UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

_________________________________________

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____________

Commission file number [ ]

_________________________________________

PACIFIC THERAPEUTICS LTD.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1500 – 409 Granville St. in Vancouver BC, V6C 1T2 Canada

(Address of principal executive offices)

Tel: 604-559-8051

Fax: 604-559-8051

(Name, Telephone, E-Mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: |

| 38,976,825 CLASS A COMMON SHARES, | Canadian National Stock Exchange |

| NO PAR VALUE |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

2

NONE

_________________________________________

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

NONE

Indicate the number of outstanding shares of each of the Company’s classes of capital or common stock as of the close of the period covered by the annual report:

38,976,825

Class A Common Shares, no par value as of December 31, 2014.

Indicate by check mark if the registrant is a well-known seasoned Company, as defined in Rule 405 of the Securities Act.

YES [ ] NO [ X ]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES [ ] NO [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [ ] NO [ X ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site: www.pacifictherapeutics.com, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [ ] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 in the Exchange Act. (Check one):

| Large Accelerated Filer [ ] | Accelerated Filer [ ] | Non-Accelerated Filer [ X ] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| [ ] U.S. GAAP |

[ X ] International Financial Reporting Standards as issued by the International Accounting Standards Board |

[ ] Other |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 [ ] Item 18 [ X ]

If this is an annual report indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act:

YES [ ] NO [ ]

3

PACIFIC THERAPEUTICS LTD.

Table of Contents

| Page | ||

| PART I | 1 | |

| Item 1. | Identity of Directors, Senior Management and Advisors | 1 |

| Item 2. | Offer Statistics and Expected Timetable | 1 |

| Item 3. | Key Information | 1 |

| Item 4. | Information on the Company | 6 |

| Item 5. | Operating and Financial Review | 7 |

| Item 6. | Directors, Senior Management and Employees | 10 |

| Item 7. | Major Shareholders and Related Party Transactions | 12 |

| Item 8. | Financial Information | 13 |

| Item 9. | The Offer and Listing | 13 |

| Item 10. | Additional Information | 14 |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 23 |

| Item 12. | Description of Securities Other Than Equity Securities | 23 |

| PART II | 23 | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 23 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 23 |

| Item 15. | Controls and Procedures | 23 |

| Item 16A. | Audit Committee Financial Experts | 25 |

| Item 16B. | Code of Ethics | 25 |

| Item 16C. | Principal Accountant Fees and Services | 25 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 25 |

| Item 16E. | Purchases of Equity Securities by the Company and Affiliated Purchasers | 25 |

| Item 16F. | Change in Registrant’s Certifying Accountant | 26 |

| Item 16G. | Corporate Governance | 26 |

| PART III | ||

| Item 17. | Financial Statements | 26 |

| Item 18. | Financial Statements | 26 |

| Item 19. | Exhibits | 26 |

| SIGNATURES | 26 | |

4

Part I

Brief Introduction

Pacific Therapeutics Ltd. (the “Company”, “Issuer” or “PTL”) is a British Columbia, Canada corporation, incorporated on September 12, 2005. It is a reporting Company in British Columbia and Ontario, and its shares are listed for trading on the Canadian National Stock Exchange (“CNSX”).

Item 1. Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management.

The term of office of the Company’s directors expires annually at the time of the Company’s annual general meeting. The term of the office of the officers expires at the discretion of the Company’s directors. Below is a list of the Company’s directors and senior management:

| Name | Tital in the Company | Date of Appointment to Office |

| Douglas H. Unwin, B.Sc., MBA | President, CEO, Director | September 12, 2005 |

| 1500 – 409 Granville Street | ||

| Vancouver, BC V7G 2S2 | ||

| Douglas Wallis, CA | Director | May 10, 2011 |

| 7178 Quatsino Drive | ||

| Vancouver, BC V5S 4C3 | ||

| M. Greg Beniston, LLB | Chairman | Chairman since October 31, 2007; |

| 1802 – 1000 each Ave | Corporate Secretary: from September 2005 to October 31, 2007 | |

| Vancouver, BC V6E 4M2 | ||

| Wendi Rodrigueza, PhD | Director | November 5, 2009 |

| 46701 Commerce Drive Rd | ||

| Plymouth, MI 48170 | ||

| Derick Sinclair, CA | CFO and Corporate Secretary | since September 1, 2007; |

| 1550 Ostler Court | Corporate Secretary since October 31, 2007 | |

| North Vancouver, BC V7G 2P1 | ||

Please also see Item 6 of this Form 20-F for more information about the directors and senior management.

B. Advisers.

The Company’s outside legal counsel is Hunter Taubman Weiss LLP, at 130 w. 42nd Street, Suite 1050, New York, NY 10023; Tel: (212) 732-7184.

C. Auditors.

The Company’s auditors are Davidson & Company Chartered Professional Accountants at 1200-609 Granville Street, Vancouver, BC V7Y 1G6; Tel: (604) 687-0947.

Item 2. Offer Statistics and Expected Timetable

Not Applicable

5

Item 3. Key Information

A. Selected financial data For the Years Ended December 31, 2014, 2013 and 2012

The following selected information should be read in conjunction with the Company’s financial statements, and notes, filed with this Form 20-F. This information, and all other financial information in this Form 20-F, is stated in Canadian dollars unless otherwise noted.

The financial information is presented on the basis of International Financial Reporting Standards. With respect to the Company’s financial statements, there are no material differences from applying these principles compared to applying United States generally accepted accounting principles.

| Period ended | FYE 2014 (IFRS) |

FYE 2013 (IFRS) |

FYE 2012 (IFRS) |

| Net Sales | $Nil | $Nil | $Nil |

| Net loss and Comprehensive Loss | ($693,645) | ($740,846) | ($605,468) |

| Basic and diluted loss per share | ($0.02) | ($0.03) | ($0.03) |

| Weighted average shares | 37,830,595 | 27,561,948 | 21,637,193 |

| Year ended | FYE 2014 (IFRS) |

FYE 2013 (IFRS) |

FYE 2012 (IFRS) |

| Total assets | $67,315 | $287,044 | $206,533 |

| Net Assets | ($875,761) | ($440,144) | ($430,990) |

| Share capital | $2,760,010 | $2,699,210 | $1,995,716 |

| Contributed surplus | $289,766 | $123,704 | $206,212 |

| Deficit accumulated during the development stage | ($3,955,537 | ($3,263,058) | ($2,662,918) |

| Common Shares Issued | 38,976,825 | 37,456,825 | 22,586,825 |

| Dividends | $Nil | $Nil | $Nil |

B. Capitalization and indebtedness.

The following table sets forth our capitalization as of December 31, 2014 and December 31, 2013. This table should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our financial statements and related notes included elsewhere in this Registration Statement on Form 20-F.

| As of December 31, 2014 | As of December 31, 2013 | |

| Current Liabilities: | ||

| Accounts payable and accruals: | $943,076 | $727,188 |

| Non-Current Liabilities: | $Nil | $Nil |

| Equity: | ||

| Common shares | $2,760,010 | $2,699,210 |

| Subscriptions Received | $30,000 | $Nil |

| Contributed Surplus | $289,766 | $123,704 |

| Accumulated deficit | $3,955,537 | ($3,263,058) |

| Total equity | ($875,761) | ($440,144) |

| Liabilities and equity: | $67,315 | $287,044 |

C. Reasons for the offer and use of proceeds.

Not Applicable.

