UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

For the quarterly period ended September 30, 2023

Or

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

(212 ) 715-3170

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

1

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at October 20, 2023 | |||||||

| Class A common stock, $0.001 par value | ||||||||

| Class B common stock, $0.001 par value | ||||||||

2

LADDER CAPITAL CORP

FORM 10-Q

September 30, 2023

| Index | Page | |||||||||||||

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact contained in this Quarterly Report, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “might,” “will,” “should,” “can have,” “likely,” “continue,” “design,” and other words and terms of similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short-term and long-term business operations and objectives and financial needs. Although we believe that the expectations reflected in our forward-looking statements are reasonable, actual results could differ from those expressed in our forward-looking statements. Our future financial position and results of operations, as well as any forward-looking statements are subject to change and inherent risks and uncertainties. You should consider our forward-looking statements in light of a number of factors that may cause actual results to vary from our forward-looking statements including, but not limited to:

•risks discussed under the heading “Risk Factors” herein and in our Annual Report on Form 10-K for the year ended December 31, 2022 (“the Annual Report”), as well as our consolidated financial statements, related notes, and the other financial information appearing elsewhere in this Quarterly Report and our other filings with the United States Securities and Exchange Commission (the “SEC”);

•labor shortages, supply chain imbalances, the broader impacts of the Ukraine-Russia and Hamas-Israel conflicts, inflation, and the potential for a global economic recession;

•changes in general economic conditions and in the commercial finance and the real estate markets;

•changes to our business and investment strategy;

•our ability to obtain and maintain financing arrangements;

•the financing and advance rates for our assets;

•our actual and expected leverage and liquidity;

•the adequacy of collateral securing our loan portfolio and a decline in the fair value of our assets;

•interest rate mismatches between our assets and our borrowings used to fund such investments;

•changes in interest rates affecting the market value of our assets and the related impacts on our borrowers, including any unforeseen impacts of the transition to Term Secured Overnight Financing Rate (“SOFR”);

•changes in prepayment rates on our mortgages and the loans underlying our commercial mortgage-backed and other asset-backed securities;

•the effects of hedging instruments and the degree to which our hedging strategies may or may not protect us from interest rate and credit risk volatility;

•the increased rate of default or decreased recovery rates on our assets;

•the adequacy of our policies, procedures and systems for managing risk effectively;

•a potential downgrade in the credit ratings assigned to Ladder or our investments;

•our compliance with, and the impact of, and changes in laws, governmental regulations, tax laws and rates, accounting guidance and similar matters;

•our ability to maintain our qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes and our ability and the ability of our subsidiaries to operate in compliance with REIT requirements;

•our ability and the ability of our subsidiaries to maintain our and their exemptions from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”);

•the effects of climate change or the potential liability relating to environmental matters that impact the value of properties we may acquire or the properties underlying our investments;

•the inability of insurance covering real estate underlying our loans and investments to cover all losses;

•the availability of investment opportunities in mortgage-related and real estate-related instruments and other securities;

•fraud by potential borrowers;

•our ability to attract and retain qualified employees;

•the impact of any tax legislation or IRS guidance;

2

•volatility in the equity capital markets and the impact on our Class A common stock;

•the degree and nature of our competition; and

•the market trends in our industry, interest rates, real estate values and the debt securities markets.

You should not rely upon forward-looking statements as predictions of future events. In addition, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The forward-looking statements contained in this Quarterly Report are made as of the date hereof, and the Company assumes no obligation to update or supplement any forward-looking statements.

Part I - Financial Information

Item 1. Financial Statements (Unaudited)

The consolidated financial statements of Ladder Capital Corp and the notes related to the foregoing consolidated financial statements are included in this Item.

Index to Consolidated Financial Statements (Unaudited)

3

Ladder Capital Corp

Consolidated Balance Sheets

(Dollars in Thousands)

| September 30, 2023(1) | December 31, 2022(1) | ||||||||||

| (Unaudited) | |||||||||||

| Assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Mortgage loan receivables held for investment, net, at amortized cost: | |||||||||||

| Mortgage loans receivable | |||||||||||

| Allowance for credit losses | ( | ( | |||||||||

| Mortgage loan receivables held for sale | |||||||||||

| Securities | |||||||||||

| Real estate and related lease intangibles, net | |||||||||||

| Investments in and advances to unconsolidated ventures | |||||||||||

| Derivative instruments | |||||||||||

| Accrued interest receivable | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities | |||||||||||

| Debt obligations, net | $ | $ | |||||||||

| Dividends payable | |||||||||||

| Accrued expenses | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

Commitments and contingencies (Note 17) | |||||||||||

| Equity | |||||||||||

Class A common stock, par value $ | |||||||||||

| Additional paid-in capital | |||||||||||

Treasury stock, | ( | ( | |||||||||

| Retained earnings (dividends in excess of earnings) | ( | ( | |||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

| Total shareholders’ equity | |||||||||||

| Noncontrolling interests in consolidated ventures | ( | ||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

(1)Includes amounts relating to consolidated variable interest entities. Refer to Note 2 and Note 9.

Refer to the accompanying notes to consolidated financial statements.

4

Ladder Capital Corp

Consolidated Statements of Income

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net interest income | |||||||||||||||||||||||

| Interest income | $ | $ | $ | $ | |||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Net interest income (expense) | |||||||||||||||||||||||

| Provision for (release of) loan loss reserves, net | |||||||||||||||||||||||

| Net interest income (expense) after provision for (release of) loan losses | |||||||||||||||||||||||

| Other income (loss) | |||||||||||||||||||||||

| Real estate operating income | |||||||||||||||||||||||

| Net result from mortgage loan receivables held for sale | ( | ( | ( | ||||||||||||||||||||

| Realized gain (loss) on securities | ( | ( | |||||||||||||||||||||

| Unrealized gain (loss) on securities | ( | ( | ( | ( | |||||||||||||||||||

| Realized gain (loss) on sale of real estate, net | |||||||||||||||||||||||

| Fee and other income | |||||||||||||||||||||||

| Net result from derivative transactions | |||||||||||||||||||||||

| Earnings from investment in unconsolidated ventures | |||||||||||||||||||||||

| Gain on extinguishment of debt | |||||||||||||||||||||||

| Total other income (loss) | |||||||||||||||||||||||

| Costs and expenses | |||||||||||||||||||||||

| Compensation and employee benefits | |||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||

| Real estate operating expenses | |||||||||||||||||||||||

| Investment related expenses | |||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

| Total costs and expenses | |||||||||||||||||||||||

| Income (loss) before taxes | |||||||||||||||||||||||

| Income tax expense (benefit) | |||||||||||||||||||||||

| Net income (loss) | |||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests in consolidated ventures | ( | ( | |||||||||||||||||||||

| Net income (loss) attributable to Class A common shareholders | $ | $ | $ | $ | |||||||||||||||||||

| Earnings per share: | |||||||||||||||||||||||

| Basic | $ | $ | $ | $ | |||||||||||||||||||

| Diluted | $ | $ | $ | $ | |||||||||||||||||||

| Weighted average shares outstanding: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

Refer to the accompanying notes to consolidated financial statements.

