UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File No. 001-35971

ALLEGION PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices, including zip code)

+(353 ) (1 ) 2546200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbols | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

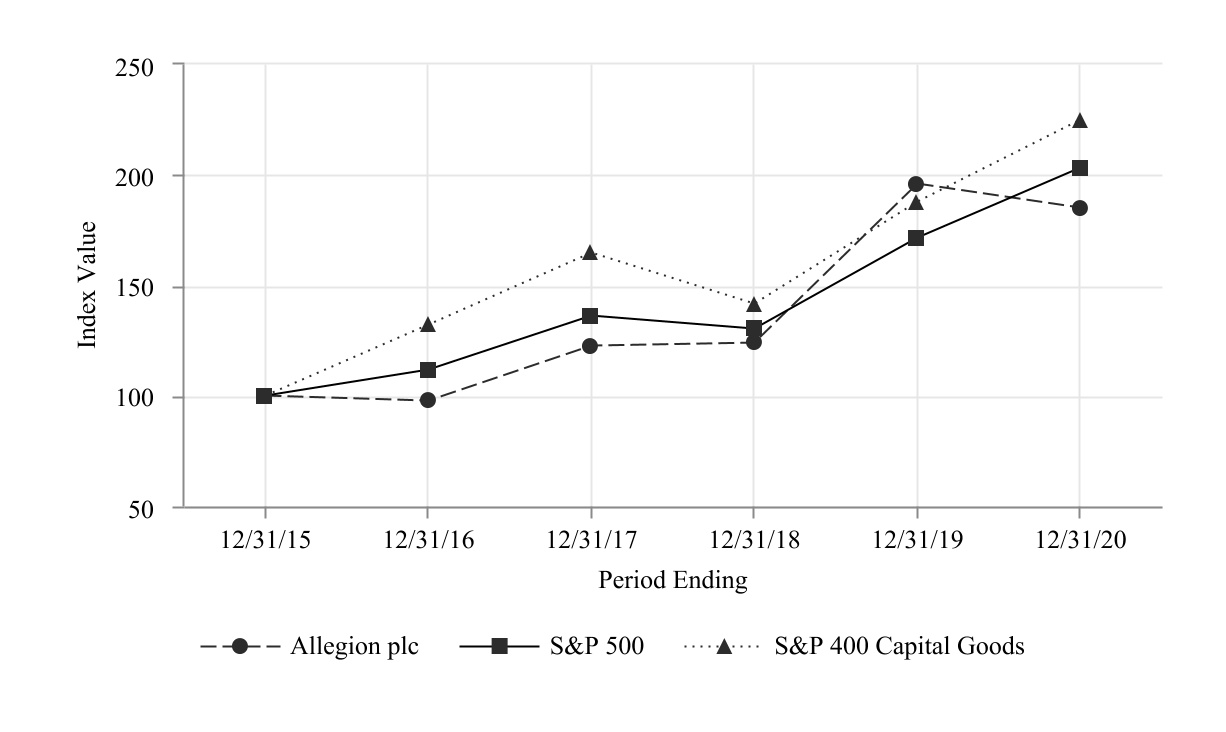

The aggregate market value of ordinary shares held by non-affiliates on June 30, 2020 was approximately $9.4 billion based on the closing price of such stock on the New York Stock Exchange.

The number of ordinary shares outstanding of Allegion plc as of February 11, 2021 was 90,732,297 .

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed within 120 days of the close of the registrant’s fiscal year in connection with the registrant’s Annual General Meeting of Shareholders to be held June 3, 2021 (the "Proxy Statement") are incorporated by reference into Part II and Part III of this Form 10-K as described herein.

ALLEGION PLC

Form 10-K

For the Fiscal Year Ended December 31, 2020

TABLE OF CONTENTS

| Page | |||||||||||

| Part I | Item 1. | ||||||||||

| Item 1A. | |||||||||||

| Item 1B. | |||||||||||

| Item 2. | |||||||||||

| Item 3. | |||||||||||

| Item 4. | |||||||||||

| Part II | Item 5. | ||||||||||

| Item 6. | |||||||||||

| Item 7. | |||||||||||

| Item 7A. | |||||||||||

| Item 8. | |||||||||||

| Item 9. | |||||||||||

| Item 9A. | |||||||||||

| Item 9B. | |||||||||||

| Part III | Item 10. | ||||||||||

| Item 11. | |||||||||||

| Item 12. | |||||||||||

| Item 13. | |||||||||||

| Item 14. | |||||||||||

| Part IV | Item 15. | ||||||||||

| Item 16. | |||||||||||

CAUTIONARY STATEMENT FOR FORWARD LOOKING STATEMENTS

Certain statements in this report, other than purely historical information, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "forecast," "outlook," "intend," "strategy," "future", "opportunity", "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," or the negative thereof or variations thereon or similar expressions generally intended to identify forward-looking statements.

Forward-looking statements may relate to such matters as: statements regarding the potential impacts of the global COVID-19 pandemic, projections of revenue, margins, expenses, tax provisions, earnings, cash flows, benefit obligations, dividends, share purchases or other financial items; any statements of the plans, strategies and objectives of management for future operations, including those relating to any statements concerning expected development, performance or market share relating to our products and services; any statements regarding future economic conditions or our performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. These statements are based on currently available information and our current assumptions, expectations and projections about future events. While we believe that our assumptions, expectations and projections are reasonable in view of the currently available information, you are cautioned not to place undue reliance on our forward-looking statements. You are advised to review any further disclosures we make on related subjects in materials we file with or furnish to the United States Securities and Exchange Commission (SEC). Forward-looking statements speak only as of the date they are made and are not guarantees of future performance. They are subject to future events, risks and uncertainties – many of which are beyond our control – as well as potentially inaccurate assumptions, that could cause actual results to differ materially from our expectations and projections. We do not undertake to update any forward-looking statements.

Factors that might affect our forward-looking statements include, among other things:

•adverse impacts to our normal business operations due to the global COVID-19 pandemic;

•competitive factors in the industry in which we compete, including technological developments and increased competition from private label brands;

•the development, commercialization and acceptance of new products and services that meet the varied and evolving needs of our customers;

•the demand for our products and services, including changes in customer and consumer preferences, and our ability to maintain beneficial relationships with large customers;

•our products or solutions fail to meet certification and specification requirements, are defective or otherwise fall short of customers’ needs and expectations;

•the ability to complete and integrate any acquisitions and/or losses related to our investments in external companies;

•business opportunities that diverge from our core business;

•our ability to operate efficiently and productively;

•our ability to effectively manage and implement restructuring initiatives and other organizational changes;

•disruptions in our global supply chain, including product manufacturing and logistical services provided by supplier partners;

•the effects of global climate change or other unexpected events, including global health crises, that may disrupt our operations;

•our ability to manage risks related to our information technology and operational technology systems and cybersecurity, including implementation of new processes that may cause disruptions and be more difficult, costly or time consuming than expected;

•our reliance on third-party vendors for many of the critical elements of our global information and operational technology infrastructure and their failure to provide effective support for such infrastructure;

•disruption and breaches of our information systems;

•ability to recruit and retain a highly qualified and diverse workforce;

•economic, political and business conditions in the markets in which we operate, including changes to trade agreements, sanctions, import and export regulations and custom duties;

2

•conditions of the institutional, commercial and residential construction and remodeling markets, including the impact of work-from-home trends;

•fluctuations in currency exchange rates;

•availability of and fluctuations in the prices of key commodities and the impact of higher energy prices;

•potential further impairment of our goodwill, indefinite-lived intangible assets and/or our long-lived assets;

•interest rate fluctuations and other changes in borrowing costs, in addition to risks associated with our outstanding and future indebtedness;

•the impact our outstanding indebtedness may have on our business and operations and other capital market conditions, including availability of funding sources and currency exchange rate fluctuations;

•risks related to corporate social responsibility and reputational matters;

•the ability to protect our brand reputation and trademarks;

•the outcome of any litigation, governmental investigations or proceedings;

•claims of infringement of intellectual property rights by third parties;

•adverse publicity or improper conduct by any of our employees, agents or business partners;

•changes to, or changes in interpretations of, current laws and regulations;

•uncertainty and inherent subjectivity related to transfer pricing regulations;

•changes in tax requirements, including tax rate changes, the adoption of new tax legislation or exposure to additional tax liabilities and revised tax law interpretations; and

•risks related to our incorporation in Ireland, including the possible effects on us of future legislation or interpretations in the U.S. that may limit or eliminate potential U.S. tax benefits resulting from our incorporation in a non-U.S. jurisdiction, such as Ireland, or deny U.S. government contracts to us based upon our incorporation in such non-U.S. jurisdiction.