6

D. Forward-Looking Statement and Risk factors.

Forward-Looking Statements

This Form 20-F and the documents to which we refer you contain forward-looking statements. In addition, from time to time, we or our representatives may make forward-looking statements orally or in writing. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Such forward-looking statements relate to future events or our future performance. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential” or “continue” or the negative of these or similar terms. In evaluating these forward-looking statements, you should consider various factors, including those described in “Risk Factors” below. These and other factors may cause our actual results to differ materially from any forward-looking statement. Forward-looking statements are only predictions. The forward-looking events discussed in this Form 20-F, the documents to which we refer you and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us.

Risk Factors

An investment in the Common Shares of the Company must be considered highly speculative due to the nature of the Company’s business. The risk and uncertainties below are not the only risks and uncertainties the Company may have. Additional risks and uncertainties not presently known to the Company or that the Company currently considers immaterial may also impair the business, operations and future prospects of the Company and cause the price of the Common Shares to decline. If any of the following risks actually occur, the business of the Company may be harmed and its financial condition and results of operations may suffer significantly. In addition to the risks described elsewhere and the other information in this Form 20-F, the Company notes the following risk factors:

Issuer Risk - Risks that are specific to the Company

Insufficient Funds to Accomplish the Company's Business Objectives

The Company remains under constant working capital pressures. As of December 31, 2014, the Company had a working capital deficit of $940,241. In the near future, potential revenues cannot support existing and upcoming expenses or other capital requirements. When the current funding has been expended, the Company will require and is planning for additional funding. There is no assurance that this funding will be available when required by the Company and/or available on suitable terms. Furthermore, the Company expects negative operating cash flows for the immediately foreseeable future.

Substantial Capital Requirements for Research and Development

The Company anticipates that it may make substantial research and development expenditures for clinical trials in the future. As the Company has no operating revenue being generated from its research and development activities, the Company does not expect to generate any revenue in the near future and may have limited ability to expend the capital necessary to undertake or complete future research and development work. There can be no assurance that debt or equity financing will be available or sufficient to meet these requirements or for other corporate purposes or, if debt or equity financing is available, that it will be on terms acceptable to the Company. Moreover, future activities may require the Company to alter its capitalization significantly. If the Company is unable to obtain additional financing, it may be unable to complete the development and commercialization of PTL-202 and PTL-303 or continue its research and development programs.

Unanticipated Costs and Delays

The Company may be subject to unanticipated costs or delays that would accelerate its need for additional capital or increase the costs of individual clinical trials. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to significantly delay, scale back or discontinue the development and/or commercialization of one or more of its product candidates. The Company may also be required to:

-

seek collaborators for our product candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might otherwise be available; or

-

relinquish or license on unfavorable terms its rights to technologies or product candidates that it otherwise would seek to develop or commercialize itself.

7

Uncertainty of Additional Financing

The Company does not have the existing capital resources to fund operations to complete a pivotal bio-availability study of PTL-202 providing information for future development studies. The Company anticipates that it will need to raise additional capital, through private placements or public offerings of its equity or debt securities, in addition to the capital on hand, to complete the long-term development and commercialization of its current product candidates. The inability of the Company to access sufficient additional capital for its operations could have a material adverse effect on the Company’s financial condition, results of operations or prospects. In particular, failure to obtain such financing on a timely basis could cause the Company to miss certain acquisition opportunities and reduce or terminate its business.

Dilution

To date the Company’s sources of cash have been limited primarily to proceeds from the founders, friends and retail investors. It is likely that the Company will enter into more agreements to issue Common Shares and warrants and options to purchase Common Shares.

The impact of the issuance of a significant amount of Common Shares from the exercise of the Company’s outstanding warrants and options could place downward pressure on the market price of the Common Shares.

The Company cannot be certain that additional funding will be available on acceptable terms, or at all. To the extent that the Company raises additional funds by issuing equity securities, its shareholders may experience significant dilution. Any debt financing, if available, may involve restrictive covenants, such as limitations on the Company’s ability to incur additional indebtedness, limitations on its ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact its ability to conduct business.

No History of Sales or Profits

The Company does not have a history of earnings or profit, has never had any products available for commercial sale and has not generated any revenue from product sales. The Company does not anticipate that it will generate revenue from the sale of products for the foreseeable future and has not yet submitted any products for approval by regulatory authorities. The Company continues to incur research and development and general and administrative expenses related to its operations. There is no assurance that in the future the Company will develop revenues, operate profitably or provide a return on investment. Therefore, investors should not invest on the expectation of receiving dividends or any guaranteed return on their investment of any nature. The Company is expected to continue to incur losses for the foreseeable future and expects these losses to increase as it continues research activities and development of its product candidates, seeks regulatory approvals for its product candidates, and acquires rights to additional products for development. If the Company’s product candidates fail in clinical trials or do not gain regulatory approval, or if its product candidates do not achieve market acceptance, the Company may never become profitable. Even if the Company achieves profitability in the future, it may not be able to sustain profitability in subsequent periods.

No History of Paying Dividends

An increase in the market price of the Company’s Common Shares, which is uncertain and unpredictable, may be an investor’s sole source of gain from an investment in the Company’s Common Shares. An investment in the Company’s Common Shares may not be appropriate for investors who require dividend income.

No dividends have been paid on the Company's Common Shares since inception and there is no assurance that such dividends will be earned or paid in the future. For the foreseeable future, the Company expects to re-invest in its operations all cash flow that might otherwise be available for distribution to shareholders in the form of cash dividends. While the payment of stock dividends is an alternative, there is no assurance that these will be paid in the foreseeable future. The Company does not anticipate paying any dividends on the Shares in the foreseeable future. As a result, capital appreciation, if any, of the Company’s Common Shares will be the shareholder’s sole source of gain for the foreseeable future.

Influence of Principal Shareholders

As at the date of this filing, Directors and Officers will own approximately 20.7% of the issued and outstanding Common Shares of the Company. As a result, these shareholders, together or individually will have the ability to control or influence the outcome of most corporate actions requiring shareholder approval, including the election of directors of the Company and the approval of certain corporate transactions. The concentration of ownership of the Company may also have the effect of delaying or preventing a change in control of the Company.

8

Commercializing of Drug Candidates

In order to successfully commercialize drugs, the Company must enter into collaborations with partners to develop a capable sales, marketing and distribution infrastructure. The Company intends to enter into partnering, co-promotion and other distribution arrangements to commercialize products in most markets. However, the Company may not be able to enter into collaborations on acceptable terms, if at all, and may face competition in its search for partners with whom to collaborate. If the Company is unable to develop collaborations with one or more partners to perform these functions, it may not be able to successfully commercialize its products, which could cause the Company to cease operations.