5

Ladder Capital Corp

Consolidated Statements of Comprehensive Income

(Dollars in Thousands)

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net income (loss) | $ | $ | $ | $ | |||||||||||||||||||

| Other comprehensive income (loss) | |||||||||||||||||||||||

| Unrealized gain (loss) on securities, net of tax: | |||||||||||||||||||||||

| Unrealized gain (loss) on securities, available for sale | ( | ( | |||||||||||||||||||||

| Reclassification adjustment for (gain) loss included in net income (loss) | ( | ||||||||||||||||||||||

| Total other comprehensive income (loss) | ( | ( | |||||||||||||||||||||

| Comprehensive income (loss) | |||||||||||||||||||||||

| Comprehensive (income) loss attributable to noncontrolling interest in consolidated ventures | ( | ( | |||||||||||||||||||||

| Comprehensive income (loss) attributable to Class A common shareholders | $ | $ | $ | $ | |||||||||||||||||||

Refer to the accompanying notes to consolidated financial statements.

6

Ladder Capital Corp

Consolidated Statements of Changes in Equity

(Dollars and Shares in Thousands)

(Unaudited)

| Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||

Class A Common Stock | Additional Paid- in-Capital | Treasury Stock | Retained Earnings (Dividends in Excess of Earnings) | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||

Shares | Par | Consolidated Ventures | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | ( | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares acquired to satisfy minimum required federal and state tax withholding on vesting restricted stock and units | ( | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2023 | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

Refer to the accompanying notes to consolidated financial statements.

7

Ladder Capital Corp

Consolidated Statements of Changes in Equity

(Dollars and Shares in Thousands)

(Unaudited)

| Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||

Class A Common Stock | Additional Paid- in-Capital | Treasury Stock | Retained Earnings (Dividends in Excess of Earnings) | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||

Shares | Par | Consolidated Ventures | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Grants of restricted stock | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | ( | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares acquired to satisfy minimum required federal and state tax withholding on vesting restricted stock and units | ( | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Forfeitures | ( | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||

Refer to the accompanying notes to consolidated financial statements.

8

Ladder Capital Corp

Consolidated Statements of Changes in Equity

(Dollars and Shares in Thousands)

(Unaudited)

| Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||

Class A Common Stock | Additional Paid- in-Capital | Treasury Stock | Retained Earnings (Dividends in Excess of Earnings) | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||

Shares | Par | Consolidated Ventures | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Grants of restricted stock | — | ( | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | ( | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Re-issuance of treasury stock | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Shares acquired to satisfy minimum required federal and state tax withholding on vesting restricted stock | ( | ( | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Forfeitures | ( | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2023 | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

Refer to the accompanying notes to consolidated financial statements.

9

Ladder Capital Corp

Consolidated Statements of Changes in Equity

(Dollars and Shares in Thousands)

(Unaudited)

| Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||

Class A Common Stock | Additional Paid- in-Capital | Treasury Stock | Retained Earnings (Dividends in Excess of Earnings) | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||

Shares | Par | Consolidated Ventures | |||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||

| Contributions | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Grants of restricted stock | — | ( | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | ( | ( | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Re-issuance of treasury stock | — | ( | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Shares acquired to satisfy minimum required federal and state tax withholding on vesting restricted stock | ( | ( | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Forfeitures | ( | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||

Refer to the accompanying notes to consolidated financial statements.

10

Ladder Capital Corp

Consolidated Statements of Cash Flows

(Dollars in Thousands)

(Unaudited)

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | $ | |||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| (Gain) loss on extinguishment of debt | ( | ( | |||||||||

| Depreciation and amortization | |||||||||||

| Non-cash operating lease expense | |||||||||||

| Unrealized (gain) loss on derivative instruments | ( | ||||||||||

| Unrealized (gain) loss on equity securities | ( | ||||||||||

| Unrealized (gain) loss on Agency interest-only securities | |||||||||||

| Provision for (release of) loan loss reserves | |||||||||||

| Amortization of equity based compensation | |||||||||||

| Amortization of deferred financing costs included in interest expense | |||||||||||

| Amortization of premium/discount on mortgage loan financing included in interest expense | ( | ( | |||||||||

| Amortization of above- and below-market lease intangibles | ( | ( | |||||||||

| (Accretion)/amortization of discount, premium and other fees on loans | ( | ( | |||||||||

| (Accretion)/amortization of discount and premium on securities | ( | ( | |||||||||

| Net result from mortgage loan receivables held for sale | |||||||||||

| Realized (gain) loss on securities | |||||||||||

| Realized (gain) loss on sale of real estate, net | ( | ( | |||||||||

| Realized (gain) loss on sale of derivative instruments | |||||||||||

| (Earnings) loss from investments in unconsolidated ventures in excess of distributions received | ( | ( | |||||||||

| Insurance proceeds for remediation work due to property damage | |||||||||||

| Insurance proceeds used for remediation work due to property damage | ( | ( | |||||||||

| Origination of mortgage loan receivables held for sale | ( | ||||||||||

| Repayment of mortgage loan receivables held for sale | |||||||||||

| Proceeds from sales of mortgage loan receivables held for sale | |||||||||||

| Change in deferred tax asset (liability) | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accrued interest receivable | ( | ||||||||||

| Other assets | |||||||||||

| Accrued expenses and other liabilities | ( | ||||||||||

| Net cash provided by (used in) operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Origination and funding of mortgage loan receivables held for investment | ( | ( | |||||||||

| Repayment of mortgage loan receivables held for investment | |||||||||||

| Purchases of securities | ( | ( | |||||||||

| Repayment of securities | |||||||||||

| Basis recovery of interest-only securities | |||||||||||

| Proceeds from sales of securities | |||||||||||

| Capital improvements of real estate | ( | ( | |||||||||

| Proceeds from sale of real estate | |||||||||||

| Capital distribution from investment in unconsolidated ventures | |||||||||||

| Proceeds from FHLB stock | |||||||||||

| Purchase of derivative instruments | ( | ( | |||||||||

| Sale of derivative instruments | |||||||||||

| Net cash provided by (used in) investing activities | ( | ||||||||||

11

| Nine Months Ended September 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flows from financing activities: | |||||||||||

| Deferred financing costs paid | ( | ( | |||||||||

| Proceeds from borrowings under debt obligations | |||||||||||

| Repayment and repurchase of borrowings under debt obligations | ( | ( | |||||||||

| Cash dividends paid to Class A common shareholders | ( | ( | |||||||||

| Capital contributed by noncontrolling interests in consolidated ventures | |||||||||||

| Capital distributed to noncontrolling interests in consolidated ventures | ( | ( | |||||||||

| Reissuance of treasury stock | ( | ||||||||||

| Payment of liability assumed in exchange for shares for the minimum withholding taxes on vesting restricted stock | ( | ( | |||||||||

| Purchase of treasury stock | ( | ( | |||||||||

| Issuance of common stock | |||||||||||

| Net cash provided by (used in) financing activities | ( | ( | |||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | ( | ||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | $ | |||||||||