Some of the significant risks and uncertainties that could cause actual results to differ materially from our expectations and projections are described more fully in Item 1A. "Risk Factors." You should read that information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report and our Consolidated Financial Statements and related notes in Item 8 of this report. We note such information for investors as permitted by the Private Securities Litigation Reform Act of 1995.

3

PART I

Item 1. BUSINESS

Overview

Allegion plc ("Allegion," "we," "us" or "the Company") is a leading global provider of security products and solutions that keep people and assets safe and secure in the places where they reside, work and thrive. We create peace of mind by pioneering safety and security with a vision of seamless access and a safer world. Seamless access allows authorized, automated and safe passage and movement through spaces and places in the most efficient and frictionless manner possible. Central to our vision is partnering and developing ecosystems to create a flawless experience and enable an uninterrupted and secure flow of people and assets. We offer an extensive and versatile portfolio of mechanical and electronic security products and solutions across a range of market-leading brands. Our experts across the globe deliver high-quality security products, services and systems, and we use our deep expertise to serve as trusted partners to end-users who seek customized solutions to their security needs.

| Allegion Principal Products | |||||

| Door closers and controls | Doors and door systems | ||||

| Electronic security products | Electronic, biometric and mobile access control systems | ||||

| Exit devices | Locks, locksets, portable locks, key systems and services | ||||

| Time, attendance and workforce productivity systems | Other accessories | ||||

Access control security products and solutions are critical elements in every building and home. Many door openings are configured to maximize a room’s particular form and function while also meeting local and national building and safety code requirements and end-user security needs. Most buildings have multiple door openings, each serving its own purpose and requiring different specific access-control solutions. Each door must fit exactly within its frame, be prepared precisely for its hinges, synchronize with its specific lockset and corresponding latch and align with a specific key to secure the door. Moreover, with the increasing adoption of the Internet of Things ("IoT"), security products – including keys – are increasingly linked electronically, integrated into software and popular consumer technology platforms and controlled with mobile applications, creating additional functionality and complexity. Seamless access capitalizes on the ability for multiple products and brands to work in tandem, allowing people and assets to move efficiently and safely by adapting access rights for various settings or use cases. These solutions can also provide insights on usage and traffic patterns to improve hygiene of high-traffic areas, boost efficiency and improve visitor, staff and tenant experiences.

We believe our ability to deliver a wide range of solutions that can be custom configured to meet end-users’ security needs is a key driver of our success. We accomplish this with:

•Our extensive and versatile product portfolio, combined with our deep expertise, which enables us to deliver the right products and solutions to meet diverse security and functional specifications and to successfully and securely integrate into leading technology and systems;

•Our consultative approach and expertise, which enables us to develop the most efficient and appropriate building security and access-control specifications to fulfill the unique needs of our end-users and their partners, including architects, contractors, homebuilders and engineers;

•Our access to and management of key channels in the market, which is critical to delivering our products in an efficient and consistent manner; and

•Our enterprise excellence capabilities, including our global manufacturing operations and agile supply chain, which facilitate our ability to deliver specific product and system configurations to end-users and consumers worldwide, quickly and efficiently.

We believe the security products industry will benefit from several global macroeconomic trends, including:

•Expected growth in global electronic products as end-users adopt newer technologies in their facilities and homes;

•Heightened awareness of security and privacy requirements;

•Increased focus on touchless solutions that help promote a healthy environment; and

•The shift to a digital, interconnected environment.

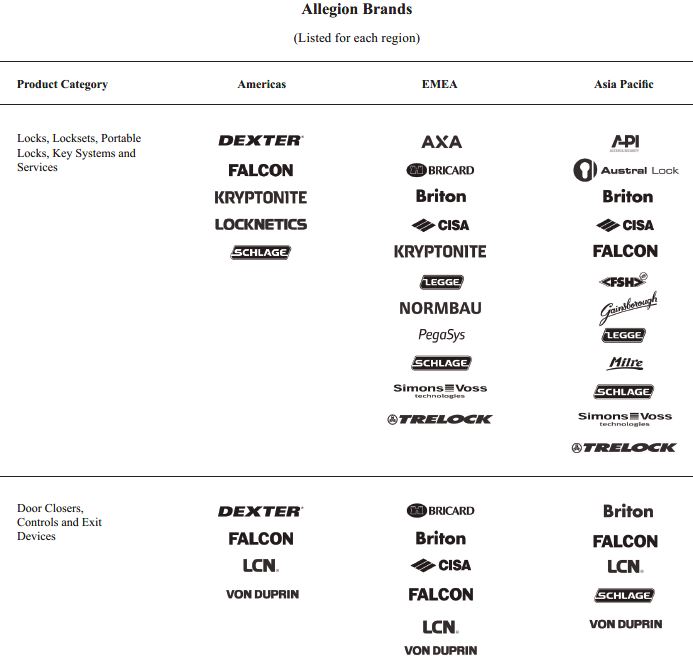

We operate in three geographic regions: Americas; Europe, Middle East and Africa ("EMEA"); and Asia Pacific. We sell our products and solutions under the following brands:

4

5

We sell a wide range of security and access control solutions for end-users in commercial, institutional and residential facilities worldwide, including the education, healthcare, government, hospitality, commercial office and single and multi-family residential markets. Our leading brands include CISA®, Interflex®, LCN®, Schlage®, SimonsVoss® and Von Duprin®. We believe LCN, Schlage and Von Duprin hold the No. 1 position in their primary product categories in North America while CISA, Interflex and SimonsVoss hold the No. 1 or No. 2 position in their primary product categories in certain European markets.