Dependence on the Success of PTL-202

PTL-202, the Company’s lead product candidate, has been tested in pre-clinical models of lung Fibrosis. These tests indicate that PTL-202 may be an effective drug to treat Pulmonary Fibrosis. PTL-202 was cleared by regulators to begin Phase 1 clinical trials during 2012. This drug/drug interaction trial was concluded in September 2012.

In order to market PTL-202, the Company, in conjunction with its collaborators, will have to conduct additional clinical trials, including bioequivelency, Phase 2 proof of principal clinical trials as well as Phase 3 clinical trials, to demonstrate safety and efficacy. The Company has not initiated any Phase 2 or Phase 3 clinical trials with any of its product candidates. If the proposed clinical trials generate safety concerns or demonstrate a lack of efficacy, or competitive products developed by third parties show significant benefit in the indications in which the Company is developing product candidates, any planned clinical trial may be delayed, altered or not initiated and PTL-202 may never receive regulatory approval or be successfully commercialized.

The Company’s other product candidate, PTL-303, has only been tested in cellular assays to determine a signal as a possible drug candidate. PTL-303 has not been tested in animals or humans.

Even if the Company’s product candidates receive regulatory approval, the Company or its collaborators may not be successful in marketing them for a number of reasons, including the introduction by competitors of more clinically-effective or cost-effective alternatives or failure in the Company or collaborator’s sales and marketing efforts.

Any failure to obtain approval of PTL-202 or PTL-303, and successfully commercialize them, would have a material and adverse impact on the Company’s business, which could cause the Company to cease operations.

Reliance on the Company’s management

Investors will in large part entrust their funds to the directors, management, and other professional advisors in whose judgment investors must depend with only limited information about their specific evaluation of the “sound business reasons” on which any reallocation of funds would be based. The Company's financing and enterprise acquisition/development policies and practices may be changed at the discretion of the Board of Directors. Persons who are not willing to rely on the Company’s management and/or Directors should not purchase the Company’s Shares.

Attraction and Retention of the Company’s Management

The Company will need to expand and effectively manage its managerial, operational, financial, development and other resources in order to successfully pursue its research, development and commercialization efforts of existing and future product candidates. The Company's success depends on its continued ability to attract, retain and motivate highly qualified management, pre-clinical and clinical personnel. The loss of the services of any of the Company’s senior management could delay or prevent the commercialization of its product candidates. Although the Company has entered into an employment agreement with Douglas H. Unwin, its Chief Executive Officer, the agreement permits Mr. Unwin to terminate his employment with the Company at any time, subject to providing the Company with advance written notice.

The Company may not be able to attract or retain qualified management and scientific personnel in the future due to the intense competition for qualified personnel among specialty pharmaceutical, biotechnology, pharmaceutical and other businesses. If the Company is not able to attract and retain the necessary personnel to accomplish its business objectives, the achievement of its development objectives, its ability to raise additional capital and its ability to implement its business strategy may be significantly reduced. In particular, if the Company loses any members of its senior management team, it may not be able to find suitable replacements in a timely fashion, or at all, and the business may be harmed as a result.

Use of Contract Personnel

9

From time to time the Company will need to contract additional personnel to continue its expansion. The Company uses scientific, clinical and regulatory advisors extensively to assist in formulating its development and clinical strategies. These advisors are not the Company’s employees and may have commitments to, or consulting or advisory contracts with, other entities that may limit their availability to the Company. In addition, these advisors may have arrangements with other companies to assist those companies in developing products or technologies that may compete with the Company’s. If the Company is unable to contract the correct personnel, it may be unable to implement or complete its product development programs, resulting in the inability to commercialize its product candidates or generate sufficient revenue to continue in business.

Dependence on key employees, suppliers or agreements

Executive management of the Company's business is primarily provided by the Company's CEO, CFO, and Board of Directors. At this stage of its corporate development, the Company has necessarily limited the establishment of extensive administrative and operating infrastructure. Instead, the Company may rely, for necessary skills, on external adviser/consultants with extensive senior level management experience in such fields as formulation, drug development, pharmaceutical regulations, finance, manufacturing, marketing, law, and investment. The future success of the Company is very dependent upon the ongoing availability and commitment of its directors, officers and advisor consultants, not all of whom are or will be bound by formal contractual employment agreements. The absence of these formal contractual relationships may be considered to represent an area of risk.

Dependence on Third Parties to Conduct Clinical Trials

The Company will hire third parties to conduct clinical trials. If these third parties do not perform as contracted or expected, the Company may not be able to obtain regulatory approval for its drug candidates, preventing the Company from becoming profitable.

The Company relies on third parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories, to conduct its pre-clinical research and clinical trials. Although the Company relies on these third parties to conduct its clinical trials, it is responsible for ensuring that each of its clinical trials is conducted in accordance with its investigational plan and protocol, as approved by the FDA and non-U.S. regulatory authorities. Moreover, the FDA and non-U.S. regulatory authorities require the Company to comply with regulations and standards, commonly referred to as Good Clinical Practices (“GCPs”), for conducting, monitoring, recording and reporting the results of clinical trials to ensure that the data and results are scientifically credible and accurate and that the clinical trial subjects are adequately informed of the potential risks of participating in clinical trials.

The Company’s reliance on third parties does not relieve it of the above responsibilities and regulatory requirements. If the third parties conducting the Company’s clinical trials do not perform their contractual duties or obligations, do not meet expected deadlines or need to be replaced, or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to GCPs or for any other reason, the Company may need to enter into new arrangements with alternative third parties, and its clinical trials may be extended, delayed or terminated. In addition, a failure by third parties to perform their obligations in compliance with GCPs may cause the Company’s clinical trials to fail to meet regulatory requirements, which may require the Company to repeat its clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, the Company may be unable to obtain regulatory approval for or commercialize its current and future product candidates.

Marketing and Distribution Risk

If the Company is unable to develop its sales and marketing and distribution capability on its own or through collaborations with marketing partners, it will not be successful in commercializing its product candidates. The Company currently does not have a marketing staff nor a sales or distribution organization. The Company does not intend to develop a sales or distribution organization internally.

The Company currently does not have marketing, sales or distribution capabilities. The Company has decided to collaborate with third parties that have direct sales forces and established distribution systems, either to augment or substitute in lieu of its own sales force and distribution systems. To the extent that the Company enters into co-promotion or other licensing arrangements, its product revenue is likely to be lower than if the Company directly marketed or sold its products, when and if it has any. In addition, any revenue received will depend in whole or in part upon the efforts of such third parties, which may not be successful and will generally not be within the Company’s control. If the Company is unable to enter into such arrangements on acceptable terms or at all, it may not be able to successfully commercialize its existing and future product candidates. If the Company is not successful in commercializing its existing and future product candidates, either on its own

10

or through collaborations with one or more third parties, future product revenue will suffer and the Company may incur significant additional losses.