| Non-cash investing and financing activities: | |||||||||||

| Securities and derivatives purchased, not settled | |||||||||||

| Securities and derivatives sold, not settled | |||||||||||

| Repurchase of treasury shares, not settled | |||||||||||

| Repayments in transit of securities (other assets) | |||||||||||

| Repayment in transit of mortgage loans receivable held for investment (other assets) | |||||||||||

| Settlement of mortgage loan receivable held for investment by real estate, net | ( | ||||||||||

| Real estate acquired in settlement of mortgage loan receivable held for investment, net | |||||||||||

| Net settlement of sale of real estate, subject to debt - real estate | ( | ||||||||||

| Net settlement of sale of real estate, subject to debt - debt obligations | |||||||||||

| Real estate acquired in former unconsolidated venture agreement | |||||||||||

| Transfer of real estate, net into real estate held for sale | ( | ||||||||||

| Dividends declared, not paid | |||||||||||

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the consolidated statement of cash flows ($ in thousands):

| September 30, 2023 | September 30, 2022 | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Short-term unsettled U.S. Treasury securities classified in other assets on the consolidated balance sheet | |||||||||||

| Total cash, cash equivalents and restricted cash shown in the consolidated statement of cash flows | $ | $ | |||||||||

Refer to the accompanying notes to consolidated financial statements.

12

Ladder Capital Corp

Notes to Consolidated Financial Statements

(Unaudited)

1. ORGANIZATION AND OPERATIONS

Ladder Capital Corp (“Ladder,” “Ladder Capital,” and the “Company”) is an internally-managed real estate investment trust (“REIT”) that is a leader in commercial real estate finance. The Company originates and invests in a diverse portfolio of commercial real estate and real estate-related assets, focusing on senior secured assets. The Company’s investment activities include: (i) the Company’s primary business of originating senior first mortgage fixed and floating rate loans collateralized by commercial real estate with flexible loan structures; (ii) owning and operating commercial real estate, including net leased commercial properties; and (iii) investing in investment grade securities secured by first mortgage loans on commercial real estate. Ladder Capital Corp, as the general partner of Ladder Capital Finance Holdings LLLP (“LCFH” or the “Operating Partnership”), operates the Ladder Capital business through LCFH and its subsidiaries. As of September 30, 2023, Ladder Capital Corp has a 100 % economic interest in LCFH and controls the management of LCFH as a result of its ability to appoint its board members. Accordingly, Ladder Capital Corp consolidates the financial results of LCFH and its subsidiaries. In addition, Ladder Capital Corp, through certain subsidiaries which are treated as taxable REIT subsidiaries (each a “TRS”), is indirectly subject to U.S. federal, state and local income taxes. Other than such indirect U.S. federal, state and local income taxes, there are no material differences between Ladder Capital Corp’s consolidated financial statements and LCFH’s consolidated financial statements.

Ladder Capital Corp was formed as a Delaware corporation on May 21, 2013. The Company conducted its initial public offering (“IPO”) which closed on February 11, 2014. The Company used the net proceeds from the IPO to purchase newly-issued limited partnership units (“LP Units”) from LCFH. In connection with the IPO, Ladder Capital Corp also became a holding corporation and the general partner of, and obtained a controlling interest in, LCFH. Ladder Capital Corp’s only business is to act as the general partner of LCFH, and, as such, Ladder Capital Corp indirectly operates and controls all of the business and affairs of LCFH and its subsidiaries. The IPO transactions described herein are referred to as the “IPO Transactions.”

13

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Principles of Consolidation

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). In the opinion of management, the unaudited financial information for the interim periods presented in this report reflects all normal and recurring adjustments necessary for a fair statement of results of operations, financial position and cash flows. The interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2022, which are included in the Annual Report, as certain disclosures that would substantially duplicate those contained in the audited consolidated financial statements have not been included in this interim report. Operating results for interim periods are not necessarily indicative of operating results for an entire fiscal year.

The consolidated financial statements include the Company’s accounts and those of its subsidiaries that are majority-owned and/or controlled by the Company and variable interest entities for which the Company has determined itself to be the primary beneficiary, if any. All significant intercompany transactions and balances have been eliminated.

Provision for Loan Losses

The Company uses a current expected credit loss model (“CECL”) for estimating the provision for loan losses on its loan portfolio. The CECL model requires the consideration of possible credit losses over the life of an instrument and includes a portfolio-based component and an asset-specific component. In accordance with ASC 326 reporting requirements, the Company supplemented its existing credit monitoring and management processes with additional processes to support the calculation of the CECL reserves. The Company engages a third-party service provider to provide market data and a credit loss model. The credit loss model is a forward-looking, econometric, commercial real estate (“CRE”) loss forecasting tool. It is comprised of a probability of default (“PD”) model and a loss given default (“LGD”) model that, layered together with the Company’s loan-level data, fair value of collateral, net operating income of collateral, selected forward-looking macroeconomic variables, and pool-level mean loss rates, produces life of loan expected losses (“EL”) at the loan and portfolio level. Where management has determined that the credit loss model does not fully capture certain external factors, including portfolio trends or loan-specific factors, a qualitative adjustment to the reserve, is recorded. In addition, interest receivable on loans is not included in the Company’s CECL calculations as the Company performs timely write off of aged accounts receivable. The Company has made a policy election to write off aged receivables through interest income as opposed to through the CECL provision on its statements of income.

Loans for which the borrower or sponsor is experiencing financial difficulty, and where repayment of the loan is expected substantially through the operation or sale of the underlying collateral, are considered collateral dependent loans.

For collateral dependent loans, the Company measures expected losses based on the difference between the collateral’s fair value and the amortized cost basis of the loan. When the repayment or satisfaction of the loan is dependent on a sale, rather than operations, of the collateral, the fair value is adjusted for the estimated costs to sell the collateral.

14

The Company may use the direct capitalization rate valuation methodology, the discounted cash flow methodology, or the sales comparison approach to estimate the fair value of the collateral for collateral dependent loans and in certain cases will obtain external appraisals and take into account potential sale bids. Determining fair value of the collateral may take into account a number of assumptions including, but not limited to, cash flow projections, market capitalization rates, discount rates and data regarding recent comparable sales of similar properties. Such assumptions are generally based on current market conditions and are subject to economic and market uncertainties.

The Company’s loans are typically collateralized by real estate directly or indirectly. As a result, the Company regularly evaluates the extent and impact of any credit deterioration associated with the performance and/or value of the underlying collateral property as well as the financial and operating capability of the borrower/sponsor on a loan-by-loan basis. Specifically, a property’s operating results and any cash reserves are analyzed and used to assess: (i) whether cash flow from operations is sufficient to cover the debt service requirements currently and into the future; (ii) the ability of the borrower to refinance the loan at maturity; and/or (iii) the property’s liquidation value. The Company also evaluates the financial wherewithal of any loan guarantors as well as the borrower’s competency in managing and operating the properties. In addition, the Company considers the overall economic environment, real estate sector, and geographic submarket in which the collateral property is located. Such impairment analyses are completed and reviewed by asset management and underwriting personnel, who utilize various data sources, including: (i) periodic financial data such as property occupancy, tenant profile, rental rates, operating expenses, the borrowers’ business plan, and capitalization and discount rates; (ii) site inspections; and (iii) current credit spreads and other market data and ultimately presented to management for approval.