6

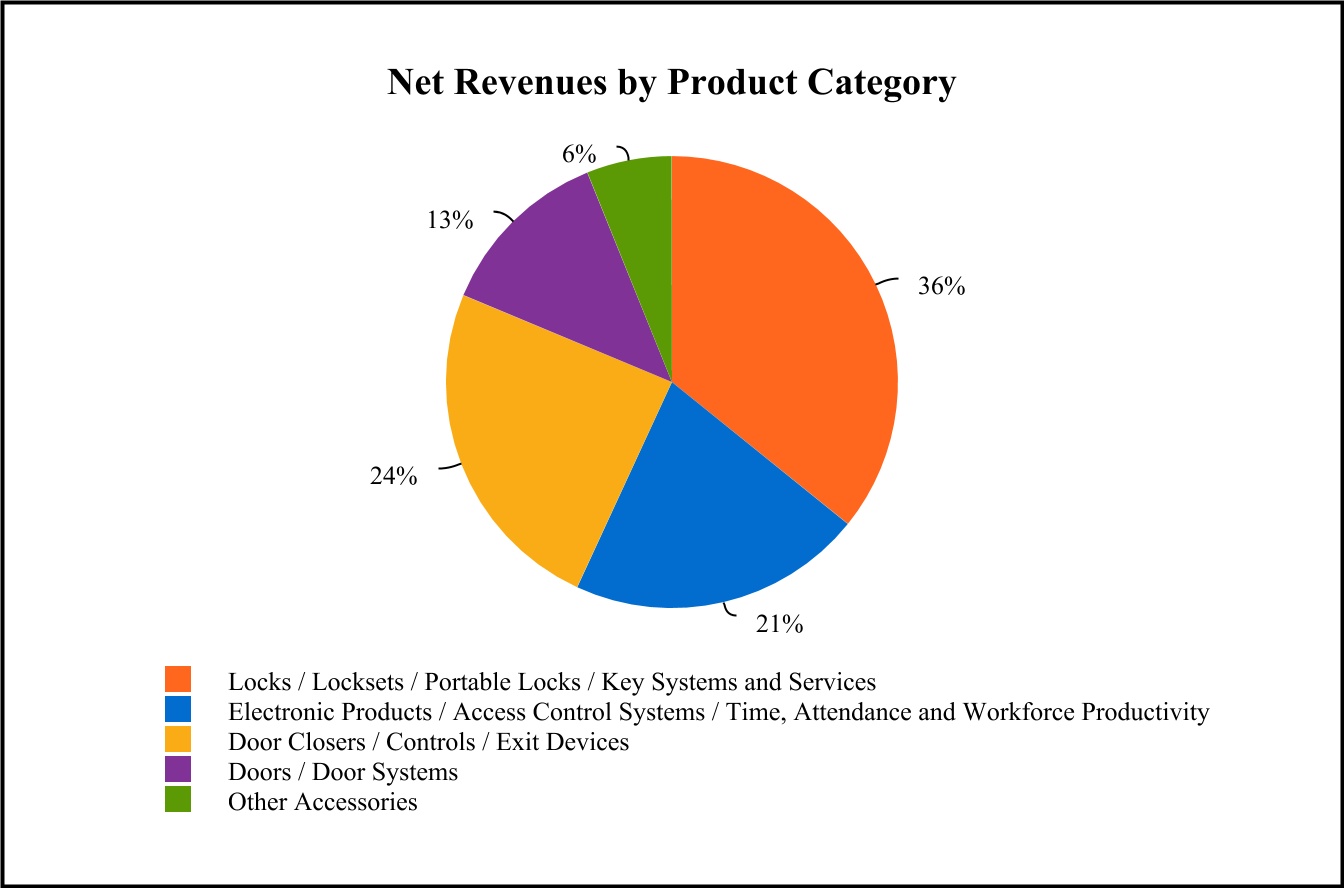

During the year ended December 31, 2020, we generated Net revenues of $2,719.9 million and Operating income of $403.5 million.

History and Developments

We were incorporated in Ireland on May 9, 2013, to hold the commercial and residential security businesses of what was then Ingersoll Rand plc ("Ingersoll Rand"). On December 1, 2013, we became a stand-alone public company after Ingersoll Rand completed the separation of these businesses from the rest of Ingersoll Rand via the transfer of these businesses from Ingersoll Rand to us and the issuance by us of ordinary shares directly to Ingersoll Rand’s shareholders (the "Spin-off"). Our security businesses have long and distinguished operating histories. Several of our brands were established more than 100 years ago, and many originally created their categories:

•Von Duprin, established in 1908, was awarded the first exit device patent;

•Schlage, established in 1920, was awarded the first patents granted for the cylindrical lock and the push button lock;

•LCN, established in 1926, created the first door closer;

•CISA, established in 1926, devised the first electronically controlled lock; and

•SimonsVoss, established in 1995, created the first keyless digital transponder.

We have built upon these founding legacies since our entry into the security products market through the acquisition of Schlage, Von Duprin and LCN in 1974. Today, we continue to develop and introduce innovative and market-leading products. For example, in 2018, we announced the formation of Allegion Ventures, a corporate venture fund that invests in and helps accelerate the growth of companies that have innovative technologies and products such as touchless access and workspace monitoring solutions that complement our core business solutions. Since its formation, Allegion Ventures has invested nearly $15 million in several early-stage companies that share our pioneering vision and seek to find smart and innovative solutions that help keep people and assets safe and secure in the places where they reside, work and thrive.

Recent examples of successful product launches by Allegion are illustrated in the table below:

7

| Product | Brands | Year | Innovation | |||||||||||||||||

| Residential Locks, Cylinders and Levers | Schlage, Gainsborough, CISA | 2018/2019/ 2020 | Next-generation Schlage smart locks include the first WiFi enabled deadbolt to work with Key by Amazon and Ring devices with built-in connectivity (Schlage Encode); Z-wave smart deadbolt and Zigbee-certified model compatible with Amazon Key and Ring devices (Schlage Connect); fire-rated smart lock for Australia and New Zealand paired with a mobile app (Schlage Omnia Breeze) for convenient access and security that meets current fire and accessibility requirements. Next generation Gainsborough Freestyle Trilock features three-in-one functionality: passage, privacy or dead lock mode; and can be operated using the built-in keypad, a key override or through the mobile app. In conjunction with the optional WiFi bridge, the lock can be programmed and operated from anywhere in the world. First CISA motorized lock solution for high security connected smart doors (Domo Connexa), manageable in proximity and remotely using a mobile app. | |||||||||||||||||

| Commercial Locks, Cylinders, Levers and Electronic Access Platforms | Schlage, SimonsVoss, CISA | 2018/2019/ 2020 | Enhancements to our comprehensive portfolio of globally available mechanical, wired electrified and wireless electronic solutions provide a common aesthetic and consistent user experience throughout a building; firmware releases added functionality and USB communication mode for readers (Schlage). Mobile-enabled versions of locks, readers and controllers (Schlage NDE, LE, MTB and CTE), mobile credentials, Bluetooth Low Energy and RFID technology and integrations between electronic locks and exit devices (Schlage, CISA). SimonsVoss offers new option for wireless online connections to a virtual network (SmartHandle AX, SmartIntego) and a retrofit, no-drill locking option for lockers and furniture in schools, hospitals and industry facilities that integrates into the existing SimonsVoss digital eco-system for offline and online access (SmartLocker). Expanded radio network technology to include European frequency band 868MHz and 920MHz technology. Mortice self-locking system with a mono-point motorized lock variant (CISA) and new platformed, modular replacement of cylindrical locks (Schlage ALX). | |||||||||||||||||

| Exit Devices and Closers | Von Duprin, Falcon, LCN, CISA | 2018/2019/2020 | Award-winning and cost-effective retrofit exit device that allows for remote undogging and monitoring with partner software (Von Duprin); new fire-rated retrofit series (Falcon); and quiet exit solutions (Von Duprin). Range of touchless solutions, including automatic operators, actuators and wireless transmitters (LCN) and a range of asymmetric rack-and-pinion door closers and an entry-level, high-efficiency option (CISA). | |||||||||||||||||

| Doors and Door Systems | TGP, AD Systems | 2019 | First to the market surface mounted, top-hung single-leaf, sliding flush wood doors that achieve a 45-minute UL 10B fire rating (FireSlide). Fire-rated and impact safety-rated glass doors with a heat resistive perimeter frame, which features nearly colorless transitions between adjoining pieces of low-iron glass, eliminating the need for colored internal glass unit spacers or vertical frame mullions (Fireframes ClearView). | |||||||||||||||||

| Bike Lighting and Portable Locking Solutions | AXA, Kryptonite, Trelock | 2018/2019 | Innovation in bike safety including rechargeable lights and expanded lines of folding locks from each of our Global Portable Security brands (AXA, Kryptonite, Trelock); and ergonomic cable and chain locks and expanded track-and-trace services (AXA). | |||||||||||||||||

| Software, Mobile and Web Applications | Allegion (Overtur, ENGAGE), Schlage, Gainsborough, Interflex, ISONAS | 2018/2019/2020 | Cloud-based suite of tools for project teams to collaborate on specifications and the security design of doors and openings (Overtur). Multiple enhancements to the user experience include simplified account and site set-up and gateway site survey (ENGAGE) and mobile apps for iOS and Android phones (Schlage, CISA, Gainsborough) to lock, unlock, issue mobile keys and status check. Schlage Mobile Student ID allows university students, faculty and staff to add student ID cards to their Apple Wallet or Google Pay for door access, payments, attendance tracking and ticketing. Visitor management modules and managed service featuring a cloud-based solution of time recording (Interflex); cloud-hosted access control platform with real time events, alerting and user-initiated door control (ISONAS). | |||||||||||||||||

8

Industry and Competition

The global markets we serve encompass institutional, commercial and residential construction and remodeling markets throughout North America, EMEA and Asia Pacific. As end-users continue to adopt newer technologies, including IoT, in their facilities and single and multi-family homes, growth in electronic security products and solutions is expected to outperform growth in mechanical security products and solutions. We also expect the security products industry will continue to benefit from favorable trends such as increased concerns about safety and security, new attention on touchless solutions that help promote a healthy environment and technology-driven innovation that enables seamless access and a better user experience as people and assets traverse multiple locations and facilities.