Industry Risk - Risks faced by the Company because of the industry in which it operates

Research and Development

The Company is developing new, proprietary substances, methods and processes intended to enhance the therapeutic effects of existing drugs in the treatment of diseases characterized by progressive Fibrosis. The existing drugs that form the basis of the Company’s efforts to develop new substances, methods and processes are well known, yet any scientific evidence that may exist to support the feasibility of the Company’s goals is not conclusive. If the Company is not successful in developing and marketing any new drugs, combinations of existing drugs or reformulation and repurposing of existing approved drugs it may never generate revenues and the business may fail.

Clinical Trial Design

The Company’s business strategy is to combine, reformulate and repurpose existing drugs for the treatment of new indications, and these new drug combinations or formulations may have the ability to treat many indications. The Company may incorrectly assess the market opportunities of an indication or may incorrectly estimate or fail to fully appreciate the scientific and technological difficulties associated with treating a specific indication. Furthermore, the quality and robustness of the results and data of any clinical study the Company conducts will depend upon the selection of a patient population for clinical testing. If the selected population is not representative of the intended population, further clinical testing of product candidates or termination of research and development activities related to the selected indication may be required. The Company’s ability to commence clinical testing or the choice of clinical development path could compromise business prospects and prevent the achievement of revenue.

Product Failure in Clinical Trials

Clinical trials may fail to adequately demonstrate the safety and efficacy of product candidates. The Company will be required to demonstrate with substantial evidence through well-controlled clinical trials that its product candidates are safe and effective for use in a diverse population before the Company can seek regulatory approvals for their commercial sale. Negative results from clinical trials will prevent the commercialization of a drug candidate. If the Company cannot show that its product candidates are both safe and effective in clinical trials, it will need to re-evaluate its strategic plans.

Positive results from pre-clinical studies and early clinical trials should not be relied upon as evidence that later-stage or large-scale clinical trials will succeed. Success in early clinical trials does not mean that future clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety and efficacy to the satisfaction of the FDA and other non-U.S. regulatory authorities, despite having progressed through initial clinical trials.

Even after the completion of Phase 3 clinical trials, the FDA or other non-U.S. regulatory authorities may disagree with the Company’s clinical trial design and its interpretation of data, and may require the Company to conduct additional clinical trials to demonstrate the efficacy of its product candidates.

Regulatory Risk and Market Approval

Any products that the Company develops will be subject to extensive government regulations relating to development, clinical trials, manufacturing and commercialization. In the United States, for example, the drug combinations that the Company intends to develop and market are regulated by the FDA under its new drug development and review process. Before any therapeutic products can be marketed, the sponsor company must obtain clearance from the FDA by submitting an investigational new drug application, then by successfully completing human testing under three phases of clinical trials, and finally by submitting a new drug application.

The time required to obtain approvals for drug combinations or reformulations from the FDA and other agencies in foreign locales with similar processes is unpredictable. There is no assurance that the Company will ever receive regulatory approval to use its proprietary drug combinations or reformulations as human therapeutics. If such regulatory approval is not obtained, the Company may never become profitable.

Failure to Receive Regulatory Approval f or Clinical Trials

The Company’s clinical development programs for PTL-202 and PTL-303 may not receive regulatory approval for clinical

11

trials if the Company fails to demonstrate that they are safe and effective in pre-clinical trials. Consequently, failure to obtain necessary approvals from the FDA or similar non-U.S. regulatory agencies to operate clinical trials for the Company’s product candidates could result in delays to the Company’s product development efforts.

Manufacture and Supply of Drug Candidates

The Company does not own or operate manufacturing facilities, and it depends on third-party contract manufacturers for production of its product candidates. The Company has no experience in drug formulation or manufacturing, and it lacks the resources and the capability to manufacture any of its product candidates. Product candidates have been purchased in limited quantities for pre-clinical studies from scientific supply houses. For Phase 1 and 2 clinical trials of PTL-202, the Company will need to obtain additional quantities of active pharmaceutical ingredients. The Company will need to contract with a manufacturer for a supply of PTL-303 for pre-clinical, and Investigational New Drug-enabling toxicology studies and initial clinical trials (Phase 1 and 2). If, in the future, one of the Company’s product candidates is approved for commercial sale, the Company or its collaborator will need to manufacture that product candidate in commercial quantities. The Company cannot guarantee that the third-party manufacturers with which it has previously contracted will have sufficient capacity to satisfy future manufacturing needs of PTL-202 or PTL-303, or that the Company will be able to negotiate additional purchases of active pharmaceutical ingredients or drug products from these or alternative manufacturers on terms favourable to the Company, or at all.

Third party manufacturers may fail to perform under their contractual obligations, or may fail to deliver the required commercial quantities of bulk active ingredients or finished product on a timely basis and at commercially reasonable prices. Any performance failure on the part of the Company’s contract manufacturers could delay clinical development or regulatory approval of the Company’s product candidates or commercialization of its future product candidates, depriving the Company of potential product revenue and resulting in additional losses.

If the Company is required to identify and qualify an alternate manufacturer, it may be forced to delay or suspend its clinical trials, regulatory submissions, required approvals or commercialization of its product candidates, which may cause it to incur higher costs and could prevent the successfully commercializing its product candidates. If the Company is unable to find one or more replacement manufacturers capable of production at a reasonably favourable cost, in enough volume, of adequate quality, and on a timely basis, the Company would likely be unable to meet demand for its product candidates and its clinical trials could be delayed or it could lose potential revenue. The Company’s ability to replace an existing active pharmaceutical ingredient manufacturer may be difficult because the number of potential manufacturers may be limited and the FDA or non-US regulator must approve any replacement manufacturer before it can begin manufacturing the Company’s product candidates. Such approval would require new testing and compliance inspections. It may be difficult or impossible for the Company to identify and engage a replacement manufacturer on acceptable terms in a timely manner, or at all.

The Company expects to continue to depend on third-party contract manufacturers for the foreseeable future. The Company’s product candidates require precise, high quality manufacturing. Any of the Company’s contract manufacturers will be subject to ongoing periodic unannounced inspection by the FDA and non-U.S. regulatory authorities to ensure strict compliance with current Good Manufacturing Practice (“cGMP”), and other applicable government regulations and corresponding standards. If the Company’s contract manufacturers fail to achieve and maintain high manufacturing standards in compliance with cGMP regulations, the Company may experience manufacturing errors resulting in patient injury or death, product recalls or withdrawals, delays or interruptions of production or failures in product testing or delivery, delay or prevention of filing or approval of marketing applications for the Company’s product candidates, cost overruns or other problems that could seriously harm its business.

Significant scale-up of manufacturing may require additional validation studies, which the FDA must review and approve. Additionally, any third party manufacturers the Company retains to manufacture its product candidates on a commercial scale must pass an FDA or non-US regulator pre-approval inspection for conformance to the cGMPs before the Company can obtain approval of its product candidates. If the Company is unable to successfully increase the manufacturing capacity for a product candidate in conformance with cGMPs, the regulatory approval or commercial launch of any related products may be delayed or there may be a shortage in supply.

Market Acceptance of the Company’s Products

Even if the Company receives the necessary regulatory approvals to commercially sell its drug candidates, the success of these candidates will depend on their acceptance by physicians and patients, and reimbursement among other things.