When a debtor is experiencing financial difficulties and a loan is modified, the effect of the modification will be included in the Company’s assessment of the CECL allowance for loan losses. If the Company provides principal forgiveness, the amortized cost basis of the loan is written off against the allowance for loan losses. Generally, when modifying loans, the Company will seek to protect its position by requiring incremental pay downs, additional collateral or guarantees and, in some cases, lookback features or equity interests to offset the effects of modifications granted should conditions impacting the loan improve.

The Company designates a loan as a non-accrual loan generally when: (i) the principal or coupon interest components of loan payments become 90-days past due; or (ii) in the opinion of the Company, it is doubtful the Company will be able to collect all principal and coupon interest due according to the contractual terms of the loan. Interest income on non-accrual loans in which the Company reasonably expects a full recovery of the loan’s outstanding principal balance is recognized when received in cash. Otherwise, income recognition will be suspended and any cash received will be applied as a reduction to the amortized cost basis. A non-accrual loan is returned to accrual status at such time as the loan becomes contractually current and future principal and coupon interest are reasonably assured to be received in accordance with the contractual loan terms. A loan will be written off when management has determined principal and coupon interest is no longer realizable and deemed non-recoverable.

Recently Adopted Accounting Pronouncements

In March 2022, the FASB issued ASU 2022-02 Financial Instruments - Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures, (“ASU 2022-02”). ASU 2022-02 eliminated the recognition and measurement guidance for troubled debt restructuring for creditors that have adopted ASC 326 and requires them to make enhanced disclosures about loan modifications for borrowers experiencing financial difficulty. The standard is effective for fiscal years beginning after December 15, 2022. The adoption of ASU 2022-02 did not have a material impact on the Company’s consolidated financial statements.

Recent Accounting Pronouncements Pending Adoption

Management is evaluating any new accounting standards that have been issued or proposed by FASB and that do not require adoption until a future date. These new standards are not expected to have a material impact on the consolidated financial statements upon adoption.

15

3. MORTGAGE LOAN RECEIVABLES

September 30, 2023 ($ in thousands)

| Outstanding Face Amount | Carrying Value | Weighted Average Yield (1)(2) | Remaining Maturity (years)(2)(3) | ||||||||||||||||||||

| Mortgage loan receivables held for investment, net, at amortized cost: | |||||||||||||||||||||||

| First mortgage loans | $ | $ | % | ||||||||||||||||||||

| Mezzanine loans | % | ||||||||||||||||||||||

| Total mortgage loans receivable | % | ||||||||||||||||||||||

| Allowance for credit losses | N/A | ( | |||||||||||||||||||||

| Total mortgage loan receivables held for investment, net, at amortized cost | |||||||||||||||||||||||

| Mortgage loan receivables held for sale: | |||||||||||||||||||||||

| First mortgage loans | (4) | % | |||||||||||||||||||||

| Total | $ | $ | (5) | % | |||||||||||||||||||

(1)Includes the impact from interest rate floors. Term SOFR rates in effect as of September 30, 2023 are used to calculate weighted average yield for floating rate loans.

(2)Excludes non-accrual loans of $58.4 million. Refer to “Non-Accrual Status” below for further details.

(3)The remaining maturity is calculated based on the initial maturity. The weighted average extended maturity for all loans is 2.0 years.

(4)As a result of rising prevailing rates, the Company recorded a lower of cost or market adjustment as of September 30, 2023. The adjustment was calculated using a 5.94 % discount rate.

(5)Net of $9.2 million of deferred origination fees and other items as of September 30, 2023.

As of September 30, 2023, $3.0 billion, or 87.7 %, of the outstanding face amount of our mortgage loan receivables held for investment, net, at amortized cost, were at variable interest rates linked to Term SOFR. Of this $3.0 billion, 100.0 % of these variable interest rate mortgage loan receivables were subject to interest rate floors. As of September 30, 2023, $31.4 million, or 100 %, of the outstanding face amount of our mortgage loan receivables held for sale were at fixed interest rates.

December 31, 2022 ($ in thousands)

| Outstanding Face Amount | Carrying Value | Weighted Average Yield (1)(2)(3) | Remaining Maturity (years)(2)(3) | ||||||||||||||||||||

| Mortgage loan receivables held for investment, net, at amortized cost: | |||||||||||||||||||||||

| First mortgage loans | $ | $ | % | ||||||||||||||||||||

| Mezzanine loans | % | ||||||||||||||||||||||

| Total mortgage loans receivable | % | ||||||||||||||||||||||

| Allowance for credit losses | N/A | ( | |||||||||||||||||||||

| Total mortgage loan receivables held for investment, net, at amortized cost | |||||||||||||||||||||||

| Mortgage loan receivables held for sale: | |||||||||||||||||||||||

| First mortgage loans | (4) | % | |||||||||||||||||||||

| Total | $ | $ | (5) | % | |||||||||||||||||||

(1)Includes the impact from interest rate floors. December 31, 2022 LIBOR rates are used to calculate weighted average yield for floating rate loans.

(2)Excludes non-accrual loans of $53.8 million.

(3)Includes the impact of one loan with a principal balance of $51.5 million, which was extended through 2026 in January 2023.

(4)As a result of rising prevailing rates, the Company recorded a lower of cost or market adjustment as of December 31, 2022. The adjustment was calculated using a 5.16 % discount rate.

(5)Net of $21.5 million of deferred origination fees and other items as of December 31, 2022.

16

As of December 31, 2022, $3.4 billion, or 87.2 %, of the outstanding face amount of our mortgage loan receivables held for investment, net, at amortized cost, were at variable interest rates with $2.3 billion linked to LIBOR and $1.1 billion linked to Term SOFR. Of this $3.4 billion, 99 % of these variable rate mortgage loan receivables were subject to interest rate floors. As of December 31, 2022, $31.4 million, or 100 %, of the outstanding face amount of our mortgage loan receivables held for sale were at fixed interest rates.

For the nine months ended September 30, 2023 and 2022, the activity in our loan portfolio was as follows ($ in thousands):

| Mortgage loan receivables held for investment, net, at amortized cost: | |||||||||||||||||

| Mortgage loans receivable | Allowance for credit losses | Mortgage loan receivables held for sale | |||||||||||||||

| Balance, December 31, 2022 | $ | $ | ( | $ | |||||||||||||

| Origination of mortgage loan receivables (1) | — | ||||||||||||||||

| Repayment of mortgage loan receivables (2) | ( | — | |||||||||||||||

| Non-cash disposition of loans via foreclosure (3) | ( | — | — | ||||||||||||||

| Net result from mortgage loan receivables held for sale (4) | — | ( | |||||||||||||||

| Accretion/amortization of discount, premium and other fees | — | ||||||||||||||||

| Release (addition) of provision for current expected credit loss, net (5) | — | ( | — | ||||||||||||||

| Balance, September 30, 2023 | $ | $ | ( | $ | |||||||||||||

(1)Includes funding of commitments on existing mortgage loans.