The security products markets are highly competitive and fragmented throughout the world, with a number of large multi-national companies and thousands of smaller regional and local companies. This high fragmentation primarily reflects local regulatory requirements and highly variable end-user needs. We believe our principal global competitors are Assa Abloy AB and dormakaba Group. We also face competition in various markets and product categories throughout the world, including from Spectrum Brands Holdings, Inc. in the North American residential market. As we move into more technologically advanced product categories, we may also compete against new, more specialized competitors.

Our success depends on a variety of factors, including brand and reputation, product breadth, innovation, integration with popular technology platforms, quality and delivery capabilities, price and service capabilities. As many of our businesses sell through wholesale distribution, our success also depends on building and partnering with a strong channel network. Although price often serves as an important customer decision point, we also compete based on the breadth, innovation and quality of our products and solutions, our ability to custom-configure solutions to meet individual end-user requirements and our global supply chain.

Products and Services

We offer an extensive and versatile portfolio of mechanical and electronic security products and solutions across a range of market-leading brands:

•Locks, locksets, portable locks and key systems and services: A broad array of cylindrical and mortise door locksets, security levers and master key systems that are used to protect and control access and a range of portable security products, including bicycle, small vehicle and travel locks. We also offer locksmith services in select locations;

•Door closers, controls and exit devices: An extensive portfolio of life-safety products and solutions generally installed on fire doors and facility entrances and exits. Door controls include both mechanical door closers and automatic door operators. Exit devices, also known as panic hardware, provide rapid egress to allow building occupants to exit safely in an emergency;

•Electronic security products and access control systems: A broad range of electrified locks, access control systems, key card and reader systems and accessories, including IoT, Bluetooth Low Energy (BLE), Power over Ethernet and cloud-based solutions;

•Time, attendance and workforce productivity systems: Products and services designed to help business customers manage and monitor workforce access control parameters, attendance and employee scheduling. We also offer ongoing aftermarket services in addition to design and installation offerings;

•Doors and door systems: A portfolio of hollow metal, glass and specialty doors and door systems; and

•Other accessories: A variety of additional security and product components, including hinges, door pulls, door stops, bike lights, louvers, weather stripping, thresholds and other accessories, as well as certain bathroom fittings and accessibility aids.

Customers

We sell most of our products and solutions through distribution and retail channels, including specialty distribution, e-commerce and wholesalers. We have built a network of channel partners that help our customers choose the right solution to meet their security needs and help commercial and institutional end-users fulfill and install orders. We also sell through a variety of retail channels, including large do-it-yourself home improvement centers, multiple online and e-commerce platforms, as well as small, specialty showroom outlets. We work with our retail partners on developing marketing and merchandising strategies to maximize their sales per square foot of shelf space. Through our Interflex and API Locksmiths businesses and Global Portable Security brands, we also provide products and services directly to end-users.

Our 10 largest customers represented approximately 24% of our total Net revenues in 2020. No single customer represented 10% or more of our total Net revenues in 2020.

9

Sales and Marketing

In markets where we sell through commercial and institutional distribution channels, we employ sales professionals around the world who work with a combination of end-users, security professionals, architects, contractors, engineers and distribution partners to develop specific, custom-configured solutions for our end-users’ needs. Our field sales professionals are assisted by specification writers who work with architects, engineers and consultants to help design door openings and security systems to meet end-users’ functional, aesthetic and regulatory requirements. Both groups are supported by dedicated customer care and technical sales-support specialists worldwide. We also support our sales efforts with a variety of marketing efforts, including trade-specific advertising, cooperative distributor merchandising, digital marketing and marketing at a variety of industry trade shows.

In markets in which we sell through retail and home-builder distribution channels, we have teams of sales, merchandising and marketing professionals who help drive brand and product awareness through our channel partners and to consumers. We utilize a variety of advertising and marketing strategies, including traditional consumer media, retail merchandising, digital marketing, retail promotions and builder and consumer trade shows, to support these teams.

We also work actively with several industry bodies around the world to help promote effective and consistent safety and security standards. For example, we are members of Builders Hardware Manufacturers Association (BHMA), Construction Specification Institute, Door and Hardware Institute (DHI), FiRa Consortium, Internet of Things Consortium (IoTC), Physical Security Interoperability Alliance (PSIA), Security Industry Association, Security Technology Alliance, ASSOFERMA (Italy), BHE (Germany) and UNIQ (France).

Production and Distribution

We manufacture our products in our geographic markets around the world. We operate 30 principal production and assembly facilities – 15 in Americas, 9 in EMEA and 6 in Asia Pacific. We own 16 of these facilities and lease the others. Our strategy is to produce in the region of use, wherever appropriate, to allow us to be closer to the end-user and increase efficiency and timely product delivery. Much of our U.S. based residential portfolio is manufactured in the Baja region of Mexico under the Maquiladora, Manufacturing and Export Services Industry ("IMMEX") program (formerly known as the maquiladora program). In managing our network of production and assembly facilities, we focus on continuous improvement in customer experience, employee health and safety, productivity, resource utilization and operational excellence.

We distribute our products through a broad network of channel partners. In addition, third-party manufacturing and logistics providers perform certain manufacturing, storage and distribution services for us to support certain parts of our manufacturing and distribution network.

Raw Materials

We support our region-of-use production strategy with corresponding region-of-use supplier partners, where available. Our global and regional commodity teams work with production leadership, product management and materials management teams to ensure adequate materials are available for production.

We purchase a wide range of raw materials, including steel, zinc, brass and other non-ferrous metals, to support our production facilities. Where appropriate, we may enter into fixed-cost contracts to lower overall costs.

Intellectual Property

Intellectual property, inclusive of certain patents, trademarks, copyrights, know-how, trade secrets and other proprietary rights, is important to our business. We create, protect and enforce our intellectual property investments in a variety of ways. We work actively in the U.S. and internationally to try to ensure the protection and enforcement of our intellectual property rights. We use trademarks on nearly all of our products and believe such distinctive marks are an important factor in creating a market for our goods, in identifying us and in distinguishing our products from others. We consider our CISA, Interflex, LCN, Schlage, SimonsVoss, Von Duprin and other associated trademarks to be among our most valuable assets, and we have registered these trademarks in a number of countries. Although certain proprietary intellectual property rights are important to our success, we do not believe we are materially dependent on any particular patent or license, or any particular group of patents or licenses.