In the United States and elsewhere, the Company’s product revenues will depend principally upon the reimbursement rates established by third-party payors, including government health administration authorities, managed-care providers, public

12

health insurers, private health insurers and other organizations. These third-party payors are increasingly challenging the price, and examining the cost effectiveness, of medical products and services. In addition, significant uncertainty exists as to the reimbursement status, if any, of newly approved drugs, pharmaceutical products or product indications. The Company may need to conduct post-marketing clinical trials in order to demonstrate the cost-effectiveness of products. Such clinical trials may require the Company to commit a significant amount of management time, financial and other resources. If reimbursement of the Company’s product candidates is unavailable or limited in scope or amount or if pricing is set at unsatisfactory levels, the Company’s revenues could be reduced.

In some countries other than the United States, particularly the countries of the European Union and Canada, the pricing of prescription pharmaceuticals is subject to government controls. In these countries, obtaining pricing approval from government authorities can take six to twelve months or longer after the receipt of regulatory marketing approval of a product for an indication. To obtain reimbursement or pricing approval in some countries, the Company may be required to conduct a clinical trial that compares the cost-effectiveness of its product candidate to other available therapies. The Company’s revenues could be reduced if reimbursement of a product candidate is unavailable or limited in scope or amount or if pricing is set at unsatisfactory levels.

Canadian, US, European and other foreign governments continue to propose and pass legislation designed to reduce the cost of healthcare, including drugs. In the United States, there have been, and the Company expects that there will continue to be, federal and state proposals to implement similar government control. In addition, increasing emphasis on managed care in the United States will continue to put pressure on the pricing of pharmaceutical products. For example, the Medicare Prescription Drug Improvement and Modernization Act of 2003 reforms the way Medicare will cover and reimburse for pharmaceutical products. The legislation expands Medicare coverage for drug purchases by the elderly and eventually will introduce a new reimbursement methodology based on average sales prices for certain drugs. In addition, the new legislation provides authority for limiting the number of outpatient drugs that will be covered in any therapeutic class. As a result of the new legislation and the expansion of federal coverage of drug products, the Company expects that there will be additional pressure to contain and reduce costs.

The Medicaid program and state healthcare laws and regulations in the USA may also be modified to change the scope of covered products and/or reimbursement methodology. Cost control initiatives could decrease the established reimbursement rates that the Company receives for any products in the future, which would limit its revenues and profitability. Legislation and regulations affecting the pricing of pharmaceutical products, including PTL-202 and PTL-303, may change at any time, which could further limit or eliminate reimbursement rates for PTL-202 or other product candidates.

If the Company’s drug candidates fail to gain market acceptance, it may be unable to generate sufficient revenue to continue in business.

Failure to Obtain Regulatory Approval Outside the United States

The Company intends to market certain of its existing and future product candidates in non-North American markets. In order to market its existing and future product candidates in the European Union and many other non-North American jurisdictions, the Company must obtain separate regulatory approvals. The Company has had no interactions with non-North American regulatory authorities, and the approval procedures vary among countries and can involve additional testing, and the time required to obtain approval may differ from that required to obtain FDA approval.

Approval by the FDA or other regulatory authorities does not ensure approval by regulatory authorities in other countries, and approval by one or more non-North American regulatory authorities does not ensure approval by regulatory authorities in other countries or by the FDA. The non-North American regulatory approval process may include all of the risks associated with obtaining FDA approval. The Company may not obtain non-North American regulatory approvals on a timely basis, if at all. In addition, the Company may not be able to file for non-North American regulatory approvals and may not receive necessary approvals to commercialize its existing and future product candidates in any market. If such regulatory approval is not obtained, the Company may never become profitable.

Product Liability

The use of the Company’s drug candidates in clinical trials and the sale of any products for which regulatory approval is obtained may expose the Company to product liability claims from consumers, health care providers, pharmaceutical companies or other entities. Any claim brought against the Company may cause the diversion of resources from normal operations or cause the Company to cease the sale, distribution and marketing of its products that have received regulatory approval. This may cause the Company to cease operations.

13

Intellectual Property Rights

The Company’s commercial success will depend, in part, on obtaining and maintaining patent protection, trade secret protection and regulatory protection of its proprietary technology and information as well as successfully defending third-party challenges to its proprietary technology and information. The Company will be able to protect its proprietary technology and information from use by third parties only to the extent that valid and enforceable patents, trade secrets or regulatory protection cover them and the Company has exclusive rights to utilize them. The ability of the Company’s licensors, collaborators and suppliers to maintain their patent rights against third-party challenges to their validity, scope or enforceability will also play an important role in determining the Company’s future.

Reliance on Licensors to Maintain Patent Rights

The Company’s commercial success may also depend, in part, on maintaining patent rights that have been licensed related to products that the Company may market in the future. Since the Company will not fully control the patent prosecution of any licensed patent applications, it is possible that the licensors will not devote the same resources or attention to the prosecution of the licensed patent applications as the Company would if it controlled the prosecution of the applications. The licensor may not pursue and successfully prosecute any potential patent infringement claim, may fail to maintain their patent applications, or may pursue any litigation less aggressively than the Company would. Consequently, the resulting patent protection, if any, may not be as strong or comprehensive.

Uncertainty of Patent Protection

The patent positions of life science companies including specialty pharmaceutical companies can be highly uncertain and involve complex legal and factual questions that include unresolved principles and issues. No consistent policy regarding the breadth of claims allowed in such companies’ patents has emerged to date in the United States, and the patent situation outside the United States is even more uncertain. Changes in either the patent laws or in interpretations of patent laws in the United States or other countries may diminish the value of the Company’s intellectual property rights. Therefore, the Company cannot predict with any certainty the range of claims that may be allowed or enforced in its patents or in-licensed patents.

Reliance on Trade Secrets

The Company also relies on trade secrets to protect its technology, especially where the Company does not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. While the Company seeks to protect confidential information, in part, through confidentiality agreements with employees, consultants, contractors, or scientific and other advisors, they may unintentionally or wilfully disclose the Company’s confidential information to competitors. Enforcing a claim against a third party related to the illegal acquisition and use of trade secrets can be expensive and time consuming, and the outcome is often unpredictable. If the Company is not able to maintain patent or trade secret protection on its technologies and product candidates, then the Company may not be able to exclude competitors from developing or marketing competing products, and the Company may not be able to operate profitability.

Intellectual Property Infringement Claims

There has been, and there will continue to be, significant litigation and demands for licenses in the life sciences industry regarding patent and other intellectual property rights. Although the Company anticipates having a valid defence to any allegation that its current product candidates, production methods and other activities infringe the valid and enforceable intellectual property rights of any third parties, the Company cannot be certain that a third party will not challenge this position in the future. Other parties may own patent rights that the Company might infringe with its drug candidates, products or other activities, and the Company’s competitors or other patent holders may assert that the Company’s products and the methods employed are covered by their patents. These parties could bring claims against the Company causing substantial litigation expenses and, if successful, may require payment of substantial damages. Some of the Company’s potential competitors may be better able to sustain the costs of complex patent litigation, and depending on the circumstances, the Company could be forced to stop or delay its research, development, manufacturing or sales activities. Any of these costs could cause the Company to go out of business.