(2)Includes $28.2 million of repayments in transit.

(3)Refer to Note 5 Real Estate and Related Lease Intangibles, Net for further detail on foreclosure of real estate.

(4)Includes unrealized lower of cost or market adjustment and realized gain/loss on loans held for sale.

(5)Refer to “Allowance for Credit Losses” table below for further detail.

| Mortgage loan receivables held for investment, net, at amortized cost: | |||||||||||||||||

| Mortgage loans receivable | Allowance for credit losses | Mortgage loan receivables held for sale | |||||||||||||||

| Balance, December 31, 2021 | $ | $ | ( | $ | |||||||||||||

| Origination of mortgage loan receivables (1) | — | ||||||||||||||||

| Repayment of mortgage loan receivables | ( | — | ( | ||||||||||||||

| Proceeds from sales of mortgage loan receivables | — | ( | |||||||||||||||

| Net result from mortgage loan receivables held for sale (2) | — | ( | |||||||||||||||

| Accretion/amortization of discount, premium and other fees | — | ||||||||||||||||

| Charge offs | ( | ||||||||||||||||

| Release (addition) of provision for current expected credit loss, net (3) | — | ( | — | ||||||||||||||

| Balance, September 30, 2022 | $ | $ | ( | $ | |||||||||||||

(1)Includes funding of commitments on existing mortgage loans.

(2)Represents unrealized lower of cost or market adjustment on loans held for sale.

(3)Refer to “Allowance for Credit Losses” table below for further detail.

17

Allowance for Credit Losses and Non-Accrual Status ($ in thousands)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| Allowance for Credit Losses | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Allowance for credit losses at beginning of period | $ | $ | $ | $ | |||||||||||||||||||

| Provision for (release of) current expected credit loss, net (1) | |||||||||||||||||||||||

| Charge-offs | ( | ||||||||||||||||||||||

| Recoveries (2) | ( | ||||||||||||||||||||||

| Allowance for credit losses at end of period | $ | $ | $ | $ | |||||||||||||||||||

(1)There were no

(2)Recoveries are recognized within the consolidated statements of income through “Provision for (release of) loan loss reserves.”

| Non-Accrual Status (1) | September 30, 2023(2)(3) | December 31, 2022(2)(4) | |||||||||

| Amortized cost basis of loans on non-accrual status, net of asset-specific reserve | $ | $ | |||||||||

(1)As of September 30, 2023 and December 31, 2022, the loans on non-accrual status were greater than 90 days past due and are considered collateral dependent.

(2)Includes two retail loans with an amortized cost basis of $25.8 million and asset-specific reserves of $2.7 million.

(3)Includes one mixed-use loan with an amortized cost basis of $35.3 million, for which the Company determined no asset-specific reserve was necessary.

(4)Includes one mixed-use loan with an amortized cost basis of $30.5 million.

During the nine months ended September 30, 2023, the Company modified two first mortgage loans with a combined amortized cost basis of $106.6 million as of September 30, 2023, or 3.2 % of the Company’s mortgage loan receivable portfolio. Together, these modifications resulted in a weighted average extension of 2.3 years, in exchange for terms that included $6.0 million of payments that reduced our amortized cost basis and $6.5 million of reserve replenishments. No principal or interest was forgiven, and Ladder also received a 15 % non-controlling common equity interest in one of the properties. The payment structure of both loans was modified to defer a portion of the contractual interest until maturity and the Company is accruing only the current pay component. As of September 30, 2023, both loans are current. Subsequent to the modifications, for the three and nine months ended September 30, 2023, the Company accrued $0.7 million and $1.8 million of interest income related to these two loans, respectively.

Current Expected Credit Loss (“CECL”)

As of September 30, 2023, the Company has a $40.6 million allowance for current expected credit losses, of which $39.6 million pertains to mortgage loan receivables and $1.0 million relates to unfunded commitments. This allowance includes $2.7 million of asset-specific reserves relating to two retail loans. As of September 30, 2023, the Company concluded that none of its other loans required an asset-specific reserve.

As of December 31, 2022, the Company had a $21.5 million allowance for current expected credit losses, of which $20.8 million pertained to mortgage loan receivables and $0.7 million related to unfunded commitments. This allowance included $2.7 million of asset-specific reserves relating to two retail loans with an amortized cost basis of $26.0 million as of December 31, 2022. The Company concluded that none of its other loans are individually impaired as of December 31, 2022.

The total change in provision for loan loss reserves for the three and nine months ended September 30, 2023 was an increase of the provision of $7.5 million and $19.1 million, respectively. The net increase for the three and nine months ended September 30, 2023 represents an increase in the general reserve of loans held for investment of $7.3 million and $18.8 million, respectively, and an increase related to unfunded loan commitments of $146 thousand and $270 thousand, respectively. The increase in provision associated with the general reserve during the three and nine months ended September 30, 2023 is primarily due to adverse changes in macroeconomic market conditions affecting commercial real estate.

18

The total change in provision for loan loss reserves for the three and nine months ended September 30, 2022 was an increase of the provision of $1.5 million and $1.4 million, respectively. The net increase for the three months ended September 30, 2022 represents an increase in the general reserve of loans held for investment of $1.5 million and a decrease related to unfunded loan commitments of $13 thousand. The net increase for the nine months ended September 30, 2022 represents an increase in the general reserve of loans held for investment of $4.2 million and an increase related to unfunded loan commitments $0.3 million partially offset by a $3.1 million recovery of provision. The increase in the general reserve during the three and nine months ended September 30, 2022 was primarily due to an overall increase in the size of our balance sheet first mortgage portfolio as a result of net originations during that time and adverse changes in macroeconomic conditions.

Loan Portfolio by Geographic Region, Collateral Type and Vintage (amortized cost $ in thousands)

| September 30, | December 31, | ||||||||||

| Geographic Region | 2023 | 2022 | |||||||||

| Northeast | $ | $ | |||||||||

| South | |||||||||||

| Southwest | |||||||||||

| Midwest | |||||||||||

| West | |||||||||||

| Subtotal mortgage loans receivable | |||||||||||

| Individually impaired loans | |||||||||||

| Total mortgage loans receivable | $ | $ | |||||||||

19

Management’s method for monitoring credit is the performance of a loan. The primary credit quality indicator management utilizes to assess its current expected credit loss reserve is by viewing the Company’s mortgage loan portfolio by collateral type. The primary credit quality indicator is reviewed and updated by management on a quarterly basis. The following tables summarize the amortized cost of the mortgage loan portfolio by collateral type as of September 30, 2023 and December 31, 2022, respectively ($ in thousands):