10

Facilities

We operate through a broad network of sales offices, engineering centers, 30 principal production and assembly facilities and several distribution centers throughout the world. Our active properties represent approximately 6.3 million square feet, of which approximately 37% is leased. The following table shows the location of our principal worldwide production and assembly facilities:

| Production and Assembly Facilities | ||||||||||||||

| Americas | EMEA | Asia Pacific | ||||||||||||

| Blue Ash, Ohio | Clamecy, France | Auckland, New Zealand | ||||||||||||

| Boulder, Colorado | Durchhausen, Germany | Brooklyn, Australia | ||||||||||||

| Chino, California | Faenza, Italy | Bucheon, South Korea | ||||||||||||

| Ensenada, Mexico | Feuquieres, France | Jinshan, China | ||||||||||||

| Everett, Washington | Monsampolo, Italy | Melbourne, Australia | ||||||||||||

| Indianapolis, Indiana | Osterfeld, Germany | Sydney, Australia | ||||||||||||

| Irving, Texas | Renchen, Germany | |||||||||||||

| McKenzie, Tennessee | Veenendaal, Netherlands | |||||||||||||

| Mississauga, Ontario | Zawiercie, Poland | |||||||||||||

| Perrysburg, Ohio | ||||||||||||||

| Princeton, Illinois | ||||||||||||||

| Security, Colorado | ||||||||||||||

| Snoqualmie, Washington | ||||||||||||||

| Tecate, Mexico | ||||||||||||||

| Tijuana, Mexico | ||||||||||||||

Research and Development

We are committed to investing in our research and development capabilities with a focus on technology innovations that will deliver growth through the introduction of new products and solutions. In addition, we invest in initiatives that continuously drive improvements in product cost, quality, safety and sustainability.

Our research and development team is managed as a global, collaborative group to identify and develop new technologies and worldwide product platforms. We organize our resources regionally to leverage expertise in local standards and configurations for the benefit of our customers. Further, we operate a global technology center in Bangalore, India, which augments and supports the regional engineering teams.

Seasonality

Our business experiences seasonality that varies by product line. Because more construction and do-it-yourself projects occur during the second and third calendar quarters of each year in the Northern Hemisphere, our security product sales related to those projects are typically higher in those quarters than in the first and fourth calendar quarters. However, certain other businesses typically experience higher sales in the fourth calendar quarter due to project timing. In 2020, we experienced lower sales volumes during the second quarter, principally due to the economic challenges stemming from the COVID-19 pandemic, which were most pronounced during this quarter. This is not anticipated to be a long-term trend in the seasonality of our businesses. Net revenues by quarter for the years ended December 31, 2020, 2019 and 2018, were as follows:

| First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||||||||||||||||||||

| 2020 | 25% | 21% | 27% | 27% | ||||||||||||||||||||||

| 2019 | 23% | 26% | 26% | 25% | ||||||||||||||||||||||

| 2018 | 22% | 26% | 26% | 26% | ||||||||||||||||||||||

11

Human Capital

The Company’s human capital strategy is foundational to achieving our business strategy and the responsibility of our Senior Vice President – Human Resources and Communications. To ensure we attract and retain top talent, we strive for a diverse and inclusive culture that rewards performance, provides growth and development opportunities and supports employees and their families through competitive compensation, benefits and numerous volunteer and charitable giving opportunities.

As of December 31, 2020, we had approximately 11,500 employees around the world, the vast majority working full time. Our employee base is supplemented by contingent labor where demand fluctuates or we experience short-term needs for specialized skills.

Compensation and Benefits

Compensation and benefit programs are tailored to be competitive in the geographies where we work, including the total package (which varies by country/region) that includes hourly and salaried compensation, performance incentive and equity plans, retirement, insurance and government social welfare programs, disability and family leave, education benefits to pursue degrees and certifications and additional offerings to support financial stability and personal planning. Health and wellness programs are provided globally and contribute to a productive, sustainable workforce by empowering our employees to take personal responsibility for their health, safety and well-being. In addition, we maintain tobacco-free facilities and pursue strategies to incentivize healthy behaviors and outcome-driven rewards. Pay for performance strategies consider not only accomplishments, but how individuals achieve results. The Allegion Leadership Behaviors – be a pioneer, break boundaries, coach, champion change, be courageous and inspire – are used to identify key talent and to train and develop aspiring leaders. They also work in concert with our performance management system to reinforce our values and code of conduct in assessing how people lead and deliver top performance.

Talent Attraction

Talent attraction efforts begin well before people walk in our doors. Around the world, our sites partner with schools and support teachers, providing mentoring, grants, scholarships, internships, co-op programs, classroom technology and on-site activities. Our sites also sponsor science, technology, engineering and math ("STEM") programs and competitions such as robotics and engineering competitions. These programs expose students to careers in manufacturing and technology and provide educators with programming to encourage academic excellence and social development.

Key capabilities have been identified for our long-term corporate business strategy: talent, customer focus, innovation, partnering, pace and agility and collaboration. In recruiting for open positions, we participate in community job fairs and outreach to secondary schools, technical training programs, colleges and universities; promote open positions through internal and external recruiters, on websites and through social media; and encourage Company employees to refer talent.

Talent Development and Succession Planning

Talent development and succession planning at all levels of the organization are instrumental in ensuring we have the key capabilities to deliver the value proposition expected by our customers and employees. Inclusive succession planning is supported through the Allegion Leadership Behaviors, individual career mapping, assessment of performance and talent pipeline planning up to and including the Chief Executive Officer ("CEO"). On a quarterly basis, the executive team reviews talent development, focusing on developing a diverse succession bench, as part of their quarterly business review and a key component of the Allegion Operating System, our system of annual operation to support governance, reporting processes and management of the business. These cross-functional reviews highlight individuals who are ready for new opportunities, individuals who are on a special assignment or project and individuals early in their career that demonstrate emerging leadership skills.

Learning and Development

Opportunities for on-going learning and development are delivered to employees through structured coursework, on-site and expert-led training and experiential, applied development. The Allegion Academy is offered globally, supporting multiple languages and providing more than 17,000 self-guided online courses, as well as community channels on targeted skills and inclusion and diversity. We offer programs to provide successive levels of development, including reskilling and upskilling existing employees, as well as strengths-based leadership curriculum. Enterprise excellence initiatives and sprint teams expand skills in lean manufacturing and quality principles and lead to redesigning workflow to boost productivity and reduce waste.

12

Employee-led resource and affinity groups provide enrichment opportunities for women’s leadership, early-career professionals, creativity and innovation, health and fitness, community volunteering and philanthropy.

Engagement, Inclusion and Diversity

A commitment to engagement, inclusion and diversity is core to the Allegion Operating System. Engagement surveys provide team leaders with insights on potential areas of focus and help them prioritize and take action on their teams’ foundational, inclusion, growth and development needs. Strengths-based leadership is an element of our commitment to inclusion: the more employees understand their own strengths, the better equipped they are to add value and appreciate the contributions of diverse members of their teams.

Inclusion and diversity are topics for learning communities, employee roundtables and ongoing, regular analysis and dialogue among our people leaders, executive leadership and our Board of Directors. We believe in fundamental standards that support our employees, including a commitment to building and maintaining diverse and inclusive workplaces, safe and healthy practices and competitive wages and benefits. We embrace all differences and similarities among colleagues and within the relationships we foster with customers, suppliers and the communities where we live and work. Whatever background, experience, race, color, national origin, religion, age, gender, gender identity, disability status, sexual orientation, protected veteran status or any other characteristic protected by law, we make sure that potential and current employees have every opportunity for application and the opportunity to give their best at work because it’s the right thing to do.

We are dedicated to fulfilling equal opportunity commitments in all decisions regarding all employment actions and at all levels of employment. In partnership with the Company’s Human Resources organization, the Company’s Equal Employment Opportunity Officer ensures that the applicable policy and procedures are appropriately established, implemented and disseminated, including those prohibiting discrimination, harassment, bullying and/or retaliation.