Licensed Patent Rights

The Company has licensed patents and plans to license technologies and other patents if it believes it is necessary or useful to use third party intellectual property to develop its products, or if its product development threatens to infringe upon the intellectual property rights of third parties. The Company may be required to pay license fees or royalties or both to obtain such licenses, and there is no guarantee that such licenses will be available on acceptable terms, if at all. Even if the Company is

14

able to successfully obtain a license, the rights may be non-exclusive, which would give the Company’s competitors’ access to the same intellectual property it has rights to, which could prevent the Company from commercializing a product.

The Company’s licensors may terminate the license. Without protection for the intellectual property that is licensed, other companies may be able to offer substantially similar products for sale, the Company may not be able to market or sell the planned products or generate any revenues.

Licenses and Permits to Operate

The operations of the Company may require licenses and permits from various governmental authorities, in both domestic and foreign jurisdictions. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to carry out its research and development of its projects. Without these licenses and permits the Company may not be able to market or sell the planned products or generate any revenues.

Competition

The pharmaceutical industry is intensely competitive in all its phases, and the Company competes with other companies that have greater financial resource and technical facilities. Competition could adversely affect the Company’s ability to acquire suitable projects in the future.

Significant and increasing competition exists for pharmaceutical opportunities internationally. There are a number of large established pharmaceutical companies with substantial capabilities and far greater financial and technical resources than the Company. The Company may be unable to acquire additional attractive pharmaceutical development opportunities on terms it considers acceptable and there can be no assurance that the Company's research and development programs will yield any new drugs or result in any commercially viable compounds or technologies.

Conflicts of Interest

Certain of the directors and officers of the Company will be engaged in, and will continue to engage in, other business activities on their own behalf and on behalf of other companies (including life science companies) and, as a result of these and other activities, such directors and officers may become subject to conflicts of interest. The British Columbia Business Corporation Act (“BCBCA”) provides that in the event that a director has a material interest in a contract or proposed contract or agreement that is material to the Company, the director shall disclose his interest in such contract or agreement and shall refrain from voting on any matter in respect of such contract or agreement, subject to and in accordance with the BCBCA. To the extent that conflicts of interest arise, such conflicts will be resolved in accordance with the provisions of the BCBCA. To the knowledge of the management of the Company, there are no existing or potential material conflicts of interest between the Company and a proposed director or officer of the Company except as otherwise disclosed herein.

Foreign Currency Risk

A substantial portion of the Company’s expenses and future revenues may be incurred in foreign currencies. The Company’s business will be subject to risks typical of an international business including, but not limited to, differing tax structures, regulations and restrictions and general foreign exchange rate volatility. Fluctuations in the exchange rate between the Canadian dollar and such other currencies may have a material effect on the Company’s business, financial condition and results of operations and could result in downward pressure for the Company’s products or in losses from currency exchange rate fluctuations. The Company does not actively hedge against foreign currency fluctuations.

Public Company Risk - Risks related to the Company’s shares being listed on a stock exchange

Price Volatility of Publicly Traded Securities

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market prices of securities of many companies have experiences wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. It may be anticipated that any quoted market for the Common Shares will be subject to market trends generally, notwithstanding any potential success of the Company in creating revenues, cash flows or earnings. The value of the Company’s Common Shares will be affected by such volatility.

An active public market for the Common Shares might not develop or be sustained. If an active public market for the Common Shares does not develop, the liquidity of a shareholder’s investment may be limited and the share price may decline below the

15

initial price shareholders paid for their shares.

Certain Canadian Laws Could Delay or Deter a Change of Control

Limitations on the ability to acquire and hold the Company’s Common Shares may be imposed by the Competition Act (Canada). This legislation permits the Commissioner of Competition (Canada) to review any acquisition of a significant interest in the Company. This legislation grants the Commissioner jurisdiction to challenge such an acquisition before the Canadian Competition Tribunal if the Commissioner believes that it would, or would be likely to, result in a substantial lessening or prevention of competition in any market in Canada.

The Investment Canada Act (Canada) subjects an acquisition of control of a company by a non-Canadian to government review if the value of the Company’s assets as calculated pursuant to the legislation exceeds a threshold amount. A reviewable acquisition may not proceed unless the relevant minister is satisfied that the investment is likely to be a net benefit to Canada.

Any of the foregoing could prevent or delay a change of control and may deprive or limit strategic opportunities for the Company’s shareholders to sell their Common Shares.

The Company is at Risk of Securities Class Action Litigation

In the past, securities class action litigation has often been brought against a company following a decline in the market price of its securities. This risk is especially relevant for the Company because biotechnology, specialty pharmaceutical and biopharmaceutical companies have experienced significant stock price volatility in recent years. If the Company faces such litigation, it could result in substantial costs and a diversion of management’s attention and resources, which could harm the Company’s business.

Item 4. Information on the Company

A. History and development of the company.

Name and Incorporation

The Company was incorporated under the British Columbia Business Corporations Act (“BCBCA”) on September 12, 2005 as “Pacific Therapeutics Ltd.”.

The head office of the Company is located at Suite 1500, 409 Granville Street, Vancouver, British Columbia, V6C 1T2, and the registered and records office of the Company is located at Suite 1023, 409 Granville Street, Vancouver, British Columbia, V6C 1T2. The Company’s phone number is (604) 738-1049 and its web site is www.pacifictherapeutics.com. The information on our website does not form a part of this Form 20-F.

The Company is a reporting Company in British Columbia and Ontario and its shares were listed for trading on the Canadian National Stock Exchange on November 16, 2011.

Inter-Corporate Relationships

The Company does not have any inter-corporate relationships.

Significant Acquisitions and Dispositions

Other than the potential licensing of a technology for oral disintegration, the Company has not completed any acquisitions or dispositions since its date of incorporation and is not currently in negotiations with respect to any potential material acquisitions or dispositions..

Operating and Financial Review and Prospects

From inception through to December 31, 2012, the Company incurred total expenses in the development of its intellectual property of $1,836,405, which includes $548,204 of research and development expenses (research and development expenses on the financial statements have been offset by $53,277 in funding from the Industrial Research Assistance Program (“IRAP”) and $187,427 in Scientific Research and Experimental Development ("SR&ED") tax credits), $398,431 of professional fees and $889,770 of wages and benefits.

16

B. Business overview

Business Strategy

The Company is focused on combing, reformulating and repurposing approved drugs. It is initially developing drugs for diseases of progressive excessive scarring, including Idiopathic Pulmonary Fibrosis, Liver Cirrhosis, Pulmonary Fibrosis associated with Scleroderma and Post Lung Transplant Bronchiolitis Obliterans. The Company assumes the clinical, regulatory and commercial development activities of its product candidates and advances them through the regulatory and clinical pathways toward commercial approval. This strategy reduces the risk, time and cost of developing therapies for Fibrosis by avoiding the risks associated with basic research and using compounds with unknown safety and toxicity. The Company leverages its expertise to manage and perform critical steps in drug development including the design and conduct of clinical trials, the development and execution of intellectual property strategies, the recruitment and selection of development partners and the interaction with drug regulatory authorities.