Amortized Cost Basis by Origination Year as of September 30, 2023 | ||||||||||||||||||||||||||||||||||||||

| Collateral Type | 2023 | 2022 | 2021 | 2020 | 2019 and Earlier | Total (1) | ||||||||||||||||||||||||||||||||

| Multifamily | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Office | ||||||||||||||||||||||||||||||||||||||

| Mixed Use | ||||||||||||||||||||||||||||||||||||||

| Industrial | ||||||||||||||||||||||||||||||||||||||

| Retail | ||||||||||||||||||||||||||||||||||||||

| Manufactured Housing | ||||||||||||||||||||||||||||||||||||||

| Hospitality | ||||||||||||||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||||||||

| Subtotal mortgage loans receivable | ||||||||||||||||||||||||||||||||||||||

| Individually Impaired loans | ||||||||||||||||||||||||||||||||||||||

| Total mortgage loans receivable (2) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Amortized Cost Basis by Origination Year as of December 31, 2022 | ||||||||||||||||||||||||||||||||||||||

| Collateral Type | 2022 | 2021 | 2020 | 2019 | 2018 and Earlier | Total | ||||||||||||||||||||||||||||||||

| Multifamily | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Office | ||||||||||||||||||||||||||||||||||||||

| Mixed Use | ||||||||||||||||||||||||||||||||||||||

| Industrial | ||||||||||||||||||||||||||||||||||||||

| Retail | ||||||||||||||||||||||||||||||||||||||

| Hospitality | ||||||||||||||||||||||||||||||||||||||

| Manufactured Housing | ||||||||||||||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||||||||

| Subtotal mortgage loans receivable | ||||||||||||||||||||||||||||||||||||||

| Individually Impaired loans | ||||||||||||||||||||||||||||||||||||||

| Total mortgage loans receivable (3) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

(1)For the three and nine months ended September 30, 2023, there were no write offs.

(2)Not included above is $21.3 million of on all loans at September 30, 2023.

20

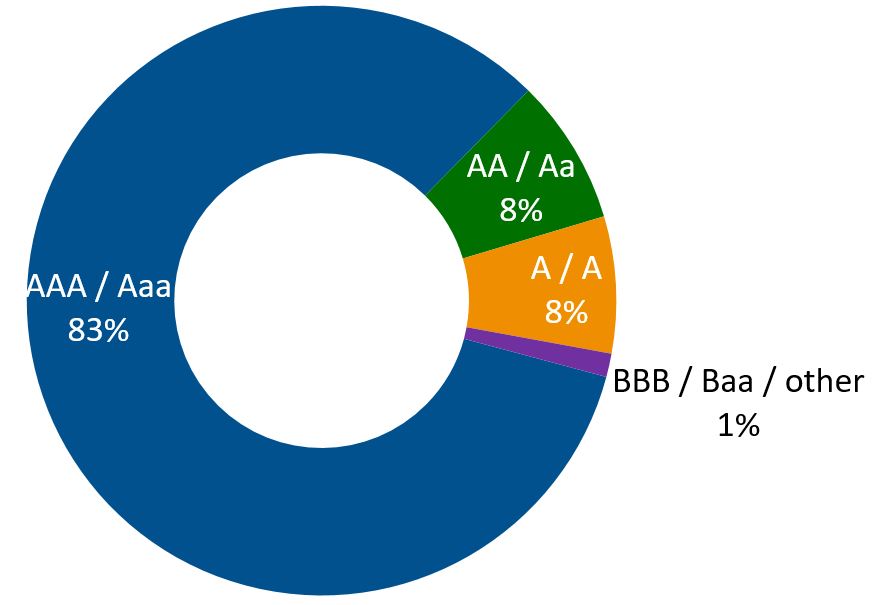

4. SECURITIES

The Company invests in primarily AAA-rated real estate securities, typically front pay securities, with relatively short duration and significant credit subordination. We continue to actively monitor the impacts of current market conditions on our securities portfolio.

Commercial mortgage-backed securities (“CMBS”), CMBS interest-only securities, U.S. Agency securities, corporate bonds and U.S. Treasury securities are classified as available-for-sale and reported at fair value with changes in fair value recorded in the current period in other comprehensive income. As of September 30, 2023, the Company does not intend to sell these investments and it is not more likely than not that the Company will be required to sell the investments before recovery of their amortized cost bases.

Government National Mortgage Association (“GNMA”) interest-only, Federal Home Loan Mortgage Corp (“FHLMC”) and equity securities are recorded at fair value with changes in fair value recorded in current period earnings. The following is a summary of the Company’s securities at September 30, 2023 and December 31, 2022 ($ in thousands):

September 30, 2023

| Gross Unrealized | Weighted Average | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset Type | Outstanding Face Amount | Amortized Cost Basis | Gains | Losses (7) | Carrying Value | # of Securities | Rating (1) | Coupon % | Yield % | Remaining Duration (years) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | $ | $ | $ | $ | ( | $ | (2) | AAA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS interest-only(3) | (3) | ( | (4) | AAA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GNMA interest-only(5) | (3) | ( | AAA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency securities | ( | AAA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total debt securities | $ | $ | $ | $ | ( | $ | (6) | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | N/A | ( | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for current expected credit losses | N/A | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total securities | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

December 31, 2022

| Gross Unrealized | Weighted Average | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset Type | Outstanding Face Amount | Amortized Cost Basis | Gains | Losses (7) | Carrying Value | # of Securities | Rating (1) | Coupon % | Yield % | Remaining Duration (years) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | $ | $ | $ | $ | ( | $ | (2) | AAA | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS interest-only(3) | (3) | ( | (4) | AAA | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GNMA interest-only(5) | (3) | ( | AAA | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency securities | ( | AAA | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury securities | ( | AAA | N/A | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total debt securities | $ | $ | $ | $ | ( | $ | (6) | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | N/A | ( | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for current expected credit losses | N/A | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total real estate securities | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)Represents the weighted average of the ratings of all securities in each asset type, expressed as an S&P equivalent rating. For each security rated by multiple rating agencies, the highest rating is used. The ratings provided were determined by third-party rating agencies. The rates may not be current and are subject to change (including the assignment of a “negative outlook” or “credit watch”) at any time.

(2)As of September 30, 2023 and December 31, 2022, includes $9.0

(3)The amounts presented represent the principal amount of the mortgage loans outstanding in the pool in which the interest-only securities participate.

(4)As of September 30, 2023 and December 31, 2022, includes $0.3 million and $0.4 million, respectively of restricted securities which are designated as risk retention securities under the Dodd-Frank Act and are therefore subject to transfer restrictions over the term of the securitization trust and are classified as held-to-maturity and reported at amortized cost.

21

(5)GNMA interest-only securities are recorded at fair value with changes in fair value recorded in current period earnings. The Company’s GNMA interest-only securities are considered to be hybrid financial instruments that contain embedded derivatives. As a result, the Company has elected to account for them as hybrid instruments in their entirety at fair value with changes in fair value recognized in unrealized gain (loss) on securities in the consolidated statements of income.

(6)The Company’s investments in debt securities represent an ownership interest in unconsolidated VIEs. The Company’s maximum exposure to loss from these unconsolidated VIEs is the amortized cost basis of the securities which represents the purchase price of the investment adjusted by any unamortized premiums or discounts as of the reporting date.