Civic Involvement

Civic involvement is part of the value proposition we offer employees and supports inclusion, diversity, growth and development. The Company and its employees provide multi-faceted support for our communities, guided by three philanthropic pillars: safety and security; wellness; and addressing the unique needs of the communities where we work, live and thrive. Corporate sponsorships and voluntary employee payroll deductions support a wide range of non-profits, including those that address housing and school security and safety; children and youth programs; education and scholarships for people of color and those who are economically disadvantaged and support for Historically Black Colleges and Universities; community safety nets for basic needs (e.g., food, shelter, transportation) for underserved people and to break the cycle of poverty; wellness, mental health, health research, emergency relief and blood supply initiatives; and programs to advance equality, justice and address systemic bias. In addition to corporate sponsorships, site leaders and employees are encouraged to organize local volunteer and fundraising activities, provide grants to local organizations and serve on boards and committees. Recognizing the growing number of people facing food insecurity in the wake of the COVID-19 pandemic, we supplemented on-going food drives at local sites with a one-time $500,000 gift to support communities in need in the fourth quarter of 2020.

Respect for Human Rights

Our respect for human rights is expressed in standards for our employees, our business partners, our customers and our communities. We have adopted and continue to uphold our Global Human Rights Policy, with standards that align with basic working conditions and human rights concepts advanced by international organizations such as the International Labor Organization and the United Nations. This policy also represents our own minimum standards for working conditions and human rights in our business and supply chains. In addition, we conduct risk assessments and continue to have conversations with the suppliers and companies we work with about the importance of human rights.

Employee Health and Safety

Employee health and safety are top priorities, and we consistently rank as the safest among leading competitors on core measures such as the total recordable incident rate. ‘Be safe, be healthy’ is a core organizational value in our proactive safety culture and has guided our response to the COVID-19 pandemic throughout 2020. We have adopted numerous health and safety measures in accordance with best-practice safe hygiene guidelines issued by recognized health experts like the U.S. Centers for Disease Control and Prevention (“CDC”), the European Centre for Disease Prevention and Control (“ECDC”) and the World Health Organization (“WHO”), as well as any applicable government mandates. These health and safety measures include, but are not limited to:

13

•Work-from-home arrangements for employees, where possible;

•Continuous safe hygiene education in accordance with evolving guidelines;

•Regular communication updates to leadership and team members;

•Aggressive and regular deep cleaning and disinfecting schedules;

•Social distancing measures, such as signage and physical barriers or reconfigurations of workspaces;

•Reduced density measures, such as staggering work shifts and breaks;

•Mask use requirements and expectations at our facilities;

•Temperature and health screenings prior to entering facilities;

•Increased available supplies for employees, like masks, cleaning solutions, hand sanitizers, thermometers and gloves; and

•Temporary travel, visitor and in-person meeting restrictions.

Senior executives and the CEO have responsibility for risk management, employee accountability and safety hazard recognition and take a personal responsibility toward executing on safety initiatives. The Company monitors leading and lagging indicators related to health and safety as part of its ongoing management of the Allegion Operating System and regularly updates the Corporate Governance and Nominating Committee of the Board of Directors on key accomplishments and employee health and safety topics.

Regulatory Matters

We are subject to a variety of federal, state and local laws and regulations, both within and outside the U.S., relating to environmental, health and safety concerns. We are committed to conducting our business in a safe, environmentally responsible and sustainable manner, in compliance with all applicable environmental, health and safety laws and regulations, and in a manner that helps promote and protect the health and safety of our environment, associates, customers, contractors and members of our local communities worldwide. We operate with principles that support our proactive commitments, including:

•Integrating sound, environmental, health, safety (EHS) and sustainability strategies in all elements of our business functions, including objectives and measurements;

•Conducting periodic, formal evaluation of our compliance status and annual review of objectives and targets;

•Creating a workplace culture where all employees are responsible for safety;

•Making continuous improvements in EHS and sustainability management systems and performance, including the reduction in the usage of natural resources, waste minimization, prevention of pollution and prevention of workplace accidents, injuries and risks;

•Designing, operating and maintaining our facilities in a manner that minimizes negative EHS and sustainability impacts;

•Using materials responsibly, including, where feasible, the recycling and reuse of materials; and

•Acting in a way that shows sensitivity to community concerns about EHS and sustainability issues.

We recognize that these principles are critical to our future success. We have a dedicated environmental program designed to reduce the utilization and generation of hazardous materials during the manufacturing process and to remediate any identified environmental concerns. As to the latter, we are currently engaged in site investigations and remediation activities to address environmental cleanup from past operations at current and former production facilities. We also regularly evaluate our remediation methods that are in addition to, or in replacement of, those we currently utilize based upon enhanced technology and regulatory changes. We are sometimes a party to environmental lawsuits and claims and have, from time to time, received notices of potential violations of environmental laws and regulations from the U.S. Environmental Protection Agency (the "EPA") and similar state authorities. We have also been identified as a potentially responsible party ("PRP") for cleanup costs associated with off-site waste disposal at federal Superfund and state remediation sites. For all such sites, there are other PRPs and, in most instances, our involvement is minimal.

In estimating our liability, we have assumed that we will not bear the entire cost of remediation of any site to the exclusion of other PRPs who may be jointly and severally liable. The ability of other PRPs to participate has been taken into account, based on our understanding of the parties’ financial condition and probable contributions on a per site basis. Additional lawsuits and claims involving environmental matters are likely to arise from time to time in the future. For a further discussion of our potential environmental liabilities, see Note 21 to the Consolidated Financial Statements.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934. The SEC maintains an Internet website that contains reports, proxy and information

14

statements and other information regarding issuers that file electronically with the SEC. The public can obtain any documents that are filed by us at www.sec.gov.

In addition, the Company's Annual Report on Form 10-K, as well as future quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to all of the foregoing reports, are made available free of charge on our Internet website (https://www.allegion.com) as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The contents of our website are not incorporated by reference in this report.

15

Item 1A. RISK FACTORS

We discuss our expectations regarding future performance, events and outcomes in this Form 10-K, quarterly and annual reports, press releases and other written and oral communications. All statements except for historical and present factual information are “forward-looking statements” and are based on financial data and business plans available only as of the time the statements are made, which may become outdated or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could significantly differ from our expectations. You should carefully consider the risk factors discussed below, together with all the other information included in this Form 10-K, in evaluating us, our ordinary shares and our senior notes. If any of the risks below actually occurs, our business, financial condition, results of operations and cash flows could be materially and adversely affected. Any such adverse effect may cause the trading price of our ordinary shares to decline, and as a result, you could lose all or part of your investment in us. Our business may also be adversely affected by risks and uncertainties not known to us or risks that we currently believe to be immaterial. We assume no obligation to update any forward-looking statements as a result of new information, future events or other factors.

Strategic and Operational Risks

Our normal business operations have been, and are expected to continue to be, adversely impacted by the global COVID-19 pandemic.

The COVID-19 outbreak, which was declared by the WHO as a pandemic in March 2020, and preventative measures taken to contain or mitigate this pandemic have caused, and are continuing to cause, business slowdowns or shutdowns in various regions around the world. This pandemic has also caused, and may continue to cause, disruption to our global supply chain and business operations, in addition to the various effects noted elsewhere within the risk factors contained in this Annual Report on Form 10-K. Actions taken to help limit the spread of COVID-19, such as general public health decrees or other government mandates to restrict business activities and travel, avoid large gatherings or to self-quarantine, have impacted and will likely continue to impact our ability to carry out business as usual, including the temporary suspension of some of our operations, shortages in materials, reduction in customer demand, increased absenteeism, costs associated with operational changes and an extended period of remote work arrangements for some of our employees which could increase cybersecurity risks and other operational risks. Conversely, as governments ease their restrictions and social interactions increase prior to the development and distribution of an effective vaccine or treatments for COVID-19, preventative and precautionary measures may not be sufficient to mitigate the risk of increased infection and could result in increased illness among our employees, business partners and others, and lead to further business interruption. In addition, a significant number of our customers, suppliers, vendors and other business partners have been adversely affected by the COVID-19 pandemic. While we cannot predict the impact that this pandemic will continue to have on our customers, suppliers, vendors and other business partners and each of their financial conditions, any material adverse effects on these parties could adversely impact us.