Its strategy includes reformulating approved drugs to increase efficacy and patient compliance, and completing the further clinical testing, manufacturing and other regulatory requirements sufficient to seek marketing authorizations via the filing of a New Drug Application (“NDA”) with the FDA and/or a potential Marketing Application Authorization (“MAA”) with the European Medicines Evaluation Agency (“EMEA”) or similar marketing authorizations by regulators in other countries including Canada.

The main elements of the Company’s strategy are as follows:

1) Identification of Product Candidates

The Company performs scientific evaluations and market assessments of drugs and drug combinations and research from academics and other drug development companies. As part of this process, the Company will evaluate the clinical and pre-clinical research and the intellectual property rights associated with the potential products and research to determine the commercial potential of the product candidate.

The Company intends to mitigate the risks associated with development and commercialization of drug candidates by targeting drug candidates that:

-

are combinations of already approved compounds;

-

have well established safety records;

-

have potential to be reformulated to a once a day oral dose;

-

have potential to be reformulated to an oral dissolving technology;

-

are already marketed in countries other than the United States or Europe; and

-

have pre-clinical animal data or clinical data of potential efficacy in Fibrosis additional indications.

The Company has initially focused on Fibrosis indications as it believes there is a large unmet medical need in this area. As an example, Idiopathic Pulmonary Fibrosis (IPF) affects more than 130,000 Americans (IPF Summit 2011). An estimated 48,000 cases of IPF are diagnosed annually (Am J Respir Crit Care Med. 2006;174(7):810-816). In addition, patients with IPF have poor prognosis; an estimated 40,000 people die each year from IPF. Further, there are no FDA approved treatments for IPF (IPF Summit 2011).

The Company has developed the Scientific and Advisory Board (“SAB”) to support this strategy. The members of both of this group are very experienced in the clinical development of drug candidates for Pulmonary Fibrosis, lung transplant, airway disease and Scleroderma. In the future, the Company may develop product candidates for other indications but the current strategy is to leverage the expertise and skills the Company has in Fibrosis, particularly Idiopathic Pulmonary Fibrosis.

2) In-licensing

In identifying a promising product candidate, the Company seeks to negotiate a license to the rights for the candidate from the holder of those rights. Typically the goal is to secure licenses that permit the Company to conduct further research, development and clinical trials as well as engage in additional intellectual property protection. The Company will also seek terms that provide it with the rights to further licensing of manufacturing and marketing rights to any resulting products. This process is known as in-licensing.

3) Product Development

17

Upon securing the appropriate rights to the product candidate, the Company will advance the candidate through the regulatory and commercialization pathways for marketing approval in major markets. This process includes implementing intellectual property strategies, formulation and reformulation strategies, making regulatory submissions, conducting or managing clinical trials, and performing or managing the collection, collation and interpretation of clinical and field data and the submission of this data to relevant regulatory authorities.

4) Partnering

To enhance its capabilities to develop and market its product candidates, the Company may enter into agreements or partnerships with companies that have formulation, drug development, sales or marketing expertise, or all of the above. Entering into such an agreement may provide cash to develop other products or advance other products in the Company’s portfolio. In addition, entering into a partnership with a company that has complementary skills and using that company’s expertise to further accelerate development of its product candidates, may enhance the returns to the Company from the product candidate.

5) Outsourcing

In order to optimize return on investment and the development of product candidates, the Company uses a virtual company business model which includes outsourcing all non-core business activities. Factors that the Company considers to determine core and non-core activities include:

-

Infrastructure cost

-

Operating cost

-

Frequency of use

-

Regulatory protocol

-

Requirement for third party verification

-

Capacity

-

Quality control

Management has determined that having its own laboratory and staff for conducting infrequent pre-clinical studies is not a core capacity that is required and, therefore, it has to develop relationships with labs that it may outsource this work to. In order to maintain quality control, these projects are managed very closely by the Company’s staff and the Company develops all protocols for the completion of this work. Other functions the Company has decided to outsource include analytical assay development, formulation, clinical trials and manufacturing. It is currently more cost-effective to outsource these tasks due to the Company’s sporadic requirements. As these requirements become less sporadic the Company may develop internal capabilities to complete currently outsourced tasks.

6) Principal Products

-

PTL-202

The Company’s lead product candidate, PTL-202, is a combination of drugs that have been separately approved for marketing by the FDA for sale in the United States. In animal trials, the combination was more effective than either of its components at reducing indicators of Fibrosis. The Company is planning to complete development of a once a day pill of the combination using proprietary in licensed technologies. The Company conducted a drug/drug interaction study in 2012 and plans to conduct a bioequivalence study in 2013 with PTL-202 in humans.

The Company found a combination of two compounds developed in France that showed efficacy in human Fibrosis. The efficacy of this combination to prevent further Fibrosis in humans was confirmed in two separate independent proofs of principal Phase 2 clinical trials in Radiation Induced Fibrosis. The Company took one of the compounds, Pentoxifylline, and combined it with a powerful antioxidant and then conducted experiments in a mouse. These experiments showed that the new combination was effective at reducing the progression of the Fibrosis in the mouse lung. This new combination is being developed as the Company’s lead drug candidate, PTL-202. A provisional patent was filed in the United States by the Company in October 2007 to cover the composition of matter and method of use of this combination. In October 2008, the Company filed an application under the Patent Cooperation Treaty based on the above provisional application. The Company received a positive preliminary examination of the PCT application in the spring of 2009. During 2012 the patent prosecution continued and the Company filed Reponses to patent examiners in Europe and the US.

18

The combination has now been formulated into a once a day tablet and the drugs included in PTL-202 have been successfully tested in a drug/drug interaction study in humans in 2012.

-

PTL-303

The Company’s other product candidate, PTL-303, is a combination of drugs including one that has been approved for use in Japan and other jurisdictions. This combination may have a wide range of uses, including treating, preventing and reducing disorders of progressive scarring in humans.

The Company does not have any funds allocated for the further development of PTL-303 at this time.

The composition, including a cytokine modifier and anti-oxidant which is a precursor of Glutathione, was investigated for its antifibrotic activity by employing two In Vitro collagen synthesis assays. The Company discovered that the combination PTL-303 brings about substantial synergistic anti-fibrotic effects in a TGF-Beta1 mediated collagen synthesis assay, when compared to the individual drugs.

The composition can be administered in any convenient manner, such as a pill, or inhalation, and may be formulated for injection.

A provisional patent titled “Composition and Method for Treating Fibrosis” was filed by the Company with the United States patent office on October 29, 2008. The application number is 61/109,446. A PCT application covering the technology of PTL-303 was filed by the Company in October 2009.