The following summarizes the carrying value of the Company’s debt securities by remaining maturity based upon expected cash flows at September 30, 2023 and December 31, 2022 ($ in thousands):

September 30, 2023

| Asset Type | Within 1 year | 1-5 years | 5-10 years | After 10 years | Total | |||||||||||||||||||||||||||

| CMBS | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| CMBS interest-only | ||||||||||||||||||||||||||||||||

| GNMA interest-only | ||||||||||||||||||||||||||||||||

| Agency securities | ||||||||||||||||||||||||||||||||

| Total securities (1) | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

(1)Excluded from the table above are $0.1 million of equity securities and $(20.0 ) thousand of allowance for current expected credit losses.

December 31, 2022

| Asset Type | Within 1 year | 1-5 years | 5-10 years | After 10 years | Total | |||||||||||||||||||||||||||

| CMBS | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| CMBS interest-only | ||||||||||||||||||||||||||||||||

| GNMA interest-only | ||||||||||||||||||||||||||||||||

| Agency securities | ||||||||||||||||||||||||||||||||

| U.S. Treasury securities | ||||||||||||||||||||||||||||||||

| Total securities (1) | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

(1)Excluded from the table above are $0.1 million of equity securities and $(20.0 ) thousand of allowance for current expected credit losses.

During the three and nine months ended September 30, 2023, the Company did not 0.7 million and $1.2 million of equity securities, respectively.

22

5. REAL ESTATE AND RELATED LEASE INTANGIBLES, NET

The Company’s real estate assets were comprised of the following ($ in thousands):

| September 30, 2023 | December 31, 2022 | ||||||||||

| Land | $ | $ | |||||||||

| Building | |||||||||||

| In-place leases and other intangibles | |||||||||||

| Undepreciated real estate and related lease intangibles | |||||||||||

| Less: Accumulated depreciation and amortization | ( | ( | |||||||||

| Real estate and related lease intangibles, net(1) | $ | $ | |||||||||

| Below market lease intangibles, net (other liabilities)(2) | $ | ( | $ | ( | |||||||

(1)There was unencumbered real estate of $104.8 million and $140.3 million as of September 30, 2023 and December 31, 2022, respectively.

(2)Below market lease intangibles is net of $15.2 million and $13.6 million of accumulated amortization as of September 30, 2023 and December 31, 2022, respectively.

At September 30, 2023 and December 31, 2022, the Company held foreclosed properties included in real estate and related lease intangibles, net with carrying values of $94.4 million and $103.1 million, respectively.

The following table presents depreciation and amortization expense on real estate recorded by the Company ($ in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Depreciation expense(1) | $ | $ | $ | $ | |||||||||||||||||||

| Amortization expense | |||||||||||||||||||||||

| Total real estate depreciation and amortization expense | $ | $ | $ | $ | |||||||||||||||||||

(1)Depreciation expense on the consolidated statements of income also includes $0.1 million and $0.3 million of depreciation on corporate fixed assets for the three and nine months ended September 30, 2023, respectively, and $8 thousand for the nine months ended September 30, 2022.

The Company’s intangible assets are comprised of in-place leases, above market leases and other intangibles. The following tables present additional detail related to our intangible assets ($ in thousands):

| September 30, 2023 | December 31, 2022 | ||||||||||

| Gross intangible assets(1) | $ | $ | |||||||||

| Accumulated amortization | |||||||||||

| Net intangible assets | $ | $ | |||||||||

(1)Includes $2.8

The following table presents increases/reductions in operating lease income related to the amortization of above or below market leases recorded by the Company ($ in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Reduction in operating lease income for amortization of above market lease intangibles acquired | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Increase in operating lease income for amortization of below market lease intangibles acquired | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

23

The following table presents expected adjustment to operating lease income and expected amortization expense during the next five years and thereafter related to the above and below market leases and acquired in-place lease and other intangibles for property owned as of September 30, 2023 ($ in thousands):

| Period Ending December 31, | Increase/(Decrease) to Operating Lease Income | Amortization Expense | ||||||||||||

| 2023 (last three months) | $ | $ | ||||||||||||

| 2024 | ||||||||||||||

| 2025 | ||||||||||||||

| 2026 | ||||||||||||||

| 2027 | ||||||||||||||

| Thereafter | ||||||||||||||

| Total | $ | $ | ||||||||||||

Rent Receivables

There were $0.9 million and $1.3 million of rent receivables included in other assets on the consolidated balance sheets as of September 30, 2023 and December 31, 2022, respectively.

Operating Lease Income & Tenant Reimbursements

The following is a schedule of non-cancellable, contractual, future minimum rent under leases (excluding property operating expenses paid directly by tenant under net leases) at September 30, 2023 ($ in thousands):

| Period Ending December 31, | Amount | |||||||

| 2023 (last three months) | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Thereafter | ||||||||

| Total | $ | |||||||

Tenant reimbursements, which consist of real estate taxes and other municipal charges paid by the Company, which were reimbursable by our tenants pursuant to the terms of the lease agreements, were $1.4 million and $3.5 million for the three and nine months ended September 30, 2023, respectively, and $1.4 million and $3.9 million for the three and nine months ended September 30, 2022, respectively. Tenant reimbursements are included in operating lease income on the Company’s consolidated statements of income.

Acquisitions

The Company acquired the following properties during the nine months ended September 30, 2023 ($ in thousands):

| Acquisition Date | Type | Primary Location(s) | Purchase Price/Fair Value on the Date of Foreclosure | Ownership Interest (1) | ||||||||||||||||||||||

| September 2023 | (2) | Mixed use | New York, NY | $ | ||||||||||||||||||||||

| Total real estate acquisitions | $ | |||||||||||||||||||||||||

(1)Properties were consolidated as of acquisition date.

(2)In September 2023, the Company acquired a mixed use portfolio consisting of four properties in New York, NY via foreclosure. The portfolio served as collateral for a mortgage loan receivable held for investment. The Company obtained a third-party appraisal of the property. The $30.4 million fair value was determined by using the sales comparison and income approaches. The appraiser utilized a terminal capitalization rate of 5.5 %. There was no gain or loss resulting from the foreclosure of the loan. The key inputs used to determine fair value were determined to be Level 3 inputs.

24

The Company acquired the following properties during the nine months ended September 30, 2022 ($ in thousands):

| Acquisition Date | Type | Primary Location(s) | Purchase Price/Fair Value on the Date of Foreclosure | Ownership Interest (1) | ||||||||||||||||||||||

| February 2022 | (2) | Apartments | New York, NY | $ | ||||||||||||||||||||||

| Total real estate acquisitions | $ | |||||||||||||||||||||||||

(1)Properties were consolidated as of acquisition date.

(2)In February 2022, the Company acquired, via change in control, a previously held interest in a non-controlling equity investment in a mixed use property with one remaining residential condo unit and one remaining retail condo unit in New York, New York. The carrying value of the property at the time of change in control was $15.4 million, which was determined to be fair value. The fair value of the remaining condo unit was determined based on comparable sales in the building and the value of the remaining retail unit was valued utilizing a direct capitalization rate of 5.5 %. The key inputs used to determine fair value were determined to be Level 3 inputs.