The global economic uncertainty due to this pandemic has also negatively impacted, and may continue to adversely affect, our results of operations and financial condition. For example, this pandemic has led to changes in commercial real estate occupancy, increases in work-from-home arrangements, constraints on government and institutional budgets and an uncertain business climate, which have all contributed to declines and delays in new construction and renovation activity during 2020, including in many of the commercial and institutional construction markets we serve. These challenges may be significant and continue beyond the COVID-19 pandemic, and the rate and sustainability of future growth remains uncertain, as the long-term impacts of the pandemic and related market disruption are not yet known.

Additionally, as a result of the global economic disruption and uncertainty due to the COVID-19 pandemic, interim impairment tests were performed on select goodwill and indefinite-lived trade name assets in the first quarter of 2020, resulting in impairment charges of approximately $96.3 million. If the on-going economic impact of the COVID-19 pandemic proves to be more severe than estimated, the economic recovery takes longer to materialize or does not materialize as strongly as anticipated, this could result in further impairment charges in the future.

Despite our efforts to manage and mitigate these impacts to the Company, their ultimate impact also depends on factors beyond our knowledge or control, including the duration and severity of this pandemic, third-party actions taken to contain its spread and mitigate its public health effects, the development, distribution and acceptance of an effective vaccine and the pace of global economic recovery following containment of the spread. The impact of the COVID-19 pandemic continues to evolve, and its ultimate impact on our business is highly uncertain and difficult to predict. The continued spread of COVID-19 may have further adverse impacts on our business, operations, customer demand, supply chain, cash flow generation, financial position and liquidity and may also exacerbate other risks and uncertainties described in this Annual Report on Form 10-K. Further, our management is focused on mitigating the impacts of COVID-19 which has required, and will continue to require, a large investment of time and resources, which may divert attention and resources from other business matters.

16

Increased competition, including from technological developments, could adversely affect our business.

The markets in which we operate include a large number of participants, including multi-national, regional and small, local companies. We primarily compete on the basis of quality, innovation, expertise, effective channels to market, breadth of product offering and price. We may be unable to effectively compete on all these bases. Further, in a number of our product offerings, we compete with our retail customers and technology partners who use their own private labels. If we are unable to anticipate evolving trends in the market or the timing and scale of our competitors’ activities and initiatives, including increased competition from private label brands, the demand for our products and services could be negatively impacted.

In addition, we compete in an industry that is experiencing the convergence of mechanical, electronic and digital products. Technology and innovation play significant roles in the competitive landscape. Our success depends, in part, upon the research, development and implementation of new technologies and products including obtaining, maintaining and enforcing necessary intellectual property protections. Securing and maintaining key partnerships and alliances, recruiting and retaining highly skilled and qualified employee talent and having access to technologies, services, intellectual property and solutions developed by others will play a significant role in our ability to effectively compete. The continual development of new technologies by existing and new competitors, including non-traditional competitors with significant resources, could adversely affect our ability to sustain operating margins and desirable levels of sales volumes. To remain competitive, we must develop new products and respond to new technologies in a timely manner.

Our growth is dependent, in part, on the development, commercialization and acceptance of new products and services.

We must develop and commercialize new products and services that meet the varied and evolving needs of our customers and end-users in order to remain competitive in our current and future markets and in order to continue to grow our business. The speed of development by our competitors and new market entrants is increasing. We cannot provide any assurance that any new product or service will be successfully commercialized in a timely manner, if ever, or, if commercialized, will result in returns greater than our investment. Investment in a product or service could divert our attention and resources from other projects that become more commercially viable in the market. We also cannot provide any assurance that any new product or service will be accepted by the market.

Changes in customer and consumer preferences and the inability to maintain beneficial relationships with large customers could adversely affect our business.

We have significant customers, particularly major retailers, although no one customer represented 10% or more of our total Net revenues in any of the past three fiscal years. The loss or material reduction of business, the lack of success of sales initiatives or changes in customer preferences or loyalties for our products related to any such significant customer could have a material adverse impact on our business. In addition, major customers who are volume purchasers are much larger than us and have strong bargaining power with suppliers. This limits our ability to recover cost increases through higher selling prices. Furthermore, unanticipated inventory adjustments by these customers can have a negative impact on sales.

We also sell our products through various trade channels, including traditional retail and e-commerce channels. If we or our major customers are not successful in navigating the shifting consumer preferences to distribution channels such as e-commerce, our expected future revenues may be negatively impacted.

If our products or solutions fail to meet certification and specification requirements, are defective, or otherwise fall short of end-users' needs and expectations, our business may be negatively impacted.

The security and access control product markets we serve often have unique certification and specification requirements, reflecting local regulatory requirements and highly variable end-user needs. While we strive to meet all certification and specification requirements, if any of our products or solutions do not meet such requirements, or contain, or are perceived to contain, defects or otherwise fall short of end-users' needs and expectations, we may incur significant costs and our business, results of operations or financial condition may be negatively impacted.

Additionally, as end-users have continued to adopt newer technologies in their facilities and homes, accelerated by the increasing adoption of IoT technologies, growth in sales of electronic security products and solutions are expected to outperform growth in sales of mechanical security products. Electronic security products and solutions are increasingly more sophisticated and technologically complex than the mechanical security products we sell, and have an increased risk of design or manufacturing defects, which could lead to product liability claims, recalls, product replacements or modifications, write-offs

17

of inventory or other assets and significant warranty and other expenses. Product quality issues can also adversely affect the end-user experience, resulting in reputational harm, loss of competitive advantage, poor market acceptance, reduced demand for products and solutions, delay in new product and service introductions and lost sales. Further, adverse publicity, whether or not justified, or allegations of product or service quality issues, even if false or unfounded, could damage our reputation and negatively affect our sales.

Our business and innovation strategies include making acquisitions of, and investments in, external companies. These acquisitions and investments could be unsuccessful or consume significant resources, which could adversely affect our operating and financial results.

We will continue to analyze and evaluate the acquisition of strategic businesses or product lines with the potential to strengthen our industry position or enhance our existing set of products and services offerings. We cannot provide assurance that we will identify or successfully complete acquisitions with suitable candidates in the future, nor can we provide assurance that completed acquisitions will be successful, including efficient integration and creation of synergies.

Some of the businesses we may seek to acquire may be marginally profitable or unprofitable. For these businesses to achieve acceptable levels of profitability, we must improve their management, operations, products and market penetration. We may not be successful in this regard, and we may encounter other difficulties in integrating acquired businesses into our existing operations.

Acquisitions may involve significant cash expenditures, debt incurrence, operating losses and expenses. Acquisitions also involve numerous other risks, including:

•Diversion of management's time and attention from daily operations;

•Difficulties integrating acquired businesses, technologies and personnel into our business;

•Difficulties completing the transaction in a timely manner;

•Difficulties realizing synergies expected to result from acquisitions;

•Difficulties in obtaining and verifying the financial statements and other business information of acquired businesses;

•Inability to obtain regulatory approvals and/or required financing on favorable terms;

•Potential loss of key employees, key contractual relationships or key customers of acquired companies or of us;

•Difficulties competing in the new markets we enter;

•Assumption of the liabilities and exposure to unforeseen liabilities of acquired companies;

•Dilution of interests of holders of our ordinary shares through the issuance of equity securities or equity-linked securities; and

•Difficulty in integrating financial reporting systems and implementing controls, procedures and policies, including disclosure controls and procedures and internal control over financial reporting, appropriate for public companies of our size at companies that, prior to the acquisition, had lacked such controls, procedures and policies.

