay or require termination of research and development programs, preclinical studies and clinical trials, material characterization studies, regulatory processes, the establishment of our own laboratory or a search for third party marketing partners to market our products for us, which could have a materially adverse effect on our business.

The amount of capital we may need will depend on many factors, including the progress, timing and scope of our research and development programs, the progress, timing and scope of our preclinical studies and clinical trials, the time and cost necessary to obtain regulatory approvals, the time and cost necessary to establish our own marketing capabilities or to seek marketing partners, the time and cost necessary to respond to technological and market developments, changes made or new developments in our existing collaborative, licensing and other commercial relationships, and new collaborative, licensing and other commercial relationships that we may establish.

Until we can generate a sufficient amount of product revenue, if ever, we expect to finance future cash needs through public or private equity offerings, debt financings, or corporate collaboration and licensing arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available, we may be required to delay, reduce the scope of, or eliminate one or more of our research or development programs or our commercialization efforts. In addition, we could be forced to discontinue product development and reduce or forego attractive business opportunities. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience additional significant dilution, and debt financing, if available, may involve restrictive covenants. To the extent that we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or our product candidates, or grant licenses on terms that may not be favorable to us. We may seek to access the public or private capital markets whenever conditions are favorable, even if we do not have an immediate need for additional capital at that time.

-17-

Our fixed expenses, such as rent and other contractual commitments, will likely increase in the future, as we may enter into leases for new facilities and capital equipment and/or enter into additional licenses and collaborative agreements. Therefore, if we fail to raise substantial additional capital to fund these expenses, we could be forced to cease operations, which could cause you to lose all of your investment.

We have limited experience in drug development and may not be able to successfully develop any drugs, which would cause us to cease operations.

We have never successfully developed a new drug and brought it to market. Our management and clinical teams have experience in drug development but they may not be able to successfully develop any drugs. Our ability to achieve revenues and profitability in our business will depend on, among other things, our ability to develop products internally or to obtain rights to them from others on favorable terms; complete laboratory testing and human studies; obtain and maintain necessary intellectual property rights to our products; successfully complete regulatory review to obtain requisite governmental agency approvals; enter into arrangements with third parties to manufacture our products on our behalf; and enter into arrangements with third parties to provide sales and marketing functions. If we are unable to achieve these objectives we will be forced to cease operations and you will lose all of your investment.

Development of pharmaceutical products is a time-consuming process, subject to a number of risks, many of which are outside of our control. Consequently, if we are unsuccessful or fail to timely develop new drugs, we could be forced to discontinue our operations.