The Company allocates purchase consideration based on relative fair values, and real estate acquisition costs are capitalized as a component of the cost of the assets acquired for asset acquisitions. During the nine months ended September 30, 2023 and September 30, 2022, all acquisitions were determined to be asset acquisitions.

Sales

The Company sold the following properties during the nine months ended September 30, 2023 ($ in thousands):

| Sales Date | Type | Primary Location(s) | Sales Proceeds | Net Book Value | Realized Gain/(Loss) | Properties | ||||||||||||||||||||||||||||||||

| August 2023 | Hotel | San Diego, CA | (1) | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Totals | $ | $ | $ | |||||||||||||||||||||||||||||||||||

(1)Included within sales proceeds is $31.3 million of mortgage financing that was assumed by the buyer.

The Company sold the following properties during the nine months ended September 30, 2022 ($ in thousands):

| Sales Date | Type | Primary Location(s) | Net Sales Proceeds | Net Book Value | Realized Gain/(Loss) | Properties | ||||||||||||||||||||||||||||||||

| March 2022 | Office | Ewing, NJ | $ | $ | $ | |||||||||||||||||||||||||||||||||

| March 2022 | Warehouse | Conyers, GA | ||||||||||||||||||||||||||||||||||||

| June 2022 | Apartments | Stillwater, OK | ||||||||||||||||||||||||||||||||||||

| June 2022 | Apartments | Miami, FL | ||||||||||||||||||||||||||||||||||||

| September 2022 | Retail | Wichita, KS | ||||||||||||||||||||||||||||||||||||

| Totals | (1) | $ | $ | $ | ||||||||||||||||||||||||||||||||||

(1)Excludes $3.7 million of prepayment costs upon repayment of the mortgage financing in connection with the sales that is recorded within interest expense on the consolidated statement of income, such amount was correspondingly paid by the buyer and received by the Company as part of the sale and recorded in fee and other income on the consolidated statement of income.

25

6. DEBT OBLIGATIONS, NET

The details of the Company’s debt obligations at September 30, 2023 and December 31, 2022 are as follows ($ in thousands):

September 30, 2023

| Debt Obligations | Committed / Principal Amount | Carrying Value of Debt Obligations | Committed but Unfunded | Interest Rate at September 30, 2023(1) | Current Term Maturity | Remaining Extension Options | Eligible Collateral | Carrying Amount of Collateral | Fair Value of Collateral | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | $ | $ | $ | — | 9/27/2025 | (2) | (3) | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 12/19/2023 | (4) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 4/30/2024 | (6) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 1/2/2024 | (7) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | 1/22/2024 | (8) | (5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Committed Loan Repurchase Facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Securities Repurchase Facility | — | 5/27/2024 | N/A | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Uncommitted Securities Repurchase Facility | N/A (10) | N/A (10) | — | 10/19/2023 | N/A | (9) | (11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Repurchase Facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revolving Credit Facility | — | 7/27/2024 | (12) | N/A (13) | N/A (13) | N/A (13) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage Loan Financing | — | 2024-2031 (14) | N/A | (15) | (16) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLO Debt | (17) | — | 2024-2026 (18) | N/A | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings from the FHLB | | — | 2023-2024 | N/A | (19) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Unsecured Notes | (21) | — | 2025-2029 | N/A | N/A (22) | N/A (22) | N/A (22) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt Obligations, Net | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)Interest rates on floating rate debt reflect the applicable index in effect as of September 30, 2023.

(2)Two 12 -month extension periods at Company’s option. No new advances are permitted after the initial maturity date.

(3)First mortgage commercial real estate loans and senior and pari passu interests therein. It does not include the real estate collateralizing such loans.

(4)Two additional 364 -day periods at Company’s option.

(5)First mortgage and mezzanine commercial real estate loans and senior and pari passu interests therein. It does not include the real estate collateralizing such loans.

(6)Three additional 12 -month extension periods at Company’s option.

(7)One additional 12 -month extension periods at Company’s option. No new advances are permitted.

(8)Two additional 12 -month extension periods at Company's option. No new advances permitted during the final 12 -month period.

(9)Commercial real estate securities. It does not include the first mortgage commercial real estate loans collateralizing such securities.

(10)Represents uncommitted securities repurchase facilities for which there is no committed amount subject to future advances.

(11)Includes $1.9 million of restricted securities under the risk retention rules of the Dodd-Frank Act. These securities are accounted for as held-to-maturity and recorded at amortized cost basis.

(12)Three additional 12 -month periods at Company’s option.

(13)The obligations under the Revolving Credit Facility are guaranteed by the Company and certain of its subsidiaries and secured by equity pledges in certain Company subsidiaries.

(14)Anticipated repayment dates.

(15)Certain of our real estate investments serve as collateral for our mortgage loan financing.

(16)Using undepreciated carrying value of commercial real estate to approximate fair value.

(17)Presented net of unamortized debt issuance costs of $2.8 million at September 30, 2023.

(18)Represents the estimated maturity date based on the remaining reinvestment period and underlying loan maturities.

(19)Investment grade commercial real estate securities. It does not include the first mortgage commercial real estate loans collateralizing such securities.

(20)Includes $2.3 million of restricted securities under the risk retention rules of the Dodd-Frank Act. These securities are accounted for as held-to-maturity and recorded at amortized cost basis.

(21)Presented net of unamortized debt issuance costs of $12.5 million at September 30, 2023.

(22)The obligations under the senior unsecured notes are guaranteed by the Company and certain of its subsidiaries.

26

December 31, 2022

| Debt Obligations | Committed / Principal Amount | Carrying Value of Debt Obligations | Committed but Unfunded | Interest Rate at December 31, 2022(1) | Current Term Maturity | Remaining Extension Options | Eligible Collateral | Carrying Amount of Collateral | Fair Value of Collateral | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility(2) | $ | $ | $ | — | 9/27/2025 | (2) | (3) | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 2/26/2023 | (4) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 12/19/2023 | (6) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 4/30/2024 | (8) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 1/3/2023 | (2) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | 1/22/2024 | (9) | (7) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Loan Repurchase Facility | — | 7/14/2023 | (10) | (11) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Committed Loan Repurchase Facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committed Securities Repurchase Facility(2) | — | 5/27/2023 | N/A | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Uncommitted Securities Repurchase Facility | N/A (13) | N/A (13) | — | 3/2/2023 | N/A | (12) | (14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Repurchase Facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revolving Credit Facility | — | 7/27/2023 | (15) | N/A (16) | N/A (16) | N/A (16) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage Loan Financing | — | 2023 - 2031(17) | N/A | (18) | (19) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLO Debt | (20) | — | 2024 - 2026(21) | N/A | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings from the FHLB | — | 2023 - 2024 | N/A | (22) | (23) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Unsecured Notes | (24) | — | 2025 - 2029 | N/A | N/A (25) | N/A (25) | N/A (25) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt Obligations, Net | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)LIBOR and Term SOFR rates in effect as of December 31, 2022 are used to calculate interest rates for floating rate debt, as applicable.