7) Oral Dissolving Technology

The Company has executed a letter of intent with Globe Labs Ltd. Of Vancouver, BC for the potential in-license of an oral dissolving tablet technology. The technology may be used for the delivery of up to three different compounds. The initial use of the technology maybe for the delivery of sildenafil citrate for the treatment of erectile dysfunction.

Principal Products

1) PTL-202

Once a Day Formulation Combination of Pan-phosphodiesterase inhibitor, Pentoxifylline, with N-acetylcysteine

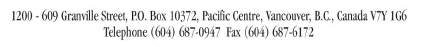

Idiopathic Pulmonary Fibrosis (“IPF”) is a long term, progressive form of lung disease characterized by progressive buildup of scar tissue on the supporting framework (interstitium) of the lungs. The term Idiopathic is used only when the cause of the Fibrosis is unknown. Despite extensive investigation, the cause of IPF remains unknown. The disease involves abnormal and excessive deposition of scar tissue (Fibrosis) in the Pulmonary Interstitium (mainly the walls of the Alveoli) with minimal associated inflammation (Figure 1). The symptoms initially develop slowly. The most common symptom is progressive difficulty in breathing, but also includes dry cough.

Figure 1 - Human Airways

19

The Company’s lead product, PTL-202, is a combination of two compounds designed to treat IPF: Pentoxifylline (PTX) and NAC (N-acetylcysteine). The Company has completed pre-clinical studies on PTL-202, development of a pill that can be taken once a day and completed a drug/drug interaction study in humans in 2012. A pivotal bio-equivalency study is planned for 2013 and maybe followed by a Phase 2 Proof-of-Principle clinical trial beginning in 2014.

Therapeutic Approach

The combination of drugs in PTL-202 is intended to stop the progression of IPF by reducing the amount of several messenger molecules that are known to be associated with scarring. In addition, the combination has anti-oxidant properties that protect the lung cells from further damage caused by the Fibrosis.

PTX increases the diameter of blood vessels and enhances blood flow. PTX has been successfully and safely used for many years for treatment of vascular diseases such as cramping in the leg.

There is growing evidence that PTX is an anti-inflammatory and may inhibit scarring in the lung.

NAC (N-acetylcysteine), the second compound in the PTL-202 combination, has been shown in animals to prevent some of the effects of IPF, including the progressive deterioration of patients.

Pre-clinical Studies

The Company has conducted a number of pre-clinical studies using PTL-202 for the treatment of lung Fibrosis in a mouse. The Company believes that these studies show that PTL-202 has the potential to be a safe and effective treatment for IPF.

The Company conducted proof-of-concept animal studies to evaluate the relative efficacy of stand-alone or combination treatments of PTX and NAC in lung Fibrosis. In the initial experiment, wet lung weight was measured under various treatments. From this early experiment, it was determined that PTL-202 may be more effective than its separate components.

In further pre-clinical experiments, PTL-202 treatment was more effective than either PTX or NAC alone on lung Fibrosis in mice. In addition, treatment with PTL-202 caused a significant reduction in TNF-alpha in the lung fluid. This finding indicates that PTL-202 may act by reducing the amount of TNF-alpha. TNF-alpha is thought to stimulate the formation of scar tissue. Moreover, there were no deaths or abnormal reactions with a daily administration of PTL-202 during the experiments, indicating a lack of side effects which is consistent with the data from earlier clinical trials in humans for PTX and NAC separately.

The results of these extensive pre-clinical studies suggest that PTL-202 may be safe and effective agent for the treatment of Pulmonary Fibrosis.

20

DEVELOPMENT PLANS OF PTL-202

Formulation Development

The goal of the Company is to develop a pill containing both drugs that only needs to be taken once per day. Existing, marketed, modified release versions of the drugs will be evaluated as a simple daily or twice daily fixed dose combination formulation. Given, the preliminary dose ranges/strengths of 600-1200mg of PTX combination with 600mg-1200mg NAC once a day, the physical size for an ingestible tablet will be a barrier to success. Current formulation of PTX, with Vitamin E rather than NAC, in a Phase 2 study has shown inhibition of messenger molecules and a reduction in scar tissue. Both PTX and NAC are water soluble molecules, with short resident time in the bloodstream. This high water solubility presents a challenge to once-a-day administration as both molecules are rapidly absorbed and metabolized quickly by the body. The goal from a development perspective is to deliver an appropriately formulated controlled release product, reducing the absolute amount of drug per tablet needed to achieve a clinically effective blood level. To accomplish this goal formulation development prototypes will target release of the drugs to provide sustained levels of the drug in the blood.

A controlled release formulation of PTL-202, a fixed dose combination of pentoxifylline (PTX) and N-acetylcysteine (NAC), for the potential treatment of idiopathic pulmonary fibrosis (IPF), Liver Cirrhosis and other fibrotic diseases was completed in 2012.

Phase 1: Clinical Studies

The Company has completed the initial clinical study of PTL-202. The study was a drug/drug interaction study. This study, conducted in humans was intended to determine if any new by products are created by the combination of the drugs in PTL-202 and to determine if the combination is bio-equivalent to its generic counter parts. The study included 12 healthy males. The bio-analytical portion (PK assay development and good laboratory practice validation) of the above-mentioned study was completed by a lab contracted by the Company. Therefore, following the Company’s stated business strategy, the Company acted as a sponsor of the study and the CROs were hired to execute the objectives of the study. Successful completion of this Phase 1 study of PTL-202 is a major milestone because as many as 30% of Phase 1 drug trials are failures.

A further pivotal bio-equivalency study is planned for 2013. This study would include up to 20 individuals and take about 2 months to complete.

Phase 2: Proof- of-Concept in Humans

The proposed Phase 2 study is a proof-of-concept or proof-of-relevance trial. The proposed study utilizes principles of adaptive design approach and has two interconnected parts. The proof-of-concept trial will be designed to assess the safety and efficacy of PTL-202 in patients with IPF. Study patients will receive formulated PTL-202 or individual components of PTL-202. Neither the patient or the physician will know if they are getting PTL-202 or a component.

The objectives of the study are:

-

To evaluate the safety and tolerability of 12 months of treatment with PTL-202 in patients with IPF versus placebo and individual components of PTL-202 (PTX and NAC);

-

To compare changes in forced vital volume capacity in IPF patients treated with PTL-202 versus treatment with PTX and NAC alone and placebo;

-

To compare changes in the following parameters in IPF patients treated with PTL-202;

-

Diffusion capacity for carbon monoxide;

-

Extent and nature of IPF-related abnormalities on high resolution CT; and

-

To compare quality of life evaluations in IPF patients treated with PTL-202 and individual components of PTL- 202 versus placebo.

The cost to complete the Phase 2 study is estimated at $8 million. Additional funds will be required to complete this phase of the development of PTL-202. On completion of this proof-of-principal study the Company will look to out-license PTL-202 to a larger company capable of completing the development and commercialization of PTL-202. Such additional funds would likely be raised through a private placement of securities. There is no assurance that such funding will be available. See also “Risk Factors” in this filing.

2) PIPELINE PRODUCT: PTL-303

Fixed Dose Combination of TGF-ß Inhibitor and NAC - Pre-clinical

21