Further, as part of our innovation strategy, from time to time we invest in start-up companies and/or development stage technology or other companies. In evaluating these opportunities, we follow a structured evaluation process that considers factors such as potential financial returns, new expertise in emerging technology and business benefits. Despite our best efforts to calculate potential return and risk, some or all of these companies we invest in may be unprofitable at the time of, and subsequent to, our investment. We may lose money in these investments, including the potential for future impairment charges on the investments, and the anticipated benefits of the technology and business relationships may be less than expected.

We continually look to expand our services and products into new international markets, and as we do, we will have only limited experience in marketing and operating services and products in such markets. In some instances, we may rely on the efforts and abilities of third-party and foreign business partners in such markets. Certain international markets may be slower than our established markets in adopting our services and products, and our operations in such markets may not develop at a rate that supports our level of investment. In addition to the risks outlined above, expansion into certain new markets may require us to compete with local businesses with greater knowledge of the market, including the tastes and preferences of end-users and businesses with dominant market shares. Any acquisitions or investments may ultimately not be successful, may harm our business or financial condition and/or result in impairment charges.

We may pursue business opportunities that diverge from our core business.

We may pursue business opportunities that diverge from our core business, including expanding our products or service offerings, investing in new and unproven technologies and forming new alliances with companies to distribute our products and services. We can offer no assurance that any such business opportunities will prove successful. Among other negative effects,

18

our investment in new business opportunities may exceed the returns we realize. Additionally, any new investments could have higher cost structures than our current business, which could reduce operating margins and require more working capital. In the event that working capital requirements exceed operating cash flow, we may be required to draw on our revolving credit facility or pursue other external financing, which may not be readily available.

Our enterprise excellence efforts may not achieve the improvements we expect.

We utilize a number of tools to improve efficiency and productivity. Implementation of new processes to our operations could cause disruptions and may prove to be more difficult, costly or time consuming than expected. There is no assurance that all of our planned enterprise excellence projects will be fully implemented, or if implemented, will realize the expected improvements.

We may not be able to effectively manage and implement restructuring initiatives or other organizational changes.

We have, from time to time, restructured or made other adjustments to our workforce and manufacturing footprint in response to market or product changes, performance issues, changes in strategy, acquisitions and/or other internal and external considerations. For example, we recently announced that effective January 1, 2021, our EMEA and Asia Pacific operating segments would be combined to form the new Allegion International segment. These restructuring activities and other organizational changes often result in increased restructuring costs, diversion of management’s time and attention from daily operations and temporarily reduced productivity. If we are unable to successfully manage and implement these and other organizational changes, we may not achieve or sustain the expected growth or cost savings benefits of these activities or do so within the expected timeframe. These effects could recur in connection with future acquisitions and other organizational changes and our Net revenues and other results of operations could be negatively affected.

Disruptions in our global supply chain, including product manufacturing and logistical services provided by supplier partners, may negatively impact our business.

Our ability to meet our customers' needs and achieve cost targets depends on our ability to maintain key manufacturing and supply arrangements, including execution of supply chain optimizations and certain sole supplier or sole manufacturing arrangements. The loss or disruption of such manufacturing and supply arrangements could interrupt product supply and, if not effectively managed and remedied, have an adverse impact on our business.

We procure certain products, components and logistical services from supplier partners located throughout the world. Our reliance on these third parties reduces our control over the manufacturing and delivery process, exposing us to risks including reduced control over quality assurance, product costs, product supply and delivery delays. If we are unable to effectively manage these relationships, or if these third parties experience delays, disruptions, capacity constraints, regulatory issues or quality control problems in their operations or otherwise fail to meet our future requirements for timely delivery, our ability to ship and deliver certain of our products to our customers could be impaired and our business could be harmed.

The effects of global climate change or other unexpected events, including global health crises, may disrupt our operations and have a negative impact on our business.

The effects of global climate change, such as extreme weather conditions and natural disasters occurring more frequently or with more intense effects, or the occurrence of unexpected events including wildfires, tornadoes, hurricanes, earthquakes, floods, tsunamis and other severe hazards or global health crises, such as the outbreak of Ebola or the global COVID-19 pandemic, or other actual or threatened epidemic, pandemic, outbreak and spread of a communicable disease or virus, in the countries where we operate or sell products and provide services, could adversely affect our operations and financial performance. Extreme weather, natural disasters, power outages, global health crises or other unexpected events could disrupt our operations by impacting the availability and cost of materials needed for manufacturing, causing physical damage and partial or complete closure of our manufacturing sites or distribution centers, loss of human capital, temporary or long-term disruption in the manufacturing and supply of products and services and disruption in our ability to deliver products and services to customers. These events and disruptions could also adversely affect our customers’ and suppliers’ financial condition or ability to operate, resulting in reduced customer demand, delays in payments received or supply chain disruptions. Further, these events and disruptions could increase insurance and other operating costs, including impacting our decisions regarding construction of new facilities to select areas less prone to climate change risks and natural disasters, which could result in indirect financial risks passed through the supply chain or other price modifications to our products and services.

In particular, the ultimate extent of the impact of any epidemic, pandemic or other global health crisis on our business, financial condition and results of operations will depend on future developments which are highly uncertain and cannot be predicted,

19

including new information that may emerge concerning the duration and severity of such epidemic, pandemic or other global health crisis, actions taken to contain or prevent their further spread and the pace of global economic recovery following containment of the spread.

We may be subject to risks relating to our information technology and operational technology systems.

We rely extensively on information technology and operational technology systems, networks and services including hardware, software, firmware and technological applications and platforms (collectively, "IT Systems") to manage and operate our business from end-to-end, including ordering and managing materials from suppliers, design and development, manufacturing, marketing, selling and shipping to customers, invoicing and billing, managing our banking and cash liquidity systems, managing our enterprise resource planning and other accounting and financial systems and complying with regulatory, legal and tax requirements. There can be no assurance that our current IT Systems will function properly. We have invested and will continue to invest in improving our IT Systems. Some of these investments are significant and impact many important operational processes and procedures. There is no assurance that any newly implemented IT Systems will improve our current systems, improve our operations or yield the expected returns on the investments. In addition, the implementation of new IT Systems may cause disruptions in our operations and, if not properly implemented and maintained, negatively impact our business. If our IT Systems cease to function properly or if these systems do not provide the anticipated benefits, our ability to manage our operations could be impaired.

We currently rely on third-party vendors for many of the critical elements of our global information and operational technology infrastructure and their failure to provide effective support for such infrastructure could negatively impact our business and financial results.

We have outsourced many of the critical elements of our global information and operational technology infrastructure to third-party service providers in order to achieve efficiencies. If such service providers do not perform or do not perform effectively, we may not be able to achieve the expected efficiencies and may have to incur additional costs to address failures in providing service by the service providers. Depending on the function involved, such non-performance, ineffective performance or failures of service may lead to business disruptions, processing inefficiencies or security breaches.

Disruptions or breaches of our information systems could adversely affect us.

Despite our implementation of cybersecurity measures which have focused on prevention, mitigation, resilience and recovery, our network and products, including access solutions, may be vulnerable to cybersecurity attacks, computer viruses, malicious codes, malware, ransomware, phishing, social engineering, denial of service, hacking, break-ins and similar disruptions. Cybersecurity attacks and intrusion efforts are continuous and evolving, and in certain cases they have been successful at the most robust institutions. The scope and severity of risks that cyber threats present have increased dramatically and include, but are not limited to, malicious software, attempts to gain unauthorized access to data or premises, exploiting weaknesses related to vendors or other third parties that could be exploited to attack our systems, denials of service and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and corruption of data. Any such event could have a material adverse effect on our business, operating results and financial condition, as we face regulatory, reputational and litigation risks resulting from potential cyber incidents, as well as the potential of incurring significant remediation costs.